•

•

•

•

•

•

•

•

•

•

Chairman of the Board - Kevin Lesch klesch09@gmail.com

President - Allyson Padilla allyson@blanksinsurance.com

President-Elect - Patrick Taphorn, CIC, CSRM ptaphorn@unland.com

Vice President - Thomas Evans, Jr. tom.evans@assuredpartners.com

Secretary/Treasurer - Cindy Jackman, CIC, CISR cjackman@arlingtonroe.com

IIABA National Director - George Daly george.daly@thehortongroup.com

Mohammed Ali - mali@aliminsurance.com

Amiri Curry - acurry@assuranceagency.com

Charles Hruska - chas@hruskains.com

David Jenk, Esq. - djenk@nwibrokers.com

Jeff McMillan - jeff@mcmillanins.com

Patrick Muldowney - patrick.muldowney@alliant.com

Lindsey Polzin - lpolzin@presidiogrp.com

Ray Roentz - ray.roentz@hwcrins.com

James Sager - james@sagerins.com

Luke Sandrock, CIC - lsandrock@2cornerstone.com

Noele Tatlock - ntatlock@unland.com

Budget & Finance | Cindy Jackman, CIC, CISR cjackman@arlingtonroe.com

Education | Lisa Lukens salibainsurance@gmail.com

Farm Agents Council | Steve Foster s.foster@ciagonline.com

Government Relations | Dustin Peterson dustin@peterson.insurance

Planning & Coordination | Nick Gunn, CIC ngunn@envisionins.com

Technology | Brian Ogden brian@ogdeninsurance.com

Young Agents | Renee Crissie rcrissie@acrisure.com

Follow us on socials.

Insurance Products Administrator

Director of Information and Technology

Director of Education and Agency Resources

Accounting & Admin Services

Director of Human Resources, Board Admin

Sr. Vice President/Chief Financial Officer

Chief Executive Officer

Director of Membership Services

Director of Government Relations

Office Administrator

Director of Communications

Marketing Representative

Rebecca Buchanan (217) 321-3010 - rbuchanan@ilbigi.org

Shannon Churchill (217) 321-3004 - schurchill@ilbigi.org

Brett Gerger, CIC (217) 321-3006 - bgerger@ilbigi.org

Tami Hubbell, CIC (217) 321-3016 - thubbell@ilbigi.org

Jennifer Jacobs, SHRM-CP (217) 321-3013 - jjacobs@ilbigi.org

Mark Kuchar (217) 321-3015 - mkuchar@ilbigi.org

Phil Lackman, IOM (217) 321-3005 - plackman@ilbigi.org

Lori Mahorney, CISR Elite (217) 415-7550 - lmahorney@ilbigi.org

Evan Manning (217) 321-3002 - emanning@ilbigi.org

Kristi Osmond, CISR Elite (217) 321-3007 - kosmond@ilbigi.org

Rachel Romines (217) 321-3024 - rromines@ilbigi.org

Tom Ross, CRIS, CPIA (217) 321-3003 - tross@ilbigi.org

Carol Wilson, CPIA (217) 321-3011 - cwilson@ilbigi.org

Volunteering, participating, contributing, giving, etc… in other words, “INVOLVEMENT” is the cornerstone of the independent agent channel. Whether it be sponsoring a local little league team, participating in local boards (boys & girls club), participating in local parades, celebrity bartending locally, volunteering as a firefighter, putting on community cooks outs, or donating time to a local food bank, agents are a pillar in their local community. These are all great examples of how you bind your communities together and make them a better place to live. The part that many agents miss out on are the National and State opportunities to get involved on a grander scale. Many times agents don’t participate on a National or State level as there are only so many hours in a day, week, month, and year. Choosing what to participate in is a huge decision in which you have to weigh family obligations, local community obligations, National and State time obligations, and, oh yeah, “When do I sell insurance?” You can spread yourself too thin and then provide no value to any of those channels. I’ll give a little of my unsolicited advice.

First, divide and conquer, utilize staff to help, and participate locally. Just make sure your agency name is attached to the staff. Start by participating on a State level, such as Big I Illinois association involvement in CONVO, a committee, or one of several other ways. You will find that the time commitment is not nearly as much as you think, and the overall value will be exponential compared to the time investment. Nothing furthers you as an agent more than participating and interacting with peers to identify and solve problems as they arise in the market and/or industry.

Once you have the State portion tackled, try dipping your toes in the National waters. National participation will open up a whole new world for you and your agency. Staff in your agency will help take some of that local time, but they can also help with State and National participation, which will provide the staff with a sense of importance. Don’t we all just want to seem that we are needed and a vital part of the organization? Employees, many times want to feel like they are making a difference and this will provide them with those avenues.

Second, determine what level of involvement works best for you and the agency you own or work for. Don’t go all in with everything right away, get overwhelmed and crash and burn. Then you’re done with that aspect forever and will never realize the benefits that could have been provided to you and your agency. Take some baby steps when jumping into the State and National participation. Attend some State events (Sales & Leadership, Tech Conference, CONVO), share your expertise in the magazine or in CONNECT, volunteer to participate in a committee, and maybe event join the Big I Illinois Board of Directors.

