PUBLISHER The Drinks Association

www.drinksassociation.com.au

All enquiries to: The Drinks Association Locked Bag 4100, Chatswood NSW 2067 ABN 26 001 376 423

The views expressed in Drinks Trade are those of the respective contributors and are not necessarily those of the magazine or The Drinks Association. Copyright is held by The Drinks Association and reproduction in whole or in part, without prior consent, is not permitted.

Other Drinks Association publications include: Drinks Trade Online www.drinkstrade.com.au Drinks Guide www.drinksguide.com.au

PUBLISHING EDITOR Ashley Pini ashley@hipmedia.com.au

EDITOR Melissa Parker melissa@hipmedia.com.au

DIGITAL EDITOR Ioni Doherty ionid@drinks.asn.au

STAFF WRITER Cody Profaca cody@hipmedia.com.au

CONTRIBUTORS Industry Leaders and supply partners of the Drinks Association.

SENIOR DESIGNER Jihee Park jihee@hipmedia.com.au

CONTRIBUTING DESIGNER Evelyn Rueda.............evelyn@hipmedia.com.au

Produced and contract published by:

ACCOUNTS: accounts@hipmedia.com.au Bay 8 / 6 Middlemiss Street, Lavender Bay, NSW 2060 Ph: 0410 600 075 www.hipmedia.com.au | facebook.com/drinksmedia ABN: 42 126 291 914

Welcome to the 2023 Drinks Guide, published and distributed courtesy of the supply partners within, and the Drinks Association.

The Drinks Guide, formally known as Thomson’s Liquor Guide, has been published since 1976 and, to our knowledge, is the longest serving liquor publication in Australia. I first worked on the title in 1997, and with previous owners, National Publishing Group produced the title six times a year. It was the industry bible for supplier information, including format size and LUC. The internet soon cut into that style of publishing and while updates to the directory are now made online via www.drinksguide.com.au, the annual Drinks Guide carries editorial and opinions in an industry ‘yearbook’ existing as a time capsule from which we can reflect and learn.

The Suppliers Directory still exists, and with good reason. Google any alcoholic product these days and you’ll likely get pages of retailer hits, a Wikipedia rundown and maybe (on page three) a news article in which that brand has appeared, on www.drinkstrade.com.au of course. But what of the trade asking the simple question: which supplier brings that brand into the country? You’ll find the Suppliers Directory starting on page 123.

The guide is jammed packed with commentary from industry leaders; those that help define the drinks landscape and bring innovation to market, and those charged with retailing and developing the best customer experience possible. We have the big end of town and the bespoke, craft retailers represented in this edition – so we hope there will be something for everyone.

Our data partners this year are CGA by Nielsen IQ, bringing the perennially difficult on-premise data and analysis to life for the Australian market. Their report starts on page 34 and is a must-read 6-page article. They are supported with reports from Growth Scope and Shopper Intelligence.

We have researched the must enter beer, wine and spirit shows – and listed entry dates and contact details, starting on page 54.

We trust you’ll find the 2023 Drinks Guide useful and thank the supplier and retailers that contributed to the 47th consecutive year of Drinks Guide (incl. Thomson’s Liquor Guide).

Cheers!

For the past decade gin has had great tonic to mix with, but whisky and rum have been patiently waiting for a premium cola to complement rather than hide their unique flavour profiles. Enter Fever-Tree Distillers Cola.

14 The Year in Review – Ioni Doherty – Drinks Trade Online

POINT OF VIEW –INDUSTRY

The Drinks Association –Georgia Lennon, CEO

Australian Grape & Wine –Tony Battaglene – outgoing CEO

Champagne Bureau Australian – John Noble – Director

Retail Drinks Australia –Michael Waters – CEO

Australian Women in Distilling Association – Kristy BoothLark – President

Women of Australian Distilling K athleen Davies – Founder

Australian Distillers Association – Paul McLeay – Chief Executive

Growth Scope – Mel Anderson – Director Research & Product

Shopper Intelligence ANZ –David Shukri – Australian Client Service Director, Sydney

34 CGA by NielsenIQ – Scott Elliott – Managing Director, Asia Pacific

POINT OF VIEW –RETAIL /WHOLESALE/ DISTRIBUTION

Australian Liquor Marketers and Independent Brands Australia – Chris Baddock –CEO

Coles Liquor – Darren Blackhurst – Chief Executive

Endeavour Group – Steve Donohue – CEO & Managing Director

Ebev – Ian Harris – Chief Executive Officer

Independent Liquor Group (ILG) – Paul Esposito – Chief Executive Officer

Liquor Barons – Chris O’Brien – General Manager

Paramount Liquor – Nathan Rowe – Director

Accolade Wines – Andrew Clarke – Managing Director, ANZ

Ampersand Projects – Alex Bottomley, Shaun Rankins, Marcus Kellett, Proprietors and Directors 64

Archie Rose Distilling Co – Will Edwards – Founder 66 Australian Distilling Co –Michael Hickinbotham –Founder 68 Australian Vintage Limited –Jeff Howlet – General Manager, Asia Pacific 70 Bacardi-Martini Australia –Donna Mulholland, Marketing Director

Brown Family Wine Group –Dean Carroll – CEO

Brown Forman - Eveline Albarracin – Vice President, Managing Director ANZPI, IMENA, Turkey

Spirit

to

Campari Group – Simon Durrant – Managing Director, Australia

77 Carlton & United Breweries –Danny Celoni – CEO 81 Casella Family Brands – Mark Churi – General Manager, Sales 82 Coca-Cola European Partners – Peter West – Vice President and General Manager, Australia, Pacific, Indonesia 84 Coopers Brewery – Michael Shearer – General Manager 87 De Bortoli Wines – Darren De Bortoli – Managing Director

DrinksWorks Australia – Judd Michel – General Manager

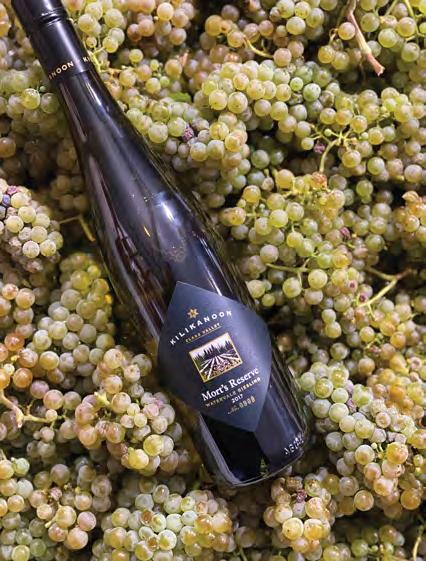

90 Duxton Vineyards – Wayne Ellis – Managing Director 92 Emperor Agency – Kyla K irkpatrick – Chief Executive Officer 94 Fever-Tree Australia – Andy Gaunt – Managing Director 96 Hard Fizz – Wade Tiller –Chief of Fizz 99 K ilikanoon Wines – Travis Fuller – Chief Executive Officer 100 Lion Australia – David Smith –Managing Director, Australia 102 Pernod Ricard Australia – Glen Scarlet – Commercial Director

Samuel Smith & Son – Paul Midolo – Executive Director 106 Single Vineyard Sellers – Stuart Leece – Director 109 Swift & Moore Beverages –Michael McShane – Managing Director 110

Top Shelf International – Drew Fairchild – CEO

Treasury Premium Brands ANZ – Angus Lilley – General Manager Sales & Global Growth Channels

Vintage House Wine & Spirits – Tim Boydell – Managing Director 117 Young & Rashleigh Wine Merchants/Cutting Wine Merchants NSW – Mal Williams – Co-Managing Director

William Grant & Sons – Colin Rochester – Managing Director, ANZ

Vanguard Luxury Brands –James France – Founder

Diageo Australia – Angus McPherson – Managing Director

Big Drop Brewing – Darren West – Country Director, Australia/NZ

A – Z Supplier Partners Directory

WE TAKE A LOOK BACK AT THE BIGGEST STORIES FROM THE PAST 12 MONTHS ON DRINKS TRADE DIGITAL.

BY Ioni Doherty, Editor, Drinks Trade Online

DECEMBER 2021

Endeavour’s most successful new beer brand of the year

Mighty Craft estimated approximately 3 million litres of Better Beer will be sold in FY22 putting it on track to be one of the biggest mainstream beer launches of the year. In fact, it is on track to deliver sales of 10 million litres for FY23.

At the time Endeavour Group Beer Category Manager Harriet Wischer said: “As the exclusive national retailer for Better Beer, we certainly suspected that the launch was going to be huge in Australia, but it has been bigger than anyone could have expected. Better Beer is our most successful new brand beer launch this year.”

