TECHNOLOGY: HOW DOES EMERGING TECHNOLOGY TRANSFORM BANKING?

SUSTAINABILITY: ARE BANKS AND FINTECHS OVER-RELIANT ON CARBON OFFSETTING?

TECHNOLOGY: HOW DOES EMERGING TECHNOLOGY TRANSFORM BANKING?

SUSTAINABILITY: ARE BANKS AND FINTECHS OVER-RELIANT ON CARBON OFFSETTING?

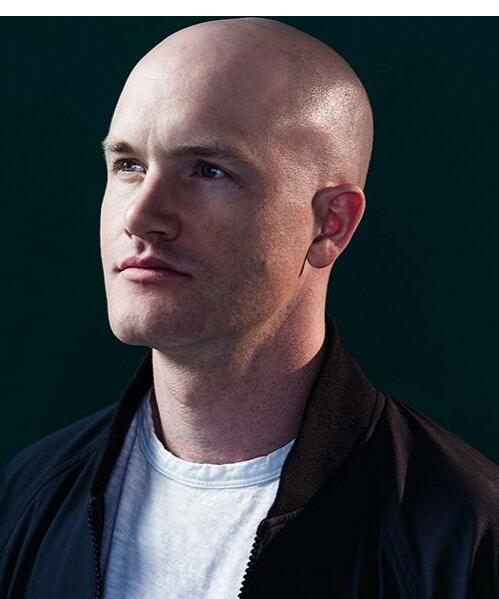

FINTECH CEOS TO WATCH

YBS:

MAKING CUSTOMERS CENTRAL TO DIGITAL TRANSFORMATION

We explore the future of NFTs and their post-crypto winter potential

Creating frictionless finance and regulations in the crypto space are topping the trends this month

January saw Davos take centre stage once more in the snowy setting of the Swiss Alps. Talk about DeFi, CBDCs and the future of cryptocurrency was top of the agenda for the WEF leaders, as they attempted to shape and action their strategy of a global, digital financial superhighway consistent with the Great Reset agenda.

But as some delegates pointed out, the renegade nature of the digital currency space means placing greater regulatory power over the democratised financial sector so that governments have more control, might prove more difficult than first thought.

These are exciting times, and although there has been a slump in crypto over the past few months, it's an area that continually grows and changes - with new coins and use cases for NFTs exploding.

This month, we’ve focused on three key areas; namely embedded finance, new banking technologies on the horizon, and of course, the seemingly unlimited potential of NFTs.

In the words of Bob Dylan, ‘the times they are a-changing’ - and from where we’re sitting, a clash between innovators and regulators will continue over the next few months.

It’s a ‘pass the popcorn’ period in the story of fintech - and we’re privileged to have a front row seat.

We hope you enjoy the issue.

JOANNA ENGLANDjoanna.england@bizclikmedia.com

It’s a ‘pass the popcorn’ period in the story of fintech - and we’re privileged to have a front row seat”

Lending industry dynamics and consumer financing habits are changing rapidly and a whole new breed of financial institutions is fundamentally redefining the industry’s modus operandi.

Now more than ever, meeting customers’ needs and speed are crucial factors, and this applies to both lenders and borrowers alike.

There are 4 key aspects that should drive any financial institution’s decisions:

1. Client expectations are always more demanding in terms of the overall experience

2. More and more alternative lenders are disrupting the industry

3. Regulatory requirements are increasing

4. Operational challenges have to be faced, both from a technological and operational perspective.

CRIF supports lenders on their journey to a more efficient and productive operating model, traditionally providing information, advanced analytics, and innovative solutions to help their business grow.

Thanks to the continuous search for cutting-edge technological solutions, CRIF launched a new native-cloud Digital Lending Platform built in partnership with Microsoft, which allows lenders to easily activate a digital channel for the entire lending process.

Delivered in an as-a-service model only, reducing IT complexity and effort, the CRIF Digital Lending Platform takes advantage of all CRIF data, analytics, and solutions, providing a fully digital end-to-end customer experience, with customer onboarding, profiling, and instant decisions, complete with all regulatory checks such as KYC/KYB and AML.

With the CRIF platform, lenders can easily activate an online channel both for consumer and business requests, providing them with a fully digital experience and reducing the time taken to evaluate their applications.

For more information: www.crif.com

CRIF is a global company specializing in credit & business information systems, analytics, outsourcing and processing services, as well as advanced digital solutions for business development and open banking. Throughcontinuous innovation, the use of state-of-the-art technology and a strong information management culture, CRIF supports 10,500 banks and financial institutions, more than 600 insurance companies, 82,000 business clients and 1,000,000 consumers in more than 50 countries across 4 continents.

All eyes are on China as the world’s second-largest economy battles multilayered issues to ease its economic woes. Problems include workforce issues for the manufacturing industry as extreme measures to curb COVID-19 resulted in draconian lockdowns that impoverished the working classes. The property market is also in a state of flux due to overborrowing, the financial downturn, and poor build quality. Both these issues have caused well-attended demonstrations throughout major cities in China over the past 12 months.

Which fintech trend will have the biggest impact on the fintech space this year?

READ MORE

15% Ethical investing

55% Payment solutions

READ MORE

READ MORE

1% Other Ronaldo NFT launch sees search traffic surge

29% Higher compliance regulations

The number of people searching for NFT-related search terms exploded after professional footballer Cristiano Ronaldo launched an NFT collection in partnership with Binance.

READ MORE

“Embedded finance is going to play a huge part in the future of fintech – particularly in terms of bringing regulated financial services products into everyday life”

James Simcox

Chief Product Officer

Equals Money

“Unfortunately, it has become all too common to default to carbon offsets as a way to claim net-zero targets”

Anna Krotova Director of Sustainability Mambu

“The ease of use of crypto wallets needs to improve… the user experience in general is not always to the standard that mainstream users expect”

Wes Levitt Head of Strategy

Theta Labs

£100mn

UK-based fintech challenger Allica Bank has secured £100mn in a Series C funding round led by technology investor TCV – the backer behind industry heavyweights Nubank, Brex and Revolut.

TCV is joined in the Series C round by existing investors Warwick Capital Partners and Atalaya Capital Management. Allica intends to use the money to scale rapidly and accelerate its presence in the UK market, having already lent £1bn and reached the milestone of being profitable on a month-bymonth basis.

Allica is a London-based digital challenger bank that provides banking services to SMEs and entrepreneurs including lending, savings and payments. Despite accounting for a third of the UK’s economy, these SMEs, which typically employ up to 250 people, are often neglected by high-street banks and other fintechs, Allica says.

The bank is led by Richard Davies, a vastly experienced executive whose CV includes stints at both HSBC and Revolut.

The French fintech, which provides up to €50,000 of instant credit to European consumers at checkout, has raised €60mn in funding itself. The company hopes to expand beyond its five current markets.

The Warsawheadquartered venture capital firm has launched a €150mn deeptech fund, which will invest in fintech, cybersecurity and AI among others.

The chairman of loyalty fintech Bink, which is backed by two of the UK's biggest banks, is stepping down as the company reportedly seeks investment that will keep the lights on.

PLAID

US fintech Plaid is laying off more than 250 employees – roughly a fifth of its workforce – to ensure that a year defined by fintech layoffs went out in the worst possible fashion.

W I N N E R S L O S E R S

FEB23

In a short period of time, the metaverse has emerged as one of the most promising technologies for the future of commerce. But it’s still in its nascency – so what’s next?

1992 2012

Oculus would take a big step towards enabling the metaverse when it crowdfunded US$2.5mn in 2012.

The company was acquired by Facebook two years later before releasing the Rift, the world’s first virtual reality headset made widely available to consumers, in 2016.

By 2020, manufacturers were shipping more than 5mn shipments of virtual reality (VR) and augmented reality (AR) headsets per year. There is a consensus that, although the metaverse could be accessed in a number of ways, consumers will need an immersive headset to take full advantage.

In 2021, Facebook positioned itself to capitalise on the future of the metaverse by rebranding its parent company as Meta. It also announced it would invest US$10bn and hire 10,000 in Europe to build out a metaverse.

The word ‘metaverse’ came runner-up in a public vote to determine the Oxford English Dictionary’s word of the year – on its 30th birthday, no less. The word became one of the hottest fintech buzzwords of the year and investors spent millions acquiring virtual real estate in the metaverse.

According to analysts, the global metaverse industry will be worth nearly US$100bn by 2030 – almost 50 times what it’s worth today. But adoption will be defined largely by the number of people buying VR headsets. In the US alone, around 15% of people own a VR headset today, compared with 53% for tablet computers.

