June 2023

fintechmagazine.com

FINTECH UNICORNS

THE ROYAL MINT: INSIDE THE TECH-LED REINVENTION OF BRITAIN'S COIN MAKER

SUNRISE BANKS: IMPROVING CUSTOMERS' LIVES THROUGH MISSION-DRIVEN LENDING

June 2023

fintechmagazine.com

FINTECH UNICORNS

THE ROYAL MINT: INSIDE THE TECH-LED REINVENTION OF BRITAIN'S COIN MAKER

SUNRISE BANKS: IMPROVING CUSTOMERS' LIVES THROUGH MISSION-DRIVEN LENDING

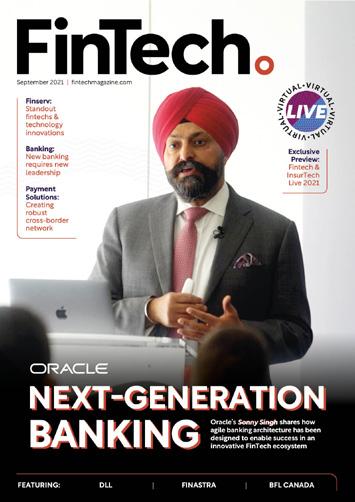

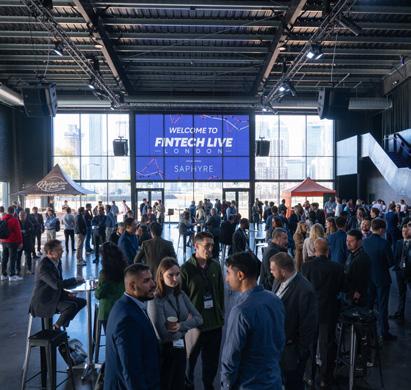

We speak to Saphyre Founders the Roche brothers, who run through ways traders can gain a competitive advantage using AI-powered tools

FinTech magazine is an established and trusted voice with an engaged and highly targeted audience of 2,000,000 global executives

Digital Magazine

Website Newsletters

Industry Data & Demand Generation

Webinars: Creation & Promotion

White Papers & Research Reports

Lists: Top 10s & Top 100s

Events: Virtual & In-Person

WORK WITH US

Finance is so integral to our daily lives that it really is a privilege when consumers choose to bank, or move money, or settle bills with any one fintech solution. But with great power comes great responsibility

Customers trust us to keep their data secure, offer reliable financial services, and never step beyond their expectations of data sharing or data custody.

These themes are central to the June issue of FinTech Magazine, where we have a feature on customer data platforms. There is a fine line when it comes to the amount of data that customers are prepared to dispense – not just for data privacy reasons, but because more data fields slows down the onboarding process and puts off customers. Yet fintechs and other service providers need to gather information on their users to offer a personalised service.

In this issue, we also explore the world of responsible finance. In today’s uncertain economy, responsible lenders are more crucial than ever. They are less focused on margins than their mainstream counterparts, yet this integral part of their mission is something that increases their exposure to risk and makes them vulnerable to fluctuations in the market. We find out not only how they’re coping, but how they’re thriving.

We hope we can give you a brief respite from your week. Take a weight off and enjoy flicking through the June issue.

ALEX CLERE“THERE IS A BALANCE BETWEEN NOT COLLECTING TOO MUCH DATA, AND NOT PERSONALISING SERVICES ENOUGH”

The Backbase Engagement Banking Platform is the evolution of digital banking.

Built for fast implementation and ease-of-use, the platform allows financial institutions to rapidly deploy digital solutions that delight customers and empower employees.

With the power of one platform, you can:

Engage your customers

Create tailored customer journeys from account signup to product up-sell

Empower your employees

A 360° view of your customer helps you deliver personalized and instant service

Ready to get the full picture?

Talk to our specialists

Leverage a composable architecture

Select best-of-breeds partners for your perfect end-to-end solution

Reduces overhead and drive greater innovation with our cloud model.

Start small, grow big Future-proof digital solutions can be customized to your needs now, then scaled later.

This advertisement can only scratch the surface of what the Backbase Engagement Banking Platform can do for your business, employees and customers.

Ready to get the full picture?

Function as an agile workforce to fast-track consumer innovation

German Chancellor Olaf Scholz was joined at an EU summit by fellow eurozone leaders in meeting Christine Lagarde, Head of the European Central Bank (ECB), to discuss concerns about European banking’s stability following the collapse of Silicon Valley Bank and the takeover of Credit Suisse.

For Scholz, stringent rules and regulations imposed in the EU have kept “the banking system stable” and, despite the fact his native Deutsche Bank saw shares tumble 14% at one point in March 2023, there is “no cause for concern”. Whether a tactic to allay market fears or a genuine assessment, Scholz’s words were backed by a summit consensus that the European banking system remains safe for now.

TITLE: CEO AND CO-FOUNDER

COMPANY: STRIPE

INDUSTRY: FINTECH

Patrick Collison is an Irish billionaire entrepreneur known as the co-founder and CEO of Stripe, a fintech unicorn that offers financial services to ecommerce. His brother, John Collison, is his fellow co-founder and the acting president of Stripe. The brothers hail from County Tipperary, Ireland, and jointly head the company out of San Francisco and Dublin. John has an estimated net worth of $11.4bn and Patrick a net worth of $5.5bn.

Self-made millionaires from their early teens, the Collison brothers have faced a meteoric rise to the top of the fintech industry with their company, Stripe

Patrick & John Collison are the renowned sibling duo who co-founded fintech’s highest-valued company, Stripe.

Founded in 2009 – when they were but 21 and 19, respectively – both Collisons’ net worth exceeded $1bn before they’d even reached 30. Receiving a market valuation of US$95bn at the end of 2022, Stripe is now the world’s leading fintech company. But how did the brothers get there?

Born in Dromineer

Raised in Dromineer, a small town in Ireland’s County Tipperary, it’s almost fitting that the tech-giant siblings grew up with limited access to the internet, needing the help of satellite links to access the world wide web. As such, the internet represented “a connection to the greater world” for Patrick and “had a lot of significance”.

Despite the disadvantage, the brothers showed signs of success in tech from an early age. Patrick was taking computing courses at the University of Limerick aged eight, before going on to win the 41st Young Scientist and Technology Exhibition award at 16 for his LISPtype programming language software, Croma.

Starting up

Patrick and John set up the software company Shuppa aged 19 and 17 respectively in Limerick. In need of funding, the brothers had no luck with Enterprise Ireland but did receive interest from Y Combinator, of Silicon Valley.

Shuppa was then merged with the startup of two Oxford graduates, Harjeet and Kulveer Taggar, becoming Auctomatic – a softwareas-a-service platform allowing big sellers on eBay to track inventory and traffic. The quartet also developed an iPhone app to provide an offline version of Wikipedia, before the company was sold to Live Current Media for $5mn in March 2008.

Becoming teenage millionaires, Patrick dropped out of the Massachusetts Technology Institution to take on the role of Auctomatic’s director of engineering. It was at this point, following the brothers’ experiences with Auctomatic, that “the online payments industry was an unusually compelling example of an entire industry that is going to have its lunch eaten”.

The brothers had already found a gap in the market by finding solutions for big eBay sellers, so in 2010 they did it again with Stripe, simplifying payment acceptance on any app or website without the need for ecommerce operators to obtain licences or strike deals with various banks. Stripe did it all for them, levying a 2.9% fee in return.

“We’re not a glamorous business, just an infrastructure company that, hopefully, we’ll be able to compound for a long time”

There were early admirers, too, with PayPal co-founders Elon Musk and Peter Thiel investing $2mn in Stripe alongside investment firms SV Angel, Sequoia Capital, and Andreessen Horowitz in 2011.

The Collison brothers would only have to wait five years before becoming the world’s then-youngest self-made billionaires after investment from Capital G and General Catalyst Partners took the company’s valuation up to $9.2bn – taking their net worth to a respective $1.1bn in 2016.

The investment didn’t stop there, with a further $150mn funding round raising the Collisons’ worth to $3.2bn the following year. And, in 2019, investments of $250mn saw Stripe’s valuation soar to $35bn.

Notwithstanding the unprecedented growth rate of the company, John said to the Irish Independent in 2020: “We're still quite early in Stripe’s journey. And when

“The online payments industry was an unusually compelling example of an entire industry that is going to have its lunch eaten”

I say that, you might roll your eyes, given that we've been at this for 10 years. But we’re still growing at quite a fast rate and still investing very heavily in future growth.”

This rate of expansion appears to have accelerated faster than either sibling expected: in 2022, Stripe received a public valuation of $95bn – more than double its worth just three years prior.

Despite Stripe’s rise to become the gold standard of fintech unicorns, Patrick and John have been keen to uphold the company’s core values. “We’re not a glamorous business, just an infrastructure company that hopefully we’ll be able to compound for a long time,” Patrick told Forbes.

Words are nothing without action, and the Collison brothers keep to their modest selfassessment of business management with a hands-on approach. Both still review every product launched and complete friction logs to ensure the user experience of their payment solutions remains a friendly one.

Philanthropy, too, has been core to the Collisons’ ethos as fintech billionaires. Their company contributed $1mn to the prohousing-development lobbying organisation California YIMBY and offers a fee discount to non-profit organisations.

Though the company’s growth rate may have been overvalued – with its latest round of funding in 2023 pricing Stripe at $50bn, as opposed to the $95bn market valuation touted in 2022 – it’s clear that Stripe remains the largest fintech in the world. And, if the Collisons are to be believed that Stripe is still in its early days, then it will surely remain in the upper echelons of the fintech unicorn table for some years to come.

The investor, Saxo Bank founder, and Concordium blockchain pioneer talks to us about emerging technology, the startup experience, and why he gave up his dream of becoming an archeologist

Q. DESCRIBE YOUR ROLE AND YOUR BACKGROUND. HOW DID YOU GET HERE?

TITLE: FOUNDER & CEO

COMPANY: SAXO, SEIER CAPITAL & CONCORDIUM BLOCKCHAIN

INDUSTRY: BANKING

LOCATION: DENMARK

Lars Seier Christensen is a founder at Denmark’s Saxo Bank and is currently Chairman at the Concordium blockchain foundation, as well as Founder and Owner of his family office, Seier Capital. He is a supporter of FC Copenhagen and passionate about restaurants, adding his favourite childhood hangout to his portfolio two years ago.

