Quarter 1.2023: Licensed Estate Agents Auctioneers Property Managers Consultants and Valuers fitzroys.com.au | 9275 7777 We know Melbourne. Melbourne CBD Office Market Report Vol.2 April 2023 Q1 2023

Melbourne’s CBD office market increased by 96,448 square metres over 2022, with office space now totalling 5.12 million square metres, an all-time high.

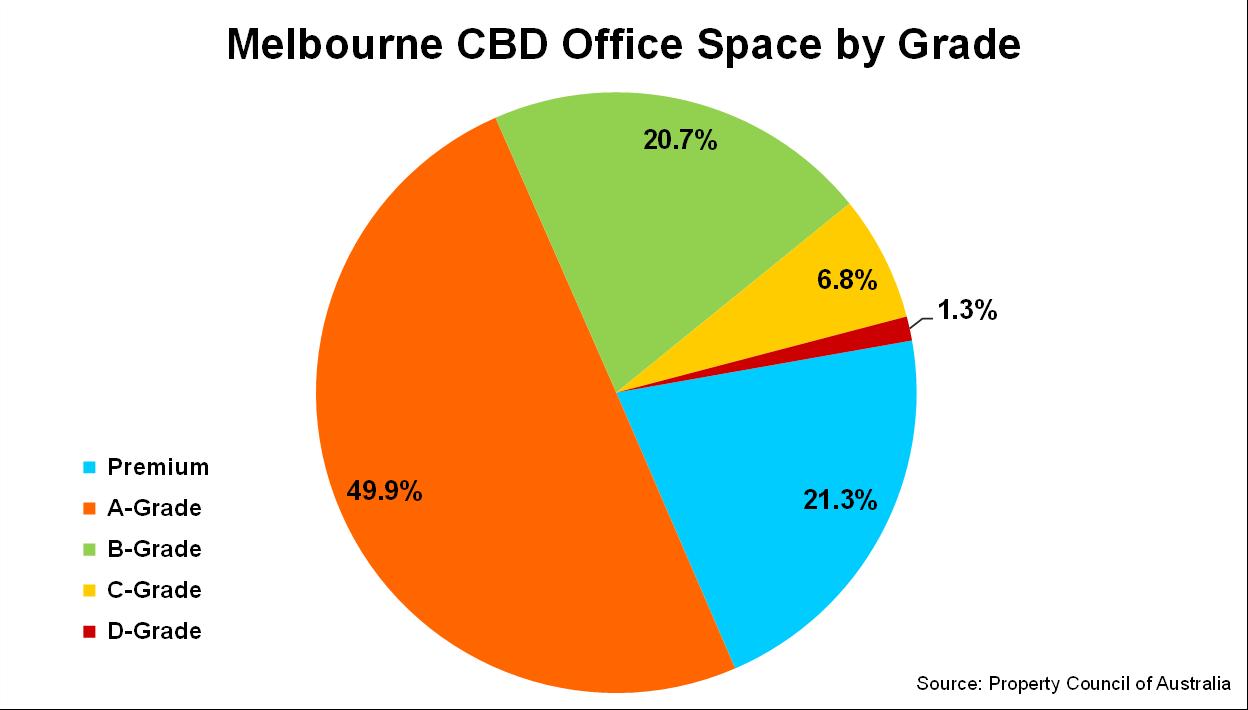

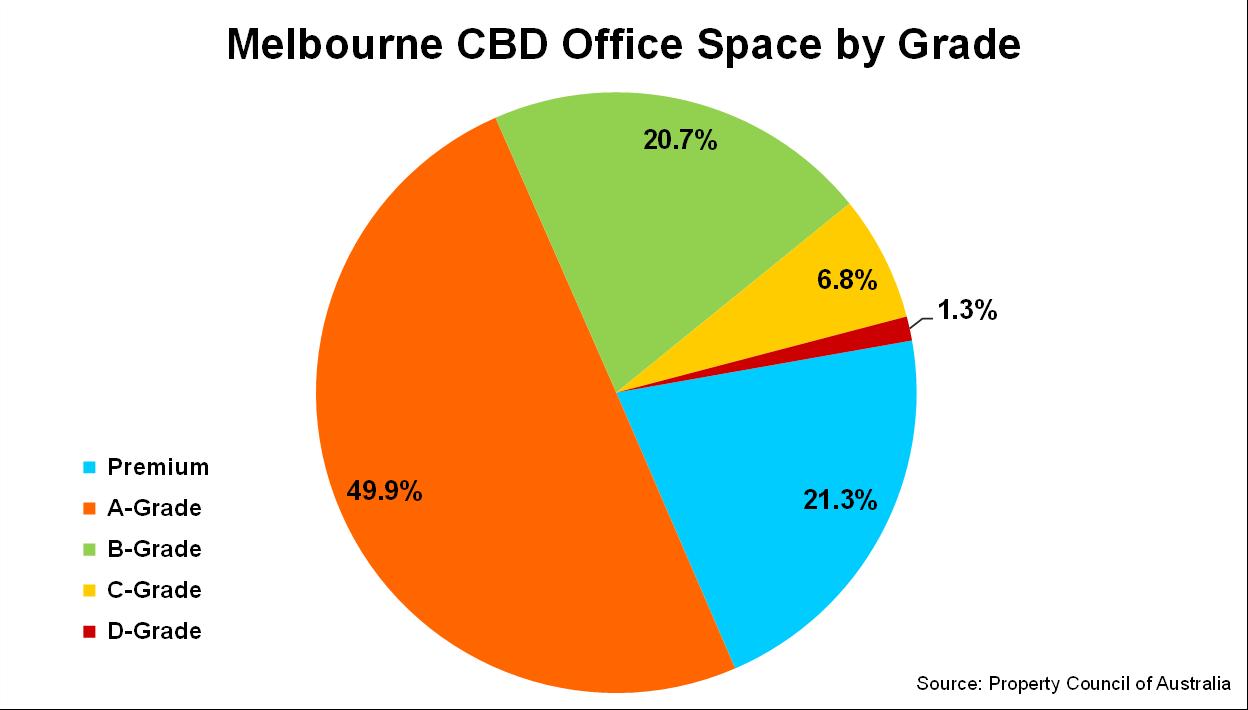

In terms of quality of space, as at January 2023, A-Grade quality office space accounts for almost half of all office space across the Melbourne CBD and has grown the most since 2013, with 608,826 square metres of A-grade office space delivered to the market over the past 10 years.

With new supply having peaked in 2020, 109,231sqm was added to Melbourne CBD office market in 2022, largely through refurbished stock – led by Peakstone’s 637 Flinders Street (25,716sqm), AMP Capital’s 600 Bourke Street (21,661sqm) and 12,377sqm coming online within the Rialto Towers at 525 Collins Street.

The completion of Australian Federal Police’s 23,000sqm office at 140 Lonsdale Steet was the only new development

added to the Melbourne CBD office market in 2022.

By precinct, 41% of the new and refurbished stock added to the Melbourne CBD was located in the Western precinct followed by the North Eastern and Docklands precincts. The Western precinct continues to hold the most office space in the Melbourne CBD with 33% followed by the Docklands which comprises 1.2 million square metres having doubled in size over the past 10 years.

Looking forward, there are four new developments which are under construction or have begun siteworks. Looking ahead through to 2026, the pipeline of new supply is expected to deliver 264,700sqm of new and refurbished space across the Melbourne CBD.

2 Melbourne CBD Office - Market Report | Q1. April 2023 MELBOURNE

CBD OFFICE - MARKET REPORT, Q1

Supply

Melbourne CBD Office Space by Grade

MELBOURNE CBD OFFICE - MARKET REPORT, Q1

Pre-commitments

