We produce Digital Content for Digital People across 20+ Global Brands, reaching over 15M Executives

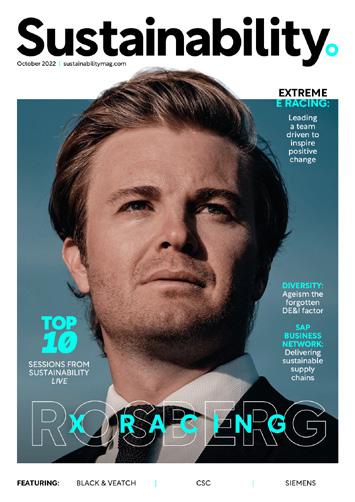

Digital Magazines

Websites

Newsletters

Industry Data & Demand Generation

Webinars: Creation & Promotion

White Papers & Research Reports

Lists: Top 10s & Top 100s

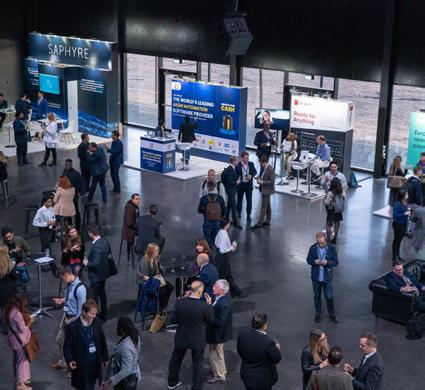

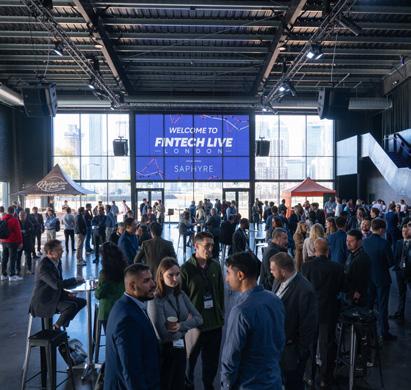

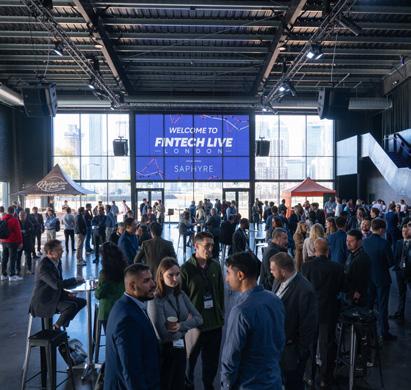

Events: Virtual & In-Person

Work with us

In 10 or 20 years’ time, it’s entirely plausible that I’ll be dictating this editor’s letter to a virtual assistant through a VR headset. That’s if there’ll even be a need for me at all. Journalism is often touted as one profession that could be swiftly replaced by AI and automation

In this month’s edition of FinTech Magazine, we have two features examining the potential impact of the metaverse on financial services. First, we ask whether this new technology could offer banks an exciting new frontier. Then, we look at the rise of non-fungible tokens (NFTs), which to date have been mainly traded as digital artworks but could represent a lucrative new revenue stream for the global video game industry. Working in fintech every day, we are often guilty of being blind-sided by new technologies and losing sight of the broader perspective. There are roughly 1.5bn unbanked and underbanked people in the world today, largely in rural communities or developing countries. We ask what more can be done to engage those underserved populations in the financial system. It’s an important topic – what hope do we have of driving uptake in new technologies, like the metaverse, when so many people still lack access to a bank account?

So take a few minutes out, pour yourself a mug of something hot, and enjoy the May issue of FinTech Magazine!

ALEX

“HOW DO WE DRIVE UPTAKE OF NEW TECHNOLOGIES WHEN SO MANY ARE STILL EXCLUDED FROM THE FINANCIAL SYSTEM?”

14 BIG PICTURE Argentina’s economy hit by three-figure inflation

16 LIFETIME ACHIEVEMENT AWARD Chris Comparato CEO, Toast

20 FIVE MINS WITH Hannah Lewis UK Country Manager, American Express

The Backbase Engagement Banking Platform is the evolution of digital banking.

Built for fast implementation and ease-of-use, the platform allows financial institutions to rapidly deploy digital solutions that delight customers and empower employees.

With the power of one platform, you can:

Engage your customers

Create tailored customer journeys from account signup to product up-sell

Empower your employees

A 360° view of your customer helps you deliver personalized and instant service

Ready to get the full picture?

Talk to our specialists

Leverage a composable architecture

Select best-of-breeds partners for your perfect end-to-end solution

Reduces overhead and drive greater innovation with our cloud model.

Start small, grow big Future-proof digital solutions can be customized to your needs now, then scaled later.

This advertisement can only scratch the surface of what the Backbase Engagement Banking Platform can do for your business, employees and customers.

Ready to get the full picture?

Function as an agile workforce to fast-track consumer innovation

Rows and rows of fully stacked shelves in a supermarket in Argentina. Consumer spending power is being seriously impacted by rising inflation, which in March topped 100% for the first time since 1991. Food and drink prices soared by nearly 10% in a single month, while popular cuts of meat were 30% more expensive. A severe drought affecting food crops is exacerbating the situation, leaving household budgets under severe strain. South America’s third most populated country has deep-seated and long-running issues with its economy, often described as being in “perpetual crisis” and where 40% of people live in poverty.

and off. Toast

If you lived on planet Earth during the pandemic – or any time since, for that matter – chances are you ordered in. With restaurants shuttered and social distancing rules in place, many of us took advantage of the speed and convenience of food delivery. It’s a growing trend and a market that’s expected to be worth as much as US$430bn globally by 2030.

Along with the rapid rise of digital payments, it is one of the consumer demands that is driving a technological revolution in the restaurant business. One company that is helping to serve restaurants and meet those needs is Boston-based Toast, which has been on an astronomical ascent since it was founded in 2011. The company has raised more than US$900mn in funding since the beginning of 2015 – during which time it has been led by one man.

Consumers are dining out more again Chris Comparato has an extensive background leading high-growth SaaS companies, which explains why he was such a good fit for the top job at Toast when he was appointed in February 2015. Before Toast, he led all customer success functions at Acquia and Endeca, as well as roles at consulting firms Keane and Cambridge Technology Partners.

When the COVID-19 pandemic hit, Toast was doing well. Revenue had increased by more than 100% yearon-year, and the firm had just raised US$400mn in its largest funding round

to date led by the likes of Bessemer Venture Partners and Tiger Global Management. It was a stern test – not just for Toast, but for its merchants too, who were already having to adapt rapidly to dining habits in constant flux.

“If you look at the course of the last two-and-a-half years, the restaurant industry has been incredibly resilient,” Comparato told CNBC earlier this year. “We're making sure that our merchants and restaurants are ready to adapt and be resilient. Restaurants continue to struggle with staff shortages, food inflation, and how to engage their team. Our platform helps our customers strengthen their position on those three dimensions.”

Following a turbulent few years, restaurants are under pressure to move with consumer habits and offer fantastic experiences online

is one of the companies helping them do it

“We enable restaurants to deliver fantastic experiences to guests, freeing up their time and energy to do more of what they love”

Despite the challenges of the past few years, restaurants are beginning to bounce back. More consumers are dining out again, and food delivery is a long-term trend that will prevail because of its overwhelming convenience to customers. Inflation poses a new threat – both in terms of business rates, but also consumer budgets facing greater pressure – though research from restaurant marketing company Popmenu suggests that almost 60% of US consumers were dining out more last year, despite rising menu prices.

Toast continues to add more restaurants Toast’s system helps restaurateurs to reduce ticket times by up to 40%, connecting the kitchen with the frontof-house to ensure that no tickets are

“Restaurants have been incredibly resilient but they continue to struggle with staff shortages, food inflation, and how to engage their team”

lost and orders are picked up accurately. A bill-splitting feature allows diners to share the cost of a meal with others at their table, while handheld units let waiters put down their pad and pen.

Toast is trusted by nearly 80,000 individual restaurants, having added another 23,000 net new locations last year. It’s not just for big chains; even for small franchises, Toast can help realise productivity savings and empower staff to turn over tables more quickly.

Explaining the value that Toast brings, Comparato recently told the Entrepreneur podcast: “Our platform enables restaurant operators to deliver great guest experiences, whether it's ordering off-premise through online ordering; whether it's ordering takeout; whether it's having a tremendous dining

experience within the restaurant. We enable restaurants to deliver these fantastic experiences. We want to make sure that we're freeing up their time and energy to do more of what they love.”

