By Robyn Rivera

By Robyn Rivera

By Robyn Rivera

By Robyn Rivera

Chairman of the Board | Jay Peterson, AFIS, LUTCF (217) 935-6605 | jay@peterson.insurance

President | Kevin Lesch (630) 830-3232 | klesch@arachasgroup.com

President-Elect | Allyson Padilla (618) 393-2195 | allyson@blanksinsurance.com

Vice President | Patrick Taphorn, CIC, CSRM (309) 347-2177 | ptaphorn@unland.com

Secretary/Treasurer | Cindy Jackman, CIC, CISR (800) 878-9891 x8745 | cjackman@arlingtonroe.com

IIABA National Director | George Daly (708) 845-3311 | george.daly@thehortongroup.com

Region 1 | James Sager (618) 322-9891 | james@sagerins.com

Region 2 | Ray Roentz (618) 639-2244 | ray.roentz@hwcrins.com

Region 3 | Christopher Leming (217) 321-3185 | cleming@troxellins.com

Region 4 | Bart Hartauer, CIC (815) 223-1795 | hartauer@hartauer.com

Region 5 | Noele Tatlock (309) 642-6855 | ntatlock@unland.com

Region 6 | Thomas Evans, Jr. (779) 220-6564 | tevans@crumhalsted.com

Region 7 | David Jenk, Esq. (312) 239-2717 | djenk@nwibrokers.com

Region 8 | Charles Hruska (708) 798-5700 | chas@hruskains.com

Region 9 | Lindsey Polzin (630) 513-6600 | lpolzin@presidiogrp.com

Region 10 | Mohammed Ali CS (847) 847-2126 | mali@aliminsurance.com

At-Large Director | Amiri Curry (847) 797-5700 | acurry@assuranceagency.com

At-Large Director | Jeff McMillan (815) 265-4037 | jeff@mcmillanins.com

At-Large Director | Patrick Muldowney (312) 595-7192 | patrick.muldowney@alliant.com

At-Large Director | Luke Sandrock, CIC (815) 772-2793 | lsandrock@2cornerstone.com

Budget & Finance | Cindy Jackman, CIC, CISR (800) 878-9891 x8745 | cjackman@arlingtonroe.com

Education | Lisa Lukens (618) 942-2556 | salibainsurance@gmail.com

Farm Agents Council | Steve Foster (217) 965-4663 | s.foster@ciagonline.com

Government Relations | Dustin Peterson (217) 935-6605 | dustin@peterson.insurance

Planning & Coordination | Nick Gunn, CIC (309) 691-1300 | nickgunn@nixonagency.com

Technology | Brian Ogden (217) 632-2206 | brian@ogdeninsurance.com

Young Agents | Renee Crissie (224) 217-6577 | renee@crissieins.com

Director of Information and Technology Shannon Churchill - (217) 321-3004 - schurchill@iiaofil.org

Director of Education and Agency Resources Brett Gerger, CIC - (217) 321-3006 - bgerger@iiaofil.org

Accounting & Admin Services Tami Hubbell, CIC - (217) 321-3016 - thubbell@iiaofil.org

Director of Human Resources, Board Admin Jennifer Jacobs, SHRM-CP - (217) 321-3013 - jjacobs@iiaofil.org

Sr. Vice President/Chief Financial Officer Mark Kuchar - (217) 321-3015 - mkuchar@iiaofil.org

Chief Executive Officer Phil Lackman, IOM - (217) 321-3005 - plackman@iiaofil.org

Central/Southern Marketing Representative Lori Mahorney, CISR Elite - (217) 415-7550 - lmahorney@iiaofil.org

Director of Government Relations Evan Manning - (217) 321-3002 - emanning@iiaofil.org

Office Administrator Kristi Osmond, CISR - (217) 321-3007 - kosmond@iiaofil.org

Director of Communications Rachel Romines - (217) 321-3024 - rromines@iiaofil.org

Director of Membership Services Tom Ross, CRIS, CPIA - (217) 321-3003 - tross@iiaofil.org

Products & Services Administrator Janet White, CISR - (217) 321-3010 - jwhite.indep12@insuremail.net Director of Prof. Liability & Ins. Products Carol Wilson, CPIA - (217) 321-3011 - cwilson.indep12@insuremail.net

From tools to outdoor signs, our Contractor’s insurance coverages are a great foundation for those in the business of building. Trust in Tomorrow.® Contact us today.

“Trust in Tomorrow.” and the “Grinnell Mutual” are registered trademarks of Grinnell Mutual Reinsurance Company. © Grinnell Mutual Reinsurance Company, 2022.

I want to start off by wishing everyone a fantastic holiday season. If the past few years have taught me anything, it is how important family is and to value the moments we have together.

Relationships are what I would like to focus on this month, specifically the relationships we have with our carriers.

One of the most popular events of our annual convention is the Tradeshow. This year I made it a point to go around and visit every booth to thank them for attending and being part of CONVO 2022.

A common theme I heard amongst the attendees was that CONVO is a great place for them to see and interact with multiple agents. For them, that is especially important in today’s environment because they are having trouble getting to see their agents on a regular basis.

While I don’t want to sit here and preach to my fellow agents, I would like to REMIND you that as independent agents, one of the greatest things we offer to our clients is the ability to provide multiple options. With those options, we offer great relationships with the carriers that offer value beyond just competitive insurance prices.

Our carrier relationships help us understand the marketplace, give us underwriting expertise, discover support programs, provide us claim support, or even may help you write that tough-to-place account. I cannot tell you the number of times I have been sitting with a carrier marketing representative, explaining an account to them that I felt there was no way they would ever consider writing. Lo and behold, they were placing the insurance

Make the TIME to see your carrier. It is worth the investment and part of the process that makes our industry the best option for the insurance consumer.

My book recommendation of the month: Patrick Lencioni, The Ideal Team Player: How to Recognize and Cultivate the Three Essential Virtues – some fun holiday reading for you.

Happy Holidays!

d , a n d t h e r e i s n o n e e d t o d r i v e i n t h e n a s t y J a n u a r y w e a t h e r ! C h o o s e o n e , t w o , o r t h r e e d a y s ( B E S T V A L U E ) E a c h c l a s s i n s t r u c t o r i s e x t r e m e l y k n o w l e d g e a b l e i n t h e i r f i e l d ( r e p r e s e n t a t i v e s f r o m N C C I a n d F E M A , 2 0 + y e a r S t a t e R e g u l a t o r , a n d m o r e ! ) R e a d t h e s p e a k e r b i o s h e r e P l u s t h e P F T A s e s s i o n i n c l u d e s E t h i c s C E c r e d i t

And that’s the Silver Lining®.

It shouldn’t take a storm of immense proportions to find out who your customers can count on.

As the famous Ricky Bobby said, “If you ain’t first, you’re last.” How did you get to be first? You prepare, you plan, and you execute. Seems simple, correct? You need to identify your clients, competitors, and community (the 3 Cs ) that you want to engage. Do you want to be local, regional, statewide, or national? What tools do you need to achieve your agency’s mission and goals? Do you have the infrastructure to achieve your agency’s mission and goals? Do you have the human capital that you need to achieve the agency’s mission and goals?

