•

•

•

•

•

•

•

•

•

•

Setting & Achieving Agency Goals

Chairman of the Board - Kevin Lesch klesch09@gmail.com

President - Allyson Padilla allyson@blanksinsurance.com

President-Elect - Patrick Taphorn, CIC, CSRM ptaphorn@unland.com

Vice President - Thomas Evans, Jr. tom.evans@assuredpartners.com

Secretary/Treasurer - Cindy Jackman, CIC, CISR cjackman@arlingtonroe.com

IIABA National Director - George Daly george.daly@thehortongroup.com

Mohammed Ali - mali@aliminsurance.com

Amiri Curry - acurry@assuranceagency.com

Charles Hruska - chas@hruskains.com

David Jenk, Esq. - djenk@nwibrokers.com

Jeff McMillan - jeff@mcmillanins.com

Patrick Muldowney - patrick.muldowney@alliant.com

Lindsey Polzin - lpolzin@presidiogrp.com

Ray Roentz - ray.roentz@hwcrins.com

James Sager - james@sagerins.com

Luke Sandrock, CIC - lsandrock@2cornerstone.com

Noele Tatlock - ntatlock@unland.com

Budget & Finance | Cindy Jackman, CIC, CISR cjackman@arlingtonroe.com

Education | Lisa Lukens salibainsurance@gmail.com

Farm Agents Council | Steve Foster s.foster@ciagonline.com

Government Relations | Dustin Peterson dustin@peterson.insurance

Planning & Coordination | Nick Gunn, CIC nickgunn@nixonagency.com

Technology | Brian Ogden brian@ogdeninsurance.com

Young Agents | Renee Crissie renee@crissieins.com

Follow us on socials.

Insurance Products Administrator

Director of Information and Technology

Director of Education and Agency Resources

Accounting & Admin Services

Director of Human Resources, Board Admin

Sr. Vice President/Chief Financial Officer

Chief Executive Officer

Director of Membership Services

Director of Government Relations

Office Administrator

Director of Communications

Marketing Representative

Rebecca Buchanan (217) 321-3010 - rbuchanan@ilbigi.org

Shannon Churchill (217) 321-3004 - schurchill@ilbigi.org

Brett Gerger, CIC (217) 321-3006 - bgerger@ilbigi.org

Tami Hubbell, CIC (217) 321-3016 - thubbell@ilbigi.org

Jennifer Jacobs, SHRM-CP (217) 321-3013 - jjacobs@ilbigi.org

Mark Kuchar (217) 321-3015 - mkuchar@ilbigi.org

Phil Lackman, IOM (217) 321-3005 - plackman@ilbigi.org

Lori Mahorney, CISR Elite (217) 415-7550 - lmahorney@ilbigi.org

Evan Manning (217) 321-3002 - emanning@ilbigi.org

Kristi Osmond, CISR Elite (217) 321-3007 - kosmond@ilbigi.org

Rachel Romines (217) 321-3024 - rromines@ilbigi.org

Tom Ross, CRIS, CPIA (217) 321-3003 - tross@ilbigi.org

Carol Wilson, CPIA (217) 321-3011 - cwilson@ilbigi.org

The only thing that piques my interest more than education is data. I am a true data nerd and devour as much data as possible so that I can recognize trends and provide valuable direction and insights. Sometimes, I fall into the data vortex and can’t find my way out . As an ex-regulator, I take The X-Files (vague 1993 TV show reference) stance in “Trust No One.” There are sooooo many variables when it comes to data: How was it collected? Is the data timely? How big was your sample? What was the source, what questions were asked, what does it mean, what is valuable about the data, who produced the data, what is the purpose of the data, and many other questions? Let’s break down those variables that I just mentioned, and you will see that they have their own variables, which then those variables have their own variables (data vortex).

How was the data collected? - This is very important in determining how relevant and accurate the data is at this point in time. How many eyes have seen and hands have touched the data? Did you get it from the horse’s mouth, so to speak, or did they get it 2nd or 3rd hand? Was it downloaded, copied/pasted, or involved in data entry? An example is the 2024 Illinois Annual P&C Marketplace Summary – This data is derived from company filings with their regulators and compared to previous filings (I like this). The one downside is that they got this from AM Best, which got it from Department filings, which then most likely had to enter the data manually, which can have some errors even if it is proofed, but overall, it is very reliable. The downside is that having multiple entities touch the data increases the chance of error.

Is the data timely? - This one is huge and, in the insurance world, is challenging as numbers/data typically lag. Any workers’ compensation study you see is most likely from one-and-a-half years old data. Can you imagine if investors and bankers made their decisions based on data that is a

year and a half old? This aspect makes historical data even more important in identifying trends. The first Chat GPT data input was many years old and sometimes produced outdated responses.

How big was your sample? - If the topic you produce data from has a universe of 1000, but you only look at 10, how relevant is the data? Is your sample representative of a wide variety of the universe (large and small)? Entities that produce studies in a way that skews the data to the point of view or narrative that they want to produce typically have sampling issues. This is one of the first things I look at before I waste my time reading an article with supportive data to make the producer of the article’s point.

What was the source? - Wikipedia? Is it a trusted source? What makes a source trusted? As far as I know, there is only one trusted source, “Me.” But now, you can’t trust me as I didn’t support my conclusion with data. AM Best, NAIC, and Insurance Journal are typically considered great sources and resources for the insurance industry. The problem is that even trusted sources make mistakes. When I was a regulator, I found a major trusted source’s workers’ compensation data report to have errors and flaws that they had to correct. Had the data nerd not been on the case, that report would have been considered reliable.

What questions were asked? - Were they relevant to the topic? Were they timely? Were they leading? Questions asked have the most significant effect on skewing data. While I love data, I hate skewed data. Many reports these days are skewed to try to fit a particular narrative. For instance, when the Illinois Public Interest Research Group (IPIRG) produced their auto rate study, they asked what state had the lowest premium increase in 2022? The answer was California. The data fit their narrative but came nowhere near telling the story. What the data failed to indicate was that California rates are the highest in the nation. Had they shown the true data, it would have indicated that Illinois was 5th in autos insured and 25th in rates. Words matter, and better yet, questions matter.

The remaining questionsWhat does it mean? What is valuable about the data? Who produced the data? What is the purpose of the data? – all go to narratives, stories, and manipulation of the market. Good data people will tell you they can make data say what ever they want using the same data universe. It is what they choose to spotlight, highlight, and focus on that makes the case for their particular narrative. Again, “Trust No One.”

It is hard to find trusted sources and studies that don’t skew the data in some way, as today’s

publications are competing on much broader levels than they did historically. It used to be publications such as newspapers and magazines that produced studies and data to inform. Nowadays the definition of publication is soooooo broad and meant to drive “clicks” that the old stalwarts, the printed newspaper and magazines have almost gone the way of the dinosaur. Accuracy is no longer a must as it is who can get it in front of insatiable consumers first. In the immortal words of Ricky Bobby, “If you ain’t first, you’re last.” There are still some great studies and data produced, but you have to sift through a bunch of rocks to find the gold. Studies and data are a lot like the gold rush. At first, prospectors found gold to be plentiful, but now you have to work very hard to find small amounts of gold. Gold would be those studies that contain data that is accurate and useful.

The 2024 Illinois P&C Marketplace Summary is as good of a resource for data that you can find. It will be up to you to dive into the data (like I have) to make it useful to your agency and help guide you through these rough waters. Question all data and studies without a biased lens and try to discern what story the data is actually telling. Included in this magazine is just a small portion of the data collected. Make sure to visit the website to view the full report.

As always, this just Brett’s 2 Sense and I hope it was helpful. You can contact me through my CONNECT and if it is urgent, do not hesitate to reach me through CONNECT. I may be pushing you to CONNECT. If you need any clarification or have any suggestions for future articles please email me at bgerger@ilbigi.org.

Brett Gerger - Big I Illinois Director of Agency Resources/Education - bgerger@ilbigi.org

Published in the American Agency Bulletin, produced by the National Association of Local Fire Insurance Agents (Big I ) in 1903

The agency movement is built upon common loyalty to a common cause, the union of all agents in defense of the rights of a single agent...the power contained in this kind of cooperation has already been felt, but the time is sure to come when it will be shown to a striking degree, and the light which it throws upon the essential spirit of agency cooperation will weld the local agents of the country together in bonds that cannot be broken...

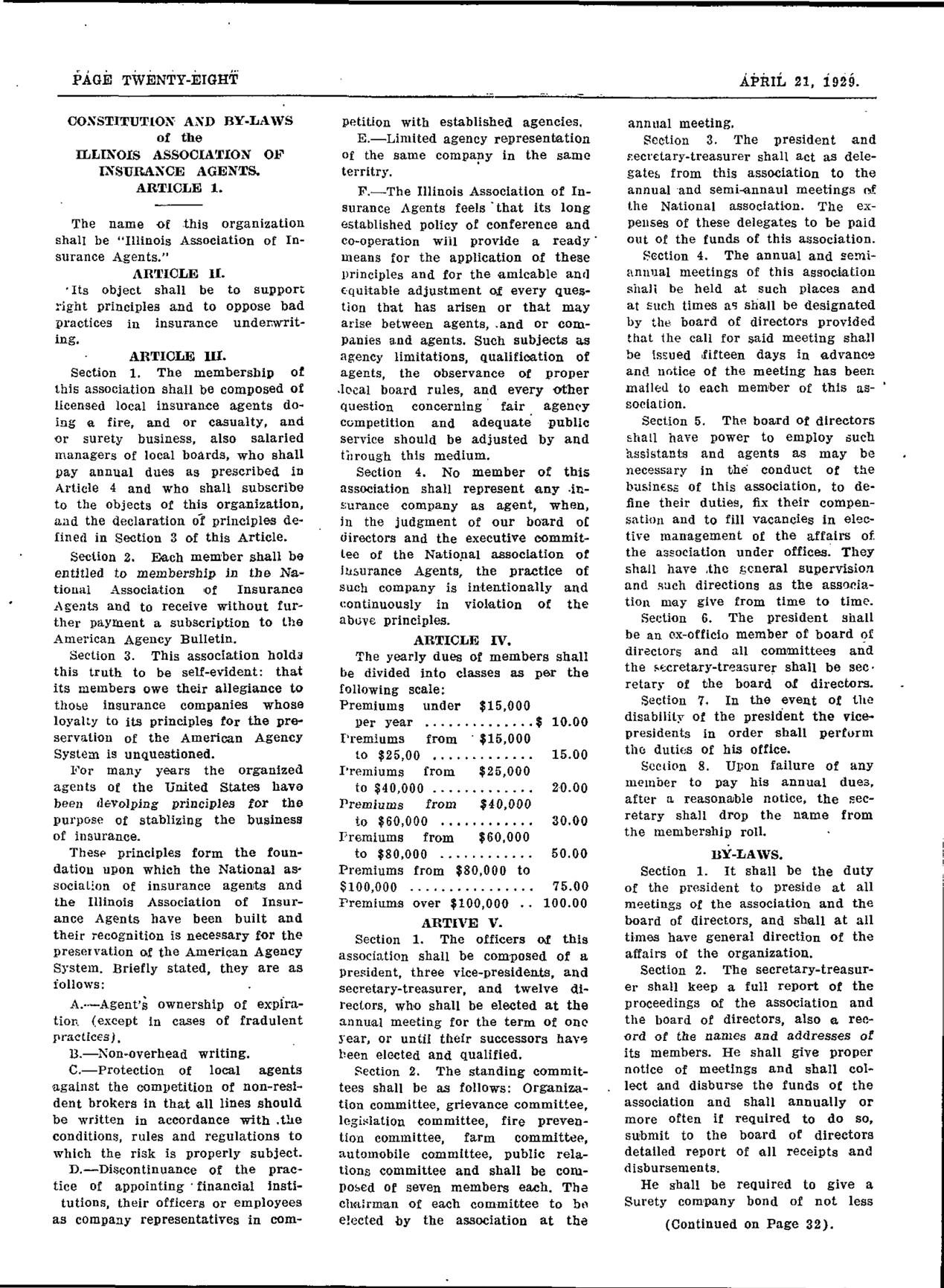

The first record of the Constitution and By-Laws for the Illinois Association of Insurance Agents appears in the April 1929 edition of Association News, published by Shirley Moisant out of his Kankakee insurance agency. Membership dues were calculated based on premium and still are today. The Board included five Officers and 12 Directors and there were seven

