Diversity in insurance

Meeri

The

Feedback matters

Jacqueline

Braver together

Gabriela

THE 2022 ANNUAL GUIDE TO THE MOST INFLUENTIAL, INNOVATIVE COMPANIES AND POWERFUL FIGURES WITHIN THE FINTECH INDUSTRY

Meeri

Jacqueline

Gabriela

THE 2022 ANNUAL GUIDE TO THE MOST INFLUENTIAL, INNOVATIVE COMPANIES AND POWERFUL FIGURES WITHIN THE FINTECH INDUSTRY

The pace of change in the insurance industry has accelerated in recent years with insurtechs finding innovative solutions to traditional challenges, and digital transformation leading to changes in how insurance companies interact with customers, how they underwrite and price policies, and how they manage risk.

Automation technologies and AI analytics are enabling more targeted insurance products, improved services and growing customer engagement.

But why does the insurance sector seem to be far slower than most other financial industries to adopt more modern technologies? In this edition of The Fintech Times, industry experts reveal the challenges insurance companies face when modernising legacy systems.

They include Teodor Blidarus, CEO and co-founder at bank and insurance fintech enabler FintechOS, who suggests that legacy systems are often mission-critical, so you are “effectively trying to change the wheels of the car while it is moving”.

In most cases, decades of customisations have made legacy

systems extremely brittle and difficult to modernise, creating a genuine fear within organisations of touching these old systems, he adds. Discover more food for thought on the topic on page four.

Sticking with this issue’s theme of insurtech, it was a pleasure to speak to Meeri Savolainen, co-founder and CEO at INZMO, to learn more about her passion for ensuring a more diverse insurtech industry.

As Meeri explains: “As a female founder in insurance, a centuries old industry with let’s face it a bit of an image problem – male dominated, overly old fashioned, slow to change, clunky IT systems – I’m acutely aware more needs to be done to attract female talent to the sector.” You can read more of our conversation on page eight.

After experiencing a huge boom in popularity with novelty collectables and digital art, NFTs still remain a mystery to a large number of people. With the hype dying down, features editor Polly Jean Harrison explores if NFTs have a future in fintech on page six. And what is this new generation of NFTs, and

how is it different to anything we’ve seen previously?

On page 15, Adam Vissing, VP sales and development at IXOPAY, discusses payments setup and return on investment, while on page 14 Nina Kerkez, AML expert, LexisNexis Risk Solutions, addresses the sphere of financial crime prevention in 2023.

You can enjoy insight from Jacqueline Dewey, CEO of Smart Money People, on why capturing feedback from your customers is more important than ever on page 16.

I also loved hearing from Gabriela Hersham, co-founder and CEO of Huckletree, on why she wanted to build the UK’s first Web3 office hub to spark innovation and collaboration – page 21.

Finally, another highlight this issue is our editorial director, Mark Walker’s book review of Emmanuel Daniel’s first book The Great Transition: The Personalization of Finance is Here. Happy reading!

Claire Woffenden, Editor The Fintech Times

From automating processes to improving risk modelling through data insights and intelligence, technological innovation is shaking up the insurance industry. But why is the insurance sector slower than most industries to adopt more modern technologies? Industry experts reveal the challenges insurance companies face when modernising legacy systems.

Technology is often complex, and the longer a system has been around, the more difficult it may be to modify. They could have a number of interconnected components that make it tough to change certain parts without breaking another part of the system. Think of it like planting a new tree in an old forest: the new tree may bring new growth and energy to the forest, but it may also be difficult to integrate it into the existing ecosystem without unforeseen issues arising. There is a risk that the modernisation process could lead to disruptions or downtime, which could impact the business’ operations and reputation.

In short, legacy systems are hard to modernise because they can’t start from scratch, whereas new insurtechs are hitting the scene doing just that – especially when it comes to being digital and mobile first, with a focus on digital payments and quick claims resolutions and reimbursements. For example at Faye, when our travellers qualify for a reimbursement on common travel inconveniences – like a flight delay – we immediately send them funds to Faye Wallet, our secure digital debit card that they can add to Apple Wallet or Google Wallet, rather than having them paying for things like meals in the airport out of pocket. We also enable them to file claims digitally, in-app which takes minutes. You can try to build such products at legacy companies, but it can get lost in the noise. Legacy players in insurance – especially travel insurance – will be losing customers looking for a more personal touch and a strong digital experience that newcomers have.

Some challenges of legacy are the speed and performance of big batch processes as databases grow, the ability to find skilled programmers, obsolescence and lack of support for hardware and operating systems, thus the overall cost of keeping the lights on. It is often costly to make simple changes to products or indeed launch new ones, so this can inhibit a business keeping pace with the market. One approach which has been successful in some instances has been to preserve legacy systems as ‘system of record’ and retain key business processes but integrate with more modern technology. More cutting-edge digital technology can be deployed and develop at the pace the business needs augmenting the valuable and sustainable element of the legacy system. In other words the optimum transition might be a partial one not a full replatform.

In a word, people. Specifically, their mindset and motivation. For most, modernising means iterating on what you’ve got. But that only improves what you can do today and won’t allow insurers to compete in a landscape dominated by a proliferation of distribution, massively changed customer expectations and new products in embedded, risk-removing and adaptive solutions. To truly transform, insurers must drop legacy mindsets and business models and adopt data-fluid and intelligent ecosystem models. This will change the operating model, massively increase the knowledge of a customer and crucially, an insurer’s ability to act on it. Until they make this shift, they will only be able to fight for profit between the cost against the risk.

Legacy systems can be exceptionally difficult to work with, even if documentation is clean and resident knowledge exists. Today’s development methodologies are much more efficient and cleaner with built-in software for testing, documentation, regression, etc., so modernising legacy systems may be possible – but you have to weigh if it’s worth pursuing that vs. just writing new, clean code for the same service. Trying to modernise an existing system can be an enormous and ongoing spend of dollars, resources, and opportunity costs. While creating a new system might seem more expensive on its face, until you actually have your technical team share the trade-offs, you might be pleasantly surprised. Additionally, I’ve found that the pursuit of building new systems actually has a by-product of making your development team feel significantly higher morale and purpose, and who doesn’t want an excited, motivated technology team?

Legacy systems are often mission-critical, so you are effectively trying to change the wheels of the car while it is moving. In most cases, decades of customisations have made legacy systems extremely brittle and difficult to modernise, creating a genuine fear within organisations of touching these old systems. The knowledge of how legacy systems work and the technology with which they were implemented has often been lost as employees leave and/or retire, further increasing the risk of making any changes. On top of the need for expertise, modernising a legacy system is often a large and expensive project with high risk, so companies have little appetite to take such an extensive infrastructural overhaul on.

PAUL RUSU, DIRECTOR CONSULTING & INSURANCE SOLUTIONS EMEA OF TECH OPTIMISATION ORGANISATION SOFTSERVE

Legacy systems are an integral part of the insurance IT landscape which have been developed internally for decades and are not going to disappear soon. But although businesses are dependent on them, they recognise the importance of transitioning away from those cumbersome structures if they are to improve competitiveness and efficiency. For now, both internal user acceptance and skills are usually still available and consequently many jobs depend on existing systems, so that radical change is rarely embraced. Most insurers have therefore tried to optimise their system landscape over time due to fears of business and IT disruption. Therefore, the replacement of older systems is being driven forward in measured steps. System landscapes are slowly in upheaval, allowing future-oriented architectures and uniform SaaS or IaaS cloud-based solutions to be explored to enable the integration of new technologies and modules. This means interfaces between legacy systems and state-of-the-art technologies can be deployed in order to increasingly support digital capabilities. Most insurers realise that their main source of differentiation and competitiveness will lie in the ability to better serve customers. This will now be driven less by legacy systems, but more increasingly complemented by new digital capabilities.

