Food Africa Business

BEVERAGE TECH AFRICA

Focus on Ghana

MEAT & POULTRY MEA

Flavor modulation in meat

FOOD INGREDIENTS AFRICA

Flavored tea trends

FOOD SAFETY AFRICA

AI in food safety management

Food safety incidents in Africa

BEVERAGE TECH AFRICA

Focus on Ghana

MEAT & POULTRY MEA

Flavor modulation in meat

FOOD INGREDIENTS AFRICA

Flavored tea trends

FOOD SAFETY AFRICA

AI in food safety management

Food safety incidents in Africa

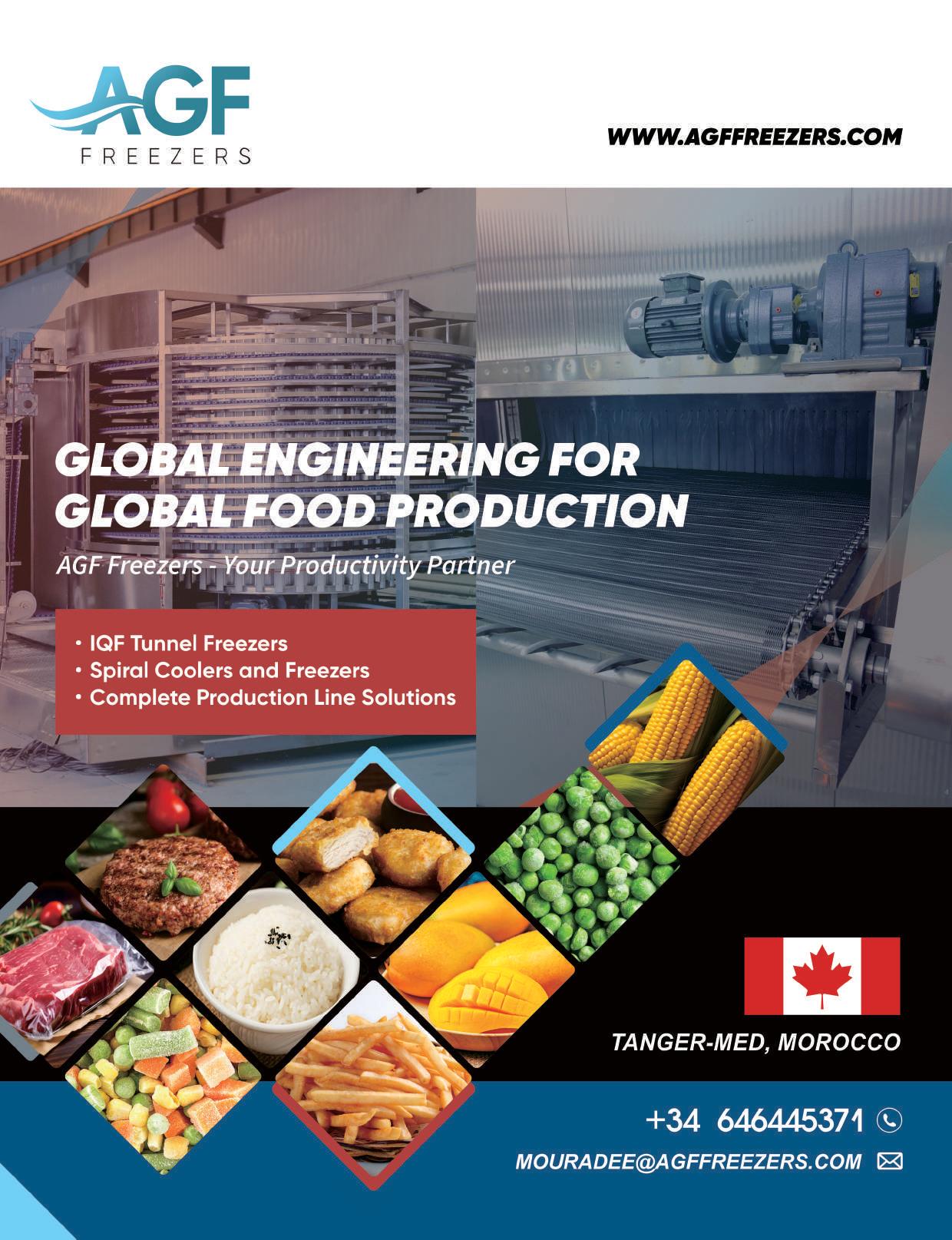

CEO Ian Nieuwoudt gives

COMPANY FEATURE: Natural Drinks: Rooted in traditions

Looking for innovative food solutions that bring joy to consumers and meet the latest market trends? Connect with our experts at the IFF booth to discover advanced, insight-driven solutions that delight taste buds, are cost-effective and inspire healthier living.

FOUNDER

Francis

LEAD

Abel Ndeda

EDITOR

Francis Watari

EDITOR

Nicholas Ng'ang'a

ASSOCIATE

Wachio Monica

BUSINESS

Virginia Nyoro

BUSINESS

Vivian Kebabe

HEAD

Clare Ngode

ACCOUNTS

Jonah Sambai

Tel: +254725 343932

Email: info@fwafrica.net

Company Website: www.fwafrica.net

Africa’s food industry is undergoing significant transformation, with manufacturing playing a key role in adding value to agricultural produce. Food processors are moving beyond raw exports to develop readyto-eat products and beverages, targeting both local and global markets. Technological advancements, such as Artificial Intelligence (AI) and smart logistics, are enhancing efficiency, while sustainability practices are gaining momentum to reduce environmental impact.

With growing investments in infrastructure and food safety frameworks, the manufacturing sector is poised to unlock new opportunities, driving economic growth and improving food security across the continent.

In this 64th Issue, we feature Natural Drinks, a South African beverage company redefining the industry with innovative approaches that resonate with modern consumers, offering a new take on traditional products.

In addition, the Beverage Tech Africa Section explores Ghana’s alcoholic beverage industry, where beer dominates the market. However, much of the industry remains decentralized, with homebrews, neighborhood bars, and informal taverns shaping consumer habits.

The Food Ingredients Africa Section spotlights Flavoured Tea. With African companies embracing flavored varieties to tap into the youth and millennial markets, there is a strategic shift that highlights the growing influence of Africa’s ingredients on global tea trends.

As Africa transitions toward mass production of meat products, get to understand how companies are utilizing flavor modulators to create unique taste and texture profiles, in our MEAT & POULTRY MEA insert. These efforts reflect the diverse dietary preferences shaped by cultural, geographical, and individual factors.

In the sustainability section, we highlight how the confectionery industry is balancing

indulgence with ethical practices. Companies are adopting eco-friendly packaging and sustainable sourcing to align with the needs of both consumers and the environment, despite challenges in maintaining profitability.

AI is transforming food quality management by automating processes and improving efficiency. However, balancing the benefits and limitations of AI adoption is crucial to achieving long-term success and reliability in food safety operations.

This edition offers a comprehensive overview of the latest trends shaping Africa’s food and beverage industry. From innovative products, sustainability initiatives, appointments and latest news, it equips readers with valuable insights to make informed decisions, drive business growth, and stay ahead in an evolving market.

Enjoy the Read!

Abel Ndeda Lead Editor, Food Business Africa

CFSE 2024 - China Fisheries & Seafood Expo

Oct 30, 2024 - Nov 1, 2024

Hongdao International Convention and Exhibition Center (HICEC), China www.chinaseafoodexpo.com

Coffee Expo Vietnam 2024

Oct 31, 2024 - Nov 2, 2024

Saigon Exhibition and Convention Center (SECC), Vietnam www.coffeeexpovietnam.com/

Gulfood Manufacturing 2024

Nov 5, 2024 - Nov 7, 2024

Dubai World Trade Centre, U.A.E www.gulfoodmanufacturing.com

The Speciality Food Festival

Nov 5, 2024 - Nov 7, 2024

Dubai World Trade Centre, U.A.E www.speciality.ae/

IAOM Middle East & Africa

Date: Nov 10-13, 2024 - Nov 16, 2024

Dubai World Trade Centre, U.A.E www.iaom-mea.com/IAOMDUBAI-2024/

SIAL InterFOOD 2024

November 13, 2024 - November 16, 2024

JIExpo Kemayoran, Indonesia www.sialinterfood.com

AgroBusiness MEDAFRICA Expo 2024

Nov 14, 2024 - Nov 16, 2024

Medina Expo Center, Tunisia www.agrobusiness-medafrica.com/en

Africa Food Show Morocco

Nov20, 2024 - Nov 22, 2024

Office Des Foires et Des Expositions de Casablanca Morocco, Morocco www.morocco.africafoodshow.com

SAUDI HORECA Riyadh 2024

November 25, 2024 - November 27, 2024

Riyadh International Convention & Exhibition Center www.saudihoreca.com

MEGA HORECA NIGERIA

December 3, 2024 - December 5, 2024

Balmoral Convention Center, Nigeria www.megahorecaexpo.com/nigeria

Food Africa 2024

December 3, 2024 - December 5, 2024

Egypt International Exhibition Center www.oodafrica-expo.com

AFMASS Food Manufacturing Expo

Uganda

February 11-13, 2025

Hotel Africana, Kampala, Uganda www.ug.afmass.com

FEBRUARY 11-13, 2025 | KAMPALA, UGANDA

No.1 Trade Shows for Food Service, Hospitality & Travel Industry in Africa

Guan Chong Bhd (GCB), the world’s fourth-largest cocoa grinder, is in talks to acquire a 25 percent stake in Transcao Côte d’Ivoire (Transcao CI), a cocoa manufacturing company based in Ivory Coast.

