Are you our next Copywriter? ?

WEDDING PLANNER

Are you our next Wedding Planner? ?

Are you our next Life Coach?

Are you our next Bookkeeper?

By Warren Strybosch

The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

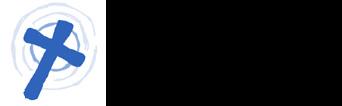

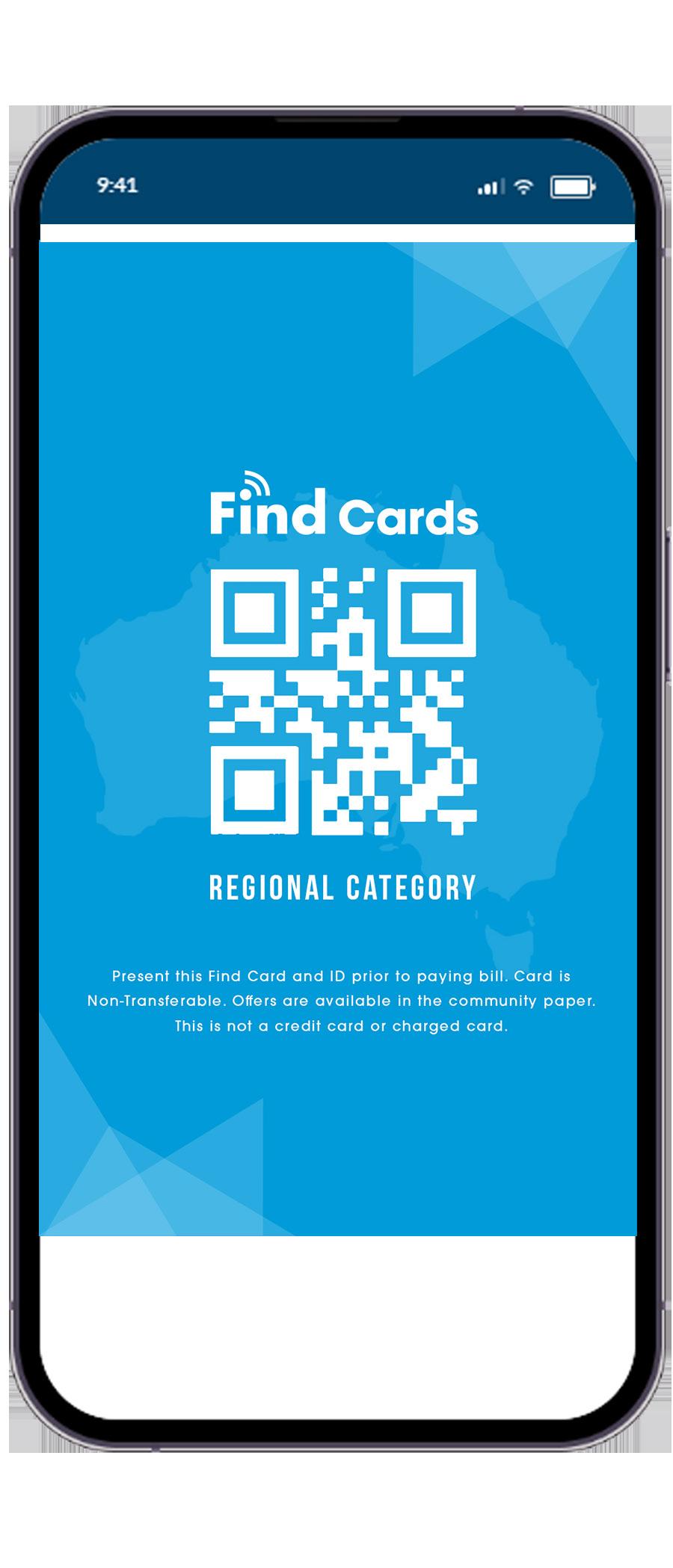

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

By Gen Alcampor

As the summer holidays come to an end, it’s time to pack the backpacks, sharpen the pencils, and get ready for another exciting year of learning, growth, and new adventures.

The first day of the school year is always exciting and rather chaotic. Friends have a chance to catch up who may not have seen each other for weeks, and even friends who have spent a lot of time together are still excited to see each other again. Everyone is clamouring to tell their class all about what they got up to, the adventures they had and even what they received for Christmas. I’m not sure how much schoolwork gets done on that first day as even the teachers seem happy to be back amongst the pandemonium of day one.

If your family is completely new to the school system with your little one starting Foundation, the nerves for both the parent and student can be that much higher with many tears shed. But by the end of the day for most people, this anxiety is removed, and everyone settles into a new normal.

Although starting a new school year can bring a mix of excitement and nerves for teachers and students alike – for parents, it can also bring some added costs. But don’t worry, there are programs designed to make it easier!

In Victoria there are a couple of programs to help families with the cost of school-related expenses: the Victorian School Saving Bonus and the Camps, Sports and Excursions Fund (CSEF).

The Victorian School Saving Bonus is a great initiative that aims to help families with the cost of school uniforms and other essential supplies. If you're a parent or guardian in Victoria, you might be eligible to receive a bonus to make things a little easier.

This bonus helps with essential items like uniforms, shoes, and school bags – things that every student needs to start the school year off right. Whether your child is heading into kindergarten, primary school, or high school, this bonus is designed to ease the financial load.

Who can access the Victorian School Saving Bonus? Eligibility can depend on factors like your family’s income or if you're receiving other forms of financial assistance. It’s worth checking in with your school or local council to see if

you can apply for this bonus. Even if you don’t think you qualify, it’s always a good idea to ask. Schools are there to support families, and they can guide you through the application process.

The Camps, Sports, and Excursions Fund (CSEF) is another great program that helps students participate in extracurricular activities like school camps, sporting events, and excursions. These activities can often come with an extra cost, but the CSEF is here to help ensure that all students have the opportunity to get involved, regardless of their financial situation.

This fund helps cover the costs of things like:

• School camp fees

• Sports programs and equipment

• Excursions and incursions

• Outdoor activities like swimming or team-building exercises

• Whether your child is looking forward to a school camp, an exciting excursion, or a new sport, the CSEF can help cover these costs, making sure that they don’t miss out on the fun because of financial barriers.

Who can apply for CSEF? If you hold a Health Care Card or Pensioner Concession Card, or if your family receives certain government assistance, you may be eligible to apply for the CSEF. The application process is simple, and you can check with your school to see if you're eligible and how to apply.

1. Victorian School Saving Bonus: Reach out to your child’s school or your local council to inquire about

eligibility and application details. Some schools will automatically inform families of how to apply, while others might require you to fill out an application form.

2. CSEF: You can apply for the CSEF through your child’s school. They’ll provide you with the necessary forms and guide you through the process. Be sure to apply as early as possible, as some schools have specific deadlines for applications.

