Fintech is finding itself at a turning point amid rumblings the industry is ‘losing its lustre’. We’ve seen firms struggle to raise fresh funds, reports of falling valuations, fire sales, staff layoffs and recruitment freezes.

Some fintechs have abruptly closed while others have bid their farewells before they’d even had the chance to say hello.

Of course, the fintech industry is not alone with companies across every sector and around the world also facing several macroeconomic problems, including price volatility, supply shortages, security issues and economic uncertainty as the war in Ukraine rumbles on.

Which is why we wanted to put the spotlight on how we can take stock and progress over the coming months to ensure fintech remains one the world’s greatest success stories.

For this issue of The Fintech

Times, we’ve spoken with dozens of leaders across the fintech industry to get an understanding of the priorities that feature prominently on their agendas.

Turn to page 10, as a handful of those CEOs share their insightful views on how we can move fintech forward in 2023. Then, throughout December, The Fintech Times website is sharing even more insight from global fintech leaders on their key takeaways and lessons learned from 2022 and their predictions on the year ahead.

In this issue, we also address what it takes to be a fintech CEO. I think we can all agree that a fintech leader is someone who needs to be constantly on their toes to ensure their company stays ahead of the curve, but how can they develop that distinct set of qualities and skills necessary to be a successful CEO?

Turn to page six, as features editor Polly Jean Harrison rustles up the ingredients to cook up the perfect CEO!

We also hear from Reltime CEO Peter Michel Heilmann as he outlines the Norwegian fintech’s embedded finance and global Web3 financial solutions – on page four – while Alex Mifsud, CEO and co-founder of embedded finance firm Weavr, talks us through the company’s approach to bringing the best out of its people.

Finally, we put the spotlight on the development of central bank digital currencies (CBDCs). An estimated 90 per cent of the world’s central banks are pursuing CBDC projects but who is winning the race, and why? Turn to page 14 to learn more. Happy reading!

Claire Woffenden, Editor The Fintech Times

While worldwide firms tackle the complexities of engaging with this technology revolution, global Web3 financial ecosystems such as Reltime continue to carve out a path to make adoption as easy as possible

Touted as the ‘next evolution of the internet’, Web3 promotes the incorporation of the industry’s most exciting innovations; most notably those of decentralisation, blockchain technologies and token-based economics.

The sector is moving at breakneck speed, which is why firms will need to move even faster if they’re to stand any chance of leading the way.

For this reason, Oslo-headquartered Reltime unveiled its FastTrack to Web3 initiative. The service acts as a white-labelled B2B2C Web3 bankingas-a-service (W3BaaS) solution for anyone wishing to enter the Web3 embedded finance space efficiently.

Armed with Reltime’s W3BaaS, companies can build their own Web3 financial ecosystem within the short scope of three weeks. The solution is fully customisable and engaging companies can integrate various currencies (digital and fiat), settings, web domains and user experiences into the W3BaaS.

Additionally, the solution can

also be customised to support various languages, user experiences, backend processes and brand identities; in line with Reltime’s clients’ specific needs.

The game-changing Web3 pioneer and rising fintech star from the Nordics, which believes in putting ‘financial power in the hands of people and businesses’, is also expected to incorporate white-labelled virtual and physical cards into its solution early next year. Reltime has built its own Layer 1, Proof of Authority blockchain, with built-in identity, from the ground up.

Running in tandem with its FastTrack to Web3 initiative, the company also recently introduced its FastTrack to Embedded Finance solution. Designed for telecom operators, financial service providers focusing on specific target groups, neobanks, gaming and virtual sports Metaverse enterprises, supermarket chains, shopping malls and e-commerce firms, the solution enables companies to offer real-time Web3 financial services.

The solution is fully compliant, including consideration of PEP, AML, low-cost eKYC and regulatory radar.

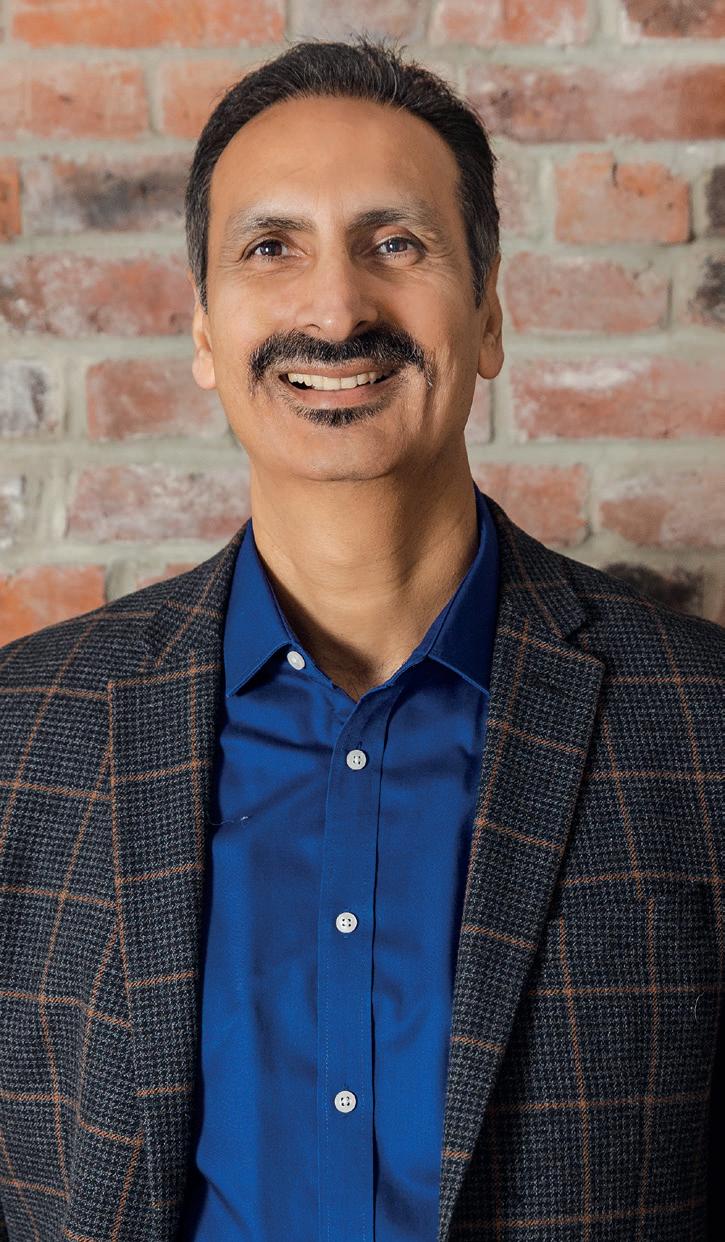

“Through Reltime’s best-in-class FastTrack to Embedded Finance, game-changing financial services can be provided to your customer base under your own brand, providing attractive new revenue streams while reducing your customer churn,” says Peter Michel Heilmann, CEO of Reltime (pictured).

Companies can make the provision of seamless and safe Web3 financial services a reality for their customers, utilising Reltime’s decentralised, realtime, plug-and-play, low-cost solutions.

Merchants can expect to find Reltime’s W3BaaS particularly useful in a range of instances, including the ability to offer QR code payments to customers locally or globally, getting paid instantly, as a viable, cost-effective alternative to accepting traditional cards.

“Our new B2B2C solution gives companies the opportunity to enjoy the same benefits as Reltime’s current global, trusted, high-performance, Web3 platform is offering,” adds Heilmann.

Fundamentally, the white-labelled embedded finance solution will enable non-financial companies to launch neobank-type of services to their customers locally, regionally and globally, a process that traditionally would take several months to complete.

Following the announcement of its W3BaaS solution, Reltime has continued to focus on various elements of Web3 and the company’s role in its eventual widespread adoption.

It also recently confirmed speculation that it was working on creating its own decentralised exchange (DEX); being the foremost component of Web3 technology.