Find your sweet spot and embrace it. State involvement could also be as little of a contribution as providing educational class content. Once you have done the State participation and you are ready for a new challenge look for National level opportunities. A great way to participate nationally is by attending the Legislative Conference in Washington, DC, held every spring, or young agents attending the September Big I Young Agents Leadership Institute event.

As with anything, you get out what you put in. Everyone is always hesitant to pull the trigger and commit. But everyone I have ever talked to who participated did not regret that

decision and were glad they did. The reason I said baby steps is so that you can access what you are able and willing to do without negatively affecting your family and community. I guarantee you will not look back and regret getting involved. Don’t sit on the sidelines; get in the game. You miss 100% of the shots that you don’t take . Be a change agent. Move the needle. Be a thought leader. Give it 110%. It’s a win-win. We have nothing to fear but fear itself. Insert any other cliché that you can think of. In other words, quit making excuses and start making a positive difference through involvement. Complaining is not a solution and does nothing to perpetuate change or problem-solving. Solutions require thoughtful/ insightful input as well as engaged participation with your peers. Involvement is the only way that we solve or navigate issues facing our industry. If everyone just stayed in the bubble of their community and didn’t venture out to broaden our reach and scope, then we would operate in silos and be doing our clients a great dis-service.

Lastly, remember EIGHTS. Engage, Interject, Gain, Help, Teamwork and Selflessness.

Engage – get involved and participate, which is the first step.

Interject – we all bring a unique perspective to the table, so don’t be afraid to share yours.

Gain – gain knowledge, esteem and perspective from the process.

Help – help others, which is the cornerstone of service that would not only concern your clients but also other agents.

Teamwork – see this involvement as a team, and once you do that, you can truly step out of your bubble and collaborate, which will produce much better results for all involved.

Selflessness – is when you truly step outside of your comfort zone and participate for the greater good of the group and not just the individual (the most rewarding aspect).

The people who live by EIGHTS are the ones who win awards in our industry. And isn’t it all about the awards?

As always, this just Brett’s 2 Sense and I hope it was helpful. You can contact me through my CONNECT and if it is urgent, do not hesitate to reach me through CONNECT. I may be pushing you to CONNECT. If you need any clarification or have any suggestions for future articles please email me at bgerger@ilbigi.org.

3 Time-Saving Resources from Trusted Choice® to Help You Enjoy a

With just a few minutes of set-up you can automate a full year of social posts. Most users report saving an average of 5 hours each week. You just pick the topics, connect your accounts, and Social Jazz does the rest.

Use the AI Toolkit to begin leveraging the power of AI for your marketing projects. Tasks like writing emails, blogs or website copy typically take hours but can now be completed in just a few minutes.

Save weeks of planning by downloading ready-to-use, consumer friendly videos to use on your website or social media. Choose from over 25 videos that provide detailed explanations of common coverages.

By MarketScout, a division of Novatae

The average rate increase for personal lines coverages across the United States rose from 4.75% in the first quarter of 2024 to 7.6% in the second quarter.

“Some homeowners insurers are increasing rates because they feel the exposure reported is less than the replacement cost, thereby resulting in generally higher claims than anticipated. Building materials are more expensive due to inflationary pressures, so claim payments are larger than anticipated,” said Richard Kerr, CEO of Novatae Risk Group. “Auto insurance rates are up because of increased repair costs and higher-than-expected liability claims,” said Kerr.

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout’s analysis of market conditions. These surveys help to further corroborate MarketScout’s actual findings, mathematically driven by new and renewal placements across the United States.

A summary of the second quarter 2024 personal lines rates: Personal Lines

By

The composite rate for US property and casualty insurance increased slightly from 3.9% in the first quarter to 4.36% in the second quarter of 2024.

“Insurers are comfortable with their pricing, and as a result, there was no significant movement in rates for any coverage or industry group,” said Richard Kerr, CEO of Novatae Risk Group. “We are at the beginning of hurricane and wildfire season, so property rates could change based on these potentially catastrophic events. But for now, all is steady.” added Kerr.

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout’s analysis of market conditions. These surveys help to further corroborate MarketScout’s actual findings, mathematically driven by new and renewal placements across the United States.

A summary of the second quarter 2024 rates by coverage, cyber liability, industry class and account size:

By Coverage Class

By Account Size

Industry Class

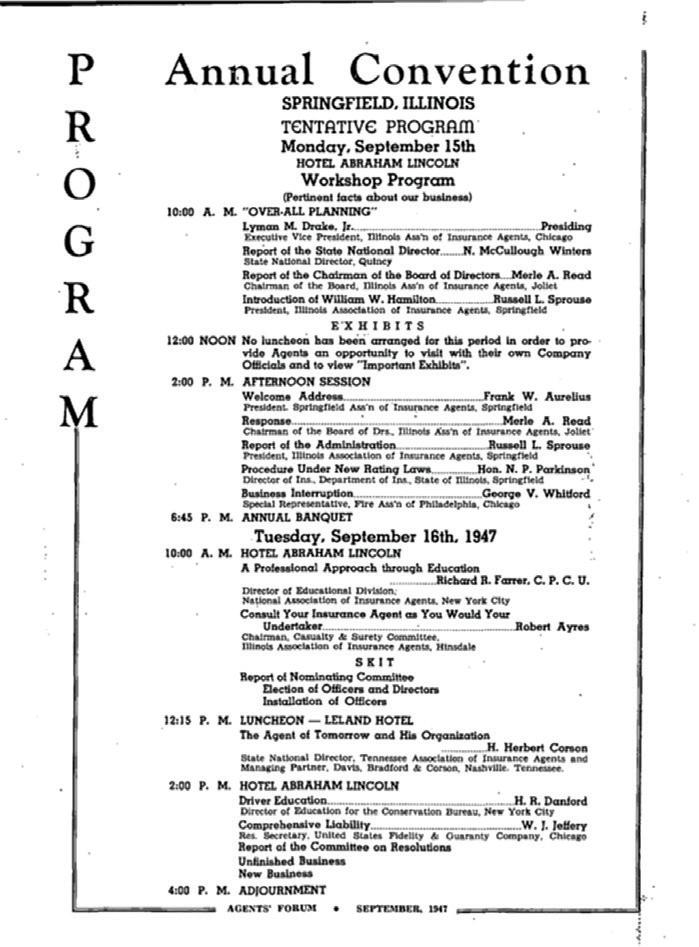

Planning a successful convention is no easy feat. From juggling ideal venues and captivating speakers to navigating the unprecedented challenges of a virtual event during the pandemic, these seasoned planners have faced numerous hurdles. Sandy Cuffle, the driving force behind the association’s annual event from 1996 to 2011, and her successor, Shannon Churchill, who continues the tradition today, have witnessed the convention evolve significantly. Despite the obstacles, they’ve created unforgettable experiences. As the event landscape has shifted, so have the organizers’ strategies, always focusing on delivering an engaging and rewarding experience for attendees.

What were the biggest challenges you faced while planning CONVO?

Sandy: Finding suitable venues and speakers to accommodate our convention attendees was a major hurdle. Creating an event that was both special and entertaining for everyone involved – from the new president to our dedicated agents and representatives – was another significant challenge.

Shannon: Pivoting to a virtual convention during the pandemic was undoubtedly our biggest challenge. The logistics and maintaining the event’s integrity under such unprecedented circumstances were incredibly demanding. Even in normal times, balancing the needs of all stakeholders and creating an event that keeps attendees and exhibitors coming back year after year is no easy feat.

Can you share a particularly memorable moment or highlights?

Sandy: One of the most unforgettable experiences was my first solo convention with Walter Payton as the keynote speaker. He was an absolute gentleman. After a private signing for the executive committee and board of directors, he surprised everyone by going into the kitchen to meet the staff and sign autographs for them. All he asked for was an egg sandwich. His humility and kindness were truly inspiring. After eating it he asked me to please come dance with him. There were just the two of us and no music. He wanted to know what I wanted him to talk about. I explained that I was confident that he could talk about anything that he wanted to. I went on to tell him that he had the largest sold-out luncheon we had ever had and that he was definitely the draw.

I told him I had only one request for him. It seemed that the Peoria Rotary had held a meeting there that morning and one of the attendees was a gentleman in his 90s. One of the staff had pointed him out to me and I invited him to come in and listen to Walter. The gentlemen refused. He said that all he wanted was to shake his hand. It seemed that the gentleman had been a news reporter in his younger days and had interviewed Walter when he had just started his career. I explained all of this to Walter, and he said, “No problem,” and walked down the hallway to the dining room. As he approached the gentleman, Walter stopped in his tracks, grabbed the gentleman’s hand, patted him on the back, and told him how happy he was to see him after all the years. Never had I ever seen a man almost “float” out of the hotel but that day I did! Absolutely the best convention for me.

Shannon: There are countless memorable moments, but two stand out.

First, we threw a costume party years ago that we questioned if it would ever work, and it turned out to be one of the best and most involved big parties we’ve ever had. With so many people getting into the spirit and coming up with a variety of ideas for costumes, it was a joy to see and experience.

Second, the roaring 20s party we threw several years ago. Seeing everybody really get into that era and enjoy the dancing and the theming was so fun! Plus, we were able to surprise attendees with a dance routine from the staff and executive committee!

Of course, the satisfaction of seeing attendees have those “aha” moments during keynote sessions is always rewarding.

What was the most popular theme or your favorite theme of a past event?

Sandy: Attendees need to not only get valuable training and education at an event but also have fun, network, and make valuable contacts. I can think of three events that seem to be the most popular:

• Indoor carnival games

• A County Fair in the parking lot with fair food and rides and games

• Las Vegas night with gambling tables, Vegas-style entertainment, and prizes

How has the event changed from your first convention to your last or now?

Sandy: The event has evolved to keep pace with changing times, attendee preferences, and industry trends. Topics, speakers, locations, and entertainment must adapt to meet the needs of our audience. However, the core desire for quality education, networking opportunities, and enjoyable experiences remains constant.

Shannon: Honestly, my first convention - I had no idea what I was doing. I was kind of thrown into it last minute after helping my mom for years. It’s completely different being solely in charge of everything.

Now, with a stronger foundation and a deeper understanding of the event’s goals, I focus on creating experiences that resonate with all stakeholders while staying aligned with the association’s vision.