The start of a new school year is an exciting time, but it can also be stressful for families who are worried about the costs. Programs like the Victorian School Saving Bonus and the CSEF are here to make sure that all students can start their school year with the resources and opportunities they need to succeed. These programs help families with essential school expenses, allowing them to focus on what really matters: education, growth, and making memories with friends. They also ensure that students have the chance to participate in important activities that promote teamwork, health, and personal development.

This school year is a fresh start filled with new possibilities. With the help of programs like the Victorian School Saving Bonus and the CSEF, you can rest easy knowing that there are resources available to help make school more affordable. So, take a deep breath, get ready for an exciting year ahead, and don’t forget to check out these programs to make the most of what’s available!

Here’s to a successful, fun, and fulfilling year of learning!

By Liz Sanzaro

It is very unfortunate that the beautiful, clean windows that allow us to enjoy our gardens or views also have an impact on birdlife. Most of us will have experienced the horrible sound of a bird flying at full speed and slamming into a window.

Birds are confused by the reflection on the surface of a clean window which often reflects the garden that we have planted for us to enjoy and watch the birds visiting. Dr Ann Jones recently spoke about a tall skyscraper in America that in one season alone caused the death of over 1000 migratory birds. This particular incident caused such distress that people started to find solutions to prevent this from happening. https:// www.theguardian.com/us-news/2023/ oct/07/chicago-mccormick-placebuilding-bird-deaths-windows

It seems obvious when you think about it. In our own homes we have decals on the sliding doors and full-length windows so that people don’t try to walk through them. It turns out a similar thing applies for birds. Birds need a series of dots in any pattern you like but the distance between the dots needs to be close enough so that the gaps don’t appear as thoroughfares through which a bird might attempt to fly.

their brains sorted before they fly off. It is not necessary to intervene unless there are predators nearby that would take advantage of a bird on the ground.

If you do think it is necessary, throw an old teatowel over the bird and gently pick it up, putting it in a box until it recovers. If the bird's beak is open and it is breathing in and out through the beak, that is a sign that the bird is in shock and needs to be put in a quieter place ASAP and left alone until it calms down.

If it is still looking unwell after 30 minutes you can take it to your local vet who is obligated to look after wildlife without a fee. The bird may need some antiinflammatories.

It's currently not fashionable to have scrim curtains, but these will work just as well as any decals on the glass, On very hot days, exterior blinds will also prevent these accidents.

as we allow more tall buildings to be built, without consideration for the effect on bird life. One way is to install the window on a slant with the bottom being inwards at around 20 degrees, this prevents the mirror effect.

Also a reminder for other wildlife, to have at least two dishes of water on your property during the very hot days over 30° if you are thinking of encouraging birds to visit you, do not feed magpies on mincemeat as their diet needs to include calcium and other minerals that they get from eating insects, without which their bones become bendy and any offspring they have may not survive.

Let’s make sure we give our wildlife at least the best chance to enhance our treed green Maroondah.

By Jodie Moore

Pricing a product or service is one of the most critical decisions a business owner must make. Charge too much, and you risk scaring away potential customers. Charge too little, and you might not cover your costs or earn the profit you need to sustain and grow your business.

Here’s a step-by-step guide to help you understand how to determine the right price for your product or service using smart pricing strategies.

The first step in pricing is understanding all of the costs involved in delivering your product or service. These costs typically break down into two categories:

• Fixed Costs: These are costs that remain constant, regardless of how much you produce or sell. They include things like rent, utilities, software subscriptions, and salaried employees.

• Variable Costs: These fluctuate depending on how much you produce or sell. Materials, hourly wages, packaging, and shipping costs all fall under this category.

Once you’ve calculated both fixed and variable costs, you can figure out your break-even point—the minimum number of sales you need to cover both types of costs. This is crucial, as it ensures that your pricing will at least allow you to avoid losses.

Next, you’ll want to research the market. Understanding what your competitors charge is an essential part of the pricing strategy. However, just copying your competitors isn’t always the best approach. Look at:

• Direct Competitors: These are businesses offering similar products or services. What price range do they offer, and how does your product compare in terms of quality and features?

• Indirect Competitors: These may not be offering exactly what you do,

but they still capture your potential customers’ attention. For example, a local bakery might compete with a coffee shop that offers prepackaged pastries.

• Customer Expectations: What do your customers value most? Are they looking for premium quality, or are they more focused on affordability? This can help you position your price in a way that aligns with what your target market expects.

One of the biggest mistakes small business owners make is not accounting for the profit margin. After covering all your costs, you need to ensure that you’re making a profit. Profit margin is typically calculated as a percentage of the cost of goods sold (COGS). A common rule of thumb for small businesses is to target a profit margin between 10% and 20%, though this can vary depending on the industry. For instance, if your total cost per product is $50, and you want a 20% profit margin, you would add $10 to the cost (for a total price of $60). This ensures that your pricing strategy not only covers costs but also allows for sustainable growth.

4.

Psychological pricing can have a powerful impact on your sales. For instance, pricing something at $99.99 instead of $100 can trigger a perception of a better deal, even though the difference is just one cent.

In addition to this “charm pricing,” consider tiered pricing strategies, bundling, or offering discounts for bulk purchases. Offering multiple price points or subscription-based pricing can also appeal to different customer segments and encourage repeat business.

Even with all the research and calculations in place, pricing is not a one-time decision. Over time, customer behaviour, market conditions, and your business costs can change. That’s why it’s important to test your pricing strategy. You might try offering a new product at a slightly higher price to see how customers respond or provide limitedtime discounts to see if they increase sales volume.

By tracking your sales data and monitoring customer feedback, you’ll be able to adjust your pricing strategy as needed, ensuring long-term profitability.

Pricing is both an art and a science. By carefully calculating costs,understanding market conditions, factoring in profit margins, and considering psychological pricing techniques, you can find a price point that supports your financial goals. In the end, the right price isn’t just about what customers are willing to pay—it’s about creating a balanced strategy that ensures your business can thrive in both the short and long term.

By Ethan Strybosch

The digital marketing trends every nonprofit business is jumping on this year

With the new year comes new resolutions, fresh goals, and the motivation to better ourselves and our businesses. As January gets well underway, the time to build stronger donor relationships, increase engagement and create a greater impact in your Not-For-Profit (NFP) is now. What can you do right now to start reaching your goals and growing your NFP?

Digital Marketing.

Here are four digital marketing trends shaping the NFP sector in 2025:

• AI in operations

• Short-form media

• Data-driven decision making

• Business-donor transparency

AI in operations

Chatbots and virtual assistants are evolving to be capable of more humanlike interactions, providing the capacity for the automation of routine tasks such as lead nurturing and email marketing, which in turn allows human teams more time and resources for strategic work and brainstorming.

Improving skills in, and familiarity with customer service tools that utilise AI — especially those with customer segmentation and content personalisation abilities — could improve customer and donor relations with your NFP. The skills these AI tools possess allow them to interpret sentiment in conversation, so they can provide customers or donors with a more personalised experience.