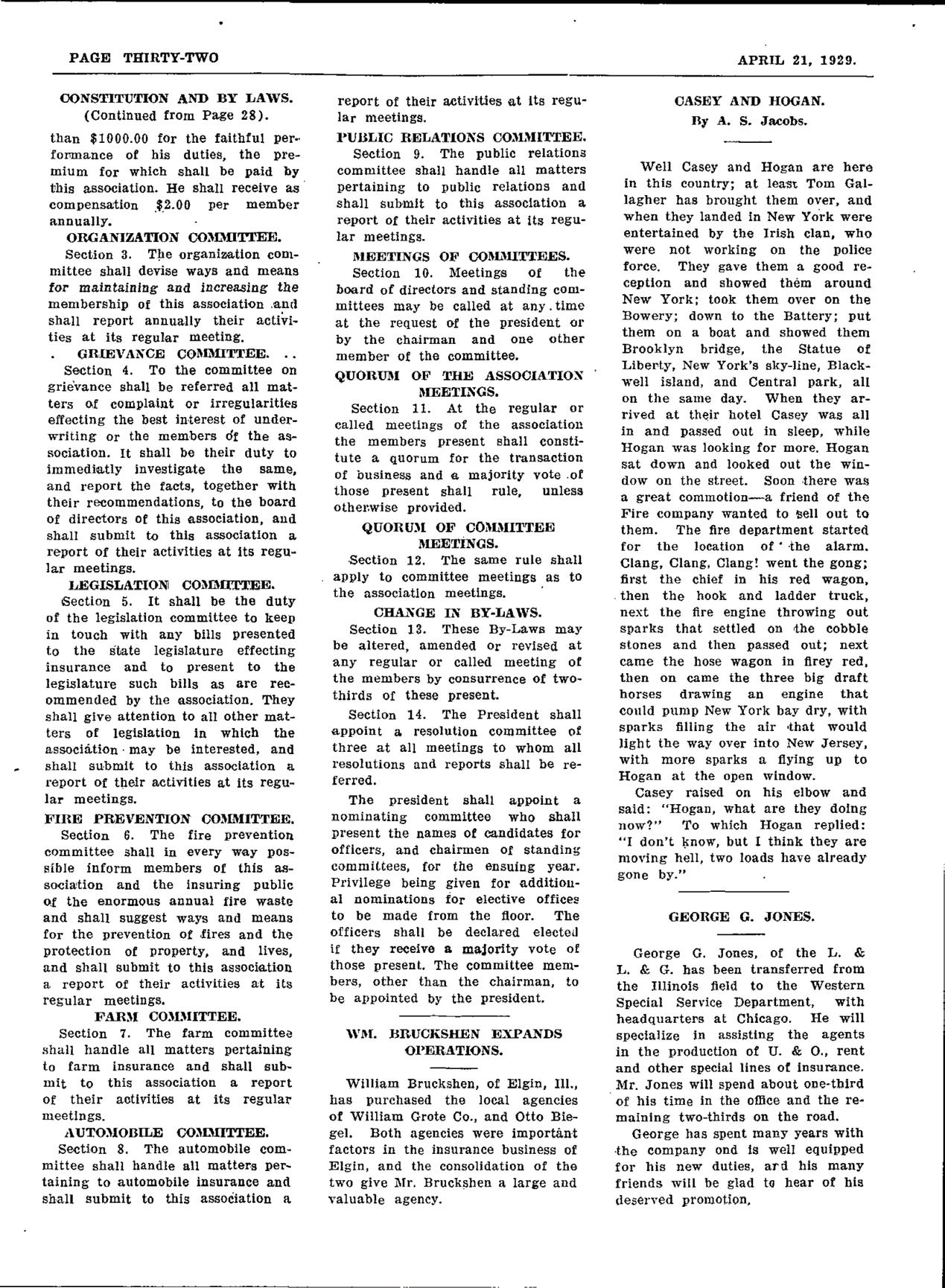

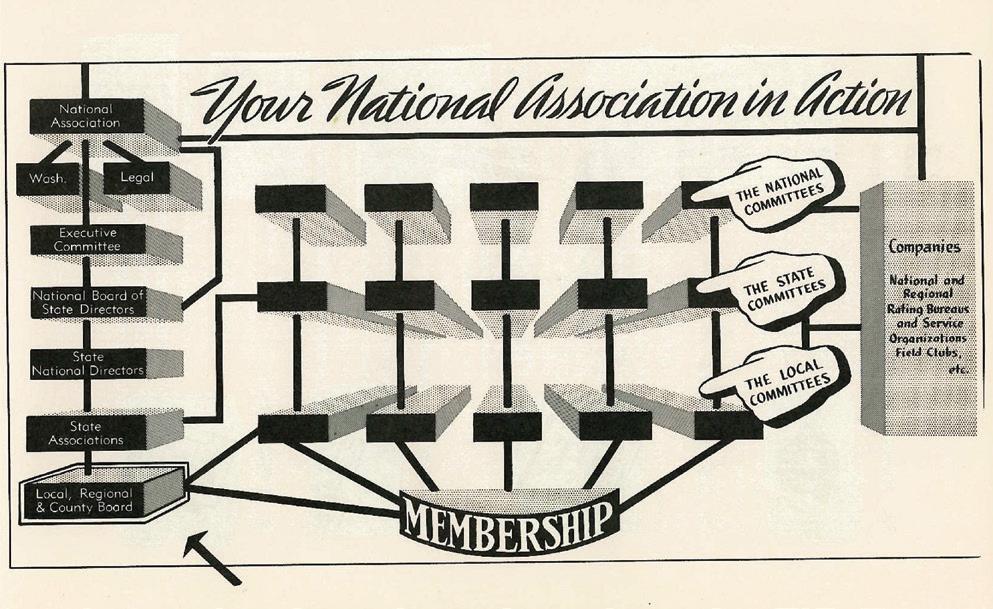

A History of the Illinois Association of Insurance Agents, written by Lillian Herring, reports that eight Regional Vice Presidents and 10 Chairmen of Standing Committees had been established in the years that followed the 1934 move of the association headquarters from Kankakee to Chicago. Regional meetings had been held successfully throughout the state; however, due to gas rationing a shift was made in 1943 to Local Board Development and statewide adoption of the National Association’s education program. The Peoria Association of Insurance Agents was the first local board in the state to make this training available to its members. View more on local boards on the next page.

By 1975, the board consisted of approximately 30 members, plus several special committees. The Executive Committee began the task of reviewing the existing board and committee structure and recommending a revision to “make it more manageable”. Board Chair Jack Payan’s report on the issue explained, “We find that the committee structure has been growing laterally to the extent that it is becoming quite difficult to work with.”

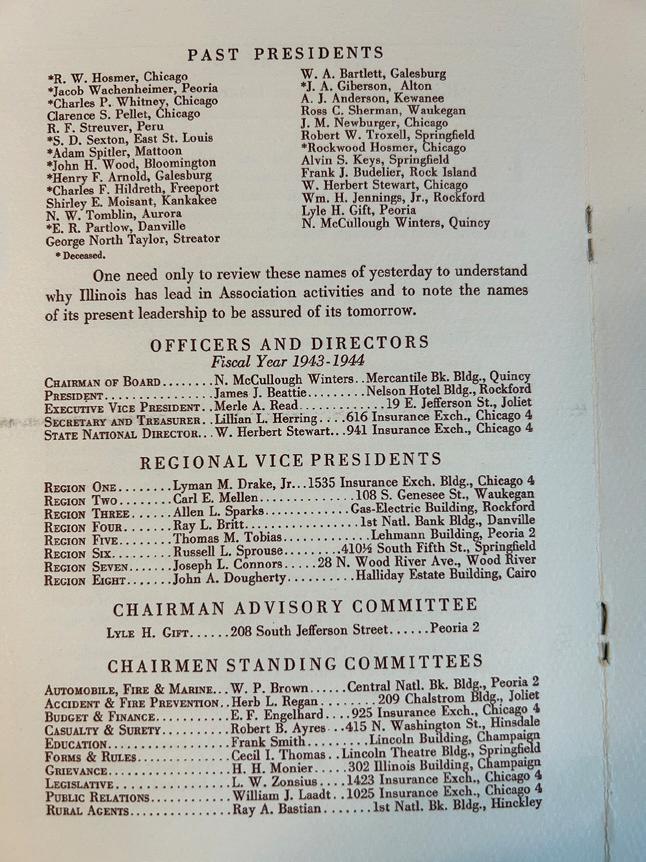

An advisory committee consulted no less than 12 Past Presidents to gather input and planned to make a recommendation to reduce the number of districts. According to meeting minutes, the attempt “failed miserably” and resulted in a proposal to add two new regions for a total of 16.

At the 1977 Convention in New Orleans, LA, members voted to adopt a new version of the By-Laws. While the By-Laws did not specify the number of regions, they did include several changes to the Standing Committees which numbered 18 at that time. One of the original association committees, Legislation, had been renamed to Government Affairs. Two new committees that exist today were added at that time –Planning & Coordination, and Young Agents Committee.

In 1993, the IIAI merged with the Professional Insurance Agents (PIA) to become the PIIAI. The merger resulted in a board of more than 40 members with 20 regional directors to ensure that members of each prior organization had a voice on the new board. However, it wasn’t long before it became clear that there were a number of redundancies in services between the two organizations and Illinois, along with other merged states, recommended that the national organizations work to share or consolidate services for efficiency and to better serve the membership. Consolidation talks were soon abandoned by the organizations and in 2000, the PIIAI Board of Directors voted to disaffiliate with PIA National. A Task Force, Chaired by Past President John Alexander recommended a new board structure in 2001. This reduced the number of Regional Directors to 10 and created 5 new At-Large positions, a structure that remained in place until last year.

