There are many different ways that you can save, take advantage of our competitive interest rates and innovative products to cultivate healthy savings habits. Save P2500 or more in your savings or current account, maintain it for at least three months and you could win a bull and five cows, giving you even more ways to save and invest in your future.

A winners draw will be held every quarter. Competition runs from 1 September 2022 until 31 August 2023.

Terms and conditions apply.

THEME: Refocusing strategies to sustain businesses and drive change.

“The only way that we can live is if we grow. The only way we can grow is if we change. The only way we can change is if we learn. The only way we can learn is if we are exposed. And the only way that we are exposed is if we throw ourselves into the open.” – C. Joybell

C. Using this chance to wish our readers more wellbeing and immerse contentment in the year 2023.

On the cover we have featured Hollard Insurance Botswana’s Group Brand Manager, Tsaone Puleng who gives us insight on Corporate Social Impact in our country. Present features inside this Feb-March edition is Letshego Group’s Head of Group Legal, Governance and Group Company Secretary, Gorata Tlhale Dibotelo as she brings in fierce Letshego culture in her DNA, the drive and ambition to match that of the business.

Perchance another insightful read would be the FNB Budget Review Seminar of the year 2023 as the seminar convened business and industry leaders as well as policymakers in a discussion to decipher the national budget with a view to strengthen the value chain and share ideas to uncover opportunities for economic growth. In the innovation and technology section, we shared on how technology is affecting the global financial landscape. Read on these articles in order to stay updated on the new innovation changes around the globe.

The Banking section we also talk on the Standard Bank being ranked as the most valuable banking brand in South Africa, and on the African continent, for 2023 for a second year in Brand Finance’s annual ranking of the world’s Top 500 Banking Brands.

The hospitality section we cover on Chef Rachel aka Rachel’s Table as she joins MultiChoice’s HONEY TV (DStv 173). The hospitality and tourism sector has been pulling their socks up as the Okavango Wilderness Safaris increased donation of seeds for Botswana Farmers. Then the mining section we have the Khoemacau announcement on their successful ramp-up to full production, followed by the De Beers’ confident talks on delivering a Botswana diamond deal and finally ending our mining section with the hydrogen production heighten around the globe more especially the continent of Africa.

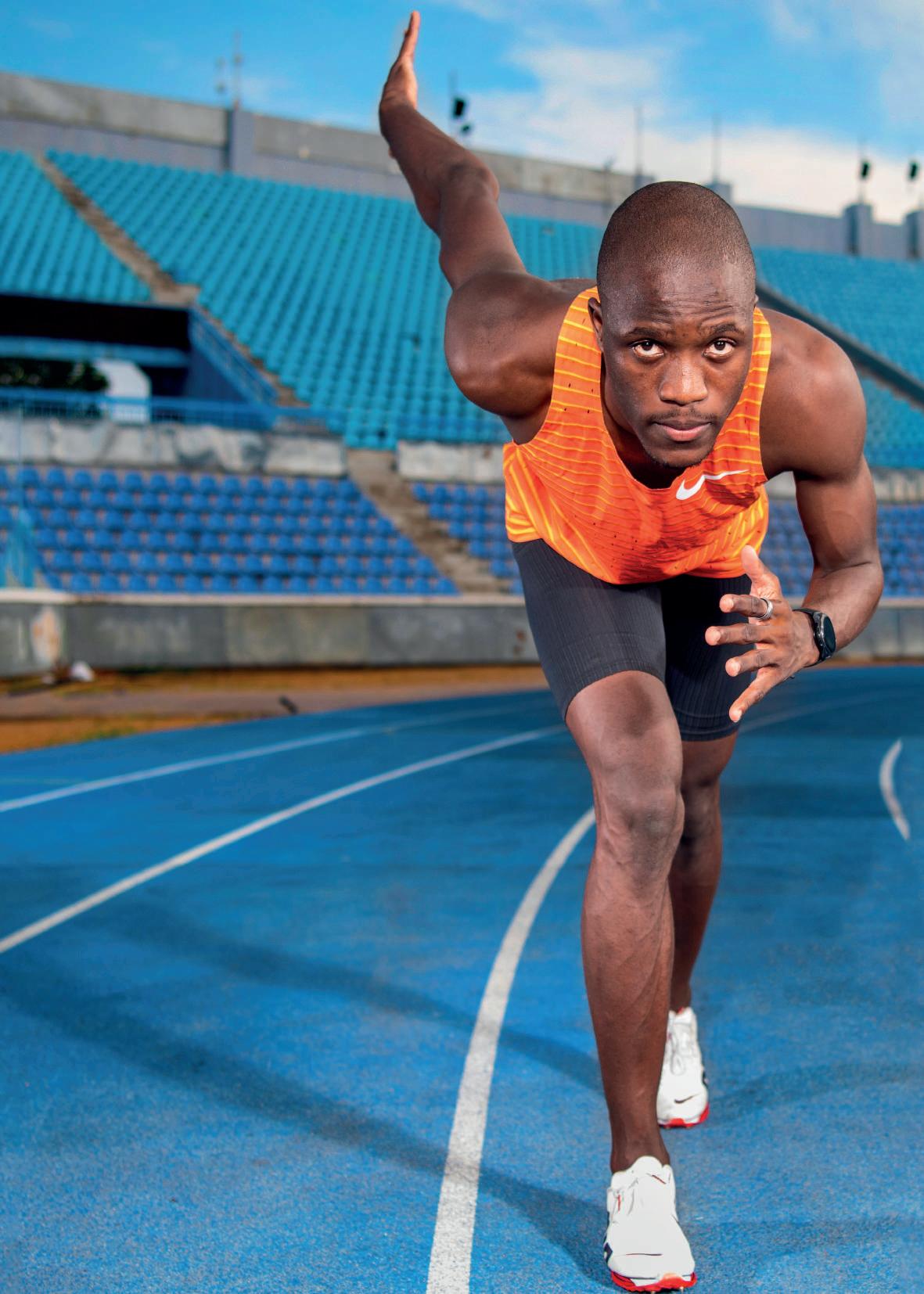

To add on we as the Noble Magazine family have decided to take a leap and include two new sections which are health and sports. In the health section we cover on awareness of non-communicable diseases also including an article on computer ergonomics as it lives amongst us. In the sport section we touch on the BTC launch of the 2023 Francistown Marathon, including the return of the Toyota 1000 desert race in the diamond-mining town Jwaneng and many more.

We leave you with the words of Alfred North Whitehead “No one who achieves success does so without acknowledging the help of others. The wise and confident acknowledge this help with gratitude”. From the Noble team we urge you to strategies your goals and plans for this year in a way that you contribute not only to your success but also to have a social impact.

www.noble.co.bw

DIRECTOR OF MARKETING

Herine Lilian-Moloi

EDITOR-IN-CHIEF

Phenyo Mmati Babusi

CONTRIBUTORS

Staff Writer

Bontle Lulu

Lorraine Dudu A Kinnear

CONTRIBUTING AGENCIES

Wow Factor Hotwire

PR Practice

The Dialogue Group

Red Pepper Incepta

Horizon Ogilvy

DESIGN & LAYOUT

Allin Group

ABOUT THIS ISSUE

February-March 2023

Volume 7, Issue 38

ONLINE ISSUE

www.noble.co.bw

ISSN 2520-4610 (Online) ISSN 2520-4602 (Print)

NOBLE is published Bi-monthly, by Noble Insider (Pty) Ltd, Plot 863, Extension 2, Gaborone Botswana. We have an Online publication which is published monthly.

CONTACT INFORMATION

Tel / Fax +267 3116681

For Subscriptions: visit www.noble.co.bw; write Noble Subscriber Service, P. O. Box 402462 Gaborone Botswana or call +267 73 048 407

For Article Reprints or Permission to use Noble content including text, photos, illustrations, logos, and video: e-mail nobleulla2020@gmail. com

. Permission to copy or republish articles can also be obtained through the Copyright Clearance Center at www.copyright.com. Use of Noble content without the express permission of Noble or the copyright owner is expressly prohibited.

Copyright © 2023 Noble Insider. All rights reserved. Printed in Botswana

Liberator Living Annuity provides an income to individuals during their retirement. This aids the customer to maintain their current standard of living without having to worry about earning a future income.

