Workers Compensation Insurance • No volume requirements • Competitive rates • Multiple options for premium payments • Open to Shock Loss/High Mods Send in your submissions today. For more information contact a marketing rep at 844-761-8400 or email us at Sales@Omahanational.com. [ Coverage in: AZ • CA • CT • GA • IL • NC • NE • NJ • NY • PA • SC Smart. Different. Better. Omaha National Underwriters, LLC is an MGA licensed to do business in the state of California. License No. 078229. “A” (Excellent) rated coverage through Omaha National Insurance Company, Preferred Professional Insurance Company, and/or Palomar Specialty Insurance Company. You’l l l ike us because t here’s nobody l ike us.

INSIGHTAPRIL 2023 GOVERNMENT RELATIONS Navigating Employment Law Interview with Representative Keicher Final Details Inside! THE IMPORTANCE OF THE ASSOCIATION’S ROLE IN STATE AND FEDERAL GOVERNMENT RELATIONS

Insurance coverage is really just a promise. A promise to be there when things go bad. A promise of “we’ll take care of your customers.” Find out more about the Silver Lining and how we value our agent relationships. Visit thesilverlining.com. Promise. The worst brings out our best.®

CONTENTS IIAPAC: Your Association is Fighting for You Legislator Interview: Representative Jeff Keicher How Does InsurPac Work? Navigating Illinois Employment Law Changes By Jennifer Jacobs Five Issues on the Agenda at the 2023 Big “I” Legislative Conference By Teddie Norton Reilly 2023 EDGE Conference - Final Details Insurance Industry Legislative Day - Wrap-Up 10 11 12 14 16 18 24 The Independent Insurance Agents of Illinois (IIA of IL) has been providing members with a sustainable competitive advantage since 1899. Insight is the official publication of the Independent Insurance Agents of Illinois (IIA of IL). The magazine is published monthly for the members of the IIA of IL, with the office located at 4360 Wabash Avenue, Springfield, Illinois 62711-7009; Consumer Website: www.ChooseIndependent.com. The IIA of IL welcomes letters discussing concerns of the insurance industry, articles, editorials, other matters of interest to the membership. The editor reserves the right to edit and select submissions for publication. Address submissions for review to Rachel Romines at rromines@iiaofil.org. For advertising information, contact Tami Hubbell at thubbell@iiaofil.org. In This Issue President’s Message Brett’s 5 Sense e-Insight Associate News 7 8 13 20 info@iiaofil.org | www.iiaofil.org | (800) 628-6436 or (217) 793-6660 | Fax: (217) 793-6744 Editor & Graphic Design - Rachel Romines | Advertising - Tami Hubbell Association Update IIA of IL News Classifieds 22 23 26 April 2023 2009 • 2010 • 2011 • 2012 • 2013 • 2014 2015 • 2016 • 2017 • 2019 • 2020 • 2021 • 2022 16 11 18 conference April 13-14 Bloomington/Normal 24

Board of Directors

Executive Committee

Chairman of the Board | Jay Peterson, AFIS, LUTCF (217) 935-6605 | jay@peterson.insurance

President | Kevin Lesch (630) 830-3232 | klesch@arachasgroup.com

President-Elect | Allyson Padilla (618) 393-2195 | allyson@blanksinsurance.com

Vice President | Patrick Taphorn, CIC, CSRM (309) 347-2177 | ptaphorn@unland.com

Secretary/Treasurer | Cindy Jackman, CIC, CISR (800) 878-9891 x8745 | cjackman@arlingtonroe.com

IIABA National Director | George Daly (708) 845-3311 | george.daly@thehortongroup.com

Regional Directors

Region 1 | James Sager (618) 322-9891 | james@sagerins.com

Region 2 | Ray Roentz (618) 639-2244 | ray.roentz@hwcrins.com

Region 3 | Christopher Leming (217) 321-3185 | cleming@troxellins.com

Region 4 | Bart Hartauer, CIC (815) 223-1795 | hartauer@hartauer.com

Region 5 | Noele Tatlock (309) 642-6855 | ntatlock@unland.com

Region 6 | Thomas Evans, Jr. (779) 220-6564 | tevans@crumhalsted.com

Region 7 | David Jenk, Esq. (312) 239-2717 | djenk@nwibrokers.com

Region 8 | Charles Hruska (708) 798-5700 | chas@hruskains.com

Region 9 | Lindsey Polzin (630) 513-6600 | lpolzin@presidiogrp.com

Region 10 | Mohammed Ali CS (847) 847-2126 | mali@aliminsurance.com

At-Large Director | Amiri Curry (847) 797-5700 | acurry@assuranceagency.com

At-Large Director | Jeff McMillan (815) 265-4037 | jeff@mcmillanins.com

At-Large Director | Patrick Muldowney (312) 595-7192 | patrick.muldowney@alliant.com

