On the LEVEL

FALL 2022

Season of Change Autumn ushers in challenges, CHIPS, and a graduating class of new apprentices.

Season of Change Autumn ushers in challenges, CHIPS, and a graduating class of new apprentices.

Times are strange… but compared to what? I sometimes wonder if the generations before us didn’t think the times they lived in were strange and that the next generation was never going to amount to much.

The local, national and international scenery keeps changing: New York State redistricting sending elected officials into a panic, domestic economy spiraling out of control, turmoil throughout the world.

Our business partners are changing as well:

● My good friend of 40 years, Joan Cusack-McGuirk, has retired from Montefiore St. Luke’s Cornwall and Dan Maughan has taken over the reins.

● Mike Gaydos has retired from the Ironworkers Local 417 and Matt Stoddard has stepped up to the helm.

● One of the great SMACNA chapter executives, Bruce Sychuk, from British Columbia, retired on Aug. 31.

● And pending retirees, Bob Kaehler, president of Perreca Electric and former CCA Board president (as well as a great sounding board and advisor to me), and Maria Martini from the Bricklayers’ Newburgh office, are starting their countdowns of working days.

By the way, these folks are all younger than me and I frequently am asked when I am throwing in the towel. My answer is always “not anytime soon.” I still enjoy working with my colleagues, overcoming the challenges and helping to bring about positive change to our members and communities.

While the thoughts of playing more golf, wintering in warmer weather and sleeping until 7 a.m. during the week do sound marginally attractive, I am not ready yet. I like hatching and tweaking new ideas into shape and the challenges of putting out fires. I like meeting new people, working with my business partners and members, and making a difference in our communities. Certainly, keeping our associations’ goals top of mind with our elected officials is not something I want to step away from.

Yep, I’m still in it for the long run. Some days are better than others but I couldn’t be happier working with our office staff to deliver top-notch service to our members and partners. As for the challenges that are looming ahead of us, I say bring them on and we’ll slice and dice them into opportunities for more jobs for our businesses.

To me, it’s all about the relationships and challenges and I still enjoy them every day. Please join me in wishing those that joined the retirement ranks this year (or are planning on doing so in the near future) all the best in a long and healthy next phase.

To the people filling the shoes of the retirees, much success and I look forward to working with you! As for me, you’re stuck with me until it’s not fun and challenging anymore.

All the best,

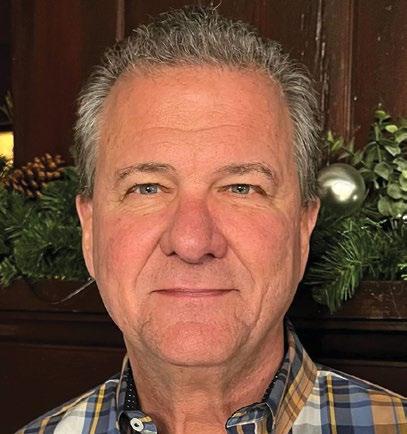

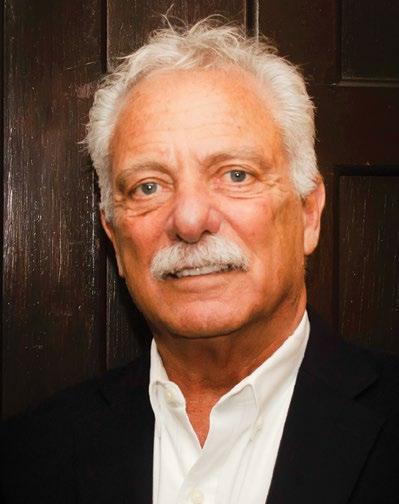

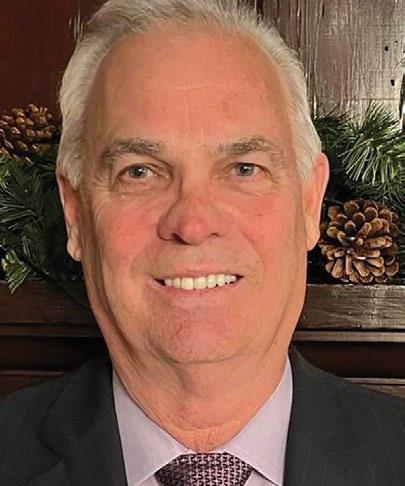

Construction Contractors Association Mike Adams — President James McGowan — First Vice President Joseph Perez — Second Vice President Josh Ingber — Secretary-Treasurer Joseph Barone Roland Bloomer Dan Depew Scott Dianis Louis J. Doro Ira Gold Jay Harrison Robert Kaehler Alfred D. Torreggiani Charlotte Van Horn

Fabricators, Erectors & Reinforcing Contractors Association Justin E. Darrow — Chairman. Jake Bidosky — Vice Chairman Bernie Hillman — Secretary Daniel Teutul — Treasurer

SMACNA of Southeastern NY James D’Annibale — President Steve Mulholland — Vice President Dominick DiViesti — Treasurer Mark DiPasquale — Secretary Louis J. Doro — Immediate Past President Daniel Harden Richard K. Berg Walter “Chip” Greenwood William Haskel Dennis LaVopa, Jr.

Association Staff: Alan Seidman — Executive Director Lisa Ramirez — Director of Communications and Membership Millie Rodriguez — Executive Assistant Vincent Rouhotas — Administrative Assistant

The bipartisan CHIPS and Science Act of 2022 was signed into law Aug. 9, federal legislation proponents say will position U.S. workers, communities, and businesses to win the race for the 21st Century and create countless jobs, boost domestic supply chains, and, at its core, significantly ramp up semiconductor production and research.

The construction industry is celebrating the news. Not only will CHIPS lead to the construction of semiconductor plants, but support facilities - everything from schools and training facilities to research centers and the necessary infrastruc ture - must also be built, generating jobs for years, even for those without experience in semiconductor plants or manufacturing. And perhaps most significantly, it also supports goodpaying, union construction jobs by requiring Davis-Bacon prevailing wage rates for facilities built with CHIPS funding.

“The CHIPS Act is yet another significant step forward for the men and women who build our country from the ground up,” said Patrick Purcell, Executive Director, New York State Laborers’ LECET

(Laborers-Employers Cooperation and Education Trust). “By investing in technology infrastructure, our country is making an investment in working men and women. New York State is open for business and the members of the New York State Laborers Union are ready to build the future, and they are the best workforce to do it safely, with skill, on time and under budget.”

These funds also come with strong guardrails, ensuring that recipients do not build certain facilities in China and other countries of concern, and preventing companies from using taxpayer funds for stock buybacks and shareholder dividends. It also requires recipients to demonstrate significant worker and community investments, including opportunities for small businesses

and disadvantaged communities, ensuring semiconductor incentives support equitable economic development.

In New York, lawmakers are already making the case to bring one of several National Semiconductor Technology Centers to the Capital Region, which would serve as a hub of talent, knowledge, investment and equipment and has the potential

to establish upstate New York as an epicenter of American chip manu facturing and research.

America invented the semiconduc tor, and chips now power everything from medical devices and cars to computers, smartphones and weapons systems. The U.S. once dominated the supply chain, but in 2019 U.S. production accounted for only 11 percent of global

semiconductor fabrication capacity, down from 13 percent in 2015 and continuing a long-term - and profound - decline from 40 percent in 1990, reports the U.S. Commerce Department. Much of the overseas semiconductor manufacturing capacity is now in Taiwan, South Korea, and, increasingly, China.

Further, amid the strains in international supply chains caused by coronavirus lockdowns and border closures, shortages were exacerbated as producers shifted production to meet demands for electronic devices that require more complex, higher-margin chips, leaving more traditional industries such as automobiles with insufficient supplies.

The Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act is a $280 billion investment in manufacturing, research, and technology. Through federal subsidies, grants, loan guarantees, investments, and tax credits, the CHIPS Act will funnel money directly to manufacturers and other industries. The CHIPS and Science Act:

• Provides $52.7 billion for American semiconductor research, development, manufacturing, and workforce development. This includes $39 billion in manufacturing incentives, including $2 billion for the legacy chips used in automobiles and defense systems, $13.2 billion in R&D and workforce development,and $500 million to provide for international information communications technology security and semiconductor supply chain activities.