In 1943, the IIAI had coextensive boards, which were local or county associations of insurance agents that required their members to also be a member of the state association. At one time, the association had as many as 61 local boards recorded. In the late 70s, early 80s, the coextensive requirement was removed from the IIAI By-Laws. Finding volunteers to run the local boards became increasingly challenging over the years and by 1998, the number of boards had diminished to 21 and then to 5 in 2001.

Currently, there are active local groups in Southern Illinois, DuPage County, Northeastern Illinois, and Chicagoland.

After careful consideration by the Planning & Coordination Committee and Board of Directors, a plan was crafted for a new board structure that relies less on “regions” in which an agency is located and allows more flexibility in order to ensure the board better represents the membership in terms of agency size, business mix, and personal qualifications of the potential volunteer. After approval by the membership in October of 2023, the state is divided into only three geographic regions that are represented by a Regional Director. Up to 7 Directors with experience and attributes that best reflect the agency models and demographics that make up the membership, will be nominated by the association’s Leadership Development and Succession Planning Committee and the slate of candidates presented to the primary contact of each member agency for a vote of approval later this summer.

In addition to the Officers, up to Five At-Large Directors, and a representative of the Farm Agents Council, the Board includes Chairpersons of the following Standing Committees: Budget & Finance, Education, Government Relations, Technology, Young Agents, and Planning and Coordination.

The best way for you or an employee of your agency to get involved is to join a committee. If you are considering service to the association or just curious about what it’s like to be involved, please complete the form on our website at ilbigi.org/about-us/get-involved-volunteer. You will be contacted by a Committee Chair or Staff Liaison who will provide additional details and answer any questions you might have. Or, reach out to one of our current volunteers, found on our website at www.ilbigi.org/about-us.

By Kelly Donahue Piro

I know so many agencies that do not focus on goals, as a matter of fact, they don’t even mention goals. I spent years at agencies trying to implement goals and was astounded at how many humans don’t have goals.

They wander around in life with no goals. To me, that is wandering. No purpose in life.

Goal setting can drive success and challenge people to do hard things. Clear precise insurance goals can lead a team into a place of success they have never known and never been a part of. Leading and guiding them there can be your biggest success or your biggest challenge.

Insurance goals can keep your agency moving and growing even during difficult times. Goals can transform an agency into a well-oiled machine producing and causing agency growth that in turn becomes profit and also causes client satisfaction.

Remember to make your goals SMART, specific, measurable, achievable, relevant, and time-bound.

What are your agency goals? I hope you have an answer!

You need to start by looking at a 10-year plan and working backward. You want to determine your 10-year target. Once you have determined what this is. It will help you create your yearly and 5-year plans to accomplish your 10-year goal.

All of your other goals will lead to your 10-year goal. It is best to start with numbers. Agency Performance Partners uses a growth calculator that helps determine where the agency should be in 10 years.

Your 10-year plan is your long-term vision while you will have short-term objectives that should be met to help you accomplish your long-term goal.

Goals are a great way to accomplish success for you and your team. Everyone feels great when they successfully complete a goal. You need to make your goals logical, consistent, and accomplishable.

I like to mention that I worked at an agency that had monthly goals, we met every month to discuss where we were, but the monthly goal was easier for us because if we had a bad week, we could make it up the next week. I always made my goal by the end of the month. It was stressful during those bad weeks, but a relief at the end of the month.

You could also have quarterly insurance goals each year. The more you track and have clear expectations of goals set the more successful your team will be at following them and the more successful they will feel as employees of your agency.

You need to remember that your agency would not function without your amazing staff, make sure they are part of the reward. It always feels good to receive bonuses and extra incentives when you help your employer reach their goal.

If your team knows what they are going after and they work as a team to accomplish a common goal they will be more excited about their job and their contribution!

If you don’t have insurance goals currently, then what is everyone doing? What are they striving for? Do they have their own goals?

If they are salespeople they may have a goal because they get paid only commission, but what about service staff? Retention is part of growth, right?

Goals provide structure, they provide direction and they should provide reward when they are met. That reward may be their pay, but you want to make sure they feel recognized for their contribution to the agency.

I heard stories of agency owners who promised lavish trips, they were won and he attended them and did not allow staff to go on them. He actually was an exclusive agent and unbeknownst to the staff, they couldn’t go on them, they were only for the principal agent. When this is the way you treat your staff there is a problem!

However, that same agent decided to make everyone 1099 and work for commission only. His service staff who he thought wouldn’t do so well, made the most money that year, even more than the sales staff.

Don’t underestimate the power of goals and people’s desires to succeed, especially if they are competitive. Goals can accidentally cause people to have more focus and help implement processes and procedures.

So you have a team and their goal is to do annual renewal review calls, if they put their heads together and come up with a plan, a strategy it will help everyone reach their goals. Make sure you are aware of their personal and insurance goals and do what you can to help them achieve them.

If they accomplish their goals you will be that much closer to accomplishing your agency goals! You will then start seeing efficiency, better retention, and overall profitability.

Identifying Your Agency’s Key Goals

What are you looking for?

• Better Retention

• Renewal Review Calls

• Building Rapport

• Discovering Missing Coverages

• Growth

• Better Sales Processes

•Aligned Agency Sales Process

• Better Leads

• Referrals

• Online Leads

• Local Leads

• Customer Satisfaction

• Phone Greeting Upgrade

• Building Relationships

• Knowing Your Clients

• Meeting Needs

• Finding Discounts

Sit down and evaluate or do an assessment of your agency.

What is the status? Are there processes and procedures that lead to the goals the agency has? Do you have a mission, vision, and values statement for the agency? Are there clear roles and job descriptions?

If you don’t know where to start we can help. If you want a 3rd party to come in and do an evaluation, we do that at APP. It is a great way to start. Doing a comprehensive review of your agency can be a game changer. You may learn things about your agency you didn’t know about.

Staff may not like something or may have suggestions that will help motivate and bring staff together., You can find out so many things by doing an assessment. Maybe some of your staff have goals even though the agency doesn’t. It is a great way to get to know your agency and your staff better.

List your strengths and weaknesses. Use this as a guide to spark thought and get started on listing your agency’s and your staff’s strengths and weaknesses.

Industry Expertise Competition

Diverse Products Complexity

Personalized Service Regulatory Challenges

Claims Assistance Price Sensitive

Risk Management Dependence on External Factors

Local Presence Limited Control Over Underwriting

Client Education Retention Challenges

Technology Integration Cyber Security Concerns

You need to use your chart to leverage your agency’s strengths and weaknesses and your staff’s individual strengths and weaknesses to then build up to accomplishing individual and agency goals.

If you’ve followed APP for a while you know we are big on visions and values. Your vision tells us where you want to be in 10 years and your values help you figure out how to get there.

Your goals should align with your visions and values. So let’s say you want to grow by X% in 10 years, you would divide that amount by 10 that is each year, then divide that by 12 which would help you determine roughly how much you need to grow each month to hit those goals.

This is a rough explanation because you would also have to consider retention in the mix, but it is a start. So say you have to grow by 10,000 a month and you have 10 producers.

Each producer would have to sell at least $1,000 in premium every month to hit their 10-year goals. Hopefully, you will increase it and challenge your staff.

It is great to accomplish your goals but it is even cooler to exceed them. Make sure your goals are realistic and attainable, you don’t want to overwhelm your staff with goals that just aren’t realistic or attainable, which leads to burnout and unhappiness.

Insurance Goals have to be measurable. Numbers never lie, as hard as we would like to think they do. So we need to make clearly defined goals that make sense, but that also guide our staff step by step to hit their goals and the agency’s goals. These goals must be measurable. It can be the number of policies, number of calls, policy premiums, etc. But you must find a way to measure them to track success.

Let’s look at Key Performance Indicators. Below is a list of KPIs that can be used to gauge agency success. You as a leader or your team will need to determine which ones you want to use or which work best to track your agency’s success.

We know all agencies are different. Your average premium as a PL agent compared to a CL agency would be drastically different. You need to take some time and determine what works best. Some agencies only write commercials, and some only personal. Some agencies do not deal with claims.

So take the list below and use what works.

• Policy retention rate

• New Business Growth

• Average Premium Size

• Policy Cross Selling

• Conversion Rate

• Customer Lifetime Value

• Claims Processing Time

• Agent Productivity

• Customer Satisfaction or Net Promoter Score (NPS)

• Loss Ratio

• Expense Ratio

• Online Engagement and Web Traffic

• Lead Source Performance

• Churn Rate

• Profit Margin

This is where you want to use your management system and numbers very wisely. You want data-driven insights, facts not feelings.

These numbers will show you where you are doing well and where you need to improve. You want to use these numbers to determine what insurance goals you want to reach, some areas may need more improvement than others. Remember to make your goals realistic and attainable.

One of your biggest lead generators is your own book of business. If you don’t require your team to cross-sell and upsell, now is the time.

Besides doing those, what other lead generation do you use? Do you pay for leads, what marketing do you do? Do you have salespeople prospecting? What are the techniques? What is working and what is not?

These are the discovery questions you need to use to determine what your insurance goals for the agency will be when it comes to new business and prospecting. What strategies do your sales team use to “close the sale?” Now the old saying “the customer is always right”, didn’t really mean that.

It is meant to make the customer “feel” like they are always right!!! There is a difference.

We need to have empathy and let the customer know we understand, but we also need to provide solutions to their biggest challenges and when this happens we become their hero!

We at APP talk a lot about customer service and how we tend to give more time to lower-tier clients and we give them better customer service. Many agencies argue this point until they hear us out.

How much time do you spend with Timmy, who walks into the office to pay every month and occasionally has to come in to reinstate his policy that was canceled?

Then you have Kelly who has personal and business policies (about 17) that are all set up on automatic withdrawal and calls in only twice a year for a certificate or to change a car.

Are we really spending equal time and attention on both? Taking the time to re-evaluate your agency’s customer service and adjusting things accordingly could also make a huge difference in retention and referrals.

In this day in age it is very important to have an online presence and effective digital marketing strategies. If you don’t have anyone to do this we recommend finding someone or outsourcing it. When someone in your city searches for insurance you want to be in the top 10 hopefully top 5.

A monthly newsletter, podcasts, and blogs are all great ways to have an online presence. You may also combine these with automation so the leg work is done by your systems. There are a ton of opportunities on social media as well, not only are there local groups but there are local social media groups and at times they will ask insurance questions. Look into local groups like community forums or Mom/Dad groups. You’d be surprised how people trust these local groups for referrals.

Networking in your community is also important. Do you volunteer, have charitable events, or donate to a cause? Do you go to local networking groups or local chapters, Lion’s clubs, Legions, or Rotary clubs?

These are all connected to the local community and are great places to network. You don’t have to go in with guns blazing, you go in as a local business and supporter and when asked have a great 30-second commercial that includes who, what, when, and where.

How are you there to help provide support and education to the group? Make insurance goals for each of these pieces, get out there, and get known.

If you have a well-trained and motivated team you’re already halfway to your goal. If not you need to get there. But how you ask? Here is a secret: the more motivated and driven you are, the more excited you are, the more you can get your team excited and motivated.

