April 2023 fintechmagazine.com

BANKING: RISE OF THE SUPER APP

BANKING: RISE OF THE SUPER APP

TRANSITIONING TO RENEWABLE ENERGY

TRANSITIONING TO RENEWABLE ENERGY

E-WALLET EVOLUTION

E-WALLET EVOLUTION

April 2023 fintechmagazine.com

BANKING: RISE OF THE SUPER APP

BANKING: RISE OF THE SUPER APP

TRANSITIONING TO RENEWABLE ENERGY

TRANSITIONING TO RENEWABLE ENERGY

E-WALLET EVOLUTION

E-WALLET EVOLUTION

As the financial markets become increasingly digitised and regulated, financial inclusion has never been more relevant

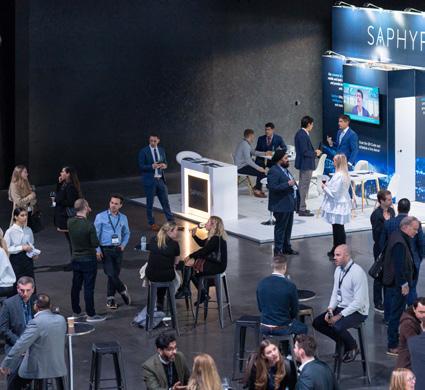

We produce Digital Content for Digital People across 20+ Global Brands, reaching over 15M Executives

Digital Magazines

Websites

Newsletters

Industry Data & Demand Generation

Webinars: Creation & Promotion

White Papers & Research Reports

Lists: Top 10s & Top 100s

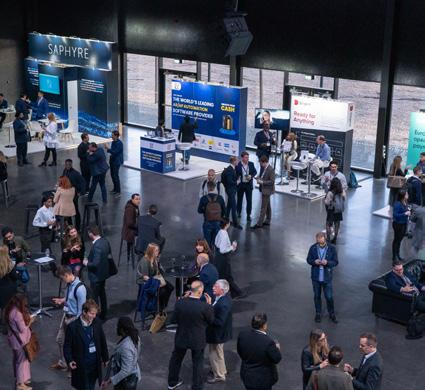

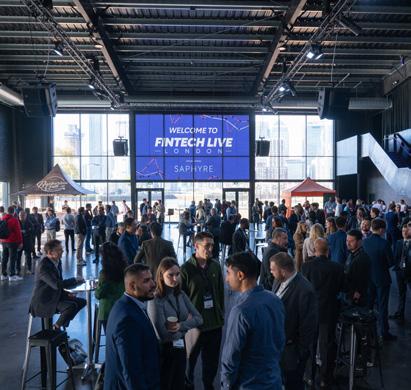

Events: Virtual & In-Person

Work with us

The fintech space is thriving, despite the challenges facing the global economy.

Over the past three years, blockchain has become a mainstream technology with numerous usecases. Equally, Open Banking has transformed the transactional space, with embedded finance and BNPL flourishing in a post-pandemic environment. This month, we’ve investigated the evolution of e-wallets, super apps, and the way regulation in digital currencies is impacting financial inclusion.

Change drives innovation and resilience. Although the current financial situation has been devastating in many respects, those companies that survive do so because they are robust enough to diversify, providing different products and services that are required.

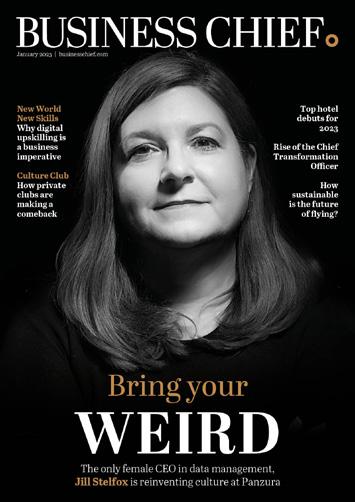

I have my own change to announce, as April is my last month as Editor-in-Chief of Fintech Magazine. I am handing over the reins to the highly capable-Alex Clere, who has been my most excellent wingman for the past 12 months.

Alex will no doubt bring a refreshing dimension to FinTech Magazine moving forward. Change is healthy and breeds creativity.

Thank you for all your support, and enjoy this month’s issue.

JOANNA ENGLANDjoanna.england@bizclikmedia.com

22

30 SONAE Universo, a different approach to banking

48 VOLANTE TECHNOLOGIES Driving cloud payments modernisation with VolanteTechnologies

70 ZURICH INSURANCE Zurich France: driving change in insurance risk resilience

Segmentation has never been this rewarding

Stop ransomware in its tracks.

Boost security performance with Akamai Guardicore Segmentation.

Learn more

Steve Winterfeld of Akamai discusses the company’s university-based founding and how it merged into a leading multibillion-dollar cybersecurity firm

Akamai was founded following a competition at the Massachusetts Institute of Technology (MIT), entered by its co-Founder and CEO Frank Thomson Leighton—Dr Tom Leighton. Since that time, the organisation has expanded massively, and in the words of Steve Winterfeld , Advisory CISO at Akamai, the company “continues to solve hard problems.”

The cybersecurity company plays a critical role for corporations as it focuses on the future, to determine whether threat motivation will change and how to best combat ransomware attacks, state-sponsored DDoS attacks, and ransomware that could turn into wiperware.

“Those are real concerns, and we’re keeping an eye out for those. And so we have probably 15 security capabilities backed up by services, responding to customers’ needs and rapidly growing on the edge compute and cloud side.”

“We started out with a web application, or as it is more commonly called now, web application and API protection, and expanded into protecting the infrastructure against DDoS to include the DNS infrastructure and recently added internal infrastructure protection and visibility through micro-segmentation,” explains Winterfeld.

As an established cybersecurity organisation, Akamai can now focus on what customers need.

Winterfeld explains that, in response to its clients’ feedback, the company has been acquiring the necessary assets and tools to fulfil those needs with the recent purchase of Guardicore. Guardicore’s leading microsegmentation products will be added to Akamai’s comprehensive portfolio of Zero Trust solutions to protect enterprises from damage caused by breaches like ransomware, while safeguarding the critical assets at the core of the network.

“We bought Linode, which is a cloud provider. And so now we have an integrated platform to build and perform on as well as secure.”