Today, Toast is a public company, having listed on the New York Stock Exchange in September 2021 as part of a successful IPO that valued the company at US$20bn and made all three of its original founders billionaires.

As for Comparato, he continues to lead the business as it recruits even more restaurants into the Toast ecosystem –or Toasters, as the company calls them. His name gives some clues to his Italian heritage, and subsequently his favourite type of cuisine when he decides to eat out.

“Italian of course,” he says.

Hannah Lewis is the UK Country Manager at American Express. She talks about payment innovations, flexible working environments, and diversity developments

Q. DESCRIBE YOUR JOURNEY INTO FINTECH. HOW DID YOU GET HERE?

» I was first introduced to the world of payments while working at a large professional services consultancy and was instantly intrigued.

On the one hand, payments are something we all make and need, but there can also be a lot of backend complexity that the consumer doesn’t want to have to spend time thinking about. There was clearly a huge opportunity for innovation, particularly when it came to digitally connecting buyers and sellers, and that really excited me. It was this that ultimately led me to American Express – a brand and culture with a customer focus that has consistently driven innovation. I’ve seen the space change and develop a lot, particularly over the past decade, and 14 years later I’m still incredibly proud and excited to be working here!

Q. WHO WAS YOUR CHILDHOOD HERO AND WHY?

» Probably Helen Sharman. I was a slightly geeky kid from Yorkshire, so I found the prospect of a female chemist from Sheffield becoming the first Brit in space, and still one of the youngest ever people in space, really inspiring.

Q. WHAT'S THE BEST PIECE OF ADVICE YOU’VE EVER RECEIVED?

» Be authentic. I think many of us start out in a career with stereotypes in our minds around what a successful leader looks like, and it's all too easy to feel like you have to be just like that to succeed. Yet, you can never be as good at being somebody else as the best version of yourself.

It’s important to listen and to take on advice, but digest it and incorporate it in a way that feels right for you and still allows

you to be yourself. Being encouraged to feel comfortable being myself and doing things in my own authentic way early in my career has been incredibly valuable for me.

» Probably my iPad – I love that I can video call both family and colleagues wherever I am and properly connect. Personal travel is also much more enjoyable if my children can be distracted with their favourite cartoons on a long train or plane journey.

» We’ve made huge progress collectively across the industry, and I’m pleased to be a part of that – but there’s obviously much more still to be done. In addition to ambitious targets and robust measurement, we need to look at practical measures to bring more women and underrepresented groups into the industry, at all levels. That might require looking beyond traditional requirements and investing in people with different skill sets to take advantage of the full spectrum of potential that is out there.

I’m really proud of the progress we’ve made at American Express, with women making up 48% of senior management here in the UK. My personal experience has been really positive; I have grown through the company as I’ve had some very inspiring women role models and leaders.

What’s important to me now is making sure we continue to build on this so that anyone would see our business as a place where they want to work and grow their career.

» I’m fortunate to have been surrounded by incredibly talented and inspirational people throughout my time at American Express. I have had some fantastic leaders, team members and senior role models to learn from, and now in my role as UK Country Manager, I get to work with people from across the whole business. Hearing their diverse range of experiences and perspectives is one of my favourite parts of the job.

I’ve also met and worked with some incredible people across the industry, whose expertise and insights have been enormously valuable. Staying close to industry bodies and advisors is also key in keeping up to date.

Q.

ACHIEVEMENT FROM THE PAST 12 MONTHS OF WHICH YOU ARE PARTICULARLY PROUD?

» I started my role as UK Country Manager as we emerged from the pandemic and began the return to UK offices with a new, flexible working model: Amex Flex. This was a big change for everyone involved, but the potential was also really exciting. Through Amex Flex, colleagues now have the choice to work entirely virtual, entirely in the office, or a hybrid across both.

Amex Flex gives colleagues the ability to benefit from both in-person collaboration and coaching opportunities in the office, as well as the flexibility of being able to spend more time at home. I think there are still things we’re learning about with this new approach, but colleague feedback has been

overwhelmingly positive. I’m really proud that we have been able to find ways to bring back the benefits of in-person connections while also giving our colleagues, including myself, the flexibility to spend more time at home, with all the personal possibilities that enables.

» Authentic

» Ambitious

» Approachable

» I love the fact that the status quo is constantly challenged and the desire across fintech to both make improvements and drive efficiencies for customers has raised the bar for everyone, simplifying processes, reducing friction and increasing security.

I’m also pleased to see the efforts to bring more women and other underrepresented groups into the industry, who I know will push the frontiers of what we can do even further.

» I’m incredibly passionate about continuing to ensure American Express is one of the best places to work. That means fostering a welcoming and inclusive culture, while providing the backing to colleagues to develop and grow their careers. We know that when our colleagues thrive, so do our customers, so it’s a critical focus for us.

More personally, I’m really excited about the potential American Express has in the UK, and I’m looking forward to leading the business to deliver on that.

Accelerate growth and create wholistic business value with pioneering technology-fuelled digital solutions tailored to the realities of your enterprise and the financial services industry. Inspire customer loyalty and success.

Gautam Samanta, Coforge EVP and Global Head of Banking and Financial Services, stresses that digital transformation is all about delivering value.

Coforge is a global digital services and solutions provider, and helps its clients embrace emerging and new technologies to achieve real-world business impact.

The company’s proprietary platforms power critical business processes across a select number of sectors, and it has a presence in 21 countries, with 25 delivery centres across nine nations.

One of the sectors in which Coforge is a key player is banking and financial services (BFS), where it is helping its BFS clients on the digital transformation journey by making the road as straight and smooth as possible.

“Digital transformation is an evolutionary process, not a revolutionary one,” says Samanta. “So we do not see it as disruptive.”

He adds that having a clear vision of what digital transformation is - and isn’t - is what shapes the solutions that help Coforge’s clients achieve their goals.

“For us, digital transformation is not just a marketing phrase to wrap around software services. It is not about the technology.

It is about delivering business value for stakeholders, including shareholders, customers and employees.”

Samanta adds that Coforge’s approach is effective because its solutions also “absorb the realities of our customers’ enterprises” - the reality being that “the old and the new often coexist in business processes that can sometimes be decades old”.

“One of the things that differentiates us is that we are pragmatic in our approach to helping clients,” Samanta adds. “Yes, we transform with the new, but not at the expense of the old, which often has value.”

It helps, too, that Coforge has a deep understanding of what value looks like in BFS, because the company has chosen to focus its attention on this sector, as well as a small number of other verticals.

“We focus on very select industries, and have a deep understanding of the underlying processes of those industries, which provide us with a distinct perspective,” says Samanta.

AD FEATURE WRITTEN BY: ALEX CLERE

PRODUCED BY: MICHAEL BANYARD

AD FEATURE WRITTEN BY: ALEX CLERE

PRODUCED BY: MICHAEL BANYARD

Rewind for a moment, if you will, to 1898 – you’ll find that the world is a very different place. The US president is William McKinley; in England, Queen Victoria is into the last few years of her reign; and in the Netherlands, her third cousin, Wilhelmina, is embarking on what would eventually become a near-60-year spell on the throne.

Meanwhile, in the Netherlands that same year, two Dutch banking cooperatives were inaugurated that would go on to form the backbone of one of the world’s largest financial institutions – one that, this year, is celebrating its 125th anniversary. Raiffeisen-Bank was founded in Utrecht and Boerenleenbank was founded in Eindhoven, originally acting as banking cooperatives to serve local farming communities.

Nearly 75 years later, the two would merge, taking the first two letters of their respective names to create a brand that is still familiar to this day: Rabobank.

When Bart Leurs, Rabobank’s current Chief Innovation and Technology Officer, dials in from his home office to talk about the company’s innovation strategy, there’s a small parallel with the bank’s agri-heritage: he is speaking from Utrecht, where he lives with his family – and where Raiffeisen-Bank began its journey exactly 125 years ago.

Leurs is a seasoned banking executive who joined Rabobank in 2016, first serving

as Head of FinTech & Innovation before four years as Chief Digital Transformation Officer. He has held his current role since September 2021. Prior to that, he spent almost two decades at ING, where he spent two years as Head of Strategy for ING Direct, followed by a number of senior positions within the company in Canada, Germany, and Belgium.

According to Leurs, that experience overseas has given him a deeper appreciation for the financial challenges in existence around the world, as well as an understanding of Rabobank’s reputation abroad.