Control over income

Clients can select how much income they receive and can change this to meet their needs

Exposure to investment returns

Clients can invest in a range of portfolios to boost their investment value

Leaving a legacy In the death of the client, ALL of the remaining investment value can be passed on to beneficiaries.

Unlike a Life Annuity, a Living Annuity gives you:

Control over Income

• You can choose how often you receive your annuity salary

• You can choose the percentage amount you want as a salary

Exposure to Investment Returns

• You can choose the investment portfolios you want to invest your pension in

• There is fund growth in line with market movements less charges and income

Leaving a Legacy

• Your beneficiaries are guaranteed 100% of your pension fund balance (less any applicable tax) should you pass away at any time in the life of the policy

Get in touch with us today and learn more about how you can invest your retirement funds through the Liberator Living annuity.

Tsaone Puleng

Group Brand Manager - Hollard

Tsaone Puleng

Group Brand Manager - Hollard

Established 1980, Hollard is the largest independent insurance and insurance investment company in South Africa. Hollard Insurance Botswana being part of the international Hollard Insurance Group which includes businesses formed with strong local partners in Namibia, Mozambique, India, Pakistan, the United States, United Kingdom and Australia. The Hollard Botswana branch shares the Hollard Afro-centric vision and unwavering focus on designing and delivering new, appropriate and affordable insurance products designed for Africa’s unique needs. It has access to all its resources, skills, broker support programs and training; innovative products; infrastructure; customer-centric initiatives and product design capacity in both life and general insurance.

Joining the organization in 2018 as the Group Brand Manager with the work experience of Acting Public Relation and Marketing Manager, Tsaone Puleng has a background of Bachelor of Business Administration (marketing), marketing and communications at the University of Botswana and also a

certificate from Botswana Accountancy Collage. Her entry year in Hollard Insurance Botswana marks significant at how it was the same year were Hollard Botswana took the initiative to get the organisation known using various communication channels of media the likes of radio and print.

“Hollard for a long time was known as a South-African company and our clients only came across it when dealing with our brokers and partners. Though we have a strong belief in long lasting partnerships we realised the need to have a voice of our own and we came up with a strategy to not only make ourselves known to Batswana but to also win their trust by creating the Tshepa Hollard Campaign. This campaign is aimed at listening to the voice of Batswana when it comes to insurance and making sure we tailor make our products and services to serve them in the best way possible and ensuring that we are held to the promises we have made to all our stakeholders. Hollard Insurance Botswana is a one stop shop as we have both life and short-term and we often say we insure everything and everyone that you love. ,” shares Group Brand Manager, Tsaone Puleng.

“Our ethos is to enable better futures and not only through our products and services but this extends to our partnerships and social impact. Whilst we understanding that insurance is immensely important especially in the world we live now, we acknowledge that the provision of our products and services on its own is not enough to ensure one’s better future. Our products and services on their own are able to ensure our clients better futures and ensure that future generations are well taken off however we operate within a communities in which we have a corporate responsibility to ensure that they too have a better future.

We believe in shared value and as corporate citizen we have taken it upon ourselves to improve the social and economic conditions in the regions we operate in through partnerships and Programmes not only in the now but that will span into the future. We have been in the market for 17 years and our partnerships have contributed to our staying power hence why we believe with the right partnerships we can also do a lot of social good Our survival translates to the success of partners and communities we serve regardless of the economic climate,” said Hollard Insurance Botswana’s Group Brand Manager, Tsaone Puleng.

She further expressed that Hollard’s focus has been on Youth and Women Empowerment alongside Financial literacy. A few years ago Hollard Partnered with Project124 Entrepreneurship Program which aims to build those better entrepreneurs. Project124 is the leading youth led and private owned entrepreneurship development program in Botswana, carefully crafted to revolutionize youth entrepreneurship and facilitate effective creation of sustainable jobs for young people around the country. Building the economy, one business at a time. The program reaches an average of 150 entrepreneurs in Botswana annually, and has now reached a consolidated average of 528 entrepreneurs in the last

Continues in Page 10

4 years who created exciting projects that continues to add value to different communities around the country.

Unemployment is a reality and it is destroying the resilience of young people especially in developing countries such as Botswana. Entrepreneurship is the sure plan any country can trust to tackle many of social ills in our communities. It doesn’t only take great ideas to bring the change, it also take great entrepreneurs to build sustainable businesses that will bring the impact hence why as Hollard we jumped at the opportunity of going into a partnership with Project 124. We are not enabling Project 124’s future but of the many entrepreneurs and aspiring entrepreneurs we can help them reach country wide.

Another initiative Hollard brought is streetwise finance. The seed for the StreetWise Finance programme was first sown when a group of Hollard’s bright and energetic financial professionals became aware of how poorly many of their own friends and family members managed their personal finances and how inadequately prepared, they were for retirement. (Even those with qualifications and jobs that involved taking care of corporate assets seemed to struggle with managing their own money!)

“The root cause was ALWAYS poor financial education – mixed with a dollop of intimidation because they were either embarrassed to admit how little they knew, and ask for the information they needed, or because there were

cultural inhibitions about discussing money matters. There are also way too many Batswana who are living in the now, and not thinking about their financial needs in the future,” shares Group Brand Manager, Tsaone Puleng. She further narrates how all these issues combined, is the reason why the finances of many Batswana spiral out of control, leaving them vulnerable, desperate and potentially depressed. This programme aims to help individuals out of the hole they have dug themselves into or prevent them from getting there and we are currently working with our partners to take it into the communities we operate in.

The aftermath of the Covid 19 pandemic taught the organisation that in order to survive in the industry certain changes have to be made and in terms of transitioning the organization towards success in the ‘new normal’, Hollard made their strategies from feedback making decisions to digitalize services, product reconfiguring and coming up with new products that speak to the needs of their stakeholders. The pandemic brought about a lot of changes and Hollard responded to some of them by bringing in new products such as the SMME product offering to cushion the risks SMME’s face on the daily basis. We saw the borders close also to imports and Batswana were forced to produce their own food which is a good thing, so Hollard responded to that also by coming up with an Agri Product that ensures that all farming equipment, employees and produce are covered.

The biggest weakness identified is that Batswana are unsure on insurance and

that the urban communities are more insured than those in the rural areas. Hence why Hollard has been focusing on educating Batswana on the importance of insurance and building partnerships that will ensure that insurance information and products reach even the remote areas. They are doing this through partnerships with the likes of Botswana Post through an affordable insurance product called Motshidisi Funeral Plan that requires one to only have a proof of ID (Omang). Hence why the Hollard partnered with post office after noticing they are more accessible and fast communication mode. Services such as motshidisi have made it easy and education drives to close the gaps of those that don’t know about insurance.

Concluding Hollard Botswana’s Group Brand Manager, Tsaone Puleng emphasised that “Listening and Responding to the bigger conversation in a solution driven way is critical for the survival of any business because we do not operate in a silo, we need people in order to succeed and our success is a win for those we serve.”

Our products and services on their own are able to ensure our clients better futures and ensure that future generations are well taken off however we operate within a communities in which we have a corporate responsibility to ensure that they too have a better future.

Reap more than what you sow with our agriculture products, designed to protect your investments.

Reap more than what you sow with our agriculture products, designed to protect your investments.

LIVESTOCK INSURANCE

LIVESTOCK INSURANCE

Your Insured livestock will be covered against death resulting from perils such as;

Your Insured livestock will be covered against death resulting from perils such as;

• Fire

• Fire

• Lightning

• Redwater Fever, Heartwater Fever, Gall Sickness, Pulpy Kidney, Blue Tongue – provided proper vaccinations have been carried out.

• Redwater Fever, Heartwater Fever, Gall Sickness, Pulpy Kidney, Blue Tongue – provided proper vaccinations have been carried out.

• Calf Extension – cover for calves older than 24hrs & younger than 6 months, limited to 20% of the insured amount of a cow.

• Calf Extension – cover for calves older than 24hrs & younger than 6 months, limited to 20% of the insured amount of a cow.