Better Beer is now the most followed beer on social media with over 100,000 followers on Instagram, the highest of any beer brand in Australia.

Created in partnership with The Inspired Unemployed, Better Beer has enjoyed overwhelming demand since launching in November last year.

Mark Haysman, Managing Director

of Mighty Craft said: “Mainstream beer is a huge category in Australia and Better Beer has clearly struck a chord with a wide spectrum of enthusiastic beer consumers. The Inspired Unemployed boys have a huge following across Australia with over 2.5m followers across their platforms and importantly it is one of the most engaged platforms in the country. This unique partnership is definitely disrupting this category and offering a popular new alternative that has very quickly gained sales momentum.”

The product is an exclusive retail

partnership (for packaged products) between Endeavour Drinks Group (Dan Murphy’s and BWS), Mighty Craft Limited and Torquay Beverage Company.

The initial volume of stock to support the launch sold out within the first week of release.

Coca-Cola Europacific Partners Australia (CCEP) sold its interest in the Australian Beer Co (ABCo) to joint venture partner, Casella Family Brands (CFB), Australia’s largest family-owned wine company.

The sale (for an undisclosed sum) follows CCEP’s earlier decision to exit the production, sale and distribution of beer and Magners cider products in Australia, including the sale of Western Australia’s Feral Brewing Co. Casella and ABCo are neighbours in Yenda, New South Wales.

Vice President & General Manager, Australia, Pacific & Indonesia, Peter West, said the decision to

sell its interest in ABCo followed a strategic review of CCEP Australia’s arrangements relating to beer and apple cider to focus on its spirits, alcohol ready-to-drink and non-alcohol ready-to-drink portfolios.

“With CCEP’s exit from the Australian beer and apple cider categories in Australia, the decision to sell our interest in ABCo was the natural next step,” said Mr West.

John Casella, Managing Director of Casella Family Brands, said, “ABCo is an exciting business led by a state-ofthe-art brewery, and we welcomed the opportunity to acquire full ownership. We will endeavour to maintain the excellent relationships the CCEP team has established with customers in the beer and cider category in Australia.”

President Asia Pacific and Global Travel at Diageo, Sam Fischer commenced as CEO of Lion Group alongside David Smith – also exDiageo – who commenced in the role of Managing Director in late January.

Mr Fischer joined Lion from Diageo, where he was President Asia Pacific and Global Travel, and a member of the Global Diageo Executive Committee. Prior to Diageo, he spent 15 years with Colgate-Palmolive starting in Australia and moving on to hold senior

commercial roles working across several markets in Europe and Asia.

At the time, Lion’s Chairman Sir Rod Eddington said, “On behalf of Kirin and the Lion Board I am thrilled to welcome Sam home to Australia and to Lion. Sam brings 30 years of global leadership experience, deep expertise in alcohol beverages and FMCG businesses and a strong track record in driving business growth.

Endeavour Group removed Russian-made products from its shelves at Dan Murphy’s and BWS and from ALH hotels including Russian Standard, Beluga, Green Mark and Red Square.

A spokesperson from Endeavour said, “We have currently identified 47 products of Russian origin that we are in the process of removing from our stores, hotels and online platforms.

“All impacted suppliers have been engaged with and advised of our decision, and we thank them for their understanding. We will continue to monitor and review the situation, and work with our suppliers throughout this process.”

A spokesperson from Endeavour said the organisation is deeply concerned with the situation in Ukraine and joins the calls for peace. Reports say that the move was prompted by calls from the Australian Ukrainian community.

Coles have said they will do the same, taking steps last night to roll this out across Liquorland, Vintage Cellars and First Choice stores.

A Coles Liquor spokesperson said, “The thoughts of everyone at Coles Liquor are with the people of Ukraine and we hope for a peaceful resolution to the current crisis as soon as possible.

At the same time, Stoli Group, producers of Stolichnaya vodka distanced itself from Russia issuing a statement condemning the military action in Ukraine and saying it stands ready to support the Ukrainian people.

“We are absolutely not a Russian company. We are a global organisation with a significant portfolio of spirits and wine brands from around the world, with Stoli’s European Global HQ based in Luxembourg,” said Damian McKinney, Global CEO, Stoli Group.

APRIL 2O22

Australian whisky brand, Starward gained global recognition when it was awarded Double Gold at the San Francisco World Spirits Competition Founder, David Vitale said, “To be recognised, on a global stage, as some of the finest quality whisky in the world is a true testament to our incredible Australian ingredients and of course, the team’s ability to keep our innovative ethos fresh. It’s Australian whisky, and we are ecstatic to be celebrating this with the world!”

Australian whiskies had over 60 entries with close to half of them receiving a 46 per cent gold medal or higher. Callington Mill Distillery in Tasmania also performed well and won five double gold medals in this year’s content. The distillery’s entire Leap of Faith series received awards.

Accolade Wines was named Large Supplier of the Year at Endeavour Group’s inaugural supplier awards.

A spokesperson from Endeavour said, “As the signature award of the program, it celebrates an exemplary partner who has achieved over and above expectations resulting from their collaborative ways of working and shared values.

“Accolade Wines has worked with Endeavour Group on strategic initiatives to innovate in the wine category, including exploring new formats, brands, premium customer experiences and digital campaigns to meet the changing needs of customers.”

Accolade was also awarded Supply Chain of the Year Awards for its “great capacity to persist, adapt and transform in the face of change”.

Carlton & United Breweries was named Account Team of the Year, Diageo is Digital Partner of the Year and Mighty Craft was rewarded for its collaboration in the creation of Better Beer, the biggest new beer brand launch across Endeavour Group since 2014, with awards for Best Brand Activation and Product of the Year, The inaugural awards presentation was celebrated by more than 500 suppliers at the Timber Yard venue in Port Melbourne, where guests mingled while enjoying food as well as cocktails inspired by iconic ALH hotels around the country, as well as non-alcoholic drinks from Dan Murphy’s ZERO% popup bar.

Australian Vintage Limited ventured into premium spirits and RTDs and launched Tempus Two gin, Mr Stubbs cocktails and The Rescued Spirit Co. in June.

Craig Garvin, AVL Wines CEO, said, “These new brands have been developed in response to global drinks trends and each offers a distinctive point of difference – from a world-first gin to a playful sustainable spirit and high-quality cocktail convenience.”

AVL found itself with a load of grape spirit on its hands and with that came opportunity.

“The idea for our Tempus Two Gin range came from a desire to creatively harness the unique wine spirit that was extracted during the process used to make our low alcohol Lighten Up wines. We saw an opportunity to develop the varietal properties of the alcohol that was spun off and repurpose it into a range of high- quality gins,” Andrew Duff, Tempus Two’s Chief Winemaker said.

The Rescued Spirit Co is a whole new feel-good brand, and it ranges a vodka and a gin. Young, zingy and fresh, the gin and vodkas are made from the rescued grape spirit made at home in Mildura and with citrus fruit from the Murray-Darling Basin that might not be pretty enough for market but tastes great when infused with AVL’s grape spirit. And its production is powered by renewable energy. There are two gins and two vodkas, each infused with orange or with lemon and lime.

The Mr Stubbs cocktail range includes a Margarita, Cosmopolitan and Espresso and Cocktails are as

easy to make and are promoted to deliver bartender worthy cocktails on the go.

Paramount Liquor celebrated thirty years of business this year and became Australia’s largest familyowned liquor wholesaler upon merging with Queensland’s Liquid Specialty Beverages.

Paramount bought an equity stake in Liquid Specialty Beverages last year after a decade of the two businesses working closely together.

Paramount spent the past year planning to integrate Liquid Specialty Beverages under the Paramount umbrella to service more than 9,000 onpremise customers from Adelaide to far north Queensland.

Paramount operates in Victoria, South Australia, New South Wales & the ACT with warehouses in NSW, VIC and SA. Liquid Specialty Beverages services venues from the Northern Rivers of New South to Port Douglas in Far North Queensland, through its two warehousing facilities.

Suppliers and customers benefit from a single, on-premise focused solution, including the unified ordering portal Paramount launched last year.

Supplier partners’ brands are now marketed and distributed nationally across five distribution centres, totalling more than 50,000sqm.

Three decades on, it is a long way from the single bottle shop opened by Mark and Christine Rowe when the couple moved from Queensland to Melbourne in 1992 with a truckload of XXXX to sell.

The consumer and the producer bore the brunt of a record hike in spirits excise tax, and the Australian spirits industry called it ‘crippling.’