“It really broadens your perspective of the world,” he tells FinTech Magazine. “It has really enriched my work and my life, in general, and given me new inspiration thanks to the different cultures and the different ways that people look at life.”

125 years after its founding, Rabobank is an immense organisation with international reach. Rabobank is one of the leading banks in the Netherlands with a focus on mortgages and SME lending. In 50 years, the number of local led Rabobanks reduced considerably, from 1,192 independent local member banks in 1972 to one Rabobank with 78 regional areas today.

Globally, Rabobank’s business is focused on being a food and agri bank, true to its roots as a farmers’ banking cooperative.

As such, it’s heavily active in North America, South America, and Australia –parts of the world where food and crop production make up vital parts of the economy. But Rabobank finances all players throughout the entire food value chain, from farmers at one end to retailers at the other.

Rabobank’s balance sheet globally is more than €600bn and, last year, the bank made almost €2.8bn in profit from €12bn’s worth of revenue.

Despite its massive scale, Rabobank hasn’t allowed its growth to diminish its cooperative heritage or dampened its core values; in fact, the business still operates with much the same mindset today as it did over 100 years ago.

“The idea behind the cooperative was to fix things together that you cannot fix alone”

BART LEURS CHIEF INNOVATION & TECHNOLOGY OFFICER, RABOBANK

“The idea behind the cooperative was to fix things together that you cannot fix alone,” Leurs explains. “At that time, it was bigger farmers helping smaller farmers to access credit so they could build and grow their business. Of course, we have grown to be a much bigger bank that’s not only focused on food and agri anymore, but that has broadened its scope and its activities. But the mentality and culture of a cooperative –of fixing things together – still exists within the organisation.”

In part, he credits Rabobank’s success to its operating model, which is unique among global institutions of this size. As a cooperative, Rabobank exists for the mutual benefit of its members. Unlike listed companies, this means that it’s able to take

TITLE: CHIEF INNOVATION AND TECHNOLOGY OFFICER

INDUSTRY: BANKING

LOCATION: NETHERLANDS

Bart Leurs, Rabobank’s current Chief Innovation and Technology Officer (CITO), joined Rabobank in 2016, first serving as Head of FinTech & Innovation before four years as Chief Digital Transformation Officer. As CITO, Bart is leading the change to continuously improve the effectiveness of the bank's 'Tech engine' and is driving the organisation to innovate and make use of the possibilities of Tech & Data. He has held his current role since September 2021. Bart previously worked at ING, leading various business departments. He has over 20 years of experience conceiving and delivering new and innovative digital services at banks.

a more strategic long-term approach rather than focusing on just short-term profits. You occasionally see that distinction in family-run businesses as well, Leurs points out.

Over time, the cooperative’s main priorities have evolved, even while its focus on food and agri have remained the same. Today, Rabobank has its eyes firmly set on deepset social issues that affect all of society – including food security and energy security.

According to the United Nations’ Food and Agriculture Organization (FAO), food security remains one of the most pressing concerns in today’s world. Its latest update, published at the end of 2022, lays bare the issues facing the global food supply chain:

“Malnutrition in all its forms remains a challenge, and child malnutrition, in particular, is expected to be higher due to the effects of the COVID-19 pandemic,” the FAO writes.

The report continues: “Climate change poses the greatest threat to rural small-scale producers, particularly poor and vulnerable communities. This pressure comes through increasingly frequent extreme weather events such as droughts, storms, and floods, as well as gradual changes such as shorter rainy seasons, delayed onset of rain, rising sea levels, and melting glaciers.”

Facing this complex combination of risk factors, it’s clear to see why food producers and other stakeholders within the food supply chain need financing from a reliable partner like Rabobank. “We are the biggest

bank around the world in food and agri, and we deal with all the players in the food value chain – from the farmer up to Walmart,” Leurs says. “We see that, with a growing population plus issues around sustainability and being able to feed the world within the bounds of the planet, there’s really a role for us as a bank.”

Part of Rabobank’s role in that mission is supporting the food producers it works with to be able to play their part in the fight against climate change, and, in particular, stick to the Paris Accord goal of keeping global warming below +1.5°C compared to pre-industrial levels. As well as providing financing and knowhow, Rabobank also encourages companies to play their role in the green transition by nurturing accelerated innovation.

“With the challenges that we face in the world today, there’s always a need for innovation, so I don’t think we’ll ever slow down”

BART LEURS CHIEF INNOVATION & TECHNOLOGY OFFICER, RABOBANK

SUREPAY

FOUNDED: 2016

HEADQUARTERS: UTRECHT, NL

This Dutch fintech is a prime example of innovation beginning with a big idea before honing down on something more specific. Originally launched within the bank with the aim of creating a huge alias database, it soon pivoted to creating a system that conducts an IBAN name check. Today, it is the name-number check done in the Netherlands, as well as multiple European countries. Its two founders, David-Jan Janse and Marcel Rienties, left Rabobank to launch SurePay as a standalone entity, and now the company is in the midst of accelerating growth. Rabobank retains a share in SurePay, having chosen to bring on board a co-investor who could help make it even bigger.

PEAKS

FOUNDED: 2016

HEADQUARTERS: AMSTERDAM, NL

Peaks, the retail investing app that allows consumers to invest in ETFs and ETPs, is a good example of Rabobank realising that its continued ownership would not bring out the best from the brand. An internal startup, Peaks was one of the first innovations that Rabobank invested majorly into, before reaching the conclusion that the business model Peaks was pursuing would need a new owner – one with a European retail presence larger than Rabobank could offer. Rabobank eventually sold its stake in 2021.

FOUNDED: 2019

HEADQUARTERS: UTRECHT, NL

Another of Rabobank’s own initiatives, Datakeeper is a Dutch startup that’s focused on secure and privacy-by-design identification and data sharing of a.o. address, passport, income and pension data. With the Datakeeper identity wallet app, customers can quickly, easily and securely share the exact personal data that businesses need from them for onboarding (KYC) or accessing services. With the rise of Web3, Rabobank’s Bart Leurs says that the use-case for this kind of technology is going to grow in the coming years. It makes sense for Rabobank to be involved, he says, because the bank has been taking care of data and money for 125 years.

FOUNDED: 2015

HEADQUARTERS: NEW YORK CITY, US & UTRECHT, NL

Foodbytes by Rabobank is an online connection hub for corporates, investors and startups in the food and agri world. What began as a live pitch event has evolved into a digital marketplace where startups and multinationals can discover and collaborate together. This initiative uses Rabobank’s global ecosystem to connect the food value chain and strengthen the future of our planet. “We’re really proud of Foodbytes because it fits the nature of our organisation and the mission that we have,” Leurs says.

ACORN

FOUNDED: 2020

HEADQUARTERS: UTRECHT, NL

Acorn is a digital platform that empowers smallholder farmers around the world to access the voluntary carbon market. Acorn supports smallholders to transition to agroforestry – where trees grow among other crops, leading to better soil quality and more sustainable farming. This provides certified, nature-based carbon credits, which Acorn offers to responsible corporates to help them reach their climate goals.

The startup has already enabled more than 100,000 farmers to put their land to good use, covering over 135,000 hectares of land – the equivalent to nearly 14 cities the size of Utrecht. Acorn supports smallholders by monitoring the biomass growth, issuing carbon credits and ensuring that farmers receive 80% of the €3.5mn of total revenue generated so far.

FOUNDED: 2021

HEADQUARTERS: UTRECHT, NL

Carbon Insights is a feature within Rabobank’s banking app that helps retail clients make more carbon-conscious decisions. In practice, Carbon Insights leverages payment data to give app users insights on their carbon footprint and helps them understand where it comes from. Carbon Insights also gives suggestions on actions customers could take to reduce their footprint.

Initial results show that more than half of users became more aware of their CO2 impact and a substantial number of long-term users have made more sustainable decisions. With this in mind, Rabobank continues to further scale this solution while designing for behavioural change.

“At this point, more than 60% of our innovation projects are geared towards that transition,” Leurs elaborates, “towards making the food value chain more effective and more sustainable in the future.”

In the same report, the FAO also pinpoints energy security as a major global concern. The two are very closely linked; food production is a resource-intensive industry, meaning fluctuations in wholesale energy prices – as we have been seeing since the beginning of the war in Ukraine – have a major impact on farmers, growers, and food producers.

“Agri-food systems are becoming more energy-intensive,” the FAO report says, “and this has implications for food prices, as well as for the environment. On the one hand, several studies have highlighted the relationship between energy and

food prices, and the recent hikes in food prices have been pushed up by increases in energy prices. On the other hand, it has been estimated that almost a third of the emissions of the global agrifood system comes from energy-related activities.”