The common theme here: develop your agency’s mission and goals to achieve that mission. The toughest thing is determining what you want your agency to be and determining the steps needed to achieve that mission. A poorly thought-out or insufficient mission will do more harm than good. Your agency’s mission statement should define who you want to be and the purpose of your agency. Failure to convey that clearly and concisely can confuse everyone involved, which may lead to failure. The first step, determine what you want to be and put it in writing clearly and concisely so that people can buy into what you are trying to achieve.

Secondly, what is your scope? Do I want to be the best local agent and serve my immediate community? Do I want to serve a broader community encompassing multiple towns? Do I want to serve as a statewide agent/broker and resource to help other agencies help their communities thrive? Do I want to cross state lines and broaden my touch into other states to make a difference nationally? Hopefully, the root of all these questions and answers is how you can make a difference. I was always told, “If you aren’t going to make a difference, then why do it?” These are all questions you must answer before moving forward. Over the years, these answers may evolve and change, so you need to plan for that ( I know, more work).

Now, ask yourself these questions: Do I have the tools I need to serve and reach the scope I have chosen? Do I have the technology? Do I have the knowledge to utilize the technology to the best of its capabilities? Is my computer a $1,000 deck of cards (for you solitaire players)? Do I optimize social media to my chosen scope? Do I utilize online chat? Do I partner with insurers that meet my real-time goals? I know, again, with a bunch of questions. These are just some of the questions that you need to answer.

Let’s look at your infrastructure and answer these questions: Do I have offices or spaces that serve no purpose? Do I need more office space? Do I need less office space? Do I need any office space? Your scope will help determine these answers. Infrastructure, in the future, may have out-of-the-box solutions that I would have never dreamed of five years ago. Virtual reality? Who knows? Never say never.

The most important part of the equation is human capital: Do employees buy into what I’m selling? Do my employee’s talents align with the agency’s mission and goals? Do my employees reflect the agency culture? You should know that if I had an agency, the culture would be education driven, and my employees could never have enough knowledge to serve our clients. One of the most important aspects of human capital is having the right administrative people in place to support our workforce. I always said, “If you’re a good agent, you’re probably a bad bookkeeper, and if you are a good bookkeeper, you are probably a bad agent.” Sad but true. The hiring choices you make will determine your fate. I was told by a manager once, “You settle on spouses, not employees.”

Go through this and answer the questions and think through where you are, as time does not stand still. If you stop to smell the roses, your competitor with trample them as they run by you. We must be sharks constantly moving forward but with a dolphin mindset doing it efficiently and smartly.

Finally, work smarter and harder (not a misprint). Utilize what we provide with respect to education (www.iiaofil. org/Education) and solutions (www.iiaofil.org/Resources). Use the easy button when you can, as that is why we are here. Then you can focus on answering all of the above questions.

Should you have any questions regarding this issue, do not hesitate to reach out to me directly. The first five agencies to email me their mission statement will receive a Starbucks gift card.

As always, this is just Brett’s 2 Sense and I hope it was helpful. If you need any clarification or have any suggestions for future articles please email me at bgerger@iiaofil.org.

Gerger | IIA of IL Director of Education & Agency Resources bgerger@iiaofil.org | (217) 321-3006

As your new national director, I wanted to share some information with all of you. First, there is some important leadership information that is worthy of communication to our membership. I want to announce the Big “I” Board of Directors elected our very own Greg Sandrock as the newest at-large Executive Committee member. This is a big deal for Illinois as Greg is now on a path to becoming National Big I Chair several years from now. Greg’s term began immediately following the September Big “I” Board meeting.

In addition, I would like to include a summary of the recently published Agency Universe Study. This study provides a comprehensive look at the entire independent agency system. The study details statistics about independent insurance agencies, including information about revenue, employee mix, ownership structure, the mix of products and segments, technology, marketing, and much more. I encourage you to learn more by accessing the entire Agency Universe Study on the Big “I” website.

Key findings from the Agency Universe Study are on the next page.

Also, IIABA President & CEO Bob Rusbuldt, the longestserving CEO of the association, announced that he will retire on August 31, 2023, after 37 years. It was announced that the long-time Big “I” head of Government Affairs, Charles Symington, will become IIABA’s next President & CEO on September 1, 2023. On behalf of the IIA of IL membership, I congratulate Greg, Bob, and Charles. We are so thankful for their amazing service.

George Daly - IIA of IL National Director - IIABA - (708) 845-3311 - george.daly@thehortongroup.com

The number of independent insurance agencies has increased and business conditions for agencies remain favorable, according to the 2022 Agency Universe Study. While the majority of agencies reported revenue increases, the percentage is lower than in the previous study released in 2020.

Future One, a collaboration of the Big “I” and leading independent agency companies, has released key findings from the recently completed Agency Universe Study, hailed as the most comprehensive look at the independent agency system.

“The 2022 Agency Universe Study shows the resiliency of the independent agency system as it continues to grow and adapt through the challenges of the last couple of years,” says Bob Rusbuldt, Big “I” president & CEO. “It is amazing that during the pandemic the independent agency system added nearly 4,000 new agencies. The study also offers insights on how agencies can better prepare themselves for the future. Staffing and marketing are issues for agencies, and the Big ‘I’ continues its support of independent agencies through resources, programs and guidance to face these challenges head-on.”

The study looks at many statistics about independent agencies operating in the U.S., including their numbers, revenue base and sources, number of employees, ownership, mix of business, diversification of products, technology used, non-insurance income sources and marketing methods.

“As the independent agency channel recovers from the coronavirus pandemic and weathers economic uncertainties, technology adoption continues to prove itself critical to continued success,” says Chris Boggs, Big “I” vice president of agent development, education and research. “Agencies are demonstrating flexibility and progress in digitalization as the insurance industry works together to incorporate tech solutions that support agents’ roles as trusted advisors.”

1. The number of independent agencies has increased. In 2022, the estimated total number of independent property-casualty agents and brokers in the U.S. stands at 40,000, an increase from 36,000 in 2020. While mergers & acquisitions activity continues to impact the agency channel, the increase in the number of agencies is driven by small agencies, as agents continue to establish their own agencies or move from the captive to independent space.

2. Business conditions continue to be generally favorable. The majority of agencies - 62% - report increases in total revenue between 2020 and 2021, but this proportion is lower than the 70% in 2020. Twenty-five percent report a decline in revenue, with an average decrease of 22%. In particular, fewer agencies report personal lines revenue increases in 2022, 60% compared to 67% in 2020. More than 1 in 5 say the pandemic has impacted their operations and revenue.

3. Technology has become a crucial part of operations and customer service. Nearly half (47%) say they have offered more digital solutions to clients due to the pandemic. Usage of mobile apps from carriers has increased to 40%, up from 32% in 2020, and apps for clients has increased to 20%, up from 10%. Most agencies would be comfortable allowing clients to self-serve for policy documents and identification cards, at 77%, while 2 in 3 are open to self-service for billing inquiries and claims filings. Nearly half are planning to offer online purchase and quoting to customers in the next two years.

Challenges with technology continue, with 41% of agencies citing dealing with multiple carrier interfaces as a challenge. While only 7% currently use a commercial lines rater, 23% are planning to do so. One-third see the need for more carrier application programming interface (API) integration with agency management systems (AMS). And 51% are looking for more operating efficiencies to help service customers.

4. Principal aging remains stable. The average age of agency principals is 54 years old, with 17% age 66 or older. More than 8 in 10 agencies have a perpetuation plan, on par with 2020, but it often centers around children and family. Similar to 2020, 4 in 10 agencies anticipate some ownership change in the next five years.

