2022 VANGUARD HONOREES 100 LEADERS SHARE THEIR SECRETS TO SUCCESS HOUSINGWIRE MAGAZINE ❱ October/November 2022 October/November 2022

HOUSINGWIRE

EDITOR-IN-CHIEF SARAH WHEELER MANAGING EDITOR JAMES KLEIMANN SENIOR MORTGAGE REPORTER BILL CONROY REAL ESTATE & TITLE REPORTER BROOKLEE HAN MORTGAGE REPORTER FLÁVIA FURLAN NUNES REPORTER CONNIE KIM LEAD ANALYST LOGAN MOHTASHAMI CONTRIBUTORS RICK SHARGA, SCOTT OLSON

REALTRENDS

VICE PRESIDENT OF REAL ESTATE MARK ADAMS EDITORIAL DIRECTOR TRACEY VELT DIRECTOR OF RANKINGS PROGRAMS LIZ SMITH EXECUTIVE MANAGER, CEO PROGRAMS JILL OLMSTED SENIOR DATA ANALYST KEERI TRAMM

FINLEDGER

CEO CLAYTON COLLINS

COO DIEGO SANCHEZ

DIRECTOR OF FINANCE ANDREW KEY DIRECTOR OF PEOPLE AND CULTURE AMY BEARD CHIEF OF STAFF ALEX BRIDGEMAN

VICE PRESIDENT OF GROWTH CAREN KARRIS GROWTH MARKETING MANAGER GREG ROBERTS

MAGAZINE EDITOR AUDREY LEE

SENIOR GRAPHIC DESIGNER EMILY CARPENTER

GRAPHIC DESIGNER BRANDON JOHNSON

VICE PRESIDENT OF PRODUCT HOLDEN PAGE UX/UI MANAGER BO FRIZE

WEB DIRECTOR BRENT DRIGGERS

AD OPS COORDINATOR ELIZABETH LEDOUX

DIRECTOR OF HW+ & EVENTS BRENA NATH

SENIOR WEBINAR & EVENTS MANAGER ALLISON LAFORGIA MARKETING PROGRAM MANAGER LESLEY COLLINS

MEMBERSHIP COORDINATOR SARAHI DE LA CUESTA

PEOPLE OPERATIONS MANAGER JAMIE BRIDGES

AD OPERATIONS MANAGER MATTHEW STAFFORD MEMBERSHIP DEVELOPMENT SPECIALIST CAROLINE ABAD EMAIL MARKETING SPECIALIST ALI MORRISSEY

GROWTH COORDINATOR SYDNEY SMITH

SENIOR EVENTS MANAGER KATIE GALBRAITH

EVENT SPECIALIST MAKENNA CLAY BUSINESS ANALYST WHITNI ROWE SOCIAL MEDIA STRATEGIST KENNEDY BENJAMIN

REVERSE CHRIS CLOW

SALES

EDITOR JOE BURNS REPORTER TANNISTHA SINHA JLAWS@HOUSINGWIRE.COM OR (469) 870-4572

SVP SALES AND OPERATIONS JENNIFER WATSON LAWS

VP SALES MICHAEL ORME WESTERN CHRISTI HUMPHRIES, LINDSLEY HARRIS, CASS HECKEL

CENTRAL & NORTHEAST SAMANTHA STEIN SOUTHERN AMINA JAHIC

CLIENT STRATEGY MANAGER ADINA RITTER STRATEGIC ACCOUNT MANAGER BRIA SOYELE SALES MARKETING MANAGER TOD MOHNEY

CONTENT SOLUTIONS

MANAGING EDITOR MALEESA SMITH CONTENT EDITOR JESSICA DAVIS

ASSOCIATE EDITOR MARNI DAVIMES MULTIMEDIA PROJECT MANAGER DALTON JOHNSON

JUNIOR DIGITAL PRODUCER ELISSA BRANCH CONTENT SOLUTIONS COORDINATOR EUNICE GARCIA

HOW TO REACH US LETTERS TO THE EDITOR EDITOR@HOUSINGWIRE.COM TIPS AND STORIES EDITORIAL@HOUSINGWIRE.COM CURRENT MEMBERSHIP / SUBSCRIPTION HWPLUSMEMBER@HOUSINGWIRE.COM NEW MEMBERSHIP / SUBSCRIPTION HOUSINGWIRE.COM/MEMBERSHIP MARKETING & ADVERTISING

ADVERTISING CLIENT SUCCESS CLIENTSUCCESS@HOUSINGWIRE.COM

MORTGAGE DAILY EDITOR

HW MEDIA CORPORATE

4 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

The intersection of housing and innovation

OUR OCTOBER/NOVEMBER ISSUE has long focused on the state of housing, but what’s unique about the theme this year is the collaboration and synergies that are happening in the space. The state of housing at this point is, in fact, innovation.

This issue includes two big features — our 2022 HousingWire Vanguard honorees and a power-packed list of the housing companies that made the Inc. 5000 list.

What’s remarkable, and not too surprising, is the way these two lists intertwine. The leaders who made the Vanguard list are also at the helm of the companies on the Inc. 5000 list. Then, take it a step further with the third feature in this issue, on page 90, and you can see that many of these companies and people are the same key stakeholders at the forefront of the conversation for integrating innovation into more government

regulations and policies.

Neither of these lists is easy to make, as they highlight years and years of hard work. So those listed, both people and companies, deserve a huge round of applause.

Brena Nath HW+ Managing Editor @BrenaNath

Brena Nath HW+ Managing Editor @BrenaNath

Tweets From The Streets

Honored that Griffin Funding made the list for the 4th time! by @GriffinFunding

The information contained within should not be construed as a recommendation for any course of action regarding legal, financial or accounting matters. All written materials are disseminated with the understanding that the publisher is not engaged in rendering legal advice or other professional services. HW Media does not guarantee the accuracy of information provided, and is not liable for any damages, losses or other detriment that may result from the use of these materials.

© 2022 by HW Media, LLC • All rights reserved

1 7 3

LETTER FROM THE EDITOR 5 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

Shaping the Next Generation of Leaders

MBA Education offers professional growth and training opportunities that help build your institutional knowledge and competitive advantage with a badge of quality and excellence. Join an elite group of professionals that have achieved the industry standard in professional success this year. • Accredited Mortgage Professional (AMP) Graduates: 285 • Certified Mortgage Banker (CMB) Graduates: 35 • Certified Mortgage Compliance Professional (CMCP) Graduates: 56 • Certified Residential Underwriter (CRU) Graduates: 758 get started today: mba.org/education24323

People Movers

Fannie Mae and Freddie Mac appoint a chief audit executive and chief compli ance officer respectively.

Hot Seat

Dominic Iannitti, CEO of DocMagic, answers ques tions about DocMagic’s digital revolution.

Take Five

Lesli Gooch, CEO at the Manufactured Housing Institute, shares her biggest business success.

Event Calendar

Conference season contin ues with events from MBA and NRMLA in Nashville and Atlanta.

Local Intel

Boston expereinces a shift toward younger buy ers entering the housing market.

Trade Desk

Six trade organizations share their events and plans for the end of the year.

Title 106

The ‘Texas Title Queen’ Rachel Luna stumbled into the world of title and never wanted to leave.

Mortgage 110

As the housing market shifts from refi to purchas es, HELOCs are gaining popularity.

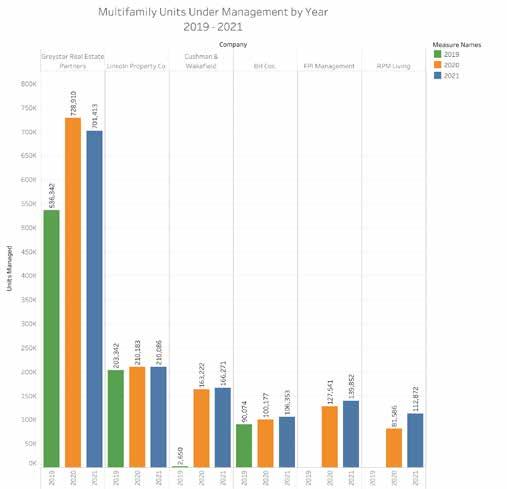

Real Estate 114

The rental market reports on another year’s finances with some familiar compa nies coming out on top. Kudos 120-

Planet Home Lending stocks food pantry shelves with produce they planted and harvested themselves.

Parting Shot

Logan Mohtashami pre sented on the savagely un healthy housing market at the Economic Conference.