» I am the Chairman of the Concordium blockchain foundation and also of my own investment family office, Seier Capital. I founded Saxo Bank and ran it as CEO for 20 years, after having learned the trade in the finance sector in London.

Q. WHAT DID YOU WANT TO DO AS A JOB WHEN YOU WERE A CHILD?

» I have always been very interested in history and philosophy, and was particularly fascinated by Ancient Greece and Rome. So as a child, I wanted to become an archeologist.

Q. IF YOU HAVE ANY WORDS OF WISDOM FOR YOUR EIGHT-YEAROLD SELF, WHAT WOULD THEY BE?

» Always do what you love and success will follow. Don’t follow others’ advice and opinions if you don’t agree, not even mine.

Q. WHAT’S THE BEST PIECE OF ADVICE YOU EVER RECEIVED?

» EI had the privilege of knowing Jack Welch and his very focused approach on keeping things simple and delegating responsibility to your management. I found it very helpful.

Q. WHO OR WHAT INSPIRES YOU IN FINTECH TODAY?

» I am very involved in blockchain technology, following the synergies between this new technology and the traditional financial sector with great interest. I believe many inefficient processes in settlement, trading, compliance, and many other areas can be greatly improved by managing data on a blockchain.

Q. HOW DID YOU GET INTO BLOCKCHAIN, AND WHAT EXCITES YOU MOST ABOUT IT?

» I was made aware of Bitcoin back in 2011 and have followed the industry with increasing intensity since then. I believe that blockchain has a similar transformative potential as the internet had back in the ‘90s, and I enjoy being involved at the cutting-edge of technology again.

Q. IF THERE’S ONE PIECE OF TECHNOLOGY YOU COULDN’T LIVE WITHOUT, WHAT WOULD IT BE?

» I am a heavy user of my IPad, which has replaced the normal portable computer for me. It’s easy to carry around, and is invaluable for both business and recreation.

Q. WHEN YOU LOOK BACK AT FOUNDING SAXO BANK, IS THERE ANYTHING THAT YOU THINK WOULD BE DIFFERENT ABOUT THAT PROCESS TODAY? HAS THE STARTUP EXPERIENCE CHANGED?

» We never took in funding in the first 10 years, which taught us a healthy balance between income and investments. We simply had to build the platform at a pace where profitability followed along. So we never over-extended ourselves or had to focus on bringing client adoption along.

Today, many startups have too much money, really, and therefore focus too much on product and too little on client relevance. That leads to a lot of white elephants, and you find out too late that the clients don’t like or don’t use what you have built.

» The team is the most important. It should be a leadership team with different competences and a clear division of responsibilities. The products and services will always change, but the team shouldn’t, if it is the right people. Apart from that, obviously, the big idea and, very importantly, the scalability of the idea.

» I am definitely proud to be Danish, but for many reasons. Denmark is a good, safe country which cares for its people. We excel in a number of industries, and fintech is just one of them. But it is good to see young entrepreneurs carrying forward the torch from Saxo Bank.

» I am proud of what we are building at Concordium and that our idea of finding common ground between the power of decentralised systems and the world that exists around us is gaining ground. People now increasingly understand that this will be a merger between two worlds more than a replacement, and that both worlds can contribute to a more efficient future economy.

» LA couple of months ago, I read David Chalmers’ book, Reality+, an interesting investigation of the simulation hypothesis. The best book on that subject that interests me a lot.

» More of the same, as I enjoy working with blockchain and investments, and have no plans to reduce my activity level. Then I really would like to see FC Copenhagen, where I am a big shareholder, win the Danish championship this season.

“I AM PROUD TO BE DANISH FOR MANY REASONS; WE EXCEL IN A NUMBER OF INDUSTRIES, AND FINTECH IS JUST ONE OF THEM”

Accelerate growth and create wholistic business value with pioneering technology-fuelled digital solutions tailored to the realities of your enterprise and the financial services industry. Inspire customer loyalty and success.

Gautam Samanta, Coforge EVP and Global Head of Banking and Financial Services, stresses that digital transformation is all about delivering value.

Coforge is a global digital services and solutions provider, and helps its clients embrace emerging and new technologies to achieve real-world business impact.

The company’s proprietary platforms power critical business processes across a select number of sectors, and it has a presence in 21 countries, with 25 delivery centres across nine nations.

One of the sectors in which Coforge is a key player is banking and financial services (BFS), where it is helping its BFS clients on the digital transformation journey by making the road as straight and smooth as possible.

“Digital transformation is an evolutionary process, not a revolutionary one,” says Samanta. “So we do not see it as disruptive.”

He adds that having a clear vision of what digital transformation is - and isn’t - is what shapes the solutions that help Coforge’s clients achieve their goals.

“For us, digital transformation is not just a marketing phrase to wrap around software services. It is not about the technology.

It is about delivering business value for stakeholders, including shareholders, customers and employees.”

Samanta adds that Coforge’s approach is effective because its solutions also “absorb the realities of our customers’ enterprises” - the reality being that “the old and the new often coexist in business processes that can sometimes be decades old”.

“One of the things that differentiates us is that we are pragmatic in our approach to helping clients,” Samanta adds. “Yes, we transform with the new, but not at the expense of the old, which often has value.”

It helps, too, that Coforge has a deep understanding of what value looks like in BFS, because the company has chosen to focus its attention on this sector, as well as a small number of other verticals.

“We focus on very select industries, and have a deep understanding of the underlying processes of those industries, which provide us with a distinct perspective,” says Samanta.