5. Finding qualified staff and marketing continue to be key agency challenges. Forty-one percent find it challenging to find and screen job candidates with strong potential, the No. 1 challenge of 2022, which gained slightly from 39% in 2020. The second most challenging issue is having a significant marketing or advertising budget at 36%, up from 30% in 2020. Other key concerns include obtaining enough leads (35%); growing commercial (35%) and personal lines (32%); making the personnel, tech and other expenditures necessary to grow significantly (33%); investing in a strong online presence (32%); and remaining competitive with InsurTech direct carriers (31%).

6. Emerging purchase channels’ impact on personal lines remains a concern. Agencies continue to express concern about emerging purchase channels’ impact on their business, with 35% of agencies believing personal lines direct purchase through the insurance company will significantly impact their agency over the next two years, the same percentage as in 2020. Thirty-three percent of agencies are also concerned about direct purchase through non-insurance websites, and 32% are concerned about direct purchase through car manufacturers. One in 4 express similar concerns about small commercial direct purchase or purchase through emerging online providers.

7. Inclusion gains some ground. In 2022, 47% of agency principals are women, a gain from 42% in 2020, and 83% are white, compared to 88% in 2020. Medium-sized and larger agencies are especially likely to have male principals or senior managers. One in 4 agencies have added staff this year, and 19% are leveraging independent contractors, primarily producers.

By AnneMarie McPherson SpearsThe 2022 Agency Universe Study was first conducted in 1983. Since 2002, the study has been completed biennially. Since 2004, the Agency Universe Study has relied on internet data collection. In total, 1,452 respondents were included in the 2022 study, conducted by Zeldis Research in cooperation with Future One.

To order a copy of the 2022 Agency Universe Study Management Summary, which provides an overview of the highlights from the complete study, visit the Big “I” Agency Universe Study webpage.

In addition to the Big “I,” the Future One coalition includes the following company partners: National General, an Allstate company; Amerisure; Central Insurance Companies; Chubb; CNA; Foremost, a Farmers Insurance company; Grange Insurance; Hartford Steam Boiler (HSB); Liberty Mutual Insurance/Safeco; Nationwide; Progressive Insurance; Selective Insurance; The Hanover Insurance Group; The Hartford; Travelers; and Westfield Group.

AnneMarie McPherson Spears is IA news editor and can be reached at annemarie.mcpherson@iiaba.net.

“The 2022 Agency Universe Study shows the resiliency of the independent agency system as it continues to grow and adapt through the challenges of the last couple of years.”

No agent ever said they enjoy wasting time. But they have said fast online quoting with a clear understanding of appetite is key to a successful partnership.

UFG Insurance listened.

Welcome to a better way to work online — because you deserve it.

Get down to (small) business with this robust businessowners policy, including select endorsements to take coverage to the next level.

Get from start to bind with fast efficiency thanks to smart tools and straight-forward appetite within this enhanced quoting experience.

UFG’s rejuvenated online experience isn’t about being better than others — it’s about being better for agents like you. Explore our simple solutions for complex times and experience service aimed to exceed expectations.

ufginsurance.com/online

By Robyn Rivera

By Robyn Rivera

Insurance is a referral-driven business, and it used to be that smaller, independent agents relied exclusively on that channel for new business.

But today, there are so many affordable ways for smaller businesses, like local insurance agencies, to market that it’s not only worth it but essential that you do some marketing.

Opportunities are mainly online. With low-cost website marketing and hyper-targeted social media ads, insurance agents can create a local brand. Referrals are still essential, but they tie in with online reputation.

Here are some of the essentials for marketing an insurance agency today. Execute these, and your local brand and lead generation will keep you busy and growing.

Today, it’s rare to meet a client face to face before they’ve looked at your insurance website. It’s just second nature for consumers to “feel out” a business online. This is true of both referrals and new leads.

It’s important, therefore, that your website makes an excellent first impression. You need a clean, modern design that radiates expertise.

This is a conversion-based website design, meaning that its primary goal is to get leads to contact the agency. A phone number and request an estimate form are front and center.

Many insurance websites also offer gated content or an email newsletter sign-up to capture emails. This is effective for nurturing leads who are still researching their insurance options.

Professional website designs are neither expensive nor time-consuming to build when you choose the right website builder. There’s no reason for an independent agent to have a sub-optimal website.

Pro Tip: Offer Useful Information

For insurance agents, information is a lead-generation tool. People are confused by insurance, so when you answer questions, you earn trust.

Blog, send an email newsletter and create social media posts that provide useful info on insurance. This will help you nurture leads, stay top of mind with current clients and improve your website SEO.

Create some videos, and put them on your website, social media and YouTube channel.

Also, use visuals, like an infographic.

Tip

When you offer insurance, the main thing leads want are estimates. We live in the world of Geico’s “15 minutes” and Progressives’s “price tool.”

Digital consumers expect speed. Make them wait, and you lose the lead.

It used to be common for independent, local agents to mesh a free consultation with providing estimates. At one time, it was possible to arrange face-to-face meetings based on the premise of providing an estimate.

If you try to do this now, you’ll kill your lead generation. Today, you have to provide real-time quotes.

Streamline your quote process, and use it as an introduction for new leads. Use it as a gateway to providing other consultative services that are of high value coming from a local agent.

While your website content is vital, there is another type of online content equally important: online reviews.

Today’s consumers check online reviews for most services, including insurance agents. What’s said about you in those reviews has a big influence on their decision to work with you.

This starts with your service itself. Realize that everything you do with clients impacts your marketing. Today a business must make customer service part of their culture. When in doubt, put the customer’s needs first. Overwhelm people with your service.

Also, follow up with people to encourage them to review you. Mention it in phone call followups, or follow up with an automated email, like the one on the left.

Try to get reviews on the major platforms, including Google, Top Rated Local® and Facebook. Do not solicit reviews for Yelp as they have a strict policy against it.

Keep an eye on what’s said about you, and respond to anything negative. Reviews are also a great place to get customer feedback that can help you improve your service.

There are still a lot of independent insurance companies that don’t do a good job of gaining or highlighting reviews. If you do, you’ll have a strong competitive advantage with your lead generation.

Another excellent way to be proactive about customer comments is to put testimonials on your website. This is a way to get positive comments in front of people before they go searching third-party sites.

You can have a testimonials page, but what’s more effective is spreading the content around your site, close to your calls to action. Video testimonials are also really effective.

Most insurance websites make grand claims about the value they offer and how much they care about their clients. But they offer little proof.

Instead of you saying how great you are, let your clients say it. It’s more persuasive with today’s audiences.

Also, there are widgets that allow you to embed reviews from Google or Facebook, and the Top Rated Local badge links to that site where all your reviews are together with a rating score.

No leads are hotter than those that come through referrals. Encourage clients to send you referrals with a rewardsbased program.

The best way to run a referral program is to have a small gift just for a referral that results in a quote. You can also have monthly and yearly drawings.

Make sure current clients know about your referral program. You can also use social media posts to update people on monthly or annual drawings.

