•

•

•

•

•

Omaha National Underwriters, LLC is an MGA licensed to do business in the state of California. License No. 078229. “A-” (Excellent) rated coverage through Omaha National Insurance Company, Omaha National Casualty Company, Preferred Professional Insurance Company, and/or Palomar Specialty Insurance Company. Just about everything. We do everything in-house to make sure you and your customers receive the highest level of service and satisfaction. Experience the Omaha National advantage:

Competitive commissions

No volume or premium commitments

Simplified annual audits

Dedicated sales representative

Attentive customer service from a real person Send us a submission and let us prove it. 844-761-8400 omahanational.com

INSIGHT May 2024 ILLINOIS 40 40 UNDER Part 3 History of Community Involvement Insurance Industry Economic Impact Study EMPLOYMENT | REVENUE | INVESTMENTS ANNIVERSARY

Ease of doing business. Ease of doing business means being there for agents and policyholders. It’s also about being committed to providing top customer service, fast claims handling, and a well-rounded, innovative, diverse product line. Want to learn more? Visit thesilverlining.com. The worst brings out our best.® Work with us.

Jacobs

10 Federal Legislative Conference Recap By Evan Manning 12 History of Community Involvement - 125th Anniversary Celebration 16 Navigating E&O Risks in the Excess and Surplus (E&S) Market By Ashely Riley 17 Providing Quality Submissions By QuoteWell 18 13 Steps to Effective, Clear Communication By John Chapin 20 Insurance Industry Economic Impact Study 25 40 Under 40 - Recognizing young, bright stars in the insurance industry 33 Unifying Voices - Empowering Diversity in Insurance By

Insight is the official publication of Big I Illinois. The magazine is published monthly for the members of the state association, with the office located at 4360 Wabash Avenue, Springfield, Illinois 62711-7009; Consumer Website: www.ChooseIndependent.com. Big I Illinois welcomes letters discussing concerns of the insurance industry, articles, editorials, other matters of interest to the membership. The editor reserves the right to edit and select submissions for publication. Address submissions for review to Rachel Romines at rromines@ilbigi.org. For advertising information, contact Tami Hubbell at thubbell@ilbigi.org. 14-Time Winner

May 2024 ILLINOIS Table of Contents In This Issue 17 25 8 Brett’s 5 Sense 24 Trusted Chocie 34 Associate Member News 36 Agency Member News 37 Big I Illinois News 38 Classifieds Features info@ilbigi.org | www.ilbigi.org | (217) 793-6660 40 UNDER 40

Jennifer

INSIGHT

Board of Directors

Executive Committee

Chairman of the Board - Kevin Lesch klesch@arachasgroup.com

President - Allyson Padilla allyson@blanksinsurance.com

President-Elect - Patrick Taphorn, CIC, CSRM ptaphorn@unland.com

Vice President - Thomas Evans, Jr. tom.evans@assuredpartners.com

Secretary/Treasurer - Cindy Jackman, CIC, CISR cjackman@arlingtonroe.com

IIABA National Director - George Daly george.daly@thehortongroup.com

Directors

Mohammed Ali - mali@aliminsurance.com

Amiri Curry - acurry@assuranceagency.com

Charles Hruska - chas@hruskains.com

David Jenk, Esq. - djenk@nwibrokers.com

Jeff McMillan - jeff@mcmillanins.com

Patrick Muldowney - patrick.muldowney@alliant.com

Lindsey Polzin - lpolzin@presidiogrp.com

Ray Roentz - ray.roentz@hwcrins.com

James Sager - james@sagerins.com

Luke Sandrock, CIC - lsandrock@2cornerstone.com

Noele Tatlock - ntatlock@unland.com

Committee Chairs

Budget & Finance | Cindy Jackman, CIC, CISR cjackman@arlingtonroe.com

Education | Lisa Lukens salibainsurance@gmail.com

Farm Agents Council | Steve Foster s.foster@ciagonline.com

Government Relations | Dustin Peterson dustin@peterson.insurance

Planning & Coordination | Nick Gunn, CIC nickgunn@nixonagency.com

Technology | Brian Ogden brian@ogdeninsurance.com

Young Agents | Renee Crissie renee@crissieins.com

Follow us on socials.

