The official magazine of Home Builders Association of Middle Tennessee President

Brandon Rickman

Vice President Jim Hysen

Secretary/Treasurer

Kelly Beasley

Executive Vice President John Sheley

Editor and Designer Jim Argo

Staff

Connie Nicley

Kim Grayson

THE NAIL is published monthly by the Home Builders Association of Middle Tennessee, a non-profit trade association dedicated to promoting the American dream of homeownership to all residents of Middle Tennessee.

SUBMISSIONS: THE NAIL welcomes manuscripts and photos related to the Middle Tennessee housing industry for publication. Editor reserves the right to edit due to content and space limitations.

POSTMASTER: Please send address changes to: HBAMT, 9007 Overlook Boulevard, Brentwood, TN 37027. Phone: (615) 377-1055.

10

The HBAMT’s Annual Golf Tournament returns this August. Sign up now to participate in the big event and join us on the course.

14

The HBAMT Spring Fling & Builders Show is set for next week. Exhibit booths are SOLD OUT, but you can attend the BUILDERS ONLY event by securing a sponsorship.

Lower mortgage rates and limited existing inventory helped to push new home sales up in March, even as builders continue to grapple with increased construction costs and material supply disruptions.

Sales of newly built, single-family homes in March increased 9.6% to a 683,000 seasonally adjusted annual rate from a downwardly revised reading in February, according to newly released data by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

“A lack of resale inventory combined with many builders offering price incentives helped to push new home sales higher in March,” said Alicia Huey, chairman of the National Association of Home Builders (NAHB) and a builder and developer from Birmingham, Ala. “However, sales are down 3.4% compared to a year ago because of the shortage of electrical transformer equipment and building material price volatility.”

“The average Freddie Mac mortgage rate gradually fell from near 6.7% at the beginning of March to 6.3% at the end of the month, and this helped to push new home sales higher in March,” said Danushka Nanayakkara-Skillington, NAHB’s assistant vice president for forecasting and analysis.

A new home sale occurs when a sales contract is signed or a deposit is accepted. The home can be in any stage of construction: not yet started, under construction or completed. In addition to adjusting for seasonal effects, the March reading of 683,000 units is the number of homes that would sell if this pace continued for the next 12 months.

New single-family home inventory fell 9.5% in March, however, it remained elevated at a 7.6 months’ supply at the current building pace. A measure near a 6 months’ supply is considered balanced. Completed, ready-to-occupy inventory stood at 70,000 homes in March and is up 119% from a year ago. However, that inventory type remains just 16% of total inventory. Total new home inventory peaked in October at 466,000 and has been declining since that time, with a total inventory of 432,000 available for sale in March.

The median new home sale price rose in March to $449,800, up 3.2% compared to a year ago. Elevated costs of construction have contributed to a rise in home prices.

Regionally, on a year-to-date basis, new home sales rose 1.7% in the Northeast, but fell 19.6% in the Midwest, 5.8% in the South and 32.2% in the West. n

Single-family production remained at an anemic pace in February as builders continue to wrestle with elevated mortgage rates, high construction costs and tightening credit conditions that threaten to be exacerbated by recent turmoil in the banking system.

Single-family production showed signs of a gradual upturn in March as stabilizing mortgage rates and limited existing inventory helped to offset stubbornly high construction costs, building labor shortages and tightening credit conditions.

Overall housing starts in March decreased 0.8% to a seasonally adjusted annual rate of 1.42 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

The March reading of 1.42 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts increased 2.7% to an 861,000 seasonally adjusted annual rate. However, this remains 27.7% lower than a year ago. The multifamily sector, which includes apartment buildings and condos, de-

creased 5.9% to an annualized 559,000 pace.

“With builder sentiment climbing for four consecutive months and single-family starts continuing to move gradually higher from low levels since the beginning of the year, this indicates that a turning point for single-family construction will occur later this year after declines in 2022,” said Alicia Huey, NAHB chairman. “However, builders are still challenged by ongoing supply-chain issues and a skilled labor shortage.”

“We expect choppiness for single-family construction in the months ahead, with the

The NAHB released its NAHB/Westlake Royal Remodeling Market Index (RMI) for the first quarter, posting a reading of 70, edging up one point compared to the previous quarter.

The NAHB/Westlake Royal RMI survey asks remodelers to rate five components of the remodeling market as “good,” “fair” or “poor.” Each question is measured on a scale from 0 to 100, where an index number above 50 indicates that a higher share view conditions as good than poor.

The Current Conditions Index is an average of three components: the current market for large remodeling projects, moderately-sized projects and small projects. The Future Indicators Index is an average of two components: the current rate at which leads and inquiries are coming in and the current backlog of remodeling projects. The overall

RMI is calculated by averaging the Current Conditions Index and the Future Indicators Index. Any number over 50 indicates that more remodelers view remodeling market conditions as good than poor.