AD FEATURE

WRITTEN BY: SCOTT BIRCH PRODUCED BY: MICHAEL BANYARD

PRODUCED BY: MICHAEL BANYARD

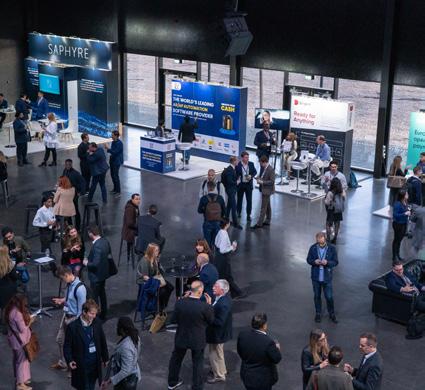

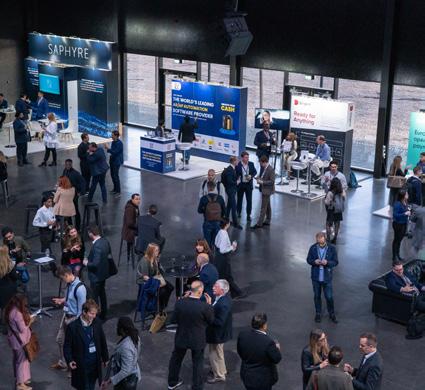

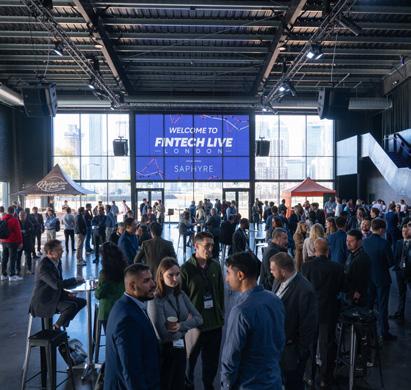

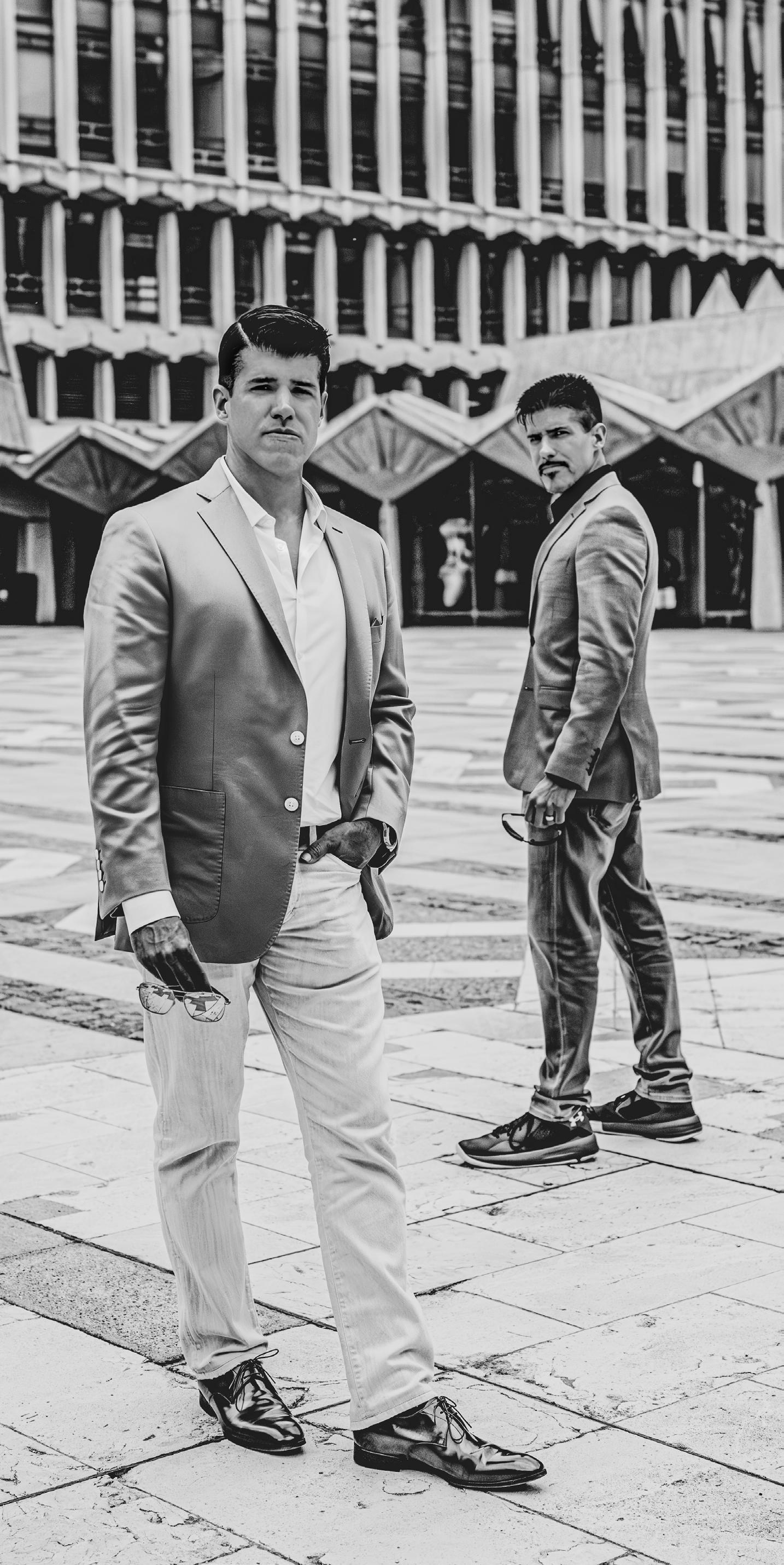

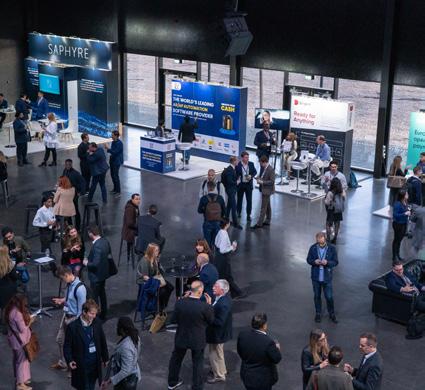

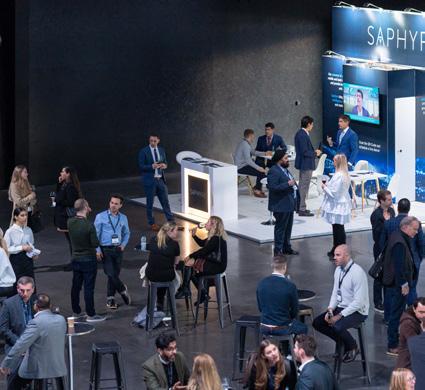

intech is a challenging arena that innovates at an extraordinary pace, posing difficulties even for those with years of industry experience. The convergence of the financial world with emerging, transformative technology is rightly shrouded in language that is often difficult to decipher. That’s one of the great things about speaking with Stephen Roche and Gabino Roche, Jr. – the twin brothers

behind fintech juggernaut, Saphyre. They use metaphors and refreshingly plain language, that even a journalist can understand, to explain how forces such as AI are fundamentally changing the global financial system.

Of course, this is also important when explaining the benefits that Saphyre can offer clients and partners – and they are clearly doing a great job of that as more industry heavyweights join the ‘Saphyre Endeavour’.

The finance industry is catching on to Saphyre’s secret sauce and realising the opportunity to gain competitive advantage with AI-powered trading tools

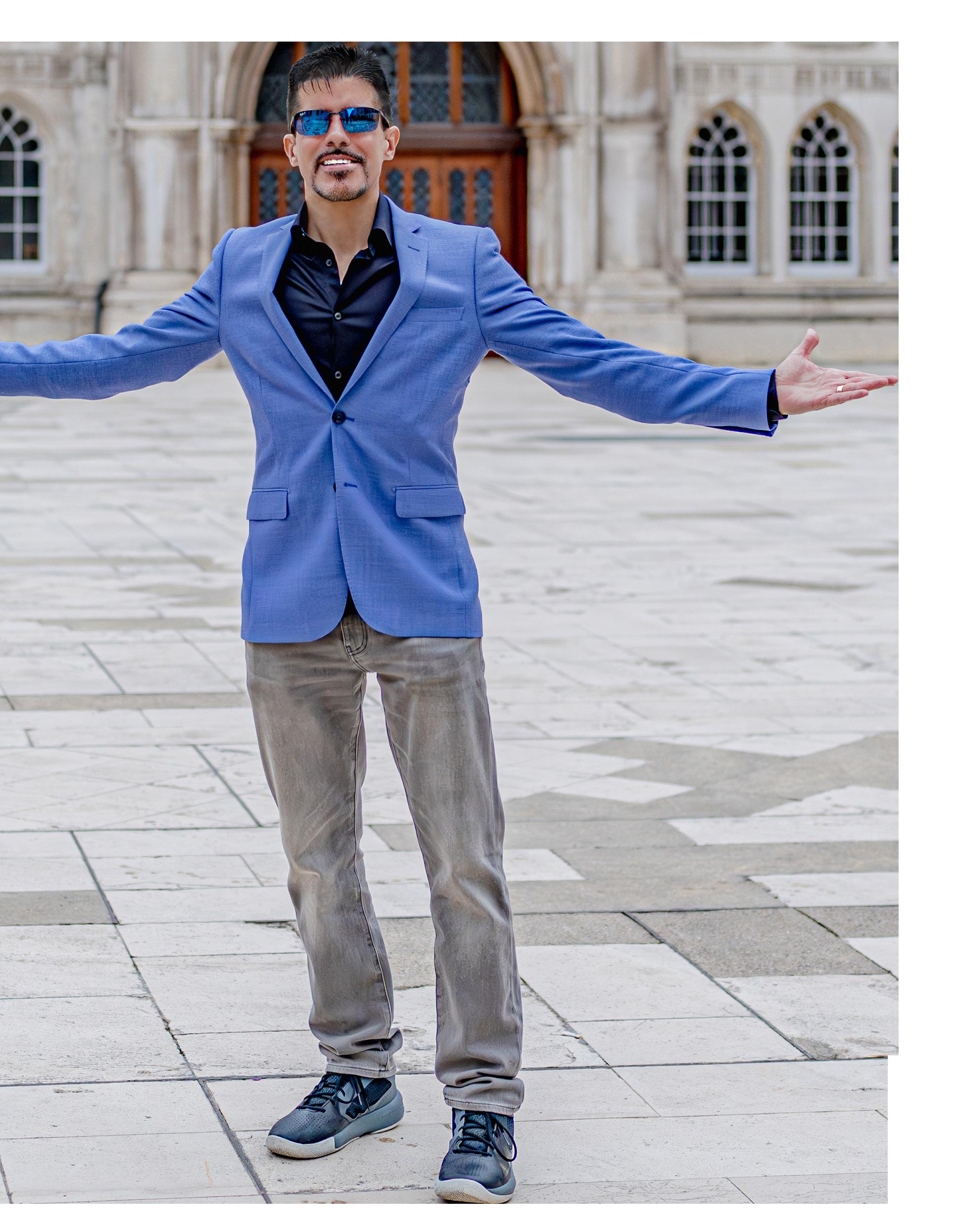

The Roche brothers, Stephen Roche and Gabino Roche, Jr.

The Roche brothers, Stephen Roche and Gabino Roche, Jr.

“Firms have a concern about being left behind in today’s hyper-competitive financial services landscape,” explains Gabino. “That's why it’s important that publications like FinTech share the advances that we are making with tools such as AI, and the firms that are adapting this technology, so that we can fully convey the direction that financial services are moving in.”

“There are a lot of technology vendors who pay lip service to solving the pain points that Saphyre’s proprietary platform finally solves. Stephen and I love to tell our clients, ‘Here are the keys, you can drive the car today – not in 6 months, not in a year to get things into place’. We resolved to make Saphyre’s platform turnkey whether you are a global asset manager, a boutique bank, or a multinational custodian. When you adopt our technology, you can drive today – and you will realise the benefits. That makes the product real for an audience that tends to be skeptical of new technology.”

So, how exactly is Saphyre transforming the landscape

of financial services? It’s a question that the Roche brothers tackle on a regular basis. So much so, that they have a short and a long version ready to pitch.

“What Saphyre does is instantly set up new and existing funds securely between external financial institutions, so that they can be ready to trade quickly, while eliminating post-trade issues,” says Stephen.

“Synchronising reference data in the pre-trade space eliminates much of the existing post-trade work, or redundancies, and provides critical groundwork for the move to T+1 in North America by May 2024.”

Saphyre's functionality for a client starts in the pre-trade space, before a trade even occurs, driven by intelligence rooted in more than 105 patents. For example, if a Fortune 500 company is setting up a new pension fund, the legal entity associated with that fund may need an investment management firm (many of the world’s largest are Saphyre clients). They also need to communicate with a custodian, who needs to

then communicate with broker-dealers. It’s an intricate web of interfacing that is necessary for the whole machine to run.

Saphyre’s platform connects them all together to track that onboarding process: the Know Your Customer (KYC) protocols, the tax, legal, and compliance work –as well as the operational setups including things like order management systems. It’s a proprietary system that is unrivalled in an industry where most of this process was historically held together by a disparate patchwork of emails, spreadsheets, and faxes.

All of that helps firms to get ready to trade quickly and – with certain markets, currencies, trading instruments and asset classes – that speed is a very important, powerful benefit to these financial institutions.

A significant benefit to this up-front work being done in the pre-trade phase is that it takes around 70 to 75% of the work out of the posttrade, too.

“The analogy that I like to give is that you should be treating trades the same way

as air travel,” says Stephen. “You set up your security precautions before any threat occurs, use a black box, add AI intelligence, some automation – and you can ensure your trades land in the destination while eliminating most of the issues in the post-trade.

“Investments are currently being done in post-trade. In other words, they are in the business of putting together crashed planes and trying to get them to fly again. We're in the business of not having planes crash – ever. “

Certain industries are known to be laggards when it comes to embracing and adopting new technologies, and you could be forgiven for thinking that finance was not one of those. However, many processes are still in the relatively dark ages when it comes to digitalisation.

Gabino and Stephen both share anecdotes of some financial organisations being stuck in a time warp. This rocky horror show includes the use of faxes (remember those?), spreadsheets, and emails.

“SAPHYRE QU ICK LY BECAME THE DOM INANT PLAYER IN A MARKET THAT WAS STARVED OF TRUE I NNOVAT ION, W H ICH I S VERY IMPORTANT FOR US”

STEPHEN ROCHE PRESIDENT & CO-FOUNDER, SAPHYRE

COMPANY: SAPHYRE

INDUSTRY: FINTECH

LOCATION: NY, US

Stephen has 20+ years of business development and consulting experience in the IT solution space, working with Fortune 1000 companies and start-ups.

He spent eight years in the B2C retail environment successfully helping brick and motor stores gain market share in NYC. In 2003, he transitioned his career with AT&T, working exclusively on B2B IT solutions.