• Provides a 25 percent investment tax credit for capital expenses for manufacturing of semiconductors and related equipment. These incentives will secure domestic supply, create countless goodpaying, union construction jobs and high-skilled manufacturing jobs, and inspire hundreds of billions more in private investment.

CHIPS Act Promises to Create Jobs, Jumpstart Economy continued...• Requires recipients to demonstrate significant worker and community investments, including op portunities for small businesses and disadvantaged communities, ensuring semiconductor incentives support equitable economic development.

• Requires Davis-Bacon prevailing wage rates for facilities built with CHIPS funding.

• Authorizes $10 billion to invest in regional innovation and technology hubs across the country, bringing together state and local governments, institutes of higher education, labor unions, businesses, and community organiza tions to create regional partnerships to develop technology, innovation, and manufacturing sectors. These hubs will create jobs and position communities to lead in high-growth, high-wage sectors such as artificial intelligence, advanced manufacturing and clean energy.

• Provides STEM (science, technology, engineering, and mathematics) education and workforce development opportunities so more Americans can participate in good-paying skilled jobs. Further, CHIPS authorizes expanded investments in STEM education and training from K-12 to community college, undergraduate and graduate education.

• Authorizes investments to expand the geographic and institutional diversity of research institutions, including Historically Black Colleges and Uni versities, other minority-serving institutions, and academic institutions providing opportunities to historically-underserved students.

• Gives agencies and institutions the mission and the tools to combat sexual and gender-based harassment, a demonstrated barrier to participation in STEM.

Source: U.S. Federal news brief/fact sheet, Aug. 9, 2022

The construction industry can look forward to long-term job growth and economic development. As a result of the CHIPS Act, communities across the country are already approving multi-million dollar projects to build and improve roads, water infrastructure, and new buildings. It’s estimated there are about $33 billion in semiconductor fabrication plants in the planning stage. Companies have already announced projects, including:

• Micron: $40 billion investment in memory chip manufacturing, critical for computers and electronic devices, which will create up to 40,000 new jobs in construction and manufactur ing. This investment alone will bring the U.S. market share of memory chip production from less than 2 percent to up to 10 percent over the next decade.

• Qualcomm and GlobalFoundries: Have announced a partnership that includes $4.2 billion to manufacture chips in an expansion of Global Foundries’ Malta, New York facility.

Qualcomm, the world’s leading fabless semiconductor company, announced plans to increase semi conductor production in the U.S. by as much as 50 percent over the next five years. (“Fabless” means the company designs and sells the

hardware and semiconductor chips but does not manufacture the silicon wafers used in its products; instead, the fabrication is outsourced to a manufacturing plant or foundry.)

• Intel and Samsung: Have signaled an intent to relocate and expand operations in the U.S.

Source: U.S. Federal news brief/fact sheet, Aug. 9, 2022

CCA members are among the most generous folks around. They’re committed to their communities, and no matter how busy things get they’re volunteering, fundraising, and finding all kinds of wonderful ways to give back.

We’d love to shine a light on these good deeds. If your organization or someone within it is out making the world a bit brighter, please tell us about it so we can include it in “On the Level.”

Whether they’re coaching a local team, serving as a volunteer first responder, collecting supplies for a shelter, or giving their time and skills to worthy effort, we want to know.

We can’t wait to share these inspiring stories with our On the Level readers!

We are pleased to welcome Price and Price Enterprises, Inc. (DBA Melwain Surety Bonds) and the Fischer Group at Graystone Consulting-Morgan Stanley to the Construc tion Contractors Association of the Hudson Valley.

Price and Price Enterprises, Inc. | DBA Melwain Surety Bonds A family owned surety agency operating in the Long Island area for three generations, and their success depends on the loyalty and confidence of their customers. They value this relationship and show their appreciation in the form of excellent and expedient service. Their broad range of markets allows them to place difficult risks, otherwise turned down by other agencies. They understand that everyone does not have the same financial situation, and have therefore affiliated themselves with different sureties who tailor their response to your individual needs.

516-295-6081 | www.melwainbonds.com.

845-562-4280

LRamirez@CCAHV.com CCAHV.com 330 Meadow Avenue Newburgh, NY 12550

The Fischer Group at Graystone Consulting - Morgan Stanley Led by founder Marc Fischer, an Institutional Consulting Director with more than 30 years of experience, and is one of the original 25 teams selected to join Graystone in 1991 and remains committed to its core principles of objectivity, transparency and advanced investment solutions. Over the years, the Fischer Group has been recognized as one of the first teams to embrace alternative investments as a means to reducing overall portfolio risk, while also increasing a client’s probability of achieving desired returns. They continue to leverage knowledge and expertise and bring fresh, forward-think ing strategies to a broad array of institutional clients and private wealth families.

585-389-2271 | www.graystone.morganstanley.com/thefischer-group-at-graystone-consulting

The CCA congratulates the 14 graduates of the Build-n-Beyond Hudson Valley pre-apprenticeship program, who were celebrated June 1 in a ceremony at Laborers Local 17 in Newburgh.

The graduates represent the second cohort of the program, in which young and early-career women and minority candidates complete 160 hours of instruction as pre-appren tices, setting them up for automatic entry into full apprenticeships in the building trades.

Through hands-on learning, site visits, and classroom instruction, pre-apprentices tackle labor history, industry skill-building, personal finance, tools/materials, and specialized coursework such as OSHA-10, CPR/First Aid, construction math, excavator safety, and more.

LEVEL:

As Local 17 Business Manager Todd Diorio individually announced the graduates, each selected a hat or t-shirt representing their appren ticeship path. They also received a nice stash of gifts to ready them for the job, including boots, hard hats, safety vests and tools.

The class of 2022 included Tylishia Stewart, Ivan Gonzales, Jordan Medina, Richard Rosales, Kevin

Correa, Kamrin Langford, Ameer Williams, Marvin Hall, Devone Jackson, Grace Alvarenga, Elizabeth Alvarenga, Julianna Blizzard, Dani McCarvel and Veronica Humbert. Please join us in wishing them a long, successful and safe career!

To learn more about the Build-nBeyond Hudson Valley program contact Director Jeff Beck at jbeck110@gmail.com.

What obligation does an injured worker have to seek work, even if they are no longer capable of performing their pre-injury job?

In New York State, the law is complex and nuanced, but the bottom line is that workers who can no longer perform their pre-injury job duties as a result of an injury sustained on the job are required to seek work within their new limitations. Recent court decisions, as well as the 2007 Spitzer reforms, have eroded and narrowed this principle, but the thrust of public policy has always been to encourage everyone to work within their capacity, even after injury. But that may soon change.

At the close of the last legislative session, late in May and early June, the New York State legislature passed a bill that would make a fundamental philosophical change to the Workers’ Compensation System: A1118/S.768 would alter the definition of temporary total disability. If the governor signs this legislation, an injured employee would be considered totally disabled if they are unable to perform their pre-injury job duties or any modified employment offered by the employer.

Supporters of the bill argue that it is a necessary protection for employees. Under the current system, as an injured employee’s medical condition improves, the employee’s benefits begin to decrease. Advocates for injured workers believe this decrease is unfair. In order to continue to receive benefits, employees must make a good faith effort to find work within their medical limitations.

Since not all employers can accommodate lighter duty, claimants are forced to seek work on the larger employment market and may find it difficult to return to their pre-injury position. Supporters believe injured workers should not face any financial penalty for not returning to their pre-injury job.

Opponents of the bill argue that A1118/S.768 reflects a radical change. The purpose of workers’ compensation is to provide financial protection for workers who can’t work as a result of occupational injury, and to give them the medical and vocational aid they need to return to the workforce. There is nothing unfair, they argue, about requiring someone to continue working within their limitations either while recovering from injury or when they have reached maximum medical improvement.

Moreover, law judges exercise discretion and now weigh occu pational factors when determining the lost wage-earning capacity of permanently partially disabled workers. Workers’ with poor prospects for reemployment receive higher benefits than those who can readily find employment. Finally, employees who return to work at a lower salary than their pre-injury wages can receive workers’ compen sation benefits that bridge much of the gap in compensation.