The move aims to strengthen GCB’s position in the global cocoa supply chain and expand its footprint in Ivory Coast, the world’s largest cocoa-producing country.

GCB’s subsidiary, GB Cocoa

Singapore Pte Ltd, has signed a Memorandum of Understanding (MoU) with Transcao CI’s shareholders, Conseil du Café-Cacao (CCC) and Transcao Negoce, granting GCB exclusive negotiation rights for three months to finalize the deal.

Brandon Tay Hoe Lian, Managing Director and CEO of GCB, emphasized the strategic significance of the partnership, stating, “The collaboration between GCB and CCC will strengthen our position as the world’s fourth-largest cocoa grinder. It allows us to leverage each other’s strengths to export Ivory Coast’s cocoa ingredients to customers worldwide.”

He added that the partnership aligns with GCB’s vision to become a preferred supplier of cocoa ingredients globally. The deal, if concluded, would mark another milestone for GCB, which commissioned a 60,000 metric ton (MT) per year cocoa grinding facility in Ivory

Coast in 2023.

The facility is GCB’s first outside of Asia and has the potential to increase its capacity to 240,000 MT annually. In 2023, GCB’s total cocoa grinding capacity reached 330,000 metric tons, while its industrial chocolate capacity increased to 116,000 MT.

With operations in Malaysia and Indonesia and a sales presence in over 80 countries, the partnership with Transcao CI is expected to further bolster GCB’s global operations.

Ivory Coast has been actively implementing policies to encourage local cocoa processing, including offering tax incentives and other benefits to Ivorian companies.

The biggest cocoa producer has deepened its collaboration with Ghana in the cultivation, processing, and marketing of cocoa and cashew nuts, two of the most significant agricultural products for their economies.

NETHERLANDS – Heineken N.V. has reported a 3.3 percent organic growth in net revenue, reaching €9,072 million (US$9.8B) for the third quarter of 2024.

The growth is attributed to a 0.7 percent increase in total consolidated volume and a 2.6 percent rise in net revenue per hectolitre.

The beer giant’s premium offerings also saw robust growth, led by regions such as Europe, Africa & Middle East, which offset slight volume declines in the Americas and Asia Pacific markets.

Notably, the brewer's premium beer volume increased by 4.5 percent, with Brazil, South Africa, and India driving growth.

The flagship Heineken brand saw an 8.7 percent volume increase, with double-digit expansion in 30 markets.

Heineken 0.0, the company’s alcoholfree variant, posted a 3.4 percent increase in volume, with Brazil, the United States, and Vietnam leading its growth. Meanwhile, Heineken Silver showed high-twenties growth, particularly in China and Vietnam.

Dolf van den Brink, Heineken’s CEO and Chairman of the Executive Board, said, “We delivered a solid quarter of balanced growth, organically growing beer volume 0.7% and net revenue 3.3%. Our business continues to deliver in line with our plan in aggregate, despite some markets navigating challenging consumer and industry trends.”

In the Africa and Middle East region, Heineken recorded a 23.1 percent organic growth in net revenue, with a 5.7 percent increase in total consolidated volume.

The company also saw a 16.7 percent rise in net revenue per hectolitre in the region. Strong growth in Nigeria, South Africa, and Namibia—despite declines in Ethiopia and Burundi—contributed to a 6.4 percent organic rise in beer volume.

Meanwhile, Heineken Beverages South Africa has introduced Savanna Neat, a new whisky-flavored cider under the Savanna brand.

The latest variant blends the classic Savanna crisp, dry cider with a touch of whisky flavor and notes of toasted oak.

The new flavor variant, described as “giving whisky” by the campaign’s creative director Steph Van Niekerk, aims to appeal to a generation seeking fresh, unconventional flavors. It is available in a 330ml bottle.

Cape Food Ingredients (CFI) has doubled its factory and office space in Kenya, reflecting continued solid growth in sales and manufacturing volumes.

CFI East Africa (also known as CAPEL Food Ingredients) has been manufacturing flavours and ingredient specialties for over 7 years in Kenya.

The factory also maintained its FSSC/ISO status in its recent 2024 audit, showing a clear commitment to quality production for East Africa.

As part of the expansion of production powder blending facilities have doubled in capacity. For manufacturing of liquids such as flavours, additional blending room has been commissioned.

Product development for customers in East Africa has been enhanced by a new Tasting Evaluation Center. Customers are encouraged to come and work with the New Product

Development team to achieve their goals, whether in beverages, dairy, confectionery, snacks and sauces.

The facilities also boast a full test bakery for breads, cakes, muffins and similar.

The expanded production and product development facilities work together with CFI's other regional factories and NPD Centers inWest Africa (Accra) and Southern Africa (Cape Town). By sharing formulations which are appropriate for Africa, cost for customers are lowered while maintaining quality. CFI has numerous unique products for lowering product costs.

In addition, with its regional centers in full operation, customers benefit from low MOQs, much faster delivery/ transit times, local currency invoicing and also avoid the headaches and high cost of importing flavours and other ingredients.

KENYA – IMCD Group, a global leading distributor of speciality chemicals and ingredients, has made a significant advancement in East Africa’s food innovation landscape with the inauguration of its new Food and Nutrition Applications Laboratory in Nairobi, Kenya.

The facility is designed to provide a dynamic platform for the creation and optimization of formulations in various market segments, including beverages, bakery, dairy, confectionery, snacks, and savory foods.

Located strategically in Kenya’s capital, the lab serves as a hub for co-innovation, bringing together IMCD’s customers, suppliers, and technical experts to address the evolving needs of consumers across Kenya and the broader East African region

“This significant investment by our company will definitely support the development of innovation concepts that shall inspire future menus and products,” said Faisal Abdi, the General Manager of IMCD’s business in East Africa.

“East Africa is a vibrant and diverse space, especially in the food and beverage side, where we see a lot of innovation and interest in adopting new trends, with the major drivers being the growing urbanisation and rising middle class, which are increasingly shaping consumer preferences and tastes. These have led to the growth of the formal retail and food delivery services in the region.”

During the lab’s launch event, customers and suppliers were invited to a firsthand experience of the lab’s capabilities, exploring diverse product innovations that align with local preferences.

George Olan’g, IMCD’s Food & Nutrition Business Unit Manager, underscored the lab’s role in setting new standards for food production and quality in East Africa. “With the launch of our new Laboratory, we are making a significant leap in enhancing food innovation across Kenya and the broader East African region,” said Olan’g.

He highlighted that the facility is built to “support partners in navigating emerging trends” and meet rising consumer demands, reflecting IMCD’s strategic commitment to sustainability and innovation.

UGANDA – The Ugandan government, through the Uganda Coffee Development Authority (UCDA), has distributed 56 moisture meters valued at UGSH 672 million (US$183,124.63) to farmers, processors, and traders.

The initiative aims to improve the quality of Uganda’s coffee and cocoa, two of the country’s key agricultural exports.

Of the 56 moisture meters, 38 were provided by UCDA, while 18 were acquired through the European Union-funded Cocoa and Coffee Development Project (CoCoDev).

The move is part of a broader effort to enhance postharvest handling and ensure that Uganda’s coffee and cocoa meet international quality standards.

The distributed moisture meters will help ensure compliance with industry regulations, including maintaining moisture levels of less than 14 percent for Fair Average Quality (FAQ) coffee and a maximum of 12.5 percent percent for exportgrade coffee.

The National Coffee Roadmap, signed by President Yoweri Kaguta Museveni in 2017, aims to boost Uganda’s coffee

production to 20 million 60 kg bags by 2030, with anticipated annual foreign exchange earnings of US$1.5 billion.

Uganda has reached a historic milestone in its coffee sector, generating US$1.144 billion from the export of 6.13 million bags of coffee during the 2023/2024 financial year.

This represents a 6.33 percent increase in volume and a 35.29 percent rise in value compared to the previous fiscal year, according to the UCDA.