While co-founding Saphyre and managing strategic relationships with the largest financial institutions in the world, Stephen has leveraged his B2B deal-making experience to build a premiere, professional marketing arm of the upstart FinTech firm.

COMPANY: SAPHYRE

INDUSTRY: FINTECH

LOCATION: NY, US

Gabino is an adept business technology strategist, portfolio consultant, and product manager with over 20 years of experience in global IT and business operation environments at start-ups and Fortune 500 companies.

He has built successful financial products for Goldman Sachs, JP Morgan, State Street, and Credit Suisse prior to co-founding Saphyre.

In May, Gabino was nominated Industry Person of the Year at the 2023 Global Custodian Awards.

#1 Saphyre won ‘Fintech of the Year’ at the Global Custodian Leaders in Custody awards in May 2023

105 Recognised patents

2017 Year founded in US US$18.7m Series A funding

70-75% Amount of post-trade work Saphyre can eliminate

This is not representative of the entire industry of course, but it does highlight how Saphyre’s strategic relationships like FXall are using the platform to harness an entirely new approach.

Announced in February, the strategic alliance between Saphyre and the London Stock Exchange Group’s (LSEG) FXall business aims to digitise account onboarding for FXall clients through Saphyre’s AI technology.

“In the old days, you'd have to call up the banks to get the currency rates for different currencies,” says Gabino. “A platform like FXall actually draws from multiple liquidity providers to give you the best price. This is significant as it proves that Saphyre is now directly linked to trading activities, which is the breadwinning side of the business for a lot of financial institutions.”

Since that announcement, a growing number of other EMS platforms have started

new formal discussions with Saphyre. Saphyre’s ability to serve multiple asset classes brings another valueadd to its clients that was previously unmet.

Traditionally, many platforms are exclusively focused on certain asset classes. If a firm wants to do a certain type of trading and processing, you have to use certain solutions associated with that asset class –creating a messy network of multiple platforms within a firm’s framework.

Agility is one thing that Saphyre prides itself on, and if you want an analogy, you are not going to be disappointed.

“We move much faster than the generally accepted pace of things,” says Stephen. “We're like a speedboat doing several runs around a large cruise ship or oil tanker.”

Market forces are also, in a way, playing into the company’s hands – with turmoil in the US banking sector, ongoing geopolitical tensions, and inflation spiking globally, to name just a few pain points. In periods of uncertainty, technology and innovation have a serious role to play, and a solution like Saphyre could prove instrumental.

Saphyre has been nominated for numerous industry awards, and Gabino has emerged as a consequential fintech influencer.

They were nominated for Fintech of the Year by Global Custodian magazine and won the highly coveted award in May 2023. They have also been featured by Forbes and the Wall Street Journal, while being regular faces on the cover of FinTech

GABINO ROCHE JR CEO & FOUNDER, SAPHYRE

“IN THE OLD DAYS, YOU’D HAVE TO CALL UP THE BANKS TO GET THE CURRENCY RATES FOR DIFFERENT CURRENCIES”

Magazine and keynote speakers at FinTech LIVE.

“Saphyre quickly became the dominant player in a market that was starved of true innovation, which is very important for us,” says Stephen.

It’s not all plain sailing of course, and while Saphyre has grown exponentially in a short space of time, there are still challenges to overcome. The tactical solutions that Saphyre provides are plain to see in today’s financial environment. However, the financial industry’s historic aversion to adopting cutting- edge technology is also well known.

Right now, the firms that understand the strategic benefit are realising the first mover advantage. Although much of the investment being made by institutions today is focused on posttrade, Saphyre’s entire premise is built around the concept of solving these issues from inception, in the pre-trade first.

With significant investments made in posttrade solutions, Saphyre is trying to bridge the gap

– to get leaders thinking about the pre-trade.

Stephen says there is a major opportunity to show and validate post-rate solutions using pre-trade data, and that Saphyre is working on an exciting securities lending solution right now.

“We're in the B2B space now, but this will also be repeatable to B2C. It's going to be very interesting. We are 90% there on setting that up. That will be something to look out for in the coming

months, and it will be very exciting for this space, because that's a huge addressable market that hasn't been solved yet,” adds Gabino.

It all sounds like Saphyre’s stock is rising – despite economic volatility that would keep many financial executives up at night. But every crisis presents an opportunity and Gabino believes that the silver lining of today’s uncertainty could be perhaps the greatest boon for fintech firms yet.

When reflecting on what he thinks about when getting out of bed in the morning, he gets enthused by the opportunity ahead that his team sees.

“Do we have our infrastructure in place with the right players to show how we can help them navigate these conditions in the market?” he says. “Or if we haven't, how do we get those firms to quickly adopt us so that we can help them.

The account transition issues are ongoing in the market. Can a bank remember all the account information, data, and documents and can we digitally help assist clients on both sides of the angle –the banks and depositors do this seamlessly and quickly? The answer is absolutely yes! These are the things that actually motivate us to wake up each morning.”

Stephen added, “People adopting our technology in advance of these kinds of crises will benefit from it. People who don't, will struggle, and would only then realise the change they need to make after the fact.”

“We work harder, smarter, faster to change the face of the finance industry because this is something worth striving for.”

“

BECAUSE TH I S I S SOMETH I N G W ORTH STR I V ING FOR”

STEPHEN ROCHE PRESIDENT & CO-FOUNDER, SAPHYRE

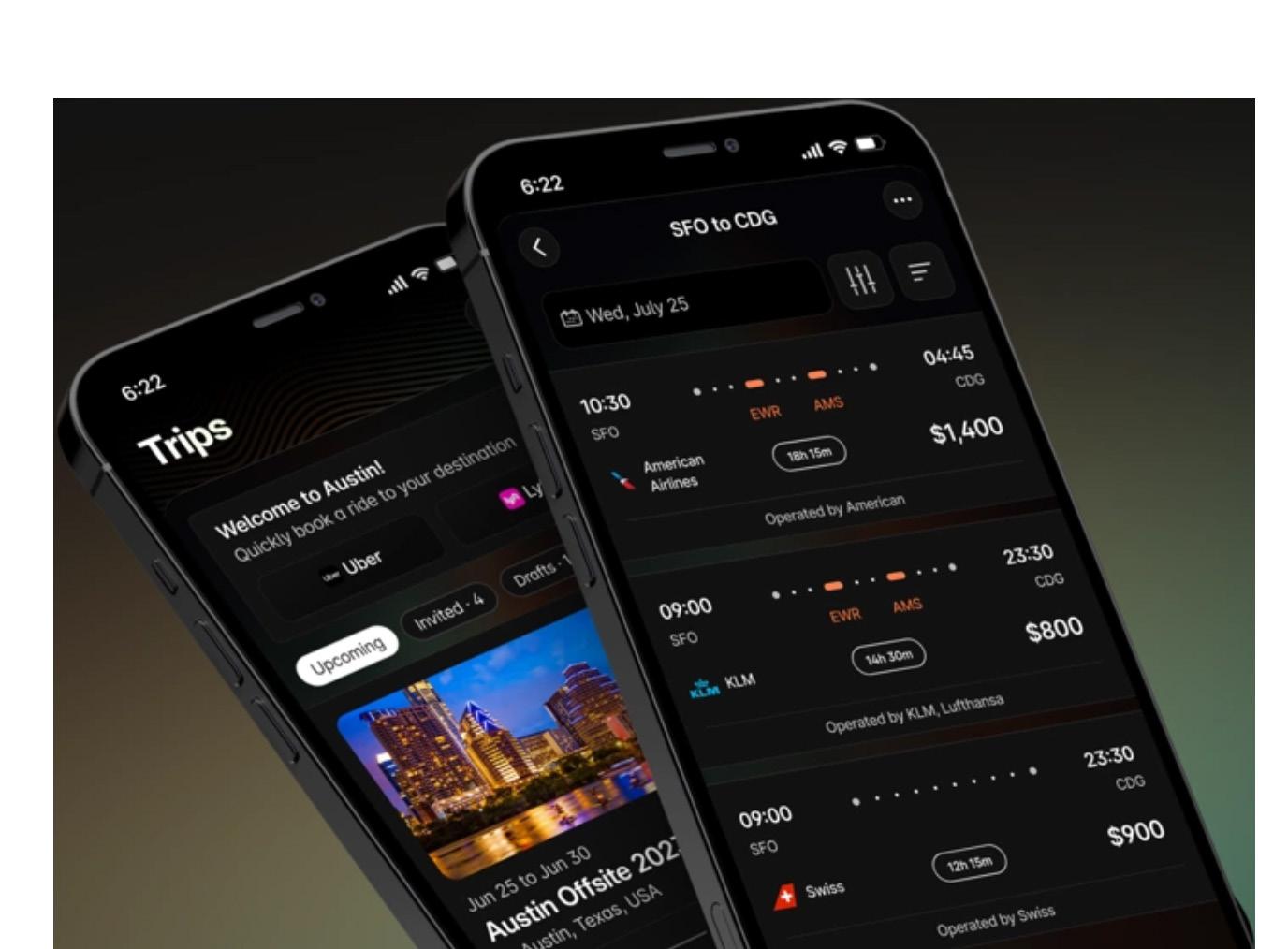

The relationship between a user and a fintech begins with data. Customers enter their details, and the extent of that data collection has the power to define a fintech’s relationship with that customer for the user’s entire lifecycle. Collecting poor or insufficient data can hamper fintechs, yet asking for too much in the first instance can be prohibitive as well.

Indeed, according to research from software company Fenergo, a third of financial institutions report losing customers due to a slow or inefficient onboarding process. In reality, it is likely to be higher –it is, after all, a statistic that many providers shy away from acknowledging. It’s a problem, Fenergo says, that costs the industry US$10bn a year in lost revenue.

The question of how much data to collect is a constant balance between observing the fintech’s business requirements and respecting the customer experience. Asking for too many details at first signup puts customers off, as Alistair Dent, Chief Strategy Officer for data consultancy Profusion, explains: “You can either have an involved and detailed data collection that few people complete, or a simple and quick route to signup with more customers about whom you know less.

“Over the last 10 years, fintechs have tended to migrate to the latter end of this spectrum. The argument goes that if you sign up more customers, you can collect information as you go (progressive signup)

Rich customer data helps fintechs and financial service providers to personalise their products – but ask for too much, and you risk the dreaded dropoff

We help you accelerate digital transformation and discover unlimited performance, productivity and efficiency gains.

