GIPA aims to promote business and investment links overseas through highly talented Indonesian professionals and executives – a true partner for Indonesia’s economic diplomacy and human capital development.

GIPA represents Indonesian professionals and executives in eight key industries across G20 and ASEAN, encompassing 80% of the world's GDP and 60% of the world's population The eight key industries represented are: (1) Financial Services, (2) Healthcare and Life Sciences, (3) Technology, (4) Professional Services, (5) Public Sector and International Organizations, (6) Industrials, Products, and Logistics, (7) Infrastructure, Energy, and Resources, (8) Creative, Communication, and Media

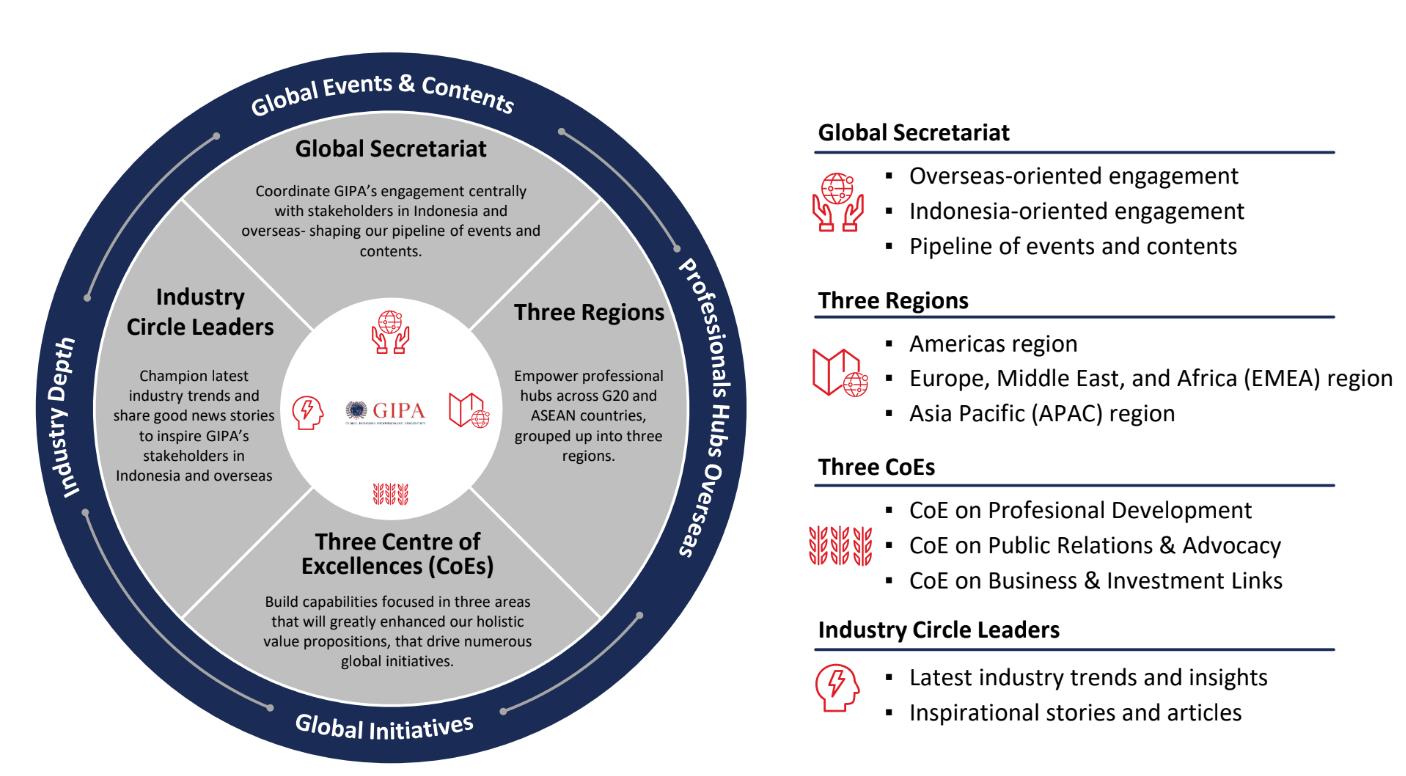

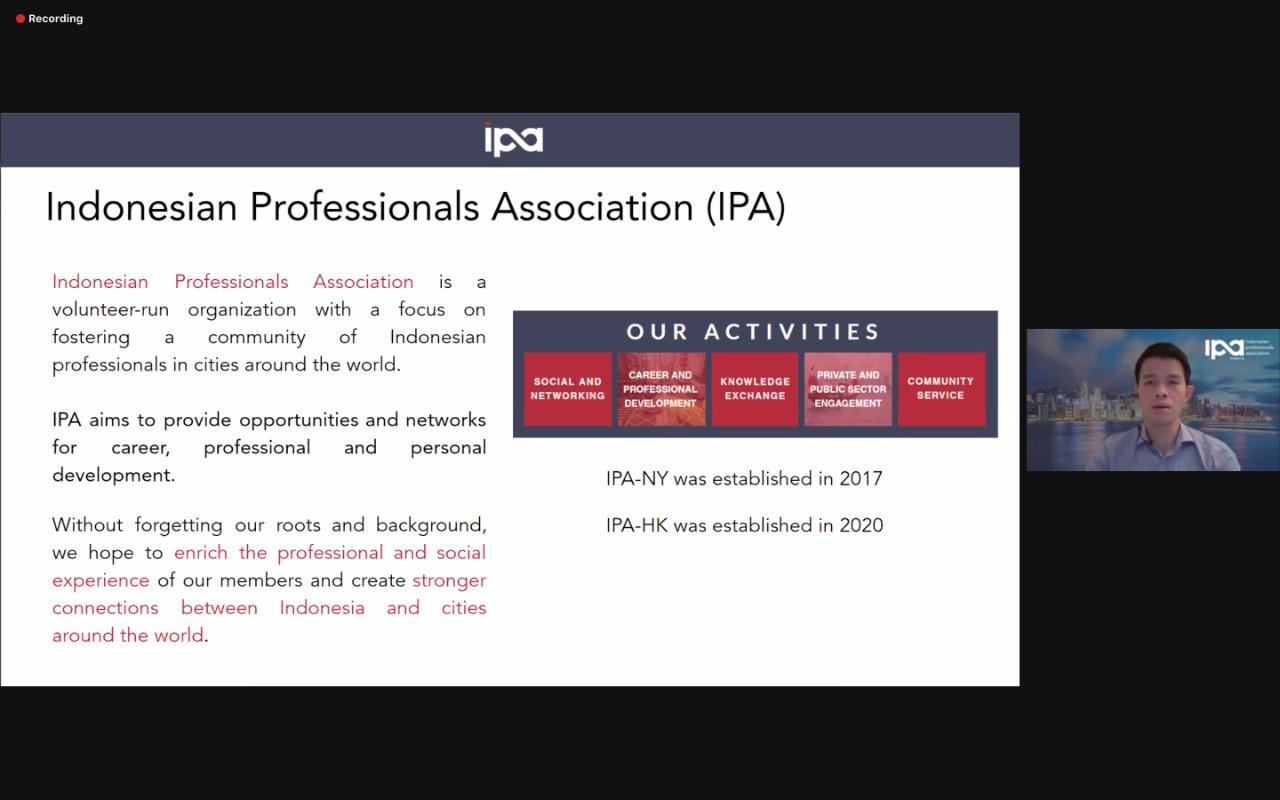

GIPA champions three Centre of Excellences (CoE) on Professional Development (PD), Public Relations (PRA), and Business and Investment Links (BIL).