One thing we can do is reduce the amount of water needed for growing crops, and transitioning to renewable energy wherever possible within the food value chain. But the FAO also highlights the source of energy for cooking as a problem: in 2019, a third of the global population relied on wood, charcoal or agricultural residues for their household cooking needs – a demand that, in some cases, outstripped the abundance of natural supply.

Explaining how Rabobank empowers the energy transition, Leurs says: “We are one of the biggest financiers of wind farms around the world, but we also have the obligation of making sure that we bring clients with us in making this huge transition to a more

electrified world. In energy security, our knowledge is younger than it is in agri-food, but we can still have a major impact and we know we already have a strong position.

“That’s why we have chosen those two – agri-food and energy – as the main transitions to bank on for the future. We know that, if we do a good job with our clients in those two areas, we will also do a good job for the planet.”

Leurs joined the business in October 2016, and since then, he knows that there have been improvements. Even from the beginning, Rabobank has always been an innovative organisation: it was the first bank to offer internet banking and ATM withdrawals to its clients in the Netherlands; and it pioneered a payments system called iDEAL, which has become instrumental to transactions, taking less than a decade after

launch to capture 50% of online payments made in the country. But it hasn’t always got everything right.

“We have made lots of mistakes and had quite a lot of setbacks,” Leurs freely admits, “but we have tried to learn from every single one of them.

“When I joined Rabobank, it already had a strong history of innovations. But my perception coming into the bank was that innovation was very disorganised. We were doing lots of different things in different places, and it was very tech-driven. Innovation was part of our IT department, and there was no structured way of bringing innovation to fruition. In that respect, we moved from being an organisation of inventors – people who create technical solutions without much coordination – to being an organisation that has a mature innovation governance with seasoned innovation professionals.

Leurs says that, in those days, innovation within Rabobank lacked direction. “We collaborated with tech startups and tried a bunch of different things just to generate power and enthusiasm. However, we learned that you can only be successful and impactful on innovation when it’s

“Our Innovation Factory is the machine that creates the unicorns!”

BART LEURS CHIEF INNOVATION & TECHNOLOGY OFFICER, RABOBANK

linked to the mission and strategy of your organisation,” he says.

In the intervening years, Rabobank has worked on a number of different approaches. One is to ensure that every innovation project is intrinsically linked to the bank’s mission and strategy – and to those important transitions of energy security, food security, and financial inclusion for all; the other is to view innovation as a craft.

“I believe you can learn innovation, but you need discipline and structure. Things don’t just happen by accident. We’re not all Steve Jobs. You have to get a sense not only of how you generate ideas, but also how you validate (or invalidate) them quickly and integrate them with the mission of the organisation.

“We have organised ourselves quite well. We started with the concept of ‘businessled’ innovation, and we said we’re not going to build projects outside the organisation that are not being inherited by the mothership. We’ve really set business-led innovation as the key.”

Within Rabobank itself, there are a number of separate work streams that help the bank dial-up its innovation efforts. The first is called the ‘Innovation Factory’. Rabobank has recognised the need to ‘industrialise’ innovation, so it has assembled a talented team of innovation experts with experience in founding startups, building and scaling corporate ventures and shaping partnerships with fellow innovators. These experts accelerate Rabobank’s internal ventures including scouting and shaping partnerships via its Open Innovation activities. “It is the machine that creates the unicorns,” he jokes.

“You can only be successful and impactful on innovation when it’s linked to the mission and strategy of your organisation”

BART LEURS CHIEF INNOVATION & TECHNOLOGY OFFICER, RABOBANK

Then the company has a corporate venture fund, Rabo Frontier Ventures, that is investing in early-stage fintech companies and several venture capital funds, as well as an open-innovation ecosystem that allows it to bring external innovators into the business and give them the chance to start working with Rabobank.

“We have organised innovation portfolio management,” Leurs continues. “We have a funnel where we’re constantly looking at how many innovations we have and in which phase of development – whether they’re just starting an innovation project or scaling up within the organisation.”

Innovation has its own centralised budget allocated that is ring-fenced, meaning other tech projects within the bank don’t eat into innovation. The bank’s innovation leads are connected to board members, ensuring that there’s corporate buy-in for major innovation projects.

And the bank isn’t afraid of letting go where it needs to: take the example of Peaks, a retail investing app where Rabobank was an early-stage backer. Rabobank itself was not able to turn the company into a success and, recognising that there was a better place for Peaks, chose to sell its stake in the company to allow the fledgling fintech to fly.

“With the challenges that we face in the world today, there’s always a need for innovation, so I don’t think we’ll ever slow down. We will always need innovation to continue making those energy and food transitions a success, so I don’t see a world where we will never need to innovate.

“Of course, that doesn’t mean you can’t be sensible with what you spend and what you get out of that expenditure. We’re super-realistic. If we see that our innovation projects aren’t moving fast enough throughout the year or we’re not going to

use up our allocated budget, we give it back to the organisation. We don’t need to use up our budget to show that we’re successful. But I think it would be naive to think you can just pause your innovation. I don’t think that’s an option in today’s world.”

Innovation is embedded in Rabobank’s DNA From Leurs’ perspective, this cooperative mentality makes Rabobank ideal for outside partners to deal with – whether that’s startups, consultants, or innovation enthusiasts. That doesn’t mean that new relationships are always seamless, though. Any organisation of Rabobank’s size would find it difficult to integrate with young, agile entrepreneurs – particularly those that are used to moving at pace, and less experienced in dealing with a heavilyregulated industry that has internal safeguard layers, protocols, and approval procedures.

“We have had a number of successful collaborations, but we have also had some failures around collaborating with startups, too. We always start with good intentions, but, sometimes, it can be a difficult thing to marry the small with the big.”

Leurs believes that innovation is baked into Rabobank’s DNA. It’s an integral part of the way it does business. “I honestly think that the cooperative culture in the organisation translates into our people being willing to work with teams, to help each other get results. That, in the end, is what you need to get great innovation and great new ideas.”

The metaverse has the potential to transform ecommerce entirely, but what effect will it have on banking – and should we be investing in it now?

WRITTEN BY: ALEX CLEREThe metaverse seems like such nascent technology that it’s hard to believe that it’s a full seven years since Oculus Rift became the world’s first widely available VR headset. Indeed, the word ‘metaverse’ was first coined by sci-fi writer Neal Stephenson over 30 years ago – such is the amount of time it takes for technologies like VR and the metaverse to fully embed themselves into any industry, let alone one as regulated as financial services.

So when we talk about the future of banking existing in a virtual space, we are talking about an evolution that will be decades – not just years – in the making.

There are, however, some banking brands that have already taken their first steps into the metaverse. At this point, much of the activity seems to be laying a foundation for a future where VR is a way of life – buying up retail space, establishing a brand presence, testing out the water. Indeed, from the tentative first steps that have been taken so far, it seems as though financial institutions are cautiously optimistic about the potential for metaverse technology.

But Rebecca Bezzina, SVP and Managing Director at R/GA London, believes that it’s just the next chapter in the evolution of banking: “Digital banking has been undergoing a major transformation process where we have moved from bricks and mortar to digital banking, with the latter being the norm now,” Bezzina says.

“What were once high-touchpoint relationships are now, in some cases, completely virtual. This transformation has been driven by focusing on creating seamless experiences, often at the expense of human contact.”

We help you accelerate digital transformation and discover unlimited performance, productivity and efficiency gains.

OUTRUN THE COMPETITION

Go further. Grow faster. Work smarter. Our expertise operationalizing transformative technologies drives rapid, scalable change.

TURBO BOOST YOUR TALENT

Create a culture where human ingenuity and digital innovation can thrive in perfect harmony, and maximize productivity.

DELIGHT YOUR CUSTOMERS

Increase satisfaction and deliver seamless customer experiences. We help you prioritize customer demands and champion their needs at every stage.

We take what’s possible to the Next Level. Now.

Find out more at roboyo.global

Ciara Conway, Head of Architecture at Opencast, an independent digital transformation and technology consultancy, explains what brands are already getting up to in the metaverse: “The metaverse is here and it’s already evolving at pace. For example, JP Morgan has entered the metaverse and set up a branch in Decentraland, a marketplace for digital assets called the Onyx Lounge.

“In financial services, customers have been losing the personal relationship with their banks, and the metaverse carves out a unique way for banks to leverage new ways of engaging with customers, as well as creating decentralised brand experiences.”