At-Large Director | Luke Sandrock, CIC (815) 772-2793 | lsandrock@2cornerstone.com

Committee Chairs

Budget & Finance | Cindy Jackman, CIC, CISR (800) 878-9891 x8745 | cjackman@arlingtonroe.com

Education | Lisa Lukens (618) 942-2556 | salibainsurance@gmail.com

Farm Agents Council | Steve Foster (217) 965-4663 | s.foster@ciagonline.com

Government Relations | Dustin Peterson (217) 935-6605 | dustin@peterson.insurance

Planning & Coordination | Nick Gunn, CIC (309) 691-1300 | nickgunn@nixonagency.com

Technology | Brian Ogden (217) 632-2206 | brian@ogdeninsurance.com

Young Agents | Renee Crissie (224) 217-6577 | renee@crissieins.com

Director of Information and Technology Shannon Churchill - (217) 321-3004 - schurchill@iiaofil.org

Director of Education and Agency Resources Brett Gerger, CIC - (217) 321-3006 - bgerger@iiaofil.org

Accounting & Admin Services Tami Hubbell, CIC - (217) 321-3016 - thubbell@iiaofil.org

Director of Human Resources, Board Admin Jennifer Jacobs, SHRM-CP - (217) 321-3013 - jjacobs@iiaofil.org

Sr. Vice President/Chief Financial Officer Mark Kuchar - (217) 321-3015 - mkuchar@iiaofil.org

Chief Executive Officer Phil Lackman, IOM - (217) 321-3005 - plackman@iiaofil.org

Central/Southern Marketing Representative Lori Mahorney, CISR Elite - (217) 415-7550 - lmahorney@iiaofil.org

Director of Government Relations Evan Manning - (217) 321-3002 - emanning@iiaofil.org

Office Administrator Kristi Osmond, CISR - (217) 321-3007 - kosmond@iiaofil.org

Director of Communications Rachel Romines - (217) 321-3024 - rromines@iiaofil.org

Director of Membership Services Tom Ross, CRIS, CPIA - (217) 321-3003 - tross@iiaofil.org

Products & Services Administrator Janet White, CISR - (217) 321-3010 - jwhite.indep12@insuremail.net

Director of Prof. Liability & Ins. Products Carol Wilson, CPIA - (217) 321-3011 - cwilson.indep12@insuremail.net

IIA of Illinois Staff 28 8 6 5 20 Cover Tip 27 2 APPLIED UNDERWRITERS BERKSHIRE HATHAWAY GUARD INS. GROUP EBRM GRINNELL MUTUAL IIA OF IL SOLUTION CENTER OMAHA NATIONAL UNDERWRITERS SECURA INSURANCE WEST BEND MUTUAL INSURANCE CO ADVERTISERS Find us on Social Media

“Trust in Tomorrow.” and the “Grinnell Mutual” are registered trademarks of Grinnell Mutual Reinsurance Company. © Grinnell Mutual Reinsurance Company, 2023. grinnellmutual.com PERSONAL | BUSINESS | REINSURANCE TRUST US TO MAKE THEM A BIG DEAL Your customers have big dreams for their small businesses. Our Businessowners policies combine the property, liability, and business-interruption coverages they need to help them grow. Trust in Tomorrow.® Contact us today.

Independent, Authorized General Agent for An Independent Licensee of the Blue Shield Association

“How Do You Attact Talent?”

I have been asked the question many times, “How do you attract talent?” or “Why do people come work for you?” and I am never really sure how to answer those questions; for a couple of reasons. One, I don’t want to give away our secrets, and two, I am not sure I really know the answers.

Over the last couple of years, our agency has tried to break down the hiring and recruiting processes to decipher what has worked, why, and how we can replicate successful hires.