October/ November

13

15

17

19

20

102

122

2022 8 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

By Don Neff

2022 Vanguard Honorees

By Rohit Gupta

Digital transformation in

By Romi Mahajan

By Romi Mahajan

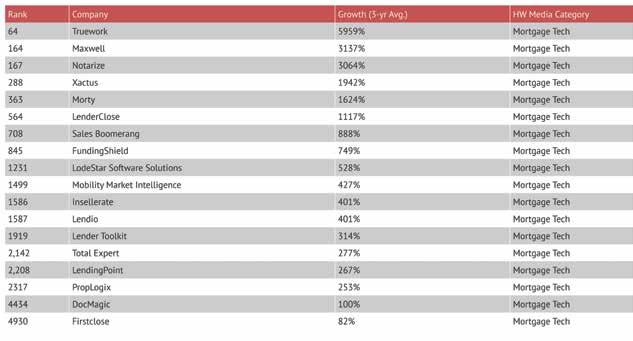

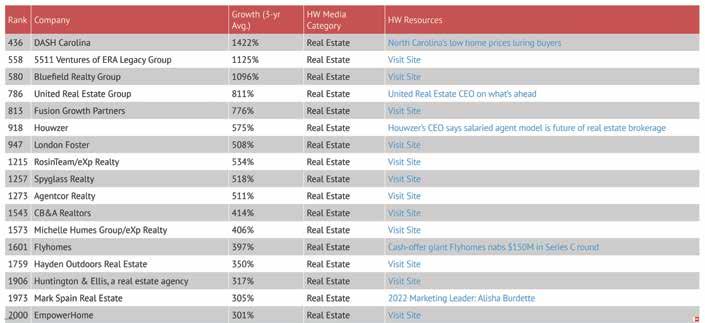

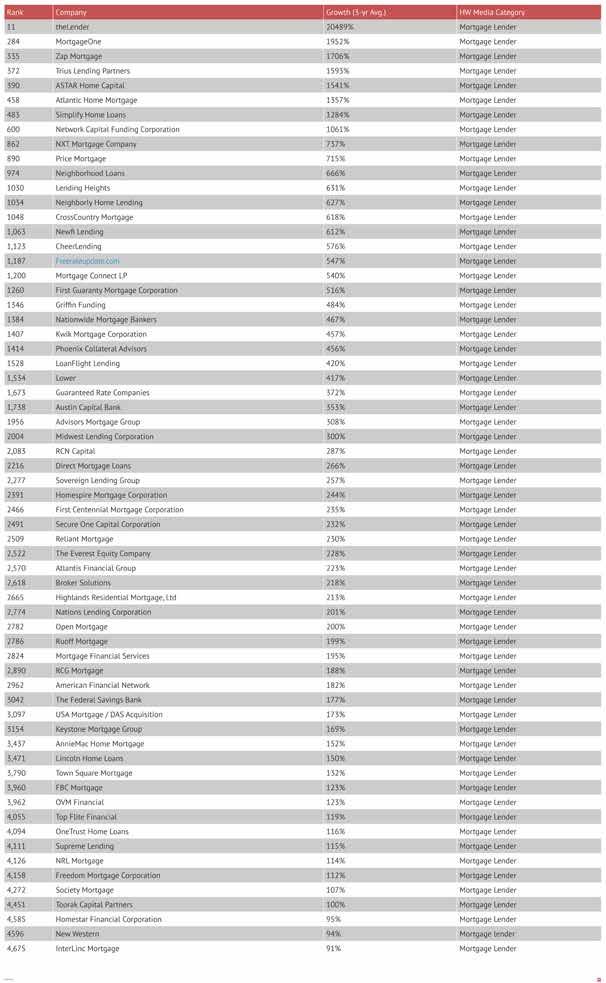

Meet the 100 HousingWire Vanguard award winners. These leaders have changed the landscape of housing forever, and they share their insights on the best advice they’ve ever received, the secrets to their success and more. 30f f features An inside look at the latest trends in housing regulations and policy featuring the 2022 Vanguards Federal regulation leaders Seth Appleton, Armando Falcon, Faith Schwartz and Katie Sweeney sat down with HousingWire to discuss the future of housing policies. 84 The housing industry makes its mark on the 2022 Inc. 5000 list Companies in the housing ecosystem — from mortgage to real estate, title and appraisal — made a strong showing in the Inc. 5000 list this year. 90 COVID helps green the building industry

22 Putting the housing market into perspective

24

the housing market: possibilities and problems

26 9 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

Congratulations Jerry Weiss

HousingWire has honored Jerry Weiss, Freddie Mac’s EVP and Chief Administrative Officer, as one of the key leaders moving the industry forward. Congratulations to Jerry who, for nearly two decades, set the standard for leadership excellence at Freddie Mac while playing a major role in how we execute our mission of making home possible.

Visit

Visit

freddiemac.com 2022 HousingWire Vanguard

Katharine Loveland | Volly | CEO

Volly appointed Katharine Loveland as its CEO. She will focus on delivering Volly’s comprehensive technology suite of products and services to customers. Loveland was previously the vice president of customer success at the appraisal management software company Reggora. Prior to her stint at Reggora, Loveland spent eight years at Accenture, the multinational professional services firm.

Dave Applegate | Cenlar FSB | Chairman

Cenlar FSB, the nation’s second-largest mortgage servicer and largest sub-servicer, named Dave Applegate as the company’s chairman. In this role, Applegate will continue to invest in all aspects of the franchise. Ap plegate previously held leadership positions at Homeward Residential, Radian Mortgage Insurance, GMAC Mortgage and Bank and Common Securitization Solutions, a joint venture owned by Fannie Mae and Freddie Mac. Applegate also served on the Fannie Mae advisory board.

Ross Gloudeman | Xactus | Chief Compliance Officer

Xactus appointed Ross Gloudeman as the chief compliance officer. Gloudeman will be responsible for over seeing Xactus's regulatory compliance framework and administering regulatory changes required by the credit and mortgage industries. He most recently served as the general counsel and chief compliance officer at Azminuth GRC, a regulatory tech company. Gloudeman's 15-plus years of experience include senior man aging director of enterprise risk at Home Point Financial.

Mike Smith | Doma | Chief Financial Officer

Doma appointed Mike Smith as its chief financial officer. In his position, Smith will continue to support Do ma's goals in improving the home-closing process. Smith has 30 years of experience working with teams and companies to navigate IPOs, acquisitions and other public company transitions. Smith originally joined Doma as the chief accounting officer, and he previously held the same role at Banc of California Inc., where he also served as director of treasury. He also held CAO roles at loanDepot and CapitalSource Inc.

Casey Crawford | Live Oak Bancshares | Board of Directors

Live Oak Bancshares and its subsidiary, Live Oak Bank, have appointed Casey Crawford, the co-founder and CEO of Movement Mortgage, to its board of directors. Crawford founded distributed retail nonbank Movement Mortgage in 2008. He has been awarded the John Maxwell Transformational Leadership Award, HousingWire Vanguard award and Charlotte Business Journal's Most Admired CEO. Crawford said he joined the board of directors of Live Oak Bancshares "to transform the way banking is done.”

Cissy Yang | Fannie Mae | Chief Audit Executive

Fannie Mae appointed Cissy Yang as chief audit executive. Yang will be responsible for leading the compa ny’s audit strategy, including internal controls, operational processes and risk assessments. Yang was most recently at Credit Suisse, where she served as head of audit for investment banking, fixed income and U.S. legal entities and compliance in the Americas. She previously worked at PriceWaterhouseCoopers and Ar thur Andersen.

Dennis Hermonstyne Jr. | Freddie Mac | Senior Vice President, Chief Compliance Officer

Freddie Mac named Dennis Hermonstyne Jr. as senior vice president and chief compliance officer. Hermons tyne will manage the agency's compliance risk management program to ensure adherence to legal and con servatorship obligations. He was most recently at Santander Bank, where he served as executive vice presi dent and chief compliance officer, and previously worked as deputy chief compliance officer at E-Trade Bank.

PEOPLE MOVERS

13 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

The competitive edge you need to stay ahead. Complimentary seat saved at HousingWire’s virtual events and access to on-demand librariesJointoday:housingwire.com/membership HW+ members get exclusive access to: Deeper dives into the stories impacting the housing industry and your bottom line Connect with other industry leaders and HW Editors in an exclusive membersonly experience Premium Content Virtual Events HW+ Slack ChannelCircle App 14 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

Dominic Iannitti

President and CEO DocMagic

HousingWire recently spoke with Dominic Iannitti, president and CEO of DocMagic, about eNote adoption.

Q&A

HousingWire: Where does the industry stand in terms of digital adoption, and more specifically the adoption of eNotes?

Dominic Iannitti: Many lenders were considering, or at least researching, digital implementations when the pandemic hit, putting industry adoption on the fast track.