The excise rate of $94.41 per litre of pure alcohol increased from $90.78 in February.

To compare that to the tax on beer, the customer pays $1.20 per standard drink in spirit compared to 38 cents per standard drink of draught beer and less than 25 cents for a 100 mL glass of wine.

Australia imposes the third highest tax rate on spirits in the world, trumped only by Norway and Iceland.

The spirits industry said it is unfair, unsustainable, and a gross disadvantage.

Four Pillars has informed its consumers the cost of its Rare Dry Gin will increase by $3 per bottle from $75 to $78. Manly Spirits (pictured below) will increase their Dry Gin by $5 per bottle to $80.

Australian Distillers Chief Executive Paul McLeay said Australia’s outmoded alcohol tax regime indexes spirits excise to inflation, creating a situation where the tax take from spirits compounds every six months and grows further out of proportion to other drinks containing the same proportion of alcohol. As a result, up to 60 per cent of the retail price of an average 700mL bottle of spirits in Australia is now tax.

Geelong distiller Sebastian Reaburn from Anther Distillery told AFR Weekend the federal government now makes more from the sales of a bottle of spirit than the producer and the retailer. He said it was rare the tax per bottle is less than $30. If the bottle retails for $35, then the retailer and the producer are fighting over $5.

Automatic increases in line with the CPI mean the Federal Government’s average tax take from the distilling industry, which includes the manufacturing of premixed spirits, increases by $100 million-$120 million every year.

“This places an enormous burden on a local industry that barely existed a decade ago but is now highly acclaimed around the world, thanks to the hard work and creativity of Australian distillers. We should be celebrating them, not stifling them,” says Mr McLeay.

Greg Holland, Spirits & Cocktails Australia says the tax is cannibalising our industry.

“It has an insatiable appetite; no matter how hard our distillers and manufacturers work to grow, it keeps taking more. We look forward to working with the new Federal Government to build a more sustainable future for the Australian spirits industry,” said Greg Holland, Spirits & Cocktails Australia.

CUB released Sungazer and Empire, new types of fruity beer that is a subcategory in itself.

Fruity Beer hit the shelves and the brewing giant said it is a major departure from the beers that CUB has brewed for the past 190 years. Its watermelon flavour, mango flavour and strawberry & lime flavour are sweeter with reduced bitterness.

CUB says that its Fruity Beers differs from these craft beers which contain fruit.

A spokesperson from the company said, “Australian craft beer has a great history of using fruit in the ferment, which gives a subtle fruit undertone

with a strong beer taste.

“Fruity Beer is different. It has fruity flavours added at the end of the process, resulting in a much stronger fruity flavour and less beery taste.”

It says that this new type of flavoured beer expands the boundaries of the beer category and its testimony to the growth opportunities that CUB sees within the category.

While beer is still Australia’s most popular alcoholic drink, the release of Fruity Beer comes as drinkers’ palates change and they increasingly enjoy wine, RTDs or seltzers instead of classic Aussie lagers.

Australian winemaker and sparkling wine specialist, Trina Smith, collaborated with G H Mumm Chef de Caves, Laurent Fresnet, and released Mumm Tasmania. The Champagne house looked to Tasmania as part of its Mumm Terroir series celebrating prestigious wine regions known for producing exceptional Pinot Noir.

Mumm Tasmania went on sale late October.

Lark Distilling Co announced Satya Sharma, currently the Regional Managing Director South East Asia and Australasia for William Grant & Sons, as their new CEO, effective from May 1, 2023.

Mr. Sharma joins the Tasmanian whisky business with a wealth of global experience, having worked across the William Grant & Sons portfolio across Asia and the UK, as well as developed a world’s first with the “Distiller’s Library” concept.

FOR THE DRINKS ASSOCIATION AND ITS BOARD, THERE IS A GREAT SENSE OF RELIEF AND EXCITEMENT AS WE CLOSE OUT 2022. WE CONTINUE TO SEE THE ON-PREMISE SECTOR RECOVER, AND WE LOOK TO CHRISTMAS WITH A GREAT SENSE OF OPTIMISM.

No business in the Australian drinks industry has gone untouched by the extraordinary times of the past two years. And the challenges continue with supply chain uncertainty, inflation and COVID ongoing.

But this holiday season, many will feel great relief at being able to travel overseas to see family for the first time in years, and the fact that we can gather around the Christmas table without restrictions – and hopefully less sickness - will be appreciated by many. Our industry proved to be amazingly resilient through the height of COVID. We adapted, some of us re-invented ourselves, and many rallied to support our on-premise partners whose trade suffered so significantly during the lockdown periods. We can all feel proud of how we continue to move through these uncertain times.

In July, the Drinks Association and the industry gathered in person to celebrate the tenth annual Australian Drinks Awards. It’s been a decade of commissioning Advantage Australia to conduct its Engagement Program for the industry; a decade of celebrating the best performing brands in the Australian market and its best performing suppliers. For the first time, Accolade Wines won

the Supplier of the Year Award, and it also tied first to share the Supply Chain Management Award with Australian Vintage Limited. Carlton & United Breweries won the Category Management Award, while Brown Family Wine Group was awarded Most Improved Supplier of the Year. Thirty-six brands were recognised

The Drinks Association continues its commitment to advancing the Australian drinks industry as a destination of choice for jobseekers, continuing the evolution of diversity, inclusivity and equity with the great support from the Embrace Difference Council.

These awards are especially significant.

They represent an industry that innovates; an industry ambitious to operate more sustainably, conduct itself fairly, and move the dial when it comes to improving equity, diversity and inclusion.

as Australia’s fan favourites and those gaining most in popularity, as determined via research undertaken by Thrive Insights, and three Contribution to Industry Awards were given to Taylors Wines, Bacardi-Martini and Treasury Wine Estates.

These awards are especially significant. They represent an industry that innovates; an industry ambitious to operate more sustainably, conduct itself fairly, and move the dial when it comes to improving equity, diversity and inclusion.

The Council is led by Chair Sandra Gibbs from Asahi Beverages, with Lion’s Sarah Abbott leading the See Difference workstream (primarily concerned with the development and updating of the industry Scorecard and Toolkit) and Campari’s Stephanie Shedden leading the Create Difference workstream (primarily concerned with running events, including International Women’s Day and the return of the State Chapter events).

My great thanks to these leaders and their workstreams who continue to give their time to support the improvement of the industry as a whole.

From all of us at the Drinks Association, best wishes for Christmas and a Happy New Year.

THE LAST 12 MONTHS HAVE BEEN BOTH AN EXCITING AND A DIFFICULT TIME. THE ENVIRONMENT IS CHALLENGING AS THE SECTOR LOOKS TO OVERCOME THE HANGOVER FROM THE CLOSURE OF THE CHINA MARKET DUE TO THE PUNITIVE TARIFFS IMPOSED AFTER THE CHINESE GOVERNMENT LAUNCHED AN ANTI-DUMPING INVESTIGATION.

On the international front, some positive messages have come out on the relationship between China and Australia. The most recent example is the Australian foreign minister, Penny Wong’s meeting with her Chinese counterpart – the second in as many months – on the margins of the UN General Assembly session. The biggest obstacles to returning to more normal relations are China’s trade measures on Australia’s exports of wine, barley, coal, lumber and lobsters. Politically, no Australian government can do much to move forward while the measures are in place. Equally, Beijing cannot remove them without it looking like a humiliating backdown involving a massive loss of face. Movement won’t be possible now until after the Communist Party congress. Australia is currently prosecuting a case in the World Trade Organisation on the imposition of punitive tariffs for wine and barley. The wine case is likely to be decided by the end of 2023. If there is an improvement in relationships, it will provide an exit opportunity where both sides can save face. However, I would caution against optimism for a rapid reopening of the Chinese market, and the more likely outcome is for the punitive import duties to remain in place for some years.

The loss of a market for some 120 million litres of red wine has put immense pressure on both grape growers and exporters. The industry is now entering a very difficult time. The pressure on red grape prices is clear. However, there are very different stories within the industry. Some regions are short of fruit, and while domestic demand in a post-COVID world has been solid, cost of living pressures will impact demand and input costs, and labour shortages and logistics issues will squeeze margins. Many people are looking for government to help. However, the budgetary pressures on the government make this unlikely. We will do this by investing in innovation, building our brand credentials as a country and diversifying our markets.