• Explosion

• Lightning

• Explosion

• Emergency slaughter/ Euthanasia on medical grounds

• Emergency slaughter/ Euthanasia on medical grounds

• Accident

• Accident

• Transit

• Transit

• Smoke

• Smoke

• Windstorm

• Windstorm

This policy also includes Special Extensions;

This policy also includes Special Extensions;

• Attacks by dogs and wild animals

• Attacks by dogs and wild animals

• Snake bites

• Snake bites

• Freezing of livestock

• Plant poisoning

• Plant poisoning

CROP INSURANCE

CROP INSURANCE

Your crops will be covered against perils such as;

Your crops will be covered against perils such as;

• Fire

• Fire

• Lightning

• Lightning

• Explosion

• Explosion

• Earthquake

• Earthquake

• Windstorm

• Windstorm

• Hail

• Hail

• Excessive Rainfall • Transit

• Excessive Rainfall • Transit

• Hijacking cover

• Freezing of livestock

• Hijacking cover

AGRI PERSONAL INSURANCE COVERS INCLUDE: Motor Vehicles, Houseowners, Householders, Personal All Risks, Personal Accident, Pleaseure Crafts.

AGRI PERSONAL INSURANCE COVERS INCLUDE: Motor Vehicles, Houseowners, Householders, Personal All Risks, Personal Accident, Pleaseure Crafts.

AGRI COMMERCIAL INSURANCE COVERS INCLUDE: Fire & Allied Perils, Business Interruption, Motor Vehicles, Electronic Equipment, Burglary, Money, Goods in Transit, Business All Risks, Fidelity Guarantee, Public Liability, Personal Accident, Workers Compensation, Irrigation Equipment, Machinery Breakdown & Plant All Risks.

AGRI COMMERCIAL INSURANCE COVERS INCLUDE: Fire & Allied Perils, Business Interruption, Motor Vehicles, Electronic Equipment, Burglary, Money, Goods in Transit, Business All Risks, Fidelity Guarantee, Public Liability, Personal Accident, Workers Compensation, Irrigation Equipment, Machinery Breakdown & Plant All Risks.

FOR MORE INFORMATION: Tel: (+267) 395 8023 | (+267) 74 243 842

FOR MORE INFORMATION: Tel: (+267) 395 8023 | (+267) 74 243 842

Email: servicecentre@hollard.co.bw

Email: servicecentre@hollard.co.bw

Standard Bank which is also the umbrella for Stanbic Bank Botswana which is Africa’s largest bank by assets, has for the second year been ranked most valuable banking brand in South Africa and on the African continent this year 2023 in Brand Finance’s annual ranking of the world’s Top 500 Banking Brands. Standard Bank also increased its brand value by over 10% in the last year to reach over $1.74 billion US dollars.

Annually, Brand Finance tasks 5000 of the biggest brands to the test and publishes around 100 reports, ranking brands across different sectors and countries. The world’s top 500 most valuable and strongest banking brands are included in the annual Brand Finance Banking 500 ranking. Brand Finance is the world’s leading independent brand valuation consultancy and uses the royalty relief approach to quantify the financial value of a brand and this method estimates the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use. This value is a theoretical net economic benefit that the brand owner would

achieve by licensing its brand in the open market.

Stanbic Bank Botswana being part of the Standard Bank Group provides the full spectrum of financial services, working to help make Batswana’s dreams a lasting reality in line with the Bank’s Purpose to fuel Botswana’s growth. Across their business and the breadth of services and solutions, with Stanbic Bank, IT CAN BE. It has direct, on-the-ground representation in 20 African countries and in 7 global financial centres. Standard Bank Group has more than 1 100 branches and 6 500 ATMs in Africa, making it one of the largest banking networks on the continent. It provides global connections backed by deep insights into the countries where it operates.

Standard Bank’s Group Chief Executive, Sim Tshabalala states that in the year 2019, Standard Bank began a journey that fundamentally redefined its business. The Group’s purpose of “Africa is our home, we drive her growth”, aiming to connect Africa to the world in pursuit of inclusive and sustainable growth for the continent.

“We’re delighted that we continue to lead as Africa’s most valuable brand. It’s the independently assessed indication that our business model – with its focus on providing consistently excellent service and complete banking, asset management and insurance solutions to our clients – is paying dividends,” said Standard Bank’s Group Chief Executive, Sim Tshabalala.

Stanbic Bank Botswana celebrates this achievement for the Group as a whole, committed to continuing to live the brand in Botswana and, crucially, to deliver

shared value for and with Batswana. “This is an incredible victory for all in the Standard Bank family and we celebrate with our colleagues across the continent. The Stanbic Bank Botswana team continue to work tirelessly to ensure that we consistently deliver exceptional client experiences for all our customers here in Botswana and deliver on our brand promise ‘It Can be’,” said Stanbic Bank Botswana’s Chief Executive, Chose Modise.

Having operated in Botswana for over 30 years, Stanbic Bank Botswana continues to receive prestigious awards as testament to the helpful role we play in supporting Botswana’s economic activity in various sectors. The bank currently employs over 600 members of staff and has a national footprint comprising 13 branches. Six branches located within Gaborone, with representation in Francistown, Letlhakane (a digital branch), Maun, Mogoditshane, Palapye, Selebi Phikwe and Kazungula. The Bank also services customers through a network of 80 ATMs countrywide; and over 3 585 Point of Sale (POS) machines with 861 integrated with store tills in various retailers and outlets in a bid to offer greater convenience and onthe-go banking for its valued customers.

Stanbic Bank Botswana is committed towards attaining the Vision placed in order to create value for clients and the communities it serve by providing access to digital financial and related solutions that support sustainable growth. The Stanbic Letsema 2025 Strategy is a clear, actionable and measurable roadmap towards attaining this and achieving the growth and performance measures, both financial and Social, Economic and Environmental (“SEE”), for we believe Botswana is our home and we drive her growth.

Acquiescently, Africa’s inclusive finance provider, Letshego Africa (“Letshego Holdings Ltd” / “Letshego Group”) confirms the appointment of Gorata Tlhale Dibotelo as Head of Group Legal, Governance and Group Company Secretary as of February 14, 2023, having met all requisite listing and company regulations, as well as regulatory requirements. Basing her in the Group’s headquarters in Gaborone.

Joining Letshego from her role as Head of Legal Services and Board Secretary at the Botswana Stock Exchange (BSE), prior Gorata worked as a Senior Associate at Armstrongs Attorneys. Currently now serving as the Group Compliance Officer to the BSE.

Ms Dibotelo attains a Bachelor of Laws Degree from the University of Botswana, a Master’s Degree in Commercial Law from the University of Cape Town ad completed the Executive Development Programme at Stellenbosch University’s Business School.

Letshego’s Group Chief Executive, Aupa Monyatsi, indicates that they are pleased to welcome Gorata to the team, and to see her take on such a key and strategic role within the Group. “A consummate professional with a depth of experience, expertise and indeed passion, we know that she has the very tenets of Letshego

culture in her DNA, and the drive and ambition to match that of the business. As we continue to deliver on our panAfrican growth strategy, creating value for shareholders and stakeholders alike we celebrate this addition to the robust Letshego leadership team” said Monyatsi.

Letshego Africa also named Letshego Holdings Ltd (“Letshego Group”) is a African multinational organisation, headquartered and listed in Botswana and focused on delivering inclusive finance solutions to underserved populations across its 11 sub Saharan Africa footprint. A staff complement of over 3,000 both including direct and indirect sales agents, with more than four hundred thousand

customers, Letshego is synonymous with leveraging innovation and technology to improve the lives of individuals who have limited access to traditional financial services.

Previous year 2022, Letshego celebrated 23 years of supporting regional communities, making strong progress with the launch of its Transformational Strategy in September 2020, towards the Group’s vision to be a world-class retail financial services organisation, improving the lives of mass and middle market individuals and micro and small entrepreneurs.

Budgeting is a process of projection of revenues and expenses, cash flows, production lines, working capital requirements, capital expenditure, etc. in respect of near future years, which is based on some rationale logic about the future prospects and using the experience in past till date, presented to the management of the company for decision making. In short term it is a tactical implementation of a business plan.