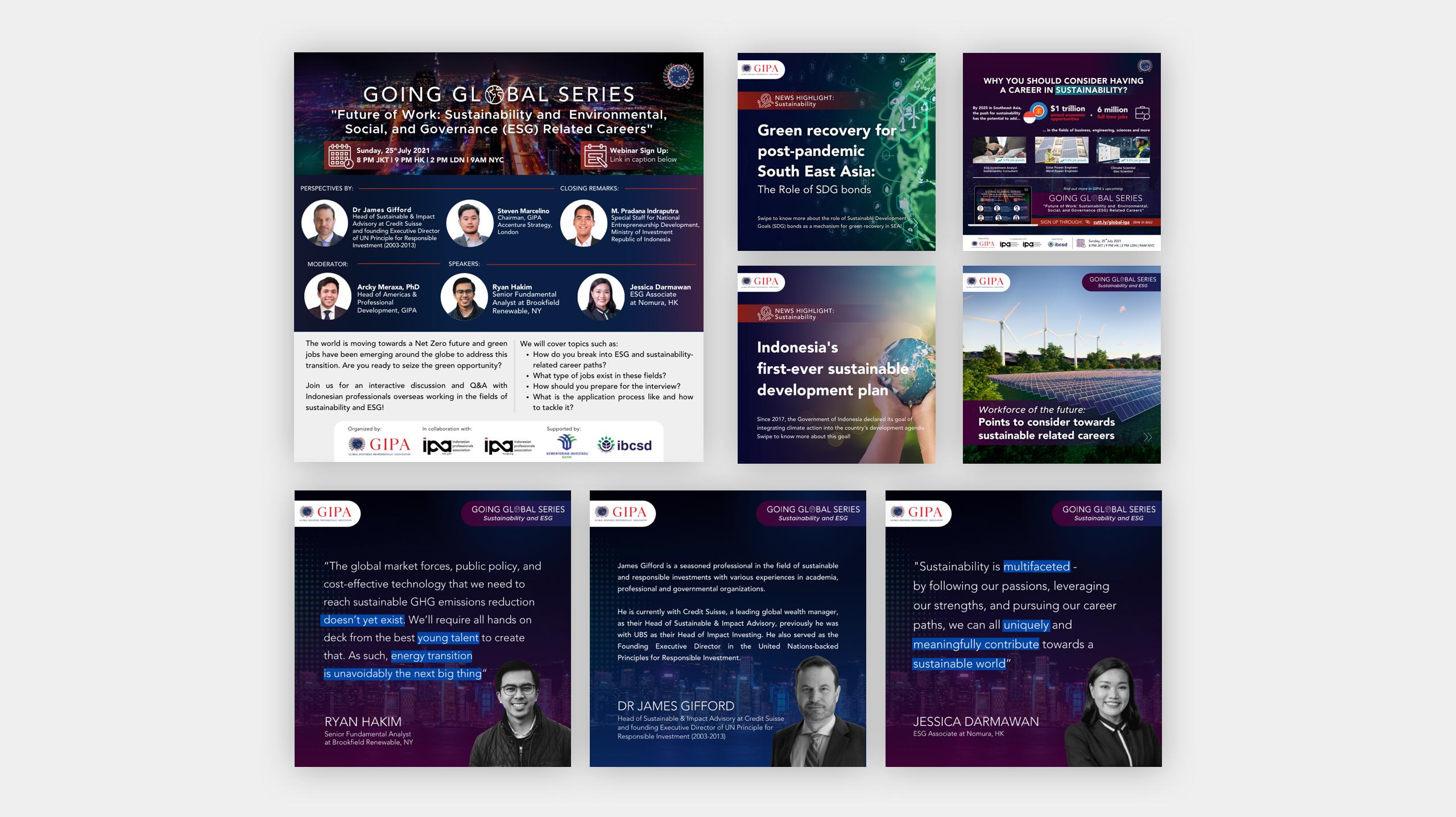

Going Global Series (GGS) focuses on market-relevant career insights and personal experiences to encourage Indonesians overseas and back home to go global for their professional career. Working in a global environment and obtaining international work exposure have been an interest for both Indonesian students overseas and in Indonesia GGS aims to inspire more Indonesians to kick start their journeys of becoming the next global leaders, as part of GIPA's drive to further Indonesia's human capital development from abroad

GGS event aims to inspire Indonesian students and graduates abroad to reimagine their career trajectories through a global lens In this event, we invited Indonesian professionals working in Brookfield Renewable and Nomura to share their insights about the ESG field.

This event is proudly supported by Ministry of Investment (BKPM), Indonesia Business Council for Sustainable Development (IBCSD), Indonesian Professionals Association (IPA) NY and Indonesian Professionals Association (IPA) HK

REGISTERED INDIVIDUALS COUNTRIES

INSTITUTIONS REPRESENTED

Broad representations of students, professionals, executives, and government officials across the 8 industry groups with 31% attendees currently living or studying abroad across 16 countries:

90%

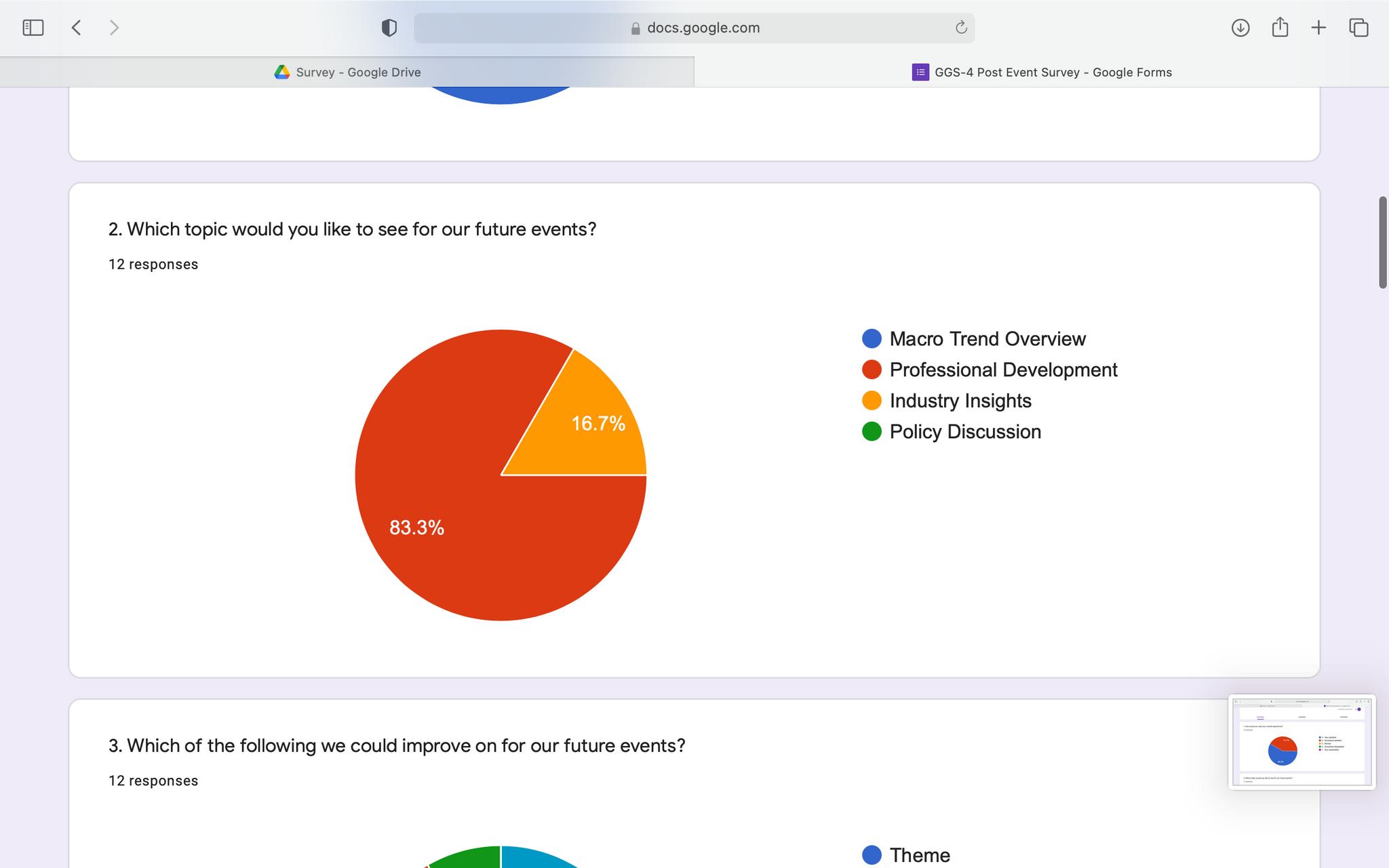

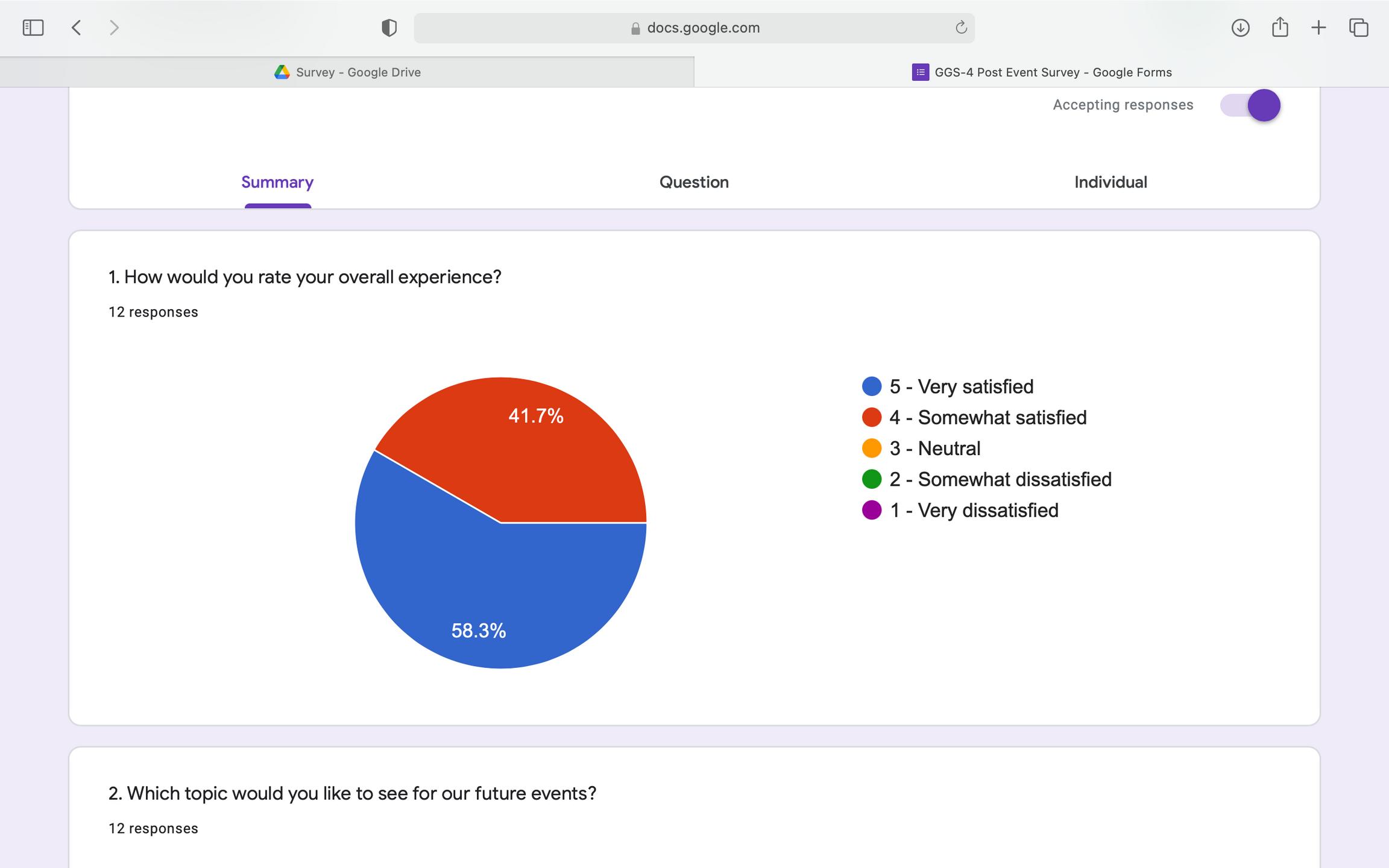

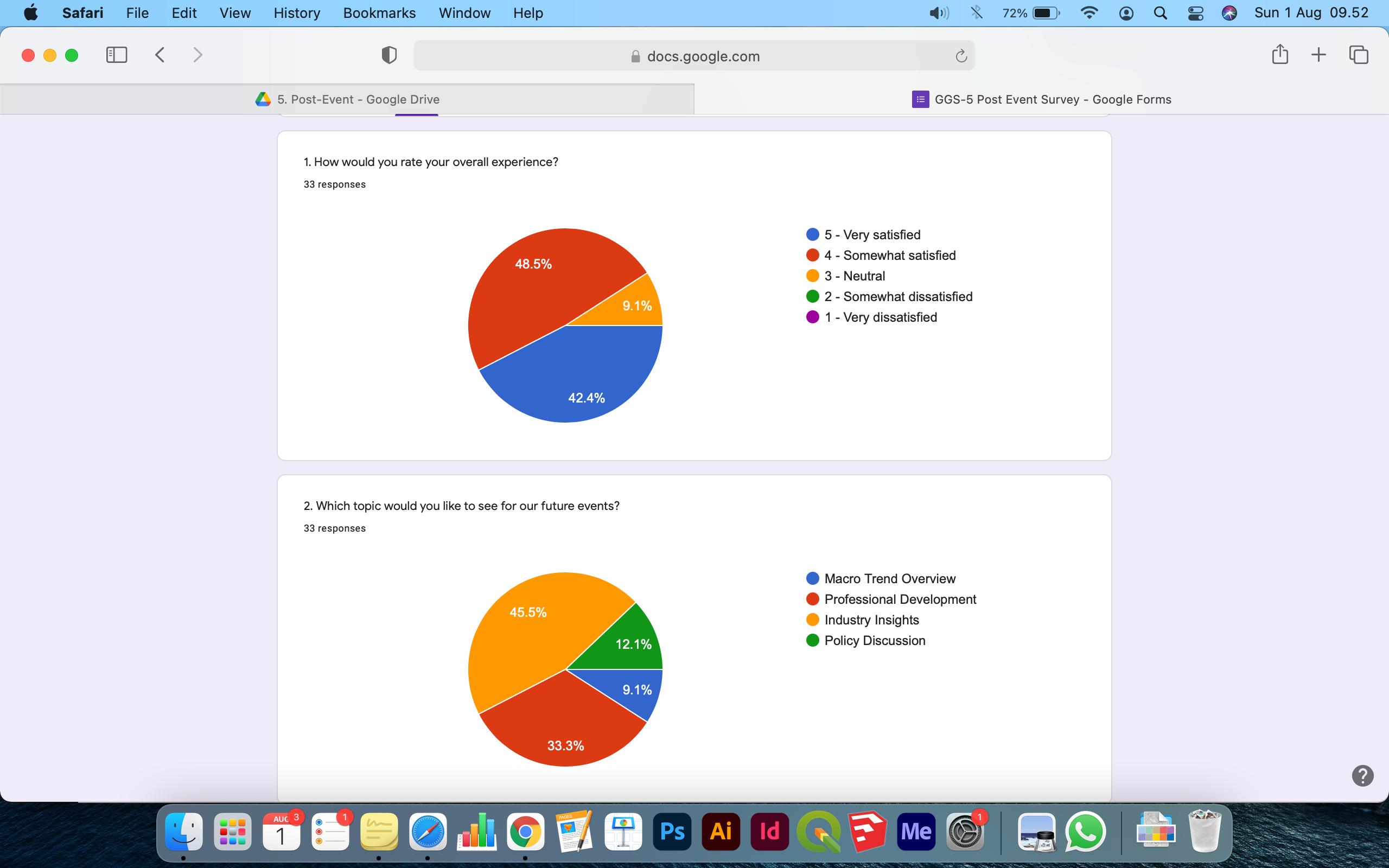

33% were satisfied with the event prefers Professional Development topic

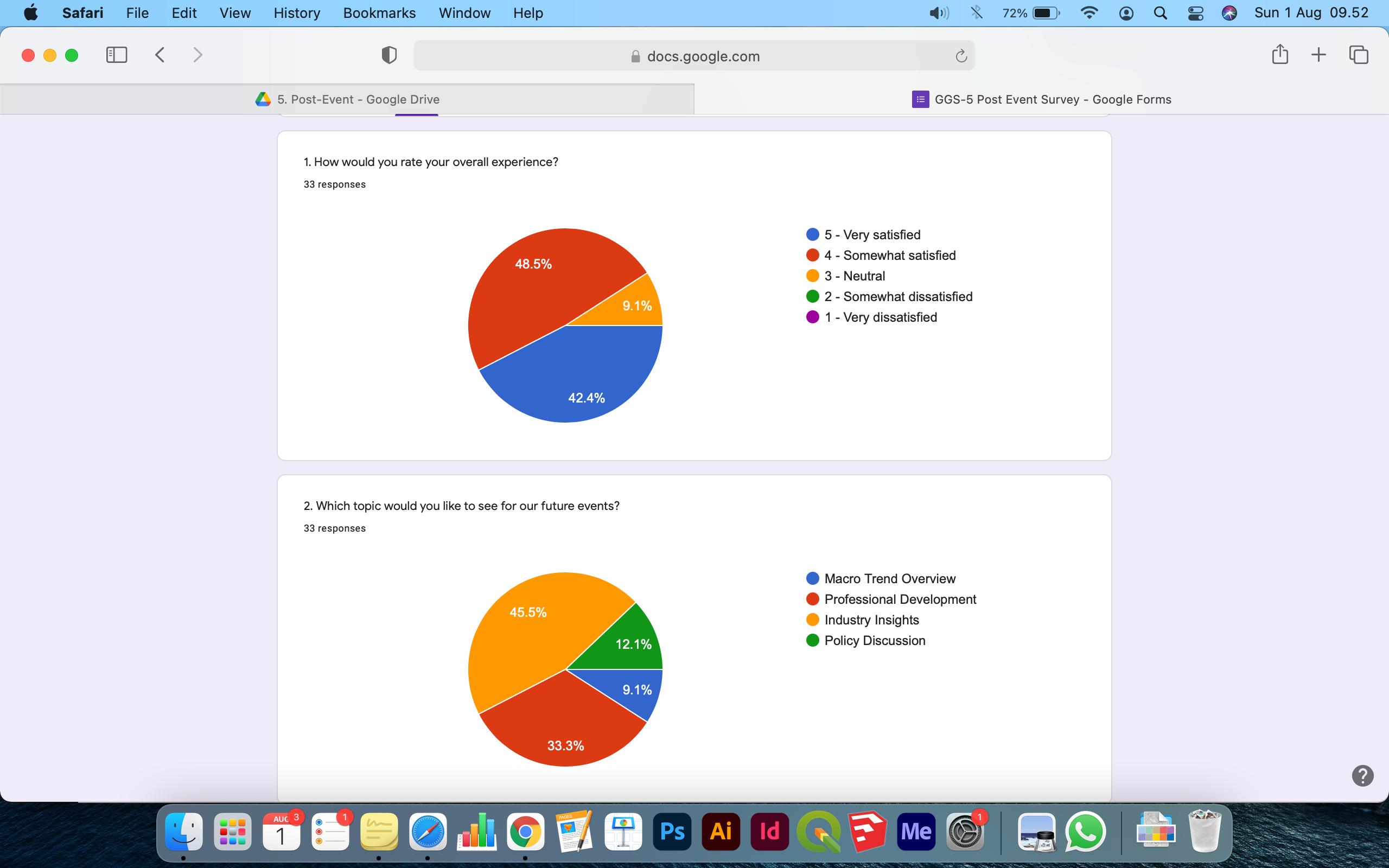

42% of the audience were very satisfied with the event and 33% of them would like to see more of the Professional Development topic on our future events.

USA - HONGKONG - UK - JAPAN - SINGAPORE - MALAYSIA - GERMANY - FRANCE - SOUTH KOREANETHERLANDS - BRUNEI - NIGERIA - RUSSIA - SPAIN - TAIWAN - TURKEY

USA - HONGKONG - UK - JAPAN - SINGAPORE - MALAYSIA - GERMANY - FRANCE - SOUTH KOREANETHERLANDS - BRUNEI - NIGERIA - RUSSIA - SPAIN - TAIWAN - TURKEY

65,500 audience reached on Instagram & LinkedIn

22 student associations and communities engaged around the globe

As pre-event marketing, GIPA ran 9 promotions on Instagram and other social media channels reaching 65,500 people with more than 400 profile and website visits. We also engaged with 22 student associations and communities around the globe

