throughout the sales process. We offer superior products that employers love, like payroll-plus-comp, and we make onboarding smooth and easy. When you or your clients call us, a real live person answers the phone. Simply put, you get the attention you deserve. Omaha National Underwriters, LLC is an MGA licensed to do business in the state of California. License No. 078229. “A” (Excellent) rated coverage through Omaha National Insurance Company, Preferred Professional Insurance Company, and/or Palomar Specialty Insurance Company. 844-761-8400 • omahanational.com

INSIGHTAUGUST 2023 Adopting & Thriving in Today’s Challenging P&C Landscape What’s New in Agency Marketing How to Map the Insurance Customer Journey Plus October 10-12 • Peoria, IL REFOCUS • CONNECT • EMPOWER

Comprehensive insurance programs for your fire suppression and alarm installation accounts. SECURA Insurance and Bedford Underwriters work together to provide tailored coverage solutions for these unique industry risks. Insurance you can defend with Interested in learning more? Contact Bedford Underwriters at 800-735-1378 ext. 112 or quotes@BedfordUnderwriters.com

CONTENTS INSIGHT Magazine: 14-Time APEX Winner The Power of Using an Agency Valuation as Business Planning Tool By Luke Hippler Adopting & Thriving in Today’s Challenging Landscape By Dustin Lemick & Conor Redmond What’s New in Insurance Agency Marketing By Daniel Smith CONVO 2023 - Refocus, Connect, Empower Focus on Customers to Drive Growth & Retention By Agent for the Future How to Map the Insurance Customer Journey By Agentero How the Insurance Industry Can Use Technology to Survive a Hardening Market By AgentSync 8 12 14 17 20 25 26 28 The Independent Insurance Agents of Illinois (IIA of IL) has been providing members with a sustainable competitive advantage since 1899. Insight is the official publication of the Independent Insurance Agents of Illinois (IIA of IL). The magazine is published monthly for the members of the IIA of IL, with the office located at 4360 Wabash Avenue, Springfield, Illinois 62711-7009; Consumer Website: www.ChooseIndependent.com. The IIA of IL welcomes letters discussing concerns of the insurance industry, articles, editorials, other matters of interest to the membership. The editor reserves the right to edit and select submissions for publication. Address submissions for review to Rachel Romines at rromines@iiaofil.org. For advertising information, contact Tami Hubbell at thubbell@iiaofil.org. In This Issue President’s Message Brett’s 5 Sense Trusted Choice e-Insight 9 10 18 19 info@iiaofil.org | www.iiaofil.org | (217) 793-6660 Editor & Graphic Design - Rachel Romines | Advertising - Tami Hubbell Associate News Association Update IIA of IL News Classifieds 30 35 37 38 August 2023 2009 • 2010 • 2011 • 2012 • 2013 • 2014 • 2015 2016 • 2017 • 2019 • 2020 • 2021 • 2022 • 2023 12 8 28 26

Board of Directors

Executive Committee

Chairman of the Board | Jay Peterson, AFIS, LUTCF (217) 935-6605 | jay@peterson.insurance

President | Kevin Lesch (630) 830-3232 | klesch@arachasgroup.com

President-Elect | Allyson Padilla (618) 393-2195 | allyson@blanksinsurance.com

Vice President | Patrick Taphorn, CIC, CSRM (309) 347-2177 | ptaphorn@unland.com

Secretary/Treasurer | Cindy Jackman, CIC, CISR (800) 878-9891 x8745 | cjackman@arlingtonroe.com

IIABA National Director | George Daly (708) 845-3311 | george.daly@thehortongroup.com

Regional Directors

Region 1 | James Sager (618) 322-9891 | james@sagerins.com

Region 2 | Ray Roentz (618) 639-2244 | ray.roentz@hwcrins.com

Region 3 | Christopher Leming (217) 321-3185 | cleming@troxellins.com

Region 4 | Bart Hartauer, CIC (815) 223-1795 | hartauer@hartauer.com

Region 5 | Noele Tatlock (309) 642-6855 | ntatlock@unland.com

Region 6 | Thomas Evans, Jr. (779) 220-6564 | tom.evans@assuredpartners.com

Region 7 | David Jenk, Esq. (312) 239-2717 | djenk@nwibrokers.com

Region 8 | Charles Hruska (708) 798-5700 | chas@hruskains.com

Region 9 | Lindsey Polzin (630) 513-6600 | lpolzin@presidiogrp.com

Region 10 | Mohammed Ali CS (847) 847-2126 | mali@aliminsurance.com

At-Large Director | Amiri Curry (847) 797-5700 | acurry@assuranceagency.com

At-Large Director | Jeff McMillan (815) 265-4037 | jeff@mcmillanins.com

At-Large Director | Patrick Muldowney (312) 595-7192 | patrick.muldowney@alliant.com

At-Large Director | Luke Sandrock, CIC (815) 772-2793 | lsandrock@2cornerstone.com

Committee Chairs

Budget & Finance | Cindy Jackman, CIC, CISR (800) 878-9891 x8745 | cjackman@arlingtonroe.com

Education | Lisa Lukens (618) 942-2556 | salibainsurance@gmail.com

Farm Agents Council | Steve Foster (217) 965-4663 | s.foster@ciagonline.com

Government Relations | Dustin Peterson (217) 935-6605 | dustin@peterson.insurance

Planning & Coordination | Nick Gunn, CIC (309) 691-1300 | nickgunn@nixonagency.com

