INSIGHT INTO CIRCULARITY AND SUSTAINABILITY OF PLASTCS

INSIGHT VOL. 2 NO. 1 | MARCH 2024

THE SEARCH FOR CIRCULARITY

Two contradictory things can be true at once. First, plastics play a vital role in driving industrial development, creating jobs, expanding opportunities, and generating wealth to improve people’s lives. Second, plastics also contribute to a growing problem of waste in our environment.

The answer to this conundrum is a true circular economy, which is restorative and regenerative by design – materials constantly flow around a “closed loop” system, rather than being used once and then discarded. In the case of plastic, this means simultaneously keeping the value of plastics in the economy, without leakage into the natural environment. It sounds great, but it’s easier said than done: more than 40 years after the launch of the first universal recycling symbol, just 14 per cent of the plastic packaging used globally is recycled, while 40 per cent ends up in landfill and 32 per cent in ecosystems (with the remaining 14 per cent used for incineration or energy recovery). To move society away from the “take, make, dispose” mindset that has long-informed business models, a fundamental rethink is required.

The good news is, it’s already underway. This digital eBook takes an in-depth look at how companies are addressing the challenges facing the plastics and packaging sectors and provides information on advancements and potential solutions associated with sustainability and circularity in plastics.

– Mark Stephen, Editor, Canadian Plastics

2 INSIGHT INTO CIRCULARITY OF PLASTICS 14 3 The Flexibles Dilemma 5 Driving Green 8 Asked and answered 10 Teaming up to tackle flexible plastic packaging 12 Shaping a bold new era in plastics packaging 14 Shareholders put pressure on the fashion industry to move to sustainable packaging 16 Environmental repercussions of moving from plastic packaging to paper 16 Most consumers don’t prioritize sustainable packaging, survey says 17 Nova launches Centre of Excellence for Plastics Circularity 17 Aptar is helping brands hit sustainability targets 17 5 CONTENTS CANADIAN PLASTICS Stephen Kranabetter | Associate Publisher | 416-561-5362 | skranabetter@canplastics.com Mark Stephen | Editor | 416-510-5110 | mstephen@canplastics.com CANADIAN PACKAGING Stephen Dean | Senior Publisher | 416-510-5198 | sdean@canadianpackaging.com George Guidoni | Editor | 416-510-5227 | gguidoni@annexbusinessmedia.com Vol. 2 No. 1 | March 2024 Produced by INSIGHT INSIGHT INTO CIRCULARITY AND SUSTAINABILITY OF PLASTCS We do not assume any legal liability or responsibility for the accuracy, completeness or usefulness of any information, apparatus, technique or process disclosed herein.

IMAGES

COVER PHOTO: IPOPBA/GETTY

THE FLEXIBLES DILEMMA

NAVIGATING CHALLENGES AND FORGING SOLUTIONS FOR FLEXIBLE PLASTIC PACKAGING IN CANADA

Once upon a time there was a plastic bag and a cardboard box. And every day they would take the Product of Goodness from one part of the kingdom to another, safely and joyfully. Together the bag and the box brought great joy to people across the kingdom. But one day the Great Brand Owner in the Sky appeared and told the bag and the box that together they were now too heavy. The bag and the box were sad, for they made a great team, and they made many people happy every day. But they knew that

one of them would have to leave. The box even tried dieting, desperate to lose weight and stay with his friend the bag. But it was to no avail. And one day the bag found itself all alone. But this made the Almighty Merv very unhappy. For the bag, it complained, couldn’t be recycled. And so, it sent the bag to the Big Hole in the Ground where it stayed for the rest of its days. Now that troubled the Great Brand Owner in the Sky deeply. She didn’t want the bag to go to the Big Hole in the Ground, but the box on its own wasn’t strong enough to carry the Prod-

uct of Goodness from one part of the kingdom to another. And together the box and the bag were just too heavy. She simply didn’t know what to do. So, the Great Brand Owner in the Sky went to the Almighty Merv and explained how troubled she was. And together they agreed to gather all their friends from across the kingdom and work hard to find a way to keep the bag from going to the Big Hole in the Ground. And a CPP Working Group was born… I’ve had the immense privilege of leading the Canada Plastics Pact (CPP) for several 1

INSIGHT INTO CIRCULARITY OF PLASTICS 3

Flexible plastic packaging is a package or container made of flexible or easily yielding materials that, when filled or closed, can be readily changed in shape. There are two types of flexible plastic packaging: multi-material structures and mono-material structures.