The Current Conditions Index averaged 75, dropping two points compared the previous quarter. Two of the three components declined as well: the component measuring large remodeling projects ($50,000 or more) fell three points to 71 and the component measuring small remodeling projects (under $20,000) declined by two points to 77. Meanwhile, the component measuring moderately-sized remodeling projects (at least $20,000 but less than $50,000) remained unchanged at 78.

The Future Indicators Index increased two points to 64 compared to the previous quarter. The component measuring the current rate at

2023 data posting significant year-over-year weakness before improving on a sustained basis,” said NAHB Chief Economist Robert Dietz. “The multifamily market softened in March, and we anticipate ongoing declines for apartment construction in the months ahead due to tighter lending conditions in the commercial real estate sector.”

On a regional and year-to-date basis, combined single-family and multifamily starts were 8.3% lower in the Northeast, 34.5% lower in the Midwest, 11.5% lower in the South and 28.2% lower in the West.

Overall permits decreased 8.8% to a 1.41 million unit annualized rate in March. Single-family permits increased 4.1% to an 818,000 unit rate, but are down 29.7% compared to a year ago. Multifamily permits decreased 22.1% to an annualized 595,000 pace.

Looking at regional permit data on a yearto-date basis, permits were 24.5% lower in the Northeast, 25.3% lower in the Midwest, 15.7% lower in the South and 28.1% lower in the West.

The number of single-family homes under construction in March was 716,000, the 10th monthly decline. In March, builders completed 15,000 more homes than began construction, resulting in a decline for the construction pipeline.

There are now 958,000 apartments under construction, which is the highest level since the fall of 1973. n

which leads and inquiries are coming in rose two points to 59 and the component measuring the backlog of remodeling jobs increased two points to 69.

“Remodelers are generally optimistic about the home improvement market, although some are noting negative effects of material shortages and higher interest rates,” said NAHB Remodelers Chair Alan Archuleta, a remodeler from Morristown, N.J. “Customers are still undertaking larger projects, but are mostly paying cash rather than financing them.”

“An overall RMI of 70 is consistent with NAHB’s projection that the remodeling market will grow in 2023, but at a slower pace than in 2022,” said NAHB Chief Economist Robert Dietz. “One potential area of growth, given the aging U.S. population, is aging-inplace remodeling. In fact, 63% of remodelers reported in the first quarter doing aging-inplace work, with bathroom projects like grab bars and curb-less showers being particularly common.” n

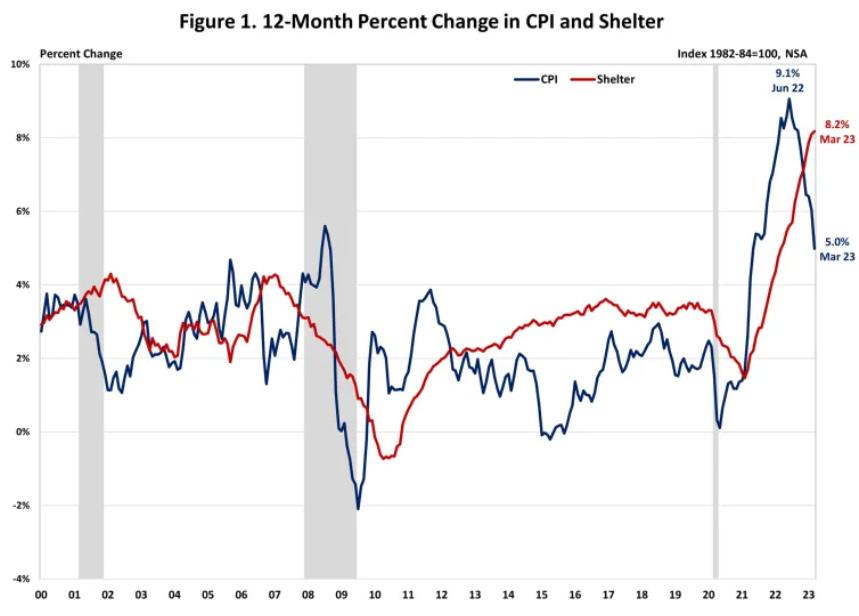

Consumer prices in March saw the smallest year-over-year gain since May 2021 with a ninth consecutive month of a deceleration. While the shelter index (housing inflation) experienced its smallest monthly gain since November 2022, it continued to be the largest contributor to the total increase, accounting for over 60% of the increase in all items less food and energy.

