LOOKING BACK AT IMO 2020

The impact of the sulfur reduction rule is hard to pinpoint but is felt in the marketplace

SPRING 2023

In the Lead Fuels Institute’s John Eichberger

Bulk Plants

How easy is it to add biofuel storage?

April 18-20, 2023 Dallas, TX

When best-guesses just don’t cut it.

Sharing growth-igniting data and insights is what we do at NACS, and the NACS State of the Industry Summit is where it’s all unveiled. Join us next month in Dallas for two jam-packed days designed to help you understand the industry outlook, and use it to your advantage.

Register Now: convenience.org/CarpeData

MAKE BETTER DECISIONS.

SPRING 2023 COVER STORY Looking Back at IMO 2020 What was the actual impact of lowering sulfur in maritime bunker fuels? In The Lead The Fuels Institute hits 10 years of moving transportation mobility forward. Adding Biofuels to Bulk Plants How easy is it to bring biofuel storage into a bulk plant or terminal operation? 38 34 30 FuelsMarketNews.com FMN Magazine SPRING 2023 | 1

04 From the Editor 06 NACS News 10 Fuels Institute 12 Fueled for Thought RETAILER OPERATIONS 14 When the Lights Go On Prepare now so that you’re not left asking where everyone went. 16 Cutting the Cost With EV Charging How convenience stores can get their money’s worth on EV charging stations. 18 The Sophistication of Wetstock Management Wetstock management solutions can take forecourt analytics to the next level. 22 Fighting Fuel Theft A Q&A with RDM Industrial Electronics. COMMERCIAL FUELS 24 Back to Basics Fuel economy and maintenance and repair strategies can combat today’s supply-chain issues and rising fuel costs. FUEL MARKETERS 28 Diesel Powers Forward What’s in store in 2023 for consumer diesel vehicles and diesel fuel prices? 46 Industry News 48 Remember This? 24 14 28 FuelsMarketNews.com 2 | FMN Magazine SPRING 2023

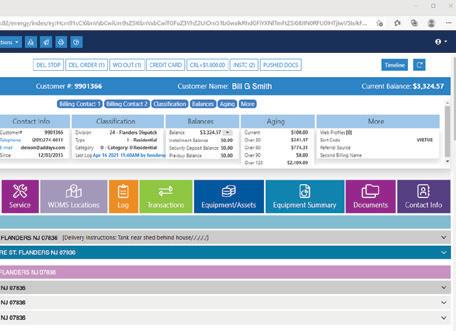

SOFTWARE FOR THE PETROLEUM & CONVENIENCE STORE INDUSTRIES Learn more at addsys.com 800-922-0972 SYSTEMS ALWAYS MOVING FORWARD Thank you to our clients for consistently collaborating with us to bring innovative software solutions to the industry. Experience that fuels the Future Your driver Jim B will be delivering fuel today to 12 East 2nd St. Anywhere, NC ADD ENERGY Co.

FROM THE EDITOR

Decarbonizing Maritime Shipping

This issue’s cover story reexplores IMO 2020, an initiative by the International Maritime Organization to radically reduce the sulfur found in bunker fuels. The article covers how what was once seen as a potentially major disruption to the world’s fuel logistics was overwhelmed, and largely absorbed, by the double impact of the COVID-19 pandemic and the Russia-Ukraine war. The article explores this in detail and includes expert commentary, so please check it out.

However, not covered in the article are future initiatives planned for maritime fueling. IMO 2020 was focused on addressing a traditional pollutant, sulfur oxide, but the next step is aimed at reducing greenhouse gas emissions. The goal there is to cut such emissions in half by 2050, and then completely at some unstated point later in the century. This is a tremendous challenge. The possible solutions and their impacts on shipping logistics and costs are mostly uncertain today.

The plan is to implement the reduction in phases, with short-, medium- and long-term perspectives. Part of this will encompass (as with the trucking industry) improvements in the overall system, such as more hydrologically efficient hulls, combined with a variety of less-carbon intensive fuels. IMO lists such potential future fuels and propulsion as ammonia, biofuels, electric power, fuel cells, hydrogen, methane and wind.

Ammonia is seen as a potential leader given it has a reasonable energy density. However, to say the technology is in its infancy is an understatement, as an article from DNV, an assurance and risk management firm, notes. For starters, the ammonia in question is green ammonia, which cannot be made from petroleum sources and is currently not being produced.

The propulsion technology is also in its infant stage. The DNV article highlighted a huge maritime two-stroke engine that is being developed by MAN Energy Solutions, but it must deal with both a very slow flame propagation and combustion temperatures roughly three times greater than that of diesel. While ammonia combustion may be low on carbon, it produces the conventional pollutant nitrogen oxide, which can be handled with conventional catalytic techniques, and also nitrous oxide, which itself is an extremely aggressive greenhouse gas. One possibility is to also use ammonia with fuel-cell technology, another area that needs considerable development.

The final propulsion source on the list, wind, is a bit ironic. The greenhouse gas emission reduction goals of the Paris Accords (COP 21) would have carbon emissions at a preindustrial baseline level—essentially matching the age of sail. Pure sailing vessels would still suffer from the same disadvantages that saw them quickly eclipsed by steam propulsion as the technology developed in the mid to late 1800s. A future system would likely be a hybrid similar to that used in the transition period—sails plus an alternative engine-propulsion system. As we’ve found with power-generating windmills, there are days, if not weeks, when the wind fails to blow.

EDITORIAL

Keith Reid Editor-in-Chief (847) 630-4760; kreid@fmnweb.com

Kim Stewart Editorial Director (703) 518-4279; kstewart@convenience.org

Ben Nussbaum Senior Editor (703) 518-4248; bnussbaum@convenience.org

Lisa King Managing Editor (703) 518-4281; lking@convenience.org

CONTRIBUTORS

Al Barner, Madeline Bennett, John Eichberger Joe O’Brien, Brian Reynolds, Allen Schaeffer, Roy Strasburger

DESIGN Imagination www.imaginepub.com

Cover image by Sven Hansche/Shutterstock

ADVERTISING

Ted Asprooth (847) 222-3006; tasprooth@convenience.org

PUBLISHING

Stephanie Sikorski Publisher (703) 518-4231; ssikorski@convenience.org

Nancy Pappas Marketing Director (703) 518-4290; npappas@convenience.org

Logan Dion Digital Ad and Media Trafficker (703) 864-3600; production@convenience.org

EDITORIAL COUNCIL

RETAILER/MARKETER MEMBERS

Mark Fitz, president, Star Oilco; Derek Gaskins, chief marketing officer, Yesway; Jeff Reichling, general manager of fuel, Kwik Trip Inc.; Jim Weber, executive vice president of merchandise and marketing, The Spinx Company

VENDOR/SUPPLIER MEMBERS

Regina Balistreri, director of marketing, ADD Systems; Joe O’Brien, vice president of marketing, Source North America Corporation; Kaylie Scoles, marketing director, RDM Industrial Electronics Inc.; Jen Threlkeld, product marketing manager, Dover Fueling Solutions

Fuels Market News Magazine is published quarterly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscription Requests: circulation@fmnweb.com

POSTMASTER: Send address changes to Fuels Market News Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Keith Reid is the editor-in-chief of Fuels Market News.

He can be reached at kreid@fmnweb.com.

Contents © 2023 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria, VA, and additional mailing offices.

1600 Duke Street, Alexandria, VA, 22314-2792

PUBLISHED BY

FuelsMarketNews.com 4 | FMN Magazine SPRING 2023

YOU CAN TURN A PROFIT WHEN YOU TURN THE TABLES. Make a clean break with Flex Fuels — and give yourself a financial advantage the majors don’t want you have. It’s more affordable for customers and more profitable for you. Add E15 & E85 today. We can help. flexfuelforward.com

U.S. C-Store Count Stands at 150,174

There are 150,174 convenience stores operating in the United States, according to the 2023 NACS/NielsenIQ Convenience Industry Store Count. The count is up 1.5% from December 31, 2021, snapping a four-year run of declines. There are roughly 100 stores fewer than before the COVID-19 pandemic struck.

With the U.S. population at 334.2 million, according to the U.S. Census Bureau, there is one convenience store per every 2,225 people.

Convenience stores sell an estimated 80% of the motor fuels purchased by consumers in the United States. The new store count shows that 118,678 convenience stores sell motor fuels (79.0% of all convenience stores).