Technology | Brian Ogden (217) 632-2206 | brian@ogdeninsurance.com

Young Agents | Renee Crissie (224) 217-6577 | renee@crissieins.com

APPLIED

BERKSHIRE HATHAWAY GUARD INS. GROUP

BIG I EMPLOYEE BENEFITS

BRITECO JEWERLY INSURANCE

EBRM

EBRM

FORRESTON MUTUAL INSURANCE COMPANY

GRINNELL MUTUAL

IA VALUATIONS

THE INSTITUTES

OMAHA NATIONAL UNDERWRITERS

SECURA INSURANCE SOCIETY

WEST

Director of Information and Technology Shannon Churchill - (217) 321-3004 - schurchill@iiaofil.org

Director of Education and Agency Resources Brett Gerger, CIC - (217) 321-3006 - bgerger@iiaofil.org

Accounting & Admin Services Tami Hubbell, CIC - (217) 321-3016 - thubbell@iiaofil.org

Director of Human Resources, Board Admin Jennifer Jacobs, SHRM-CP - (217) 321-3013 - jjacobs@iiaofil.org

Sr. Vice President/Chief Financial Officer Mark Kuchar - (217) 321-3015 - mkuchar@iiaofil.org

Chief Executive Officer Phil Lackman, IOM - (217) 321-3005 - plackman@iiaofil.org

Central/Southern Marketing Representative Lori Mahorney, CISR Elite - (217) 415-7550 - lmahorney@iiaofil.org

Director of Government Relations Evan Manning - (217) 321-3002 - emanning@iiaofil.org

Office Administrator Kristi Osmond, CISR - (217) 321-3007 - kosmond@iiaofil.org

Director of Communications Rachel Romines - (217) 321-3024 - rromines@iiaofil.org

Director of Membership Services Tom Ross, CRIS, CPIA - (217) 321-3003 - tross@iiaofil.org

Products & Services Administrator Janet White, CISR - (217) 321-3010 - jwhite.indep12@insuremail.net

Director of Prof. Liability & Ins. Products Carol Wilson, CPIA - (217) 321-3011 - cwilson.indep12@insuremail.net

IIA of Illinois Staff 40 31 24 16 7 36 39 34 13 11 Cover Tip 4 27 32

UNDERWRITERS

INSURANCE

BEND MUTUAL INSURANCE

Find us on Social Media

CO ADVERTISERS

Independent, Authorized General Agent for An Independent Licensee of the Blue Shield Association

14-Time Winner AWARD OF EXCELLENCE Magazines, Journals & Tabloids 1-2 Person Produced Rachel Romines Director of Communications Independent Insurance Agents of Illinois INSIGHT

Be Part of the Solution

I am stunned that I have only a month to go as President of your association. The year seems to have flown by. I was once told that as you get older, each year becomes a smaller fraction of your total life; thus, as you get older, the year just feels shorter. I wish I remembered who that was. If you are out there, let me know.

This month I want to take the opportunity to talk about your membership and ask you for your support and to be involved. Another wise person (again, who I cannot remember) said if you are not part of the solution, there is only one other option (part of the problem for those of you playing at home).

So become part of the solution. There are many ways to get involved and support the IIA and the advocacy efforts made on behalf of our membership.

Attend CONVO - I hear from multiple carriers that our state’s convention is tops in the country. Every year the IIA staff brings forth a relevant and worthwhile agenda that should not be missed. See page 20 of this issue for details on this year’s event.

Support Advocacy Efforts – Our industry is facing legislation from lawmakers at the state level and federally that can change how we do business and adversely affect the customers we have vowed to protect. There are different ways to support these efforts:

CONTRIBUTE

Support for our PACs is a crucial part in helping the IIA of IL reach our legislators and help them understand why they should support our views and our industry.

• Individually, you can contribute to InsurPAC – the national insurance Political Action Committee.

• Individually or through your corporation (agency), contributions can be made to IIAPAC, the Independent Insurance Agents Political Action Committee.

TIME

• Attend the Illinois legislative conference in March –participate in advocacy efforts made in Springfield by seeing our local representatives face-to-face and sharing stories and information about our industry.

• Attend the Federal legislative conference in April –participate in advocacy efforts made in Washington DC by going to Capitol Hill and speaking directly to our senators and representatives.

Finally, I ask that we begin to participate again.

• Attend local IIA functions. Interact with other agents and attend functions that help you understand what is happening in our industry and contribute to a common voice.

• Participate in local IIA boards – become part of the solution!

• Send your staff to IIA functions – their livelihood is just as much affected as the agency owners and principals.

I am not asking that you do everything. Take one piece. If you can’t attend the legislative day, send $50 to the PAC. If you can’t attend the CONVO, send an account manager. Remember, be part of the solution.

Book of the month, “The 4 Disciplines of Execution” by Chris McChesney. Would definitely be a good read for all of us.

august 2023 insight 9 president's message | INSIGHT

Kevin Lesch - IIA of IL President - (630) 830-3232 - klesch@arachasgroup.com

Lesch, center, pictured with (l-r), Jon Jackman, Cindy Jackman, Phil Lackman, and Jay Peterson - 2023 Federal Legislative Conference

By Daniel Smith

By Daniel Smith

Every year we see new innovations in industry technology, and the marketing aspect is no different. There seem to be new platforms, programs, consultants, and thought leaders around every corner telling you what you should be doing. Let’s review.

CRMs, Automation, and Referral Platforms Galore

Maybe your agency already has a marketing platform in place – maybe even several – or maybe you’re deciding on one now. But the constant complaint I still hear from agents is utilization. If you’re not getting use out of these platforms, then you’re not getting ROI. You must utilize them and measure performance if you’re going to see what’s really working. Here are a few questions to ask as you assess them:

1. What is the goal? Reviews, leads, customer experience, referrals, or something else?

2. How much time are they taking? Are they saving your team time, or are they taking time away from other tasks?

3. Are you seeing your goal(s) realized? I’d recommend giving any platform or program a solid six months of use, then take a step back and review the results.