With an initial roll-out expected in January 2023, the company’s DEX will support P2P trading, swapping, pooling,

Companies can make the provision of seamless and safe Web3 financial services a reality for their customers, utilising Reltime’s decentralised, real-time, plug-and-play, low-cost solutions

winning and the farming of digital assets, commodities, precious metals, and foreign exchange for businesses, traders and producers worldwide; without the need for an intermediary.

“Our DEX could be used as a platform for local fair trade and premium cocoa producers to trade their quality beans directly with buyers on the other side of the planet, without the interference of any intermediaries,” Heilmann cites as a real-world example of the DEX’s capabilities.

The DEX’s internal smart contract capabilities are to support every stage

of the transaction automatically, from the seller to transporter to buyer; championing transparency in the process.

“The Reltime DEX is securing the buyer and seller until the goods have been delivered,” affirms Heilmann.

When it comes to trading, Reltime will be able to secure the best delivery solutions by performing artificial intelligence (AI) and machine learning (ML)-backed electronic know-yourcustomer (eKYC) checks; mitigating money laundering cases in the process.

The company’s partners will benefit from the ability to create, mint and list their own tokens on the DEX, via an initial DEX offering (IDO) or initial game offering. Unsurprisingly, Reltime has experienced immense demand for its new-found DEX, confirming heightened

interest from potential partners worldwide, including in Europe, the Middle East, Africa and Asia; with particularly strong interest reportedly coming from trusted partners in Latin America.

On this note, Reltime has demonstrated its ability to respond to market demand with its recently announced expansion into Southern Africa; achieved through its partnership with the pan-African financial services firm Khumalo and Mabuya Chartered Accountants (KnM).

Despite McKinsey forecasting 10 per cent per annum growth in the continent’s financial services market, reaching approximately $230billion in revenues by 2025, just three countries have real-time payments and the necessary payment rail infrastructure in place.

Reltime is seizing the white spaces emerging across the African market at astonishing speed, with a particular focus on distribution, acquisition, lending, borrowing and the provision of advanced infrastructures relating to Web3.

South Africa is of specific importance to the company’s expansion. The country is among the top 10 countries in the world to adopt digital assets and McKinsey predicts that South Africa will account for $80billion

of the continent’s financial services revenues by 2025.

Reltime will also be looking to roll out its services to the Southern African countries of Angola, Botswana, the Comoros, Eswatini, Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia, Seychelles, Zambia and Zimbabwe.

“The timing of our strategic collaboration could not have been better,” comments Heilmann. “We are building a new movement in Africa and globally to change the way people and businesses financially interact and transact. The burgeoning region is very close to my heart, since, as a child, I lived and went to school in Ndola, Zambia. We warmly welcome Reltime Africa and its leadership team to our rapidlygrowing family and congratulate KnM on its tenth anniversary.”

With its partners by its side and a strong reputation for Nordic accountability, Reltime is swiftly scaling up around the world, offering its unique global Web3 financial platform as a white-labelled solution. Next year, the fintech for good will launch the world’s first Web3 and Metaverse payment, digital identity and cold storage biometric card.

It is also committed to becoming the leading, preferred and trusted financial Web3 and Metaverse partner for people and businesses anywhere in the world. The only question that remains is, with the Web3 industry evolving just as fast as Reltime is reacting, what innovations could be next on the company’s agenda?

Reltime is leading a growing, global family of people, merchants and businesses large and small, taking back control of their finances, identity and assets in a whole new way. It envisions making Web3, Metaverse and decentralised finance the new normal for billions of people as well as millions of merchants and businesses world-wide. Reltime offers a unique gateway to companies wishing to enter the Web3, Metaverse and blockchain space. End-users of Reltime’s B2B2C partners can move, lend, borrow, earn, swap, stake, interact, transact and do more with money in and to 150 countries in less than five seconds – bypassing any middleman.

Website: www.reltime.com LinkedIn: www.linkedin.com/ company/reltimedefi Twitter: twitter.com/reltime_rtc

What exactly does it take to become the chief executive officer of a fintech company?

Polly Jean Harrison , features editor of The Fintech Times, explores the recipe

Ithink we can all agree a fintech CEO is definitely a person to watch.

They are the people we look to in the industry to give comments on the trends and discuss the comings and goings of fintech. They lead their companies to success and try to pull them out of failures, riding the storm of tough times until the sun comes out. Being a chief executive officer is what many aspire to, though often those in the role never intended on taking on the mantle.

But what exactly does it take to be a fintech CEO? Who’s got the mettle to take on the giant that is fintech and pilot a successful company through the industry? Do you have to be a certain kind of person to take on the reins, or can anyone give it a go? What are the essential ingredients? Is it creativity? Multitasking? Nerves of steel? Or simply being at the right place at the right time?

Let’s look at just what qualities a CEO needs to have in their arsenal, and together we’ll build a perfect CEO.

Simon Eglise, CEO and co-founder at EC1 Partners, a fintech recruitment agency, believes that an ideal attribute of a CEO is to believe in their company’s vision. “A CEO has to really see the vision and be able to execute it and have the team, company or staff to buy in and believe in that vision too.

“Being able to make a vision or end goal a reality is only possible if you can attract good people to your business, retain them, and have the company or teams unite to make your vision happen.”

He continued: “All CEOs I interact with generally possess a great visionary element on where they can take the business, how they can do that and what it means for those involved. Most CEOs

weren’t necessarily a CEO before –how do you know you can do it or equally can’t? Be prepared to step out of your comfort zone, this is a role that can pull you in a lot of directions, often simultaneously, and this can be hard for some people to manage. Be comfortable admitting what you are good at or not good at – nobody is perfect or ‘Superman/Superwoman’.”

A CEO does a lot of talking. Whether that’s to their team, to investors or to the media, you can bet a chief executive is going to need to be able to get their message across and dole out instructions when needed.

Always be honest and proactive with your team.”

So, quite plainly, communication is the number one skill a CEO should have according to Larry Hipp, CEO of cross-border payment solution Brightwell. “When times are challenging, people are often anxious about what is coming next,” he continued. “A leader must clearly communicate what is happening and the potential outcomes with their team. In my experience, being authentic and real is the best way to move through challenging times.

“Always over-communicate with your team. People want to hear from the top leaders in any organisation. If you’re not upfront and transparent with your communication, the team may doubt your ability to lead them to success.

Though a CEO is top of the food chain when it comes to fintech companies, it cannot be understated how important the team around them is to the running of the company. From their c-suite executives down to the lowest rungs of the ladder ‘knowing how to find – and more importantly keep – the right team is incredibly important’. Bhairav Trivedi, CEO of Crown Agents Bank, continued: “As a CEO, a big part of your role is recognising not only what your business needs and executing that, but also bringing in resilient, quick thinking, understanding individuals who can help you in that pursuit and ultimately bring value to your company and drive future success.”

Bob Bennett, founder and CEO of SaaS-based solutions provider, EngageSmart agrees with this and said: “Talent is

where it all begins, and this extends beyond employees to include customers, their clients, our partners, and our investors. Their opinions, needs, and aspirations drive us, and we strive to respond with transparency and a sense of urgency. Good companies have good people, but it takes great people to make a great company.”

Shamus Rae, founder and CEO of Engine B, a digital technology company specialising in AI and data analytics for the professional services industry, added: “Being a fintech CEO is part holder of the vision and part coach and mentor. The mistake many business leaders make is trying to pigeonhole people when a CEO needs to hire people with different skills, sell them the vision, give them the space to try, fail and grow, and nurture them to be bigger and better than they think they are and get out of the way.”

Whether the industry likes it or not, regulation and the ongoing voyage of compliance is something every fintech must face, and the CEO, while likely not directly involved, has the responsibility of taking on that regulation –

organisations that get the technology-side but they actually don’t get the regulatory climate their customers have to operate in – even some big and substantial fintech businesses.”