In the last 12 months, Australian Grape & Wine has capitalised on its high reputation with the government and been awarded two significant grants. We are using these grants to diversify our markets and improve coordination between the Federal government, States and all our grape and wine sector organisations. The signing of the Australia-India Comprehensive Economic Cooperation Agreement (AI-CECA) and the finalisation of

the Australia-United Kingdom Free Trade Agreement have also provided excellent opportunities. Australian Grape & Wine is undertaking a long-term strategy to improve the economic viability of Australian wine exports to India. The project builds on the outcomes of the recently signed Australia-India Comprehensive Economic Cooperation Agreement (AICECA).

While the current environment is challenging, we have a strong platform to deliver future success and build resilience in the sector. Australian Grape & Wine is committed to working openly and collaboratively with all parts of the supply chain to deliver outcomes in the form of improved financial viability.

National Wine Centre, Botanic Road, Adelaide SA 5000, Australia +618 8133 4300 www.agw.org.au secretariat@wineindustrycode.org

The actions of the Champagne Bureau in 2022 focused mainly on developing new education programs that support the knowledge and interests of key Champagne ‘prescriptors’ including importers, distributors and wine communicators along with the industry professionals who are at the frontline of Champagne service and sales.

The brut, non-vintage style of Champagne remains the largest category in our market and makes up around 90% of the total volume – but this doesn’t mean our Champagne tastes are boring! We have seen the high demand for Champagne wines in both off premise and on premise businesses continue to evolve with significant interest in Blanc de Blancs and Blanc de Noirs styles and increased sales of prestige cuvées, vintage and rosé categories.

Our mission in Australia is to ensure that we have a number of educational approaches to assist our target audiences with a broad understanding of what makes Champagne so unique. One thing we have learned is that there is a great opportunity to present the diversity of Champagne wines available in Australia alongside a modern vision of what Champagne is, and the contemporary developments taking place in the region.

In July, we launched a new style

of Champagne ‘workshop’ designed for wine communicators, sommeliers and hospitality professionals - and were overwhelmed with the positive response. We have presented this new concept to restaurant and bar teams in their venues and in partnership with Sommeliers Australia we recently completed a national series of Champagne workshops in Sydney, Melbourne, Adelaide, Brisbane and Perth. The program included six different workshop sessions with each

featuring six Champagne cuvées organised into six topics: Chardonnay, Meunier, Pinot Noir, Champagne Production, Champagne Terroirs and Champagne Rosé.

The workshop style is not intended as a lecture, but merely Champagne facts presented in a fun ‘two way’ communication style; the objective is to generate interesting discussions

that challenge existing industry assumptions about Champagne. We also managed to taste some spectacular Champagne!

The ongoing relationship with Sommeliers Australia is very valuable to the Champagne Bureau mission and we were proud to present a very special Champagne workshop for the 12 finalists of the 2022 Sommeliers Australia Education Scholarship at The European in Melbourne in September: Congratulations to all of this years’ finalists, and to Ella Stening for being awarded Dux!

This year, along with individual departments within Comité Champagne we introduced webinars for Champagne importers and distributors. This allows us to use an online platform to communicate industry developments and innovations directly to this important cohort, live from Epernay in the heart of Champagne.

It was quite a good year for Champagne in Australia, but I’m looking forward to an action packed 2023!

02 9698 4403 info@champagne.com.au

I AM HAPPY TO REPORT THAT AUSTRALIA’S THIRST FOR CHAMPAGNE CONTINUED TO GROW IN 2022 AND WE HAVE MAINTAINED OUR INCREDIBLE POSITION AS THE 6TH LARGEST

MARKET IN THE WORLD.

SINCE FORMING IN LATE 2018 FOLLOWING THE CONSOLIDATION OF THE FORMER STATE AND TERRITORY LIQUOR STORE ASSOCIATIONS, RETAIL DRINKS AUSTRALIA, IS THE ONLY NATIONAL INDUSTRY BODY AND UNITED VOICE FOR THE ENTIRE RETAIL LIQUOR SECTOR. WE WORK PROACTIVELY TO NURTURE A STABLE POLITICAL, SOCIAL AND COMMERCIAL ENVIRONMENT IN WHICH OUR INDUSTRY MAY GROW SUSTAINABLY.

Our advocacy efforts in the legislative and regulatory environment (as a trusted advisor to both industry and government), is complemented with the delivery of relevant, cost-effective services to members. Put another way, we work hard to enhance the freedom to retail responsibly, but we also work just as hard to find ways to help our members’ businesses run more efficiently and effectively. Our efforts raise the overall professionalism of the industry and its people.

We’re proud to have achieved many key policy and advocacy outcomes since becoming Retail Drinks. A few of the most significant include: (1) keeping liquor retail open and helping to secure over $8 million in annual liquor licence fee waivers throughout the entire COVID-19 pandemic; (2) securing extended trading hours in NSW and SA; and (3) creating an industry-first and globally best-practice Online Alcohol Sale & Delivery Code of Conduct, which is helping to inform legislative reform across Australia.

eCommerce is growing fast to meet customer demands for convenience. Regulating it is a top priority of governments around the country and Retail Drinks is leading the effort to ensure new laws are practical and do

not bind this important sales channel in red tape. Our Online Code is the best tool to help signatories earn society’s trust to do business online.

Taking the initiative for advocacy on this and many other issues is made possible by the support of members. We commission research and meet with regulators and Ministers to ensure our perspective informs every big decision, from store promotions to the availability of alcohol beverage products. Through our work, community leaders understand and appreciate that our industry is diverse and dynamic, and we are significant economic contributors who understand the obligation to retail responsibly.

The only constant is change, and whilst our organisation is in the strongest position it has been for decades, it is only as strong as the support it receives from its membership. Having strength in numbers only enables greater effectiveness. If simply being a member of your industry association is not enough and you’re looking for a tangible ROI, don’t worry, we’ve got you covered here too.

Our three most popular, successful, and tangible member services are focused on business insurance, electricity, and merchant services. Those

costs have steadily increased in recent years and today in most instances are in the ‘Top 5’ annual costs of doing business, behind purchasing stock, wages, and rent.

Our Business Insurance Program is saving members an average of around 20% ($1,500) on their annual premiums, and with better coverage. Our free Electricity Health Check service has identified average savings of $3,648 on members’ energy bills, and our recently launched Merchant Services ‘Pricing Comparison Service’ is already showing great promise with average annual fee savings of 35% ($3,588) identified.

There are many, many more services and benefits. I encourage those who are not yet members to see for yourself, and importantly to get on board and be part of a growing community of likeminded retailers and start enjoying the benefits that membership can offer your business.

RETAIL DRINKS AUSTRALIA www.retaildrinks.org.au

THE

Our Purpose is to:

• Promote awareness of women working within the industry, as well as promoting industry awareness to new women entering the industry. In addition, we aim to promote the standards of best practice for the industry as a whole.

• Encourage women to seek out opportunities within the distilling industry including employment, knowledge growth, up-skilling and networking.

• Support women though industry workshops, forums and utilising the sharing of existing industry knowledge and capability.

• Celebrate the presence of women in the distilling industry, creating and using existing platforms to recognise, nurture and reward achievements and create more diversification within the industry.

• Invite complementary industries to be involved in AWDA as well as participate in events and activities

www.australianwomenindistillingassociation.com Awdainfo@gmail.com

AUSTRALIAN WOMEN IN DISTILLING ASSOCIATION INC WAS FORMED BY WOMEN IN THE INDUSTRY, TO PROMOTE, ENCOURAGE, SUPPORT AND CELEBRATE OTHER LIKE-MINDED WOMEN IN THE AUSTRALIAN DISTILLING INDUSTRY STANDARDS OF BEST PRACTICE FOR THE INDUSTRY AS A WHOLE. KRISTY LARK-BOOTHMale-dominated occupations are those comprised of 25% or fewer women. In a 2021 study of the Australian spirits industry conducted for Spirits & Cocktails Australia, Deloitte Access Economics found that women make up 48% of the workforce across manufacturing, wholesaling, retailing and hospitality. This stems from a higher share of female workers in hospitality (52%), as women make up just 36% of employees in spirits retailing and approximately 10% of roles in distilling.