Big I Illinois Staff

Director of Information and Technology

Director of Education and Agency Resources

Accounting & Admin Services

Director of Human Resources, Board Admin

Sr. Vice President/Chief Financial Officer

Chief Executive Officer

Director of Membership Services

Director of Government Relations

Office Administrator

Director of Communications

Marketing Representative

Shannon Churchill (217) 321-3004 - schurchill@ilbigi.org

Brett Gerger, CIC (217) 321-3006 - bgerger@ilbigi.org

Tami Hubbell, CIC (217) 321-3016 - thubbell@ilbigi.org

Jennifer Jacobs, SHRM-CP (217) 321-3013 - jjacobs@ilbigi.org

Mark Kuchar (217) 321-3015 - mkuchar@ilbigi.org

Phil Lackman, IOM (217) 321-3005 - plackman@ilbigi.org

Lori Mahorney, CISR Elite (217) 415-7550 - lmahorney@ilbigi.org

Evan Manning (217) 321-3002 - emanning@ilbigi.org

Kristi Osmond, CISR Elite (217) 321-3007 - kosmond@ilbigi.org

Rachel Romines (217) 321-3024 - rromines@ilbigi.org

Tom Ross, CRIS, CPIA (217) 321-3003 - tross@ilbigi.org

Carol Wilson, CPIA (217) 321-3011 - cwilson@ilbigi.org

Director of Professional Liability & Insurance Products

40 Applied Underwriters 32 Berkshire Hathaway Guard Ins. Group 32 DocuSign 7 EBRM 9 The Institutes 35 JM Wilson Cover Tip Omaha National 39 Secura 22 SwissRe 4 West Bend Insurance Company Advertisers

ILLINOIS

Independent, Authorized General Agent for An Independent Licensee of the Blue Shield Association

Brett Goes to Washington

I just returned from the Big I Legislative Conference held in Washington, DC. A large contingency made up of Big I Illinois staff and members divided and conquered 12 meetings with various Illinois legislators. If you have never been on this trip, you are definitely missing out on a truly great experience. We had several first-timers as well as some seasoned veterans. Every first-timer I had in my group for the meetings I attended was extremely engaged and provided valuable input. I would say all the first-timers walked away with a feeling that it was well worth the time and effort. The cherry blossoms were in full bloom, the weather was fantastic, and our groups were more than prepared and knowledgeable about the issues we are facing nationally. This trip opens you up to what we are facing as a nation and not just in our Illinois bubble.

Washington (more so than on the State level) is where you get to truly see how the sausage is made. Being Illinois, we met with more Democrats than we did Republicans. Back when I was a young regulator, as I have previously conveyed, it was more about relationships rather than having an R and D behind your name. People could cross the aisle to produce a solution that was well-balanced. You quickly learn that the people elected to represent us in Washington have very limited knowledge of the issues unless a group or constituent has educated them, regardless of if you have a R or D behind your name. One legislator said it best in one of our sessions – “tell your story, or somebody else will.” In today’s climate, you could tell right away which legislators were interested in what we had to say and which legislators could care less about what we had to say. I will say the legislators I was a part of meeting with treated us with great respect and took notes as to our concerns, and at the end of the day, you just want to be heard. In years past, I remember some staffers going through the motions and just scribbling or not taking any notes. The legislators that I met with that shared our concerns and were championing our causes were very engaged and went to great lengths to meet with us during a very hectic

time. The Japanese Prime Minister was speaking on the house floor and they had various votes happening. Overall, I thought that all the legislators that I met with on this trip are serving their constituents well and while I may not agree with them politically, I truly respect them and their service to Illinois. Hopefully we start moving back to the days of relationships meaning something and crossing those aisles to find some sense of commonality.

You truly get how hectic all of their lives are and are amazed how they accomplish anything. Their day is probably scheduled from 7 am to midnight while even including scheduled times for eating and going to the bathroom. As you come into their office, a group is leaving, and as you are leaving, another group is arriving. If you are lucky enough to meet with the actual legislator, they may be ushered away with no notice as a committee or a vote is happening, and they have to get to the floor to do what they are elected to do. Their staffers work at a breakneck pace and juggle all of their commitments while keeping them informed of the issues and topics. I have personally seen the State level of commitment, and it cannot hold a candle to the Federal level of commitment. I truly understand how valuable it is to know the inner workings of the various processes and navigation tools that would make your job as a freshman legislator easier. You can see why the “swamp” perpetuates as without mentors or people to guide you, you could get chewed up and spit out. I have a feeling that most people go to Washington with great intentions and to make the nation a better place, but somewhere along the line, they get sucked into the process and go along to get along. The thing that is imperative is leadership and transformational personalities that are like the blue light that bugs are attracted to (a tractor beam, so to speak). The problem is if you try to swim against the stream (to affect change), you just get tired and burned out, and if you don’t, it will remain the status quo. I don’t think we have met that transformative figure yet, but hopefully, they are warming up in the bullpen.

8 Insight May 2024

AI generated: Brett’s face on Ernest’s!

Overall, Washington was a great experience and well worth the time and money as we got to tell our story. Whether or not we made a difference remains to be seen, but I felt we did. It is good for our representatives to see that we made the effort and to show how committed we are to the process. The main thing we provide, as an association, is an expertise level that they rarely see regarding the topics that are near and dear to our hearts. We were able to answer/address any of their concerns regarding the various issues and come at them with a great variety of viewpoints. Our representation was from the broker side to the largest of agencies to the smallest of agencies and finally the regulator perspective. I cannot see any other group bringing such a wide range of expertise.