Clearly, then, there is still a lot more that banks can do to capitalise on the metaverse and set themselves up for future success in the virtual realm.

“The metaverse provides banking brands a way to deliver richer experiences and reconnect with their customers,” Bezzina tells us. “There are many ways banks are entering this space, testing and learning, from virtual locations being set up offering basic banking services to an opportunity to provide customer services through avatars. Banks have an opportunity to utilise new technologies to better serve their customers and put the human touch back into banking while better blending the real, digital and physical experiences.”

REBECCA BEZZINA SVP AND MANAGING DIRECTOR, R/GA LONDONDavid Donovan, Executive Vice President at Publicis Sapient, explains what banks are already doing in this space: “Some banks have been embracing the metaverse economy already, but others should learn from organisations that have been operating in this field and use it to take steps into the metaverse economy themselves.

“THE METAVERSE PROVIDES BANKING BRANDS A WAY TO DELIVER RICHER EXPERIENCES AND RECONNECT WITH THEIR CUSTOMERS”

It’s not a prerequisite of entering the metaverse that you own a VR headset. After all, the term ‘metaverse’ just refers to any virtual space in which participants can interact with one another. However, by accessing the metaverse through a browser or any other technology that is not a VR headset, users will – in all likelihood – be restricted from enjoying the full experience. In order to immerse themselves in this technology, people will need to invest in a headset. With household budgets being placed under immense pressure, how likely does it seem that the average consumer will fork out $500 for the privilege? Indeed, the question of headset ownership is one of the biggest sticking points for proponents of the metaverse. One day, VR headsets might be ubiquitous – but as of the end of 2021, S&P Global Market Intelligence estimates that there are just 28.5mn AR and VR headsets installed worldwide. That’s about 9% of the US population – worldwide. From a commercial perspective, many businesses will be happy with that rate of adoption; after all, you don’t need every single person in the world to be participating in the metaverse before it becomes a worthwhile investment.

“One way of doing this is to take advantage of the trust customers have in them by processing digital payments. Mastercard is already showing how a traditional financial institution can cater to digital payments demand while keeping their consumers within the existing network and brand.

“Meanwhile, the US Bank is becoming the latest leading player to offer custody services, demonstrating that there's a strong desire for funds that deal in bitcoin to have a bank's name backing them up.

“Breaking into the area by processing payments and offering custody services

will help banks to prepare for a future where digital assets are fully incorporated into traditional financial transactions like mortgages, loans, and trading of equities.

“Additionally, banks should start widely embracing metaverse payment platforms. Meta recently launched a pilot that lets people use WhatsApp to send value from a digital wallet to others, offering benefits like international transfers without fees. There is huge value in this: the metaverse will open up ecommerce, cross-border activity, and increase globalisation by creating a seamless experience.”

“THE METAVERSE WILL OPEN UP ECOMMERCE AND CROSSBORDER ACTIVITY, INCREASING GLOBALISATION BY CREATING A SEAMLESS EXPERIENCE”

DAVID DONOVAN EXECUTIVE VICE PRESIDENT, PUBLICIS SAPIENT

Are we still light years away from a virtual future? Despite the promise that the metaverse offers, there are still barriers to overcome. One of the biggest is the apparent disconnect that exists between consumers and banking leaders. According to an Accenture survey of roughly 9,000 consumers released at the beginning of this year, 55% of consumers are interested in participating in the metaverse – including 90% of those who want to do so within the next 12 months.

Yet banking executives are far more hesitant. When KPMG took the pulse of 100 senior banking leaders for its 2022 Banking Industry Survey, it found that just 13% of respondents said their bank already has a presence in the metaverse, while barely half (51%) believe their organisation will be active in the metaverse in the next 18 months.

“The internet in three dimensions has enormous potential,” says Opencast’s Ciara Conway. “However, there are still challenges that need to be addressed before the metaverse can be fully embraced by the financial services sector. For example, governance and security is a growing concern, so it is critical that businesses ask themselves whether they have the right regulations and controls to ensure everyone can interact within the metaverse safely.

“Another barrier to quick adoption is digital identity. As the metaverse opens up more opportunity for fraudsters, more effort will be needed to manage identity authentication. Currency within this virtual space has not yet been fully defined; while most assume blockchain will be the technology to underpin decentralised commerce, the crypto market currently lacks regulation and stability.”

Those stumbling blocks may go some way to explain why half of banking executives seem comfortable with the idea of being absent from a platform where their clients are present – at least in the near-future. In a difficult economic climate, businesses cannot ignore the financial implications of launching in the metaverse either, Conway says. “If it doesn’t make sense from an ROI point-of-view, it’s likely adoption will stall.”

What more can banking brands do in future?

Publicis Sapient’s David Donovan has a parting word of advice for those visionary brands who are already considering entering the metaverse. “Something banks can implement in the future is communicating with customers using AR and VR,” he says. “This could include using VR glasses, so customers can manage their banking and finance from anywhere in a much more immersive way than is currently possible on a phone app.

“Banks and financial institutions should also realise that millions of people are spending time on metaverse platforms – whether that’s games, virtual concerts or real-estate sales channels. These all create new advertising opportunities –from digital billboards to partnerships with celebrities whose avatars will speak to potential customers.”

“THE

IS HERE AND IT’S ALREADY EVOLVING AT PACE”

CIARA CONWAY HEAD OF ARCHITECTURE, OPENCAST

PRODUCED BY:

GLEN WHITE

Idon’t want to sound alarmist, but the world has until 2025 to implement massive changes, ecologically speaking, or we’re all going to have a big problem on our hands,” says Adam Thompson, Head of Global Sustainable Finance and ESG for IBM Consulting.

Thompson, who is an expert in data and sustainability, is also, in his spare time, an EU Climate Pact Ambassador – a platform that informs, inspires, and supports climate policies and action in local communities and broader networks.

The British father of three – who currently lives in the Bavarian Forest, Germany, is a passionate advocate for renewable innovations, green technologies, and the transformation of the financial space. From where he’s sitting, accountability is key in driving the change required to prevent climate disaster and mass migration that currently looks imminent if we don’t act NOW!

He says: “In my day job, I work with clients to holistically look at how they embed environmental, social governance, or economic factors into their decision making and how do they operationalise that as part of a transformation for pathways to netzero, for climate, nature, or indeed how to rebalance society as a whole. The EU Climate Pact is work that I do in my spare time, along with living as self-sustainable as possible. So, I hopefully not just talk the talk, but also walk the walk.

Indeed, Thompson, who sees his position more as a vocation than a career, does not describe sustainable finance and ESG merely as trends. “This is a movement – a global,

worldwide movement. This is not just about how to apply technology across services. This is really about how we, as one planet and as one society, ensure that we have a planet for the next generation.”

They are powerful words – but ones he stands by. “We need to consider how, in 10, 20 years down the line, the next generation is going to be able to balance their resources. We are on a tightrope, and what’s interesting is that FinTech startups are really beginning to look at nature-based solutions, and these solutions have had incredible exponential growth in a short amount of time by embracing exactly the very solutions that IBM has been speaking about.”

“It’s fundamental to everyone's ‘livelihood’ that we address this”

ADAM THOMPSON

HEAD OF GLOBAL SUSTAINABLE FINANCE AND ESG, IBM CONSULTING

But where does the world’s biggest technology company fit into all this? Well, according to Thompson, it comes down to data, meaningful and accurate communications, and collaborative innovation. He explains that IBM Consulting is the linchpin of the organisation, and that its role is to talk to clients and understand where they are in terms of their ESG and sustainability drives.

“We measure their performance with regards to their own indicators on sustainable finance and how we can actually leverage data as to whether that’s from geospatial feeds or whether that’s from their own existing data streams they have to date”.

TITLE: HEAD OF GLOBAL SUSTAINABLE FINANCE AND ESG

COMPANY: IBM CONSULTING

INDUSTRY: IT SERVICES

LOCATION: GERMANY

Adam is IBM Consulting’s Head of Global Sustainable Finance and ESG Leader

On both a personal and professional level, Adam is dedicated to lead and contribute to the necessary changes required, in order to make our planet more sustainable - since 2022 Adam has proudly performed his voluntary role as a European Climate Pact Ambassador.

Adam has already worked across 30+ countries in Europe, Africa, Middle East, India and Asia Pacific, and managed teams of 100FTEs+. Consequently, Adam is even more motivated to address sustainability challenges, as he's seen first-hand the impact climate change is having for various populations around the world.

