BATTLING ILLEGAL SLOTS

COVID LEFTOVERS

GUN LAKE’S SAL SEMOLA

MICRO-BETTING MANIA

GUN LAKE’S SAL SEMOLA

MICRO-BETTING MANIA

Land

How changes in federal regs may make it easier for tribal gaming

Innovation and Partnership –Playtech Brings the Source of Success to the U.S.

Why gaming can become the next big thing in the Lone Star State

London-based Playtech, one of the most prominent suppliers of online gaming content and software in the world, is on a mission to duplicate its success in European iGaming markets as it expands across the nascent North American online gaming market with its casino, poker, bingo and sports betting products.

14 Skill Game Conundrum

States with regulated casinos continue to battle the spread of unlicensed, unregulated so-called “skill games” as their manufacturers continue a quest to achieve legitimacy in the U.S.

By John Brennan

By John Brennan

Proposed changes to U.S. Interior Department rules for taking land into trust could give tribes a more predictable and timely process for establishing gaming on tribal lands.

By Ryan Sawyer and Thomas ZittTired of watching potential gaming revenue flood to neighboring states, Texas lawmakers again embark on an effort to establish casinos in the state, despite the lieutenant governor's opposition.

By David RittvoAs some effects of the Covid-19 crisis continue to linger in the industry, operators look to how the pandemic has permanently changed the way they do business.

By Jess MarquezMicro betting technology and its variety of in-game wagers are changing the way Americans bet on sports.

By Dave Bontempo

By Dave Bontempo

The fifth annual Eilers & Krejcik Gaming Slot Awards honored a diverse collection of suppliers, again headed by Aristocrat.

By Frank Legato

By Frank Legato

It was a turning point in my life when I got accepted to dealers school at Caesars Atlantic City back in 1978, although it put on the back burner my goal of becoming a professional musician. That was, after all, kind of a pipe dream, to be honest. I couldn’t read or write music, my band only played varieties of rock or pop songs, but mostly we played original music.

Imagine, if you will, a casino lounge act that in the late ’70s could only play a few Beatles, Stones and CSNY tunes, and the rest would be songs you never heard of before. Yeah, you get the idea.

At the same time, my partner and I had our second son, and supporting them moved to the top of my priority list. Up until then, I used the typical Atlantic City hustle of working your rear-ends off during the summer running a gas dock and collecting unemployment for the winter. It wasn’t a bad life, but it turns out I had some ambition.

Last month, I read a report out of Chicago announcing that Chicago City Colleges would get involved in dealer training for the new Bally’s hotel casino that will rise there over the next several years. That’s what happened with Atlantic Community College. My advice, if you’re at loose ends—take full advantage of it.

Even if you never rise above the level of a dealer, where else could you go to school for free and come out the other end with a $50K-a-year position at least? Chicago seems to be just as interesting as the Philadelphia/South Jersey area is, and I can attest that I met some very interesting people amid some very unique circumstantances.

And that starts with the instructors. Caesars, back in the ’70s, didn’t draft some egghead professors to teach you the games. They employed the people who knew the games the best. And yes, while there were some former dealers from Caesars Palace, most of the teachers came from the illegal gambling towns across the Northeast, South and Midwest.

Take Ramon, for example. He had worked in the Cuban gaming halls of Union City after emigrating from Havana, while his archnemesis Ray came from the Puerto Rican gambling houses on Long Island. Or Big Steve from Stuebenville, Ohio, who loved the phrase “dummy up and deal.” Then there was Mark, a low-key former Caesars dealer, who came to Atlantic City on the promise he’d be

promoted to deal in the corral at Caesars Palace where the tips were the best—and the Rainman played. Took him five years to get back to Vegas.

When I went to dealers school, all dealers had to take blackjack as a first game. I remember asking the casino manager, Jess Lenz, whether I should take a second game, something other than blackjack, that would make me more valuable to the managers. He told me that it wasn’t necessary, that there would be plenty of work for everyone.

He was right. I worked six-day weeks, 10 hours a day, but I was buried in the $2 and $5 blackjack pits every hour of every day. Later when I took baccarat, my life changed again, because I got noticed, because I was needed. And it turned out I was a pretty good dealer, after all.

So it wasn’t only the art of dealing you were learning. You heard all the tall tales and all the horror stories that these vastly experienced instructors could pass out, giving you at least that secondhand knowledge. And you also learned how to groom yourself. Some of us were just out of high school, so the idea of dressing to the nines often came down to the latest fashion in disco or a miniskirt. But since those fashions didn’t cut it in those day with the greatest generation, it was important that non-uniformed executives cut a sharp figure.

For those of us who had that extra ambition, Caesars offered management courses, and to say those classes weren’t much more valuable would be a lie. I never took advantage of those courses in the casino. It seems my big mouth disqualified me from getting promoted, while some of my more reasonable colleagues broke through that ceiling. But what I learned during those years benefited me greatly as I began to write about the industry.

My instructors were excellent. Little did I know that Jess Hinkle was one of the first Native Americans to attain an important role in the business even prior to IGRA. Or that Bill Downey Sr. would pass on to his sons Bill Jr., now a top gaming attorney, and Chris, one of the top slot executives in the country, his expertise. Maybe I would have paid closer attention.

So anyone who thinks that dealer training or free management courses are useless should think again. For those of us who couldn’t afford a bachelor’s or a master’s degree, it might just be the ticket.

Roger Gros, Publisher | rgros@ggbmagazine.com twitter: @GlobalGamingBiz

Frank Legato, Editor | flegato@ggbmagazine.com twitter: @FranklySpeakn

Jess Marquez, Managing Editor jmarquez@ggbmagazine.com

Monica Cooley, Art Director mcooley@ggbmagazine.com

Terri Brady, Sales & Marketing Director tbrady@ggbmagazine.com

Becky Kingman-Gros, Chief Operating Officer bkingros@ggbmagazine.com

Lisa Johnson, Communications Advisor lisa@lisajohnsoncommunications.com twitter: @LisaJohnsonPR

Columnists

Frank Fantini | Dave Forman

Contributing Editors

Rae Berkley | Dave Bontempo twitter: @bontempomedia

John Brennan | Alan Campbell | Keli Elkins David Rittvo | Ryan Sawyer

Bill Sokolic twitter: @downbeachfilm

Thomas Zitt

EDITORIAL ADVISORY BOARD

Rino Armeni, President, Armeni Enterprises

•

Mark A. Birtha, Senior Vice President & General Manager, Hard Rock International

•

Julie Brinkerhoff-Jacobs, President, Lifescapes International

•

Nicholas Casiello Jr., Shareholder, Fox Rothschild

•

Jeffrey Compton, Publisher, CDC E-Reports

twitter: @CDCNewswire

•

Dean Macomber, President, Macomber International, Inc.

•

Stephen Martino, Vice President & Chief Compliance Officer, MGM Resorts International, twitter: @stephenmartino

• Jim Rafferty, President, Rafferty & Associates

• Thomas Reilly, Vice President Systems Sales, Scientific Games

• Michael Soll, President, The Innovation Group

• Katherine Spilde, Executive Director, Sycuan Gaming Institute, San Diego State University, twitter: @kspilde

• Ernie Stevens, Jr., Chairman, National Indian Gaming Association twitter: @NIGA1985

• Roy Student, President, Applied Management Strategies

• David D. Waddell, Partner Regulatory Management Counselors PC

Casino Connection International LLC. 1000 Nevada Way • Suite 204 • Boulder City, NV 89005 702-248-1565 • 702-248-1567 (fax) www.ggbmagazine.com

The views and opinions expressed by the writers and columnists of GLOBAL GAMING BUSINESS are not necessarily the views of the publisher or editor.

Copyright 2023 Global Gaming Business LLC. Boulder City, NV 89005

GLOBAL GAMING BUSINESS is published monthly by Casino Connection International, LLC. Printed in Nevada, USA.