These days lenders are seeking to leverage mort gage technology to streamline the loan process. Many have digital capabilities in place already, and with so many warehouse lenders ready to fund eNotes and servicers ready to support them, along with increased expansion in the investor space, the popularity of eNotes is growing.

HousingWire: Talk to us about DocMagic’s setup process for lenders to get started with Total eClose, eNotes and a secure eVault.

Iannitti: We’ve partnered with many lenders that started with a hybrid model and then made the transition to utilize eNotes and, in many cases, to completely paperless closings.

eNotes are a game-changer for risk reduction, processing speed and overall efficiency. By leveraging both eNotes and DocMagic’s award-winning eVault technology, lenders can experience an array of eClosing benefits.

Our eVault technology has been the industry leader for many years, giving us the expertise to implement and support the critical aspects of eNotes.

DocMagic’s eClosing Team has personally super vised thousands of eClosings. Whether it’s getting set up with MERS, partnering with eNote-ready investors or servicing eNotes, we wrote the playbook on how to make it happen for lenders and their supply chain partners.

HousingWire: What are some of the efficiencies of eNotes, and how will lenders that implement eNotes now benefit compared to those that wait?

Iannitti: The expediency of eNotes carries through the entire process — from originator to warehouse, investor, custodian, and servicer — in a matter of seconds. Your workforce is more productive, mov ing loans forward through the pipeline at the speed of a click.

Errors in quality are costly, but especially in this environment.

Having everything signed electronically and dated correctly is critical. The eNote can be registered immediately with MERS, allowing loans to be de livered within minutes of closing — that’s real efficiency.

Organizations that implement eNote technology will gain a competitive advantage over those that wait. The efficiencies, benefits and ROI of eNotes are not a nice to have, but a must. This is positively where the industry is heading.

HousingWire: What should lenders be looking for in a long-term eClosing vendor/partner?

Iannitti: Lenders should start by choosing a vendor with experience — thousands of successful eClosing transactions. An inexperienced vendor may not have all of the necessary components in place to do business with other providers in the space.

Lenders should also select a vendor offering all-hybrid and fully end-to-end paperless eClosings. The best option is a one-stop shop that provides every element of an eClosing. Why go to one vendor for document generation and another for eNotes?

Finally, look for a vendor that can scale to your future growth. Some vendors have components of this technology, but can they help you scale to thou sands of eNotes by the end of the year? DocMagic offers a fully cloud-based service layer and flexible technology designed with capabilities adaptable to every conceivable eClosing option.

HOTSEAT SPONSORED CONTENT

Lesli Gooch

CEO, Manufactured Housing Institute

Lesli Gooch, CEO of Manufactured Housing Institute (MHI), is known for her ability to achieve policy and political goals that translate into significantly improved housing options nationwide. Gooch’s advocacy efforts in the manufactured housing industry have had a far-reaching impact on mil lions of Americans striving for affordable homeownership. Gooch was recently recognized as one of HousingWire's 2022 Women of Influence.

Here, Gooch answers five questions that give an inside look at her life:

1. People would be surprised to know I ... went fly fishing and I enjoyed it.

2. My biggest learning opportunity was... running for Congress.

3. Biggest business success this year... MHI displayed three manufactured homes on the National Mall for Homeownership Month

4. After I am finished with my career, I hope people remember... there is always a path to ‘yes’ if you listen to and hear one another.

5. Last concert I attended was... Eric Church.

TAKE 5 17 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

HOUSINGWIRE ANNUAL ALL THINGS HOUSING October 3rd - 5th Fairmont Scottsdale Princess Resort, Scottsdale, AZ HousingWire Annual is designed to bring the community from across the housing ecosystem together to share strategies, drive businesses forward, discover new technologies, discuss best practices and connect. Join us this October 3-5 in Scottsdale, AZ for a can’t miss agenda! 2022 by housingwireannual.com 18 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

NRMLA 2022 Annual Meeting

November 1-3

Cost to attend: Member $800 Non-member $1,050 Presented by National Reverse Mortgage Lenders Association

ATLANTA, GA

THE LARGEST GATHERING of reverse mortgage professionals is taking place in November. The National Reverse Mortgage Lenders Association will host its Annual Meeting, a place for industry profes sionals to get the low-down on all things reverse. NRMLA’s Annual Meeting brings together professionals who have originated reverse mortgages exclusively for decades and mortgage professionals who are new to the game and want to learn how to offer reverse mort gages in a safe and ethical manner. This year's sessions will focus on compliance, sales and marketing.

LISTEN NOW

Angel Booth of Premier Reverse Closings

For this episode of The RMD Podcast, Reverse Mortgage Daily Editor

Chris Clow sits down with Premier Reverse Closings (PRC) Senior Sales Executive Angel Booth. Booth discusses what helps keep her and other professionals engaged in the reverse mortgage indus try for the long haul and what the closing side of the business is seeing in terms of opportunities and challenges in today’s mortgage marketplace.

Chris Clow: If you look back to what the reverse mortgage environment was 10 years ago, where the industry at large was still dealing with the fallout of the financial crisis and maybe some irresponsibly originated loans, and then you look at where we are today in terms of reputation, how do you think things have changed?

MBA Annual

October 23-26

Cost to attend: Member $1,499 Non-member $3,699

Presented by Mortgage Bankers Association

NASHVILLE, TN

TRAVEL TO MUSIC CITY for four days of nonstop mortgage knowl edge. MBA Annual is one of the largest gatherings of real estate finance professionals. Everyone from young professionals to CEOs can learn and grow at MBA Annual. Featured at this event are an ‘mPowering You’ summit for young women in real estate finance, a DEI-focused meeting, a regulatory meeting and the installation of the 2023 MBA officers. There are dozens of panels, keynotes and net working opportunities. Some of the most notable speakers include the former speaker of the house, Paul Ryan, Roger Ferguson, presi dent and CEO of TIAA and a special concert featuring Darius Rucker.

Event TIP

Angel Booth: I think it shed light on our indus try. I truly believe that many of the policies and procedures that they put in place stemmed from the things that were going on on the conventional side because we had already addressed a lot of the things that we had in our own history. But we're such a small industry, a lot of that wasn't really getting picked up.

When the financial crisis came to fruition, we had to deal with changes like the HECM lending limit and protecting the non-borrowing spouse and so many different things that we were already changing within our industry. We know that things are not going to always stay the same, we know that things are going to change, but more often than not, they're changing for the betterment of the perception of the product. But as we see, we have ebbs and flow. (...)Nothing's going to change and happen overnight, but I think we are definitely heading in the right direction, and even if it’s a little bit difficult, we know it's for the betterment of the program. So we have to be okay with that and let those things happen. Scan the code to listen now!

"Conferences are an opportunity to meet other industry professionals that are really interesting and won derful human beings that I might not otherwise cross paths with. And if we get to partner together or help each others’ careers down the line, then that’s just icing on the cake."

- Heather Siegel, Lead Account Executive Qualia

EVENT CALENDAR

19 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

By Brooklee Han

Phoenix, Arizona

Phoenix has been arguably one of the hottest housing markets in the country over the past two years, but as interest rates have climbed, demand has cooled and inventory has risen dramatically. At some points this past summer, the active listing count for the Phoenix-Mesa-Scottsdale metro area topped 10,000, according to data from St. Louis Fed. “Inven tory is rising, and days on market is also a bit longer, but we still have a significant turnover of existing product,” Bob Nathan, a local Engels & Völkers agent, said. “It is not a crazy hot market anymore, it is now just a very strong market, but there are less concessions being given up by the buyer. So it is a little bit more back toward normal.” However, as interest rates continue to rise, homebuying demand cools further and concerns about a possible recession become more prevalent. Accordingly, Phoenix is feeling the pain. The city ranked at No. 8 in a Redfin analysis of metro areas most likely to feel a big impact as these gloomy economic scenarios materialize.

Lafayette, California

Just 25 miles east of San Francisco, Lafayette, California, is known for its high quality of life, top-rated schools, low crime rate and some of the highest home prices in the country. In June, the median sales price for a home in Lafayette came in at $2.065 million, according to Redfin. Despite the steep home prices, homebuying competition was intense in Lafayette until mortgage rates began to rise.. “We have gone from so many offers on homes and not a lot of inventory to a slightly sleepier environment as people pause and figure out lending and what they can now afford with the decline in the stock market and rising interest rates,” said local agent Dana Green, team leader of the Compass-based Dana Green Team. For sellers, Green said this change means having to alter pricing strategies and being a bit more modest with list prices. However, she noted that this shift did not come as a surprise. “We all saw it coming based off of the number that came out Q1 this year,” she said. “We were at such an unbeliev able high, and it obviously can’t stay that way forever. It is hard to know what a normal market looks like anymore. We went from a normal but strong market to the COVID market and now this sudden shift, so we are still trying to figure out what our new normal is.”