Short-form media

TikTok, Instagram, and YouTube are gaining popularity as effective ways to provide information and convey your nonprofit’s mission while catering to the population’s growing desire for simple, entertaining and interactive pieces of content.

With a little strategic planning, marketing teams can embrace the changes in these media platforms and use them for their benefit. Interactive features such as polls and quizzes, and short-form content such as YouTube shorts and Instagram reels can be utilised to boost engagement and target your niche audiences. Adapting to Live-streaming and Q&A’s

can open additional opportunities for real-time engagement.

Data analytic techniques have become standard practice to guide nonprofits in their decision-making.

By collecting and analysing donor data, and using analytic techniques, your business can assess campaign strategy success, donor giving patterns, and audience engagement quickly and easily.

By maximising the use of data analytics you can make more effective decisions for your NFP.

Research is suggesting that transparency in nonprofits improves volunteer engagement and donor contributions, which can contribute to the overall success of your business.

You can maximise transparency in your nonprofit in a number of areas including:

• Finances: Share detailed financial reports, revenue breakdowns, and spending allocations openly on your website.

• Funding: Explain clearly how donor contributions are used and the intended impact of different donation types.

• Annual Reports: Publish annual reports showcasing the financial health, accomplishments and program outcomes of your NFP.

• Policies: Make organisational policies including conflict of interest and whistleblower policies easily accessible and public.

• Partnerships: Clearly disclose partnerships in the non-profit and forprofit sectors and their contributions to the finance and mission of your business.

As digital marketing becomes integral to nonprofit businesses and trends in digital marketing continue to evolve, nonprofits that embrace these trends will be better equipped to connect with their communities, enhance their operations, and achieve their mission more effectively. By integrating AI, creating engaging short-form content, leveraging data-driven insights, and maintaining transparency, your organisation can reach those New Year’s goals and stay ahead in 2025.

Keeping your not-for-profit at the forefront of digital marketing in 2025 starts with staying informed

By Warren Strybosch

I thought it would be worth reminding everyone that it is important when seeking financial planning advice, to do some due diligence in relation to the person and/or company you are about to deal with before entrusting your money to them. Firstly, I want to tell you my story and why I got into financial planning.

It all began over 25 years ago. I was a secondary teacher and I wanted to go back and do some further studies. Prior to becoming a teacher and before joining the army, I was halfway through my accounting qualifications. I thought that would be a good place to start –to go and complete my accounting degree. However, someone mentioned that I should look at financial planning. It was an emerging profession that would bring together insurance agents, investment advisors, and the like. It sounded interesting so I decided to do an introductory subject in this area with the Securities Institute of Victoria and Deakin.

It did not take long before word got around that I was studying financial planning. I was approached by an older friend of mine who had trouble reading and understanding financial matters. He presented me with a piece of paper and asked me to explain what the share certificate meant. I had to point out to my friend that what I was holding was not a share certificate but in fact a letter confirming he had gifted over $150,000 to someone we both knew who called himself a financial planner.

There is a lot to this story, but the end result was that whilst my friend got hi s money back, many other people who also

got caught up in the scheme (we are talking about thousands of people in my community and around Australia), lost their money, their homes, ended up in divorce and some becoming so physically sick they could not get out of bed.

How did this happen?

Well, the person selling the scheme worked in a trusted position and told everyone he was a financial planner. Unfortunately, no one at the time did any due diligence to determine if he was really a financial planner. It was only later discovered that this person, whilst he was listed on the ASIC register as a financial planner, was licenced by a company that was in the process of being deregistered.

Also, the person was selling a scheme that was literally too good to be true. People were being told that their money would double or triple in only a couple of years’ time when the company they invested in listed on the stock exchange.

Unfortunately, many people believed his story…he was a good salesperson. He was raided by ASIC and the whole scheme fell apart.

It was because of this event that I decided to become a fully licensed financial planner. I made it my mission to try and protect as many people as possible; to educate them and help them with their financial needs. I have been working as a financial planner for over 20 years now and I see part of my role, for which I am unapologetic for, is to try and remove people from our profession that are, in my opinion, doing that wrong thing.

Even now, I find myself currently dealing with mortgage brokers and ex-financial planners who think it is ok to either provide advice when they are not qualified and/ or licenced to do so or they are setting

up schemes to either defraud the ATO or someone else. It never ends.

So, who can you trust and talk to when it comes to your money and needing advice?

In Australia, financial planning is governed by strict regulations designed to protect consumers. However, just like anywhere, there are still important steps to take to ensure you’re working with someone you can trust. Here’s how you can go about finding a trustworthy financial planner and making sure their advice is in your best interests.

1. Understand the Regulatory Framework in Australia

• Australian Securities and Investments Commission (ASIC): ASIC regulates financial planners in Australia and ensures that they adhere to the legal requirements of the industry. You can check the ASIC Financial Adviser Register to verify whether a financial advisor is licensed and check for any disciplinary action against them.

• Australian Financial Services (AFS) License: Anyone providing financial advice must hold an AFS license or be an authorized representative of an AFS license holder. This ensures they meet the standards for providing financial advice in Australia.

2. Check for Relevant Qualifications and Credentials

• Qualifications: Nearly all of the current financial planners have updated their qualifications in the past few years, For most, they will have a bachelor or post grad in financial planning.

• Financial Advice Association of Australia (FAAA) or Institute of Financial Professionals (IFPA): Look for advisors who are members of the FAAA or IFPA, as they adhere to the association's code of ethics and ongoing professional development requirements. Note: it is not a requirement to belong to an association anymore so whilst this was a requirement to practice financial planning in the past it is no longer a requirement.

• Registered Tax (Financial) Adviser or Accountant: If you’re dealing with tax and investment strategies, you might want to look for an adviser with this registration, ensuring they’re qualified to give advice on tax issues. As an example, I am both a financial planner and an accountant. There are not many people in Australia who are both.

• Best Interest Duty: Since 2013, Australian financial advisers have been legally required to act in their clients' best interests under the Corporations Act. This means they must prioritize your needs over their own financial interests. The “best interest duty” requires financial advisers to act with care, skill, and diligence.

• Fiduciary Duty: Some advisers might have a fiduciary duty (i.e., they must act in your best interest) while others may not. Financial planners who are fiduciaries are required to disclose any conflicts of interest and provide clear, unbiased advice. While the legal duty to act in your best interest is broad, it’s still important to ask upfront whether they have a fiduciary obligation and how they’re compensated.

• Fee-for-service (fee-only): Advisors who charge a fixed fee or an hourly rate are typically considered to be more transparent and less likely to have conflicts of interest. This means they don’t earn commissions from the financial products they recommend.

• Commission-based: Some advisers earn commissions from recommending specific products, such as insurance or investment products. It is important to understand why they receive commissions and how this might have an impact on the advice provided. For instance, we only receive commissions for personal insurance advice because people are reluctant to pay large fees to get advice in this area especially if they are unsure if they will obtain the insurance cover to begin with.