In 2022/2023, Uganda exported 5.8 million bags of coffee valued at US$846 million. This remarkable achievement marks the highest earnings for Uganda’s coffee sector in the past 30 years.

The UCDA credits this growth to its stringent regulatory measures and the enhanced quality of the region’s coffee. The agency has been pivotal in rolling out quality controls and providing extensive support to farmers.

To enhance production, the country's agriculture sector has been strengthened by the launch of the UGSH10.8 billion (US$2.9M) Coffee and Cocoa Value Chain Development Project (CoCoDev) Matching Grant Scheme.

TANZANIA – Tanzania has unveiled plans to construct four new cashew processing factories in the southern regions by the 2025/26 season, marking a significant step towards enhancing local cashew processing and increasing the value of its exports.

The new facilities will include a factory at the Maranje Industrial Cluster in Mtwara Rural district, two factories in Tandahimba and Newala districts

under the Tanzania National Cashew Cooperative Union (Tanecu), and a fourth factory owned by the Tunduru Agricultural Marketing Cooperative Union (TAMCU).

The projects are slated for complettion ahead of the 2025/26 cashew trading season to fully utilize the two newly constructed 10,000-tonne capacity warehouses at Maranje Industrial Cluster.

The Tanecu factory, a TSH3.4 billion investment in Newala, will have an annual processing capacity of 3,500 tonnes of raw cashew nuts and is projected to generate sales of TSH147 billion once fully operational.

PROJECTS ARE SLATED FOR COMPLETTION AHEAD OF THE 2025/26 CASHEW TRADING SEASON TO FULLY UTILIZE THE TWO NEWLY CONSTRUCTED.

MOROCCO – Teralys, a subsidiary of the Moroccan-based investment company Al Mada, has announced the acquisition of Nutkao, an Italian agroindustrial firm and spread manufacturer, for €450 million (US$498.2 million).

Al Mada, which is owned by the King of Morocco, holds significant assets including the supermarket chain Marjane in Morocco and Senegalese food producer Patisen. This investment marks the first European venture by the King Mohammed VI and his dynasty.

Teralys plans to introduce new products and expand into new markets, particularly in Africa. Nutkao, established in 1982, is a producer of spreads and organic creams and operates as a smaller rival to Ferrero’s well-known Nutella brand.

The company has production facilities in Italy, Belgium, and the United States, as well as a cocoa processing plant in Ghana.

The acquisition aligns with Teralys’

strategy to expand in Africa’s food sector and follows Al Mada’s July 2023 purchase of a majority stake in Patisen, a major Senegalese manufacturer.

Patisen operates in over 30 African countries with a portfolio of roughly 50 brands, specializing in the production and distribution of various consumer food products such as broths, beverages, edible oils, and spreads.

Nutkao distributes its products, including pistachio-based specialties, ingredients for the pastry sector, “Free From” creams, and ice cream preparations, to around 80 countries.

Nutkao generates about two-thirds of its turnover abroad with a significant production presence in the United States. In 2023, its EBITDA amounted to about €40 million. The company expects EBITDA to rise to €45 million in its current financial year.

In 2018, Nutkao acquired Afrotropic, a cocoa bean processing plant in Ghana, allowing the company to control its

supply chain and process high-quality cocoa beans while maintaining a secure production process.

In addition to its Italian facilities, Nutkao has a state-of-the-art plant in Battleboro, North Carolina, USA, which adheres to BRC and FDA standards to ensure high-quality production for the American market.

UGANDA – The Uganda National Bureau of Standards (UNBS) is preparing to take legal action against those forging quality marks, which allows them to illegally penetrate the Ugandan market with inferior products.

James Kasigwa, Executive Director of UNBS, highlighted that this malpractice not only compromises product quality but also hinders manufacturers from accessing the competitive East African market and beyond.

The statement is on the backdrop of reaffirmation from the Minister of State for Trade, General Wilson Mbadi, who has reiterated the government’s dedication to bolstering the decentralization of the Uganda National Bureau of Standards (UNBS) services.

This initiative is aimed at reducing the cost of doing business for Micro, Small, and Medium Enterprises (MSMEs) and is part of a broader strategy to grow Uganda’s economy from USD 49.5 billion in FY 2023/2024 to a projected USD 500 billion over the next 15 years.

The UNBS decentralization agenda is designed to improve efficiency in service delivery by reducing the cost of doing business. With over 90% of enterprises in Uganda classified as MSMEs and 60% of these located outside the central region, decentralizing services is expected to facilitate the certification and growth of these enterprises.

This move is also seen as a way to improve compliance with standards and enhance the competitiveness of locally manufactured products in line with the Parish Development Model and the National Development Plan IV.

In the financial year 2023/2024, UNBS certified over 5,000 products and over 1,600 MSMEs. General Mbadi recognized these achievements and urged continued efforts to support the production of quality goods that can compete on both regional and international markets.

At the same time, UNBS Executive Director, Engineer James Kasigwa, outlined the challenges faced by the Bureau, particularly in terms of limited financial and human resources.

He noted that these constraints hamper service delivery and restrict the Bureau’s ability to generate the muchneeded Non-Tax Revenue (NTR) for the government.

IVORY COAST – Kineden Commodities

SA, one of Ivory Coast’s largest sustainable cocoa traders, has secured a financing package of nearly €60 million (US$64.8M) from a consortium of international banks to support its operations over the next three cocoa seasons.

The structured financing will enable Kineden to optimize the cost of its financial resources, secure cocoa supplies amid rising prices, and expand into agricultural processing. Of the total financing, €20 million (US$21.6M) has been allocated for the 2023-2024 cocoa season.

The funds will help the trader navigate a volatile market marked by record cocoa prices and heightened competition for cocoa bean supplies. The company aims to use the financial boost to secure its purchases and strengthen its position as a key player in the Ivorian

agro-industrial sector.

Kineden, founded in 2014 and a major player in certified sustainable cocoa, is also looking to diversify its trading activities.

The company plans to expand into other agricultural commodities, such as cashew nuts, and increase its involvement in the processing of agricultural products, with the strategic vertical and horizontal integration of the agricultural value chain expected to further solidify it’s role in the Ivorian agro-industry.

Kineden’s Managing Director, Stéphane Apoque said, “These optimised funds send a strong signal to the Coffee and Cocoa Council, which, under the leadership of its Director General Yves Birahima Kone, is working to develop local entrepreneurs capable of mobilizing the necessary funds to fulfil the government’s ambitions of

industrializing the sector and improving incomes for Ivorian farmers.”

Kineden Commodities exports over 50,000 tons of cocoa beans annually and holds UTZ and FairTrade certifications, further underscoring its commitment to sustainable production.

The funding comes as cocoa production in Ivory Coast is projected to reach nearly 2.2 million tonnes in the 2024/2025 campaign, a 25 percent increase from the previous harvest, driven by favorable weather conditions.

GHANA – The Ghana Cocoa Board (COCOBOD) has introduced a zero-borrowing arrangement to finance cocoa purchases for the 2024/2025 crop season, marking a significant shift in the sector’s financial strategy.

The new approach aims to make the cocoa industry more viable and sustainable by eliminating the need for loans from external sources, says the Board.

Joseph Boahen Aidoo, Chief Executive Officer of COCOBOD, described the zero-borrowing model as a homegrown financing innovation.

Under the new arrangement, international buyers will pay directly into the Cocoa Marketing Company’s account on behalf of COCOBOD, bypassing the traditional practice of securing syndicated loans from foreign lenders. This move is expected to significantly reduce the cost of borrowing for the board.

Aidoo noted that international borrowing had become increasingly expensive, with interest rates exceeding 8 percent in recent years. He also cited Ghana’s recent debt restructuring as a factor that had negatively impacted COCOBOD’s creditworthiness.

The shift to local financing is seen as a solution to reduce dependency on external loans and to enhance the sector’s financial sustainability.

“The financing arrangement being pursued now is a homegrown model, and so far, so good. We are unburdened with any interest and ancillary costs, which significantly reduces the financial pressure on the industry,” he said.

Ghana’s cocoa production recently hit a 23-year low of 425,000 metric tons, raising concerns about the sector’s ability to self-finance.

However, the direct payment system is expected to accelerate cocoa revenue inflows and help stabilize the Ghanaian cedi.

In a bid to further support the sector, Ghana increased the fixed farmgate price for cocoa by 45 percent, from GH¢33,000 to over GH¢48,000. Additionally, the country has collaborated with Ivory Coast, the world’s largest cocoa producer, to harmonize farmgate prices. The collaboration is expected to stabilize cocoa production and ensure that the industry, a major economic contributor, remains robust.

USA – A team, led by researchers at Penn State, recently developed an electronic tongue that can identify differences in similar liquids, such as milk with varying water content; diverse products, including soda types and coffee blends; signs of spoilage in fruit juices; and instances of food safety concerns.

