Vol.5 October 2024

Vol.5 October 2024

The Melbourne CBD office market increased by 67,497sqm over the first half of 2024 now totalling 5.23 million square metres, a record high. The Melbourne CBD office is now Australia’s largest office market for the first time in 25 years, having grown by more than one million square metres over the past 12 years.

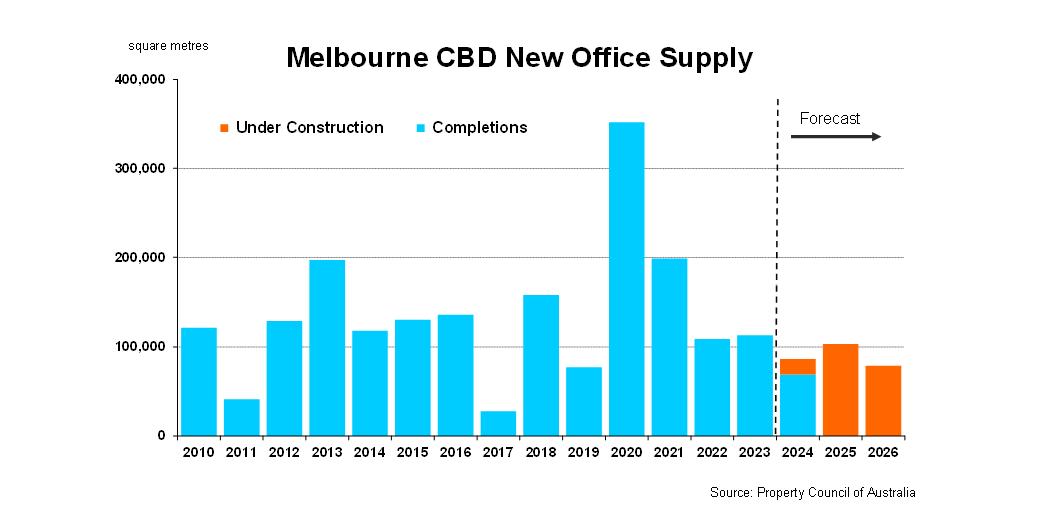

The only addition to the CBD office market in 2024 was the completion of National Pension Service of Korea’s 693 Collins Street, Docklands which added 69,000 square metres. In contrast, 1,503sqm was withdrawn through minor refurbishments.