Opponents of the bill are also concerned about the financial impact of the legislation. The legislature passed the bill without even considering the impact of this change on the New York State economy and on the competitiveness of New York businesses. As of this writing the New York Com pensation Insurance Rating Board has not priced the cost of making this change. The private market for disability insurance has vastly curtailed the writing policies that strictly define disability as your

Barry Lovell, President Lovell Safety Management Co., LLC.

Looming Workers Comp. Changes have Supporters, Opponents inability to perform your “own occupation” because the cost of such policies was too expensive. Our own anecdotal review of a subset of our claims suggests that permanent partial disability claims may increase in cost by as much as 39 percent.

Even if one agrees with the idea that injured workers should not face any financial penalties nor have to find work within their limitations if they can’t go back to work with the same employer, New York State may simply not be in a position to provide this generous benefit at this

moment. The economic disruption of COVID-19 has made New York less competitive with other states. Now may simply not be the time to take this pioneering step in the expansion of workers’ compensation benefits.

These are some of the workers’ compensation bills passed by the NYS Senate and Assembly during the 2022 legislative session. They must be presented to Governor Hochul before the end of the year for veto or signature into law:

This bill defines “temporary total disability” as an injured worker’s inability to perform their pre-injury employment duties or any modified employment offered by the employer that is consistent with the worker’s disability.

The bill’s sponsors say it will encourage employers to establish return to work programs and ensure that permanently disabled workers with serious injuries are given the opportunity to return to work. In addition, sponsors say current wage replacement for workers receiving temporary benefits is insufficient. If signed into law, it becomes effective immediately. The New York Compensation Insurance Rating Board has not yet calculated the cost of this bill. Lovell did a random sample of 25 recent claims that featured temporary partial benefits and found that, when recalculated at the temporary total rate, claims costs increased by 39 percent.

The 2017 legislature, in recognition of the high standard required for mental stress claims, and the hazards and exposure experienced by first responders, removed the restriction that a mental stress claim for a first responder had to be greater than the stress sustained by a similar worker. This bill expands that exemption to cover all workers who allege an extraordinary work-related stress to file a mental stress claim irrespective of a work-related emergency. If signed before the end of the year, this bill would be effective Jan. 1, 2023. The New York Compensation Insurance Rating Board has not calculated its financial impact.

This bill increases the minimum weekly compensation benefit for workers who sustain new accidents (on or after the date the bill is signed) and ensures that benefits for permanent or temporary partial disability, or permanent or

temporary total disability, be at least one-fifth of the New York State Average Weekly Wage (SAWW). The current minimum weekly benefit for those earning more than $150 per week is $150.

Sponsors say the legislation would “provide equity and fairness to low-wage workers injured on the job and ensure that future benefits are adjusted automatically with inflation.” The current SAWW is $1,688.19 for injuries occurring July 1, 2022 through June 30, 2023. If this bill passes, employees would be entitled to no less than $337.64 per week (one-fifth of $1,688.19), in lieu of the current $150 per week.

If the injured worker receives a wage equal to or less than one-fifth of the SAWW, their benefit would be their actual earnings, so those with wages of $337.64 per week or less would receive full salaries.

The New York Compensation Insurance Rating Board has not calculated the financial impact of this bill.

“Y’know they’re still shippin’ them over here. They put ‘em in cars, they put ‘em in yer tv. They put ‘em in stereos and those little radios you stick in your ears. They even put ‘em in watches, they have teeny gremlins for our watches!”

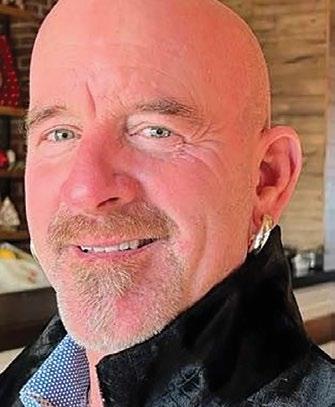

— Murray Futterman Dan Depew Director of Business Development Holt Construction

This publication is for people in the construction industry; builders, suppliers, engineers, architects and owners. Most of you reading this live here in the United States, and what you do every day underscores the proud intent encompassed by the phrase “Made in America.”

It was the patriotic mantra echoed in homes in the early 1940s, when the U.S. was at war with Germany and Japan. This was based on both national pride and necessity; America was one of the few countries still manufacturing anything, and we needed to swiftly grow our economy. As soldiers returned home, the demand for “Made in America” remained strong.

I first became aware of “Made in America” when I was about 10 years old while shopping with my mom, and it seemed every clothing rack and every shelf was filled with products boasting “Made in America.” This was also when one of my favorite movies, “Gremlins,” was in theaters, and there’s a memorable scene in which Murray Futterman tells his grandson why folks should buy American-made products:

• Futterman Reason No. 1: As a WWII veteran, buying American was a matter of national pride.

• Futterman Reason No. 2: Foreign countries hide Gremlins inside products bound for the U.S. Those Gremlins would then, at a pre-ordained time, simultaneously destroy the cars, planes and dishwashers upon which Americans rely, creating mass chaos and destruction.

That’s not what happened in the film, but by the early 1990s, around the end of the Gulf War and with the economy beginning to wane, the U.S. began to walk back the “Made in America” focus. It’s when we saw the lean into cheaply made goods, and large trade treaties like NAFTA pushed low cost manufacturing. Thus began the wave of cheaply made, short lasting, disposable goods.

To many Americans, the quality-to-savings trade-off was worth it, and this new infatuation with low-cost items affected everything from simple items to complex goods. In the early 2000s, when ultra conservatives made a push through the Tea Party faction, there was a renewed interest in “Made in America” goods, but by then the damage to U.S. manufacturing was too deep. At best, a final product could claim it was Made in the USA, but as much as 90 percent of its components were likely manufactured elsewhere.

And while cheap, internationally-produced components coupled with final “Made in the USA” bragging rights may seem to be the best of both worlds, it was, in many ways, the end of America controlling its own destiny.

Meanwhile, some contend that if we interrupt trade or overburden international goods with high tariffs, continued...

Americans will pay far higher prices. This stance, though, has recently been rebuffed by our current situation with inflation. I’m not saying globalization caused inflation in everything, but one can argue that dependency on goods delivered by foreign companies overseen by adversarial governments (who can reduce exports for any reason, at any time) is a grave threat to national security.

The supply chain is affecting inflation, and foreign governments are affecting what we pay for materials and goods. But not the way we thought it would. And yes, almost everything has a Gremlin in it. In fact, Gremlins are the widgets that make up the things we need; they’re the components, and without them, we have nothing.

Most of you know what I’m talking about here. HVAC, electrical components, computer chips and every small nut and bolt needed to get a thing built, assembled, or fixed is simply not available, and even when we can it the price is astronomical, the lead time is crazy and the quality is poor.

So maybe old man Futterman wasn’t entirely wrong after all. Sure, he was wrong about monsters popping out of appliances, but we are exposed to a global market, including countries with whom we are not in complete alliance.

The drive to globalize all aspects of the U.S. supply chain was to reduce cost, increase competition, and yes, increase profits for American manufacturers. We are poised at the beginning of a solution to a problem faced by all of us.

The answer is the repatriation of manufacturing of key components back to the United States. This is already afoot in the design world, and we shall soon be seeing a building boom driven back to U.S. manufacturing. If I’m right about all this, the way we prepare students for work and careers will change too. Get ready.

We’re not just invested in your family’s financial security, we’re invested in you.

Working with Affinity BST Advisors is like having a quarterback leading your team, looking out for the big picture and maneuvering you through the little details of getting you where you want to go.

We empower our clients with knowledge so that they know they are making the best decisions for themselves and their families.

Affinity BST Advisors provides comprehensive wealth and life planning for business owners, executives, and successful families. Our first focus is learning about what our clients want to achieve and creating strong relationships. From there, we present plans and options that progress towards securing family legacies. Learn more at www.affinityBSTAdvisors.com

By Lisa Ramirez, Director of Communications and Membership

By Lisa Ramirez, Director of Communications and Membership

TOWN OF WALLKILL, NYThe Orange County Partnership has named Town of Montgomery Supervisor Brian Maher the organization’s 2022 Most Valuable Partner, citing the significant economic development that has occurred under his watch.