According to the researchers, the electronic tongue can be useful for food safety and production, as well as for medical diagnostics. The team also found that results were even more accurate when artificial intelligence (AI) used its own assessment parameters to interpret the data generated by the electronic tongue.

The sensor and its AI can broadly detect and classify various substances while collectively assessing their respective quality, authenticity and freshness.

This assessment has also provided the researchers with a view into how AI makes decisions, which could lead to better AI development and applications, they said.

Corresponding author Saptarshi Das, Ackley Professor of Engineering and Professor of Engineering Science and Mechanics noted that the team is trying to make an artificial tongue, but the process of how people experience different foods involves more than just the tongue.

“We have the tongue itself, consisting of taste receptors that interact with food species and send their information to the gustatory cortex — a biological neural network,” he added. The tongue comprises a graphene-based ion-sensitive fieldeffect transistor, or a conductive device that can detect chemical ions, linked to an artificial neural network, trained on various datasets.

Critically, the sensors are non-functionalised, meaning that one sensor can detect different types of chemicals, rather than having a specific sensor dedicated to each potential chemical. The researchers provided the neural network with 20 specific parameters to assess, all of which are related to how a sample liquid interacts with the sensor’s electrical properties.

Based on these researcher-specified parameters, the AI could accurately detect samples — including watered-down milks, different types of sodas, blends of coffee and multiple fruit juices at several levels of freshness and report on their content with greater than 80% accuracy in about a minute.

INDONESIA – Diageo, the producer of renowned brands such as Johnnie Walker and Smirnoff, has commenced the expansion of its spirits manufacturing facility in Tabanan, Bali, Indonesia.

The company aims to strengthen its production capabilities to serve key markets in the Asia-Pacific region.

The expansion will add 8,800 square meters to the facility, although Diageo has not disclosed the current size or the expected increase in production capacity.

Originally built in 2014, the Tabanan facility produces several of Diageo’s flagship brands, including Captain Morgan rum, Smirnoff vodka, Smirnoff Ice, Gilbey’s gin, and Bell’s Scotch whisky, primarily for the Indonesian market.

However, since 2021, Diageo has expanded exports from this site to additional markets, including Thailand,

Timor Leste, the Philippines, Singapore, and Malaysia.

The expanded facility is set to open within the next 18 months and will operate with 95 percent less energy than traditional production methods, aligning with Diageo’s global sustainability goals.

Once operational, it is expected to enhance the Asia-Pacific division’s contribution to Diageo’s global sales and business.

Still in Asia, Diageo India has launched its first sensory experience home, The Flavour Lab by The Good Craft Co, in Bangalore, with the aim of promoting Indian craft spirits.

The Flavour Lab is a part of Diageo India’s broader initiative, The Good Craft Co, established in 2022 to foster innovation and growth within India’s spirits startup ecosystem.

The Flavour Lab brings together Indian craft stories, ideas, and the craft spirits community under one roof, providing a platform to nurture

innovation.

This marks Diageo India’s first global direct-to-consumer experiential ecosystem, centered on education, advocacy, empowerment, and appreciation for Indian craft spirits and their makers.

Dubbed a ‘playroom for craft spirits,’ The Flavour Lab offers visitors a curated experience through four interactive zones.

WORLD – Global food commodity prices experienced their steepest increase in 18 months during September, driven by notable rises in key commodities, particularly sugar, according to the Food and Agriculture Organization (FAO) of the United Nations.

The FAO Food Price Index, which tracks the monthly changes in international prices of a basket of widely traded food commodities, averaged 124.4 points in September, marking a 3.0 percent rise from August and a 2.1 percent increase from the same period last year.

Sugar prices led the surge, with the sugar price index jumping by 10.4 percent. This spike was driven by concerns over worsening crop conditions in Brazil, the world’s largest sugar producer, and uncertainty surrounding India’s decision to allow more sugarcane to be diverted for ethanol production.

These factors contributed to fears of

reduced sugar export availability from India, a key global supplier.

The vegetable oil price index climbed by 4.6 percent, with prices for palm, soy, sunflower, and rapeseed oils all increasing. Lower-thanexpected production in Southeast Asia contributed to the rise in palm oil prices, while soyoil prices were supported by lower-than-anticipated crushings in the United States.

Dairy prices also rose, with the dairy price index up 3.8 percent in September. Quotations for whole milk powder, skim milk powder, butter, and cheese all saw gains.

The meat price index edged up by 0.4 percent, driven primarily by higher prices for poultry meat due to strong demand for Brazilian products. Prices for bovine and pig meat remained stable, while those for ovine meat declined slightly.

In its latest Cereal Supply and

Demand Brief, FAO raised its global cereal production forecast for 2024 to 2,853 million tonnes, reflecting upward revisions to rice and wheat output, which offset a small reduction in global coarse grains production. However, the revised figure remains slightly below the record output of 2023.

FOOD COMMODITIES AVERAGED 124.4 POINTS IN SEPTEMBER, MARKING A 3.0 PERCENT RISE FROM AUGUST AND A 2.1 PERCENT INCREASE FROM 2023.

SOUTH AFRICA - Daybreak Foods has appointed Aubrey Dali, a Chartered Accountant (SA), as its new Chief Financial Officer, effective from October 2024. Dali brings over 20 years of experience in financial management, having worked across various sectors, including agriculture, FMCG, pharmaceuticals, and healthcare distribution.

Throughout his career, he has held several senior roles, such as Financial Director and Group Finance Executive, at companies like Omnia Holdings, Aspen Pharmacare, SAB, and PEPSICO. His academic credentials include a Bachelor of Commerce in Accounting from the University of Cape Town and an Honours degree from the University of KwaZulu-Natal.

In 2015, he was recognized as one of South Africa’s top 35 Chartered Accountants under 35. Dali’s expertise spans finance transformation, leadership, governance, and strategic planning, with international experience in financial systems across multiple regions. Daybreak Foods expects his wealth of experience to support the company's growth and operational efficiency.

KENYA - Kenya Breweries Ltd (KBL), a subsidiary of East African Breweries PLC (EABL), has appointed Charles Okanya as the Acting Marketing Director, effective September 1, 2024. Currently serving as the Head of Consumer Planning at EABL,it was reported that Okanya would take charge of all marketing activities at KBL on a temporary basis.

With over 15 years of experience in strategy and marketing insight across

various African markets, Okanya is known for his ability to merge consumer behaviour with business objectives to drive sales.

Before joining Diageo Kenya seven years ago, he worked with renowned research and strategy firms, including Nielsen, Synovate, Kantar, and Ipsos, where he led advertising research. Throughout his career, he has conducted over 100 market and social research studies in Sub-Saharan Africa, equipping him with deep insights into cultural nuances. KBL particularly noted his expertise in consumer understanding and its alignment with marketing strategies.

NIGERIA - AACE Foods, a Nigerianowned company, has appointed Mrs. Nwabuike Gloria as its new Managing Director, taking charge of its mission to deliver high-quality food products to customers.

Gloria brings over 20 years of experience in marketing and business management, having previously worked at leading companies like Nestle, Mondelez, and CHI, a subsidiary of Coca Cola. Her expertise spans Marketing Strategy, Innovation, and Business Management, and she has successfully managed major accounts and led marketing initiatives across various regions.

AACE Foods believes her diverse experience and strong leadership skills make her well-suited to drive the company’s growth. She succeeds Temitope Jebutu, who served as the Managing Director for a decade following his role as Factory Manager, but has not disclosed his future plans. Gloria’s appointment is expected to further strengthen AACE Foods’ market position and support its vision for expansion and innovation in the food industry.

KENYA - The Board of the Kenya Tea Development Agency (KTDA) has reappointed Enos Njiru Njeru as its national chairman for another threeyear term. Njeru, who first assumed the role on July 17, 2023, represents the Embu Tea Zone. Eric Chepkwony, representing the Bomet Tea Zone, has been elected as the Vice-chairman of the Board.

The elections were overseen by Dr. Andrew Karanja, the Agriculture and Livestock Development Cabinet Secretary, and Jacob Kahiu, Chairman of the Tea Board of Kenya. The board has set key objectives for its term, including promoting a culture of tea consumption, enhancing tea quality, diversifying product offerings, establishing a Common User Facility, and expanding the tea market. These initiatives aim to strengthen the tea sector and improve overall industry performance.

NIGERIA - Beta Glass Plc, a member of the Frigoglass Group and a leader in beverage glass packaging solutions in West and Central Africa, has appointed Alexander Gendis as its new Chief Executive Officer, effective September 30, 2024.

Gendis is a seasoned executive with over 25 years of experience

in manufacturing and packaging, specialising in general and supply chain management, marketing, and leadership across various regions, including East and West Africa, Europe, Southeast Asia, and Australia. Prior to this appointment, he was the Managing Director of Engee PET Manufacturing Company in Nigeria, where he significantly boosted growth, production, and revenue.