The gain of 2,148 stores was largely driven by an uptick in the number of c-stores selling fuel. In all, the industry picked up 2,037 additional sites that offer fuel and 111 c-stores that don’t sell fuel. This also marks a reversal from prior years, which saw the number of fuel-selling locations contract as the number of non-fuel c-stores expanded.

In addition, there are “gas station/kiosk” stores that sell fuel but not enough of an in-store product assortment to

be considered convenience stores. Overall, there are 13,346 kiosks. The kiosk format continued to decline—down 11.2% the past year and 49.3% over the past six years—as more consumers sought out stores that have robust food and beverage offers.

“The value of convenience continues to grow, and that’s a driving factor why every retailer, regardless of channel, seeks to provide it. And it’s also clear that the convenience offer at convenience stores resonates with consumers, given the record in-store sales at convenience stores and increase in store count,” said NACS Managing Director of Research Chris Rapanick.

Texas continues to have the most convenience stores (116,018 stores), or more than one in 10 stores in the United States. The remainder of the top 10 is the same from the year prior: Despite a decline in store count, California remains second at 12,000 stores, followed by Florida (9,596), New York (7,917), Georgia (6,719), North Carolina (5,749), Ohio (5,673), Michigan (4,879), Pennsylvania (4,728) and Illinois (4,666). Alaska grew its store count by 9.2% but still has the fewest stores (190) of any state.

JONI HANEBUTT /SHUTTERSTOCK FuelsMarketNews.com 6 | FMN Magazine SPRING 2023

“One of the most impartial, eclectic and diverse meetings I attend all year.”

“An experience unlike any other in the industry…a diverse group of stakeholders, getting together to discuss very pressing topics.”

“What I found here is openness…different technologies…we keep it all in the room…we’re not afraid to say what we feel.”

These are just some of the many comments we have received from folks who have joined us for our annual FUELS conferences.

The FUELS’23 Conference is shaping up to be one of our best ever! We have finalized our agenda and we will be celebrating our 10th Anniversary. It should be a very special opportunity to network, engage and participate in a unique and inclusive setting.

Topics Include:

Lessons Learned from Past 10 Years

Why the Focus on Decarbonization and How Do We Account for It?

EV Infrastructure – The Perspective of Drivers and Charger Operators

The Economics of Charging – Utilization, Timing and Demand Charges

Addressing the Elephant in the Room – Internal Combustion Engines

Feeding the Big Dogs – Powering Commercial Vehicles

Creating A Hydrogen Economy

The Energy Transition of Retail

Finding Solutions that Work for All

The Next Big Breakthrough?

Register now for THE conference of the year for unbiased research and dialogue with key stakeholders in the energy sector that will reimagine the transportation industry.

To find out more and to register, go to www.fuelsinstutue.org

It’s Time for the NACS State of the Industry Summit

There’s still time to register for the NACS State of the Industry Summit taking place in Dallas, Texas, April 18-20, 2023.

The NACS SOI Summit is the only industry event that delivers actionable insights behind the data on the latest financial, operational, categorical, regional market and consumer trends in convenience. Attendees receive early access to 2022 convenience industry data , which drives the NACS State of the Industry Report, offering exclusive industry information not available anywhere else.

Retailers and suppliers rely on this proprietary data from the summit to benchmark their performance by region and top-performing quartiles, see what’s working and not

Calendar of Events

APRIL

NACS State of the Industry Summit

April 18-20 | Hyatt Regency

DFW International Airport | Dallas, TX

NACS Leadership for Success

April 30-May 05 | Virginia

Crossings Hotel & Conference Center | Glen Allen (Richmond), VA

MAY

NACS Convenience Summit Europe

May 30-June 01 |

Intercontinental Dublin | Dublin, Ireland

working for others across key categories, learn what drives the consumer to enter their store (or not) and purchase what they do, and to gain ideas on how to take their business to the next level. NACS is uniquely positioned to provide data and insights laser-focused on the needs of the convenience industry and is backed by its 50+ years of strategic analysis in the space.

The conference is held over two jam-packed days, and those who attend include fuel and convenience retailers and industry partners who want to make data-driven decisions and know the value of using insights and benchmarking to improve their businesses. The event not only builds new connections and opportunities but also is the premier opportunity to upskill future leaders who can impact performance as they grow and develop their convenience and fuel industry knowledge.

Register today at www.convenience.org/events/SOI

JULY

NACS Financial Leadership Program at Wharton

July 16-21 | The Wharton School | University of Pennsylvania | Philadelphia, Pennsylvania

NACS Marketing Leadership Program at Kellogg

July 23-28 | Kellogg School of Management | Northwestern University | Evanston, Illinois

NACS Executive Leadership Program at Cornell

July 30-August 03 | Dyson School | Cornell University | Ithaca, New York

OCTOBER

NACS SHOW

October 03-06 | Georgia World Congress Center | Atlanta, Georgia

NOVEMBER

NACS Innovation Leadership Program at MIT

November 05-10 | MIT Sloan School of Management | Cambridge, Massachusetts

For a full listing of events and information visit www.convenience.org/events.

FuelsMarketNews.com 8 | FMN Magazine SPRING 2023

Call (310) 214-3118 to schedule your one-on-one demo today or email sales@triniumtech.com www.TriniumTech.com/Fuel Business Software for Fuel Marketers of All Sizes “Trinium has enabled us to upgrade our technology to a more modern and functional system, while providing us the necessary flexibility to customize the system to fit our specific needs." Dave Olson, Partner Ernie’s Fueling Network www.erniesfuelingnetwork.com Fuel Software WHOLESALE FUEL & LUBRICANTS CARDLOCK MANAGEMENT INTEGRATED ACCOUNTING Get inside consumers’ minds. And shape your future accordingly. This year, you won’t just know why. You’ll see why. convenience.org/voices

Without Trucks, America Stops

Carbon

BY JOHN EICHBERGER

We have all seen the bumper stickers—“Without trucks, America stops.” And it’s true. According to American Trucking Associations (ATA), 72% of the nation’s freight is moved by trucks. At the same time, as the industry and the nation consider strategies to reduce carbon emissions from the transportation sector, these vehicles must be a focus of our efforts. They account for 24% of U.S. transportation greenhouse gas emissions. In doing so, we also must recognize the complexity and unique characteristics of medium- and heavy-duty vehicles (MHDV) to find solutions that balance environmental progress with economic activity.

WHAT IS AT STAKE?

To really understand the market, it is important to put it into context. The following data again comes from ATA:

• Gross freight revenues from trucking were valued at $875.5 billion in 2021, 80.8% of the nation’s total freight bill. This is equal to 4% of the U.S. gross domestic product.

• Commercial trucks paid $48.46 billion in federal and state highway-user taxes in 2020 (a pandemic year). This accounts for 24% of all government spending on roadways.

• There were 38.9 million trucks registered and used for business purposes in 2020.

• Registered trucks drove 302.14 billion miles in 2020 (again, a pandemic year) and consumed 44.8 billion gallons of fuel.

• 95.7% of for-hire carrier companies on file with the Federal Motor Carrier Safety Administration operate 10 or fewer trucks.

• 7.99 million people were employed in jobs related to trucking in 2021, excluding those who were self-employed.

Because this sector is extremely diverse, reducing emissions will require a multifaceted approach that applies customized solutions to different vehicle types and use applications. According to a Fuels Institute report published in April, 94% of commercial vehicles sold are deployed in 17 different use-case applications, each of which carries with it unique operating characteristics and energy requirements.

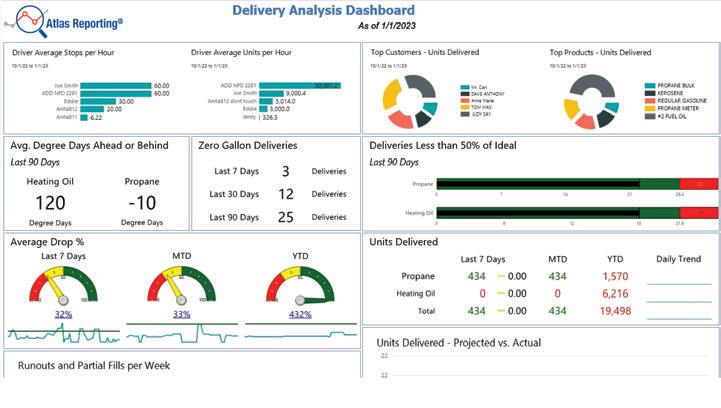

MARKET SHARE OF ALTERNATIVE MHDVs IS LIMITED

According to data provided by Statista, 99.5% of commercial vehicles in the U.S. in 2020 were powered by diesel or gasoline-fueled engines. And despite growing discussions about electrification of the MHDV market, forecasts for market penetration remain relatively anemic.