Women working in male-dominated industries may face a variety of challenges, including;

• Not having the confidence to apply for career advancement

• Imposter syndrome

• Pay equity ensuring women and men performing the same role are paid the same amount

• Lack of mentoring and career development opportunities

• Sexual harassment

• Fewer female role models in senior leadership positions to aspire to

• Feelings of isolation and exclusion

My reason for founding this movement in 2014 was based on my own personal experiences during the beginning of my liquor industry career in the 1990’s. During this time, there was no female representation in middle

and senior management positions within the male-dominated companies I worked for. There was no one to shine a light on women and their achievements. Fast forward to today, and I still see the opportunity for women to excel and have the confidence to strive for leadership roles, fight for equal opportunity and genuinely build their careers within the Australian Distilling Industry. Part of our way of combating this is to make sure each woman apart of the initiative has an equal opportunity to be recognised; we post headshots and roles of every woman on the organisation’s website. https://www. womenofaustraliandistilling.com/

Throughout the last 12 months, Women of Australian Distilling has challenged preconceptions of the female role in distilling through exposure and education. Participation in events such as the YCK Laneways ‘Front and Centre’ highlighted female achievements and influence through live masterclasses encompassing

multiple different spirits such as gin, vodka and whisky. The Sydney Maritime Museum ‘The Ladies of Spirit’ event earlier in the year, highlighted women in gin and their involvement in production and distillation. A major hit was the International Women’s Day initiative in collaboration with Bloodwood Newtown and WOHO, which saw five amazing distillers able to speak on their experience in the industry and allowed a networking opportunity to highlight collaboration and support. Women of Australian Distilling constantly works behind the scenes to consult with inspiring women and collaborate with companies passionate about female recognition, referring and recommending women daily to allow for opportunities that would have otherwise been unobtained.

Women are often reluctant to talk up their accomplishments because they are often dismissed when they do. Women of Australian Distilling aims to help shine a light on Women’s achievements, and guide and encourage women in the industry to follow their passions within their chosen careers.

www.womenofaustraliandistilling.com/contact

CRAFT DISTILLING IN AUSTRALIA IS GOING FROM STRENGTH TO STRENGTH. THIS YEAR MARKS 30 YEARS SINCE BILL LARK WAS GRANTED THE FIRST CRAFT DISTILLERY LICENSE IN AUSTRALIA IN MORE THAN 100 YEARS. AUSTRALIAN CONSUMERS ARE NOT JUST FALLING IN LOVE WITH THE EXCITEMENT AND DIVERSITY OF THE SPIRITS CATEGORY AND ALL THAT COMES WITH IT, BUT THEIR PREFERENCES ARE ALSO INQUIRING INTO LOCALLY PRODUCED PREMIUM PRODUCTS.

Queensland Rum is going through a similar maturation process. For the last few years, many producers have been laying down product and allowing it to mature. We are already seeing the early fruits of some magnificent rum hitting the Australian shelves, and next year, we expect to see that increase substantially.

Australian craft gin has been a hero of the craft industry for several years. With unique Australian botanicals and innovation, we have some of the most intriguing and remarkable gin the world has enjoyed. Along with the consumer desire to be locally inquisitive, Australian gin is a genuine success story and will continue its rapid growth.

More than 350 Australian craft producers are now producing gin, vodka, rum, whisky, brandy and liqueurs. Every region across Australia has a proud local product they can consume at affordable prices. Australian spirits support our bartenders and on-premise mixologists. Craft spirits make extraordinary cocktails or full-bodied serves enjoyed straight up.

The Australian spirits industry now employs more than 4000 people in manufacturing alone. More than twothirds of Australian craft distilleries are in regional areas. Under the leadership of the new President of the Australian Distillers Association, Holly Klintworth, from Bass & Flinders Distillery, on the Mornington Peninsular, Australian Distillers have optimism for growth and are working closely with government and the industry to ensure growth in a safe, smart and sustainable way.

In June this year, Australia’s Starward Whisky was named the Most Awarded Distillery of the Year at the world’s largest and most competitive international spirit competition, the 2022 San Francisco World Spirits Competition (SFWSC). Melbournebased Starward is the first Australian distillery to take the top honour in the competition’s 22-year history, beating close to 5,000 of the world’s most renowned spirits, including whisky, gin, and tequila from countries such as Scotland, Japan, the USA and UK.

Never Never Distilling Co from McLaren Vale in SA was awarded the

Champion Australian distillery for the third year at the Australian Distilled Spirits Awards 2022.

We are seeing more distilleries commit to sustainability with several members, including Four Pillars Gin, Lark Distillery and Cape Byron, sharing their experiences of becoming Carbon Neutral with members through the sustainability webinar earlier this year.

Australian Distillers Association, Suite 1601, 447 Kent Street, Sydney, NSW, 2000 www.australiandistillers.org.au

WITH THE DOMINANCE OF BIG BOX RETAILERS BEING A KEY POINT OF OFF-PREMISE COMPETITIVE INTENSITY FOR ALL LIQUOR MARKET PARTICIPANTS (BOTH SUPPLIERS AND OTHER RETAIL CHANNELS AND BANNERS) THE ABILITY TO OPEN UP PANDORA’S PROVERBIAL ‘BIG’ BOX OF LIQUOR INSIGHTS WILL UNDOUBTEDLY SHED SOME LIGHT ON HOW BEST TO CAPITALISE ON THIS VAST CHANNEL OPPORTUNITY.

Before opening the box, it is important to contextualise what we may find inside. Retailers as the point of sale are a critical access point to shoppers and subsequently consumers, but understanding what happens at the point of sale is only one piece of the puzzle. Recent data from the IRI Shopper Panel tells us that more than 80% of liquor purchase decisions are made BEFORE a shopper enters a store (or logs online in the evergrowing world of ecommerce), and the consumption occasion is the number one driver of purchase choice.

With this in mind, Growth Scope’s unique dataset provides key insights into the consumption occasions that drive purchase behaviour, including

but not limited to the choice of retail channel. At Growth Scope we have developed a proprietary occasion segmentation model, dividing up all consumption activity into 13 discrete occasions. An individual liquor

consumer can engage in multiple different types of occasions over time, but at any given point in time they can only engage in one. These occasions can be loosely summarised as different consumer age groups consuming either

alone, with their partner, in small social groups or in large social groups.

Firstly, looking at the top five occasions where the liquor consumed was purchased from a big box retailer and comparing the prevalence of these occasions among other retail channels, we can immediately see that occasions that drive people to Big Box are notably different to those that drive people to other retail channels.

Occasions where the consumers are older and consuming in smaller more intimate groups dominate big box, while family drinking occasions are actually the number one occasion for other channels combined.

Drilling down into just two of these occasions for the purposes of this short article, we will highlight some of the key differences between the occasions, consumers, shopping behaviour and product choices that underpin people’s decision to purchase from a Big box retailer based on the underlying occasion.

Consumers and shoppers engage in different shopping behaviour for

different occasions, so these highlights should NOT be interpreted from an overall market perspective, but only within the context of these two specific occasion types.

PURCHASING FROM A BIG BOX RETAILER: RETIREE TIME VS. FAMILY TIME OCCASIONS

• Retiree time are occasions where retirees are drinking either alone, or with their partner. This is the largest occasion for people who shop at Big Box based on share of consumers.

• Family time occasions are when parents who have dependent children are drinking with family members other than just their partner. This is the largest occasion for non big box purchases based on share of consumers.

The following highlights are all based on consumers who engaged in one of these two occasions AND made their purchase of what was consumed from a big box retailer.

Big Box Other off-premise channel

Despite both consuming liquor purchased from a Big box retailer, retiree time occasions are far more likely to involve watching TV, around pre-dinner time on a day that is less likely to be Saturday compared to family time occasions. Occasion

The retiree time consumer who shops at a big box retailer for this occasion is skewed towards males who are very unlikely to be in paid employment (due to being in the retiree age group) and therefore drawing in a lower annual household income. In comparison the family time shopper who purchases from a big box could be either gender, in paid employment with a higher annual household income.

On family time occasions when shopping at big box, beer is a much more popular choice compared to retiree time occasions where red wine is the main product of choice. This preference for red wine on retiree time occasions also coincides with product choices centred around pairing well with food. Meanwhile family time occasions are far more likely to drive people to choose a product that is popular/enjoyed by the group than family time occasions are.

People shopping at a big box retailer for a retiree time occasion are far more likely than a family time shopper to make their purchase more than a week in advance of the consumption occasion. They are almost exclusively drawing from purchases made as part of a pantry stock shopper mission on these occasions. When shopping at a big box retailer for retiree time occasions people are also more likely than those shopping for family time occasions to buy the same thing every time. Habitual stock up behaviour is the key characteristic of a retiree time shopper vs. being more open to trying new things for family time.

These highlights are but a tiny peek into the full contents of Pandora’s ‘big’ box of insights, but even at this high level they clearly show that a one size fits all approach to targeting and shopper activation will not work, even within the one channel or one retail banner.

To get the most out of your shopper marketing activity not only do you need to consider the channel of purchase, but also the occasion for which purchases are being made.

Growth Scope provides a one stop source of insight into the liquor consumption occasions that drive shoppers into different stores for different reasons, and the purchase choices they make once they arrive.