“The more motivated and driven you are, the more excited you are, the more you can get your team excited and motivated. “

Work with your management team with this being the goal. Find what excites and motivates your people! Another way to motivate your team is to provide training.

How often do see a greenhorn come in and start working in our office, we throw them with the most senior agent and forget about them. This is NOT the way to do it. You need to have some type of internal processes and procedures and a guide or training about them.

Don’t forget about your long-time staff either, a refresher course is great, the more you train the more you help build them to think and be open-minded enough to change and improve. Learning and education help us all grow and do better, it gives us the ability to also bring new ideas to the agency.

There are huge benefits to fostering a positive work culture and recognizing employee contributions. People who come to work because it is a happy place are already way far ahead of those who don’t have a positive culture!

So if right now you don’t have a positive culture, it is time to turn it around, make positive changes, and get your leadership team and staff to help foster this by adding training and fun activities and incentives, so work is not just people working 9-5 for a paycheck, make it better than that!!

Make it fun!

The insurance industry is shifting and changing with the world and society. New technology has brought not only a ton of great things, but it has also brought more risk.

Our agencies need to ask more questions not only to cross-sell and upsell but also to protect our agencies and the carriers we partner with.

We are in a very hard market, does your staff know how to handle upset customers? Do they know how to listen and problem-solve instead of react and rewrite every client?

Goal setting not only helps us as individuals and companies, but it can also prepare us for harder times.

With processes, procedures, and goals set up to hit, we can be a well-oiled machine, the best in the business, we have to be openminded and goal-oriented. This will keep us ahead of our competition.

In conclusion, you need to have clear and actionable insurance goals. You as an agency owner need to have even harder goals that show grit and your willingness to commit to the agency, your staff, and the final destination.

You cannot expect everyone else to have goals if you don’t. Embrace a goal-oriented mindset, because a mindset is a huge strategy and is committed to achieving your objectives. You are probably an owner or manager and you had a mindset to get where you are today! Keep it up and step it up a notch.

Strategic Insurance Goal setting can and will transform your agency, it will allow for long-term success on a path that everyone in your agency understands and will be striving for!

Kelly Donahue-Piro, founder and president of Agency Performance Partners, is a no-nonsense effectiveness expert who has helped hundreds of insurance agencies identify and capitalize on sustainable improvement opportunities. Connect with her on social platforms, via email at kelly@ agencyperformancepartners.com, or by phone at 401-4156205.

By Eric Kuhen and Gabrielle Iacona

For an insurance firm to grow during a hard market your producers need better strategies for driving new business – especially as productivity benchmarks have increased. So how can you boost producer productivity? What are the most effective tools to measure their progress and success?

Most personal and commercial lines brokers will find 2023 to be another year of rising premiums as firms continue to operate in a hard market. It will be a tough year in a challenging market requiring agents and brokers to double down on their commitment to working smarter, finding creative solutions and anticipating client needs. A hard market is the time for your producers to focus on new business, implement aggressive marketing efforts and proactively reach out to retain existing customers. With rate increases here to stay for the foreseeable future, what are your producers doing to stay relevant in the industry? They can’t simply rely on renewals and rate increases to show year-over-year growth any longer. So, what’s their business plan and who’s holding them accountable to create or sustain substantial growth?

What are the benchmarks producers need to reach to be successful?