The Partnership lauded Maher for his efforts in striking the necessary balance between maintaining his town’s bucolic identity while fostering an environment that will attract well-paying jobs and significant tax revenue to Montgomery. About 350 business, civic and political leaders were on hand for the June 7 event, which was held at the Barn at Villa Venezia.

“If you are worried about where our next generation of leaders is coming from, stop worrying,” said Orange County Partnership President and CEO Maureen Halahan. “Brian simply gets things done.”

Maher’s political career began in 2009 when, at age 23, he was elected mayor of Walden, the largest of three villages in the Town of Montgomery. He served three consecutive terms while also serving as chief aide to State Senator Bill Larkin.

In 2019 Maher saw a divided Montgomery engage in a bitter battle over its economic future and decided to run for supervisor. His

successful bid for the post - which followed a primary and a three-way race in the general election - was built on his promise to engage the entire community in the drafting of a Comprehensive Plan to precisely define how and where economic development would take place.

Orange County Executive Steve Neuhaus praised Maher’s ability to unite Montgomery behind the Comprehensive Plan, which, when completed, provided the neighbor hood protections residents wanted while also enabling the town to grow its tax base.

“There is no one more deserving of the MVP award than Brian,” Neuhaus said.

Thanks in part to Maher’s efforts, Medline Industries, a global manu facturer and distributor of medical supplies, expanded its Orange County presence into Montgomery with a new 1.3-million-square-foot

distribution facility. Amazon, too, built a 1-million-square-foot distribution center in the town.

In accepting the award, Maher credited the town’s administrative team with helping him secure support for the Comprehensive Plan. He also praised their efforts and assistance in establishing programs for residents and businesses struggling with the impacts of COVID-19.

The key to promoting economic development, Maher said, is to present the public with facts, adding, “The more people are involved in their government, the more honest the government is.”

The Orange County Partnership is a private, not-for-profit organization that markets the county to companies interested in expanding their locations or opening new facilities. For more information visit www.ocpartnership.org or call 845-294-2323.

Montgomery Supervisor Brian Maher, center, and members of the Orange County Partnership Board of Directors

Many contractors view liquidated damages (LDs) as unfair penalties forced upon them by owners as a means to guarantee aggressive project schedules. Some contractors even walk away from an otherwise highly profitable project when an owner refuses to remove or reduce LDs.

However, some of the tri-state’s largest and most successful construction firms are far less concerned, and even welcome, LDs. Why? They have a clear understanding of what LDs are, the liability potential they replace, and how to mitigate against their assessment through the inclusion of other contractual provisions.They view LDs more as a liability limitation than a potential profit loss.

First, the contractor needs to understand what LDs are and, more importantly, what type of potential liability/damages they seek to replace. Although subject to various limitations, interpretations, etc., LDs should be reasonable

Michael Catania is a Managing Partner with Catania, Mahon & Ryder and head of the Construction Practice Group. mcatania@cmrlaw.com

Michael Catania is a Managing Partner with Catania, Mahon & Ryder and head of the Construction Practice Group. mcatania@cmrlaw.com

approximations of damages an owner might suffer should the contractor fail to timely complete the project. The “estimate” part is key, as LDs are enforceable only where actual damages are too difficult to ascertain at the time of contract execution. [1]

For example, XYZ Corp. is developing a $50 million mixed-use project with a 2-year completion date. It has financed the project through a construction loan, hired a design team and an owner’s representative, purchased the necessary insurance, and even pays for temporary heat and light. What extra costs will XYZ Corp. incur if the project comes in three months late? More importantly, how could it accurately determine such costs two years before anticipated completion? For example, any estimate of lost profits/rental income would necessarily be based on assumptions, i.e., that tenants have been found, leases signed, and municipal approvals and certificates of occupancy obtained. Even increased financing costs could change dramatically over two years depending on the type of loan and ability to refinance.

Nevertheless, XYZ Corp. should be able to reasonably estimate its additional per-month costs for maintaining the project staff and site, interest payments on construc tion financing, and maybe even what anticipated market rents for the finished spaces could be, and determine an approximate per-diem amount of these added expenses/ losses. That per-diem amount could then be written into the contract’s LD clause.

However, if XYZ Corp. goes too far in the amount of LDs demanded in the contract, such that a court may interpret the LD provision to be a penalty rather than reasonably approximate compensation for loss, the LD provision will not be enforced.[2]

Second, contractors should consider an LD clause as a potential cap on liability, specifically as to delay damages. Why? Because an owner cannot recover both actual and liquidated damages, as liquidated damages are in lieu of, not in addition to, other compensatory damages. [3]

A valid liquidated damages clause controls the rights of the parties in the event of a breach, notwithstanding

that the stipulated sum may be less than the actual damages allegedly sustained by the injured party.[4] So, assuming the contract contains proper LD language (see below), an owner’s delay damages are capped regardless of its actual damages.

Continuing on with the above example, what if XYZ Corp. sets LDs at $1,000 for every day the contractor is over the completion date? At the time of bid, the contractor knows that even in the worst-case scenario (unexpectedly long lead times, subcontractor issues, weather-related delays), completion could be delayed by no more than two months. This “worst-case” scenario would cost the contractor no more than $60,000. Depending on the size of the project and the anticipated profit margin, the contractor may accept this number as a reasonable amount or increase its bid accordingly.

Now assume the contractor is awarded the job and, as the completion date nears, it is running three weeks behind. Typically, it would have to accelerate (via overtime, double shifts, etc.) to avoid what could be significant delay damages. However, with LDs fixed at $1,000 per day, the contractor can now compare the costs of acceleration with the $21,000 deduct for a 3-week delay and choose the less costly option.

Notwithstanding everything above, and in limited cir cumstances, owners have been able to recover LDs and their actual delay damages. How? Typically, it is a result of overly narrow and restrictive contractual language regarding LDs. A 2019 case involving the Dormitory Authority of the State of New York (DASNY) is a good example of this. Its contract had an LD clause that sought to compensate DASNY for the “loss of beneficial use of the Work.” However, a separate contract provision purported to allow DASNY to recover any “actual damages” sustained by the contractor’s delay aside from the “loss of use” covered in the LD clause. The court, holding that it was “readily apparent” from these two provisions that the parties had agreed to both LDs and certain actual delay damages, denied the contractor’s

motion to dismiss DASNY’s claim for “extended design and construction management fees totaling $613,000.”[5]

How can the above outcome be avoided? First, make sure that the LD clause does not restrict the type of delay damages it is meant to replace. Second, expand the LD clause to include all costs, claims and damages that in any way relate to delay in completion. Consen susDocs’ standard Owner-Constructor LD clause is an excellent example of this type of language, including “all liability for all extra costs, losses, expenses, claims, penalties, and any other damages of any nature incurred by Owner resulting from not attaining the Substantial Completion date.”[6]

LDs are negotiable. Owners are often willing to compromise on the amount and language of LDs. They may also consider a cap on total liability, typically tied into the contractor’s profit.

Further, LDs do not have to commence immediately after a missed substantial completion date. Many contracts provide a “grace period” during which LDs will not be assessed. Finally, an owner who insists on large LDs is likely to experience financial gain should the project come in early and might be very amenable to an early completion bonus.

[1] Melwood Const. Corp. v. State, 126 Misc. 2d 156, 157, 481 N.Y.S.2d 289, 290 (Ct. Cl. 1984), aff’d, 119 A.D.2d 734, 501 N.Y.S.2d 604 (1986).

[2] City of Rye v. Pub. Serv. Mut. Ins. Co., 34 N.Y.2d 470, 315 N.E.2d 458 (1974) (“If [the LD provision] is grossly disproportionate to the anticipated probable harm or if there were no anticipatable harm, the provision will not be enforced.”)

[3] Levitt Corp. v. Levitt, (E.D.N.Y. 1978) aff’d 593 F.2d 463 (2d Cir. 1979).