Of the space that is under construction, pre-commitment levels remain modest compared with previous years with 30% pre-leased. With development activity projected to remain below average levels for the medium term, adversely impacted by the elevated high vacancy rates, pre-leasing activity is anticipated to increase as tenants seek to upgrade their workplaces to encourage staff back into offices.

CBD Projects Under Construction/Siteworks

Beyond those offices currently under construction, there are a number of projects at various stages of development approval proposed for the Melbourne CBD office market including: DEXUS’ 60 Collins Street (42,182sqm), Stage 2 of 555 Collins Street (35,000sqm) and Hines’ development at 600 Collins Street (60,000sqm).

3 Melbourne CBD Office - Market Report | Q1. April 2023

Address Type Major Tenant Commitments NLA (sqm) Completion 440 Collins Street Full Refurbishment n/a 4,373 2023,Q4 555 Collins Street New Development Amazon, Aware Super, Allianz Australia 48,500 2023,Q4 500 Bourke Street Full Refurbishment TAL, PKF, Holding Redlich 46,125 2023,Q4 693 Collins Street New Development Medibank 70,000 2024,Q1 130 Little Collins Street New Development Strata Development 9,600 2024,Q2 435 Bourke Street New Development n/a 62,000 2026

Source: Property Council of Australia / Fitzroys

Over 2022, net absorption totalled negative 13,663sqm with the occupied space in the CBD office market adversely impacted by both new supply and subdued tenant demand. In comparison, the 10-year average annual net absorption level for the Melbourne CBD office market is almost 50,000sqm. While the Melbourne CBD office market recorded negative net absorption over the past two years, it obscures the clear “flight to quality,” trend as many businesses are vacating older, secondary office buildings in favour for new high-quality space. In the six months to January 2023, prime (premium and A-grade office space) net absorption totalled 40,054sqm, whereas tenants vacated 55,708sqm of secondary office space in the Melbourne CBD office market.

