PROGRAM

CONVO Program | 3 TABLE OF CONTENTS 4 4 5 5 7 9 11 12 12 13 14 16 25 27 28 31 38 40 41 42 44 45 46 46 48 50 51 52 Advertiser Index IIA of IL Staff Directory Welcome 2023-2024 IIA of IL President Attendee Information Schedule at a Glance Concurrent Education Session List Game Night Complimentary Headshots IIA of IL Awards Day One Schedule Day Two Schedule Big Party Day Three Schedule Speaker Bios Trusted Choice Hard Market Toolkit Exhibitor List IIA of IL Solution Center Exhibit Hall Floor Plan IIAPAC Contributors InsurPAC Contributors Important Dates IIA of IL Board of Directors Get Involved Past Presidents Cartwright Merit Award Winners IIA of IL Award Recipients Sponsors

Shannon Churchill Director of Information & Technology FAC Liaison CONVO Coordinator (217) 321-3004 schurchill@iiaofil.org

Brett Gerger, CIC Director of Education & Agency Resources (217) 321-3006

bgerger@iiaofil.org

Tami Hubbell, CIC Accounting & Administrative Services/Tradeshow Admin (217) 321-3016 thubbell@iiaofil.org

Jennifer Jacobs, SHRM-CP Director of Human Resources Board Administrator (217) 321-3013

jjacobs@iiaofil.org

IIA OF IL STAFF DIRECTOR y

Mark Kuchar Chief Financial Officer AIS Administrator (217) 321-3015 mkuchar@iiaofil.org

Phil Lackman, IOM Chief Executive Officer (217) 321-3005 plackman@iiaofil.org

Lori Mahorney, CISR Elite Central/Southern IL Marketing Representative (217) 321-3008 lmahorney@iiaofil.org

Evan Manning Director Government Relations (217) 321-3002 emanning@iiaofil.org

Kristi Osmond, CISR Education Assistant (217) 321-3007 kosmond@iiaofil.org

Rachel Romines Director of Communications Young Agents Committee Liaison (217) 321-3024 rromines@iiaofil.org

Tom Ross, CRIS, CPIA Director of Membership Northern IL Marketing Rep (217) 321-3003 tross@iiaofil.org

Carol Wilson, CPIA Director of Professional Liability & Insurance Products (217) 321-3011 cwilson@ilbigi.org

Independent Insurance Agents of Illinois 4360 Wabash Avenue, Springfield, IL (217) 793-6660 | info@iiaofil.org | www.iiaofil.org

4 | IIA of IL

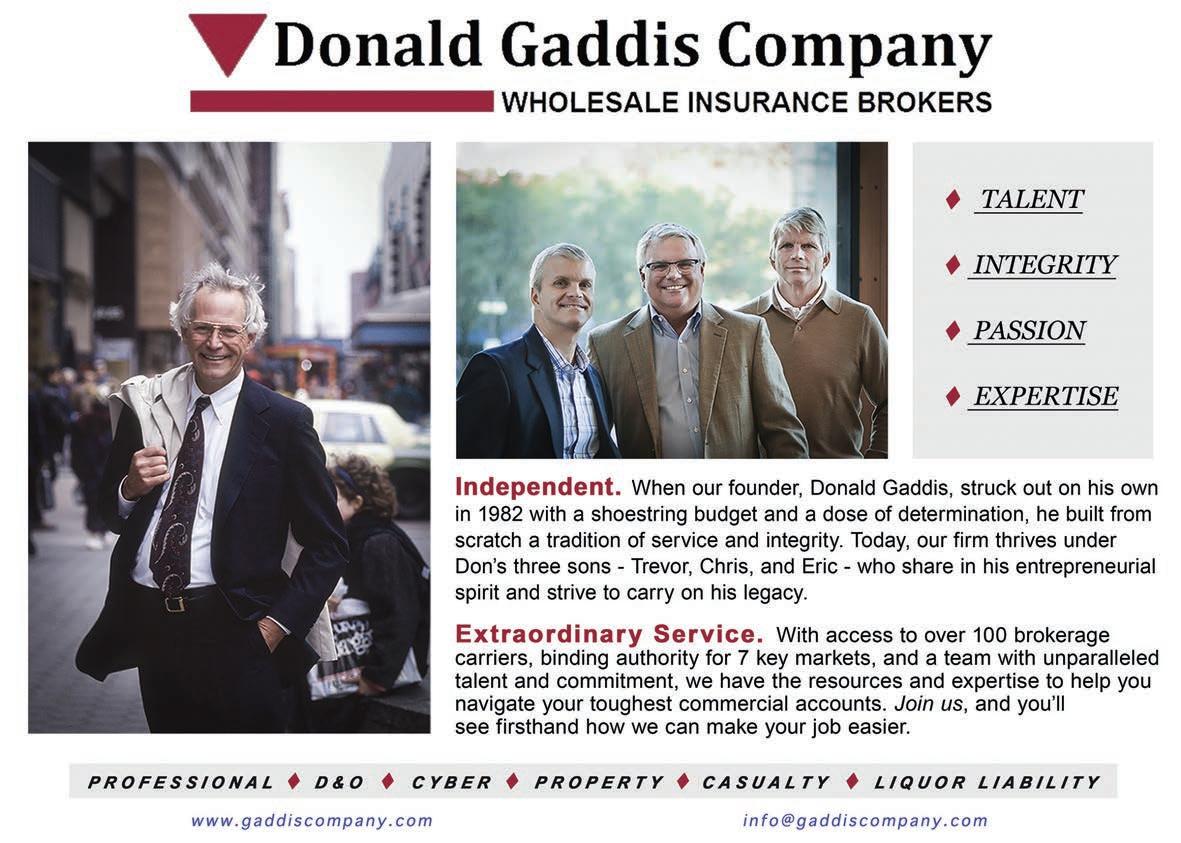

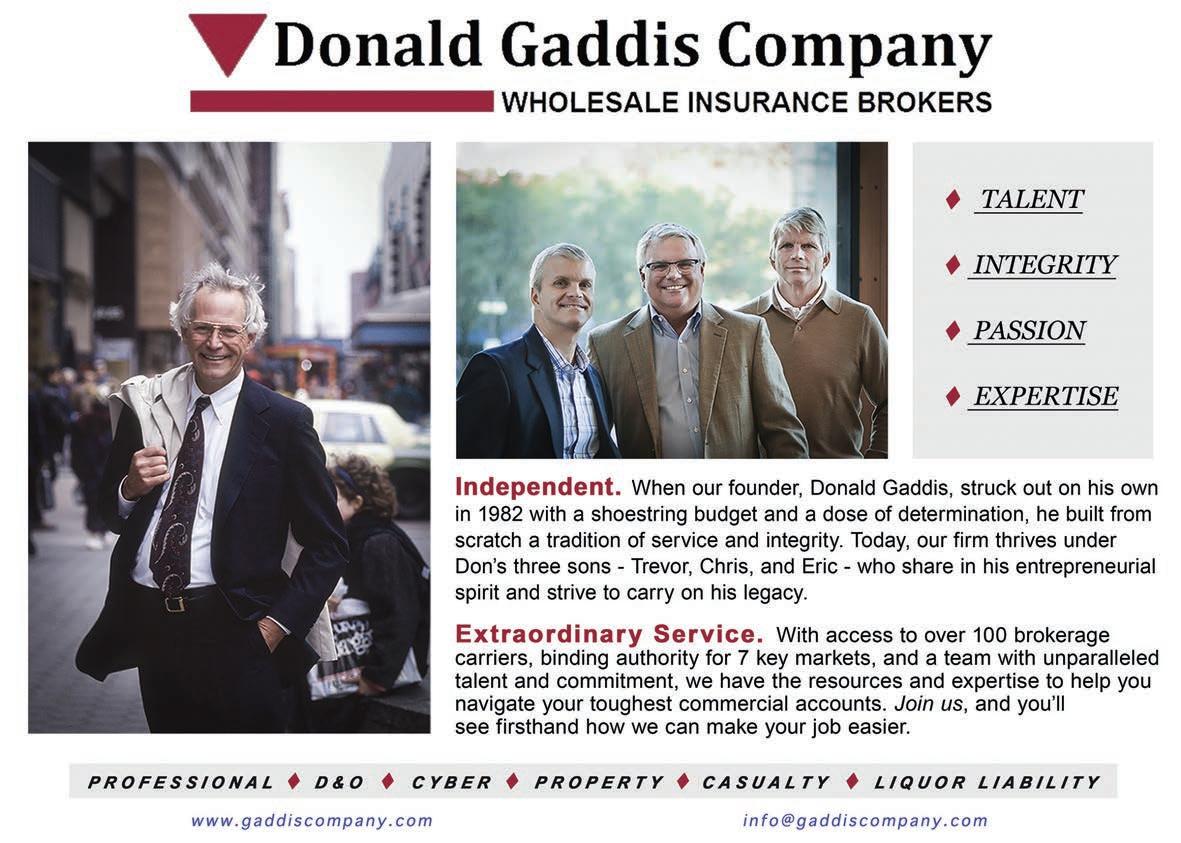

Arlington/Roe Berkshire Hathaway GUARD Ins. Companies Big I Markets Donald Gaddis Company, Inc. Illinois Public Risk Fund Imperial PFS IMT Insurance J M Wilson 20 34 26 30 26 19 8 7 18 10 6 8 20 2 23 11 Omaha National Underwriters, LLC Previsor Ins. & Missouri Employers Mutual Progressive SECURA Insurance TAPCO Underwriters, Inc The Hanover Insurance Group, Inc. Utica National Insurance Group West Bend Mutual Insurance Co.

PROGRAM ADVERTISERS

Welcome to CONVO 2023!

Wow...what an interesting year it has been. Now more than ever, it is important for us to come together, connect & share our thoughts, challenges, frustrations, and more. You are amongst friends here, and we are all in this together! Use the next few days to refresh and refocus yourself and your goals. Throughout the event, we will share resources and tools to empower you and your team to drive your business forward. On behalf of the IIA of IL Board of Directors, Volunteers, and Staff, thank you for choosing to be here. We are really looking forward to connecting with you over the next few days.

Make sure you connect with peers in education sessions, during the Tradeshow, or even in the hallways between events. If you need anything, stop by the IIA of IL registration desk or find an IIA of IL staff member or volunteer. We are here to help in any way we can.

Finally, before tip-off, I wanted to remind you of the resources provided to you, not only during CONVO but throughout the year. The entire team of the IIA of IL works all year long to fulfill our mission of providing a sustainable competitive advantage for our members. Check out the website at www.iiaofil.org to review what we can do for your agency. Or find an IIA of IL staff or board member. We would love to talk with you! We have some big announcements coming over the next few months, so keep an eye out for upcoming news and hints throughout the event.