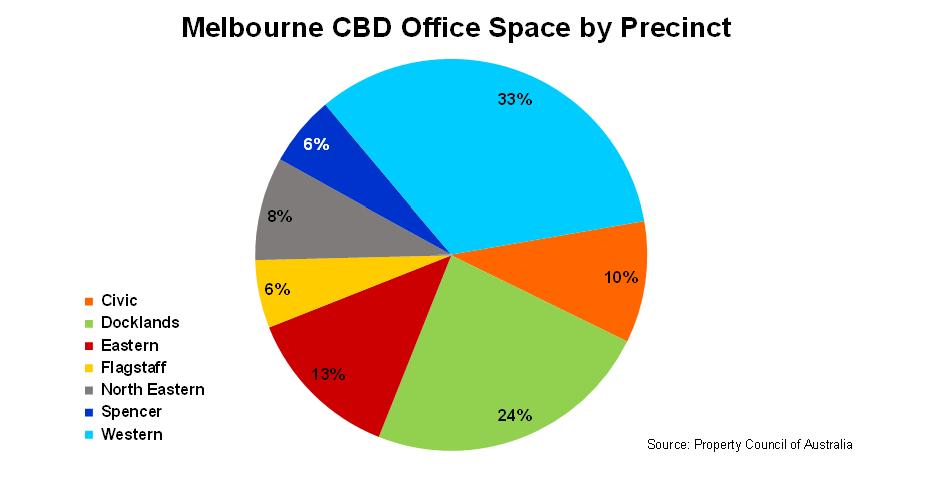

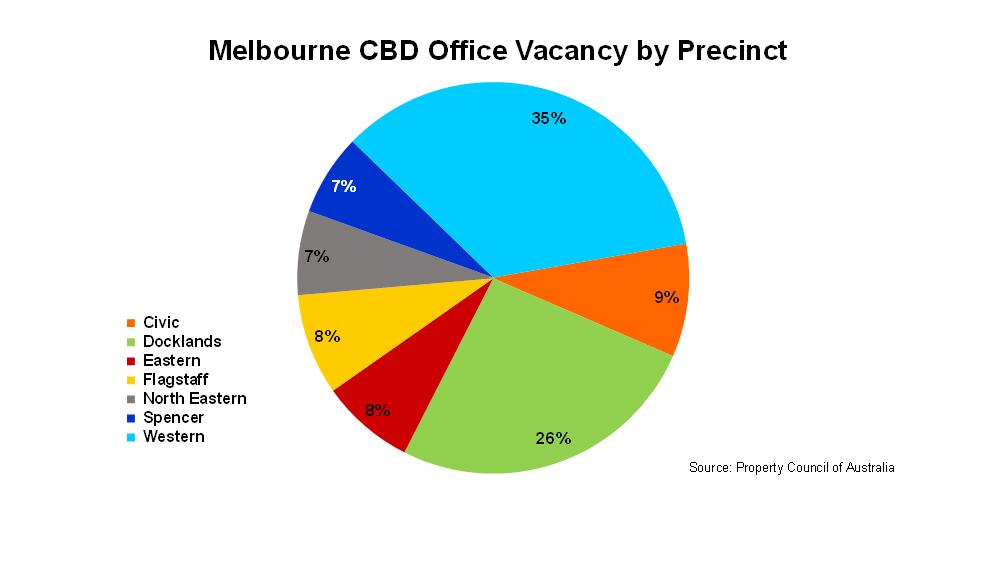

The Western precinct continues to hold the most office space in the Melbourne CBD with 33% followed by the Docklands which comprises 1.2 million square metres having increased by almost 75% over the past 10 years.

As at July 2024, A-Grade space accounts for almost half of all office space across the Melbourne CBD. Reflecting the evolving demand of tenants over the past 10 years, Premium-grade office space has grown the most in the Melbourne CBD office increasing by 551,500 square metres.

There are seven (7) new developments which are under construction or have begun siteworks. Looking ahead through to 2026, the pipeline of new supply is expected to deliver almost 200,000sqm of new and refurbished space across the Melbourne CBD, around half the longterm average. With the constrained development pipeline, the location of the new supply is relatively evenly spread with new stock being delivered in the Western, Civic and Docklands precincts.

Of the space that is under construction, pre-commitment levels remain modest with currently 34% pre-leased. New development activity is projected to remain subdued for the medium term, adversely impacted by the elevated high vacancy rates and cost of construction. Pre-leasing activity is anticipated to increase with attractive leasing terms available for lease occupiers.

Beyond those offices currently under construction, there are a number of projects at various stages of development approval proposed for the Melbourne CBD office market including: DEXUS’ 60 Collins Street (42,182sqm), Stage 2 of Charter Hall’s 555 Collins Street (35,000sqm) and Hines’ development at 600 Collins Street (60,000sqm).

Source: Property Council of Australia/Fitzroys

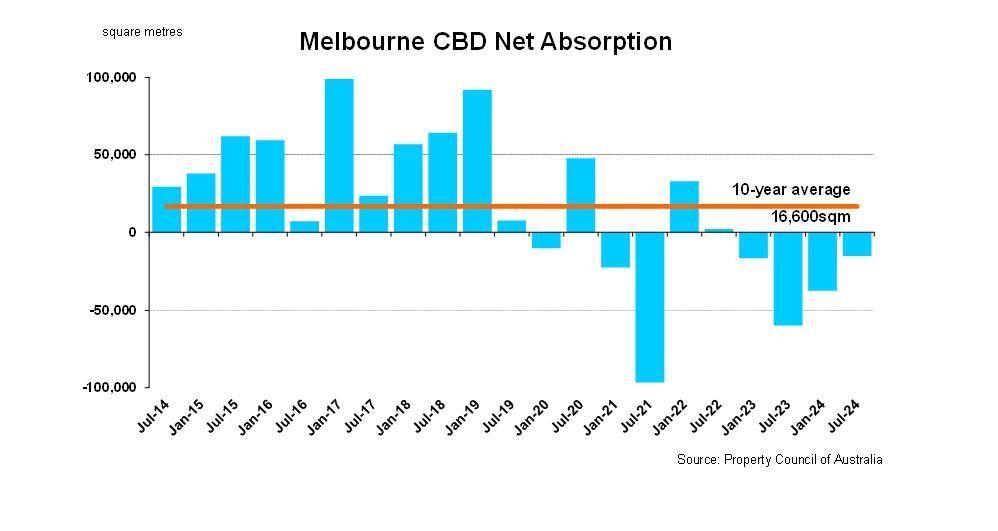

Although net absorption in the Melbourne CBD office market remains negative, green shoots of recovery are emerging with improved tenant enquiry levels.