Get out your highlighters. I will now give you a few of my insights from the small amount of data we have accumulated.

I think it is time to stop using the term “Attracting Talent.” We looked at ourselves and who we are fundamentally as an insurance agency. When my father started his insurance career, he didn’t just put his phone number in the phone book (for some of you, that is a big book of yellow pages that lists all the businesses in the area) and expected the phone to ring. He went out into the community, spoke to business owners, and found clients, attracted clients.

I believe that needs to be the mindset when it comes to finding new employees – find talent, attract talent. Go out into the community and proclaim how great an industry we have and why someone with incredible talents should be working in the insurance business.

Based on where our agency has had success, my next insight is to look at certain industries that may fit well with the culture of your agency or niche that you currently have or are looking to get into. Talk to people you know, circles of influence, or look at who you are connected with on LinkedIn. Call them up, email them, take them out for coffee, and see if they are ready for a change.

Our agency has had great success with a certain coffee chain with a fantastic training program that teaches their people to talk and interact with their customers, think quickly, and act under pressure. These employees perform great in our office. Every time I am going to get coffee, I may also be recruiting. Can I write off all my coffee as a recruiting expense? (Do I even know what a write-off is?)

Just some thoughts.

We have some golf outings coming up that I would truly enjoy seeing everyone at, please come out and golf or, at the very least, join us at the reception to support our regions as well as IIAPAC.

The book of the month is a recommendation by Ned Cooke of Joseph M Wiedemann & Sons, Inc. It is a cookbook, BBQ USA, 425 Fiery Recipes from All Across America, by Steven Raichlen.

april 2023 insight 7 president's message | INSIGHT

Kevin Lesch - IIA of IL President - (630) 830-3232 - klesch@arachasgroup.com

President Lesch with the team at Árachas Group.

Formed in 1974, InsurPac, the Big I’s federal political action committee (PAC) is one of the largest small business PACs in the country and the most recognized PAC in the insurance industry.

How Does InsurPac Work?

Agents, brokers and carrier partners protect their business by contributing to InsurPac.

$$ is distributed to U.S. Congressmen, Senators and candidates seeking federal office who are supportive of the IA system and small business in general.

PROTECT. PROMOTE. PERPETUATE

Those relationships help open doors to advocate for or against legislation that directly impacts the IA system.

Recent Victories

InsurPac allows our federal lobbyists to constantly attend fundraising events on Capitol Hill. At each of these events they develop relationships with members of Congress and their staff.

The Big “I” successfully defended important tax policies from attempts by the current Administration and Congress to overturn them. These tax policies include maintaining the current tax rates for S-corps and Ccorps, keeping the 20% small business tax deduction intact, and preventing an increase in the capital gains tax.

The Big “I” was one of the only small business groups to successfully secure an exemption, legislatively and regulatorily, for its members from reporting beneficial ownership to the Treasury Department’s Financial Crimes Enforcement Network (FinCEN).

The Big “I” has successfully advocated for the extension of the National Flood Insurance Program (NFIP) on numerous occasions over the last several years.

Strength In Numbers

InsurPac speaks as a collective voice for thousands of donors whose contributions directly to federal campaigns might go unnoticed.

How Can I Contribute?

1. Donate online at insurpac.com/donate

2. Make a check payable to InsurPac and mail to 20 F. St. NW, Washington, D.C., 20001

Over 3,445 independent agents and brokers contributed a total of $1,269,794.59 in 2022.

During the most recent election InsurPac disbursed $1,911,500 to a total of 228 federal campaigns, winning 210 of them to chart an 92% victory rate.

april 2023 insight 13 online journal at www.iiaofil.org/Resources/Insight INSIGHTeINSIGHTAPRIL 2023 GOVERNMENT RELATIONS Navigating Employment Law Interview with Representative Keicher Final Details Inside! THE IMPORTANCE OF THE ASSOCIATION’S ROLE IN STATE AND FEDERAL GOVERNMENT RELATIONS

April 13-14

Holiday Inn ■ Bloomington/Normal, IL

Day and a half Program focused on Professional Development, Personal Growth, Leadership Skills, and Relationships

Designed to meet the needs of everyone in our industry young agents, veteran agents, CSR’s

9 hours continuing education

conference

Powered by:

Like regular Bingo, but better! Music • Food • Drinks • Fun Thursday

social event.

evening

Education Sessions

The Independent Agency Playbook for Navigating a Hard Market

Presented by David Carothers

This session will explore the ins and outs of a hard market and why it occurs. Attendees will discuss strategies for managing the hard market and how to embrace technology to help streamline processes and workflows. Using examples and case studies, David Carothers will provide real-life scenarios for navigating the hard market and will also provide additional resources and information to help attendees come out of the hard market even more successful than they were prior to these market conditions.