Shannon: We’ve had a lot of good themes over the years. I’ve enjoyed the sports parties and the County Fair. Plus, of course, the roaring 20s party, Halloween costume contest, and even a haunted house. Our attendees continue to love the casino night - that’s why it’s stuck around for so many years.

But I think one of my most favorite events that I’ve ever planned, and it wasn’t necessarily the theme of the entire convention but was when we did a food fight challenge in Tinley Park. We featured local chefs where contestants could get involved and a live auction. It was a live throwdown right in the middle of the big party and it was absolutely amazing! We raised a ton of money for charity and just seeing everybody coming together for a united cause was really cool.

What was or is your favorite part of the planning process?

Sandy: My favorite part is the feeling I got when the last class is over, the last meal was served, and the entertainment was off the stage. Then and only then could I sit down, prop my feet up, take a deep breath, and maybe even have a cold beer to toast a successful event!

Shannon: What I love most about the planning process is the collaborative spirit of the team. Everyone has a role and contributes to creating an exceptional event for our members

We know there is a lot that happens “behind the scenes.” What is the biggest disaster you had to fix in the moment, that an attendee may not have known about?

Sandy: A very long time ago, one of our attendees passed away in their room shortly after checking in. With people everywhere, starting to shuffle off to events off site, we tried our best to keep this as private as possible, for everyone involved. But, of course, the service elevators were down, leading to a very public exit. Fortunately they did manage to handle it with as much decorum as possible.

Shannon: There isn’t really one moment that stands out, but we’ve definitely had some spur of the moment challenges!

We’ve had a keynote speaker not show, so we had to pivot to rearrange programming.

One year, it rained and we were having our party in the parking lot in a tent... we were all out drying the tent with extra towels and blankets - anything we could find! It delayed room-cleaning services the following day.

With all the moving parts, you always prepare that something is going to go wrong because people are not perfect. The main goal is to contain the domino effect so that the one issue doesn’t impact anything else.

To

15-17

CONVO is the premier annual event of the Big I Illinois and includes the Midwest’s largest industry tradeshow. The event is designed for agents to come together for connections, networking, education, industry trends, and of course, fun.

Earn up to 12 hours of Illinois CE credit with industry-driven educational programming. You’ll hear about the latest topics and news that matter most to you from leading experts and your peers. But don’t take our word for it. Here is what past attendees are saying:

Over my 34 years in the insurance industry, I’ve appreciated the educational topics offered at CONVO. They’re typically not the standard topics, and I find that beneficial to my everyday business. Socializing with other agents from around the state is always fun, and it’s nice to have a group you can have in-depth industry-specific conversations with. But the part of CONVO I never miss is the Tradeshow. The ability to put faces to the voices I’ve been working with at different companies is nice. I typically also have a few specific accounts that I’m looking for homes for and have the chance to speak with carriers I don’t represent to gauge their appetites. I would recommend the CONVO to all experience levels in our industry.

- Sarah Marshky

CONVO is one of the best ways to get required CE anywhere. Our association seems to always come up with the top instructors in our industry every year! In today’s insurance market, we need to share ideas and know what companies are doing/planning. We need comradery in tough times. CONVO and our association are more important than ever.

- Kevin Beck

Many of the education sessions featured during CONVO cannot be found anywhere else. We bring in topic experts and speakers from all over the country.

The people are what make this event great. Learn and network with your peers and industry partners. Build your community. The CONVO schedule features plenty of opportunities to chat.

(Subject to Change)

Tuesday, October 15

10:00 – 4:00 pm Independent Agent Invitational Golf Outing

1:00 – 4:00 pm Concurrent Education Sessions (CE)

5:00 – 6:00 pm Welcome Reception and Meet & Greet

- Enjoy a drink and hors d’ oeuvres before heading out to dinner.

6:00 – 8:00 pm Dutch Dine Arounds/Company Dinners

- Head out for dinner with your Company Partners, old friends, or new acquaintances. Don’t have dinner plans? Sign up for the Dutch Dine Arounds with Big I Illinois staff. We’ve has made reservations and travel arrangements. **Hence the name “Dutch,” each attendee is responsible for paying for their own dinner.

6:00 – 8:00 pm Past President’s Dinner (Invite Only)

8:00 – 11:00 pm Casino Night

- Sit back, relax, and let the good times roll. When you come back from dinner join us for an exciting evening of fun & games.

Wednesday, October 16

7:00 am Continental Breakfast/CONVO Registration Desk Opens

8:00 - 11:00 am Keynote General Session (CE)

- Overview and Outlook for the P&C Industry: Trends, Challenges and Opportunities with Dr. Robert Hartwig

- We will also recognize our award recipients including Agent of the Year, Agency of the Year, Young Agent of the Year and more.

11:00 am – 2:00 pm Tradeshow and Lunch ** NEW TIMING

2:00 – 4:00 pm Concurrent Education Sessions (CE)

4:00 – 5:00 pm Closing Keynote General Session (CE)

- with Ben Zobrist, former Chicago Cub

6:00 – 11:00 pm Champagne Celebration - Dinner, Dancing, and Drinks

Thursday, October 17

7:00 – 8:30 am Hot Breakfast

8:30 – 11:30 am State of the Association Address and Keynote

- Learn about trends and challenges facing the independent agency system during the State of the Association Address. Association will provide updates on legislative and regulatory issues impacting your business and your clients, connect you with tools and resources to navigate the changing market.