LOCAL INTEL

20 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

British Columbia, Canada

Vancouver, Huntsville, Alabama

Huntsville, Alabama, is perhaps best known as the birthplace of the Saturn V rocket that would one day send Neil Armstrong and Buzz Aldrin to the moon. However, it wasn’t always a bustling metropolis for the military technologies and aerospace industries. The city’s initial growth is attributed to the cotton industry and trade associated with railroad industries. “We have always been known for great white-collar jobs, but we just didn’t have anything to fill the gap,” said John Brooks, a local agent with Coldwell Banker of the Valley. The opening of an Amazon distribution center and the addition of a second Toyota plant, among other things, have changed the situation. The abundance of job opportunities combined with Huntsville’s strong public school system and growing arts and cul ture scene have made the city a place many wish to call home. “We are usually ranked as one of the best places to live, and with this latest huge migration, a lot of people decided to move here, which gave us a bustling real estate market,” Brooks said. Like else where in the country, high levels of housing demand resulted in rapidly rising home prices and low inventory, but as interest rates have risen and fewer people are looking to make cross-country moves, Brooks said things have slowed down. “I think Huntsville will still see some relocations probably into next year, and I think that is going to help our local market stay balanced,” he said. “We have definitely started getting more inventory, which is a healthy thing because it is not sustainable for everyone to continue to go up $40,000 over list price on every single home.”

With easy access to the Pacific Ocean, great skiing and a milder climate than other parts of the country, it is a wonder why everyone doesn’t want to live in Vancouver, British Columbia. Even during the height of the pandemic, when many people looked to get out of cramped cities, the housing market in Vancouver remained strong as homebuyers from other parts of the country decided to take advantage of remote work opportunities and relocate. But over the past few months, local eXp Realty agent Sarah Kwan has noticed a shift in the market.

“There are definitely a lot more price reductions,” she said. “I first noticed the drop in March because I had a townhome listing and the week prior there was another unit that was virtually the same and it had twice as much foot traffic as we had.” According to Kwan, pric es have dropped an average of 2% month over month, but in some markets, she has seen prices drop 10% month over month. Despite these drops, she said that if a property shows well and is priced strategically, it will still generate plenty of interest and possibly even a multiple-offer situation. “In markets where we have seen large price drops in the past 30 days, it is very important that you are looking at sold inventory on a weekly basis and maintaining communication with your clients so you can make changes if you need to.” Kwan said she doesn’t confirm the final list price until right before the home is listed. Looking ahead, Kwan expects the market to continue to slow down. “It was expected regardless of interest rates. It was kind of bound to happen. There is only so long it can keep going up,” she said.

Boston, Massachusetts

Founded in 1630, Boston is one of the oldest cities in the U.S. In its centuries of existence, the city and its housing market have seen a lot. As one might expect, despite its high home prices, the metro’s housing market is pretty hearty. In July, Redfin named the city as one of the met ro areas with the lowest chance of a housing downturn if the U.S. entered a recession. “We are seeing pockets of high activity, but prices are super stable,” said Ricar do Rodriguez, a Boston-based Coldwell Banker agent. Rodriguez attributes at least some of Boston’s resilience to the metro's limited inventory and constant stream of demand, thanks to the various industries that call the city home. But while other markets across the country are dealing with shifting conditions and changing trends, Rodriguez said he has noticed a new homebuying trend in Boston. “Our buyers are younger than they used to be,” he said. “I think during the pandemic, a lot of people passed along financial resources to their children earlier than they would have because I am seeing more young people engage in the homebuying process than I have in my 20 years in the industry.”

LOCAL INTEL

21 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

OVID helps green the building industry

Homebuilders are implementing resilient features for highuse areas of the home.

By Don Neff

The benefits of green building materials and practices have been discussed when creating our homes and workplaces for a while now. The COVID-19 pandemic required a light-speed adjustment in this direction, as our offices were locked down with stayat-home orders and everyone worked away from office colleagues and technology support. Working remotely, although not a new concept, became our new normal, and hybrid and remote office environments will continue to be part of our future. In a short amount of time, it became apparent that we would need to embrace green building concepts such as daylighting, orientation, insulation, ventilation and mass (DOIVM*) for a healthier home environment. In addition, technology needed to be integrated into our work-from-home lives in new ways we had not thought of before.

As people spend more and more time at home, it will be essential for homebuilders to include these innovations in future builds that create a more sustainable and durable home for families who use their in-home appliances and resources more than they did in the past.

REMOTE WORK TECHNOLOGY IS HERE TO STAY.

Zoom meetings from home offices have become widely used— in addition to other tech tools like Skype, MS Teams, Bluebeam and CaptureQA— to support productivity at home and for business to continue. Working from home reduces commute time, saves gas and encourages savings. Equally important, working from home requires creative solutions to “unplug” from work. This involves physical and mental separations, including programmed downtime to maintain work-life balance. The physical separation can be achieved through architectural design solutions for new construction or remodeling and creative space-planning ideas for previously established home layouts. These designs and redesigns address the need for multiple work areas for dual-income earners or home-schooling needs

where families are all working and studying under the same roof. Without establishing these boundaries to separate work and personal time, the pressures of home and work-life stresses can lead to burnout, overwhelm us emotionally and ultimately compromise our immune systems.

HOW ARE WE INTEGRATING GREEN BUILDING PRODUCTS AND PRINCIPLES?

We all know about plug loads creating excess electrical demand and occupant behavior putting wear and tear on home operating systems. Both can unravel the most sustainably designed and constructed healthy home-work environment. This risk of poor system performance grows when five or more people are all living and working at home—around the clock, and potentially taxing the home’s systems, such as active or passive ventilation.

A healthy home supports occupant health. But without feedback loops, we have no metrics to measure brewing problems, which can lead to a subtle deterioration of indoor air quality or potential long-term deterioration of the home.

Sensors that measure temperature, humidity, moisture level, water leaks, hot spots, cold spots, mold growth, carbon dioxide (CO2), volatile organic compounds (VOCs), carbon monoxide (CO), supply and usage of site-generated solar energy and battery charge levels are just a few examples of things to keep an eye on.

The integration of these sensors into a data hub or dashboard— either centralized at one workstation, distributed throughout on a room-to-room basis or both—is also important. The dashboard can provide immediate feedback to understand occupant effects, system function and overall home performance. Examples of a power usage dashboard have been demonstrated by Southern California Edison in their Southern California Energy Education Center, showing variable costs in real time when several appliances automatically turn on and off throughout the day, either in parallel or in series.

Measuring this cost will help occupants adjust their behaviors to schedule usage during nonpeak pricing periods. The real test will be when major equipment and appliance manufacturers provide integrated plug-and-play whole-house solutions on a large production scale.

These advanced systems can also include the programming of

C

22 ❱ HOUSINGWIRE COMMENTARY OCTOBER/NOVEMBER 2022

home maintenance activities into the system, with maintenance alerts, monitoring for compliance and tracking completion with automated recordkeeping. A robust online customer service system could then be a game changer for sustainable building practices.

WHAT DOES THE FUTURE HOLD?

The COVID-19 pandemic inspired some sustainable concepts, but the future holds many more building technologies, including leading trends from Europe and American universities that could gain widespread adoption by homebuilders. These concepts incorporate energy efficiency, resource conservation, automation and modern technologies, including different levels of integration. Here we explore a few examples of sustainable techniques and technologies, such as dynamic glass and flexible building skins that could be adopted by homebuilders. It’s the home of the future, and the future is now. We learned about several of these new technologies at the International Advanced Building Skin Conference in Bern, Switzerland.

Level 1: Aerogel insulation is a high-performance product that marries thermal functionality with fireprevention properties. Aerogel insulation presents a new product with construction applications not only in exterior (building) envelopes, but also in fireresistive assemblies. It is reportedly such a good insulator that a blowtorch on one side won’t ignite a match on the other side. In fire-prone areas, we think this idea will be embraced by builders and buyers alike.

Level 2: Transparent solar panels are thin and flexible “see-through” membranes for application on exterior building assemblies and envelopes. These are a topic of research in MIT’s “Center for Excitonics,” an energy frontier research center funded by the US Department of Energy. The efficiency of these transparent panels is not as great as conventional solar panels, but partially and fully transparent solar panels can be integrated into windows in buildings and cover larger areas than their traditional counterparts.

In terms of overall electricity potential, it’s estimated that there is five billion to seven billion square meters of glass surface in the United States. And with that much glass to cover, transparent solar technologies have the potential to supply some 40% of energy demand in the United States—about the same potential as rooftop solar units.