The Fed’s ability to address rising housing costs is limited as shelter cost increases are driven by a lack of affordable supply and increasing development costs. Additional housing supply is the primary solution to tame housing inflation. The Fed’s tools for promoting housing supply are at best limited. In fact, further tightening of monetary policy will hurt housing supply by increasing the cost of AD&C financing. This can be seen on the graph below, as shelter costs continue to rise despite Fed policy tightening. Nonetheless, the NAHB forecast expects to see shelter costs decline later in 2023.

The Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) rose by 0.1% in March on a seasonally adjusted basis, following an increase of 0.4% in February. The price index for a broad set of energy sources fell by 3.5% in March as the gasoline index (-4.6%), the natural gas index (-7.1%) and the electricity index (-0.7%) all decreased. Excluding the volatile food and energy components, the “core” CPI rose by 0.4% in March, following an increase of 0.5% in February. Meanwhile, the food index was unchanged in March with the food at home index falling 0.3%.

Most component indexes continued to increase in February. The indexes for shelter (+0.6%), motor vehicle insurance (+1.2%), airline fares (+4.0%), household furnishings and operations (+0.4%) as well as new vehicles (+0.4%) showed sizeable monthly increases in March. Meanwhile, the indexes for used cars and trucks (-0.9%) and medical care (-0.3%) declined in March.

The index for shelter, which makes up more than 40% of the “core” CPI, rose by 0.6% in March, following an increase of 0.8% in February. The indexes for owners’ equivalent rent (OER) and rent of primary residence (RPR) both increased by 0.5% over the month. Monthly increases in OER have averaged 0.6% over the last three months. These gains have been the largest contributors to headline inflation in recent months.

During the past twelve months, on a not seasonally adjusted basis, the CPI rose by 5.0% in March, following a 6.0% increase in February. This was the slowest annual gain since May 2021. The “core” CPI increased by 5.6% over the past twelve months, following a 5.5% increase in February. The food index rose by 8.5% while the energy index fell by 6.4% over the past twelve months.

NAHB constructs a “real” rent index to

indicate whether inflation in rents is faster or slower than overall inflation. It provides insight into the supply and demand conditions for rental housing. When inflation in rents is rising faster (slower) than overall inflation, the real rent index rises (declines). The real rent index is calculated by dividing the price index for rent by the core CPI (to exclude the volatile food and energy components). The Real Rent Index rose by 0.1% in March. n

The 12th Annual HBAMT Golf Tournament is set for Thursday, August 17 at the Towhee Club in Spring Hill. Sign up now to sponsor at one of the following levels!

TITLE SPONSOR $10,000 1 available

l Company name featured as headliner on all materials

Lunch Sponsor $5,000 1 available

Breakfast Sponsor $3,000 1 available

Platinum $1,200 5 available

Gold Sponsor $1,500 9 available

Silver Sponsor $600

Hospitality Cart $2,000 2 available

Wrap-up Party Sponsor $3,000 1 available

l Booth at registration, awards wrap-up & course hole

l Opportunity to hand out promotional materials

l Signage provided o

l Company name featured as Lunch Sponsor on all material

l Booth at check-in and Golf Tournament course hole

l Opportunity to hand out promotional materials

l Four (4) tickets to Wrap-up o

l Company name featured as Breakfast Sponsor on all material

l Booth at check-in and Golf Tournament course hole

l Your booth will be breakfast ticket pick up point for all golfers

l Opportunity to hand out promotional materials

l Two (2) tickets to Wrap-up o

l Company name featured on all materials

l Booth at wrap-up & course hole

l Opportunity to hand out promotional materials at hole

l Signage at tournament provided

l Two (2) tickets to wrap-up o

l Single hole sponsor for both morning & afternoon rounds

l Opportunity to hand out promotional materials at hole

l Signage at tournament provided

l Opportunity to hand out information & goodies

l Two (2) tickets to wrap-up o

l Hole sponsor for both morning & afternoon rounds

l Opportunity to hand out promotional materials at hole

l Two (2) tickets to wrap-up o

l Hospitality cart with your name on it

l Opportunity to ride cart in morning & afternoon rounds moving freely within the course handing out beverages & goodies o

l Company name featured as Wrap-up Sponsor on all material

l Booth at check-in and Golf Tournament course hole

l Opportunity to hand out promotional materials

l Two (2) tickets to Breakfast o

Indicate which of the six (6) sponsorship levels shown above you selected and return the completed form below to the HBAMT to sign up today! (List company EXACTLY as you want it to appear on signage.) CONTACT

Your Name (print)

BUILDER BAR!

DON’T MISS OUT ON THIS TERRIFIC OPPORTUNITY!

Return your registration form to the HBAMT today to reserve your sponsorship!

= SOLD

Tuesday, May 9th

To sponsor, return your registration form to the HBAMT

Tuesday, May 11

2023 SPRING BUILDERS SHOW EXHIBITORS/SPONSORS REGISTRATION FORM cnicley@hbamt.org

Secure your spot today by returning the registration form provided below to the HBAMT today!