Afamiliar figure among the Silicon Valley financial and tech elite, you’d be forgiven for thinking Max Levchin’s background must have assisted in his meteoric rise to wealth and fame.

But rather than hailing from a privileged upbringing, Levchin is a prime example of how hard work and ability result in success.

Born in Kyiv, Ukraine in 1975 to Ukrainian-Jewish parents, he was a sickly child who suffered from severe breathing problems as an infant that went on to affect him throughout childhood. His parents and grandmother urged him to take up the clarinet as a way to boost his beleaguered lung capacity, and there were times the family feared young Max would not reach adulthood as a result of his health issues.

Nevertheless, despite the challenges, he was a bright and hard-working student. In 1991, when the family emigrated to the US, with very little leftover cash to start a new life in their chosen home of Chicago, he joined Mather High School and excelled academically.

In 1997, Levchin graduated from the University of Illinois with a degree in computer science. But during his time as a student, he had demonstrated an aptitude for entrepreneurship, founding not just one, but four startups alongside his studies.

They were all tech companies with a focus on online ad banners and whitelabel classified ads, marketing networks, and newspaper sites.

While three of his early attempts failed early on, one made the grade and was quickly bought up by the late 90s online advertising company LinkExchange.

The sale of this first startup enabled Levchin to move to California - which was already booming as the US hub of tech innovation. Despite having created and sold a company, Levchin was far from financially flush, and upon arriving in Palo Alto slept on a friend’s floor, who happened to be a student at Stanford University.

Levchin found the lure of elitist education a huge draw and according to reports, spent much time sneaking into lectures to listen to the professors, and enjoy the free air conditioning. One day, however, he attended a talk by a young entrepreneur named Peter Thiel and realised the pair had a shared vision.

By 1998, Levchin and Thiel were business partners in their first venture - a security company named FieldLink. The startup provided a data encryption service for PDAs and palm pilot devices, enabling them to serve as digital wallets. It was a disruptive idea and soon attracted the attention of the wider fintech community.

“

The very first company I started failed with a great BANG ”

Levchin and Thiel later rebranded the company as Confinity - and developed the Paypal product, which enabled in those early days the digital transfer of funds via PDA devices.

Confinity merged with X.com in 2000, an online bank co-founded by Elon Musk, Harris Fricker, Christopher Payne, and Ed Ho, and by 2001, had rebranded again to the name of its premier product, PayPal.

PayPal went public shortly afterward and was later acquired by eBay in July 2002. Levchin had hit the big time, with his 2.3% stake in the business worth an estimated US$34mn at the time of its sale.

Not only had Levchin secured his financial future, but his innovation and brilliance now had the attention of Silicon Valley’s most influential figures. With his newfound wealth, he was able to indulge and experiment with his love of entrepreneurship and was even named by the MIT Technology Review as Innovator of the Year - and one of the top 100 innovators in the world under 35 years of age.

In 2004, he launched Slide - a precurser to the social media platform boom that enabled users to log on and network socially. Slide was bought by Google in 2010 for US$182mn, and for a year, Levchin remained with the company as its VP of engineering.

In 2012, a year after leaving Slide, he launched his next startup - a tech funding company called HVF. The idea was that HVF would seek out innovative startups that leveraged data. But as usual, the idea evolved, and within months, Levchin was concentrating once again on fintech,

founding Affirm - a company that he saw could carve out a next-generation credit network for users.

The team behind Affirm also included Palantir Technologies co-founder Nathan Gettings and Jeff Kaditz of First Data.

Not content to stay within the boundaries of fintech, by now Levchin was looking further afield. He could see the way technologies and the analysis of data could be used to help people not just with transactions, but even with their personal lives. In 2013, he launched Glow, a data-driven fertility and women’s health tracking app that has been instrumental in transforming fertility management for its users.

He also dabbled in political affairs and was listed as a contributor to a Silicon Valley lobby group led by Facebook CEO, Mark Zuckerberg. The group seeks action in helping skilled immigrants in their journey into the US tech industry.

He also became embroiled in debates on terrorism when he supported the NSA’s actions in surveillance during the Edward Snowdon revelations, which saw other tech industry leaders criticise the heavy-handed approach by the NSA.

Affirm is one of the world’s leading BNPL operators. In January 2021, the company went public, doubling its valuation from $12bn to $24bn. Today, in the current financial climate, its stocks

have taken a considerable hit. But it remains an established and well-used lender, with its customer-friendly, flexible services continuing to attract the spender’s interest.

In terms of his personal life, Levchin is intensely private. He married his long-term girlfriend in 2008 and has two children.

“ Being an entrepreneur is not about being in love with an idea, it's about being IN LOVE with running A COMPANY ”

The CEO of international payments business TransferGo has first-hand experience of how difficult cross-border transactions can be. He’s used that knowledge to his advantage

» Before starting TransferGo, I was running an import-export business, and making payments internationally was a challenging undertaking. I realised that the system was stacked in favour of traditional financial institutions, and I thought that it was ripe for disruption. The more I researched, the more I was convinced that there was a sizable opportunity for a fintech to offer fast, low-cost and convenient international payments.

» Ever since I was young, I have admired Steve Jobs. He had a unique ability to make the future, and all the innovation it may bring, feel as though it’s within easy reach. When he spoke, he could transport an audience into a new and exciting world that is not yet here. It’s such a rare skill but it’s a critical trait for any ambitious entrepreneur who wants to bring their customers along with them on their journey.

» I was once told that people often overestimate the ups and downs in business, and over time, I’ve come to realise that it’s true. The highs are never quite what you imagine, while the lows do not have to indicate the end of the world. That means that leaders should seek to take more risks, especially during the early stages of a business, embrace

“In business, the highs are never quite what you imagine while the lows do not have to be the end of the world”

failure as you do success, and realise that if the worst outcome is having to move back in with your parents for a short while, then you can learn from the experience and put it into practice in your next venture.

Q. NAME ONE PIECE OF TECHNOLOGY YOU COULDN’T LIVE WITHOUT (BESIDES YOUR MOBILE PHONE)

» I’m going to have to cheat and say my mobile phone - I couldn’t live without it!

Q. WHO DO YOU LOOK UP TO IN TERMS OF LEADERSHIP AND MENTORSHIP?

» There are too many people to name but I am incredibly pleased to be working alongside an experienced board who bring knowledge and experience from the industry, and teach me new things every day. Self-development is a critical

part of any leadership role, and I make sure it is part of my job description.

Q. TRANSFERGO IS MOVING FROM STRENGTH TO STRENGTH – DID YOU EVER THINK YOUR PLANS WOULD TAKE YOU TO THIS POINT WHEN YOU FIRST STARTED OUT?

» I think you have to have an optimistic mindset as an entrepreneur, so yes, I did believe TransferGo would be, and would achieve, what it has already. But of course, whatever type of business, to meet demand you need to continuously change and grow so our plans are always taking us in new directions. You also have to demand more of yourself and the team around you, so it’s important not to get complacent as it's ultra-competitive out there. That said, we’ve just had our 10-year anniversary and sometimes it’s important to reflect and look at how far you’ve come. 2012 Year founded

» Ukraine has always been a large part of our business. When the war broke out, I’m proud of the job we did to ensure our staff, with families back in Ukraine, had the support and resources to evacuate, should they want to leave. We also worked non-stop with our Ukrainian banking partners so that we could continue to support our customers there and keep money flowing into the country. We did all of this without making a big fuss about it or trying to promote ourselves, unlike some other businesses.

» Driven, direct and inquisitive.

300

Number of employees Number customersof

» Our mission – supporting migrants and making the world fairer for them – is more important today than it has ever been. Political, demographic, economic and even environmental forces are going to mean that migration continues to shape economies and societies across the globe. We’ll be there to help and ensure that people can move money around quickly and affordably..

» I’m focussed on the next 10 years at TransferGo, ensuring that we’ve got the best team in place to deliver new products and serve new markets. We’ll have some exciting announcements soon, so watch this space!

“Self-development is a critical part of any leadership role, and I make sure it is part of my job description”

Segmentation has never been this rewarding

Stop ransomware in its tracks.

Boost security performance with Akamai Guardicore Segmentation.

Learn more

Steve Winterfeld of Akamai discusses the company’s university-based founding and how it merged into a leading multibillion-dollar cybersecurity firm

Akamai was founded following a competition at the Massachusetts Institute of Technology (MIT), entered by its co-Founder and CEO Frank Thomson Leighton—Dr Tom Leighton. Since that time, the organisation has expanded massively, and in the words of Steve Winterfeld , Advisory CISO at Akamai, the company “continues to solve hard problems.”