The primary reason for the slow rate of adoption is price. Statista reports that electric-powered medium-duty trucks in 2025 will cost twice as much as comparable diesel vehicles, while heavy-duty electric trucks will cost more than 2.5 times as much.

For some applications, such as parcel delivery vehicles that travel a consistent range and return to a base each night and school buses that have prolonged downtime throughout the day, electrified powertrains are attractive for both emissions and economic reasons. Other segments of the MHDV market, however, do not present the same opportunities for electrification.

MORE OPTIONS FOR MHDV MARKET

The diversity of vehicle type and duty cycle within the MHDV market makes application of some decarbonization strategies more challenging than within the light-duty market, but it also creates opportunities for more options that may not be viable with passenger vehicles. For example, incorporating more biodiesel and renewable diesel into the fuel supply can dramatically reduce the carbon intensity of the fuel these vehicles burn. In fact, these fuels represent a 68% reduction in carbon intensity compared with straight diesel fuel and can be blended in higher concentrations (thereby improving the associated carbon benefits) than most light-duty vehicles can accommodate with gasoline-ethanol blends.

MHDVs are also capable of running on a wide variety of gaseous fuels, like natural gas, which can lower carbon emissions. When renewable natural gas is used in these vehicles, the carbon intensity has the potential to be negative due to the nature of renewable gas.

In an era where decarbonizing transportation has been identified as a key objective, addressing the MHDV sector is critical. There are strategies that will fit certain use-case applications but not others. Recognition of this reality is important, especially when considering public policy initiatives.

FuelsMarketNews.com 10 | FMN Magazine SPRING 2023

reduction for MHDVs requires taking multiple approaches.

Electric powertrains are gaining market share in the lightduty vehicle market, but the slow rate of adoption among commercial vehicles globally indicates that additional strategies must be available for many vehicle applications.

14,000 Commercial vehicle fleet in the United States in 2020, by fuel type (in 1,000s) Diesel Gasoline Compressed natural gas Electric 11,000 3,000 0 2,000 4,000 6,000 Fleet Structure 8,000 10,000 12,000 60 10 Sources: IHS Markit; Diesel Technology Forum ©Statista 2022 Purchase costs Projected heavy-duty truck purchase costs between 2020 and 2030, by fuel type (in U.S. dollars) 500,000 400,000 300,000 200,000 100,000 0 380,500 Electric Diesel 277,000 2020 2025 2030 177,000 105,000 105,000 108,000 Sources: Global Commercial Vehicle Drive to Zero; Calstart; FIER Automotive ©Statista 2022 Purchase costs in U.S. dollars Projected medium-duty truck purchase costs between 2020 and 2030, by fuel type (in U.S. dollars) 400,000 300,000 200,000 100,000 0 322,000 Electric Diesel 206,000 2020 2025 2030 147,500 109,500 109,000 111,000 Sources: Global Commercial Vehicle Drive to Zero; Calstart; FIER Automotive ©Statista 2022 FuelsMarketNews.com FMN Magazine SPRING 2023 | 11

John Eichberger is executive director of The Fuels Institute. For more information, visit www.fuelsinstitute.org.

3 Future Fuels to Keep an Eye On

BY JOE O’BRIEN

Although EV expansion is garnering a lot of attention right now, it is not the only horse jockeying for a position in the automotive energy race. With that in mind, here are three additional future fuels that have favorable odds in the next 10 to 15 years.

ETHANOL

A few indicators point to the expansion of ethanol. First, federal and state funding for ethanol is plentiful and rising. The U.S. Department of Agriculture has offered $100 million to help transportation fueling and fuel distribution facilities make equipment compatible with biofuels. Energy Marketers of America reports that $75 million of the funding is being made available to fuel retailers, with 40% of it earmarked for businesses with less than 10 stations.

States are also offering incentives. For example:

• In Kansas, an income tax credit is available for 40% of the cost to install alternative fueling infrastructure.

• Through 2026, Nebraska is offering a credit of 5 cents on each gallon of E15 sold and 8 cents per gallon of E25 or higher blends sold.

• Cost-share grants in Iowa help facilities upgrade or install new E85 or dual E15 and biodiesel infrastructure.

Secondly, the development of higher ethanol blends between E15 and E85 continues.

Ethanol Producer reported in October that the U.S. Environmental Protection

Agency approved the continuation of research in Nebraska to confirm the long-term adaptability and feasibility of E30.

RENEWABLE DIESEL

Although the adoption of medium-sized electric trucks used for short local runs is accelerating, the transition to long-haul electric vehicles is expected to be slower. The energy that long-haul trucks consume combined with larger payload considerations complicates the electrification of the heavy-duty truck fleet.

Concurrently, global supplies of diesel have dropped due to geopolitical instabilities and a decrease in refining capacity. As a result, demand for diesel is volatile and unpredictable for 2023.

That notwithstanding, diesel’s volatility is creating a market for renewable diesel. Renewable diesel is made from the same resources as biodiesel but produced using a different process. The result is a fuel that is chemically identical to petroleum diesel and can support the hauling capacity needed by today’s truck fleet. It can also be used to create biodiesel blends, which would seem to make it uniquely suited for bridging a supply gap.

FUELED FOR THOUGHT

FuelsMarketNews.com 12 | FMN Magazine SPRING 2023

However, that optimism may not be grounded in reality.

A report from Cerulogy suggests that bullish projections from the Energy Information Administration (EIA) about the expansion of renewable diesel are not realistic. The report concluded that a generous policy environment for renewable diesel has led to new stand-alone facilities, conversions of existing refinery units and coprocessing with fossil fuels at existing refineries. Nevertheless, renewable diesel production capacity is still likely to fall short.

Total diesel production capacity has dropped by about 180,000 barrels per day since 2019. That being said, about 21 proposed or under-construction renewable diesel projects join a handful of plants with existing renewable diesel refining capacity. This would seem to indicate renewable diesel production is expanding, but perhaps not quite as vigorously as initially projected by the EIA.

HYDROGEN

While growth in hydrogen fueling appears strongest in the Asia-Pacific region and Europe, there is evidence that expansion in the U.S. is also on the horizon.

Auto manufacturers including Honda, Hyundai and Toyota are currently offering fuel cell electric vehicles (FCEVs) to customers in markets where hydrogen fuel is available—most notably California. However, the infrastructure for distributing hydrogen nationwide in the United States still needs to be developed. (More than 800 public hydrogen stations were deployed globally in 2021. By contrast, there were only 43 retail hydrogen stations in the U.S. in mid-2020.)

Although the federal government is allocating funding toward hydrogen fueling, the near-term boost for hydrogen in the U.S. is likely to be modest. The $1.2 trillion U.S. bipartisan Infrastructure Investment and Jobs Act apportioned $62 billion to the Department of Energy (DOE) for

investments in infrastructure, including $9.5 billion for clean hydrogen. Part of the financing will fund the creation of regional hydrogen hubs (H2Hubs). Utilization of clean hydrogen in the transportation sector will be among the characteristics the DOE will evaluate when selecting proposals for the H2Hubs funding.

Although light-duty applications for hydrogen appear sluggish, it is gaining traction as a diesel alternative in the U.S. In a draft of its National Clean Hydrogen Strategy and Roadmap, the DOE reports that “hydrogen and fuel cells offer significant opportunities for applications requiring long driving ranges, fast fueling and large or heavy payloads.”

The draft goes on to say, “Fuel cells are particularly viable for applications such as heavy-duty trucks that require fast fill times comparable to diesel today, or long driving ranges above 500 miles.”

Several commercial heavy-duty truck manufacturers have announced plans to expand production of hydrogen-powered heavy-duty trucks. Additionally, electric vehicle maker Nikola Corp. announced it is working with KeyState Natural Gas Synthesis to create Pennsylvania’s first low-carbon hydrogen production supply chain.

Future fuels aside, the internal combustion engine may ultimately be the dark horse in race.

A Fuels Institute literature review points to the ICE’s staying power and continued dominance for the next decade. The report, “Future Capabilities of Combustion Engines and Liquid Fuels,” suggests that ICEs will continue to play a significant role through at least 2035. According to the report, ICE design improvements in pursuit of a lower carbon footprint continues to be the subject of research efforts. This is an indication that automakers aren’t giving up on the ICE just yet, though no major vehicle manufacturer has decided to invest all R&D efforts in internal combustion engines.