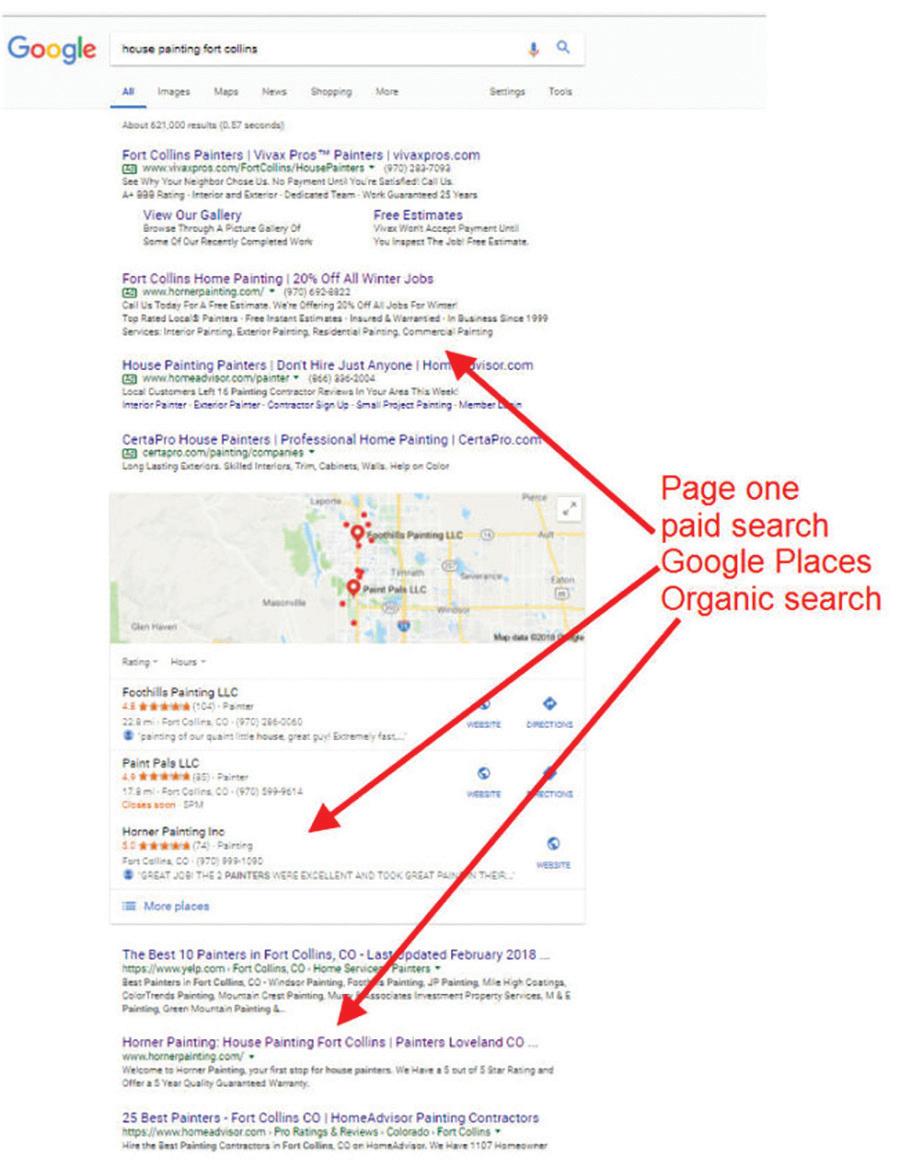

To drive traffic to your website, you’ll want to show up for insurance-related searches in your area. There are three ways to dominate the search results.

The first is pay-per-click advertising. These ads are run through auction-based systems, like Google Adwords and Bing Ads. The main advantage here is that you show in the top positions (reserved for paid ads) and that you can control the ad copy and landing page. For example, you might want to run an advertisement for hail damage insurance after a big storm. Your ad and the page it goes to on your website can match that offer. You can even target the ad so it only displays in the area with the most damage.

Next, you need to set up your Google Business Profile. This is the maps listing and review platform Google uses for geo-targeted searches. It’s a free listing you can optimize with your descriptions and by getting customer reviews.

Then you have the organic website listings. These are also free clicks, with ranking gained by optimizing your website for keywords, gaining links, getting social media traffic and adding content to your blog.

If you do each of these tactics effectively, you can show up in three places on page one:

A promotional video is a fast, effective way to communicate the value you offer.

Embed your video on your website homepage and on your Facebook business page. Optimize for local search (insurance + city name) for YouTube searches, which are easy to rank for.

A professional video is an investment that can pay off years.

There are a lot of options when it comes to insurance today - too many options. So why should someone choose to work with you?

Many independent agencies don’t really have a solid answer to that question because they don’t have a unique value proposition (UVP).

A UVP is an area in which you excel. It’s a service only you offer. It’s the specialized solution you have that solves a particular problem, and it’s the reason you’re a better choice than the competition.

With the legal marijuana industry booming in Colorado, this represents a major business opportunity for this agent.

Most independent agents make claims about their personalized services and the advantages they offer over big, national insurance companies. That’s a legit UVP, but be aware you may have to get even more specific by developing a specialization.

Consider things like types of events or accidents, health conditions, business verticals or financial considerations that give you a specialized edge.

You can advertise on Facebook and Google with retargeting banner ads.

Retargeting ads display to people who’ve previously visited your website or Facebook page. These banner ads remind them of your brand and motivate them to come back to your site.

Retargeting works well because people online tend to hesitate and get distracted. These ads are a gentle reminder that they need to get more insurance.

Facebook advertising is a remarkable tool. It allows you to target audiences based on precise demographics, life events and interests.

You can even take the list of your current clients and create a lookalike audience, which is just what it sounds like - a group with many similar characteristics to your client list.

You can also retarget both people who visited your website or interacted with your Facebook or Instagram pages.

It’s important to create a Facebook business page so you have a marketing presence there. You probably won’t get much of an organic following for your posts, but many people will look you up on Facebook to feel you out, much as they do with your website. You can set up an estimate request form and communicate with leads directly on messenger.

Facebook is another tool in your arsenal that’s effective at capturing and nurturing leads.

If you’re thinking all this digital marketing sounds like it would be difficult to track, you’re right. It’s a real challenge to keep up with all the channels, changes in technology and new communication trends.

The right marketing software is the key to success. First, you need to use customer relationship management (CRM) software to track activity with leads and clients. For insurance agents, this is a must just so you can stay organized.

But it’s also a great way to track the customer journey from lead to long-term client.

The Marketing 360® CRM is part of the comprehensive insurance marketing platform that integrates all the marketing channels we’ve discussed here, as well as email marketing. It’s an all-in-one platform that has everything you need. Plus, work with their marketing team at any time to take your growth to the next level. Find out more at www.marketing360.com.

This article was originally published on the Marketing360® Blog at https://blog.marketing360.com/local-advertising/ how-to-market-an-insurance-agency-insurance-marketingideas-tips-and-lead-generation-strategies/

Robyn Rivera has been a Content Marketing and SEO Specialist at Madwire® since 2013 and has experience writing content for small businesses from a variety of industries. As the Brand Content Manager, she manages the Marketing 360®, Top Rated Local® and Websites 360® blogs. She also loves helping small businesses grow and their local communities glow!

Today, there are so many affordable ways for smaller businesses, like local insurance agencies, to market that it’s not only worth it but essential that you do some marketing.

In insurance, the buyer-seller relationship is complex.

Business owners - the buyers - want to protect their business, identify newly emerging risks and seek data to make more informed decisions. Insurance producers - the sellers - want to engage in professional relationships, be a valued partner and help business owners protect their assets, employees and sustainability. Given that, it is logical to assume that buyer and seller goals and objectives are aligned.