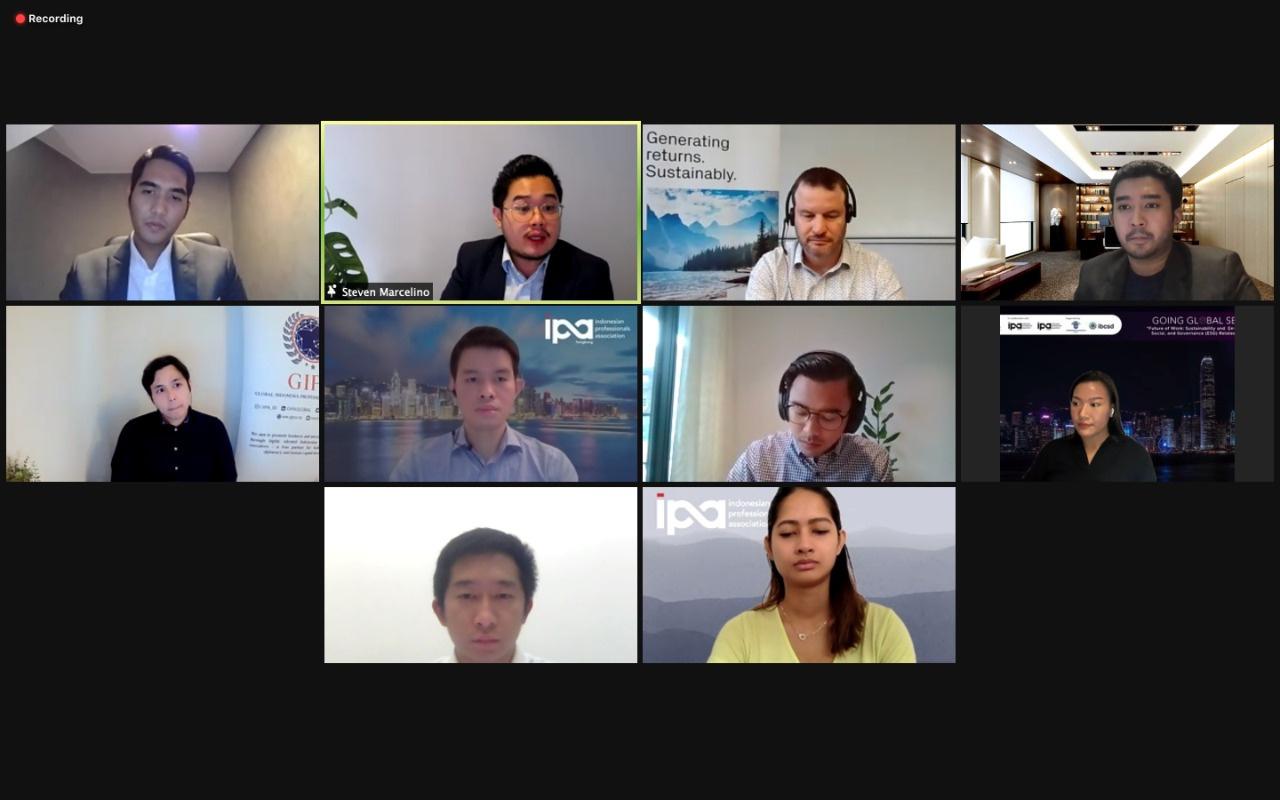

London, 25 Juli 2021 - Riset dari perusahaan konsultan Bain & Company menunjukan bahwa perkembangan ekonomi berkelanjutan di Asia Tenggara memiliki potensi untuk menciptakan 6 juta pekerjaan dan US$ 1 triliun per tahun pada tahun 2030. Guna mengembangkan sumber daya manusia (SDM) Indonesia di bidang sustainability dan ESG, Global Indonesia Professionals Association (GIPA), sebuah asosiasi non-profit untuk kalangan profesional dan eksekutif Indonesia yang bekerja di mancanegara, mengadakan forum Going Global Series: Sustainability and ESG Related Careers “GIPA ingin menciptakan pemimpin masa depan,” ujar Steven Marcelino, Chairman GIPA sebagai kata sambutan.

Forum lalu diwarnai oleh kata pembuka dari seorang ketua dari Persatuan Bangsa-Bangsa (PBB), yang mengatakan bahwa isu sustainability menjadi semakin relevan dengan performa keuangan dari usaha setiap tahun “Kini, sustainability sudah menjadi masalah tingkat board-level dan ditanggapi dengan sangat serius di masa depan perusahaan,” katanya.

Rangkaian acara Going Global Series diselenggarakan oleh GIPA setiap caturwulan, guna menghubungkan profesional dan eksekutif mancanegara dengan mahasiswa serta profesional muda Indonesia Indonesia diproyeksikan akan memiliki defisit tenaga kerja sebanyak 3,8 juta pada tahun 2030. Rangkaian acara ini diharapkan akan meningkatkan edukasi dan kualitas SDM dari Indonesia “Dengan Going Global Series, GIPA percaya kami dapat membantu mengisi kesenjangan bakat, dan membantu mahasiswa transisis menjadi profesional, serta profesional transisi menjadi eksekutif dengan pengalaman global.” ujar Arcky Meraxa, Ph.D., Kepala Professional Development serta Kepala Kawasan Amerika di GIPA, yang juga membimbing acara tersebut selaku moderator.

Forum ini lalu memfasilitasi diskusi antara 2 narasumber Indonesia yang berpengalaman di bidang sustainability dan ESG yang berkarir di Jepang dan Amerika Serikat, tentang cara memulai karir di bidang-bidang tersebut Acara ini didukung oleh Indonesian Professionals Association (IPA) New York, IPA Hong Kong, The Indonesia Business Council for Sustainable Development (IBCSD) dan Badan Koordinasi Penanaman Modal (BKPM) Acara juga disaksikan oleh 391 mahasiswa dan profesional muda yang berdomisili di 114 kota dan 21 negara secara virtual.

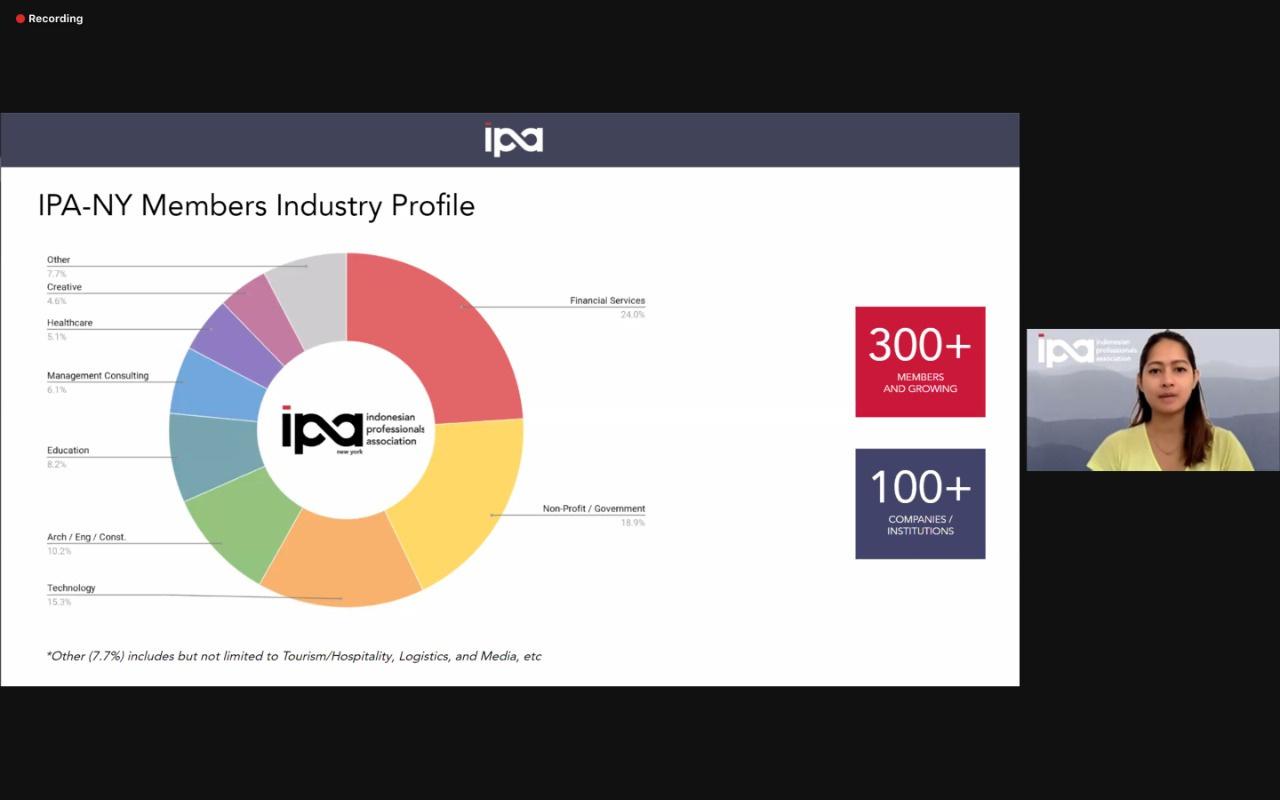

GIPA lalu membuka peluang bagi mahasiswa dan profesional untuk berinteraksi dengan kedua narasumber eksekutif tersebut, yaitu Ryan Hakim, Senior Fundamental Analyst di Brookfield Renewable, Amerika Serikat, dan Jessica Darmawan, ESG Associate di Nomura, Hong Kong Narasumber kali ini diperkenalkan oleh Felix Leonard, selaku Board Member IPA-HK dan Stephanie Kalele, selaku Board Member IPA-NY, yang mewakili komunitas indonesia professional yang terdiri lebih dari ratusan anggota di negara masing masing.