Moreover to achieve the goals in a business’s strategic plan, a detailed descriptive roadmap of the business plan is needed as a way that it sets measures and indicators of performance. Four dimensions to consider when translating high-level strategy are mission, vision, and goals, into budgets. Then as an organization there must be one or more strategies to achieve your goals. The company can increase customer spending by expanding product offerings, sourcing new suppliers, promotion, etc.

Tracking and evaluating the effectiveness of the strategies, using relevant measures vital, example being, measuring the average weekly spending per customer and average price changes as inputs.

Budgeting is a critical process for any business in several ways:

• Aids in the planning of actual operations: this process gets managers to consider how conditions may change and what steps they need to take, while also allowing

managers to understand how to address problems when they arise.

• Coordinates the activities of the organization: budgeting encourages managers to build relationships with the other parts of the operation and understand how the various departments and teams interact with each other and how they all support the overall organization.

• Communicating plans to various managers: communicating plans to managers is an important social aspect of the process, which ensures that everyone gets a clear understanding of how they support the organization.

• Motivates managers to strive to achieve the budget goals: budgeting gets managers to focus on participation in the budget process. It provides a challenge or target for individuals and managers by linking their compensation and performance relative to the budget.

• Control activities: managers can compare actual spending with the budget to control financial activities.

• Evaluate the performance of managers: budgeting provides a means of informing managers of how well they are performing in meeting targets they have set.

Types of Budgets:

A robust budget framework is built around a master budget consisting of operating budgets, capital expenditure budgets, and cash budgets. The combined budgets generate a budgeted income statement, balance sheet, and

cash flow statement.

Revenues and associated expenses in day-to-day operations are budgeted in detail and are divided into major categories such as revenues, salaries, benefits, and non-salary expenses.

2. Capital budget

Capital budgets are typically requests for purchases of large assets such as property, equipment, or IT systems that create major demands on an organization’s cash flow. The purposes of capital budgets are to allocate funds, control risks in decision-making, and set priorities.

3. Cash budget

Cash budgets tie the other two budgets together and take into account the timing of payments and the timing of receipt of cash from revenues. Cash budgets help management track and manage the company’s cash flow effectively by assessing whether additional capital is required, whether the company needs to raise money, or if there is excess capital.

The Budgeting Process for most large organisations usually begins four to six months before the start of the financial year, while some may take an entire fiscal year to complete. Most organizations set budgets and undertake variance analysis on a monthly basis. Starting from the initial planning stage, the company goes through a series of stages to finally implement the budget. Common processes include communication within executive management, establishing objectives

Continues in Page 16

With the inevitable effects of climate change on ecosystems and communities, the business world is quickly realizing they can do well by doing good. Sustainability is increasingly becoming a crucial concept in all aspects of a business. A growing number of organizations are considering ways to incorporate a balance among environmental, economic and social value creation in their operations and business models. But what exactly does it mean to be sustainable in a business?

In Business, sustainability refers to the practice of operating without negatively impacting the environment and the community as a whole. It is the management and coordination of environmental, social and economical demands and concerns to ensure responsible, ethical and continuous success. An environmentally aware business recognizes its responsibility to the environment and community by contributing to the structure within which it operates through sustainable business practices. Businesses must ensure a long-term vision that recognizes that we cannot conduct business operations outside of taking care of the environment in which our businesses exist.

Apart from making a positive impact on the community and the environment, implementing sustainable business strategies improves a business’ brand image and can help drive its success. Almost every investor today considers environmental, social, and governance (ESG) metrics to analyze an organization’s ethical impact and sustainability practices. Factors such as a company’s carbon footprint, water usage, and community development efforts are examined by investors to determine if the business would be a worthy investment. According to research by Deutsche Bank, which evaluated 56 academic studies, “companies with high ratings for environmental, social, and governance (ESG) factors have a lower cost of debt and equity; 89 percent of the studies they reviewed show that companies with high ESG ratings outperform the market in the medium (three to five years) and long (five to ten years) term.” When a business fails to assume the responsibility of sustainability, this is not only detrimental to its operations, but it will lead to issues such as environmental degradation, inequality, and social injustices.

A sustainable business observes “the triple bottom line”, a concept that was first coined in the year 1994 by John Elkington, founder of a British consultancy called SustainAbility. Through this concept, Elkington argues that businesses should set three unique and separate bottom lines, the measure of profit and loss, the measure of social responsibility and the measure of environmental responsibility. The triple bottom line, therefore, comprises the three Ps which are Profit, People and Planet. It aims to measure the financial, social and environmental performance of the corporation over a period of time. Thus, a sustainable business earns its true profit by being socially responsible and ensuring a sustainable use of environmental resources.

Sustainability has become an operational and strategical imperative, it helps solve and mitigate ecological, social and economic problems through the strategic management of resources. The growing number of countries announcing pledges to achieve net zero emissions and carbon neutrality is illustrative of why it is critical for businesses to prioritize sustainability. According to The World Counts, Strip mining is one example that portrays the destruction and harm caused to people and the environment. Also known as surface mining, strip mining involves the stripping away of earth and rocks to reach the coal underneath. If a mountain happens to be standing in the way of a coal seam within, it will be blasted or levelled - effectively leaving a scarred landscape and disturbing ecosystems and wildlife habitat. Due to this invasive and destructive activity, wildlife species face severe impacts resulting from their habitats being destroyed. These effects would not exist if business were more responsible in their operations. Simply put, if businesses don’t act responsibly as members of the global community, the majority of many species will not survive past the 21st century. Environmental Sustainability notes that “the human-caused rate of extinction of species of both plants and animals at present is hundreds of times higher than the natural rate in the past.” It is time to act now. This calls for an urgent need for businesses to become part of the solution, cut down emissions and waste, and contribute towards a healthier and livable planet.

Continued from Page 15

and targets, developing a detailed budget, compilation and revision of budget model, budget committee review, and approval.

A cost benefit analysis or also known as cost budget analysis, is a systematic process to evaluate the benefits and costs of projects. It’s a tool that project managers may use to attempt to provide an evidence-based review and analysis of a project without considering biases, opinions or politics. Instead, it uses data and costs to assign dollar values to intangible and tangible benefits and costs to evaluate the feasibility of a project. It also uses opportunity cost to help project managers to determine which projects are worth pursuing and which to pass on completing.

Cost benefit analysis may not be effective for larger project because it may not accurately account for all financial concerns, especially how finances may change. It does not account for uncertainties like income level, inflation, interest rates and varying cash flows. While cost benefit analysis is data driven, it doesn’t necessarily account for benefits not directly convertible to cash amounts. Similarly, value is subjective, meaning the value of intangible benefits may be debatable. Stakeholders or other important parties may try to influence the cost benefit analysis based on their own interests or interpretations of value. However, using net present value (NPV) may help you better account for these concerns.

Cost benefit analysis also has an inherent cost associated with it. It requires time and money to complete, such as the labour costs required to hire an analyst or the time your project manager uses to create a list of each asset, benefit and cost. The assumptions or estimates provided may also be inaccurate, leading to inaccurate results.

Budgeting is a process of projection of revenues and expenses, cash flows, production lines, working capital requirements, capital expenditure, etc. in respect of near future years, which is based on some rationale logic about the future prospects and using the experience in past till date, presented to the management of the company for decision making. In short term it is a tactical implementation of a business plan.

Numerous industries have benefited from technological innovation and one sector that has benefited greatly from contemporary technological advancements is finance. In the last few decades, technology has essentially transformed how we interact and handle finances from a personal and organisational point of view. Payments are made and received easily using a plethora of platforms and tools. Many get to enjoy financial services they would typically only get from a brick-and-mortar banking institution from their hand-held devices. One can perform transactions from anywhere, only requiring a stable connection. The financial industry is being affected by tech, we simply cannot ignore that fact.

In the last week, different professionals in Gaborone heard from a team at Odoo, a company that focuses on developing technologies that create ease in process management for businesses. They offer a suite of tools for managing businesses, such as customer relationship management (CRM), e-commerce, billing, accounting, manufacturing, warehouse, project management, and inventory management. This tool simply put, is a one-stop shop for most if not all business processes for whatever size business one operates. Globally, many have been raving about Chat

Generative Pre-Trained Transformer, popularly known as ChatGPT which is a tool that will aid consumers in quicker decision-making for their purchases and business with faster communication of relevant information of their products and services. A tool that will replace Google search marketing? Nobody knows. One thing is for sure, each year, many technologies are developed based on user experiences that are meant to create an ease of use of money. Most of it is good but there are some pockets of scary realities that exist within this sphere too.