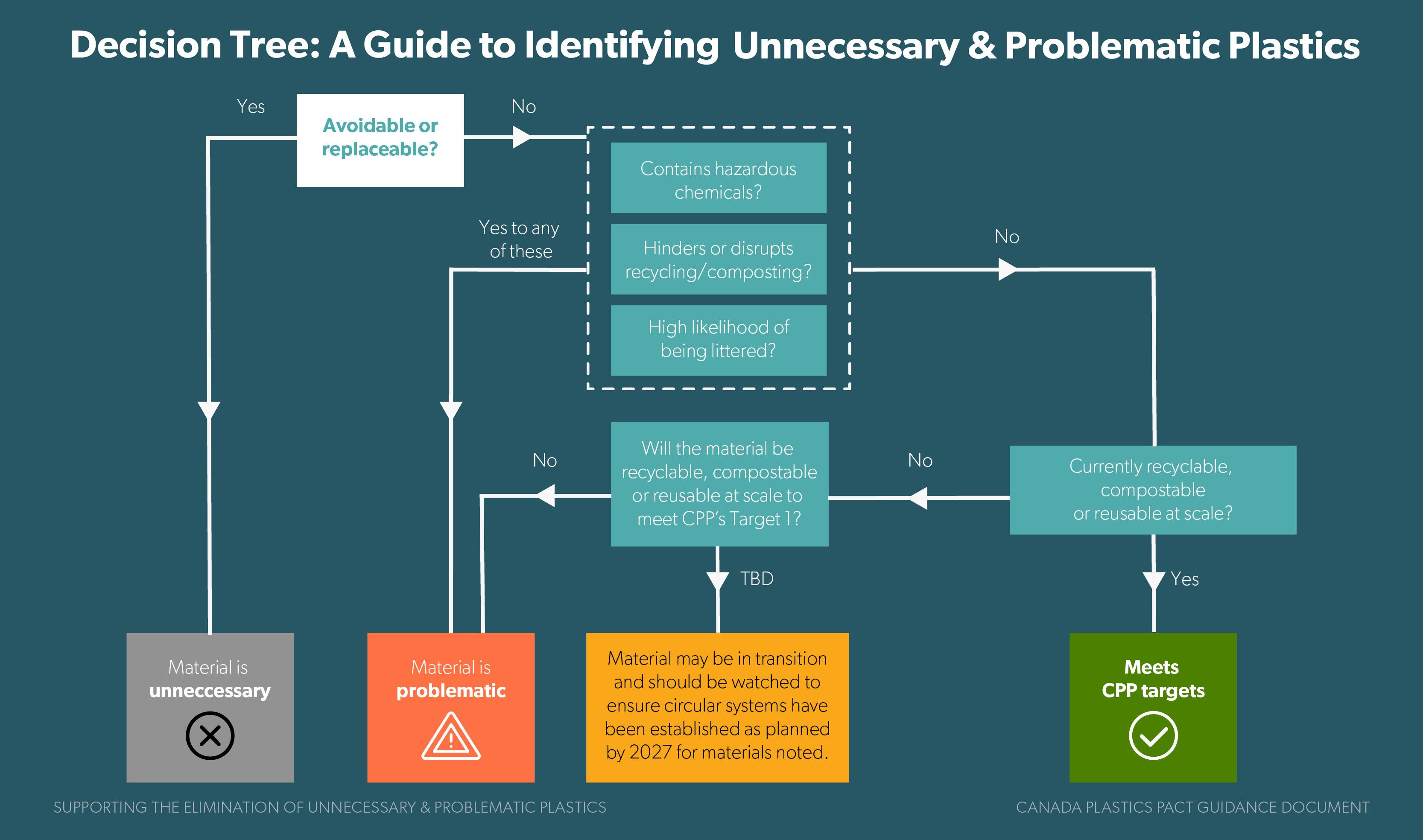

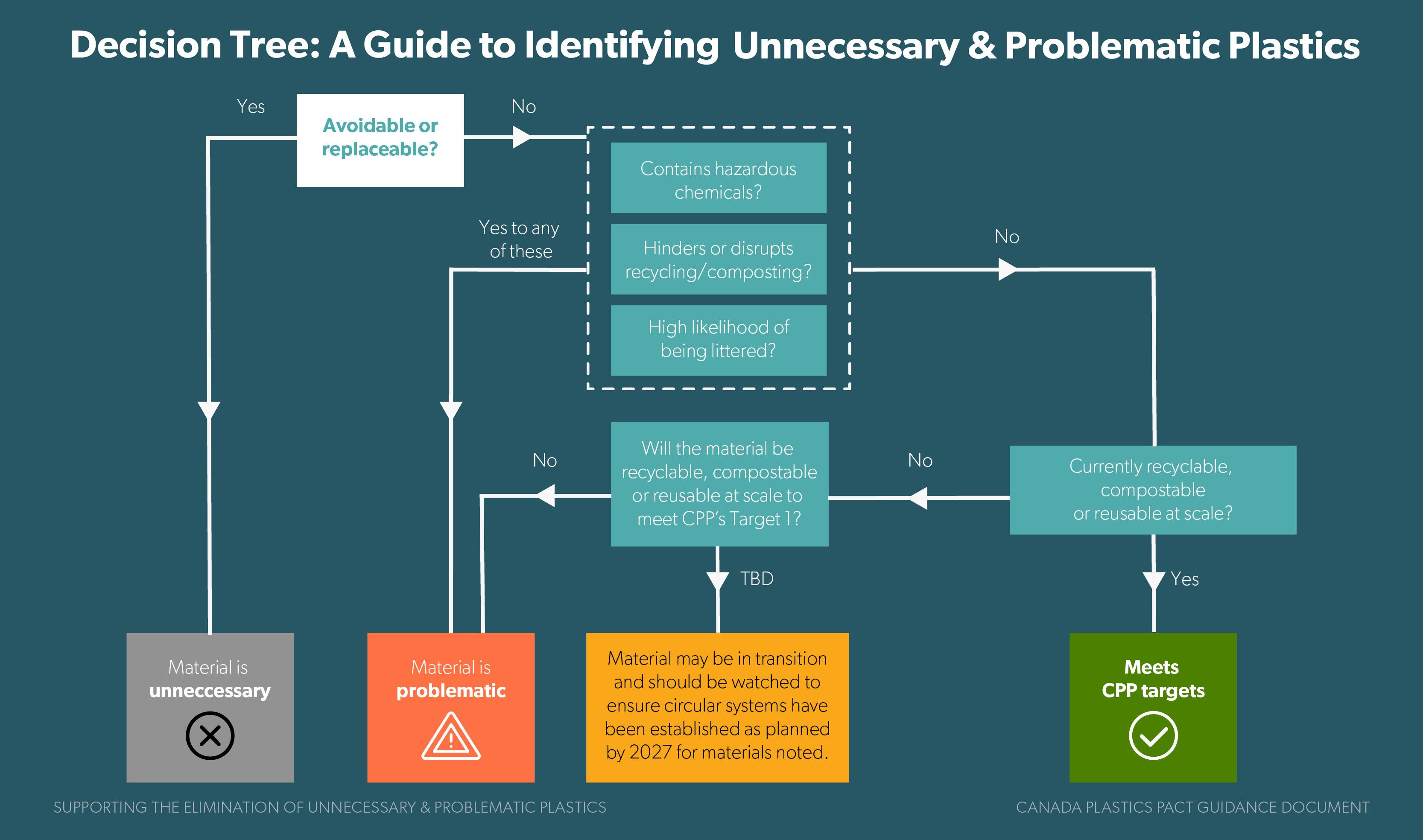

Decision Tree: A guide to Identifying Unnecessary & Problematic Plastics1

months now. One of the things that I’ve learnt in my previous experiences leading source reduction and sustainability efforts in the food industry is the power of simplicity, in both strategy and communication. And so, I wanted to start this article with a parable - childlike in its simplicity - to illustrate what I believe is the crux of the issue we are facing around the use of flexible plastic packaging in this country.