Level 3: Dynamic glass windows can help enhance indoor comfort while providing unobstructed views to the outside. In some applications, dynamic glass windows, each with a unique IP address, allows occupant-controlled shading through an electrochemical process inside the glass. This light-sensitive window glass can change from clear to tinted on

demand to achieve various levels of shading without mechanical systems. Electromagnetic glass automatically tints when heat from direct sunlight warms the glass. The shading results in a lower heat load for the building. These features combine translucent functionality and energy efficiency in one elegant solution.

Level 4: Technology solutions include current market solutions and blue-sky future concepts to explore.

1. Remote mobile security is currently available in the nation’s markets as evidenced by numerous products integrating digital image, sound capture and two-way communications with access controls and emergency service provider notifications.

2. Remote sensing functionality for lighting and HVAC systems integrates with the mobile security features above, allowing control of several house-specific operating systems. This is like a programmable 24hour setback thermostat to mirror in-home occupant behaviors, which can operate remotely from your cell phone. Sensors can also detect leaks or system trouble signals, alerting users to issues before major damage or complete failure occurs.

3. Precise point-of-use delivery designs promote wateruse efficiency and energy conservation through trunk, branch and twig pipe sizing coupled with a primary and secondary water heater closer to the point of use. When coupled with a demand pump, water is no longer wasted.

4. Power generation and energy conservation blend solutions above with sustainable building designs. Passive-haus designs are super-insulated buildings with DOIVM-driven design attributes.

Level 5: Lifestyle predictive behaviors is a programmed set of parameters for all the above referenced technology solutions, which recognize changing needs over time. Community wide examples include age-specific active adult master-planned communities with a wide array of physical and social recreational programs. Home-specific examples include universal designs for aging in place. And even one step further is embracing baubiologie, or healthy home designs, to respect and respond to these age-related lifestyles.

The nation’s building industry is experiencing a dramatic renaissance of innovation, driven by concurrent revolutions in digital data capture and green building practices. These trends have accelerated thanks to the COVID-19 pandemic, driving rapid adoption and diffusion of new technology. We believe that these products and principles will persist long after the pandemic is over.

*Credit to Chris Prelitz, sustainable home builder and consultant in Laguna Beach, CA for the acronym, DOIVM.

Don Neff is the President of LJP Construction Services.

Don Neff is the President of LJP Construction Services.

23 ❱ HOUSINGWIRE COMMENTARY OCTOBER/NOVEMBER 2022

P

utting the housing market into perspective

The challenges that first-time homebuyers face and the obstacles still ahead

By Rohit Gupta

2022 has been filled with discussions on homeownership affordability challenges for good reason. The challenges buyers face today are significant: higher interest rates, higher home prices, historically low inventory, increasing costs for labor and materials and supply chain challenges.

On the surface, these factors might make the outlook for the housing market look bleak, particularly for first-time homebuyers. Looking deeper, however, it is clear that the market conditions are not so simple. Despite continuing affordability challenges, many Americans still desire and aspire to homeownership. They simply need assistance to clear the hurdles in their path.

THE STATE OF THE MARKET

Homeownership affordability is inarguably lower now than it was before the COVID-19 pandemic.

Home prices have increased exponentially over the past two years, with the Federal Housing Finance Agency reporting an 18.3% increase from May 2021 to May 2022. And though the housing supply has steadily increased since February, it still remains tight. This has not only affected home prices but also rent, placing affordability pressure on non-homeowners as well.

Interest rates further complicate the market as they have increased from a record low of 2.65% in January 2021 to 5.22% in August 2022. Perhaps because of this change, only 17% of consumers reported it is “a good time to buy” in Fannie Mae’s June 2022 Home Purchase Sentiment Index.

All of these statistics, however, tell only part of the story. Financial obligations, such as debt and lease payments, remain historically low as measured by the Federal Reserve Board’s financial obligations ratio. U.S. Bureau of Economic Analysis Data indicates that disposable personal income per capita continues to rise and household balance sheets remain strong.

Additionally, the labor market is currently very strong. The U.S. Bureau of Labor Statistics reported that at the end of June, the job openings rate (the number of open roles among all positions filled or open) is 6.6%. Further, income growth continues, strengthening the average consumer’s financial position.

WHO ARE FIRST-TIME HOMEBUYERS?

Over time, the average age of the first-time homebuyer rises and falls. Per the National Association of Realtors, the current average first-time homebuyer age is 33 years old. The U.S. Census Bureau reports that more Americans are reaching that prime homebuying age in the next four years than in the last decade. This suggests more first-time homebuyers may be preparing to enter the market than we have seen in quite some time, and the industry needs to be ready to support them.

OBSTACLES FACING FIRST-TIME HOMEBUYERS

First-time homebuyers face several unique challenges that make homeownership seem less attainable, but the biggest is affording a down payment. In a December 2021 survey of nonhomeowners by NerdWallet, 36% of respondents said the main reason they do not currently own a home is they lack enough money for a down payment. Low income and credit scores were the next most common reasons at 34% and 32%, respectively.

“Home prices have increased exponentially over the past two years, with the Federal Housing Finance Agency reporting an 18.3% increase from May 2021 to May 2022.“

- Rohit Gupta

24 ❱ HOUSINGWIRE COMMENTARY OCTOBER/NOVEMBER 2022

Only 16% of respondents stated they have no interest in buying, and only 9% cited their main reason as waiting for lower mortgage rates.

For many, student loan debt is a significant challenge to accruing enough savings for a down payment. This is particularly a concern of millennials, who are a key first-time homebuyer demographic. In June 2021, 35% of millennials surveyed by the National Association of Realtors stated that student loan debt was a barrier to buying a home. Another 2021 study by Experian reported that millennials between the ages of 25 and 34 were the most likely to hold student loan debt and that millennials overall owe an average of $40,000.

Policymakers continue to wrestle with the challenges of student debt. In August, President Biden issued an executive order that may further remove barriers against homeownership for those repaying student loans. The white house reported that if all borrowers were to claim the relief provided by the order, up to 43 million borrowers would receive some relief, and approximately 20 million borrowers would have their full remaining balance forgiven. Altogether, potential homebuyers with student loan debt may be better positioned to buy a home than they were prior to the COVID-19 pandemic.

As for the next most-cited barriers to homeownership, low income and credit scores, the market currently suggests trends may be moving in the right direction. Wages are steadily rising, household debt service payments have remained steady for the last year, and the Federal Housing Finance Agency (FHFA) has initiatives under way to validate and approve new credit score models.

OPPORTUNITIES REMAIN

If the biggest obstacle to homeownership for most first-time homebuyers is the lack of funds for a down payment, then the first solution is finding low-down payment options. There is a significant difference in saving for a 20% down payment versus a 3 to 5% down payment. Lower down payment programs can assist those interested in homeownership in achieving their dream sooner. For a household earning the national median income, it could take up to 14 years to save a 20% down payment for a single-

family home of a median price. And during that decade or two, home prices may continue to rise, and the potential buyer will lose the opportunity to build wealth through equity.

Fortunately, there are conventional and government down payment programs for lenders to leverage. Various government agencies, including government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac, and the Federal Housing Administration, offer low-down-payment programs that can help potential homebuyers enter the market earlier. On the conventional and portfolio side, the private mortgage insurance (PMI) industry plays a critical role in supporting first-time homebuyers and low-income families who are not able to make a 20% down payment. The industry is well capitalized and takes an active role in working with lenders, the GSEs and the FHFA to identify areas for expansion of the credit box. In the last year, PMI helped more than 2 million homeowners purchase or refinance a mortgage. According to the U.S. Mortgage Insurers trade association, in 2021 nearly 60% of purchase originations with PMI were attributable to first-time homebuyers. Over 40% went to borrowers with income below $75,000 per year.

PMI bridges the gap for homebuyers, helping first-time homebuyers and low-income borrowers achieve homeownership earlier than otherwise possible.

Not only does PMI serve the lender by supporting low-down payment lending, but it also provides benefits to the homebuyer. PMI companies offer homebuyer education courses that help prepare the homebuyer for homeownership. Additionally, some mortgage insurance companies offer products that aid the borrower after closing. Programs are available that help offset the costs of a homeowner’s insurance or major appliance repairs, both of which are beneficial for first-time homebuyers.

LOOKING FORWARD

The affordability challenges in today’s market cannot be dismissed or ignored, but they are not insurmountable. Overall, many consumers are still better positioned to buy a home today than they were prior to the COVID-19 pandemic, especially with the low-down-payment options available. The PMI industry stands ready to play a critical role in increasing the accessibility, affordability and sustainability of homeownership.