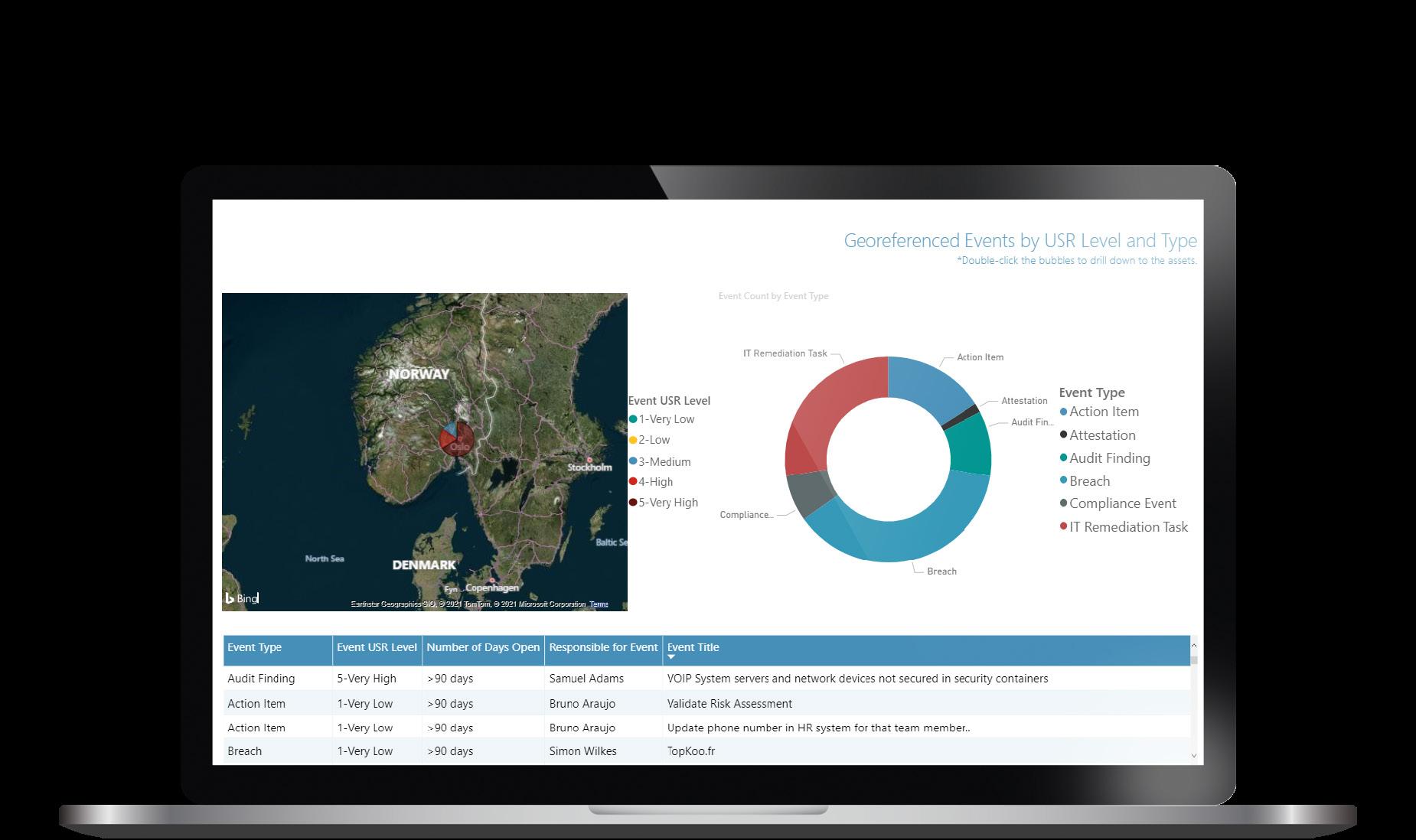

A prime example of Akamai’s ability to meet customer demands, particularly in high-risk environments, is its partnership with First Bank, which is “very concerned about its real-time visibility into its network. We’re partnering with them on a software-based microsegmentation, where they’re able to see those data flows and create segments.”

The entrance of Silicon Valley Bank’s headquarters in Santa Clara, California. The bank’s collapse, which unfolded over the course of just 48 hours, has sent shockwaves through the international banking community and briefly left account holders in a state of limbo. The favourite of tech startups faced a ‘hole’ in its finances, after rising interest rates impacted its investments in US government bonds and left it unable to honour customer withdrawals. New York’s Signature Bank has also collapsed, while Credit Suisse was left scrambling to secure funding before being rescued by rival UBS.

BY THE NUMBERS

What do you predict will be the most disruptive fintech trend in 2023?

READ MORE

27% OPEN BANKING

10% PEER-TO-PEER FINANCE

Southeast Asian fintech Aspire seals $100mn

READ MORE

51% AI SOLUTIONS

11% BLOCKCHAIN

Aspire, a Singapore-based fintech that provides financial services to businesses, has raised US$100mn as part of an oversubscribed Series C funding round.

READ MORE

Marqeta acquires card management platform Power Card issuing platform

Marqeta has agreed to acquire Power, a New York-based credit card programme management platform, in a US$223mn all-cash deal.

“We need to strike a balance between our energy transition goals and the ongoing welfare of citizens”

Mike Penrose Co-Founder and Partner FuturePlus

“For a cashless society to be truly successful, digital payments must be accessible and appealing to everyone”

Sahar Salama CEO and Founder TPAY Mobile

“Contactless payments become more popular, the finance industry must step up to the challenge”

Brad Hyett CEO, PHOS

Digital ecosystem fintech MNT-Halan has raised US$400mn in the biggest funding event in Egypt and the Middle East for the past 12 months. The money will be used to drive forward the company’s expansion strategy.

MNT-Halan, one of Egypt’s fastest-growing fintechs, received an investment of more than $200mn from Chimera Abu Dhabi in exchange for 20% of the company.

Additionally, MNT-Halan is in the advanced stages with leading international investors to raise $60mn of primary capital. Following the completion of these investments, MNT-Halan’s valuation will exceed $1bn.

MNT-Halan Founder and CEO, Mounir Nakhla, explains: “As one of the region’s premier and most progressive investors, Chimera Abu Dhabi brings a unique and dedicated understanding of our business. I am excited for what lies ahead as we continue to grow both organically and inorganically by offering cutting-edge financial products and services locally and internationally to empower the underserved.”

The affordable lending fintech, which stops consumers falling into the hands of high-cost and payday lenders, has secured a £40mn senior debt facility.

CUSHON

The workplace savings and pensions

fintech is celebrating after selling an 85% stake in the company to banking giant NatWest for £144mn.

There’s not much love for cryptocurrencies as public sentiment remains ‘slightly negative’, according to a tracking tool created by GBBC Digital Finance (GDF).

ZIP

The Australian BNPL fintech is reversing many of its international expansion plans, focusing on the domestic market in a push for profitability.

W A Y U P S W A Y D O W N S

APR23

In 1991, the UNEP Finance Initiative was launched when a group of banks partnered with UNEP (United Nations Environment Programme). The aim of the partnership was to promote better sustainability practices throughout the world and enhance the role of the global finance industry in that implementation.

Just 12 months later, the core aims and objectives of the UNEP Finance Initiative were reached. The group of commercial banks involved began to engage in an evangelisation programme that began to engage more banks and financial services institutions, VCs, agencies, and more in a conversation regarding financial sustainability.

As the dialogue and engagement increased, the UNEP Finance Initiative established three regulatory frameworks for financial institutions to work towards. They are: The Principles for Responsible Investment (PRI); The Principles for Responsible Banking (PRB); and the Principles for Sustainable Insurance (PSI).

By 2019, according to data from NatWast – a founding member of the UNEP Finance Initiative – a third of the world’s banks (197) had joined the Responsible Banking Initiative. Signatory banks have to commit to taking three key objectives to improve the impact of their services in a sustainable capacity.

By 2021, the sustainable banking sector had developed strong regulatory practices surrounding lending. In May of that year, the rules around SLLPs (SustainabilityLinked Loan Principles) were further tightened and clarified to reflect key performance indicators that would fully support the sustainable banking objectives and borrower performance.

The future of sustainable finance involves going mainstream, with banks of all sectors launching new products that support the sustainability agenda. Customers at a grassroots level will be given the opportunity to select, or opt out of, products that offer personalised suggestions regarding purchases made and their environmental impact.

Henrique Dubugras is the 27-year-old Brazilian billionaire whose startup, Brex, aims to redefine the corporate credit card

Henrique Dubugras was born in São Paulo, Brazil in 1995. 27 years later, he lives in Los Angeles and is worth over a billion dollars, having co-founded two major fintech startups.

“I started coding when I was 12, because there was this game I wanted to play. It was like a paid game and my parents didn’t want to pay for me; I figured out, if I learned how to code, I could play it for free.”

His early start in coding flourished into founding his first company aged just 16: EduqueMe started as a crowdfunding company aimed at sponsoring Latin American students in top US colleges. In 2013, he co-founded Pagar.me, which was awarded Microsoft’s Startup of the Year prize in the 2014 Spark Awards and sold in September 2016, with a staff of over 100 people and having processed over $1.5bn in GMV in 2016. In 2017, he co-founded Brex with the aim of redesigning the corporate credit card experience for startups.

Dubugras met Pedro Franceschi through a Twitter argument in 2012 when they were both in high school in Brazil. The

heated discussion quickly turned into a Skype call that instigated a long friendship and partnership. They founded Pagar.me together in 2013, and after selling it in 2016, they went to Stanford together to study computer science; they lasted less than a year before dropping out in favour of developing Brex.

“WE BASICALLY JUST REBUILT THE ENTIRE SYSTEM AND THE ENTIRE STACK FROM SCRATCH”

When founding their previous startup, Pagar.me, as young Brazilian entrepreneurs in the US, they struggled to get a corporate credit card: “By seeing that problem of our batchmates and ourselves not being able to get a corporate credit card or having to personally guarantee it, we had the idea of building something better.” And so Brex was born.

Brex

“We’re going to do everything from scratch.”

Armed with the experiences they had gained through Pagar.me and supported by YCombinator – a community that funds early stage startups – Dubugras and Franceschi started Brex with a vision

to reinvent the corporate credit card, preventing startup founders from using their personal cards and accounts to support their business. They worked from the ground up, implementing a people-oriented approach to their recruitment and fundraising processes, ensuring their staff product was going to be well-made and well-supported.

“When we’re redefining the experience, there’s no way you can just build an app on top of an existing thing,” Dubugras said in an interview with YCombinator. This approach is clearly working, as the pair featured on Forbes’ 2019 ‘30 under 30: Finance’ list – the youngest self-made billionaires added to the 2022 Forbes Billionaires’ list.

Although the initial intention was to target startups, Dubugras is sure that established

“ONE THING I BELIEVE IN WHOLEHEARTEDLY IS DOING THINGS THE RIGHT WAY, NOT THE FAST WAY”

companies will benefit from Brex, too, with the Brex card boasting an increasing customer base: “We’re pretty sure that, if someone starts with Brex, they can scale all the way with us versus having to migrate to a different solution.”