Shannon Churchill CONVO Coordinator

2023-2024 IIA of IL President

Allyson Padilla, AAI, was born into Blank’s Insurance Agency but began her insurance career full-time in 2008. The agency provides all types of insurance and bonds, including personal lines and commercial insurance. She works in all facets of the agency but is primarily focused on commercial lines, agency marketing, and advertising.

Check out the October issue of Insight magazine for an interview with Allyson outlining her goals for the year.

CONVO Program | 5

Introducing...

WELCOME

ALL WHEELS WELCOME.

FOUR WHEELS, TWO WHEELS OR NO WHEELS AT ALL, WE CAN HELP YOUR CUSTOMERS INSURE ANYTHING

It’s no secret why drivers use independent agents. You offer quality service, and expertise that’s second to none. But Progressive can help too. We’re not only a leader in auto insurance, but also truck, boat, motorcycle and RV. Plus, our claims service keeps the promises we make to your customers.

So no matter what you’re helping your customers insure, together — we can provide peace of mind.

Choice and service made simple… now that’s Progressive.

Progressive Casualty Ins. Co. and its affiliates. 12A00257.05 (07/12)

Proud Platinum Sponsor of the IIA of Illinois since 2005!

ATTENDEE INFORMATION

Name Badges

Admission to all meetings and entertainment events will be by name badge only. Please wear your name badge at all times. It is your ticket to education and social events.

Lanyard Colors

Blue: Agents

Red: Company Representatives

Continuing Education Credit

***NEW PROCEDURE*** We will be using QR Codes during education sessions to track CE. Each class will be given specific instructions on when to scan in/out as required.

Three-hour sessions will have two scans.

One-hour sessions will have one scan.

You are required to use your mobile device to scan the QR code which will be provided during the session. After scanning the code, you will be directed to a website to answer a few questions and complete your CE request. See the classroom volunteer with questions.

Wednesday afternoon concurrent education sessions will begin at the top of the hour and end at the 50-minute mark, allowing attendees 10 minutes to switch classes. CE is awarded in one-hour segments allowing you to fully customize your schedule.

NOTE: You must be on time to each class. Anyone that is late to class, or leaves early, will NOT receive CE credit.

The maximum number of Illinois CE hours a licensed individual may earn is 12 for the entire event.

If you should have questions or need anything throughout the event, visit the IIA of IL Registration Desk or see an IIA of IL staff member.

Tradeshow – New Booth Procedure for Prize Drawings

If you have entered a prize drawing for one of the exhibitors, you will want to make sure you are on the tradeshow floor (hospitality area) at 5:45 p.m. on Wednesday. Each exhibitor will be drawing and announcing their winners live. If your name is called and you are not present, exhibitors have the option to draw someone else. It is the responsibility of the exhibitors to get prizes to the winners.

CONVO Program | 7

Program-sunrise-OUTLINES.indd 1 8/8/23 2:25 PM

2023 JM Wilson IIA of IL Convo

PERSONAL | BUSINESS TIMES LIKE THESE CALL FOR IMT’S WORRY FREE BUSINESSOWNERS INSURANCE. Give your policyholders the protection they deserve to keep their business covered, even in the worst of times. Learn how you can represent IMT Insurance by visiting imtins.com/contact The information presented here is intended for informational purposes only and does not supersede any provisions in your insurance policy and related documents. See applicable terms and conditions or your policy provisions for details. We provide customized insurance on admitted paper for commercial businesses in niche classes, such as special events, nonprofits, and sports and recreation risks. Our coverage offers protection for a wide range of industries to help you diversify your book of business and support your agency’s growth. Learn more about SECURA’s Specialty Lines Want to learn more about what SECURA’s Specialty Lines has to offer? Scan the QR code or visit secura.net/specialty for more information. Commercial | Personal | Farm | Agribusiness | Specialty Specialty Lines is one of our specialties

SCHEDULE AT A GLANCE

Tuesday, October 10

10:00 am

Noon - 5:00 pm

1:00 - 4:00 pm

5:00 - 6:00 pm

6:00 - 8:00 pm

Independent Agent Invitational Golf Outing - Weaver Ridge Golf Club

Convention Registration - 1st Floor - Hotel

Concurrent Education Sessions (CE)

- Look for class details on page 14

Welcome Reception and Meet & Greet - Hotel - Marquette A Ballroom

Dinner Break

Dutch Dine Arounds

-Hotel Lobby - Meet at 5:50 pm

-Must sign up. See registration desk for details.

Past Presidents Dinner (Invitation Only)

- Hotel - Cheminee Ballroom

Young Agents Network Dinner

- Must sign up. See registration desk for details.

8:00 - 11:00 pm

Game Night - Hotel - Cotillion Ballroom

Wednesday, October 11

7:00 am

7:00 am

8:00 - 11:30 am

11:30 am - 12:45 pm

1:00 - 4:00 pm

3:30 - 6:30 pm

6:30 - 11:00 pm

Registration Open - Civic Center - 1st Floor

Hot Breakfast - Civic Center - 4th Floor

General Session (CE) - Civic Center - 4th Floor

- Look for session details on page 16

Lunch and Networking - Civic Center - 4th Floor

Concurrent Education Sessions (CE)

- Look for sessions on page 17

Scan this code with your smart phone to view the schedule online.

Tradeshow - Civic Center - 1st Floor (See note about exhibitor prizes on page 7)

Big Party - Hotel - Marquette Ballroom

Thursday, October 12

7:00 - 8:30 am

8:30 - 11:30 am

Hot Breakfast - Hotel - Cotillion Ballroom

State of the Association Address and Refocus, Connect, and Empower Your Agency for the Future (CE)

-Hotel - Marquette Ballroom

- Look for session details on page 27

CONVO Program | 9

previsorinsurance.com | mem-ins.com 1.800.442.0593 that help you lead with confidence. As the region’s leading provider of workers compensation insurance. Our focus lets us invest in programs and services that save lives and transform workplaces. For agents, that means a better value — and a better experience — for your clients. Work comp experts

Back to Bascis: Understanding the Surplus Line Insurance

- David Ocasek

Business Planning to Improve Your Agency Valuation

- Jeff Smith

Attracting Your Ideal Client in a Hard Market Through Podcasting

- Derek Hayden

Managing & Leading a Remote Workfoce

- April Simpkins

Why West Bend?

4 Key Business Income Concepts

- Chris Boggs

Brett’s 2 Sense Nonsense

- Brett Gerger

Building Relationships and Referrals in a Digital World

- Daniel Smith & Abby Wheeler

Best Practices in Agency Compensation

- Brian Lawrence

Demystifying the Business Income Report/Worksheet

- Chris Boggs

Avoiding Legal Concerns Due to Emerging Trends

- Rick Pitts

How to Communicate Your Value in a Hard Market

- Brandon Hardesty

#1 We are a people business – approachable, accessible, and we value our relationships with our independent insurance agents above all else.

#2 Commitment to excellence – since 1894, we’ve built our reputation on our innovative products, steady growth, and financial stability, earning us an A rating from AM Best.

#3 Mutual insurer – we make decisions based on what’s best for our agents, policyholders, and associates for the long term.

#4 Product line – includes a broad selection of personal lines coverages under a package policy and commercial, specialty, bonds, and work comp underwriting; we quote and issue quickly.

#5 Service – begins and ends with our people, from our experienced loss control reps to our dedicated claims service team and customer service all-stars; we care for our agents and policyholders.

You’ll find this and so much more. Find out why agents choose West Bend by visiting thesilverlining.com.

CONVO Program | 11

WEDNESDA y, OCTOBER 11 - 1:00 - 4:00 PM C IVIC C ENTER - 4 TH F LOOR 1:00 - 1:50 pm 2:00 - 2:50 pm 3:00 - 3:50 pm

CONCURRENT SESSIONS

It’s our traditional Casino Night, but with a “spin!”

In addition to casino games, attendees have the option to play some traditional game night games...

... and maybe a few not-so-traditional games.

TUESDAY, OCTOBER 10

8:00 - 11:00 pm

Hotel, Cheminee Ballroom

This event benefits IIAPAC.

with a spin...

All games earn chances to win great prizes!

12 | IIA of IL

Presented during the General Session on Wednesday, October 11, 8:00 to 11:30 am.

Agent of the Year

The Agent of the Year Award is given for the outstanding performance of an individual retail agent member of the IIA of IL in the categories of production, use of technology, professional development and civic responsibility.

Agency of the Year

The Agency of the Year Award is presented to an IIA of IL member agency that exemplifies leadership and innovation within the industry. The Agency of the Year demonstrates strong growth, innovative marketing strategies, creative utilization of evolving technology, top-level customer service and dedication to the community.

Young Agent of the Year

The Young Agent of the Year award recognizes the achievements of young agents in Illinois. The nominee must have demonstrated service to the insurance industry, professional trade associations, and community in a manner that would be considered exceptional for a person of his or her age. The award is given for career service and is not limited to activities during this past year.

Cartwright Merit Award

The Charles M. Cartwright Merit Award is considered the most prestigious award the IIA of IL presents. Named for Charles Cartwright, editor of the National Underwriter for more than 50 years, and champion of associations and the insurance industry, the award is presented at discretion of the IIA of IL Executive Committee to the “Person who has performed the most meritorious service for the good of the insurance agents of Illinois.”

See previous award recipients on pages 50-51.

Wondering how you can be a recipient next year?

CONVO Program | 13

2023 IIA OF IL AWARDS

Sign up to receive notifications when 2024 award applications are being accepted!

Go to www.iiaofil.org/ IIA-of-IL-Awards or scan the code below for details.

DA y ONE

Tuesday, October 10

10:00 am - 4:00 pm Independent Agent Invitational Golf Outing - Weaver Ridge Golf Club

Noon - 5:00 pm Convention Registration - Hotel

1:00 - 4:00 pm

Concurrent Education Sessions (CE)

E&O Roadmap to Cyber and Privacy Insurance (CE)

Speaker: Sam Bennett - Hotel, LaSalle

The world is changing, and agents and brokers have a duty to educate themselves and their clients on the need to protect their businesses from the exposures created by technology. To do this, we must fully understand the available exposures and coverages. During this session, Sam will address how the coverage forms we use to finance these risks ‘work.’ Cyber policies differ from other property and liability policies we use to protect our clients. Understanding how insuring agreements are chosen to effectively address the various cyber exposures that our clients face each day, both first and third parties, will help participants be better risk management partners for their clients. Sam will share insights into cyber and privacy coverage issues, including a review of losses resulting from cyber and electronic activities, and help participants identify effective loss control measures to mitigate as much uncertainty as possible. Participants will also learn more about the resources available through the IIA of IL.