Joe O’Brien is vice president of marketing at Source™ North America Corporation. He has more than 25 years of experience in the petroleum equipment fuel industry. Contact him at jobrien@sourcena.com or visit sourcena. com to learn more.

A report from Cerulogy suggests that bullish projections from the Energy Information Administration (EIA) about the expansion of renewable diesel are not realistic.

FuelsMarketNews.com FMN Magazine SPRING 2023 | 13

IMAGE PROVIDED BY SOURCE NORTH AMERICA CORPORATION

When the Lights Go On

Prepare now so that you’re not left asking where everyone went.

BY ROY STRASBURGER

Afew weeks ago, my wife, Eva, and I had a lovely meal in London with a couple of our very good friends. The location was a fabulous Italian restaurant in the center of the city. When we arrived, the place was packed. In the intimately lit dining area, every table was filled with couples conversing, friends carousing or businesspeople cutting deals across the table. We had a delightful meal of

antipasto and pasta, and we finished the occasion with a leisurely after-dinner drink. During our meal, we were deep in conversation, talking about old friends, new adventures and where we thought the world was headed. Unexpectedly, the restaurant’s lights came up. When we looked around, all our fellow diners were gone. We had, once again, managed to close the restaurant—having had a wonderful time in the process.

Have you ever had that feeling? Being somewhere and suddenly looking around and wondering why you are the last person there? If you’re not careful, you may one day have that same feeling regarding the fuel business.

The retail fuel industry is going through the most disruptive change since the introduction of self-service gasoline. Alternative fuels are a real thing, and electricity is currently

RETAIL OPERATIONS

FuelsMarketNews.com 14 | FMN Magazine SPRING 2023

leading the charge (see what I did there?).

So, what have you done to prepare yourself for a change in your business, your customer, and your competition? Let’s take each one separately.

Change in business. The retail fuel industry is going through a revolution (not evolution). You may not see it your area, but it is already happening in Europe and California and will be felt in the rest of the United States over the next 10 years. Although gasoline will still be needed, the demand for gasoline is going to go down due to the phasing out of cars with an internal combustion engine. That means that fewer gallons are going to be sold at each retail location. Even if fuel profit margins go up dramatically, it is not going to make up for the loss of gross profit dollars when fewer gallons are sold.

If you are the owner of a site that is barely making it with the current fuel situation, you need to start thinking about how you are going to prepare for the future. Keeping your head in the sand and continuing to do business as usual is not a strategy for success.

Change in customer. Your customers’ expectations of convenience are going to be redefined along with the change in transportation. Two things are going to be at the forefront: ridesharing and electric vehicles. Whether autonomous vehicles become a reality for widespread public use soon is still a big question. What will become more prevalent, though, will be people sharing vehicles and driving less, whether it’s through Uber-like programs, car-ownership sharing

programs or a more efficient public transportation system. There will be fewer vehicles on the road and fewer opportunities for people to stop at your store. Customers will start thinking that convenience is based more on delivery, foodservice, unique products, occasional electric charging top ups and innovations that create a destination rather than simply an additional purchase when they fill their tank.

Change in competition. As fuel volumes go down, the retail gasoline business is going to be dominated by the operators who can pump the most gallons at the lowest cost. They will be the last people in the room. High-volume sites are going to need attractions and offers that make them very unique to bring in the remaining internal combustion engine drivers. Not only that, if they decide to get into electric charging stations, their competitors are going to be nontraditional sites that also offer charging stations, such as shopping malls, pharmacies and people’s homes.

The retailers who are going to come out ahead in the recharging game will be those who are located on major thoroughfares where drivers will need to top up on long drives or those located in residential areas where there are not abundant home or apartment charging stations. The fuel retailers who are in the middle of this spectrum—and that is most fuel sites in the United States—will not survive as they are today.

What is the solution? Explore your options. Now is the time to start looking at your future. You need to be ready when the lights come on.

Roy Strasburger is the CEO of StrasGlobal. For 35 years, StrasGlobal has been the choice of global oil brands, distressed assets managers, real estate lenders and private investors seeking a complete, turnkey retail management solution.

RETAIL OPERATIONS DNY59/GETTY IMAGES

Have you ever had that feeling? Being somewhere and suddenly looking around and wondering why you are the last person there? If you’re not careful, you may one day have that same feeling regarding the fuel business.

FuelsMarketNews.com FMN Magazine SPRING 2023 | 15

Cutting the Cost With EV Charging

How convenience stores can get their money’s worth on EV charging stations.

BY MADELINE BENNETT

Installing electric vehicle (EV) charging stations doesn’t have to result in prohibitive energy bills for convenience store operators. By reducing demand charges and accessing federal grant funds and tax incentives, convenience retailers can profitably install EV charging stations, maintaining or even growing their customer base as more Americans shift toward electric vehicles.

NEVI GRANTS FOR EV FAST CHARGING STATIONS

Financial incentives from the federal

government and states can help offset the cost of installing EV charging stations. Convenience stores are encouraged to apply to the National Electric Vehicle Infrastructure (NEVI) program, created as part of the $1.2 trillion Infrastructure Investment and Jobs Act signed into law in 2021. Convenience stores qualify for NEVI funding if they have:

• Access guaranteed 24 hours a day, 365 days a year

• Facilities to simultaneously charge four vehicles

• 150kW of power capacity per port

• ADA compliant parking spaces

• Restroom amenities

• A location within one mile of designated FHWA Alternative Fuel Corridors

• A location at least 50 miles from an adjacent NEVI-funded charging station

NEVI requires stations to be at least 97% reliable, and because states and localities are encouraged to deploy projects that use smart charge management, to minimize impacts to the grid. Among solutions, battery-assisted charging offers both these benefits. After a successful NEVI grant application, convenience stores can receive up to an 80% rebate on the upfront cost of installing EV charging stations. NEVI grants can be competitive and may involve upgrades to a site’s entire power grid. Another way to decrease the cost of EV charging stations is through investment tax credits offered by the federal government as part of the recently passed Inflation Reduction Act (IRA).

RETAIL OPERATIONS

FuelsMarketNews.com 16 | FMN Magazine SPRING 2023

INVESTMENT TAX CREDITS FOR BATTERY-ASSISTED AND BATTERYINTEGRATED EV FAST CHARGING STATIONS

Demand charges are tied to the highest peaks of electricity usage within a specified period by commercial or industrial customers, which includes convenience stores. Demand charges can be extreme. They can be triggered when a charging station gets a few drivers in a row using a lot of energy or many drivers each using a small amount. EV charging platforms can reduce demand charges by using battery storage. While battery-assisted EV charging stations produced by private companies can look more expensive than ones from public utilities, installing them is usually far less costly for convenience stores.

One year after NEVI was created, the federal government created an additional option for businesses looking for tax credits to help fund their investment in battery-assisted or battery-integrated EV charging stations. These tax credits come with fewer requirements than NEVI funding. Convenience stores can qualify for IRA tax credits if the technology they are purchasing:

• Has a storage capacity of not less than 5 kilowatt hours

• Is completely constructed by 2025

• Is not transportation property (e.g., is not a car, bus or other vehicle)

Businesses can qualify for tax credits equal to a 6% to 50% discount on their purchase of energy storage technology. The amount that the government awards depends on factors such as whether the purchased products are made in the United States and whether the product is installed in an “energy community”–an area that historically produced other forms of energy, such as coal or oil. It could be possible for specific sites to access both NEVI grants and IRA tax credits. Convenience stores should consult charging station vendors and tax advisors to find the charging solutions that work for their needs.

THE BUSINESS CASE FOR INSTALLING EV FAST CHARGING STATIONS AT CONVENIENCE STORES

Installing EV charging stations opens high-potential revenue streams for convenience store owners. An increasing number of Americans drive electric vehicles. Today, 3.4% of light-duty vehicles on the road are fully electric, up from less than 1% four years ago, according to a report from the U.S. Energy Information Administration. This trend is only projected to accelerate, especially as some states, such as California and New York, have announced plans to halt the sale of combustion vehicles in coming years. The federal government intends to end its purchase of new gas vehicles for government use by 2035.

A high volume of sessions per day makes the EV fast charging business feasible. The EV boom will create a consistent stream of repeat customers spending time and money at businesses with fast charging stations. Convenience stores can remain integral to drivers’ routines as drivers make charging stops during commutes and trips. Since up to 90% of drivers make a purchase at retail stores while charging their EV onsite, installing EV charging generates guaranteed revenue. Similar to gas pumps, EV charging stations can be integrated with customer rewards or loyalty programs to keep drivers returning and ensure an excellent customer experience.