Important Tip: Since 2019, Australian financial advisers are required to disclose all fees upfront, which has helped reduce conflicts of interest. Still, always ask for a Statement of Advice (SOA), which outlines their recommendations and the cost of those services.

• ASIC Financial Adviser Register: You can verify if an adviser is properly licensed by checking the ASIC Financial Adviser Register. It provides details of advisers’ qualifications, history, and whether they've faced any disciplinary action.

• FAAA’s Adviser Search: The Financial Advice Association of Australia has an online Adviser Search tool, where

• you can find members who meet professional standards, including compliance with the FAAA's Code of Ethics.

• Google Reviews, Testimonials, and Word of Mouth: It can be helpful to search for reviews online or ask friends, family, or colleagues if they’ve worked with a particular adviser. Personal referrals can help you feel more confident in your choice.

• Awards. Some advisors have won awards. Whilst this is not a true indication of trustworthiness, it is good to know that they are contributing to their profession or are known by their peers.

Here are some key questions to ask when choosing a financial planner:

• Do you have a best interest duty?

• How are you compensated (fees, commissions, or both)?

• How much do you charge and are you on the higher or lower end when it comes to fees compared to other advisors?

• Can you explain the reasons behind your advice?

• What are your qualifications and experience?

• How often will we meet to review my financial plan?

• Can you provide a detailed Statement of Advice (SOA)?

7. Evaluate Their Communication and Transparency

• Clear Communication: A trustworthy financial planner should explain things in a way that is clear and understandable. If you don’t understand their recommendations or they use jargon, that’s a red flag.

• Transparency: Make sure the adviser is open about any potential conflicts of interest, fees, and commissions. They should be willing to provide a detailed breakdown of their costs and explain the reasons behind their recommendations.

Get

If you’re ever unsure about an adviser’s recommendations, don’t hesitate to seek a second opinion from another licensed professional. This helps ensure that you’re not missing out on better options or falling victim to bad advice.

9. Look for Long-Term Relationship Compatibility

Financial planning is not a one-off task; it’s an ongoing relationship. Make sure that you feel comfortable with the

adviser and that they take the time to understand your unique financial goals. Choose someone who listens and gives you advice tailored to your situation, rather than offering generic solutions.

• High-pressure tactics: If an adviser is pushing you into a decision or pressuring you to sign something immediately, that’s a red flag.

• Unexplained fees or commissions: If they’re not transparent about how they earn money or can’t clearly explain the fees involved, walk away.

• Unclear advice or evasiveness: If the adviser is evasive when explaining how their advice benefits you or how their fees are structured, that’s a sign to be cautious.

Finding a trustworthy financial planner in Australia requires some effort, but it’s worth it for your financial peace of mind. By making sure they have the right qualifications, adhere to ethical standards, and are transparent about their fees, you can build a relationship based on trust. Don’t rush the process—take the time to find an adviser who aligns with your values, understands your goals, and has the skills to help you achieve them.

Do you have any specific questions about finding a financial planner in Australia, or are you navigating a particular financial situation you need advice on? If so, consider giving Find Wealth and Find Retirement a call on 1300 88 38 30

Warren Strybosch

1300 88 38 30 |warren@findwealth.com.au www.findwealth.com.au

Financial Planning is offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth & Find Retirement.

Wealth is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221).Part of the Centrepoint Alliancegroup https://www. centrepointalliance.com.au/

Warren Strybosch is Authorised representative (No. 468091) of Alliance Wealth Pty Ltd. Services offered are superannuation, retirement planning and aged care advice.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

By Warren Strybosch

In Australia, most people who earn an income need to submit a tax return, but the specifics depend on your income, situation, and other factors. Here’s an overview of who typically needs to file:

1. You Earn Above the Tax-Free Threshold

• The tax-free threshold in Australia is $18,200 (as of the 2023-24 financial year). If your income exceeds this amount, you'll need to file a tax return. This includes wages, salaries, business income, investments, etc.

• If you earn $18,200 or less, and you have no other taxable income, you may not need to file. However, in most cased, even if you do earn under the threshold the ATO requires you to submit a return even if you believe it is not necessary. Also, you might still want to, to claim any tax withheld or get a refund that might be owing to you.

2. Self-Employed or Business Owners

• If you’re self-employed, a freelancer, or run a business (whether full-time or part-time), you must submit a tax return, even if your income is below the threshold.

• You’ll need to report your income and expenses, and you might be subject to Goods and Services Tax (GST) if you earn over $75,000 per year.

• If you receive income from investments, such as interest, dividends, or rental income, you may need to file, regardless of whether you’re employed. This income is taxable, and you’ll need to report it.

• If you’re a resident for tax purposes and earn income from overseas, you must declare this income in your Australian tax return, even if tax has already been paid in another country.

• If your employer has withheld tax from your wages, you need to file a return to settle your final tax liability. Often, this will result in a refund if too much tax was withheld.

• Similarly, if you have had PAYG (Pay As You Go) withholding or other tax taken from government payments (like pensions or unemployment benefits), you might need to submit a return.

• If you want to claim deductions (e.g., work-related expenses, education costs, donations to charity), you need to file a tax return to do so.

• Similarly, to claim tax offsets like the Low Income Tax Offset (LITO), Senior Australians Tax Offset (SATO), or the Family Tax Benefit, a return is required.

• If you rent out property or receive income from renting assets (like a car or equipment), you need to file a return, even if your total income is below the threshold.

• If you have assets overseas or income from outside Australia, you need to declare these. Australia has strict rules on foreign income, and failing to declare it can lead to penalties.

• If you receive government payments from Centrelink (e.g., the JobSeeker Payment, Parenting Payment), you may need to lodge a tax return, especially if your total income exceeds the taxfree threshold or if your payments include taxable components.

• Students and Part-Time Workers: Even if you’re a student or working part-time, you may need to submit a tax return if your income exceeds $18,200, or if you’ve had tax withheld and are eligible for a refund.

• Retirees and Pensions: Retired individuals who receive a pension or income from superannuation may need to submit a return depending on their income level. Often retirees have the misconception that if they are in receipt of the Age Pension or are fully retired and over the age of 67 and do not earn more than the tax-free threshold that they are not required to submit a return. This may be incorrect and not doing so might require the estate to lodge several returns when you pass away causing unwanted issues for the executors.

• Even if your income is below the threshold, you might still want to file to claim any refunds or offsets. The Australian Tax Office (ATO) may also pre-fill some of your information, so filing can be easier than expected.

• The Australian financial year runs from July 1 to June 30, and tax returns are generally due by October 31. If you’re using a tax agent, you can file later, usually 15th of May the following calendar year, but you’ll need to sign up with one before the October deadline.

In short, it is better to simply submit your return and keep everything up to date.

By Kathryn Messenger

Your skin is not just the shell to your body, it’s actually an organ, and whilst topical creams, lotions and balms all have their place, if the issue is due to the relationship between your skin and other organs, the topical treatment will likely fall short.