Many of the companies I have spoken to since arriving in this role have spoken to me with great passion about their work, done often over many years, to identify opportunities to reduce and eliminate their packaging. Not all, by any means, but a significant number. And they have shared how this work often inevitably pushed them towards flexible solutions. And how this has now put them between a rock and hard place. Reduce GHGs and packaging footprint by increasing reliance on flexibles, but in turn accept that more of their packaging goes to landfill. It’s what I’ve ended up calling the Flexibles Dilemma. And it’s not going to be resolved anytime soon.

At CPP, we recognize that plastic reduction is fraught with uncomfortable compromises and imperfect solutions. There is no magic wand or silver bullet and each area of the matrix of companies, sectors, interests, and stakeholders that make up the plastic supply chain moves at a different speed and for different reasons.

Out of this complexity come dilemmas. And under those circumstances, one size most definitely does not fit all.

As such, what matters here is not the decisions themselves: one company is going to choose flexibles while another is not, but the Decision Tree, or how we make those decisions in an imperfect world.

At CPP we will be doubling our efforts to accelerate the infrastructure solutions we need so that no more bags end up going to the Big Hole in the Ground. But until then, Brand Owners need to be supported in figuring out how to make the best decisions for themselves.

And that is why CPP has just published a Five-Year Roadmap (2023-2027) for Advancing Flexible Plastic Packaging in Canada. It’s designed for stakeholders across Canada. including manufacturers, producers and brown owners, retailers, stewardship agencies, recyclers, and governments, to work together on clear and practical objectives.

The Flexible Plastics Roadmap acknowledges the fact that in 2023, flexibles are a problem and are likely to remain so for a few years still to come. Even though flexible packaging and films represent 47% of the plastic packaging placed into the Canadian market (equal to 1.89 million tonnes in 2019), less than 2% is being effectively recycled. Average collection rates are only 15% for households and 6% for IC&I.2

It also acknowledges the fact that, in many cases, flexible packaging is the best option. It is lightweight, adaptable, less costly, and reduces greenhouse gas emissions.

The Roadmap identifies three areas where we think we can collectively make progress.

The first is about mindset and how we think about packaging and the need for it. Entitled Upstream Innovation and Design for Circularity, the core principle here is that we must begin any work around flexibles by looking for opportunities to eliminate the plastics we don’t need, to move to other types of packaging or to replace packaging altogether where it makes sense.

Our mindset in this country is still primarily one of recycling rather than reduction, and this needs to change.

I was one of the pioneers of the food waste movement in Canada and have seen how the entire food industry was able to shift its thinking from how to deal with waste to how to prevent it in the first place. Similar coalitions to CPP worked over decades to drive the message to business leaders across the industry that they shouldn’t just be looking at the cost to dispose of food waste, but of all the embedded costs (raw material, labour, energy, opportunity cost of unsold products) of that waste. To a large extent it worked.

The extremely low cost of virgin plastics and the absence of similarly meaningful data on the embedded costs of plastics today mean that business leaders have a harder time with that narrative. While no-one wants a straw in a turtle’s nose, if a CFO must choose between virgin plastic or post consumer recycled (PCR) with the latter being more expensive, it’s a quick decision, turtle or no turtle.

I am committed to demonstrating to our industry that the same principles apply with plastics as they do with food waste, and we will be commissioning research to that end next year. We will also be unveiling the first of our

new Accelerator Pods later this year focused on scaling re-use models across the country.

While reduction or re-use needs to be the priority, if you move through the Decision Tree and recognize that flexibles remain the best option for your company then the focus shifts to making good design decisions. And this is really about using packaging that creates the fewest barriers to recycling. To support these efforts, CPP has developed a Canadian version of the Golden Design Rules for Plastics Packaging

Further, we are recommending that all CPP Signatories review their flexible plastic packaging portfolios by the end of 2024 to ensure packaging is easily identifiable and to explore and identify opportunities to switch to mono-polyethylene (PE) and mono-polypropylene (PP).3

If this is the stage you find yourself at in the Decision Tree, CPP recently published its Pathways to Mono-material Flexible Plastic Packaging Guide, as a supplement to the Flexibles Roadmap. This guide offers a host of practical information and guidance on how to move from multi-material flexible packaging to mono-PE or PP and was developed in line with the Golden Design Rules.

The final area of focus in the Flexible Plastics Roadmap is about sorting, recycling and end market development. The goal here is clear: a significant increase in flexible packaging sorting and recycling capacity enabling over 30% of household flexibles to be effectively recycled by the end of 2027, while at the same time supporting the creation of stable end markets for PCR content.

While, if you are a brand owner, these targets may feel a long way off, they matter. The plastics problem will only be solved by the whole supply chain working together. And that can only happen when there is clarity and understanding about the needs, motivations and drivers of each part of the chain.

At its heart, that is what CPP seeks to do.

In the meantime, we will continue to support those who are having to make imperfect choices while pushing for a world without plastic waste or pollution. A world with no more bags going into the Big Hole in the Ground.

Cher Mereweather

Managing Director, Canada Plastics Pact cmereweather@plasticspact.ca

4 INSIGHT INTO CIRCULARITY OF PLASTICS

2 Canada Plastics Pact. (2021, May). Foundational Research & Study: Canadian Plastic Packaging Flows

3 Mono-PE is a flexible packaging material composed of a single layer of polyethylene and Mono-PP is a type of flexible packaging material made from a single layer of polypropylene.