While installing EV charging stations looks like a large upfront expense, when done carefully it is an affordable, smart investment. Choosing an EV charging station that manages demand charges and applying NEVI funding and/or IRA tax credits can keep costs low and charging profitable. Convenience stores are in an exciting position to be leaders in EV charging, and a range of public and private options exist to help make that future a reality.

RETAIL OPERATIONS

Madeline Bennett is the sales development representative at Electric Era Technologies. Electric Era engineers advanced storage systems for EV fast charging stations.

Financial incentives from the federal government and states can help offset the cost of installing EV charging stations.

FuelsMarketNews.com FMN Magazine SPRING 2023 | 17

ELECTRIC ERA TECHNOLOGIES

The Sophistication of Wetstock Management

forecourt analytics

BY BRIAN REYNOLDS

There are some strange happenings out on the forecourt and some nagging issues that require more than traditional ways of doing business. Some involve acts of nature. Others involve acts of human nature. Wetstock management solutions, typically involving tank gauges and sophisticated tank monitoring software, can analyze fuel products

and tank activities on a real-time basis and can provide an explanation for strange events—and actionable recourses for not-so-strange (but no less critical) events.

Let’s look at a few of these.

EARTHQUAKES

First, a look at nature intruding on retail fueling operations.

On July 8, 2021, a 6.0 magnitude earthquake was felt along Antelope Valley, 20 miles southwest of Smith Valley, Nevada. The quake was detected as far away as San Francisco and Carson City, Nevada. It also caused tank probes to bobble due to tank slosh. Wetstock technology recorded the entire event. Aftershocks were also detected.

Generally, wetstock tank charting capabilities are designed to continuously time stamp and record fuel tank inventory for purposes such as leaks, theft, sales and deliveries. Now, a new feature can be added to the wetstock repertoire of events that can be monitored for in real time—seismology! A wetstock management system recorded the quake from start to finish. The United States Geological Survey with

RETAIL OPERATIONS

Wetstock management solutions can take

to the next level.

FuelsMarketNews.com 18 | FMN Magazine SPRING 2023

its remote sensors has nothing on fuel operators with wetstock management. We have gas stations on every block in town with tanks full of fuel and probes in them.

Next, let’s explore the more adventurous events.

HIGH NOON FUEL THEFT

Humans have many good traits, but greed is not one of them.

As crazy as it sounds, emboldened thieves are no longer restricted to operating in the dark shadows of the night when it comes to stealing fuel. In fact, stealing in broad daylight at a busy gas station works to the thieves’ advantage when taking high volumes of fuel.

This is accomplished by either hacking into the dispenser and appearing to be making a normal gas transaction or by parking a van directly above a UST, opening a removable floor and vacuum pumping directly into a container. Daylight and a busy location seem to offer a stealthy security blanket for the bandits.

The most organized theft that I have heard of to date is where a typical-appearing service truck and masquerading service technician seem to be calibrating dispenser meters. This caper is complete with orange cones and a safety vest. The crook commences to steal volumes of fuel. As with any business enterprise, legitimate or not, a solid ROI dictates the risk vs. reward merits of the endeavor. As prices hover around the $5 per gallon mark for diesel, and given the ease with which it can be redistributed, such as passing it off as heating oil, fuel theft is an extremely attractive business model.

It’s difficult to report what the average amount of fuel stolen per event is, but frequently the number is over 500 gallons. Diesel weighs approximately 7 pounds per gallon, so 500 gallons x 7 pounds = 3,500 pounds.

That much fuel (or more) is going to require a big truck. Using wetstock detection methods and correlating them with video surveillance shows

that the caper appears to often include more than one vehicle.

Clearly the fuel thieves are operating with a high level of knowledge regarding fueling systems, both the dispensers and the automatic tank gauge (ATG). One of the reasons why busy gas stations are hit is because the ATG doesn’t recognize a rapid loss, as the volume stolen is commingled with the volume sold and the system simply doesn’t recognize the loss. A full, sophisticated wetstock management solution can spot such discrepancies and minimize fuel loss.

THE REGULATOR IS COMING AND WE’RE MISSING REPORTS

Another issue with human nature is wanting to be efficient … but losing control and quality of life in the process.

For a fuel retailer, nothing ruins your day like missing compliance reports when the regulator is coming to see you. The more locations an operator has, the more reports he or she must keep up with. In today’s world the term “keeping your head in the clouds” no longer means staying out of touch. In fact, keeping records in a location that can be retrieved quickly from anywhere, such as the “cloud,” is a good thing.

A computer maintenance management system (CMMS) is how successful retailers manage their entire operations, and the forecourt is no exception. A CMMS offers cloudbased document retention along with work-order management.

In today’s world the highly specialized skilled-labor workforce is being asked to do more work with less help. Using a CMMS is a great way to regain efficiencies and provide quality of life by automating as many things as possible. Regulators are unforgiving of inefficiency and are rumored to be stepping up enforcement to increase state revenues.

True CMMS systems also allow the mechanism for environmental compliance vendors to become willing

RETAIL OPERATIONS CHANIN NONT/GETTY IMAGES

Brian Reynolds works for Dover Fueling Solutions in ClearView, wetstock management sales. He can be reached at Brian.Reynolds@ DoverFS.com or (325) 733-6490.

In today’s world the term ‘keeping your head in the clouds’ no longer means staying out of touch. In fact, keeping records in a location that can be retrieved quickly from anywhere, such as the ‘cloud,’ is a good thing.

FuelsMarketNews.com FMN Magazine SPRING 2023 | 19

accomplices for assisting in populating databases, and their ability to do so correctly is something that can be monitored automatically as well. Here are some of the features that a forecourt CMMS can provide:

• A secure and organized system for pass or fail of tank systems in a location that can be accessed from any Internet-enabled device

• At-a-glance document audit for purposes of knowing if any compliance inspection testing reports are missing

• ATG compliance

• SIR compliance and inventory control

• Annual compliance testing, inspections and interstitial monitoring

• Monthly visual walk-through reports

• Asset management at a glance

with details such as warranties and how expenses are being monitored to avoid duplication of effort on maintenance

• Integration and tracking of work orders by allowing vendors access to a mobile app

• Limited-visibility access to regulators, which in many instances satisfies their curiosity without them needing to come to your locations Wetstock management solutions, all the way through CMMS integration, have a range of exceptional capabilities, including some they were never designed to provide—like tracking natural events. However, where human nature is concerned regarding day-today operations, these solutions provide a ROI not just in financial terms but in peace of mind as well.

RETAIL OPERATIONS

As crazy as it sounds, emboldened thieves are no longer restricted to operating in the dark shadows of the night when it comes to stealing fuel.

FuelsMarketNews.com 20 | FMN Magazine SPRING 2023

July 16-21, 2023

The Wharton School

University of Pennsylvania

Endowed by:

July 23-28, 2023

Kellogg School of Management

Northwestern University

Endowed by:

July 30-August 3, 2023

The Dyson School

Cornell University

Endowed by:

November 5-10, 2023

MIT Sloan School of Management

Massachusetts Institute of Technology

Supported by:

November 12-17, 2023

Yale School of Management

Yale University

Endowed by:

Questions? Contact: Brandi Mauro | NACS Education | Program Manager (703) 518-4223 | bmauro@convenience.org The only convenience industry MBA. Turn your potential into reality. convenience.org/NACSExecEd Join the Masters. Earn the exclusive Master of Convenience designation by completing 3 of our 5 programs. convenience.org/NACSMaster

Kaylie Long Scoles Marketing Director RDM Industrial Electronics Inc. www.rdm.net

FIGHTING

FUEL THEFT

PRICES HAVE DROPPED SOMEWHAT. IS FUEL THEFT STILL AN ISSUE?

Fuel theft has been rampant since prices skyrocketed after the start of the Russia-Ukraine war. Although the prices have now moderated somewhat, the issue has not gone away. For just one example, this January, thieves in Hilltown Township, Pennsylvania, stole $3,000 worth of diesel—261 gallons—at a retailer by using two trucks with extra tanks and accessing, then bypassing, the pay system in the dispenser.

HOW IS FUEL BEING STOLEN?

There are numerous ways. You can steal fuel from the tanks directly through the UST manhole with specially modified trucks or vans if they can be parked over the manhole during vulnerable hours. There are a variety of ways to steal fuel directly from the dispenser, particularly older models, if you can gain access to the insides and manipulate some of the electronic systems. I won’t go into specifics on how, obviously, but unfortunately you can find tutorials on the internet.