Gendis also previously held CEO roles at Verde Beef Processing in Ethiopia and Bel Impex in Nigeria, and served as Managing Director at Pepsi SevenUp Bottling Company and DHL. His early career was spent at PZ Cussons, where he led transformative projects in countries such as Kenya, Indonesia, and the UK, driving significant business improvements and revenue growth.

KENYA - The Kenya Association of Manufacturers (KAM) has appointed Tobias Alando, the current Chief Operating Officer, as Acting CEO following the resignation of CEO Anthony Mwangi, who stepped down after two years of service. The Board expressed confidence in Alando’s ability to guide the organisation through the transition and continue building on the achievements made under Mwangi's leadership.

In a statement from KAM’s Board Chairperson, Jane Karuku, the Association thanked Mwangi for his dedicated leadership and notable contributions to both KAM and the manufacturing sector. Karuku further urged members, partners, and stakeholders to offer their continued support during the leadership transition, expressing optimism that Alando’s interim leadership would ensure a smooth and successful changeover.

The Board emphasised its belief that Alando would continue advancing the strong foundation established by Mwangi.

Tropace Health and Wellness Teas has launched two new tea variants, Tropace Hibiscus Immunity Tea and Tropace Hibiscus Nursing Tea.

The Tropace Hibiscus Immunity Tea features a blend of hibiscus, ginger, clove, and black pepper, designed to enhance immune function, provide antioxidant benefits, and support digestive health.

In contrast, the Tropace Hibiscus Nursing Tea is tailored for lactating mothers, promoting lactation and assisting with postpartum weight management while also being rich in antioxidants. All products are 100% organic, herbal, and caffeine-free.

www.tropacehealth.com

Astral Foods has introduced new pack sizes to its popular GOLDI Chicken crumbed range, now including 480g and 500g options alongside the existing 1kg pack.

This expansion aims to give consumers more variety and flexibility in their purchasing choices. The crumbed chicken products, proudly made in South Africa, are designed for quick and convenient preparation, making them ideal for a range of occasions. The smaller pack sizes are anticipated to hit supermarket shelves shortly, enhancing accessibility for consumers seeking easy meal solutions.

www.astrolfoods.com

Coca-Cola Nigeria has unveiled a new product, the CocaCola Wozzah Limited Edition Flavour, an infusion of African culture.

The product was launched officially in Port Harcourt, Rivers State capital. According to the company’s director, Soji Omoigui, the product is also meant to meet the requirements of the modern day younger consumer, the Gen Z.

This new product is part of a broader strategy by Coca-Cola Africa, which introduced the Wozza edition in May in South AFrica.

www.coca-cola.com

Cway Group has broadened its portfolio with three new soft drinks available in 400ml bottles. They include Fuji Probiotic, a carbonated probiotic yogurt drink aimed at promoting digestive health while tapping into the rising popularity of drinkable yogurt. Another addition is Café Coffee Milk, described as the “perfect café experience” accessible to all, catering to Nigeria's expanding coffee culture. Lastly, Assam Milk Tea combines authentic Assam tea leaves with creamy milk, presenting a unique flavor profile for tea enthusiasts.

www.cwaygroup.com

South Africa's canned meat processor,Bull Brand has launched a limited edition heritage pack to celebrate the nation’s culture and the brand's 67-year legacy.

This initiative represents a shift from the company's usual branding, featuring a specially designed can that embodies South African heritage. The heritage cans were scheduled to be available in stores starting in September, aligning with Heritage Month celebrations.

This move not only pays tribute to the country’s diverse culture but also reinforces Bull Brand's longstanding presence and commitment to the South African market.

www.bullbrand.com

Glenfiddich, the esteemed whisky brand from William Grant & Sons, has launched its 31-year-old Grand Château whisky, which is the first to undergo finishing in red wine casks sourced from the Bordeaux region of France, creating a distinctive flavour profile.

The Grand Château is initially matured in American oak casks for 22 years before undergoing a nine-year finish in exceptional Bordeaux red wine casks.

This extended finishing process results in a complex and balanced whisky, featuring rich flavours of caramelised cherry, apple, warming spices, and toasted oak, alongside fruity, floral notes and earthy undertones.

www.glenfiddich.com

By Abel Ndeda

For many years, South Africa has been celebrated as one of the world's top 15 largest alcoholic beverage markets and the largest in Africa. The nation is well-known for beer and its cherished tradition of grilling meat, known locally as "braai." However, the landscape of this multibillion-dollar industry is experiencing a significant shift as consumers increasingly seek natural and healthier beverage options.

South Africans have embraced this new wave of nonalcoholic beverages with enthusiasm. This has led to significant investments being channeled towards research and development, as well as big brands expanding production capabilities. Even so, one investor, Ian Nieuwoudt, a winemaker by trade whose experience has led him to perfect a range of non-alcoholic, naturally carbonated drinks, has stood out with a company offering naturally fermented beverages rooted in South African heritage.

Founded in 2014, Natural Drinks boldly filled a niche using an innovative approach that brings a fresh perspective to a traditional industry, resonating deeply with modern consumers who desire authenticity and health-conscious beverage options. Many describe Natural Drinks’ brands as "the closest taste to what my grandmother used to make, now just easier to get hold of and enjoy all year round—guilt-free."

This sentiment reflects the deep connection people feel with these drinks, which use traditional production methods to deliver genuine flavours.

Natural Drinks' journey began with a simple but powerful idea of producing non-alcoholic drinks using natural fermentation methods, associated with traditional ginger beer. This dedication to traditional production, particularly for their flagship products like GemmerKat Ginger Beer and PorcuPine Pineapple Beer, quickly set them apart from competitors in the carbonated, no-preservative category. Consumers were drawn to the nostalgia and authentic, bold flavours, and more importantly, the health benefits. The drinks are preservativefree and have a much lower sugar content compared to conventional soft drinks, making them a healthier choice for South Africans concerned about wellness.

“There is a much bigger appetite for healthier beverages produced locally, and Natural Drinks is continuing a deep tradition of creating nostalgic moments for South Africans at an affordable price, one bottle at a time,” says Ian.

The growing demand for non-alcoholic drinks in South Africa has led to a revenue estimate of US$5.48bn in 2024, with a projection of annual growth of 6.27% (CAGR 2024-

2028), according to Statista.

As the company grew, so did challenges in operations and riding the waves of market trends. Natural Drinks was faced with limited capital and a lack of industry knowledge. However, by consistently listening to consumer feedback and analysing emerging trends, Natural Drinks adeptly made informed decisions about its product line. This proactive approach allowed the company to adapt and thrive amidst the evolving beverage industry landscape.

“We realised that our customers wanted lighter, healthier options that didn’t compromise on taste,” Ian shared in an interview in 2023. This insight led to the expansion of the portfolio through the development of new flavours such as GemmerKat Ginger Beer LITE and Gecko Grapefruit Lemonade, launched in 2023. The company said the additions provide consumers with refreshing alternatives to regular high-sugar soft drinks while bearing the signature

CONSUMERS WERE DRAWN TO THE NOSTALGIA AND AUTHENTIC, BOLD FLAVOURS, AND MORE IMPORTANTLY, THE HEALTH BENEFITS PLUS BEING PRESERVATIVE-FREE AND HAVE A MUCH LOWER SUGAR CONTENT COMPARED TO CONVENTIONAL SOFT DRINKS.

of Natural Drinks’ quality. The growth also stimulated a comprehensive rebranding strategy.

To solidify its presence and growth, the company needed to maintain the brands’ relevance and appeal to its target audience while still staying true to its core values and identity. Rather than pursuing a complete overhaul, Natural Drinks opted for a more strategic approach.

In 2024, the company embarked on a brand-refresh journey, collaborating with Cape Town’s renowned brand specialists

and design studio, Supernova Collective. The goal was clear: to refresh the brands’ identities in a way that honoured its South African roots while appealing to modern consumers. “We are very excited to have reached this milestone in our journey, as it symbolises not just a new look, but a deeper alignment with our consumers' values and expectations,” says Andre Nieuwoudt, Operations and Marketing at Natural Drinks.

Supernova Collective’s founders, Jo Sagrestano and Riekus Raath, took on the challenge, drawing inspiration from South Africa’s diverse landscapes and wildlife. Each flavour variant in the Natural Drinks portfolio was given a distinct animal mascot and a landscape scene representing various regions of the country. This thoughtful design helped bridge the gap between the product and the culture it draws from. “Our goal was to create designs that not only honour Natural Drinks’ rich history but also visually embody the spirit of South Africa’s landscapes, wildlife, and traditions," says Jo Sagrestano.

