BRENT DONNELLY

CURRENCY TRADER, STRATEGIST, AND AUTHOR

INITIAL REACTIONS TO THE INVASION

TERMS OF TRADE SHOCK FOR EUROPE

• ENERGY PRICES EXPLODE

• FEARS OF A COLD WINTER IGNITE PANIC

• AFTER 6 MONTHS, THE WORST CASE SCENARIO IS PRICED IN

INITIAL REACTIONS TO THE INVASION

TERMS OF TRADE SHOCK FOR EUROPE

TERMS OF TRADE SHOCK: EUROPE

• GERMAN TRADE BALANCE COLLAPSES

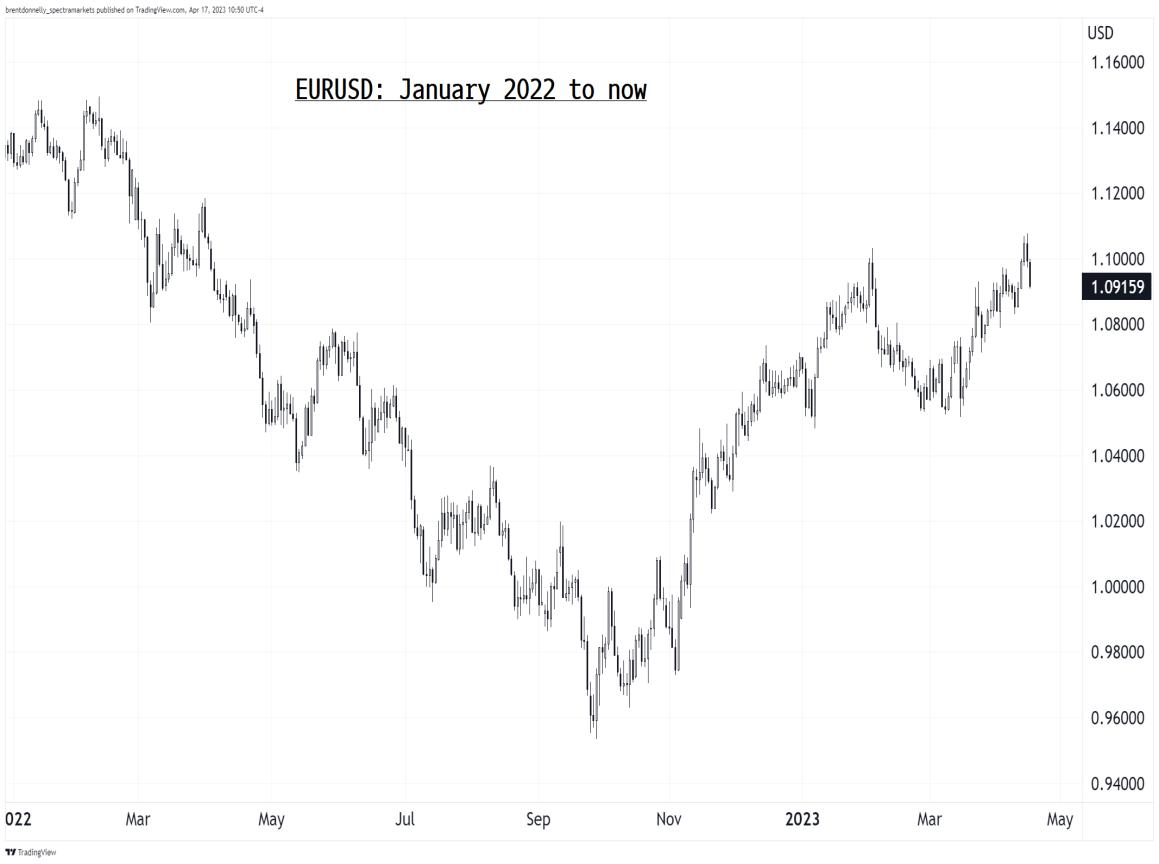

• EURUSD PLUMMETS

• BAD FOR THE ECB… INFLATION WAS ALREADY A PROBLEM

TERMS OF TRADE SHOCK: JAPAN

• OIL PRICE RISE TRIGGERS PANIC BUYING OF USDJPY BY OIL IMPORTERS

• RISING YIELDS FORCE BOJ TO INTERVENE IN JGB MARKET TO CAP YIELDS

• PERFECT STORM FOR A DISORDERLY RISE IN USDJPY

THE FEAR

THE REALITY

THE REALITY: THE SHOCK WAS SHORT-LIVED

USDJPY REVERSED TOO, BUT NEEDED MOF HELP

WHAT ABOUT THE DOLLAR?

• EVEN AS THE DOLLAR RALLIED, SOME FEARED THAT CUTTING RUSSIA OFF FROM SWIFT AND SEIZING ITS RESERVES COULD HURT THE DOLLAR’S

GLOBAL STATURE

• COULD WEAPONIZATION OF THE DOLLAR TRIGGER DEDOLLARIZATION?

THE END OF THE DOLLAR?

SOUNDING THE ALARM

OVER THE US DOLLAR’S RESERVE STATUS AND US DEBT LEVELS ALWAYS SOUNDS SMART

IT’S A THEME THAT GETS CLICKS AND SELLS MAGAZINES

CONTEXT IS IMPORTANT: THIS IS A PERENNIAL, EVERGREEN THEME

THE USA IS DOOMED. EVERY YEAR.

THE FEAR

THE REALITY: USD IS STABLE, AND ITS PERFORMANCE IS CYCLICAL

Actual performance: US DOLLAR, 1973 to now – No structural decline

THE REALITY

• GLOBAL DOLLAR USAGE IS STEADY OVER THE PAST 30 YEARS

Most used currencies in global transactions (1989 to now)

• USD AS A % OF CENTRAL BANK RESERVES FELL FROM 2003 TO 2010 BUT HAS BEEN STABLE SINCE

Source: BIS Triennial Report, 2022

THE REALITY

• PETRO YUAN AND YUAN AS A RESERVE CURRENCY ARE NOT HAPPENING IN ANY MEANINGFUL WAY

• CAPITAL CONTROLS AND OTHER ISSUES LIKE RULE OF LAW MAKE CNY UNATTRACTIVE

• DEEP US CAPITAL MARKETS AND RULE OF LAW ENSURE GLOBAL DOMINANCE OF USD FOR MANY DECADES

CONCLUSION

• FIAT CURRENCIES ARE SLOWLY MELTING UNDER THE HEAT OF EXTREMELY AGGRESSIVE FISCAL AND MONETARY POLICY, BUT THE USD IS THE CLEANEST DIRTY SHIRT

• THIS IS AN ARGUMENT FOR HARD ASSETS, NOT FOR THE END OF THE DOLLAR

• THE DECLINE OF THE AMERICAN EMPIRE AND LOSS OF RESERVE CURRENCY STATUS (IF IT HAPPENS) WILL TAKE MANY DECADES

• WORRYING ABOUT THE END OF THE DOLLAR IS NOT USEFUL ON ANY TRADING OR INVESTING TIME HORIZON

• THE VALUE OF THE DOLLAR IS CYCLICAL

• DEDOLLARIZATION IS NOT HAPPENING

“SLOWLY… THEN ALL AT ONCE”

ONLY SOUNDS SMART WHEN HEMINGWAY SAYS IT…