The cybersecurity company plays a critical role for corporations as it focuses on the future, to determine whether threat motivation will change and how to best combat ransomware attacks, state-sponsored DDoS attacks, and ransomware that could turn into wiperware.

“Those are real concerns, and we’re keeping an eye out for those. And so we have probably 15 security capabilities backed up by services, responding to customers’ needs and rapidly growing on the edge compute and cloud side.”

“We started out with a web application, or as it is more commonly called now, web application and API protection, and expanded into protecting the infrastructure against DDoS to include the DNS infrastructure and recently added internal infrastructure protection and visibility through micro-segmentation,” explains Winterfeld.

As an established cybersecurity organisation, Akamai can now focus on what customers need.

Winterfeld explains that, in response to its clients’ feedback, the company has been acquiring the necessary assets and tools to fulfil those needs with the recent purchase of Guardicore. Guardicore’s leading microsegmentation products will be added to Akamai’s comprehensive portfolio of Zero Trust solutions to protect enterprises from damage caused by breaches like ransomware, while safeguarding the critical assets at the core of the network.

“We bought Linode, which is a cloud provider. And so now we have an integrated platform to build and perform on as well as secure.”

A prime example of Akamai’s ability to meet customer demands, particularly in high-risk environments, is its partnership with First Bank, which is “very concerned about its real-time visibility into its network. We’re partnering with them on a software-based microsegmentation, where they’re able to see those data flows and create segments.”

WRITTEN BY: ALEX CLERE

PRODUCED BY: MICHAEL BANYARD

WRITTEN BY: ALEX CLERE

PRODUCED BY: MICHAEL BANYARD

In recent years, Yorkshire Building Society has undertaken a transformational journey –one that starts and ends with the customer

When Yorkshire Building Society’s (YBS) Chief Commercial Officer, David Morris, and Director of Business

Transformation, Ben Sampson, join me to discuss the seismic change that the mutual has enjoyed over the last five years, there’s more than 100 miles between them. Morris is joining from Oxfordshire in the south of England, while Sampson is dialling in from Halifax in the north. It’s a sign of the times – in business today, it’s not unusual for colleagues to be separated by postal codes, time zones or even oceans. But it’s also a mark of how far Yorkshire Building Society has come since it was founded in 1864.

YBS can trace its roots back more than 150 years to the Huddersfield Equitable Permanent Benefit Building Society, whose members would meet each morning from 5-8am – not on Zoom, but in a single room in the Yorkshire town. Early directors of the society included a dentist, a shoemaker and a plumber. At the end of the first year, there were just six borrowers and assets of around £4,000 – over £400,000 in today’s money.

The name itself stems from the West Yorkshire Building Society, which was founded two years later in Dewsbury –a short six-mile hop from the town of Huddersfield. For over 100 years, the two building societies operated in separate orbits – orbits that would rarely stray outside this small, 10-mile patch of northern England. In 1982, the West Yorkshire Building Society

and the Huddersfield Building Society merged with another local mutual, the Bradford Building Society, to create the entity that exists today.

It is a history of consolidation: in the years after the merger, the newly rebranded Yorkshire Building Society would gradually accumulate more of its peers from across the UK, slowly increasing its sphere of influence and growing steadily in size. The Haywards Heath, Barnsley, Chelsea, and Norwich & Peterborough Building Societies were all subsumed into YBS and today the group has a balance book in excess of £55bn.

Being local and mutually owned means that Yorkshire Building Society is motivated by its members, not by a distant shareholder who they’ve never met. Everything that YBS does is for the service of its members.

“I don't actually think we are local at all anymore,” Morris says. “We've got a national branch network, a sophisticated digital footprint across all our brands and we've obviously got customers from all over the British Isles. We've got customers in Northern Ireland, Scotland, Cornwall, and a huge London presence.”

Instead of thinking local, YBS today thinks about local values. It has expanded far beyond Yorkshire’s borders, but the organisation is still proud of its heritage and

is committed to upholding the traditional values that are said to define this beautiful part of the world: humanity, empathy, honesty, and a sense of doing the right thing.

“I’m a proud Yorkshireman. I'm a local lad,” says Ben Sampson. “I love coming to work at the Yorkshire Building Society because whilst we're national and we make a national impact, I think the culture and the roots of the business feel very Yorkshire. If you ask a Yorkshireman what they think about being from Yorkshire, they'll use words like openness, integrity, fairness and honesty – and I think we have a culture that really thrives on that.”

• Historical area of northern England made up today of four counties

• Nearly 15,000km² ranging from peaks and dales to heritage coastline

• Major cities include Leeds, Bradford, Sheffield, Hull and York

• Renowned for its food and drink including strong tea, batter puddings, Wensleydale cheese, Pontefract liquorice, and its forced rhubarb

• Population according to the 2021 UK census: 5.5mn

“ I’M A PROUD YORKSHIREMAN . I LOVE COMING TO WORK BECAUSE, WHILST WE MAKE A NATIONAL IMPACT, THE CULTURE AND THE ROOTS OF THE BUSINESS FEEL VERY YORKSHIRE”

BEN SAMPSON, MBA DIRECTOR OF BUSINESS TRANSFORMATION, YBS

TITLE: DIRECTOR OF BUSINESS TRANSFORMATION

INDUSTRY: FINANCIAL SERVICES

LOCATION: UNITED KINGDOM

Ben began his career at HBOS and worked in various business areas until 2008 when Lloyds TSB took over during the financial crisis. At the newly formed Lloyds Banking Group Ben undertook significant roles in both the Integration and Verde (TSB creation) programmes. Since Joining YBS Ben has led a number of high profile programmes of work that have helped transform and modernise the society, such as the lending re-platforming work to move YBS to the IRESS MSO platform. In his current role as Director of Business Transformation, Ben is responsible for the strategic design, business case and planning of the YBS transformation. This includes overall sponsorship and ownership of the benefits and benefits for the programme and accountability to the Executive and board.

UNITED KINGDOM

David began his career at Citigroup and has subsequently worked at various Financial Services institutions across the UK and abroad. He is responsible for the innovation, development and ongoing management of the Society’s mortgages and savings products, YBS’s marketing and its digital channels, mortgage distribution and the Society’s branch network. David is also responsible for our Commercial Lending and is Chair of Accord Mortgages Ltd. Prior to joining YBS David was the Head of Products at Coventry Building Society.

In every organisation’s history, there are usually a few executives that have a defining impact. For YBS, one of the most influential was Mike Regnier, the erstwhile chief executive who left to become CEO of Santander UK at the beginning of 2022.

David Morris says: “What Mike did was come in and effectively provide quite a lot of strategic clarity in terms of what we can and can't be. We need to be a savings and mortgage business and we need to get simple, lean, and focused. That's really been the mantra over the last eight years. What we've seen since about 2018 is an acceleration of that vision.”

Yorkshire Building Society focuses on mortgages, savings products and commercial lending, shying away from everyday transactional banking (which is highly regulated with a lot of competition) in favour of higher-interest products that encourage consumers to put some of their money aside. That means YBS has three core lines of business, which Morris describes as “low-touch but meaningful”. The company is one of the largest lenders in the UK: “We’re very big but we’re focused,” he explains.

The sheer scale that YBS has been able to achieve is testament to the laser-tight focus within the business. “We want to make sure we're doing things purposefully; we want to make sure we've got the capability to execute against that; and critically we only compete in parts of the market where we think we can win,” Morris continues.

On mortgages, this means a higher proportion of its lending goes to firsttime buyers or customers who are often overlooked by other providers. This allows them to occupy the underserved space in between other mainstream lenders, carving out a competitive advantage for themselves. “They’re good people but for whatever reason other banks are not providing solutions that help them get on the housing ladder,” Morris says. YBS still lends to more affluent customers who have higher equity in their homes, but they are clear that the

“ I FIND MYSELF ENGAGED BY PEOPLE WHO ARE ABLE TO BREAK PARADIGMS, THINK DIFFERENTLY AND LIFT THEMSELVES OUT OF THE STATUS QUO ”

DAVID MORRIS BA, MA CHIEF COMMERCIAL OFFICER, YBS

business’ focus is on being purposeful and finding innovative solutions.

This incisiveness and clarity of focus, coupled with the fact that YBS is “just a building society”, often leads to people underestimating their scale or level of expertise. Morris says: “I think the YBS of today is far more capable than people realise. It's very interesting when you go out into the market and people say, ‘oh you're a building society, do you know X’ or ‘do you know Y’? Of course we know it, we're really very good. It's just we're very, very focused.”