WHAT SHOULD STORE ASSOCIATES DO?

Associates are often inexperienced and busy at peak times during the day, and managers may be distracted with any number of tasks. The thieves are very accomplished at knowing how not to draw attention at the site. They may even pretend to be maintenance personnel. Train staff to be very aware of customers who are spending too much time at a dispenser. Train them to look for unusual behaviors on the forecourt and the types of behaviors to watch out for and what actions to take. And if maintenance personnel arrive unexpectedly, have staff confirm with headquarters that there is maintenance scheduled for that day.

HOW CAN AN OPERATOR PHYSICALLY PREVENT THEFT?

There are a variety of ways. For the USTs themselves, you can make sure they are secured with quality locks and caps. They can also be blocked off, to a varying degree, to where essential access is not a burden but unauthorized access draws attention. Cameras

FuelsMarketNews.com 22 | FMN Magazine SPRING 2023

FIGHTING

THEFT

can also help bring visibility to these back-site areas. Similarly, cameras with recorders can put more eyes at more angles on the forecourt to discourage theft and, if nothing else, make arrest and prosecution easier.

A quality wetstock management system might also be useful for catching theft in process, although it needs to be sufficiently sophisticated to detect theft during high-volume hours.

WHAT ABOUT THE DISPENSER ITSELF?

There are several solutions that are viable at the dispenser. Fuel theft solutions can be broken down into low, medium and maximum security. An easy and low-cost first step is to upgrade the standard dispenser locks, place security warning labels on the outside of the pump and place security tape. The next level of security includes devices such as pulser covers and boxes used to enclose the pulser with a lock to help prevent tampering and fuel theft. To achieve maximum dispenser security, an alarm should be installed that will trigger an alert when the dispenser has been breached.

Fuel-dispenser security systems such as the Defender One provide a comprehensive solution to guarding the upper and lower door, which protects against both fuel theft and skimmers. We saw a need and developed a solution that sounds an alarm if the upper or lower door is breached. It disables the pump, without killing the AC power, so that fuel cannot be dispensed. This security device is controlled by a simple key fob with in-store monitoring available. The in-dispenser alarm system pays for itself in a few months, and with no subscription fees, it is a cost-effective solution for both small and large retailers.

This interview is brought to you by RDM Industrial Electronics Inc.

FuelsMarketNews.com FMN Magazine SPRING 2023 | 23

Back to Basics

Fuel economy and maintenance and repair strategies can combat today’s supply chain issues and rising fuel costs.

BY AL BARNER

Today’s fuel prices have reintroduced a bevy of asset management challenges for fleets that significantly impact the bottom line of every organization. This is especially a concern since fuel is the largest component of total cost of ownership for any fleet. And while it is challenging to procure new trucks, it’s equally important to have a solid fuel economy and maintenance strategy to identify where costs are eroding the bottom line.

Fleet professionals are struggling

with pinpointing why and where their costs are rising, important questions often asked by c-level executives. The simple answer is that inflation is driving all prices up, extended life cycles are driving costs up (the additional maintenance repairs, component parts and fuel degradation), not to mention rising labor rates for drivers, mechanics and third-party providers.

More importantly, fuel prices have overtaken the driver shortage as the top concern expressed by drivers and motor carriers, as reported by the

American Transportation Research Institute’s (ATRI) 2022 Top Industry Issues survey. Also, when fuel rises quickly over a short period, it becomes tough for a fleet to pass this cost to its customers.

Similarly, according to the 2022 National Private Truck Council (NPTC) Benchmarking survey, “Equipment and maintenance-related issues surged into second place and fuel-related issues driven by the spike in diesel prices leapfrogged other issues to take the number three position—up more than 10 times year over year.”

A significant problem facing the industry is that many fleets still do not use data analytics to pinpoint their diesel cost per mile (CPM), and instead continue focusing on diesel cost per gallon. Companies must analyze their OBC/ELD and maintenance data to determine KPIs such as fuel economy and MPG per model year, mile-per-year

COMMERCIAL FUELS

FuelsMarketNews.com 24 | FMN Magazine SPRING 2023

(MPY) analysis by model year and fleet utilization by miles to establish a baseline.

This approach, combined with a fleet modernization plan and corresponding fleet services support, can help keep a fleet’s cost per mile in line.

This level of planning and additional line-item visibility can also make all the difference in the world in front of the leadership team. Fleet personnel should be able say to leadership, here’s what we foresee happening, this is why maintenance is rising, this is why our tire cost is rising, this is why our fuel cost is rising, and here’s what we plan to do about it.

EFFECTS OF EXTENDING TRUCK LIFE CYCLES AND THE FUTURE OF PROCUREMENT

According to Steve Smith, senior industry adviser at DDC FPO and president of Smith Transportation Consulting Services, “When the economy starts to slow down, the industry’s kneejerk reaction is to extend the life of equipment,” he commented at the recent ATA MCE 2022 conference. “However, extending the life of a tractor could help fleets save capital in the short term, but eliminate cashflow due to the cost of repairs.”

Unfortunately, according to the NPTC, many private fleet respondents report they were forced to extend their equipment trade cycles due to the unavailability of equipment.

CPM have increased dramatically over the past few years, and several key drivers must be tracked to independently understand how they impact the P&L. This includes cost increases on parts, service and fuel when trade cycles are extended. This will lead to maintenance being performed at a higher rate, but also replacement

components typically not addressed in a shorter life cycle. Parts and service have seen a 10% to 20% increase in cost, depending on the component.

Fuel has been volatile, with cost increases and decreases of more than 25% in a quarter. Trying to forecast future costs can be a challenge; this is why it’s recommended to focus on a controllable baseline. For example, fuel planning should be based on gallons used and not price. This allows fleets to maintain operating controls during times of price variation. Parts can be tracked by VMRS code and frequency. Older vehicles can be used as a benchmark to determine planned expenditures. Many industry trade organizations can provide industry vertical data, as can the right asset-management partner.

“Always get current with your trade cycle. With a tractor, let’s call it five years, but it really depends on your business and how many years you are going to drive,” added Smith. “You will go down a maintenance and repair hole very quickly if you try to extend tractor life cycles.”

Ultimately, a data-driven LCCM (life-cycle cost management) plan helps corporate fleets make measurable changes to both the financial and environmental bottom line. The average driving MPG for a 500-unit fleet operating a five-year life cycle is 8.41, while the average for an eight-year cycle is 7.90. Organizations that have switched from an eight- to five-year life cycle have resulted in a net reduction of 2,494,770 gallons of fuel. This will have a significant impact over the next five to 10 years, producing a 6.1% reduction in CO2, or 25,122 metric tons. This calculation further confirms that a shorter life cycle is more cost-effective.

COMMERCIAL FUELS XH4D/GETTY IMAGES

Fuel prices have overtaken the driver shortage as the top concern expressed by drivers and motor carriers, as reported by the American Transportation Research Institute’s (ATRI) 2022 Top Industry Issues survey.

FuelsMarketNews.com FMN Magazine SPRING 2023 | 25

FUEL STRATEGIES

That MPG gap created from running vehicles longer results in increased fuel spend, increased carbon output and essentially more cost overall, eating into profits. So, as we’re thinking about managing our life cycle and mitigating cost in these challenging times, there are several things to consider when it comes to fuel.

First, it’s important to understand how a dual MPG on tractors works for both newer and older models. There is a minimal break-in period for newer units, but it’s not like it used to be 10 or 15 years ago when we saw a half-mile penalty. Today they start at 8.41 per gallon, and as the vehicle enters the end of its life cycle, you will typically see fuel degradation. As you think about managing a life cycle, you can’t base your procurement cycle one year out. Therefore, you must have a multiyear approach and a one-, three-, and five-year plan for equipment replacement.

The goal of achieving optimum fuel savings needs to be owned by everyone, including technicians, drivers and analysts. Each group needs to work together to review data, buy fuel correctly, eliminate idle time

and work on route optimization to realize proper utilization of the truck. What’s more, aftertreatment fault codes must be closely monitored and dealt with promptly. Organizations should also work with drivers to implement speed/accelerator limiters, which have been more widely accepted even though, for the first time since 2005, they made ATRI’s list of drive concerns because of road rage from speed differentials. While it’s an area of concern, it’s also why it is essential to have open communications with drivers.

PROPER MAINTENANCE REDUCES M&R AND FUEL COSTS

If you previously operated a truck for four or five years and are now dealing with supply chain challenges, you will be required to stretch that truck to six or seven years, and the maintenance you perform on that truck will be different.