The decision to incorporate South African imagery into the packaging was not just aesthetic but strategic. The refreshed branding proved successful, with a growth in the company’s loyal customer base. It became increasingly clear that South Africans value products that resonate with their identity. By aligning the product’s visual appeal with local culture, Natural Drinks strengthened its connection to the market.

Natural Drinks adheres to high food safety standards, including certifications such as R638 and GFSI, ensuring compliance and maintaining product quality. The approach has strengthened

THERE IS A MUCH BIGGER APPETITE FOR HEALTHIER BEVERAGES PRODUCED LOCALLY, AND NATURAL DRINKS IS CONTINUING A DEEP TRADITION OF CREATING NOSTALGIC MOMENTS FOR SOUTH AFRICANS.

Ian Nieuwoudt, Founder and MD Natural Drinks

its partnership with major chains like Shoprite/Checkers, Food Lover’s Market, and Spar, as well as every farmstall and independent store in between. This dual strategy of focusing on both large-scale distribution and local partnerships allowed the company to reach a wider audience while staying true to its roots.

In addition, the beverage company is also investing in sustainability initiatives. It emphasises the use of natural ingredients and traditional production methods, reduces sugar content, and employs fermentation processes that avoid preservatives. These practices align with broader sustainability trends and reflect the company’s commitment to environmental and health-conscious principles. The company notes that GemmerKat Ginger Beer, produced using traditional methods, contains about 40% less sugar compared to regular soft drinks and uses real ground ginger powder.

South Africans are estimated to consume up to 24 teaspoons of sugar per day, double the daily WHO recommendation. According to the South Africa Department of Health, half the adult population is either overweight (23.6%) or obese (26.2%).

To address this issue, in 2018, the South African government introduced the Health Promotion Levy (HPL), a tax on sugary drinks aimed at reducing the population’s sugar consumption.

Now in its second decade, Natural Drinks continues to innovate, with plans to introduce new flavours and expand its footprint beyond South Africa. “We believe in making beverages that taste great but are affordable and also good for you,” says Ian. “Our focus is on maintaining the integrity of our traditional methods while keeping up with what our consumers need.”

As Natural Drinks expands, it is clear that their future will be as rich as their heritage. By continuing to listen to its consumers and focusing on local values, Natural Drinks is wellpositioned for a bright future, where its products will not only refresh but also resonate with the people who enjoy them

By Francis Watari

When you think of Ghana, the first thing that strikes your mind is the vast land of clustered pods full of valuable cocoa beans. The West African country, now the second-most populous country in the region with nearly 35 million people, has made significant strides in the alcoholic beverages sector.

There is a strong tradition of artisanal alcoholic drinks in Ghana, with pito, a type of beer made from fermented millet or sorghum, palm wine (from the palm tree), and akpeteshie (Ghana's local gin with a very high alcohol content) all being quite popular. These artisanal drinks are cheap and widely available.

According to Report Linker, Ghana ranked 36th globally in terms of alcoholic drink consumption in 2023.While relatively

more developed than neighbouring countries, Ghana's beer market is still dominated by the informal sector, where homebrew and neighbourhood bars and taverns are common. This has not deterred foreign investments into the industry that is facing a growing middle-class consumer base. The industry is also playing a crucial role in the nation's economy. For instance, in 2021, the Ghana Revenue Authority (GRA) collected GHS526.48 million in revenues from domestic taxes on alcoholic beverages. According to Fitch Solutions, a data, research, and analytics firm, spending on alcoholic drinks grew by 13.6 percent, and consumption grew by 5.2 percent in 2023.

Additionally, the firm forecasts that alcoholic drink spending in the country will grow at an annual growth rate of 13.4%, from US$2.0 billion in 2022 to US$2.8 billion in 2026.

As spending on alcoholic drinks continue to grow, the market is witnessing a steady increase in consumption of locally produced beverages, pushing its dominance to about 90 percent. In addition, consumers have become more adventurous in brand selection and more accommodating of home-grown brands, citing improvements in product quality, packaging, marketing, and distribution.

Two large players Diageo-owned Guinness Ghana Breweries and A.B. InBev-owned Accra Brewery command 99% of the market while the remaining 1% is being scrambled by importers and small producers. The imported drinks are usually international brands, mainly grey market products and are sold through supermarkets and shops usually owned by importers and distributors.

Alcoholic beverages imported into the country increased from US$56 million in 2019 to US$87 million in 2023, highlighting room for upscaling local production. Although import levels remain high in Ghana, manufacturing, bottling and packaging capacity have been boosted substantially over the past decade, with major players investing in infrastructure and trying to source inputs locally.

For example, Guinness Ghana Breweries (GGB), one of the major players in the industry, invested US$24 million in 2021 to increase its production capacity to meet the growing demand. The beverage giant aims to increase its usage of local raw materials to 70% by the end of this year through its Local Raw Material (LRM) program launched in 2012. Guinness Ghana uses maize, sorghum, and cassava in its brewing processes, sourced from farmers across 11 of Ghana's 16 regions.

As with many African countries, beer tends to dominate alcoholic drink consumption patterns in Ghana. In Ghana,

especially lagers and stouts, is experiencing sturdy growth, a reflection of consumers socializing again post-pandemic. The popularity of beer in both urban and rural areas is due to growing disposable income and its availability in pubs and nightclubs throughout the country. Historically, beer consumption per capita in Ghana reached an all-time high of 9.16 litres in 2019 and had an all-time low of 5.01 litres in 2014, data from Helgi Library shows.

Ghana has been ranked 109th within the group of 161 countries, in terms of beer consumption per capita. Fitch Solutions projects per capita beer consumption to reach 11.2 litres in 2026, increasing from 10.5 litres in 2022. Currently, Guinness Ghana Breweries controls an estimated 69% of the market for the beer and stout category, while Accra Brewery (ABL) controls approximately 30%.

However, other categories, such as Ready to Drink products

Source: Euromonitor International

(RTD), cider and canned spirits, are becoming more popular, particularly among younger consumers.

In the wines and spirits category, the industry is recording declining demand due to rising global inflation and reducing purchasing power. The most affected range includes premium spirits and wines. Nonetheless, the demand for sweet red and white wine during social events such as weddings and parties is on the rise, especially post-pandemic. Most consumers are going for the premium wines which are more reasonably priced such as wines imported from Europe and South Africa mostly that are entry level options readily accessible from popular supermarkets. Due to economic conditions, industry sources expect an influx of cheap wines to be available on the market which will boost consumption and popularity among lowerincome consumers.

Ghanaian consumers are seeking out lowerpriced whiskey brands and locally produced

distilled spirits made with herbs, known as bitters. The introduction of new flavors, such as natural ingredients, fruitherb blends, and sweet-tasting spirits in the industry, has brought about renewed interest in spirits compared to previous years.

OPPORTUNITIES AND CHALLENGES FACING THE INDUSTRY

Like any other growing markets, Ghana's alcoholic beverage industry continues to grapple with significant challenges hindering exponential growth. A lack of a proper regulatory framework has resulted in the rise of illicit and unlicensed brews. According to Research and Markets, up to 45% of the alcohol consumed per annum is illicit, above Africa's average 40%. The high rates of illicit consumption pose a threat to alcoholic beverage companies. Illicit drink consumption rates could be even higher, taking into account that traditional illicit brewing is more prevalent in rural areas, where data is virtually unavailable.

The government is trying to fight back illicit brews by implementation of Tax Stamp Policy which requires manufacturers and importers to present government-supplied stamps on products to confirm that the appropriate tax has been paid and help consumers identify genuine products.

Interestingly, the rise in taxes and excise duties has fueled the increase in illicit alcohol and smuggling. In 2023, the Ghana Revenue Authority (GRA) raised the Value-Added Tax (VAT) from 12.5% to 15% and doubled taxes on spirits and wines, which significantly increased production costs and prices. These tax hikes, combined with the recent depreciation of the Ghanaian Cedi, have reduced consumer purchasing power. As a result, many consumers have turned to smuggled or illicit alcohol.

In Ghana, advertising alcoholic beverages is highly restricted compared to other African countries. The Food and Drugs Authority (FDA) must approve all ads, which must include the statement, “This advert has been vetted and approved by the FDA,” and celebrities are banned from endorsing alcohol to avoid influencing youth.

ACCORDING TO RESEARCH AND MARKETS, UP TO 45% OF THE ALCOHOL CONSUMED PER ANNUM IS ILLICIT, ABOVE AFRICA'S AVERAGE 40%, POSING A SIGNIFICANT THREAT TO ALCOHOLIC BEVERAGE COMPANIES.

Despite the regulatory challenges, the future of the alcohol industry in Ghana still looks promising. The beverage industry enjoys a stable political environment that has created a favourable business environment, bolstering investors' confidence to continue investing in the country.