Ryan Hakim, Senior Fundamental Analyst di Brookfield Renewable, Amerika Serikat memberikan arahan bagi kaum muda yang ingin memiliki pekerjaan di ESG atau sustainability ke depannya, untuk menguasai bidang engineering energi terbarukan “Kami membutuhkan inovasi di bidang infrastruktur, tidak hanya di bidang energi tetapi juga elektrifikasi Kami membutuhkan lebih banyak insinyur Jika Anda mengambil master di bidang teknik, akan mudah untuk mencari pekerjaan” katanya Untuk mendominasi bidang ESG, Ryan berkata, penting untuk menguasai satu area subjek yang khusus. “Asah sebuah subjek dan kembangkan pintasan Anda sendiri untuk mendekati subjek itu, begitulah cara Anda mengembangkan kredibilitas ”

Jessica Darmawan, ESG Associate di Nomura, Hong Kong sudah menempuh karir di ESG selama 10 tahun, sebelum tren ESG muncul di seluruh dunia “Ini adalah waktu yang mengasyikan untuk ESG. Banyak inovasi baru, dan produk ESG telah mengungguli produk keuangan tradisional,” katanya Ia juga memberi arahan agar peserta yang ingin karir di ESG untuk memiliki public speaking dan people skills “Bekerja di ESG, Anda harus mengatasi banyak tantangan dunia yang besar. Anda perlu berinteraksi dengan banyak mitra dan stakeholder Di sekolah dulu, saya selalu mengikuti partisipasi MUN dan debat Ini memberikan banyak kesempatan berbicara secara umum. Salah satu kelas favorit saya saat S2 Bisnis adalah negosiasi Saya belajar untuk menemukan kesamaan dan kolaborasi dengan sesama ”

M Pradana Indraputra, selaku Staf Khusus Pengembangan Kewirausahaan Nasional BPKM menutup acara ini dengan menekankan pentingnya ESG untuk ekonomi bangsa “Data menunjukkan bahwa ESG sangat penting dan merupakan masa depan investasi,” katanya. “Untuk pemerintah, salah satu tugas kita adalah menarik investor asing Mereka menanyakan bagaimana pemerintah bisa mengatur dan memastikan kondisi lingkungan di Indonesia Ada banyak pekerjaan yang akan dibutuhkan di ESG.”

Kedua perspektif ini disambut dengan hangat dari peserta forum yang berinteraksi dalam sesi tanya jawab Dengan forum ini, GIPA berharap untuk dapat terus mendukung perkembangan sumber daya alam manusia di Indonesia untuk meraih perkembangan ekonomi kelas dunia

James Gifford is a seasoned professional in the field of sustainable and responsible investments with various experiences in academia, professional and governmental organizations He is currently with Credit Suisse, a leading global wealth manager, as their Head of Sustainable & Impact Advisory, previously he was with UBS as their Head of Impact Investing James also has experienced working in various universities around the world He was a Senior Fellow in the Centre for Sustainable Finance and Private Wealth at the University of Zurich, Senior Fellow in the Initiative for Responsible Investment in Harvard Kennedy School, Member of the Sustainable Investment Advisory Board in Brown Advisory and an Honorary Research Fellow in the University of St Andrews He also served as the Founding Executive Director in the United Nations-backed Principles for Responsible Investment. He has a PhD in Economics from the University of Sydney and a Master’s in Environmental Management From the University of New South Wales.

He opines that ESG has and will continue to be a strong indicator in the financial performance of the company moving forward.

Sustainabiliy has just become more and more relevant to the nancial future of a company"

Pradana is the Special Staff to the Minister of the Investment Republic of Indonesia For National Entrepreneurship Development, being one of the Youngest Special Staff in the country He is responsible for providing strategic counsel to the Minister of Investment

He also presently serves as the Head of Investment Committee at The Indonesian Sharia Economic Society and Head of The Business Center at ILUNI UI, University of Indonesia Alumni Association, one of the largest and most prestigious alumni associations in the country

He opines that ESG factors will continue to rise in popularity especially among young investors and customers who are more environmentally aware. He believes that ESG investments will be the future of investment.

"ESGs are vital, inevitable and most importantly the future of investment "

Ryan is a fundamental analyst at Brookfield Renewable As a subject matter expert on US wholesale power markets, Ryan assists the commercial and M&A teams value and structure transactions across a number of Brookfield Asset Management’s funds, which collectively oversee $600 billion in assets under management, including 21 GW of renewable generating capacity

Ryan was previously an economics consultant at London Economics International where he worked on asset valuation, cost-benefit analysis, and expert testimony for a range of clients, including private equity, independent developers, utilities, and regulators. Ryan holds an MPA in International Finance and Economic Policy from Columbia University and a BA in Economics and Politics from SOAS, University of London.

"The global market forces, public policy, and cost-effective technology that we need to reach sustainable GHG emissions reduction doesn’t yet exist. We’ll require all hands on deck from the best young talent to create that. As such, energy transition is unavoidably the next big thing”

RYAN HAKIM

Senior Fundamental Analyst at Brookfield Renewable, NY

is multifacetedby following our passions, leveraging our strengths, and pursuing our career paths, we can all uniquely and meaningfully contribute towards a sustainable world”

Jessica Darmawan is currently with Nomura, a global financial services group with an integrated network spanning over 30 countries, as an ESG Associate for the Asia exJapan region.

Previously, she was at Temasek as an Associate in their Sustainability & Stewardship Group and at PwC as a Senior Consultant in their Sustainability & Climate Change Consulting practice. She also did a sustainable palm oil research fellowship at the World Resources Institute in the past Jessica pursued an MBA at HKUST Business School with a merit scholarship and a BA in International Relations from American University She was selected as one of the 24 most promising global social entrepreneurs to participate in the University of Pennsylvania’s Global Social Impact House Fellowship

"SustainabilityJESSICA DARMAWAN

BRE Academy and CFA Academy are both useful platforms to learn more about ESG and do some courses If you ' re a student, you might be eligible to receive discounts and grants for your course

Previous experiences in research, non-profits, and consulting is helpful to have knowledge of the context and the trends, challenges, and opportunities in ESG during the interview process You can seek to find more experience in these types of organization:

Research fellowships at a research / think tank / policy / law institution

Management consulting

Financial institutions

Non-profit organizations - such as WWF, Greenpeace, etc

Operating Companies -such as Unilever, Danone, etc

Policy jobs, either in consulting, trade groups, or progressive governments

Networking is very helpful Go to many events and engage with sustainability communities to meet with experts and practitioners for potential partnerships and also understand what opportunities may be available at their organizations

1. I've been hearing from people around me that working in the ESG sector is exhausting because it's still considered as activism, a kind of work that's not really worth the hustle, that it doesn't really "give back" to you. Is that true? How has your experience in pursuing a career in ESG rewards you and what keeps you going?