“We normalise and transform that into insights that can be actionable for themselves, for their own clientele, but also ensure that that’s competitive and comparable with their other industry incumbents and geos accordingly. We also work with our technology partners here in IBM as well as our ecosystem partners, where we have really leading edge and specific requirements, putting our IBM research and quantum into freight so we can actually provide new innovative solutions with regards to ESG and sustainable finance.”

For Thompson, it’s not just a job but a role that he embraces with zeal. “I also try to share knowledge and experiences as to how we can all make an impact individually with regards to climate; how we can all be more self-sufficient in our daily lives and make

“I try to share knowledge and experiences as to how we can all make an impact in regards to climate”IBM Consulting: Tacking ESG and finance through technology WATCH NOW

ADAM THOMPSON HEAD OF GLOBAL SUSTAINABLE FINANCE AND ESG, IBM CONSULTING

less waste, but actually be more circular and regenerative in our day-to-day activities.”

Circularity is a key part of the research and development IBM Consulting is concentrating on. The concept focuses on business accountability, from production, to supply chains to the customer, and then to the recycling of products once they have been discarded. This is key in circumventing the ‘throwaway’ nature of the current industrial business systems that sees millions of tonnes of waste being dumped into the environment rather than managed sustainably.

But the definition of sustainable finance and its place within ESG isn’t always immediately clear. This is, in fact, a point that Thompson is keen to clarify.

“Sustainable Finance is really an umbrella regarding embedding ESG into any of the decision making and insights. At IBM, we also provide data curation accelerators to support the embedding of ESG into decision flows. Indeed, we also provide analytical suites regarding big data and new data sets that organisations might not necessarily have to date, for example whether its measuring biomass in nature, or societal impacts and related ecosystem services.

“We actually provide that as an end-toend data stream so that when you actually want to create new value add or products for your own services or for your own clientele, you can then also containerise them, easing consumability accordingly.”

“Our Consulting Sustainability Services approach also enables clients to co-innovate

by scaling to other use cases such as ‘key focus themes of climate-first but not Climate-Only, with for example the 30/30 agreement from COP15 etc.’ Or, indeed if you wanted to do something that’s completely nuanced, such as naturebased solutions such as engineered reefs, we would support organisations from an IBM garage co-creation all the way through to the solution that you can then assetise that and actually sell that as a service, as well as having it recognised on your balance sheet –a true sustainable transition”

With such strict goals regarding timelines and creating more sustainable financial systems globally, the work is challenging. Thompson explains that the ideal transition into sustainable finance needs more progress and catalysts. In recent times various geopolitical factors and energy crises as well as certain corporations’ unwillingness to genuinely embrace the ESG agenda has slowed the ESG momentum. He speaks about the green asset ratio (GAR) and what that currently means in relation to assets being categorised as “green” by the EU taxonomy for Europe.

“Right now, organisations might find that they’re in single digits in terms of percentage points, which will be quite normal as we’re both on a transition journey, and there is diverging scope and value between the various financial institutions structures. But that said, what would ‘Good’ look like? Well, for most organisations, by 2025 to 2030, ‘Good’ needs to look like most organisations starting to be at the minimum 50% mark and above, to show true transitional improvements.”

Despite the challenging outlook for many companies to reach their needed

sustainability commitments, Thompson is optimistic that technology and co-innovation are the accelerators to make those aims a reality. “When you realise it’s only Europe that we might get up to 25% of renewables by the end of the year, then compared to where we originally started in the early 2000’s we were still in single digits, then there’s definitely the ability to transform. Capital, ironically, is not the challenge. The challenge is to put the capital to those projects, which would actually contribute to meaningful change and support for example the achieving Europe’s Fit for 55 Target of 40% renewable energy by 2030”.

“And this isn’t just about a tick box exercise; this is really looking at it holistically by saying to clients, ‘If you want to invest in wind turbines or if you want to invest in solar power farms, that’s great, but you also need to look at some of the other green elements beyond climate and secularity, for example, about societal impact’ etc.”

Thompson says that having a more transparent landscape regarding the implementation of sustainable finance and ESG will act as a catalyst for greater adoption of practices and that ESG risk ratings require more oversight ref the granularity of good quality primary datasets to ensure all

“It’s very clear that the runway that we all have to address this is shortening”

ADAM THOMPSON HEAD OF GLOBAL SUSTAINABLE FINANCE AND ESG, IBM CONSULTING

corporations are working towards impactful ratings and consequently investments.

“ESG risk ratings have been very diverse. In that level of granularity, it’s been ranging from the 50 to 100 mark, through to 300, depending on which rating agency has been leveraged. That’s going to be the next one where this secondary data source – which has been good in front or perfect for the last number of years – will change.”

“More importantly, it’ll provide that holistic, quadruple bottom line that the people, planet, prosperity, and purpose lens for the consumer can be included in.”

He continues: “Some organisations talk about ESGI [Environmental Social Governance Impact] – that quadruple bottom line is intrinsic and linked to our UN SDGs. It’s not just about making a return on investment over five or 10 years. It’s about having something that’s regenerative, that has a positive impact on society.

“But when it comes to the industry as a whole, I think we’re at a crossroads. You have those who are really embracing sustainable finance – based on my own dialogue with institutions, this certainly happens in Europe a lot more than in the US to date.

“Potentially once we have clarity on the US Security Exchange Commission in terms of regulations, this dynamic might change. But right now, it has been regulatory driven. But what is also clear generation-wise, from a consumer spending perspective, this is also changing the trend and the focus of ESG adoption.”

Digital partners driving the ESG movement. IBM is naturally not alone in its efforts to deliver this ESG message and works with a wide network of technology giants globally to innovate and deliver new products, services, and ideas within the ESG and sustainable

finance markets, including AWS, Celonis, Microsoft, Oracle Salesforce, SAP, Workday.

“If we’re talking sustainability performance management, a lot of corporations obviously have a book of record. So, with our Partners SAP, Oracle and Workday, absolutely we will work hand in glove together, and we complement one another, whether it be embracing their integrated sustainability software capabilities, or a co-innovation of new assets, or indeed where we take some of our own sustainability software portfolio offerings such as Envizi to provide a holistic solution jointly to our clients.

“In terms of the social element, we work market leading companies such as FRDM, where we actually look at the whole endto-end value chain and environmental factors, but also take into account a multitude of social factors from employee welfare, diversity and inclusion, and working conditions for all those from tier one to tier X suppliers.”

However, he points out that despite the advantages of the digital ecosystem, and the advances IBM Consulting has made, many challenges still exist because technology stacks aren’t standardised across the board. “When you’re talking about other platform providers, we have alliances, but we also leverage their platforms. So, it will never be one size fits all.”

The future of sustainable finance Thompson is keen to emphasise that, despite the broad technocratic processes involved with implementation of ESG regulations, it is ultimately all about serving humanity more effectively, as well as preserving the environment.

“First off, we already have goals in place that we don’t leave anybody behind – the 17 UN SDG (sustainable development goals) make that very clear.

“For myself, I would like to see that we don’t just act as the torch-bearers, but we actually take more accountability than we do today, in terms of when we make financial investments, and that we ensure that it’s

“There will be a domino effect from nature and, in terms of biodiversity degradation, water scarcity, and obviously climate change itself in terms of the temperature rises”ADAM THOMPSON

not just during the light power, but beyond.” Here is the need of life-cycle investing and circularity transition indicators as part of financial investing.

Circularity in terms of production, use, and recycling, is key. “It’s more about becoming attuned to the needs of both the industry but also the needs of the planet, as we are going through this sustainable transition. And I can see innovation playing a fundamental role in the creation of more secondary markets for further recycled and repurposed materials too. But it’s ultimately a collaborative dialogue because we all have a role to play from design to consumption to regeneration – both at a corporate and individual level.”

Furthermore, Thompson explains that whilst COP27 and COP15 have played a vital role in addressing the needs of the planet as we move forward, time is of the essence. “The timeline for required change is actually lower than 2025. You realise very quickly that there will be a domino effect from nature and in terms of biodiversity, degradation, water scarcity, and obviously climate change itself in terms of the temperature rises and consequently climate human migration as a result”.

He concludes: “It’s fundamental to everyone’s livelihood that we address this. And sustainable finance is absolutely key in playing that by channelling funds and investments in the right direction to make impactful change. But it’s very clear that the runway that we all have to address this is shortening. We need to take action now for the foreseeable future.”