This clarity of focus is clearly winning: in H1 2022, YBS outperformed some of the UK’s traditional ‘big six’ banks in terms of

“ WE HAD A GOOD PHYSICAL BUSINESS MODEL , GOOD BRANCHES, BUT WE WERE REALLY LAGGING BEHIND ON BOTH TECHNOLOGY AND DIGITAL PERFORMANCE ”

BEN SAMPSON, MBA DIRECTOR OF BUSINESS TRANSFORMATION, YBS

both book growth and yield performance. It is also highly competitive now on digital. Morris believes that there are other financial institutions who could learn from this focused strategy.

When you think about digital transformation, you tend to think about the process of replatforming and the multiple legacy systems that often hold firms back. That is one of the key tenets of digital transformation after all. But, as with any sizeable undertaking within a business, the most important thing to get right from the outset is strategy. It can be a challenge to get everybody within a business subscribed to a digital transformation – it requires a huge

cultural shift – but it can also be difficult to get all your objectives aligned.

When Director of Business Transformation Ben Sampson joined the business, YBS had an ageing legacy platform powering its websites; it didn’t have a consumer app; and the percentage of customers signing up through digital was somewhere between 15% and 20%.

It’s not an atypical hangover for a building society to have; indeed, according to research from the Building Societies Association published in 2021, twothirds of building societies identify digital transformation as the main challenge facing the sector in the next five years.

“We had a good physical business model, good branches,” Sampson says. “But we were really lagging behind on both the technology front and the digital commerce performance front.”

First, Yorkshire Building Society established a single vision and ambition organisation-wide that everybody was aligned to. Digital transformation has proven to be a considerable, long-term investment for the business – the single biggest programme of work that YBS has ever done, as Sampson puts it. “That’s as significant as the replatforming for me,” he says. “A business that gets unified behind that single goal, which can then lead to all the important elements of conditions for success such as the ability to have razor-sharp prioritisation discussions. They’re not possible if you’ve got different viewpoints, because it just becomes an argument.”

YBS built and launched its first native apps for iOS and Android, getting into the pockets of its customers for the first time. The demand has always been there: research shows that a majority of UK banking customers want their banks to offer

mobile apps. It established a partnership with identity confirmation provider HooYu, allowing it to elevate its onboarding and ID verification process. Together, they developed a programme called “experiencedriven acquisition”, which involved building a more seamless account opening process. Alongside the partnership with HooYu, YBS also redesigned some customer journeys and replatformed to make this project work.

YBS has also invested heavily in modernising its mortgage origination system. A new platform was introduced in 2018 and through the programme this has been extended, adding the remaining products one by one. Significant time has also been spent optimising this tool, working with technology partner Iress to create innovative solutions and leverage its capabilities. Permanent squads were also set up, allowing technical expertise and strong relationships with the supplier to develop. The result is that the speed of change has increased by 300%.

Morris says this has had a huge impact on the business: “When I started at YBS I saw our mortgage business had lots of potential. I think it is easy to overlook the impact of our transformation here but, for me, this has been the spark that enabled the broader transformation. With our mortgage engine firing, we have been able to subsequently transform our savings proposition and invest further and faster in our digital transformation.”

The results have been staggering, the company says: digital acquisition has gone from 20% of the mix to over 70% and the online book is over 2.5 times bigger than it was before the transformation began; over 20% of lending originated utilises the new capabilities the transformation delivered; and digital satisfaction has increased by over 40% in the last 12 months alone.

It also transitioned away from waterfall development, which just wasn’t cutting it with the modern digital technologies, and created a ‘digital services tribe’ instead. It was the first time that YBS had attempted to work in that agile way at scale, so clearly the technical undertaking itself was vast. But it all stemmed from a single collective vision that helped to clearly define the building society’s priorities, who it was and who it served as a business, and exactly how it would take advantage of the digital opportunity before it.

“As we have learned we have sped up certain bits, slowed down and reordered priorities,” David Morris says. “But we have done this in a way that is completely

1864 YEAR FOUNDED 1982 MERGER BETWEEN THREE BUILDING SOCIETIES CREATED YBS

£60bn YEARLY REVENUE

consistent with our long-term vision, which remains unchanged. This has allowed us to continue to review and improve our performance in terms of delivery and value creation. Our modular approach has also helped enable this.”

At that time, YBS had never undertaken a digital transformation programme on this scale before. It needed some support to mobilise and to get that initial jumpstart, which is when it partnered with business consultancy Johnston Carmichael. Their expertise and knowhow supported YBS in accelerating and creating pace, but it also offered a couple of additional edges – like challenging YBS’ own internal ways of thinking, and lending an experience and a pragmatism that firms like Johnston Carmichael benefit from.

They've got a team of very experienced, highly professional people that have been through a number of cycles of both the external environment and transformations,” Ben Sampson says. “That experience is invaluable when you've got a company like YBS, which has good core capability but maybe hasn't done this before and is lacking in that real-world experience. Johnston Carmichael certainly brought that. They came in, they gave us a huge injection of pace, they gave us some really strong critical thinking, and they brought a clear view of design thinking.”

Carmichael is indicative of YBS’ broader thinking around collaboration and partnership, as Sampson explains: “We want to be more selective about the partnerships we have. We can't throw good money after bad if we get that wrong. So we tend to go with trusted partners and longer-term

relationships. We will often run competitive processes with people we've worked with before and we look for a cultural match –people that will work well in our business. It’s vital that we have people who have done this before. We want to learn from others, we want to take their experience to help us be successful.

“The thing that's absolutely essential from any partnership for us is that they must help us to learn, and to be able to do that, they need to leave a legacy of us being able to do things ourselves. We don't want transactional relationships that give us a step change that then falls away. It's one thing to transform, but it's another thing to then optimise. And to be able to optimise, we need to be building our capability as we do it.”

David Morris concurs: “We want people who can augment, people who can do things that we can't or people who can help us accelerate. We’re not looking for people to

come in and do the stuff that we can already do, because we already have some skillful, capable people within the business.”

So who inspires them? “I believe in the power of people and in creating environments that allow people to thrive,”

Sampson says. He is drawn naturally to people who have overcome adversity: to Stephen Hawking, who became the preeminent scientist of his generation despite battling personal adversity; to Richard Branson, who built Virgin from the ground up and who today is quite pioneering about the way in which he nurtures his teams, giving them unlimited time off as an example.

Sampson also identifies with Steven Bartlett, the founder of marketing agency Social Chain and the youngest investor in the history of Dragon’s Den (the UK version of Shark Tank). He also has a podcast charting

the highs and lows of being a CEO. Sampson calls him an inspirational figure and likes the fact that Bartlett dropped out of university, like he did.

David Morris says that central to his style of leadership is a ‘belief in better’. He is inspired by people – both from within YBS and outside the organisation – who are able to think differently, challenge the ordinary and strive for something extraordinary. “I genuinely find myself engaged by people who are able to break paradigms, think differently and lift themselves out of the status quo. People who are able to say ‘here's a completely different way of doing things’.”

That disruptive mindset has always been rare, but wherever they exist those people are usually invaluable assets. There is clearly something of a disruptor personality trait among Morris and Sampson themselves. When we first speak, it is just a few days before Christmas – yet there is no let-up

for either of them. They brim with passion about the progress that YBS has made, the potential it’s unleashing within the organisation, and crucially the benefits it will bring for customers.

YBS has spent the better part of eight years reorienting its business towards customers: giving them the platforms and digital channels they expect, but also honing its propositions so that it can meet underserved demand in the grey space between traditional high-street lenders.

David Morris believes that, because business value has played such an integral role in YBS’ transformation, the customer has become an inescapable end-goal. Every path that YBS takes now leads to the customer. That means the customer has become a really useful currency for explaining digital initiatives to executive

stakeholders within the business, particularly those that are not digitally confident.

“To me, digital inherently means being customer-centric,” Morris says. “So when we're trying to build customer journeys, there's no point building great technology if it doesn't work for the customer. We've recognised that the solutions we need to create have to be built with the end-user in mind. I think that's just a natural, inherent part of this type of transformation.”

Sampson concurs: “We're building things that meet customer needs and wants, and that's research-based. That's quite powerful.”

Customer-centric design permeates every pore at YBS, including recruitment. Everybody that has been brought into this digital transformation journey has been steered by customer demand – from UX and UI designers through to programme managers. Much like its namesake region, Yorkshire Building Society has a distinctive character, a flavour, a non-negotiable way of doing things. It only takes on new people that fit into this customer-led culture. “You can be the world’s greatest project manager

or the most sophisticated architect, but if you don’t understand the YBS culture then it just doesn’t work,” Morris says.

