Melbourne CBD Office Leasing Market Report

Quarter 1.2023:

Vol.4 March 2024

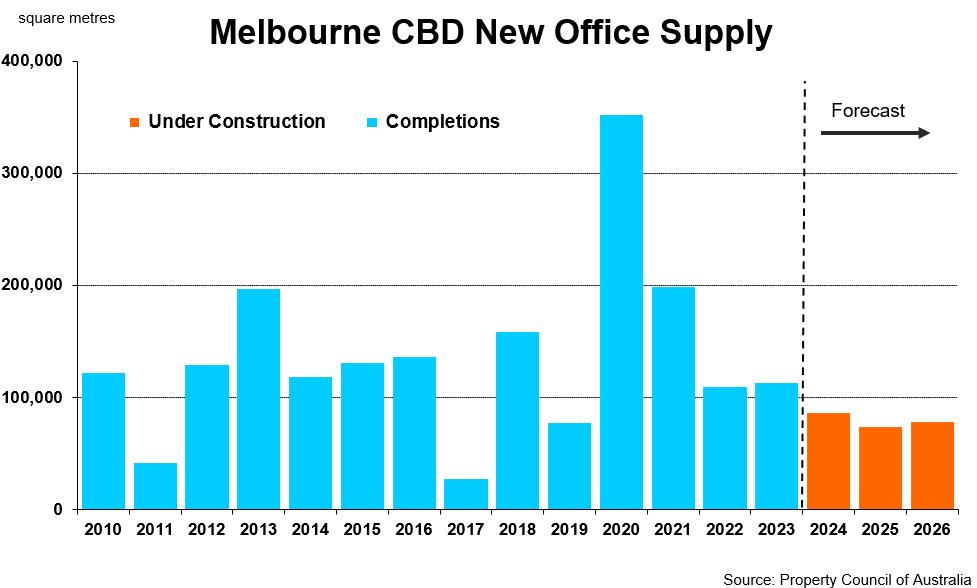

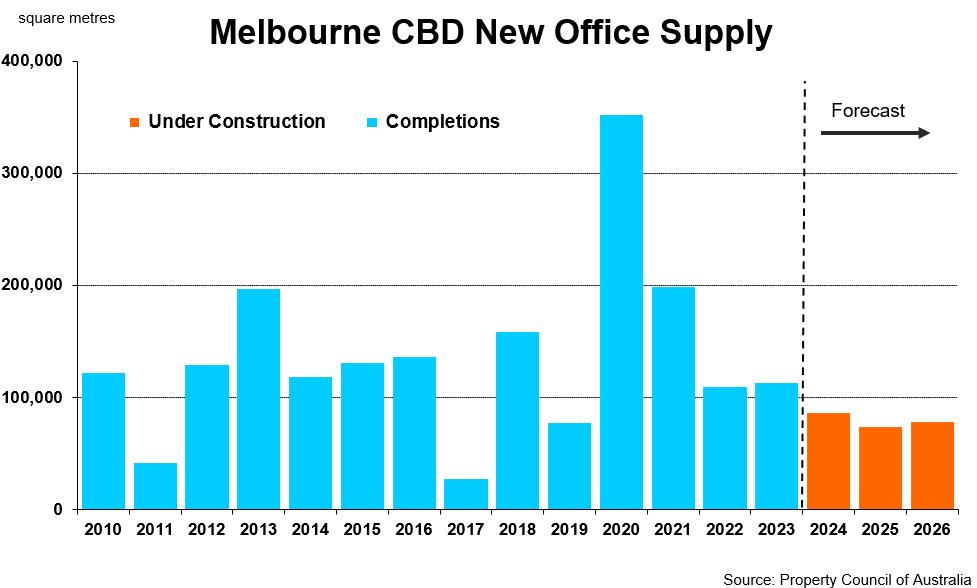

Looking forward to 2026 there are 7 new projects which are under construction or have begun siteworks that will deliver 237,750sqm of new office space.

Melbourne’s CBD office market increased by 42,118 square metres over 2023, with Melbourne’s CBD office market space now totalling 5.17 million square metres, an all-time high. Over the past 15 years, office space in the Melbourne CBD has grown by 1.2 million square metres and is now 33% larger than 2009 levels.

As at January 2024, A-Grade space accounts for half of all office space across the Melbourne CBD and has grown the most since 2014. In the past 10 years 534,845 square metres of A-grade space has been delivered to the market. In contrast, both C-Grade and D-Grade office stock in the Melbourne CBD office market has declined over the past decade.

With new supply having peaked in 2020, 113,281sqm was added to Melbourne CBD office market during 2023, largely through refurbished stock – led by ISPT’s 500 Bourke Street (43,125sqm) and Victoria University’s 300 Flinders Street (12,656sqm).