Let’s look at the aftertreatment system again. Trucks that operate for four or five years, typically under warranty, may have a system short of fueling with regeneration or possibly one cleaning the diesel particulate filter (DPF) system. Fleets that operate

COMMERCIAL FUELS

Fuel has been volatile, with cost increases and decreases of more than 25% in a quarter.

Trying to forecast future costs can be a challenge; this is why it’s recommended to focus on a controllable baseline.

DOUBLETREE STUDIO/SHUTTERSTOCK FuelsMarketNews.com 26 | FMN Magazine SPRING 2023

longer life cycles must overcome additional challenges for their fuel strategy and the broader fuel management system, tires, and so on. Tires, in particular, are significant because a longer life cycle can impact replacement cycles, the type of tires, and service and repair costs over a more extended period.

Furthermore, fleets may also find they need to replace their one box system, which is the box that holds the DPFs on class 8 tractors. This may result in error codes for their DPF system, causing regenerations to increase. When this occurs, drivers must stop more often to regenerate the system, which can adversely impact their business. This eventually results in DPF replacement along with components such as crossover pumps, dosage valves, and in some cases crossover tubes—line-item expenses that add up significantly over time.

However, if truck life cycles are extended but PM cycles aren’t

realigned, your entire M&R operation may no longer be in sync with thirdparty provider recommendations in regard to internal mechanics and key operating components, which negatively affects each truck’s performance.

Data analytics and these strategies will help you better understand the big picture and how today’s fuel prices and life cycle extensions impact your cost structures. You’ll also be able to pinpoint at the line-item level where specific expenditures are adding up. With this visibility, you can instill much-needed confidence in the leadership team to make the right procurement decisions that benefit the bottom line in the long run. Companies must also work with a partner that can help determine the cost by VMRS codes and set a strategy for asset procurement, which is critical when all your baselines for the previous 10+ years are no longer relevant.

Al Barner , CTP, is senior vice president of strategic fleet solutions for Fleet Advantage, a leading innovator in truck fleet business analytics, equipment financing and life-cycle cost management. For more information visit www.fleetadvantage. com

Simplify your search, social and reputation management with Is your c-store brand showing up online? Brought to you by NACS, THRIVR is an easy-to-use platform that helps you gain new customers, retain the ones you have and build basket size—from the first mile to the last. Get started with a digital health check and schedule an initial one-on-one information session at convenience.org/thrivr Business listings on nearly 150 networks Social media for multiple retail locations Local search rankings on Google, Yelp and more WITH NACS THRIVR, YOU CAN OPTIMIZE: BROUGHT TO YOU BY POWERED BY

Diesel Powers Forward

What’s in store in 2023 for consumer diesel vehicles and diesel fuel prices?

BY ALLEN SCHAEFFER

BY ALLEN SCHAEFFER

By all accounts, the year ahead promises more of the same: an off-balance economy tipping toward the recessionary zone, with lingering labor and supply chain issues and dynamic energy markets.

Annual auto sales in the United States in 2022 were down 8.6% due to continuing supply problems and, most recently, headwinds due to higher interest rates as well as a slowing of automotive demand. Automotive sales will end the year at about 13.8 million, which is the lowest since 2011, when the economy was recovering from the Great Recession. Consumers have

more efficient vehicle choices than ever before, with manufacturers offering a growing array of fully electric vehicles including pickup trucks, cars and SUVs along with a few fuel cell vehicles and a host of plug-in hybrids, as well as those powered by conventional internal combustion engines. EV sales in 2022 were 5.9% of all vehicles for the entire year, up from 3.3% for all of 2021. The diversity in fuel options and vehicle technology choices today compared to a decade ago seems mind-numbing, making it clear that at least for the moment, we are not a one-size-fits-all world when it comes to our vehicles.

Looking at diesels, for 2022 these vehicles represent 1.3% of total sales compared to 1.2% in 2021. For 2023 there are 32 options for diesel engines in vans, pickup trucks and SUVs available in the United States. In the advanced diesel vehicle category, last year’s U.S. sales were led by the Mercedes Sprinter Van followed by three pickups—Chevy Silverado, GMC Sierra and Ram 1500—and then the Ford Transit van.

Commercial diesel models classified as Class 2 and 3 vehicles (over 8,500 lbs. gross vehicle weight rating) are series 2500 and 3500 heavy-duty pickup trucks. Sales of these commercial diesels represented an estimated 3.5% of total sales in 2022, up from 3.2% in 2021, as the overall declining vehicle market enabled a greater share with similar sales volumes.

This year, General Motors will debut a new diesel engine (Duramax 3.0L inline six-cylinder model LZ0) in the

FUEL MARKETERS

FuelsMarketNews.com 28 | FMN Magazine SPRING 2023

Chevrolet Silverado 1500 pickup truck. GM’s diesels include those rated by the U.S. EPA at 29 mpg city, with some models having a driving range of 756 miles on a single tank of fuel. No range anxiety here!

Diesel drivers have choices about fueling their vehicles. All diesel models available today are certified by manufacturers as capable of using B20 fuels—20% biodiesel/80% ultra-low-sulfur petroleum diesel. According to the U.S. Department of Energy Alternative Fuels Data Center, more than 800 retail stations sell biodiesel across the country.

DIESEL FUEL PRICES: SETTLING DOWN?

Distillate fuels like diesel were in high global demand in 2022, with prices substantially impacted by the Russian war against Ukraine, seeing the highest price at the pump ever recorded. At the time of this writing, diesel prices are running at $4.549 (national) to $5.08 a gallon (West Coast), up 89 cents per gallon from last year.

Recent studies by the Clean Fuels Alliance America showed that the U.S. production of biodiesel and renewable diesel consistently reduces distillate fuel prices by increasing the supply. As the production and availability of cleaner, better fuels grew over the last decade, the price impact increased to a 4% benefit in 2020 and 2021, keeping diesel fuel prices lower at the pump.

Looking ahead to the rest of 2023, the Energy Information Administration’s (EIA) Short-Term Energy Outlook forecasts global oil inventories higher at the end of 2023 than earlier predictions, leaving crude projections for $92 per barrel in 2023, which is $3 per barrel less than forecasted in December 2022.

EIA projects U.S. refinery utilization will remain near its five-year average through 2023. It expects that the combination of a slight contraction in the economy and refinery maximization of distillate fuel production will

reduce distillate prices in the next five months.

RENEWABLE BIODIESEL FUELS

The use of renewable biodiesel fuels is growing as a key strategy to help decarbonize the transportation sector. More investment in feedstocks and refining capacity to produce the high-quality renewable fuels is necessary to achieve these strategic goals. The global renewable diesel market by production has reached 2.61 billion gallons in 2021. The market is expected to reach 7.45 billion gallons per year by 2027.

According to the EIA, biodiesel production averaged about 0.123 million barrels per day in 2022 and is expected to expand to 0.128 million barrels per day in 2023. Biodiesel net imports are expected to average 0.003 million barrels per day in 2022 and 2023, up from 0.001 million barrels per day in 2021. EIA also forecasts that more renewable diesel fuel will have been produced than conventional biodiesel fuels at the end of 2022. Depending on feedstocks, using advanced renewable biodiesel fuels instead of petroleum-based fuels lowers greenhouse gas emissions by anywhere from 50% to 85%, along with reductions in other emissions like particulates.

No one knows exactly where this year will take us, but at this moment it feels like flashing yellow lights at a busy intersection. Will supply chain pressures finally ease? Will a new COVID-19 variant upend the global workforce? What happens in the Russia-Ukraine war? If there is a recession, how long will it last and how bad will it be? When will retail fuel prices come back to earth? Will automakers’ bets on EVs pan out? What is the future for internal combustion engines and sustainable fuels as a key climate strategy?

That’s why in 2023 maybe the best advice comes from the airline industry: “Even if the captain has turned off the seat-belt sign, we recommend you keep your seat belt fastened at all times.

FUEL MARKETERS BLOOMBERG

IMAGES

CREATIVE/GETTY

The diversity in fuel options and vehicle technology choices today compared to a decade ago seems mind-numbing, making it clear that at least for the moment, we are not a one-size-fits all world when it comes to our vehicles.

FuelsMarketNews.com FMN Magazine SPRING 2023 | 29

Allen Schaeffer is the executive director for the Diesel Technology Forum, a nonprofit organization dedicated to raising awareness about the importance of diesel engines, fuel and technology.

LOOKING BACK AT IMO 2020

What was the actual impact of lowering sulfur in maritime bunker fuels?