That applies not just to the people that YBS recruits, but the partners it chooses to work with as well. The building society partnered early on with Johnston Carmichael to help them quickly realise pace, mobilise the digital transformation programme and become clearer on the designs of its digital products. This allowed it to remain focused from the outset on the customer.

“What Johnston Carmichael brought to the table was an acceleration of what we were trying to do, [along with] huge amounts of experience and pragmatism,” Sampson explains. “They used that to not only help us think about what we wanted to do, but to be a critical friend and challenge us in our thinking, and help us avoid pitfalls that others might have experienced who went before us.”

Looking ahead to the future, Morris continues: “Over the last 2-3 years, we've been able to prove just how much opportunity there is in the business and how digitising parts of our enterprise has created huge amounts of value. I think our vision for the next 12-18 months is about how we can go from good to great. We think our approach can be really quite distinct and unique by taking this best-of-breed approach, using digital and human to create something that's distinct in the market. And I think a big focus for us over the next period is going to be about how we create an operational model that supports this powerful acquisition capability we've built.”

“ TO ME, DIGITAL INHERENTLY MEANS BEING CUSTOMERCENTRIC. THERE'S NO POINT BUILDING GREAT TECHNOLOGY IF IT DOESN'T WORK FOR THE CUSTOMER ”

DAVID MORRIS BA, MA CHIEF COMMERCIAL OFFICER, YBS

Banking has changed drastically in the past decade, driven by emerging technologies. Which technologies do our four experts think has had the most impact?

WRITTEN BY: ALEX CLERE

WRITTEN BY: ALEX CLERE

Banking has changed considerably in the last decade and our expectations of what a bank is, and where we should find it, are drastically different. It’s indisputable that technology has been the driving force behind this change. With that in mind, we asked four senior industry executives to give us their view on the technology that is influencing banking.

The fintech industry has experienced rapid global expansion as banks seek to modernise in the midst of evolving laws and regulations. As we look to 2023, many banks will partner with agile fintechs and turn to the cloud to develop new products and services to keep up with today’s digitally savvy customers. To unleash the full potential of these collaborations there will be challenges to overcome. For established banks it will be essential that fintech partners do not introduce systemic risk to their supply chains – especially as regulatory oversight grows. To help navigate the changing landscape, adopting a hybrid cloud approach, including the use of industry-specific clouds with built-in security and compliance controls, can support the secure modernisation the banking industry craves. In the year ahead, fintech should partner with established technology providers to explore the adoption of industry cloud platforms that help remove barriers within partnerships which restrict agile innovation.

One area of growing interest to financial regulators is ESG reporting. Next year, I see fintech incorporating ESG reporting into their business models to help banking clients evaluate and reduce their environmental impact.

A hybrid cloud architecture has an important role to play by enabling companies to tap into other capabilities, such as software powered by AI, to draw on multiple data sources and provide real-time tracking for things like energy usage and carbon emissions.

PRAKASH PATTNI MD FOR FINANCIAL SERVICES DIGITAL TRANSFORMATION IBM

PRAKASH PATTNI MD FOR FINANCIAL SERVICES DIGITAL TRANSFORMATION IBM

“ AS WE LOOK TO 2023 , MANY BANKS WILL PARTNER WITH AGILE FINTECHS AND TURN TO THE CLOUD TO DEVELOP NEW PRODUCTS AND SERVICES”PRAKASH PATTNI MD FOR FINANCIAL SERVICES DIGITAL TRANSFORMATION, IBM

To survive and thrive banks need a platform for agility, scale and innovation. So what sort of platform should banks be using? The answer is a composable one – cloud-native, driven by data but in a way that is explainable and extensible.

Harness the power of data and leading-edge technology to turn existing know your customer (KYC) and anti-money laundering (AML) compliance challenges into opportunities

Banking’s new business models are about spinning up new products and bringing them to market rapidly. Composability, where services are broken down into specific capabilities, enables this. It maximises freedom, speed and flexibility while connecting with an ecosystem of third-party offerings that further increases choice and boosts innovation.

Banks should look at some of the most successful B2B technology companies to understand the value of composability. These companies have taken a function and created an entire suite of software capabilities, accessed through a single platform – think Salesforce for CRM, or ServiceNow for workflow management.

Once a business is plugged into these platforms, they have everything they need, whether they choose to enable all the modules at once or gradually over time. And all without the burden of integrating, updating, localising and innovating, which falls to the platform provider to do.

For large banks, adoption of composable banking is likely to be incremental. They

cannot simply give up on their incumbent technology, but must progressively renovate in order to run down their legacy investments. Challenger banks, fintechs and non-banks will want to scale fast, and adopt specific capabilities that have been precomposed for specific use-cases such as SME lending or digital mortgages.

From the adoption of chatbots to ML-powered risk and decisioning models, the banking industry continues to progress at an exponential rate. As financial institutions grow their business and adopt new technology, their stockpile of data is growing at the same rate. However, with great data comes great responsibility, and financial data often comprising sensitive and personally

ADAM LIEBERMAN HEAD OF AI AND MACHINE LEARNING FINASTRAWITH GREAT DATA COMES GREAT RESPONSIBILITY, AND FINANCIAL DATA OFTEN COMPRISES SENSITIVE AND PERSONALLY IDENTIFIABLE INFORMATION”

identifiable information falls under the most stringent governance. This dampens the spirit of innovation as banks need to collaborate and share data with one another to solve the world’s toughest financial problems such as AML or fairness in credit decisioning.

Thanks to evolving technology in the field of private AI, banks now have a suite of privacy enhancing tools (PETs) to collaborate at scale and solve these pressing financial problems together, without the requirement of physical dataset share, moving data, or manual partner agreements. PETs allow them to answer questions and develop models collaboratively with data they cannot see in a completely decentralised fashion for fully remote data science and analysis. This allows banks to own their own data, which never leaves their servers, and allows external model developers and software engineers to work with data in a private manner and build models and apps without needing physical access to datasets. Private AI and the suite of PETs are driving the future of collaboration and innovation in financial services, giving data its invisibility cloak.

Modern, cloud-based core banking systems (CBS) are facilitating a move towards coreless architectures, which in turn will drive innovation and transform customer experience in the banking world.

In the 2022 Publicis Sapient Global Banking Benchmark Study, which surveyed

1,000 senior banking leaders, the top priority to achieve operational transformation (cited by 37%) was to transition to a modern, cloud-based CBS. Among leaders of the largest institutions (with assets of more than US$1tn), 48% of respondents made this their number one goal.

Modern, cloud-based CBS systems are widely regarded as the way forward with lots of banks prioritising how to transition to a coreless architecture as their top objective for 2023. This is because the old system of banks running legacy CBSs have run their course. These systems are difficult to change and it’s extremely hard to build new

ADAM LIEBERMAN HEAD OF AI AND MACHINE LEARNING, FINASTRAcapabilities or innovate on these systems. Banking architectures are undergoing a profound transformation leading to an entirely different, "minimalist" approach to the CBS.

But what is coreless architecture? In short, in a "coreless" architecture, the key functions such as accounts, transactions and product definitions sit in the "core" but everything else sits outside of it, connecting to the core via APIs. This bears virtually no resemblance to legacy systems, which ran a huge range of arguably unwieldy functions.

PRODUCED BY: JAKE MEGEARY

PRODUCED BY: JAKE MEGEARY

Who better to introduce the business of globally recognised financial ratings organisation Moody’s Corporation than its Chief Financial Officer (CFO), Mark Kaye?

“Our mission is to provide trusted insights and standards that help decision makers act with confidence. In support of the corporate mission, within finance we strive to advance Moody’s business strategy by providing bestin-class, near real-time financial reporting and data-driven insight, mutually enabled by operating effectiveness.”