Postmaster: Send Change of Address forms to: 1000 Nevada Way, Suite 204, Boulder City, NV 89005

Publication

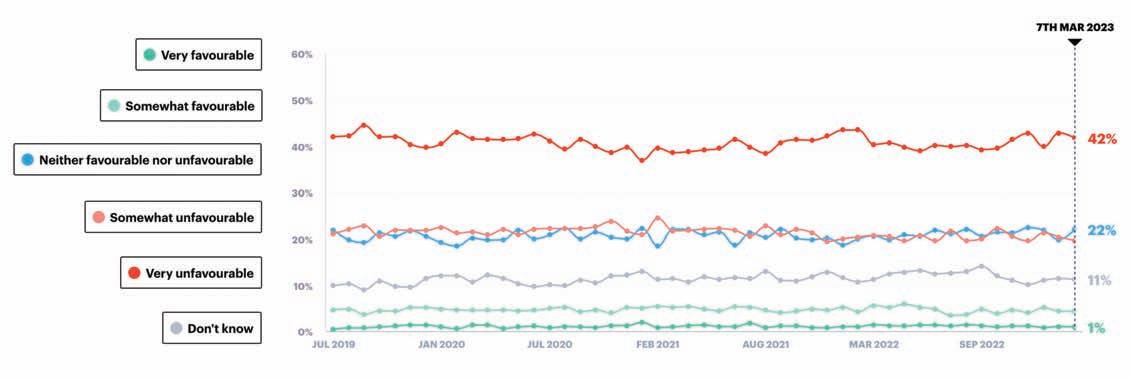

With years of attacks on the gaming industry to bolster opinion, it’s no surprise that the majority of British citizens have a negative view of gaming. In a monthly tracker, the YouGovUK website has consistently shown that a vast majority have an unfavorable or very unfavorable view of gaming, while less than 1 percent of respondents have a very favorable view. Contrast this with the U.S.,

The economic bounceback from the pandemic has been hampered by the reluctance of people to return to their previous jobs. That was particularly evident in the hospitality and retail industries, but things are improving. According to the Nevada Department of Employment, Training and Rehabilitation’s (DETR) January 2023 economic report, the total number of jobs in Nevada has surpassed 1.5 million. Las Vegas employment increased by 4,000 jobs (0.4 percent) since December and saw an increase of 62,600 jobs (6 percent) since January 2022. Reno employment had an increase of 800 jobs (0.3 percent) since December, and an increase of 11,900 jobs (4.6 percent) since January 2022. Nevada’s jobless rate still exceeds the national number.

where the annual State of the States survey by the American Gaming Association shows that at least 50 percent of Americans have a favorable view of gaming. Gaming observers in the U.K., however, say the opinion isn’t in step with reality since studies have consistently shown the problem gambling rate in the U.K. is only 0.2 percent to 0.3 percent.

Unemployment Rate - U.S. and NV January 2023

When Matt Sodl formed Innovation Capital, LLC with principals of The Innovation Group, a boutique investment bank focused on gaming was something new. Now, nearly 20 years later, Innovation Capital has advised on over $11 billion in transaction volume within the gaming, leisure, restaurant and retail industries. Most recently, the company acted as financial advisor to Bally’s in its successful bid for the Chicago casino project. Sodl talks about the current economic climate and why it continues to foster opportunities for tribes and corporations alike. He spoke with GGB Publisher Roger Gros from his offices in Boca Raton in February.

“We continue to believe that we’ve got the project that will open the quickest. We’ll start paying New York the taxes the quickest. It’s in an area that doesn’t need zoning approval.”

—Caesars Entertainment CEO Tom Reeg, on an earnings call, predicting that the operator’s Caesars Palace Times Square project will be the most beneficial to New York City

GGB: You’ve got a couple of earth-shaking deals right now, especially with the Bally’s Chicago deal. How did you accomplish that?

Matt Sodl: We had good fortune to be in some interesting situations over the last couple years in the postCovid era. The Bally’s Chicago project was one where we and Bally’s assembled a great team that put together a very good project, and we were very competitive. Going into it, everyone was telling us there’s an incumbent in that market that is a shoo-in to get the license. But we took a good project together with good people and aligned ourselves with the right constituents and the right piece of real estate. We put a $1.7 billion project together, and kudos to the Bally’s team and Soo Kim for the leadership and creating what is it going be a flagship property for them.

You had another impressive announcement last month as well in Miami. My partner Kevin Scheible was the lead on that project. He was advising the Poarch Band of Creek Indians from Alabama on their acquisition of a Magic City casino in Miami. We just opened an office in Florida a couple of years ago, and it’s nice to get a very large transaction done in the South Florida market. A lot of eyeballs were on that transaction because of because of the Seminoles having a monopoly on the state. But Poarch Creek saw what the opportunity is in the Miami market, and I think what they plan to do with that development opportunity is going to be pretty interesting.

In this current financial environment with a looming recession and high inflation, I would think that would mean making deals would be put on the back burner. But that doesn’t seem to be true. What are you seeing?

It’s a difficult environment to get to get deals done. The financing markets come in and out of favor. It’s a very choppy financial market. So, just when you put a deal like this together—whether it be Bally’s or Magic City—we have to navigate the financial markets. It means that the good transactions, the better projects are going to get done.

M&A activity always seems to happen whether it’s a good times or bad, and especially now in the sports betting field. Is that true?

When you look at the state reports of who the sports betting market share leaders are in the regional markets, it comes down to a handful of companies. There are dozens of new entrants that are trying to get a piece of what is a very small pie because the market share leaders aren’t going anywhere. They’ve built good products, they have cash resources, and they can be very aggressive from a marketing perspective. That means that these new entrants better have a unique twist on a product, or deep pockets behind them.

1 2 3 4 5

In the mainstream casino business, we’ve seen most of the big companies swallow each other up. Is there anything left to consolidate?

That’s a good question. Most of the big deals have gotten done. Caesars has pruned most of their non-core assets off and sold them. I would see perhaps some activity in the lower to mid-cap market. There are a handful of companies out there that have either, whether it be new projects that will put them on the map for some of the larger companies or some of these smaller companies who’ve tried to undertake some pretty large projects and haven’t had the most success. So you could bet that they’re on the radar of some distress companies looking to take advantage of an opportunity there.

April 19-20: East Coast Gaming Congress, Hard Rock Hotel & Casino, Atlantic City, New Jersey. Produced by Spectrum Gaming and Cooper Levenson. For more information, visit eastcoastgamingcongress.com.

April 19-20: SAGSE LATAM 2023, Buenos Aires Hilton, Buenos Aires, Argentina. Produced by Mongraphie. For more information, visit SAGSELATAM.com.

May 9-11: SBC Summit North America, Meadowlands Exposition Center, East Rutherford, New Jersey. Produced by SBC. For more information, visit SBCEvents.com.

May 15-17: Casino Marketing Boot Camp, General Managers Edition, Rolling Hills Casino Resort, Corning, California. Produced by J Carcamo & Associates. For more information, visit CasinoMarketingBootCamp.com.

May 23-25: CasinoBeats Summit (CBS), InterContinental in St. Julian’s, Malta. Produced by SBC. For more information, visit SBCEvents.com.

May 23-25: Gambling & Risk Taking Conference, Park MGM, Las Vegas. Produced by UNLV’s International Gaming Institute. For more information, visit unlv.edu/igi/conference.

May 25-27: Gambling Brasil, Frei Caneca Convention Center, Sao Paulo, Brazil. Produced by Afiliados Brasil. For more information, visit GamblingBrasil.com.

June 13-15: Canadian Gaming Summit, Metro Toronto Convention Centre, Toronto, Ontario, Canada. Produced by the Canadian Gaming Association and SBC. For more information, visit canadiangamingsummit.com.

June 20-23: International Gaming Summit, Culloden Estate and Spa, Belfast, Northern Ireland. Produced by the International Association of Gaming Advisors. For more information, visit TheIAGA.org.

August 8-10: OIGA Conference & Tradeshow, Cox Business Convention Center, Tulsa, Oklahoma. Produced by the Oklahoma Indian Gaming Association. For more information, visit oiga.org/tradeshow.