Rohit Gupta is president and CEO of Enact Mortgage Insurance

“PMI bridges the gap for homebuyers, helping firsttime homebuyers and low-income borrowers achieve homeownership earlier than otherwise possible.” - Gupta

25 ❱ HOUSINGWIRE COMMENTARY OCTOBER/NOVEMBER 2022

D

igital transformation in the housing market: possibilities and problems

Nine categories for digital transformation

By Romi Mahajan

Over the past five years, the idea of digital transformation has animated the pages of the business and technology press and the agendas of executives around the world. The basic notion is a simple one in articulation. Organizations need to incorporate digital technologies across their fabric.

They need to make internal and external-facing processes and engagement more efficient and rewarding to all parties. It is easier said than done.

This dichotomy between intention and reality is visible in the digital transformation endeavors that have been undertaken across the housing space. Despite the difficulties, there are remarkable advancements in a variety of areas across the industry and throughout the housing supply chain.

Here, we will discuss a sampling of achievements and areas that continue to offer potential but require further work.

For many, this author included, the housing market is characterized more by opacity than transparency.

Certainly, education and free resources are available for anyone capable of doing the research. The options for most, while not limited, are certainly circumscribed by the industry as it exists today. In Silicon Valley speak, this all translates to one unvarnished truth: The housing market is ripe for disruption.

And while this is true, and while some aspects of the housing market and process have indeed been disrupted, other parts give new life to the phrase “the more things change, the more they stay the same.”

Below I’ve detailed the nine steps of the buying and selling process and given each a score from one to 10. A score of one indicates a full digital transformation, and a score of 10 indicates that nothing has developed digitally *Note: This is not an exhaustive list of areas.

1. Search initiation, Score: 2

2. Search process, Score: 6

3. Buying process, Score: 6

4. Final transaction process, Score: 8

5. Mortgage financing affordability, Score: 9

6. Valuation, Score: 2 Appraisal, Score: 7 AI and computer vision tools, Score: 3

9. So now what? Score: 7

WHY THESE SCORES?

Industry watchers can offer their opinions, but the realities are complex and messy. Digital transformation is not a spell whose mere incantation can change a large industry overnight.

Rhetoric and reality don’t always match in the housing industry. We need to avoid the hyperbole and disingenuous claims made de rigueur by Silicon Valley public relations professionals and instead focus our energies on one of the most important sectors of our economy, and indeed of society as a whole, housing.

7.

8.

26 ❱ HOUSINGWIRE COMMENTARY OCTOBER/NOVEMBER 2022

Part of the process Score Explanation

Search initiation

2

Search process

6

Buying process

6

It is a truism in housing now that, for the most part, search initiation is done online, largely from mobile devices. Companies like Zillow and Redfin have embraced this trend and made the process much easier for the consumer and almost fully digital.

After search initiation, there is the ensuing process to find the right house. The process is analog and physical, though the agent has access to a variety of digital tools at their disposal.

Much of the literature on buying a house makes it appears as though the buying process is simple and quick. But most buyers’ testimonies prove that the steps are opaque and require hand holding. It is in contrast with the notion of digital transformation, which values transparency and self-service.

Final transaction process

8

Mortgage, financing, affordability

Valuation

9

Before a buyer gets the keys, there is a lot of back and forth—on the phone and conducted via third parties. Companies like Flueid digitize and use data to enhance parts of the transaction process , and they are moving towards a one-click close. But we are still far away from the entire process being digitized.

Financing is the least digital and most antiquated part of the process. For the most part, the instruments, qualification process and lending aspects haven’t changed for decades. Innovative companies like Rook are changing the game, but their processes aren’t operating at scale.

2

Appraisal

AI and computer vision tools

So now what?

7

Valuation is an area that, in many scenarios, is highly digitized. Auto mated valuation models (AVM) from companies like Quantarium, along with shifts in regulation, bode well for digitization.

Traditional appraisal processes are being changed by companies like Reggora, but the persistence of bias-prone appraisers has been a real scarlet letter on what could be a far fairer process.

3 The advances in AI and computer vision are phenomenal, but we need to see a lot more in terms of adoption and scale.

7

When a buyer closes on a home, then, in the words of an industry watcher, “the real fun begins.” We do a poor job as an industry of help ing first-time homebuyers understand what the current condition of a house might mean for the near future and their plans. Companies like PUNCHLIST USA are working on this, and we expect to see a lot more from them soon.

Romi Mahajan is president at KKM Group and an advisor at Quantarium and Rook Capital.

27 ❱ HOUSINGWIRE COMMENTARY OCTOBER/NOVEMBER 2022

2022 VANGUARD HONOREES 100 LEADERS SHARE THEIR SECRETS TO SUCCESS 30 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

Dawar Alimi, Paul Anastos

Robert Baca, Alok Bansal

John Beacham, John Berkowitz

Vicki Brown, Michael Catalano

Bill Dallas, David Dickey

Tommy Dunbar, Armando Falcon

Kristy Fercho, AJ Franchi

Chase Gilbert, M. Ryan Gorman

Chris Heller, Mat Ishbia

Tawn Kelley, Jarred Kessler

Len Krupinski, Rose Lally

Kosta Ligris, Alex Lofton

William Lyons, Benjamin Madick

Christopher Mayer, Mary Ann McGarry

James O’Bryon, Pete Pannes

Tom Piercy, Andy Pollock

Pete Roeske, Sean Ryan

Rob Sayre, Lisa Schreiber

David Sheeler, Thomas Showalter

Desmond Smith, Dan Snyder

David Stevens, Susan Sullivan

Jeff Tennyson, William Tessar

Dale Vermillion, Natalie Verrette

Don Wenner, Shane Westra

Thaddeus Wong, Ron Zach

Faisal Adil, James Albertelli

Susan Anthony, Seth Appleton

Rob Barber, AJ Barkley

Gino Blefari, Peter Bowman Gary Clark, Court Cunningham

Raj Dosaj, Michael Dubeck

Vanessa Famulener, Mike Farr

Erika Garcia, Donna Gibson

Jeff Gravelle, Heather Harmon

Kuba Jewgieniew, Jay Jones

Aaron King, Chris Knight Shelley Leonard, Pamela Liebman

Michael Lucarelli, Gene Lugat

Sandra Madigan, Scott Martino

Steve Meirink, Marc Minor

Kevin Pezzani, Kristi Pickering

Steve Price, Tammy Richards

Priscilla Salud, Dave Savage

Faith Schwartz, Shaival Shah

Jeremy Sicklick, Jim Smith

Dan Sogorka, John Stevens

Steve Sussman, Katie Sweeney

Rick Triola, Michael Valdes

Jerry Weiss, Joe Welu

Arvin Wijay, Charles Williams

33 82

34-35 36-37 38-39 40-41 42-43 44-45 46-47 48-49 50-51 52-53 54-55 56-57 58-59 60-61 62-63 64-65 66-67 68-69 70-71 72-73 74-75 76-77 78-79 80-81

31 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

Vanguards: The top 100 executives in housing

By Lesley Collins

Each year, the HousingWire Vanguards represent an elite group of industry executives who are moving the housing market forward. But these industry veterans didn’t fall into these roles overnight. The vast majority of them have carved unique paths for them selves, picking up invaluable knowledge along the way to help them better strategize and lead their organizations. Chris Heller, chief real estate officer at OJO Labs, earned his real estate license when he was 20 years old and built one of the most successful real estate teams in the U.S. Priscilla Salud, chief operating officer, started her career as a file clerk and held every single position along the way before leading Archwell’s HR division and building out the organization’s entire global operations in India and Southeast Asia. Shelley Leonard is using her decades of experience to steer Xactus with a fresh approach toward advancing the modern mortgage experience. She previously served as chief product and digital officer at Black Knight and led the servicing technologies business, including the MSP loan servicing solution — a business with over $800 million of revenues. Kosta Ligris owned a title and settlement business for almost 20 years prior to his role as CEO at Stavvy, providing industry experience that helps him understand the unique challenges that come with processing mortgages. Having served in every operations role over her 28-year mortgage career, Academy Mortgage Corporation president Kristi Pickering has acquired the knowledge and experience that has provided her great acumen to see the big picture in her current leadership role. The following pages include the origin stories of 100 industry elites who contin ue to have a major impact on the housing landscape. Congratulations to the 2022 HousingWire Vanguards who continue to improve and shape the housing landscape.

32 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

Faisal Adil

President Altitude Home Loans

ALTITUDE HOME LOANS president and CEO Faisal Adil cares not only about the mortgage business but, more importantly, about all the people who are part of it. Whether working with a client, an employee or an es crow officer, Adil ensures that they are treated equally with appreciation, encouragement and empathy.