Hard Market Panel Presentation

Panelists: Cindy Jackman, Chris Knox, Brian Ogden, Brent Timmerman

If the current market conditions have your head spinning, this session is for you! Following his morning session, David Carothers will moderate a panel of experienced insurance professionals to hear their tips, tricks, and advice. Having had to navigate tough market conditions in the past, attendees will hear more about the panelists’ past experiences, what worked for them, and what didn’t.

Sell and Create Desire to Close QUICKLY!

Presented by John DeJulio

This exciting training will change the way you approach your business. International speaker and CEO, John DeJulio will teach you EXACTLY what to do, specifically in the insurance industry, to automate a constant flow of clients. In addition, John will teach the exact strategies and tools only the best in the world know when it comes to speaking and influencing so that these leads not only want to do business with you but convert quickly!

Show Down to Speed Up

Presented by Chris Cline

In today’s world there is no shortage of options, risks, and even distraction. While it is important to be nimble and innovative, it has never been more important to also act with intent. In this interactive session, we’ll then explore the concept of slowing down to speed up as thought exercise in aligning strategies to business decisions.

Insurance Marketing in a Hard Market

Presented by Andrew Bartlett

The way insurance agencies market and advertise their business has changed drastically over the years. In this session, attendees will learn how their insurance knowledge can be used to create content to help build their brand through marketing and communications and broaden their sales tactics and avenues through which they sell insurance.

“Once I attended my first Edge Conference, I wanted to keep coming back every year because of all the people I got to meet and network with, while also learning from the speakers that spoke at the conference.”

-

Cody Imming, long-time EDGE attendee

april 2023 insight 19 www.ILYoungAgents.com

JM Wilson Announces New Hires and Promotions

JM Wilson has announced several new hires and promotions.

Paige Craft has joined JM Wilson as Assistant Surety Underwriter. Paige is respon-sible for assisting surety underwriters on a wide variety of risks, including processing bond renewals and following up on new and renewal quotes for independent insurance agents in all states that JM Wilson serves. Previously, Paige was a Senior Administrative Assistant at a claims processing company, as well as a Front Desk Supervisor for a hotel management group.

Lesley Boles, CIC, has been added as Personal Lines Underwriter. Lesley is responsible for underwriting a wide variety of new and renewal personal lines risks, as well as strengthening relationships with independent insurance agents and company underwriters in all states that JM Wilson writes in. Lesley has prior experience in an insurance agency where she was a Personal Lines Manager and Claims Service Manager.

The managing general agency and surplus lines broker has hired Jennifer Mikos-Benavides as Assistant Transportation Underwriter. She is responsible for assisting underwriters with a wide variety of new and renewal commercial transportation accounts, as well as maintaining relationships with carriers and independent insurance agents in Illinois, Iowa, and Wisconsin. Prior to joining JM Wilson, Jennifer worked in banking and commercial loans for over 20 years.

Tim Frawley has been promoted to Executive Property & Casualty Underwriter and is responsible for underwriting a wide variety of new and renewal property and casualty risks, as well as building relationships with independent insurance agents and company underwriters in Illinois and Iowa. With an increased level of product knowledge, Tim is a leader and resource to other un-derwriters in his department. Tim joined JM Wilson in 2016 as an Assistant Property & Casualty Underwriter before being promoted to Underwriter in 2017, and Senior Underwriter in 2019.