[4] X.L.O. Concrete Corp. v. John T. Brady & Co., 104 A.D.2d 181 (1984), aff’d, 66 N.Y.2d 970 (1985) (Holding that “even though its actual delay damages may, in fact, be greater than $2,000 per day, N.Y.U. is, as a matter of law, limited to the sum for which it bargained.”)

[5] Framan Mech., Inc. v. Dormitory Auth. of State of New York, 63 Misc. 3d 1218(A), 114 N.Y.S.3d 814 (N.Y. Sup. Ct. 2019)

[6] ConsensusDocs® 200 Standard Agreement And General Conditions Between Owner And Constructor (Lump Sum) section 6.5 “Liquidated Damages”

As within any industry, there are critical issues and areas that keep every business owner up at night. The construction industry is no different and comes with its own unique challenges.

Respondents also felt that supply shortages and the rising cost of materials were critical issues that contractors face today. Again, none of these answers come as a surprise given the current environment in which construction companies are operating.

Joseph Peresan Partner

The Bonadio Group explores these challenges through our “2022 New York Contractors State of the Industry Study,” an annual construction industry survey that focuses on four key topics: contracts, profitability, critical issues, and outlook for the future.

Unsurprisingly, the most important issue within the construction field, the study found, is the labor shortage. Almost everyone within the industry is aware of the labor shortage as more individuals turn away from blue collar jobs. From not having qualified personnel or being unable to retain qualified personnel, the labor shortage is hitting the industry hard, creating a competition over labor between competitors. Of the survey respondents, 82 percent reported this single issue as extremely important.

Since 2014, attracting and retaining qualified personnel has maintained the top spot as the most critical issue within the industry. While a large focus has been placed on this problem, it certainly is not going away any time soon. But is this just a myth that everyone is believing and repeating? Are all companies in the construction industry actually impacted by the labor shortage? Well, not all, but a significant number are facing issues with attracting and retaining qualified personnel.

The vast majority (75 percent) of respondents reported that their company is struggling to find enough labor to meet their current demands.

That is no small number and is a strong indicator of why this has been the most critical issue within the industry for the last decade, if not longer.

The Bonadio Group

The Bonadio Group

With all else being equal, we asked survey respondents to determine how much they would increase their workforce to meet their current work demands.

Approximately 57 percent said an increase of 6 percent or greater was needed and 37 percent said their company would need to increase their workforce by 1-5 percent.

These are staggering numbers for any company to attempt to add, let alone to try and predict if the workforce will be available as work is being bid out weeks or months in advance.

Within the industry, several tactics are being taken to try and help develop and retain qualified personnel. One of the most common ways is through a company-spon sored internal training program, which can provide benefits outside of just attracting and retaining qualified personnel. If your company has enough resources, it is wise to create an internal training program, which has been done by approximately 60 percent of the survey respondents’ companies, a slight increase from our previous survey. The creation of an internal training program can be used as a recruitment tool, as individuals can advance their professional standing and skills. Additionally, by investing in your employees, they will feel rewarded and appreciate the additional opportunities provided to them that cannot be provided everywhere.

Companies are spending a lot of their efforts - time and money - investing in recruiting practices. Others have found no other choice but to increase their compensation and benefit packages during this highly competitive

labor environment. This strategy saw a sharp increase from our previous survey. Other common strategies are the focus on improving company culture and employee retention practices. These tactics have been important areas of focus. Companies without strong employee engagement and a positive, meaningful environment are seeing their employees disengage and look elsewhere for work. When a strong company culture is created, employees ultimately want to stay and will actively recruit their friends within the industry to come work for the company, becoming your most important recruiters.

One of the underutilized strategies based on survey respondents is the use of technology on job sites to help offset the lack of qualified labor. While individuals can never be replaced by automation and artificial intelli gence, the use of technology on job sites will continue to expand and if you are late to change you will be left behind. Historically, the construction industry is one of the slowest to make changes, however, this should not be a reason to avoid innovation. Where feasible, management should look to invest in technologies that allow the company to create efficiencies at job sites to help offset some of the labor issues.

Lastly, a trend that is gaining some momentum is reducing the amount of work for laborers, particularly top performers, to avoid burnout. Companies should focus on simplifying work when possible, implementing design thinking, and improving the work environment to help laborers focus and relieve stress at the job. The focus is learning to do less better, rather than doing more with less.

Beginning in 2003, The Bonadio Group has conducted a survey of the New York construction industry. The information in this year’s report, “2022 State of the Industry Study: New York Contractors,” is designed to help construction executives evaluate their standing on issues ranging from financial management techniques to economic outlook and provide an assessment of whether their organization is competitive with other companies. The full study is available at www.bonadio.com/industries-served/construction.

CCA members are among the kindest, most generous people around. Here, we celebrate their good deeds and labors of love:

July isn’t when we typically spy St. Nick up on the rooftops, but Santa (aka Ulster Savings Bank’s President and CEO Bill Calderara) was on the roof of People’s Place, a food pantry and thrift store, to raise funds for their Project Santa Christmas Toy Drive.

Seen and unseen, big and small, union carpenters and contractors perform generous acts of kindness daily, helping those who need a little extra support to cope with tough times.

Throughout months of hospital stays, 11-year old Izzy dreamt of a tree house where she could be ‘in the clouds’ doing arts and crafts with her friends. With the help of Make A Wish Hudson Valley, Carpenters Local 279 and local leaders, Izzy’s wish was granted.

Carpenters Local 279 Business Manager Scott Smith and dozens of members of Local 279 volunteered their time and resources to build the treehouse of Izzy’s dreams. When she recently returned home from months of treatment for a brain tumor, she celebrated at a special event and ribbon-cutting in her Yulan backyard.

This year marked the third that Santa Bill was among the participating volunteer Santas from throughout Ulster County, who spend time on the roof while friends and colleagues make donations to help get him down (or donate more to keep him up there!). Ulster Savings raised over $5,000 before Santa Bill returned to terra firma.

Last year, 2,500 children in Ulster County received toys, a craft or a game, warm winter items, books, and stockings filled with goodies thanks to Project Sants. Ulster Savings Bank is a longtime benefactor.

People’s Place is a not-for-profit organization feeding, clothing, and responding to the needs of the people in Ulster County with kindness, compassion, and the preservation of human dignity since 1972. Located in Kingston, they are a thrift store, food pantry, wellness empowerment center and café.

We want to shine a light on your organization’s good deeds, so if you’re working to make the world a bit brighter, please tell us about it. Email Communications Director Lisa Ramirez at LRamirez@CCAHV.com with a little information and a photo (if you have one) so we can include it in an upcoming issue “On the Level.”

More than 560 Bonadio Group employees spent a day in August serving their community during Bonadio’s fifth annual Purpose Day, benefitting more than 25 non-profit organizations.

“The Bonadio Group is committed to serving the communities in which our employees live and work with promise, purpose and passion,” said CEO Bruce Zicari. “It’s critical for us to provide our people with opportunities to support organizations in our communities that are working to make a difference.”

Walden Savings Bank employees raised thousands of dollars for four local community organizations with a Casual Friday fundraiser.

Each week, employees who make a voluntary $3 donation get to dress casually on Fridays. Casual Friday fundraising is a long tradition at Walden Savings, but this year it was revised in celebration of WSB’s 150th anniversary. Walden Savings Bank matched the donations, and recently $1,500 was donated to nonprofits chosen by the employees. The recipients were:

● Newburgh LGBTQ+ Center, a hub of resources, education, community building, advocacy, and organizing. (www.NewburghLGBTQCenter.org)

● Hudson Valley Cancer Resource Center, a voice of advocacy and support for people living with and affected by cancer. (www.HudsonValleyCancer.org)

● Big Brothers Big Sisters of Orange County (www.mentorachild.org)

● Take Me Home Pet Rescue, which rescues dogs from high kill shelters in North Carolina and places them in New York foster homes until permanent homes are found. (www.tmhPetRescue.com)

“It’s wonderful to see the wide range of organiza tions our Walden Savings Bank employees choose to help with our donations,” said President and CEO Derrik Wynkoop.