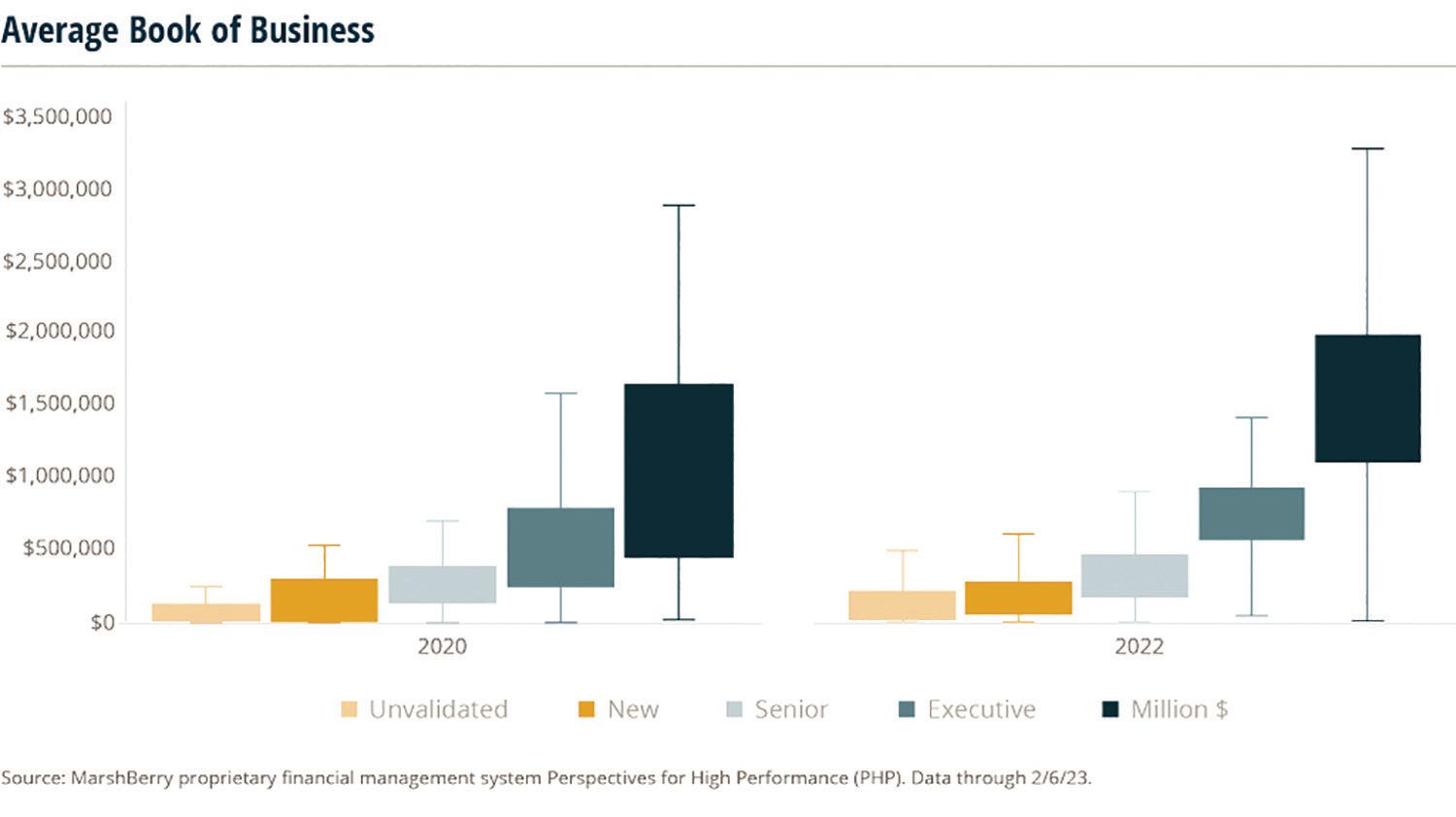

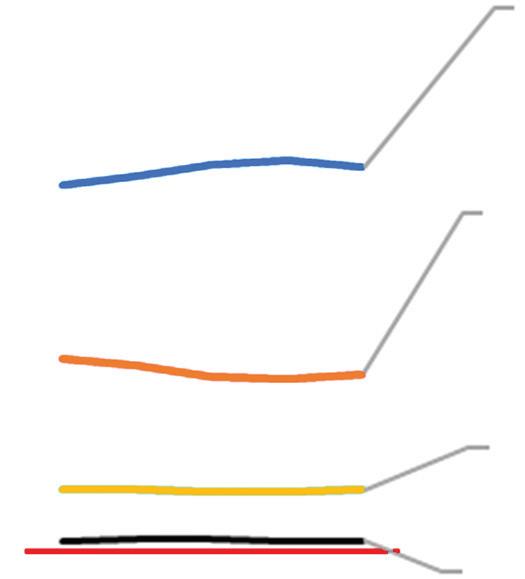

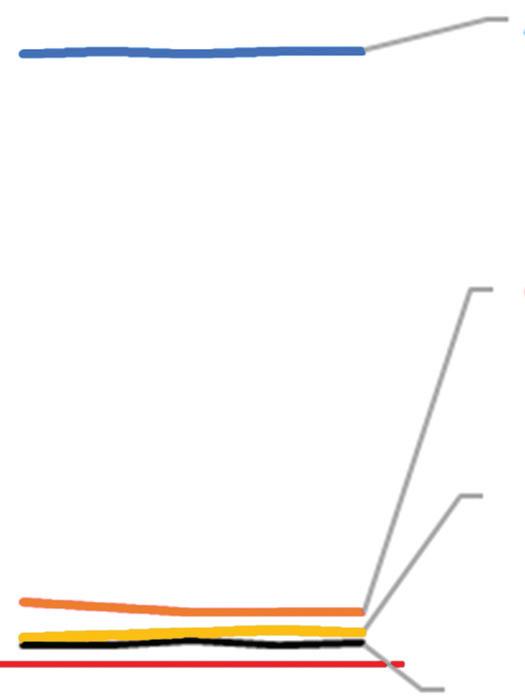

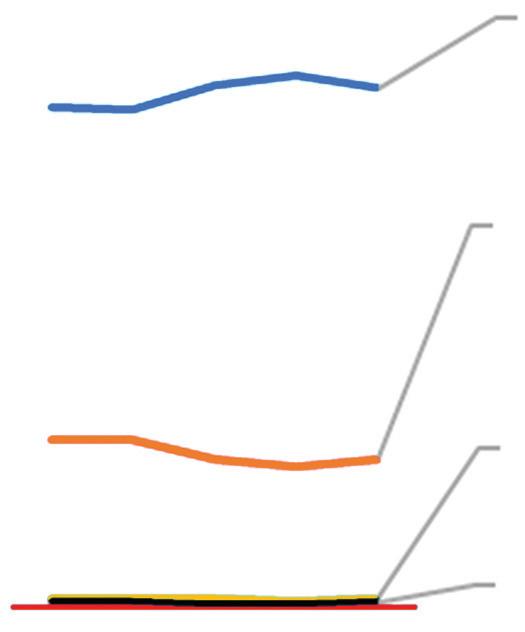

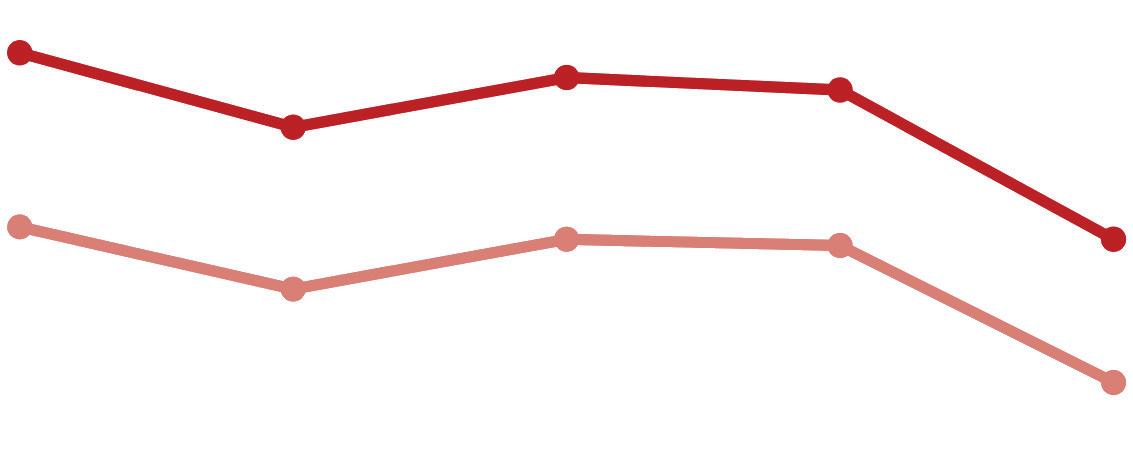

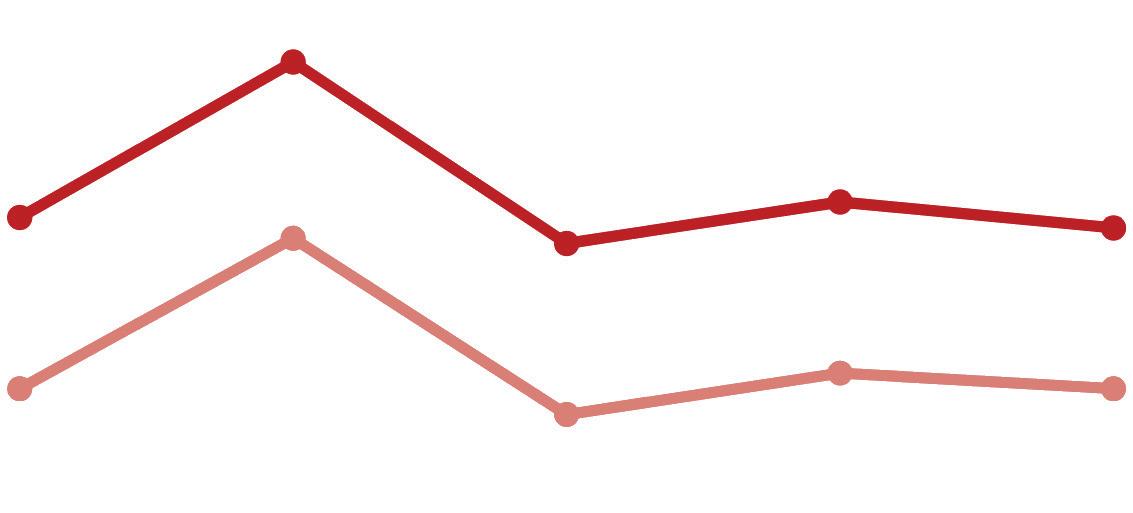

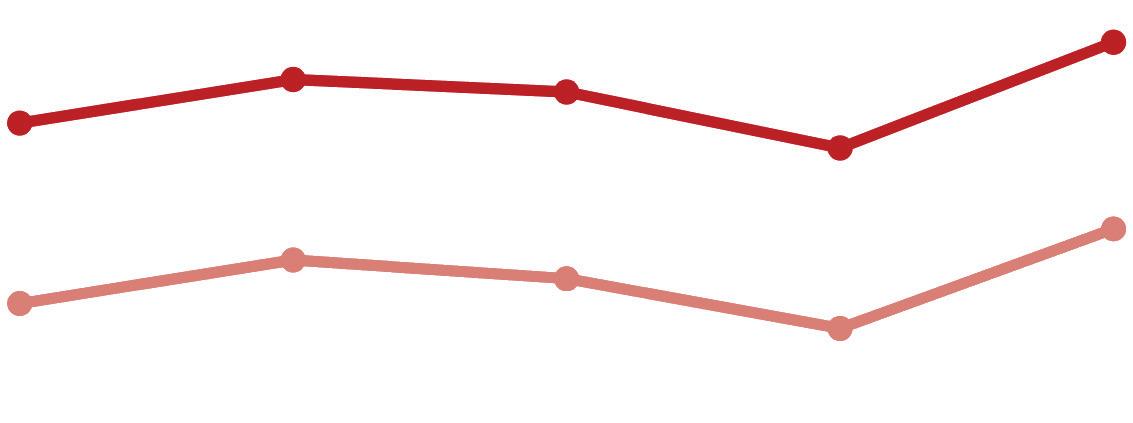

Data from MarshBerry’s proprietary financial management system, Perspectives for High Performance (PHP), shows that average benchmarks for producers have changed drastically in the last three years. Since 2020, the expected book sizes for producers have become more competitive, with each skill level having higher upper and lower quartile ranges. As shown on the charts below, producers should strive for their average book size to fall within the shaded region for their respective skill level, as that is where the majority of producers within the industry are performing. Anything below the shaded region signifies that they are performing well below industry standards and are likely to be outperformed by their peers.

The ranges for producers were more forgiving in 2020, allowing producers to have smaller book sizes (for their respective skill level) and still remain competitive. However, in 2022, those ranges became stricter and narrower. The minimum threshold for million-dollar producers’ average book size has increased from roughly $500K to over $1M. Similarly, executive producers needed a minimum of a $550K book in 2022 to be considered ‘average,’ whereas in 2020 they only needed a book size of $300K.

How can you boost insurance producer productivity and accountability?

Firms looking to achieve double-digit growth, in a highly competitive hard market, need to proactively give their producers new goals and strategies to increase productivity. Here are five ways to drive optimal insurance producer accountability.

1. Set defined new sales expectations and goals. Setting individual producer goals requires historical reflection on several years of production and strategic planning. Here are some categories of goal setting:

• Minimum goal: Minimum amount of new business to maintain producer status. Could also be used for carrying-out negative ramifications if minimum goal is not achieved.

• Individual goal: Producer’s stated personal goal.

• Stretch goal: The best-case scenario goal typically used for closed business scoreboards. Could be set at individual or organization level.

2. Implement incentives. Ensure you have a measurable spread between new and renewal commission percentages. MarshBerry typically recommends a 15% to 20% difference between new and renewal rates, which helps producers focus on new business production over renewal compensation, as new business is vital to the firm’s success.

3. Create accountability in the sales process. Producer accountability should be based on a mandatory minimum level of new business production (e.g., $100,000 in revenue) and a stretch goal (e.g., $150,000 in revenue). The plan should also incorporate negative and positive compensation incentives. For example, a producer who does not meet the minimum should face an automatic renewal rate reduction (e.g., from 25% to 20%). Those who hit the stretch goal should be eligible for enhanced new business commissions (e.g., from 40% to 50%).

4. Establish minimum account thresholds. Small business units (SBUs) are accounts that fall below a certain commission dollar amount and are handled by dedicated service staff. Firms striving to increase growth should establish a minimum account threshold for which producers are not paid renewal commission.

5. Have a carrier strategy. Having a strategy surrounding carrier relationships can be the difference between not hitting a goal or hitting a stretch goal. In what ways can you partner with a carrier to maximize success? Carriers hold a lot of industry data that can help your producers stand out and differentiate them from their competition. Additionally, find a niche that gets your producers excited and figure out what carriers support that niche. Spending more time here can be critical to a producer’s success.

With each producer focusing on expanding their own book, and rates still rising, it is hard to determine if your producers are “producing enough” to grow the firm at a competitive rate. Organic growth and sales velocity are the leading indicators of a firm’s longevity, both of which are highly dependent on the performance of production staff. But at the individual producer level, do you know how much your producers need to grow their books of business to secure your firm’s permanency in the market?

MarshBerry’s Producer Stack Rank (marshberry.com/marketintelligence/data-analytics/proprietary-analytics) models statistics on how your producers are performing on an individual level compared to all producers within MarshBerry’s proprietary database. This tool can help reveal whether your producers are growing at the rate of other similar producers within the industry – or falling behind.

To learn more about how to drive producer productivity and accountability, or how to measure their success with MarshBerry’s Producer Stack Rank, contact Eric Kuhen, Vice President, at Eric.Kuhen@MarshBerry.com or (440) 637-8118.

We distinguish our Workers’ Compensation coverage by providing value-added services before, during, and after a claim.

Upfront loss control measures

Responsive claims handling

Facilitation of quality medical care (when an accident does occur)

We’ve been successfully protecting our policyholders and their employees since 1983.

Our Workers’ Compensation policy is available nationwide except in monopolistic states: ND, OH, WA, and WY.

Loss Ratios

Premium Growth Rates

Commission Data

Line of Business Details

Surplus Lines Utilization

Penetration Rates

Source: © A.M. Best Company - Used by Permission

Big I Illinois is providing this summary of the Illinois property and casualty (P-C) insurance marketplace as a benefit of your membership.

What follows is a graphic and numeric presentation of the Illinois P&C industry data from an Independent Agent’s perspective. The 2023 data used is the most recent available from A.M. Best Company and includes all 50 states and the District of Columbia (equaling the 51 entities referred to in the data in this report). The 2024 United States Annual P&C Marketplace Summary in full is available to members at www.ilbigi.org.

This Summary emphasizes direct premiums, direct losses, and the associated direct underwriting results before reinsurance. Also included is data from nearly 3,000 insurers that are domiciled in the United States, and if they have written premiums in Illinois then their data is incorporated. As Independent Agents, this is the marketplace experience for the business we place (or compete against) for our clients in Illinois.

Premiums Overall

In 2023, Illinois P&C premiums reached $36 billion, ranking Illinois 5 of 51 in total premiums in the United States. That is 3.8% out of $953 Billion in premiums nationwide. On a relative comparative basis, per capita premiums rank Illinois 22 of 51 for all P&C premiums combined, 33 of 51 for Personal Lines, 8 of 51 for Commercial Lines, and 14 of 51 for Agricultural Lines.

Lines of Business

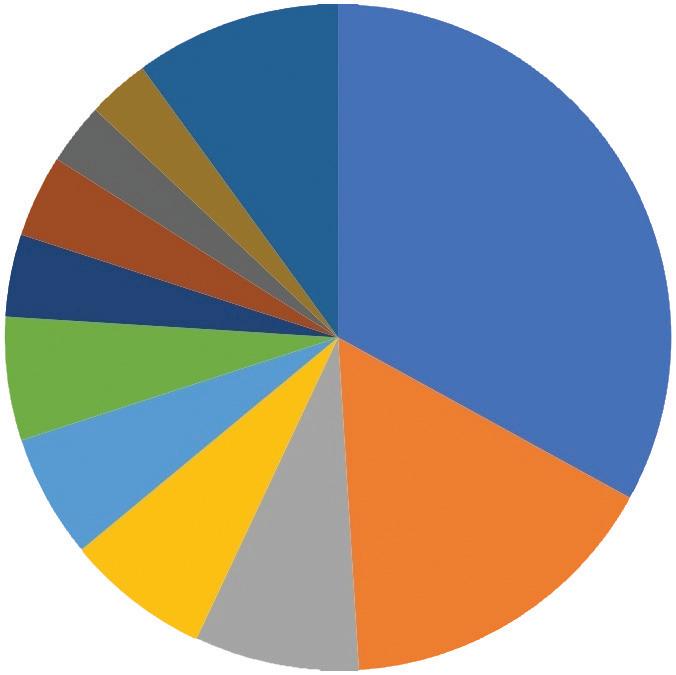

In Illinois the largest Line of Business for independent agents was Other Liability (Occurrence) (as determined by direct written premium). The second largest Line of Business in Illinois was All Private Passenger Auto, and the third was Workers’ Compensation. For comparison, in the United States those Top 3 Lines of Business are: All Private Passenger Auto, Homeowners Multi-Peril, and Other Liability (Occurrence).