Adam Mandwee, TRS has been promoted to Fleet Transportation Manager. Adam is responsible for managing the day-to-day operations of the Fleet team and developing rela-tionships that foster growth with carriers and new and existing independent insurance agents in all states that JM Wilson writes. Adam joined JM Wilson in 2016 as an assistant transportation underwriter. Promotions in the transportation practice soon followed to the positions of underwriter, senior underwriter, and assistant fleet manager, before this latest promotion to Fleet Transportation Manager. Adam attended Western Michigan University and earned a bachelor’s degree in Business Management with a minor in General Business. In addition, Adam also earned his TRS (Transportation Risk Specialist) designation from the MCIEF (Motor Carrier Insurance Education Foundation.)

20 insight april 2023 INSIGHT | associate news

Thank you to our Associate Members.

Diamond Level

Platinum Level

Progressive Surplus Line Association of Illinois

Gold Level

Arlington/Roe

Blue Cross/Blue Shield of IL

Keystone Insurance Group, Inc.

Pekin Insurance

Silver Level

Imperial PFS

IMT Insurance

SECURA Insurance

West Bend Mutual Insurance Co.

Bronze Level

AAA Insurance

A. J. Wayne & Associates

AMERISAFE

AmTrust North America

Auto-Owners Insurance Co.

Badger Mutual Insurance Company

Berkley Management Protection

Berkshire Hathaway Guard Insurance Companies

BluSky Restoration Contractors

Central Illinois Mutual Insurance Company

Chubb

Columbia Insurance Group

Continental Western Group

Cornerstone National Insurance Company

Cowbell Cyber

Donald Gaddis Company, Inc.

Donegal Insurance Group

EMC Insurance

Encova Insurance

Erie Insurance Group

Foremost Choice Property & Casualty

Forreston Mutual Insurance Company

Frankenmuth Insurance

Grinnell Mutual Reinsurance Company

IA Valuations

Illinois Mine Subsidence Ins. Fund

Illinois Public Risk Fund

Indiana Farmers Insurance

Insurance Program Managers Group

J M Wilson

Liberty Mutual/Safeco Insurance

Madison Mutual Insurance Company

Main Street America Insurance

Maximum Independent Brokerage, LLC

Mercury Insurance Group

Method Workers Comp

Midwest Insurance Company

Nationwide

NHRMA Mutual Workers’ Compensation

Previsor Insurance & Missouri Employers Mutual

PuroClean Disaster Services

Rockford Mutual Insurance Company

ServiceMaster DSI

SERVPRO of Gurnee

Society Insurance

SPRISKA - Specialty Risk of America

Travelers

UFG Insurance

UIG - The Agent Agency

Utica National Insurance Group

W. A. Schickedanz Agency, Inc./Interstate Risk Placement

Western National Insurance

Westfield

april 2023 insight 21

associate news | INSIGHT

Association Update

Quarterly Board Meeting

The IIA of IL Board of Directors held its second quarterly board meeting virtually on March 23rd. Phil Capps of Kerber, Eck & Braeckel presented the consolidated financials and reported a clean audit opinion to the board of directors. Committee Chairs reported on the work that has been taking place at the committee level to prepare for the EDGE Conference, to develop positions on current legislation and to evaluate and programs and resources for the membership. The Planning & Coordination Committee presented a proposal to restructure the board positions to allow more flexibility in regard to the regional positions and to elect board members who represent the varied interests of the membership. Board members were invited to share feedback which will be considered by the committee before the proposal is presented to the board for approval in at the May 23 board meeting in Elgin.

Several staff members enjoyed a virtual visit with associate member:

March Wrap-Up

6 days

9 Cities

175 members

1,330.1 miles on the van

Association staff hit the road in March on a mission to visit as many members as we could in nine different locations. With a goal of bringing association programming to areas where we didn’t have programming scheduled in 2023, we made stops in Effingham, Marion, Edwardsville, Vernon Hills, Downtown Chicago, Joliet, Westmont, Quincy and Rock Falls. If you’re feeling left out Bloomington and Peoria – we held the Protégé Sales Bootcamp and have the EDGE Conference and Farm Agents Summer Meeting coming to Bloomington this year and Peoria has hosted the Farm Agents Winter Meeting and will be the site of our 2023 CONVO!

The IIA of IL team shared:

• strategies for successful hiring

• low cost digital marketing tips for your agency

• making the most of market access programs

• resources to use when evaluating your agency tech

• a legislative update and more!