Where money is involved, there is typically an array of risks matched by governing principles and codes. The global community works very hard in ensuring that money is not being used to harm the planet, other human beings, and any other living things on the planet. However, one might wonder if technology has created a gap in financial regulations. How does the government, and corporations establish proper channels and regulations for finance’s newest entrants - Central Bank Digital Currencies (CBDCs), Mobile Money platforms that can allow fund transfers without the need for certain proof-points? Legal and compliance are never too far behind in the world of finance. For instance, any exchange of electronic data between financial institutions is governed by the ISO 20022 standard. This is in place

for the maintenance procedure for the repositories’ content. It describes a metadata repository that contains descriptions of messages and business processes. The standard applies to the transfer of financial data between financial institutions, including information on payments, securities trading and settlement, credit and debit card transactions, and other financial data. Therefore, while tech companies continue to innovate – standards are being updated on a year-to-year basis.

Secure FinTech development is challenging, time-consuming, and most importantly, expensive. When approaching a FinTech project, teams from various businesses should have the necessary knowledge and experience with FinTech security requirements. Your project has a good chance of failing and costing the company more than it could ever imagine if none of these are in place. Making a highly secure and compliant financial platform without wasting resources is essential when investing in Fintechs. Consideration of the end-users experience with the platform is also crucial. There is no point in creating a FinTech application for a market that is incapable of using the platform effectively or even understanding it. Research plays a critical component in making sure that the financial solutions being developed by any organisation is a fit for that specific market.

The financial landscape is changing rapidly at the moment and is anticipating further changes in the next few years. Money plays an important role in everyday living and day to day running of organisations. It is important to stay informed on what changes are on the ground and which are underway. Seven key technologies, according to a McKinsey analysis, will propel fintech growth and mold the financial industry’s competitive landscape over the next ten years and it’s important to keep an eye on the progression of those different technologies. These technologies are:

1. Artificial intelligence will drive massive value creation

2. Blockchain will challenge current financial practices.

3. Financial services players will be liberated by cloud computing (as noted earlier with the Odoo platform)

4. The Internet of Things (IoT) will lead to a new era of financial trust

5. Entry barriers will be lowered by serverless, open-source, and SaaS

6. Application development will be redefined by no-code and low-code.

7. Manual labor will be replaced by hyper-automation. Artificial intelligence, deep learning, eventdriven software, and robotics are all examples of hyper-automation.

Whether you are a big player or small player in the financial services sector, the advancement of technology in

today’s business landscape cannot be ignored. All players must stay well informed about new developments that affect the industry. Being aware helps anyone be in a better position to plan for their personal finances, for that of their organisations, and the people that will get affected in any process that takes place in those instances. An important step in managing any change is staying informed.

Where money is involved, there is typically an array of risks matched by governing principles and codes. The global community works very hard in ensuring that money is not being used to harm the planet, other human beings, and any other living things on the planet.

Orange Botswana through the Orange Foundation continues to show its commitment to closing the digital divide by donating to Moreomaoto Primary School in the Northwest District.

Through its CSR arm, the Orange Foundation aims to bridge the existing digital divide in remote communities by championing innovation and investment.

Kickstarting it’s 2023 roll-out, Moremaoto was the 60th primary school to benefit from Orange Foundation’s digital school programme by receiving ICT equipment worth P100,000.

The digital equipment donated will be used to assist the learners of Moreomoato Primary school in their studies, giving them access to the opportunities and educational enrichment available through digital technology. The donation will furthermore help facilitate the operations of the school, providing a much-needed enhancement to the existing ICT equipment used by the school.

Speaking at the official handover, Legal and Corporate Affair’s Director, Lepata Mafa indicate that Orange Botswana recognizes the importance of education for all citizens of Botswana. The telco company has aligned all effort to promote quality education with the vision 2036 that emphasizes education and skills as a basis for human resource development.

“We are determined to play our part as a responsible corporate in transforming and shaping the future through various initiatives that promote education. The Digital schools programme is our effort to ensure that children have access to quality education with the integration of ICTs in learning. The programme addresses issues of digital inclusion by

leveraging technology to improve access to education,” she said.

The donation made to Moremaoto Primary School included but was not restricted to; 50 Tablets, 2 Raspberry web servers loaded with content, 50 Headphones , Projector and 1 Projector screen, 1 Laptop and a printer.

The Orange Foundation additionally donated an additional 5 laptops, and 4 printers to be used in various sectors of the Boteti West Cconstituency. The laptops and printers are to be shared with the various empowerment partners, operating as NGOs in the area. The NGOs currently implementing an array of developmental interventions throughout the Boteti West Constituency.

Receiving the donation at a ceremony held at Moremaoato Primary School, His Honour, Vice-President and Member of Parliament for Boteti West, Slumber Tsogwane, said,” I would like to thank Orange Botswana and the Orange Foundation for their generous donation towards the young minds and futures of Boteti-West and Botswana. I believe that the ICT/digital equipment handed over today will go a long way in improving the services of Moremaoto Primary School and richly enhance the educational experience of the school’s learners. Furthermore, I am excited about the opportunities that will be availed to the learners as they step into a more digitally inclusive world.”

Launched in 2018, the Digital School Programme’s mission is to implement and integrate ICT in education and

champion the issues of digital inclusion. Orange Digital Schools Programme prioritizes the implementation and integration of ICT in education while addressing issues of digital equality and solidify the mission of investing in the youth, the programme has seen 30, 000 students benefiting from deployed schools, with 509 teachers trained in using digital kits as a mode of teaching.

Moremaoto Primary is the 60th school to receive donations as part of this nationwide initiative. The school continues to perform well in the Primary School Leaving Examinations (PSLE), and consistently works to ensure children learn vital life lessons both inside and outside the classroom. Moremaoto Primary boasts excellent academics, leadership, sports, and culture.

A total of 30 000 number of students have benefitted from the digital school’s programme. 590 teachers have been trained in using digital kits as a mode of teaching. Orange Botswana anticipates 86 number of schools to benefit from the programme in the year 2023 alone and are eager to keep extending the numbers.

The Orange Foundation looks forward to growing the Digital Schools Programme even further, expanding it beyond secondary education and truly living up to our aim of providing access to education for all. We strive to provide Batswana across all ages with innovative and relevant solutions and bring them even closer to better opportunities, both locally and internationally.

GABORONE –Stanbic Bank Botswana continues to support the drive towards greater academic excellence across Botswana. Building on a number of years working to empower youth academic progress, the Bank recently donated textbooks to Mahupu Unified Secondary School valued at P20,000.00. The donation, which comprises over 70 textbooks ranging from English Literature to Mathematics, Design & Tech and Home Economics, and indeed more, was driven by the Bank’s Legal department, and follows 13 donations by various departments and branches made in 2022.

“Our anniversary year may have ended but this does not mean that the needs of communities need to be overlooked. Aware of the challenges schools are facing, and in constant engagement with Mahupu especially, we recognised

that our contribution stands to make a difference to young learners. If we can help influence, support, and shape greater academic performance, then we know we are truly improving lives of the future leaders of this beautiful country. The onus is on us as a community collective to encourage them, support them, empower them and show that, truly, It Can Be. A brighter future, a world of possibilities, and dreams realised – It Can Be,” said Stanbic Bank Communications Manager, Ruth Sibanda.

Stanbic Bank has a well-established relationship with Mahupu Unified Secondary School, in 2022 the Bank handed over a donation valued at P150,000.00 in celebration of the school’s remarkable position 3 in the National 2021 Examination Certificate ranking. A great milestone for the students and indeed the school. In June

2022, the bank donated school shoes and socks for each student, 190 various subjects revision, financial literacy books, and other essential stationery. In addition, the Bank has, in 2020, hosted 60 Business Studies students from the school for an educational trip to Gaborone in effort to further improve their academic experience.