OUTRUN THE COMPETITION

Go further. Grow faster. Work smarter. Our expertise operationalizing transformative technologies drives rapid, scalable change.

TURBO BOOST YOUR TALENT

Create a culture where human ingenuity and digital innovation can thrive in perfect harmony, and maximize productivity.

DELIGHT YOUR CUSTOMERS

Increase satisfaction and deliver seamless customer experiences. We help you prioritize customer demands and champion their needs at every stage.

We take what’s possible to the Next Level. Now.

Find out more at roboyo.global

or from usage data. You can still find products at all points on this spectrum, but more and more are at the ‘simple’ end.

“The downside is that it does allow for less personalisation, meaning it’s harder to encourage usage once customers have signed up, and sometimes the products seem less ‘smart’. What the best brands are doing (copied from the signups of tech firms like Spotify) is to give customers the choice. Make the data collection optional, but make it obvious at each stage how each piece of additional information helps make their experience better. Visibly adding or removing tabs, shifting buttons up or down the page, or even just a ‘profile-o-meter’ filling up will show users how the tool is learning more about them and will adapt to their usage.”

The quality of data is just as important as the quantity of data, Louise Potts, Head of Banking Customer Advisory Practice at SAS UK&I, tells FinTech Magazine: “The more good-quality data and information an organisation has on its customer, the better service it can offer. However, the quality of this data is hugely important, especially for those using artificial intelligence (AI) and analytics to inform decision making.

“MORE THAN EVER BEFORE, IT IS IMPORTANT FOR FINTECHS TO UTILISE MODERN TECHNOLOGIES SUCH AS ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING”

JAY REILLY SVP EMEA, PRECISELY

There are differing levels of cloud adoption across the broad church that is finance, our experts say. Many fintechs were born on the cloud, never having to face up to their legacy technologies – although maybe, as they mature over the next decade or two, that situation could change. By contrast, many incumbent institutions have been slower to make the transition for a number of different reasons.

“A lot of fintechs were born cloud native, or very nearly cloud native, so they are arguably much more comfortable with what ‘cloud’ means in practice,” SAS’ Potts notes. “Many finserv providers have cloud strategies and are on the journey to cloud. For the bigger and more established organisations, there are considerations due to their more complex data and technology estates that have evolved over years and may have been impacted by mergers, acquisitions or even splitting.”

Reilly adds: “Many fintechs seek ways to leverage cloud transformation to organise and enrich data at scale, and take advantage of opportunities presented by the increased availability of data. More than ever before, it is important for them to utilise modern technologies such as artificial intelligence and machine learning to capitalise on this data influx.

“An ever-growing number of fintechs have started moving their infrastructure, applications, and associated customer data to the cloud. Many have opted for a hybrid approach, but there is a mix of on-premise capabilities that work side by side with cloud-based infrastructure. These companies are working with leading cloud providers to help facilitate their cloud migration, and these providers will offer tailored capabilities such as managing and storing data compliance and security. Agile, digitalfirst or startup fintechs are more likely to embrace cloud solutions than more complex companies dealing with legacy IT headaches.”

“For example, in Latin America, where many people have thin credit files, we are seeing organisations turning to alternative data sets – not just traditional credit information – to understand if a person is a candidate for credit. This might be data surrounding their regular monthly repayments, such as utility bills or a phone contract, rather than solely relying on a banking file.”

Jay Reilly, SVP EMEA at Precisely, concurs that fintechs tend to lack integrity of data rather than quantity: “To have insight into customer lifecycles, fintechs need to be able to quickly connect customer data across the organisation and understand the context in which customers are engaging.

“A GOOD CUSTOMER DATA STRATEGY SHOULD ENABLE SMARTER AND MORE INFORMED DECISION MAKING, AND HELP ORGANISATIONS TO OFFER A BETTER AND MORE PERSONALISED LEVEL OF SERVICE”

In most cases, financial services data isn’t lacking in quantity – it’s the integrity of that data that’s the biggest challenge.”

He believes that, as part of strong data governance, fintechs should ensure they have a data catalogue which precisely defines its ownership and ability to set data policies and specific standards, and implementing a data quality management framework.

In many cases, fintechs have an inherent headstart on legacy institutions. Many were founded on cloud technologies, and, with the exception of some early

fintech pioneers, most will be free from the shackles of legacy technology.

The challenge for fintechs comes with the sheer number of data integrations that are necessary to offer services to customers. “Fintechs often need to integrate data from sources such as banks and data enrichment credit bureaus,” Reilly explains. “These companies use methods such as APIs, data lakes or data warehouses to consolidate this and manage the data more effectively.”

“A good customer data strategy should enable smarter and more informed decision making, as well as helping organisations to offer a better and more personalised level of service,” Potts continues.

“Many fintechs excel at this, having developed their processes and strategies around the idea of customer-centricity. With all information and data organised in a customer-centric way, rather than in single databases, fintechs can access a complete overview of their customers, the products they are using and the status of their accounts.

“Many of the traditional banks are dealing with more siloed data. For example, data is structured by service or product, such as mortgage, loan or current account. As financial services have evolved, and in a digital-first world, this sort of data ecosystem will hinder the level of service the organisation can offer.”

This improved level of data agility can help create better customer service, according to Potts. “One example of this is money-saving apps such as Snoop, where you can connect your accounts via a single app to view and manage your spending across different accounts and get money-saving suggestions. These apps allow customers to have a better understanding of their finances, which is something that many will find useful in the current economic environment.”

What more can fintechs do to improve their data strategy, ensuring they are meeting the fine balance between collecting enough

data to personalise services without putting off consumers at the onboarding stage?

“Data plays a crucial role within these businesses to enable them to optimise and scale,” Profusion’s Dent says. “Everything from marketing and customer service through to product development and HR can be informed by collecting and analysing company data. The insights gained can both help inform the strategic direction of a company and make existing processes much more efficient and effective. With many fintechs growing rapidly and operating in an incredibly competitive sector, the edge data analytics brings could be the difference between success and failure, especially in today’s uncertain economic times.”

Precisely’s Reilly continues: “Most fintechs have undergone significant digital transformations, aiming to improve efficiency and the customer experience. To succeed, it is imperative that they fuel business intelligence reporting with data that is accurate, consistent, and contextual –data with integrity. Although many fintechs recognise both the benefits of effective data management, and the risks that come with hosting a vast amount of data, they do not always have an effective strategy in place nor clear business goals.

“To drive actionable decisions and realise game-changing benefits from true business intelligence that can keep up with the business’ growth, fintechs need to invest in people, process and, certainly, technology that combines data integration, data quality and governance, location intelligence and data enrichment capabilities. This will enable them to establish a base of high-integrity data that they can genuinely trust to inform their business decisions. By doing so, they will also have the insights needed to ensure they are using customer data in a meaningful way and can identify new ways to enhance the customer experience.”

“MAKE DATA COLLECTION OPTIONAL, BUT MAKE IT OBVIOUS AT EACH STAGE HOW EACH PIECE OF ADDITIONAL INFORMATION MAKES THE CUSTOMER EXPERIENCE BETTER”

ALISTAIR DENT CHIEF STRATEGY OFFICER, PROFUSION

WRITTEN BY: TOM CHAPMAN

PRODUCED BY: KRISTOFER PALMER

WRITTEN BY: TOM CHAPMAN

PRODUCED BY: KRISTOFER PALMER

The Royal Mint is a company that needs little introduction, at least not to the majority of the Great British public, coin collectors, or those interested in the Royal Family.

Founded more than 1,100 years ago in around 886 AD, the Mint – as it’s colloquially known – is one of the UK’s oldest brands and remains the official maker of British coins. It’s also billed as the home of precious metals (think gold bullion bars) and recently launched a luxury jewellery collection called 886 by The Royal Mint.

That’s without mentioning the illustrious commemorative coins side of the business, which continues to thrive, and the iconic Olympic medals it created for London 2012. It will come as no surprise, however, that The Royal Mint has had to digitally adapt to rapidly-evolving societal norms and technological advances.

Much of that responsibility has fallen to Richard Hobbs, Group IT Director of The Royal Mint, who joined just before the pandemic in early 2020. Hobbs has been spearheading The Royal Mint’s technology transformation and implementing a five-year strategy that supports the organisation as it diversifies –which, he believes, is on the right track.

“We’re transforming from a traditional manufacturer into a modern, digital-oriented organisation,” says Hobbs. “And over the last five years or so, we’ve been very successful in our commercial diversification but also in introducing new technology into the business.”

Like all forward-thinking manufacturing businesses, The Royal Mint has come to recognise the undeniable importance of sustainability and, with that, is factoring sustainable practices into its everyday operations.