*Applicable towards three hours of the necessary credit for the E&O discount

*Satisfies the IL Ethics credit requirement.

Sponsored by:

14 | IIA of IL

5:00 - 6:00 pm

Insurance Game of Games (CE)

Speakers: Nicole Broch, Luke Praxmarer, Brett Gerger

- Hotel, Marquette B Ballroom

Do you hate to be entertained while learning? If “yes,” this class is not for you.

Do you prefer to learn in a fun, engaging, and relaxed environment? Then this class is for you! Join hosts, Luke Praxmarer & Nicole Broch for interactive games of “Pursuing Trivia” and “Agent’s Feud,” putting your insurance skills to the test. Will your team outsmart the others and win prizes?

This session covers a variety of topics, including Personal Auto & Home, Commercial Property & Auto, Personal Umbrella, EPL, Business Income, Workers Comp, and more. Your hosts will prove learning can be fun in this session of wits, laughter, and knowledge.

Welcome Reception and Meet & Greet

- Hotel, Marquette A Ballroom

Kick off CONVO at the Welcome Reception. Join us for a drink and hors d’ oeuvres before heading out to dinner at the Dutch Dine Arounds, with your company partners, with old friends or new acquaintances.

6:00 - 8:00 pm Dinner Break

Don’t have dinner plans? Here are some options:

Dutch Dine Arounds (Sign up required)

- Hotel Lobby - Meet at 5:50 pm

- See registration area for sign up sheets.

Sign up to join a group dinner coordinated by IIA of IL staff. We’ve made the reservations and travel arrangements, you bring your awesome self as we discuss life, the insurance industry and anything you want!

* Attendees are responsible for paying for their own dinner.

First-Time Attendees & Young Agents Network Dinner (Sign up required)

- Hotel, 11th Floor - Private Lounge

- See registration area for sign up sheet.

Past Presidents Dinner (Invitation Only)

- Hotel, Cheminee Ballroom

8:00 - 11:00 pm

Game Night - All Attendees Welcome

- Hotel, Cheminee Ballroom

Our Tuesday evening social event is always a great time! This year, it’s Game Night! In addition to traditional Casino games, attendees will have a chance to play several other classics! Sit back, relax, and let the good times roll! This event benefits IIAPAC.

CONVO Program | 15

Scan this code with your smart phone to view the schedule online.

DA y TWO

Wednesday, October 11

7:00 am Registration Opens - Civic Center, 1st Floor

7:00 am Hot Breakfast - Civic Center, 4th Floor

8:00 - 11:30 am General Session (CE) - Civic Center, 4th Floor

IIA of IL Agency of the Year, Agent of the Year, and Young Agent of the Year Awards will be presented. The Cartwright Merit Award Committee will address the audience. Attendees will also hear state and national updates, and more.

Four Ways to Define and Enhance Your Agency Culture

By April Simpkins

By April Simpkins

According to a recent survey, 46% of job seekers said culture was one of the deciding factors in the application process. In recent years, workplace cultures have undergone a dynamic shift. For many organizations, culture has been redefined by remote work, the talent shortage, increased mental health awareness, and a multigenerational workforce. We have five generations in the workplace, four of which dominate this space. Understanding each generation’s perspective on the changes in culture and leadership can create an engaged team that attracts top talent.

Sponsored by:

One key element of a healthy culture is ensuring everyone on your team brings their authentic selves to work, feels included in decisions that impact them, and is provided tools and support so they can do their best work. This energetic and information-packed presentation will explain the correlation between leadership, workplace culture, and attracting top talent.

Attendees of this presentation will learn the following:

• The difference between culture and subculture and how the latter impacts business.

• How to identify and define the company’s culture more clearly based on the four distinct styles.

• Tips on building a sustainable culture that develops and prepares multigenerational leaders.

16 | IIA of IL

11:30 am - 12:45 pm Lunch and Networking

- Civic Center, 4th Floor

Take a break from learning to grab a bite to eat. Use this time to check in at the office and connect with people you have met throughout CONVO.

1:00 - 4:00 pm Concurrent Education Sessions (CE)

1:00 - 1:50 pm

Sponsored by:

- Each class is filed for CE in one-hour segments, allowing you to fully customize your schedule.

Back to Basics - Understanding Surplus Line Insurance

Speaker: David Ocasek

- Civic Center, 4th Floor, Room 401

This session will give agents a solid background in the origins, uses and regulation of the surplus line market.

Sponsored by:

1:00 - 1:50 pm

Managing and Leading a Remote Workforce

Speaker: April Simpkins

- Civic Center, 4th Floor, Room 402

Hybrid and remote work is here to stay and has changed the backdrop of the workplace. While every job is not remote capable, organizations that champion remote and hybrid work will fair far better than their counterparts with retention, productivity, and job satisfaction. A recent survey of ten thousand workers revealed that 23% of those surveyed would take a 10% pay cut to work from home permanently.

Remote work is not new; for many employers, it can be an enticing offering and motivator in the fight for talent. This presentation examines challenges employers face when determining if hybrid and remote work should be integrated long-term. A decision like this requires changes to culture, processes, and engagement strategies.

Attendees of this presentation will learn the following:

• How “presenteeism” impact the remote work model.

• Employment best practices and policies to consider when establishing hybrid and remote work standards.

• How to Integrate the remote work experience into an established “in-person” culture.

Day two continued on next page.

CONVO Program | 17

Workers compensation for the companies that build America and keep it working Workers Compensation Insurance • No volume requirements • Competitive rates • Multiple options for premium payments • Open to Shock Loss/High Mods Send in your submissions today. For more information contact a marketing rep at 844-761-8400 or email us at Sales@Omahanational.com. [ Coverage in: AZ • CA • CT • GA • IL • NC • NE • NJ • NY • PA • SC Smart. Different. Better. Omaha National Underwriters, LLC is an MGA licensed to do business in the state of California. License No. 078229. “A-” (Excellent) rated coverage through Omaha National Insurance Company, Preferred Professional Insurance Company, and/or Palomar Specialty Insurance Company.

1:00 - 1:50 pm

Business Planning to Improve Your Agency Valuation

Speaker: Jeff Smith

- Civic Center, 4th Floor, Room 403

The first step in business planning is knowing where you are and identifying the risks in your business. During this session, agency owners will learn how to effectively business plan with the goal of improving their agency’s value. The session will identify the most important risk factors in an agency valuation and review the strategy to address each of these concerns to grow agency value. The agents will leave with practical tools to leverage in the journey to maximize the value of the agency.

Sponsored by:

1:00 - 1:50 pm

Attracting Your Ideal Client in a Hard Market Through Podcasting

Speaker: Derek Hayden

- Civic Center, 4th Floor, Room 404

In this 50 minute session, insurance professionals will learn how to define their ideal client and use unique sales and marketing strategies to attract those clients during a hard market. Attendees will understand how to create a podcast to gain attention in their marketplace. Attendees will also understand how to use podcasting material to build an arsenal of niche content and build their book of business with ideal clients.

Sponsored by:

Day two continued on next page.

CONVO Program | 19 DA y TWO

Scan this code with your smart phone to view the schedule online.

INTEGRITY, FAMILY, COMMUNITY & SERVICE Serving independent agents since 1964. Managing General Agents | Wholesale Insurance Brokers (800) 878-9891 | ArlingtonRoe.com SEARCH BY KEYWORD We’ve made it easy to browse 1,000+ eligible class codes online. Scan the QR code to start searching: From A to Z Not sure where to get a quick quote on the next new business account? Start with TAPCO. 800-334-5579 www.GoTAPCO.com 800 334 5579 800 334 5579 CALL 800-334-5579 to speak live with a TAPCO underwriter. Get a quote in a five-minute phone call. 800 334 5579 YOUR QUOTE IS ON ITS WAY! You will receive a quote in your email in-box before the call is ended! With more than 1,000 eligible classes TAPCO has got you covered! Make the logical choice. Call, quote and bind with TAPCO today:

2:00 - 2:50 pm

Four Key Business Income Concepts

Speaker: Chris Boggs

- Civic Center, 4th Floor, Room 401

Businesses exist to make money. Even “non-profits” need to make money to survive. Thus, every business’ greatest exposure is the loss of needed income.

Some estimates are that approximately 25% of business operations that suffer a business-closing loss never reopen. Likewise, approximately 50% of those that do re-open close down within a short period after re-opening due to the business-closing loss.

Why do these businesses cease to exist? It’s not the lack of property insurance on the building or personal property. The real reason is the loss of income.

The most important asset requiring protection is the business’ income. In this session the four most important business income concepts are discussed. Upon these concepts business income is built. After this session, business income coverage will be far less mystifying.

Sponsored by:

2:00 - 2:50 pm

Best Practices in Agency Compensation

Speaker: Brian Lawrence

- Civic Center, 4th Floor, Room 402

The pandemic, inflation, and insurance talent gap have created a recent surge in salary expectations. Are your salary and benefits package competitive enough to attract and retain the talent required for your agency to thrive? We will analyze available data from Illinois, Big I Best Practices, and OIA Valuations to provide a snapshot of current compensation levels within the industry and across the broader labor market. We will also share a few compensation models and innovative practices some agencies have employed to attract and retain talent. Participants will leave with a better understanding of current market conditions and strategic insights to evaluate their compensation practices.

Sponsored by:

Day two continued on next page.

CONVO Program | 21

DA y TWO

2:00 - 2:50 pm

Brett’s 2 Sense Nonsense

Speaker: Brett Gerger

- Civic Center, 4th Floor, Room 403

In this session, based on his monthly Insight magazine column, Brett Gerger will channel his years of experience working for the Department of Insurance to enlighten attendees on a variety of topics. Attendees will hear Brett’s take on current market conditions, give his advice on finding the right talent for your agency, and so much more! This class will be highly interactive, and attendees are encouraged to bring their burning questions. According to Brett, his answers may solve the world’s problems, so bring a notepad.

Sponsored by:

2:00 - 2:50 pm

Building Relationships and Referrals in a Digital World

Speakers: Daniel Smith & Abby Wheeler

- Civic Center, 4th Floor, Room 404

Much of an insurance agent’s success is based on relationships and referrals. So, is your agency properly utilizing digital relationship and referral tools? This session will discuss how strengthening your relationships through social media content can lead to a better customer experience and a happier team, and harnessing online reviews can drive referral traffic. You’ll walk away with new perspectives on how to enhance what you’ve done for years to build relationships and earn referrals.

Sponsored by:

22 | IIA of IL

DA y

Scan this code with your smart phone to view the schedule online.