However, getting to a place of alignment can be challenging. Meaningful dialog is often difficult to initiate, and buyers are usually overwhelmed with day-to-day business activities. Meanwhile, producers struggle to capture the attention of prospects, who often favor the status quo and incumbent relationships.

Creating and maximizing appointments with prospects and driving growth with existing clients frequently hinges on the ability to connect, pique curiosity and lead change behavior. Often, what is lacking is a set of core beliefs that can be used as an anchor to inform messaging, initiate meaningful dialog and shift perceptions.

In sales, assertions and statements should be avoided because they can perturb buyers and build walls that create additional barriers to a productive relationship. However, there is a place for statements and assertions, particularly when they are used for positioning purposeful conversations.

Three core belief statements that our consulting practice encourages producers to share with prospects and clients include:

• The vast majority of businesses are unknowingly at risk.

• The process many business owners follow to make insurance buying and risk management decisions is flawed and potentially dangerous to the business.

• A business is frequently better served when one agency manages all of its insurance and risk management programs.

These are powerful belief statements. If believed to be true by the producer, these statements can serve as a framework for creating alignment with their buyers because they are focused on the buyer, not the producer.

• The business is assuming risks unknowingly.

• The buying process is preventing the business from identifying business risks and the most effective way to avoid, accept or transfer them.

• Multiple broker relationships are failing to address interrelated risks that require property-casualty, health and personal lines producers to work together.

The set of core beliefs above would also prevent a producer from:

• Assuming that the current policy is accurate or adequate.

• Engaging with a prospect who believes that the only value a producer brings is the opportunity for savings.

• Failing to discuss integrated risks.

Core beliefs work as a north star. Once embraced, it is difficult to support behaviors that would go against them.

For core beliefs to be impactful, they must be more than just a list of statements. They must resonate and be believed deeply by the seller.

Here are some questions to consider to help create your core beliefs:

• What barriers exist that prevent my buyers from achieving their goals and objectives?

• What are the top three to five risks that could limit my buyer’s competitiveness and sustainability?

• What status quo mindset or processes must be disrupted to help my buyers make informed decisions?

• How does my approach compare to my competitors and how does it reduce the likelihood of risks for my buyers?

When producers spend time considering these questions and developing a core set of beliefs and corresponding statements, they can develop their own north star— their set of values that provide context for meaningful conversations.

Susan Toussaint is vice president, growth solutions with ReSource Pro. For more than a decade, Susan has been training, coaching and developing programs to help insurance professionals overcome barriers to organic growth.

IPMG’s Claims Management Services division (CMS) is that partner. As a full-service claims management company, IPMG CMS accepts the responsibility and expects to be held accountable for the results we achieve on behalf of our clients.

» Workers’ compensation claims management

» Property and liability claims management

» Auto liability and physical damage claims management

» Professional liability claims management

» Strong emphasis on public entity and long-term care sectors

» Nurse case management

» Risk management/loss control

» Medical bill review

» Pharmacy benefit management

» Aggressive litigation management

» Utilization review

» Electronic claim reporting with immediate acknowledgment and adjuster assignment

» 4-hour assigned adjuster contact on every claim

» Online claim review including adjuster notes and financials

» Industry leading analytics with national database for benchmarking purposes

» Adjuster book of business analysis – to ensure workload does not affect service levels

» Closing ration analysis – a monthly review to ensure adjusters are achieving maximum production

» Claims diary tracking

» Formal litigation handling guidelines and practices

» Comprehensive medical bill review – average 59% cost reduction

» Pharmacy benefit program – average 35% cost reduction

» ISO claims search

» Medicare section 111 data reporting and compliance

For more information please contact:

MIKE CASTRO

Sr. VP, Claims Management Services

Mike.Castro@ipmg.com 630.485.5895

BOB SPRING

VP, New Business Development

Bob.Spring@ipmg.com 630.485.5885

Many independent insurance agencies have ideas about how to reach their audience through marketing, but often these ideas are not formed into a strategy that can provide consistent action and measurable results. Let’s address some of the most common areas where a strategy could be developed.

When you add new clients you have a small window where you can impress them and begin developing brand loyalty. The keys to this are often answering their questions before they have them:

• What will they need to do if they have a claim?

• How can they easily access their policy information?

• Who do they need to contact and for what (their agent, CSR, etc.)?

• Where can they view information from your agency (website, app, social media, newsletter, etc.)?

Provide this in a branded and easy to use manner and you’ll immediately make an impact.

Some of your best new business opportunities come from referrals and reviews. How are you harnessing this with marketing? Are you asking for Google reviews? Are you giving people an easy way to refer business to you? Are you making them aware of complimentary lines of business that could round their account?

Many clients complain that they only hear from their agent at renewal time or if they have a claim. Many agents tell us they’re happy with that status quo. Why? Those conversations don’t have to be negative, unless there is another reason they would be unhappy. Use thoughtful outreach to check in during their term, whether it is at midterm or on specific dates like birthdays. You may find that you learn about changes that need to be made to their policy or other opportunities you might have missed.

Independent agents are some of the most consistent businesses in country when it comes to impacting their community. They help with charities, contribute to nonprofits, and sponsor countless activities. How do let people know about your advocacy? It doesn’t have to be selfserving. Use it as a way to promote the cause itself through your platforms. Keep a “humble” tone in your marketing language and you will find it can have a significant impact.

Often times, I talk to agencies that have an AMS, a CRM, a marketing portal, a social media scheduling tool, and other technology for their agency. Many times, these aren’t be utilized fully, and sometimes not at all. If you develop a marketing strategy and these programs don’t help you implement it, get rid of them.

The above are just a few of the ways you can plan for your agency’s marketing strategy. One additional thing to keep in mind is your goals for this marketing. Once you’ve developed a plan, set goals for it and then measure your results throughout the year. Utilize tools like social media statistics, email open rates, website/search traffic, and new/ renewal business trends to track your outcomes.

I believe you’ll find that being intentional makes a world of difference.

Daniel Smith, CAE, is the Chief Marketing Officer and co-founder of Market Retrievers, a digital marketing firm focused on building and implementing strategies for independent insurance agencies. He previously worked for the independent agents association in Tennessee for over 14 years and served as the CMO and COO. He is also a licensed P&C agent. He may be reached at dsmith@ marketretrievers.com.

Giving back in a meaningful way to the people your agency serves is a time-tested win-win that provides a range of benefits to the community. Similarly, it helps grow your organization by generating new business leads, differentiating your brand, promoting your values, building staff morale, widening your social circle and receiving invaluable insights into the local ecosystem.

But what are the best strategies for growing relationships in the area your agency operates? Here are some tips to consider on how to optimize your resources and maximize community engagement.

The first thing to consult is a mirror. What are your values? Where do your strengths lie? And, of course, how much free time do you have?

Community engagement can be as simple as hanging a poster in your office window or as involved as hosting an annual charity event, fundraising for a cause or founding a new recreational club. The spectrum of possibilities is broad enough to encompass just about any schedule, personality type or agency profile.

Whatever path you choose, it ought to showcase your strengths. If patience, communication and strategic thinking are your strong suits, maybe coaching a local sports team is for you. If teamwork, communication with many personality types and perseverance are fortes, perhaps volunteering at a nonprofit is a possibility.

If public speaking is a strength, sharing your expertise via speaking engagements is also an option. Thought leadership can be its own form of community engagement. The topic can be anything in which you have a deep understanding or technical skill. But always conduct webinars, lunch-and-learns, industry meetings and other similar events with thought leadership in mind rather than developing sales opportunities.