Join us for a round of golf complete with food and beverages, friendly competition, and a great opportunity to network with agents in advance of CONVO.

Tuesday, October 15 - 10:00 am Shotgun Start

Weaver Ridge Golf Club, Peoria, IL

See for yourself the Midwest’s Largest industry tradeshow featuring over 120 vendors. Look for markets, VAs, technology and more to benefit your agency.

CONVO offers several opportunities to build your community of knowledgable professionals, make new friends and contacts, and find out what yoru old friends and peers have been up to!

Welcome Reception - Dutch Dine Arounds Casino Night - Tradeshow - Champagne Celebration

Marrott Pere Marquette & Civic Center

October 15-17

Peoria, IL

Your company should be a part of the Midwest’s largest industry tradeshow. Exhibit booths are on sale now. Secure your space right away as this event will sell out quickly!

Studies say it takes seven to 11 times for somebody to see your message and actually remember it. One of the best reasons to sponsor a portion of CONVO is the number of people (over 800!) that will have eyes on your brand. This is an opportunity for your business to solidify your presence in the industry. Plus, sponsoring is yet another way your company can build trust with current and potential agencies.

And to top it off, you’ll be helping keep the costs down for agents to attend the event. Your contracted agencies will continue to attend to increase their knowledge, which in return, could affect your bottom line.

Every person that attends CONVO will receive an event program. This is the guide to the entire event and will be referenced by attendees multiple times throughout the three days, and even after the event is over!

For 125 years, independent insurance agents in our state have helped guide the Association in its mission, goals, and decisions. But why? Why is it important to commit one of your most valuable assets – time – to the organization. As you might imagine, we’re a little biased. But let’s look at some of the reasons and the feedback from members about why it is such an important endeavor.

For You and Your Agency

You’ve no doubt heard the phrase “You get out of it what you put into it,” hundreds of times. But there’s a reason for that – it’s often true. In the case of the Association, it’s no different. Want to develop your leadership skills? Consider serving on one of our Committees or on our Board. Want to enhance your insurance knowledge? Take one of our many professional development courses. Hoping to increase your network? Attend events and meet counterparts from all aspects of the industry. The opportunities for personal growth and development are endless.

Ray Roentz, Big I Illinois Board member and president of Heneghan, White, Cutting, & Roentz Insurance Agency in Jerseyville, adds, “In order to serve my clients and be the best agent I could be I knew that I would need a direct line to professionals and experts who have been in the industry for a long time. Big I Illinois was that ‘direct line’ for me. It helped direct me towards obtaining my CIC, learning management and resources to measure success, and provide all the resources one needs for professional growth. I hope to be involved in the Association a long time so that I may have a chance to pay back the debt that I owe to those who helped me by helping those who follow.”

Your agency will benefit as well, with access to resources and exclusive member information. You can find avenues for the development of your team and also learn from your peers about better ways to operate your business or grow your book.

Pat Taphorn, Big I Illinois President-elect and president of Unland Insurance & Benefits in Pekin, agrees, “Networking with high level professionals who can assist each other with best practices to grow our business effectively. This benefit is also derived from the vast array of product and service offerings from the Big Illinois staff to help all agents achieve optimum results.”

For the Insurance Industry

We all know the state of the marketplace right now. Your involvement in Big I Illinois helps show the strength of the independent agency system. The latest Big I Market Share report showed that our growth continues. Involvement in our advocacy efforts help us maintain a voice “on the Hill” for you at both the State and National level. Carriers notice involvement as well, often telling us that agencies whose teams are involved are considered to be of a “higher caliber” than some others.

Bill Lawrence, our AIS Board President and the president of P/L/R Insurance Services in Bloomington, adds, “I think it’s important to give back. If all of us sit on the sidelines reaping the benefits of the organizations to which we belong, there wouldn’t be anybody keeping the organizations alive. The staff does an amazing job, but without member participation, organizations die.”

“If all of us sit on the sidelines reaping the benefits of the organizations to which we belong, there wouldn’t be anybody keeping the organizations alive.”

Association

Where would Big I Illinois be without the involvement of our members? Quite frankly, we probably wouldn’t exist. Our volunteer leaders, our sponsors, the members in our courses and at events – all of these go away without member involvement. And though it may seem like there are other please to find some of these resources, you might be surprised when you stop and consider how much is actually available to members.

Luke Sandrock, a Big I Illinois Board member and partner at Cornerstone Agency in Morrison, feels that volunteering can provide its own reward, “I really appreciate volunteering alongside peers and mentors who I have a great deal of respect for in this industry. There has been a huge benefit for me to be a part of this association and I hope to be able to give something back in return.”

Your Association is here to represent you. To be your advocate, your supporter, your resource center, and an extension of your team. Statistics from the American Society of Association Executives show that professionals who are involved in a trade association are more connected to their profession, have longer careers in their industry, and are also likely to earn more. But even apart from that, why wouldn’t you be involved?

• Time? You might be wasting more of it without the Association’s resources

• Money? If you utilize even a few of the resources the ROI is an easy calculation

• Competition? Do you really want your competition having resources that you don’t?

Your involvement matters. For you, your agency, your industry, and this Association. Let’s all keep working together towards our common goals!