Before Brex and Pagar.me, Dubugras was a Developer for Cronus Emulator, a tech leader for social ticketing company Ingresse and iOS Developer for Views, a geolocationbased shopping startup. He currently sits on the boards for the Expedia Group and Mercado Libre alongside his volunteer work as an Adviser at Instituto Alpha Lumen where he helps with fundraising and education near his hometown.

In March 2012, Dubugras founded Estudar nos EUA (‘Study in the USA’), which is aimed at disseminating information and opportunities related to studying abroad – particularly in the USA – at both undergraduate and postgraduate level. Although he didn’t end up completing his degree at Stanford, in 2014, Dubugras was approved as a Fellow in the selection process for undergraduate scholarship from Fundação Estudar in association with Pagar.me. Founded by Jorge Paulo Lemann and the Lemann Group, Fundação Estudar is a highly selective honours association that “exists to form restless and transformative leaders” – a life to which Dubugras has taken the fasttrack route.

Matt Cox, Vice President and General Manager, EMEA at FICO answers questions from FinTech Magazine about his career and financial fraud

» Before starting at FICO, I held various leadership roles at major banks. Barclays was my last home before FICO, and a joint venture between Barclays and Swedbank landed me in Sweden. They launched a business that covers primary countries in Scandinavia – Sweden, Norway, Denmark, and now they’re in Finland too. Before joining Barclays in 2008, I worked at Santander for five years and was part of the Abbey National acquisition in 2004. My work experience initially focused on the UK market but, as time went on, I covered most of the international portfolios and was on the banking side as an expert in fraud and risk.

I’ve really enjoyed working internationally. I’ve been lucky enough to stay in countries with different cultures to those I grew up in and that gives you a whole new perspective, especially helpful when joining a global operation like FICO. My background is in

transformation, and I’m always interested in strategy and analytics. All of this combined led me to a career with FICO.

» Get out and see as much of the world as you can. My family always encouraged me to travel, and I’m glad they did! It’s not just about learning and appreciating differences in cultures, but also the similarities.

Travelling helps you build your adaptability, resilience, and creativity. Getting lost in a foreign country where few people speak English is a great way to learn new languages and things about yourself you didn’t already know.

In my work life, some of the best advice I’ve received centres around learning and trying new things. No matter what position you may have risen to, there is always another lesson to learn or voice to be heard. In fact, the more your career progresses, the more important it is to see real value in developing new skills and abilities. There are countless

opportunities to learn and if you stop looking for them, you will not only stall, but slide back in your progression. This is a crucial consideration in the world of fraud. Scams develop at a rapid pace and to think you’ve seen it all before is a huge mistake.

Q. NAME ONE PIECE OF TECHNOLOGY YOU COULDN’T LIVE WITHOUT AND TELL US WHY (EXCLUDING YOUR MOBILE PHONE)

» I’m a big fan of electronic music and, before starting my professional career, I travelled to do a bit of DJing in nightclubs. That hobby has stayed with me throughout my career and now plays a prominent role in helping me unwind after a stressful day or week. Therefore, my DJ equipment is probably something I couldn’t live without nowadays.

Q. WHO DO YOU LOOK UP TO IN TERMS OF LEADERSHIP AND MENTORSHIP?

» It’s hard to pick just one! We all have our different strengths, and I like to have lots of sources. Whether at work or in my personal life, leaders have always been those who work diligently and are driven by the prospect of supporting others. I always have respect for colleagues across the industry who break new ground. The strong leaders I’ve seen are brave enough to make mistakes but are quick to learn from them and adapt accordingly.

There are a few key figures who mentored me early on in my career, and my hope now is to be able to do the same with new recruits at FICO. It’s all about passing on knowledge acquired

through the years so they progress at a fast pace.

Q. WHICH MAJOR EMERGING TREND IN FINTECH EXCITES YOU THE MOST RIGHT NOW AND WHY?

» Rising consumer awareness around scams and fraud in general is great to see. Widespread educational efforts made by banks and financial service providers are coming to fruition and are helping authorities catch criminals.

We survey consumers across the world every year and the results show not only an increased awareness and proactive nature around scams, but a desire for banks to have strong fraud teams. Our most recent consumer survey shows that strong fraud protection was the top priority when choosing a financial institution. This has almost become a new marketing tool for banks, to show they are ahead of the curve and actively preventing financial fraud.

What is crucial, however, is that this trend does not stop. Fraudsters showed their ingenuity during the pandemic. When the world moved online, they knew there was ample opportunity and a new wave of scams surged across the market.

» The limits of decisioning technology are pushed further back as we dive deeper into data. It’s impressive to see the complex questions we can answer through the consolidation of software. Across most of their departments, banks run decision engines that, for example, keep finances secure, offer lines of credit, or plan collections.

We’re finally starting to see a more connected approach to managing customers and the customer journey, so rather than multiple systems making individual decisions, a bank would have one “brain” coordinating all these decisions.

» In the last five years or so, FICO has accelerated its development of the FICO Platform and our analytical capabilities. The growth trajectory of the platform across multiple use-cases has hit double digits, and we are seeing a 40-50% year-on-year growth on our platform. I moved to Managing Director and General Manager of EMEA at FICO in December 2021, and my focus will be to continue our fantastic growth trajectory.

“OUR MOST RECENT CONSUMER SURVEY SHOWS THAT STRONG FRAUD PROTECTION WAS THE TOP PRIORITY WHEN CHOOSING A FINANCIAL INSTITUTION”

The Backbase Engagement Banking Platform is the evolution of digital banking.

Built for fast implementation and ease-of-use, the platform allows financial institutions to rapidly deploy digital solutions that delight customers and empower employees.

With the power of one platform, you can:

Engage your customers

Create tailored customer journeys from account signup to product up-sell

Empower your employees

A 360° view of your customer helps you deliver personalized and instant service

Ready to get the full picture?

Talk to our specialists

Leverage a composable architecture

Select best-of-breeds partners for your perfect end-to-end solution

Reduces overhead and drive greater innovation with our cloud model.

Start small, grow big Future-proof digital solutions can be customized to your needs now, then scaled later.

This advertisement can only scratch the surface of what the Backbase Engagement Banking Platform can do for your business, employees and customers.

Ready to get the full picture?

Function as an agile workforce to fast-track consumer innovation

WRITTEN BY: GEORGE HOPKIN

PRODUCED BY: JACK MITCHELL

WRITTEN BY: GEORGE HOPKIN

PRODUCED BY: JACK MITCHELL

Universo has been able to succeed with a different approach to banking services in Portugal. This has been reached by being “different”. But what does it mean being different? From our conversation we understand many things make Universo different, starting with the strong will to be “different”.

But there is much more: a broad ambition and challenging culture inherited from Sonae DNA; the ability to combine digital and physical worlds; the capacity to create and leverage ecosystems; the nerve of trying new technologies and emerging companies as partners (Universo started cloud-native already in 2015 and was one of the first clients of emerging companies at the time, as Mambu or Mastercard Processing Europe). The use of AI at its core and seeing itself as a technology company are some of the clues to understand “who” Universo is.

As a multinational corporation managing a broad portfolio of companies in retail, telecommunications, financial services, technology, and real estate, Portugal-based Sonae’s solid culture and highly-developed ability to innovate and execute its actions take the benefits of progress to an ever-increasing number of people. It is a major employer in Portugal with a global customer base and a wide range

Operating

of Sonae Universo, explains why Universo is “different”

of conscious focus, including impressive sustainability commitments and a focus on conscious practices.

The creation of the Universo was part of Sonae’s innovation policy that looks to challenge an industry while also fulfilling Sonae’s mission of bringing the benefits of progress and innovation to a growing number of Portuguese families.

Financial accessibility for all Sonae’s portfolio includes the Universo brand, a financial institution focused on B2C segment, offering accounts, payments, cards, credit (credit lines, in-store credit, BNPL…), personal loans, insurance, and

“Over the course of the past few years, Universo has been consolidating its position as a reference operator in the Portuguese financial services market”

CARLOS BRAZIEL DAVID CHIEF OPERATING OFFICER, SONAE

investments. Founded 7 years ago, the company has more than a million clients and over €1bn of production generated yearly across its financial offers.

Universo integrates Sonae retail loyalty programmes to reach a wide base of the Portuguese families. Universo combines the Continente Loyalty programme and the Worten Resolve program to deliver a large range of benefits to its customers.