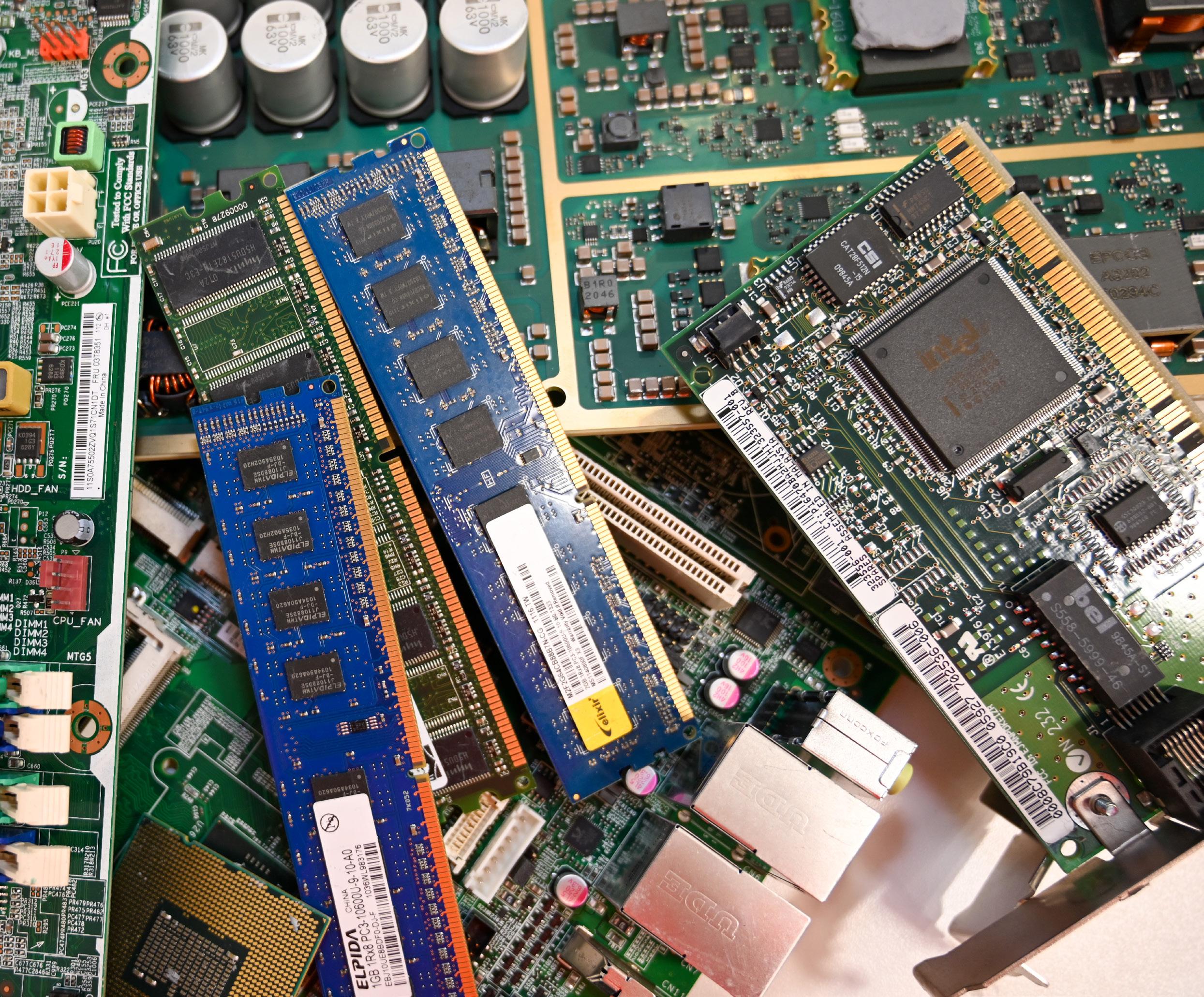

Later this year, The Royal Mint is opening a plant to recover precious metals from electronic waste. Once up and running, the precious metals’ recovery site is expected to process 90 tonnes of UK-sourced e-waste every week.

Clearly, then, The Royal Mint requires a powerful ERP system in the form of

“We’ve been really successful in our diversification, but also in introducing new technology to help the organisation”

RICHARD HOBBS GROUP IT DIRECTOR, THE ROYAL MINT

Gwillimdesign process

Microsoft Dynamics 365 for Finance and Operations to support this groundbreaking journey. The aim, Hobbs explains, was for this technology to support that entire manufacturing process – from the minute the e-waste is sourced, all the way through to products reaching the consumer.

That includes being able to track e-waste loads as they come in, manage the process of removing component parts, identify them, and then move them into The Royal Mint’s business. Building an effective ERP system was therefore “critical”, but also served as a huge opportunity for the tech team.

“There aren’t many opportunities to implement a greenfield ERP in an existing

TITLE: GROUP IT DIRECTOR

COMPANY: THE ROYAL MINT

INDUSTRY: CONSUMER GOODS

LOCATION: CARDIFF

Rich joined The Royal Mint in January 2020, bringing 20 years’ experience from financial services, where he worked for Barclays Bank, Barclaycard, Lloyds Banking Group and Admiral Insurance. During his time, Rich has led his team to implement the technology strategy at The Royal Mint, driving forward its digital transformation, modernising cybersecurity and growing the IT function as The Royal Mint diversifies and expands its business. Working closely with the executive board, Rich has led in driving a culture of technological innovation, enabling the delivery of The Royal Mint’s

Hitachi Solutions is a global Digital, Data and Technology consultancy specialising in end-to-end transformation using Microsoft Cloud Services, Dynamics 365 Business Applications, Power Platform and Azure, including Application Modernisation and Data & Analytics. Our highly skilled teams drive improvements, create efficiencies and enable growth to revolutionise the Public Sector.

Jamie Watson, Client Director at Hitachi Solutions Europe, explains why his firm was well-equipped to assist The Royal Mint in its ambitious transformation

Embarking on its world-first Sustainable Precious Metals (SPM) programme, The Royal Mint (TRM) needed a partner that could seamlessly establish a new ERP system. The Mint joined forces with global consultancy firm Hitachi Solutions, which specialises in people-first business transformation using Microsoft technologies.

Jamie Watson, Client Director at Hitachi Solutions Europe, explains: “From a tech perspective, this involves the full suite of Dynamics 365 (D365) Business Applications: the Power Platform, Azure, and the data and AI platforms. “From a people perspective, it’s centred around change management and digital innovation.”

Detailing Hitachi Solutions’ engagement with TRM, Watson adds: “We worked very closely with The Royal Mint team to deliver a people and business-led engagement that initially focused on understanding their needs and goals. “We prioritised those needs and worked out what enabling technology was required within the Microsoft technology stack to turn those needs

into real-life outcomes. “Since then, we’ve continued our relationship, successfully tendered the SPM ERP transformation programme, and we’ve gone live with the D365 Finance and Supply Chain Management solution.”

The design and build of TRM’s new ERP solution means it will prove to be extremely sustainable in the long term. “As a collective team,” Watson continues, “we had less than six months to design, configure, test and deploy a production-ready ERP solution, which, for anyone familiar with these types of programmes, is almost unheard of.”

Watson said the project had provided “huge opportunity” for transformation across TRM’s organisation. He adds: “We can focus less on keeping the lights on and focus more on continually adding new functionality like the Power Platform, robotic process automation, and even brand-new technologies that are hitting us across AI and machine learning. “That will certainly become relevant to The Royal Mint and could, in itself, provide significant long-term benefits.”

business, so we were very quick to recognise it as an opportunity to test drive some of our assumptions and processes,” says Hobbs.

“It’s been a great learning curve for us to start on our ERP journey and, in fact, we delivered the MVP ERP within 15 weeks of inception. That was done by January and we’re already at the end of phase two, which is implementing a second phase of change.

“It’s been a really successful programme that’s had a big impact on the business.”

The pronounced importance of cloud computing to modern living, technology and the manufacturing industry is well documented. The Royal Mint’s IT transformation from on-premise to the cloud allowed for greater technological flexibility.

“Our new ERP sits on the cloud, giving us the ability to be really quick and nimble, keep it updated, and take on technology,”

“Sustainability is now at the heart of The Royal Mint – and technology plays a crucial role in this journey”

RICHARD HOBBS GROUP IT DIRECTOR, THE ROYAL MINT

says Hobbs. “But it also enables integrations to be fast and effective, allowing us to scale up the product during busy periods and to be elastic without even thinking about it.”

Moreover, cloud computing has allowed The Royal Mint to enhance its data management and cybersecurity, both of which lie at the heart of the aforementioned technology strategy. A data management function has been created to appropriately surface information to the business, which is self-serving and maintains an organised, controlled, and secure data team.

Moving to the cloud and the implementation of modern ERP across the Mint has even helped change internal perceptions of the technology department, with Hobbs adding: “We’re now seen as much more of an enabling function than a

cost function. When the business is moving fast, trying new things, and diversifying quickly, it needs the technology to do it.”

The Royal Mint has been able to count on a whole host of partners to help carry out its recent technological transformation and activities.

Its primary partner within the ERP space has been Hitachi Solutions, which worked closely with The Royal Mint’s tech team to implement the Dynamics 365 system managing the precious metals recovery site.

“We’re essentially a public sector organisation, so we have to go through a procurement process,” explains Hobbs. “When we spoke to Hitachi, from quite early on we recognised there was a really strong cultural fit.

886AD

Founded in 886 AD during the time of Alfred the Great, The Royal Mint is one of the oldest brands in Great Britain

800

The Royal Mint employs more than 800 people across functions including manufacturing and technology

Away from producing currency for the UK and other countries, The Royal Mint has successful businesses across commemorative coins and investments as well as its new luxury jewellery range

“Knowing an ERP project is potentially two or three years long, we wanted to make sure we could work together. The technology itself is quite prescribed but, on the softer side of things, Hitachi were able to engage with us and support us in our decision making.”

Also key was Hitachi Solutions’ experience in working with similar organisations and its success rate in implementing Dynamics 365. This meant that, rather than simply responding to The Royal Mint’s questions, project team members were able to add some colour to the conversations around what they’d seen before.

“We were so lucky,” Hobbs continues. “Hitachi brought in a great project team who we kept for the whole duration; they engaged with The Royal Mint side of things really effectively. It felt like they were part of our own team.

“Hitachi Solutions has been a great partner of ours for about two years now, helping to shape our story and the build we’ve just completed.”

Using Dynamics 365 and sitting within a Microsoft Azure cloud means the Mint has, of course, worked closely with Microsoft, while Optimizely provides its website platform. The emphasis from The Royal Mint’s point of view is on gathering a small but focused group of partners that help the company push through its strategy.

“We recognise that we don’t know the answers to everything,” says Hobbs. “Picking

On a mission to expand on its digital e-commerce operation, with the customer at the forefront, The Royal Mint leveraged Expleo’s domain expertise and best-in-class proprietary methods for testing and assuring technology rollouts.

Find out how Expleo can help your organisation embrace a culture of hyperautomation. LEARN MORE

As the country’s oldest company and holder of the exclusive contract to produce the nation’s coinage, The Royal Mint is an icon of British business. Expleo was offered a rare opportunity to partner with one of the country’s greatest establishments in its digital transformation.

In 2020, Richard Hobbs, Group IT Director of The Royal Mint recognised the significance of innovation within the technology function and formulated a plan to bring new technologies into the business, while accelerating time to market with new product offerings. This coupled with heightened customer expectations around seamless online experiences provided the impetus for the Royal Mint to replace legacy systems and digitalise manual processes that were tying up resources and time. The Royal Mint issued a tender for a project to digitalise its IT infrastructure, selecting Expleo to automate the testing of its e-commerce digital platforms and oversee the testing process for its switch to a new payment provider. Hobbs, architect of the

Royal Mint’s digital agenda, envisioned an ‘automation-first’ approach to IT refurbishment, geared towards expanding the company’s product suite and client base.