Loss Ratios

Illinois’s average loss ratio across all P&C Lines of Business was 69.0%, with the highest loss ratios experienced in Farmowners MultiPeril (125.6%), Homeowners Multi-Peril (96.9%), and Allied Perils Only (76.8%). Comparatively, the United States average loss ratio was 65.9%, with the highest loss ratio in Hawaii (140.5%), and the lowest in District of Columbia (43.4%). In the United States, the Lines of Business with the highest loss ratios are Multi-Peril Crop (102.2%), Private Crop (98.8%), and Farmowners Multi-Peril (79.0%).

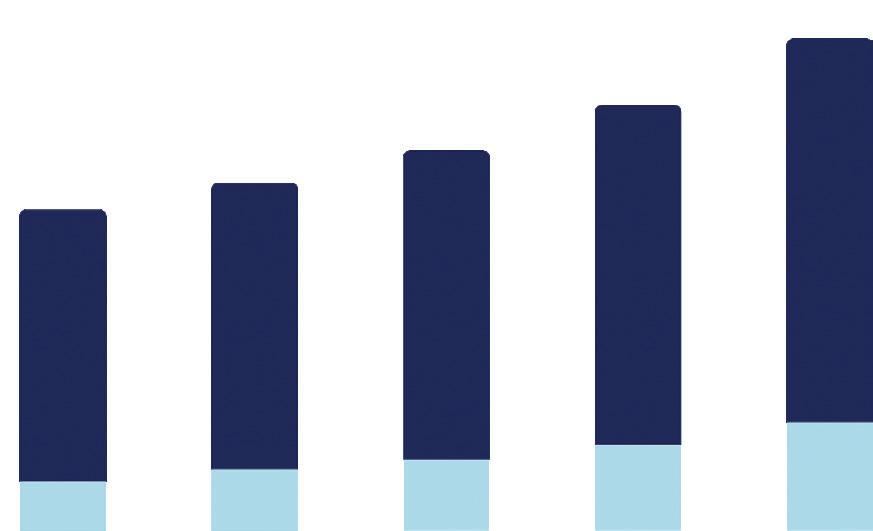

Premiums grew 7.4% in Illinois from 2022 to 2023 for all P&C Lines of Business combined, placing it 43 of 51 in the United States and District of Columbia. The fastest growing Lines of Business in Illinois are Fire Peril Only (18.3%), Allied Perils Only (17.4%), and All Private Passenger Auto (15.1%). By comparison the United States grew by 10.6%, with the fastest growing state being Florida (16.1%), and the slowest being District of Columbia (3.4%). The United States fastest growing Lines of Business are Fire Peril Only (29.9%), Allied Perils Only (27.0%), and Earthquake (16.7%).

Independent Agents control 61.0% of the Illinois P&C marketplace. This compares to the United States average of 62.2%, with the highest penetration in Massachusetts (79.6%), and the lowest in Alabama (51.6%). In Illinois, the top penetration rates by Lines of Business for Independent Agents are: International (100.0%), Burglary & Theft (98.6%), and Ocean Marine (98.5%). In the United States, top penetration rates by Lines of Business for Independent Agents are: International (100.0%), Ocean Marine (96.5%), and Burglary & Theft (96.3%).

Commissions

The average commission rate in Illinois was 11.2% for all P&C Lines of Business combined. By contrast, the average commission rate in the United States was 11.4%. The highest average commission was in the District of Columbia (13.8%) with the lowest in Delaware (9.9%).

Surplus Lines utilization is on the rise across all states. In Illinois, the average percentage of premiums going to UNLICENSED insurers (that is, Surplus Lines) was 8.1%. That percentage was 8.0% one year ago, and 5.3% five years ago. In the United States the corresponding figures are 9.3%, 9.0%, and 6.2%, respectively. In Illinois, the top 3 Lines of Business with premiums going to Surplus Lines insurers are: Private Flood (45.3%), Earthquake (40.0%), and Other Liability (Claims-made) (39.1%). In United States, the top 3 Lines of Business with premiums going to Surplus Lines insurers are: Earthquake (50.8%), Private Flood (46.2%), and Products Liability (42.1%).

State Farm Group (G) was the largest insurer group in Illinois, and it writes 14.9% of all P&C premiums. Progressive Northern Insurance Company emerges as the largest pure Independent Agent policy-issuing insurer, State Farm Mutual Automobile Ins Co as the largest Exclusive-Captive policy-issuing insurer, and Progressive Universal Insurance Company as the largest Direct policyissuing insurer.

Independent Agent-focused Lines of Business are designated by an asterisk (*).

Accident & Health

Aggregate Write-Ins

* Aircraft (all perils

* All Commercial Auto

* All Private Passenger Auto

* Allied Perils Only

* Boiler & Machinery

* Burglary & Theft

* Commercial Multi-Peril

Credit

* Earthquake

* Excess Workers' Comp

* Farmowners Multi-Peril

* Federal Flood

* Fidelity

Financial Guaranty

* Fire Peril Only

* Homeowners Multi-Peril

* Inland Marine

* International

* Medical Malpractice

Mortgage Guaranty

* Multi-Peril Crop

* Ocean Marine

* Other Liability (Claim-made)

* Other Liability (Occurrence)

* Private Crop

* Private Flood

* Products Liability

* Surety Warranty

* Workers' Compensation

The table below compares Illinois P&C premiums to the United States both in total, and on a per capita basis. Per capita premiums are provided to give a relative sense of the cost of premiums, but also allows comparing premiums state to state. For insights, per capita premiums are provided for the following groupings of Lines of Business: Total (All Lines of Business Combined), Personal Lines of Business, Commercial Lines of Business, and Agricultural Lines of Business.

The definition of Total, Personal, Commercial, and Agricultural Lines of Business are as follows:

• Total (All Lines of Business Combined) includes premiums for all 32 P&C Lines of Business.

• Personal Lines includes All Private Passenger Auto, and Homeowners Multi-Peril.

Total (All Lines) Premiums

Total (All Lines) Per Capita Premium

$35.8 billion $953,042,560,000

$2,851 (Rank is 22 of 51)

Personal Lines Per Capita Premium $1,218 (Rank is 33 of 51)

Commercial Lines Per Capita Premium

(Rank is 8 of 51)

• Commercial Lines includes All Commercial Auto, Commercial Multi-Peril, Other Liability (Claims-Made), Other Liability (Occurrence), Products Liability, and Workers’ Compensation.

• Agricultural Lines include Farmowners Multi-Peril, Multi-Peril Crop, and Private Crop.

In this table, total and per capita premiums are provided for each Line of Business grouping. Also provided is the largest/ highest state and the smallest/lowest state for either total premiums, or per capita premiums.

Note: The most recent population estimate from the United Census Bureau is the basis for the per capita comparative premium figures. Source: © A.M. Best Company - used by permission, and United States

($112.3 billion) Vermont ($1.6 billion)

($2,111)

(Release Date: December 2023) Groupings of Premiums Illinois (Rank) United States (Average State) Largest/Highest State Smallest/Lowest State

of

of Columbia ($964)

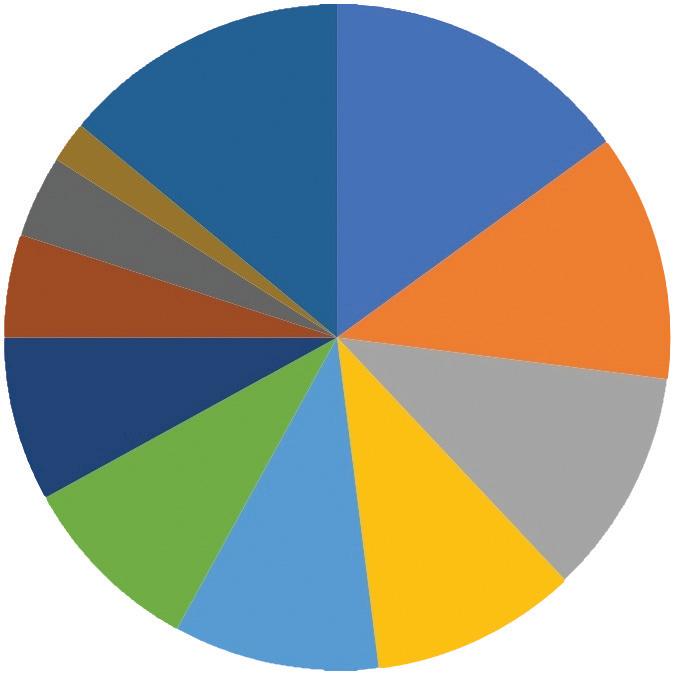

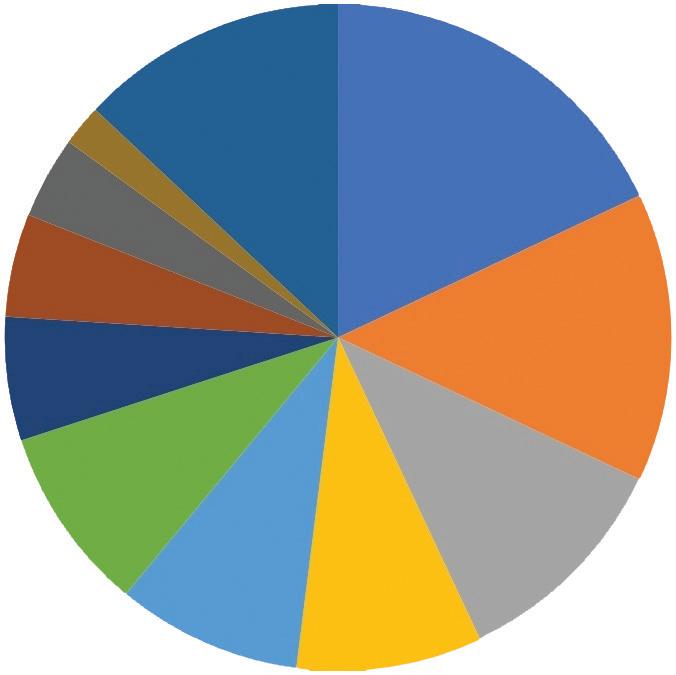

The charts below show the top ten Lines of Business written by Independent Agents in Illinois and the United States. This is based in the “All Other” pie section.