3:00 - 3:50 pm

Demystifying the Business Income Report/Worksheet (CP 15 15)

Speaker: Chris Boggs

- Civic Center, 4th Floor, Room 401

Businesses exist to make money. Without income, businesses cease to exist.

Business Income coverage is the most important property coverage any and every business should have.

Fear of the Business Income Report / Worksheet (the CP 15 15) sometimes dissuades agents from writing the coverage. Six pages and many blank spaces coupled with the fact that the worksheet is not in “accounting speak” make the form seem more daunting than it really is.

When the CP 15 15 is understood, there is no more fear. And the secret is, the CP 15 15 is very easy to understand – and explain. After this session, fear of the CP 15 15 will only be a shadow of the past.

Day two continued on next page. Sponsored by:

5 REASONS to Choose Utica National’s Agents’ Errors & Omissions Program

Since 1966, Utica National Companies have been a continuous leader in the E&O market.

More than 10,000 agents have placed their trust in Utica National’s E&O program and their state association. Let us earn your business!

Claims Strength – Utica National’s E&O claims team is 100% dedicated to E&O and has decades of experience. When needed, we engage top litigators with proven track records of successful results.

Customized Coverage – More than just solid, comprehensive coverage; we offer choices based on your operation and risk appetite. We provide several options when you are planning to retire, sell, or purchase another agency.

Direct Access to Underwriters and Claim Specialists

– Need input regarding an E&O exposure or potential claim situation? With Utica National, you can speak directly with an Underwriter or Claim Representative.

Leading-Edge Risk Management – We offer resources on contemporary topics like social media, cyber liability, and multilingual communications so you can understand the hazards involved and take steps to reduce your risk.

Flexible Payment Options – We offer multiple billing options including electronic fund transfer without any interest charges or fees*.

For more information on how you can protect your agency from the financial hardship that results from an E&O claim, visit www.uticanational.com/EO.

CONVO Program | 23 TWO

*A nominal fee per installment applies to direct bill invoiced policies using the 12-payment option. Fees vary by state.

This summary represents an outline of coverage available from the companies of the Utica National Insurance Group. No coverage is provided by this summary. All coverages are individually underwritten. Coverage availability, terms and conditions are dictated by the policy and may vary by state. In the event of a loss, the terms of the policy issued will determine the coverage provided.

3:00 - 3:50 pm

Avoiding Legal Concerns Due to Emerging Trends

Speaker: Rick Pitts

-

Civic Center, 4th Floor, Room 403

This fast-paced one hour seminar is in four parts. The first examines the state of the legal system, including caseloads, time delays, and overall costs. The idea is to emphasize to the attendees that it pays to be cognizant of the costs and time drains of legal action defense. The section concludes with a discussion from a purely errors-and-omissions perspective – where do claims come from and who makes them?

With this background in place, the remaining three sections of the hour look at three recent cases. In each, the desire is to identify the background of the issue, what the case speaks to in terms of that issue from the producer’s perspective, and then move toward a solution that benefits the insured as well as the producer. Rick will also discuss some of the issues being seen recently by IL agents including website ADA compliance and digital image copyright infringement.

The first of the three involves cyber-related risks. The development of a new national standard is discussed using the recent New York state regulations as a model. Producers gain an appreciation of the cyber risk overall in today’s world. Then the section pivots to a discussion of multi-factor authentication and the impact it had on one insured. The section ends with a reminder of the importance of accuracy on all insurance applications.

The third takes a similar approach with a recent liquor liability case from Indiana. While the relationship between a liquor liability policy and a commercial general liability form is a well-explored topic in general, there is nevertheless an important lesion to be gleaned from the Ebert case. Insureds need to be in the right coverage for their business risk and it is incumbent upon the producer to at least advise the insured of the need.

The last section looks at a new sharing economy issue – how to insure a private vehicle engaged in delivery (as opposed to passenger delivery). Using the Malzberg decision, the case shows the limitations of existing law and concludes with an admonition to make sure that all uses of a private passenger vehicle are properly accounted for.

Sponsored by:

24 | IIA of IL

DA y TWO

Scan this code with your smart phone to view the schedule online.

3:00 - 3:50 pm

How to Communicate Your Value in a Hard Market Speaker: Brandon Hardesty

-Civic Center, 4th Floor, Room 404

It’s rarely easy to get prospects and customers to understand the immense value you bring to the table (until there’s a claim). Add on carrier capacity and restrictions, rising premium costs and team members with less hard-market experience and the task becomes more challenging. Join MarshBerry Vice President, Brandon Hardesty, as he shares the language and strategy you need to communicate and grow, how to understand the importance of an association or network partner to achieve growth goals, and creating a strategy and succession plan for your firm to move forward in the current market.

Sponsored by:

3:30 - 6:30 pm

Tradeshow

-Civic Center, 1st Floor

Meet with over 120 vendors and learn about the valuable industry products and services which will make your agency stand out. See exhibitor list on page 38.

6:30 - 11:00 pm Big Party Hotel, Marquette Ballroom

When we talk networking, the BIG PARTY is one of the most talked about events

TWO

Wednesday, October 11 6:30 - 11:00 pm Hotel - Marquette Ballroom BIG PARTY Food Drinks dancing friendly competition EVERYONE WELCOME! Sponsored by favoriteWearyoursports apparel!

IPRF is the Leader in Workers' Compensation Coverage

Since our inception in 1985, the Illinois Public Risk Fund has invited public entities and government agencies to examine our outstanding record for costeffective workers' compensation coverage.

Today, over 700 risk managers rely on IPRF for:

24/7/365 Claim Reporting

In-house Nurse Case Management

Aggressive subrogation program which will include members out of pocket expenses.

Loss Control training and support that includes an extensive library of online training courses, simulator training and sample safety guides.

IPRF members can select their own defense counsel subject to IPRF’s litigation management process and approval.

26 | IIA of IL

Dedicated Claims Team Prescription Drug Programs PROUDLY SERVING THE PUBLIC SECTOR www.IPRF.com(800)289-IPRF(708)429-6300(708)429-6488 Fax

Big “I” members enjoy exclusive online market access FOR independent agents, FROM independent agents. TAKE A SCROLL THROUGH OUR SOLUTIONS. CYBER LIABILITY AFFLUENT SMALL COMMERCIAL AUTO & HOME BONDS www.bigimarkets.com BIGIMARKETS.COM No fees. No minimums. Own your expirations.

DA y THREE

Thursday, October 12

7:00 - 8:30 am Hot Breakfast

- Hotel, Cotillion Ballroom

8:30 - 11:30 am State of the Association Address and Keynote: Refocus, Connect, and Empower Your Agency for the Future (CE)

- Hotel, Marquette Ballroom

Learn about trends and challenges facing the independent agency system during the State of the Association Address. Association leaders will empower you with news on legislative and regulatory issues impacting your business and your clients, connect you with tools and resources to navigate the changing market and challenge you to refocus on what matters most to keep your agency ahead of the curve. Members in attendance will vote on a proposal to amend the Association By-Laws.

In a world with no shortage of options, risks, and distractions when it comes to technology, it’s important to be nimble but also act with intent. Chris Cline will begin this session by challenging you to slow down to speed up when planning your business strategy for the future.

Cline will moderate a panel of experts with various technology backgrounds who will explore industry and tech space trends including artificial intelligence, data, best practices, virtual assistants, and what’s coming next. Finally, we will look at where we go next. You and your agency are leaving a legacy whether you are managing it or not. We’ll close with a powerful discussion on the significance of legacy and taking control of your most personal and valuable asset as Chris Cline shares insights from his new book, The Inertia of Legacy.

At the end of this session, you’ll hear a special announcement!

CONVO Program | 27

Chris Cline ACT

Paul Hawkins HawkSoft

Murali Natarajan West Bend

Lindsey Polzin Acrisure dba Presidio

Ray Roentz Moderator

Sam Bennett, CIC, CPRM, AFIS, CRIS, CPIA, is an active retail producer, presenter, and shareholder in Harrison Agency, Inc. of Columbia, MO. He began his insurance career in 1987 and has been an Independent Insurance Agent from the beginning. He has worked with individuals, families, and small businesses his entire career. In this capacity, he has worked in the personal lines, commercial lines, agribusiness and life and health marketplaces. As a result of working with many types of clients, many carriers, and many coverage needs, Sam has grown to understand and appreciate the important ways an insurance professional must work with markets and clients in today’s insurance world.

Sam obtained his Certified Insurance Counselor (CIC) designation in 1996. He has taught coursework for the National Alliance in their CISR program since 2000, has presented in their CIC program since 2004, and in 2009 became a National Faculty Member of the Society of CIC. In 2021 he obtained his Certified Personal Risk Manager designation from the National Alliance and is a presenter in that program. Sam is also a speaker in IRMI’s Agribusiness and Farm Insurance Specialist (AFIS) program, their Transportation Risk and Insurance Professional (TRIP) program and their Construction Risk Insurance Specialist (CRIS) program, as well as presenting coursework in the AIMS Society’s Certified Professional Insurance Agent (CPIA) program. Over the years, Sam has been retained by several law firms to offer expert review of cases involving agent standard of care and coverage questions. He has been called upon to offer insurance education in conferences and symposiums across the country over the past twenty plus years.

Christopher J. Boggs, CPCU, ARM, ALCM, LPCS, AAI, APA, CWCA, CRIS, AINS, currently serves as a Senior Product Manager with Verisk (ISO). He and his team manage and develop policy language for Verisk’s ISO Commercial Property line of business.

Prior to his current role, Boggs was vice president of agent development with the Independent Insurance Agents and Brokers of America (IIABA or the Big “I”).

During his greater-than-three-decade insurance career, Boggs has authored over 2,000 insurance and risk management-related articles on a wide range of topics. Additionally, Boggs has written 15 insurance and risk management books.

Boggs has been a regular speaker at industry events, including the National Association of Mutual Insurance Companies (NAMIC), the National Society of Insurance Premium Auditors (NSIPA), the American Association of Managing General Agents (AAMGA), the Institute of Work Comp Professionals (IWCP), the Chartered Property Casualty Underwriter (CPCU) Society and many state association conferences. He has also earned numerous professional accolades including the 2017 Institute and Faculty of Actuaries (IFoA) Brian Hey Prize and the 2019 Casualty Actuarial Society (CAS) Charles A. Hachemeister Prize as part of a of professional collaboration with a diverse group of professionals.

His professional background includes work as an insurance educator, risk management consultant, loss control representative, insurance producer, property claims manager, journalist and columnist, and underwriting quality assurance manager.

28 | IIA of IL

SPEAKER

Sam Bennett

Scan this code with your smart phone to view the schedule online.