We can’t talk about CEOs in the fintech space without also acknowledging the lack of diversity among the cohort. Gender diversity within the space is still far too low, with less than six per cent of fintechs having female CEOs according to a report by Fintech Diversity Radar. Justina Tartilaite, co-founder and CEO of B2B tax credit identifier, Adsum, said: “There is still a gender inbalance when it comes to working in fintech. This continues to be a male-dominated industry where it can be difficult for women to join in and find their place.

This is particularly evident when it comes to venture capital; capturing and holding the attention of investors and being taken seriously, is often harder for women seeking venture capital than men. I certainly felt the pressure when taking Adsum forward for venture capita; and other investments, and I can say now that practice and confidence are essential to a good pitch”.

“It’s also important to acknowledge that the gender pay gap remains a significant barrier to equality in the tech industry, with the disparity between still at almost three per cent. Building Adsum on a foundation of equal opportunity ensures we do not fall into this trap, and my hope is that future CEOs take inspiration from our approach.”

No matter how fast your industry moves, recognise that nothing that lasts can be built in a day. Consistent work compounds over time. It encourages talent to join your vision. Most importantly, it gives you the energy to tackle the inevitable setbacks that will emerge in your journey. You need to know where you’re headed, yes, but every day of consistent work gets you closer to that goal in so many ways.”

Henderson added: “Just because you’ve got the lauded title of CEO doesn’t mean that you don’t have to roll your sleeves up and get into the weeds of the business. If your mindset is ‘I’m the CEO, that job is beneath me’, that’s a recipe for disaster. I would argue that in a small fintech startup, as CEO you need to be prepared to do a bit of everything.”

It’s easy to simplify a fintech CEO down to one key list of qualities, however it would be remiss to think that every single chief executive in the industry follows this list and that there is a one size fits all formula to creating a fintech leader.

“The ideal attributes for a fintech CEO is a tough question to answer given the different sizes of each firm, the variety of what fintech entails and the diverse focus of what each fintech does,” said Eglise.

“At present, I am seeing some really diverse profiles in this space. Some CEOs come from very strong technical backgrounds which serve well for certain businesses, some are more commercial or sales-led – there isn’t a right or wrong fit here.”

and an understanding of the landscape is all but crucial according to Ian Henderson, CEO of Kyckr, an Australianlisted regtech.

He said: “I’ve lived and breathed that for my whole career in banking and financial services, prior to Kyckr. But if a CEO has come from left field – say from a completely different industry - with big ideas on how to shake up the finance market with a new fintech solution, then it’s essential they have a firm grasp on the regulatory landscape from the get-go.

“Having the right knowledge and competence applies to lots of different businesses, but in fintech – you’re going to be operating i n the world of highly-regulated financial services.

“I’ve come across so many fintech

There are many different qualities and attributes we could list to say exactly what a CEO needs to be. However, a successful chief executive often comes down to one thing – putting in the work. Having these fantastic qualities and an impressive CV will only get you so far, the willingness to roll up your sleeves and get on with it will take you further.

Peter Hazlehurst, CEO and co-founder of Synctera, a BaaS building platform, said: “Fintech leaders need tenacity, creativity and especially consistency. Whether that’s learning about a new industry, building a new product, or creating a new company, you need to show up and put in the work, day after day.

An industry filled with cookie-cutter clones would be boring at best, but the idea of one ‘perfect’ character probably isn’t realistic.

Steve Pomfret, CEO of Cygnetise, a digital authorised signatory management, firm agrees: “One continually should be growing and getting better, adapting with dynamic forces internally and externally. If everything is going smoothly, rest assured that it won’t last long. One needs to expect the unexpected, and where possible try to be at least one step ahead of the game. One needs to stay humble and make sure they are surrounded by some very steady heads that act as stabilisers. Ego should be forgotten. There is a fiduciary responsibility to look after your shareholders. This, where possible, should be instilled in the culture of the organisation. There is no such thing as a perfect CEO.”

One thing is clear – there are many factors that go into what a CEO should be, but there is no singular recipe of ingredients that you can throw in a pot to end up with a perfect person to lead a fintech company. However, arming yourself with a checklist would make things a whole lot easier, as the effort, work and abilities of a chief executive cannot be understated.

There are many different qualities and attributes we could list to say exactly what a CEO needs to be. However, a successful chief executive often comes down to one thing – putting in the work

The Card and Payments Awards (TCPA) are known as the most prestigious awards event in the payments industry, and the leading payments industry networking event of the year having supported the industry for almost two decades. The Awards will celebrate its 18th birthday in 2023!

With 1,100 guests attending on the night, from more than 300 different companies, and a compelling list of blue-chip sponsors. TCPA recognise excellence and innovation across the industry. Each year many eligible organisations compete for one of the sought-after awards which are judged by an independent panel of industry experts.

In 2023, there are a total of 22 awards up for grabs covering the whole ecosystem. This year brings the addition of new categories to recognise the Best Achievement in Sustainability, Best Payment Facility and Best Future Payments Initiative.

This year’s sponsor panel includes Prime Sponsor TSYS, a Global Payments Company, Silver Sponsor MongoDB, American Express, Discover Global Network, The Fintech Times, Fiserv, Global Processing Services, HSBC Corporate Cards, Ingenico, Mastercard, Reward, Thales DIS UK and VISA.

TCPA is known as the ‘go-to’ event for networking among a senior audience, hosted by the likes of Claudia Winkleman, Gyles Brandreth and Alistair McGowen to name a few. It guarantees a great night of

The shortlist for The Card and Payments Awards (TCPA) 2023 has been revealed : has your company made the coveted shortlist?

important business conversations and recognition of the best initiatives that the industry has to offer consumers. We cannot wait to welcome our new celebrity host for 2023 who we are confident will blow the audience away! Here’s what one of our judges – Rachael Jenkinson, VP, customer solutions, Mastercard – has to say “As a networking event TCPA is second to none for those in the UK and Irish card and payments industry. It’s a wonderful platform to recognise innovation from all parts of the payments ecosystem, that truly benefits consumers and businesses.”

There are lots of ways to get involved in the UK and Ireland’s premier awards and networking event. It’s too late to enter now with the shortlist already complete and the final judging session by our independent panel of judges taking place in just a couple of weeks. All that’s left to do it is come along and get a flavour for yourself of why TCPA continues to be the go-to event for the payments industry.

If you are looking for an amazing evening of networking, while gathering valuable industry information in relation to the programmes and products that are working the best and wowing consumers and business partners alike, then this is the event for you.

You can either use this as a valuable team building opportunity or invite your clients along to this important industry event on Thursday 2 February 2023. Book your table at www. cardandpaymentsawards.com/ 2023live/en/page/table-booking.

Watch out for 2024. Consumers love businesses that can show they are good enough to be recognised for an award, whether that is as a finalist or a winner. As a finalist (and hopefully a winner), bringing your clients and customers to this fantastic five-star black-tie event is a fantastic relationship building exercise. Entries are now closed for 2023.

Subscribe to our mailing list to stay in the loop and be informed when entries open for 2024 at https://mailchi. mp/7bf21f1d598a/newsletter

With sponsorship you are announcing how important best practice is to your organisation – you are willing to invest in an industry event that independently critiques industry practices, and then rewards and recognises best practice across a variety of disciplines. Find out more about how you can benefit from a sponsorship package at www.cardandpaymentsawards. com/2023live/en/page/why-sponsor

New judge for 2023, Candice Pressinger, director of customer data security at Elavon, says: “TCPA is critical for recognising industry excellence and best-of-breed products in the payment ecosystem. The awards is an important opportunity for showcasing innovation and recognising our community’s newcomers or unicorns. It also provides networking opportunities with top-tier businesses and thought leaders.