This table compares annual premium rankings for all 32 P&C Lines of Business (LOB). Shown under the column heading “Illinois LOB Ranking” are the top 10 Lines of Business in terms of premiums for Illinois in 2023. Shown under the column heading “United States LOB Ranking” are the top 10 Lines of Business in terms of premiums nationwide in 2023. The column heading “Percent of Time #1 LOB (All States),” shows that the #1 Line of Business for the United States in 2023 was also the top Line of Business in most individual states. Specifically, Private Passenger Auto was the number one Line of Business in 67% of all states, meaning it was #1 in 34 of the 51 states and District of Columbia.

The last column, “Percent of Time in Top 10 LOB (All States),” shows the frequency of each Line of Business in any state’s Top 10 Lines of Business. For example, Private Passenger Auto, Commercial Multi-Peril, and Homeowners Multi-Peril were in every state’s Top 10 Lines of Business (100%), but Aircraft was in the Top 10 only once (2%), Medical Malpractice was in the Top 10 three-times (6%), and so on. continued...

Source: © A.M. Best Company - used by permission.

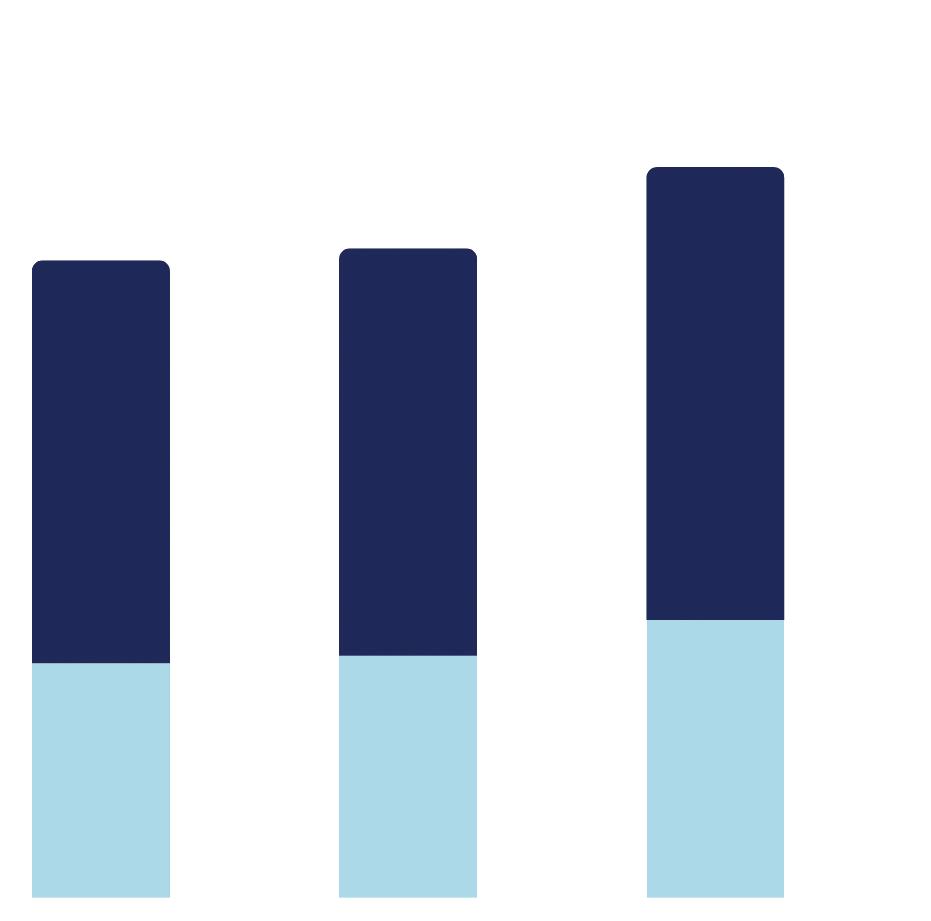

Illinois 1-Year and 5-Year Average Loss Ratios by Line of Business

Aircraft (all

This bar chart, Illinois 1-Year and 5-Year Average Loss Ratios by Line of Business, shows Loss Ratios for the 26 P&C Lines of Business focused on by Independent Agents. These 26 Lines of Business were previously highlighted earlier in this Summary. The 1-Year Loss Ratio is for 2023. The 5-Year Loss Ratio is the average Loss Ratio for 2019 to 2023.Notes: International is not shown as there is less than 5 years data available. And, after the bar chart is a definition of “Loss Ratios,” and the formula for how loss ratios are calculated.

Loss Ratios are calculated as “adjusted calendar year loss ratios.” The losses used in the ratio of losses to earned premiums equals the paid losses that year, plus any estimates of future losses that will be paid from claims that year (new reserves), plus any changes in reserves from previous years made that year (prior reserves). The “adjusted” part is if dividends are paid out under a Line of Business, then the Loss Ratio is adjusted for that cost. Where dividends are a factor (for example, workers’ compensation), it is important to include them whenever Loss Ratios of different Lines of Business are compared.

Adjusted Calendar Year Loss Ratio =

The table on the next page, Lines of Business Loss Ratios, compares the 1-year and 5-year average Loss Ratios in Illinois, and then the United States, by Line of Business, and for all lines combined, to the range in loss ratios for the 50 states and the District of Columbia. The Lines of Business are those 26 focused Lines of Business focused on by Independent Agents.

Note: individual state loss ratios can and do vary considerably, especially with low premiums in a state, and/or an individual Line of Business. Also, negative loss ratios are possible if there are prior year claim reserve reductions impacting loss ratios.

The chart/graph on the right, Illinois 1-Year and 5-Year Premium Changes, shows the percentage change in direct written premiums for the 26 different P&C Lines of Business focused on by Independent Agents. The 1-Year growth rate is the percentage change in premiums from 2022 to 2023. The 5-Year growth rate is the percentage that results when the premiums from the first year equal the most recent year, when the percentage is applied annually.

Note: International is not shown as there is less than 5 years data available.

The table below, Line of Business Premium Change compares the 1-year and 5-year average premium change in Illinois to the range of premium changes in the United States and across the 50 states and the District of Columbia.

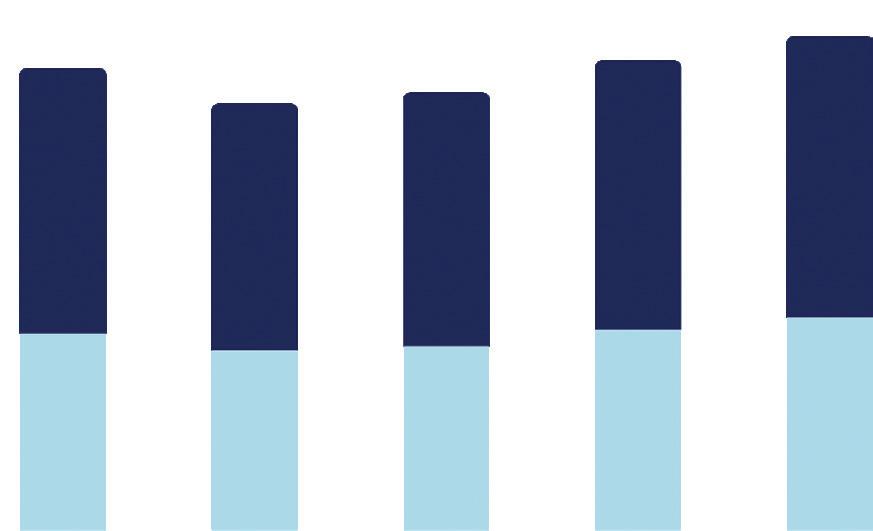

The clustered bar chart on the next page, Illinois Top 10 Lines of Business and 5-Year Penetration Rates, shows 5 years of penetration rates, from 2019 to 2023, for the top 10 Lines of Business written through Independent Agents in Illinois. The clustered bars are organized by the rankorder of premiums of each Line of Business. The final cluster of bars labeled Total (IA-Focused Lines) is the trend for the 26 P&C Lines of Business focused on by Independent Agents.

Independent Agent penetrations are estimated based on premiums of insurers using Independent Agents either directly, or in combination with other Distribution Styles (like Managing General Agents).

Independent Agent Penetration Rates Defined =

Independent Agent Written Premium by LOB All Written Premium by LOB

Penetration Rates of Total (All Lines)

The formula below shows how commission percentages are calculated, where the commission % equals the direct and contingent commissions, divided by the Line of Business written premium.

$2,000

Wednesday, October 16, 2024

6:00 to 11:00 pm

During CONVO (October 15-17)

By Jennifer Jacobs

Two students have been awarded the inaugural Insurance Careers Scholarship.

Kennedy B. just graduated high school with 39 credit hours towards her Associate’s Degree at her local community college. She plans to transfer to ISU where she will pursue a double major in Marketing and Insurance. Kennedy has been involved with the CEO program and has volunteered in the community.

Aiden N. plans to major in Business Administration and Minor in Mass Communications. He served as Student Body President in High School and enjoyed being the voice of his classmates in Student Government. He also participated in a number of clubs and organizations, in addition to helping less fortunate in the community. Aiden’s family has a background in construction and he hopes to use that knowledge and understanding in a role in the insurance industry when he graduates.

We wish our scholarship recipients the best and will be checking in with them periodically to offer support in their journey.

If you offer internships at your agency, please post them atilbigi.org/careers. Members can post for free using the CareerPlug “basic” account. As we increase our marketing and visibility to college students, we’ll be directing them to this site to find open opportunities in the industry. If you’re curious about starting an internship program, but don’t know where to begin, Invest breaks it down in a complete guide to internships at investprogram.org/professionals/recruit/internship.aspx. Save the date- a webinar series on maximizing capacity at your agency through internships is set to begin on August 15th. Details coming soon!

We’re going to hack your hiring challenges at CONVO! If you’re struggling with talent, tell us: What is your biggest challenge? How have you been burned? Where in the process are you losing candidates? We’ll take a look at the scenarios and share ideas for overcoming common obstacles. Look for details coming to ILConvention.com.

Jennifer Jacobs is the HR Director for Big I Illinois and can be reached at (217) 321-3013 or email jjacobs@ilbigi.org.

By Shannon Churchill

The Farm Agents Council (FAC) hosted their 94th Annual Golf Outing & Summer Meeting on June 13-14 in Bloomington, IL. This event is a great representation of the Farm Agents Council, with lots of great people coming together for good conversations, fun, networking and friendship. The event has all the usual features of three hours of education for IL CE credits, a niche tradeshow, good food and beverages, and of course networking.

Side note, if your agency deals in crop, agriculture or farm, I highly recommend you consider becoming a part of the Farm Agents Council, if you are not already. Send an email to farmagents@ilbigi.org to discuss!