Adil started Altitude Home Loans in the face of the COVID-19 pandemic. Recognizing an opportunity when other lenders panicked, Adil launched a company geared for remote work, staffed with people he trusted to do their jobs and do them well. Adil’s ability to inspire commitment, loyalty, success and belief in oneself was instrumental in driving the company’s growth from five to 130 employees in six months. Adil’s comittment to the company’s core culture of empathy, excellence and doing the right thing filtered through to every employee.

Even as the COVID-19 pandemic waned, Adil contin ued to empower his employees to always be the best they could be and never fear innovating.

James Albertelli

CEO Voxtur Analytics

JAMES (JIM) ALBERTELLI, CEO of Voxtur Analytics, is a real estate technology visionary with a proven track record of execution. This year Albertelli upended the en tire title insurance industry by overseeing the launch of the attorney opinion letter, a cheaper alternative to title insur ance, which is now accepted by Fannie Mae and Freddie Mac. He is making homeownership more accessible and affordable using validated data to underwrite real prop erty value, condition, tax and title, focusing on providing certainty, transparency and fundamental fairness to those who loan, buy, sell or otherwise transact real property.

Albertelli is redefining standards across the lending lifecycle by using targeted data analytics to simplify tax solutions, property valuation and settlement services for investors, lenders, government agencies and servicers. He has brought together a team that differentiates itself by offering a unique set of complementary services across the lending lifecycle, incorporating machine learning and artificial intelligence expertise into all products and services.

What’s the best advice you’ve ever received?

You cannot control everything, so do the best with what you can control. I received that from my grandmother, mom and dad.

Give first. Give when you don’t have anything to give. Trust the abundance of the universe always.

What’s the best advice you’ve ever received?

33 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

Dawar Alimi

CEO Lender Price

DAWAR ALIMI, CEO and co-founder of Lender Price, has been in the mortgage industry for over two decades, building technology and running various companies over the years. He has earned a spot as a well-respected thought leader in financial technology and innovation.

Under Alimi’s leadership and vision, sales revenue at Lender Price has increased in the last 12 months with an overall growth trend of over 300% since the company launched in 2015, despite a decline in mortgage vol umes. This caught the eye of the private-equity world re cently, providing the company with the right capital infu sion to help continue delivering innovation to the industry.

Lender Price is now one of the leading companies in the mortgage industry. 22 of the top 30 wholesale lenders are now leveraging the Lender Price platform, including 8 of the top 12 banks and credit unions. On average, close to $30 billion in funded loan volume passes through the platform every month.

Paul Anastos

Chief Innovation Officer Guaranteed Rate Companies

AS CHIEF INNOVATION OFFICER at Guaranteed Rate, Paul Anastos focuses on differentiating Guaranteed Rate from its competitors by enhancing the company’s suite of proprietary technology and developing effec tive marketing solutions to promote its brand and mort gage professionals. Anastos currently oversees a team of 350, which includes talent from across Guaranteed Rate Companies — Guaranteed Rate, Guaranteed Rate Affinity, OriginPoint and Proper Rate — as well as the standalone AI mortgage technology company, Gateless. He also collaborates with the organization’s worldclass executive and technology teams to modernize the mortgage process and implement revolutionary Fintech solutions.

Within the last year, Anastos has helped drive the development of end-to-end digital solutions to serve customers across a diverse array of financial products beyond mortgages. The organization has recently re leased a steady stream of announcements, including new product launches, such as its 100% digital home equity line of credit and personal loans.

What has been the secret to your success?

It’s working with talented people who want to be the best, who are the best and who are committed to making us the best. When you work with a team like that in whatever you do, you can do great things.

What’s the best advice you’ve ever received?

Don’t let the things that matter least control the things that matter most.

34 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

Susan Anthony

Chief Operating Officer

Finance of America Reverse

Finance of America Reverse

SUSAN ANTHONY, chief operating officer of Finance of America Reverse (FAR), is an industry visionary and veteran who is inpsired daily to find ways to provide 10star experiences for her partners, borrowers and team. Anthony has a proven track record of aligning IT strategy with the corporate mission to support outstanding custom er service, quality products, substantially improved pro cesses and growth. As a leader in the industry, Anthony is helping FAR transform the way people approach re tirement through the knowledge they’ve built over years. Its mission is to continue to invest in resources around the power of education.

Anthony is one of many female leaders at the helm of FAR, helping turn people’s retirement visions into realities. She finds joy in implementing innovative ideas and putting them into best practices for the company. Her peers and colleagues characterize her as a dynamic and engaging leader with a proven track record of sustainable business growth, product innovation and industry leadership.

Seth Appleton

President MISMO

SETH APPLETON is leading an innovative and collab orative effort to accelerate the industry’s digital transfor mation. As the president of MISMO, he works across the real estate finance ecosystem — with lenders, servicers, issuers, mortgage insurers, service providers, technology companies, GSEs and government agencies and regu lators among others — to shape the future of how infor mation is exchanged in the industry. Appleton is leading MISMO’s work on more than 30 initiatives aimed at solv ing key business challenges and creating opportunities through standardization and collaboration.

Appleton has led MISMO to several key milestones over the past year. MISMO membership has increased significantly, up from 320 members in 2021 to 500 mem bers in 2022. MISMO initiatives increased from 19 to 34 over the past year. And the number of eNote registrations continues to grow. To date, there have been more than 1.7 million eNote registrations. Since eNotes are MISMO SMART Docs, this is a significant accomplishment for MISMO and the industry.

What has been your secret to success?

Surrounding myself with the right people and making sure that I identify their talents and allow them to use them to the best of their abilities.

What has been your secret to success?

Surround yourself with great people that work as a cohesive team. And never be afraid of learning new skills and subjects.

35 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

Robert Baca

Chief Technology Officer

ICE Mortgage Technology

ROBERT BACA, chief technology officer at ICE Mortgage Technology, owns the strategy and execution for the technical infrastructure that supports one of the largest client bases in the housing industry. When devel oping innovative solutions across the ICE platform, he approaches each project with a customer-first mentality, a focus on collaboration and a dedication to quality. As a leader, Baca never shies away from a challenge, embraces sincerity and encourages everyone to share their ideas.

The innovative technology that Baca’s team delivers not only helps ICE customers drive efficiencies across their workflows while saving time and money, but also pushes the broader industry forward on the digital mortgage journey. When deciding where to invest his team’s time and resources, he always develops solutions that are de signed to help them be successful and keep the customer top of mind.

What has been the secret to your success?

Treating others better than I treat myself and al ways helping others before helping myself, focus ing on the customer, listening to folks and paying attention to what they are saying and helping out no matter where the help is needed.

Alok Bansal

Managing Director and Global Head of Mortgage Services Visionet Systems

ALOK BANSAL is the managing director and global head of mortgage services at Visionet Systems, and he is instrumental in scaling the organization to new heights. In less than four years, Bansal has successfully led mortgage business growth from 200 employees to more than 4,000 mortgage and tech professionals, while registering stellar revenue growth.

Bansal has been the catalyst of growth through stra tegic partnerships, designing and developing product solutions like automated underwriting, data manage ment, fraud detection, consumer behaviors analytics and managing large-scale operations enabling disrup tive growth to the client partners. Today the mortgage business contributes over 51% to the overall business of Visionet, processing over 65,000 loan applications every month.

Under Bansal’s leadership, Visionet is now one of the highest performing tech-enabled business services pro viders, catering to 300+ leading financial institutions, Realtors, investors and servicers dominant in the hous ing industry.

What has been the secret to your success

Successful hiring, leading by example and giving my team freedom to make decisions independently.

36 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

Rob Barber CEO ATTOM

THROUGH HIS CLEAR AND CONCISE DIRECTION, ATTOM CEO Rob Barber ensures the company delivers data-driven critical insights and analytics-ready property data solutions that address a wide range of business needs.

Barber’s laser-sharp focus on positioning ATTOM as the most comprehensive property data provider remains steadfast. It continues to influence and secure partner ships with industry-leading companies to bring new datsets to the market to power innovation.

Barber directs the enterprise, data and proudct strate gy, customer acquisition and service, as well as corporate management teams and leads the company’s corporate M&A strategy. Barber’s passion for property data guides the ATTOM team of forward-thinking experts, who are dedicated to ensuring ATTOM’s key stakeholders achieve success through a culture of integrity and excellence in a positive and collaborative environment.

Setting a full schedule for Mondays, front-loading the week with important tasks aligned with goals. It helps ensure it’s nearly impossible to have a bad or unproductive week.

AJ Barkley

Head of Neighborhood and Community Lending Bank of America

AJ BARKLEY is the head of neighborhood and commu nity lending for Bank of America, leading the bank’s work to ensure broad-based and equitable access to lending and capital for individuals, families and small businesses across the economic spectrum.