Top of the list of deliverables was a highperformance website – RoyalMint.com. Expleo quickly implemented a robust testing framework to identify defects within the existing IT infrastructure and put in place a quality assurance tool that has allowed The Royal Mint to develop new functionality for a smoother customer journey. This intervention dramatically reduced the number of hours required to execute a core regression test pack by 80%.

Expleo’s

Mint’s website helped the company to unlock new revenue streams across its products. Additionally, the improved testing and bug detection capabilities decreased the risk of lost sales due to system downtime, while bolstering the security of The Royal Mint’s website, and mitigating the risk of cyber-attacks.

our partners based on shared synergies and the ability to work well together is the driving factor for me.”

Another important partner for The Royal Mint is Expleo, which has grown to become a force in the fields of engineering, technology and consulting.

“Expleo has supported the expansion of our commercial horizons,” Hobbs says. “Their team’s technical know-how enabled us to improve our development processes and increase efficiencies across the board.

“Expleo facilitated a re-platforming of our website and oversaw the testing process for our switch to a new payments provider. Through this engagement with Expleo, we’ve been able to expedite time-

Royal Mint Pattern

Royal Mint Pattern

to-market with a new product line, unlock viable new revenue streams and become more commercially agile.

“Overall, this phase of automation has allowed us to focus resources on more strategic initiatives, increase productivity, improve customer satisfaction and boost revenue growth.”

The Royal Mint is focused on working towards a sustainable future for its business and the environment, and this includes developing talent within the technology team.

Hobbs says: “Our technology function is robust and we want to ensure we’re sustaining as well as attracting talent to the business.”

The Group IT Director and his team have forged partnerships with the University of South Wales and the National Cyber Security Academy. They collaborate in a number of ways, including supporting students with projects and dissertations, attending speaking opportunities and sharing insights to provide students with case studies to aid their assessments.

“Hitachi Solutions has been a great partner of ours for about two years now, helping to shape our story and the build we’ve just completed”

RICHARD HOBBS GROUP IT DIRECTOR, THE ROYAL MINT

“It’s important for us as a team to engage with the local communities we operate in,” Hobbs adds. “It also allows us to demonstrate the amazing local career options that we have on offer, helping us to attract talent into the business. We work closely with educational establishments and it’s a mutually beneficial relationship; we offer our knowledge and, eventually, this may make its way back into the business via employment opportunities.”

The tech team also works with the Network 75 scheme on technical apprenticeships, allowing students to gain hands-on experience at a world-renowned organisation. The Royal Mint hires directly from university, with three technology team members being employed via this route.

“It’s important for me to ensure my team is happy, whilst delivering our technology strategy and offering a premium experience for our customers,” Hobbs continues. “Our technology function provides lots of opportunities in which our staff can fully immerse themselves, whether that’s working on our new ERP system on the cloud, data management, cybersecurity or working with our project partners.”

What next for technology at the Mint? The outlook for The Royal Mint is transformational, and its technology strategy plays a huge part in delivering some of these exciting plans.

The precious metals’ recovery site will soon go live and begin putting tonnes of e-waste to good use. Cybersecurity innovation and use of data to enhance customer experience is also on the agenda, as are various improvements to the website. It’s projected that the ERP journey will be complete in around 18 months’ time.

Furthermore, Hobbs predicts that AI and machine learning will become increasingly influential in both the technology and manufacturing spaces.

“It’s really interesting to think about how we can harness new technology like generative AI,” he adds. “What impact will it have in the manufacturing space? What can we teach it about our manufacturing processes to constantly enhance and develop them? The scope of potential innovation is boundless.”

“We work closely with educational establishments, and it’s a mutually beneficial relationship”

RICHARD HOBBS GROUP IT DIRECTOR, THE ROYAL MINT

How secure are the payment technologies we rely on, and what regulatory implications exist around the integrity of modern transactions?

WRITTEN BY: ALEX CLEREAs mobile payments and contactless card payments increase in popularity, the security of transaction technologies is thrust into sharp focus. According to UK Finance, nearly a third of adults are registered to use mobile payments – a figure that rises to more than 60% of Americans, according to separate research from YouGov.

This increased adoption places a burden of obligation and responsibility on payment service providers and processors. So, what should we be looking out for around the security of transaction technologies?

What regulatory implications currently exist?

As you would expect from a heavilyregulated industry like finance and payments, there are certain regulatory minima that payments companies must follow.

“Payments have always been a tradeoff between security, cost, and ease of use,” explains Andrew Neeson, Managing

PayEX offers customizable AR/AP Automation software for B2B businesses looking to optimize their working capital and unearth hidden revenue otherwise written off due to manual processes and slow communication

Editor and Research Director at regulatory intelligence firm VIXIO. “This trinity can often feel like a fine balancing act, with the exertion of one typically being at the expense of the other. For example, it is possible to add so many layers of security that a payment could be made virtually impenetrable to fraudsters. However, in doing so, it could also mean prohibitively high costs and a level of complexity that would frustrate users.

“Contactless is a great example of how this can work in practice. While it makes payments easier for both consumers and merchants, there is a trade off in terms of a cost to security (no PIN authentication),

which is balanced by maximum spend limits to minimise risks. This can be adjusted as risk becomes better understood or for public policy reasons, such as the increase in contactless limits during COVID-19 in many parts of the world. Regulators often deal with this trade off.

“In terms of transactional security, one of the big pieces of regulatory interventions in the EU and UK was the introduction of Secure Customer Authentication. With some notable exemptions, banks require two forms of identification at checkout, in the form of something the user knows, something the user has and something the user is.

“PAYMENTS HAVE ALWAYS BEEN A TRADE-OFF BETWEEN SECURITY, COST, AND EASE OF USE”

ANDREW NEESON MANAGING EDITOR & RESEARCH DIRECTOR, VIXIO

“When introduced, this was controversial – and it still is – resulting in a heated consultation. The big issue for some payment firms and merchants was they feared that the introduction of additional friction (security) would cause shoppers to abandon their baskets and loss of sales would outweigh any fraud prevention benefits. The regulator had a difficult job in trying to balance concerns, ensuring a level playing field as well as adequately protecting users from fraud. Acknowledging this challenge, the European Banking Authority’s chief recently noted that it was their job to make everyone equally unhappy with the rules and guidance that it oversees.”

“FINANCIAL INSTITUTIONS MUST EMPLOY CUTTINGEDGE TECHNOLOGY TO MONITOR TRANSACTIONS AND DETECT SUSPICIOUS ACTIVITIES PROACTIVELY”

ANDREW NOVOSELSKY CPO, SUMSUB

One of the most pressing security concerns emerging out of the pandemic is the prevalence of contactless payments. UK Finance’s figures show that nearly 70% of debit card transactions are now contactless, representing a multi-billion-dollar industry. Their popularity only increased during the pandemic, as wary consumers and businesses owners tried to reduce contact and observe social distancing as best they could.

Andrew Novoselsky, CPO at Sumsub, says: “Contactless payments have seen a significant rise in popularity, and we see new features being actively launched; for

instance, Apple just announced Apple Pay Later, allowing users to split purchases from $50-1,000 in four payments. However, evolving so rapidly, the payments industry is not without its weak spots, and it is crucial to identify and address them to ensure the security and efficiency of the payment system.

“One significant weak spot is bank card fraud in contactless payments. Recent reports suggest that hackers are using stolen credit card data to conduct fraudulent transactions using Apple, Samsung, and Google Pay. This highlights a significant issue in the financial industry, as many businesses rely on mobile payments to accept

transactions. The fraudulent purchases made contactlessly are challenging to detect, which makes it easier for fraudsters to get away with their criminal activities.

“To combat this, it is crucial for financial institutions to invest in robust security measures to prevent such frauds. One of the possible ways to tackle this rising type of payment fraud is transaction monitoring. Financial institutions must employ cuttingedge technology to monitor transactions to detect suspicious activities proactively. AI-powered transaction monitoring solutions are able to identify and prevent fraudulent transactions by immediately freezing accounts and reporting such activities to relevant authorities. Furthermore, it is essential to educate users about the dangers of storing sensitive data on mobile devices and educate them on best practices for safe mobile payment transactions.”

As new technologies come online, it is likely we will need greater regulatory safeguards to protect consumers against abuse or fraud. In 20 years’ time, it is entirely plausible that we will be paying for parking from inside our car, or ordering groceries through smart refrigerators. Who knows, maybe our smart doorbells will even use machine learning to let delivery drivers into our homes to put the delivery into our cupboards? As always, these technical opportunities present regulatory challenges.

VIXIO’s Andrew Neeson says that, although the channel may change, the underlying technology behind it will still be similar to the card payments we make today – though that is not always a good thing.

“The payments infrastructure designed for one channel does not necessarily translate well to others,”

Neeson says, “and fraudsters are adept at switching targets as new opportunities open up. In the same way chip-and-PIN did not protect card users from online payment fraud, a shift in channel can open up new potential weak spots where existing protections (including regulatory requirements) are not adequate.

“Regulators are constantly battling with fast-changing technologies and consumer habits. In reality, regulators tend to be behind the curve on this and only tend to intervene when a particular market starts to mature and potential detriment can be identified.

“Buy-now-pay-later is probably a good example of this: in many countries, it sits outside of existing consumer credit regulations. As the market has matured, several countries have begun to bring it into regulatory scope.”

“THE PAYMENTS INDUSTRY IS NOT WITHOUT ITS WEAK SPOTS, AND IT IS CRUCIAL TO IDENTIFY AND ADDRESS THEM TO ENSURE THE SECURITY AND EFFICIENCY OF THE PAYMENT SYSTEM”

ANDREW NOVOSELSKY CPO, SUMSUB

For more than 60 years, Sunrise Banks has been lending for positive social good. Based in Saint Paul, Minnesota, it claims to be the “world’s most socially responsible bank”. It’s a tall claim – but judging from the contents of its latest social impact report, one that it proudly lives up to.

In 2022, Sunrise's Twin Cities Road Crew toured Saint Paul and neighboring Minneapolis, helping nearly 150 teachers to deliver lessons in financial literacy and empowering 3,300 low-to-middle-income students with the confidence to save, spend and bank wisely.

Last year, Sunrise Banks provided US$1.245bn in loans including nearly $150m to consumers – as well as $1.1bn to businesses and the third sector, including $25m to affordable housing projects, $87m towards economic development, and $186m for the region’s small businesses. It is this local yet high-impact lending that is the driving force behind Sunrise’s mission as a responsible, community-driven lender.

