Melbourne CBD Office Market Report.

Melbourne’s CBD office market has grown by 60,273sqm during 2022 with office space totalling 5.09 million square metres, the second largest office market in Australia.

Refurbishments accounted for the vast majority of stock additions to the Melbourne CBD in 2022 to date, led by AMP Capital’s 600 Bourke Street (21,661sqm) and 12,377sqm coming online within the Rialto Towers at 525 Collins Street.

Other refurbished space to re-enter the Melbourne CBD office market in 2022 included 7,250sqm in 140 William Street and 6,762sqm in 150 Lonsdale Street.

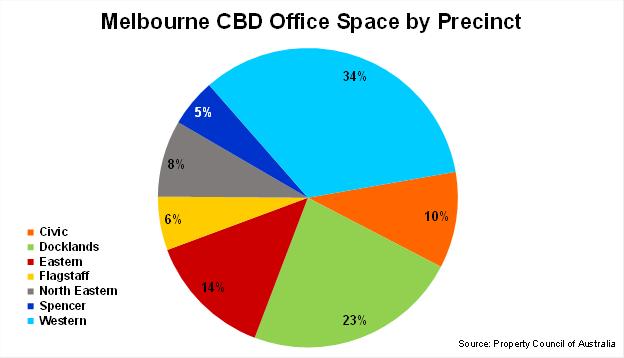

By precinct, 74% of the new and refurbished stock added to the Melbourne CBD was located in the Western precinct followed by the Civic and North Eastern precincts. The Western precinct continues to hold the most office space in the Melbourne CBD with 34% followed by the Docklands which comprises almost 1.2 million square metres having doubled in size over the past 10 years.

Melbourne CBD Office Space by Precinct

Melbourne CBD New Office Supply

Of the space that is under construction,

moderate with 48% pre-leased. Although the precommitment levels are relatively low in comparison to recent years, the outlook of new supply is muted with the forecast of stock expected to remain below the 10-year average for the medium term.

With employers focused on the attraction and retention

talent, offices offering quality amenities will underpin

employees to return to the workplace in the new “normal”. This is likely to result in the level of commitment increasing across the stock currently under construction.

While the Victorian economy was the hardest hit hardest by the pandemic, Victoria’s total employment has increased by 28,500 people over the year to August 2022. Total employment across Victoria has risen by 280,000 people since the trough in August 2020 with full-time employment well above its pre-pandemic levels, boosting the need for office accommodation.

Reflecting the employment growth of Victoria, the State’s unemployment rate has fallen to 3.7% as at August 2022, down from 7.0% as at August 2020.

The growth of employment in Victoria was largely driven by the traditional white collar sectors of professional services and finance. In addition to the strong gains of this key sector, the health and construction sectors recorded solid growth over the year.

Highlighting the growing business investment environment, as at July 2022, there were 74,000 jobs being advertised in

Victoria compared with only 27,900 in July 2020. Looking ahead, employment is forecast to grow by 1.75% over the 12 months to June 2023.

The sharp improvement in employment and job ads resulted in net absorption in the six months to July 2022 remaining positive, increasing by 1,991 square metres, up from negative 96,635 square metres in the corresponding half year, a year earlier. All grades of Melbourne CBD office space recorded positive net absorption in the six months to July 2022 except for B-grade stock. The level of Melbourne’s CBD net absorption over the past six months was dominated by Premium grade and A-grade space as occupiers upgraded to better quality accommodation to encourage staff into workplaces in the wake of the pandemic. Net absorption of A-grade office space in the Melbourne CBD totalled 43,394sqm in the six months to July 2022, resulting in 94,647sqm – the highest annual level in five years.

Melbourne CBD Net Absorption & Total VacancySquare Metres

Victoria’s strengthening economy coupled with employment growth resulted in improving levels of tenant demand over the past six months.

Despite recording positive net absorption in the six months to July 2022, vacancy rose in the Melbourne CBD, impacted by new additions. The Melbourne CBD office vacancy rate rose to 12.9% as at July 2022 – its highest level since July 1999, up from 11.9% in January 2022. Notwithstanding this rise in vacancy, the Melbourne CBD office market has the third lowest vacancy amongst all of Australia’s major CBD office markets only trailing behind Canberra at 8.6% and Sydney at 10.1%, which both also recorded rises in vacancy rates over the past six months.

Similar to the other CBD office markets of Australia, Melbourne’s CBD vacancy rate is also now above its 10-year average. In terms of quality grades, Premium grade vacancy rose to 10.9%, its highest rate since 2004, whereas A-grade vacancy fell to 13.0%, the first fall since July 2019. Over the six months to July 2022, C-grade and D-grade vacancy rates all recorded increases

Sublease vacancy in the Melbourne CBD office market continued to rise, increasing from 2.5% in January 2022 to 2.6% as at July 2022 – its highest level since 1995. In terms

Melbourne CBD Vacancy

of the quantum of sub-lease space, the current level of 132,528 square metres is the highest on record as businesses reconsidered their office space needs with major occupiers in particular offering space. Collectively, Premium and A-grade office space account for 93% of total sub-lease vacancy across the Melbourne CBD office market as at July 2022.

By precinct, while the majority rose in the six months to July 2022, all precincts with the exception of the Spencer precinct are now above their 10-year averages. The Docklands precinct rose to 13.4%, its highest level on record, impacted by tenant

relocations. The North Eastern precinct also increased, rising to 10.7% - its highest level since 1997.

While employment growth has been solid over the past year, office occupancy levels remain significantly below pre-COVID levels with Melbourne recording 39%, the lowest of all Australia’s capital cities as at August 2022. With the Victorian government lifting its COVID-19 work-from-home recommendations in September, occupancy rates of Melbourne offices are expected to steadily rise through the remainder of 2022.

Looking forward, tenant demand is expected to continue to gather momentum through 2022, led by smaller occupiers as businesses return back to offices in earnest. While tenant demand continues to recover, the total vacancy rate of the Melbourne CBD office market is likely to remain above 10year average for several years, given the significant volume of backfill and sublease space that is currently being marketed.

Prime face rents continued to show resilience; with the level

showing signs of peaking. Reflecting the preferences of tenants, face rents in the secondary market

Face Rents

have remained stable however continue to diverge against

Incentives remain at 30-year highs for both prime and

given the elevated sub-lease vacancy and uncommitted pipeline of new supply coupled with uncertain working business models establishing for businesses resulting in a reduction of onsite staff. Looking ahead, face rents are expected to continue to increase and with incentives beginning to moderate, effective rental growth should subsequently recover.