Back to the event, the golf outing sold out with 112 golfers putting up awesome scores (17 under for our winners). Mother nature was on our side again, with glorious sunshine and a beautiful breeze. Temperatures got a little warm, but we will take it! After golf the niche tradeshow and social hour brought in over 140 people and 19 exhibitors. Friday morning education session was a new spin for us with bringing in keynote presenter, Rob Sharkey, the SharkFarmer and host of 8+ seasons of SharkFarmer TV, Sirius XM, PBS and Acres TV personality. He shared his story of grit and determination… coming back from the hog market crash, farming, and how the SharkFarmer was born. His compelling message revolved around never giving up on your dreams, embracing challenges and strategically pivoting in the face of adversity. Here is what some of the attendees had to say:

“I recently heard Rob Sharkey, “The Shark Farmer,” share his journey of diversifying his farming model at the FAC Summer Meeting. His blend of humor and personal stories made understanding his path both enjoyable and memorable. Rob’s ability to connect on a personal level while sharing his experiences was truly inspiring.” – Derek Carroll

“Rob Sharkey did a great job showing how you can persevere and overcome your failures and obstacles in life. Keep a positive attitude and move forward. He also reminded us how quick life can change through a brief moment when an accident happens that changes your entire life.” – Joe Heneghan

“Rob Sharkey “The Shark Farmer” offers a fun, lighter approach to agriculture by offering his own personal experiences, not limited to success, but also his struggles in farming. Agriculture surrounds all of us. Rob managed to connect the dots to farm/crop insurance and its importance in everyday life.” – Dave Fulton

“The Shark Farmer was not only very interesting but also very informative. Just when I thought I knew where the story was headed but it took an unexpected return. I highly recommend.” – Jeff McMillan

During the event, the FAC recognized the recipient of the Will Cook Memorial Scholarship, which was established in honor of late FAC member and Frontier-Mt. Carroll Mutual Insurance Company employee, Will Cook. The scholarship is awarded annually to one Illinois high school senior interested in pursuing an agricultural area of study including, but not limited to, farm labor, grower, farm/ranch management, biology, horticulture, farm science, agriculture sales or insurance. The recipient will receive $1000 towards their first semester of college. After careful review of many great applications, Governing Board Chair, Luke Sandrock, on behalf of the FAC Board, presented the inaugural scholarship to Emma Dinges of Sublette, IL. Watch for more information in a future issue of Insight.

During the Golf Outing & Annual Meeting, the FAC raised over $1,000 for the Big I Illinois State Political Action Committee fund.

Overall, the event was a great success and the FAC Board is looking forward to welcoming everyone back to Bloomington, IL on June 12-13, 2025. Mark your calendars now!

First-place

Adam

Ryan

Pete

Drake

Second-place

Ryan

Luke

Jim

Kief

Blake Hoveln

Megan Stark

Devin Conkright

Steve Foster

Kyle Perry

Thank you to our Associate Members.

Progressive Surplus Line Association of Illinois

Silver Level

Arlington/Roe

Blue Cross/Blue Shield of IL Pekin Insurance

A. J. Wayne & Associates

AAA, The Auto Club Group

AMERISAFE

AmTrust Insurance

Amwins

Auto-Owners Insurance Co.

Berkley Aspire

Berkley Management Protection

Berkley Small Business Solutions

Berkshire Hathaway GUARD Insurance Companies

Bliss McKnight

BluSky Restoration Contractors, LLC

Boundless Rider

BriteCo Jewelry & Watch Insurance

Central Illinois Mutual Insurance Company

Chubb

Columbia Insurance Group

Cornerstone National Insurance Company

Cowbell Cyber

Donald Gaddis Company, Inc.

Donegal Insurance Group

EMC Insurance

Encova Insurance

Erie Insurance Group

Foremost Choice Property & Casualty

Forreston Mutual Insurance Company

Frankenmuth Insurance

Grinnell Mutual Reinsurance Company

IA Valuations

Illinois Mine Subsidence Ins Fund

Illinois Public Risk Fund

Keystone Insurance Group, Inc.

SECURA Insurance

Bronze Level IMT Insurance

Imperial PFS

Independent Mutual Fire Insurance Company

Indiana Farmers Insurance

Insurance Program Managers Group (IPMG)

J M Wilson

Liberty Mutual/Safeco Insurance

Limit

Madison Mutual Insurance Company

Main Street America Insurance

Maximum Independent Brokerage, LLC

Mercury Insurance Group

Method Workers Comp

Midwest Insurance Company

Nationwide

NHRMA Mutual Workers’ Compensation

Pinnacle Minds, Inc.

Previsor Insurance & Missouri Employers Mutual (MEM)

Rhodian Group

Rockford Mutual Ins. Co.

ServiceMaster DSI

Society Insurance

SPRISKA - Specialty Risk of America

Steadily

Summit Insurance

Travelers

UFG Insurance

Universal Property & Casualty

Utica National Insurance Group

W. A. Schickedanz Agency, Inc./Interstate Risk Placement

West Bend Insurance Company

Western National Insurance

Westfield

Roger E. Needham, 56, of Roscoe, Illinois passed away unexpectedly on Friday, May 24, 2024, in Nashville, TN surrounded by his family. Roger was born in Carthage, Missouri on April 6, 1968, to Melvin E. “Gene” and Judy J. (Bittick) Needham. He was a graduate of Pierce City High School. He was united in marriage to Susan “Sue” E. Owens, to which they raised 3 beautiful children.

Roger was the CEO of Forreston Mutual Insurance Company, President of the NIRPC, Member of the Beloit Rifle Club, Merit Society, Claims Committee and NAMIC CCP, Board Member for CFM, CNI and Innovating Holdings, Chairman of Friends of NRA in Winnebago-Boone Counties, Board member of the NAMIC PAC and Board member of the Roscoe Police Department Pension Fund. Throughout his time with these organizations, Roger was the proud recipient of the 2005 IAMIC Volunteer of the Year award, 2023 FNRA Volunteer of the Year award, as well as the scheduled recipient (September 2024) of the prestigious NAMIC Service Award, which his father also received in 1991. Roger held the current designations of PFMM, AIC, API, ARE and was striving to achieve CPCU designation, to which he had one class remaining.

In his free time, Roger was an Auctioneer for FNRA, involved in the Bike MS Series, enjoyed spending time at the gun range serving as a Range Safety Officer, supporting Winnebago County 4-H Shooting Sports, Assistant Coaching girls’ basketball, smoking cigars, drinking bourbon and most of all, spending time with his beloved Grandchildren.

Roger is survived by his Wife; Sue of Roscoe, Illinois, two Daughters; Nicole (Paul) Pearson of Poplar Grove, Illinois, Kimberley (Alex) Smith of Indiana, Son; Brandon (Randi) Needham of Rockford, Illinois, four grandchildren, Mother; Judy, one brother, and two sisters. Extended family consisted of many cherished nieces, nephews, in-laws, aunts, uncles and many neighbors and friends that he considered family.

He is preceded in death by his Father; Melvin of Wentworth, Missouri. Roger’s final selfless act of kindness was giving back to those in need through organ donation.

The entire Big I Illinois team is deeply saddened by the loss of Roger. We extend our heartfelt condolences to his family and friends.

Valery C. “Larry” Leffelman; age 85 of Sublette, died Tuesday May 14, 2024 at his home surrounded by his family.

He was born November 30, 1938 in Sublette, the son of Charles and Mildred (Kuebel) Leffelman. Larry was an insurance agent and owned and operated Leffelman & Associates, Inc. since 1969. He was a veteran of the Army National Guard and a 50-year member and past commander of the Amboy American Legion Post. Larry was a member of Our Lady of Perpetual Help Catholic Church in Sublette where he had been a religious education teacher. He was a member and past president of the Independent Farm Insurance Agents of Illinois as well as a member of the Independent Insurance Agents of Illinois (Big I Illinois). Larry was village president of Sublette for 11 years and had been a member of the Mendota Knights of Columbus Council and the Mendota Elks Lodge. He felt very blessed and was passionate about God and his family, community, and country. He had a legendary and unforgettable personality (Larry, the legend - “you’re just saying that because it’s true”)

Larry married Rose Ella Bonnell on May 27, 1961 at Our Lady of Perpetual Help Catholic Church in Sublette.

He is survived by his wife Rose, daughters Jennifer (Brad) Considine of Geneva, Christine (Ed) Klein of Sublette, Amy (Gerry) Staszewski of Hampshire, 11 grandchildren, and one sister Diane (Jim) Flaherty of Mendota.

Larry was preceded in death by his parents and one brother, Eugene Leffelman.

The Big I Illinois staff and board of directors sends our sincere condolences to Larry’s family and friends.

Northern Illinois Golf Invitational

May 22 - Barlett Hills Golf Club, Bartlett, IL

Illinois Golf Outing

June 6 - Hickory Ridge Colf Course, Carbondale, IL

Big I Illinois Executive Committee members met in late June for their annual planning retreat to set goals for the upcoming fiscal year. President-Elect Pat Taphorn lead planning discussions on educating agents on the importance of legislative advocacy, promoting enthusiasm for the industry and careers in insurance, and providing opportunities for new and young agents to learn and grow alongside their peers.

42. Central Illinois agency for sale after 40+ years. Primarily personal lines. Strong retention and continuing growth and profitability. Several major carriers with unique access contracted. Current owner is close to retirement and will help with transition. Very good relationships with the local community. This is a rare opportunity to own an active producing agency.

Send your contact information to Tami Hubbell at thubbell@ilbigi.org and reference this ad.

13. We are a 100 year old Northbrook agency looking to discuss any mutually beneficial opportunity. Our producers, mergers, clusters and agency purchases receive 50% commissions on new and renewal business without any expenses. We can provide: office space, phones, agency management system, service renewals and changes. The companies we represent are: Badger Mutual, Employers Mutual, General Casualty, Guide One, Hartford, Kemper, Progressive, Rockford Mutual, Safeco, State Auto, Travelers and Met Life. Contact:

Nancy Solomon Martini, Miller & Schloss, Inc. (847) 291-1313 Ron@martini-miller.com

20. Since 2004, Central Illinois Agents Group LLC has been providing independent agents with a variety of markets with contingency opportunities. Agents have availability to several markets that they may not be able to sustain or maintain on their own. We have markets for personal, commercial, agricultural and crop insurance lines. Let us help you get to the next level.

Visit www.ciagonline.com for contact information.

23. Are you looking for an exit strategy while still continuing to produce for a few years or are you ready to sell now? Paczolt Insurance would like to talk with you! We are an independent agency dating back to the 1970s that is located in the western suburbs. Our focus is on mid-to-small commercial accounts and personal lines. Our companies include EMC, Badger Mutual, Safeco, Progressive, and Travelers. We have the flexibility and capital to get a deal done. Contact:

Susan Troppito Paczolt Insurance

susan@piaigroup.com (708) 215-5202

02. Forest Park/Oak Park agency for over 60 years, will meet your needs by providing space, markets, marketing & sales support, automation, merging with or purchasing your agency. Perpetuation/ Succession Plans, Buy-Sell Agreements also available. We have experienced, educated and dedicated staff for you and your clients. Have access to our numerous companies, office services and many other resources. Retain ownership in your book with contingency. Please look closely at us- we are an agency you want to do business with! We’ve done it before, we know howwe make it easy! Visit our website at forestagency.com/ agents.html, or call for a confidential discussion and a list of Agency benefits.

Dan Browne will provide an agency evaluation/ appraisal at little cost to you. Please call:

Dan Browne or Cathy Hall Forest Insurance (708) 383-9000 www.forestinsured.com/mergers-acquisitions