“Sunrise Banks is a social enterprise that just happens to be a bank,” says Tyler Seydel, the company’s Chief Fintech Officer. He believes there is a “double bottom-line” component to everything the bank does. Of course there is the usual margin component, which allows it to remain profitable and sustainable. But more important is the mission component, which champions positive social impact through the products they offer.

Banks is driven by its mission to provide affordable lending to as many people as possible

TITLE: CHIEF FINTECH OFFICER

COMPANY: SUNRISE BANKS

INDUSTRY: BANKING

LOCATION: UNITED STATES

Tyler Seydel is the Chief Fintech Officer at Sunrise Banks.

Tyler has spent 15+ years in the prepaid/national products space. In his tenure, he has worked in compliance, BSA, TPR and risk; managed core as well as national products operations; and led sales, business development, strategy and innovation.

Tyler earned an MBA, as well as his CRCM. Tyler is driven and competitive and spends time volunteering in the community through avenues such as Feed South Dakota. He is a new parent to a bubbly young boy and enjoys cigars in his fleeting free time.

While it’s easy to measure profits (many fintechs will know the feeling of seeing them eroded by the rising cost of doing business), how difficult is it to measure social impact? “You can measure it by way of some of our external manifestations,” Seydel continues. These include being a certified B Corporation as well as a Community Development Financial Institution (CDFI), which means the US treasury recognises Sunrise Banks for providing financial services specifically to low-income, underserved communities and those most in need.

The bank is also a Global Alliance for Banking on Values (GABV) institution – a benchmark that holds it to various standards in the provision of economic, social and environmental development. Community-mindedness and sustainable value are so ingrained to the way Sunrise Banks operates that staff get 40 hours of paid volunteering time every year and, in 2022 alone, the business donated almost $9,000 to various good causes during Charitable Giving Week as a result of employees’ own generosity.

“Sunrise Banks is very forward and active in putting mission with margin,” Seydel says. “That way, we can do sustainable good for our communities and our other stakeholders.”

Although Sunrise Banks is based around the Twin Cities Metro region, Seydel himself is based in Sioux Falls, South Dakota – where the business has a fintech partnership division. A graduate from Colorado Tech, he previously worked for Meta Payment Systems, where he says he faced an inflection point: choose to go down the client relationships and partnerships route, or pursue regulations instead.

He went after regulations – a decision that ultimately led to a career in regulatory compliance, joining Sunrise Banks in August 2012 and, following “opportunity after opportunity”, several senior roles in sales, operations and business development. He was appointed to his current role, Chief Fintech Officer, a year ago.

The fintech division at Sunrise Banks, which Seydel is now charged with heading up, is focused on fintech partnerships and creating opportunities for entrepreneurs who have conceived a way to lift up communities or make consumers’ lives better. “What we do in the fintech division is take those dreams and find a path to saying ‘yes’ – although we’re not the Make-A-Wish Foundation,” Seydel is keen to point out, stressing that there must be value alignment

“HOW CAN WE TAKE A PRODUCT, HAVE THE LOWEST INTEREST RATE WE CAN, AND MAKE IT EASY TO REPAY?”

TYLER SEYDEL CHIEF FINTECH OFFICER, SUNRISE BANKS

between fintechs and the bank’s own social mission and regulatory sustainability.

The bank runs the full gamut of collaboration – from pairing with fintechs who already have a product in the market and simply want another issuing or sponsoring institution, to co-creating from scratch with like-minded innovators who arrive with the seed of an idea in search of expertise to make it come to fruition. Alternatively, a third route might include the bank itself conceiving an idea that would benefit its customers and seeking partnerships that will enable it to facilitate that product launch. “Those are typically the three delivery channels in which the bank does fintech books of business,” Seydel says.

To understand what their customers need, Sunrise Banks needs to first know

who they are. Thankfully, the organisation boasts a diversity of thinking to introduce a list the bank’s 319 employees are majority female (55% versus 45%, to be precise), with almost a quarter (23%) coming from underrepresented social groups. The bank’s staff speak a wide range of different languages – from native American tongues such as Choctaw to world languages like Farsi, Mandarin, Amharic and Tagalog.

The need to identify with the bank’s diverse customer base is clear to see.

Although the region is less deprived than Minnesota as a whole, there are still 270,000 people living below the poverty line – and there is a real mixed picture when it comes to poor and rich. It is a melting pot that neatly encapsulates the spirit of America, with lots of opportunity but also lots of

wealth inequality. Sunrise Banks’ four retail locations, spread throughout Minneapolis, are strategically located in low-to-middle income census tracts to help the bank better serve its underrepresented customers. The Twin Cities region has plentiful graduate prospects too, with Sunrise Banks partnering with local universities on a successful internship programme.

The core tenet of high-impact lending revolves around providing credit to as many customers as possible, Seydel puts it: “How can we take a product, have the lowest interest rate we can, and make it easy for them to repay so they don't even have to think about it? All they need to think about is what they're going to use that money for, and everything else happens on the backend without them needing to do a thing.”

One way the bank does this is by removing the need for credit checks in some products – which rely on an often-outdated snapshot of a customer's circumstances, and can marginalise those customers most in need of credit. If a borrower is in full-time employment and earns enough to be able to repay their loan, why shouldn't they be considered a safe debtor? Traditional credit checks, which have been accused of being outdated in the past, place surprisingly little emphasis on a borrower's earnings and instead focus on debt history and the promptness with which they repaid previous loans. In theory, a customer's financial situation could have worsened and their ability to repay deteriorated – but so long as they have repaid loans in the past, they are likely to be accepted by traditional lenders.

Sunrise Banks turns this antiquated process on its head. The effect is a suite of lending products that boosts financial

inclusion for the bank's customers and drive down the cost of referencing. “With credit checks, there's going to be a document; there's going to be some compliance risk there; there's going to be a need for us to capture consumer information for us to run them through and provide them disclosures,” Seydel explains. “If you can take that component and design a product without doing a credit check, and remove all that complexity, then you'll reduce the cost. That's what we did.”

So doesn't the removal of credit checks add extra risk? In short, yes. Seydel acknowledges that there is inherently more risk, but the bank takes measures to ensure a customer's ability to repay and guard against lending to customers who can't afford it. Credit files don't contain information about earnings anyway, so Sunrise Banks is focusing on a metric that it believes is more central to a customer's ability to repay.

“What you're doing is knowingly accepting a marginal amount more risk,” he continues. “It’s all about driving down the credit product cost, it's about inclusivity, and it's about creating an environment that allows people to participate.”

One of the ways Sunrise may improve its credit decisioning in future is by utilising open banking, which will connect directly to a customer's bank account and provide a clearer picture of their incomings, outgoings, and transactional history. But that still stops short of a full credit check. It stresses that this would be to aid the impact of what it already does; and, as a social enterprise, it has no plan to compromise on its mission in pursuit of greater profit margins.

Seydel says: “When we start to talk about open banking, gaining access to that data will

“WE ARE PROBABLY GOING TO SEE A SITUATION WHERE SOME CUSTOMERS WILL NEED TO CYCLE THROUGH SOME DEBT”

TYLER SEYDEL CHIEF FINTECH OFFICER, SUNRISE BANKS

allow us to look at underserved communities and structure products that appeal to them. When you look at Sharia-compliant loans, for example, you can't have interest rates with those. So how does the bank go about ensuring that margin? For us, that's secondary to how we actually structure that product.”

Another way Sunrise Banks improves financial inclusion for its customers is by allowing all customers – regardless of their race or background – to have access to the financial system. The diverse approach it takes to its workforce is mirrored in the work that it does with its customers, including those who are most often excluded from accessing financial services. This includes migrants.

Some migrants, particularly undocumented migrants, may lack a social security number (SSN), making it difficult for them to bank, save and borrow. But Sunrise Banks has a purpose loftier than one person's immigration status, so they have created innovative ways to ensure they can still offer products and services to that customer. One product replaces the need for a SSN with an individual tax identification number (ITIN), which an undocumented migrant is more likely to possess. It's all about creating products that are tailored to unique demographics or customer groups, the bank says, rather than just being another rejection letter along the way. In turn, doing good creates a competitive benefit for the bank.

“If those customers need to get a mortgage

and they have an ITIN, there's nowhere else in the Twin Cities to go,” Seydel says. “You're coming to Sunrise.”

With much of the current debate about fintechs geared towards profitability, Tyler Seydel believes that many of the integration partners they work with will switch from customer acquisition to customer retention. Instead of trying to recruit new users –and paying handsomely for the privilege – fintechs will instead seek to drive brand loyalty from the regular users they already have in their database. Incentivising them to use your product more, or spend more when they're on your platform, can be an incredibly powerful way of remaining resilient through a recession.

Banks will also have to adapt. When economic prospects worsen, it becomes more likely that governments will step in and provide assistance programmes for the hardest-hit consumers. This was the case in many countries, including the US, during the

COVID-19 pandemic. “What we are doing as an institution is aligning ourselves more with government aid disbursements,” Seydel explains when asked how Sunrise is adapting to the bigger picture.

And as consumers feel the squeeze, their needs are going to change – and that is going to have to be reflected in the products that banks and lenders offer. A combination of recessionary economic forces, inflation, and bleaker job prospects mean that customers will require more small-dollar credit to tie them over between paychecks or welfare checks. It's also likely that, while their month-to-month requirements might remain low, some customers will require a greater frequency of credit – perhaps a few times a year, or at key holidays when funds are tight. Sunrise Banks' fair and low-interest model means it's ideally placed to assist customers in those circumstances without deepening customers' debt position.

“We are probably going to see a situation where some customers will need to cycle through some debt. They're taking out

TYLER SEYDEL CHIEF FINTECH OFFICER, SUNRISE BANKS

TYLER SEYDEL CHIEF FINTECH OFFICER, SUNRISE BANKS

a product, paying it off, and maybe then taking out the product once again. We need to look at that and think seriously about whether these folks are becoming trapped in a cycle of economic conditions. What can we do to help them out?”

In our conversations with Seydel, it's clear above all else that mission and purpose are the biggest motivations behind the bank's work. It goes without saying that, regardless of what the economy gives us, Sunrise will continue to prioritise its customers –championing financial inclusion, caring about people’s household budgets, and living up to its obligations as a socially minded business.