Mahupu Unified Secondary School is a Government-owned learning institution in the Kweneng District. The school is located in Takatokwane village 180 km west of Gaborone, and has 1,600 enrolled learners, including boarding students.

“We thank the Bank for this kind gesture and for continuing to build on their efforts and relationship with our school. This is a partnership, and we see that in every engagement, with long-term mutual commitment that ultimately sees

the greatest impact in the lives of our young learners. This is not something one can put a price on, for the longterm value it brings is truly infinite,” said William Mbinda, School Head, Mahupu Unified Secondary School

Stanbic Bank Botswana believes in creating value for clients and communities by providing access to digital financial and related solutions that support sustainable growth, as well as through engagements such as these to solve for wider social, economic and environmental or “SEE” impact. The donation marks the 14th of this nature under the Stanbic Bank Botswana’s 30th anniversary celebrations banner which kickstarted in 2022. Under this initiative, the Bank has supported schools, clinics, hospitals, and brigades, just to name a few under their corporate and social investment policy with a focus on education and health pillars.

“Our engagement with Mahupu stems from 4 years ago when we first engaged with the school, and we hope to see it grow even stronger in the future, for this is not an isolated effort. It is a commitment. And so, to the learners at Mahupu and indeed across Botswana, we say this: Believe in your dreams and work towards achieving your academic goals. Keep raising the bar. It Can Be!” continued Sibanda.

For more information contact:

Taazima Kala-Essack, Hotwire PRC Lead Consultant

taazima@hotwireprc.com or +267 3923579 OR

Ruth Lorato Sibanda, Stanbic Bank

Botswana Public Relations Manager sibandar@stanbic.com or +267 3618230

Botswana

Stanbic Bank Botswana is part of the Standard Bank Group, Africa’s largest bank by assets.

The group has direct, on-theground representation in 20 African

countries and in 7 global financial centres. Standard Bank Group has more than 1 100 branches and 6 500 ATMs in Africa, making it one of the largest banking networks on the continent. It provides global connections backed by deep insights into the countries where it operates.

Stanbic Bank Botswana provides the full spectrum of financial services, working to help make Batswana’s dreams a lasting reality in line with the Bank’s Purpose to fuel Botswana’s growth. Across our business and the breadth of our services and solutions, with Stanbic Bank, IT CAN BE.

Stanbic Bank Botswana’s Corporate and Investment Banking (CIB) serves a wide range of requirements for banking, finance, trading, investment, risk management and advisory services. CIB delivers this comprehensive range of products and services relating to: investment banking; global markets; and global transactional products and services. Stanbic Bank Botswana’s Corporate and Investment Banking expertise is focused on industry sectors that are most relevant to emerging markets. It has strong offerings in Power and Infrastructure, Mining and Metals, Industrials, Fast Moving Consumer Goods (FMCG), Telecommunications and Media, Oil and Gas and Non-Banking Financial Institutions & Financial Institutions. Furthermore, CIB offers Investor Services which include highly specialised financial administrative services such as custodial and trustee services which are instrumental to the investment management and governance process in the market.

Stanbic Bank Botswana’s Business Client Segment (BCB) owns, localises and executes the Business & Commercial Banking (BCB) strategy by deploying locally relevant client value propositions in strategic focus sectors in order to deliver scale, client value and bank commercial value in line with business objectives. It drives the effective deployment of direct banking solutions to meet the needs of all business owners, as well as building and maintaining

effective relationships with clients to entrench our position as a partner for growth amongst businesses of all sizes across multiple industries.

The Consumer & High Net-Worth Client Segment owns, executes, scales, entrenches and commercialises the Consumer & High Net Worth Client value proposition; and build, maintain and scale quality client relationships. This includes the identification of local market 3rd party products and ecosystems, informed by client analytics and engagements.

Having operated in Botswana for over 30 years, Stanbic Bank Botswana continues to receive prestigious awards as testament to the helpful role we play in supporting Botswana’s economic activity in various sectors.

Stanbic Bank Botswana currently employs over 600 members of staff and has a national footprint comprising 13 branches. Six branches are located within Gaborone, with representation in Francistown, Letlhakane (a digital branch), Maun, Mogoditshane, Palapye, Selebi Phikwe and Kazungula. The Bank also services customers through a network of 80 ATMs countrywide; and over 3 585 Point of Sale (POS) machines with 861 integrated with store tills in various retailers and outlets in a bid to offer greater convenience and on-the-go banking for its valued customers.

Stanbic Bank Botswana is committed towards attainment of our Vision to create value for clients and the communities we serve by providing access to digital financial and related solutions that support sustainable growth. Our Letsema 2025 Strategy is a clear, actionable and measurable roadmap towards attaining this and achieving our growth and performance measures, both financial and Social, Economic and Environmental (“SEE”), for we believe Botswana is our home and we drive her growth.

For further information, go to www. stanbicbank.co.bw

According to the World Economic Forum report New Vision for Education: Fostering Social and Emotional Learning Through Technology, the gap between the skills people learn and the skills people need is becoming more obvious, as traditional learning falls short of equipping students with the knowledge they need to thrive.

Just like the economy and job marketplace, education is constantly changing. In order to be successful in the three areas (student life, adulthood, and working), you need to acquire a set of universal skills. Refusing to adapt would do a terrible disservice to students, leaving them poorly prepared for their futures. According to the framework by the American National Education Association, key 21st-century skills fall under one of these three categories (learning skills, Literacy skills and Life skills).

Today’s job candidates must be able to collaborate, communicate and solve problems such skills developed mainly through social and emotional learning (SEL). Combined with traditional skills, this social and emotional proficiency will equip students to succeed in the evolving digital economy.

Learning Skills:

Critical thinking is the ability to analyze different kinds of facts in order to form an opinion or to come to a conclusion.

Creativity is a skill required in almost every profession. Creativity is the ability to come up with new ideas or concepts in a given field.

Collaboration is the ability to work with other professionals in the field as part of a team is one of the most

essential skills out there.

Communication is the skill that links together all the other learning skills. Skills like being able to think critically, being creative, and collaborating with others can only be put to use if you know how to communicate ideas clearly and effectively.

Literacy skills examples are information literacy (ability to work with statistics and data and sift through the plethora of information online to find what you are looking for), media literacy (nowadays, media consumption is something that is constant, and being able to differentiate between reliable and unreliable (fake news) sources is a must), technology literacy (being technological literate is one of the few skills that are applicable in nearly every industry as knowing how to use email, social media, and PowerPoint presentations are essential in today’s world).

Common Life Skills are adaptability or flexibility (the economy can change hourly, and sometimes what worked yesterday may not work today hence the inability to adapt has led to many people becoming unemployed and has made businesses fail), leadership (virtually everyone needs leadership skills, be it entry-level positions or those not in leadership positions, because they can better understand company decisions and prepare to take on leadership roles in the future by acquiring leadership skills), initiative and determination(nowadays, employers seek out people who constantly show initiative such as willingness to complete tasks out of their job description or work overtime in order to grow professionally. More and more companies reward their employees less on how long they have been in a company and more on what they can contribute to a company. Hard work and

the ability to come up with new ideas for improvement will lead to success).

In continuation of life skills is efficiency (Being efficient is essentially the same as being productive, which means this is a skill everyone can acquire) and lastly social skills (One of the most influential factors in one’s career success is networking and as mostly known sometimes the “who you know” is as significant as “what you do and how well you do it.” The ability to socialize and form work relationships with professionals that are part of the same industry, as you as well as other industries, can do wonders for your career, and this is only possible if you develop great social skills).

Promoting data literacy in organization starts with culture. Organizations need to establish data-first cultures that encourage the use of data, with strong support for the use of facts in decision making and a culture that celebrates curiosity and critical thinking. Creating this type of culture requires a combination of the right technology and the right people. Recruitment will be one of the first areas where we see this shift taking place, as companies hire datadriven employees who champion the use of data throughout their organization.

This journey will be uncomfortable at times, but one we need to embrace. Humans more than machines will oppose this change, but one thing is clear, it needs to start from the top. Leadership teams need to believe in it, promote it and live by it. Data literacy is a new language, and we all need to be fluent in it. With data everywhere, it will become the means of communication between IT and business, between the citizen data scientists and the domain experts.