FuelsMarketNews.com 30 | FMN Magazine SPRING 2023

By Keith Reid

Do you remember IMO 2020?

The International Maritime Organization’s 2020 sulfur reduction rule? If it slipped your mind, you’re not alone. What was once considered a potentially earth-shaking issue for the entire fuels market has since been easily eclipsed by other factors.

IMO 2020 was supposed to have a significant impact on distillate prices and availability and be generally disruptive to refined fuels in general. In 2012, the International Maritime Organization (IMO) lowered the maximum sulfur content in marine fuels to approximately 35,000 ppm, with the intent to get sulfur content down to 5,000 ppm between 2020 and 2025. While the regulation was not universal, the IMO is made up of nearly 200 member countries that represent the most active shipping markets and ports throughout the world.

Maritime bunker fuel oil is a distillate comparable to diesel, heating oil or jet fuel. There has been a steady process of reducing sulfur levels in diesel, heating oil and gasoline, yet certain markets, such as maritime and aviation, had been able to absorb the remaining high-sulfur fuels. This made high-sulfur fuels cost-effective while simultaneously reducing strain on the refining sector and making sour crude more viable. IMO 2020 impacts this balance and was seen as potentially creating significant disruptions to refining and shipping and ultimately increasing the price of most refined fuels and the products that are shipped using this fuel. It was also seen as potentially disrupting global supply chain logistics.

The Fuels Institute commissioned a literature review on the subject in 2019, titled “IMO 2020,” that reviewed over 30 reports, blogs, columns, presentations, email updates and other literature covering the projected impact. The primary theme was uncertainty. Both the maritime and refining industries had several ways in which they could react to the challenge, the specifics of which could potentially lead to varying degrees of impact on fuel markets.

FuelsMarketNews.com FMN Magazine SPRING 2023 | 31

The report noted that many media sources were indicating a virtual apocalypse from the switch to low-sulfur bunker fuels. It cited such projections as “one of the most disruptive changes to ever affect the refining and shipping industries— global impacts totaling in excess of $1 trillion over 5 years” and “consumers could be hit by $240 billion by 2020.” These projections not only included the direct impact on the fuel product but also the carryover impact on the supply chain. Some combination of the following was seen as meeting the challenge:

• Shipping companies switching to lower-sulfur fuel. The cost of the fuel would be higher but there would be no significant capital outlays for the shippers. The refining industry would have to make major moves (which had not occurred at the time and would likely take at least four years to implement) to upgrade refineries to “full conversion” capabilities where high-sulfur fuel could be desulfured. This approach is capital intensive to the refining sector.

• Adding scrubber technology to ships. Technology exists to remove the sulfur at the vessel itself, in the same way power plants can remove high-sulfur content from coal or oil. This would require a significant capital outlay on the part of shippers, yet the fuel cost would be lower and there would also likely be more international availability in lessdeveloped regions.

Other possibilities, such as changing over to marine gas oil, which is typically very expensive, or liquefied natural gas (LNG), which requires new vessel construction or significant modifications, were considered marginal alternatives.

HOW IT PLAYED OUT

Going on three years since the implementation date, what exactly has happened? Detailed, authoritative data is hard to come by, but according to an Offshore Energy article by Jasmina Ovcina Mandra published in September 2022, IMO 2020 has successfully dropped sulfur oxide emissions by 77%.

While the article does not provide nuance on the extent to which compliance or shipping disruptions from COVID-19 created the 77% drop, other data suggest that very low sulfur fuel oil (VLSFO) was the primary route initially taken by shipping companies. S&P Global Commodity Insights from March 2021 indicated that about 78% of the fuels tested globally met the IMO 2020 sulfur standard.

There was some movement to LNG and marine oil gas and scrubbers. The ROI for scrubber adoption hinges on the price differential between the low- and high-sulfur fuels. Scrubbers need a differential of about $100 per metric ton of bunker fuel to provide a solid ROI, according to longtime maritime fuels journalist and editor Sam Chambers, writing in Splash247.

During the COVID-19 disruptions, Ship & Bunker data showed a differential drop to $45 per ton at the lowest point. Since the Ukraine war, VLSFO peaked at over $1,000 with differentials reaching over $500 according to Chambers. In February 2022 the differential had dropped to $160 per ton.

PANDEMIC AND UKRAINE WAR DISRUPTIONS

The literature review concluded that the price impacts to gasoline and diesel would range from 25 cents to 75 cents per gallon and would likely be limited to a window of two to three years. That may or may not have been the case. The apocalyptic price predictions largely materialized, though IMO 2020 was virtually unacknowledged in the market analysis. The double whammy of the pandemic and the Russia-Ukraine War that the fuels world has been reeling under since 2019 more than muddied the waters.

“IMO 2020 definitely was a big point of the supply and demand conversation around two to three years ago, but how things change once a pandemic floors a global economic engine,” said Joe Butler,

PREVIOUS PAGE: STUDIO CONCEPT/SHUTTERSTOCK; THIS PAGE: TRYAGING/GETTY IMAGES FuelsMarketNews.com 32 | FMN Magazine SPRING 2023

business unit leader at Pilot Company and a Fuels Institute board member. “I don’t think I’ve heard anything about how the IMO sulfur specs are contributing to fundamental global shortages in a while.”

He noted that the current discussion is focused on a range of other issues, including the supply and demand rebalance from lingering COVID-19 impacts, ESG impacts to capital expenditure in traditional hydrocarbon, a supply rebalance with the war, lingering demand impacts from Chinese COVID issues, the current economic slowdown in Europe, potential recession impacts domestically and conversion of units to renewable diesel/ sustainable aviation fuel to meet anticipated demand.

That doesn’t mean it didn’t have an impact or change the distillate production stream going forward.

“IMO 2020 is definitely competing with desulfurization capacity. It’s just that it seems like it is being drowned out by the cacophony of other louder issues,” Butler said.

Stephen Jones, an oil market strategist and a board member for the Fuels Institute, concurred. “Although hard to substantiate, and perhaps being overshadowed by larger factors, I do think the sulfur limit is a contributing factor among many that add up to some of the price strength and general market tightness.”

VGO IMPACT

Troy Vincent, senior market analyst at DTN, has extensive experience analyzing maritime fuels. He noted that vacuum gas oil (VGO) is one area where IMO 2020 has made a significant impact.

“Many ships switched over to this VLSFO, and ultimately what that does is it cuts a good portion of refinery inputs for distillate output, namely VGO,” Vincent said. “It put that in the bunker fuel stream. So you went from taking that VGO and splitting it into diesel molecules that would be used for on-road diesel and diverting that in a post-IMO 2020 world into producing VLSFO bunker fuel. As a result, middle distillate refinery

yields have dropped as VGO gets utilized for bunker fuel.”

Vincent sees the VGO impact as an indefinite component of the market that will push prices higher, and IMO 2020 as a market driver, but not one that will right-size the market and keep prices elevated forever. That is especially the case if the global economy continues to weaken.

Vincent noted another impact on the diesel market that ties in IMO 2020 and other desulfurization efforts. “The desulfurization process at the refinery level is very energy intensive,” said Vincent. “With natural gas prices at record highs all around the world, this incentivized running lighter, sweeter crudes with lower diesel yields. That’s one reason that crack spreads for diesel have been as high as they are.”

The disruptions of the past several years seem to have masked, and perhaps eased, the anticipated impact of IMO 2020. Desulfurization is now baked into the market. According to Vincent, it’s most likely to be a more notable factor when disruptions occur moving forward.

“When something does go wrong from a supply perspective, IMO 2020 is always going to be pulling that VGO toward the [bunker] fuel market,” he said. “Anytime you have a supply shortage or outage or a refinery problem, it’s just going to exacerbate things. This did change the game. At the time it wasn’t all that important because of COVID and everything else, but as we look forward—particularly in the Atlantic Basin and Europe—this is going to continue to keep that part of the market tighter than you would otherwise have expected.”

Keith Reid is editor-in-chief of Fuels Market News. He can be reached at kreid@fmnweb.com

FuelsMarketNews.com FMN Magazine SPRING 2023 | 33

In 2012, the International Maritime Organization (IMO) lowered the maximum sulfur content in marine fuels to approximately 35,000 ppm, with the intent to get sulfur content down to 5,000 ppm between 2020 and 2025.

FuelsMarketNews.com 34 | FMN Magazine SPRING 2023

The Fuels Institute Hits 10 Years of Moving Transportation Mobility Forward IN THE LEAD

JOHN EICHBERGER EXECUTIVE DIRECTOR THE FUELS INSTITUTE