DRIVING GREEN

NEXEO PLASTICS PAVES THE WAY WITH SUSTAINABLE MOBILITY SOLUTIONS

REVOLUTIONIZING THE ROAD –UNVEILING THE FUTURE OF SUSTAINABLE MOBILITY

In the ever-evolving landscape of automotive manufacturing, Nexeo Plastics is taking the lead in driving sustainability with our portfolio of sustainable materials that includes the latest innovations from our suppliers. We’re committed to revolutionizing the road, from encouraging customers to adopt bio-based plastics to helping customers meet their net zero carbon goals. Let’s discuss the details of our sustainable solutions and their pivotal role in shaping the future of mobility.

EMBRACING SUSTAINABILITY IN RESPONSE TO ENVIRONMENTAL CONCERNS

The automotive industry is at a crossroads as it tries to respond to global environmental concerns and to adopt more sustainable practices. Original Equipment Manufacturers (OEMs) are now prioritizing the reduction of their carbon footprints through Extended Producer Responsibility (“EPR”) programs and seeking to achieve end-of-life recyclability goals. Although legislation mandating EPR’s is being developed specifically for EV battery producers and packaging manufacturers, we expect this trend to spread to other automotive segments.

Our sustainable solutions aim to cover the entire spectrum of goals our customers are striving to achieve. We want to help customers minimize reliance on traditional plastics, reduce their own and their customers’ carbon emissions, and, in general, help everyone mitigate their environmental impact. Carbon mass balance, Circularity, or a combination of both have become the chief philosophies in the industry, and Nexeo Plastics has product solutions for each approach.

KEY FEATURES AND BENEFITS

Currently, the sustainable options that are typically most appealing to automotive OEMs include a variety of commodity and

INSIGHT INTO CIRCULARITY OF PLASTICS 5

PHOTO: POGONICI/SHUTTERSTOCK.COM

engineered bio-based plastics, derived either directly from renewable resources, such as sugarcane, or through the mass balance approach using ISCC PLUS certifications for existing products. Both methods are often ideal to ensure compatibility with existing manufacturing processes for seamless integration. And the result? A reduced carbon footprint throughout the vehicle’s life cycle, achievement of end-of-life recyclability goals, and enhanced brand image and consumer appeal through sustainability initiatives.

NEXEO PLASTICS’ DIFFERENTIATING FEATURES

What sets Nexeo Plastics apart? We have access to both emerging and existing sustainable material options from large suppliers in the industry. With global ISCC PLUS approved facilities, we can maintain chain of custody for certification from our global suppliers to our customers.

In conclusion, Nexeo Plastics is driving change by providing sustainable solutions that not only meet the needs of the present but also pave the way for a greener and more

sustainable future in the mobility industry. We are happy to answer any questions you or your customer may have. Join us on this journey towards sustainable mobility!

Taylor Burnham

Product Manager for Healthcare and Sustainability, Nexeo Plastics

TBurnham@nexeoplastics.com

Christian M. Sodeikat

End Market Manager – Mobility, Nexeo Plastics

CSODEIKAT@nexeoplastics.com

6 INSIGHT INTO CIRCULARITY OF PLASTICS

APRIL 23

1A: Environmental Regulation & Compliance 2024

1B: Anaerobic Digestion: Compliance and Optimization

APRIL 24

2A: Driving Environmental Performance in a Complex World

2B: Environmental Issues: Air Quality, Climate Change, and Decarbonization

2C: Ontario’s Excess Soils Regulation and Contaminated Sites 2024

April 25

3A: Water & Wastewater: Regulation and Compliance 2024

3B: The Evolving Landscape of Extended Producer Responsibility (EPR)

3C: Dealing with Environmental Emergencies and Spills Course

Annett RWDI

Byron

Bergeron RWDI

Bobechko

Georgakopoulos

www.canect.net @CANECTEvent #CANECT

Melissa

Brad

Janet

WeirFoulds LLP

Linda

Blue Heron Environmental

David Ellis Azura Associates

John

Willms & Shier Environmental Lawyers LLP

Sarah Gilbert Bennett Jones LLP

Len Griffiths Bennett Jones LLP

George Jaikaran RWDI

Randy Sinukoff Stantec Consulting Ltd.

Stay up to date with new regulations and best practices and connect with Canada’s leading environmental professionals 24 ENVIRONMENTAL COMPLIANCE AND DUE DILIGENCE TRAINING EVENT APRIL 23 – 25, 2024 | VAUGHAN, ON REGISTER TODAY: WWW.CANECT.NET | SAVE 10% WITH PROMO CODE READER

Chairs CANECT Courses

ASKED AND ANSWERED

ONTARIO’S EFS-PLASTICS IS A LEADING PLAYER IN THE PLASTICS RECYCLING INDUSTRY. HENDRIK DULLINGER, THE COMPANY’S VICE PRESIDENT OF BUSINESS DEVELOPMENT, TALKS ABOUT HOW TO SURVIVE, AND WHAT IT TAKES TO THRIVE.

TELL US A LITTLE BIT ABOUT EFS-PLASTICS

EFS-plastics is an Ontario-based plastics recycler that processes over 100 million pounds of post-consumer plastics every year. Our headquarters is in Listowel, Ont., and specializes in mixed rigid plastics processing.

We also run a U.S. plant in Hazleton, Pa., which specializes in flexible plastics. Our latest expansion brought us to Lethbridge, Alta., where we will start to produce high-quality resins for packaging applications in January 2025. This will be the first plant to produce a food grade PET product as well.

WHERE DO YOU SOURCE YOUR MATERIALS?

We work directly with municipalities and waste management companies. Once the transition to EPR will be completed in Ontario by 2026 and Alberta in 2025, we will be working directly with the producers and producer responsibility organizations to process their materials. We hope to gain long-term supply agreements from this change that would guarantee us consistent supply and enable us to engineer our resins to the spec of the producer.