Ryan:

Some roles and industries contribute to ESG objectives without being bonafide “ESG jobs” or needing to ensure ESG compliance For example, engineering, finance, business development, software development, data analysis - many skills in those jobs are transferable in and out of ESG-specific sectors

Jessica:

It depends on what role or impact you provide in this, as there are many ways to contribute towards advancing ESG I think some considerations for this could be:

(1) Time horizon - sustainability & ESG impacts take time, you may be working on an ongoing project (for example, improving sustainable agriculture in Indonesia) and the tangible outcomes/impacts typically don’t happen immediately and may take years to realize I remember being exhausted and frustrated because of this sometimes, but I try to focus on my long-term commitment in this field In the past month, something that I worked on a few years ago had an amazing outcome and while I’m no longer involved in that project/company, it felt rewarding Consider what legacy or impact you want to create :)

(2) Awareness/perception/integration of ESG - Years ago, ESG was considered to be more of “activism”, CSR marketing, or “greenwashing”, but nowadays it’s becoming mainstream and a core focus across markets, regulations, industries, and organizations ESG has evolved across the years, and now more than ever we need more talent, innovation, and enthusiasm to accelerate this area further This evolution has kept me going, and I’m excited to see how it will continue to evolve in the future.

2. Could you give us tips & tricks to get an ESG job outside of Indonesia, other than through doing a masters abroad?

Ryan:

Most firms like to hire locally because it is easier from an administrative and cost point of view I think the easiest way to get an ESG job outside of studying or moving abroad before getting hired is to become a specialist in a particular subject matter.

Jessica:

For my previous job in Singapore, I found the job listing on LinkedIn while I was based in Jakarta and previously had not studied or worked in SG before I do think it is possible to get a job overseas without having to pursue a degree there. I’d suggest setting up job posting alerts on LinkedIn in the locations of interest, and continue to apply, apply, apply. I agree with Ryan’s answer that being a specialist/subject matter expert was very helpful - because due to certain regulations, companies overseas typically have to justify hiring talent from overseas compared to hiring locally. At that time, the jobs in SG were looking for candidates with an ESG background and sustainability consulting project experience, and this was still quite niche in SG

3 What kind of certifications that might be important in the near future for ESG and which standard do you think is good for us to learn first?

Jessica:

There are various international frameworks and guidelines, depending on the industry There’s currently no universal standard yet in ESG criteria and reporting. For the purpose of attracting investment, generally, investors are looking beyond financial data & performance and looking into the organization’s non-financial data & performance (such as ESG criteria) as part of their investment origination and due diligence While there’s no universal standard yet, typically companies report their ESG data and performance against reporting frameworks such as GRI, SASB, etc Then this information may need to be verified by third-party verification Having this ESG data & reporting info is helpful, as nowadays investors may allocate their funds/investment towards specific ESG criteria.

4. What are the opportunities for ESG roles in companies internally, to ensure that ESG goals are being met by those companies?

Ryan:

My understanding is that internal roles typically fall under compliance teams within the organization Jessica will have a better perspective

Jessica:

It can depend on the company, their operations, and the products/solutions they offer

Sustainability Managers that do the company ’ s sustainability management and strategy

Sustainability professionals to manage, track, implement and report against ESG KPIs.

5. What opportunities are there in the ESG field? Do you think it's a progressive career path or have the people in the field faced challenges in getting to higher-level positions within an organization?

Ryan:

Many areas within ESG are still being figured out. It would be rare for there to be a clear career path within ESG The best opportunities in my opinion would be engineering, public policy, finance, manufacturing, transportation, and entrepreneurship

Jessica:

Based on my experiences, there’s been an exponential growth in ESG investments and sustainable finance - so there’s a growing need for ESG professionals within financial institutions These dedicated roles generally follow the organization’s typical career progression (for example, the typical career path in Investment Banks is Analyst -> Associate -> Vice President -> Executive Director -> Managing Director) There are also growing opportunities related to ESG data analytics, technologies/innovation, and entrepreneurship. In my experiences, my ESG roles have typically followed the company ’ s general career progression/promotion cycles

6 What are the feasible timeline and steps that can be taken in the ESG career path for someone who has just graduated from their bachelor or master study?

Ryan:

It would depend on the field of study But because ESG is so nascent, there is no clearly defined career path outside of traditional businesses like construction and finance. Public policy and entrepreneurship however is an open field.

Jessica:

Based on my experiences - two things to consider (1) your interests & (2) industry trends. With a bachelor in IR, I first pursued my interest in ESG from a research & policy angle Then I started to see the importance of the private sector in advancing sustainable development, which led to my career shift to sustainability consulting. This gave me exposure to diverse industries, clients, and projects. From there, I saw the growing trend in ESG investing and financing, and I got curious about the career opportunities and skillsets needed for ESG investing Then I transitioned into the finance sector, first at a government-owned investment fund, then currently at an Investment Bank.

7. How you will provide guidance to teams on investment specific and sector wide risks throughout the due diligence and ESG screening process?

Jessica:

The ESG universe is broad and comprehensive, and there is no universal standard for ESG (compared to the universal financial accounting standards, for example) - you need to tailor the ESG issues, criteria, and activities based on the industry, company, or business/investment process To provide tailored guidance, requires continuous learning (for example, growing my understanding of the trends in ESG bonds issuance, how to structure a green bond, etc) and awareness-raising It helps to understand what role ESG plays in financial markets, clients, and banking products, and start the conversation based on aspects that banking colleagues are familiar with (such as the traditional bond issuance and use of proceeds) and then including ESG as part of those conversations (for example, a green bond would require specific use of proceeds towards environmental activities/goals)

8. What kind of opportunities are available to low-skilled workers, and what kind of training can possibly be given to make ESG jobs accessible to them?

Ryan:

Many aspects of ESG still belong in the physical world Construction, supply chain management, and manufacturing are all going to be important in the energy transition.

Jessica: I agree with Ryan’s answer - To add, training on ESG compliance, performance tracking, reporting, and due diligence would be helpful - because nowadays regulations, stock exchanges, and investors are requiring companies to report their ESG activities, performance, data, and impacts For example, from working in manufacturing you could transition towards a supply chain sustainability professional managing the ESG compliance of the manufacturing process.

9. What sort of skills/knowledge are generally required to start a role in ESG?

Ryan:

In my opinion, experience and genuine interest in a particular subject is the most useful tip if you ’ re looking for a specialist role If you have no relevant experience, demonstrating your knowledge and interest by writing (blogging, journaling, writing essays) can go a long way in mentally digesting and articulating a complicated industry for yourself.

Jessica:

Agree with Ryan’s answer - To add, it’s helpful to get an understanding of what specific work tasks, activities, and skills are required in the sustainability job you ’ re interested in (such as on LinkedIn job postings, etc). Then you can start to map your career path and build your job candidacy from there - for example, if certain certifications are required for that role (CFA, PMP, LEED etc) then getting those certifications can help you in transitioning to that role or give you an advantage against other job candidates

10. Could the panellists elaborate more on that and, perhaps, how the intersection of data science skills in ESG finance roles (if any)?

Jessica:

As there’s no universal standard yet in ESG / Sustainability - there’s a growing need for ESG ratings / scores of companies against benchmarks which are based on market data, company disclosure / performance, AI / NLP analysis & scoring systems, etc Lots of companies have been growing their ESG data analytics & solutions offerings.

11. What would you recommend to someone who is looking to transition and any advice on how best I can leverage my current skillset into this sector?

Ryan:

Writing about topics that you are interested in (blogging, writing essays, journaling) can go a long way in helping you articulate your opinions, knowledge, and reasons for switching industries.