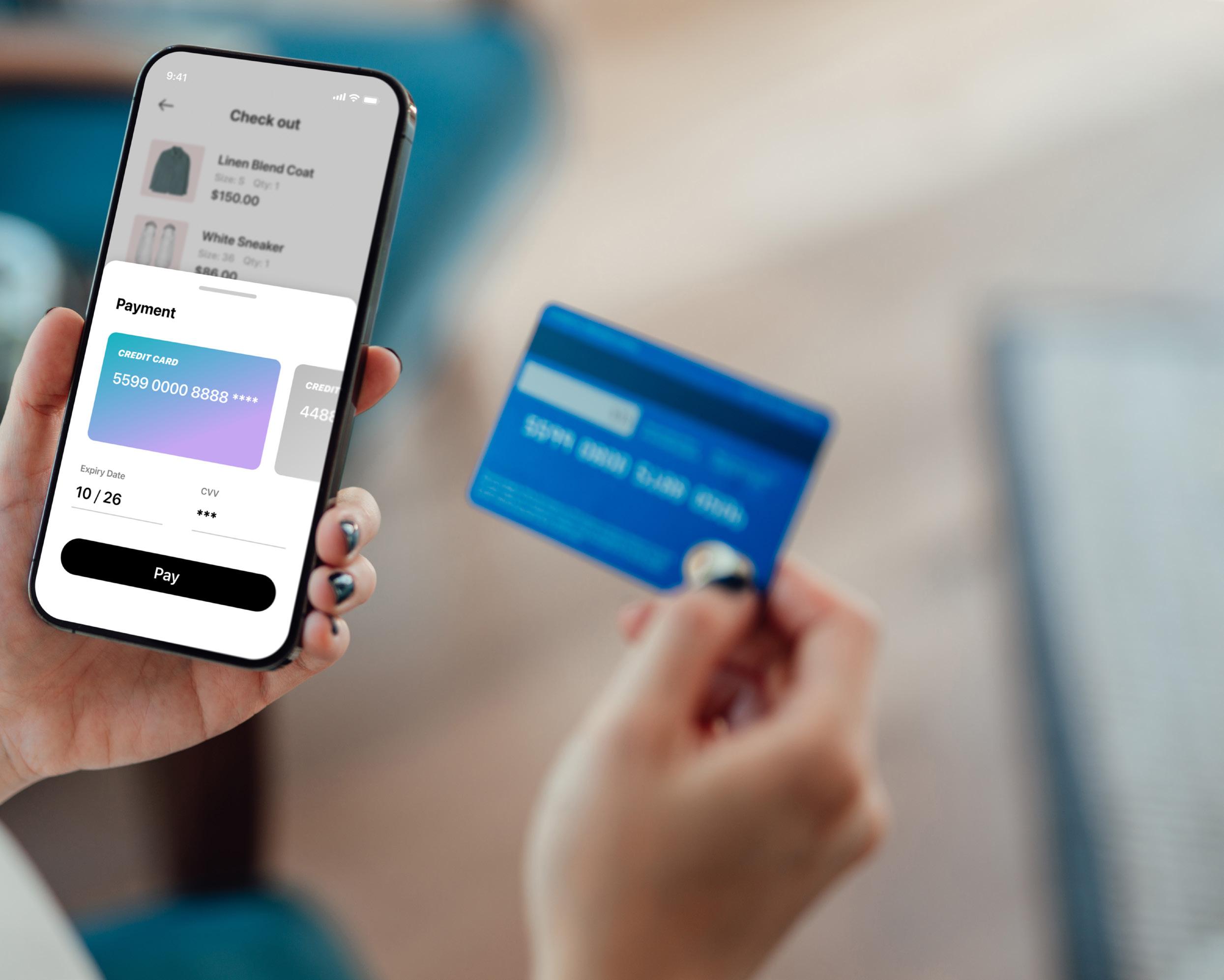

Cold, hard currency is going extinct as digital transactions and CBDCs trend globally. But when will it happen and what are the consequences?

WRITTEN BY: JOANNA ENGLANDCash is a critically endangered species in the financial currency ecosystem. In comparative terms, it is being eradicated far faster than it took settlers in Mauritius to exterminate the dodo back in the 1600s – an appallingly swift process of approximately 90 years.

Doubtless, those settlers barely gave a thought to their actions, which saw the lowered population – and then the complete decimation – of a species that had been around for thousands of years. The dodo had been in existence since prehistoric times, peacefully contributing to its environment and the balance of nature, and it still had much to give.

Likewise, the existence of currency in a solid form still plays a critical role as the bedrock of our modern-day economy.

Cash has been with us for thousands of years. According to historical documents, the first standardised coins were created in a region of western Turkey in at least 700BC. They were made of a substance called electrum – which is a silver and gold amalgam – and marked the introduction of a new payment movement that would transform the world.

PayEX offers customizable AR/AP Automation software for B2B businesses looking to optimize their working capital and unearth hidden revenue otherwise written off due to manual processes and slow communication

Prior to that, goods were bartered as payments, with livestock being considered one of the most valuable payment options. The word ‘cattle’ even originates from the Latin words ‘caput’ and ‘capital’. Essentially, transactional systems that have seen the physical transfer of goods for payments are a fundamental part of developing human history and societal behaviours.

And while ‘moving with the times’ is inevitable, it might be wise to stop and think about whether ditching our coins and notes entirely, which have served us well for aeons, in favour of the entirely intangible yet inarguably more convenient digital payments, is a wise idea.

According to a 2015 survey by Pew, over three-quarters of US consumers used cash. By 2022, 60% of US consumers only used cash ‘on occasion’, and 40% said they were completely cashless.

In the UK in 2022, an estimated 8mn people were still reliant on cash to carry out vital transactions. Indeed, 1.7mn in the UK are also unbanked, despite the widespread mobile technology usage. As Western countries race towards an all-digital financial landscape, sections of society risk being left behind.

On a global scale the situation is less a cause for concern and cash is still king in

“ONE CAVEAT TO THIS BENEFIT IS THAT WHILE IT’S HARD TO ‘LOSE’ MONEY IN A CASHLESS SYSTEM, PEOPLE CAN BE MORE SUSCEPTIBLE TO THEFT THROUGH FRAUDULENT ACTS”

some places. Romania, for example, still uses cash in 78% of its transactions, while 63% of Bulgarians prefer it to digital payments, along with 55% of Egyptians and 60% of Kazakhs.

Nonetheless, it's only a matter of time before innovation and convenience catch up.

Going completely cashless benefits customers and businesses – this is indisputable. But it also benefits governments. And often, these entities don’t have the best interests of their citizens at the forefront of their plans.

Most Western countries baulk at the idea of following China’s lead, and with

good reason. The country has an appalling human rights record and is deemed by many to be a complete surveillance state. It’s suggested that Chinese citizens must adhere to a social credit system curtailing their freedoms if they don’t obey state-mandated expectations; they are monitored through biometric security technologies; and they are data fed through mobile devices that track their every movement and transaction. Little wonder then, that the Chinese government has been at the forefront of the Central Bank Digital Currency (CBDC) race, already piloting digital yuan via e-wallets back in 2020.

Digital currencies can also be used as an instrument of control against dissent – and this has been seen not only in China, but in Western nations too.

“ONCE BANKS STOP ACCEPTING CASH, OR MAKE IT EVEN MORE EXPENSIVE TO PROCESS CASH, IT WILL ALL BUT DISAPPEAR”

ANIL MALHOTRA CMO, BANGO

In 2022, when truckers in Canada protested against their government’s vaccine mandates and continued lockdowns, their digital currency donations were blocked and individual bank accounts belonging to the protestors were frozen by the authorities.

Such a move might be considered by some to be sensible considering the nationwide disruption the protests caused. But the actions also demonstrated how easily governments can suppress people who don’t support them by cutting off their access to money – a life source in a capitalist economy. None of this would have been possible if the protestors had been using cash.

1 . Norway - 97% cashless

2. Denmark - 97% cashless

3. UK - 95% cashless

4. Sweden - 95% cashless

5. Switzerland - 94% cashless

Privacy is another concern. A digital transaction can be tracked from start to finish – and, arguably, is therefore considered more secure. But not everyone wants every detail of their transactional life monitored and the resulting data used to ‘profile their habits’.

Anil Malhotra, CMO of the fintech Bango, told us recently: “For most people, the main disadvantage (of going cashless) is the scrutiny that governments – and ancillary advisors and agents – can assert over an individual’s private activities. With trust in government and its officers at a low point in democratic societies with open economies, there are genuine concerns about government agents gaining greater insight into personal affairs.”