The employees’ good works included everything from weeding and mulching community gardens to conducting mock interviews and offering career guidance. All of the firm’s offices were closed so everyone could spend the day volunteering.

Benefiting organizations included:

● Albany: North Rivers Family Services; Rensselaer County Chapter NYSARC; St. Catherine’s Center for Children; Interfaith Partnership for the Homeless and Schenectady Community Ministries

● Buffalo: Niagara County SPCA; Danny’s Helping Hands; Community Services for Every1 and Artpark

● New York City: VISIONS/Services for the Blind and Visually Impaired and River Fund

● Rochester: Heritage Christian Services; Foodlink; Lollypop Farm and Seneca Park Zoo

● Syracuse: PEACE Inc., Liberty Resources and the Utica Zoo

Callanan Industries’ projects are often major roadways, but this time their help was needed for the construction of Dorothy’s Equal Access Trail, an ADA-compliant nature trail though Poestenkill Community Forest.

Callanan is a long-time supporter of The Rensselaer Plateau Alliance, which promotes the conservation of the Plateau’s forests, so when they needed materials for the new trail, Callanan happily donated the crushed stone.

Dorothy’s Trail allows people from all walks of life to enjoy nature and is named for RPA board member Jeff Briggs’ mother, Dorothy, who relied on a wheelchair later in her life. Jeff remembers taking her for car rides and having few options for places to enjoy the outdoors together. That’s when he started thinking about accessibility. “Now here we are,” Jeff says, “with a trail for everyone.”

From the trailhead, Dorothy’s Trail runs 600 feet out to a wetland overlook and 600 feet back, for a round-trip of just over a quarter mile. It has a hard surface and, at 44-48 inches, is wider than many walking trails, making it welcoming to hikers on foot or using a wheelchair.

Dorothy’s Trail is located at Poestenkill Community Forest, 200 Legenbauer Road, Averill Park. For a trail map and driving directions visit www.RensselaerPlateau.org.

Taylor will complete your demolition project with precision and care. Taylor has the experience, personnel, equipment and the technical skill to get your project completed and your building demolished, on time and within budget. Taylor’s team of field-proven professionals offer a fresh and modern approach to demolition, giving your project the attention, design and delivery it deserves.

With the end of 2022 in sight, business owners are focusing on planning for 2023. Those plans should include a review of employee benefits and what could be considered the single most important benefit – employee health insurance.

Many health insurance companies renew at the end of the fiscal year but even if that’s not the case, the time to look at your existing plan and evaluate its benefits and pricing is now. Insurers are looking to raise their rates by double digits for the new year, and that will not only affect business owners’ profitability but will also strain employees’ wallets.

For many owners, the prospect of evaluating insurance plans is daunting. There are many variables, not just in benefits and deductibles but in premiums as well. Couple that with the number of different insurers – all who offer multiple plans – and it becomes apparent why most stay with the status quo even if it might not make financial sense.

Let’s start with the basics of finding and evaluating a plan. The first step is to simply ask your employees what’s important to them. Is it a low deductible, comprehensive benefits, the ability to choose their own doctors? Do they or their family members have serious health issues, or are they generally healthy? You will need this information to make informed decisions. Make no promises, but remember that the more comprehensive the benefits, the higher the price.

Using their responses as a guide, reach out to a health insurance professional who can give you options. Major top-rated insurers have a nationwide network of doctors and facilities, while other insurers limit coverage to local or statewide areas. If your staff is mostly healthy employees who simply need annual physicals and an occasional doctor visit, a low deductible, high premium plan probably doesn’t make sense – especially since wellness visits are usually excluded from deductibles. If you have an employee with serious health concerns, there are ways to handle that

situation without impacting the rest of your staff. There may even be tax benefits to the business. That’s where professional advice becomes invaluable.

Luckily for CCA members, there are resources available to make this process less challenging. Using our business partner at Marshall & Sterling, CCA members can compare their existing plans to those available through CCA. The plans are with major, top-rated national companies and offer a variety of benefits and premiums to fit businesses’ and employees’ budgets. The plans are broken down by businesses with fewer than and those with more than five employees enrolling. Some offer add-on benefits such as vision and dental, and all include prescription coverage.

What makes CCA plans stand out from others is that they are not available on the open market and the premiums are generally lower. The expected 2023 premium rate increases are anticipated to be in the single digits compared to the double-digit increases requested by open market health insurers. CCA cannot influence how these plans are administered, but it can help facilitate the evaluation by Marshall & Sterling of association plans against your current plan.

The end of this year and at least the beginning of next year will be challenging for businesses and employees alike with high inflation and an economy teetering on recession. Take the time today to get at least this important benefit under control.

For more information about the employee health insurance plans available to CCA members, contact Millie Rodriguez at mrodriguez@ccahv.com or call the CCA office at 845-562-4280.

Robin Seidman specializes in general HR policy and procedures. reseidman@ccahv.comThere’s no greater asset in the building industry than a worker who shows up wellprepared and ready to go. It can mean the difference between a project that runs smoothly and a project that runs out of time. The Carpenters union recognizes this and has provided contractors with world-class quality and professionalism for 130 years – in addition to a can-do spirit to step up to meet any challenge. It’s not just a relationship, it’s a true partnership, and the entire building community benefits.

When you want trained professionals, you hire union carpenters.

The North Atlantic States Regional Council of Carpenters (NASRCC) has launched a new program that makes a college degree in Construction Technology within reach for many of its members.

This fall, SUNY Sullivan, in partnership with NASRCC, debuted its two-year Associate of Occupational Studies (AOS) in Construction Technology degree program. The new pathway program - which is free to qualified NASRCC members - is specifically designed to help meet the growing state-wide need for a skilled labor force in construction and create opportunities for graduates.

Upon completion, graduates will have a mastery of the skills and knowledge required to find immediate

employment or advancement in the residential construction industry.

“The union needs fresh, young leaders, and the opportunity has never been hotter,” Business Manager Scott Smith told a roomful of members who attended a recent informational session about the new program, held at the Rock Tavern Training Center. “We need you to get involved, and we expect to see some of you in leadership in the next couple of years.”

Construction Technology AOS students will complete instruction and on-the-job training through the NASRCC’s apprenticeship program in Rock Tavern, supplemented with SUNY Sullivan courses in topics such as green building, accounting, communications and computer literacy. All classes will be offered online,

eliminating the barriers many students face, such as commuting to campus or busy schedules that make it impossible to attend traditional classes.

Tuition will be paid through an NASRCC education fund, and, when needed, the union will even provide tutoring. “This is set up for your speed, at your own pace” Local 279 Council Representative Matt Ross told the prospective students. “And we’ll be here to help you succeed. We got your backs on this.”

Life experience, as well as credits earned at other colleges - even if earned years ago - may apply toward the Construction Technology AOS, making the associate’s degree even more within reach for the carpenters.

“This innovative pathway that leads to high-wage employment combines the best of apprenticeships and traditional college programs,” said SUNY Sullivan President Jay Quaintance. “On-the-job-training combined with the academic knowledge to support it ensure that these students will be ready for the ever-evolving 21st Century building trades environment.”

Graduates who want to further their studies even more can apply 61 SUNY Sullivan credits toward a bachelor’s of technology in construction supervision at Alfred State College, a SUNY college which offers 80 majors in the arts, applied technology, architecture and management and engineering technology. “This new partnership with SUNY Sullivan will expand opportunities we make available starting with pre-apprentice exploration and training programs, formal apprenticeship, and lifetime skills upgrade training.” said Tom Fischer, Director of the North Atlantic States Carpenters Training Fund. “A career in construction offers several opportunities, from jobsite, hands-on opportunities to management positions with established contractors. Through our training and our partnerships, like this one with SUNY, all kinds of options stay on the table.”

For information about the Local 279 Training Center in Rock Tavern, or to apply, visit www.carpenterslocalunion279.org or call 845-567-1810.

For information about the SUNY Sullivan Construction Technology AOS Program, visit www.sunysullivan.edu or call 845-567-1810. Applicants must have completed the North Atlantic States Carpenters Training Fund Pathways Curriculum.