According to the PCA, the Melbourne CBD office market recorded negative net absorption of 15,435sqm in the six months to July 2024, the best result in two years. In comparison, the 10-year average half-year net absorption level for the Melbourne CBD office market is 16,600sqm.

While the Melbourne CBD office market has recorded negative net absorption over the past three years, it obscures the clear “flight to quality” with tenants pursuing higher quality office accommodation encouraged by the attractive terms on offer.

In the six months to July 2024, Premium-grade offices outperformed all other grades in the Melbourne CBD with 12,304sqm absorbed. In contrast, A-grade, B-grade and C-grade offices all recorded negative net absorption in the six months to July 2024.

Victoria’s employment continues to increase, reaching an all-time high in July 2024, having increased by 121,353 new jobs over the past 12 months. Reflecting the improving labour market of Victoria, the State’s unemployment rate remains at a low rate of 3.3% as at July 2024. Looking ahead, Victoria’s employment is projected to increase further through 2024, boosting the need for office space.

Over the six months to July 2024, the Civic precinct recorded net absorption of 8,836sqm boosted by strong uptake in A-grade and B-grade stock. Other precincts to record solid absorption were North Eastern with 5,895sqm absorbed and Eastern Core with 3,352sqm taken up over the first half of 2024. In contrast, Flagstaff, Eastern, Western, Spencer and the Docklands precincts all recorded negative net absorption over the six months to July 2024.