PAUL YATES, PRODUCT STRATEGY DIRECTOR AT IPIPELINE

A PROVIDER OF CLOUD-BASED SOFTWARE SOLUTIONS FOR THE LIFE INSURANCE AND FINANCIAL SERVICES INDUSTRY

Legacy systems offer different challenges depending on the financial services sector in which they operate. In pensions and investments, policies on legacy systems are in use and being rebalanced on a relatively regular basis. For a pensions and investments provider, creating an ecosystem where all back office technology can be managed simply while interacting seamlessly with front end technology such as risk management tools and cashflow modellers is crucial. However, in the life market this ongoing policy management is not such an issue but there are still challenges with legacy systems is being able to manage and review policies in the manner that are possible on a modern system. In all sectors, customers and financial advisers are deeply frustrated with a poor experience caused by legacy systems dating from as far back as the 1970s and fixing it is a challenge some providers have delayed facing. There is a risk legacy systems become the blocker to digital transformation across financial services, such as the Pension Dashboard Programme.

After experiencing a huge boom in popularity with novelty collectables and digital art, NFTs still remain a mystery to a large number of people. With the hype dying down, features editor Polly Jean Harrison explores if NFTs have a future in fintech

Cast your mind back to 2021. Kim and Kanye got divorced, the Suez Canal was blocked by a cargo ship, and non-fungible tokens (that's NFTs to you) burst into the mainstream for the first real-time since their inception in 2014. It was a big year.

NFTs seemed to swoop into popularity out of nowhere, and suddenly everyone was talking about bored apes and every celebrity under the sun seemed to be dropping an NFT collection – Snoop Dog, Paris Hilton and John Cena to name a few. But now, over a year later, everything seems to be dying down on the NFT front, Kevin Murcko, CEO and founder of cryptocurrency exchange Coinmetro called them the year's biggest “damp squib”.

The bubble had to burst at some point, and it feels like a lot of the novelty has worn off, especially with some of the more seemingly money-grabbing drops having since retired. As Jordan Edelson, CEO at TradeZing, a live-streaming, social engagement Web3 platform says: “It looks like the hype about NFTs has finally come to an end. NFTs were a quick way to get rich, for those who could stand the risk involved. These pieces of “art” once worth hundreds of thousands now wouldn’t be able to get you a full order at Starbucks.”

However, this doesn’t mean that NFTs have died a miserable death. It seems to be quite the opposite, with the general consensus from the industry being that NFTs have simply evolved beyond the gimmick and into something with actual practical use. Rather than icons or other digital art, NFTs are going beyond the JPEGs into something new.

So, the question remains, what is this new generation of NFTs, and how is it different to anything we’ve seen previously? The CEO of Modulus, a fintech and blockchain solutions provider, Richard Gardner, said: “Just because these celebrity-buoyed use cases were what caught the attention of the media, doesn’t mean that they are the be-all and end-all of NFTs. There are a number of use cases for non-fungible tokens which could absolutely provide real value in a host of industries, including as a way to limit counterfeit luxury items, such as watches. I don’t think you’ve seen the end of non-fungible tokens, just the

demise of their hype as collectables.”

If collectables are out, are new innovations in? It all sounds good so far. Max Thake, the co-founder of peaq, a Web3 network for the Economy of Things, takes it one step further, saying how NFTs aren’t dead, they’re just looking for a purpose.

He continued: “While the market was largely down in 2022 (which goes for many other asset classes, to be fair), talented teams kept experimenting with use cases for the technology that would push it beyond JPEGs. We are past the peak of the hype triggered by the novelty of NFTs and their promise of truly decentralised ownership of unique assets, so now the focus is moving toward bringing this promise to life with more user value in mind.”

Markus Leve, co-founder at technology protocol XYO agrees that NFT innovation is far from over; “The NFT boom of 2021 brought the concept into the mainstream, with Collins Dictionary even naming it the “Word of the Year”. While NFT prices have since plummeted, this bear market is an opportunity for builders to continue making strides in the space and educate the public on real-life utility.

“The underlying technology has enormous potential to transform an array of industries. Use cases include anti-counterfeit technology, event ticketing, virtual real estate, gaming collectables, supply chain tracking, and decentralised finance loans. Artificial intelligence (AI) is an undeniably hot trend at the moment, with the industry

expected to be valued at $22.6billion by 2025. In the past few months, we saw AI-generated social media profile pictures and tools like ChatGPT explode seemingly overnight. Many NFT artists already embrace AI, and I believe we’ll continue to see a convergence of the two technologies."

It's clear that fintech and blockchain innovators are having a field day with the endless potential an NFTs can offer, and many in the industry agree they've only just started to scratch the surface. Phillip Tran, chief marketing officer at MADworld, an NFT ecosystem, called the current situation more of an “industry reset” of expectations and said:

“NFTs are evolving to embody much more than a Kickstarter-style product drop. We are only scratching the surface of possible NFT applications. For the industry to continue to grow, NFT utility must broaden its appeal and thrive for a mainstream audience.”

Liz Yang, head of growth at Web3 technology company, Chiru Labs added: “The good news is that there are many examples of projects with clear value propositions and focused execution that are continuing to build quietly in the bear market. The exciting thing about a nascent industry like ours is that there’s no playbook. In this market cycle, we're already seeing the lines blur between physical and digital, enabling richer forms of storytelling and experiences. Furthermore, bridging mainstream and Web3 audiences will require authentic and creative efforts from brands. Markets

are cyclical, and it'll be interesting to see the industry leaders that will emerge in the next bull run.”

NFT 2.0

So, we know that NFTs aren’t just pretty pictures or videos anymore. But what does that actually mean? What are the use cases for these ‘NFT 2.0s’ that go beyond art and collectables?

Tran believes the applications for these tokens can be used in mainstream businesses. He said: “Instead of being limited to a game, NFTs may be used in a marketing campaign, concert ticket, product launch, form of identity, college lecture, and so on. The idea is to align the needs of the mainstream audience and utilise NFT technology to address them in a transparent and authentic manner that builds consumer trust.

“We are still seeing tremendous corporate interest in Web3 and the solutions it provides. MADworld is having in-depth discussions with conglomerates spanning insurance, retail, banking, and media platforms - all of whom are trying to figure out their Web3 strategies. As these use cases emerge and become ubiquitous, the NFT market will attract a larger audience on a completely different scale from which it initially emerged.”

Byron Sorrells, the head of dispatch at IEX, an on-chain messaging and analytics platform, added: “I believe the way we think about NFTs is going to fundamentally transform in 2023 and we will see them used in new – nearly unrecognisable – ways.

“I think that this year NFTs will show their true potential as powerful mini-applications. NFTs have the ability to be so much more as a medium for JPEGs. They can be messages, invitations, polls, and even e-commerce storefronts – like what we’re building with Dispatch

– sent directly to Web3 wallets or engaged within Web2.

“I anticipate that this is the year when major brands and institutions will use the underlying capabilities of NFTs, not as novelties, but as core tools for engaging and driving customer conversions."

Another main use case for NFTs is through authentication or verification of real-world assets.

Jordan Edelson, said on this: “The underlying, unique, digital identifier of the token can still be used. There are companies looking into using NFTs for watch authentication or authenticating other luxury items. In real estate, the NFT could be used to represent an ownership share in a property. The applications of a unique identity that cannot be replicated are endless."

Thake added: “The future belongs to NFTs linked with real-world value and assets, from commodities to machines and connected devices. Let’s never forget that NFTs are, at the end of the day, just another token format. A token which enables people to verifiably own assets without corporate intermediaries. There is definitely space and need in this world for NFTs."

NFT use cases also come in the form of digital infrastructure, specifically memberships and granting individuals access to different things and unlocking new potential for partnerships, payments, community, identity and ownership.

As Julien Genestoux, founder & CEO at Unlock Protocol, a protocol for memberships, says: “Whether it’s big brands like Starbucks running their loyalty programs or small creators

wanting to connect with their fans in a way that’s not intermediated by social media platforms, NFTs are excellent infrastructure for direct and durable connections. They’re digital membership cards, and they live on shared public infrastructure (blockchains), which enables “multiplayer” experiences.