Having rebounded strongly following the worst of the effects of the pandemic, employment growth across the State appears to have peaked with 49,000 new jobs added during 2022 compared with 104,000 jobs added in 2021. Reflecting the easing employment growth of Victoria, the State’s unemployment rate increased to 4.0% as at January 2023, up from 3.2% as at July 2022.

Mirroring the location of new supply, the only precincts of the Melbourne CBD office market to record positive net absorption in the six months to January 2023 were the North Eastern precinct with 26,310sqm absorbed underpinned by the move of the Australian Federal Police into their new office and the Western Core precinct with 15,134sqm absorbed.

4 Melbourne CBD Office - Market Report | Q1. April 2023 MELBOURNE CBD OFFICE - MARKET REPORT, Q1

Given the current uncertain global economic conditions, increasingly occupiers are taking a disciplined approach to office space requirements. According to the Property Council, the Melbourne CBD office market recorded a second consecutive year of negative net absorption.

Demand

Melbourne CBD Net Absorption Square Metres

Tenant Enquiry

Tenant enquiry levels have more recently shown signs of improvement led by smaller sized tenants seeking to capitalise on the attractive leasing terms on offer and employers encouraging staff back into the workplace within better quality office buildings.

Tenant enquiry for Melbourne CBD office accommodation was generally in line with growth of employment across Melbourne with demand for office space led by Finance & Insurance (31%) followed by Professional Services (26%) and Government (18%). While the IT & Telecommunications sector was relatively subdued over 2022, interestingly, there was strong growth recorded in the Arts & Recreation sector. Vacancy

Recent CBD Leasing Transactions

5 Melbourne CBD Office - Market Report | Q1. April 2023 MELBOURNE

CBD OFFICE - MARKET REPORT, Q1

Address Type Tenant NLA NLA (sqm) 555 Collins Street Pre-lease Allianz Australia 6,250 530 Collins Street Existing Suncorp 9,000 385 Bourke Street Existing NPM 500 385 Bourke Street Existing Rodgers Reidy 500 637 Flinders Street Existing Wesfarmers Health 3,500 171 Collins Street Direct AEMO 5,000 567 Collins Street Sub-lease WSP 6,000 180 Lonsdale Street Sub-lease Latitude Financial 1,800

Source: Fitzroys

Tenant Enquiry by Size

Source: Fitzroys

CBD OFFICE - MARKET REPORT, Q1

Vacancy

With new supply surpassing tenant demand, correspondingly, the Melbourne CBD office vacancy rate continued to increase. According to the Property Council, the total Melbourne CBD office vacancy rate increased to 13.8% as at January 2023, its highest level since January 1999. Despite the rise, the office vacancy rate of the Melbourne CBD remains below those of the Adelaide and Perth CBD office markets. While the vacancy rate of the Hobart CBD office market is Australia’s lowest at 2.5%, only Canberra’s office vacancy rate is also lower than its 10-year average.

Vacancy by Grade

Premium grade office stock was the only grade of Melbourne CBD office space which recorded a fall in its vacancy rate, declining to 9.5% over the six months to January 2023. Despite the positive net absorption of A-grade office stock, A-grade vacancy increased to 13.7% as tenant demand was outstripped by new supply as at January 2023. B-grade office space vacancy surpassed 20% for the first time on record with 220,956sqm currently vacant of which 5,207sqm is via sub lease.

Sub-lease Vacancy

Interestingly, having reached a 28-year high in July 2022, sub-lease vacancy levels appear to have peaked in the short term, falling from 2.6% in July 2022 to 1.9% as at January 2023. While still double its 10-year average, the quantum of sub-lease space of 98,318sqm has fallen to it lowest level since January 2021. Collectively, premium and A-grade office space account for 94% of total sub-lease vacancy across the Melbourne CBD office market as at January 2023.

By precinct, while the majority recorded increases in office vacancy in the six months to January 2023, all precincts now hold vacancy rates above their respective 10-year averages. The Docklands precinct rose to 15.5%, its highest level on record, impacted by tenant relocations. Only the North Eastern and Western Core precinct recorded falls in office vacancies in the six months to January 2023.