A recognized leader in financial services, Barkley works with nonprofits, community advocacy groups, professional real estate organizations and industry leaders, advocating for housing stability, affordability and generational wealth creation for under-represented groups. Barkley is a long-time champion of affordable and sustainable homeownership, and she is responsible for the bank’s Community Homeownership Commitment, a $15 billion program to increase homeownership, par ticularly among first-time homeowners, underserved communities and multicultural borrowers. Barkley has been recognized as a HousingWire Woman of Influence for her work in this area. Barkley joined the company in 1996 and has held leadership roles in retail sales, Merril Lynch and served as the area executive for the Dallas/ Fort Worth market.

Be brief. Be bold. Be gone. When you receive feedback from others, always listen, learn and apply. Don’t forget to reflect so you can be the best you.

What’s the best advice you’ve ever received?

What is one habit that has made a crucial-difference in your success?

37 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

John Beacham

Founder and CEO

Toorak Capital Partners

AS FOUNDER AND CEO at Toorak Capital Partners, John Beacham has been a transformative leader in the private lending industry, spearheading improvements in underwriting guidelines and credit criteria. He has linked small balance commercial and residential orig inators with institutional capital, pioneering bridge loan securitizations, helping to dispel the negative association with “hard money” and creating a sustainable engine to help address the housing shortage by providing more than $9.1 billion in capital to fund housing for 40,000 families to date.

Toorak has consistently grown under Beacham’s lead ership and has been profitable every month since month five of its operation. In six short years, Toorak has provid ed more than $9.1 billion in capital to fund over 25,000 loans. In 2021, Toorak funded more than $2.5 billion in loans, added 25 lending partners and now works with over 85 partners in the U.S. and U.K.

John Berkowitz

Co-Founder and CEO OJO Labs

AS THE FOUNDER and CEO of OJO Labs, John Berkowitz is transforming the way consumers buy, sell and own homes with the industry’s first guided market place. It connects people with bespoke solutions tailored to their individual needs.

Berkowitz has taken OJO from an emerging start-up into a purpose-driven real estate industry powerhouse, all while ensuring the company’s success is intertwined with its purpose of equipping anyone to unlock the abun dant benefits of homeownership. Fueled by his commit ment to purpose, Berkowitz has scaled OJO to millions of consumers by building a company that offers a strong value proposition for consumers in any market and by supporting them at any stage of the homeownership jour ney. With a clear vision for the future in mind, Berkowitz is driving tangible impact in an industry long resistant to change.

Find something that you’re good at, and then really focus your time on it so you become the best at it – whatever “it” is.

What’s the best advice you’ve ever received?

When I started the journey to founding OJO Labs, I had a fear of failure. I was familiar with the risks and responsibilities of founding a company, and it led to significant apprehension. A mentor advised me to embrace this fear and channel my focus and energy to make sure it doesn’t become a reality.

What’s the best advice you’ve ever received?

38 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

Gino Blefari

CEO

HomeServices of America

GINO BLEFARI is the CEO and chairman of HomeServices of America, the country’s largest resi dential real estate brokerage company based on trans actions. He is also chairman of HSF Affiliates, which operates the franchise networks of Berkshire Hathaway HomeServices and Real Living Real Estate; he is chairman of both brands, Berkshire Hathwaay HomeServices and Real Living Real Estate.

Blefari joined the HomeServices of America family from Silicon Valley, at CA-based Intero Real Estate Services, which he founded in 2002 and through mid-2014 served as its president and CEO. Under Blefari’s direction, Intero became the fastest organically growing company in the history of real estate.

Blefari is ranked among the top five most powerful and influential leaders in the residential real estate industry, according to the Swanepoel POWER 200 rankings from 2016 to 2021. He received the 2007 Italian Business Man of the Year awared by the Italian American Heritage Foundation along with several other accolades.

Peter Bowman

Co-Founder and CEO Flueid

FLUEID’S CO-FOUNDER and CEO, Peter Bowman, began bringing real estate online in the mid-1990s. He has devoted his career to being a technologist and data expert, driving innovation within the real estate, mort gage and title sectors. Bowman conceptualized a firstof-its-kind title decision engine in the 2000s and has leveraged his depth of experience in developing Flueid’s core software as a service product: the Flueid Decision platform. Under his guidance, Flueid has reached reve nues of more than $32 million between 2017 and 2021. Bowman has partnered with Flueid’s leadership team to create people-centric initiatives that support employ ees at an individual level. He has established a monthly, always-on cadence of career development check-ins and meets with the full Flueid employee base weekly to build knowledge and understanding of the company’s vision. Additionally, he created an Employee Well-Being Fund to support teammates facing both challenging and celebratory life events.

What’s the best piece of advice you’ve ever received?

Do everything with integrity and honor, and it will continue to give back for your entire career and life.

39 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

Vicki Brown

Executive Vice President LoanCare

VICKI BROWN is an industry veteran with over 36 years of servicing and subservicing experience. She has a professional approach and work philosophy that em phasizes delivering a superior customer experience first and foremost.

Brown came to LoanCare in 1990 and moved into cli ent relations in 2007 where she successfully managed 70 clients by partnering with not just LoanCare teams, but also with her clients to establish consistent processes and messaging from the time a loan originates to the time it goes through servicing.

With extensive experience in technology, mortgage and other industries, Brown brings a unique perspec tive to any situation and possesses a powerful talent for fostering collaboration across operational teams on all sides to enhance services and the experience provided to homeowners and clients alike.

What has been your secret to success?

I am passionate about treating others with re spect, no matter their title or responsibility. I have an open-door policy for all team members. I am very transparent, approachable and supportive.

Michael Catalano

Co-founder and General Partner

PURE Property Management

AS CO-FOUNDER and general partner at PURE Property Management, Michael Catalano is driven to transform the cumbersome and complex process of man aging and renting properties into simple and satisfying experiences. Through his dynamic leadership, Catalano has been able to influence industry leaders to band to gether and build together, resulting in PURE’s team of experienced industry professionals and seasoned tech nology innovators. PURE’s team is well on its way to pro viding a consistent high-tech, high-touch and hyperlocal property management service nationwide.

With his exceptional relationship-building skills and respect in the industry, Catalano has been actively in volved in every one of PURE’s 40 acquisitions, which has grown the business to over 20,000 single residen tial properties under management. With the launch this year of HOA, PURE now actively manages over 13,000 HOA properties.

What has been the secret to your success?

It’s about the people. We’re a people-first company. From the outside, people will say we’re just acquiring doors. But the reality is we’re attracting the right people. That’s been our not-sosecret secret.

40 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

Gary Clark

Chief Operating Officer

Sierra Pacific Mortgage

AS CHIEF OPERATING OFFICER, Gary Clark is at the forefront of Sierra Pacific Mortgage’s growth and has led the way by recognizing the organizational strengths, galvanizing them with improved processes and then tak ing them to market. Clark has worked in virtually every el ement of mortgage lending — starting in the industry over 40 years ago and developing his expertise in everything from governance and risk management to policy and advocacy. The broad spectrum of his accomplishments distinguishes Clark as an exemplary leader. Clark cham pions the Mortgage Action Alliance grassroots advocacy network, which allows constituents to play an active role in shaping legislation and regulations.

Clark was awarded the designation of certified mort gage banker by the Mortgage Bankers Association in 2006, and he continues to be a tireless advocate for the mortgage industry through his service on the MBA Residential Board of Governors.

What has been the secret to your success?

When people come to me for answers, I always try to provide the background and “why” behind the decision. I think any successful individual will go beyond what is asked and deliver more than what is required.

Court Cunningham

CEO/Co-Founder Orchard

AS CO-FOUNDER and CEO of Orchard, Court Cunningham sets the company vision and strategy that propelled Orchard to 850 employees in five years. Under Cunningham’s leadership, Orchard achieved triple-digit growth in 2021 and will more than double its growth this year. Orchard’s explosive growth is a testament to Cunningham’s commitment to delivering value to home buyers and the real estate professionals who serve them. Cunningham inspires and empowers the entire compa ny. Through transparent town halls and regular commu nication, Cunningham helps everyone to feel ownership over the work they do. Orchard’s spring 2022 anony mous engagement survey for employees revealed over 90% confidence in Orchard’s leadership, with 100% of employees sharing that the leaders at Orchard keep them informed about what is happening, both within the orga nization and within the larger industry.

What has been the secret to your success?

Success begins with the people you hire. As a CEO, you should build a team around you that is empowered to take risks, own them and find a way to try new things.

41 ❱ HOUSINGWIRE OCTOBER/NOVEMBER 2022

Bill Dallas Chairman Dallas Capital