Jessica:

Due to ESG compliance, disclosure, and reporting becoming more required for listed companies, stock exchanges, regulations, and investors, there’s a growing need for ESG reporting and communications professionals Additionally, see if you can add on more roles and activities at your current job - lots of professionals transitioned from a different role into a dedicated sustainability role within the same company. For example, your role could be 80% marketing and 20% volunteering at first to look into sustainability opportunities / risk / strategy at your tech company Because there’s a growing tech industry trend towards sustainability commitments (for example, Amazon, Facebook, Google committed to net-zero carbon emissions) -> this could lead to a need for a full-time, dedicated sustainability role at your tech company or within the tech industry

12. While financing and economy are two inseparable components in the sustainability practice, how much does one need to learn or allocate resources to understanding them to prepare for a career in sustainability?

Ryan:

Finance (both private and public) will be inextricably linked to developing the infrastructure needed for the energy transition The energy transition is inextricably linked to economic performance in the long term. Any leadership or strategy job will require an understanding of both However, other job functions such as engineering, construction, or manufacturing, which are also essential, don’t necessarily require the same depth of understanding

Jessica:

To add to Ryan’s answer - if you are approaching this from a financing and investment angle, there’s a significant financing gap and investment needed to achieve the UN SDGs There’s also growing demand from investors for ESG investments and financial products. It’s helpful to understand how to address this challenge and trend (how to create a supply of ESG financial products/solutions, how to bridge that financing gap -> what sectors need the most financing, how to attract capital to that sector, etc). Overall understanding of the dynamics and different ways to approach & contribute towards sustainability is a good place to start.

13. For speakers - Have you considered focusing on contributing to the country more directly with your rare talent, skills and knowledge?

Ryan:

Yes, hopefully someday if the right opportunity arises

Jessica:

Throughout my career, I’ve been fortunate to work on projects that contribute directly to Indonesia While in Washington, DC, my work involved developing an online mapping tool for real-time monitoring and alerts of forest fires in Indonesia. While in Singapore, I worked to source ventures, technologies, and projects that contributed towards sustainable agriculture, improved community livelihoods, and protecting the environment & biodiversity in Indonesia for investment/funding Now in Hong Kong, I work with Indonesia’s private & public sector in advising and facilitating capital raising, financing, M&A, underwriting etc in accelerating their sustainability objectives and transformation towards a sustainable future

14. Does Brookfield Renewable focus solely on renewable energy when making ESG investments? On top of that, have you had the opportunity to work across different Brookfield entities (real estate, etc) within your role? Thanks!

Ryan:

Different funds across Brookfield have different goals and strategies. Some funds exclusively focus on renewable energy, some funds have broader mandates and can invest in ESG related companies Brookfield’s Global Transition Fund led by Mark Carney invests in a wide range of ESG activities outside of energy. I work with multiple funds like our super core, transition, debt, and infrastructure funds, but not real estate specifically

15 Could you elaborate on how you objectively measure ESG impact of a certain project/deal/investment? What is the metric or KPI for success?

Jessica:

As there is no universal standard for ESG criteria and measurement - the key here is materiality and what ESG criterias & impacts are material to the organization. More and more organizations are creating their own in-house ESG framework / methodology and scoring system to measure ESG impacts of certain projects / deals / investments Typically, organizations also use thirdparty ESG data vendors, ratings / score, software, and analytics as a source of information and to inform their measurement process.

16. How do you think this will affect talents to be moving into ESG related work in Indonesia?

Ryan:

In my view that makes ESG more pressing. What makes ESG investments in Indonesia less appealing is the regulatory environment - if regulation can de-risk returns, Indonesia could be a highly attractive place for investments in the energy transition For example, in most regions in the US, clean energy projects can get investment tax credits, production tax credits, tax equity financing, liquid energy, capacity, and REC markets, RPS programs, and other programs that compensate clean energy investments

17. How is the prospect of ESG investment in Indonesia compared with other countries in the region, lets say Thailand and Vietnam, and what are the key points to get more financing in ESG?

Jessica:

The regulatory context, processes, and incentives can also influence the ease of doing business and attractiveness of ESG investing in a particular country Additionally, evaluating the business opportunity, investment risks and returns, and market conditions & competitiveness can also add to the quantity and quality of the prospects.

18. Is there a specific timeline that experts and governmental bodies are aiming for in terms of shifting corporate behaviour towards sustainability before it is too late? Are there real strategies, regulatory or otherwise, that are employed right now to accelerate the momentum towards the adoption of ESG in catching up with that timeline?

Ryan:

A few of the strategies in place in many (not all) US states: RPS programs, investment tax credits, production tax credits, direct state procurements, Clean Energy Standards (CES), tax incentives for EVs and distributed energy

Jessica:

More and more countries, central banks, regulatory bodies, and multilateral organizations are setting net-zero carbon commitments and building policies to achieve & create an ecosystem around this. For example, Indonesia has committed to achieving net-zero carbon emissions by 2060 or sooner. Singapore will aim to halve its 2030 peak greenhouse gas emissions by 2050, has a national blueprint for sustainability, its Monetary Authority has been developing policies and incentives to build SG as a sustainable finance hub in Asia This is a growing trend in other countries around the world - there’s the EU Taxonomy, China Taxonomy, and upcoming ASEAN Taxonomy to classify green activities, which is accelerating investors and corporations to adopt and integrate ESG in their organization and activities

19. Other than "Renewable Energy" which has been widely discussed, how would ESG/Sustainable Investment be related to Country Development

Jessica:

There are many examples of this - one example is Infrastructure -> developing sustainable airports, green ports, sustainable transport requires investment, technical expertise, planning/strategy and can also lead to the growth of sustainability jobs, talent, and economy

20. Could you give some insights how sustainability/ESG in the financial sector really affect us as individual and in our day-to-day lives, or even for communities in cities or rural areas?

Ryan:

To name a few ways sustainability impacts our day to day lives: reduced health risks, natural disaster risk mitigation, job creation, reduction of food scarcity risks.

Jessica:

The concept that “climate risk is a financial risk” is becoming widely accepted - this means that investments and financing are moving towards more sustainable areas (for example, renewable energy sources vs finite fossil fuels) This can impact reducing carbon emissions, improving living environments, job creation, and making sure that the future generations can continue to be sustained, have access to resources, and grow like the previous generations.

21. How can I contribute to sustainable finance & ESG practices as an academic faculty?

Ryan:

Research in market design, policy incentives, and creative financing would be three important ones I can think of Production tax credits, investment tax credits, tax equity investments, safe harbouring, RPS market design, wholesale market design, and clean energy standards (CES) are some important areas of research in the Indonesian context. If these are solved, investing becomes much more attractive

Jessica:

Developing sustainability technologies/solutions for commercialization/investments is also key.

22. If you are invited by an undergraduate business school, what would be your recommendation to the dean and lecturers to help build the foundation for graduates on ESG Jessica:

I think it’s also important to grow a “sustainability mindset” amongst students. Why is sustainability / ESG important, what are the risks & opportunities? What is our role in this? How can we contribute to addressing the challenges and capturing opportunities? To raise awareness, motivate, and engage students in ESG / sustainability is absolutely key - we need more talent, creativity, and innovation to achieve a sustainable future.

Global Indonesia Professionals’ Association (GIPA)

gipa.co | council@gipa.co

Aldrich Williams Research Associate

Arcky Meraxa, PhD Head of Americas & Professional Development Centre of Excellence

Difa Farzani Research Associate

Hilmi Kartasasmita Head of Indonesia

Kei Putri Graphic & Motion Designer

Kenzo Baskoro Social Media Manager

Kevin Halim

Executive Head of Department for Data, Platforms & Operations

Kezia Kho Media Relations & Press Officer

Rachel Kindangen Platform & Operations Manager

Shanen Kurniawan Data Analytics and Visualisation Manager

Steven Marcelino Chairman

Steven Wijaya Secretary General

Viancqa Kurniawan Executive Head of Department for Content & Digital Publishing