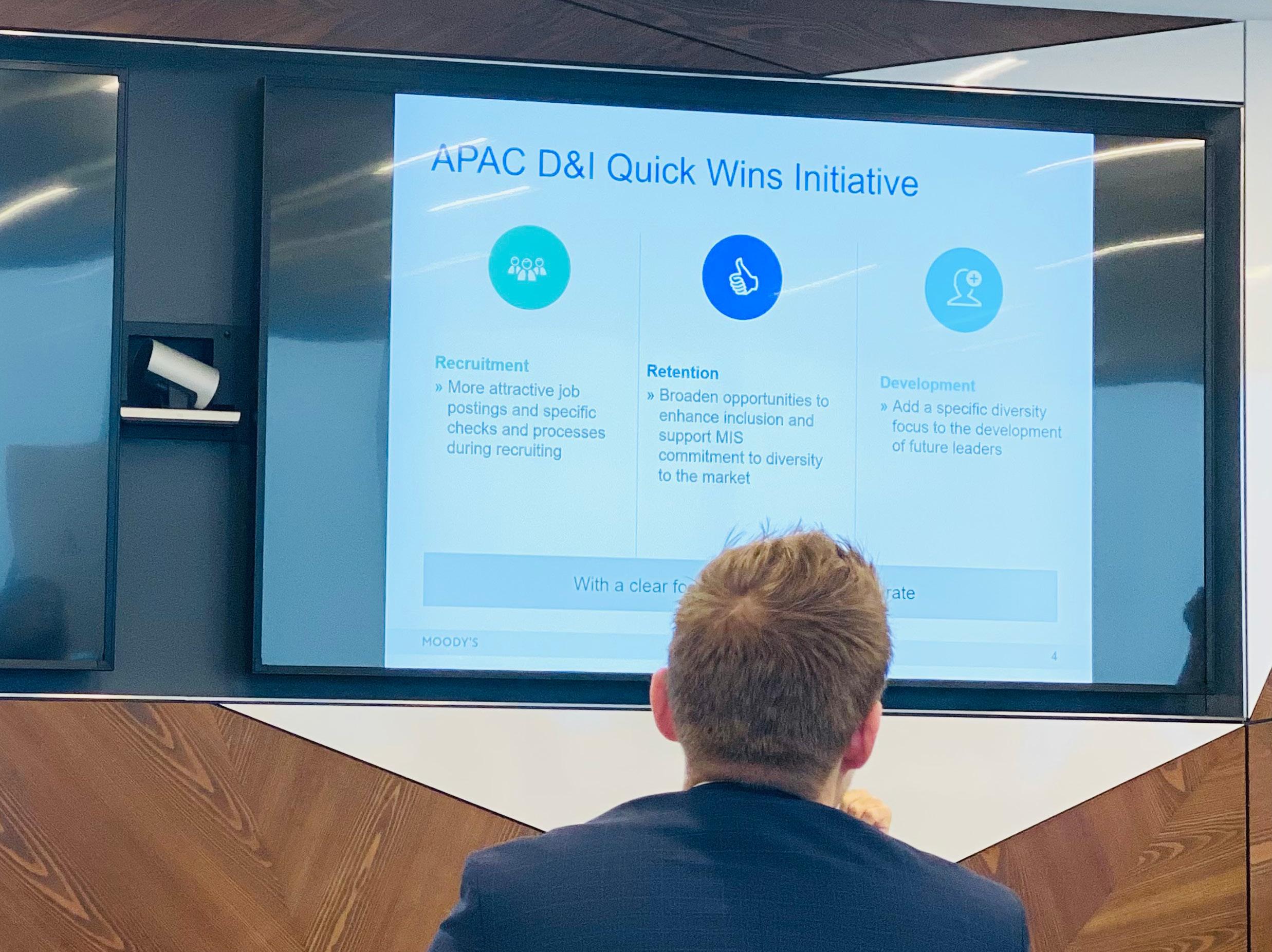

Moody's finance and operations – and within that, the company's enablement organisation – are led by Managing Director Jeff Klebanoff. “We focus on finance transformation, global business services, our automation and analytics strategy, but, first and foremost, we focus on our people and culture. We have a very broad, diverse group of folks working on transformation and enablement activities across Moody's.”

Data management and analytics are crucial to providing insights to the business. “In finance, data is key, but we are interested in the story that lies behind the data. We have a lot of focus on deciding what the right business information (BI) tools are to ensure that we can transform data, visualise it, and help people to analyse it – and it's really important that they understand what the numbers are telling us. One of the key

responsibilities of being a business partner is to help them leverage the data to make the right decisions for the business units.

“Finance is no longer about reporting on what has already happened. Now, we're trying to shift the emphasis and reporting in a way that enables the business to be proactive, leveraging the numbers to predict what might happen – moving from hindsight to insight.”

“As such, a core priority of the company is upskilling employees to help them understand where data is stored and how it is governed, making sure the data is of good quality and presented in a way that allows our stakeholders to understand the insights about their business, their numbers, and their people. That way, the company can be sure it's presenting the best quality and most useful information. It's not merely about efficiency, it’s really about value-driven insights,” Klebanoff says.

Moody's Global Business Services is an organisation recently created to bring together 'value stream organisations' such as accounts payable, billing, collections and cash application. “If you consider our location strategy for finance, and how we manage our third parties, these and other services have become very focused on controls and the automation of controls.

“There is more to come, and we are very excited about the prospects ahead of us”

MARK KAYE EXECUTIVE VP AND CFO, MOODY'S CORPORATION

“To make our clients' value drivers more efficient, we have to make the experience better, not just for our people, but for the ones who are actually using our services. They want to make sure their bills are getting paid on time, the customers are getting accurate information, or we're collecting the appropriate amounts and interacting effectively with our sales people and with our customers. We need to make sure that that's an effective, efficient process so we can keep a close eye on the KPIs and address issues they may be facing.

“How do we make sure that experience is a good one for everybody? How do we give people more time? How do we make it easier to get things done? How do we eliminate that non-value-added time with process improvement, or automation – or even the elimination of processes? Transparent transformation doesn't happen overnight. It's something we put in place, enable, and then take time to stabilise and optimise.”

Jeff Klebanoff and his team have put a Process Excellence Program (PEP) in place to address this. It focuses on enabling the business to execute on their own projects, while providing support by leading endto-end projects and offering stakeholders a suite of tools, templates and self-paced learning, alongside mentoring to improve project success and full lifecycle project management support. “This is something at the centre of finance transformation for us. Value drivers are going to be at the heart of all the work we're doing as a finance organisation.”

Mark Kaye introduces the corporation-wide initiative that is being focused on here.

“To execute on our finance mission, we launched the Finance Transformation

1909 Year founded

$6.2bn Revenue (USD)

14,000+ Number of employees

programme in 2019. This initiative aims to complement the implementation of modern technology solutions that enable heightened controls, efficiency, risk reduction, and data visualisation, ensuring that we attract and retain critical talent, while also focusing on continuous process improvement. As a result, over the last three years, we have re-imagined our finance operating model, standardised our global business processes, upskilled our employees and deployed enabling technologies, such as the SAP S/4HANA enterprise resource planning (ERP) system and Power BI dashboards, to deliver enhanced insights to our business stakeholders.”

“EY and Moody’s have worked together to develop an Integration Factory that can quickly integrate acquisitions”

SCOTT BELTRAN SENIOR PARTNER AT EY AND GLOBAL COORDINATING SERVICES PARTNER AT MOODY'S, EY

“There is more to come, and we are very excited about the prospects ahead of us.” Important as technology is, it's not everything – as Klebanoff reiterates: “You can’t scale intelligent automation and robotic process automation (RPA) without the people and the culture. One of the main areas of focus when we think about transformation is the people aspect. How do we ensure that the people are part of the transformation? Are they ready for and do they understand the change? Are they equipped with the skills to participate? We've embarked on a people journey, as well as a digital journey.

“We're busy upskilling, having realised we didn't have enough people who were strong in some of these new analytics and BI tools. We didn't have people who were really focused on the process. Some of them were unfamiliar with the SAP system we were putting in place – a lot of the traditional accounting that folks used to do changes when you automate, optimise and put in new systems. So, a very big emphasis has been placed on training; we created learning journeys aligned to the new roles required to support this enhanced finance organisation. When someone needs to develop a skill set, we give them the appropriate curriculum, as well as opportunities to put into practice – I believe this is essential to successful transformation.

We're trying to shift the emphasis and report in a way that enables people to be proactive, leveraging the numbers to predict what might happen – moving from hindsight to insight”

JEFFREY KLEBANOFF MANAGING DIRECTOR - FINANCE TRANSFORMATION, MOODY'S CORPORATION

TITLE: MANAGING DIRECTOR - FINANCE TRANSFORMATION

INDUSTRY: FINANCIAL SERVICES

LOCATION: NEW YORK CITY

Jeff is a seasoned technology and business transformation leader of the Finance Transformation, Global Business Services & Analytics team. He manages a global team that oversees the implementation of new technology solutions across Moody’s, supports the enablement of end-to-end digital solutions and data-driven insight, enables the organisation through process improvement and is responsible for global Finance services that enhance the customer and employee experience. Recently, Jeff has also taken on a leadership role in supporting the People Evolution effort to transform Moody’s People Organization. One other major area of focus for Jeff is the cultural aspects of the organisation. He has more than 75 mentees and is also an Executive Sponsor of the Moody’s Minds Business Resource Group, which is extremely focused on employee wellbeing. Jeff joined Moody’s in 2019 and prior to that, worked at OppenheimerFunds for over 5 years and PwC for almost 15 years.