Chris Boggs

Nicole Broch spent over a decade as an Independent Insurance Agent and Manager of a successful partnership between a community financial institution and a local independent agency in Springfield, Illinois. She attended The Hartford School of Insurance and achieved her National Underwriter awarded Personal Lines Coverage Specialist (PLCS) designation in 2005. She went on to receive the National Alliance CISR designation in 2007 and CIC designation in 2009.

In addition to teaching National Alliance CISR modules, IIABA Errors & Omissions, Ethics, and customer service and professional development topics for IIAs, PIAs, and trade associations throughout the country, she is the Territory Sales Manager for The Hanover Group, supporting independent agents throughout Central and Southern Illinois.

Through Chris Cline’s 25+ years in the insurance industry, he has established himself as an industry resource for topics such as perpetuation, merger and acquisition, culture, agency operations, marketing and sales, data and analytics, and has had multiple speaking engagements around these topics. As of spring 2022, Chris has begun assuming leadership of the Agents Council for Technology as ACT’s Executive Director.

In his prior role at Westfield, Chris led a team focused on the entire agency life cycle and has experiences ranging from graphic design, marketing, sales, training, compliance and personal lines P&L leadership. Through his diverse background and life-long focus on continual learning (he’s a closet science geek), Chris has developed a passion for the independent agency channel and helping agencies across key strategic areas such as perpetuation, hiring, culture, DE&I, data/analytics, the customer, information security, and technology. He was also the inquisitive and thought-provoking host of Westfield’s awardwinning podcast, Closing the Gap.

Chris earned his Bachelor of Arts in Graphic Design from the University of Akron.

Brett Gerger is the Director of Education and Agency Resources for the IIA of IL. Previously, he served as the Chief Deputy Director of Product Lines and Licensing at the Illinois Department of Insurance and was responsible for management of Licensing and Continuing Education Units; Property & Casualty; Life & Annuity; Health; and Producer Regulatory. Prior to that Brett served as the Deputy Director for Property & Casualty at the Department which oversaw Producer Regulatory Unit; Licensing & Continuing Education; and Property & Casualty consumer and compliance units.

Gerger served on many insurance license test development panels throughout his career as a subject matter expert. Most recently, Gerger served as the State of Illinois Group Insurance Division Manager with the Illinois Department of Central Management Services. In that role, he had oversight and management for the planning and implementation of policy and operations of the State’s insurance programs, including property, liability and benefits.

Gerger started his 25+ year career at the Illinois Department of Insurance in the Producer Regulatory Division. Brett has his bachelor’s degree from the University of Illinois at Springfield.

CONVO Program | 29 SPEAKER BIOS

Chris Cline

Nicole Broch

Brett Gerger

SPEAKER

Brandon Hardesty is an accomplished sales director with over 20 years’ experience in Fortune 500 company sales, marketing and strategy. In his role, Brandon is responsible for providing management consultation, strategic planning, coaching and sales leadership to MarshBerry’s portfolio of insurance brokerage clients and carriers.

Prior to MarshBerry, Brandon worked for Hub International Limited where he acted as the Sales Director - Commercial Programs. In this role, he was charged with hiring and expediting the qualification process of producers, managing and deepening carrier partner relationships, and growing and retaining a $120M+ book of business. Also during his time at Hub, he developed programs and tools to drive organic growth as the National Business Development Manager for Employee Benefits.

Brandon also worked at Allstate-Ivantage Select Agency, Hays Companies and Wells Fargo all in key business development roles. He has a Bachelor of Liberal Arts & Science degree from the University of Illinois.

30 | IIA of IL

Brandon Hardesty

Paul Hawkins, CEO and Co-Founder of HawkSoft, began developing HawkSoft’s first software program while working as an independent insurance agent in Portland, Oregon, and seeing first-hand the opportunities for increased efficiency and improved product support that software automation could provide. Throughout his 6-year career as an insurance agent, Paul developed many software tools that he and his coworkers used to boost their agency’s success. In 1995, Paul founded HawkSoft to devote his full attention to helping all independent insurance agents. Paul serves as President and CEO of HawkSoft and is a member of the board of directors. He is a frequent speaker at insurance industry events and has received the Legend Award from The Brokers Insurance Group.

In September of 2021, Derek Hayden exploded onto the insurance influencer scene when he was announced as the winner of The Protégé, an insurance sales-based reality show. An insurance sales producer from small town America, Derek made waves by utilizing the tools and strategies he learned on the reality show to lead the competition in sales and ultimately take home the title of The Protégé.

As an insurance and risk management professional with 10 years of sales experience, Derek understands that insurance professionals often struggle to differentiate themselves in the marketplace. By expanding on the concepts he learned throughout The Protégé, Derek aims to solve this problem by giving agencies and producers a proven roadmap to a lucrative insurance sales career in 2022 and beyond. His focus on modern sales techniques will give new and seasoned agents a refreshing view on how to build their books of business and gain the success they desire.

CONVO Program | 31 SPEAKER BIOS

Derek Hayden

Is Your Agency Prepared for the Hard Market? Equip your team with the expertise they need to support clients during this demanding time. Download this free toolkit today and continue to focus on what you do best – providing excellent customer service to your clients. Turn the hard market into your agency’s success story! Includes: Expert advice Client talking point FAQ solutions Email templates Renewals forms And more! TrustedChoice.IndependentAgent.com/Hard-Market

Paul Hawkins

Phillip Lackman serves as the Chief Executive Officer of the Independent Insurance Agents of Illinois (IIA of IL) and has served as lobbyist for the IIA of IL, the Illinois Association of Insurance and Financial Advisors (NAIFA IL), Illinois State Association of Health Underwriters (ISAHU) and the Illinois Association of Mutual Insurance Companies (IAMIC).

In his role as CEO, he works with the Board of Directors to develop goals and initiatives in response to the developing needs of membership and guides the IIA of IL staff in implementation of those initiatives.

In 2011, Lackman was named Speaker of the Illinois Third House, the professional organization for registered lobbyists in Illinois, and served a one-year term. He was inducted into the Samuel K. Gove Illinois Legislative Intern Hall of Fame in 2016, which honors former legislative interns whose careers have exemplified distinguished public service.

Prior to joining the IIA of IL, Lackman held the position of Director of Legislative Affairs for the Illinois Life Insurance Council and served as Secretary of State Jim Edgar’s Deputy Director of Legislative Affairs. He began his career in Springfield as a Legislative Analyst with the Senate Republicans.

Lackman graduated from Illinois State University in Normal, Illinois with a B.A. in Political Science/Speech Communication and completed the Illinois Legislative Staff Internship Program.

He serves as an Ambassador for the Hope School in Springfield and on the Board of the Panther Creek Homeowners Association.

Brian Lawrence is the Director of HR Solutions for Ohio Insurance Agents (OIA). He is responsible for providing HR support and resources for the membership which includes approx. 1000 independent insurance agencies across Ohio. He recently launched a new intern program for OIA and works with RMI programs to promote careers in the IA industry. His HR career spans 25 years across Insurance, Financial Services, Healthcare, and Association Management. The majority of experience included 20+ years at Nationwide including seven years as an HR Director/HR Business Partner providing strategic support to executive leadership teams including P&C, Commercial and Non-Standard Customer Service Operations, Life Insurance and Annuity Operations, & Nationwide Pet Insurance.

Brian has a passion for connecting small business to HR best practices and ideas that can help them attract and retain talent. His father was a life-long small business owner of a retail and shoe repair business, Lawrence’s Shoes, in Cincinnati. As a kid Brian and his siblings vacationed at tradeshows, stuffed envelopes for promotional mailings, audited inventory, and cleaned store windows.

Brian is a graduate of Ohio University. He has served the community as a foster parent for over ten years and a youth sports coach. Outside of work and family he enjoys traveling and hiking including having visited 15 national parks and 44 of the 50 United States.

32 | IIA of IL

SPEAKER

Brian Lawrence

Scan this code with your smart phone to view the schedule online.

Phil Lackman

Kevin Lesch, CBC, is the COO of Arachas Group, a Keystone Partner, located in Bartlett, IL. He began his career at his father’s agency focusing on Personal Lines before moving to Commercial Specialty, Commercial Lines, and then finally to Benefits.

In 2013, he took over as President of the agency and then bought out both partners in 2015.

As IIA of IL Government Relations Director, Evan Manning is responsible for all aspects of the association’s government relations program. IIA of IL also represents NAIFA-Illinois, Illinois State Association of Health Underwriters, and Illinois Association of Mutual Insurance Companies, collectively referred to as the Illinois Coalition of Insurance Brokers and Financial Advisors. The Coalition represents thousands of individuals and firms providing insurance and financial advice to Illinois consumers and businesses.

Manning has experience in the private sector and most recently was an Appropriations Budget Analyst on the Senate Republican Staff.

Murali Natarajan is currently the SVP & CIO of West Bend Mutual insurance. He joined WMBI in 2017 with 20 years of insurance industry experience and 24 years of technology experience. In Partnership with various leaders at WBMI, he is also responsible for creating and executing the technology vision and strategy for the various business units in the company. He is a business savvy leader with a keen ability to drive technology enabled business transformation.

David Ocasek is Chief Executive Officer of the Surplus Line Association of Illinois, a non-profit association created by public statute to act as a liaison between the Illinois Department of Insurance and surplus line producers and to provide marketplace data, education and compliance support.

Mr. Ocasek joined the Association in 1991 and became CEO in 1998. He is responsible for the development and implementation of the overall strategic goals of the Association with a focus on technology, education and regulatory affairs. During his tenure, he has guided the Association through major business model and regulatory changes, as well as a 1700% growth in premium and processing volume.

He teaches an accredited Illinois continuing education course on surplus line insurance and has been an editor and contributor to multiple editions of the American Bar Association’s Annotations to Surplus Lines Statutes book.

He has been active participant and fundraiser for Envision Unlimited, serving people with disabilities, and the Pediatric Brain Tumor Foundation. He also serves on the advisory board of the Katie School of Insurance and Risk Management at Illinois State University.

Allyson Padilla, AAI, was born into Blank’s Insurance Agency but began her insurance career full-time in 2008. The agency provides all types of insurance and bonds, including personal lines and commercial insurance. She works in all facets of the agency but is primarily focused on commercial lines, agency marketing, and advertising.

CONVO Program | 33 SPEAKER BIOS

Kevin Lesch

Evan Manning

Murali Natarajan

David Ocasek

Allyson Padilla

Richard S. Pitts is a 1983 graduate of Wabash College and a 1986 graduate of Indiana University School of Law – Indianapolis. Pitts clerked for the Honorable Patrick D. Sullivan, a judge of the Indiana Court of Appeals in 1986-87. Rick is admitted to practice before Indiana state and federal courts, the United States Supreme Court and the United States Court of Appeals for the Seventh Circuit and is a member of local, state, and national bar associations.