At Growth Scope, we democratise access to consumer and shopper insights for small, medium and large industry suppliers, manufacturers and retailers.

Growth Scope exists to assist businesses to achieve their organic growth potential by affordably arming them with market-ready insights in an easy to use and digest format, covering the who, what, when, where, why and how much of liquor consumption and shopping in Australia. Both on and offpremise. We cover all liquor categories, premises, channels and banners, meaning we are the only integrated source of insight across the entire liquor landscape in Australia.

We also assist businesses in identifying their where to play and how to win choices by synthesising otherwise inaccessible and complex data into easy to interpret frameworks.

The challenge with most traditional data and insights tools is that they consider either the shopper OR the consumer but lack a clear line of sight between the two. This is where Growth Scope is different and unique. We provide a true line of sight between liquor consumption occasions and associated shopping behaviour.

Australian Client Service Director, Sydney

Australian Client Service Director, Sydney

How quickly things can change...

Remember the days when the offpremise liquor channel was soaring high with billions of dollars in growth?

Today, the comparative figures are hovering around 0% and the world looks like a very different place.

The pressure is on the industry to adapt, to evolve, and to answer the golden question...what do shoppers want?

At Shopper Intelligence, we’ve been surveying liquor shoppers for well over a decade. Earlier this year, our annual state of the nation highlighted ten crucial trends that everyone in the offpremise channel ought to be aware of.

Here’s a recap on three of the biggest...

The headline story this year is that, at a total level, shoppers are less satisfied with the off-premise channel now than they were two years ago.

Within this, big box banners saw their satisfaction levels drop year-onyear. Conversely, smaller format stores improved and it was independents who enjoyed the biggest gains.

Dan Murphy’s shoppers remain the most satisfied with a net favourable score of 72%, albeit that marks a 2% drop on the previous year.

At the other end of the spectrum, Thirsty Camel shoppers are the least satisfied (60% net favourable), but interestingly, registered the biggest increase in satisfaction year-on-year.

From a beverage point of view, shoppers in spirits categories are now the most content. Despite solid improvements, it’s the RTD shoppers who still bring up the rear, with a net favourable score of only 64%.

These findings point to just how important differentiation is in the

80% to consume the same day, the implications are clear. One size does not fit all. Traditional merchandising approaches aren’t optimized for a new cohort of drinkers.

Another much-discussed group of shoppers that falls below average on satisfaction is the non-alcoholic buyers.

This is a fast-evolving group and one that is being targeted today in a way never before seen. Their shopping motivations and behaviours are different so they demand a distinct strategy.

channel today. Shoppers see less distinction between banners and categories. They have unmet needs and they’re looking at retailers and brands for solutions.

What’s more, there are some significant shopper groups whose satisfaction levels fall well below average.

Among them are female shoppers and younger age groups, both of whom say they’re less satisfied with their experience in the off-premise.

When it comes to 18-24-yearolds, our data shows store and shelf layouts often fail to meet their needs. With over half of under 30’s buying liquor for a specific occasion and over

As an example, their number one importance factor is not price, as it is for traditional alcohol shoppers. In fact, it is the ability to identify value at shelf.

The differences don’t end there. Innovation, information, promotions and pre-store comms are all much more critical if you want to engage the no-alc shopper.

So the question ought not to be whether a differentiated strategy is needed. The answer to that is very clearly yes. The real question is how seriously do you want take the no-alc opportunity. The answer to that will determine how much time you invest in understanding this shopper.

When it comes to 18-24-year-olds, our data shows store and shelf layouts often fail to meet their needs.

Of the many fascinating trends we’ve seen from shoppers in the last year, the last one to touch on here relates to mission-based shopping.

For several years now, we’ve talked to the industry about the differing approaches of younger vs. older shoppers. More than half of those under 34, for example, buy liquor with a specific occasion in mind, and eight out of ten intend to consume it the same day.

These behaviours are vastly different compared to older shoppers.

If you’re over 55, there’s a one in two chance you buy liquor to stock up, and only a one in three likelihood you’ll consume it the same day you bought it.

So, the store ought to reflect these differences, right? Where products are located, how they’re laid out, the

theatre that accompanies them and the information given to shoppers - all these aspects ought to reflect the intended audience.

Yet how often is that the reality? How often do we take a generic approach and then settle on price activity when things don’t seem to be working?

If we want to do a better job for shoppers, encourage them to choose one retailer over another, and put an extra item in their basket, we have to be more targeted.

Don’t allow a black and white, cut and paste strategies to restrict your growth and your success.

Get under the skin of the specific dynamics, behaviours and motivators that drive shoppers in your category.

That’s one way to change things very quickly in your favour.

HEAD OFFICE:

201/18 Rodborough Road PO Box 6060 Frenchs Forest NSW 2086 +61 407034188 info@shopperintelligence.com.au

More than half of those under 34 buy liquor with a specific occasion in mind, and eight out of ten intend to consume it the same day.CGA BY NIELSENIQ Scott Elliott Managing Director, Asia Pacific

CGA ARE THE MARKET LEADING RESEARCH

FOR THE ON PREMISE CHANNEL. WITH 30+ YEARS OF BUILDING EXPERTISE AND INNOVATION WITH AN

NARROW FOCUS (BEVERAGES IN ON PREMISE), THERE IS SIMPLY NO OTHER BUSINESS WITH THE PROVEN CREDENTIALS, TRACK RECORD OR BREADTH OF EXPERIENCE OF MEASURING SALES PERFORMANCE WITHIN THIS FASCINATING CHANNEL.

Now fully partnered with NIQ, CGA is expanding their global reach at pace and bringing a host of proven, best-in-class measurement, analytics and consumer solutions to new On Premise markets around the world. These markets have been carefully selected based on client request, their strategic importance for global brand owners and where a genuine lack of performance measurement exists.

The CGA ‘On Premise toolkit’ has been honed over many years, in many markets, and has been proven unequivocally to be a game changer for brand owners who need robust insights in order invest intelligently in this complex channel.

The product roadmap for Australia is following a well-walked path and begins with the provision of brand new consumer insights all focused, uniquely, on the actual visitors to the On Premise. OPUS (the On Premise User Study) is not a broad consumer insight survey, to be used in a generic fashion across multiple channels. There is simply no other consumer research program which offers the depth and richness of the On Premise visitor’s behaviour, needs, influences and brand/category preferences that OPUS

does. A key reason for its long-term success in over 20 countries.

BeverageTrak, launching next month, is again a unique sales tracking solution which is only available in North America currently. Being able to code and fully normalize hundreds of millions of transactions from disparate On Premise POS systems is perhaps one of the best examples of CGA’s truly differentiated, and frankly unmatched, skillset. BeverageTrak will shortly allow Australian and New Zealand drinks suppliers to see how their brands are selling to consumers, against the category and named competitors… by the hour! These insights add incredible value to trade marketing tactics, activation plans and sales teams looking to understand low level competitive dynamics.

Finally, and planned for Q1 2023, CGA will launch the full market measurement solution which is the global benchmark for On Premise performance tracking, OPM. When OPM lands in any market, it becomes a breakthrough moment for suppliers who need to understand their share of the channel, sub-channel, specific geographies and categories. In every market that benefits from OPM, every

major player uses it in order to make better investment decisions which offer less risk and more defined upside assessment.

We are genuinely delighted to bring these solutions to Australia for the first time and, as proven in other regions, partnership and collaboration can only help this process. We hope that any supplier who is invested in this wonderful, experience-driven, channel will work with us to help bring these capabilities to life as quickly as possible, for the benefit of the whole industry who has been working in the ‘dark’ for far too long.

To learn more about CGA’s consumer research and market measurement services across both Australia and New Zealand, please contact James Phillips at james.phillips@cgastrategy.com

CGA, Strawberry studios, Watson Square, Stockport, Greater Manchester, SK1 3AZ +44 (0) 161 476 5580 www.cgastrategy.com hello@cgastrategy.com

EXTREMELYIN A PRESENTATION TO DRINKS ASSOCIATION MEMBERS, CGA BY NIELSENIQ’S SCOTT ELLIOTT AND JAMES PHILLIPS EXPLORED HOW ON PREMISE TRENDS HAVE SHIFTED IN AUSTRALIA POST-PANDEMIC – AND HOW THESE TRENDS COMPARE TO THE GLOBAL RECOVERY OF THE CHANNEL. CGA by NielsenIQ

Following the end of lockdowns and restrictions around the world, it’s clear that consumers are continuing to prioritise the On Premise – with 84% of global consumer typically visiting the channel, a three percentage point increase versus last year. Drink-led occasions in particular have seen growth, with weekly visits increasing 12pp versus pre-COVID-19 levels. This trend is reflected in the Australian On Premise, with 88% of Australian consumers planning on going out more or as often during the remainder of 2022, with consumers visiting casual dining restaurants, pubs and restaurants more often versus six months ago.