WHAT GETS IMPACTED IN THE PROCESS WHEN USING PCR?

Let me start by stating, that the latest studies from renowned environmental firms show that PCR from mechanical recycling has a far lower environmental footprint than any other competing technology currently available in the market. We are talking about a GHG emission saving of up to 50 per cent compared to chemical recycled resins and 70 per cent compared to virgin plastics. For this reason, mechanical recycled resin should be preferred over other recycled resins if suited for the product application.

We understand that our PCR has limitations in certain applications and most of our customers have a low tolerance for specs and gels, thus we are investing heavily in advanced sortation, washing, and extrusion. The industry is quite evolving, and we are seeing great success with high incorporating rates with those customers that invested in PCR by updating their conversion equipment.

“Post-consumer resin from mechanical recycling has a far lower environmental footprint than any other competing technology currently available in the market.”

WHERE DO YOU SEE DEMAND COMING FROM?

Recycled content legislation and EPR remain the main drivers for demand. We have very strong sales in the regulated market. However, since the 2025 voluntary brand goals are in sight, we saw a lot more traction in the first quarter of 2024. This traction is coming from brands as well as converters.

HOW IS RECYCLING TECHNOLOGY CHANGING OVER TIME?

As every player in this industry understands quality concerns and market needs better and better, we are seeing improvements and innovation for every component of our process. Machinery that was state-of-the-art 10 years ago will most likely not meet the current standards anymore.

ARE INVESTMENTS IN THE LATEST TECHNOLOGY NECESSARY TO REMAIN COMPETITIVE, OR DOES OLDER RECYCLING EQUIPMENT REMAIN USEFUL?

Yes, but there’s a catch. Recyclers need commitments on both ends of the supply chain to make the necessary investments. Long-term consistent supply and a set of consistent buyers would greatly de-risk these multimillion-dollar projects.

In some cases, old equipment can be retrofitted or refurbished, which makes those investments less expensive. At EFS-plastics, we try to reuse or repurpose as much of our old equipment as possible.

Get in touch with EFS-plastics www.efs-plastics.ca | info@efs-plastics.ca

8 INSIGHT INTO CIRCULARITY OF PLASTICS

Why we need to define plastics recycling

A new standard aims to clarify how to define, measure, and report plastics recycling to improve the confidence and accuracy of waste management

The statistics on plastics and recycling in Canada are startling. According to a study by Environment and Climate Change Canada, only 9% of plastics generated by various sectors is recycled. While plastic bottles and food packaging containers tend to have much higher recycling rates, why do other ’recyclable’ items lag behind?

One barrier is the lack of clarity on what recycling and recyclability really mean. Current definitions refer to various activities that make up the recycling value chain, from collection, transportation, handling, and storing to dismantling, sorting, separating, shredding, processing, or remanufacturing. It is not clear, though, at which step a product can be considered recycled and what the measurable – and comparable –outcomes of the process are.

As a result, policymakers, manufacturers, and recyclers often use different terminology, adhere to different processes and guidelines, and establish metrics that are not comparable among different jurisdictions.

The benefits of establishing common definitions and frameworks for plastics recycling are significant. Standardized definitions will allow stakeholders from across the supply chain to consistently measure, track, and monitor the circularity of plastics, from plastic waste collection to their integration into manufacturing new products. Consistent and transparent data can drive sound decision-making in product manufacturing

and packaging and help the resource recovery and waste management sector determine optimal collection, sorting, and supply chain design.

To address this challenge, CSA Group has been working on a new standard, CSA R117, Plastics recycling: Definitions, measuring, and reporting. Developed by a balanced group of volunteer experts representing various plastic value chain participants, the proposed new standard aims to:

• provide a common definition of recycling in the context of plastics

• clarify where in the recycling process and how recycled plastic should be measured

• outline a method for calculating plastic recycling rates

• stipulate metadata that should be reported alongside any recycling and recycling rates data

The draft standard recently went through the public review process, allowing interested parties to review and provide comments. The publishing of the standard is anticipated in late 2024.

Learn more about CSA Group standards and research supporting plastics recycling and circularity.

© 2024 Canadian Standards Association. All Rights Reserved.

TEAMING UP TO TACKLE FLEXIBLE PLASTIC PACKAGING

HOW A COALITION OF CROSS-SECTOR PARTNERS IS REIMAGINING EVERYTHING FROM HOW THESE PROBLEMATIC PLASTICS ARE DESIGNED AND MANUFACTURED TO HOW THEY GET COLLECTED, SORTED AND RECYCLED

From your chocolate bar wrapper to the packaging that protects your latest online purchase, flexible plastic is everywhere. But in Canada, only three to four per cent of it gets recycled.

“In many cases it is the ideal package for many different types of products, but we haven’t done a good job of designing it for recyclability or effectively collecting and recycling it,” says Paul Shorthouse, Senior Director with the Canada Plastics Pact (CPP).

He points to how flexible plastic packaging and films often get caught on equipment, float around in the sorting plant, and

contaminate other recycling streams. Even when they’re properly sorted, preparing them for recyclers and reclaimers is no small task, with a 750-kilogram bale containing anywhere between 75,000 and 225,000 items.

But perhaps the biggest problem is that flexible packaging often contains multiple layers of different types of plastics and other materials that many recycling facilities can’t easily separate or process.

“We talk about flexibles like it’s one thing, but it’s actually many different things with hundreds of different structures and different resins,” explains Charles David Mathieu-

Poulin, Strategic Advisor at the Circular Plastics Taskforce (CPT), a CPP Partner.

That makes it difficult to offer reclaimers a pure, high-quality product, in a market where demand — and prices — are already low.

“It’s a systems problem,” says Shorthouse. “So we needed to bring the whole system of players together to address it.”