Many of the most successful salespeople are not Rhode Scholars and they possess no particular talents or gifts. Some might say, “Well, wait, they have the gift of gab. That’s a talent.” Yes, some do, but many do not, and many are introverts who are not super-comfortable on the social scene. That said, they are still successful. The reason being is that a lot, if not all, of the most important sales success traits don’t require you to be a member of Mensa nor do they require you to be a born socialite equipped with a silver tongue. So, what are these key success traits that almost anyone from any walk of life can have?

Here they are…

Trait 1: Work Ethic

You can work as hard and put in as many hours as you decide to. The most successful people in any field are the hardest workers. The most successful salespeople may not be the hardest workers in advanced evolutions of their careers, but they were when they were just starting out and building their business.

Trait 2: Grit and Determination

You can decide to have courage and resolve and be resolute in your desire to go through whatever you have to go through to come out successfully on the other side.

Trait 3: Attitude

You can decide you’re going to stay positive and have a good attitude no matter what. Sure, this may take some work especially if you tend to be negative, but ultimately your attitude is up to you.

Trait 4: Action

We don’t always have complete control over our feelings, and our thoughts can take some practice to completely control, but the one thing we always have control over is our actions. For salespeople it’s doing enough of the necessary sales activities.

Trait 5: Persistence and Perseverance

This is the long-term version of grit. It is continuing the course no matter how much hardship there is and how long it takes. Success does not come overnight and there is a lot of rejection and failure especially at the beginning of a sales career, but if you press on no matter what, you’ll eventually come out the other side a winner.

Trait 6: Follow Through and Follow Up

You decide whether or not you follow through both on tasks assigned directly to you and those you’ve passed off, to ensure they get done. You also decide how many times and how you follow up with someone. Most salespeople don’t follow up nearly enough.

Trait 7: Honesty, Integrity, and Character

This is doing the right thing, all the time. This is not making sales that shouldn’t be made. In other words, not making money at the customer’s expense. This is doing what you say you’ll do when you say you’ll do it. This is being a person of your word and keeping the promises you make.

By John Chapin

Trait

This is getting better at your profession while at the same time becoming a better you. You decide if you keep growing and becoming more both professionally and personally.

This is an aspect of the above trait but is more specific to developing your mind. While the above trait could include working on performing certain work tasks better or getting into better physical shape by eating better and exercising more, continual learning is about expanding your brain. It’s reading, studying, and taking courses that either help you professionally or personally.

You decide what level of service you provide. Do you put in extra time, effort, energy, and perhaps even money, to deliver more than people expect? Do you ‘wow’ them with your service? Putting in extra effort and going the extra mile is simply a decision.

This is responding to people as quickly as possible. It could be a text, a phone call, an email, or some other request that someone has made of you. You decide how quickly you respond whether it’s immediately, an hour or two, or 24 hours. Whatever it is, the decision is yours. Sure, there may be times when you’re on a plane or otherwise unavailable, but you decide what your rules are for how quickly you respond to people.

What’s great about the above traits is, not only will adherence to them essentially assure your success, but all of them are simply a choice, available to anyone who chooses to use them. Will it be easier if you have certain talents and abilities? Probably, but talent and special abilities are not necessary. You can decide to work hard, you can decide to keep going, you can decide to have a good attitude, you can decide to follow through and continue to follow up, you can decide to be honest, do the right thing, and not sacrifice your character, you can decide to challenge yourself and to continue to learn and to grow, you can decide to put in extra effort, and you can decide to answer emails, texts, and phone calls, and respond to other requests as quickly as possible. Sure, some of the above traits may be hard to pull off at times, or do all the time, but they require no special skills or even above average intelligence, they simply require the decision to act in accordance with them.

John Chapin is a motivational sales speaker, coach, and trainer. Go to www.completeselling.com or emaill johnchapin@completeselling.com.

“THE PROCESS OF WORKING WITH WAHVE HAS BEEN PHENOMENAL EVERYONE WE HAVE WORKED WITH HAS BEEN EFFICIENT AND VERY KNOWLEDGEABLE, AND THEIR INNOVATIVE PLATFORM AND PROCESSES HAVE RESULTED IN

THE BEST AND MOST QUALIFIED STAFF ADDITIONS WE HAVE EVER MADE!”

It’s getting harder to fill open positions in insurance. And there will be a lot more soon: 400,000 open positions by 2036 due to retirement alone. Meanwhile, turnover in the insurance industry is on the rise making it more critical than ever to be smart in your hiring

74% of employers say they hired the wrong person for the job

50% or more of a staff annual salary is spent to replace a bad hire

85% of applicants exaggerate on their resumes (and job board screening is resume-based)

10 million qualified workers are never considered (because of poorly written job postings)

more inefficient talent acquisition

WAHVE removes the burden of sifting through dozens of resumes to find the right candidate. Our direct hire talent solution helps you attract the strongest pool of candidates and screens for best fit with your needs and company culture through a unique seven-step process:

Job Request: Our system guides you through the selection of hard and soft skills necessary to define the position.

Job Ads: We create job ads that attract the best applicants and are strategically posted for maximum visibility

Applications: An intuitive application prompts applicants to enter their hard and soft skills, work experience, and other credentials necessary for the job.