If you and/or your team hasn’t been able to commit to six months of consistent use, I’d encourage you to seek outside help from either the providers themselves or a consultant. Otherwise, you may be throwing money away without ever knowing what might have been.

AI Content

I can’t keep track of the number of meetings and conversations I’ve been in with agents this year where someone has mentioned ChatGPT or some context of Artificial Intelligence (AI). Almost everyone is talking about it. The funny thing is, almost no one has used it. Pew Research shows that barely 14% of Americans have tried ChatGPT, and only 10% have used it in a “work” context. We don’t have the data for all the other similar AI programs, but I would venture to guess that they have even lower adoption.

How does this impact marketing? The initial discussions I heard were that “marketers” would be replaced by AI. Insurance agency blog posts, social media content, design, and advertising could all be handled by these newly advanced processes. However, this isn’t SkyNet. This AI can’t operate on its own, and agency marketing must still be orchestrated by humans.

While there likely is a place for AI-generated content, you’re not “missing the boat” if you’re not using it yet. However, we should all keep an eye on the harbor, because that boat’s schedule could change quickly.

Google Analytics 4

On July 1, Google began to sunset its Universal Analytics (UA) platform in favor of Google Analytics 4 (GA4). While data from UA will still be available for some period of time, the collection of new data from your website that relates to Google traffic will need to be handled in GA4. Unfortunately, the conversion is not an “automatic” process. Whomever handles your analytics (e.g., website provider, digital marketing firm, internal data person, etc.) will need to complete the conversion if they haven’t already.

Why bother? If you want to track the impact of your website, digital marketing, social media, etc. on your agency’s traffic – this is a “necessary evil” for Google. They receive 93% of search traffic, with Microsoft’s Bing at less than 3%. Another 93% stat to note – that’s also the number of Americans that use the internet. To boil it down, pretty much every one of your clients and prospects is using the internet, and almost as many are using Google to search. So, it’s very important to track this type of data.

Insurance is definitely still a referral and relationship business. But what constitutes referrals and relationships now includes digital tools like Google Reviews (the modern “referral”) and social media (the modern “relationship”). While the new marketing tools in the industry aren’t likely to replace what you’re doing now, incorporating and utilizing them to your advantage is just a smart investment for your agency’s future.

By Daniel Smith, CAE, Chief Marketing Officer and cofounder of Market Retrievers, a digital marketing firm focused on building and implementing strategies for independent insurance agencies. He can be reached at dsmith@marketretrivers.com.

See Daniel Smith in Peoria, IL on October 11!

See page 20 for event details or go to ILConvention.com.