If you weren’t able to make it to a roadshow, check out our website at https://iiaofil.org/Agency-Challenges-Solved or reach out to our staff https://my.iiaofil.org/About-Us/Staff-Directory and we will help you find the association resource to fit your agency needs.

22 insight april 2023

May

Virtual Class

The Insurance Company Operations Course describes how insurance companies function and why that is important to all insurance and risk management professionals. Learn about the important strategic decisions made by executives and the philosophy and responsibilities in product development, underwriting, distribution, claims, and other vital company departments.

Discuss how strategies, regulations and compliance affect both clients and company employees. Understand the different types of tactical strategies and the importance of effective procedures. Learn ways to establish goals and manage compliance. Insurance company organization and structure decision strategies covered in this course are: organizational format and function, culture decisions and planning, regulatory and compliance considerations, sales and marketing strategies, and reinsurance considerations. www.iiaofil.org/education

For information regarding IIA of IL membership or company sponsorship, contact Tom Ross, Director of Membership Services, at (217) 321-3003, tross@iiaofil.org.

april 2023 insight 23 iia of il news | INSIGHT

Quadstate Insurance Agency, LLC Anna, IL New Members member agency October 10-12 East Peoria, IL ILConvention.com Mark Your Calendar Education over 30 classes a month Aon Affinity Fort Washington, PA Integrated Specialty Coverages, LLC Carlsbad, CA copper associate member

10-11

Virtual!