“Continente loyalty programme – which is the major loyalty programme in Portugal –offers Universo an important differentiation opportunity,” explains Carlos Braziel David, Chief Operating Officer of Sonae Universo. “The cashback is provided by this programme,

TITLE: CHIEF OPERATING OFFICER

INDUSTRY: FINTECH

LOCATION: LISBON, PORTUGAL

Carlos B David is Executive Board member (COO) at 'Universo Sonae' companies since 2015. Universo Sonae provides financial products and services (accounts, payments, credit, insurance and investments) to individuals and businesses, having more than 1 million customers in Portugal. Before joining Sonae, Carlos was Principal at Roland Berger Strategy Consultants in Iberia, having started his career in the financial sector, at JP Morgan. Carlos holds a degree in Economics from Nova SBE, a masters in Finance

which includes major brands in Portugal, from Continente (food retail), to Galp (petrol), Zippy and Mo (fashion) as well as Burger King or Pizza Hut, to name a few."

Universo is different from neo-banks, not only due to its large partners ecosystem and related loyalty benefits, but because it innovated in payments and credit options. The major innovation was offering fixed-term credit options (3, 6 and 12 instalments), interest-free options and fixed-amount payment options, on its credit cards and online. In 2016, at the start of Universo, this was revealed to be widely appreciated by the customers and a major driver of growth.

“Universo is fully cloud based since its inception and built a network of delivery partners adopting a SaaS (Software-as-aService) model”

CARLOS BRAZIEL DAVID CHIEF OPERATING OFFICER, SONAE

“When it comes to the growth of Universo, I would separate it into two different time periods,” says Braziel David. “During the first phase, Universo focused on growing the accounts and the payments. This was done together with Mastercard Portugal alongside a groundbreaking project designed by teams from Data & Services with schemeand Mastercard Processing Europe (MPE), which helped us innovating in the payment options offered. In fact, Universo was the pioneer to offer a Mastercard-only card issued from Portugal.”

“The second period was focused on developing and internalising the credit generated by our products. Mambu is a key partner that made it possible, as well as Deloitte, who helped us building the operational model.”

“Indeed, Universo has been fully cloudbased since its inception and built a network of delivery partners adopting a SaaS (Softwareas-a-Service) model, partners such as Mambu or MPE to name two of the major ones.”

“Our belief is that being cloud native and working with partners in Saas enables Universo to scale its business, in terms of customers, offers and geographies.”

“Also, this delivery model allows our team to focus on the key assets for growth, that is focusing on our clients, our offer, our brand, our people and on our key capabilities. For example, artificial intelligence competences are kept in-house, in a large and highly-skilled team, that is at our core, making a huge contribution to our success.”

Finally, Universo is also different in combining digital with brick-and-mortar realities. “Universo’s main focus has been a swift and quick customer enrolment, using point-of-sale presence combined with digital channels,” says Braziel David. “As we have an established relationship with retailers, it was our plan – and it is our approach – to use commercial points of sale enabling a light physical presence. Thus, we are primarily digital, but we are also physically present, which is highly appreciated by our customers and partners. This combination is working and makes Universo different from other players.”

Within Universo Sonae’s ecosystem, partnerships are nurtured and valued. “Mastercard is a partner that supported Universo from the beginning and was fully aligned with Universo’s innovative approach,” recounts Braziel David. Alongside “Mastercard Processing Europe (MPE), which fostered innovation in credit options offered at Universo, among other features.”

Mastercard is a global leader in payments and has been developing cooperation models with players like Sonae to bring innovation into the industry. Indeed, Mastercard has been focused on modernising the payments ecosystem and creating stronger bonds between people through technology. Through its innovative approach and commitment to customer collaboration, Mastercard has established itself as a leader in the payments industry and a partner for businesses looking to transform their transactions.

Mastercard Processing Europe (MPE) is one of the fastest-growing issuer processors in the region with operations in 33 markets

“We are primarily digital, but we are also physically present, which is highly appreciated by our customers and partners”

CARLOS BRAZIEL DAVID CHIEF OPERATING OFFICER, SONAE

(32 EEA and Israel). The company offers a comprehensive range of payment solutions that enable customers to launch payment products with efficiency, scalability, and speed to market. MPE flexible solution leverages powerful APIs for platform integration, focusing on digital use-cases that allow for instant issuance of virtual cards and more. MPE's services offer access to the latest technologies and leverage state-ofthe-art security at the forefront.

The third key partner for Universo at this stage is Mambu, which Braziel David references as “the SaaS partner for the Credit platform, a successful Fintech provider of core credit systems”.

Mambu is a cloud-native, API-driven banking and financial services platform that offers its clients software-as-a-service (SaaS) solutions. The company's primary goal is to enable financial innovation and help its customers bring their solutions to the market faster while also lowering cost barriers and expanding their ecosystems.

The company has an extensive customer list, including fintech startups, telcos, and top-tier banks. With a presence on six continents, Mambu helps its clients transform how financial institutions operate and innovate. As the leader in cloud banking and fintech, Mambu is taking on the $250Bbn banking technology market worldwide,

servicing over 250 customers with more than 90mn end-users.

Universo has partnered with Deloitte on developing the operational model concerning credit and risk. “Together with Deloitte, we set up Universo risk, credit, and collections operations” says Braziel David.

Deloitte is a key Mambu partner, with specific expertise in helping fintechs and banks in the delivery of core transformation programmes.

“I would say that, together with the Mastercard and Mastercard Processing Europe for the payments – with Mambu and Deloitte for the credit and risk areas setup –we could fulfil this second stage of Universo being across all the credit value chain. ”

Sonae recently announced a preliminary agreement with Bankinter Consumer to create a joint venture that will take Universo to the next stage.

The joint venture will combine Sonae’s Universo businesses with Bankinter Consumer Finance in Portugal, which manages Bankinter’s Portuguese consumer credit products and services.

The agreement establishes the main terms for creating a leading consumer

“Universo's success has been driven by a challenging mindset, with a very clear purpose and distinctive culture”

CARLOS BRAZIEL DAVID CHIEF OPERATING OFFICER, SONAE

+1mn Customers

+300k Insurances Policies

credit operator in Portugal with Sonae and Bankinter Consumer Finance as shareholders.

Sonae’s CFO, João Dolores, says: "Over the course of the past few years, Universo has been consolidating its position as a reference operator in the Portuguese financial services market, leveraging its digital structure and contributing to bolstering the performance of the Group’s businesses, in addition to its ecosystem of partners. The preliminary agreement now signed with Bankinter aims to seize this successful path to establish a leading consumer credit operator in Portugal.”

Both shareholders have the ambition of growing internationally and taking some of the features that made them successful to other countries.

When asked about internationalisation, Braziel David says: “What Universo has built can be leveraged in other marketsNot only the technical solution and related partnerships ecosystem, but also the AI, risk and other core competences critical for this business.”

“Naturally, we know each market differs, and the business model must be adapted. Nevertheless, our success has been driven by our teams, by our people, that will be successful in other markets if challenged to it”.

Moreover, Braziel David says: “Universo success has been driven by a challenging mindset, with a very clear purpose and distinctive culture. Our challenge is finding business models that work and that cannot be easily replicated – creating an 'unfair advantage'. We did it once. We expect to continue doing it.”

Super apps are the banking buzzword of the moment –but what’s the score, and why?

WRITTEN BY: JOANNA ENGLAND

Super apps are the territory of the user experience experts, who aim to keep customers engaging with their products, collecting data on their behaviours, and providing a better service than their competitors.

Essentially, it's an online platform that offers personalised experiences through a series of mini apps that appeal to the company’s customer demographic.

The mechanical way to describe a super app would be that it's the Swiss Army Knife of apps. It has a wide range of capabilities: ideally, a customer could visit and carry out an array of tasks through the platform without ever having to click away to another site. An example would be a banking app that could provide budgeting services, allow you to pay your taxes and utility bills, and also manage your insurance policies. It’s multi-dimensional.

According to Jason Wong, Distinguished VP Analyst at Gartner: “It’s more than just a composite mobile app or web portal. Superapps are built as platforms to deliver modular mini-apps that users can activate for personalised app experiences.”

He goes on to say that software engineering leaders should determine whether a super app aligns with their composable business strategies.

According to an industry study by ReportLinker, an estimated 7.1bn people globally use smartphones, and the rate is growing by 10% every year.

More people are transacting online than ever before, with 92% of consumers expecting a frictionless and secure experience while shopping online1.

Ecommerce companies and payment services providers must constantly innovate to create a seamless customer experience while keeping fraudsters at bay. Leading ecommerce platforms leverage Ekata’s real-time identity insights to balance customer experience with the business risk that can erode their bottom line.