Networking is the best way to build a profile and get your brand name out there.”

Fellow judge Andrew Gilchrist, says: “As well as recognising industry leaders who continue to push the boundaries of customer service and product development, the Awards offer the chance for new businesses to raise their awareness in a crowded market, and truly gain recognition for innovation in solving consumer problems with clever, new approaches.”

While judge Maggie Boyle, VP, UK acquisition and digital, American Express, adds: “TCPA gathers in one place the trends, developments and people that span many functions and subject matter areas, bring them to life with real world use-cases and serve as a tremendous source of learning and inspiration for professionals in our field. I really value the fresh perspectives and great ideas we see showcased in the entries and awards.”

Visit www.cardandpaymentsawards. com/2023live/en/page/shortlist

Book your table package at www. cardandpaymentsawards.com or email the team info@cardand paymentsawards.com

FINTECH LEADERS SHARE THEIR VIEW FROM THE TOP ON HOW WE CAN START 2023 WITH A FORWARD FOCUS

During the second half of 2022, questions over whether fintech was ‘losing its lustre’ started to proliferate with news of multiple job layoffs and recruitment freezes across the industry and a lack of funding either stunting growth or leading to companies packing up shop completely.

The fintech industry is not alone with companies globally also facing several macroeconomic problems including price volatility, supply shortages, security issues and economic uncertainty as the war in Ukraine rumbles on.

To start 2023 on a more optimistic note, despite the gloomy outlook, we’ve turned to leaders across the fintech community to hear their views on how we can move fintech forward in the coming new year.

Layla White, founder & CEO of onboarding firm Tech Passport “Collaboration is what will drive fintech forward in 2023. IBM recently reported that 48 per cent of banks had partnered with a fintech in the last three years, while only 12 per cent listed increasing competition from fintechs, showing that collaboration is taking over from competition in this space. Through collaboration we will see the industry rise from strength to strength as we solve issues together for the good of the entire sector.”

Liam Chennells , founder & CEO at due diligence fintech Detected “We need a combination of two things. The first is that startups and scale-ups need to focus on fixing quantifiable problems with relentless obsession; the

other is that the teams responsible for innovation in big businesses need to build ways of working that allow them to share detailed requirements and a path to testing new solutions.”

Susanne Chishti, CEO FINTECH Circle, investor & board member“The financial and fintech sectors have a huge responsibility towards society overall. Fintech has the power to encourage innovation to make financial wellbeing more achievable for individuals and help businesses to make a real difference in people’s lives. The current cost of living crisis is having sweeping effects on the day to day lives of UK consumers. This will have an impact on financial firms ranging from the amount of money customers will have at any point in time to how SMEs will react to potential cash flow issues.

That’s why in 2023 the priority is to create a financial system that caters to all – so financial inclusion is not a buzzword but starts at home where four million people in the UK still have no bank account. With more households running deficit budgets, we can be certain of a huge increase in late payments, mortgage defaults and bad debts that will drastically change the personal finances of millions for years to come. How financial services responds to this will be key to how our society develops into future. I am sure that the fintech sector can contribute to society’s safety net in this high inflationary environment making ‘Fintech for Good’ a reality.”

Eduardo Martinez Garcia , CEO & cofounder of SaaS fintech platform Toqio “Financial institutions need to keep

transforming their offerings digitally and expanding their services to remain competitive. With market circumstances changing so rapidly all the time, entrepreneurs leading the change in fintech are faced with continuous challenges when trying to build and scale their businesses. In this scenario, I’d say it is crucial for leaders to keep fostering creativity and diversity as these are the things that will help us move the industry forward in 2023 and beyond.”

David Green is the CEO of Earnest , a fintech focused on making higher education accessible and affordable “Fintech is an interesting industry with great momentum, but we will create true change only when we stop thinking in silos. I’m excited to see what 2023 brings in terms of unexpected collaboration across industries that incorporate fintech, and to see new ways of bringing financial services to products or companies people are already familiar with. I hope through this consumers gain accessibility to personal finance in a way that helps them understand how to set themselves up for financial success. Ultimately, a product where form meets function is a great one!”

well as ensuring the financial health of the fintech industry itself.

Finding sustainable and healthy business models, gaining competitive advantage through flexible user-friendly products, and bringing niche and futureready technology to the mainstream, are some of the critical elements to focus on. At the same time, we must balance a steady pace of innovative reform, and embrace comprehensive regulation to redefine traditional methodologies and encourage meaningful inclusion of all sections of society.”

Nick Chandi, CEO of ForwardAI , a fintech providing aggregated access to accounting and business data

Silvia

Mensdorff-Pouilly, senior VP at FIS Banking and Payments Europe“In the last decade we have seen fintech come of age and begin to transform traditional financial services into an industry fit for the future. But we now find ourselves in a very different macro-economic environment and fintech has a crucial role to play in supporting financial health for everybody, including corporates, consumers and merchants, as

“Financial institutions and fintechs need to jointly educate small and medium businesses (SMBs) about the benefits of what fintech can do for them. Almost nine in 10 US consumers already use fintech apps and services, but there hasn’t been the same level of products, services, and adoption in the SMB space due to the complexity of the market. Many studies show that SMBs exhibit consumeresque behaviour and remain a vastly underserved market. They have enjoyed better services and products as consumers from the accelerated digitisation caused by the global pandemic, and the same level of products is now finally just catching up in the SMB space too. By educating SMBs on the value of fintech and closing the ‘expected experience’ gap, we can drive more adoption, more revenue, and more innovation. This positive loop can ultimately propel technological and financial advancement for SMBs and fintechs.”

Gemma Young, founder of fintech community Women of FinTech

“Actionable inclusion of social mobility would really move fintech forward in 2023. We face the cost of living crisis and a downturn in the economy, and should embrace social mobility to have a workforce who can bring a different background to finding solutions to these problems. By actionable inclusion I mean that rather than just talking about the importance of diversity, like so many have over the years, that each company chose achievable tasks for the year ahead that they can action to create inclusive workplaces so that diversity can thrive. This could be as simple as visibility, having diverse and inspiring speakers come to your company and inspire your workforce. Or you could create a role for someone who couldn’t afford university to learn on the job so that you are supporting social mobility.”

Ripsy Bandourian , head of open banking network Plaid Europe

“The fintech sector has come a long way over the last few years, with millions of customers across the globe educating themselves on new processes, apps and available services, including open banking. However, there is a sector-wide need to embrace this further, push the innovation limits we haven’t imagined yet, and help consumers in a time of need. While many people across the UK and Europe may turn to a ‘back to basics’ approach to finance, that doesn’t mean abandoning digital tools. There is a huge

opportunity for fintech companies to innovate as more and more people report fintech is creating real benefits in their financial lives. To enable continued growth, further development will be required – and a large part of that lies in moving regulation from open banking to open finance.

Open finance has the power to provide consumers with a holistic view of their finances, by opening up mortgage, investment, and pensions data. Without permissioned access to these data sets, there’s only so much fintech companies can create to help people manage their money. More access to more types of data means more innovation, and we hope regulators can see that and evolve policies soon.”

Slav Kulik , CEO and co-founder at software development firm Plan A Technologies

“There’s certainly a lot of great innovation in the field today, but there are also a lot of, well, copycats. I see a lot of companies basically just trying to recreate what others are doing, rather than trying to come up with something more unique. Obviously good ideas catch on, and there’s nothing wrong with learning from what others have done and adopting best practices. But I’d sure love to see more companies trying new things too instead of just trying to chase others. I believe the fintech world will continue to evolve dramatically over the next few years, and that remarkable things are possible if we take full advantage of it.”