CREATING A BLUEPRINT FOR THE PERFECT RECYCLING SYSTEM

In 2023, CPP and the Circular Plastics Taskforce joined forces with key upstream and downstream players to launch PRFLEX

10 INSIGHT INTO CIRCULARITY OF PLASTICS

(Perfecting the Recycling System for Flexible Plastic Packaging).

The initiative brings together key recycling organizations and packaging industry experts who understand the science of turning recycled resins into new products: CPP, the Circular Plastics Taskforce, the Chemistry Industry Association of Canada, Circular Materials, Éco Entreprises Québec and Recycle BC. It also attracted The Film and Flexibles Recycling Coalition of The Recycling Partnership — a U.S.-based NGO keen to learn from what is happening in Canada.

By working collaboratively, the coalition aims to improve recovery and recycling rates for flexible plastic packaging and films collected from Canadian households. “We realized that working together created a better result than just working independently,” says Shorthouse. “It’s about breaking down some of the silos.”

Over a six-month period in 2023, a research team gathered data to better understand the materials placed on the market, as well as collection and recycling rates across the country. They identified infrastructure

gaps in material recovery facilities and recycling facilities, and they assessed European models to learn from global best practices.

CATALYZING SYSTEM-WIDE CHANGE

In December 2023, the PRFLEX study findings were published, along with nine recommendations on how to improve curbside collection, enhance sorting capabilities, promote easy-to-process packaging and address other systemic issues. PRFLEX also hosted a webinar to discuss the study’s findings, attracting some of the world’s biggest brands and recycling companies.

Now, the group is working with stakeholders to implement their recommendations. Those efforts include running technical workshops to help producers and brand owners redesign for recyclability, piloting improved collection processes, and equipping material recovery facilities and recycling facilities with the latest technologies such as enhanced sensors, robotics, and artificial intelligence.

In the process, they’re creating real solutions to a complex problem. “We want to be a catalyst for change,” says Mathieu-Poulin.

INSIGHT INTO CIRCULARITY OF PLASTICS 11

CPL_Piovan_Ebook24.indd 1 2024-03-19 10:31 AM

SHAPING A BOLD NEW ERA IN PLASTICS PACKAGING

INTEGRATED TEAMS HYPER-CUSTOMIZE TO PUSH BOUNDARIES

DAVID MARNALSE AND JULIO MUZQUIZ

It’s an exciting time in the packaging industry as several factors combine to elevate our solutions to new levels of innovation, sustainability, performance, and flexibility. With the growth of e-commerce and home-delivery in recent years, our approach to packaging has evolved. This trend, coupled with ongoing consumer expectations for heightened sustainability, is converging with the rapid rise of digitization and evolving production technology. The result is an exciting new era in packaging in which polymer resin producers are working in close collaboration with manufacturing partners to create solutions we never thought possible.

For example, with more expectations being placed on the reliability aspect of caps and closures, producers have an opportunity to step up and deliver the high-quality resins backed by robust technical support that modern manufacturers demand. We are required to understand the end-use demands – to be stronger, more durable, lighter weight, more flexible, clearer, heat or cold resistant, etc. – as well as the specifications for all production equipment in use, and how to optimize for maximum efficiency. In today’s market, in fact, the technical expertise on the producer’s end might be just as important as producing and delivering a quality and consistent product.

CUSTOMIZATION, QUALITY, CONSISTENCY

Hyper-customization means finding and delivering the perfect product for our customer’s very specific needs: they may look alike to the casual eye, but we know that every package, every film, every cap and closure, every personal hygiene product requires proprietary customization with zero room for variance between shipments. We know every minute of downtime, extra cleaning, and re-runs is money off the bottom line. For example, Heartland’s H3003 biaxially oriented polypropylene (BOPP) film extrusion resin has been found to have an excellent processing window allowing for even faster production speeds.

Products that deliver low VOC, faster and better processing, along with enhanced down gauging capabilities, come with higher value. All polymers when melted emit some level of volatiles, but leading production technology and less additives can significantly reduce those volatiles. The less additives, the fewer things that can break down and create problems for the converter on their end. That’s why quality assurance is paramount to making technical recommendations with confidence. For example, Heartland Polymers has conducted trials

at the Non-Wovens Institute – the world’s first accredited academic program for the interdisciplinary field of engineered fabrics – to test and verify product quality. Recent trials found the product runs exceptionally well, which translates to less equipment maintenance as well as the potential for improved processability.

ADVANCING SUSTAINABILITY THROUGH PRODUCTION TECHNOLOGY

Smart technologies also enable technical support and QC teams to zero in on exact moments in time during the production process and to track shipments with real-time GPS, offering greatly enhanced capabilities and recording. These platforms allow teams on both ends to co-ordinate and respond faster than ever before to issues. The area of AI and digitization is a separate topic with massive implications, but suffice to say that data is power and from consumers all the way back to the producer, transparency creates common ground. Put simply, the more consumers understand how we make things, the better it is for everyone.

When it comes to sustainability, the plastics industry is no longer trying to keep up with consumer demands and expectations, we are leading new ground through research and the adoption of emerging technologies. Today, there can be no trade-off between performance and sustainability: manufacturers and their customers expect both. It is by integrating technical teams across producer and manufacturer that we gain the boots-on-the-ground reality of what is required, what is possible, and what optimizations are required on both ends. Through communication and a shared vision of what success looks like, we are delivering on products with increased recyclability, lighter weight, more durable, and extremely flexible.

David Marnalse is a Senior Account Manager at Heartland Polymers. With over 25 years in the industry, he is committed to delivering a new and more efficient customer experience to help industry meet the challenges of modern production.

Julio Muzquiz is the Technical Services Supervisor at Heartland Polymers. He brings unparalleled technical expertise to Heartland backed by more than 25 years of providing polyolefins technical support for High Density Polyethylene (HDPE), Linear Low Density Polyethylene (LLDPE), and Polypropylene (PP) resins.