Ekata, a Mastercard company, uses sophisticated data science and machine learning to fuel global payments and ecommerce companies with identity verification data that empowers them to reduce friction, maximise approval rates, and fight payment fraud in every transaction.

WWW.EKATA.COM

1According to VansonBourne, 2020, “Infinite want: Consumers demand speed and security in the digital experience.” https://www.vansonbourne.com/work/29081801ep

The adoption of smartphones has created the demand for super apps – not always for the best reasons. The Chinese government has embraced the concept, mainly because the country’s leadership has long been keen on developing methods to interact digitally with its 1.4bn inhabitants.

However, super apps also have a wide range of uses. For example, in January, the US-based fintech Medsi launched its new “fintech and healthtech proposition for customers in Mexico”. The platform enables a demographic that has a high number of citizens without any healthcare insurance options to access healthcare through its unique payment gateway and telehealth offerings.

Medsi offers a revolving line of credit that can be used by families for essential or elective health services and procedures. Once approved via an intuitive, threeminute application process, users can simply schedule disbursements, while Medsi pays the private doctor or clinic directly upon fulfilment via a QR code using the Medsi Credit app on their smartphones, available via Google Play or the App Store. It’s simple, fast, low-cost, and provides a much needed service. So, what’s not to like?

According to a recent report by the designer trade title UXDesign.cc, while super apps are considered a growing trend, the consumer marketplace is also treating them with a degree of suspicion.

There is, in general, a lack of consumer trust – especially regarding the collection of data and the rising power of the tech industry’s ongoing issues with privacy and security.

Ani Ghanti writes: “It seems like every week there’s a news story about a public trust slip-up from big-tech. Over the years, this has gradually eroded consumer trust. Contrary to my first point about the mobile-first generation in emerging economies, the developed economies have experienced the desktop era of the internet and have ‘grown-up’ with it over the last three decades.

“They’re aware of the potential for security loopholes and data abuse from app providers. So, to convince users to adopt a super app built by Google or Meta (or anyone else), the value proposition better be really compelling.”

In the case of Medsi, the super app is already providing a valuable service to families who might otherwise have foregone the luxury of healthcare – and it's saving them money, too.

Speaking about the potential of combining fintech platforms with other offerings, Manuel Villalvazo, Medsi CEO and Co-Founder, explains: “The new offering is designed for the 55%+ of Mexicans who belong to the informal sector or are new to credit, making strides towards true, incremental financial inclusion.

He continues: “There’s massive, pent-up demand to be unlocked in Mexico, and we’ve generated even-higher-thanexpected demand in just five months of operating commercially.

“With the availability of our savings-tocredit finance solution, a much broader set of customers can now gain access to the treatments and procedures they want via a different type of ‘health assurance’ coverage that they completely own and control.”

Villalvazo points out that Mexico has the second-highest out-of-pocket (OOP) healthcare spend worldwide, with a whopping 45% of OOP costs being covered directly by patients, making the country an outlier even within Latin America. The potential provided by the super app model therefore has far-reaching implications.

Now one of the world’s leading payment technology companies, Volante launched in 2001, at a time when the US – and, indeed, the world –was still reeling from the aftershocks of 9/11. The dot com crash had only taken place six months prior, too, and the markets were understandably awash with uncertainty.

It takes a special kind of optimism to launch a disruptive startup in such circumstances, but that was exactly the challenge faced by Vijay Oddiraju, the man that co-founded Volante Technologies in Silicon Valley with two like-minded entrepreneurs, Venkat Malla and Uday Thakur, with a small office and some big ideas.

“Our whole idea was to help financial institutions accelerate and ease the development of financial applications. I knew it was something very different, and I also knew it would be very helpful to the business marketplace,” he says.

Conversely, launching that initial operation didn’t present the challenges Oddiraju would have expected: from the very start, doors opened. Even setting up that first office in Palo Alto, California, seemed almost too easy.

He says: “Starting the company at such a point was very interesting because of two things. Firstly, the whole environment was very gloomy and lots of companies had shut

down because of the dotcom crash. But, on the flip-side, there was a lot of available, cheap, leased space in the Bay Area and Silicon Valley.”

Timing is everything, and though it was a difficult period all-round, the stars seemed to fortuitously align for the Volante team, creating the perfect conditions for launch by turning a crisis into an opportunity.

“When it came to the equipment, we lucked out. Huge servers with high-end capabilities were being auctioned in various places in the Bay Area; we went to just one auction in San Francisco and kitted out all our IT needs.”

The good luck continued and, within a year, Volante Technologies had gained traction. Its flagship offering was a unique, cloud-native, low-code financial messaging

“The customers that signed up with us in 2003-2004 are still our customers; that speaks volumes about our relationships with them and our ongoing partnerships”

VIJAY ODDIRAJU CEO AND FOUNDER, VOLANTE TECHNOLOGIES

and integration platform based on microservices’ architecture – all of which was very innovative at that time, predating the now-ubiquitous usage of these terms.

Customers loved Volante’s platform as it enabled them to build secure, resilient, and innovative standards-based financial applications much faster than ever before –so much so that many of those who started working with the company 20 years ago are still with them today. These included toptier financial organisations seeking to disrupt their markets and serve their customers with superior digital services.

Since then, Volante has moved from strength to strength. In 2015, the company noted that many of its customers were actually using

TITLE: CEO AND FOUNDER

INDUSTRY: SOFTWARE DEVELOPMENT LOCATION: UNITED STATES

Vijay Oddiraju is CEO and Co-Founder at Volante Technologies. Vijay began his career in Oracle’s consulting division, working with enterprise customers on strategies for solving complex technology modernisation challenges. He then followed his entrepreneurial instincts to found a series of successful startups in the financial messaging and integration software space. He co-founded Volante in 2001 and has served as CEO since then, guiding the company into the commanding position in cloud payments that it holds today. As a leader, Vijay’s philosophy is to “think big, never shy away from risk, and always give back”.

its platform to build payment-processing solutions, even though there were a number of long-established payment system technology providers in the market.

To expand market share and serve its customers better, Volante capitalised on this opportunity by launching its own payments solution, VolPay, built on the bedrock of the company’s low-code financial platform. It followed up shortly after in 2017 with the launch of Volante Payments as a Service (PaaS), offering an innovative, cloud-native, SaaS approach to payments processing.

In the years after launch, the company has achieved an enviable series of firsts:

• Volante processed the first real-time payment in the US and the first instant payment in Saudi Arabia.

• The company’s PaaS processed the firstever European SEPA payment in the cloud in 2018.

• In 2021, Volante signed the largest PaaS deal in history, with a Tier 1 financial institution.

• Notably, Volante topped the IBS Intelligence Sales League Table in wholesale payments for two years running in 2021 and 2022, the first time any provider did so.

Year-on-year for the past five years, the company has also doubled its revenues and bookings. Indeed, today, Volante is a truly global entity, headquartered in New York with offices in Boston, Mexico City, Bogota, Dubai, London, Chennai, Hyderabad, and Pune.

Recently, Volante also launched a development centre in Romania, continuing

to expand and enter new marketplaces as it grows. “Globally, we’re well diversified,” Oddiraju says. “We have 1000-plus staff and over 150 customers worldwide, a lot of which are top-tier banks.”

“My gut feeling is that, in the next five or maybe ten years... financial businesses will all be relying on cloud and SaaS providers”

VIJAY ODDIRAJU CEO AND FOUNDER, VOLANTE TECHNOLOGIES

Oddiraju explains that central to the company’s success has been its ability to serve its customers well and create a trust-based relationship with them.

“A large part of the whole aim from day one has been to be the trusted partner for our customers, because we are providing software that runs their mission-critical systems. And, because they are large institutions with equally large economies, we need to have those long-term, sustainable partnerships.”

Building these long-term relationships with customers is part and parcel of the DNA of Volante: “The customers that signed up with us in 2003-2004 are still our customers, and that speaks volumes. It’s centred around the collaborative innovation we carry out to address their needs, and doing so in a timely fashion.”

Part of Volante’s success is also rooted in its longevity in the marketplace. Unlike many recent entities, its business model has been strengthened rather than weakened by market instabilities. Notably, Volante and its customers have emerged with renewed vigour from the 2001 crisis, the 2008-2009 recession, and the pandemic.

That said, it took the founding team time to develop the software products to the standard they wanted; Oddiraju is a firm believer in the strength of a good value proposition.

“If you have a good value proposition – whether it's an up market or a down market – people will listen to you and may want to collaborate with you. And that's exactly what happened for us.”