I am registering as an: r EXHIBITOR - $595 per booth r SPONSOR - $550

EXHIBITORS are provided exhibit space inside the exhibit tent. SPONSORS enjoy all the benefits of an exhibitor, including access to the tent, without being provided exhibit space in the tent.

Your name: ______________________________________

Company: _______________________________________

Cell: __________________ Email: ____________________

EXHIBITORS: Top 3 booth location preferences (not guaranteed): ________ ________ ________

Number of booths you’re purchasing (no more than two): _______ x $595 = your total payment: $____________

SPONSORS: will be charged $550.

Credit Card ______________________________________

Credit Card # ______________________ Exp. __________

Credit Card V-Code _______________

The “v-code” is found on the back of the card, usually printed or embossed atop or near the signature strip. It is comprised of three digits found to the right of a longer number.

Signature ________________________________________

Exhibit Booths have SOLD OUT but you can still participate in the Builders Show by securing a SPONSORSHIP!

Twenty SPIKES (in bold) increased their recruitment numbers last month. What is a SPIKE?

SPIKES recruit new members and help the association retain members. Here is the latest SPIKE report as of March 31, 2023.

CHEATHAM COUNTY CHAPTER

Chapter President - Roy Miles

Cheatham County Chapter details are being planned. Next meeting: to be announced.

Chapter RSVP Line: 615/377-9651, ext. 310

DICKSON COUNTY CHAPTER

Chapter President - Mark Denney

The Dickson County Chapter meets on the third Monday of the month, 12:00 p.m. at Colton’s Steakhouse in Dickson. Next meeting: to be announced.

Price: FREE, lunch dutch treat.

Chapter RSVP Line: 615/377-9651, ext. 264

MAURY COUNTY CHAPTER

Chapter President - Lisa Underwood Maury County Chapter details are currently being planned. Next meeting: to be announced.

Chapter RSVP line: 615-377-9651, ext. 312; for callers outside the 615 area code, 1-800-571-9995, ext. 312

METRO/NASHVILLE CHAPTER

Chapter President - Tonya Esquibel

The Metro/Nashville Chapter meets on the third Tuesday of the month, 11:30 a.m. at the HBAMT offices.

Next meeting: to be announced.

Topic: to be announced.

Price: to be announced.

RSVP to: cnicley@hbamt.org

ROBERTSON COUNTY CHAPTER

Next meeting: to be announced.

Robertson County RSVP line: 615-377-9651, ext. 313.

SUMNER COUNTY CHAPTER

Chapter President - Joe Dalton

The Sumner County Chapter meets on the fourth Tuesday of the month, 11:30 a.m. at the new Hendersonville Library.

Next meeting: to be announced.

Chapter RSVP Line: 615/377-9651, ext. 262

WILLIAMSON COUNTY CHAPTER

Chapter President - Christina James

The Williamson County Chapter meets on the third Tuesday of the month, 11:30 a.m. at the HBAMT offices.

Next meeting: to be announced. Builders Free pending sponsorship.

Price: $10 per person with RSVP ($20 w/o RSVP).

Chapter RSVP Line: 615/377-9651, ext. 305

WILSON COUNTY CHAPTER

Chapter President - Margaret Tolbert

The Wilson County Chapter meets on the second Thursday of the month at varying locations in the Wilson County area.

Next meeting: Thursday, June 8th.

Topic: Panel Discussion with Top Builders and Developers. More details coming soon!

RSVP to: cnicley@hbamt.org

HBAMT REMODELERS COUNCIL

Council President - Eli Routh

The HBAMT Remodelers Council meets at varying locations throughout the year.

Next meeting: to be announced.

Topic: to be announced.

Council RSVP Line: 615/377-9651, ext. 263

RSVP to: cnicley@hbamt.org

INFILL BUILDERS COUNCIL

The Infill Builders Council typically meets on the third Thursday of the month, 11:30 a.m. at the HBAMT offices

Next meeting: to be announced.

Price: to be announced.

RSVP to: 615/377-9651, ext. 265.

MIDDLE TENN SALES & MARKETING COUNCIL

Council President - Kelvey Benward

The SMC typically meets on the first Thursday of the month, 9:00 a.m. at the HBAMT offices*.

Next meeting and topic: Thursday, May 4th at the HBAMT.

Topic: “Marketing Your Homes in a Multicultural Market,” with an expert panel of sales professionals.

SMC members free thanks to US Bank! Non-SMC members

$15 w/RSVP, $20 w/o RSVP

RSVP REQUIRED - LIMITED SEATING

RSVP to: cnicley@hbamt.org