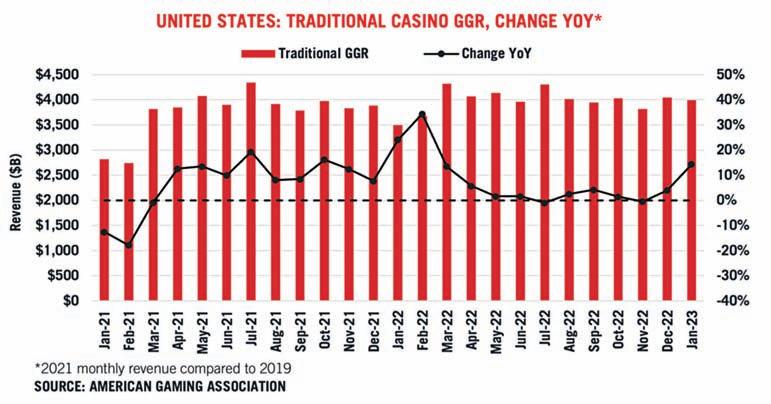

The commercial gaming industry entered 2023 on the heels of back-toback record revenue years, generating more than $60 billion in 2022. With continued macroeconomic uncertainty likely this year, all eyes in the industry are focused on whether consumers will be able to propel the continued expansion of the commercial gaming market.

January revenue numbers are now in across the country, and it’s clear gaming is off to a quick start in 2023: commercial operators brought in $5.4 billion in gaming revenue in the month, an all-time monthly high.

Here are three key takeaways on the industry’s promising beginning to the year and its outlook for the future.

Combined revenue from land-based casino slot machines and table games across the country reached $3.99 billion in January, marking a 14.3 percent increase from January 2022. Slots generated $2.86 billion in revenue, a 15.5 percent year-over-year increase, while revenue from table games gained 14.7 percent year-over-year, reaching $838 million.

This rise is partially due to the impact the Covid-19 omicron variant had on consumer behavior last January—as well as the launch of two additional commercial casino markets since last January in Virginia and Nebraska. Last year’s favorable comparison aside, this was the highest grossing January in history for the brick-andmortar segment.

While gaming’s expansion to new markets is contributing to growth, so is rising revenue in existing markets. At the state level, 31 of 33 commercial gaming jurisdictions that were operational in January 2022 (and have reported Jan-

uary 2023 revenue figures) posted year-over-year revenue growth.

The only two markets that did not report growth are Washington, D.C. and West Virginia. The sports betting market in Washington, D.C. experienced a decline of 23.8 percent compared to January 2023, likely due to increased competition from Maryland launching online sports betting. Meanwhile, West Virginia revenue declined by 6.3 percent, largely due to one less week of reported operations in January 2023 compared to January 2022.

While in-person gaming remains the bedrock of the gaming industry, the expansion and maturation of complementary verticals is also an important driver of gaming’s momentum.

Fueled by a busy sports calendar and the launch of mobile sports betting in Kansas, Louisiana, Maryland and Ohio (retail and mobile) since January 2022, nationwide sports betting activity—both online and in-person—saw a significant boost, with January wagering handle expected to reach an all-time high of more than

BY DAVE FORMAN$10 billion once all states report their data.

This surge in betting activity resulted in revenue of $922.7 million, a year-over-year increase of 43.3 percent. The Ohio market alone generated gross revenue of $208.9 million in its first month of operation, setting a single-month sports betting record for any state, albeit helped by promotional spending.

Combined January revenue generated by continuing iGaming operations in Connecticut, Delaware, Michigan, New Jersey, Pennsylvania and West Virginia increased by 20.6 percent yearover-year to $482 million, tying the single-month record from December 2022. All six markets reported annual growth for the vertical, with Connecticut, Michigan and New Jersey setting single-month state records for iGaming revenue.

Taken together, the online sports betting and casino gaming segments captured a quarter (24.8 percent) of monthly industry revenue—their largest share since the peak of the Covid-19 pandemic when brick-and-mortar casinos across the country were shuttered.

Ultimately, January’s revenue figures show that gaming is appealing to consumers in new markets but is also still growing its share of con-

sumer entertainment spending across existing verticals and markets. While we can’t predict how shifting macroeconomic conditions will affect the industry throughout the year, it’s evident gaming’s fundamentals remain solid and the industry’s future remains bright.

The American Gaming Association will continue to track and analyze the commercial gaming sector’s performance throughout the year via our Commercial Gaming Revenue Tracker.

This column was written prior to the release of January 2023 Arizona and Illinois commercial sports betting revenue figures.

Dave Forman is vice president, research for the American Gaming Association.

Afew years ago, we published a research note titled “Nevada Triple Play” extolling the investment virtues of three family-controlled, Nevada-centric gaming companies—Eldorado Resorts, Monarch Casino and Golden Entertainment.

Later, we added a fourth, Full House Resorts, which, while neither a family company nor fully Nevada-focused, possessed many of the same strengths and opportunities. The stocks of all four companies have since soared, providing returns of several hundred percent each.

Since then, Eldorado has purchased Caesars Entertainment and changed its name to Caesars. Monarch and Golden have achieved much of the business potential we saw for them. Full House is still to play out.

So where do we stand on those companies today? We are still with them, though for reasons that vary as the businesses have changed, and recognizing that the returns of the past several years are unlikely to repeat for most over the next several. Here’s a fresh look at the quartet:

• Caesars has undergone the greatest transformation from its much, much smaller Reno beginnings.

The investment thesis: The same steadfast family control, a CEO in Tom Reeg focused perhaps like no other in the industry on the bottom line, and the potential of all of its large and varied assets—Las Vegas Strip resorts, regional casino network and 60 million-plus player database upon which to build a highly profitable online gaming and sports betting operation.

Given the prospect of generating EBITDAR approaching $5 billion in several years and an ever-improving balance sheet, it is likely that the stock will double in a reasonable amount of time from its recent $40 to $55 range, and then perhaps far more in the long-term.

Caesars sound bite: Size matters.

• Golden. With the sales this year of its Maryland casino and its slot routes business, Golden will become a pure play on the growth of southern Nevada.

The investor focus is on development of the

Strat in Las Vegas into a casino resort matching the revenue and profitability of would-be Strip peers like Circus Circus, Luxor and Excalibur, expanding the Las Vegas Valley tavern business to its stated goal of up to 100 units from today’s 64, developing its dominant Laughlin presence into a profitable and growing Las Vegas alternative and LV residents’ getaway, and maximizing returns of its locals casinos.

Achieving that should lift the stock from its recent $40-plus range to $60 or so, and even to near $80 if Golden receives the valuation multiples commensurate with its significant free cash flow and physical assets.

But in simplifying its business and generating more than $500 million from its Maryland and route sales, Golden has opened other possibilities.

The company will be positioned to grow. That could come through casino acquisitions. But it also could come in unconventional ways, such as extending the highly profitable tavern business (EBITDA exceeding $500,000 per unit) to other states, perhaps in partnership with Illinois-based J&J Ventures, which is buying its route business.

Golden could become an acquisition candidate itself. CEO and principal shareholder Blake Sartini was COO of Red Rock Resorts, whose chief shareholders, his brothers-in-law Frank and Lorenzo Fertitta, want to make their locals casino empire hyperlocal, including tavern development. Then again, a merger with another mid-size operator facing the same issues, say Monarch Casino, could make sense.

Finally, and perhaps most likely, Golden becomes a low-debt cash-generating machine returning capital to shareholders with special and recurring dividends and stock repurchases while Sartini and President-CFO Charles Protell search out expansion opportunities.

Golden sound bite: Optionality.

• Monarch Casino has come closest to achieving the potential we saw for it in Nevada Triple Play. While the stock might add another $10 or $20 or even $30 to its current $70s range, another fourbagger is unlikely.

And though CEO John Farahi is on the hunt

BY FRANK FANTINIfor an acquisition, one wonders if the uber-prudent businessman can find a property to match the mature Atlantis in Reno and soon-to-mature Monarch in Black Hawk, Colorado.

Aside from such an acquisition, the question is where the family-controlled company goes from here, especially with the Farahi brothers in their 70s. One possible answer is that John’s son Dan grows into greater responsibility. Another is that son and former COO David returns to take the helm.

For now, the debt-free company is sharing its growing mountain of cash with shareholders. Monarch recently announced a $5 a share special dividend and 30 cents-a-share quarterly dividend. Further dividend growth appears likely as the mountain rises.

One thing we know, John Farahi is an exceptional operations CEO and a man of utmost integrity and purpose. He will find the best route for shareholders.