Oddiraju points out that not only was the company built after a crash, but it has also weathered the 2008 financial crisis – an event that rocked world economies to the core; it’s something many more recently launched fintechs and technology companies have no experience of.

“We didn't shy away from the challenge of the 2008 crash. We said, ‘Well, look, where is our product being used most?’, and then we started saying, ‘Okay, customers are using payment systems integration from our low-code platform. How can we help them more?’. Then we enhanced our payment solutions.”

The move gave Volante Technologies the opportunity to help its customers to be more innovative. For example, the Bank of New York Mellon used VolPay to transact the first real-time payment in American history..

Of course, as digital commerce became mainstream, demand increased; as a firstto-market entrant into a new space, Volante had had the time to perfect its products and solutions, making it the go-to company.

Once COVID-19 hit, digital transactions exploded, with the company's growth and market presence achieving the same. “Our product was the first cloud-native payment product to be launched in the world.”

Volante’s headstart on transactional cloud technologies has stood it in good stead. Now, its services are so fine-tuned that the company’s able to launch new products and services at pace, deploying them to customers so swiftly that they can use and deploy them for their own customers within days or weeks.

“The ability to reach different regions quickly to roll out new products and services is phenomenal.”

“In the last three or four years, cloud adoption has become the number one phenomenon. My gut feeling is that, in the next five-to-ten years, there won't be any data centres – those are going to be controlled by the banks and the financial institutions, who will all be relying on cloud infrastructure providers and Payments as a Service (PaaS) offerings,” predicts Oddiraju.

Volante Technologies was launched with a low-code platform, purpose-built by its founding team of technologists and software engineers. Later, it moved into cloud-native products. This was all underpinned by the microservices’ architecture built from the very beginning: modular in design, rather than monolithic like many legacy systems.

“If you want to have a lateral scaling of the application and add new functionality, customers can simply add more modules to the base product without complication. For example, if they want to add real-time payments, it's very easy.”

“We constantly evaluate where we stand; with our cloud-native microservices, for example, you can add functionality very quickly”

VIJAY ODDIRAJU CEO AND FOUNDER, VOLANTE TECHNOLOGIES

According to Oddiraju, the products are popular because many digital payment providers still work with legacy technology. “When they started, that was top of the line, so they did very well. But we have the advantage, because we got into payments much later.”

The low-code platform also enables customers to develop their complex applications in record time. “When somebody wants real-time payment compliance, we can turn around and give it to the customers very quickly.”

The third aspect is the product deployment, which is pure SaaS in the cloud. “We are on the forefront of it. If a customer wants to choose us, they have the advantage that we can not only deploy that on the

cloud, but we can also provide payment as a service (PaaS). It’s a huge differentiating factor. There’s even a sizeable number of customers using us in that fashion today, as well as the small and medium-sized customers.”

Automation looms large in Volante’s current and future products and services – and the speed at which technology is accelerating means the leadership team aims for constant evolution.

“The ability to evolve faster through innovation and automation will help everybody to accelerate. As for the future, that's where we'll see a lot more potential with the core product that we have: innovation.”

Oddiraju continues: “We constantly evaluate where we stand; with our microservices, for example, you can add functionality very quickly.”

Within the current ecosystem, there's a sizeable development community of engineers that play a critical innovator role, brainstorming new solutions and challenging existing technologies; they’re a core part of Volante’s future strategy, working on the low-code platform “to help Volante’s customers in a better fashion”.

He adds to conclude: “Much higher levels of acceleration will happen as time moves forward, and we will be at the forefront of that.”

“If you have a good value proposition, whether it's an up market or a down market, people will listen to you”

VIJAY ODDIRAJU CEO AND FOUNDER, VOLANTE TECHNOLOGIES

The use of cash continues to diminish across modern society, with notes and coins being seen as increasingly archaic in the payments world; meanwhile, digital wallets – also known as e-wallets –

E-wallets are essentially financial transaction apps that can be run through mobile devices. They securely store payment information and passwords, allowing users to pay via those devices rather than carrying around payment cards.

Setting one up couldn’t be simpler: the user downloads the app; enters their credit card, debit card, or banking information; and then uses their device as a contactless payment portal through tap-to-pay tech.

According to reports, the very first e-wallet –established as far back as 1997 – was linked to the first digital payment system. CocaCola built a payment system that enabled transactions to be carried out via text message, allowing them to buy soft drinks through their mobile phones. This event was the launchpad of the modern day e-wallet, although the systems and solutions employed today operate on multiple levels,

E-wallets are gaining ground – especially among the younger generations. We track their progress and predictions

AWS provides the extensive and flexible cloud and AI/ML capabilities that Wipro employs in its end-toend solutions such as Lab Bank and banking services on AWS Cloud. Wipro solutions on AWS transform businesses and produce improvements in efficiency, and cost savings for financial services organisations.

Read more about Wipro Industry Solutions on AWS

Current innovations used by mobile devices and digital wallets are:

• Magnetic secure transmission (MST): Using the same technology generated by a magnetic card strip, mobile devices generate the encrypted field that is the point of sale, which can be read by digital payment machines.

• QR codes: Quick response codes are matrix barcodes that utilise the wallet's scanning system to initiate payment.

• Near field communication (NFC): A technology that enables two smart devices to engage and share information via electromagnetic signals. Each device needs to be within approximately 4cm of the other to carry out a transaction.

“CONTACTLESS PAYMENTS INCREASED BY 12% IN 2020, SPURRED ON BY CONSUMERS LOOKING TO MITIGATE THEIR USE OF CASH TO PREVENT THE SPREAD OF COVID-19”

BRAD HYETT CEO, PHOS

• Apple Pay: This versatile solution that uses NFC technology can be used for numerous payment options via the mobile device or a smart watch. Apple Pay uses the NFC system in conjunction with the Secure Element chip, which stores the bank card data in encrypted form.

• Dwolla: With its low transaction fees plus easy-to-use automation and security, Dwolla has attracted a high number of users. The system acts as a middle-man for banks, individuals, and entrepreneurs.

• Google Pay: Google Pay is essentially the Android version of Apple Pay. It’s a multifunction mobile app that manages the transactions of credit cards and debit cards. Google Pay enables contactless payments and any fees associated with it are paid by the merchants.

• Cash App: Riding the wave of the peerto-peer payment system, Cash App was created by Square and is a simple, seamless app that enables users to receive and send payments. The e-wallet also functions as a digital bank account, providing users with opportunities to invest and trade both stocks and cryptocurrencies.

• PayPal: With its international payments functionality, PayPal is the best option for people who travel, because the e-wallet has been recognised in most countries since it first launched in 1998.

At this point, the benefits of using e-wallets should be fairly clear, but with one defining factor outshining the rest –namely, security. When customers input their card details via an online portal to buy an item online, there is a risk that it's an unsafe site, a scam to steal card details and then empty bank accounts.

E-wallets enable users to store a small amount of money electronically so that even if a scammer attempts to steal the details, there’s no danger of an account being drained of funds.

They are also easy to open, and convenient to use, since customers don't have the additional responsibility of carrying around payment cards. Additionally, they are very handy for international travellers, since they are not attached to a specific country or location.

Essentially, e-wallets are the natural evolution of the digital payments space. According to Brad Hyett, CEO of phos – a UK-based fintech that specialises in Point of Sale (PoS) innovations for merchants –contactless payments have provided an easy, convenient, and safe way to pay for goods in store.

He says: “As contactless payments become more popular, the finance industry must step up to the challenge of ensuring that merchants are equipped with the right payment solutions to accept payments in a secure, efficient and simple manner.

“Contactless payments increased by 12% in 2020, spurred on by consumers looking to mitigate their use of cash to prevent the spread of COVID-19 and the demand for convenience; the simplicity of contactless card or e-wallet payments have proven to be the preferred option.”

“Over the next five years, we will see the consumer-driven consolidation of payment options become the standard. Cards, BNPL, open banking, crypto, and loyalty cards will all become commonly available in all transaction channels.”

Hyett adds: “Consumers want to be able to use their preferred payment methods, and it is imperative that businesses are equipped with the right solutions to meet these growing needs.”

Along with super apps comes the concept of the super e-wallet. No longer just a one-trick payment pony like its predecessor, the super e-wallet offers a range of payment services to the user. What it also does, though, is provide lots of data on the customer, ostensibly helping fintech companies create personalised services for their users.

They have numerous digital payment usecases, including storing electric vehicles’ key information, membership cards, gift cards, tickets to events, travel tickets, users’ driver’s licences and more. E-wallets are also increasingly being used to trade cryptocurrencies – their introduction has enabled people to use a wide manner of financial services previously not open to them. In this way, e-wallets have helped to increase financial inclusion.