The completion of Charter Hall’s 48,500sqm office at 555 Collins Steet was the only new office development added to the Melbourne CBD office market in 2023.

Conversely, more than 31,000 square metres of office space was withdrawn in the Melbourne CBD office market, all of which was within secondary grade stock.

By precinct, 57% of the new and refurbished stock added to the Melbourne CBD was located in the Western precinct followed by the Spencer precinct. The Western precinct continues to hold the most office space in the Melbourne CBD with 34% followed by the Docklands which comprises 1.17 million square metres having increased by 65% over the past 10 years.

Looking forward to 2026 there are 7 new developments which are under construction or have begun siteworks that will deliver 237, 750sqm of new and refurbished space.

2 Melbourne CBD Office - Market Report | March 2024 MELBOURNE CBD OFFICE LEASING - MARKET REPORT, Vol.4 March 2024

Supply

Pre-commitments

Of the space that is under construction, pre-commitment levels remain modest compared to previous years with currently 48% pre-leased. With development activity projected to remain at below average levels for the medium term, adversely impacted by the elevated high vacancy rates and cost of capital, pre-leasing activity is anticipated to increase as tenants seek to upgrade their workplaces to encourage staff return to the office.

Major CBD Projects

Source: Property Council of Australia/Fitzroys

Beyond those offices currently under construction, there are a number of projects at various stages of development approval proposed for the Melbourne CBD office market including: DEXUS’ 60 Collins Street (42,182sqm), Stage 2 of 555 Collins Street (35,000sqm) and Hines’ development at 600 Collins Street (60,000sqm).

3 Melbourne CBD Office - Market Report | March 2024 MELBOURNE CBD OFFICE LEASING - MARKET REPORT, Vol.4 March 2024

Address Type Major Tenant Commitments Total NLA (sqm) Completion 693 Collins Street, Docklands New Development Medibank, Seven Network, Beca 70,000 Q1 2024 130 Little Collins St, Melbourne New Development Strata Development 9,600 Q2 2024 415 Flinders Lane, Melbourne Full Refurbishment n/a 6,000 Q4 2024 800 Collins Street, Docklands Full Refurbishment n/a 28,650 Q2 2024 7 Spencer Street, Mlebourne New Development n/a 45,500 Q4 2024 25 Swanston Street, Melbourne New Development n/a 16,000 2026 435 Bourke Street New Development CBA, Baker & McKenzie 62,000 Q4 2026

While the Melbourne CBD office market recorded negative net absorption over the past three years, it obscures the clear “flight to quality,” trend and tenants prioritising buildings with greencertificated ratings.

While occupiers remain cautious in the current economic environment coupled with the rise of working from home practices, tenant demand is showing signs of improvement as more businesses develop specific workplace requirements for their organisations.

According to the PCA, the Melbourne CBD office market recorded negative net absorption of 86,531sqm during 2023, the second worst level recorded since 1990. In comparison, the average annual net absorption level over the past 10 years for the Melbourne CBD office market is almost 38,700sqm.

In the six months to January 2024, Premium grade office space recorded positive net absorption of 12,304sqm driven by tenants moving into 555 Collins Street. In contrast, A-grade, B-grade and C-grade offices all recorded negative net absorption in the six months to January 2024.

Victoria’s employment continues to increase, close to an all-time high in January 2024, having increased by 149,761 new jobs over the past 12 months. The State’s unemployment rate remains at a low rate of 3.9% as at January 2024. Looking ahead, Victoria’s employment is projected to increase further through 2024, albeit with the growth rate moderating from recent levels.

Over the six months to January 2024, the Spencer precinct recorded net absorption of 14,360sqm boosted by the completion of 555 Collins Street, followed by the Western and Docklands precincts. In contrast, Flagstaff, Eastern, Civic and the North Eastern precincts all recorded negative net absorption over the six months to January 2024.

4 Melbourne CBD Office - Market Report | March 2024 MELBOURNE CBD OFFICE LEASING - MARKET REPORT, Vol.4 March 2024

Demand

Tenant Enquiry

Demand remains healthy from occupiers seeking up to 300sqm and these groups are focussed on quality fitted space or new spec suites. Tenant enquiry levels have been skewed to smaller and medium sized firms with demand for up to 300 square metres remaining resilient. In addition, analysis of smaller firms’ enquiries has shown that organisations are consistently seeking better quality space, capitalising on the attractive leasing terms on offer.

Occupiers across all office markets and sizes are continuing to reassess their workplace needs as a result of hybrid working. Increasingly tenants are considering the CBD due to the premier amenity and connectivity of the CBD.

The competitive leasing terms on offer for CBD buildings coupled with the Metro Tunnel infrastructure works nearing

completion, has resulted in an increasingly number of tenants seeking to relocate from City Fringe markets into the CBD.