“For instance, you could give Spotify permission to see when you use your Starbucks NFT while purchasing in person, and it could use that information to curate the playlist in the coffee shop along with all of the other Starbucks members there.”

Of course, the blockchain technology behind NFTs also has a huge scope ahead, as the industry is still working and innovating in this area to disrupt the industry as a whole.

work. It can also give players new ways to participate in their favourite games through NFT investments that can be used in-game. The fintech industry has a huge role to play in making NFTs mainstream. Mature fintech platforms can help stabilise a turbulent web3 world by reducing the current barriers to entry to buying NFTs (such as setting up a wallet, purchasing crypto, and navigating complex jargon). For example, Xsolla’s NFT checkout solution which enables players to buy NFTs with international FIAT currencies."

NFT legal expert at AI company Humans.ai, Roxana Pistolea agrees, calling the current industry situation “an epochal momentum in the blockchain universe.”

“What we’re witnessing is the encapsulation of artificial intelligence, the most powerful instrument available to humanity, in NFTs,” she said.

“Imagine transforming your digital asset from a generic image that resides inside a blockchain into an intelligent asset class infused with artificial intelligence. From an innovation standpoint, by combining synthetic voices, artificial intelligence, and NFTs, we are paving the way for AI NFTs, the next evolutionary step for the digital collectables market.”

“Blockchain technology continues to mature, advance, and find use cases that mean the future of NFTs (and other blockchain-related tools such as smart contracts) is very much alive,” comments Chris Hewish, president of videogame commerce company, Xsolla.

“Just as NFTs have been used to help fintechs raise capital, my view is that NFTs will play an essential role in giving developers new ways to monetise their

So, you heard it loud and clear: NFTs are still alive and kicking.

It's clear it's going to take a lot more than a public disinterest in JPEGs and videos to call the time of death on NFTs. The future looks bright and interesting as the tokens continue to evolve, and their journey is something we’re all going to want to keep an eye on as they integrate into our everyday lives.

This year NFTs will show their true potential as powerful mini-applications. NFTs have the ability to be so much more as a medium for JPEGs

Founded in 2016 by Estonian co-founders Meeri Savolainen and Risto Klausen, INZMO is one of the fastest growing insurtech startups in Europe. With more than 80,000 customers and over 400 per cent growth in 2022, INZMO focuses on B2B2C solutions across multiple verticals from consumer electronics to bike insurance. It also recently launched a rental deposit guarantee service in Germany that aims to tackle the issue of hefty upfront deposits and make life easier for tenants in the rental market.

Savolainen took a break during her recent workcation in Mexico to share with The Fintech Times her journey from the corporate law sector to driving social change through insurtech, as well as her passion for ensuring a more diverse insurtech industry.

TFT: Tell us about your career to date and how did you get into the insurance industry?

MS: I’m the co-founder and CEO of INZMO, a Berlin based company providing insurance and financial services to the rental industry. My background is law and I graduated from the University of Tartu in Estonia with an MA in Law. At the time this was very much the career path I wanted to take, and I invested a lot of time in my studies to gain the qualifications to become a lawyer.

After graduating, I joined the team of corporate lawyers at Ernst & Young. I liked my job, worked with fantastic people and had an excellent experience. However, it was all a bit too ‘safe’ and I felt I was capable of taking on more risk and more responsibility. I know I can go back into corporate law and consulting in the future. I’ve always been driven by innovation and felt compelled to create something new that hadn’t been created before. I also wanted to lead and develop my own team and achieve something bigger.

I got into the insurance industry by chance. Seven years ago, my co-founder – Risto Klausen, a former professional motorcycle road racer and multiple Estonian and Baltic Champion in the Superbike class – and I established Bike ID, an international bike registry to counter bike theft. To further monetise our platform, we integrated an app to sell bike insurance and it was from that point we realised the potential of easy-to-use online insurance services. When pitching the solution to potential partners, we got

a lot of valuable feedback and interest to sell P&C (property & casualty) products using our app and technology. A year later we pivoted the business to become an online B2B2C insurance agent and renamed the company INZMO.

TFT: Tell us more about INZMO

MS: INZMO is building the financial ecosystem to serve the European rental industry. We aim to own all of the financial services that tenants and landlords need to avoid and reduce rental debts, with the goal of freeing up liquidity and offering more financial flexibility.

On the tenants’ side: we help people get into homes faster and deposit-free. We aim to offer all of the potential coverage to protect risks in the household and their income. And we help to lift the financial burden of having a place of your own with a small credit product that helps those tenants who need it, to move in and pay the rent.

For property managers/landlords, it’s all about helping them manage renter risk more effectively and avoiding and reducing rental debts. That means making sure rents are paid on time and the cash flow is there so people aren’t getting evicted.

collaborative, non-hierarchical, we encourage experimentation and are always open to new ideas. However, a culture that supports innovation is often misunderstood. People think it’s just fun, but that’s one side of the coin. Some more challenging and less fun behaviours must counterbalance the easy-to-like ones. As a business we’re disciplined. We set high performance standards for our people, while also supporting their development. Exploring crazy ideas that ultimately fail is OK, as long as we’ve agreed on the place for failure, but mediocre knowledge and skills and poor management are not. And when it comes to leading innovation, the expectation we place on our senior leaders to lead by example, is equally high.

TFT: What are the next key talking points or challenges for the insurtech industry?

MS: The global economic environment and subsequent drop in insurtech investment continues to have an enormous impact on the sector particularly in relation to slowing down the digital transformation efforts as well as new initiatives from insurtechs.

though the results prove the opposite. I would love to see more funding going towards female-led insurtech businesses. 2023 may also see an increased focus on sustainability and ESG (environmental, social, and governance) issues, as these topics become of increasing importance to consumers and investors. This will likely lead to the development of new insurance products and services that address these concerns, as well as increased transparency and accountability in the industry.

Finally, diversity and inclusion will continue to be a priority for the sector with companies continuing in their efforts to increase diversity within their ranks and to create more inclusive environments for their employees.

TFT: What are your biggest achievements or ‘proudest moment’ so far?

MS: On a professional level, I’m massively committed to gender diversity and really proud of the fact that my startup has a 60:40 female/male split. In fact, six of the nine senior leadership positions are held by women.

This is how the rental business ultimately operates. When there’s too much bad debt, it ends up hurting both parties. It’s one of the things that the sector is trying to reduce and we’re here to help and fill the gap.

At INZMO I’m responsible for the execution of our company strategies, gathering great talents behind a common goal and fundraising to fuel growth.

TFT: How would you describe the culture of your company?

MS: This is best answered by looking at the words our employees use to describe the culture at INZMO. Freedom to operate, no micromanaging, ambitious, experienced, friendly atmosphere, challenging, flexible and innovative. Innovation is key and something we cultivate at INZMO. We are highly

However, in spite of this it’s likely we will see continued growth in the use of digital technologies to support the delivery of insurance services. This may include the use of data analytics to better understand and manage risk, the adoption of automation and AI to streamline processes, and the use of digital platforms to enable more convenient and personalised customer experiences. Funding more broadly – particularly when it comes to female led-insurtech startups continues to be challenging. And sadly, the situation has worsened compared to previous years when four per cent of VC funding went towards female-founded startups. In the past year, it has dropped below one per cent. This lack of funding is wildly fuelled by prejudice and the perception that women are less successful as entrepreneurs even

As a female founder in insurance, a centuries old industry with, let’s face it, a bit of an image problem – male dominated, overly old fashioned, slow to change, clunky IT systems – I’m acutely aware more needs to be done to attract female talent to the sector. Our gender balanced business has helped us appeal to a strong number of exceptionally talented female candidates who want to work with us because of the number of women already at the organisation, and who occupy the most senior positions.

On a personal level I’ve learnt to become more patient and a much better listener. As a fast-growing startup and working in digital insurtech which rewards hyperspeed, I’ve been used to quick fixes, being always on and had the same expectation of my teams.

The pandemic however changed all of our working lives. No longer working in-person as frequently with colleagues meant I wasn’t always aware of their personal situations (and vice versa) and how they were having to adapt to address unforeseen challenges.