The super app e-wallet concept has taken off in Asia, in particular, where the number of unbanked people is high, but mobile adoption is still higher. OMG Indonesia’s Deependra Shekhawat said recently: “With Indonesians integrating e-wallets into their daily lives and using the same environment for different purchases and purposes, it becomes easy to track their digital footprint.”

Eunice Tan of TSLA, meanwhile, points out that the growing frequency of e-wallet

“CONTACTLESS PAYMENTS BECOME MORE POPULAR, THE FINANCE INDUSTRY MUST STEP UP TO THE CHALLENGE”

BRAD HYETT CEO, PHOS

adoption is rooted in the belief that it presents a more glamorous lifestyle. “For many young people in Asia, virtual banking and e-wallets represent excitement, aspiration, and a gateway to living life more richly.”

As the global financial market becomes increasingly integrated, regulated and borderless, the case for e-wallets has grown. CBDCs will be a primary asset for e-wallets when their worldwide introduction begins in earnest.

China is leading the charge with this technology. In October 2020, for example, the government had already begun piloting its digital yuan, giving 50,000 residents of the Luohu district 200 yuan each in a digital wallet to test the transactional process and its new digital currency. The digital wallets were distributed via iShenzhen –a government-operated blockchain public services app.

China’s digital currency has been in the pipeline for the past eight years; it's currently available to users in 23 cities across China, enabling millions of users to sign up through a number of commercial banks.

A research report by CBS Insights predicts that the trend for e-wallets and super apps will see the market increase in value from a conservative US$1tn to $7tn by 2027.

Many reputable studies show that, by 2024, a third of the world’s population will be using digital wallets. Not only that, but these e-wallets will merge with the super app movement, while the current single— function payment apps will eventually disappear as users opt for multifunction transaction.

WRITTEN BY: JOANNA ENGLAND

PRODUCED BY: JACK MITCHELL

WRITTEN BY: JOANNA ENGLAND

PRODUCED BY: JACK MITCHELL

In 2022, Zurich Insurance Group announced a business operating profit of US$6.5bn, a target above the expectations of previous years. The success has been evenly distributed across the group, but the P&C line – which is the main line for Zurich France – has performed particularly well, with a 94.3% combined ratio alongside a rise in business operating profit, too.

But the growth hasn’t just been about the numbers and profit. Rather, Zurich France has enjoyed a fruitful 12 months in terms of new customer onboarding, and the development of fresh products and solutions.

One particular unit that has grown the most over recent years is Zurich Resilience Solutions, or ZRS, created to address the rapidly changing risk landscape with a holistic approach to supporting risk management and helping build resilience.

It is this area of risk and resilience that has preoccupied the strategies taken by Zurich France over the past few years.

Describing the journey, Denis Stasinski, Chief Underwriting Officer, explains that there are two clearly defined periods that mark eras of change within Zurich France: “As a starting point, we have the world before and after COVID-19. The global economy has experienced an accelerating transformation

– and this is true across geopolitical, societal, economic, and digital spheres.

“Additionally, we are starting to see the impact of climate change in both the frequency and intensity (or severity) of

CAT events. To date, global warming is obviously a concern that we have to address collectively. As an insurance company, we need to analyse and adapt our approach considering those evolutions, which impact the risk landscape we have to deal with.”

Denis Stasinski says that by focusing on digital transformation and the latest technologies, Zurich – which is a global company serving 210 countries and territories – is having greater success in delivering its solutions as well as monitoring risk and resilience.

Forging solid partnerships has been a fundamental part of Zurich’s success in its transformation journey. Currently partnered

“By focusing on digital transformation and the latest technologies, we are having greater success in delivering its solutions as well as monitoring risk and resilience”

DENIS STASINSKI CUO, ZURICH FRANCE

TITLE: CUO

COMPANY: ZURICH FRANCE

An engineer by training, Denis holds a DEA in Materials Science from the Ecole Nationale Supérieure de Chimie et de Physique de Bordeaux, as well as a master’s degree in Risk Management from the Institut de Management des Risques. He began his career in 1993 at AXA-XL as a prevention engineer and then as a senior property underwriter. He continued his career in the Civil Liability department as a senior underwriter before being promoted to Claims Manager.

In 2009, he joined RSA and took responsibility for all "1st party" underwriting lines.

with Roboyo, a collaboration of primary importance, Mathieu Pauwels, COO of Zurich France, says that Roboyo’s position as an industry leader has played a critical role.

“Roboyo is the leading pure player in the Intelligent Automation industry. It has been growing very fast over the last three to four years. Roboyo has helped Zurich Group to build and scale the Robotic practice in 2018 and 2019. Since then, Roboyo has been one of the preferred partners for all the topics around automation.”

He explains: “They are now helping Zurich France to bring automation to our business. Their key value for us is to be a real pure player in intelligent automation (across

In December 2017, he joined Zurich France as Director of Underwriting for Property, Construction & Technical Risks Underwriting. In September 2019, he was promoted to Head of Underwriting for Zurich France.

We help you accelerate digital transformation and discover unlimited performance, productivity and efficiency gains.

OUTRUN THE COMPETITION

Go further. Grow faster. Work smarter. Our expertise operationalizing transformative technologies drives rapid, scalable change.

TURBO BOOST YOUR TALENT

Create a culture where human ingenuity and digital innovation can thrive in perfect harmony, and maximize productivity.

DELIGHT YOUR CUSTOMERS

Increase satisfaction and deliver seamless customer experiences. We help you prioritize customer demands and champion their needs at every stage.

We take what’s possible to the Next Level. Now.

Find out more at roboyo.global

industries and technology-agnostic) to offer a very flexible approach (tailored to our size and our business), with deep expertise and the aim to coach, train, and support our business in the automation journey.”

The insurance industry in general has been slow to adopt the latest innovations and technologies. But Pauwels explains that the pandemic forced a situation that has driven change across the board.

“Within the last few years, the COVID19 crisis has impacted ways of working and has had an impact on everyone. During and following the crisis, technology adoption has increased at a faster pace. And that’s why I call it ‘digital acceleration’ rather than ‘digital transformation’. Digital has always

been there, it is just a matter of accelerating its utilisation and adoption. Now, employees expect a different way of working, in terms of tools and interactions with different people.”

Pauwels points out that hybrid working practices and staff working virtually has driven forward connectivity innovations – not just internally, but also externally with Zurich Insurance, its MyZurich platform having anticipated these needs from customers.

“They expect different types of services, and they expect to have them remotely. We’re offering different services, such as the MyZurich platform, which is a platform for our brokers and customers. That platform also offers a risk advisor tool, for example.

“We are commercial insurance so it’s never the same as retail insurance in terms of digitalisation. Nevertheless, we do have

digital solutions that we need to offer (especially for basic activities like insurance certificates) as there is a need for that on the market.”

One of the challenges in implementing these digital solutions comes from issues surrounding data. In hyper digitalisation, where everything goes into the cloud, concerns regarding regulations and governance are often raised, Pauwels says.

“Questions you have to address about data include: how do you govern the data? How do you make sure that you control what is on the cloud? Where is the data going? Is there any leakage? How do you protect your

TITLE: COO

COMPANY: ZURICH FRANCE

Mathieu Pauwels is Chief Operating Officer. He has 17 years of professional experience in global IT transformation programmes and in managing multidisciplinary and international teams.

Mathieu Pauwels holds a master’s degree in Finance & Business from the ICHEC Business Management School and a specialisation in Business Engineering. He also holds an Executive MBA from IMD Business School.

customer? How do you protect the data of your employee? Ultimately, it revolves around governance.”

Other issues are raised as well, according to Pauwels – especially from a sustainability standpoint. “Digital transformation has a financial cost. But it also has a sustainability cost, because you consume more servers. It’s a different cost to paper, and you’re not cutting down trees, but there’s still that energy usage question.”

Zurich Group and Zurich France are putting in place regulations to control and monitor this, as well as strong governance to make sure they have control over the data. “You have control regarding what you put on the cloud, but the growth has been exponential for the last few years. It’s certainly an area to monitor closely.”

The nature of hybrid working patterns has also changed the way teams operate and communicate with each other. Company culture has been disrupted, and taking this into consideration while transforming digitally, is a critical part of the transitional process.

Garnier, Head of UW Casualty and Motor for Zurich in France, says creating a sense of belonging and a cohesive team requires strategy. “Challenges post-COVID raised questions about how we needed to keep our employee engagement high.