Tenant enquiry for Melbourne CBD office accommodation remains diverse with demand for office space led by Professional Services (32%) followed by Finance & Insurance (25%) and IT & Telecommunications (18%). Other sectors active in the Melbourne CBD office market over the past 12 months have been the Education and the Healthcare sectors. The education sector has recovered due to the increase in students particularly from China. Whilst the number of Visa’s being issued has reduced from previous years the education sector remains one of the most significant pillars of Melbourne’s office Market.

5 Melbourne CBD Office - Market Report | March 2024 MELBOURNE CBD OFFICE LEASING - MARKET REPORT, Vol.4 March 2024

Recent CBD Leasing Transactions

6 Melbourne CBD Office - Market Report | March 2024 MELBOURNE CBD OFFICE LEASING- MARKET REPORT, Vol.4 March 2024 Address Grade Tenant NLA (sqm) 530 Collins Street, Melbourne A Slater & Gordon 3,935 Tower 4, Collins Square, Docklands Premium Optus 10,000 Queen & Collins, Melbourne Premium Hall & Wilcox 3,593 271 Collins Street, Melbourne A/Heritage Seeing Machines 2,300 737 Bourke Street, Docklands A North Western Health 2,088 399 Lonsdale Street, Melbourne B Health Careers 1,986 550 Bourke Street, Melbourne A Zendesk 1,546 300 La Trobe Street, Melbourne A Fleet Partners 1,090 181 William Street, Melbourne A AGIG 948 699 Collins Street, Docklands Pre-lease A Seven Network 4,500 555 Collins Street, Melbourne Pre-lease Premium Bendigo & Adelaide bank 4,114 697 Collins Street, Docklands A Nous 2,090 55 Collins Street, Melbourne A The Commons 5,061 Queen & Collins, Melbourne Premium A&M 900 699 Collins Street, Docklands Pre-lease A Beca 2,900 Source: Fitzroys

Vacancy

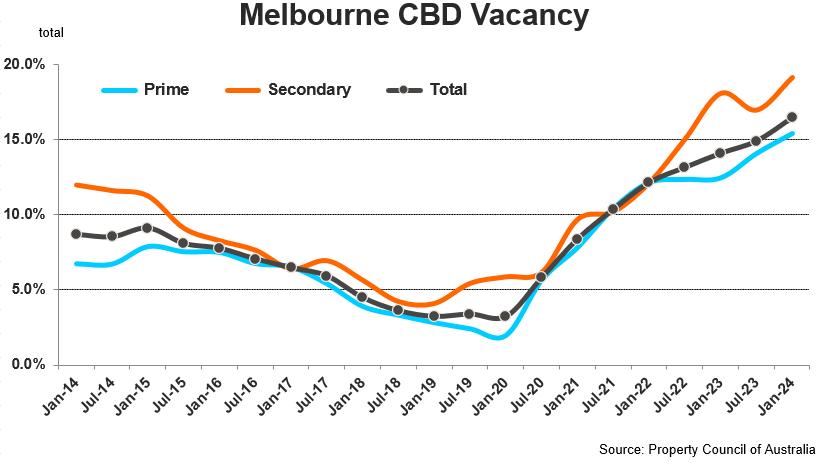

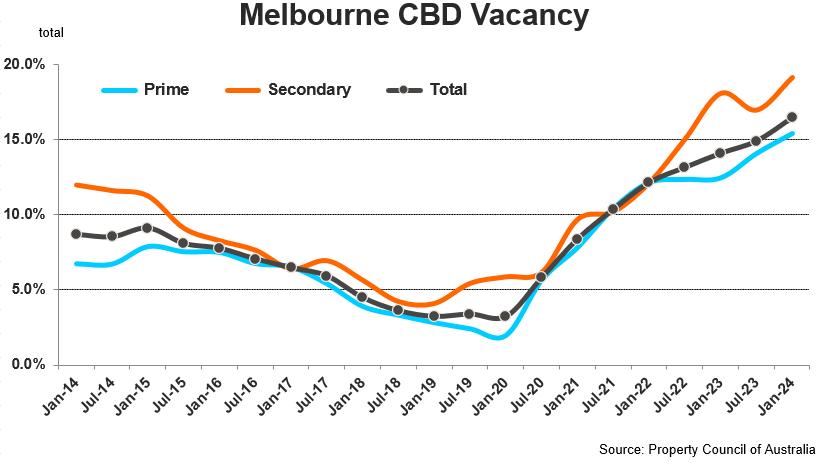

According to the Property Council, the total Melbourne CBD office vacancy rate increased to 16.4% as at January 2024.