And, because of that it was important for us all and particularly the senior team members to be better listeners, more respectful of individual situations and

“THIS APPROACH, WILDLY FUELED BY PREJUDICE AND THE PERCEPTION THAT WOMEN ARE LESS SUCCESSFUL AS ENTREPRENEURS EVEN THOUGH THE RESULTS PROVE THE OPPOSITE, IS ONE OF THE BIGGEST CHALLENGES I’VE FACED AND CONTINUE TO FACE AS A FEMALE FOUNDER”

Leading a fast-growing startup in an industry rewarding hyperspeed during a pandemic showed me the importance of taking time to listen, says INZMO Co-founder and CEO Meeri Savolainen

understanding of the need for flexible working patterns as we found it had a direct impact on levels of creativity, productivity, and collaboration.

TFT: What’s next for INZMO?

MS: We’re always working on developing and enhancing our product portfolio. Looking ahead we’re planning to integrate AI and machine learning into our platform to take even more friction out of the customer journey and enhance the customer experience.

Our ambition is to become a one-stop shop for the tenant’s home insurance needs. From insuring the actual moving process to contents and consumer electronics insurance. And we want to make everything in the insurance process instant. Not only the purchasing of a policy, but in the future, we also aim to make claim settlements in minutes after receipt of a claim.

TFT: Tell us a little more about yourself and your interests?

MS: I’m currently studying Organisational Leadership at Stanford University Graduate School of Business. While it’s been quite intense alongside my day job, I’m very much enjoying the course, learning a huge amount and already able to apply these learnings into my role at INZMO.

I’m a huge fan of the arts, it’s always been a big part of my life. I love classical music and opera and am a regular theatre-goer with a particular passion for comedy shows. In my native Estonia, we have a wealth of talented young performers who, like elsewhere in the world, struggled with theatre closures during the pandemic. I’m so pleased to be back at these venues and to be supporting my local arts communities.

I also love to travel and like others am making up for lost opportunities. I’m currently on a workcation in Mexico!

TFT: What has been the biggest challenge or most ‘tricky moment’ to overcome?

MS: A 2018 research study from Boston Consulting Group revealed that for every dollar received in funding, female founders produce 78 cents in revenue, while male founders return just 31 cents. Yet investors are willing to part with only four per cent of funds to female-led startups.

As I said previously, misconceptions of women entrepreneurs have been some of the biggest challenges I’ve faced. It’s a problem that is also exacerbated by the fact that my startup is based in Germany which accounts for a mere four per cent of all female founded startups. However, the perpetual funding challenge has shaped the way I run my startup – and for the better. We’ve been forced to learn to grow without VC cash, to do more with less and with an approach geared towards responsible and sustainable growth.

I’ve also learnt to become comfortable with the fact that the road to success is paved with losses, mishaps and mistakes, but it can still take you where you want to go as long as you don’t lose sight of your destination. Focus, stay on course and, even better, find yourself a business model that makes money. In order for a female-led company to be attractive to VC money, the company needs to be a high-performing one.

ABOUT INZMO: INZMO is one of the fastest growing financial services providers in Europe making renting a home affordable for everyone. Its aim is to become the number one provider of zero-deposit solutions for EU renters. It believes the core innovation lies in understanding customer needs, struggles and their values. It designs services around this purpose. INZMO puts the customer first. It thinks big, takes risks, innovates constantly, hires the best and puts high efforts to earn customers trust. With more than 80,000 customers and over 400 per cent growth in 2022, INZMO has acquired the recognition and investments from several insurers in Europe. In 2017, the company was recognised as the best fintech company in the StartUp Europe Awards by European Commission and in 2019 INZMO was awarded the Insurance Shaper of the Year Award.

COMPANY: INZMO

FOUNDED: 2016

CATEGORY: Financial services provider

KEY PERSONNEL: Meeri Savolainen and Risto Klausen, Co-Founders

HEAD OFFICE: Berlin, Germany

ACTIVE IN: Germany

WEBSITE: www.inzmo.com

LINKEDIN: linkedin.com/company/inzmo

The introduction of the euro at the turn of the millennium secured the European Central Bank’s (ECB) pursuit of a regional unified payment system. At last, the capabilities of a single currency were quickly realised and the ECB remained central to the integration of different economies under one financial umbrella.

The economic stability and market growth offered by this arrangement were at first achieved under the TARGET system - otherwise known as the Trans-European Automated Real-time Gross Settlement Express Transfer System. TARGET is a real-time gross settlement (RTGS) system operated by the Eurozone. But after only a few short years in operation, the baton was passed to the system’s next phase of evolution. The original TARGET system was considered too costly to operate in the long term, with its decentralised structure proving unfit for purpose.

Aptly called TARGET2 (T2), the update came into operation in late 2007, and replaced TARGET’s decentralised structure with consolidated core services in a single technical platform. Ever since, it has proved to be foundational to the Eurozone’s cross-border payment system and to the stability of the European economic area.

But how is this achieved?

T2 is a single shared platform (SSP) through which all European payments are settled, and it follows a principle of cost recovery.

Germany’s Deutsche Bundesbank, Italy’s Banca d’Italia, France’s Banque de France and Banco de España in Spain act as service providers for T2 services. This model facilitates transactions between various European countries by operating in central bank money.

Take for example two companies operating in entirely separate European countries. Company A makes an order for manufacturing equipment from company B, with the transaction settled on the T2 SSP. Company A gives the directive to bank A to make the payment, which bank A then sends as a payment order to bank B through the T2 system.

The system then debits bank A’s account in central bank money which is then credited to bank B’s account; finalising the transaction. This is a highly favourable route for settlements, as opposed to supporting bilateral agreements between correspondent banks, T2 ensures the security of the payment system with standardised procedures and regulatory framework. This approach supports the resilience of the European economy by adhering to the Eurosystem’s monetary policy and supporting the functioning of the euro money market. Payment transactions are processed one by one on a continuous basis, between the T2 working hours of 07:00 to 18:00 CET. Likewise, it also mitigates the impact of systematic and operational risk in the payments market, ensuring that no one point of failure could see economic collapse, while overseeing the efficient processing of euro-based cross-border payments. From the user’s perspective, the use of an SSP ensures the same level of functionality wherever they are in the world; carrying through business continuity.

As with any RTGS system, the availability and cost of liquidity remain a central focus to its success. For this reason, T2 is equipped with a variety of mechanisms to facilitate payments on this level. This includes mechanisms to optimise the settlement of queued payment orders alongside the application

of intraday credit. Intraday credit is collateralised by a pool of financial assets that banks pledge to their central bank.

While a proportion of these assets are used in the framework of the Eurosystem’s monetary policy operations, with the liquidity borrowed typically reinjected back into the economy, the remainder of these assets determine the maximum amount of intraday credit that can be used to cover the cost of a payment order. Negative balances can also be corrected via borrowing from the Eurosystem’s marginal lending facility.

With these mechanisms in place, banks can make use of central bank liquidity through the T2 system, which then in turn ensures the efficient circulation of liquidity in the European economic area. This is supported by corresponding features that allow T2 participants to engage in better liquidity management. For instance, the SSP allows participants to control their liquidity outflow by setting limits and actively managing payment queues.

Given its reach and ability, T2 is no doubt one of the largest and fastest payment systems in the world. According to the latest and most accessible data, T2 processed more than 96 million transactions in 2021, the highest number since its launch in 2008. On its latter remark, T2 has worked to more than satisfy its goals in its 15 years of operation, but as the ECB will be fully aware, standing still in finance doesn’t do a bank any favours.