Looking beyond the personal, ask your staff what issues are relevant to them and their communities. Consult members and other professional contacts for ideas and feedback. For online resources, check out volunteermatch.org and createthegood.aarp.org, which let you search volunteer opportunities by location, cause and other variables.

You might also consider organizations with which Nationwide has had longstanding corporate partnerships, including American Red Cross, Feeding America, Nationwide Children’s Hospital and United Way. Each year, a significant number of our associates across the country donate dollars, time and energy to important causes and charities through workplace giving and volunteerism.

“When choosing where to donate, fundraise or volunteer, give more weight to causes that overlap with your and your community’s values. Keep in mind consumers are increasingly taking note of the ideals their brands support. Our Agency Forward research found that 84% of consumers said they place high value in working with an agency that gives back to the community.”1

Once a project is chosen, try to involve your associates as much as possible. Schedule permitting, consider allowing volunteerism to occur during business hours, providing your staff with a welcome break from their daily routines.

Also, while socializing during events, don’t focus exclusively on rubbing shoulders with prominent figures, business owners or community leaders. Not only does this come off as opportunistic, but it’s also a poor business strategy. After all, good leads can come from citizens and residents just as easily as they can from the founder of an organization.

Community engagement should occur in an organic, easygoing manner. There should never be any hint of highpressure sales or marketing efforts. Remember, the goal is to brand yourself as a resource rather than a salesperson.

That being said, there’s no reason the world shouldn’t know all about your engagement efforts. Be sure to capture engagement activities in video and pictures, and then share them on social media, your website or the agency newsletter.

Consider these best practices for documenting your community engagement efforts:

• Designate a photographer, someone with a camera or a good smartphone. Test it beforehand to ensure quality.

• Make a list of photos and videos you want - such as group shots, before-and-after images of a project or interviews with staff - prior to the event.

• Whenever possible, shoot images in various candid, posed, landscape and vertical orientations to provide multiple options over a range of platforms.

• Get everyone’s full name and correct spellings so captions will be accurate and inclusive.

As an added benefit, such community service efforts can serve to reach new pools of potential associates. In the changing labor market brought on by the pandemic, more individuals are reevaluating their work life and searching for fulfillment beyond a paycheck. A report by McKinsey & Company noted the insurance industry’s increased willingness to work together toward common philanthropic goals and millennials’ growing influence on the types of charitable efforts in which it engages.

Working with carriers like Nationwide that are committed to these efforts can help clients feel well-protected and that they are contributing to making the world a better place. For example, in 2020, Nationwide invested $173 million in renewable energy and $375 million in green bonds. That same year, our involvement provided more than $256 million to support affordable housing.

1 These insights and more were uncovered through Nationwide’s ongoing Agency Forward (formerly Agent Authority) research series, which includes samples of independent insurance agents, various business owners, and consumers.

With a team of seasoned professionals with a collective 50 years of experience in their respective areas of expertiese, you can be assured we understand and value you and your agency.

Jeff Smith, JD, CIC, CAE

Chief Executive Officer jeff@iavaluations.com

Jodie Shaw, CLCS, CPIA, TRA Director - Business Development jodie@iavaluations.com

Luke Hippler, MBA Valuation Analyst luke@iavaluations.com

Craig Niess, CVA, MBA Director of Business Planning & Valuation craig@iavaluations.com

You wouldn’t leave money on the table anywhere else, so why would you do it with your agency? Simply believing that your agency is worth some multiple of revenue (2x) could be an expensive mistake. So many factors go into a true calculation of agency value. Get a professional analysis and complete a valuation that only the experienced team at IA Valuations can provide.

Here are just a few reasons why you should get started with a valuation:

You have growth ideas but no plan. Start your planning by understanding where you are. Gain an analysis and insights on how to optimize your agency value, growth opportunities, and risk factors.

PLANNING FOR YOUR NEXT CHAPTER

Understanding what your agency is worth will strengthen your position in your negotiations with prospective partners and buyers. So much goes into what your agency is worth. Don’t sell yourself short on your life’s work.

For agencies that plan to transition ownership, an annual valuation and plan will ensure that you are on track to transfer your business for the value and manner in which best suits your clients, legacy, family, and team.

READY TO GET STARTED? Get in touch with us! (800) 555-1742 • contact@iavaluations.com • iavaluations.com

A T R A D I T I O N O F T R U S T . W H A T W E D O

In order to best plan for the future, an agency owner must consider three main components: their business, financial and personal readiness. Of those three areas the most overlooked area is by far the owner’s personal readiness.

Many business owners have spent their lifetime working in their business, and the thought of not doing that every day is in a word - terrifying. They have no idea how they will spend their days if they are not working in the business that they have called home for most of their life. The business has become such a huge part of their identity, social life and sense of accomplishment that the thought of no longer having a part of their daily life is unthinkable. It is often the reason that so many business owners put off planning for the future of their business as they do not want to wrestle with what’s next for them.

Sadly, this avoidance and lack of planning often leads to limiting their options – or worse yet – their business not realizing it full value. In order to think about what the next chapter of your life may be after you transition ownership of your agency, ask yourself some of these key questions:

• What experiences have I always looked forward to having?

• What are some ways that I would love to give back to my community, family, industry or group?

• What are some key interests or hobbies that I have never been able to commit enough time and energy to?

• Are there places that I wish to visit, people I would like to spend time with or things I have always wanted to learn more about?

For those that have spent the time and given this topic a fair amount of consideration, they are ready. The have thought about all of the things, experiences and activities that they are passionate about and/or bring them a great sense of peace and satisfaction. They have hobbies, plans and a well-defined “bucket list” of items that they want to accomplish. This can include travel, volunteering, spending time with family, becoming a mentor, or even starting a different business or career.

By going through this exercise their future can start to take shape and they can answer the question of what they will need financially to be prepared to build out the next chapter of their lives. It will inform the second part of the plan which is - financial. What will I need for the next chapter?

Once your personal and financial goals have been contemplated and defined, planning for your business becomes much easier. You will be able to assess the value of your business today and combine it with the assets you have outside of your business to determine if you are well prepared to retire successfully. For some, they may determine that there is a gap between the assets that they have today plus their current business value and what they need to retire. For many, once they have defined this gap, it can serve as the roadmap for you to grow your agency’s value an create the future you have envisioned for yourself. It may also help you determine and define the options you will consider for the transition of your agency.

Without considering your personal, financial and business readiness, your plan is incomplete and increase the likelihood of making decisions that are uninformed and ones that you may ultimately regret. For more information about planning for your future, visit www.agency-focus.com.

Carey Wallace is the founder of AgencyFocus, an independent insurance agency consulting organization. She has worked in the insurance industry for the last 12 years and with entrepreneurial small businesses for her entire career. During that time, she developed key business consulting services to ensure that agencies have the information and support they need to plan for their agency and successfully perpetuate to the next generation. Find out more at agency-focus.com.

IS THE BUSINESS READY?

Do you have the plans in place to successfully transition your business to the next step(2)?

ARE YOU FINANCIALLY PREPARED?

Are your personal finances in a stage where you can afford to retire and live the lifestyle you want?

ARE YOU PERSONALLY PREPARED?

Do you have personal goals and plans for using your time? Are you prepared mentally to not be involved in your agency?