Whilst hormones are usually the first place most people look, I actually find looking to the liver can be most helpful. The relationship between the liver and the skin is strong as the major role of the liver is in detoxification, and if the liver is unable to preform this task well, it’s often the skin that suffers as the body attempts to detoxify via the skin.

But detoxification is not the only role of the liver, it also metabolises hormones. This means that there are 2 pathways by which the liver is involved: detoxification and hormones. Usually minor liver dysfunction is evident before puberty, however the change in hormones brought about by the onset of puberty can make this more obvious through symptoms like headaches, fatigue and sluggish digestion. Since the liver is primarily a digestive organ, working closely with the bowels, if constipation or food allergies are present, the toxic load of the liver can increase.

As expected, hormones also play a large part in acne, as high androgens (oestrogen and testosterone) can cause the skin to become more oily which can block the skin pores.

Stress is also involved, due to increased production the hormone cortisol with high stress. This is helpful in the short-term, but long-term high cortisol leads to inflammation.

If acne is already a problem for you, stress will likely exacerbate it with increased inflammation of the skin.

Sugar also plays an important role in the inflammatory process, as the energy high, followed by the low will also increase cortisol and lead to inflammation, along with further inflammation when the sugar is metabolised by the liver.

So, as you can see, there are a lot of factors at play, but here are some recommendations to improve acne:

• Reduce sugar intake, and include whole foods (such as fruit and vegetables)

• Reduce alcohol and processed foods

• Increase water intake to assist your body in detoxification

• Eat bitter leafy greens (rocket, dandelion greens) and cruciferous vegetables

• (broccoli, cauliflower, brussels sprouts)

• Reduce life stressors that you are able to.

If you need further support, natural medicines can help with improving liver function, regulating the nervous system response to stress and balancing hormones.

Kathryn Messenger

Rachael Hammond is a talented illustrator, artist, and graphic designer based in Melbourne with over 20 years of experience. She specializes in various media, including digital illustration, watercolour, coloured pencil, and graphite. Her work predominantly features themes of wildlife, botanical subjects, and natural history.

Rachael conducts life drawing workshops and courses, including those at Melbourne Art Class, where she teaches techniques in children’s illustration and other creative disciplines. Her classes often focus on both beginners and experienced artists who wish to refine their skills in depicting the human figure or other subjects in a dynamic and expressive way.

The Yarrunga Crafters are part of the vibrant community at Yarrunga Community Centre in Croydon Hills, offering creative activities for individuals interested in crafts and hands-on projects. These workshops and sessions, which are part of the broader range of programs at Yarrunga, foster creativity while providing an opportunity for social interaction and skillbuilding.

In 2025, the centre is expected to continue hosting a variety of programs like art and craft workshops, alongside other health and wellbeing, educational, and social groups. These initiatives aim to cater to the diverse needs of the local community, with a particular focus on accessible and inclusive offerings.

Simon & Garfunkel are the most well-known and beloved folk/rock duo of all time.

The combination of Simon’s poetic lyrics and stunning melodies with Garfunkel’s soaring tenor, and their perfectly blended, intricate harmonies, provided the perfect platform for some of the most memorable songs of all time. And yet, while their music was transcendent, their relationship was fractured and complicated. Like Lennon and McCartney, though musically complementary their differences caused impossible friction, and they parted ways in the early 1970’s. Love of their music, however, never abated. Despite successful solo careers, their reunion concerts and tours together have proven iconic, drawing millions of listeners from across generations. Music Legends: The Simon & Garfunkel Story celebrates the entire career of Simon & Garfunkel, their years together, their time apart, and their many reunions. From the team that brought you The Billy Joel Story, The Troubadours and The Paul McCartney Story, comes a thrilling 2-act celebration of some of the best songs ever written. Performed live by the Music Legends band, this promises to be an incredibly joyful show, not to be missed!

Superhero Sunday is a fun, family-friendly event held by various organizations, often focusing on raising awareness for specific causes while also celebrating superhero culture. A notable example is the one held at Rockford First in Illinois, which supports families with children who have special needs. During the event, participants dress up as superheroes, engage in various activities such as obstacle courses, and partake in special celebrations like a dance performance and a parade. The event's goal is to honor children and adults with special needs, showing them they are champions in their own right. A key part of the celebration includes surprise visits from costumed characters like Spiderman and Batman, making it an unforgettable experience.

Additionally, many churches and communities use Superhero Sunday as an opportunity to teach children about moral heroes, drawing parallels between fictional superheroes and real-life figures, especially Jesus, who is often portrayed as a problem-solving, fearless, and immortal hero .

Yarrunga Writers is a creative group based at Yarrunga Community Centre, designed for individuals who enjoy writing and wish to enhance their writing skills. The group provides a welcoming space to share and develop writing through fun and stimulating activities. It meets weekly on Mondays from 1 PM to 3 PM, with an annual fee of $125. This program is part of the broader offerings at the centre, which also includes a variety of community and educational activities.

Pottery workshops focused on creating personalized mugs are a fun, creative way to unwind while learning new skills. These classes often emphasize hand-building techniques, allowing participants to mold and shape clay into their desired form. Not only can you craft a functional item, but you also have the chance to decorate it with custom designs, such as colors, patterns, or text.

Instructors typically offer guidance to ensure your piece turns out just the way you imagine, whether it's a colorful marble effect or a unique handle design. The experience is highly social and interactive, making it perfect for groups or solo artists alike. Many of these studios provide the opportunity to leave your work for firing and glazing, turning your handmade creation into a polished piece ready for daily use.

Creating your own personalized mug through pottery workshops is a fun and fulfilling experience. Several studios offer unique opportunities for you to get hands-on in crafting a custom ceramic mug. For instance, workshops like the ones offered by Chisel Pottery let participants learn techniques like slipcasting, decorating with splatter techniques, and crafting a handle to complete their piece. These sessions typically last around 2.5–3 hours, and you'll get to take home a mug that’s uniquely yours after it's fired and glazed.

What do you think of when you hear the words “synchronised swimming” or “artistic swimming”?

Maybe it’s the glitz and glam of water ballet shows in Old Hollywood films. Or it’s the incredible athleticism and strength displayed at the Olympics every four years.

The reality for many artistic swimmers participating recreationally is somewhere in the middle. We have fun and do displays at community events, but we also work hard and challenge ourselves every session to be stronger and more graceful in the water.

Artistic swimming, previously called synchronised swimming on

Artistic swimming specific land exercises that translate to improved performance in the water. Become strong and flexible!

Swimmers can then join our recreational Showcase routine or Competition routines depending on their own personal goals and available time.

Eastern Sirens, a club located in Melbourne’s eastern suburbs, believes in the physical and psychological improvements that can be experienced from participating in artistic swimming. As an aquatic sport, swimmers use every muscle each session while controlling their bodies as they go upside down (without touching the bottom of the pool). It’s a fantastic team sport that promotes camaraderie and wellbeing.