“Zurich France wasn’t the only company facing this, but the way that we decided to tackle it was by putting in place a key initiative called People Engagement. We thought about ways to maintain the relationship between employees, between each other. Another aspect of that was how we maintained relationships with our clients and brokers.” Garnier says that even transitioning colleague relationships from

virtual to face-to-face meetings has been considered, with the aim to re-engage people. “Keeping the engagement high is also dealing with the way of working, how we deal with the office space, and the technology that is used. The way we work now is mainly hybrid. It’s a great balance between working from home or always working from the office. So this is really a critical way of keeping the engagement high from our perspective.”

While climate events have played a part in insurers globally adjusting their risk assessments, the latest Zurich Global Risk Report has pinpointed a panoramic view of the problems facing society at this current time. Despite rapid innovations in

TITLE: HEAD OF UNDERWRITING FOR LIABILITY AND MOTOR FLEETS

COMPANY: ZURICH FRANCE

Céline began her career in 1995 at Sorema (Groupama), first as a technical manager for all lines of business and then as deputy manager of the facultative large risk management department. In 2001, she joined Groupama as a general and professional liability underwriter for the Groupama and Gan networks. She joined AIG in 2007 as a liability underwriter in the middle market, and was promoted to team manager in 2012. In 2016, she joined Chubb as a liability underwriting manager. In 2018, she joined Zurich France as Head of Underwriting for Liability and Motor Fleet.

technology, there are more traditional risks of inflation, cost of living, social unrest, and geopolitical confrontations that must be considered.

Vinicio Cellerini, Head of CI Customer & Distribution of Zurich Insurance Group, also assuming the interim operational management of Zurich France, says the findings of the Global Risk Report show that companies and entities must work together to overcome these problems.

“In 2023, we’ve faced risks that are at the same time both new and familiar. We’re experiencing a return of older risk, such as inflation, the cost of living crisis, and widespread social unrest and geopolitical confrontation. But also, at the same time, there is the threat of nuclear warfare. The most critical long-term risk, though, is climate change, according to the report this year.

“To understand risk, we look at current trends and how they have developed over time. We analyse data, and we partner with prominent experts”

VINICIO CELLERINI HEAD OF CI CUSTOMER & DISTRIBUTION, ZURICH FRANCE

“If we want to dig a bit deeper into the report, then you will see that the cost-ofliving crisis is clearly ranked as the most severe global risk over the next two years, though it’s also seen as the short-term threat.”

Cooperation and partnerships to combat biodiversity loss and ecosystem collapse is, espouses Cellerini, essential, because it’s viewed as one of the fastest accelerating global risks over the next decade.

“Clearly, failure of climate mitigation and climate adaptation are the largest long-term concerns. Regarding geopolitical rivalries and new world looking stances, we can expect that they will heighten economic constraints and further exacerbate both short and longterm risks. The Global Risks Report urges countries to work together to avoid resource rivalries. This is what was really important to us regarding global risk this year.”

TITLE: GLOBAL HEAD OF CUSTOMER AND DISTRIBUTION MANAGEMENT

COMPANY: ZURICH FRANCE

Vinicio Cellerini was appointed Global Head of Customer and Distribution Management for Zurich Commercial Insurance in December 2018. Vinicio joined the Zurich Insurance Group in 1986 as a Property Underwriter and since then, has held various roles within the organisation. In January 2005, he was promoted to CEO, Global Corporate Italy before being appointed CEO, Global Corporate Switzerland in 2010. In August 2012 he moved to the UK as CEO of Global Corporate UK (which later became Head of Commercial Insurance UK).

TITLE: HEAD OF UNDERWRITING FOR SPECIALTY LINES

COMPANY: ZURICH FRANCE

Martin de Laubadère is Head of Underwriting for Specialty Lines. He joined Coface in 2006 in the

Zurich’s goal to contribute to a global movement that is centred around sustainability has led the group to partner with a range of marketplace players. Stasinski says: “Our main clients remain large international companies. But we have developed capability and expertise, in terms of risk assessment, and are ready to propose solutions for the middle market.

“In France, for example, we started to develop an MGA proposition four years ago with a partner named Etik and Tetris, dedicated to the construction sector. To

date, it has been a successful development and, obviously, it is a global initiative. We analyse this type of opportunity on a caseby-case basis.”

As part of this initiative to drive change and better sustainable practices on a global scale, Zurich Insurance has also partnered with the World Economic Forum to increase the scope of its holistic strategy. “Risk is clearly our business at Zurich,” says Cellerini. “To understand it, we look at current trends and how they have developed over time. We analyse data, and we partner with prominent experts, drawing on the experience of more than 800 risk engineers across the world.

He continues: “Zurich champions a holistic approach to risk management by helping businesses understand the triggers and the trends to look out for alongside how to prepare for possible consequences. By helping people understand how global risk interrelates, we give customers and communities the opportunity to plan ahead with confidence and work towards a brighter future. We do this because that’s who we are, and that’s why we strategically decided to partner with the World Economic Forum.”

Martin de Laubadère, Head of Underwriting for Specialty Lines at Zurich France, says technology has been key in facilitating a more sustainable approach to products and services, as well as the way the group operates.

“The integration of new technology is key for us within the client experience as we see it; it’s true for Zurich France, it’s true for the group. The main objective behind this is to propose simple solutions, for us to be more intuitive for our clients and the corporations. Individuals working for these corporations will benefit from these services.”

He says the importance of new technology has clearly grown over recent years, with it seen as a competitive advantage that Zurich Group is happy to heavily invest in. The use of data is critical, but so is the company’s approach to it and the digital platforms that process said data.

“At Zurich, we don’t limit our relationship with our clients to their difficult times, when a claim or a need for reimbursement happens; it goes way beyond that, as we see the relations with clients as broader and consequently being alongside our clients to accompany them much more in advance and manage not only the prevention of risks, but also the identification of impacting, meaningful trends.”

The core goal is to be as transparent as possible so that facts and data on risk and resilience can be shared as part of the holistic strategy. “In France, this aspect of

“Integration of new technology is key for us within the client experience. The main objective behind this is to propose simple solutions, for us to be more intuitive for our clients and the corporations”

MARTIN DE LAUBADÈRE HEAD OF UNDERWRITING FOR SPECIALTY LINES, ZURICH FRANCE

digitalisation is one of the three big pillars of our strategy for 2023-2025. The objective we want to achieve is to have a direct impact on our clients, bringing more services.

“Our A&H line of business provides the capacity to propose online certificates for clients for direct access. I also want to emphasise the importance of international programmes for our clients: we invest a lot in these aspects to ensure programmes can be delivered very efficiently and smoothly for the client.”

The next few months for the global insurance industry will see a number of shifts and trends – one of which is an overall increase in the number of claims being made.

Céline Garnier says Zurich France has had dialogue with reinsurers regarding autoliability trends from a claims’ perspective: “What we’ve seen is that amount doubled year-on-year from 2019 to 2021 to reach more than €200mn indemnity for one loss. Risk management is absolutely critical in managing this trend, but discussions about the ways contracts are structured and how the insured are made aware of the exposition and tools that we have in the insurance industry are also essential.”

She continues, underlining that the Global Risks Report outlines the environmental risks that are seen in the short-term and longterm as one of the most important issues by leaders in general. “This obviously has an impact in terms of responsibility, and from a political responsibility, we see a clear switch in corporate responsibility, and behind that that’s obviously the directors and officers.”

Martin de Laubadère adds that, from a D&O risk perspective, the evolution of the regulation will have a big influence on the

global insurance industry in 2023. “We at Zurich clearly have a lot of D&O expertise and leadership. The intention of the group, globally – but our intention, also, in France – is to maintain our presence to accompany our clients, bring our expertise, and share that with them, working together to face this risk and be more resilient as the future unfolds.”

“Other challenges will be the CAT evolution due to climate change and the necessity to adapt our insurance proposition with this evolution,” adds Denis Stasinski. “Risk assessment is and will remain key to properly understanding the impacts to help our customers adapt their business model.”

“Digital transformation has a financial cost. But it also has a sustainability cost, because you consume more servers. It’s a different cost to paper, and you’re not cutting down trees, but there’s still that energy usage question”

MATHIEU PAUWELS COO, ZURICH FRANCE

According to data from the World Bank, there are an estimated 1.4bn unbanked people worldwide in 2023.

As the use of cash diminishes and digital payments increase, many unbanked people with access to mobile technology have instead opted to explore the offerings provided by cryptocurrency and the DeFi space.

There is limited data on the interest of unbanked individuals in cryptocurrency. However, some reports suggest that digital currencies already play a significant role in financial inclusion for the unbanked, as there’s no requirement to have an active bank account and can be accessed through a mobile phone.