Portfolio Construction with Climate-related investments

November 15th, 2022

Hays

Hays

Director of Sustainable & Impact Investing, Managing Director

Mark

November 15th, 2022

Hays

Hays

Director of Sustainable & Impact Investing, Managing Director

MarkThis presentation is intended to be an unconstrained review of matters of possible interest to the audience and is not intended as personalized investment advice. Advice is provided in light of a client’s applicable circumstances and may differ substantially from this presentation. This presentation is not a recommendation of any particular investment. Alternative investments, such as private equity, are only available to investors who meet specific criteria and can bear certain specific risks, including those relating to illiquidity. Opinions or projections herein are based on information available at the time of publication and may change thereafter. Information gathered from other sources is assumed to be reliable, but accuracy is not guaranteed. Outcomes (including performance) may differ materially from expectations herein due to various risks and uncertainties. Any reference to risk management or risk control does not imply that risk can be eliminated. All investments have risk. Clients are encouraged to discuss the applicability of any matter discussed herein with their Glenmede representative. Information obtained from third parties relating to “ESG” and other terms referenced in this presentations vary as each party may define these terms and what types of companies or strategies are included based on its own taxonomy, but these efforts are limited by the extend of information shared with each information provider. Definitional variation may therefore limit the applicability of the analysis herein. Any reference herein to any data provider or other third party should not be construed as a recommendation or endorsement of such third party or any products and services offered by such third party.

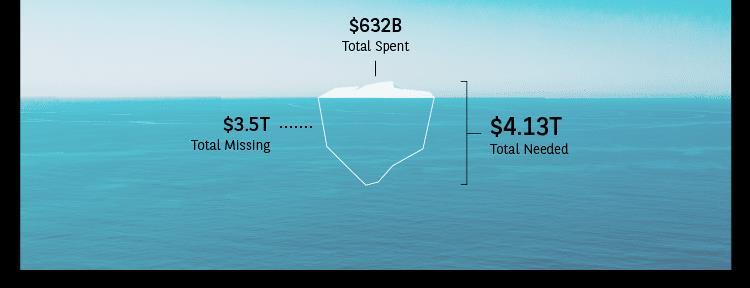

Source: Carbon Policy Initiative as of Q4 2021

Exclude the highest emitters with lack of commitments or investments going forward

Invest with leaders within sector and engage to drive change

Position towards low carbon solutions leaders

Moving from “do no harm” to “resiliency” to “solution leaders”