Matching: Our system uses proprietary data science to determine the intersections between the skills and experience of the applicant and the job.

Skills Testing: Our system evaluates an applicant’s relevant skills using validated assessments.

References: Our automated system customizes questions based on the applicant’s professional relationship with the reference

Interviews: Industry experts conduct blind interviews to further qualify the candidate, providing you with a bias-free short list of quality candidates.

Thank you to our Associate Members.

Progressive Surplus Line Association of Illinois

Silver Level

IMT Insurance

Arlington/Roe

Blue Cross/Blue Shield of IL Pekin Insurance

Keystone Insurance Group, Inc.

SECURA Insurance

Bronze Level

A. J. Wayne & Associates

AAA, The Auto Club Group

AMERISAFE

AmTrust Insurance

Amwins

Auto-Owners Insurance Co.

Berkley Aspire

Berkley Management Protection

Berkley Small Business Solutions

Berkshire Hathaway GUARD Insurance Companies

Bliss McKnight

BluSky Restoration Contractors, LLC

Boundless Rider

BriteCo Jewelry & Watch Insurance

Central Illinois Mutual Insurance Company

Chubb

Columbia Insurance Group

Cornerstone National Insurance Company

Cowbell Cyber

Donald Gaddis Company, Inc.

Donegal Insurance Group

EMC Insurance

Encova Insurance

Erie Insurance Group

Foremost Choice Property & Casualty

Forreston Mutual Insurance Company

Frankenmuth Insurance

Grinnell Mutual Reinsurance Company

IA Valuations

Illinois Mine Subsidence Ins Fund

Illinois Public Risk Fund

Imperial PFS

Independent Mutual Fire Insurance Company

Indiana Farmers Insurance

Insurance Program Managers Group (IPMG)

J M Wilson

Liberty Mutual/Safeco Insurance

Limit

Madison Mutual Insurance Company

Main Street America Insurance

Maximum Independent Brokerage, LLC

MEM

Mercury Insurance Group

Method Workers Comp

Midwest Insurance Company

Nationwide

NHRMA Mutual Workers’ Compensation

Pinnacle Minds, Inc.

Rhodian Group

Rockford Mutual Ins. Co.

ServiceMaster DSI

Society Insurance

SPRISKA - Specialty Risk of America

Steadily

Summit Insurance

Travelers

UFG Insurance

Universal Property & Casualty

Utica National Insurance Group

W. A. Schickedanz Agency, Inc./Interstate Risk Placement

West Bend Insurance Company

Western National Insurance

Westfield

Encova Insurance Announces New Senior Vice President, Small Business, and Vice President, Package Lines Underwriting

Encova Insurance has announced Michelle Shaver, MBA, CPCU, CIC, as senior vice president, small business, commercial lines, and Carrie Lowe, MBA, as vice president, package lines underwriting.

Shaver now has accountability for Encova’s $300 million small business market segment. As senior vice president, small business, she is responsible for the growth and profitability of small business by leveraging predictive analytics and Encova’s agent portal to make it easier for agents and policyholders to do business.

Shaver most recently was a small business leader for Chubb Insurance. Her background also includes serving as head of home office underwriting, chief underwriting officer at Farmers Insurance Company.

As vice president, package lines underwriting, Lowe is now responsible for overseeing Encova’s package lines underwriting functions to meet established objectives through coordination of efforts of all regional vice presidents, commercial lines underwriters and Encova appointed agents. Her leadership will help the company achieve business results to provide quality products and services in the competitive insurance marketplace.

Lowe previously worked at Westfield Insurance for more than 20 years and held positions as vice president – project and program management; commercial lines profit and product leader; and national small business sales and underwriting leader.

If you have 100 employees or less and want a retirement savings plan that is straightforward and virtually effortless, the lesser known Simple IRA plan its the bill.

Our programs are designed to meet the needs of Big “I” members with maximum lexibility at a competitive cost.

Reach out today to see how easy peasy it can be!

Contact IIABA’s Christine Munoz at christine.munoz@iiaba.net.

Amanda E. Retherford with Heneghan, White, Cutting & Roentz in Jerseyville has been named 2024 Illinois Outstanding CSR of the Year! This prestigious award, given by the Risk & Insurance Education Alliance (formerly The National Alliance), is regarded as the foremost award of its kind, and recognized the contributions and commitment of those who service clients within the insurance industry.

To be eligible for the top state honor, the 2024 candidates submitted an essay regarding current market conditions and how CSRs can adapt to navigate new challenges. Additionally, entrants must have demonstrated commendable service to their agencies, their industry, and their community.

Congratulations, Amanda!

We distinguish our Workers’ Compensation coverage by providing value-added services before, during, and after a claim.

Upfront loss control measures

Responsive claims handling

Facilitation of quality medical care (when an accident does occur)

We’ve been successfully protecting our policyholders and their employees since 1983.

Our Workers’ Compensation policy is available nationwide except in monopolistic states: ND, OH, WA, and WY.

Number of years at Big I Illinois: Two Months

What do you like most about your job?

Helping Insurance agents protect all they have worked for.

Tell us about the first job you ever had: McDonalds – and now my son is there in between semesters. Learned hard work, customer service, and setting and reaching goals there.