Monarch sound bite: Free cash flow machine.

Full House Resorts reported disappointing fourth quarter earnings that caused the stock to sell off. Our response: Thank goodness. We were able to buy a few more shares at what should prove to be bargain prices.

The fourth quarter has virtually nothing to do with its outlook.

• Full House has new properties this year in Chicagoland and Cripple Creek, Colorado, that will triple the legacy $40 million or so in EBITDA in the foreseeable future and probably quadruple it over time.

Most analysts have target prices of $13 or $14 on the stock recently selling around $8. They are being conservative. A price of $20 in a year or so is more likely. And given the same valuation as peers, $25 and even $30 is credible in time. By then, always-imaginative CEO Dan Lee and his experienced management team are sure to have found new growth opportunities to pursue.

Full House sound bite: Growth, baby!

Frank Fantini is principal at Fantini Advisors, investors and consultants with a focus on gaming.

Eldorado, Monarch, Golden and Full House would have been good stock choices—if you listened

Gold Member Profile

Everi

everi.com

Everi is a leading supplier of imaginative entertainment and trusted technology solutions for the casino, digital and gaming industry. With a focus on both customers and players, Everi develops entertaining games and gaming machines, gaming systems and services, while also providing core financial products and services, player loyalty tools and applications, and intelligence and regulatory compliance solutions.

Bronze Member Profile

Euro Games Technology Ltd.

egt-bg.com

Euro Games Technology (EGT) is a global gaming manufacturer with headquarters in Bulgaria and representative offices in Europe, Africa, Asia and North, Central and South America. Apart from its core slot business, EGT’s portfolio includes casino management and VLT systems, EGT multi-player, and EGT digital, focused on all online gaming verticals.

Associate Member Profile

CDC Gaming Reports

cdcgamingreports.com

Since 2002, CDC Gaming Reports has been one of the industry’s premier news, commentary and analysis sources. With team members in eight U.S. states and the United Kingdom, and a close operational partnership with Inside Asian Gaming, CDC Gaming Reports brings the world of gambling to the industry’s professionals.

AGEM is an international trade association representing manufacturers of electronic gaming devices, systems, lotteries and components for the gaming industry. The association works to further the interests of gaming equipment manufacturers throughout the world. Through political action, trade show partnerships, information dissemination and good corporate citizenship, the members of AGEM work together to create benefits for every company within the organization. Together, AGEM and its member organizations have assisted regulatory commissions and participated in the legislative process to solve problems and create a positive business environment.

• The new chairman of the Nevada Gaming Control Board, Kirk Hendrick, hosted a workshop meeting on March 21, to discuss modernization of Nevada’s regulatory oversight of gaming technology. This informal dialogue was designed to gather information from industry representatives highlighting experiences and practices in other gaming regions. AGEM Executive Director Daron Dorsey attended the workshop and shared a general synopsis and recommendations gathered through feedback from the membership.

• AGEM aims to continue pursuing discussions with the Pennsylvania Gaming Control Board to improve approval procedures and processes for getting land-based and online gaming products into that market. It appears that there is consensus that common ground can be found to speed up timelines, as well as working with the agency to improve general procedures going forward, so AGEM will continue the efforts on behalf of the membership.

• Some months ago, AGEM commissioned an Industry Impact Analysis and Report which provides an extensive overview into the supplier sector, both in the U.S. and globally. Members were informed at the March meeting that the report is complete and will be distributed to the membership in the coming weeks. This important study has been commissioned by AGEM several times over the years, and highlights the benefits the industry brings to communities through job creation, wage growth and general improvements to society. The latest version shows the supplier sector has been resilient over the past three years through the pandemic and that recovery and growth continue throughout the gaming supplier sector.

• A new plan for AGEM meetings and events was unveiled to the membership at the March meeting. During the pandemic, the need to switch to virtual meetings highlighted how accessible and successful the gatherings could be. Since that time, more and more members have chosen to stay “virtual,” so from April onward, the usual monthly gatherings will be held via Zoom. One of AGEM’s strengths. however, is to provide a good arena for people to get together to share information and network, so going forward, in-person events will be held every three to four months. These will consist of a variety of formats featuring key speakers or panel discussions, highlighting companies or services that are industry-related, possibly followed by a lunch or dinner or reception. More detailed plans and objectives will be shared at the next meeting that will provide a more interactive and beneficial forum for members in the long term.

• The Indian Gaming Association Trade Show and Convention took place March 27-30 at the San Diego Convention Center. AGEM’s Dorsey and President Bob Parente attended a presentation prior to the show consisting of a dedicated sponsorship towards tribal educational initiatives. This philanthropic support marks a new direction for AGEM, focusing more on educational initiatives rather than commercial ones.

The AGEM Index decreased by 1.51 points in February 2023 to 950.91, a 0.2 percent decrease from the prior month. Compared to one year ago, the index was down 2.04 points, or 0.2 percent. During the latest month, six of the 12 AGEM Index companies reported stock price increases, which resulted in five positive contributions to the AGEM Index and seven negative contributions. The largest positive contribution to the monthly index was sourced to Aristocrat Leisure Limited (ASX: ALL), whose 7.6 percent increase in stock price led to a 9.27-point gain to the index. Additionally, Crane Co. (NYSE: CR) saw its stock price increase by 3.3 percent, leading to a 4.76-point gain to the index. The largest negative contribution to the index was sourced to Konami Corp. (TYO: 9766), whose 5.7 percent decrease in stock price resulted in a 12.48-point loss for the AGEM Index. All three major U.S. stock indices saw month-over-month decreases in February 2023. The Dow Jones Industrial Average decreased by 4.2 percent from the prior month, while the S&P 500 fell by 2.5 percent. Meanwhile, the NASDAQ dipped by 0.9 percent from January.

The American Gaming Association represents numerous companies that run legal gambling businesses in the U.S., including casinos.

In a comprehensive report issued last fall, the headline on AGA’s website noted that “Americans gamble more than half a trillion dollars illegally each year.” That includes $337.9 million in illegal online casino play and $63.8 billion at illegal sportsbooks—most of them online and based in foreign countries.

But the third category—at $109.2 billion—is described not as “illegal machines” but “unregulated machines.”

Why is that? The answer is complicated.

OK, very complicated.

That’s because a significant part of that $109.2 billion includes so-called “skill games” machines that look superficially like slot machines, but which include player options that can improve their chances of winning. Is that illegal?

Almost certainly so in some states, definitely not in others—and the status is murky in still others, all depending on the state’s specific gaming regulations and laws. A number of states feature lawmakers, regulators and law enforcement officials doing what they can to outlaw these games—in large part to protect the interests of regulated gambling outfits such as casinos, horse racing tracks and state lotteries.

But in Pennsylvania, such efforts have been unsuccessful because the state’s laws are too vague on the issue. Yet in Virginia, a 2021 law passed that explicitly outlaws the machines may prove to be too specific. “It is a bit of a Goldilocks problem,” says Chris Cylke, AGA senior vice president of government relations, in terms of figuring out exactly how to outlaw such machines if a state is so inclined.

But for Michael Barley, the chief public affairs officer for leading skill

games supplier Pace-O-Matic, there’s no reason for there to be an issue at all. He says the solution is to enact legislation that permits and regulates the games.

“When has a regulatory ban ever worked?” asks Barley, whose machines are present in 11 states. “We tried Prohibition, and that didn’t work. Why not just regulate and tax us?”

But Cylke counters that “people in the gray machines market just try to obfuscate the fact of what the games really are, and they gum up the works with political contributions. It’s a weak argument.”

The company stance is that it wants to see Pennsylvania in particular join a handful of jurisdictions such as Wyoming, Georgia and Washington, D.C. in formally regulating their machines. In fact, three Keystone legislators have sponsored a bill to do just that.

The legal battle in Pennsylvania dates back even before a 2014 court ruling that found that the state’s gaming laws do not permit oversight of skill-based games by regulators. A 2019 ruling further emphasized that point, making it apparent that it would take passage of a new, more specific law to change the status quo.