May 2024 insight 9 2Sense Brett’s

Big I Illinois partners with The Institutes to provide additional opportunities for members! 10% Off Digital Content 20% Off CPCU Study Materials 35% off CEU's Unlimited Access Program FIND OUT MORE! Big I Illinois Members Only Take advantage of The Institutes' 100% online knowledge and education programs! ilbigi.org/education

Federal Legislative Conference Recap

By Evan Manning

Political activism is part of daily life for many of our independent insurance agents. However, for one week out of the year several members of the Big I Illinois take time out of their busy schedules to come down to Washington D.C. to advocate for their industry at a national level.

Beginning on April 10th, the Big I Illinois brought a total of sixteen members down to Washington D.C. for the Big “I” Federal Legislative Conference. Members of the association over two days met with thirteen members of Congress and their staff to discuss a number of issues affecting the insurance industry and our members. We had highly productive meetings, with a mixture of meetings with the individual congressperson or their staff. This event is truly one of the premiere events the Big I Illinois has to offer our members.

Attendees were also able to hear from several high-ranking leaders in Congress. On Wednesday, during the Emerging Leaders Luncheon, attendees listened to Rep. Ritchie Torres (D-NY). At the InsurPAC Major Donor Reception, several members of Congress were in attendance to meet with some of our top donors. On Thursday morning, members were able to listen to Sen. Mike Rounds (R-SD) as well as Rep. Josh Gottheimer (D-NJ). On Friday morning to end the conference, Big “I” CEO Charles Symington interviewed his close friend Rep. Patrick McHenry (R-NC). It was truly amazing to hear from all of these leaders in Congress and gaining a better understanding of the political process but an insight into their lives on Capitol Hill.

While meeting with our Illinois elected officials, our members discussed several issues including: offering our support of The Main Street Tax Certainty Act, addressing the insurance market crisis by cracking down on lawsuit abuse and encouraging risk mitigation, extending, and reforming the National Flood Insurance Program (NFIP), and protecting the Federal Crop Insurance Program (FCIP).

In 2023, Illinois finished 2nd among all states in InsurPAC donations. InsurPAC is the Big “I” political action committee (PAC), which raised a record breaking $1.31 million during the 2023 calendar year. Illinois raised $79,823 with our Young Agents raising $13,465 to finish 3rd in the country. Having a strong InsurPac is essential to keep the Big “I” the most respected and influential insurance advocacy group on Capitol Hill. U.S. Senators and Representatives are keenly aware of which groups have the largest PACs because they regularly see those lobbyists and association members at fundraising events. Not only does that constant presence reflect a strong PAC, but it also signals a vibrant and active membership that is paying attention and engaged in the political process.

If you have not already done so this year, I implore you to contribute to InsurPAC and help push Illinois to the top of the leaderboard for 2024. Contributions must be a personal contribution and can be made directly here. If you would like to join us next year for the Federal Legislative Conference, please contact me.

Evan Manning is the Director of Government Relations for Big I Illinois and can be reached at emanning@ilbigi.org.

10 Insight May 2024 Government Relations News

Big I Illinois Past Presidents Cindy Jackman (left) and Allyson Padilla (Right) congratulate Louise “BeBe” Canter (center), the first woman to serve as Big I President, on receiving the 2024 Woodworth Memorial Award.

Left to Right: Mike Wojcik, Luke Sandrock, Pat Taphorn, Cindy Jackman, Jon Jackman, Brett Gerger, Lance Grady, George Daly, Phil Lackman, Noele Tatlock, Allyson Padilla

Left to Right: Ken Samson, Luke Praxmarer, Evan Manning, Chas Hruska, Kevin Lesch, Tom Evans

May 2024 insight 11 Government Relations News

Left to Right: Pat Taphorn, Jon Jackman, Representative Mike Bost (R-IL 12th District), Cindy Jackman, Noele Tatlock

Left to Right: Lance Grady, Allyson Padilla, Luke Praxmarer, Noele Tatlock, Representative Darin LaHood (R-IL 16th District) Pat Taphorn, Cindy Jackman, Jon Jackman, Phil Lackman, Luke Sandrock, Brett Gerger

Left to Right: Tom Evans, Cindy Jackman, Pat Taphorn

Left to Right: Ken Samson, Bill Rademacher, Jon Jackman, Representative Sean Casten (D-IL 6th District) Cindy Jackman, Brett Gerger, Chas Hruska

History of Community Involvement

Just like independent insurance agents all over the state, Big I Illinois has always been deeply committed to giving back to the communities we serve. Beyond offering exceptional products, services and resources for 125 years, the state association has supported the community in many ways. In this series, we revisit our legacy of involvement.