Mike Sha , CEO and co-founder, SigFig, a US-based enterprise financial technology firm

“In many ways, 2023 is no different than any other year. Fintechs will continue to thrive by maintaining a relentless focus on the end consumer and using the power of technology and software to meet their needs in ways that are even better than what end users might have imagined. For SigFig, we will continue to do this as a white label partner to the world’s largest institutions, enabling them to focus on fostering consumer relationships while we focus on delivering customer solutions that drive scale and satisfaction.”

Ronan Burke, co-founder and CEO of Inscribe, a fintech solution for fraud detection and risk management

“The next big shift in fintech will come from advancements in terms of what it means to be able to access financial services. In this online world, what does it mean to natively onboard or underwrite someone natively? That’s going to be really different than what was done previously. That’s why we’re seeing it happen now across the fraud, identity and risk space, but also across all the various parts of the financial stack. And we’ll continue to see companies building tools for this native stack.”

Rodger Desai, CEO and co-founder of identity verification and authentication platform Prove “Businesses that prioritise the digital consumer experience and modernise

their acquisition, transaction, and engagement journeys while controlling for fraud will capture market share in 2023, as consumers flock to and remain loyal to businesses that respect their time and security. In a digital world, phones are by far the most secure, accurate, and frictionless way to prove identity, and Prove’s authentication technology will continue to be a key tool in making digital journeys far better.”

Tosin Eniolorunda , founder and CEO of TeamApt , a fintech providing business and banking solutions to SMEs

“In emerging markets, including Africa, fintechs have made great strides to digitise payments and operations for businesses and consumers in recent years. However, ensuring that these products are trusted among users is becoming increasingly important. For example, in Nigeria, online bank transfers are becoming an extremely popular method for consumers to pay businesses as they move away from cash. But businesses are mostly untrusting of this solution, because of issues related to delayed settlement times and the risk of fraud from poor KYC checks.

Building solutions that provide better KYC checks and instant settlements can help to boost trust levels as businesses adopt digital solutions in these markets. A greater focus on tackling these trust issues will be essential in 2023 to accelerate the adoption of digital financial services on the continent.”

Central bank digital currencies, or CBDCs, are digital versions of a country’s physical currency and are controlled by governments in the same way traditional currencies are. More than half of the world’s central banks are exploring or developing digital currencies, according to the International Monetary Fund (IMF), with nearly 100 CBDCs in research or development stages such as: the eNaira in Nigeria, unveiled in October 2021, and the Bahamian sand dollar, which made its debut in October 2020.

State-backed digital currencies are mooted to improve both domestic and international payments processing while also providing greater oversight and legitimacy. International cooperation – with a number of countries looking to collaborate to set standards for digital currency design – is expected to boost cross-border payment systems.

However, as Varun Paul, director for CBDCs and financial market infrastructures at digital asset custody, transfer and settlement platform Fireblocks, points out, there is huge variation between digital currencies.

Paul says: “One way of thinking about the difference is that some countries simply have more to gain from a CBDC than others. Retail CBDCs have the potential to increase the ease, speed and efficiency of retail payments, so countries with slow, expensive or clunky payments systems see an opportunity to leverage this new technology and leapfrog ahead, as in Nigeria. CBDCs can also increase

financial inclusion by providing access to the unbanked, so countries with lower banking penetration and large rural populations, like Brazil, also see this as an opportunity.

“Meanwhile, developed countries with large financial systems, such as France or Singapore, have focused more on wholesale CBDCs, where improvements in speed and cost can have a more significant impact, given the large volume of transactions between financial institutions and across borders.”

David Schwartz, president and CEO at Financial and International Business Association (FIBA), suggests Nigeria, Bahamas and China are currently leading CBDC development due to financial inclusion to individuals and businesses.

“Data from EFInA (Enhancing Financial Innovation & Access) in 2021 shows that more than half of Nigerian adults (51 per cent) are using formal (regulated) financial services such as banking, microfinance bank, mobile money, insurance, or pension accounts, up from 49 per cent in 2018.

This has largely been driven by growth in banking, with 45 per cent of Nigerians banked in 2020, up from 40 per cent in 2018.

“This growth in digital financial services and agent banking enables faster progress toward even more financial inclusivity, particularly for previously excluded groups such as women, rural and Northern Nigerians.

“A report by the IMF shows that in the Caribbean, the Bahamian CBDC created Sand Dollar has the potential to ‘foster financial inclusion and payment system

resilience’. And although the Sand Dollar has not quite taken off since its inception pre-Covid, there are major plans for education and information campaigns to push the adoption forward with the end goal of a payments systems modernisation and financial inclusion and accessibility for its citizens.

“Since the UN recognised inclusive finance in 2005 as a development concept, China has been committed to the advancement of digital technologies which naturally would include a shift to financial inclusion. The government’s 2016-2020 financial inclusion plan explicitly encourages digital technologies given that over 95 per cent of China’s on-line population of 731 million, accesses the internet through mobile devices. These include access and use of financial services, such as credit, savings, and insurance.”

The countries leading in terms of launching CBDCs are smaller countries, especially those seeking to establish themselves as industry leaders and attractive destinations for businesses in the age of Web 3.0.

This includes Nigeria and several Caribbean countries (Antigua and Barbuda, Saint Kitts and Nevis, and Montseratt, among others). Several countries have launched pilots as well, including China, Malaysia, South Africa, and Saudi Arabia. Meanwhile a number of countries in the Americas and Europe are in the research and or development stage.

Habeeb Syed, a senior associate attorney at law firm Vicente Sederberg’s Los Angeles office, said: “The reasons for developing these CBDCs are varied. There is, obviously,

benefit to be had in terms of preventing crime and illicit transactions (similar to the reasoning India espoused in its demonetisation movement), foregoing the costs associated with printing currency, preventing counterfeiting, and using the CBDC as the basis for a massive upgrade to the country’s financial infrastructure. This last one means faster transaction speeds and less transaction speeds.

“But what many governments may find the most attractive aspect of CBDCs is the prospect of full transparency and comprehensive records. While many have spoken about the illicit transactions blockchain and cryptocurrencies facilitate, at its base blockchain creates an immutable record of every single transaction. Imagine the government having real-time access to view every cent being spent or earned around the world. This would make it much simpler to prevent illicit transactions, to tax, and would allow for mass surveillance.

“Another factor to consider is the push back from those who fear big government will abuse CBDCs, and those who insist on a future built on decentralised financial systems. The latter will likely find little traction, since most more powerful governments and central banks have no reason to play along with a decentralized infrastructure. The former, however, may be able to influence the terms under which CBDCs will be adopted.

“Many countries may simply force their vision of CBDCs on the populace, and some no doubt have the ability to do this. However, it’s likely that the US will need to engage with stakeholders to assure that there are limitations on the government’s ability to abuse the vast amounts of data that would be exposed.”

Now in their ninth year, the British Bank Awards, run by Smart Money People, are back for 2023. The awards are widely recognised as the ultimate award to win within the banking industry, creating fierce competition among providers. In 2022, over 80,000 consumers helped decide the winners through the power of their reviews left on Smart Money People.

Jacqueline Dewey, CEO of Smart Money People said: “As the cost-of-living crisis continues, the financial services market remains incredibly competitive as consumers become increasingly savvy about where their money is going and who’s providing them with great service and innovative solutions. So, with fintech newcomers, established banks and building societies taking part, as well as the partners who support these companies, we can’t wait to see who emerges as winners in the British Bank Awards 2023. Only customers can decide.”

Voting opens on 9 January 2022, and you can vote for your favourite banking provider by visiting smartmoneypeople. com and clicking the ‘vote now’ banner. All customers who vote in the awards will be entered into a prize draw run by Smart Money People to win £1,000.

If you work for a banking firm or provide services to a banking firm and would like to enter the awards, you can encourage your customers to vote for you. To find out more about the nomination process and to get your unique voting link, visit smartmoneypeople.com/ british-bank-awards or email events@smartmoneypeople.com.