Melbourne CBD Vacancy by Grade

6 Melbourne CBD Office - Market Report | Q1. April 2023

MELBOURNE

Total Vacancy

MELBOURNE CBD OFFICE - MARKET REPORT, Q1

Rents & Incentives

Prime face rents continued to show resilience; with the level of incentives now showing signs of peaking having stabilised over the second half of 2022. Reflecting the preferences of tenants, face rents in the secondary market have remained stable as tenants focus their interest in prime quality office space leading to a divergence in rental levels between prime and secondary office space.

While incentive levels for both prime and secondary offices in the Melbourne CBD market remain elevated, incentives for prime space have recorded a marginal decline, reflecting the increased tenant enquiry levels.

Looking ahead, prime office face rents are expected to continue increase, with incentives beginning to moderate, leading to effective rental growth for prime office stock in the Melbourne CBD market. In contrast, rental growth for secondary offices is likely to remain modest for the medium term until the vacancy rate has peaked.

Sales Activity

Despite the subdued leasing environment, sales activity in Melbourne’s CBD office market has surpassed $3.6 billion in 2022, its highest third annual level over the past decade, a 46% increase on levels the preceding year. Transactional activity was relatively subdued in the second half of 2022 with purchasers cautious given the increasing cost of capital.

Transactional activity across the CBD office market this year has been dominated by domestic institutions boosted with a number of major transactions such as Charter Hall’s 50% share of Southern Cross Towers. With sales activity above average for the past four consecutive years, investment activity is expected to fall below average levels in coming years with the cost of capital likely to remain elevated through 2023.

Foreign investors continued to be attracted to the Melbourne CBD office market, accounting for 44% of total office sales volume over 2022, albeit with some domestic purchasers

CBD Office Net Face Rents

7 Melbourne CBD Office - Market Report | Q1. April 2023

Melbourne

$/square metre

MELBOURNE CBD OFFICE - MARKET REPORT, Q1

having acquired offices on behalf of offshore capital. Offshore purchasers were dominated by those from Singapore and Hong Kong.

While prime yields rose slightly through 2022, reflecting the increasing cost of capital for purchasers, they remain well below the 10-year average. As at January 2023, average prime office yields range between 4.5% and 5.5%. Mirroring the tenant preference for prime assets, the yield premium between prime and secondary grade offices has also begun to widen with secondary yields ranging between 5.0% and 6.0%.

Given the recent extended period of limited investment opportunities, investor demand for office assets is likely to remain robust across the Melbourne CBD, with confidence improving considering occupancy levels likely to increase through 2023 along with the positive long-term outlook for rental growth of the Melbourne CBD office market in comparison to other Australian CBD office markets.

8 Melbourne CBD Office - Market Report | Q1. April 2023

Melbourne CBD Office Sales Volume

Office Leasing Team

Phillip Cullity DIRECTOR - OFFICE LEASING 03 9275 7788 0419 322 825 cullityp@fitzroys.com.au

Office Leasing Services

Clear leasing strategy & advice

Stephen Land ASSOCIATE DIRECTOR - AGENCY 03 9275 7765 0400 950 290 lands@fitzroys.com.au

Hamish Dennis AGENCY EXECUTIVE 03 9275 7718 0406 500 232 dennish@fitzroys.com.au

Leasing of new office projects, existing developments, creative and heritage space, mixed use developments and specialist property.

Pre-commitment & pre-development advice

Project marketing

Expert negotiation

Regular client communication and progress reports

For more information on how Fitzroys Office Leasing services can help your organisation, please contact Phillip Cullity on 0419 322 825 or cullityp@fitzroys.com.au

Licensed Estate Agents Auctioneers Asset Managers Consultants and Valuers fitzroys.com.au 9275 7777 360 Collins Street Melbourne 9

information,

projections or

in this report including text, graphics, and all images are for general use only and not to be relied upon for financial or related investment in any way. No responsibility or liability whatsoever can be accepted by Fitzroys Pty Ltd for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. Reproduction of any part or whole of this report must seek prior express written approval of Fitzroys Pty Ltd. Melbourne CBD Office - Market Report | Q1. April 2023 We know Melbourne. MELBOURNE CBD OFFICE - MARKET REPORT, Q1

Disclaimer: The

views,

analysis published

Fitzroys clients include institutional, corporate and private owners within the CBD, Inner Fringe and Suburban markets. Contact us today to discover how we can secure tenants for your office property.