“The Gaming Act was intended to license slot machine operations at racetracks, casinos, hotels, and established resort hotels,” the Commonwealth’s Court ruling read. “The Pace-O-Matic games are not located at any of these types of facilities and there is absolutely no suggestion... that the Gaming Act was intended to apply to the facilities where the games are located, e.g., taverns and social clubs, or that the Gaming Act regulates the placement of slot machines at such facilities.”

And in May 2022 and in February 2023, Pace-O-Matic prevailed once again as Pennsylvania judges in two different counties ruled that the

States with casinos continue to battle unregulated “skill games,” and gaming associations continue to seek their ban, even as a few states begin to regulate and tax the slot-like games

company’s machines had been seized illegally in raids.

In Virginia, a back-and-forth on the wisdom of permitting the games led to a law that places an absolute ban on “skill games.”

But what is a skill game, anyway? Even expert poker and blackjack players, if pressed on whether those games were based on skill or luck, likely would simply answer “yes.” Both elements definitely apply.

State regulations tend to break down the “skill vs. luck” gambling issue into one of three directions.

One is whether skill is the “predominant” factor in whether a player is successful. Another is the “material element test” regarding whether chance plays a significant role in the result. The least common is the “any chance test,” which basically finds that if there is any luck involved, it constitutes illegal gambling.

The AGA has simplified this seeming conundrum, coming out against any activity where money is risked but which does not feature legal oversight. From the report:

“These unregulated machines look and act just like the slot machines found in a casino, but operate instead in unlicensed environments like bars, taverns, convenience stores and gas stations, where they prey on vulnerable consumers, including minors. Additionally, the lack of regulatory controls increases the risks they may be tied to criminal activity including money laundering, drug trafficking and violent crime.

“State lawmakers and regulators must take action to strengthen and enforce laws protecting consumers from these machines that often lure players in under the guise of being ‘games of skill.’”

But Barley disputes that characterization of his games, a popular version of which resembles a tic-tac-toe board where a player might have 30 seconds to choose which of the nine symbols on the screen to convert to “wild.” The shrewdest move would be to add the wild symbol in a slot that produces the equivalent of three consecutive matching symbols—and thus a winning result.

Pattern recognition and memory recognition skills also come into play with many games, so someone particularly adept and focused will “beat the house”—to use a gambling term—over and over, to the tune of about a 5 percent profit.

“In our games, you can win every single time. It just depends on how

you play it and if you’re a skillful, patient player,” Barley has said. “There are players that don’t put in such effort, and that’s their choice.”

Further muddying the waters is the fact that the AGA does not offer a stance on the legitimacy of “historical horse racing machines,” which quite similarly could involve the use of some skill by a player, but often do not.

Barley also notes that the reason many legislators are loathe to completely crack down on the machines is that in many cases they provide much-needed revenue for local charitable organizations. Three Pennsylvania lawmakers—state Senator Gene Yaw and state Reps. Jeff Wheeland and Danilo Burgos—in late 2021 announced plans for legislation, dubbed the “Skill Gaming Act,” that will regulate and tax such games at 16 percent of gross profits.

That bill has faced its own host of detractors, however, including operators of casinos, the Pennsylvania State Police, and former Governor Tom Wolf.

Barley also points to the company’s self-regulation efforts, such as hiring of a team of former Pennsylvania state police officers to enforce codes of conduct. That includes ensuring that the machines are not located in such an abundance in any one place that they effectively create “mini-casinos.”

He adds that the casino visitor is not similar to a visitor to a local store or tavern, who enters the door for other reasons but might spend a little extra time there to try to make a little money on one of the machines.

“They’re just two different customer bases,” Barley says.

In Virginia, House Majority Leader Terry Kilgore tried and failed in February to pass a bill legalizing skill-based games.

The state’s General Assembly had voted in 2020 to ban the machines, around the same time that the state legalized construction of casinos for the first time. But then-Governor Ralph Northam in 2021 backed a one-year

“In our games, you can win every single time. It just depends on how you play it and if you’re a skillful, patient player. There are players that don’t put in such effort, and that’s their choice.”

—Michael Barley, Chief Public Affairs Officer, Pace-O-MaticPace-O-Matic’s Dragon’s Ascent is a game focused on skill rather than chance, according to the ruling in D.C. which determined how the game fit into their standing gambling laws

delay in the ban due to economic pressures created by Covid-based shutdowns of many businesses.

An effort to declare the ban unconstitutional led to a Virginia judge issuing an injunction to block enforcement of the ban in December 2021, and the legality of the machines has been unclear ever since.

“The reach of the new law is enormous,” wrote gaming law expert I. Nelson Rose, a professor emeritus at California’s Whittier College, in support of a scrapping of the ban. “Virtually every game, both in the real world and online, would be outlawed.”

Lawmakers in numerous states have been lobbied on this debate to the tune of millions of dollars both by companies such as Pace-O-Matic and by regulated operators such as casinos and racetracks. That seems to be a major reason for the lack of consistency in support of either regulating or banning the machines—with the usual partisan political divide not being evident on the issue.

The Virginia Public Access Project concluded that Pace-O-Matic has donated nearly $1 million to political candidates in Virginia, with nearly an even split among Republicans and Democrats.

The extent of the division among lawmakers was underscored by a vote in the Kentucky House in early March in which 42 members opposed a bill to formally ban skill game machines, 35 supported it, and 23 members abstained.

That vote came just a day after a House committee had advanced the bill by a 13-7 vote. A separate bill would legalize the games under the oversight of a newly created Kentucky Gaming Commission, with truck stops permitted to have as many as 10 skill games and other businesses limited to a maximum of five.

Still, the two houses came together in mid-March and soundly defeated the skill-based machines by a margin of 64-32 in the House and 29-6 in the Senate. Pace-O-Matic spent over $135,000 on the campaign, compared with more than $800,000 by horse racing interests, according to the Kentucky Legislative Ethics Commission in 2022.

Some other states were also running campaigns that would eliminate the issue of skill games.

On one side, a joint federal and state investigation in South Carolina—where only the lottery, raffles and bingo are considered legal gambling—in December 2022 seized more than $1 million related to distribution of machines where a player can insert cash and attempt to

in

“shoot digital fish.” Such devices clearly are illegal in that state.

That raid was followed a month later by a letter sent by the AGA to the U.S. Attorneys in each state urging further action on such machines. The letter points to the “Johnson Act,” a federal law that prohibits the manufacture and sale of any “gambling device” unless a state or locality has enacted legislation specifically exempting a product from that law. That could have impact in states with no formal conclusions on skill machines, such as Pennsylvania or Virginia.

In New Jersey, the second state in the U.S. to legalize casino gambling in 1976 — and the source of the six-year legal battle to allow all state lawmakers to make their own decisions on sports betting that ended in success with a 2018 U.S. Supreme Court ruling—a spokesman for the Attorney General’s Office said that “determinations on what constitutes contests of skill are both narrow and fact-specific, such as baking or photography contests where the winner or winners are selected by a panel of judges who are using uniform criteria to assess the quality of entries.”

But Wyoming legislators in 2021 formally endorsed the Pace-O-Matic products as legal games of skill that depend primarily on a player’s skill, not on mere chance.

The Wyoming law that ended the controversy there led Pace-O-Matic executives in the summer of 2022 to invite five key Pennsylvania lawmakers to what in at least one case was an all-expenses-paid visit to the Cowboy State to meet with their legislative counterparts and hear why the legalization was approved.

While there, the guests attended what is described as “the world’s largest outdoor rodeo.” Pennsylvania’s legislative ethics laws do not prohibit such trips, even if a lobbyist pays for them.

According to Spotlightpa.org, a political action committee associated with the skill machine games industry contributed more than $1 million to elected officials from 2019 to 2022.

Opponents of skill games legalization are no less shy about lobbying lawmakers. The same news organization found that a 2019 bill proposing a ban on the games was in large part ghostwritten by executives for Parx casino, the state’s leader in that industry.

Coincidentally or not, the stalemate in Pennsylvania and elsewhere continues. And while Pace-O-Matic officials endorse legislation to regulate and tax the machines, the status quo arguably benefits them even more.

“These unregulated machines look and act just like the slot machines found in a casino, but operate instead

unlicensed environments like bars, taverns, convenience stores and gas stations. State lawmakers and regulators must take action to strengthen and enforce laws protecting consumers from these machines that often lure players in under the guise of being ‘games of skill.’”