Pre-Licensing, CIC, CISR, E&O, Ethics, Flood, Webinars

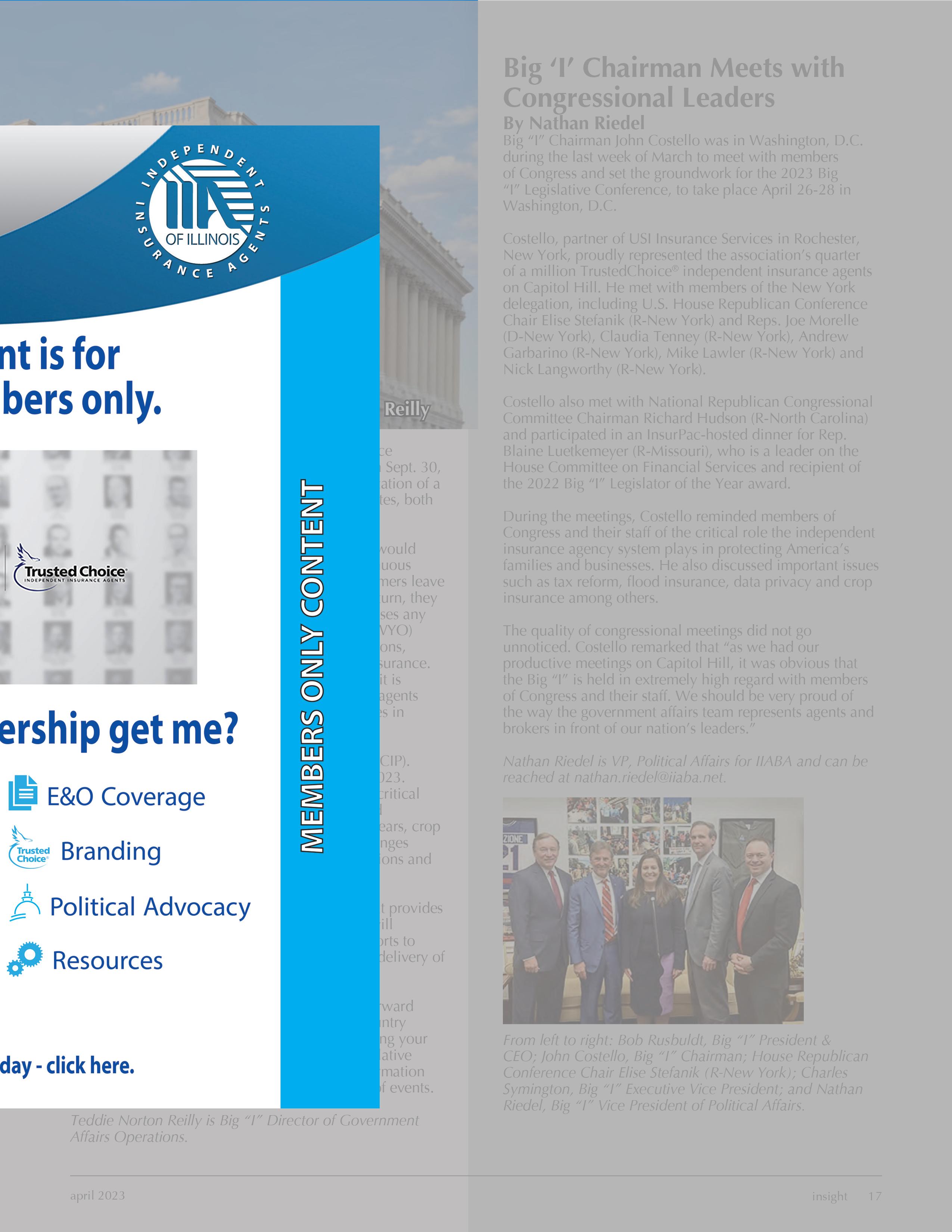

On Tuesday, March 28, 125 insurance agents and carrier representatives attended Insurance Industry Legislative Day in Springfield. The education session featured a panel discussion on legislative issues with the potential to impact the industry:

• Rate Regulation for Auto and Health Insurance

• Flood Insurance Education for all Property Producers

• Public Adjuster Reform

• Financial Literacy

• State Based Exchange

• Health Insurance Mandates

• Public Construction Bonds

• Market Conduct

• Data Security

Panel Participants:

• Kate Morthland, IL Life & Health Insurance Council (ILHIC)

• Laura Minzer, IL Life & Health Insurance Council (ILHIC)

• Kevin Martin, Illinois Insurance Association (IIA)

• Phil Lackman, IIA of IL

• Evan Manning, IIA of IL

Featured speakers included:

• Joanna Coll, General Counsel for the Illinois Department of Insurance

• Representative Bob Morgan (D-Highwood), Vice-Chair of the House Insurance Committee

• Senator Napoleon Harris (D-Dolton), Chairman of the Senate Insurance Committee

• Representative Jeff Keicher (R-Sycamore), House Republican Conference Chair and NAIFA IL member

Wrap-Up

Thank you to the event sponsors:

Platinum Sponsors

American Property Casualty Insurance Association (APCIA)

Blue Cross/Blue Shield of IL

Chubb

CNA Insurance

Forreston Mutual Insurance Company

Group Marketing Services

State Farm Insurance

Gold Sponsor

National Association of Mutual Insurance Companies (NAMIC)

Silver Sponsor

Grinnell Mutual

24 insight april 2023

Phil Lackman, left, presented Senator Harris, right, with the Legislator of the Year Award

Evan Manning

Joanna Coll

april 2023 insight 25

Representative Jeff Keicher

Representative Bob Morgan

Senator Jason Plummer, left with Dustin Peterson, IIA of IL Government Relations Committee Chair

Allyson Padilla, IIA of IL President-Elect, with Representative Adam Niemerg

Phil Lackman, left, with Representative Jeff Keicher

From left to right, Kristie McGee, Dan Kiesewtter, both of Kiesewetter Insurance in Farmington, IL, Noele Tatlock, IIA of IL Region 5 Director, Lisa Lukens, IIA of IL Education Committee Chair

From left to right, Cindy Jackman, IIA of IL Secretary/Treasurer, Senator Terri Bryant, and Tom Ripperda, Educational Concepts Unlimited

for the insurance professional by the insurance professional

AGENCY WANTED

20. Since 2004, Central Illinois Agents Group LLC has been providing independent agents with a variety of markets with contingency opportunities. Agents have availability to several markets that they may not be able to sustain or maintain on their own. We have markets for personal, commercial, agricultural and crop insurance lines. Let us help you get to the next level.

Visit www.ciagonline.com for contact information.

OPPORTUNITIES/SPACE AVAILABLE/RETAIN OWNERSHIP

13. We are a 100 year old Northbrook agency looking to discuss any mutually beneficial opportunity. Our producers, mergers, clusters and agency purchases receive 50% commissions on new and renewal business without any expenses. We can provide: office space, phones, agency management system, service renewals and changes. The companies we represent are: Badger Mutual, Employers Mutual, General Casualty, Guide One, Hartford, Kemper, Progressive, Rockford Mutual, Safeco, State Auto, Travelers and Met Life. Contact:

Nancy Solomon

Martini, Miller & Schloss, Inc.