Pitts has served as a panelist and lecturer on a variety continuing education subjects, including the Americans with Disabilities Act, “Mold: Issues Under the Microscope” for the Indiana Continuing Legal Education Forum (ICLEF), and “Insurance Issues for Builders” for the Indiana Builders Association. Rick has also served as chair of ICLEF’s “Advanced Corporate Practice” seminar and as a faculty member for various construction law seminars for Lorman Education Services. Pitts has co-authored two articles appearing in the Indiana Law Review.

Pitts is a Vice-President and General Counsel to Arlington/Roe & Co., Inc., an insurance brokerage and managing general agent in Indianapolis. Rick also serves as general counsel to the Independent Insurance Agents of Indiana, Inc. As counsel to the “Big I,” Rick speaks annually at the association’s Agency Compliance Seminars and teaches various seminars on insurance and employment related matters.

34 | IIA of IL

SPEAKER

The security you need. The name you trust. OUR PRODUCTS Businessowner’s Commercial Auto Commercial Package Commercial Property Commercial Umbrella General Liability Homeowners Personal Umbrella Professional Liability/E&O Workers’ Compensation Pay-As-You-Go options with hundreds of payroll partners! Not all Berkshire Hathaway GUARD Insurance Companies provide the products described herein nor are they available in all states. Visit www.guard.com/states/ to see our current product suite and operating area. APPLY TO BE AN AGENT: WWW.GUARD.COM/APPLY/ Visit us at Booth #302

Rick Pitts

Lindsey Polzin is the Executive Vice President for Acrisure, LLC dba Presidio in Naperville. She started her insurance career in 2000 working for her family’s agency in the personal lines division. In 2005, she moved over to the commerial side of the agency. Her family’s agency merged with other local agencies to form Presidio, an Acrisure Agency Partner.

Luke Praxmarer has been in the insurance business nearly 43 years, all in an Independent Agency. He has always been a huge advocate of agent education. Getting licensed in 1980, he then earned his AINS designation in 1982, and the CPCU designation in 1992, and completed the AAI designation in 2001. That has also been coupled with countless classes and seminars at CONVO and other IIA of IL sponsored coursework. He hopes to study for the CIC designation at some point in the future.

Luke was a principal in a family-owned agency till January 2020, when he and his brother sold their agency to Assured Partners. They are both still 100% active in the AP of IL (Elk Grove Village) office. Luke continues to teach classes and mentor many employees in his office.

The IIA of IL has always been a huge part of Luke’s professional life. He has served on the Young Agents, Government Relations, Education, and the Executive Committee. He was president in 2009-2010. That same year the IIA of IL was awarded the prestigious Maurice Herndon Award, by the Big “I” for outstanding legislative achievements by a state association. Over the years, Luke has received numerous awards from IIA of IL including the C.M. Cartwright Merit Award in 2018.

Ray Roentz, President of Heneghan, White, Cutting & Roentz, specializes in all areas of commercial insurance, as well as home, auto, life insurance, farm, and health. He currently serves as a director for the IIA of IL Board of Directors and is a member of the Planning and Coordination and Technology Committees. Ray graduated from Jersey Community High School and Quincy University, and has called Jersey County home for over 40 years.

Greg Sandrock, CIC, AFIS, is partner at The Cornerstone Agency, Inc, an all lines agency, specializing in Ag Risk Management covering property, liability, and crop risks located in Tampico, Il.

Sandrock has been very involved in the Ag market, and specifically crop insurance, for over 30 years. Over that time, he has served on various Crop Company Agency Councils. He has served the Illinois association as a Regional Director, a member of several committees, is a Past President of the IIA of IL, and served as National Director for six years. At the national level, Sandrock was previously a member and then Chairman of the Big “I” Crop Insurance Committee, and was a member of the InsurPac Board of Trustees, the IIABA Steering Committee and the IIABA Government Affairs Committee.

In 2022, Greg Sandrock was elected to the IIABA leadership team. He will serve a threeyear term as an at-large member of the seven-member Executive Committee, being responsible for the supervision and management of the affairs of the national association.

CONVO Program | 35 SPEAKER BIOS

Luke Praxmarer

Ray Roentz

Greg Sandrock

Lindsey Polzin

SPEAKER

April Simpkins, SHRM-CP, PHR, CDP is a multi-certified HR Professional with 30 years of executive-level Human Resources experience. She is the Chief Human Resources Officer for Questco, a human resources services firm focused on supporting the HR needs of smallto midsized businesses. Prior to holding this role, April was a senior level HR consultant. In this role she helped over 1000 business owners shape and develop their human capital.

April’s experience and expertise, coupled with her continued study of Human Resources trends, have made her a trusted advisor for many in the business community. It also led to an invitation to The Business Journal Leadership Trust, allowing April to share her expertise with leaders nationwide. She has been a requested presenter and guest speaker for organizations that include Harvard University Extension School, Big Brothers Big Sisters of America, The Citadel, EEOC, and The National Urban League, to name a few.

April chaired the Diversity, Equity & Inclusion Committee for Greenville SHRM. In 2020 April received Greenville SHRM’s Unsung Hero Award for her exemplary leadership in Diversity, Equity, and Inclusion. Her service and commitment to the HR community and the profession’s advancement led to her selection as a member of the HR Advisory Board for Winthrop University in Rock Hill, SC. There, she works with a team of HR thought leaders charged with designing the human resources undergraduate and postgraduate degree curriculum and programs.

April has received many awards and honors for her business acumen. Her awards include The 2020 Women In Business Achievement Award from the Charlotte Business Journal, the 2018 Fort Mill/ Tega Cay Business Person of The Year Award from the York County Regional Chamber, and the Movers & Shaker Award given by Business Leader Magazine. In 2016, April was named one of Charlotte’s 50 Most Influential Women by Mecklenburg Times. In 2021 April received the prestigious WPO Presidents Award. And in 2022 April was named to the impressive list of 100 Women to KNOW In America.

April is an advocate for mental health. She became a more visible advocate following the passing of her beloved daughter, Miss USA 2019, Cheslie Kryst who battled depression for many years. April, an ambassador for the National Alliance on Mental Illness (NAMI) and board member for NAMI Piedmont Tri-County, is committed to breaking the stigma of mental illness and promoting mental wellness in the workplace. April is certified in both Mental Health First Aid and Emotional CPR (eCPR). She has shared Cheslie’s story emphasizing the importance of mental health with audiences nationwide and on national programs including Red Table Talk, CBS Mornings, and ExtraTV. She has also contributed to print media, including the New York Times.

36 | IIA of IL

April Simpkins

Daniel Smith is the Chief Marketing Officer and a co-founder of Market Retrievers, a digital marketing agency that specializes in assisting clients in the insurance industry. He has over 16 years of experience in marketing and design for insurance agencies, carriers, and trade organizations. He has designed and implemented award-winning campaigns for content, client engagement, publishing, and programs. He is also a licensed P&C agent.

Jeffrey S. Smith, JD, CIC, CAE serves as Chief Executive Officer for Ohio Insurance Agents Association (OIA) and IA Valuations. He is responsible for leading the organization’s strategic initiatives and day to day operations.

As CEO of IA Valuations, Smith has consulted and reviewed over 200 agency valuations for independent agents across the US. IA Valuations serves independent agencies as a trusted advisor and strategic business partner as they implement strategies to increase their agency value, grow their businesses and transition their agencies. Smith provides insights into the agency’s operations, risk factors and legal guidance on how to perpetuate and maximize value in a sale.

Smith graduated with honors from Kent State University and Capital University Law School with a concentration in government relations. He is a licensed P&C insurance agent, Certified Insurance Counselor Designee, Attorney and Certified Association Executive. Smith is an active member of the Ohio State Bar Association Insurance Committee, Ohio Society of Association Executives and Ohio Lobbying Association. He also served on the Village of Marble Cliff Council and as Chairman of the Board of Trustees for the Sequent Midwest Business Health Fund.

Abby Wheeler is the VP of Marketing Campaigns and a co-founder of Market Retrievers, a digital marketing agency that specializes in assisting clients in the insurance industry. She has over 5 years of experience in social media and content creation and has directed multiple campaigns with over 1 million impressions. She has helped brands and businesses increase followers and engagement by exponential amounts and has a knack for creating content & marketing programs that show short- and long-term value.

CONVO Program | 37 SPEAKER BIOS

Daniel Smith

Jeff Smith

Abby Wheeler

38 | IIA of IL 500 AAA The Auto Club Group ||| www.aaa.com 312 Agency VA || www.agencyva.com 815 Agents Alliance Services www.agentsalliance.insure 600 AJ Wayne ||| www.ajwayne.com 711 Allstate Health Solutions || www.allstate.com 301 AMERISAFE ||| www.amerisafe.com 816 AmTrust Insurance ||| www.amtrustfinancial.com 803 Amwins www.amwins.com 219 Applied Systems, Inc. www.appliedsystems.com 619/702 Applied Underwriters www.auw.com 413/508 Arlington/Roe ||||| www.arlingtonroe.com 303 Berkley Management Protection||| www.berkleymp.com 107 Berkley Small Business www.berkleysmallbusiness.com 302 Berkshire Hathaway GUARD Ins. Companies ||| www.guard.com 101 Bliss McKnight, Inc. || www.blissmcknight.com 510 BluSky Restoration Contractors ||| www.goblusky.com 203 BriteCo Jewelry & Watch Insurance ||| www.brite.co 310 Burns & Wilcox www.burnsandwilcox.com 300 Central Illinois Mutual Ins. Co ||| www.cimico.net 214 Chicagoland SIA & Valley Ins. Agents Alliance | www.chicagolandsia.com & http://viaa4u.com 709 Chubb ||| www.chubb.com 818 Client Circle || www.clientcircle.com 320 Columbia Insurance Group ||| www.colinsgrp.com 204 Conifer Insurance Company || www.coniferinsurance.com 811 Convelo Insurance Group www.conveloins.com 601 Cornerstone National Insurance ||| www.cornerstonenational.com 411 Cowbell ||| www.cowbell.insure 501 CRDN of Chicago || www.crdn.com 613 Don R. Jensen & Company || www.donrjensen.com 319 Donald Gaddis Co., Inc. ||| www.gaddiscompany.com 801 EBRM www.ebrm.com 520 EMC Insurance ||| www.emcins.com 713 Encova Insurance ||| www.encova.com 104 Enterprise Rent-A-Car || www.ehi.com 609 ePayPolicy || www.epaypolicy.com 106 Erie Insurance ||| www.erieinsurance.com 813 Farm Agents Council www.ilfarmagents.com 806 FCCI Insurance Group || www.fcci-group.com 610 First Insurance Funding www.firstinsurancefunding.com 205 Foremost Insurance Group||| www.foremost.com 602 Forreston Mutual Ins. Co. ||| www.fmic.org 712 Frontier-Mt Carroll Mutual Insurance || www.fmcmutual.com 804 Glatfelter Public Entities || www.glatfelterpublicentities.com 217 Great American Insurance Group www.gaig.com 313 Grinnell Mutual ||| www.grinnellmutual.com 206/207 HawkSoft || www.hawksoft.com 210 Honeycomb Insurance || www.honeycombinsurance.com 821 HoundDog www.hounddog.com 202 Hourly, Inc. || www.hourly.io 218 HSB || www.hsb.com 409 IA Valuations ||| www.iavaluations.com 201 ICW Group || www.icwgroup.com EXHIBITORLIST