For this reason, partly, the ECB’s governing council has been preparing for the arrival of a much stronger RTGS over the course of recent years. Its intention is to launch a new system that consolidates T2’s key capabilities with its corresponding securities settlement engine TARGET2-Securities (T2S); which originally went live in 2015. T2S brings together over 20 central securities depositories (CSD) in Europe, creating a central pool of securities that can be moved easily and efficiently across the continent. The new RTGS is expected to fully replace T2 and optimise liquidity management across all TARGET services. Originally aiming for a launch date of 21 November 2022, the ECB’s governing council revised its arrival to 20 March 2023. According to the official announcement issued at the time, the ECB cited the need to ‘allow users more time to complete their testing in a stable environment’ in their decision to delay. This also takes into account the importance and systemic nature of T2, especially in view of the current geopolitical conditions and volatile financial markets.

“While most users would have been ready for the scheduled go-live date, others would not have fully completed their testing. Delays encountered by market participants were also due to the temporary unavailability of the test environment and initial software deficiencies,” the announcement continues.

The ECB has confirmed its commitment to supporting participants in their final preparations but has yet to reveal what the full force of its scheduled RTGS will look like. What’s sure however, is that the outcome can only produce a settlement system far above anything of its kind in the payments market.

Cryptocurrency has become an everyday facet of life and is well on the way to taking the payments industry by storm. Features editor Polly Jean Harrison finds out more about how crypto plans to change everything we know about payments

As well as its growing popularity as a digital asset, crypto has gained another significant use case over the years, payments. Supposedly, the ability to make anonymous payments was one of the primary reasons crypto was developed, and, slowly but surely, merchants and retailers are starting to embrace crypto as a payment method. Microsoft, AT&T and Twitch are some of the major companies that accept payments via Bitcoin – you can even pay for your Burger King via crypto in Venezuela.

Despite this steady uptake, there is increasing consumer demand for even more crypto payment acceptance with everyday retailers. According to research from Paysafe, 80 per cent of crypto holders want to pay for goods with their crypto balances but are unable to due to a lack of cryptocurrency acceptance at the point of sale.

For crypto holders, the future of payments and crypto go hand in hand, and there’s a real appetite for long-term growth. The same Paysafe report found 91 per cent of asset holders believe crypto payments will be as common as card payments. Cross-border payments are a particularly strong use case for crypto too, accounting for 15-20 per cent of e-commerce value according to a McKinsey report.

Wes Cecil, chief strategy officer of investment platform Structure Financial, said: “Using money transfer platforms are expensive, mediated, and slow – they set the exchange rates and levies a fee for users to send money internationally. Using crypto, cross-border payments can be made directly with little or no fees instantaneously.

“There is a massive market need for efficient, trustless, and affordable options for cross-border payments, especially in emerging markets. Latin America has become a hub for crypto development, and is the exact market where we can expect to see significant advances in crypto payments.”

A report from OMFIF on the Future of Payments stated that cryptocurrencies can improve the speed, cost and ease of access to payments – and these really are the key factors to consider.

Traditional payment systems can be clunky and slow and take time to hit the recipient, sometimes even days depending on the consumer’s location. They can also be incredibly costly, again with cross-border payments taking the brunt with an average fee of 6.4 per cent for remittance payments according to a Financial Stability Board report. Crypto payments can all but eliminate this issue, with the majority of transactions occurring in real-time with little to no

improve and become more accepted, we’ll see the marketplace move to crypto payments from the current model.”

Dennis Shirshikov, head of content at Awning, a real-estate investment company, added: “From faster and cheaper transactions to increased access to financial services, crypto has the potential to revolutionise the way we pay for goods and services. Crypto has the potential to improve payments in several ways, such as reducing costs and improving the speed of transactions.”

societies and cultures who’ve had little to no access to stable currencies. With crypto integration already happening for Visa, Mastercard, Square, PayPal, Venmo, and many more, it’s obvious cryptocurrencies will factor significantly into the future of payments.”

Despite the appetite for crypto payments and their many advantages, their widespread adoption isn’t something that will happen overnight.

Daniele Servadei, CEO of e-commerce solution Sellix said: “It will take time to fully establish these new technologies, and to build the infrastructure necessary to support them. It’s also worth noting that there are still regulatory challenges and other hurdles to be overcome before crypto payments can become widely adopted.”

In terms of the challenges involved, Lisselle Pratt, co-founder of global consulting firm Capitalixe, advised that “with the recent FTX crypto scandal and other high-profile mishaps, there is also a real risk of crypto payments being seen as unreliable or untrustworthy.

“Government regulations and consumer trust are key issues that must be addressed if crypto payments are to become mainstream. Stablecoins, backed by traditional currencies, could help mitigate this risk and make cryptocurrencies a more viable option for merchants.”

wait and minimal costs that don’t involve currency conversions when sending money overseas. This benefits everyone, from the business to the individual.

Sandy Fliderman, chief technology officer at Industry FinTech, a back office platform, said: “Crypto can improve payment processing in many facets. The most transformational will be reducing costs and eliminating the intermediaries that are involved in each transaction. As blockchain technology continues to

Crypto payments can also help with financial inclusion, particularly in emerging economies. These payments provide “alternative access to credit, investment and banking services for those who may not have had access to them before,” according to Svyatoslav Dorofeev, the CEO of crypto payments provider Calypso Group. Giving the 1.4 billion adults who remain unbanked access to these “fast, cheap and safe payment systems via crypto would open a huge new market for fintech platforms to provide more global equality in the world of payment,” added president of video game commerce company Xsolla, Chris Hewish.

H.E. Justin Sun, founder of decentralised blockchain platform TRON Network said: “Crypto offers unprecedented engagement in the global economy for bankless

Regulation is also a factor when thinking about getting mainstream crypto payments in place, with the CEO of fintech and blockchain solutions provider Modulus, Richard Gardner saying: “the largest part of this protracted timetable is that, while regulations will begin to be seriously bandied about soon across major world powers, it will likely take several years before full implementation from regulatory agencies. That means that regulations, and thus, how crypto payments work, will continue to evolve.”

In light of all of this, the future really is looking bright for payments so long as crypto is involved. As Pratt says: “The widespread adoption of cryptocurrencies as a form of payment is not just likely, but a certainty,” and we can all look forward to the huge number of benefits the future will bring.

The future really is looking bright for payments so long as crypto is involved and we can all look forward to the huge number of benefits the future will bring

The

Developments across the past 12 months will no doubt continue to bear on those in 2023 and beyond, but inevitably AML compliance teams need to be alert to the unexpected. Last year’s Russian invasion of Ukraine, for example, led to a wave of new sanctions targeting individuals and businesses and throwing an extra burden on global compliance teams.

So, what will 2023 bring? I spoke to some leading industry experts to find out.

The flurry of sanctions in 2022 focussed on confiscation and freezing of assets of key members of the Russian regime and designated businesses in key sectors, such as finance – presenting a challenge for compliance screening.

Brian Swainston, deputy MLRO and head of financial crime at asset managers Fidelity International, thinks that this year is likely to see continued emphasis of such tactics to bring an end to the conflict. “Western governments are likely to ramp up pressure on the Putin regime and extend those measures to others who benefit from continued economic ties with Russia,” he says.

Authorities in the US, EU and UK continue to levy eye-watering fines and even criminal prosecution on firms failing in their AML controls. In the UK, the regulators issued a warning shot to challenger banks last year in the form of a ‘Dear CEO’ letter.

James Treacy, managing director of AML Intelligence, publishers of The Financial Crimes Fines Review, warns that fast-growth companies should be mindful of evolving AML controls as they grow; “Fintechs will need to review their sanctions compliance programmes. Rapid growth leaves them vulnerable to sanctions compliance risks and they need to ensure they have adequate customer due diligence processes in place.”

REGULATORS AND LAWMAKERS

BE SEEN TO TAKE A MORE HARD-LINE APPROACH

No net-new AML regulations came into force in 2022, but legislation is currently making its way through various governments and 2023 will likely see the fruits of those labours. In the UK, the Economic Crime Bill paves the way for new economic sanctions and the creation of a new Public Register of Overseas Entities, designed to curb the flow of illicit money into the UK property market by forcing ultimate beneficial owners to be revealed in the purchase.

Graham Mackenzie, head of AML at the Law Society Scotland, also warns that “Chinese money laundering through conveyancing will be a significant threat to legal practices in Scotland and the rest of the UK”.