august 2023 insight 17

Relationships and Referrals in a Digital World

Building

Your Agency

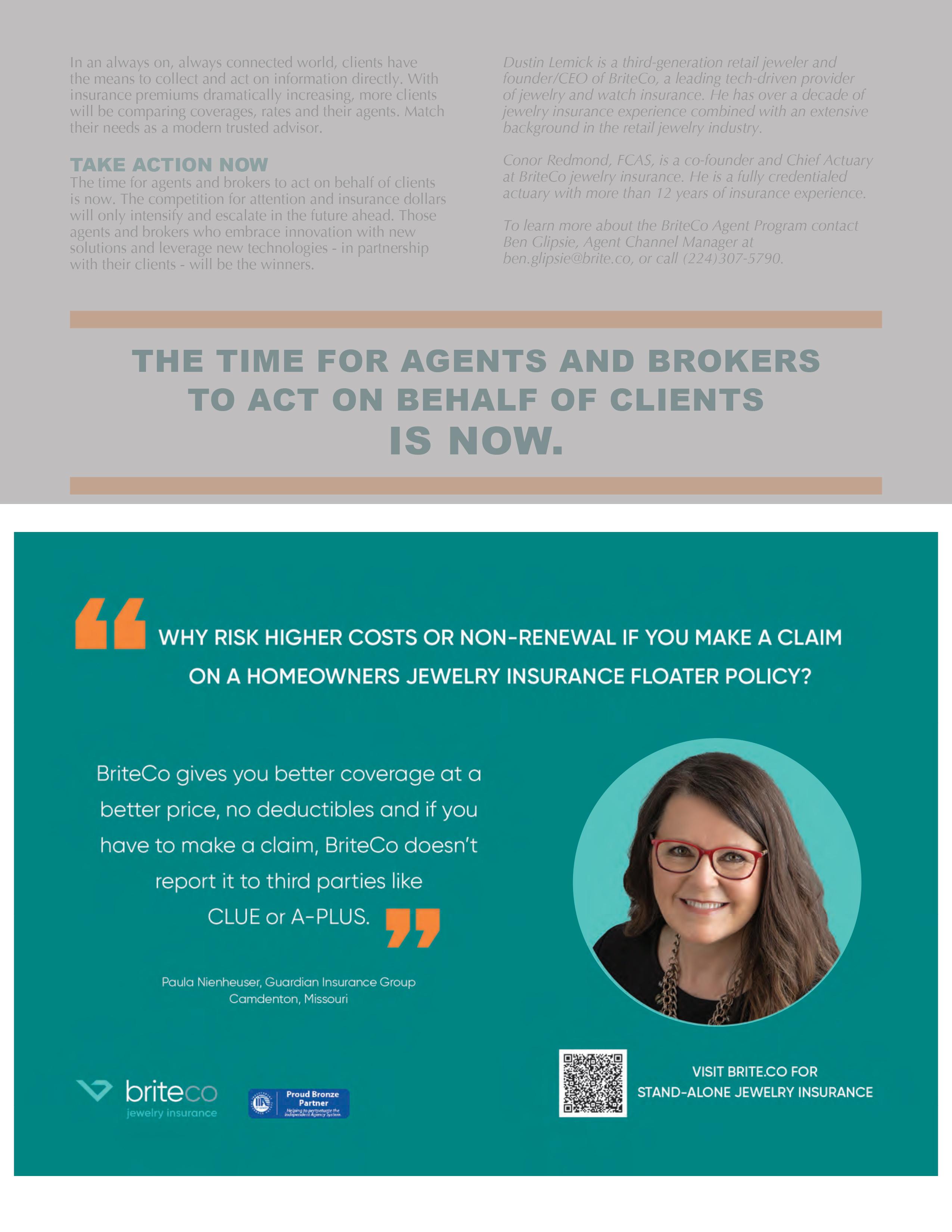

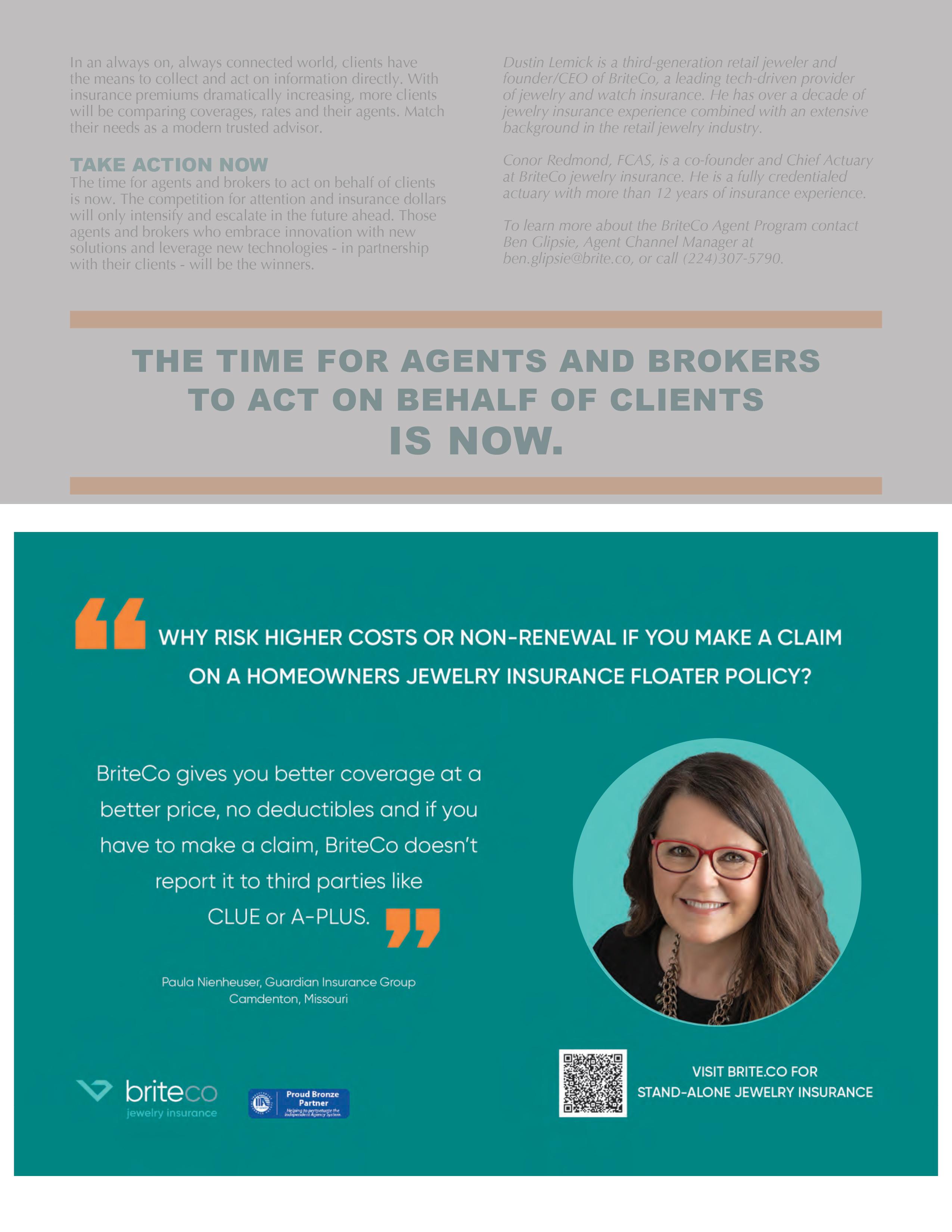

Hard Market? Equip your team with the expertise they need to support clients during this demanding time. Download this free toolkit today and continue to focus on what you do best – providing excellent customer service to your clients. Turn the hard market into your agency’s success story! Includes: Expert advice Client talking point FAQ solutions Email templates Renewals forms And more! TrustedChoice.IndependentAgent.com/Hard-Market

Is

Prepared For the

By Jenna Kleiber, Jenesis

august 2023 insight 19 online journal at www.iiaofil.org/Resources/Insight INSIGHTeINSIGHTAUGUST 2023 phone. Simply put, you get the attention Omaha National Underwriters, LLC is an MGA licensed to do business in the state of California. License No. 078229. “A” (Excellent) rated coverage through Omaha National Insurance Company, Preferred Professional Insurance Company, and/or Palomar Specialty Insurance Company. 844-761-8400 • omahanational.com Adopting & Thriving in Today’s Challenging P&C Landscape What’s New in Agency Marketing How to Map the Insurance Customer Journey Plus October 10-12 • Peoria, IL REFOCUS • CONNECT • EMPOWER In this month’s e-Insight. How To Map Out Your Insurance Agency’s Customer Journey

October 10-12

Marriott Pere Marquette & Peoria Civic Center, Peoria, IL

Earn up to 12 hours of Illinois Continuing Education credit with industry-driven educational programming. You’ll hear about the latest topics and news that matter most to you from leading experts and your peers. But don’t take our word for it. Here is what past attendees are saying:

I initially began attending conferences to expand my knowledge of industry trends, make agency owner connections, and to understand available resources. I continue to attend because the presenters and material is new and different from years prior. The connections I’ve made with other agents have been invaluable.