If you could have any career other than this, what would it be?

Advocating for seniors: negotiating their medical needs and benefits, and coordinating with their doctors and families to make sure they are all on the same page.

What is your favorite:

Pastime: Karaoke

Food: Steamed Dumplins

Movie: Independence Day

TV Show: Modern Family Band/Musician: Florence and the Machine

Tell us about your family: Wife, Jessica Daughter, Dulcinea (Dulcie) Son, Michael (Mick)

Name one thing on your bucket list: Spending a month taking trains all over Europe.

What is your biggest fear?

Heights. Flying – bungee jumping – Ferris Wheel, balance beam in HS. I really just like my feet on the ground.

Of what are you most proud either personally or professionally?

Personally, I’m most proud of finally accepting me for me, getting married, and daily creating the life I want to wake up to.

Professionally, I am proud of my Life Insurance career including helping families every day, winning awards and trips, and attending banquets. But I’m especially proud of my Life Insurance Awareness Month campaign – it was always epic!

Name something people would be surprised to know about you.

In my youth, from age 4 until about age 17, I was a competitive level tap and modern dancer.

Welcome to the team!

Big I Illinois hosted a special marketing webinar on July 11, “Go for the Gold: Capitalizing on What’s Trending with Agency Marketing.” The team from Market Retrievers showed agency’s several ways to use the Olympics to their advantage on social media. The recording is available to members at: ilbigi.org/education/education-courses/ market-retrievers.

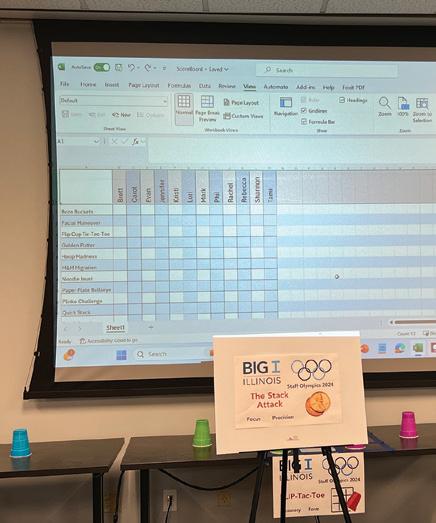

Big I Illinois staff listened to the Market Retrievers webinar and decided to take action! Check out some of the photos from our events, and view the video reel on Big I Illinois social media channels.

July 12, St. Louis

Thanks to event sponsors: Arlington/Roe, Erie Insurance, Sager Insurance Agency, and WA Schickedanz/Interstate Risk Placement

42. Central Illinois agency for sale after 40+ years. Primarily personal lines. Strong retention and continuing growth and profitability. Several major carriers with unique access contracted. Current owner is close to retirement and will help with transition. Very good relationships with the local community. This is a rare opportunity to own an active producing agency.

Send your contact information to Tami Hubbell at thubbell@ilbigi.org and reference this ad.

23. Are you looking for an exit strategy while still continuing to produce for a few years or are you ready to sell now? Paczolt Insurance would like to talk with you! We are an independent agency dating back to the 1970s that is located in the western suburbs. Our focus is on mid-to-small commercial accounts and personal lines. Our companies include EMC, Badger Mutual, Safeco, Progressive, and Travelers. We have the flexibility and capital to get a deal done. Contact:

Susan Troppito

Paczolt Insurance susan@piaigroup.com (708) 215-5202

13. We are a 100 year old Northbrook agency looking to discuss any mutually beneficial opportunity. Our producers, mergers, clusters and agency purchases receive 50% commissions on new and renewal business without any expenses. We can provide: office space, phones, agency management system, service renewals and changes. The companies we represent are: Badger Mutual, Employers Mutual, General Casualty, Guide One, Hartford, Kemper, Progressive, Rockford Mutual, Safeco, State Auto, Travelers and Met Life. Contact:

Nancy Solomon Martini, Miller & Schloss, Inc. (847) 291-1313

Ron@martini-miller.com

20. Since 2004, Central Illinois Agents Group LLC has been providing independent agents with a variety of markets with contingency opportunities. Agents have availability to several markets that they may not be able to sustain or maintain on their own. We have markets for personal, commercial, agricultural and crop insurance lines. Let us help you get to the next level.

Visit www.ciagonline.com for contact information.

02. Forest Park/Oak Park agency for over 60 years, will meet your needs by providing space, markets, marketing & sales support, automation, merging with or purchasing your agency. Perpetuation/ Succession Plans, Buy-Sell Agreements also available. We have experienced, educated and dedicated staff for you and your clients. Have access to our numerous companies, office services and many other resources. Retain ownership in your book with contingency. Please look closely at us- we are an agency you want to do business with! We’ve done it before, we know howwe make it easy! Visit our website at forestagency.com/ agents.html, or call for a confidential discussion and a list of Agency benefits.

Dan Browne will provide an agency evaluation/ appraisal at little cost to you. Please call:

Dan Browne or Cathy Hall Forest Insurance (708) 383-9000 www.forestinsured.com/mergers-acquisitions

At Grinnell Mutual, we grow long-term relationships with agents and their customers. With us, you’ll build more than just a book of business. We’ll help you build trust by taking care of your customers. Trust in Tomorrow.® Talk to us today.