A LPHABETICALL

CONVO Program | 39 IIA of IL Company Members - Icon Key ||||||| - Diamond Member |||||| - Platinum Member ||||| - Gold Member |||| - Silver Member ||| - Bronze Member || - Copper Member | - Agency Member - IIA of IL Sponsored Program

208 Illinois Casualty Company || www.ilcasco.com 802 Illinois Mutual || www.illinoismutual.com 717 Illinois Public Risk Fund ||| www.iprf.com 521 IMT Insurance |||| www.imtins.com 718 Indiana Farmers Insurance ||| www.indianafarmers.com 122 Insurance Program Managers Group ||| www.ipmg.com 809 InsureZone www.insurezone.com 701 Integrated Specialty Coverages, LLC || www.iscmga.com 410 IPFS - Imperial Premium Finance |||| www.ipfs.com 308 JM Wilson ||| www.jmwilson.com 401/420 Liberty Mutual/Safeco Insurance ||| www.libertymutual.com/www.safeco.com 715 Madison Mutual Ins Co. ||| www.madisonmutual.com 103 Main Street America ||| www.msainsurance.com 421 MAXIMUM ||| www.maxib.com 714 Mercury Insurance ||| www.mercuryinsurance.com 102 Method Insurance Services ||| www.methodinsurance.com 509 Midwest Insurance Company ||| www.midins.com 511/512 National General, an Allstate company || www.ngic.com & www.allstate.com 119 Nationwide Agribusiness ||| www.nationwide.com 807 NEXT Insurance www.nextinsurance.com 814 NHRMA Mutual Workers Compensation ||| www.nhrma.com 100 Novum Underwriting Partners || www.novumuw.com 611/612 Omaha National || www.omahanational.com 121 Openly || www.openly.com 502 Pekin Insurance ||||| www.pekininsurance.com 120 Pennsylvania Lumbermens Mutual Ins. www.plmins.com 620 Philadelphia Insurance Companies || www.phly.com 216 Pie Insurance || www.agencies.pieinsurance.com 307 Previsor Insurance ||| www.previsorinsurance.com 117 Prime Insurance Company || www.primeis.com 721/800 Progressive |||||| www.progressive.com 215 PuroClean ||| www.puroclean.com/pds-il 812 Rhodian Group ||| www.rhodiangroup.com 220 Risk Placement Services || www.rpsins.com 710 RLI Surety || www.rlicorp.com 304 Rockford Mutual ||| www.rockfordmutual.com 402 Roush Insurance Services, Inc. || www.roushins.com 118 SAYATA || www.sayata.com 306 SECURA Insurance |||| www.secura.net 700 ServiceMaster DSI ||| www.smdsi.com 321 ServPro - Cleaning, Restoration, Construction ||| www.servprolibertyville.com 720 Smart Choice || www.smartchoiceagents.com 408 Society Insurance ||| www.societyinsurance.com 209 Sola Insurance www.solainsurance.com 820 Southeast Personnel Leasing www.spli.com 305 Spriska ||| www.spriska.com 708 Steadily ||| www.steadily.com

Continued on next page.

EXHIBITOR LIST

LPHABETICALLy

40 | IIA of IL

A LPHABETICALLy 309 STONEMARK, Inc. “Premium Finance Group” || www.stonemarkinc.com 400 Surplus Line Association of Illinois |||||| www.slai.org 412 Swiss Re Corporate Solutions www.corporatesolutions.swissre.com 200 TAPCO Underwriters, Inc. || www.gotapco.com 621 The Donegal Insurance Group ||| www.donegalgroup.com 513/608 The Hanover Insurance Group ||||||| www.hanover.com 819 Total Program Management, An Amynta Co www.tpmrisk.com 213 Trava Security www.travasecurity.com 105 Travelers ||| www.travelers.com 221 UFG Insurance ||| www.ufginsurance.com 519 UIG/The Agency Agency ||| www.uigusa.com 808 Universal Property & Casualty ||| www.universalproperty.com IIA of IL Company Members - Icon Key ||||||| - Diamond Member |||||| - Platinum Member ||||| - Gold Member |||| - Silver Member ||| - Bronze Member || - Copper Member | - Agency Member - IIA of IL Sponsored Program 817 Utica National Insurance Group ||| www.uticanational.com 116 US Pro Insurance Services || www.usproins.com 311 V3 Insurance Agency www.v3ins.com 810 Venture Insurance Programs www.ventureprograms.com 719 W.A. Schickedanz/Interstate Risk Placement Inc ||| www.WAS-IRP.com 716 West Bend |||| www.thesilverlining.com 419 Western National Insurance ||| www.wnins.com 805 Westfield ||| www.westfieldinsurance.com 822 WorkExchange, Inc. www.workexchange.com