PAUL PARETTA

TITLE: SENIOR VICE PRESIDENT – PROGRAM DELIVERY & PROCESS EXCELLENCE

INDUSTRY: FINANCIAL SERVICES

LOCATION: NEW YORK CITY

Paul is a finance technology leader with extensive experience leading global businesses through large scale business and technology transformations. He has led and managed large application portfolios at Moody’s, and is currently responsible for Program Delivery and Process Excellence – a global function focused on business enablement. Paul joined Moody’s in 2011 and has held various leadership roles in the technology and finance sectors for the last 25 years.

“It's a large programme involving hundreds of people and millions of dollars, under Board scrutiny, and of course things sometimes do go wrong ”

TITLE: EXECUTIVE VP AND CFO

INDUSTRY: FINANCIAL SERVICES

LOCATION: NEW YORK CITY

Mark Kaye is the Chief Financial Officer of Moody’s Corporation with responsibility and oversight for all global financial activities. He leads a team whose mission is to provide near real-time data-driven financial insight to support the execution of superior operational and strategic decisions. He is an actively involved diversity and inclusion leader and business partner, with a passion for creating a high-performance and transparent culture, developing talent and fostering employee growth.

Mark joined Moody’s in 2018 after more than 15 years of diverse experience in business finance, financial planning and analysis, strategy and large-scale project management.

TITLE: SENIOR PARTNER AT EY AND GLOBAL COORDINATING SERVICES

PARTNER AT MOODY'S

INDUSTRY: FINANCIAL SERVICES

LOCATION: NEW YORK CITY

COMPANY: EY

Scott is Moody’s Global Coordinating Services Partner and is responsible for the oversight and delivery of all EY services to Moody’s globally. Scott is based out of the New York area and provides C-Level Consulting related to technology platform business models, digital strategy and service as a board advisor.

Scott has over 20 years of experience as a business and technology consultant and senior operating executive across the technology, media and entertainment industries.

As a Senior Partner with EY, Scott provides his clients with forward-thinking, unique global perspectives coupled with proven expertise in aligning digital strategies with business objectives.

“In a transformation, it's easy to concentrate on new systems and processes, missing the importance of people. We have to hire people and engage with partners to help us. Where we find a gap in our capabilities, we can work with partners like EY to fill them until we can hire or train people with these skill sets.”

The people journey, Klebanoff emphasises, will never be entirely complete, continuing to evolve as new tools and processes come along and finance transformation proceeds.

That all-important Process Excellence team is overseen by Senior VP Paul Paretta, in addition to programme delivery across the business. With 11 years at Moody's, Paretta has a broad portfolio of responsibilities, overlooking all the projects and programmes across the finance organisation.

“My team has a key role in helping deliver and drive those projects. As part of that, we have a focus on mergers and acquisition integration, and there’s a core capability we have developed specifically for this.”

When it comes to onboarding and working with partners, the methodology varies depending whether the partner identified is a large system integrator (SI), such as EY, or a small, boutique-type business – though the principle remains consistent.

“Of course, we look for industry experience and for the competencies we need. That's a must-have for us: they need to have the track record to deliver; we want to partner with organisations that we can rely on to work with us through the ebbs and flows of a programme. Large-scale transformations are not easy and are often fraught with all sorts of risks and, in our industry, many fail.

“For us, it’s important to ensure that in the dark hours (those really tough times in delivering a programme), our partner will be there with us throughout the journey

to help solve problems with us as part of the equation, in terms of the value-drivers of the programme. As we think about the organisations we've partnered with in the past and with whom we continue to partner, like EY, you will see this as a common theme.”

Scott Beltran, a Senior Partner at EY, explains how partnership helps to overcome the familiar headaches associated with M&A: “EY and Moody’s have worked together to develop an Integration Factory that can quickly integrate these acquisitions. The team is developed to be nimble, to expand and contract as needed while bringing together both institutional knowledge of

Moody’s and the process, communication, training, and technical skills needed at the right time, as efficiently as possible.

“We constantly measure success against predefined goals and objectives specific to each programme. As it relates to the Integration Factory, we leverage a standard project plan across four predefined phases to monitor execution. At the end of each phase, we conduct a review of project status and risks and develop mitigation strategies where needed.

“In addition, we conduct weekly operational checkpoints across our stakeholder groups to communicate status, upcoming activities

addressed. Success is measured through the successful execution of cutover and transition of users and processes to ‘business as usual’.”

However competent the team and its partners are, there will always be challenges along the way, as Paul Paretta is quick to admit. “We have an overarching, multi-year roadmap that helps us navigate the project portfolio across the finance organisation and serves as a way of communicating what work is committed and enables the right dialogue when prioritisation and trade-off discussions are needed.”

with the technology, we took a step back to assess how the finance organisation needed to change”

PAUL PARETTA SENIOR VICE PRESIDENT – PROGRAM DELIVERY & PROCESS EXCELLENCE, MOODY'S CORPORATION

As Jeff Klebanoff stresses, technology is not enough on its own; it has to be absorbed into the culture of the organisation to drive the finance transformation journey.

Paretta explains: “We launched this programme back in 2019 and before we even started with the technology, we took a step back to assess how the finance organisation needed to change to support the broader organisation’s strategic goals and objectives. We refer to this as the digitisation of finance and we started by looking at the operating model and structure of the finance organisation. Clearly,

technology is a significant component of this programme, it is the key enabler, but the people-perspective is at the heart of it all. Therefore, we ensured a key focus was on change management – we established a communications, training and engagement model that was thoughtful, intentional, timely and tailored to suit the varying needs of our stakeholders.”

Delivering significant change such as this has to be managed in a way that the organisation can effectively acclimate to new ways of working. As Paul Paretta describes: “We phased the programme into major releases. First, we rolled out enabling technologies within the SAP S/4HANA ecosystem; our global core footprint included a suite of capabilities in accounts payable, fixed assets, general ledger, consolidations and management reporting.”

“A key theme that cannot be emphasised enough is that these programmes are not easy to execute, and recognising when to adapt and pivot to changing circumstances has been a key success factor. We recognised the phasing strategy we initially set forth required even further decomposition. To that end, we introduced an additional phase that allowed us to de-risk and reduce the complexities of our next major release. In August 2021, we deployed customer billing, tax, accounts receivable, cash applications and revenue accounting to our Moody’s Analytics business. In 2023, we will kick-off deploying this same suite of capabilities to our Moody’s Investors Service business, which will benefit from the ‘global design’ we implemented during the second phase of the programme.”

Embedded finance, open banking and APIs are often terms used with seamless interchangeability. But each of these elements has become critical to driving disruption in the financial services space.

The term embedded finance refers to the integration of financial services into companies' normal services. These include all manner of different payment options at the checkout, insurance, ewallets, or any aspect connected to financial transactions.

Put simply, embedded finance enables businesses to 'embed' financial services into their business models at various points along their customers' journey by leveraging their own proprietary data on top of external financial information.

However, embedded finance wouldn’t exist without open banking, and it wouldn’t operate without APIs. Essentially, open banking has acted as a launchpad for

embedded finance. Open APIs, meanwhile, are provided by banks to companies that wish to offer embedded financial services. Ultimately, the technology that has enabled banks to offer frictionless payment experiences, is now available for the commercial and consumer sector in the form of embedded finance.

New embedded finance trends for 2023/4 As disruption sweeps the financial services industry, embedded finance is no exception to the winds of change. According to Nikhita Hyett, EU MD of BlueSnap, there are two major trends that will be leading transformation in embedded payments and strong customer authentication.

“EMBEDDED PAYMENTS - WHICH ENABLE BUSINESSES TO PROCESS THEIR OWN PAYMENTS - WILL DRIVE THIS WIDESPREAD ADOPTION”

Embedded finance is transforming the consumer and commercial space as open banking and API technology continues to disrupt fintech

“EMBEDDED PAYMENTS - WHICH ENABLE BUSINESSES TO PROCESS THEIR OWN PAYMENTS - WILL DRIVE THIS WIDESPREAD ADOPTION”

NIKHITA HYETT EU MD, BLUESNAP

She says that embedded payments will take over B2B software platforms, as they look to diversify their revenue streams and improve customer retention. “With a low market penetration of 15% in B2C transactions and 3% in B2B, we predict exponential growth in the embedded payments sector unlocking the real embedded finance opportunity.”