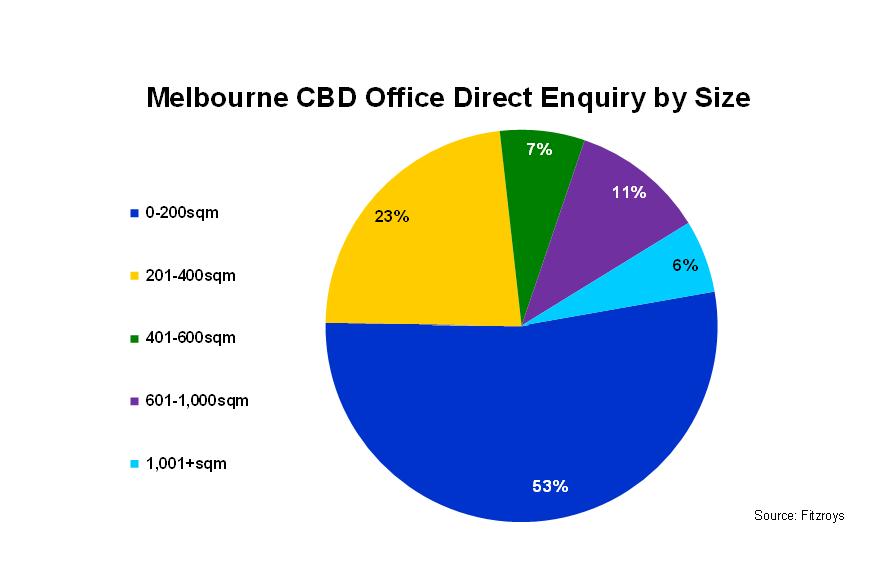

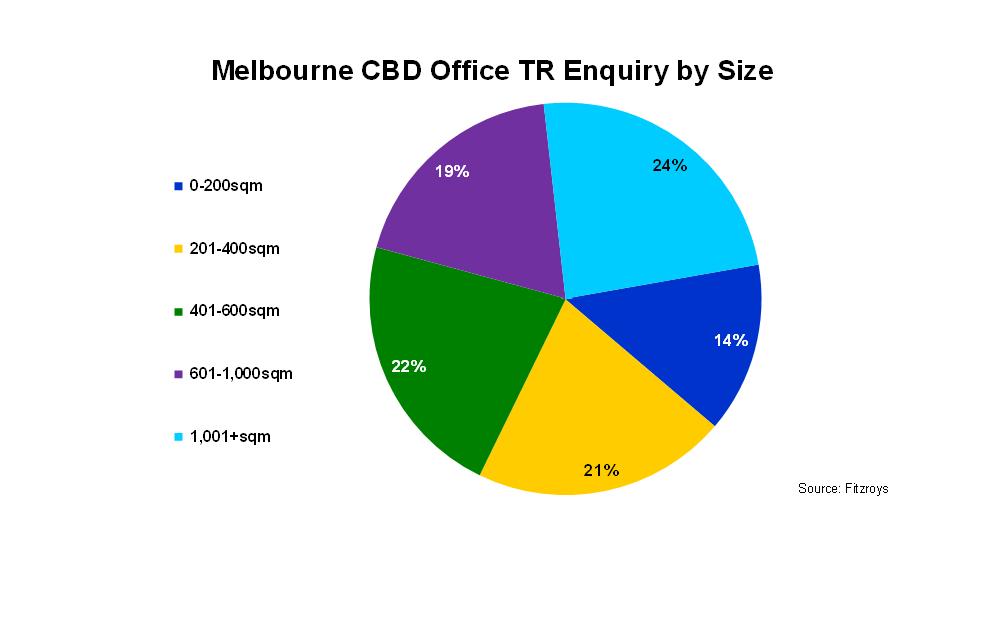

CBD enquiry levels remained healthy for groups wanting offices up to 300sqm. Spec suites and turn-key solutions are favoured as they offer new fit outs with compelling financial lease terms. Companies are keen to attract their staff back into the office and a brand new fit out is a key factor in this decision making process.

Remodelled fit outs and "2nd Gen" fit outs are also leasing well. Landlords who embark on cosmetic upgrades and improvements to the efficiency of their existing fit outs are being rewarded with securing tenants. These options are very attractive for tenants as they can use the incentive to offset rent rather than use as capital towards fit out works.

Clear space is slower to lease as the incentive is almost totally attributed to fit out cost and not to rental abatement. With total lease cost being a defining factor, Landlord contribution to works outside of the incentive is keenly sought after.

Larger corporate occupiers have been more active through 2024 as businesses now have more knowledge around the numbers of staff working from the office on an on-going basis.

Increasingly tenants are considering CBD due to the superior accessibility, new Metro Tunnel network coming on line during 2025 and the compelling lease terms and incentives available.

Tenant enquiry for Melbourne CBD office accommodation remains diverse with demand for office space led by Professional Services (42%) followed by Finance & Insurance (21%) and IT & Telecommunications (15%). Other sectors active in the Melbourne CBD office market over the past 12 months have been the Government and the Education sectors.

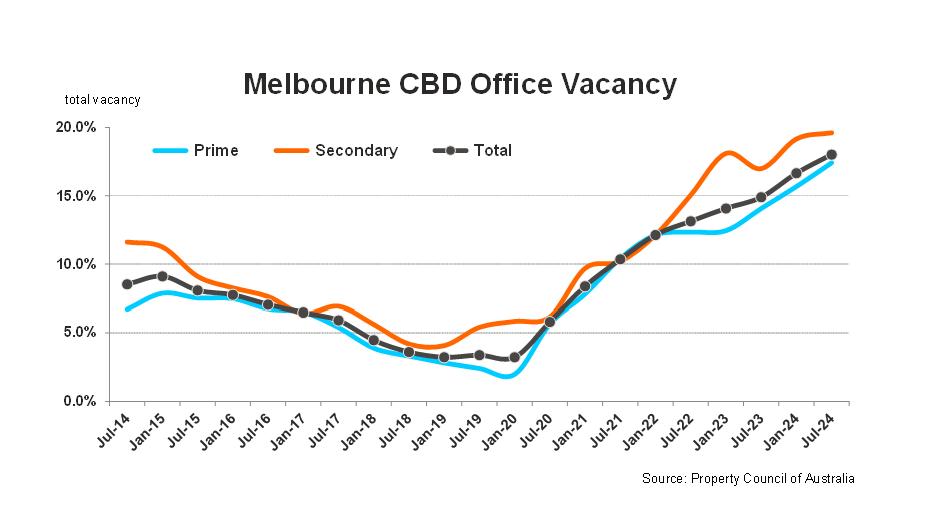

Despite the limited additions to the Melbourne CBD office market, the total vacancy rate continued to increase as tenants consolidated their offices. According to the Property Council, the total Melbourne CBD office vacancy rate increased to 18.0% as at July 2024, its highest rate since 1997.

Melbourne’s vacancy is higher than all other markets with Sydney’s CBD vacancy rate sitting at 11.6% and Brisbane at 9.5% Overall, the total Australian CBD office vacancy increased to 13.6% as at July 2024, the highest rate since 1996. Outside of the CBD office markets, the overall vacancy rate of the Australian non-CBD office markets decreased to 17.2%, although remains above its 10-year average.

The vacancy rate of all grades within the Melbourne CBD office market increased over the six months to July 2024. Despite the trend of tenants to upgrade their office accommodation, the vacancy rate of Premium space increased to 16.1%,

its highest rate since 1993 with the A-grade office vacancy rate increasing to 18%. Similarly, the B-grade office vacancy rates increased to 22.9%, a 30-year high.