—AGA

Playtech was established by Israeli entrepreneur Teddy Sagi in 1999 and has grown to become one of Europe’s most notable names in iGaming, with its software being utilized by a raft of prominent operators including the likes of Ladbrokes, William Hill and Bet365.

The firm’s innovations today run to an ample selection of web and mobile-based digital gaming applications that encompass everything from casino, poker and bingo entertainment to live-dealer and sports betting.

The London-based company released its first casino product in 2001 before going on to inaugurate its highly successful iPoker network some three years later. This was followed in March 2006 by its floatation on the London Stock Exchange with a valuation just shy of $1 billion and the subsequent appointment of former Oracle and PricewaterhouseCoopers professional Mor Weizer as chief executive officer.

The promotion of Weizer saw Playtech further ramp up its efforts at developing best-in-class gaming products and content that encompassed strong partnerships with a large number of iGaming licensees as well as the acquisition of multiple smaller software operators and developers. These endeavors resulted in rapid expansion to give the innovative company a presence in just about every corner of Europe’s flourishing online gambling industry.

“Playtech was established at the inception of the online gambling industry, and its offering has been developed with over 20 years of investment and experience in the iGaming sector,” says Weizer.

The firm highlighted quality and flexibility as other important factors in its growing success with the modular capacity offered by its Information Management Solution (IMS) platform serving as a prime example of these differentiators.

This cutting-edge advance provides licensees with all of the tools necessary to successfully manage and run an iGaming operation, while its modular construction means that distinct capabilities can be broken down into a set of easily identifiable services with distinct integrations for the more agile delivery of technology.

For iGaming operators with their own platforms, Playtech furthermore offers a software-as-a-service (SAAS) proposition for access to its vast range of innovative content. The company revealed that this plug-and-play advance gives licensees the chance to benefit from its entertainment while simultaneously taking advantage of low implementation costs and quick times to market.

Adding to its offer, Playtech runs a structured agreement model for partners who may lack the necessary technological expertise to succeed online despite having a strong retail brand. This configuration comes complete with a platform-based solution alongside a range of marketing and operational services, and has already been successfully rolled out with the state-owned

“Our mission has always been to empower our customers and partners to be successful. This continues today via our ‘source of success’ motto while delivering shared and long-term value for all of our stakeholders.”

Mor Weizer, Chief Executive Officer, Playtech

Holland Casino in the Netherlands in addition to a number of iGaming operators in Latin America.

Playtech disclosed that its forward-thinking data analytics offering is furthermore helping iGaming operators to improve player experiences and increase lifetime values. The firm asserts that this overture gives licensees all of the tools they may need to effectively evaluate “big data” and leverage real-time automated insights into players’ behavioral patterns so as to create a personalized gaming experience.

Playtech today possesses a premium listing on the London bourse’s respected main market while moreover sitting as an established member of the equally impressive FTSE 250 Index. With offices in 20 countries, the company has 180 partners operating in more than 40 regulated jurisdictions, and recently recorded adjusted EBITDA for the six months to the end of June 2022 of nearly $217 million, which equated to an increase of 64 percent year-on-year, driven almost entirely by online growth.

The firm described its initial float as “a significant milestone” that allowed it to begin raising capital to

pursue “an ambitious growth plan” that continues to be aimed at a multitude of regulated and soon-to-beregulated markets across the globe, including those in the United States, Canada and Latin America.

“Our mission has always been to empower our customers and partners to be successful,” says Weizer. “This continues today via our ‘source of success’ motto while delivering shared and long-term value for all of our stakeholders.”

With experience in the fields of online gambling, technology and finance, Weizer says he is now focused on continuing to discover ways for Playtech to “grow and innovate,” even as the world continues to come to terms with the war in Ukraine and the lingering impacts of the coronavirus pandemic.

“I have an unwavering and steadfast commitment to safeguarding our people and their families,” says Weizer. “I also have an ambition for this business to have a positive impact on people, communities, the environment and the wider industry.

“As such, we have established our five-year sustainability strategy with commitments and targets covering safer gambling, climate and diversity and

With offices in 20 countries, the company has 180 partners operating in more than 40 regulated jurisdictions, and recently recorded adjusted EBITDA for the six months to the end of June 2022 of nearly $217 million, which equated to an increase of 64 percent year-on-year, driven almost entirely by online growth.

inclusion alongside a broader contribution to the communities in which we operate.”

As part of this strategy, Playtech has detailed that it is committed to investing in responsible gambling technologies to build a safer and sustainable industry. This effort has so far included the 2017 acquisition of responsible gambling analytics solution provider Betbuddy alongside the integration of safer gambling solutions into the company’s IMS platform.

Playtech entered the budding iGaming market of the United States in Q3 2020 via its Playtech USA arm. The company initially followed a content-first approach by exploiting existing relationships to launch with New Jersey’s BetMGM, Party Gaming and Borgata brands before subsequently rolling out its online casino software in the Garden State with Bet365.

Weizer says the strict regulatory regime attached to New Jersey’s iGaming environment presented its teams with the “perfect litmus test,” as its initial expansion phase encompassed a focus on entering as many states where iGaming is legal before going on to grow its market share.

Playtech has since secured multi-product relationships with the likes of Parx Casino, 888 and Pokerstars, and is now licensed in eight American states, including Ohio, where it recently introduced a range of Class C retail sports betting kiosks via a partnership with Gold Rush Gaming.

Playtech’s American presence furthermore stretches to content and live-dealer studios for iGaming domains in Michigan as well as New Jersey, where the BetParx service is utilizing its IMS platform. The company noted that “further live facilities are progressing in Pennsylvania among other locations and where iGaming is most popular,” while it has recently grown its local operational and backoffice teams “in order to accelerate its presence in the region.”

The company admits that it entered the U.S. iGaming market later than many other European firms, but nevertheless believes that its success will be assured by the wide range of high-quality technology and capabilities it offers. It describes this portfolio as instrumental, as it looks to accelerate market penetration and deliver compelling and entertaining experiences that will simultaneously help partners to grow their businesses responsibly.

In Canada, Playtech describes the province of Ontario as “an exciting new iGaming environment” where the regulatory framework has been designed to maintain high standards across a number of areas including responsible gambling.

The firm inked a wide-ranging software and services agreement with NorthStar Gaming in December 2021 before going on to extend this relationship so as to allow the Toronto-headquartered operator to utilize its Playtech Protect advance alongside its live-dealer, poker, bingo and casino innovations.

When it comes to what is popular in the nascent iGaming market of North America, Playtech asserts that while sports betting states continue to outnumber iGaming compatriots five-to-one, official state reports surprisingly reveal that igaming accounts for some 40 percent of aggregated online and sports betting GGR in the U.S.

Playtech now employs over 130 people in the United States, and declares that it is “well-placed to serve and support the needs of American iGaming clients” across a wide range of critical areas from sales and information technology to project management and compliance.

Playtech also has noted it will only seek to deploy its retail sports betting technology “where and when this is financially and strategically viable.”

When it comes to what would constitute success for Playtech in the U.S. and Canada, it is intent on “replicating its success by becoming a leading supplier in the Americas” and “securing a significant market share” as well as a “presence in all states where iGaming is legal and competitive.”

The firm furthermore notes that it is consequently hoping to develop even more strategic projects that will help it to open up new revenue streams and further increase its standing while deploying safer gambling technologies and its “almost unparalleled library of top games” to a large club of American and Canadian partners.

“Our team’s depth and breadth of expertise forms the foundation for delivering the quality technology, must-have engaging content and reliable service that will make us a partner of choice as we expand across the United States and Canada,” says Weizer.

When it comes to what is popular in the nascent iGaming market of North America, Playtech asserts that while sports betting states continue to outnumber iGaming compatriots five-to-one, official state reports surprisingly reveal that igaming accounts for some 40 percent of aggregated online and sports betting GGR in the U.S.

Jerry Kadir joined Playtech USA some 15 months ago after nearly 18 years with Gaming Laboratories International (GLI), and he is now focused on delivering Playtech’s wide range of content to its growing list of American and Canadian clients. Kadir has a large amount of experience in the world of gaming, having previously worked across numerous states and managed multiple projects for a plethora of suppliers.