Elsewhere, greater powers for Companies House to verify the identity of directors of newly formed companies, reforms to restrict misuse of limited partnerships and greater powers of recovery for suspected criminal cryptoassets, all point towards a zero-tolerance, hard-line approach to tackling money laundering and other economic crime in the months to come.

AML COMPLIANCE

TAKE THE FIGHT TO THE CRIMINALS

Training will be high on the agenda this year, with regulators and supervisors clamping down on organisations to conduct thorough customer due diligence in both onboarding and ongoing monitoring. Adopting a true risk-based approach to financial crime risks will be key.

Mackenzie observes that in the legal sector: “Practices should look to strengthen practice-wide, client and matter risk assessments to ensure appropriate consideration of higher-risk scenarios, in line with those identified in national and sectoral assessments.”

With the same point being applicable across all other financial and professional services sectors, all firms should take a fresh look at what is the optimal mix of data, technology and training to improve risk assessments in coming months.

Account takeover, automatic push payments, fake and synthetic identities – fraud is unfortunately rife in 2023. And given the near-term economic outlook, conditions remain ripe for old and new fraud typologies to thrive.

Christine Drabble, MLRO and group compliance consultant at digital online payments firm PAYABL, is concerned about trends in the property sector, stating: “We have seen identity fraud expanding into the property market, land registry and transfer of property, and we blame lax identity checks during Covid for this.”

AML compliance teams will need to continue to invest heavily in KYC identity management and verification solutions to not only improve efficiency through digitalisation but deal with highly sophisticated fake identity adoption of both individuals and entire businesses.

Surveying the collapse of FTX in late 2022, one can’t help thinking the once bright future of cryptocurrencies is less certain. It’s hard to not argue for much tougher regulation of the sector. Regulating a sector driven by innovation and disruption, however, is a tough ask.

Paul Bark, product manager at digital securities exchange Archax, is a firm advocate of regulation, both for financial crime prevention and competitive advantage. He explains: “The industry should embrace regulation and work with the regulators to ensure it makes sense and serves a useful purpose. The regulation is in place to protect customers and should lead to a better user experience, which then improves the reputation of the industry.”

Compliance costs have risen consistently and exponentially for over a decade. Will 2023 be the year that the industry climbs off the fence and takes a wholesale approach to automation? AI, machine learning and natural language processing can vastly enhance AML compliance

efficiency, while smart transaction monitoring can detect suspicious activity faster and more accurately than manual processes.

Swainston believes that technology is really beginning to make its mark. “I’m seeing growing adoption of new technology, driven by the need to improve effectiveness to avoid regulatory fines. I also see a greater willingness for cooperation between regtechs and financial services as knowledge improves.”

With fresh market analysis on the cost of compliance for UK firms due from LexisNexis Risk Solutions in February, AML efficiency, data management, digital transformation and risk orchestration will be key talking points in 2023.

Intelligence-sharing mechanisms between financial services organisations and cross industry are well recognised as needing massive improvement. A ruling by the European Court of Justice at the end of 2022 to reverse EU commitment to a publicly available beneficial owner register, was yet another setback. Drabble advocates better information sharing. “I see regional and domestic networks with local control over key infrastructure proliferating. Better data sharing is key to unlocking financial crime networks in 2023.”

About LexisNexis® Risk Solutions

LexisNexis® Risk Solutions harnesses the power of data and advanced analytics to provide insights that help businesses and governmental entities reduce risk and improve decisions to benefit people around the globe. The LexisNexis Risk Narrative orchestration platform brings together an organisation’s entire customer onboarding and ongoing risk management activities into a single, easily configurable, and scalable platform.

For more information, please visit www.risk.lexisnexis.co.uk and www.relx.com

Crystal ball gazing can be a hazardous occupation and no more so than in the sphere of financial crime prevention says Nina Kerkez , AML Expert, LexisNexis Risk Solutions

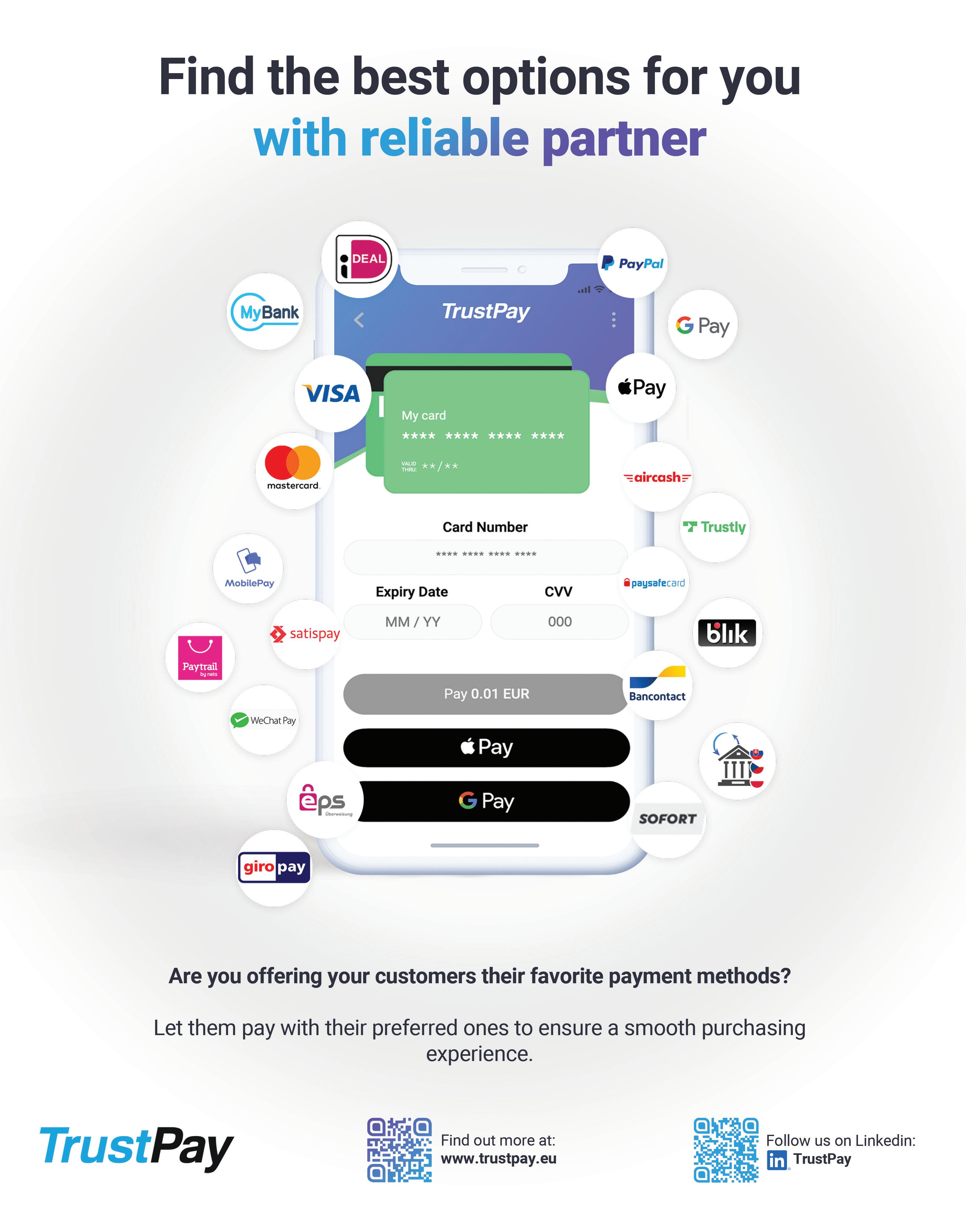

Does the following sound familiar? Just a few years ago you implemented an in-house payments system and over time added functionality and ad-hoc solutions as needed. But changes in the payments landscape and an increase in e-commerce volumes caused by the Covid-19 pandemic have made it hard to keep up with shifting demands.