- Lisa Allen

Given the current volatility of the insurance marketplace today, there is no better time to bolster support from our association as well as seek guidance from the carriers. Convention has always given me the opportunity to network with our colleagues, visit face to face with carriers we currently represent, as well as look for those who may offer a need the agency may have. The CE options have always provided the agency with our needs on different subjects.

- Dave Marker

Education Sessions

Empower

CONVO 2023 offers a variety of education sessions! The schedule allows flexibility so you can customize your time to fit your needs. Empower your team, empower yourself!

CONCURRENT EDUCATION SESSIONS

Concurrent education sessions provide a little something for everyone in the agency. This year’s topics include:

• E&O/Ethics

• Insurance Game of Games

• Brett’s 2 Sense Nonsense

• Business Interruption

• Sales

• Avoiding Legal Conerns Due to Emerging Trends

• Building Relationships and referrals in a Digital World

• Managing a Remote Workforce

• How to Communicate Your Value in a Hard Market

• Business Planning to Improve Your Agency Valuation

• Best Practices in Agency Compensation

• And so much more!

iia of il

20

2023

insight august

Schedule (Subject to Change)

Tuesday, October 10

10:00 – 4:00 p.m.

1:00 – 4:00 p.m.

5:00 – 6:00 p.m.

6:00 – 8:00 p.m.

Refocus

Independent Agent Invitational Golf Outing (See next page.)

Concurrent Education Sessions (CE)

Welcome Reception and Meet & Greet

Kick off CONVO at the Welcome Reception. Enjoy a drink and hors d’ oeuvres before heading out to dinner.

Dutch Dine Arounds/Company Dinners

Head out for dinner with your Company Partners, old friends, or new acquaintances. Don’t have dinner plans? Sign up for the Dutch Dine Arounds with the IIA of IL staff. The IIA of IL has made reservations and travel arrangements. **Hence the name “Dutch,” each attendee is responsible for paying for their own dinner.

6:00 – 8:00 p.m.

8:00 – 11:00 p.m.

Past President’s Dinner (Invite Only)

Game Night

Sit back, relax, and let the good times roll. When you come back from dinner join us for an exciting evening of fun & games.

Wednesday, October 11

7:00 a.m. Continental Breakfast/CONVO Registration Desk Opens

8:00 a.m. – Noon

Keynote General Session (CE) - “Four Ways to Define and Enhance Your Agency Culture”

April Simpkins, SHRM-CP, PHR, CDP, an HR Professional with 30 years of executive-level Human Resources experience will present this energetic and informatin-packed session. View details on the next page. We will also recognize our award recipients including Agent of the Year, Agency of the Year, Young Agent of the Year and more.

11:30 a.m. – 12:45 p.m. Lunch and Networking

1:00 – 4:00 p.m. Concurrent Education Sessions (CE)

3:30 – 6:30 p.m. Tradeshow

6:30 – 11:00 p.m. Big Party with Dinner, Dancing, and Drinks

Music, food, drinks, and dancing - this social event is always a good time!

Thursday, October 12

7:00 – 8:30 a.m. Hot Breakfast

8:30 – 11:30 a.m. State of the Association Address

Refocus, Connect, and Empower Your Agency for the Future (CE)

Learn about trends and challenges facing the independent agency system during the State of the Association Address. Association leaders will provide news on legislative and regulatory issues impacting your business and your clients, connect you with tools and resources to navigate the changing market and challenge you to refocus on what matters most to keep your agency ahead of the curve. Chris Cline, Executive Director of Agents Council for Technology, will then challenge attendees to speed up when planning your business strategy for the future. View details on the next page.

continued... august 2023 insight 21

Golf Outing

Tuesday, October 10 - Weaver Ridge Golf Club, Peoria, IL

Join us for a round of golf complete with food and beverages, friendly competition, and a great opportunity to network with agents in advance of CONVO.

Shotgun Start: 10:00 am

$175 Per Golfer

Golf is a separate fee from CONVO registration.

This outing fills up quickly, so secure your spot early!

Connect

Networking and Social Events

CONVO 2023 offers several opportunities to grow your circle of knowledgable professionals, make new friends and contacts, and find out what your old friends and peers have been up to.

WELCOME RECEPTION - Tuesday

DUTCH DINE AROUNDS - Tuesday

GAME NIGHT - Tuesday

LUNCH & NETWORKING - Wednesday

BIG PARTY - Wednesday

Non-scheduled events offer just as much opportunity to chat: elevator rides, at the buffet tables, at the bar, in the lobby - the chances are endless!

Tradeshow

The Midwest’s largest industry tradeshow will be held on Wednesday, October 11 from 3:30 - 6:30 pm.

This is your chance to see what’s new in the industry and meet with your carrier partners. You’ll be able to let the conversations flow during the three-hour tradeshow event. Explore new market opportunities featuring more than 120 top carriers, MGAs, and a variety of other vendors.