Playtech states that Kadir moreover has a detailed understanding of different regulatory agencies and the world of compliance alongside an in-depth knowledge of many casino products. The New Jersey-based professional expresses his belief that “customer satisfaction is the primary key to a successful business,” and that he looks to aid this process by “delivering what customers want on time without sacrificing quality.”

Looking ahead, Kadir says he is excited to be launching casino and live-dealer products from Playtech to partners in the United States and Canada, so as to drive the company’s expansion and further develop its relationships with licensees and operators.

Charly Jackson is responsible for managing Playtech

USA’s live-dealer studio in Michigan while additionally coordinating travel for all of the company’s American employees. Alongside these duties, the enthusiastic Southfield-headquartered figure is tasked with assisting in the design and production of the uniforms worn by all of the company’s customer-facing staff in the Wolverine State.

Before joining the ranks of Playtech USA in July 2021, Jackson worked as a customer service representative for a firm in the logistics sector. Although this post represents her first in the world of iGaming, the former teacher admits to being thrilled with an immersion in the culture of gaming and Playtech.

“We have exciting new offerings for our licensees based in the United States, such as our Fireblaze series, and I am excited for new licensees to join us as we showcase new games and tables for our American partners,” says Jackson.

With nearly a decade of experience in the iGaming sector, Gia Reece serves as the operations manager for Playtech USA’s live-dealer studio in Michigan. Reece joined the company’s ranks in March 2021 to help it build a first American live-dealer studio in New Jersey before being tasked with helping the firm to secure regulatory approval for its games and tables from the Michigan Gaming Control Board.

Reece says she is “proud to have been an essential part” of the team that brought Playtech live-dealer gaming to the American market, and is now looking forward to “contributing significantly to the growth and success” of her company’s Michigan endeavor. She furthermore expresses excitement at Playtech USA’s future prospects in the United States, and is now dedicated to “tirelessly working to create unique games that will provide an engaging entertainment experience.”

With a decade of experience in the gaming industry covering a range of information technology, field operations and sales engineer roles, Chris Applegate now serves as a customer success director for Playtech USA.

Las Vegas-headquartered Applegate held a senior technical role with online gaming software supplier GAN Limited before joining Playtech in January 2022. He says iGaming is “the next big step” in his career. He is now responsible for managing Playtech USA’s BetParx accounts in Pennsylvania, New Jersey, Michigan and Ohio while simultaneously handling its retail sports betting kiosk accounts in the Buckeye State with Gold Rush Gaming.

“I feel like I have finally found a home with Playtech USA,” says Applegate. “I am excited about what we have accomplished in the first year, including the launch of live-dealer solutions in multiple states and a state-of-the-art sports betting solution in Ohio. We have some exciting solutions planned, and I look forward to introducing these solutions in the near future.”

By Ryan Sawyer and Thomas Zitt

By Ryan Sawyer and Thomas Zitt

On March 1, the comment period closed on proposed revisions to two sets of regulations regarding development in Indian Country.

Under the leadership of Secretary Deb Haaland, the Department of the Interior is attempting to reform the process for acquiring lands into federal trust status for Native American tribes and individuals, commonly known as “fee-to-trust” or “FTT,” and on a parallel track, to rationalize and codify the rules that govern Class III compacts.

In this article, we focus on the proposed changes to the FTT process.

The acquisition of lands-in-trust status for Native American tribes is governed by the Indian Reorganization Act of 1934, with regulations codified at 25 Code of Federal Regulations Section 151, known colloquially as the 151 Regulations.

Proposed changes to the 151 Regulations could lead to a more predictable, impartial, efficient and timely process for tribal governments seeking to establish or expand their land base for economic development purposes, including new gaming developments.

To be eligible for gaming, newly acquired trust lands must meet certain criteria outlined in Section 20 of the Indian Gaming Regulatory Act (IGRA) of 1988. IGRA prohibits gaming on trust lands acquired after October 17, 1988 (the date IGRA was enacted), but allows for several “exceptions.” These exceptions are described fully in 25 CFR Section 2719, and generally include:

1. If the land was within or contiguous to the boundaries of the tribe’s reservation on October 17, 1988 (or the tribe’s last recognized reservation);

2. If the land is acquired into trust as part of the settlement of a land claim;

3. If the land is acquired into trust as the initial reservation for a tribe acknowledged by the secretary under the federal acknowledgment process;

4. If the lands qualify as “restored lands” for a tribe that is restored to federal recognition; or,

5. If the secretary issues a “Two-Part Determination” that gaming activities would be (1) in the best interest of the applicant tribe, and (2) not detrimental to the surrounding community; and the state’s governor concurs in the determination.

Under exceptions 1- 4, the tribe must request an Indian Lands Opinion from the Office of Indian Gaming to verify that the lands would qualify for gaming under IGRA. Many, if not most, of the pending applications for gaming-related trust acquisitions today involve exception 5 (two-part determination), meaning they will ultimately require approval by the state’s governor in addition to Interior. There are no proposed federal amendments or revisions to the federal process for determining gaming eligibility under IGRA.

After consultation with tribes earlier in 2022, the Office of the Assistant Secretary for Indian Affairs published the draft regulations (outlined in 25 CFR Part 151) last December. It is expected that the final regulations may be published later this year, perhaps as early as May or June, although no official release date has been announced. While the final rule may be revised pending the outcome of further tribal consultation and public comment, the draft rule contains significant substantive and process-related

changes. To remove obstacles that tribes and individual Native Americans have faced in the trust acquisition process, Interior has added new definitions, clarified requirements that have been common practices, and made other minor changes throughout the rule.

The proposed rule classifies four different forms of acquisitions—on-reservation, contiguous to reservation, off-reservation, and initial Indian acquisitions—with the last being a new fourth category designed to ease the process for those tribes that do not currently possess any land in trust. Requirements vary for each category, and the application process is more streamlined, as discussed below.

While the “purpose” of a tribal government’s acquisition must still be identified, the Bureau of Indian Affairs (BIA) would no longer be required to consider its “need.” It will now be presumed, based on decades of BIA experience in acquiring and administering trust lands, that the tribal community will benefit from the acquisition. This change would apply to all categories, saving tribes the cost and time of documenting why they “need” the acquisition (sorry, consultants).

For on-reservation acquisitions, the requirement to consult state and local governments is eliminated. However, for acquisitions of contiguous land, state and local governments will continue to have a 30-day period to submit comments regarding impacts on regulatory jurisdiction, real property taxes and special assessments. If no comments are submitted, there will be no need for the secretary to consider these issues.

Furthermore, when reviewing a tribe’s request for land that is located within or contiguous to an Indian reservation, the secretary presumes that the acquisition will be approved.

Off-reservation acquisitions would still require state and local government consultation. However, off-reservation applications would no longer require a business plan, and consideration of distance from the reservation is eliminated, with the presumption that the tribal government would factor location into its request and benefits would occur to the tribal community. However, the secretary will generally consider the location of the land

Landless tribes have a new opportunity to create reservations if they can meet updated Interior Department regulations on taking land into trust, essential to the process of building casinos that will support them financially.

in a holistic analysis of the application and in light of comments received from state and local governments.

The new rules expand the description of the allowable purpose of an acquisition beyond the current requirement to “facilitate self-determination, economic development, or Indian housing.” Under the new rules, the secretary “shall give great weight” to whether the acquisition will: “further establishment of a land base or protect tribal homelands, protect sacred sites or cultural resources and practices, establish or maintain conservation or environmental mitigation areas, consolidate land ownership, acquire land lost through allotment, reduce checkerboarding, (or) protect treaty or subsistence rights.”

The proposed rule lays out in regulatory text the process for determining whether a tribe was ‘‘under federal jurisdiction’’ in 1934, as required by Carcieri v. Salazar in 2009. The revised Carcieri analysis should make assessing statutory authority here simpler and faster for certain tribes. For tribes that already have received a favorable Carcieri analysis, no additional analysis is needed.

Requests pending on the effective date of the final rule will continue to be processed under the current rule, unless the applicant requests in writing to proceed under the new rules. Upon receipt of such a request, the secretary shall process the pending application under the new rule, although the 120day requirement for a decision would not apply (as proposed in the draft).