It’s not just us, a study looking at cognitive function in middleaged and older adults who regularly engaged in artistic swimming activities found that it provided beneficial effects on cognitive function after participation for one year. Artistic swimming provides all the benefits of regular swimming, with the additional fun aspect of being able to participate with music and learn choreography.

One of our adult swimmers describes her experience in the sport as a “whirlwind of learning, challenging my body and meeting incredible people.

the world stage, has always balanced performance with strength by making the incredibly difficult look easy. The sport has been steadily growing in its presence and appeal across Melbourne. Since the Paris 2024 Olympics, men have been allowed to compete in the sport at the highest level and there are even a few boys and men who have taken up the challenge here in Melbourne already!

The sport is perfect for both children and adults due to its nature as a low impact sport enjoyed in the water. It’s easy on joints and can be enjoyed for life.

We run base classes for all swimmers, regardless of skill level, to build their capabilities.

We do swimming for warm up and conditioning, followed by artistic swimming skills like treading water and going upside down. This is a technical class where we work on and refine our basic skills.

The mix of the three is what I love the most about this sport.”

The first artistic swimming competitions were for men, before it transitioned to a female dominated sport. Artistic swimming has a long history worldwide, with an Australian, Annette Kellermann, popularising the sport by appearing in several aquatic movies in the early 1900s. We are at a point in time where the sport will continue to develop and grow as more people get a chance to experience the absolute thrill of being able to dance and move throughout the water with ease.

Learn a new way to swim – join a free trial class and experience it for yourself.

Free trial classes are available throughout the year at Eastern Sirens located at Aquanation, Ringwood. If you are comfortable in the water and would like to have a go, please visit our website www.easternsirenssynchro.com.au

Not sure about getting in the pool yourself yet? Our annual showcase is coming up on March 23rd from 2pm at Aquanation, Ringwood. Free spectator entry to watch!

On the 23rd of January Ringwood U3A kicked off its Welcome Day with smiles, enthusiasm, and a wonderful sense of community. Held at the Norwood Football club rooms (one of our sites) the event brought together new members eager to explore what U3A has to offer and current members reconnecting after the Summer break. The atmosphere was lively as attendees mingled, shared stories, and learned about the wonderful opportunities that U3A provides for lifelong learning and friendship.

We welcomed two of our local Councillors, Linda Hancock (Wonga Ward) and Nathaniel Henderson (McAlpin Ward) who made themselves available to our members to discuss local matters in an informal setting. Their presence underscored the importance of continued learning and the value of staying connected to our community.

Many of our volunteer tutors were on hand to welcome new and current members. There were a number of new members who enrolled in another class after chatting to the tutors or current members.

Whether you are looking to pick up a new skill, make friends, or simply enjoy the journey of lifelong learning, U3A has something for you.

Ringwood U3A can be contact via u3aringwood.org.au or email info@u3aringwood.org.au or phone 0481 221 576

Pres: Wayne Makin V/Pres: Ian Young

Alistair McInnes Tres: Dianne Cowling

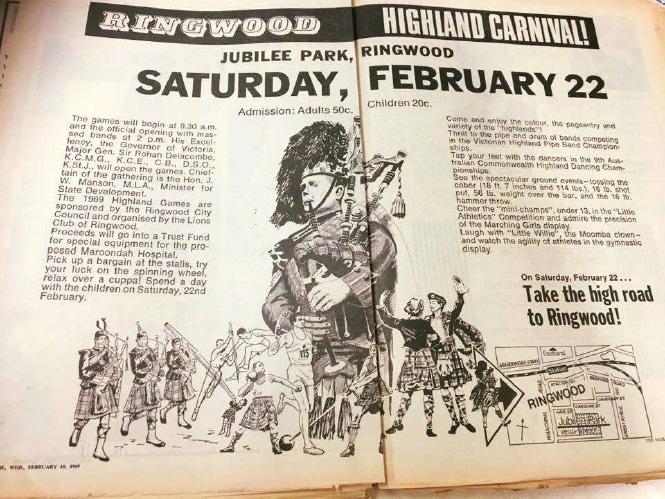

The Melbourne Highland Games & Celtic Festival is back on Sunday 23 March 2025 from 9am to 5pm at Eastfield Park, 119 Eastfield rd, Croydon,Victoria. For tickets and details see: www.melbournehighlandgames.org.au

The Melbourne Highland Games and Celtic Festival has hosted this event in Melbourne for over fifty years. It is one of the highlights of the Scottish Australian calendar and is considered the number one multicultural festival in the City of Maroondah and greater Melbourne.

This day-long celebration of Scottish/Celtic culture and heritage, held annually at Eastfield Park, Eastfield Rd in Croydon Victoria, echoes the original games that took place centuries ago in Scotland during the reign of King Malcolm III.

This multicultural inclusive event that includes wonderful music and competitions in dancing and pipe bands and world-class athletic competitions is a must-see outing for everyone. We strive to provide the best of Celtic culture on public display.

This year’s event on Sunday, 23rd of March 2025 will be our first truly international Games, in partnership with Events Victoria, the International Highland Games Federation (IHGF) and hosted by Australia’s Highland Muscle bringing up to sixty Athletes and officials from Australia, North America, United Kingdom, Europe and Japan to compete in a traditional Scottish Heavy Games Competition.

Another addition to this Grassroots event will be in the Opening Ceremony with a Traditional “Scottish Clan Role Call” and a Welcome to Country by Wurundjeri Elder Wandin followed by the Smoking Ceremony drawing strength from the Land for our Scots Warriors, spectators and indigenous peoples in attendance.

Making this an amazing event, not to be missed, showcasing the best of Scottish/Celtic Culture and Heritage, providing a history of the Clan's family-based values and the diversity of Australian society.

With an expected 7,000 attendees the festival plays a pivotal role in preserving Scottish and Celtic traditions among the Victorian diaspora and fostering connections to ancestral roots for younger generations.

Our Festival is supported by locals and travellers from all over Australia and the world, with International athletes and their entourage attending to compete in the IHGF Championship Competition in the World Hammer Throwing & World Weight for Distance Championships, sponsored by and including the Australian contingent of the Highland Muscle Organisation whose members come from all over Australia.

After nearly 60 consecutive years of staging these Games, we are very excited about this year which will be a truly international event. It will include, for the first time an international film crew targeting overseas audiences. The Film Crew will be here for the week leading up to the Games filming Maroondah, the Yarra Valley, the surrounding districts and places of interest. For further information; see our Web Site: https://melbournehighlandgames.org.au/whats-on/

With an expected 7,000 attendees the festival plays a pivotal role in preserving Scottish and Celtic traditions among the Victorian diaspora and fostering connections to ancestral roots for younger generations.

After nearly 60 consecutive years of staging these Games, we are very excited about this year which will be a truly international event. It will include, for the first time an international film crew targeting overseas audiences. The Film Crew will be here for the week leading up to the Games filming Maroondah, the Yarra Valley, the surrounding districts and places of interest.