VOTING OPENS: 9 January 2022

FINALISTS ANNOUNCED: 20 March 2022

VOTING CLOSES: 11 April 2022

WINNERS ANNOUNCED: 11 May 2022

The British Bank Awards are run by Smart Money People, the UK’s dedicated financial services review site. The awards were launched in 2015 to put consumers at the heart of the industry, as all winners are determined using data collected by Smart Money People’s reviews, ensuring that companies who win are those who really deliver great products and customer service in the eyes of the customer.

Smart Money People’s unique insight platform provides a range of tools that allow firms to understand what their customers are thinking, feeling and saying. All the votes captured for firms involved in the awards feed into the insight available for firms to access.

The British Bank Awards have been covered by a range of national and trade press as well as extensive online coverage, and winning an award provides an excellent opportunity for firms to create their own news stories and content.

Smart Money People analyses the data collated from reviews on financial products to provide customer insight to companies across the industry, showing them what they’re doing well and benchmarking against their peers.

Smart Money People also runs the Insurance Choice Awards and Consumer Credit Awards each year.

The British Bank Awards Finalist, Highly Commended and Winner badges act as a sign of excellence to consumers and financial firms who are looking for great firms to do business with. Our badges have been used in television commercials, tube adverts, billboard advertising and across a range of digital channels.

Smart Money People’s mission is to help the financially active make more successful choices and our community is passionate about finding the best companies to do business with. By taking part, you can help them find your firm too.

With 30 categories, the British Bank Awards span the wide range of the banking industry, and truly recognise those firms who are championing great outcomes and outstanding customer service for their customers.

The British Bank Awards are run by Smart Money People, the UK’s dedicated financial services review site. The awards were launched in 2015 to put consumers at the heart of the industry

Financial organisations are increasingly using smart contract solutions to record financial information, facilitate auditing and transmit data across organisations. In a nutshell, smart contracts are code that enforces the completion of an agreement in a digital way without any paperwork or input from third parties.

Developers create smart contracts by writing code that specifies the rules they want to enact. That code is then pushed to the Ethereum network, which implements the contract. At that point, the contract cannot be edited or altered by anyone and will execute without fail on the terms coded into it. This is extremely valuable for businesses, as automation brings huge efficiencies to time and cost and the code explains with full transparency how assets are processed, so they cannot be changed over time.

One of the best analogies for a smart contract is that of a vending machine, says Felix Bengtsson, chief marketing officer at Web3 strategy game Planet IX. “You plug in a token, stuff happens in the black box, and out comes a treat. The main point here is that it doesn’t matter who you are, as long as you plug in the token, you get your treat.”

Coherent Market Insight predicts that as more and more businesses utilise blockchain for business – contracts are being utilised for mortgages, rents and financial transactions, for example – the smart contracts market is set for lucrative growth in the next five years.

For Ronghui Gu, co-founder of blockchain security firm CertiK and the inaugural Tang Family Assistant Professor of Computer Science at Columbia University, smart contracts are replacing agreements that were based on little more than reputation and backed by complicated, slow, and expensive legal systems.

“Let’s take insurance as an illustrative example,” he says. “When you take out coverage with an insurer, you don’t have much more to go on than their reputation and (hopefully) their history of following through on legitimate claims.

You sign an agreement that can be hundreds of pages long and filled with obscure technical terms and legal language.

“When the time comes to make a claim, you have to hope that it isn’t classified as an act of God or excluded under some other technicality. Although you have a legal contract with the insurer, all the power is on their side: years of experience, teams of lawyers, and so on. And having

this recourse to a fair legal system is the best-case scenario – billions of people around the world have no such infrastructure to turn to.

“Smart contracts even the playing field. The exact terms of the agreement are coded into the contract and reneging on the deal is a technical impossibility. If the conditions of the contract are met, it will execute exactly as both parties agreed on.

“Taking crop insurance as an example of the power of smart contracts, a farmer in Namibia now has the same opportunity

Described as the ‘worker bees’ of blockchain technology, smart contracts are expected to reach maturity in less than five years. But what are they replacing and why are they revolutionary?

Smart contracts even the playing field. The exact terms of the agreement are coded into the contract and reneging on the deal is a technical impossibility

to protect their livelihood as a farmer in Nebraska has had for decades.

The satellites that feed weather data to smart contracts do not discriminate based on geographical location, nor are they subject to manipulation by corrupt legal systems. And reputable underwriters will be able to prove their solvency with real-time audits of their digital balance sheet.

“The same concepts apply to all other types of digital agreements. The exact value of these freer and fairer agreements is yet to be determined, but as more of the world’s business moves online the total

addressable market for smart contracts continues to grow.”

From DeFi to logistics, smart contracts are changing how businesses perform their workflow processes, says Lucas Hamrick, CEO of blockchain technology firm Ore System.

“Smart contacts are capable of performing these functions through the use of Web3 integrated websites or other user interfaces. These dashboards or websites allow users to interact with the smart contract and meet the conditions for the smart contract to begin its execution sequence. Once the permissioned-user satisfies the business’s requirements set to run the smart contract program, both parties of the transaction will receive the desired outcomes.

“Blockchain employment is only in its infancy but will expand over the coming years because of the advantages that it brings along with it. Smart contacts allow businesses can manage inventory, exchange data content, maintain oversight on delivery, and reduce the cost of administrative functions for businesses.”

stolen from DeFi platforms in 2022, we could even describe the security situation as severe. That said, the wide majority of smart contract vulnerabilities are easily avoided. Our suggestion for firms exploring DeFi opportunities is to ensure that comprehensive security audits are undertaken and that the recommendations from those audits are fully implemented. We hope the industry can commit to greater implementation of security checks to achieve greater success in this field.”

Boaz Shoshan, communication strategist at software company Orca, also warns that “the risk with smart contracts is that errors are made in their construction, which are exploited by bad actors (like a ‘loophole’)”.

Despite the lofty predictions, smart contracts are still considered a relatively nascent technology.

When implemented well, smart contracts result in greater security and transparency. However, with the rapid rise of DeFi in recent years, there are concerns over a corresponding rise in security challenges, as hackers target vulnerabilities in such platforms and protocols.

Jasper Lee, audit tech lead at DeFi infrastructure service provider Sooho.io, explains: “With record-breaking funds

“While it’s easy to see how useful smart contracts could be in various sectors, such as digital identity, trade finance, financial security/services, insurance, law, escrow, clinical trials, and many more, the reality is that we are far from using smart contracts for all of those,” says Trey Smith, CEO and founder at Web3 gaming firm MECH.

“For now, smart contracts are by and large used in those sectors where security and certainty are paramount, such as finance and insurance, and where rigidity and automation are not considered a major problem.”

When the pandemic sparked widespread job insecurity, the UK Government provided a beacon of hope with its Kickstart Scheme for young people on Universal Credit. The £2billion scheme was run by the Department for Work and Pensions (DWP) who worked with gateway providers to help employers create jobs for 16- to 24-year-olds.

The Fintech Power 50 became one of the first gateway agencies approved by the DWP to distribute funding and, until the scheme closed in August, has helped connect fintech firms across the UK with young talent.

The programme offered a £1,500 grant for companies to host a six-month placement for ‘Kickstarters’ with their wages paid in full. Wages were paid for a 25-hour working week at national minimum wage, including national insurance and pension contributions.

Sian Morris, head of talent at The Fintech Power 50 said: “The Fintech Power 50 was pleased to be participating in the Kickstart Scheme as a Government Gateway to help launch early careers within the innovative fintech community across 50 participating companies, helping to place 140 previously unemployed young people between the ages of 16-24 years old working in various exciting remote and on-site roles nationwide.

“Many of the various types of placement roles were junior marketing manager, customer success assistant, digital marketing assistant, junior project coordinator, junior support technician, junior data analyst, junior software engineer, junior business analyst, junior web designer, sales admin, account executive, finance and admin assistant.”