With new supply surpassing tenant demand, the Melbourne CBD office vacancy rate continued to increase. According to the Property Council, the total Melbourne CBD office vacancy rate increased to 16.4% as at January 2024, higher than its 10-year average of 8.3%. In comparison to the other Australian CBD office markets, only Adelaide CBD’s vacancy rate (19.3%) is higher than Melbourne, while Sydney, Brisbane and Perth CBD office markets have lower vacancy levels albeit all above their respective 10-year vacancy rates. The only major Australian CBD office market with a vacancy rate lower than 10% is currently Canberra (8.3%).

Vacancy by Grade

In terms of quality grades, Premium grade office stock was the only grade of Melbourne CBD office space which recorded a fall in its vacancy rate over the six months to January 2024, declining to 11.1%. A-grade office vacancy rate increased to 17.3%, its highest rate since 1995. Similarly, B-grade vacancy rates increased to 22.3%, a 30-year high with C-grade and D-grade vacancy rates also increasing over the six months to January 2024.

Sub-lease Vacancy

The sub-lease vacancy levels increased over the six months to January 2024. Current sub lease levels remain below the peak of July 2022 and they appear to have peaked. As at January 2024, sub-lease vacancy totalled 104,545sqm, almost double the 10-year average of the Melbourne CBD office market, resulting in a sub-lease vacancy rate of 2.0%. Collectively,

premium and A-grade office space account for 94% of total sub-lease vacancy across the Melbourne CBD office market as at January 2024. One of the most significant sub lease opportunities is the Telstra space at 242 Exhibition Street. A total of 30,000sqm is available for sub lease in 2 lots of 15,000sqm each at a heavily discounted rental.

7 Melbourne CBD Office - Market Report | March 2024 MELBOURNE CBD OFFICE LEASING- MARKET REPORT, Vol.4 March 2024

Vacancy by Precinct

All precincts have vacancy rates above their respective 10-year averages. The Docklands and Spencer precincts are the only precincts to have recorded declines in their vacancy rates in the six months to January 2024. The vacancy rates of the Civic, Flagstaff, North Eastern and Western precincts have all increased to 20-year highs as at January 2024.

Outlook

Looking ahead, with the Victorian economy is forecast to expand with labour demand remaining elevated. The vacancy rate of the Melbourne CBD office market is projected to marginally increase before declining from late 2024.

8 Melbourne CBD Office - Market Report | March 2024 MELBOURNE CBD

LEASING- MARKET REPORT, Vol.4 March 2024

OFFICE

Rents & Incentives

The CBD office market is heavily influenced by tenants seeking strong incentives to either fund the cost of their fit out or to reduce their rental.

Despite a marginal rise in gross face rents, net effective rental levels in the Melbourne CBD office market continue to face downward pressure due to elevated vacancy rates and continuing increases in outgoings.

The availability of diverse, high-quality office accommodation options in the Melbourne CBD continues to drive competition amongst owners which as a result has pushed prime incentives to historical high levels.

Looking ahead, prime office face rents are expected to continue increase, with incentives at historical highs. Incentive levels are expected to moderate through 2024, leading to effective rental growth for prime office stock in the Melbourne CBD market. In contrast, rental growth for secondary offices is likely to remain modest for the medium term until the vacancy rate has peaked.

9 Melbourne CBD Office - Market Report | March 2024 MELBOURNE CBD OFFICE LEASING- MARKET REPORT, Vol.4 March 2024

Licensed Estate Agents Auctioneers Asset Managers Consultants and Valuers fitzroys.com.au 9275 7777 360 Collins Street Melbourne 10 Disclaimer: The information, views, projections or analysis published in this report including text, graphics, and all images are for general use only and not to be relied upon for financial or related investment in any way. No responsibility or liability whatsoever can be accepted by Fitzroys Pty Ltd for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. Reproduction of any part or whole of this report must seek prior express written approval of Fitzroys Pty Ltd. Melbourne CBD Office - Market Report | Macrh 2024 We know Melbourne. Office Leasing Team MELBOURNE CBD OFFICE LEASING - MARKET REPORT, Vol.4 March 2024 Office Leasing Services CBD, fringe & suburban leasing Leasing of new office projects, existing developments, creative and heritage space, mixed use developments and specialist property. Pre-commitment & pre-development advice Project marketing Expert negotiation Phillip Cullity DIRECTOR - OFFICE LEASING 03 9275 7788 0419 322 825 cullityp@fitzroys.com.au Stephen Land ASSOCIATE DIRECTOR - AGENCY 03 9275 7765 0400 950 290 lands@fitzroys.com.au Hamish Dennis AGENCY EXECUTIVE 03 9275 7718 0406 500 232 dennish@fitzroys.com.au For more information on how Fitzroys Office Leasing services can help your organisation, please contact Phillip Cullity on 0419 322 825 or cullityp@fitzroys.com.au Fitzroys clients include institutional, corporate and private owners within the CBD, Inner Fringe and Suburban markets. Contact us today to discover how we can secure tenants for your office buildings.