Accelerated by changing consumer behaviour and digitalisation, many companies need to unify and consolidate their legacy payments infrastructure. Does it make sense to continue building on an in-house solution or instead look for third party alternatives?

The transition away from a legacy system bears risks as well as opportunities. Businesses need to ensure that:

1 The new system offers comparable, if not equivalent functionality to the legacy system

2 There will be no significant downtime during the switch

3 Existing data can be migrated

4 The benefits of the new system justify the decision

Conversely, the fact that the topic has come up likely means that fundamental issues have been identified with the legacy system. It may no longer be fit-for-purpose as technology has changed, or the ongoing costs associated with maintaining and operating an in-house solution may exceed those of a third-party solution.

Rapid changes are part and parcel of the payments ecosystem. Initial requirements are often relatively simple and dictated by short term goals, such as ‘implement a checkout page that supports major credit cards’. But as time goes on, requirements inevitably evolve to become more complex. One payment method becomes three, one payment service provider (PSP) becomes five. As the company grows and expands into new markets, previous decisions cast a long shadow.

To deal with significant overheads of adding new PSPs or payment methods (digital wallets, direct debit, crypto-based payments, etc.), businesses typically look to implement a technical layer that centralises all payment-related requirements and unifies the patchwork of solutions. But retrofitting a legacy solution with this level of flexibility often requires a significant rewrite. This raises the question: could there be a better solution out there?

Luckily, the payments market has

matured over the last decade, and solutions that tackle these problems are available. As such, the main question is: which approach is the most cost-effective and beneficial to the business over the long-term?

Building a payment solution is no easy undertaking. Risks associated with payments typically include stringent compliance requirements and regular legal and technical changes. These risks are compounded by the fact that globally operating enterprise merchants rely on a multitude of payment service providers, for the following reasons:

■ To support a wide variety of payment methods and currencies

■ To use local providers, as legal/ compliance requirements make cross-border payments challenging and local providers offer lower fees

■ To reduce the risk of depending on any single financial institution (‘multi-acquiring’) by introducing fallback options

However, each service provider uses its own unique API that needs to be integrated. This means each new PSP incurs additional costs for developers, domain experts, product managers etc. These resources are scarce and expensive and could most likely be put to better use elsewhere in the business, rather than reinventing an already existing wheel.

Compliance requirements add further upfront and ongoing costs. Meeting PCI-DSS requirements alone typically accounts for hundreds of thousands of euros, with yearly assessments and annual audits, as well as costs for security and storing sensitive payment data.

The rise of alternative payment methods and regional preferences (e.g. PayPal in Europe, WeChat Pay in China) underline the importance of an easily extensible and flexible solution. Being able to quickly add regional and new payment services provides real commercial advantages. Furthermore, integrating payment options on a checkout page is only the beginning. Reconciliation and reporting data must be supplied to other IT systems (ERP, CRM). These post-processing requirements should

not be underestimated, as the data formats used by payment providers differ widely and can change over time. Business growth through acquisitions can present another challenge, requiring additional flexibility to integrate heterogeneous IT landscapes.

There are clear benefits to choosing a mature solution, such as IXOPAY’s payment orchestration platform. First and foremost, it is ready to go today and has already benefited from long-term experience in the field. This expertise is not just limited to the developers building the platform, but comes from the cumulative expertise of all the platform’s users and the feature requests they have submitted. As well as gaining the benefits of years of expertise, outsourcing the overheads of PCI DSS compliance to a platform offering a PCI-DSS Level 1 compliant vault for payment instrument data results in far less legal exposure and compliance costs.

Designed from the ground up to be flexible and scalable, platforms such as IXOPAY cover all functions required to enable payments processing at scale, via as many providers as needed. Payment orchestration platforms provide a single technical layer that dramatically reduces the effort to set up, operate and maintain multiple payment provider relationships.

Aside from the cost benefits from transitioning to a third-party solution, it is important to ensure that the new system offers the same functionality as the legacy system. This means not only integrating existing PSPs, but migrating payment and account data, integrating other IT systems and delivering a checkout page with the payment options that customers have come to expect.

At IXOPAY, we have experience of transitioning clients from legacy systems to our payment platform –sometimes at short notice. With 170-plus payment providers and a large number of payment methods already supported by the platform, and with the ability to implement new integrations in record time, most existing payment options can be migrated easily. All payment providers are integrated using the same API, meaning that adding additional payment options later is vastly simplified with minimal configuration required.

As for the migration of customer details and payment data to the new system as well as integrating existing IT systems, IXOPAY can import tokens and credit card data into our PCI-DSS compliant vault. Customer details in the legacy

system can be added as customer profiles, and linked with the credit card data in the vault. This ensures that recurring payments and card on file transactions continue to be processed without interruptions.

Clients should not be left to face these challenges alone. Our Customer Success Team is on hand to provide support throughout the process and help clients benefit from the experience we have gained from many previous successful payment system migrations.

The world of e-commerce has changed rapidly and will undergo further changes in the near future. Keeping abreast of these changes can be a challenge – and an expensive one at that. For many larger merchants, the best ROI is achieved by turning to industry experts to handle payments, eliminating costly compliance, legal and development overheads.

There are still challenges that need to be met when transitioning from a legacy system. These include migrating customer data, ensuring existing payment methods continue to work, and integrating the payment platform with other IT systems. Working together with the right partner who understands these needs is key. Their insights and experience can benefit your business throughout the transition and beyond, providing you with a future-proof system that can grow alongside your needs.

IXOPAY is a payments orchestration platform enabling independent, flexible and global payment processing. As a highly scalable and PCI-DSS certified ‘fintech enabler’, IXOPAY fulfills the needs of large merchants as well as those of ‘white label’ clients: payment service providers, acquirers and independent sales organisations.

The modern, easily extendable architecture offers smart transaction routing and cascading, state-of-the-art risk and fraud management, fully automated reconciliation and settlements processing, comprehensive reporting as well as plugin-based integration of acquirers, payment service providers and alternative payment methods.

For those working in financial services today, there are many challenges to be faced. From supporting your customers as they come to terms with the cost-of-living crisis, to the introduction of the new Consumer Duty in July this year, it has never been more important for companies to listen to their customers, and start learning from that feedback, to ensure that products and services meet customer expectations and demand.

In any industry it’s rare for someone to make a purchase without doing some research, and in the financial services sector, this is arguably more important than other business sectors. Our recent research found that 84 per cent of consumers trust reviews from other consumers, compared to 67 per cent who trust reviews from professionals within the industry.

Consumers are much more likely to seek positive reassurance from other customers prior to taking out a financial product, and our research found over 40 per cent seek reviews if the product or service they’re considering is new to them. Added to this is the fact that customers have more information and options than ever before when considering a new product or service, and after years of being told to be cautious with scams and several banking scandals in the headlines, being able to trust an organisation is increasingly important for consumers within financial services.

Therefore, ensuring you listen to your customers and are regularly collecting feedback from them at all key stages in the customer lifecycle should form an important part of your product management approach. Customer feedback solutions don’t have to be complicated but can offer a wide range of benefits to an organisation. If you’re not actively collecting and using customer feedback on a regular basis, here’s six reasons to make you think again.

Genuine customer feedback can have a positive, psychological impact on prospective customers, building a sense of trust and credibility for your business. If the business has received a multitude of positive reviews, cautious consumers are likely to feel reassured that the product or service provided is of good quality and from a reputable company. This is

Jacqueline Dewey, CEO of Smart Money People

particularly important for financial services where we’ve been taught to be hyper-vigilant for threats from fraudsters and scams.

In fact, our research found that consumers were 69 per cent more likely to buy something after reading several positive reviews. Many consumers expect to easily find customer reviews, and so a lack of public reviews can be a red flag. When it comes to financial products, consumers rely on reviews to reassure them that they’re getting the best deal from the best company. People are becoming less comfortable signing up for credit agreements or insurance policies without some form of evidence that the company can live up to its claims.