22 insight august 2023 iia of il October

10-12, 2023 • Peoria, IL

Refocus

General Sessions

Four Ways to Define and Enhance Your Agency Culture

By April Simpkins

By April Simpkins

According to a recent survey, 46% of job seekers said culture was one of the deciding factors in the application process. In recent years, workplace cultures have undergone a dynamic shift. For many organizations, culture has been redefined by remote work, the talent shortage, increased mental health awareness, and a multi-generational workforce. We have five generations in the workplace, four of which dominate this space. Understanding each generation’s perspective on the changes in culture and leadership can create an engaged team that attracts top talent.

One key element of a healthy culture is ensuring everyone on your team brings their authentic selves to work, feels included in decisions that impact them, and is provided tools and support so they can do their best work. This energetic and information-packed presentation will explain the correlation between leadership, workplace culture, and attracting top talent.

Refocus, Connect, and Empower Your Agency for the

By Chris Cline

In a world with no shortage of options, risks, and distractions when it comes to technology, it’s important to be nimble but also act with intent. Chris Cline will begin this session by challenging you to slow down to speed up when planning your business strategy for the future. Cline will moderate a panel of experts with various technology backgrounds who will explore industry and tech space trends including artificial intelligence, data, best practices, virtual assistants, and what’s coming next. Finally, we will look at where we go next. You and your agency are leaving a legacy whether you are managing it or not. We’ll close with a powerful discussion on the significance of legacy and taking control of your most personal and valuable asset as Chris Cline shares insights from his new book, The Inertia of Legacy.

Company Opportunities

Exhibit

Your company should be a part of the Midwest’s largest industry tradeshow. Exhibit booths are on sale now. Secure your space right away as this event will sell out quickly!

Sponsor

Studies say it takes seven to 11 times for somebody to see your message and actually remember it. One of the best reasons to sponsor a portion of CONVO is the number of people (over 800!) that will have eyes on your brand. This is an opportunity for your business to solidify your presence in the industry. Plus, sponsoring is yet another way your company can build trust with current and potential agencies.

And to top it off, you’ll be helping keep the costs down for agents to attend the event. Your contracted agencies will continue to attend to increase their knowledge, which in return, could affect your bottom line.

Advertise

Every person that attends CONVO will receive an event program. This is the guide to the entire event and will be referenced by attendees multiple times throughout the three days, and even after the event is over!

For more details and to register, visit the event website.

Registration fees increase September 1. Register early!

august 2023 insight 23

ILConvention.com

Sep. 2021

UFG Insurance Recognized for Innovative Marketing Communications and Video

The Insurance Marketing & Communications Association (IMCA) announced UFG Insurance as a winner of six 2023 Showcase Awards during its Ignite annual conference in June.

“For over 60 years, the IMCA Showcase Awards have recognized the most effective and innovative work from the best minds in insurance marketing and communications,” the association explains on its website.

UFG received three silver and three bronze Showcase Awards for 2022 creative. Honored work includes a baseball-themed contest, social media content, digital collateral, a marketing campaign for the state Land Improvement Contractors Association (LICA), an agent holiday card with digital animation and an inspiring video production of UFG’s Go Beyond Award recipient.

“We are grateful to be recognized by the IMCA for the ingenuity of our marketing and communications team,” states Casey Prince, AVP and marketing communications manager at UFG. “These awards serve as a true testament to our ability to push the boundaries of creativity, innovation and excellence in insurance marketing.”

The organization also received four awards from the 44th Annual Telly Awards in June. UFG was awarded gold for a fully animated holiday message. UFG was also honored with three bronze awards for their employee appreciation, Go Beyond Award and community support videos.

“The caliber of the work this season coming from creators truly has reflected the theme of breaking out and standing out,” said Tellys Executive Director Sabrina Dridje.

The Telly Awards is the premier award honoring video and television across all screens. More than 13,000 entries are received from all 50 states and five continents and are judged by more than 200 leading experts.

SECURA Insurance Named a Top 50 Carrier by Ward Group for 10th Consecutive Year

SECURA Insurance has been acknowledged as one of the top 50 property and casualty insurance companies once again by Ward Group, based on its outstanding performance over a five-year duration (2018-2022). This marks the company’s 10th consecutive year of being honored on this prestigious list, which highlights its exceptional financial strength.

“Earning a spot on Ward’s 50 is always an honor,” said Garth Wicinsky, SECURA President & CEO. “Our inclusion on this list for the past 10 years is a reflection of our associates and independent agents working together to serve our policyholders while achieving long-term growth and financial stability.”

Ward Group is a leader in the insurance industry as a provider of benchmarking and best practices services. Annually, they conduct a comprehensive analysis of nearly 3,000 property-casualty insurance companies in the United States to identify the top performers.

Financial benchmarks include:

• Five Year Average Return on Average Equity

• Five Year Average Return on Average Assets

• Five Year Average Return on Total Revenue

• Five Year Growth in Revenue

• Five Year Growth in Surplus

• Five Year Average Combined Ratio

In addition to being named to Ward’s Top 50, SECURA has an A (Excellent) rating from AM Best, which affirms its solid financial results and ability to pay claims. SECURA is also certified as a Great Place to Work based on associate feedback about the company’s workplace culture, and was ranked number 14 on the Fortune Best Workplaces in Financial Services & Insurance for small and medium companies, number 78 on the Fortune Best Medium Workplaces, and number 66 on Fortune Best Workplaces for Millennials for small and medium companies.

West Bend Again Makes Ward’s 50 List of Top Performers

West Bend Mutual Insurance Company has placed in the coveted Ward’s 50 group of top-performing companies for 2023. The recently released list includes the best industry performers of nearly 3,000 U.S.-domiciled property-casualty insurance companies and nearly 700 life-health insurance companies. West Bend is recognized for its outstanding financial results in the areas of safety, consistency, and performance over five years (2018-2022). It is the tenth consecutive year the company has been included.