(847) 291-1313

Ron@martini-miller.com

INDEPENDENT INSURANCE AGENCIES WANTED

17. We are an Independent family-owned agency located in the Chicago area. We are looking to expand through growth and acquisition. If you have a small to medium sized agency and are looking to sell, call or send us a message. We are strictly looking for Personal Lines and Small Commercial accounts with preferred companies.

GALO Insurance Agency, Inc

(847) 832-0888

steve@galoagency.com

AGENCY/AGENTS/PRODUCERS WANTED

02. Forest Park/Oak Park agency for over 60 years, will meet your needs by providing space, markets, marketing & sales support, automation, merging with or purchasing your agency. Perpetuation/ Succession Plans, BuySell Agreements also available. We have experienced, educated and dedicated staff for you and your clients. Have access to our numerous companies, office services and many other resources. Retain ownership in your book with contingency. Please look closely at us- we are an agency you want to do business with! We’ve done it before, we know how- we make it easy! Visit our website at forestagency.com/agents.html, or call for a confidential discussion and a list of Agency benefits.

Dan Browne will provide an agency evaluation/appraisal at little cost to you. Please call:

Dan Browne or Cathy Hall

Forest Insurance

(708) 383-9000

www.forestinsured.com/mergers-acquisitions

We Make Hiring Easier +

CareerPlug’s hiring software helps agents attract more qualified candidates, identify the right candidates with confidence, and improve hiring results.

CareerPlug will provide IIA of IL members access to a free account that can be used to post jobs, manage applicants, and improve the organizations’ employment brand. Association members can also access a “Pro” version of CareerPlug for a special rate to take hiring to the next level.

Learn more about CareerPlug and check out the brand new IIA of IL job board at www.iiaofil.org

26 insight april 2023

INSIGHT | classifieds

Comprehensive insurance programs for your fire suppression and alarm installation accounts. SECURA Insurance and Bedford Underwriters work together to provide tailored coverage solutions for these unique industry risks. Insurance you can defend with Interested in learning more? Contact Bedford Underwriters at 800-735-1378 ext. 112 or quotes@BedfordUnderwriters.com

Workers’ Compensation • Transportation – Liability & Physical Damage • Construction Liability • Fine Art & Collections Homeowners – Including California Wildfire & Gulf Region Hurricane • Structured Insurance • Financial Lines • Surety Aviation & Space • Environmental & Pollution Liability • Real Estate • Reinsurance • Warranty & Contractual Liability Infrastructure • Entertainment & Sports ...And More To Come. MORE TO LOVE FROM APPLIED.® MORE IMAGINATION. ©2023 Applied Underwriters, Inc. Rated A- (Excellent) by AM Best. Insurance plans protected U.S. Patent No. 7,908,157. It Pays To Get A Quote From Applied.® Learn more at auw.com/MoreToLove or call sales (877) 234-4450

MEMBERSHIP MEANS MARKET ACCESS

FREE MARKET ACCESS FOR YOUR AGENCY WHEN YOU NEED IT

Let’s face it – Independent agents need good markets to be competitive. Greater access means more opportunities for success. WE’RE HERE TO HELP. Independent Market Solutions creates company relationships for agents who may be unable to secure appointments on their own. Through association membership, agents can access multiple insurance carriers and grow their business into long-term, direct appointments.

WWW.IIAOFIL.ORG/IMS

Workers’ Compensation • Transportation – Liability & Physical Damage • Fine Art & Collections • Structured Insurance Construction – Including New York and Project-Based Primary & Excess Liability • Financial Lines • Aviation & Space Homeowners – Including California Wildfire & Gulf Region Hurricane • Environmental & Pollution Liability • Public Entity Shared & Layered Property • Warranty & Contractual Liability • Reinsurance • Infrastructure • Surety • Entertainment & Sports ...And More To Come. MORE TO LOVE FROM APPLIED.® MORE IMAGINATION. ©2023 Applied Underwriters, Inc. Rated A- (Excellent) by AM Best. Insurance plans protected U.S. Patent No. 7,908,157. It Pays To Get A Quote From Applied.® Learn more at auw.com/MoreToLove or call sales (877) 234-4450