Carpenters, SUNY Sullivan, Join Forces to Ease Pathway to a College Degree

Carpenters, SUNY Sullivan, Join Forces to Ease Pathway to a College Degree

Advocacy. Community. Projects. News. Events. On your computer, laptop or mobile device.

Visit. Explore. Sign up now.

If you are looking to take a 179D Deduction as the official designer of a government-owned property or a commercial property owner, take note! Recently, the IRS Large Business and International Division updated its training with guidelines for IRS staff to perform examinations for 179D deductions. While this serves as an aid for IRS staff, it also provides important insights to architects, engineers and contractors.

179D tax deductions took effect in 2006, became permanent with the Con solidated Appropriations Act of 2021, and enable building owners to claim a tax deduction for installing qualifying systems that reduce energy and power costs by 50 percent or more. Qualifying systems include interior lighting, building envelope, heating, cooling, ventilation, or hot water systems.

This year, the deduction can equal up to $1.80 a square foot. If the building is 100,000 square feet, that could mean an $180,000 tax deduction.

Commercial building owners and designers of government-owned buildings are eligible for 179D tax deductions; however, the updated IRS training places more emphasis on what to watch for during government-owned building examinations.

Since government buildings are non-taxable, owners can allocate 179D tax deductions to the designer, namely the person who created the technical specifications for a new building or an

energy efficient commercial building property addition. This may include an architect, engineer, contractor, environ mental consultant, or energy services provider; it does not include a person who installs, repairs, or maintains a system. However, it is the IRS examination – not the building owner – that determines whether a taxpayer meets the definition of designer.

An allocation letter from a government building owner is not enough to establish a taxpayer as a designer eligible for the deduction. Examiners determine eligibility by reviewing contracts to see who is designated as responsible for design. To establish designer status, a designer must provide the contract along with technical spec ifications, stamped or sealed drawings, and other documentation.

Government building owners that provide an allocation letter may be interviewed by agents to ensure they have the authority to make the allocation. Also, to claim the deduction, certification by properly licensed individuals is required.

IRS examiners are encouraged to determine the Designer of Record by reviewing stamped or sealed drawings; however, this excludes shop drawings used to ensure a building conforms to an architect’s or engineer’s design requirements.

Technical specifications created by the architects and engineers take precedence over shop drawings, increasing the likelihood that

architects and engineers will qualify as designers. While not explicitly addressed, it seems likely that contractors engaged to provide both design and construction services can also meet designer status requirements.

In addition, the IRS training emphasizes tax-exempt and non-profit organizations cannot allocate 179D deductions to designers. For example, a state university that places some buildings under a private foundation cannot allocate 179D deductions.

The examination’s final step focuses on whether penalties for taxpayers are warranted based on adjustments. If an adjustment results in underpayment or an excessive refund or credit, agents will consider accuracy-related penalties (i.e., for negligence or substantial underpayment or an erroneous claim for refund.)

If you need assistance understanding, securing, and certifying 179D deductions, RBT CPAs can help.

(Source: Aberin, CJ. “IRS updates guidance on tax deductions for energy efficient buildings.” AccountingToday, July 15, 2022.)

Craig Sickler, CPA, Partner RBT CPAs, LLP

Craig Sickler, CPA, Partner RBT CPAs, LLP

We get it. You are busy writing bids, securing contracts, managing projects, and dealing with personnel issues all day long. But when do you get to plan for your own financial tomorrow and still live for today?

We’ll help you plan to do the things you live for. Whether you are imagining a retirement sailing around the world or just kicking back with your family, we can tailor a plan from a wide range of financial options to make it happen. Our team of financial planning advisors can help identify your financial planning goals and address those needs with investment strategies for potential growth. With the full suite of Northwestern Mutual resources at our fingertips, we also assist business owners in developing succession and estate plans to protect the continuity of their life’s work and position it to flourish in the future.

Patrick A Di Cerbo, CLU®, ChFC®, AEP®, MSFS, CFP® Wealth Management Advisor 518.281.8200 patdicerbo.com pat.dicerbo@nm.com

07-1016 © 2021 Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company (NM), (life and disability insurance, annuities, and life insurance with longterm care benefits) and its subsidiaries in Milwaukee, WI. Northwestern Mutual Investment Services, LLC (NMIS) (securities), a subsidiary of NM, broker-dealer, registered investment adviser and member FINRA and SIPC. Patrick A Di Cerbo is an Insurance Agent(s) of NM. Patrick A Di Cerbo, is a Registered Representative(s) of NMIS. Patrick A Di Cerbo, is a Representative of Northwestern Mutual Wealth Management Company®, (NMWMC) (fiduciary and fee-based financial planning services), a subsidiary of NM and federal savings bank. All NMWMC products and services are offered only by properly credentialed Representatives who operate from agency offices of NMWMC. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Catania, Mahon & Rider, PLLC

Laborers Local 235

MDS HVAC-R, Inc.

Marshall & Sterling

North Atlantic States Regional Council of Carpenters

SMACNA Southeastern New York

Armistead Mechanical, Inc.

Butler Construction Group, Inc.

Darlind Associates, Inc.

IUOE Local 137

Ironworkers Local 417

Tectonic Engineering Consultants, Geologists & Land Surveyors D.P.C.

ABM Air Conditioning & Heating, Inc.

Advanced Testing Company, Inc.

Barone Construction Group, Inc.

Beam Enterprises, Inc.

Butler Construction Group, Inc.

Holt Construction Corp.

Key Construction Services, LLC

James McGowan and son Masonry, Inc.

Laborers Local 17

Paramount Building Construction, Inc.

Penlyn Construction Corp.

Perreca Electric Co., Inc.

Service Scaffold company, Inc.

Tri-State Drywall & Acoustical, Inc.

Ulster Savings Bank

United Rentals

Wallkill Valley Federal Savings and Loan Assoc.

Laborers Local 754

Advanced Disaster Recovery

Beam Enterprises Inc.

Ironworkers Local 417

Lovell Safety Management Co.

NexGen Protection Services

O’Kane Enterprises

Patrick DiCerbo-Northwestern Mutual

SMW LU#38 Labor Management

Welby, Brady & Greenblatt

Marshall & Sterling

Bricklayers Local 5 Hauser Brothers, Inc.

Profex, Inc.

Beam Enterprises, Inc.

Golf Cart Sponsors

BNY Mellon

Investment Performance Services, LLC.

Plumbers & Steamfitters Local 21-HVAC-R

TDX Construction Corp.

Colandrea Buick GMC of Newburgh

Affinity BST Advisors, LLC

Fabricators, Erectors and Reinforcers Assoc. of the Hudson Valley

Catania, Mahon & Rider, PLLC

Hauser Brothers, Inc.

Lovell Safety Management Co.

By Lisa Ramirez, Director of Communications and Membership

By Lisa Ramirez, Director of Communications and Membership

Phishing is constantly evolving and cybercriminals continually adopt new forms and techniques. With that in mind, everyone must keep an eye on their inbox. Here are some tell-tale signs you’re being targeted:

Social engineering attacks like phishing have skyrocketed to take the top spot as the cause of cybersecurity breaches. What makes social engineering so effective? When cybercriminals use social engineering tactics, they prey on our natural instinct to help one another.

We think it can’t happen to us, but phishing isn’t a trap that only ensnares the gullible, warn the experts at Integrated Computer Services (ICS), a Glen Rock, N.J.-based organization specializing in IT consulting and network support for businesses with 10 to 1,000 employees. Gone are the days of poorly-worded, patently obvious attempts at scamming users out of their hard-earned cash. Today’s sophisticated phishing attacks are almost indistinguishable from legitimate business communications and are well-written, thoroughly researched, and establish a thread of communication with the victim before attempting to steal their credentials or bank balance.

Ultimately, cybercriminals use deception to trick their victims into voluntarily giving up confidential information. Phishing attacks represent a serious threat to online security for every person with a computer, tablet or smartphone. Hackers see it as an easy way to trick people into divulging sensitive information.

Automated protection cuts down on 99 percent of the spam and phishing to your inbox, but that remaining 1 percent can send you to a dangerous website, have you open a malicious file, or even inadvertently divulge sensitive information.