The Donald Gaddis Co. team and their families reently celebrated their 40th anniversary at a fun weekend at the Grand Geneva Resort in Wisconsin. The company has had a fantastic 40 years as an independent wholesaler brokerage and look forward to many more. IIA of IL has been a great partner in helping us grow and prosper, and we couldn’t appreciate that relationship more. This trip was particularly special, because we all work almost exclusively remote now, so it was great to catch up together in person.

distance calls were too pricy. It was a very soft market, but the little company had a ton of heart and chutzpa, negotiated contracts with great carriers, and wrote enough premium to pay the bills.

In 1985, the hardest market ever hit the insurance business. Sled hills closed because no one would insure them. Premiums doubled or tripled, if coverage was even available at all. The company got big enough for Dad to bring in my brothers and me. Dad sadly passed away very young in 1997. I’m sure he’s watching over us between golf rounds and super excited about how amazing his little company has become. We now have a team of 26, placing business nationwide for thousands of agents with scores of carriers. We have been blessed over the years to bring in team members who share his core tenants of passion, integrity and competence. They have been and always will be, our most important asset.

JM Wilson has announced the addition of two new hires.

Jaime Fenimore has been hired as Brokerage Underwriter. Fenimore is responsible for underwriting a wide variety of new and renewal professional and brokerage accounts, as well as maintaining relationships with carriers and independent insurance agents in all states that JM Wilson writes business.

Before joining JM Wilson, Fenimore worked for a private health insurance company as a Medicare Sales Representative. Prior to that, she was in general insurance sales for an agency. Fenimore is a graduate of Penn State University where she earned a Master of Science degree. She has also earned a CPCU (Chartered Property Casualty Underwriter) designation.

Here is a little fun history on how the agency got to where they are now, according to Chris Gaddis, president:

Donald Gaddis Co. exists because Donald Gaddis was a free spirited, entrepreneurial, gutsy and fun loving guy, and also because he was a botany major. Naturally, a botany major was going to end up working for an insurance company, and so he did, at a life insurance company in California. Then one day he got a call out of the blue to join a high risk, taxi cab insurance company in Chicago. Our young family moved out here and then that company soon tanked, but specialty underwriting got in his blood, and he loved it.

He eventually went on to run a large wholesale brokerage in Chicago. When they were acquired by a national carrier, they wanted him to stay in the office and write procedure manuals, instead of going out and doing deals. He wanted nothing to do with that, and in October of 1982 he took his small profit sharing balance and started DG Co. on a shoe string with three of his coworkers.

Their little office in the Insurance Exchange Building had old used metal desks and a linoleum floor. Applications and policies were manually typed and mailed, and communications with London were by telex, because long

Ryan Streit has joined JM Wilson as Surety Bond Manager. Streit is responsible for overseeing all aspects of the surety department including the placement of risks, making informed and timely underwriting decisions, as well as helping to provide outstanding service and growing relationships with our partner agents, their customers, and our carriers in all states that JM Wilson writes.

Streit joins JM Wilson with 10 years of experience as an underwriting manager for a surety company. He earned a Bachelor of Science degree from the University of South Dakota, and an MBA in Business Administration from the University of Sioux Falls.

JM Wilson has also announced the promotion of Heather Pifer to Senior Property & Casualty Technician in their Portage, Michigan office. Pifer has been with JM Wilson since 2018 when she joined as a Property & Casualty Technician. With her promotion, Heather is responsible for processing commercial and personal lines policies and endorsements, assisting JM Wilson underwriters, training teammates, and serving independent insurance agents in all states.

AmTrust North America

Auto-Owners Insurance Co.

Badger Mutual Insurance Company

Berkley Management Protection

AAA Insurance Arlington/Roe BlueCross/Blue Shield of IL Grinnell Mutual Reinsurance Company

Keystone Insurance Group, Inc. Pekin Insurance

Imperial PFS

IMT Insurance

West Bend Mutual Insurance Co.

Bronze Level

Insurance Program Managers Group

J M Wilson

Liberty Mutual/Safeco Insurance

Madison Mutual Insurance Company

Berkshire Hathaway Guard Insurance Companies

BluSky Restoration Contractors

Central Illinois Mutual Insurance Company Chubb ClickVSC

Columbia Insurance Group

Continental Western Group

Cornerstone National Insurance Company

Cowbell Cyber CRC Group

CRDN of Chicago (formerly Restoronics)

Donald Gaddis Company, Inc.

Donegal Insurance Group

EMC Insurance

Encova Insurance

Family Financial Solutions Group

Foremost Choice Property & Casualty

Forreston Mutual Insurance Company

Frankenmuth Insurance

Grange Insurance

Homeowners of America Insurance Company

Illinois Mine Subsidence Ins. Fund

Illinois Public Risk Fund

Indiana Farmers Insurance

Main Street America Insurance Marble Box MarshBerry

Maximum Independent Brokerage, LLC Mercury Insurance Group Method Workers Comp Midwest Insurance Company Nationwide

NHRMA Mutual Workers’ Compensation Pouch Insurance

Previsor Insurance & Missouri Employers Mutual PuroClean Emergency Restoration Services Rockford Mutual Insurance Company

RT Specialty - Naperville Sensa, Inc.

ServiceMaster DSI

Society Insurance

SPRISKA - Specialty Risk of America Synergy Select

The McGowan Companies

Travelers

UFG Insurance

UIG - The Agent Agency

Utica National Insurance Group W. A. Schickedanz Agency, Inc./Interstate Risk Placement Western National Insurance Westfield