The Ward Group’s methodology evaluates key safety and consistency measurements and performance tests. Ward’s 50 identifies companies that pass financial stability requirements and measure their ability to grow while maintaining strong capital positions and underwriting results. To be awarded the designation, companies must pass minimum thresholds of performance.

“Our consistent appearance on Ward’s 50 list is a testament to our associates for their outstanding performance and independent agents who represent West Bend,” stated West Bend’s President, Rob Jacques. “We’re honored to again join the ranks of other top property and casualty insurers in the nation.”

30 insight august 2023 INSIGHT | associate news

West Bend Mutual Insurance Company Builds Out Surety Leadership Team

West Bend Mutual Insurance Company announced changes to its leadership team. First, Jason Enders was promoted to Assistant Vice President – Surety. He’s been with West Bend for more than 16 years, most recently serving as Director of Bonds. Joining West Bend is Lance Cross, who will co-lead as Assistant Vice President –Surety. Lance spent 11 years with IAT Insurance Group in Plano, Texas, as the Regional Manager of Dallas Contract.

“As West Bend continues to build opportunities within the surety market, we will continue to focus closely on developing these types of specialized underwriting capabilities,” stated Rob Jacques, president of West Bend. “Leveraging talented associates, like Jason and Lance, is key to our success.”

Together Jason and Lance will work to refine the organization’s surety market strategy, including developing business growth through expansion in new states beyond the core footprint. This approach involves identifying and nurturing key relationships with West Bend’s independent agency partners capable of broadening coverage in their markets.

Responsive claims handling

Facilitation

We’ve been successfully protecting our policyholders and their employees since 1983.

Browse all of our products at www.guard.com.

august 2023 insight 31 associate news | INSIGHT

Workers’ Compensation APPLY TO BE AN AGENT: WWW.GUARD.COM/APPLY/ Our Workers’ Compensation policy is available nationwide except in monopolistic states: ND, OH, WA, and WY.

our

Compensation

We distinguish

Workers’

coverage by providing value-added services before, during, and after a claim.

Upfront loss control measures

of quality medical care (when an accident does occur)

you trust your insurance partner? Well, you’d better. Insurance coverage is really just a promise. A promise to be there when things go bad. A promise of “we’ll take care of your customers.” Find out more about the Silver Lining and how we value our agent relationships. Visit thesilverlining.com. Trust. The worst brings out our best.®

Do

Thank you to our Associate Members.

Diamond Level

Platinum Level

Progressive Surplus Line Association of Illinois

Gold Level

Arlington/Roe

Blue Cross/Blue Shield of IL

Keystone Insurance Group, Inc.

Pekin Insurance

Silver Level

Imperial PFS

IMT Insurance

SECURA Insurance

West Bend Mutual Insurance Co.

Bronze Level

A. J. Wayne & Associates

AAA Insurance

AMERISAFE

AmTrust North America

Auto-Owners Insurance Co.

Badger Mutual Insurance Company

Berkley Management Protection

Berkshire Hathaway Guard Insurance Companies

BluSky Restoration Contractors

BriteCo Jewelry & Watch Insurance

Central Illinois Mutual Insurance Company

Chubb

Columbia Insurance Group

Continental Western Group

Cornerstone National Insurance Company

Cowbell Cyber

Donald Gaddis Company, Inc.

Donegal Insurance Group

EMC Insurance

Encova Insurance

Erie Insurance Group

Foremost Choice Property & Casualty

Forreston Mutual Insurance Company

Frankenmuth Insurance

Grinnell Mutual Reinsurance Company

IA Valuations

Illinois Mine Subsidence Ins. Fund

Illinois Public Risk Fund

Indiana Farmers Insurance

Insurance Program Managers Group

J M Wilson

Liberty Mutual/Safeco Insurance

Madison Mutual Insurance Company

Main Street America Insurance

Maximum Independent Brokerage, LLC

Mercury Insurance Group

Method Workers Comp

Midwest Insurance Company

Nationwide

NHRMA Mutual Workers’ Compensation

Previsor Insurance & Missouri Employers Mutual

PuroClean Disaster Services

Rockford Mutual Insurance Company

ServiceMaster DSI

SERVPRO of Gurnee

Society Insurance

SPRISKA - Specialty Risk of America

Travelers

UFG Insurance

UIG - The Agent Agency

Utica National Insurance Group

W. A. Schickedanz Agency, Inc./Interstate Risk Placement

Western National Insurance

Westfield

august 2023 insight 33

associate news | INSIGHT

TRUST US TO BE BY THEIR SIDE

Our veterinarian’s package covers the specialized needs of the animal care business. From protecting medical equipment to providing coverage for pets in a doctor’s custody, we take care of veterinarians so they can care for their clients’ best friends. Trust in Tomorrow.® Contact us today.

“Trust in Tomorrow.” and the “Grinnell Mutual” are registered trademarks of Grinnell Mutual Reinsurance Company. © Grinnell Mutual Reinsurance Company, 2023. grinnellmutual.com PERSONAL | BUSINESS | REINSURANCE

Association Update

July Wrap-Up

IIA of IL Executive Committee Planning Retreat

IIA of IL Executive Committee members met at the end of June for their annual planning retreat to set goals for the upcoming fiscal year. President-Elect Allyson Padilla led the group in planning discussions on segmenting member communications to maximize effectiveness, young agents’ engagement, IIAPAC fundraising, providing resources related to technology, and working with association committees to advance these initiatives.

Annual DuPage Golf Outing

Several IIA of IL staff members attended the DuPage IIA annual golf outing, held in Wheaton on July 24.