• Requesting log-in information. If you get a message asking you for log-in credentials – even if it’s from a trusted source – you’re probably the target of a social engineering attack.

• Urgently asking for money or gift cards. There’s seldom a reason why anyone, someone you know, would urgently need money.

• Asking to verify your information. This type of social engineering asks victims to verify their info to win a prize or a windfall. But even if the message comes from a legitimate organization it could very likely be a scam. Criminals can spoof an email and imperson ate a business.

• URLs are misspelled. Usually, fake websites have an extra letter ‘S’ or ‘A’ in the spelling. For example, “www.walmarts.com.”

Source: The experts at Integrated Computer Services (ICS), Glen Rock, N.J.

Here are a few common types of social engineering attacks that might appear in your inbox:

Cybercriminals often masquerade as a supplier, requesting invoices are paid to alternative bank details. They can also pretend to be an employee, asking the HR department to pay their salary into a different account.

Payment diversion fraud targets both businesses and individuals and the results can be devastating. There’s little point requesting someone to make a bank transfer or change payment details who isn’t authorized to, so threat actors target finance and HR teams who routinely process payments and deal with changes to personal account details and are more likely to comply with the fraudulent request.

Impersonating a VIP – often the CEO – is big business for adversaries, knowing the recipient will often meet the request straightaway. Threat actors research their executive target thoroughly to make sure their spoofed email is as convincing as possible, so it stands more chance of succeeding. They prey on users’ implicit trust of their seniors to coerce them into providing commercially sensitive

information, personal information, or bank account details.

These deceitful requests often convey a sense of urgency and imply the interaction can only be carried out via email. The victim, therefore, has no time to question the validity of the request and is unable to call the CEO to confirm if it’s genuine.

The opposite of CEO fraud, whaling targets senior executives rather than impersonating them. These targets are often the decision-makers who have the authority to give the go-ahead on financial transactions and business decisions, without further levels of approval. These phishing attacks are thoroughly researched, contain personalized information about the company or individual, and are written in the company’s tone, adopting fluent business terminology that’s well-known to the VIP target. Sextortion

A form of cyber blackmail, sextortion is when cybercriminals email their target claiming to have evidence of them committing X-rated acts or offenses and

demanding payment to stop the criminals from sharing the evidence with their victim’s family or employer. Attackers count on their victims being too embarrassed to tell anyone about the email because it’s a subject most wouldn’t feel comfortable talking about with others.

The attackers often make the email sound like they’re doing their victim a favor in keeping the details to themselves. The victim may decide to pay up to stop embarrassing details about their private lives being made public, regardless of whether they’re true or not. Payments are usually demanded in Bitcoin or gift cards.

But if the victim knows they’re innocent, why do these attacks still work? It’s all about credibility –attackers harvest email addresses and passwords from previous cyberattacks, which are available on the internet, and include them in their email to add credibility. If an attacker emails you claiming to know one of your passwords and includes it for proof, you’re more likely to believe the rest of the email is genuine.

Cybercriminals are on the Hunt Using Social Engineering Tactics By Lisa Ramirez, Director of Communications and Membership

By Lisa Ramirez, Director of Communications and Membership

Orange County’s site inventory and pivotal environmental regulation changes were discussed at an informational networking session hosted by the Alliance for Balanced Growth (ABG).

The morning session, held August 16 at Delancey’s in Goshen, was moderated by ABG co-chairs John Lavelle of Rand Commercial and Andrew Fetherston of Colliers Engineering Design. About 85 business leaders, local lawmakers and others attended.

“We all benefit by knowing what’s going on out there with one another,” Lavelle said as he welcomed the attendees.

Lavelle began the discussion by noting that while there is a robust demand for commercial properties in Orange County, available sites remain in short supply. Compounding the challenge is a lack of infrastructure for those sites that are available.

Conor Eckert, Senior Development Officer and Vice President of Business Attraction for the Orange County Partnership, said that since the June launch of the ABG’s Site Inventory Program, Partnership representatives have met with officials from Blooming Grove, Monroe, Goshen and the Town of

Wallkill. Up next are meetings with representatives from Middletown, Port Jervis, the City of Newburgh and other municipalities. The Partnership, he said, believes development oppor tunities exist in food and beverage processing, advanced manufacturing, clean energy and life sciences.

“There’s real opportunity to compete for these sectors,” Eckert told the crowd.

One goal, Eckert said, is to develop a “portfolio of sites.” Eckert is heading the initiative along with Kaitlynn Lancellotti, Director of Business Retention and Expansion, and together they are compiling information on suitable properties along with zoning, infrastructure, tax and regulatory approval requirements. The focus is on properties that could accommodate new development of at least 20,000 square feet.

“I think that it is great that the organizations (the Orange County Partnership and the ABG) are coming together,” said Town of Wallkill Supervisor George Serrano. “We must have smart development. It is good to develop but being smart is getting all the parties together.”

Also at the meeting, Kimberly Semon, P.E. Senior Project Manager with Langan Engineering & Environmental Services, offered an update on PFA (polyfluoroalkyl substances) contamination and changing federal and state regulations that could impact development.

The U.S. Environmental Protection Agency issued an advisory in June that its health advisory threshold for PFAs in water sources will change from 70 parts per trillion to four parts per quadrillion, a profound decrease in tolerance. Airports, upholstery and textile factories, and landfills are among the types of properties where PFA contamination has been identified, Semon cautioned. Generally, contamination occurred between the 1940s and early 2000s Semon noted that the equipment to measure these newly reduced PFA levels has not yet been developed.

New Paltz firefighters were set to move into their new fire station in September, a 16,000 square foot model project, designed and built in line with New York’s climate goals and boasting state-of-the-art energy efficiencies.

The firestation, designed by Rick Alfandre of Alfandre Architecture, will use far less energy than comparable structures and will accommodate the needs of the fire department for generations to come. It boasts five double-bays for fire apparatus, meeting rooms, offices, a turnout gear changing room, emergency command areas, and space for training, he said.

“It’s built with insulated concrete from footing to roofs,” Alfandre said. “What that means is … there’s almost no thermal bridging or conductivity of energy through the walls.”

The all-volunteer New Paltz Fire Department had been operating out of cramped quarters off Plattekill Avenue for more than 50 years. Built in 1950, the department had long outgrown the building. Space was tight, and members did not have enough room to get their trucks in and out safely, to properly store equipment or change into firefighting gear.

The project, on North Putt Corner Road and Henry W. DuBois Drive, broke ground in 2021.

New York’s long-term climate goals include phasing out fossil heat over the next few decades, starting with new construction and then moving to retrofits of existing buildings. Buildings, at 32 percent, are the largest source of climate-damaging emissions in the state, primarily from combustion of fossil fuels for heating and hot water.

• Insulated concrete form (ICF) walls from footings to the roof. The station is a reinforced concrete building, with insulation inside and outside and almost no thermal bridging or conductivity of energy through the walls.

• Air source heat pumps cool by running refrigerant into the building through air handlers or is converted to hot water to heat the apparatus bay floor through radiant heat, which prevents tankers full of water from freezing. The rest of the building has multiple zones of space conditioning.

• An energy recovery ventilation (ERV) system circulates fresh air, creating a healthy indoor space for firefighters.

• The south-facing roof is future-proofed for Solar PV, which is in the planning stages.

• Adjacent to the apparatus bay and compartmentalized from the rest of the building, with a direct outdoor exit, is a decontamination room where firefighters can clean themselves and their equipment without bringing pollutants into the rest of the building.

• The electrically-driven overhead doors for the five bays are smooth and fast operating to assure quick truck exit.

A gas generator, there to provide power during outages, is the only fossil fuel element in the building.

The fire station was designed to meet the goals of New York’s 2019 Climate Act,which requires the state to reduce greenhouse gas emissions by 40 percent by 2030 and reach net-zero emissions by 2050. The law also requires that New York generate 100 percent of its electricity from clean and renewable resources by 2040. It’s estimated that meeting those emissions goals will add 189,000 jobs across the state by 2030, with over half of those new jobs in the buildings sector.

New Paltz Volunteers Move Into New, Energy Efficient Firehouse