12 INSIGHT INTO CIRCULARITY OF PLASTICS

SHAREHOLDERS PUT PRESSURE ON THE FASHION INDUSTRY TO MOVE TO SUSTAINABLE PACKAGING

RESEARCH SHOWS THAT FAILURE TO DO SO WILL RESULT IN LOSS OF MARKET SHARE AND REPUTATIONAL RISK

Pressure from shareholders to use packaging which is more sustainable has increased over the past three years, according to a new report1 with board directors and senior executives who work for fashion brands and retailers in the UK, US and Australia, by Aquapak Polymers Ltd, which specialises in polymer-based material technologies. Almost three quarters (74%) said that pressure had increased, with a further 15% saying it had stayed the same, and just 11% said that it had decreased.

Furthermore, 28% expect shareholder pressure to switch away from plastic to more environmentally friendly materials such as paper to increase significantly over the next three years and 55% expect it to increase slightly. Just 15% expect it to remain the same and only 2% expect pressure to decrease.

The impact on their business if the environmental performance of the packaging used is not improved is significant, with executives identifying a drop in market share, reputational risk and declining sales as the three most likely negative outcomes. These are followed by pressure from NGOs, declining share price and missing sustainability targets.

The study also shows that executives are taking the adoption of sustainable packaging seriously, although there is room for improvement. One fifth said it was ‘very good’, three

14 INSIGHT INTO CIRCULARITY OF PLASTICS

quarters described adoption as ‘good’ and 7% said it was ‘average’.

Mark Lapping, CEO of Aquapak, comments: “The fashion industry is under pressure from a number of different stakeholders to improve packaging sustainability, not least its shareholders. Our research shows that this is set to increase over the next three years. The consequences of not embracing environmentally friendly materials will mean a negative effect on the bottom line as a result of losing market to share greener competitors and a serious dent in sales.”

A drop in market share, reputational risk and declining sales are the three most likely negative outcomes of failing to improve the environmental performance of fashion industry pack aging.

To help reduce plastic packaging pollution Aquapak has developed Hydropol™, a unique new polymer which is soluble and non-toxic to marine life. Hydropol™can be used as an alternative to conventional plastic in a wide variety of applications as it provides the same functionality and performance but without the associated environmental problems. It is currently

ABOUT HYDROPOLTM

Report1

If the business does not improve the sustainability of its packaging, what do you think the impact on the business will be?

– ACCELERATING THE TRANSITION TO THE CIRCULAR ECONOMY

WHAT IS HYDROPOL MADE FROM?

The base plastic is currently used for dishwasher tablets, ingestible pill casings and soluble stitches. HydropolTM ‘s resistance to low temperature solubility and high barrier to elements adds functionality, providing a wider range of uses. It can be recycled, re-pulped, composted and is distinctively compatible with anaerobic digestion. Furthermore, if unintentionally released into the natural environment, HydropolTM – which is non-toxic and marine safe - will dissolve and subsequently biodegrade, leaving no trace.

WHAT IS HYDROPOL BEING USED FOR?

Extrusion coatings and laminates for paper/board applications are commercially available and in customer production trial stages, including a number of home delivery and ecommerce applications, packaging for dried pet food, snacks, cooked meat and convenience food applications.

Blown film products commercially available and made from HydropolTM include garment bags, ESD bags, organic waste disposal bags and laundry bags for infection control. These can be disposed of at home by the consumer in hot water or added to the recycling where they dissolve during the recycling wash processes.

Other applications under development with customers and development partners include injection moulded parts such as golf tees, nonwoven fibre for applications such as flushable wet wipes and cellulose combinations for thermoformed trays.

used to make products such as garment bags, offering all the necessary features of traditional polybags: strength and puncture resistance; clarity of film; and protection from leakages and dirt.

Crucially, Hydropol garment bags present zero end-of-life issues for consumers and brands. They can be disposed of in existing domestic waste streams without contaminat-

ing other recyclable products or they can be dissolved immediately in hot water at home without producing harmful micro-plastics. They are also compostable and degrade harmlessly on land or in the ocean.

To download the report, visit New study reveals fashion retailers and brand are exploring sustainable packaging but there’s room for improvement

INSIGHT INTO CIRCULARITY OF PLASTICS 15

ENVIRONMENTAL REPERCUSSIONS OF MOVING FROM PLASTIC PACKAGING TO PAPER

Anew report from Netherlands-based research firm Rabobank considers the environmental repercussions of moving from plastic packaging to paper, and concludes that making the switch brings up cost, sustainability, and shelf-life issues.

The report, released in January 2024, emphasizes that brands’ transition into more sustainable materials is equally as motivated by market competitiveness as it is by ethics or legal requirements, with sustainability claims said to suggest to consumers that a product – in this case, packaging – is responsible and of high quality. For many brands, this shift involves replacing virgin plastics with pulp and paper alternatives.

“The shift from plastic to paper is a key

topic in the packaging industry…however it is important to recognize that the sustainability of paper and pulp as a replacement for plastic may not be as straightforward as consumers perceive,” the report said.

Costs for pulp and paper packaging can be up to five times higher than plastic, the report notes, because more material and energy are required to create a sufficiently robust package.

Sustainability issues centre on carbon footprint and end of life: Processes like logging and pulping are said to result in higher carbon emissions that can, according to Rabobank, have a more severe environmental impact than plastics.

Additionally, the report says, paper-based packaging is not suitable for all consum-

er-packaged goods (CPG) – for example, it’s inappropriate for perishable foods and those requiring barrier protection to extend shelf life; and the protective coatings that some paper products require can affect their compostability or recyclability at end-of-life.

Legislative efforts set to fight against the environmental footprint of packaging are in development across the world, from the European Union’s Packaging and Packaging Waste Directive to federal bills and state recycling laws in the US and negotiations surrounding the United Nations’ Global Plastics Treaty. The Rabobank report says that the work underlines the packaging industry’s commitment to achieve sustainability and circularity in its packaging solutions.

MOST CONSUMERS DON’T PRIORITIZE SUSTAINABLE PACKAGING, SURVEY SAYS

There’s a big gap between consumer intent and action around sustainable packaging, a new survey of British and American consumers says.