Substantively, it does not appear that the new rule will require additional information beyond the current requirements, so there will likely be no need to alter or supplement any current pending applications under the new rules.

The draft rule would require a decision by the BIA within 120 days of assembling a complete application package. This is the big enchilada prompting a lot of anticipation in Indian Country, since “complete application packages” have all-too-frequently lingered for years without decision. However, we should clarify two important caveats.

First, there are no defined mandatory timelines required for interim steps such as completion of the National Environmental Policy Act (NEPA) process, removal of unacceptable encumbrances, completion of a Carcieri analysis (where required), or completion of title and land description reviews.

Second, we would note that a two-part determination—which applies to many of the more recent applications that involve gaming—can be a very subjective process fraught with uncertainty that, at the end of the day, is subject to a governor’s veto.

In summary, while the revised rules are highly welcomed by tribal authorities, expectations related to new gaming developments should be tempered.

While the new rules could lead to an uptick in fee-to-trust for general economic development, they are unlikely to cause a dramatic increase in the viability of new gaming-related off-reservation trust acquisitions. The new FTT rules in no way alter or streamline the process for determining whether a newly acquired trust property may be eligible for gaming under IGRA (codified at 25 CFR Part 292).

That said, the new rules could have a measurable impact on timelines for complex initial-reservation or off-reservation FTT applications that currently have the potential to be delayed due to consideration of the “need” for the acquisition and/or the distance from the applicant tribe’s reservation/tribal headquarters.

The parallel effort regarding Class III gaming compacts (codified at 25 CFR Part 293) involves issues that are more complicated and fraught. Since the existing 293 regulations address procedural matters only, Interior is seeking to codify substantive regulations (which currently exist in the form of decision letters and interpretation of case law) to “provide certainty and clarity on how the secretary will review certain provisions in a compact.”

While we don’t have the opportunity to detail the proposed draft 293 regulations in this article, we would note that commercial gaming interests have raised concerns during the public comment period, and there were also differing opinions among tribal leaders during the initial consultation.

A particularly thorny issue involves iGaming, which current rules do not address. The “overwhelming majority” of tribal leaders who submitted comments agreed that the regulations should “include provisions that facilitate statewide remote wagering or internet gaming,” although some were opposed for various legal and strategic reasons. The draft 293 regulations do include new language that clarifies iGaming may be an allowable provision in new or amended state compact agreements if certain criteria are met; however, the final rules may be modified pending Interior consideration of public comments.

We’ll be tracking how this extremely complex and contentious issue ultimately is resolved.

The proposed rule classifies four different forms of acquisitions—on-reservation, contiguous to reservation, off-reservation, and initial Indian acquisitions—with the last being a new fourth category designed to ease the process for those tribes that do not currently possess any land in trust.

By David Rittvo

By David Rittvo

It’s an odd number year, which can only mean it’s time for the Texas casino expansion discussion to begin anew during the state’s biennual legislative session.

Optimism abounds in Austin, and around the state, that the legislature can make progress on passing bills to expand gaming in Texas before the session ends in May. Let’s break down those odds.

Not much and everything, depending on who you ask. One significant change is the ability of the two federally recognized tribes in Texas to operate Class II gaming machines without fear of reprisals from state officials. The Supreme Court case Ysleta del sur Pueblo v. Texas solidified their ability to operate electronic bingo, as it is not illegal in other parts of the state.

Both the Ysleta del Sur Pueblo, located near El Paso, Texas, and the Alabama Coushatta Tribe of Texas, north of Houston, now have the autonomy to operate Class II gaming regardless of the state’s rules prohibiting gaming. Both tribes could initiate a large development project to capitalize on the market just north of Houston. While not directly impactful to the state’s budget, more legal gaming in Texas could influence the pace at which legislation advances.

Casino operations in Louisiana, Oklahoma and New Mexico continue to derive a large market share from Texans, and these markets continue to grow. In Louisiana, the gaming tax revenue from the Lake Charles and Shreveport/Bossier markets has continued to create solid funding sources for the state’s various needs.

In Oklahoma, tribes on the border—mainly the Chickasaw and Choctaw Nations—have developed large-scale, world-class resorts that provide exceptional and unique guest experiences, and ample resources for the tribes to grow and prosper. The continued annual leakage of revenue and gaming tax revenue, not to mention sales, property and other related tax revenues, should motivate the Texas legislature to consider a thoughtful gaming expansion in Texas.

Governor Greg Abbott has always opposed any expansion of gaming— until now

Opponents might counter that the state budget has an unprecedented surplus and thus requires no additional funding. While that is true, the budget surplus can easily turn to deficits, and planning for those dips is vital for a state thriving and growing like Texas.

Legislative leadership is the same as in 2021, but some of their tones and tenors have evolved. Fresh off his reelection, Governor Greg Abbot has expressed support for exploring the opportunity to expand gaming while maintaining that it should be put up to the voters through a referendum.

House Speaker Dade Phelan has been more positively vocal of his support for the passage of a bill, and believes that Texas voters would pass a statewide referendum overwhelmingly. Lt. Governor Dan Patrick has continued his vocal opposition to any bill. Although quietly, he might allow a bill to be heard in the Senate if he believes widespread support exists. All three wield varying degrees of influence over any bill’s trajectory through the legislature.

The industry’s position has remained resolute with interesting, nuanced changes that could propel the legislation forward. Las Vegas Sands (LVS) continues to be the tip of the spear and lead on lobbying efforts. Their cadre of 70 lobbyists is working very hard to demonstrate the positive economic, jobs and fiscal impacts of large-scale, resort-style casino developments.

While LVS is leading the lobbying charge, other operators with eyes set on Texas are working cooperatively to spread a message of economic prosperity.

Bills have been filed in both the House and Senate, and each mirrors the other. Senate Joint Resolution 17 and House Joint Resolution 97 offer similar paths to the development of large-scale resort destinations hosted in multiple Texas cities.

The Senate bill has been assigned to a committee, but a hearing date has not been set as of this writing. Currently, the House resolution is still waiting for a committee assignment. Each bill outlines the creation of a Texas Gaming Commission and provides for developing two large-scale resort developments in the Dallas and Houston metroplexes.

These four resorts would have to spend $2 billion each, and preference has been granted, through the horsemen’s involvement, to two existing tracks—Sam Houston Raceway, owned by Penn Entertainment; and Lone Star Park, owned by the Chickasaw Nation of Oklahoma.

Another resort could be located in the San Antonio/New Braunfels metropolitan area with a development budget of $1 billion. Finally, two other developments have been outlined in Corpus Christi and McCallan, tethered to existing horse track licenses in each city, with a required investment of

The addition of racetracks to the approved sites for casinos could make a big difference, including Sam Houston Raceway, owned by Penn Entertainment

$250 million each.

The proposed tax rate in all cases is 15 percent. The addition of the horsemen is a new factor this session. The hope is that by bringing them into the fray, the scope and reach of legislative support will expand into rural areas of Texas.

Both of these bills could be marked up and edited through the committee hearing process, with changes to the locations, spending protocols and tax rates likely before either bill exits committee and reaches a floor vote. It is important to note that during the 2021 session, previous bills failed to reach a full committee vote and thus did not progress to the floor.

The 2023 legislative drafting has coalesced the public and the industry. The results of a University of Houston Hobby School of Public Affairs poll conducted in January 2023, after the draft bill’s release, show strong support for expanding gaming across a wide range of population groups.

Over 75 percent of Texans support the passage of the legislation. Interestingly, the poll shows support from groups who have normally been opposed to the expansion of gaming, born-again Christian and evangelical Protestants.

• 75 percent of Texans support, including 41 percent strongly supporting its passage.

• 25 percent of Texans oppose, including 13 percent strongly opposing its passage.

• 66 percent or more (roughly two-thirds) of each of the 22 Texas sociodemographic subgroups examined support its passage.

• 83 percent of Black, 77 percent of Latino, and 73 percent of white Texans support its passage.

• 78 percent of men and 72 percent of women surveyed support its passage.

• Texan generational support for its passage ranges narrowly from a high of 81 percent among millennials to a low of 69 percent among Gen Z.