Hyett believes that with the current push and pull between improving conversion rates and reducing fraud, strong customer authentication (SCA) will grow beyond Europe into North America. “With 3-D Secure proving popular with merchants in Europe, as it has helped to reduce interchange fees and shift fraud liability to the acquiring bank, we can expect it to further proliferate across the pond. We’ve seen this happen

with embedded smart chips and PIN authentication in the past and expect history to repeat itself. However, for it to flourish in 2023, enablers such as EMVCo must show that false declines don’t rise in parallel.”

Embedded finance has played a key role in bringing innovative financial services to mainstream consumers. James Simcox, Chief Product Officer, Equals Money, points out that the services it provides are wide and varied - and the use cases will continue to grow as new technologies and opportunities present themselves. He says,

“WITH A LOW MARKET PENETRATION OF 15% IN B2C TRANSACTIONS AND 3% IN B2B, WE PREDICT EXPONENTIAL GROWTH IN THE EMBEDDED PAYMENTS SECTOR”

“WITH A LOW MARKET PENETRATION OF 15% IN B2C TRANSACTIONS AND 3% IN B2B, WE PREDICT EXPONENTIAL GROWTH IN THE EMBEDDED PAYMENTS SECTOR”

NIKHITA HYETT EU MD, BLUESNAP

“EMBEDDED FINANCE IS GOING TO PLAY A HUGE PART IN THE FUTURE OF FINTECH

“EMBEDDED FINANCE IS GOING TO PLAY A HUGE PART IN THE FUTURE OF FINTECH

– PARTICULARLY IN TERMS OF BRINGING REGULATED FINANCIAL SERVICES PRODUCTS INTO EVERYDAY LIFE”

– PARTICULARLY IN TERMS OF BRINGING REGULATED FINANCIAL SERVICES PRODUCTS INTO EVERYDAY LIFE”

JAMES SIMCOX CHIEF PRODUCT OFFICER, EQUALS MONEYIt’s a common misconception that BNPL (Buy Now Pay Later) and embedded finance are the same things. However, embedded finance provides access to financial services, such as lending products, and BNPL is a type of lending product. It is the point at which embedded payments meet embedded lending. BNPL has been very popular with younger consumers, partly because it offers a more digital, frictionless approach to accessing credit.

“Embedded finance is going to play a huge part in the future of fintech – particularly in terms of bringing regulated financial services products into everyday life. This could be something as simple as Uber issuing payment cards (linked directly back to an app) to their drivers to pay parking charges at airports, or Amazon offering Earned Wage Access through rapid instant payments to their staff.”

He continues, “We saw the beginning of this with the emergence of ‘Buy now, pay later’ a few years ago as a means of integrating short-term loans for consumers at checkout. This concept is only going to expand and diversify: it’s a great revenue stream for non-financial institutions, and there are lots of fintechs, including Equals Money, that have spent the last few years growing, building their license footprint and connectivity, and developing a fantastic suite of APIs that can support this massive growth.”

Hyett believes embedded finance will be at the forefront of fintech services within a decade, with payments leading the way. She says, “Embedded payments - that enable businesses to process their own payments - will drive this widespread adoption, as it represents the largest piece of the embedded finance pie.”

She says that in an increasingly competitive software market, SaaS vendors are also looking to capture new revenue streams, and help their merchants do the same by monetising their payments.

Hyett adds, “As more businesses adopt embedded payments solutions, and consumers become used to the seamless checkout experience, demand will increasingly become intertwined with this combination of superior convenience, personalisation, and cost.”

What is an NFT? Why do they exist - and are they worth the investment? We spoke to the experts to find out more

WRITTEN BY: JOANNA ENGLAND

From artwork and music to videos and traditional assets, NFTs are a growing space that is capturing the attention of Gen Z investors.

In a nutshell, NFT stands for non-fungible token. These digital tokens are created using the same programming process that generates cryptocurrency. An NFT could be any number of things, like a car, a piece of real estate, or digital artwork.

Real estate tokenisation converts the value of real estate into a token. The token is then stored on a blockchain, enabling digital ownership and transfer. These divisible tokens each represent a fractional share of the ownership stake in that real estate.

In practical terms, the owner could open an account with a blockchain trading platform, and could then create their NFT by verifying their ownership of the asset.

These details would be stored on the blockchain, until such a time as someone decided they would like to make an offer on the NFT - or, ownership of the NFT.

While buying and selling real estate as NFTs on the public blockchain is highly embryonic, the potential for such a service is huge. The cumbersome, international property market which is ripe for reinvention would benefit massively from the opportunities that the NFT market will provide.

However, the current global economic downturn has had a sharp impact on the NFT market. Sales are down, along with the price. So what do the experts forecast for this dynamic, transactional space?

Wes Levitt is Head of Strategy of Theta Labs, a leading blockchain infrastructure

provider for Web3 media and entertainment. Theta Labs recently partnered with World of Women NFT to stream WoW Miami Gala through the ThetaDrop Video Portal for all WoW NFT holders.

He says, “The NFT marketplace today contains some groundbreaking projects delivering innovation and value to users and tokenholders. However, there are also a great many low-effort projects looking to cash in on the NFT hype.”

Levitt is right. According to EarthWeb, an estimated 3,200 NFTs were sold daily, throughout 2022. And NFT trends can skyrocket. Take the recent gold rush flurry that occurred when Cristiano Ronaldo left Manchester United FC on 15 November 2022.

Analysis of Google search data revealed that online searches for ‘Ronaldo NFT' exploded 206% worldwide on 15 November, as news broke that the footballer had launched his first NFT collection, in collaboration with the Binance Marketplace.

WHILE MARK ZUCKERBERG’S ANNOUNCEMENT GOT US ALL EXCITED ABOUT METAVERSE… I DO NOT THINK IT WILL DRIVE NFTS INTO THE MAINSTREAM”

“WHILE MARK ZUCKERBERG’S ANNOUNCEMENT GOT US ALL EXCITED ABOUT METAVERSE… I DO NOT THINK IT WILL DRIVE NFTS INTO THE MAINSTREAM”

SALLYANNE DELLA CASA FOUNDER OF GLEAC

PayEX offers customizable AR/AP Automation software for B2B businesses looking to optimize their working capital and unearth hidden revenue otherwise written off due to manual processes and slow communication

Anything can be tokenised in theory, Levitt confirms, as long as scarcity is a meaningful part of the asset’s value in the first place. “Of course, demographic adoption is a barrier –assets like CS: GO skins that already have a young and tech-savvy demo are more likely to see early adoption than assets like real estate typically owned by institutions.”

Sallyann Della Casa is the Founder of GLEAC, an educational NFT and crypto fintech marketplace that enables knowledge-sharing between industry experts, and she says suitability for tokenisation depends on the asset.

“I think the real question is what’s worth tokenising. Do you want a permanent tokenisation of your shoe collection? Probably not. Do you want one of your

driver’s licenses, passports, titles to homes, cars, etc? Probably, yes.”

But as trends peak, so do incidents of fraud. And because the space is so new, there is little in the way of protection when it comes to NFT scammers. Della Casa believes the current downturn is a positive thing because it's an opportunity for a course correction.

“The flippers will hopefully get bored and go away,” she says, referring to a group of NFT marketplace watchers who buy assets and sell them quickly for a fast profit. The practice during trending peaks falsely inflates the prices of many NFTs, resulting in customers seeing their assets swiftly devaluing as the bubble has burst.

These activities, and fraudsters, have resulted in the NFT space gathering itself a somewhat renegade reputation. Della Casa explains: “We have had inflated NFTs over the last 12-18 months and every bubble pops. Another thing wrong with the market is the amount of fraudulent NFTs floating out there. Something like 80% of Opensea NFTs are fake. That’s mind-boggling. The worst part is finding out the identity of these fraudsters. Nobody has a clue who they are.”

Della Casa also questions the regulatory procedures of certain NFT platforms that don’t take action when complaints are made by users. “Who polices Opensea? I would love to know since I’ve reported the fake

“THE EASE OF USE OF WALLETS NEEDS TO IMPROVE… IN GENERAL, IT IS NOT ALWAYS TO THE STANDARD THAT MAINSTREAM USERS EXPECT OF COLLECTIBLES AND APPS”

“THE EASE OF USE OF WALLETS NEEDS TO IMPROVE… IN GENERAL, IT IS NOT ALWAYS TO THE STANDARD THAT MAINSTREAM USERS EXPECT OF COLLECTIBLES AND APPS”

WES LEVITT HEAD OF STRATEGY, THETA LABS

NFTs of my collection hundreds of times and nothing happened.”