Brett Gerger and Evan Manning addressed the group at the reception after the outing. Brett spoke about current market conditions and Evan encouraged attendees to donate to IIAPAC in order to continue IIA of IL’s legislative efforts.

august 2023 insight 35

Independent, Authorized General Agent for An Independent Licensee of the Blue Shield Association

August 16-17

Virtual Event

16 hours of IL CE credit

CE Available in other States, contact IIA of IL for details

Identify the Property and Liability Coverage provided in the Businessowners Policy and what it does and does not cover. Examine additional coverages, extensions, and endorsements to the BOP. Learn the benefits of writing Bailee coverage. Identify exposures covered by a Builders Risk Policy and the “Soft Costs” endorsement.There are so many more topics in this two-day seminar.

www.iiaofil.org/education

New Members member agency

Mt. Carroll Insurance Agency, Inc.

Mt. Carroll, IL

Sabina Martin & Associates Insurance

Oak Lawn, IL

The Youngblood Insurance Group

Louisville, IL

V Financial, LLC

Rolling Meadows, IL

Zirkelbach Insurance Agency, LLC

Ridgway, IL

copper associate member

Novum Underwriting Partners

Aurora, OH

For information regarding IIA of IL membership or company sponsorship, contact Tom Ross, Director of Membership Services, at (217) 321-3003, tross@iiaofil.org.

Pre-Licensing, CIC, CISR, E&O, Ethics, Flood, Webinars

august 2023 insight 37 iia of il news | INSIGHT

10-12 Peoria, IL ILConvention.com Mark Your Calendar Education over 30 classes a month

October

for the insurance professional by the insurance professional

AGENCY/AGENTS/PRODUCERS WANTED

02. Forest Park/Oak Park agency for over 60 years, will meet your needs by providing space, markets, marketing & sales support, automation, merging with or purchasing your agency. Perpetuation/ Succession Plans, BuySell Agreements also available. We have experienced, educated and dedicated staff for you and your clients. Have access to our numerous companies, office services and many other resources. Retain ownership in your book with contingency. Please look closely at us- we are an agency you want to do business with! We’ve done it before, we know how- we make it easy! Visit our website at forestagency.com/agents.html, or call for a confidential discussion and a list of Agency benefits.

Dan Browne will provide an agency evaluation/appraisal at little cost to you. Please call:

Dan Browne or Cathy Hall

Forest Insurance

(708) 383-9000

www.forestinsured.com/mergers-acquisitions

INDEPENDENT INSURANCE AGENCIES WANTED

17. We are an Independent family-owned agency located in the Chicago area. We are looking to expand through growth and acquisition. If you have a small to medium sized agency and are looking to sell, call or send us a message. We are strictly looking for Personal Lines and Small Commercial accounts with preferred companies.

GALO Insurance Agency, Inc

(847) 832-0888

We

OPPORTUNITIES/SPACE AVAILABLE/RETAIN OWNERSHIP

13. We are a 100 year old Northbrook agency looking to discuss any mutually beneficial opportunity. Our producers, mergers, clusters and agency purchases receive 50% commissions on new and renewal business without any expenses. We can provide: office space, phones, agency management system, service renewals and changes. The companies we represent are: Badger Mutual, Employers Mutual, General Casualty, Guide One, Hartford, Kemper, Progressive, Rockford Mutual, Safeco, State Auto, Travelers and Met Life. Contact:

Nancy Solomon

Martini, Miller & Schloss, Inc.

(847) 291-1313

Ron@martini-miller.com

steve@galoagency.com

AGENCY WANTED

20. Since 2004, Central Illinois Agents Group LLC has been providing independent agents with a variety of markets with contingency opportunities. Agents have availability to several markets that they may not be able to sustain or maintain on their own. We have markets for personal, commercial, agricultural and crop insurance lines. Let us help you get to the next level.

Visit

CareerPlug will provide IIA of IL members access to a free account that can be used to post jobs, manage applicants, and improve the organizations’ employment brand. Association members can also access a “Pro” version of CareerPlug for a special rate to take hiring to the next level. Learn more about

38 insight august 2023

www.ciagonline.com for contact information. INSIGHT | classifieds

Make Hiring Easier + CareerPlug’s hiring software helps agents attract more qualified candidates, identify the right candidates with confidence, and improve hiring results.

the brand new IIA of IL

at www.iiaofil.org

CareerPlug and check out

job board

Manufactured Homes Rental Dwellings We seek to increase our presence in the manufactured home (1977 or newer) and rental dwelling insurance markets. If you are interested in learning more, please contact us. • No supporting business requirements • Competitive pricing • Attractive commission and contingency schedules • Fast, friendly claims service 208 S Walnut Ave · P.O. Box 686 · Forreston, IL 61030 (815) 938-2273 · (800) 938-2270 (309) 303-1490 · (815) 938-2273 Fax (815) 938-2785 · Email info@forrestonmutual.com www.fmic.org Contact: Carl Beebe 309-303-1490 Agents For Unique Opportunities!

Workers’ Compensation • Transportation – Liability & Physical Damage • Construction Liability • Fine Art & Collections Homeowners – Including California Wildfire & Gulf Region Hurricane • Structured Insurance • Financial Lines • Surety Aviation & Space • Environmental & Pollution Liability • Real Estate • Reinsurance • Warranty & Contractual Liability Infrastructure • Entertainment & Sports ...And More To Come. MORE TO LOVE FROM APPLIED.® MORE IMAGINATION. ©2023 Applied Underwriters, Inc. Rated A- (Excellent) by AM Best. Insurance plans protected U.S. Patent No. 7,908,157. It Pays To Get A Quote From Applied.® Learn more at auw.com/MoreToLove or call sales (877) 234-4450

By Daniel Smith

By Daniel Smith

By April Simpkins

By April Simpkins