Ghana’s tourism industry has been expanding, leading to increased demand for alcoholic beverages from both domestic and international visitors. In 2023, the country generated US$3.8 billion from international arrivals, up from US$2.5 billion the previous year, signaling a strong recovery from the pandemic. Report Linker forecasts that tourism revenue will reach approximately US$1.62 billion by 2028, up from an estimated US$1.47 billion in 2023

By Francis Watari

Tea is much more than just a beverage; it's an experience that tantalizes the senses and offers a moment of relaxation on a busy day. It is the most widely consumed drink in the world after water, and people have been drinking it for centuries, perhaps even millennia. Drinking tea is a daily ritual for half of the world’s population because of its stimulant properties and also provides many health benefits.

Tea is derived solely from the leaves of the plant species Camellia sinensis. The plant is cultivated in more than 60 countries, primarily in Asia, Africa, South America, and parts of Eastern Europe. China produces 47% of the world’s tea, followed by India, Kenya, and Sri Lanka, according to a 2022 FAO report.

Africa, one of the historic tea producer, has been a big consumer of black tea, a type of tea that is more oxidized than oolong, yellow, white, and green teas. The popular beverage in East Africa is chai (popular blend of black tea, milk, and

spices) while in West and North Africa, it is Bisap, or Kirkade, a hibiscus-based tea and mint tea. Bisap has a tart, cranberrylike flavor and is often mixed with spices or sweeteners.

The increasing awareness of the health consciousness associated with tea consumption, particularly in terms of antioxidants and natural functional properties, has spurred demand for flavored varieties.

Flavored teas evolution is not merely a culinary innovation; it is a reflection of the diverse cultures that inhabit the African continent. This flavour blending has become a way to express identity and tradition, setting the stage for vibrant tea culture.

Nearly all tea processing and marketing companies in Africa have incorporated flavoured tea in their portfolio to capture the huge youth market and influential millennial. The group want more premium and super-premium varieties, and their expectations of what tea should be are changing, pushing the

market to adapt. Generally, these younger consumers want healthier beverages brewed with high-quality leaves and botanicals, containing no artificial flavors.

According to Data Bridge Market Research, the global flavored tea market is expected to grow at a compound annual growth rate (CAGR) of 5.5% in the forecast period of 20222029.

This market encompasses a wide array of flavors and blends, catering to the varied tastes and lifestyles of consumers worldwide. From classic combinations like citrus-infused green tea to exotic blends such as hibiscus and lemongrass, flavored teas offer a sensory experience that appeals to a broad demographic, including health-conscious individuals, tea enthusiasts, and those seeking indulgent yet wholesome beverages.

Consumers are increasingly aware of the benefits associated with flavour often infused with natural flavors that enhance taste and therapeutic properties. For example, research has concluded that chamomile tea might help relieve anxiety and discomfort due to premenstrual syndrome, lower blood sugar in people with diabetes, prevent osteoporosis, reduce inflammation, and prevent the growth of glioma, liver cancer, cervical cancer, and leukemia.

Tea drinkers are also increasingly drawn to varieties like fruit-infused teas, herbal blends, and premium teas with added ingredients such as spices and botanicals. Notably, a myriad of natural ingredients like mint, ginger, cinnamon, lemongrass and tropical fruits such as mango, pineapple, and passionfruit are becoming popular due to their perceived health benefits and unique tastes.

In contrast to the growing market, high cost of green tea compared to black tea is projected to limit the global green tea market's growth in the coming years.

Generally, the younger consumers want healthier beverages brewed with high-quality leaves and botanicals, containing no

FLAVORED TEAS EVOLUTION IS NOT MERELY A CULINARY INNOVATION; IT IS A REFLECTION OF THE DIVERSE CULTURES THAT INHABIT THE AFRICAN CONTINENT, THIS FLAVOUR BLENDING HAS BECOME A WAY TO EXPRESS IDENTITY AND TRADITION.

artificial flavors, and often sold in ready-to-drink glass bottles. This has resulted in a rise in ready-to-drink tea beverages, offering convenience and on-the-go options.

Mordor Intelligence projects the Africa Ready to Drink Tea Market size estimated at US$216.3 million in 2024, to reach US$364.5 million by 2030, growing at a CAGR of 9.09% during the forecast period 2024-2030.

With an increasing demand for flavored tea, the tea industry is incorporating various strategies, leveraging both local resources and global trends to satisfy the demand.

Tea-producing countries have now turned to incorporate local ingredients and flavors as a means of value addition to satisfy both demand and increase farmer incomes.

In East Africa, Kenya is leading the path, adding flavors like ginger, lemongrass, masala, and hibiscus to its black tea.

Melvin Marsh International launched the first flavored teas in the Kenyan market in 1995.Although other companies have entered into the market, Melvin Marsh’s product base has expanded to include other lines; not only flavored teas but also herbal and fruit infusions including green, orthodox and purple tea.

In Southern Africa, South Africa spearheads the production of flavored tea using its famous rooibos, a caffeine-free herbal tea, as a base for flavored teas, incorporating vanilla, citrus, citrus, and honey. Meanwhile, Morocco leads the race for flavored teas in North Africa. Popularly known for its mint tea, Morocco blends local herbs and spices for a refreshing, aromatic beverage that resonates with African consumers and appeals to international markets looking for exotic and natural ingredients.

Additionally, beverage consumers are increasingly willing to pay more for higher-quality, flavorful beverages. To capture this market, tea producers are increasingly shifting focus to premium teas that feature unique flavor combinations, organic

ingredients, and artisan production methods. Luxury tea brands in Africa are developing artisanal blends using premium black and green teas infused with exotic local fruits like baobab and hibiscus. For example, Stir Me tea, an affordable luxury Kenyan tea brand founded in 2017, specializes in a full range of premium loose-leaf teas and exquisite tea blends. Kenya is known for exporting large volumes of tea; once exported it generally loses its identity.

Despite its growing popularity, the flavored tea market in Africa grapples with a myriad of challenges that threaten its growth and sustainability. Climate change is one of the most pressing challenges for the African flavored tea industry. Fluctuating weather patterns, including unpredictable rainfall and rising temperatures, directly impact tea production. Additionally, tea from African countries is facing intense

ESTIMATED AT US$216.3 MILLION IN 2024, TO REACH US$364.5 MILLION BY 2030, GROWING AT A CAGR OF 9.09% DURING THE FORECAST PERIOD 2024-2030.

competition from established tea-producing countries like India and Sri Lanka. These countries have well-established brands and distribution networks that dominate global markets. African teas often struggle to compete on price and brand recognition, particularly in international markets where consumers are loyal to familiar names. The lack of well-established brands identifying tea from different African regions is also posing a considerable challenge for African tea, reducing their visibility. However, countries like Kenya have developed a national tea brand, "Chai Gold," which is seeking to increase Kenya's visibility and competitiveness.

Furthermore, over-reliance on traditional black CTC (Crush-Tear-Curl) tea production methods limits product diversification in Africa. This lack of innovation stifles the development of unique flavored teas that appeal to changing consumer preferences. Many producers in the continent have put a major emphasis on black tea without exploring the potential of herbal or fruit-infused blends that are attracting a growing audience.

The African tea industry is well-positioned to meet the growing demand for flavored tea beverages, thanks to diverse flora, local ingredients, and cultural tea-drinking practices that are becoming more popular in the international market. Bisap has become a popular ingredient in global tea blends due to its vibrant color and health benefits, such as lowering blood pressure.

As the market continues to evolve, there is significant potential for growth in both local consumption and international exports of flavored teas. By embracing diversity in flavors and promoting the unique qualities of African teas, producers can establish a strong foothold in the global beverage market while celebrating their rich cultural heritage. The future looks promising for flavored tea in Africa as it adapts to meet consumers' changing tastes and demands worldwide

By Abel Ndeda

Proteins are essential nutrients for the human body, serving as building blocks for tissue and a vital source of energy. Globally, the consumption of animal-based proteins often surpasses that of plant-based proteins, particularly in higherincome and developed economies. Meat is typically the most consumed animal-based protein worldwide, followed by fish, seafood, and dairy products. For many, animal-based proteins are more flavorful and satisfying than their plant-based counterparts. The distinct taste and texture of meat often drive dietary choices, influenced by cultural, geographical, and individual preferences.

In an era characterized by mass meat production, flavor is a critical factor that drives consumer purchases. This phenomenon has led to the concept of flavor modulation, which encompasses a complex interplay of taste, aroma, mouthfeel, and aftertaste. Flavor modulators are substances—

either chemical or natural—that interact with taste receptors on the tongue, influencing flavor perception. They can enhance sweetness, bitterness, or umami, as well as modify or mask undesirable off-flavors. This ability to improve taste and extend shelf life makes flavor modulators essential in the food industry.