The sub-lease vacancy level of the Melbourne CBD office market, decreased over the six months to July 2024, falling to its lowest level in three years. As at July 2024, sub-lease vacancy totalled 85,209sqm, still above its 10-year average, resulting in a sub-lease vacancy rate of 1.8%.

Collectively, Premium and A-grade office space account for 94% of total sub-lease vacancy across the Melbourne CBD office market as at July 2024. The sub-lease vacancy rate is expected to increase once 242 Exhibition Street, Melbourne (Ex Telstra 30,000sqm) is accounted for.

The Civic, Eastern and North Eastern precincts were the only precincts which recorded decreases in their vacancy rates in the six months to July 2024, however, the vacancy rates of Docklands, Flagstaff and Western precincts

are sitting at all time highs. Collectively, the Western and Docklands precincts account for 60% of the Melbourne CBD office market.

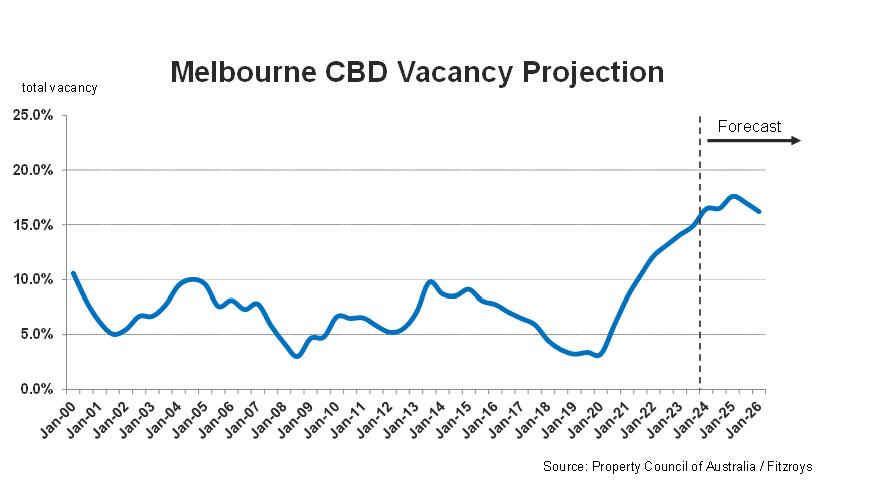

In positive news the Victorian economy is forecast to continue to create jobs and this combined with limited new construction, is expected to see the vacancy rate reach its peak at during 2025.

Despite the increasing rate of tenants relocating into the CBD, the overall vacancy rate of the Melbourne CBD office market is projected to increase through this year before declining from 2025.

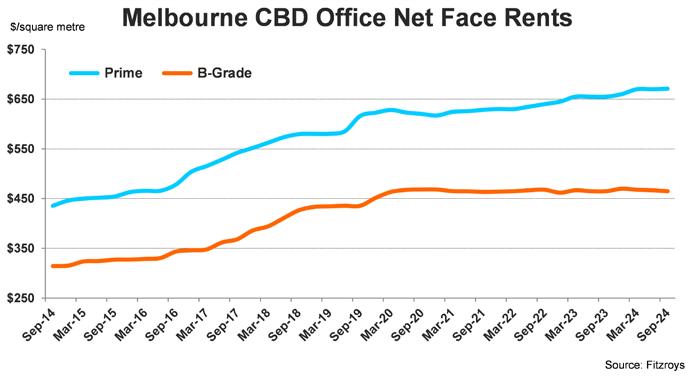

While gross face rents for Melbourne CBD offices have risen as a result of increasing outgoings and incentives, net effective rents fell over the 12 months to September 2024. The availability of diverse, high-quality offices in the CBD continues to drive competition amongst owners which has pushed prime incentives to historical high levels. Reflecting the number of prime office vacant opportunities and competition for tenants, secondary net face rents have declined slightly through 2024.

Prime Grade offices in the Melbourne CBD are projected to record net effective rental growth from 2025 as incentives begin to ease from their current historical highs. In contrast, rental growth for secondary offices is likely to remain under downward pressure until the overall vacancy rate has peaked.

Phillip Cullity Director 0419 322 825 cullityp@fitzroys.com.au

Stephen Land Associate Director 0400 950 290 lands@fitzroys.com.au

Hamish Dennis Agency Executive 0406 500 232 dennish@fitzroys.com.au