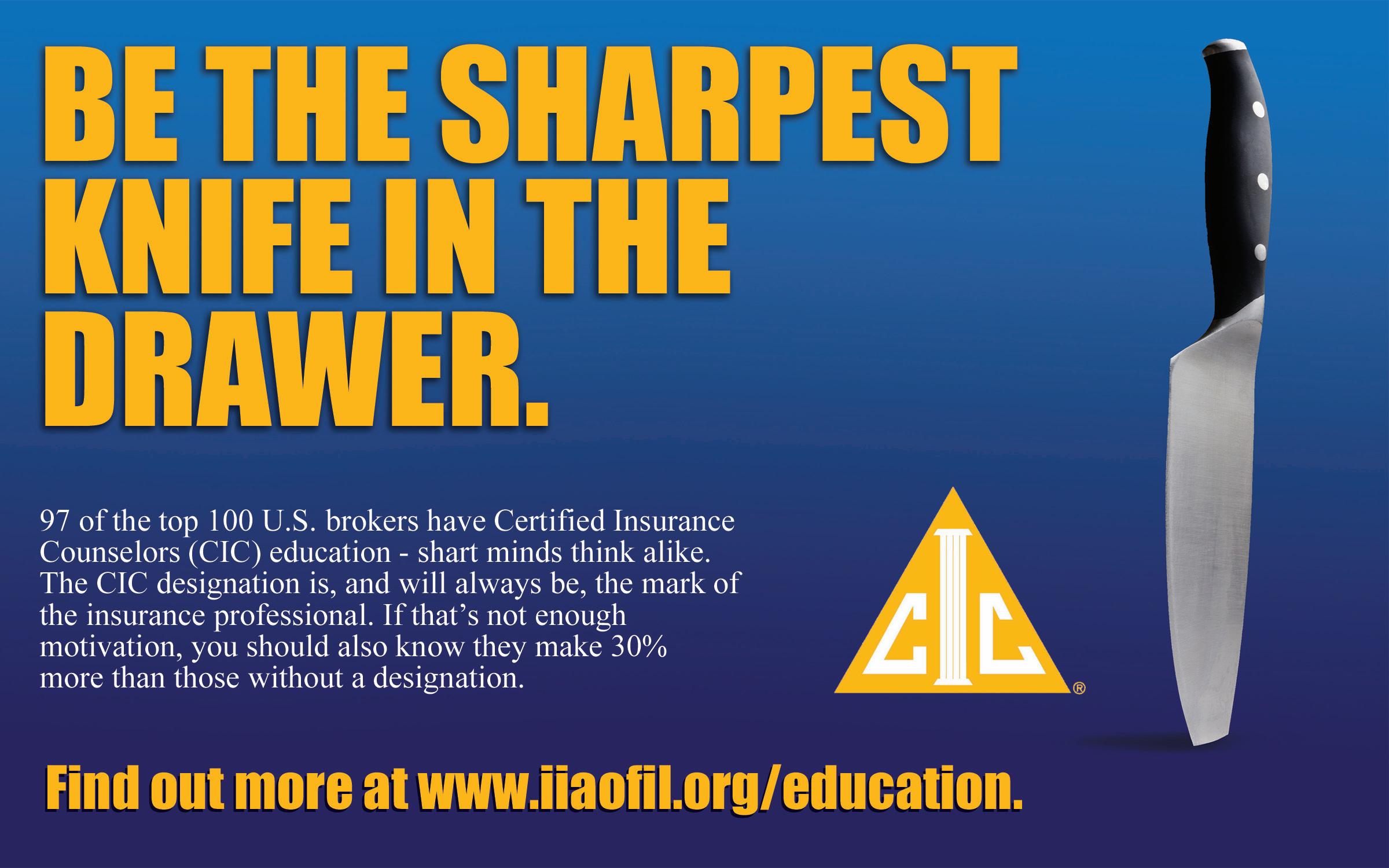

Sarah Marshky, CIC of Snyder Insurance, Champaign, IL was recently recognized for professional leadership and advance knowledge by the Society of Certified Insurance Counselors.

Marshky was awarded a certificate of achievement recognizing twenty-five consecutive years of successfully maintaining the Certified Insurance Counselor (CIC) designation. The CIC designation requires an annual continuing education update ensuring that her education is always up-to-date and relevant.

Marshky’s ongoing allegiance and support of the CIC Program is a testament to the value she places on “real world” education and professional growth. “Your clients, associates and the insurance profession as a whole benefit from such leadership and a strong commitment to continuing education,” stated William J. Hold, MBA, CRM, CISR, President & CEO of The National Alliance for Insurance Education and Research.

The CIC Program is nationally recognized as the premier continuing education program for insurance professionals, with programs offered in all 50 states and Puerto Rico. Headquartered in Austin, Texas, the Society of CIC is a not-for-profit organization and the found program of The National Alliance for Insurance Education & Research.

“We are proud to have a large presence with our national association,” said Phil Lackman, IIA of IL CEO. “Having Illinois agents participate and lead on several IIABA Committees, and Task Forces confirms Illinois’ role as a leader within the Independent Agency system and provides tangible benefits for our members.”

E&O: Duties, Best Practices, Operations, Certificates Webinar

Pre-Licensing-Property & Casualty Virtual

E&O: Identity Theft, Red Flags, and Money Laundering Webinar

Flood Insurance, FEMA, and the NFIP Webinar

Pre-Licensing-Life & Health Virtual

E&O Roadmap to Personal Auto Webinar

Deep Dive Into Agency Ethics Webinar

CISR-Insuring Commercial Property Virtual Class

E&O Roadmap To Cyber & Privacy Insurance Webinar

E&O-Roadmap to Homeowners Endorsements Webinar

EP Skylight Insurance Services, LLC Skokie, IL

Levitt Insurance Agency Washington, IL

Xartis Insurance Advisors, LLC Aurora, IL

For information regarding IIA of IL membership or company sponsorship, contact Tom Ross, Director of Membership Services, at (217) 321-3003, tross@iiaofil.org.

Pre-Licensing-Property & Casualty Virtual

Ed Symposium-Drone & Sales Virtual

CIC-Commercial Property Virtual Agent’s E&O: Defenses and Preventions Webinar

Ed Symposium-PFTA & Workers’ Comp Virtual

CISR-Commercial Casualty 1 Virtual

Deep Dive Into Agency Ethics Webinar

Ed Symposium-Flood & Cyber Virtual

CISR-Agency Operations Virtual

CISR-Commercial Casualty 2 Virtual

Mark

East Peoria, IL

“I thought the 2022 convention was great and I was very happy I attended. I do not have a license (no need for CE credit) and am relatively new to the industry, so it was great for me to soak up a lot of knowledge and meet an awful lot of people.”

- First Time CONVO Attendee ILConvention.com

17. We are an Independent family-owned agency located in the Chicago area. We are looking to expand through growth and acquisition. If you have a small to medium sized agency and are looking to sell, call or send us a message. We are strictly looking for Personal Lines and Small Commercial accounts with preferred companies.

GALO Insurance Agency, Inc (847) 832-0888 steve@galoagency.com

02. Forest Park/Oak Park agency for over 60 years, will meet your needs by providing space, markets, marketing & sales support, automation, merging with or purchasing your agency. Perpetuation/ Succession Plans, BuySell Agreements also available. We have experienced, educated and dedicated staff for you and your clients. Have access to our numerous companies, office services and many other resources. Retain ownership in your book with contingency. Please look closely at us- we are an agency you want to do business with! We’ve done it before, we know how- we make it easy! Visit our website at forestagency.com/agents.html, or call for a confidential discussion and a list of Agency benefits.

Dan Browne will provide an agency evaluation/appraisal at little cost to you. Please call:

Dan Browne or Cathy Hall Forest Insurance (708) 383-9000 www.forestinsured.com/mergers-acquisitions

20. Since 2004, Central Illinois Agents Group LLC has been providing independent agents with a variety of markets with contingency opportunities. Agents have availability to several markets that they may not be able to sustain or maintain on their own. We have markets for personal, commercial, agricultural and crop insurance lines. Let us help you get to the next level.

Visit www.ciagonline.com for contact information.

13. We are a 100 year old Northbrook agency looking to discuss any mutually beneficial opportunity. Our producers, mergers, clusters and agency purchases receive 50% commissions on new and renewal business without any expenses. We can provide: office space, phones, agency management system, service renewals and changes. The companies we represent are: Badger Mutual, Employers Mutual, General Casualty, Guide One, Hartford, Kemper, Progressive, Rockford Mutual, Safeco, State Auto, Travelers and Met Life. Contact: Nancy Solomon Martini, Miller & Schloss, Inc. (847) 291-1313 Ron@martini-miller.com

CareerPlug’s hiring software helps agents attract more qualified candidates, identify the right candidates with confidence, and improve hiring results.

CareerPlug will provide IIA of IL members access to a free account that can be used to post jobs, manage applicants, and improve the organizations’ employment brand. Association members can also access a “Pro” version of CareerPlug for a special rate to take hiring to the next level.

Learn more about CareerPlug and check out the brand new IIA of IL job board at www.iiaofil.org

Independent, Authorized General Agent for

An Independent Licensee of the Blue Shield Association

Independent, Authorized General Agent for

An Independent Licensee of the Blue Shield Association