By Warren Strybosch

At Find Retirement, we love helping people with their retirement needs. It is an exciting chapter in many people’s lives as they move from full-time work to spending more time with grandkids, travelling, playing a sport they love e.g., golf or lawn bowls, or simply having more time to work on that hobby or interest that has been sitting on the shelf for way to long.

Most often people decide to retire around the end of each financial year which is now only five months away. Can you believe January has already flown by? As such, we thought it would be timely to get those of you who are considering retirement this coming year to consider some important factors to ensure a smooth transition into your retirement years. Here’s a list of things to think about:

1. Retirement Goals & Lifestyle

• What kind of lifestyle do you want? Consider your desired activities, travel plans,hobbies,or where you want to live.

• Do you want to downsize? Many people opt to sell their homes and move to a smaller, more affordable place or relocate to a different area, perhaps even abroad.

• How will you spend your time? Having a plan for how to stay mentally and physically active can make a huge difference in post-retirement satisfaction.

• How much money do you need to live comfortably? Make sure you’ve estimated your monthly and annual living expenses in retirement, accounting for things like housing, healthcare, food, travel, and entertainment.

• Are your retirement savings enough? This includes superannuation, investment properties, shares, or other investments. Ensure they’re aligned with your estimated retirement income needs.

• Have you accounted for inflation? Over time, the cost of goods and services will likely rise. Your plan should factor in potential increases in prices over the next 20-30 years.

• When should you start claiming Social Security? For many people you will

to consider before you do.

pension when you reach age 67 and this is subject to the amount of assets you own (not including the house). For others, it may be years before you can claim the age pension, if at all, until your assets fall below the upper threshold asset test.

• Do you have an allocated pension (from your own superannuation monies)? If so, understand when you can start collecting and how much you’ll receive.

• Will your spouse's benefits impact yours? If married, coordinating Social Security and pension benefits with your spouse can increase your lifetime income.

• What’s your plan for healthcare? Should you continue to pay for private health care? The costs can be quite prohibitive but for some people who have acute health care needs, cancelling this type of insurance may not be an option.

• How will you handle long-term care costs? Nursing homes, assisted living, or in-home care can be expensive. Plan ahead for how you'll cover these potential costs. Giving money to your children is not always the wisest move given you might need to pay a refundable accommodation deposit (RAD) in the future.

• Are you prepared for out-of-pocket costs? Even with Medicare, there are deductibles, premiums, and co-pays. Plan for these potential gaps.

• Should you continue to pay life insurance premiums? If you have no debt and a suitable amount of assets in retirement, you should consider whether to continue paying high premiums or use these funds to help cover future lifestyle expenses.

• How will taxes impact your retirement income? Understand how withdrawals from pension accounts will be taxed.

• Will you need to submit a tax return? If you earn $1 of income from nontax-free sources you may need to submit a tax return, even if no tax is payable. Don’t leave it up to your estate to have to prepare lots of returns on your behalf.

• Have you paid off high-interest debt? Ideally, you should try to pay off as much debt as possible before retirement, especially credit cards or other high-interest loans.

• Do you have a mortgage? Consider whether you want to pay off your mortgage before retiring or if you’re comfortable carrying it into retirement.

• Are there any other financial obligations? Things like student loans, personal loans, or family support might need to be factored into your retirement budget.

• How should you adjust your investment portfolio as you approach retirement? Consider shifting your portfolio from high-risk assets (like stocks) to more stable investments (like fixed interest ETFs) to reduce the risk of major losses.

• Understand your withdrawal obligations? Most people do not realise you have to withdrawal minimum amounts from your pension account. As you get older this amount increases over time.

• How much risk are you comfortable taking? Think about your tolerance for market volatility and whether you're okay with potential ups and downs in your investment value.

• Do you have an emergency fund? Ideally, this should be separate from your retirement savings. Having 3-6 months’ worth of living expenses set aside can give you peace of mind in case of unforeseen circumstances (medical emergencies, unexpected repairs, etc.).

• Do you have an updated will or trust? Make sure your will or trust is in place to specify how your assets should be distributed.

• Have you chosen a power of attorney and healthcare proxy? These documents ensure someone you trust can make medical or financial decisions on your behalf if you're incapacitated.

• What are your estate tax implications? Some estate planning may be necessary to minimize taxes for your heirs, particularly if you have a larger estate.

• Do you want to keep working parttime? Many retirees enjoy working part-time or consulting to stay active and generate income.

• Are you interested in volunteering? Giving back to the community can provide a sense of purpose and fulfillment post-retirement. If any of you love writing articles then talk to me

about the Find Foundation (yes, that was cheeky place that in here).

11. Mental and Emotional Readiness

• Are you emotionally prepared for retirement? Transitioning from a work identity to retirement can be challenging. Think about how you’ll stay socially engaged and mentally stimulated. Males find it harder to transition from work to retirement because work has been their whole life. Having a network of friends who are also moving into retirement or having specific goals can help with the transition.

• What will your daily routine look like? Having a structured daily routine can help avoid the potential feeling of boredom or loss of purpose.

12. Review and Adjust Your Plan

• Do you have a retirement plan in place? Regularly review your retirement plan to ensure it’s still on track, especially if you experience major life changes (e.g., health issues, job changes, or changes in the economy).

• Are you prepared to adjust your lifestyle if needed? Flexibility is key. Economic changes, healthcare costs, or other factors may require you to adjust your plans in retirement.

13. Legacy and Giving Back

• What kind of legacy do you want to leave? Think about charitable

Here are the steps involved:

1. Email to returns@findaccountant.com.au requesting your PAYG return to be completed. Provide us with your full name, D.O.B and address

2. A Tax engagement letter will be emailed to you for signing via your mobile (no printing or scanning required).

3. You will be then sent a tax checklist to complete online. Takes less than 5 minutes.

4. We will then require you to upload your documents to our secure portal.

5. Once we have received all your documentation, we will complete the return.

6. We will email you the completed return with our invoices. Once you sign the return and pay the invoice we will lodge the return on your behalf.

contributions, setting up college funds for grandchildren, or passing down values to your family.

• Do you want to leave something for your heirs? If so, make sure your estate plan reflects these wishes.

Taking the time to consider these factors well before retirement can lead to a smoother, more secure transition, and a more enjoyable retirement overall. Do any of these stand out to you as areas you’re still unsure about or need more info on?

At Find Retirement, we would love to help you on your retirement journey. Give us a call on 1300 88 38 30 or email warren@ findretirement.com.au and book in a time to discuss your retirement needs.

This information is current as at August 2022. This article is intended to provide general information only and has been prepared without taking into account any particular person’s objectives, financial situation or needs (‘circumstances’). Before acting on such information, you should consider its appropriateness, taking into account your circumstances and obtain your own independent financial, legal or tax advice. You should read the relevant Product Disclosure Statement (PDS) before making any decision about a product. While all care has been taken to ensure the information is accurate and reliable, to the maximum extent the law permits, Alliance Wealth and its related bodies corporate, or each of their directors,officers,employees,contractors or agents, will not assume liability to any person for any error or omission in this material however caused, nor be responsible for any loss or damage suffered, sustained or incurred by any person who either does, or omits to do, anything in reliance on the information contained herein.