Manufacturers leverage flavor modulators to create products that are flavorful, consistent, and nutritionally optimized. This involves balancing or restoring the appropriate aroma, mouthfeel, and flavor to achieve the desired taste. Traditional methods for enhancing meat flavor, such as marination, smoking, curing, aging, and tenderizing, are complemented by modern technological advancements.

The competitive landscape of the flavor modulation market is marked by strategic partnerships, product innovation, and

robust marketing. Technological advancements have given rise to innovative techniques for flavor modulation. For instance, encapsulation technology allows for the controlled release of flavors during cooking or consumption, ensuring a consistent and long-lasting flavor experience. Furthermore, natural flavor enhancers have gained traction due to their ability to enhance the umami taste of meat products without relying on artificial additives like monosodium glutamate (MSG).

Ingredients such as yeast extracts, rich in nucleotides, can amplify the savory taste of meat, while fermentation products like soy sauce and miso contain naturally occurring glutamates that enhance umami flavors. Enzymes, particularly proteases, are used to break down proteins in meat, resulting in a tender texture and releasing peptides that contribute to a savory, umami-rich taste. Protease-based marinades can also streamline marination processes, reducing the need for extended times. In processed meats like sausages, adjusting the ratio of lean meat to fat can significantly impact the overall taste experience. By leveraging these innovative techniques, food manufacturers can create meat products that not only taste great but also meet the growing demand for natural and healthier food options.

For African meat producers, the future of flavor modulation is ripe with potential, paving the way for a vibrant, taste-driven market that meets the diverse needs of consumers across the continent. According to Grand View Research, the global taste modulators market was estimated at $1.45 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030, driven by rising demand for convenient and processed food.

The African meat industry is evolving rapidly, fueled by increasing demand for high-quality, flavorful products. In a region where food culture is deeply rooted in local traditions and ingredients, the ability to modulate flavors allows producers to cater to diverse consumer preferences. There is growing demand for processed and packaged meats such as sausages, cured meats, and canned products, all of which require precise flavor control. Moreover, the expanding middle class in Africa is driving the demand for premium meat products, where flavor modulation adds value by enhancing taste complexity. Liquid flavor modulators are also gaining traction, providing precise flavor adjustments. Traditional smoking methods have long been used in Africa to enhance meat flavor, but modern techniques—such as liquid smoke or natural wood chip extracts—offer producers a scalable solution to introduce smoky notes without relying solely on traditional methods.

The procedures for flavor modulation in the meat industry are heavily influenced by market trends. As regional cuisines become more accessible, flavor preferences are evolving to include a fusion of regional and international tastes. Producers are increasingly exploring novel ingredients—such as citrus-

infused marinades and exotic spice blends—to appeal to these new demands.

There is also a growing interest in "better-for-you" products. Clean-label products, which are free from artificial flavors and additives, are gaining popularity. Natural flavor enhancers— such as herbs, spices, and fermentation products—are preferred as alternatives to conventional flavoring chemicals. Manufacturers must align their products with these trends while maintaining brand consistency.

In addition, there is an increasing demand for healthier flavors made with natural ingredients and reduced fat or sodium. This trend has led to the rise of plant-based meats, prompting processors to utilize flavor modulation techniques to replicate the taste and texture of traditional meat. This includes plant-based seasonings, marinades, and smoky flavors to provide meat-like experiences for vegan and flexitarian consumers.

Furthermore, consumers are increasingly interested in ethnic and regional flavors from diverse culinary traditions, including those from Asia, Latin America, Africa, and the Mediterranean. Meat processors are integrating authentic spices and flavor profiles from these regions to create unique products that celebrate cultural diversity.

The flavor modulation market is categorized into sweet modulators, salt modulators, mouthfeel modulators, and masking modulators. Achieving the desired flavor profiles requires a careful selection of processes and technologies for creating, enhancing, and preserving taste and aroma.

Market research is a crucial first step in the development stage, identifying the flavor profiles desired by consumers or specific markets. Different meat products have unique flavor requirements, necessitating tailored modulators for specific applications. The selection of high-quality ingredients—both natural extracts (such as herbs, spices, and yeast extracts) and synthetic compounds (such as aldehydes and esters)—is key. Natural flavors are often favored for clean-label products, while synthetic compounds can offer precision and consistency.

A blend of ingredients is then tested to find the right balance that enhances the target flavor without overpowering the natural taste of the meat. This process involves understanding how different compounds interact with the meat matrix and the cooking process to amplify desirable flavors and suppress undesirable ones.

Once developed, flavor modulators undergo small-scale tests, with sensory panels evaluating their impact. These panels, consisting of trained sensory scientists and consumer representatives, assess taste, aroma, texture, and overall sensory experience. Feedback from these evaluations helps refine the balance and intensity of the modulator, while also testing for thermal stability, resistance to oxidation, and effects on the texture of the meat FBA

CAMEROON – Cameroon has ramped up its efforts to combat illegal, unreported, and unregulated (IUU) fishing with the passage of a new law targeting subsidies in the maritime fishing sector.

The legislation, approved by the National Assembly and the Senate, empowers the President to ratify an amendment to the Marrakech Agreement of the World Trade Organization (WTO).

The amendment, which incorporates the June 17, 2022, Agreement on Fisheries Subsidies into Annex 1A, aims to curtail subsidies that promote overfishing and jeopardize marine resource sustainability. Cameroonian officials view this ratification as an opportunity to enhance national capabilities for monitoring and controlling fishing activities.

By eliminating subsidies to foreign industrial vessels accused of depleting Cameroon’s territorial waters, the country also seeks to access funding from the WTO fisheries fund to improve fisheries management and promote sustainable exploitation of marine resources.

This legislative action is part of a broader governmental strategy to reform and develop a sector crucial to the national economy.

The decision to ratify the agreement has partly been influenced by recent pressure from the European Union (EU). In January 2023, Cameroon was sanctioned by the EU with a “red card” for its inadequate cooperation in responsible marine resource management.

This reprimand has galvanized national efforts to combat IUU fishing, which threatens fish stock sustainability and undermines the marine ecosystem.

The Cameroonian fishing industry has been underperforming. According to the National Institute of Statistics (INS), the country’s fish imports dropped from 241,798 tons in 2022 to 234,572 tons in 2023.

This 3% decline, amounting to 7,226 tons, is significant, but the decrease in import value is even more notable. The cost of fish imports fell by CFA20 billion (US$33 million), from CFA202.6 billion (US$335 million) to CFA182.5 billion (US$302 million), marking a 10% reduction.

Despite government efforts to boost production, Cameroon continues to face a substantial gap between fish production and demand, which remains around 500,000 tons annually. The deficit has slightly worsened, reaching 270,000 tons.

NAMIBIA – Namibia’s cattle export sector is experiencing a downturn, with a reported 24.3% decrease in total exports year-on-year as of August 2024.

Recent figures indicate that the primary factor behind this decline is diminished demand from South Africa, which has seen its cattle imports from Namibia drop by 26.8% during the same timeframe.

Data from the Livestock and Livestock Product Board (LLPB) reveals that this downturn is part of broader challenges affecting the cattle industry, where overall marketing activities fell by 17.3% compared to the previous year and 16.4% from the previous month.

As of the end of August 2024, Namibia had marketed 278,195 cattle, an increase from 210,807 during the same period in 2023. However, the sheep sector is also struggling, with marketing numbers down 26.5% compared to last year.

The reduction in slaughtering activity has impacted both export-approved and local abattoirs, leading to a 54.2% decline. Demand from South Africa has weakened by 18.7%, contributing to the decrease.

In South Africa, the Association of Meat Importers and Exporters (AMIE) has expressed alarm over prolonged delays in processing meat import permits, following new requirements imposed by the Border Management Agency (BMA).

Previously, permits were issued within two days, but importers now face wait times of eight to nine days due to updated regulations introduced by the BMA earlier this year.

Among the changes is a requirement for veterinary inspectors to be present during the unsealing of 35% to 45% of containers before samples can be taken for testing.

AMIE has urged authorities to either increase inspection capacity or return to the previous system until sufficient resources are available to manage the increased workload.

The association also claims that, in practice, the new rules are being enforced unilaterally, leaving importers in the dark about the criteria being used.

EGYPT - Egypt’s poultry farmers are facing significant financial difficulties for the second consecutive season, largely due to a government policy that has allowed a sharp rise in frozen chicken imports.

According to Tharwat Al-Zaini, Vice President of the Egyptian Poultry Producers Union, these imports have led to an average loss of about 7 Egyptian pounds (US$0.14) per kilogram of live chicken, putting the future of Egypt’s poultry sector at risk.

Official reports show that Egypt’s chicken meat production is expected to hit 1.59 million tonnes in 2023. Between 2010 and 2019, the country almost doubled its poultry production. However, this growth has stalled over the last five years.