Globally, consumers’ desire for both value and quality has increased since COVID-19, with 35% of consumers stating high quality is more important (+2pp versus 2019), and 37% stating good value (+4pp vs 2019) is more important. 63% of consumers globally state that they are likely to trade up for

a ‘better quality’ drink, highlighting how prevalent the premiumisation trend has become – even in Australia.

53% of Australian consumers were likely to pay extra for a ‘better quality’ drink when out, when surveyed in CGA’s OPUS study – a six percentage point increase versus Autumn 2022. However, Australians also tend to prefer good value, with this dichotomy presenting a significant challenge for drinks suppliers in positioning their brands.

In CGA’s exclusive Bartender research conducted earlier in the year, cocktails were tipped to be one of the biggest trends – with 59% of bartenders stating they thought cocktails are in the best position to thrive in 2022. This is reinforced with the recent growth in cocktail penetration over the last 6 months in the Australian On Premise. This trend mirrors a global shift towards more experience-led serves, with consumers around the world choosing cocktails – with markets such as the US showing a 50%+ increase in the rate of sale in this category versus 2019.

Aussie bartenders also predicted that this year would see the No/ Low alcohol trend take off in the On Premise – but this hasn’t translated to a significant uptick in popularity with consumers. Penetration of low/ no alcohol alternatives is slightly down versus six months earlier in the year (-1pp), however loyal no/low customers are actually drinking more often (September 2022 versus March 2022).

Hard seltzers are one emerging category that has seen consistent growth, booming worldwide –particularly in the US across a variety of formats. The growth of this category in Australia could in part be due to the desire to live a healthier lifestyle, with ‘to be healthy’ growing in popularity as a reason for choosing hard seltzers as a drink choice in the On Premise.

With the decline of high-tempo, late-night occasions, the suburbs have seen an uptick in visitation. This reflects a continuing trend towards the ‘importance of local’, with 27% of Australian consumers stating it’s more important now that their drink is Australian than it was 12 months ago.

AS I REFLECT ON THE PAST 12 MONTHS, IT’S DIFFICULT TO IMAGINE WHAT THE WORLD, AUSTRALIA AND THE DRINKS INDUSTRY HAVE BEEN THROUGH. MANY HOPED THAT 2023 WOULD BE A POST-PANDEMIC TRANSITION BACK TO NORMAL; HOWEVER, 2022 WAS FAR FROM NORMAL. AS AN INDUSTRY, WE ARE RESILIENT TO WHAT IS NOW THIS NEW NORMAL.

It was pleasing to see our On-Premise partners finally get back to some regularity in trading conditions, especially after Omicron severally hindered Christmas in 2021. Trading in On-Premise in recent months has been stellar, and I thank all those in hospitality who have struggled through the past few years and, most recently, the significant staff shortages. It is easy for us to forget the effects of the pandemic, which remains with us through staff shortages, supply chain disruptions and economic conditions many have never seen in Australia.

I am very proud to have led such a wonderful team across ALM and IBA and marvel at just how resilient the team and, more importantly, our retailers have been over the past year. Our National Retail Board and State Committees, who volunteer their time to support the network of +1500 IBA retailers, thank you for your continued support of local convenience liquor retailing – our principles are simple, ensuring value for money through appealing brands, and always supporting local communities.

We delivered a lot in 2022, including a re-platforming of the IGA, Cellarbrations, Bottle-O and

Porters e-commerce sites, away from ShopMyLocal.com.au. Ensuring that each of these brands’ equity is supported by their unique.com. au platforms, enabling delivery and click and collect. We have also worked throughout the year to build and launch a loyalty program, currently in pilot, with rollout across the Cellarbrations and The Bottle-O networks early next year.

It has also been a challenging year in supply chain, with worldwide disruptions. While ALM has not been immune, I’d like to thank all retailers for their patience, understanding and feedback throughout the year. I assure retailers and suppliers that we are fully aware of the continued supply chain disruptions and are investing heavily to ensure the independent trade maintains supply across the network.

As I look forward to the next 12 months, it brings with it a great deal of excitement and enthusiasm. As presented at the state-based Trade Workshops, we are focused on i) being famous for Brands with Unique Character ii) Being Frictionless in Order to Cash and iii) building Stickiness through programs which consumers and retailers cannot do

without. I am also looking forward to returning the National Trade Workshop in September 2023 in Cairns.

These are exciting times for both On and Off Premise Independent retailers. Through our scale and breadth of services, I commit my team to serve you, the local, trusted and passionate independent retailers across Australia.

Wishing you all the very best over Christmas and the New Year, and, importantly, I hope trading is wonderful and that you stay safe and find some time to spend with friends and family.

HEAD OFFICE:

1 Thomas Holt Drive, Macquarie Park NSW 2113 02 9741 3000

www.thebottle-o.com.au www.cellarbrations.com.au www.igaliquor.com.au www.portersliquor.com.au www.duncans.com.au

Our Liquorland Black and White transformation continues, allowing us to enhance our range of local wines, craft beers, boutique spirits, and RTDs, offering more choices to customers. A key milestone for the business was opening our first Liquorland store in Tasmania in Glebe Hill, where we have worked with over 60 producers to bring over 320 local Tasmanian wines, beers, and spirits to our customers.

First Choice Liquor Market continues to provide trusted value for our customers by delivering over 2000 products on Price Drop, and we continue to renew our Vintage Cellars portfolio with our relaunched VC Club resonating strongly with existing and new members.

Our challenges were industry challenges where we were impacted by availability and supply chain disruptions because of Omicron, and closer to home, we had 66 stores and their respective store team members affected by the flood events earlier in the year. We’ve worked hard with our teams to reopen these stores and support our team members.

Our vision is to be a simpler, more accessible, locally relevant drinks specialist, and our strategy is serving us well.

We have improved our offer for our customers by increasing local, craft

and boutique products and adding over 300 products to our award-winning portfolio. We are proud of our sourcing expertise that has resulted in our exclusive liquor range winning over 420 awards in the last year, including Smithy’s Beer winning the Australian Lager of the Year at the Melbourne International Beer Competition and James Busby Vineyard Series Tasmanian Pinot Noir taking out the Trophy for Best Pinot Noir in Show at the 2022 Royal Adelaide Wine Show.

We continue to drive market-leading sustainability innovations, such as the 100% recyclable eco-bottle wine range launched during the year.

And our commitment to supporting Clean Up Australia through our Drop of Good campaign is an important part of the work Liquorland, and First Choice Liquor Market stores do in their communities around the country.

As we move into the “differentiate and grow” phase of our journey towards being a simpler, more accessible, locally relevant drinks specialist, we will continue to focus on providing great value to customers across all banners and channels and delivering products and offers that meet their needs. We continue to simplify how we buy and sell and invest in service to ensure we have the right team in place to serve our customers better. Our store and support teams have delivered a strong performance against our priorities and objectives, and I really want to thank them for the hard work and effort that has gone into the program of change and growth so far.

HEAD OFFICE:

800 Toorak Road, Hawthorn East, VIC 3123 03 98293111

www.colesgroup.com.au

We’ve delivered a strong financial outcome, grown our customer connections, expanded and renewed our network of hotels and retail stores, and invested in our digital capabilities and platforms.

Our vision is to be the leading platform enabling social occasions, and there’s never been a more important time to be in the business of creating products, places and experiences that bring people back together.

We’re also pleased with the initial progress on our Sustainability Strategy, making a positive, lasting imprint in the areas of Responsibility and Community, People and Planet. We have exceeded regulatory obligations, and lead in responsible service and work to understand our influence in responsible consumption and harm minimisation. We’ve focused on being a positive, safe and inclusive place to work, as one team with a shared purpose. We’re also making progress towards decarbonisation and are committed to sustainability through innovation.

Our success as a business relies on the outstanding products that producers create and supply us with, and we launched our inaugural Supplier of the Year Awards in May to acknowledge and celebrate the achievements of our valued partners.

Like many businesses, we have faced team shortages. We’re constantly looking at how we attract, retain and develop talented people. For example, we recently launched our first Endeavour Graduate Program; an 18-month, immersive career development program with a guaranteed position at the end.

We have a diverse network of more than 2,000 retail stores and hotels across Australia and award-winning wineries in our portfolio. We’re also one of the country’s largest accommodation providers and one of Australia’s largest providers of live entertainment.