● Over £1 million in grants received and paid out to participating Kickstarters

● A total of 50 companies took part in hosting six months placements hiring 140 young, previously unemployed people in to the government funded Kickstart scheme

● 58 converted into permanent positions after the scheme

Grant Sidwell, CEO and founder of UK payment firm Tytonical, said: “The scheme has helped us grow the team by enabling us to take a chance on a young person whom we wouldn’t usually have felt taking a gamble on. They are now a valuable addition to the team.”

While Rajen Madan, founder and CEO at fintech consultancy Leading Point, said: “The scheme has helped us build out more of our marketing function in-house.

The Kickstarters have helped us with design work, website, marketing and content. Each of them have developed skills and taking on next/additional responsibilities and areas of focus aligned to their interest.”

Tosin Oke, director of SME sales at payments facilitator Payoneer, estimates the Kickstart Scheme “helped the business realise over $11million in volume which is highly significant for the company financially, while also creating more effective flows for the sales team which are more customer centric and generate higher revenue for the company.”

Jack Lewis, operations manager. Yoello, said: “The fact that our Kickstarter started on a six month Kickstart role as a junior sales executive and now holds the title of senior business development manager on a permanent basis is testament to his achievements at Yoello. We know we struck gold finding him and want him to know how much he is appreciated.”

Finally, Grace Robinson, managing director at virtual assistant firm Eden Assistants, said: “The kickstart really was just that – a

great jump start to getting my business moving. With the help of my new assistant via Kickstart I was able to move forward on projects I hadn’t previously had time for. Having an extra pair of hands meant my business could grow as we could take on more clients and keep our high levels of service. I also enjoyed the mentoring and getting to know a local young person.”

Companies weren’t the only benefactors. Not only did the Kickstart scheme provide a job for those on Universal Credit, it also helped many open themselves up to a new experience. The Fintech Times’ journalists Tyler Pathe and Francis Bignell both began their careers as Kickstarters.

Pathe (far left) said: “The Kickstarter programme served as an important stepping stone into an industry I don’t believe I would have otherwise entered. It tested my knowledge and abilities in a whole new way, and I will always be in debt to the opportunities it has generated for me in the almost two years since.

“I began our training together with other Kickstarters and was soon getting to grips with a fascinating-yet-complex industry. Fintech moves so quickly, and it’s been really interesting to

see how my personal and professional abilities have developed just as fast due to this programme. I really don’t think that I would be where I am today without the Kickstart. And of course, I am forever grateful to the team at The Fintech Times for their unwavering support and belief in me.”

Chloe Armstrong (left) says: “Being introduced to the Kickstart Scheme was one of the best choices I have made in my career. It enabled me to learn about the fintech and recruitment industry as well as email and content marketing which has led me into the world of email marketing automation.”

As the UK government’s Kickstart scheme comes to an end, The Fintech Power 50 has hailed its success in helping to launch early careers within the fintech community

Indian IT consulting and outsourcing multinational company eClerx Services Ltd is based in Mumbai and Pune, with offices globally. It is engaged in providing solutions to Fortune 500 companies, which include services in business process management, automation and analytics.

The Client Engagement Manager (CEM) will be a senior point of contact for all aspects of a client’s relationship with eClerx. They will be responsible for partnering with clients who have functional responsibilities within and/or across operations, data, technology and change management to help them achieve their goals through consultatively developing solutions.

● Lead development and delivery of innovative proposals

● Think and act critically

● Elicit client feedback and chair governance forums

● Manage and grow the portfolio of services

● Bachelor’s degree (or equivalent) in business or finance

● Excellent problem-solving and consultative capabilities

● Domain knowledge and industry awareness

● Excellent client-facing skills

eClerx has a range of benefits on offer to employees across territories. It provides a flexible work environment with remote work options available along with paid time off, holidays, sick leave and family leave. The company believes in equal opportunities and supports employees to shape their careers through various diversity, equity and inclusion initiatives.

Lloyds Banking Group is a British financial institution and one of the UK's largest financial services organisations, with 30 million customers and 65,000 employees. It provides a wide range of banking and financial services, and is focused on personal and commercial customers. It is now on the mission to build the bank of the future.

Lloyds is recruiting a Head of Engineering as it transforms its digital experience with modern engineering platforms capable of supporting ambitious business strategy targets over the next decade. You'll be a transformational leader who works collaboratively to create empowered teams who are motivated to take on business problems and realise value to customers through excellence in execution.

● Work collaboratively with other technical teams

● Optimise, evolve, deliver efficient operating model

● Support shaping of the roadmap and prioritising outcomes

● Create an organisation that is truly data driven

● Extensive software engineering background

● Understand systems thinking and service design

● Understand the benefits of BDD & TDD

● Automation of everything will be a priority

● Knowledge of modern software development toolsets including DevOps, CI/CD

Lloyds prides itself on being a 'very family friendly company' so offers flexible working hours, as well as agile working practices. Employees receive an annual personal bonus, an employer pension contribution and private medical insurance.

The global leader in business and financial data, news and insight, Bloomberg harnesses technology to connect the decision-makers to accurate information on world financial markets, which helps them make faster, smarter decisions.

The Financial Engineer will be joining a specialised area of Bloomberg that concentrates on offering premium structuring, valuation and risk services to clients including cross-asset flexible, customisable tools and models that illustrate valuation transparency.

● Familiarity with bespoke derivatives term sheets

● Industry standard valuation models

● Strong communication skills

● Ability to assess model results

● Master's degree in a technical area

● Recent experience at a dealer

● OTC Derivatives/Structured Notes

● Strong understanding of derivatives models

Career progression and learning opportunities are the big benefits here. You'll be a part of an organisation that is entering new markets, launching new ventures, and pushing boundaries. Bloomberg’s ever-expanding array of technology, data, news, and media services fosters innovation – and offers nearly limitless opportunities for career growth.

Introduce Weavr, and tell us about your offering?

Weavr is an embedded finance platform. Essentially, what we do is integrate financial services into non-financial applications.

In the past, this was a difficult task, but Weavr makes it easy. As a result, we enable the next generation of B2B and B2C applications and help innovators to create unique and powerful solutions that improve people’s lives.

There are many well-known examples of embedded finance in the world today, such as Uber and Deliveroo. However, as the technology becomes more accessible, we are beginning to see more and more. Ultimately, it’s a technology that can help businesses to become more profitable, develop better relationships with their customers and deliver even more value than before.

What makes Weavr such a good place to work?

There’s a real sense within Weavr that we’re at the start of something important with embedded finance and that, as a company, we’re helping to shape the future. That’s helped us to create a fantastic working environment and strong culture, which values the input of everyone. We put an emphasis on collaboration and an openness that permeates the entire business.

We’re trying to figure out exactly what our customers want, and that process requires everyone’s help. So, whether it’s the tech people who engineer our platform or the sales staff who sell it on to fellow innovators, everybody is committed to the same goal. It was like that when we started with a few team members, growing now to more than 100 and will continue as we expand the business both in the UK and internationally.

Tell us more about your overall culture?

For the first couple of years, we’ve operated a relatively ‘fluid and flat’ working culture. By that, I mean that things aren’t overly hierarchical and there’s more of an emphasis placed on collaborating together as equals. Obviously, as you grow quickly there needs to be some structure in place, not least so that everyone gets a sense of ownership and agency on the various parts that make up Weavr, but throughout over evolution we’ve been careful to hold on to an open culture that makes us feel like a village, albeit one that’s spread over many locations.

I’d also say that Weavr is a company that truly values the interplay of diverse personalities. In the past year or so, we’ve onboarded a lot of different personality types and have had very few problems doing so. I think that’s because of our structure but it also reflects how well our team does in accommodating new members and ensuring everyone fits in.