Malhotra also expressed concern regarding the eradication of cash having an impact on people who are currently unbanked. He said: “In the short term, in certain societies, cash is essential for financial inclusion. This is also true for certain demographic groups in all societies, such as older people. So, it follows that one disadvantage of losing cash could be the exclusion of certain groups from the mainstream economy.”

Mike Peplow, CEO of Paynetics, concurs: “Cash also has the benefits associated with anonymity. You can pay someone without having to know them personally or know their bank details, and people may see this as less of a risk as no details are exchanged. On the same note, cash cannot be traced which some people find advantageous as they don’t want the state to know their full financial history.”

He continues: “Electronic payments require a sophisticated infrastructure which, in some countries, is not yet available or is very expensive to access. This may mean it’s not possible to go cashless everywhere. There are also many people, particularly vulnerable people, who find budgeting with cash a lot easier than using electronic payments. And, for those without a fixed address or identification documents, you can use cash without having to undertake Know Your Customer (KYC) checks.”

The arguments for reducing cash use are numerous and valid. But the reduction in cash use has also occurred because digital payments are cheaper and more convenient for banks. For example, the cost of maintaining ATM networks is borne by banks, who then pass that on to their customers. As competition between banks rises, with neos

and challengers offering attractive, low-cost alternatives, incumbents have had to reassess their services to remain competitive.

The decline of cash is also being accelerated by retailers and other businesses who shun it because of administration processing time, costs and higher insurance premiums.

New technologies have also resulted in digital payments becoming extremely convenient because they can also be made in real time, via blockchain and across borders, eradicating the need for expensive and time-consuming processes that are also open to human-caused errors. And online shopping – now the dominant retail trend in Western countries – is also only possible through digital transactional methods.

Peplow says mobile technology has been the key transformative factor in the rise of digital transactions. “Accessibility and day-to-day end-user support for banking products are key. The rise of mobile banking and digital banking products has allowed more of the unbanked to become banked, though there’s still work to do.”

Malhotra comments: “Simplified personal financial management is the obvious benefit for the average person. Much of our financial activity is already quasi-digital today. In much of Europe, Asia, and the Americas, people receive money through electronic transmission from employer to bank, net contributions to the government through the digital tax system. The majority of bills are settled electronically. The dependence of physical tokens of currency is diminishing year on year. Most people can manage their finances more conveniently in this way.”

However, he concedes that although digital payment systems eradicate issues such as physical theft and loss of money,

they don’t prevent other types of financial crime; rather, fraud can be a bigger threat within a cashless system. “One caveat to this benefit is that while it’s hard to ‘lose’ money in a cashless system, people can be more susceptible to theft through fraudulent acts.”

It’s impossible to say, because some countries inevitably will be faster than others in reaching this goal.

China issued a statement in 2017 declaring it wanted to make all rural areas cashless by 2020. This has not quite been achieved – but progress has been significant. Sweden is 95% cashless, and this has raised concerns from some areas of Swedish society, where there is a belief that financial institutions and governments now have far

“CASH CANNOT BE TRACED, WHICH SOME PEOPLE FIND ADVANTAGEOUS AS THEY DON’T WANT THE STATE TO KNOW THEIR FULL FINANCIAL HISTORY”

MIKE PEPLOW CEO, PAYNETICS

too much information and control over the lives of citizens.

The UK looks set to go cashless in 2026, but that could be sped up, or slowed down, according to public opinion and decisions by banks to maintain cash services. But Malhotra predicts that it will take less than two decades to create a cashless global economy.

He says: “The world will be largely cashless within 20 years. The momentum behind online payments and electronic settlement is what is driving us towards a state of cashless-ness.”

Ultimately, digital financial superhighways are the future of commerce. However, in a world where climate events and cyber attacks dominate the headlines on a daily basis, the fallback for communities hit by

a crisis would need to be cash because its tangible nature is not affected by griddown situations.

But, unless greater attention is paid to the continued endangerment of our notes and coins, they will likely be completely phased out by 2040. In comparative terms, the first online payments occurred in the early 1990s, and this would make the demise of cash – the bedrock of our financial systems for almost 3,000 years – extinct in just 50.

In acknowledgement of the power banks have over this transition, Malhotra adds: “Cash may still be available, but, perversely, it will be accepted for curiosity value, rather like issuing music on a CD! Once banks stop accepting cash, or make it even more expensive to process cash, it will all but disappear.”

AD FEATURE WRITTEN BY: ALEX CLERE

PRODUCED BY: BEN MALTBY

AD FEATURE WRITTEN BY: ALEX CLERE

PRODUCED BY: BEN MALTBY

To anyone well-versed in marketing speak, descriptions of a superlative nature are usually best avoided. Anything that is the ‘biggest’, the ‘most’, or the ‘best’ is usually nothing more than corporate bluster and hype. But no matter which way you slice it, Fiserv is one of the largest and most significant players in financial technology.

First, take its reach: Fiserv does business in more than 100 countries, and, in the US, its products or services reach nearly 100% of households, either directly or indirectly through a financial institution, fintech, merchant, or biller. Then there’s the size of the business: Fiserv has 40,000 associates globally and serves thousands of financial institutions and millions of merchants and consumers. Finally, its impact is reflected in the range of financial solutions and services offered, spanning the full spectrum of banking and commerce.

When Head of Fintech and Growth Sunil Sachdev and President of Digital Payments Matt Wilcox join me to discuss the company’s growing focus on open finance, the two are united by a clear common cause. Simply put: leverage the expertise and innovation Fiserv has to help clients continue bringing new financial innovations to market, deepening relationships by adding more value for the consumers and businesses they serve.

“Fiserv is in a very privileged position,” Sachdev says. “We are the largest core banking provider in the US, the largest digital banking provider, and the largest bill payment and person-to-person payment provider in the country. And that’s not to mention the enviable footprint we have as a leading provider of services like merchant acquiring in markets all around the world.

“We have thousands of clients in the financial institution space, and millions of clients in the merchant and small business space. When we think about how we serve those clients every day, it's all about earning their trust and ensuring that the products and services they have from us are performing. That's paramount.”

The company’s success is testament to the transformational impact it has managed to achieve on behalf of its clients. Fiserv has a wide spectrum of clients including financial institutions, fintechs, enterprise merchants, and main-street merchants, as well as corporate entities all looking to increase engagement with their customers. The Fiserv approach to open finance helps define and accelerate its clients’ ability to innovate with new financial products and experiences, embedded directly at the point of need.

The talented people within the business help tailor approaches to individual clients, working with them to understand their

Fiserv is helping clients, including fintechs and global brands, unlock new revenue streams with solutions that reach virtually every US household

Sunil Sachdev and Matt Wilcox

Sunil Sachdev and Matt Wilcox

TITLE: HEAD OF FINTECH AND GROWTH

INDUSTRY: IT CONSULTING

LOCATION: UNITED STATES

Sunil Sachdev is a global fintech executive with a significant breadth of experience in banking and payments at companies such as American Express, Meed and Pershing. He has worked for Fiserv for nearly a decade in various roles and geographies. In recent years, he led the community bank segment, with a focus on enabling financial institutions to leverage modern technology to deliver differentiating experiences and improve time to market. Since 2021, Sunil has headed up the fintech segment, leading a team that has greatly accelerated the planning, execution and delivery of open finance and digital transformation capabilities across the enterprise.

needs and lend a guiding hand – something that becomes increasingly valuable given the recent turmoil in the markets and general economic volatility.

“Based on the broad set of ledger, processing, acquiring, payments and data services we have at Fiserv, we continually advise clients on how they need to evolve their best-of-breed offerings to stay competitive in a fast-moving regulatory and financial services landscape,” Sachdev explains. “We believe that makes Fiserv very unique. It would be harder and less cost effective for them to engage with multiple parties who may only be familiar with one specific area and not the bigger financial services picture.”

When asked who he admires or looks up to in life, Sachdev gives a wry smile. There is the touching deferential nod to inspirational colleagues and bosses-gone-by – one of them being Ken Chenault, long-time CEO of American Express, where Sachdev worked for more than a decade. But then he admits to being a long-suffering New York Knicks supporter and a fan of the Rocky movie franchise.

“I guess I enjoy the underdog story,” he says. “There’s something about those types of stories that really highlights the excellence of people, whether they're athletes or in other walks of life.”

This sentiment is pertinent to the role Fiserv plays in facilitating financial inclusion

“Fiserv is all about taking something from the whiteboard and bringing it to life. For me, that's the best part of it”

SUNIL SACHDEV HEAD OF FINTECH AND GROWTH, FISERV