Contact them on 1300 88 38 30 info@findretirement.com.au | www.findretirement.com.au

We have made it cheaper and easier for you to get your returns completed & you can do it all from the comfort of your own home.

Here are the steps involved:

1. Email to info@findaccountant.com.au requesting your PAYG return to be completed. Provide us with your full name, D.O.B and address

2. A Tax engagement letter will be emailed to you for signing via your mobile (no printing or scanning required).

3. You will be then sent a tax checklist to complete online. Takes less than 5 minutes.

4. We will then require you to upload your documents to our secure portal.

5. Once we have received all your documentation, we will complete the return.

PROFESSIONAL SERVICES

• Architect ------------------------------ 00

• Find Accountant ----------------- 34

• Financial Planning ------------- 36

• Find Insurance -------------------- 35

• Bookkeeping ---------------------- 00

6. We will email you the completed return with our invoices. Once you sign the return and pay the invoice we will lodge the return on your behalf. Email your artwork to editor@findmaroondah.com.au If you wish us to create your ad, we will do this for a minimal cost. Go to www.findmaroondah.com.au/graphic-design to upload your details and we will create this for you.

• Editor|Copywriter --------------- 00

• General Insurance ------------- 35

• Life Coach --------------------------- 36

• Mortgage Brokering ----------- 36

• Signages ------------------------------ 00

• Solicitor/Lawyer ------------------ 35

If you have any questions, contact the editor on 1300 88 38 30 or Email warren@findmaroondah.com.au

*Available until your category is taken when a Tradie joins the Find Network Team.

At Find we can help you find the ‘right’ personal insurance. Our aim is to help you obtain and retain the personal insurances that are appropriate for you and at cost that you can afford.

Personal Insurances Include:

• Income Protection (IP)

• Life Insurances or Death Cover

• Total and Permanent Disability (TPD)

• Business Expense Cover

• Child Trauma Cover

When your insurance are in place, our services do not stop there. We will provide you with an after care service that includes policy notifications, insurance report, help desk, reviews and help at claim time. We provide ourselves in providing honest advice that you can rely on.

warren@findinsurance.com.au

www.findinsurance.com.au

• Coffee Machine Machine -- 00

• Garage Doors ---------------------- 00

• Builder ----------------------------------- 00

• Electrician ----------------------------- 00

• Painter ----------------------------------- 00

• Plasterer -------------------------------- 00

• Property Maintenance ------- 00

88 38 30

Help our local kids in our local hospitals – Fundraising Event

Join us at the finish line celebration at Eastland as we cheer on Emma-Rose and the incredible team running to raise vital funds for children's care at Eastern Health.

No pre-learning required - A comprehensive first aid course.

Suitable for both people in workplaces and members of the public who would like a comprehensive first aid course.

The duration of this course is 8.5 hours face-to-face training in small groups with strict infection control practices, consists of a mixture of practical exercises and video.

Discover more

Start your engines and fuel your F1® fever at Eastland! Experience the adrenaline of high-speed thrills as the FORMULA 1 LOUIS VUITTON AUSTRALIAN GRAND PRIX 2025 roars into Melbourne!

Before the race hits the track, make Eastland your fi rst pit stop to kick off the excitement with a special Formula 1® experience.

Forget mini golf as you know it. The Holey Moley Open is ready to crown legends.

200 teams. 9 holes. $20K on the line. Got the balls? Rally your crew of 4, crush the State Champs, and earn your spot at the epic grand finale feat. mini golf, max vibes.

Bragging rights last forever. Entries? Not so much. Enter now.

PROFESSIONAL

• Lactation Consultant ----------- 39

• Swen Pouches ---------------------- 40

• Hair Dresser --------------------------- 00

• Chiropractor ------------------------- 00

• Beauty Therapy -------------------- 00

• Gym --------------------------------------- 00

• Massage Therapy ---------------- 00

Osteopathy in Australia is a government registered, allied health profession. Osteopaths focus on improving the function of the neuro-musculoskeletal system (bones, muscles, nerves and connective tissues) to optimise health and well-being.

Joanna is highly qualified and experienced in the osteopathic assessment and treatment of babies and infants.

She can assist with the following assessments:

• Gross motor development (milestones)

• Primitive reflexes

• Tongue function and it’s relation to sucking skills

• Biomechanics of the jaw and mouth

IBCLC lactation consultants are recognised around the world as the experts in lactation care. They provide evidencebased knowledge to assist mothers to establish and maintain breastfeeding. As professionals, they are charged with promoting, protecting and supporting breastfeeding. Joanna can help with a broad range of lactation consulting services, including:

• Teaching a new mum how to hold and position her baby to breastfeed

• Assess the suck, swallow and breathing of an infant

• Assess for tongue function and determine any evidence of restriction (tongue tie)

• Pre and post-frenectomy breastfeeding support

• Help increase or decrease milk supply

In-Kind Sponsorship with Find Maroondah Community Paper

We invite a representative from each sporting club to submit team selections, results and any interesting stories relating to your club/sports.

Round 10! Let’s get around our girls tonight! Only a couple games left for summer season.

Welcome to Norwood, Josh Beven!

We’re thrilled to have Josh join Norwood FNC, coming to us from Park Orchards and Hurstbridge.

Welcome Josh Holmes

We’re pleased to welcome Josh Holmes to the Norwood FNC. Josh played his juniors at Nth Ringwood and was part of the East Ringwood U19s last season. A talented young player and great addition to the squad, we’re looking forward to seeing Josh this year.

Welcome and good luck Josh.

At 21 years old, Josh is ready to peak as a senior player.

A smooth-moving midfielder with a great kick and excellent decision making, he’s set to make a real impact on the field.

Please join us in welcoming Josh to the Norwood family!

Our trivia night is back on the 15th February.

$15 entry pp, tables of 8, bring your own nibbles all for the chance to take home the cash prize for the winning table!

Speak to PT, Ben Barnard or Gav Doherty at the club to book your table.

Tomorrow Night at the nest we have the Vets T20 Vs Bayswater Park.

Bar will be open with a BBQ on. Bring your friends and family down to enjoy a great night's entertainment.

Vale Kevin Nelson

It is with great sadness of the Eastfield Cricket Club family. Kevin Nelson, a cherished member of the Eastfield Cricket Club family. Kevin’s legacy lives on through his sons, Mark and Wayne, both life members of the club, and his sons Darren, who captained our 3rd XI with pride . Our thoughts are with the Nelsons family during this difficult time. Kevin’s memory will forever be part of our Eastfield cricket history. Rest in peace. .

Simply upload your ad at www.findmaroondah.com.au/nfp-free-advertising or you can email the ad to the editor@findmaroondah.com.au and we will do the rest for you.

Senior

Karen

NextGen

Worship

Transform

Community

Children's