For example, we have a nice tradition on Fridays when random pairs are picked from across the business to speak and to catch up. While some of the conversations may veer into professional territories, the aim is for it to be non-work related.

It’s great to have important face-to-face time with these people even if it is over a webcam, or mobile phone.

Tell us more about your core values?

I always say to people: ‘values aren’t what your slide deck says they are’, but more

that values are how you behave as an organisation and, more specifically, how you behave as a leader. I also think that values are highlighted in moments of difficulty. Sometimes things go wrong in business and it’s in these periods when you prove what your true values are.

Hard as it is, I really see it as a big part of my responsibility to have values that don’t just look great in the telling but are authentic – that they mean something to the team and are reflected in how we act when no one’s looking. As an example, when something goes wrong, we remind ourselves to resist finger-pointing. It doesn’t help anybody to feel they need to direct blame away from themselves. We want self-reflective staff who are ready to turn mistakes into valuable lessons.

I should say that when we interview staff or speak to former employees about their experiences working at Weavr, we often get the feedback of it being a ‘very respectful’ workplace culture. That’s a great thing to hear and something I’m really proud of as a leader, as it’s a value that is a great foundation for bringing out the best in people.

If this sounds too cuddly, Weavr is a very ambitious company and demands a lot from every person in the team. We try not to make it harder than it needs to be, but it’s hard to change the world, and we have to deal with failure in fair proportion to success. Sometimes ambition can create a toxic culture that burns out people – we take great pains to avoid this.

Tell us more about your recent successes?

It’s certainly been a very busy few months for Weavr. The concept of embedded finance is rapidly becoming more mainstream. In fact, it seems like everyone is talking about it right now.

That’s really helping us, and we’ve managed to secure some major customers in the past few months, with many more exciting conversations happening behind the scenes as we speak.

We have recently announced our Singapore expansion, which is the culmination of many months of work and several visits to secure the right local partners and talent. This means that, in addition to the ever-growing community of innovators we’re serving in the UK and Europe, we’ll start serving innovators that are addressing markets in South East Asia.

We were also delighted to launch our latest industry whitepaper, entitled ‘Embedded Finance: Bringing Value Into Focus’ in early October. I think it’s one of the best summations of embedded finance available online and provides some amazing insights into what sets our Plug-and-Play Finance solution apart from the crowd.

We’re starting to see strong evidence about just how much embedded finance can transform a business, which is a huge moment for the entire sector. As we move forward, we can begin to talk about embedded finance as more than just a concept. We now have real-world examples of how it helps to improve performance within various businesses.

That’s going to help us, but it will also require a shift in how we speak about the topic. In some ways, it’ll be a little sad to lose the shiny tag of being ‘new’ and ‘trendy’ but it’s a natural evolution and one that will put us in great stead for further growth down the line. It also allows us to create more case studies and target customers who are more established, such as multinational corporations.

Simply put, things are probably going to become a bit more boring in the short term but in a way that benefits a lot more lives. I can live with that; my goal is to help bring embedded finance to every business that could benefit from it. It’s beginning to feel like we have a well-mapped path towards that goal. I couldn’t be more excited to make it happen.

Web: www.weavr.io Twitter: @WeavrPayments

Cryptocurrency and blockchain technologies have developed at an incredible pace, and while their uptake is on the up with more and more companies either adopting crypto payments or some form of technology using blockchain, complexities continue to baffle the parts of the population that are not in tune with the advanced technologies.

How out of tune are they? Research from Traders of Crypto found that more people believed Cardano to be a cheese or drink, than a cryptocurrency, and just under a third of its respondents had no clue what Ethereum was. In fact, 22 per cent of respondents didn’t have a clue what crypto was at all.

So, does that mean those who don’t understand it are going to be left behind? Absolutely not. One of the topics discussed within Omid Malekan’s Re-Architecting Trust: The Curse of History and the Crypto Cure for Money, Markets and Platforms is the idea that something decentralised can only see long-term success if the vast majority of a populace can trust it. Trust enables people to feel confident in learning about the technology they’re using, creating a positive cycle of trust and education. This goes both ways, as Malekan discusses how people understanding technology will also enhance trust too.

Of course, no one wants to trust anything blindly, but that begs the question: where is a good place to get an initial understanding? While I could suggest Malekan’s first book, The Story of the Blockchain: A Beginner’s Guide to the Technology That Nobody Understands (I must say the title is very fitting for the question I posed), I would be very inclined to put forward Re-Architecting Trust.

From the get-go, Malekan creates a relatable narrative that enables both crypto fanatics and complete novices in the field to find their footing. This is in large parts due to the structure of the book. Instead of jumping into the thick of things, dissecting blockchain’s usage in the modern world, Malekan turns back time and makes the focus of the book on ‘trust in finance’.

The ideology of trust remains a constant throughout both history and his book: the idea of community workers vs free loaders

is not exclusive to the modern financial world; the linear progression of the world’s evolution around financial trust is what makes the book so easy to read.

This progression of trust makes a non-fiction book almost feel fictious, in that you follow the story of ‘trust’ before another major character is brought into play and you follow their story too. The second character in question is crypto. However, the introduction of the second character is not challenging at all. Despite

comparisons are brought to the fore between the ancient world’s finances, the renaissance era and that of the 20th century. Despite the huge difference in time, none of the discussion points feel out of place, as they all help set the scene for trust in blockchain and cryptocurrency.

The discussion surrounding trust in finance is very approachable, but it’s the further comparisons to modern day platforms that enhance this. The topic of a centralised incumbent vs a decentralised entity is incredibly intriguing and made throughout the book, constantly making you wonder whether the time of money as we know it is simply outdated, and in need of reform. Cue cryptocurrency.

Each chapter feels well thought out as Malekan establishes what the status quo is, before breaking down its flaws and how crypto could be a solution to this. Crypto and blockchain aren’t perfect though, and Malekan does a good job of identifying their drawbacks. However, most of these drawbacks could be tackled if crypto had more mainstream trust – despite crypto being inherently untrustworthy.

Financing Our Future: Unveiling a Parallel Digital Currency System to Fund the SDGs and the Common Good by Stefan Brunnhuber Available: Kindle and Hardback

FinTech Women Walk the Talk: Moving the Needle for Workplace Gender Equality in Financial Services and Beyond by Nadia Edwards-Dashti Available: Hardback, and Kindle

often being highly associated with complex terms and mechanisms few understand, Malekan’s discussion of crypto does not rely upon jargon to sound informative. The structure of the book makes it that crypto’s introduction merely feels like the logical piece to follow in a puzzle, rather than being something overly complex.

Before even delving into the world of crypto, a variety of captivating

One of my favourite quotes, and a sentiment that comes up multiple times throughout the book, is “Yesterday’s confusing solution becomes today’s status quo”. This theme of being cautious of the unknown frustrates the reader: the whole time you find yourself saying “why are people so scared? Look at what happened before. It’s only a matter of time before this becomes the status quo.” Harking back to what I said before about crypto being the second main character in this book, it feels like you’re rooting for an underdog to rise up against adversity, and that always makes for a fun read.

The difficulty I found when writing this review was that I wanted to share everything I’ve learned. Every aspect of the book creates a scope for discussion. I have spoken to various friends who aren’t in the financial industry but have at least heard of crypto and been able to share my learnings, with many being impressed and intrigued by the talking points raised. We’ve been able to have a conversation exchanging ideas and concepts brought up in Re-Architecting Trust. In my eyes, that alone is the hallmark of a good book, and definitely one I would encourage others to read.

Embedded Finance: When Payments Become An Experience by Scarlett Sieber and Sophie Guibaud Available: Hardback, and Kindle

Digital For Good: Stand for Something… or You Will Fall by Chris Skinner Available: Hardback

Beyond Good: How Technology is Leading a Purpose-driven Business Revolution by Theodora Lau & Bradley Leimer

Available: Kindle, Hardback and Paperback