While about 80 per cent of consumers say they think it’s important to reduce the reliance on single-use packaging, the survey by U.K.-based PA Consulting found that an almost equal number won’t go out of their way to buy products with refillable or reusable packaging.

PA conducted the survey in November 2023 with 2,000 respondents across both the U.K. and U.S. (4,000 respondents combined) who shop from 28 leading brands.

Highlighting what PA calls “a huge gap between action and intent,” 38 per cent of respondents said they recognized the importance of being environmentally friendly but find it hard to incorporate this in their daily routine, 76 per cent don’t choose products with minimal or no plastic packaging, and 77

per cent don’t choose products made from recycled or easily recyclable materials to reduce waste. Almost half (45 per cent) said they don’t recycle paper, plastic, glass, and metal products in designated recycling bins or centres.

The survey showed slight variations between the two countries — with 82 per cent of British consumers saying they see a need for everyone to get involved in reducing single-use packaging compared to 77 per cent in the U.S. The biggest difference between the two countries in the survey came in the question of whether they recycle, with 64 per cent of U.K. residents saying they use recycling bins or centres versus 46 per cent of U.S. residents.

The survey also identified a generational split among respondents, with only 4 per cent of people from the baby boomer generation taking part in packaging deposit systems, while 21 per cent of Gen Z respondents said

they used bottle deposit systems; and a split along household income lines, with almost three-quarters of “high-income” earners using reusable cups and containers compared with 55 per cent of “low-income” earners.

Rather than charging deposits or fines, as is increasingly common, PA noted that businesses should reward positive behaviours to improve recycling: 43 per cent of respondents said they would use reusable packaging more if they received a small monetary reward for returning it and 37 per cent if there was no fee to borrow the packaging.

“Reusable and refillable packaging is at a critical juncture, with the [fast food] industry seeking ways to accelerate sustainability and new plastics and packaging regulation coming into force globally,” said Matt Millington, PA’s design strategy lead for the U.K. “However, our survey highlights that behavioral change is needed to make reusable packaging stick and close the say-do gap.”

16 INSIGHT INTO CIRCULARITY OF PLASTICS

NOVA LAUNCHES CENTRE OF EXCELLENCE FOR PLASTICS CIRCULARITY

Calgary-based materials firm Nova Chemicals Corp. has launched its new Centre of Excellence for Plastics Circularity, which is designed to be a hub for knowledge exchange and development for the circular economy of plastics.

The Centre has two key objectives, Nova

officials said in a March 14 news release: R&D collaboration across sectors, and value chain-integration. Specifically, Nova said, it wants to work with partners across industry, academia, and government to integrate expertise across such disciplines as material science, engineering, chemistry, environmental science, and public policy.

“We welcome innovators from across Canada and beyond to join us in developing scalable solutions for the world’s most complex plastics challenges,” said Nova president and CEO Roger Kearns. “Our aim is to position Canada as a global leader in circular economy best practices and sustainable plastics management.”

APTAR IS HELPING BRANDS HIT SUSTAINABILITY TARGETS

Packaging is an integral part of every brand’s success, but it’s a two-edged sword: discarded post-consumer packaging that’s blowing around on the streets or floating in a river, and showing that brand name, constitutes a very bad look for any product maker.

Aptar, a U.S.-based maker of drug and consumer product dosing, dispensing, and protection technologies, has been investing heavily in sustainable solutions for the past 10 years, and company officials say they’re committed to bringing to market 100 per cent of solutions that are reusable, recyclable or compostable, and to achieving 10 per cent recycled content for its dispensing solutions by 2025 within the personal care, beauty, home care, food, and beverage markets. “A critical facilitator of sustainability efforts is staying ahead of and up to date with trends in materials – both sourcing and the creation of the most effective materials for the manufacturing of our closures,” said Raphael Grange, global market development president at Aptar Closures. “This includes proactively removing unnecessary materials from the manufacturing process; using recyclable and recycled materials where possible; and staying abreast of the latest recycling, composting and waste management trends.”

And Aptar is showing some results. In 2019 it partnered with cleaning product maker Ecover to launch the first dispensing

closure in Europe made from 50 per cent post-consumer recycled resin (PCR). “The launch of the custom flip-top closure in PCR resin for Washing Up Liquid products made it one of the first major brands to use PCR resin in its bottles and dispensing closures in Europe,” Grange said.

A few months later, Aptar converted all its black stock closures to PCR, a variety of snap tops, tube tops, and disc tops available for use across beauty, personal care, and home care applications in North America. “Since that important milestone was achieved, we have been serving multiple personal care and homecare brands with PCR closures in the region,” Grange said.

Another example is Aptar’s SimpliCycle

recyclable flow control valve. Made from a low-density material, the valve floats during the recycling sorting process, allowing it to be easily separated from the polyethylene terephthalate (PET) stream and then recycled right along with the polypropylene (PP) and polyethylene (PE) olefin stream. “When assembled into an Aptar closure, SimpliCycle creates a fully recyclable solution for use with PET, PE or PP containers, enabling brands to achieve their fully recyclable packaging goals,” Grange said.

More recently, Aptar Closures and Unilever partnered with Ecological Group, a Brazilian waste management and recovery company, to collect and recycle biaxially-oriented polypropylene (BOPP), a flexible plastic film material, and turn it into a post-consumer recycled resin that can be used to manufacture PP closures, including closures for TRESemmé hair care product lines.

An even more recent development is Slide, Aptar’s newest linerless development for the sauces and condiments market, which features a non-detachable tamper evidence system that allowed Aptar to eliminate the need for a non-recyclable foil liner. “With Slide, the consumer can access their product with one opening gesture, delivering a convenient and memorable packaging experience while still protecting product shelf life and reducing the potential for product tampering,” Grange said.

INSIGHT INTO CIRCULARITY OF PLASTICS 17

PHOTOS COURTESY OF APTAR CLOSURES