What makes us unique is we are united around “creating a more sociable future together”. Our strategy focuses us on what matters most: bringing people together to share memorable moments.

Our strategy has three core pillars: creating leading customer offers; driving an efficient end to end business; and building partnerships that grow our industry. These strategic pillars are supported by a continuous focus on acting as one team, living Our Purpose and Values, and creating a positive and sustainable imprint.

We’ll continue to enhance our digital customer engagement platforms and use technology and innovation to enable convenience. We’re seeing

untapped growth potential through better integrated experiences. We will also unlock value via renewals and redevelopments as we create the stores and hotels of the future.

A standalone business since June 2021, we view our culture and team experience as our strongest assets, and will continue to invest in our team members and cross-skill them for multiple careers with us.

We will implement our Sustainability Strategy to leave a positive imprint on our communities, people and planet.

HEAD OFFICE:

26 Waterloo Street, Surry Hills NSW 2010 enquiries@edg.com.au endeavourgroup.com.au enquiries@edg.com.au

BRANDS DISTRIBUTED:

Dan Murphy’s, ALH, Jimmy Brings, Langtons, Shorty’s Liquor, Pinnacle Drinks

I’M SO PROUD OF AND GRATEFUL FOR EVERYTHING THE TEAM HAS ACHIEVED DURING WHAT HAS BEEN ANOTHER YEAR MARKED BY COVID RESTRICTIONS, NATURAL DISASTERS AND UNPREDICTABLE MARKET CONDITIONS.

We’ll continue to enhance our digital customer engagement platforms and use technology and innovation to enable convenience.

Executive Officer

Executive Officer

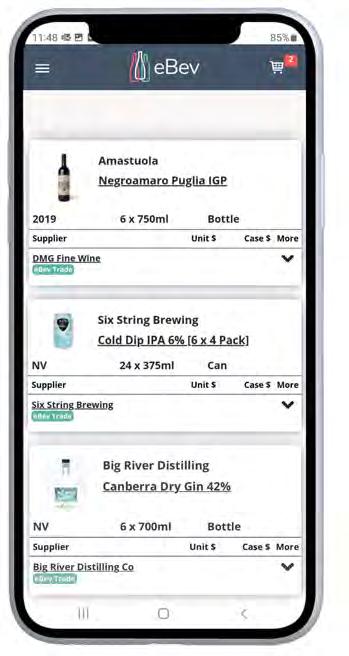

ONE WORD USED A LOT SINCE COVID IS ‘PIVOT’, AND WHILST EBEV HAS CONTINUED TO POWER AHEAD WITH ITS CORE PURPOSE AS THE LARGEST INDEPENDENT WHOLESALE BEVERAGE ORDERING PLATFORM, THE PAST YEAR HAS SEEN LARGE-SCALE FUNCTIONAL AND STRUCTURAL CHANGES TO THE PLATFORM.

GMV value for the 12 months to September 2022 is up 55%, with activated and credit-checked buyers on the platform up 152% to 3,500. That is only part of the story, an additional $10 million credit facility means the business can facilitate over $150 million in orders annually, with the tangible supplier benefit of being paid in three days across credit-checked customers. eBev Trade means suppliers no longer have to create invoices direct to venues or chase payments. Streamlining the supplier functionality also includes further integrations into back-end stock and accounting systems such as XERO, MYOB, Unleashed, Vinsight and Netsuite.

Efficiency is part of eBev’s mantra and business statement. A recent project measured the reduction in weekly ordering time from 3:00 hours to 15mins across hundreds of venues. This proven reduction is a testament to how eBev saves time and money for the buyers as well as suppliers, and with the current employment challenges, these ongoing reductions in staff time are significant. But even more importantly, a business can ensure their ordering and supplier relationships are maintained even with

staff churn, as everything is in the eBev platform.

With over 65,000 products listed, a business can keep niche, smallbatch products on the list alongside the high-volume rail pours, mixers, and even kegged beer, RTD and No/ Low drinks. In the current trading environment, an understandable shift is happening back towards the middle, driven by the difficulty of managing a long tail of suppliers. eBev enables venues to deliver a diverse and interesting beverage program with minimum effort in managing multiple suppliers. We see this as key to supporting both suppliers and the margins of venues in the resource-constrained environment in which we all operate.

Founded in 2015, eBev is Australia’s largest independent online ordering and financing platform for the Beverage Trade. With over 65,000 products from 700 suppliers, eBev’s is a ‘onestop-shop’ for everything from beer, wine, and spirits to the burgeoning

non-alcoholic category. Simplifying the ordering process for thousands of hospitality venues whilst reducing business administration for both venues and suppliers sees over $150 million in orders through the platform a year. eBev Trade now further empowers our suppliers with simplified credit functions and guaranteed payment within three days.

HEAD OFFICE: Headoffice Sydney 1300 556 081 www.ebev.com admin@ebev.com

BRANDS DISTRIBUTED:

Almost Everything

Chief Executive Officer

Chief Executive Officer

ILG MARKS ITS FOURTH CONSECUTIVE RECORD-BREAKING YEAR-END RESULT WITH $414M IN SALES REVENUE. AN EXCEPTIONAL OUTCOME DELIVERED ON THE BACK OF ONGOING OPERATIONAL CHALLENGES AND EVIDENTLY DRIVEN BY A REGIMENTED STRATEGIC PLAN PASSIONATELY SUPPORTED BY MEMBERS AND STAFF AND CONSISTENT WITH THE COOPERATIVE’S MISSION OF LONGEVITY FOR THE INDEPENDENT COMMUNITY.

Membership growth is also at its peak across all sectors both on and off premise as well as supplier-members as we welcomed over 200 new members to the ILG Family.

Coherent with ths year’s successful result, we disbursed $12M in member benefits, $2.5M in non-cash member benefits, and also repaid an additional $1M to our T-corp loan.

Nonetheless, is the increased investment in our e-commerce and digital platforms to provide members the opportunity to boost sales both online and instore. ILG’s Q-commerce collaboration has delivered an incremental $2.8M sales to participating members. Our e-commerce team is working closely with POS vendors on integration for greater flexibility and the development of a loyalty program with an intended launch date in Q4.

ILG’s retail pillar has been performing extremely well contributing

to the increased revenue outside our wholesale network. Our Bacchus Marsh store in Victoria also provides us with warehouse facilities to service our growing Victorian members. Banksia Supercellars in NSW is also our experimental outlet, allowing us to test the fesibility of pilot programs, products and services for further recommendation to our members.

ILG’s B2B platforms were recenlty launched through Liquorstop Warehouse and Liquor Co-op

offering a wide product range at wholesale prices as well as reduce the incidence of independent retailers purchasing from national chains. Once again, all these initiatives are consistent with the Co-operative’s mission of longevity for the independent community.

We will remain focused on growth for the ensuing year with the view of increasing operational efficiencies that will continue to provide our members with better prices and the opportunity to reduce the impact of increasing freight cost.

HEAD OFFICE: 16 Tyrone Place, Erskine Park NSW 2759

BRANDS DISTRIBUTED: Bottler, Supercellars, Fleet Street, Clubmart, Pubmart, The Liquor Co-op

Warehouse and is currently open to all companies holding a liquor license across NSW and will open to ACT QLD & VIC in early 2023. This initiative is aimed at helping the liquor industry connect and conduct business via a simplified online ordering system

“We will remain focused on growth for the ensuing year with the view of increasing operational efficiencies that will continue to provide our members with better prices and the opportunity to reduce the impact of increasing freight cost.”

In this economic climate, now more than ever, West Australian consumers know to support their local everything. Liquor Barons has invested largely in big impact marketing campaigns that educate consumers on supporting the little guys (us) and that’s been hugely successful.

The marketing efforts focus on promoting our 60 plus store owners and the advantages of shopping local,

as well as articulating what the benefits of being independent are to our customers.

We’ve communicated that our co-op model allows us to use our combined buying power to offer a huge range of their favourite alcohol brands at competitive prices.

But most importantly, we’ve communicated that Liquor Barons cooperative has a grassroots approach,

with community at the heart. Being independent means our humble store owners have the flexibility to support their local community in whatever way they can. By sponsoring sports clubs, community initiatives, various fundraisers and more, our independent stores do their bit to make sure the communities in our great state, well, continue being great!

We haven’t been shy about outlining how Liquor Barons is redefining what it means to be a West Aussie. From pushing boundaries to doing good deeds in our local community, our legit local store owners are pioneers, creators and innovators.

They’re our mates, local business owners and people you might have met at the local pub, who are daring to do things differently and representing what it means to be an independent WA battler.