EXHIBITOR LIST

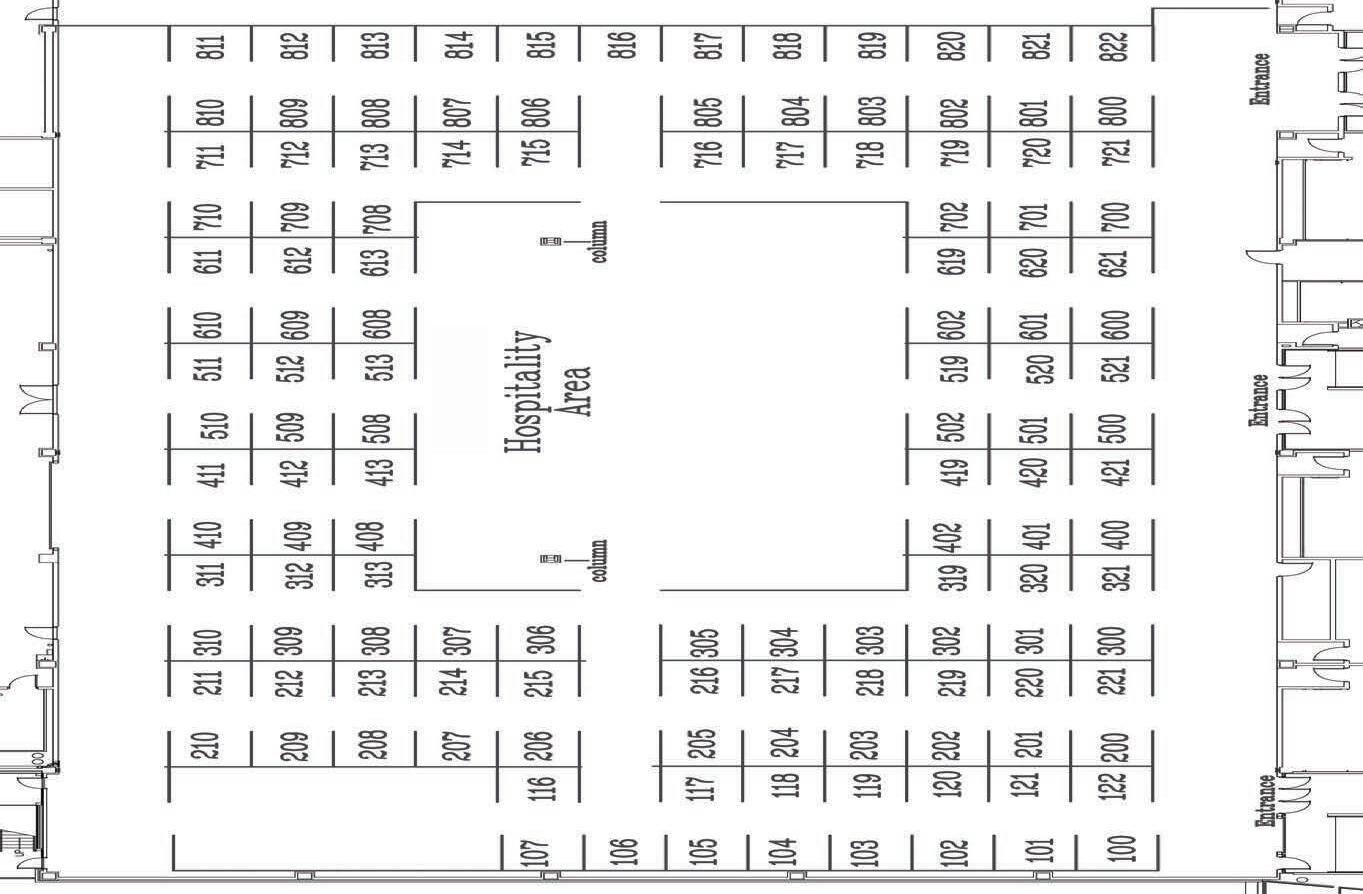

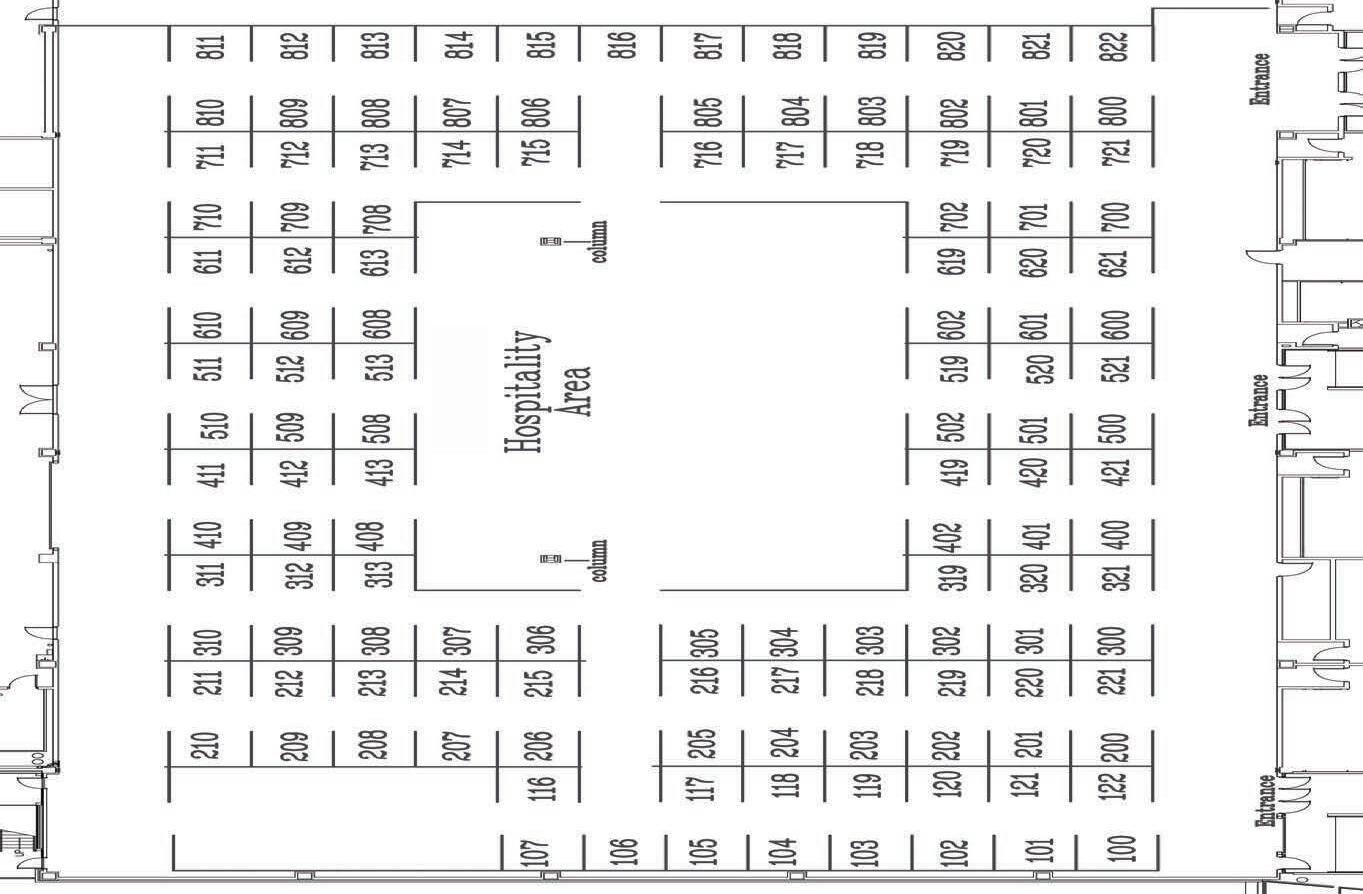

EXHIBIT HALL FLOOR PLAN

*See note on page 7

CONVO Program | 41

This is the area exhibitors will be drawing and announcing booth prize winners at 5:45 pm.

IIAP AC Independen t Insurance Agents Political Ac tion ommittee Dunk Tank

$5,000

The Hanover Insurance Group, Inc.

Alliant Insurance Services, Inc

$4,500

IIA of IL Region 1

$2,001 - 2,500

Michael Mackey

Luke Praxmarer

$1,001 - 2,000

Assured Partners of Illinois, LLC

DuPage IIA

Christopher Leming

Farm Agents Council

The Plexus Groupe, LLC

Troxell

Tyler Sandrock

Unland Insurance & Benefits

Michael Wojcik

$500 - 1,000

Christopher Gaddis

Cindy Jackman

Phil Lackman

Benjamen Leezer

James T. Shanahan Agency, Inc.

Kevin Lesch

Jay Peterson

Tom Walsh

$250 - 499

Acrisure, LLC dba Presidio

Alera Group

Amiri Curry

Arachas Group, LLC

Banterra Insurance Services

Blank’s Insurance Agency

Bob Korvas Agency, Inc.

Buttrey-Wulff-Mamminga Agency, Inc.

Charles Hruska IV

Chartwell Insurance Services, Inc.

Compass Insurance

Crossroads Insurance Services

Crum-Halsted Agency, Inc.

Cunningham Group

Dykstra Insurance Agency, Inc.

Envision Insurance

Erland Insurance Agency

Evan Manning

Fergurson Insurance Agency, Inc.

First Mid Insurance Group

First State Insurance

Foppe Insurance Agency, Inc.

Freiburg Insurance Agency

Thank you to our IIAPAC Contributors & Supporters

Frisbie & Lohmeyer, Inc.

Frost Group Inc.

Hartauer Insurance Agency

Heneghan, White, Cutting, & Roentz Insurance Agency

I I P Insurance Agency, Inc.

Insurance Planning & Management, Inc.

Insurance Providers Group of Illinois, LLC

Ken Samson

Kiesewetter Insurance Agency, LLC

Lagestee Ins. Agency, Ltd.

Langlois Insurance Agency

Leffelman & Associates, Inc.

LLC Insurance Agency, Inc.

Loman-Ray Insurance Group LLC

Macias Insurance Agency

McCutcheon Insurance Agency, Ltd.

McMillan Insurance Services, Inc.

Minton Insurance & Associates, LLC

Musso Insurance Agency

Ogden Insurance Agency, Inc.

Oliver & Associates, LLC

Patton Insurance Group LLC dba Howell Insurance Agencyy

Paul T. Price & Son, Inc.

Peterson Insurance Services, Inc.

Ramey Insurance Agency, Inc.

Ramsey Financial Services Inc.

Roanoke Insurance Group

Rosenthal Brothers, Inc.

S.T. Neswold & Associates, Inc.

Saliba-Yewell Insurance Services, Inc.

Schwaller Insurance Agency, Inc.

Secure Futures, Ltd.

Sedlak LLC dba Schmale Insurance Agency

Siegert-Lees Insurance Services, LLC

Squier Insurance Agency, Inc.

Stockyards Insurance Agency, Inc.

The Daniel & Henry Co.

The David Agency Insurance, Inc.

The Horton Group, Inc.

TW Group Inc.

Valley Insurance Group

West Central Insurance Agency, Inc.

West’s Insurance Agency, Inc.

William Rademacher Agency, Inc dba Par Insurance Agency

Willow Insurance Services, Inc.

Winters, LLP

Wirth Agency

Yaekel & Associates Ins. Service, Inc.

$1 - 249

A F I Insurance Agency, Inc

Abis Insurance Services Inc

Affiliated Insurance Agencies

Affiliated Insurance Agencies

AgData Insurance Services, Inc.

Anthem Insurance Group, Inc.

Assurance Brokers, Ltd.

Assurity Insurance Agency Inc.

42 | IIA of IL IIAPAC CONTRIBUTORS

IIAPAC Independent Insurance Agents Political Action Committee

Your Independent Insurance Agents Political Action Committee (IIAPAC) who support the legislative agenda of independent agents. IIAPAC and Democratic candidates for state office.

Bair Insurance Agency

Beck Insurance Agency

Beil & Stromberg Insurance

Biglow & Company, Inc. (Assured Partners)

Bob White Insurance Agency, LLC

Bussian Insurance Agency

Clark Carroll Insurance Agency, Inc.

Clennon Insurance Agency

Concklin Insurance Agency, Inc.

Consociate Group/Dansig, Inc.

Danielle Duerr & Associates Inc.

Dozier Insurance Agency, Inc.

First Insurance Group, LLC dba FNIC

First National Insurance Services, Inc

Forest Insurance

Freiburg Insurance Agency

Galena Financial Group, Inc.

Gardner-Whitworth Ins. Group

George Ryan, Jr. Insurance Group, Inc.

Graves Financial Services, Inc.

Group Marketing Services, Inc.

Gully & Hechler Insurance Agency

Guy Viti Insurance Agency

Guy Viti Insurance Agency, Inc.

Harnist Insurance Agency, Inc.

Henderson-Weir Agency Inc.

Hepner Insurance Agency, Inc.

Hill & Stone Insurance Agency, Inc.

Hi-Way Insurance Agency, Inc.

Imming Insurance Agency

Inner-City Underwriting Agency, Inc.

Insurance Support Systems, Inc.

InsureChampaign

Jackson & Gray Co., Inc.

Jennifer Jacobs

Jim Lyons Insurance Agency

Joe Black Agency, Inc.

Johnson Agency

Kane Insurance Group, Inc.

Karin Jones

Kensington Insurance

Kevin S. Dougherty Insurance Agency, LTD

Konen Insurance Agency, Inc.

Lane Insurance Group, Ltd.

Lawrence K. Hunt

Leonardi Insurance Agency

Leonardi Insurance Agency

Leonardi Insurance Agency

Libertyville Insurance Agency

Lincoln Insurance Agency

MAS Insurance Consultants, Inc

McKellar, Robertson, McCarty & Click Insurance Agency

Merit Insurance Group

Meyer Agency

Midstate Insurance Agency Inc.

Midwestern Insurance Associates Agency

Mihlbachler Insurance Agency, Inc.

Mudd Insurance Group, Inc.

Myers Insurance Group, Inc.

Northern Illinois Insurance Clinic, Inc dba Marvin Uecker Insurance Agency

Northwest Ins. Services, ISU Northwest Ins. Services, Arlington Financial

Nowacki Insurance Agency

Olds Insurance Agency

Olsick & Company Insurance

Partners Hometown Insurance Agency LLC

Partners Insurance Agency, Inc.

Peak Insurance Agency, Inc.

Pelz Agency

Porter-Hay Insurance Agency

Premier Ag Partners, LLC

Prime Insurance Agency, Ltd.

R.W. Gipson Agency, Inc.

Railside Citrus Insurance Agency, Inc.

Resource Insurance Advisors, Inc.

Rhonda Powell

Richard E. Bechtold Agency, Inc.

Rick’s Insurance Agency, Inc.

Robert Turner Agency, Inc.

Robertson Ryan & Associates

Sager Insurance Group, LLC

SC Crop Insurance Inc

Schulz - Brundage Inc.

Smart Risk Insurance Group LLC

Stateline Insurance Services, Inc.

Stirling Insurance Partners, LLC

Stoutenborough Insurance Agency

Straughn Insurance Agency

The Insurance House, Inc.

The Liddle Agency, Inc.

The Owens Group, Inc.

The Whitworth-Horn-Goetten Ins. Agency

The Williamson Agency

Thompson Insurance

Tony Marvin Enterprises, LLC dba Dedicated Insurance Services

Ulrich Insurance Agency

VanDenBerghe Agency

Waterman-Neely Ins. Professionals

Waterman-Neely Ins. Professionals

Wehling Insurance Agency

Weller Agency Inc.

William Wiewel Insurance

CONVO Program | 43 CONTRIBUTORS

(IIAPAC) supports candidates for and members of the Illinois General Assembly is a bi-partisan committee, making significant contributions to both Republican