While it’s possible to collect feedback from your customers internally, using an external company to support you with this data collection, or supplement your own data, can have several benefits. It’s common that a company can have a bias towards how they view their own data, especially when they’ve collected and then analysed it themselves, and it’s possible to overlook areas of opportunity, or be over-sensitive with the minutiae of the feedback received.

Duty in July. For those who need a reminder, the new Consumer Duty will require companies to act to deliver good outcomes for customers, and has four outcome rules that require companies to ensure:

● Customers receive communications at the right time, that they can understand

● Products and services meet the need of their target customers

● Products and services offer fair value

● Customers are given the support they need.

an extra five minutes of effort for your customers. Without an always-on customer feedback process, how do you measure and know if these changes have had a positive effect? By listening to and understanding what your customers are saying, any changes you introduce to a process can be understood and acted upon

However, gaining an independent and impartial view of your data offers companies a different perspective and opinion on the data. You’re also able to benefit from the external company’s experience and expertise with the nature of this data collection to ensure you’re getting the most from the data, and honing in on the key learnings from the feedback. Depending on the company you use, they may also be able to offer the ability to benchmark your performance compared to peers within your product set and/or industry and offer recommendations for improvements based on your own customer feedback.

3 COLLECT DATA TO MEET REGULATORY REQUIREMENTS, INCLUDING CONSUMER DUTY

We’re just a few months away from the introduction of the FCA’s new Consumer

As part of the new Consumer Duty, companies are required to assess and monitor whether they are delivering good outcomes to customers, with additional reporting required for their Board. With this in mind, collecting customer feedback at each stage of the client lifecycle is critical. Not only does this ensure your company is delivering on your customer’s expectations, but it also enables you meet the requirements of the regulator. There are companies that can support you with the data collection and reporting, offering you an independent and impartial view of your data. At Smart Money People we have been collecting feedback from customers on key FCA outcomes for over eight years and have a wealth of data on the industry to support and supplement a company’s reporting requirements.

Companies are always looking to make efficiencies and it’s a good thing to be questioning and challenging processes to ensure they are delivering the best possible customer outcomes. Perhaps your speed of responding to customers on the phone has improved dramatically due to a change you’ve introduced, but are your customers still getting the same level of service from you? Perhaps you’ve introduced an extra step within the application process to help make it easier for your admin team, but it’s created

It’s better to proactively embrace reviews and make sure you’re listening to your customers

quickly, making sure that customers continue to receive the best possible outcomes. This may mean reversing a newly introduced process that has unintended consequences or making a trial process permanent following positive feedback.

No company is started, or product launched without the idea of solving a problem or filling a gap in the market for customers. But in an ever-competitive world, without consumers making new purchases or retaining customers

with repeat purchases, businesses won’t survive.

Collecting customer reviews can be the ideal way to bridge the gap between your company and your audience, providing insight into what customers have loved, liked and disliked about their experience with your company. A negative review does not have to be viewed as a setback, instead, it should be a guideline for where improvements can be made, deepening your understanding of your target market’s needs, wants and preferences.

It’s equally important to consider how you acknowledge and respond to the feedback and reviews you receive. Our research found that 50 per cent of reviewers expect their review to influence readers to use or avoid the business or service, and 45

per cent expect a reply to their review. Your response acts as a public example of how you treat your customers, and what any prospective customers can expect from you, particularly when responding to any criticism.

Reviews on an external review site can also assist your business by expanding your reach further. Consumers who haven’t heard of your brand may stumble across your reviews, causing them to then look into your business as a viable option.

Collecting customer feedback publicly via a customer review platform can also improve your company’s online visibility, supporting your existing marketing strategy (for no extra cost!).

Featuring your company’s reviews in your organic search engine listings can help to improve your click-through rate, and therefore your traffic volumes. This in turn helps to boost your SEO performance, which keeps your site ranking high on Google, so it’s a win-win! We’re all well too aware within the financial services industry that companies typically need to be careful with their marketing techniques, treading carefully when making any promises or claims to potential consumers. This is even more important with new or more innovative products and services, particularly those which may not be regulated (as yet!), but still fall under the remit of any rules set by the Advertising Standards Agency. By utilising customer reviews as a marketing tactic, or even featuring some customers as case studies, prospective customers can learn about your business through genuine customers, providing reassurance, confidence and

Smart Money People is a specialist review site dedicated to financial services, with over one million financial product reviews and insights. At Smart Money People we believe that hindsight builds better foresight, and so we use the customer reviews and feedback we collect to provide actionable insights for companies within financial services.

Companies can claim their review page on Smart Money People for free to start collecting and listening to their customer feedback, and upgrade to one of our packages to benefit from access to our specialist customer insight capabilities, including the ability to benchmark your feedback against peers on a product and industry basis.

Smart Money People is also able to support companies with their Consumer Duty requirements through a range of different feedback services, which ensures companies are provided with an independent and impartial view of their

building trust in your brand, which ultimately results in more conversions.

Steve Jobs once said: “And one of the things I’ve always found is that – you’ve got to start with the customer experience and work backwards to the technology. You can’t start with the technology and try to figure out where you’re going to try to sell it. And I’ve made this mistake probably more than anybody else in this room. And I’ve got the scar tissue to prove it. And I know that it’s the case.”

Reviews are a powerful tool for any company to help ensure your delivering on a great customer experience and outcomes, but especially so for financial service providers, who often need to secure some extra credibility before consumers take the plunge.

Some companies may be deterred from encouraging customers to give feedback and leave a review in fear of negative reviews surfacing and potentially damaging their reputation. However, while you can deter consumers from leaving a review on your site, you can’t stop them from sharing with an independent review site, such as Smart Money People.

Instead, it’s better to proactively embrace reviews and make sure you’re listening to your customers. It’s almost impossible to please everybody, however, if consumers can see that you’ve responded to a negative review and made positive changes due to it, their trust in your business and its credibility will improve.

Remember, even if you don’t encourage customer reviews, your competitors probably do. If you’re not already asking your customers to leave a review and collecting that valuable feedback, there’s never been a better time to start.

performance using genuine customer data. We have over eight years’ worth of data asking customers whether they felt fairly treated, understood product details and thought products were good value for money. This means we have a wealth of historical data at our disposal to support your company to deliver good outcomes for your customers.

Smart Money People also runs the British Bank Awards, Consumer Credit Awards and Insurance Choice Awards each year. The awards are decided using data collected from the reviews received during the voting period, making them a true reflection of customer feedback and ensuring customers are being heard.

Voting in the British Bank Awards is currently open until finalists are announced on 20 March. To get involved, leave a review and vote for your favourite banking provider, or to find out more visit smartmoneypeople.com.

from the competition, or it already is the preferred choice for relevant buyers in your established regions – bring these accolades to the forefront to build trust.

target audience that run webinars, podcasts and other online activities. Having a voice that is amplified by multiple trusted media outlets will help build brand awareness.

booth design, any collateral on- and off-stage should emphasise the key differentiators of your business.

The biggest mistake you can make is thinking you can market your business to anyone and expect your marketing to reach everyone with the same velocity. It is important to have a clear strategy and messaging when it comes to marketing your fintech product or service.

Both financial and human resources are often limited when entering new markets, so prioritise your target audience based on their importance to the business (for example guided by average lifetime value) and the average sales cycle duration. The ideal scenario is getting a few quick wins (in three to six months) while building the medium to long-term pipeline. Use the ideal audience profile and the key product differentiators to drive the messaging. If your product has been independently tested and stands out

Launching in a new market is no copy and paste job. Your audience will be quick to dismiss a new market entrant that doesn’t do any homework. It can take years to fully establish the brand, build trust and grow a customer base within a new country or region. To speed up the process, have a local team, ready to meet with prospects and learn about their challenges and needs first-hand. Subsequently, adapt your content to the audience accordingly. For example, you may want to create new, high-quality, engaging content specifically for that new audience, or include a representative audience in any research you conduct, or translate your website, datasheets and other content, or even become visible in relevant local media – online and offline. Next, let’s look at online and offline tactics to connect to your audience.