FINANCIAL AID Your Guide to

ItisanexcitingtimetobeaGreenvilleUniversityPanther.Wefind ourselvesuniquelypositionedtopreparestudentsfortheopportunities andchallengesahead Throughaninnovativecurriculumanddynamic communitylife,wearecommittedtodeliveringaChrist-centered education,empoweringstudentsforlivesofcharacterandservice.

Weknowthatnavigatingthefinancialaidprocesscanbestressful,which iswhywenotonlywanttoequipyouwiththisbooklet,butwealso promisetobetheretohelpyoueverystepoftheway!Wearecommitted tomakingsurethatourstudentshaveallthesupporttheyneedtohavea life-changingexperiencehereatGreenvilleUniversity!

Eachyear,donorsandalumniatGUfundmorethan$1millionin scholarships.TheyLOVEhelpingstudents.TheybelieveinGU’sChristfocused,liberalartseducation Manygivebecausetheywantyouto experiencetheacademic,spiritual,andemotionalgrowththey experienced nottomentionforminglong-lastingfriendships while attendingGU

Again,pleaseknowthatweareheretohelpeverystepoftheway!Please emailusatadmissions@greenvilleeduorcall/textusat618-227-6166

Sincerely,

Victoria Clark

ChiefEnrollmentOfficer

Schedule a Financial Aid Call with your Admissions Counselor.

Say Yes to GU! Submit your Enrollment Deposit. The $200 Enrollment Deposit is refundable through June 1st and is applied to your bill

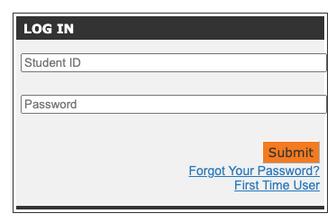

Accept your Awards and Loans. Log onto your Financial Aid Hub to view and accept your award More information on page 11

greenville edu/admissions/deposit html apply greenville edu/apply/status

Student Loan Entrance Counseling

Student Loan Master Promissory Note (MPN)

Taking out loans? Complete the following documents: Parents taking out loans? Complete the following documents:

Parent PLUS Loan Application (Available April 1st)

Parent PLUS Loan Master Promissory Note (MPN)

Please be sure to check your financial aid hub and email account to see if the financial aid team needs additional documentation

Register to attend Pre-Panther Day this summer: studentaid gov/h/complete-aid-process

Submit your final official transcripts after graduation

Set up a payment plan and/or pay your remaining balance. Bills are available after July 1st. See more information on page 12

We strongly advise that you schedule a financial aid call with the admissions team to make sure that you fully understand your award.

Your financial aid award gives you an indication of how much financial aid you qualify for. There are three primary types of financial aid:

These grants are free money This is money that you do not have to pay back. It has been offered to you based on the information that you filled out on your Free Application for Federal Student Aid (FAFSA).

Common Grants

Pell: Federal Grant

SEOG: Federal Grant

MAP: For Residents of IL only

Many institutions will offer you more money your first year than for your subsequent years That is NOT the case at GU, but we do encourage you to ask this question as you review other financial aid awards

This is free money This is money that you do not have to pay back. It has been offered to you based on need and/or merit 100% of traditional undergraduate students receive scholarships. You should see at least one GU scholarship on your award

This is your award for your entire time at GU if you maintain good standing with the institution and with your scholarship program (See your offer letter for specific parameters).

Your financial aid offer lists federal loans for which you are eligible

This is based on the information you supplied on your FAFSA. You borrow federal student loans from the US Department of Education. They are subsidized or unsubsidized Please note that you are not required to take out student loans nor are you required to take out the entire loan that you are offered. This is just one option that we provide you with to help finance your education.

Subsidized – Awarded to students who demonstrate financial need. The US Department of Education pays the interest while the student is enrolled at least half-time. Payment is deferred until 6 months after graduation or withdrawal from school. Unsubsidized – Awarded to students who complete the FAFSA each year. Interest begins to accrue at the time of disbursement. Payment is deferred until 6 months after graduation or withdrawal from school.

Parent PLUS Loan – Credit-based loan from the US Department of Education that a parent or guardian can apply for each year. The maximum amount a parent or graduate student may apply to borrow is equal to the Cost of Attendance less any other financial aid for which the student has qualified Applications open on April 1st

If a PLUS Loan is not approved, a student may be awarded additional unsubsidized loans in its place.

An origination fee is a percentage of your loan amount charged by the lender for the processing of your loan. Therefore, the amount you receive might be slightly lower than the amount you accept.

The interest rate is the percentage of the amount loaned charged as a fee to the borrower on top of the principal balance

Direct Subsidized Loans (22-23)

Direct Unsubsidized Loans (22-23)

Parent PLUS Loans (22-23)

Greenville University aims to be up front and transparent about our costs and payment options. The figures below are on an annual basis and are estimated charges.

room isn’t just where you sleep, this is your home for your time at Greenville, and we want you to make it your own! We encourage you to personalize your room to make it feel like home.

Keep in mind that full-tuition scholarships are rare. However, don’t be discouraged. With effort and work on your part, you can now have options that will allow you to graduate from college with minimal to no debt

Greenville University wants you to not only graduate with a degree but also with a resume filled with experiences. Having a student job on campus is not only a great way to help finance your education but also a great way to strengthen your resume Keep in mind if you earn $10 per hour and work for 8 hours each week in a 15-week semester, that would help you earn $1,200 a semester to help cut the costs. Greenville will partner with you to find employment. Just contact:

Kelli Pryor, Coordinator of Career Services 618.664.6655 kelli.pryor@greenville.edu

Also, many corporations that you may work for during the summer will not only pay you a salary, but they also offer scholarship opportunities In some careers, it might be possible to work and have your employer pay off your student debt for a guaranteed number of work years within the company.

Scholarships come in many forms and from many sources including your high school guidance office, local organizations, associations, foundations, employers, your church, or family members. It is never too late and always a good time to look for outside scholarships. Outside scholarships are awards that do not come directly from the university.

This aid must be counted by the Financial Aid Office as a resource, so be sure to make us aware of any money coming in from an outside source

Have you received a scholarship award from another institution that is better than your award at GU? If so, send us that scholarship offer letter and we will do our best to match what the other school is offering you.

Are you interested in choir, band, worship team, gospel choir, cheer, dance, esports, bass fishing, or outdoor adventure club? If so, you may be eligible for additional scholarships. Talk to your admissions counselor to learn more!

Ask your church representative to submit the Church Partnership Application. Applications must be received before March 1st prior to enrollment. GU will match up to $1,000 of support received from the church Learn more here.

Sometimes federal student and parent loans are not enough to cover all educational expenses. For this reason, students and parents may consider applying for a private, alternative loan that may be used as a supplemental resource for paying college costs Alternative Loans are unlike Direct or PLUS loans, for they require a separate application, a credit check, and may require a co-signor. Many factors can be used to evaluate each loan product and lender. The factors include, but are not limited to, interest rates, origination fees, loan principal reductions, borrower type, and customer service. You are free to choose any lender and loan product you feel best suits your needs Learn more about your loan options here!

We are here to help with any question you may have about your scholarships, financial aid, grants, loans, payments, or anything else you can think of! Here are a few ways to connect with the admissions team.

Schedule a personal call:

Call: 618-664-7100 Text: 618-227-6166

admissions@greenville edu