In only a short period of years, unmanned aircraft systems (UAS), also called drones, have evolved from paparazzi gadgets to valuable tools helping journalists or global media in general to research, news-gather purpose, capture and share breaking news stories.

As many study the technological development and capabilities of contemporary drone hardware and the future of drone journalism. There’s consideration on the complex place of the media’s drone use in relation to international laws, as well as the ethical challenges and issues raised by the practice.

Consequently, many media organisations have been eager to explore the possibilities of drones. The technology is set to become a mainstream tool in journalism with vast potential applications, with the likes of not only using them for commercial operations, from agriculture to emergency operations but also as tools for creating visual art in photography, videography and journalism.

According to Federal Aviation Administration (FAA) which is the largest transportation agency of the U.S. government and regulates all aspects of civil aviation in the country as well as over surrounding international waters, operators are no longer required to obtain a pilot’s license before receiving an exemption to fly a drone. The easing of regulations was a significant development for photojournalism because it put relatively inexpensive aerial photography, videography

and airborne sensors in the hands of journalists across the states. This has created vast opportunities as well as new challenges for journalists and regulators alike.

Advantages of Drone use are: Drones are unique as they offer distinct visual perspectives and can be used to explore new reporting frontiers, beyond the visuals, through data collection and integration with emerging technologies. The advantages of drone journalism are still emerging. And while there are critical regulatory and legal concerns still to be addressed, this is a field showing huge potential. UAS are delivering open-source aerial photography and disaster coverage to newsrooms across the country.

Drones are creating powerful storytelling moments, opportunities for multispectral imagery and photogrammetry. As a storytelling tool, it can take readers to new places and grant unexpected insights.

Cost-effectiveness is also a key advantage for reporters as events that are typically

covered by news helicopters can often be transitioned to lower-cost UAS. Traditional methods such as renting a helicopter to get aerial images or video were only available to large media outlets due to price. The introduction of drones, have now become a saving grace for small operations because they can capture the same images and conduct the same investigations using a platform which is accessible and pays for itself almost immediately.

Drone journalism has the potential to cover natural or man-made disasters by illustrating the extent and gravity of the situation. Their visuals can also be used to create maps of disaster areas and, combined with data, explain how different communities fared after a major storm.

Challenges on Drone Use: Navigating the cumbersome regulatory framework

Operational safety risks and hazards.

Overcoming such challenges can is possible if Operational Intelligence (OI) platforms and applications can provide operators with real-time, in-depth data access in the most remote environments or low-bandwidth situations. Incorporating weather forecasts, maps and topography of the local area and other data, pre- and post-production planning native to OI applications for UAS can help journalists and film crews ensure ease and safety when filming.

Acomponent of civil aviation is commercial aviation which is the business of operating aircraft to transport people and goods on hire. The airliners used in the transportation of passengers and cargo range from single-engine freight planes such as the Boeing 747. Commercial aircraft were accepted after the Second World War. Since then, it has been experiencing steady growth. For instance, in the 1950s, most European countries started

manufacturing new aircraft such as The Beech and Cessna.

According to Commercial Aviation’s author, Ole Steen Hansen the market share financial analysis is a top-down tool where activity at an airport is regarded as being directly proportional to growth in the combined external measure. “Hence, to produce correct predictions, is vital for the airport activity and the larger aggregate link ratio to remain constant over a specified duration and with the

expected change in commercial aviation, the financial analysis forecasting tools that will contribute to analysing the industry can be classified into four classes,” says Commercial Aviation’s author, Ole Steen Hansen.

Majority airport economic forecasts use econometrics, which relies on explanatory variables that discuss the impacts of the demand and supply of commercial aviation activities.

These variables are characterised into macroeconomic and demographic elements, aviation market forces, innovation and production costs, and technology. Other variables include legal factors, capital investment constraints or upgrades, and substitutes for air travel. The third financial tool is the Time Series analysis that involves extrapolating the current data or graph into the future.

In the next five years, commercial aviation is bound to change significantly. The first expected change will revolve around its customer relationship strategies and the rising competition in the airline industry, which is expected to be at peak in the half-a-decade period, bringing the needs for new strategies

that commercial aviation should adopt to retain its clientele or attract new ones from its competitors. To implement its Customer Relationship Management (CRM) framework. As commercial aviation ushers in a new era of profit-making planes, it is relying on the manufacturers’ modification of improved performance, fuel-efficient engines, and better maintenance techniques, for instance, longer intervals between checks ups.

They come with an intrinsic safe and secure network file server that undertakes many self-diagnostics functions. Such systems reduce operational costs. Regarding customers and airport security, airplane checkpoints are currently sorting passengers and grouping them through digital screening

technology. Risk assessment of travellers is crucial progress towards arresting terrorists and anyone who possesses a security threat.

Nevertheless the industry faces operational expenses, commercial aviation is an important part of the community as a whole, including other stakeholders. These stakeholders include pilots, plane manufacturers, and a reliable workforce. These stakeholder groups are among the factors that drive commercial aviation activity. The airline industry struggles with revenue margins, the current growth rate in most markets in conjunction with advancing innovation and customer preferences present the industry with a real opportunity. Hence, it is likely to advance in the next half a decade.

Delighted on the outcome of the positive ramp-up of mining and processing operations to 3. 65Mtpa (c.300kt per month) achieved in December 2022 at its Khoemacau mine in the Kalahari Copper Belt of Botswana.

Johan Ferreira, Chief Executive Officer of Khoemacau Copper Mining and Cupric Canyon Capital Group, comments that “We are delighted and extremely proud to have ramped-up to full production during December 2022, with mining and processing operations continuing to operate at nameplate throughout January 2023 and all key operating and cost parameters are in line with expectations. This is an incredible achievement given the inflationary environment we have been operating in”.

Additionally, he also stated that the mine has only reached such an important milestone with thanks to the extraordinary efforts of the Khoemacau team, our business partners and incountry stakeholders, who jointly stewarded the construction and successful commissioning of the mine on time and on budget against the backdrop of the Covid-19 pandemic.

This announcement follows the Company’s prior announcements regarding the completion of construction

and commissioning activities on 16 February 2022 and the production of

first copper silver concentrate on 30 June 2021.

Though some of the negotiations to agree new terms were complex, De Beers has confidence of maintain its long time partnership with Botswana.

The president of the republic of Botswana, His Excellency Dr Mokgweetsi Eric Keabetswe Masisi on Sunday 12 of February 2023 had threatened to walk away from talks on the extension of De Beers’ mining rights in the country unless Botswana got a larger share of revenues.

“The company was ‘confident that our successful partnership will continue’ and arrangements must make economic and strategic sense for both parties,” said the De Beers’ Vice President-Corporate Affairs (Global Sightholder Sales) Otsile Mabeo.

He added that the De Beers’ Anglo American is in talks with the Botswana government to extend mining rights that expire in 2029, as well as a 2011 diamond sales agreement that expires in June this year.

“It’s important to note that our negotiations span more than just the sales agreement, they also include the future mining rights for Debswana, which are more complex and require more time to land on the finer details,” expressed Mabeo.

Under the current deal, Debswana - a 54 year-old joint venture between De Beers and the Botswana governmentsells 75% of its output to De Beers, while 25% goes to the state-owned Okavango Diamond Company. Botswana supplies 70% of De Beers’ rough diamonds. Last year, Debswana’s diamond sales

hit a record $4.588-billion, compared to $3.466-billion in 2021. Diamond sales, almost entirely from Debswana, account for two-thirds of Botswana’s foreign currency receipts and a fifth of its gross domestic product.

The Botswana government officials did not immediately comment however as time went on beginning of February 2023 Botswana’s Minister of Minerals and Energy (MaE), Lefoko Moagi shared that with hope a deal would be reached before the June deadline.

“A lot has been done, and what is left is material, but it is not insurmountable, it is in our best interests that we resolve that by the deadline,” Minister of Minerals and Energy, Moagi said on the side-lines of last week’s Cape Town Indaba Mining Conference.

SUPPLIERS OF DRILLING CONSUMABLES.

DRILLING EQUIPMENT AND CONSUMABLES FOR ALL TYPES OF DRILLING WORKS FROM DOWN THE HOLE HAMMER TO DIAMOND CORING.

DRILLING EQUIPMENT AND CONSUMABLES FOR ALL TYPES OF DRILLING WORKS FROM DOWN THE HOLE HAMMER TO DIAMOND CORING.

Particular Products Supplied are:

Particular Products Supplied are:

• Drilling Fluids and Muds

• Drilling Fluids and Muds

• Diamond Coring Equipment

• Diamond Coring Equipment

• Drilling Equipment

• Drilling Equipment

• Overburden Drilling Systems

• Overburden Drilling Systems

• Geological Equipment

• Geological Equipment

• Core Trays

• Core Trays

KPJ Drilling also provide:

KPJ Drilling also provide:

• Re-conditioning of Drill Bits & Manufacturing of Augers

• Re-conditioning of Drill Bits & Manufacturing of Augers

KPJ Drilling Your Local Supplier for

KPJ Drilling Your Local Supplier for

Unit G 1 Plot 22055

Unit G 1 Plot 22055

Gaborone West Industrial Gaborone, Botswana

Gaborone West Industrial Gaborone, Botswana

P O Box 10039, Gaborone Botswana

P O Box 10039, Gaborone Botswana

+267 319 0837

+267 319 0837

+267 319 1822

+267 319 1822

+267 74 294 929

+267 74 294 929

rodney@kpjdrilling.co.bw kpjdrillingsupplies.ws

rodney@kpjdrilling.co.bw kpjdrillingsupplies.ws

DRILLING EQUIPMENT, MUDS AND ACCESSORIES

DRILLING EQUIPMENT, MUDS AND ACCESSORIES

Chef Rachel takes viewers through a thrilling cooking journey. With a focus on Batswana cuisine and interesting delicacies, each episode sees the chef break down dynamic meals that are quick and easy to make for viewers across the continent.

Think out-of-the-box yet easy. Chef Rachel holds an extraordinary passion for cooking since childhood, with a fullfledged self-taught cooking business called “Rachel’s Table.” With her roots in Botswana, everything about her cooking aims to help her clients achieve a restaurant experience from the comfort of their own homes. Rachel’s fairly new reputation has landed her an opportunity as a personal chef for one of the foreign High Commissioners

serving in Botswana, where she not only prepares lunch and dinner daily but also caters for diplomatic events hosted by the respective embassy. As a result, she has served other diplomats from all over the world and also shared a bit of her own culture with them in only one language — food!

After losing her job during the COVID-19 era, friends and family pushed Rachel to consider using her academic degrees to push her passion for food as an entrepreneur, recipe developer, food stylist and cooking class teacher. With a unique experience with allergies to many foods, she has also developed a bespoke approach to food. This inspired a healthy mealprep service designed for people with various requirements like her, but still maintaining the love for taste and exploration. Her journey has brought her to Africa’s TV screens as the brand-

new host of HONEY TV’s “My Plate” series.

My Botswana Plate premieres on HONEY DStv 173 on Saturday 11 February 2023 at WAT 15:30 | CAT 16:30 | EAT 17:30.

In early December Okavango Wilderness Safaris (OWS) visited the Okavango Delta to hand over seed to farmers in the villages of Seronga, Gunotsoga, Eretsha, Beetsha, Gudigwa, and Sankoyo. Presenting cowpeas, maize and millet seed with a value of BWP25.000 to farmers in these areas. As the ploughing season gained momentum in most parts of the country, this year’s planting season OWS partnered with Seed Co Botswana to hand over two tonnes of maize seed worth over BWP95, 000.

Over several years Okavango Wilderness Safaris has worked hard to support crop farming within its partner-communities such being providing tractors and agricultural implements to assist with ploughing fields in Eretsha and Sankoyo villages. In areas like Eretsha, OWS is part of a multi-stakeholder partnership project promoting field clustering and conservation farming and projects like this, over 100 fields have been clustered, using electric fencing to keep out elephants. Simultaneously, OWS has made available a JCB backhoe loader to de-stump fields and further increase the arable land in the clusters.

Moreover, in order to alleviate issues created among human-wildlife conflict, OWS pledges to drill six boreholes near ploughing fields in the villages of Mokgacha, Gunotsoga, Eretsha, Beetsha and Gudigwa, with aim to decrease any potential risks of encountering wildlife, particularly elephants when farmers from those villages travel to fetch water.

According to Okavango Wilderness Safaris Stakeholder Manager, Moalosi Lebekwe the organization’s objectives is to play a greater role in enhancing food production in the area, complementing governments efforts to ensure food

security. “We as OWS have been working to assist local farmers produce food over the years in various ways; this has included seed distributions and assistance with implements, among others. Now, our partnership with Seed Co Botswana takes those efforts a step further, as we hand over two varieties of white maize that prove popular and in need in the area. It is a testament to our unending desire to assist farmers in the area in a sustainable manner,” said OWS Stakeholder Manager, Moalosi Lebekwe.

Seed Co Botswana’s Hoffman Rammala assured the farmers that the seeds donated were high-quality products and will yield great results when used appropriately, supporting the opportunity for greater self-sufficiency for communities and food security nationwide.

Specially Elected Councillor, Molatlhegi Bayeyi, visited all five villages’ seed handovers in the OCT area and expressed gratitude to OWS and Seed Co for their dedication to improving farming for

the Okavango Community Trust (OCT) villages, building further on the strong relationship that OCT has with OWS.

“Wilderness has gone beyond just being a lessee, and has taken an interest in improving the livelihoods of the communities adjacent to the concessions, it would be in the best interests of the community and the company that the partnership remains in force,” stated Specially Elected Councillor, Molatlhegi Bayeyi. Testament to this is the food relief drive that Wilderness undertook during the Covid-19 pandemic, when they distributed over 200 tonnes of essentials hampers to the residents on numerous occasions.

The seed handover was very well received by farmers and community leaders alike as necessary and encouraging, given the deteriorating interest in farming amid issues of human-wildlife conflict. This remains a core focus for OWS, which is committed to creating shared value to support the communities where it operates.

Non-communicable diseases (NCDs) or in other terms chronic diseases, are noninfectious health conditions that cannot be spread from one person to another, usually of long duration and are the result of a combination of genetic, physiological, environmental and behavioural factors. The main types of NCD are cardiovascular diseases (examples being heart attacks and stroke), cancers, chronic respiratory diseases (such as chronic obstructive pulmonary disease and asthma) and diabetes.

Moreover out of the 100% living human beings on earth, 86% premature deaths are of the population disproportionately affected by NDCs which found to be in low and middle income countries. Derived from the World Health Organisation (WHO) statistics states that (NCDs) deaths cases are 41 million each year, equivalent to 74% of all deaths globally. Each year, 17 million people die from a NCD before age 70, estimated around the age range of 30 to 69. NDCs has no specific age groups, religion, country or race. Cardiovascular diseases account for most NCD deaths, or 17.9 million people annually, followed by cancers (9.3 million), chronic respiratory diseases (4.1 million), and diabetes (2.0 million including kidney disease deaths caused by diabetes). The only way to manage NDCs is to take time and learn about the condition.

One must understand NonCommunicable Disease. NDCs description are a wide range of conditions, diseases, and disorders. These have genetic, lifestyle, or environmental causes rather than viral or bacterial, and they are characterized as health conditions that aren’t caused by acute infections or illness, result

in long-term health issues, require long-term treatment and care, such as lifestyle changes or medication.

Health conditions that are considered non-communicable diseases include Cardiovascular diseases ( conditions that affect your blood vessels and heart, example being coronary heart disease, heart attack, and stroke), Cancer (this disease happens when cells in your body mutate and begin dividing and growing), Chronic respiratory diseases (such health conditions impact your lungs in the long term and do not usually subside example is asthma or chronic obstructive pulmonary disease {COPD}) and another condition is Diabetes (If your body cannot regulate the levels of sugar in your blood, you may have diabetes. It is incurable, although it can be controlled, hence once diagnosed a change of diet and maintain recommended dosages of medication to prevent the condition from worsening). Lastly we have a much common NDCs which is mental health disorders.