Independent Insurance Agents Junior Golf Classic

For nearly 50 years, Illinois agents hosted local qualifying tournaments for the Independent Agent Junior Golf Classic (IIAJC). Winners of the local qualifiers would compete at the state tournament hosted by the association and run by a network of volunteers. Winners from the state competions went on to the national, which was hosted by the Independent Insurance Agents and Brokers of America. At the height of its popularity, the IIAJC was the largest youth golf tournament in the world, with over 10,000 qualifying golfers. The Illinois state tournament was often held at Lick Creek in Pekin, Illinois and the national competition was held at a number of notable golf courses. One of the most famous players to hail from the IIAJC was Tiger Woods, who won the national title in 1990 and 1992. Later rebranded as the Trusted Choice Big I Junior Classic, participation in the event began to decline and the decision was made to discontinue the tournament in 2018.

125

125

12 Insight April 2024

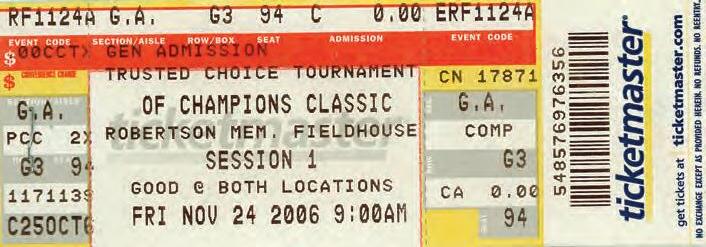

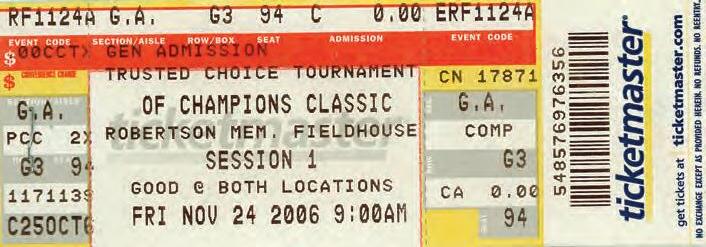

Trusted Choice Tournament of Champions

In 2006, the state association sponsored the inaugural Trusted Choice Tournament of Champions, a high school basketball tournament featuring the top teams and players from across the country. Twenty-four teams participated in the tournament, hosted by the Peoria Area Sports Commission, including six of the top 25 high school teams in the nation.

The tournament received extensive media coverage throughout Illinois and Missouri, reaching as far as Florida, Arizona and Texas, even receiving mention in USA Today

125125 April 2024 insight 13

Big I Illinois Philanthropy Efforts

Throughout the years, the state association has continually supported philanthropic efforts of many organizations. Whether it’s a staff outing, an event with agents, or raising funds, Big I Illinois is proud to have helped make a difference in our communities.

Big I Illinois has partnered with Trusted Choice over the years to raise funds to help fulfill the wishes of children with a critical illness. The Illinois Young Agents Committee also supported Make-A-Wish, raising money and awareness at several events.

Big I Illinois staff and members, and their families, joined together for Walk-forWishes events several times at locations throughout the state. We were able to help grant many wishes over the years.

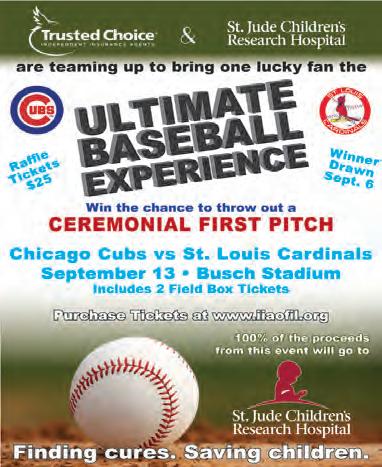

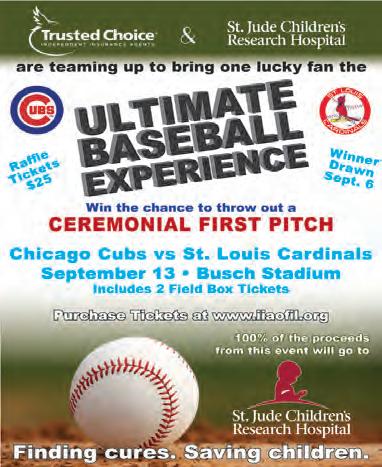

Another association charity of choice is St. Jude Children’s Research Hospital. Through our partnership, we raised money for St. Jude in several ways, including

• Ultimate Baseball Experience, 2016 & 2017 - one lucky winner threw out the first pitch at a St. Louis Cardinals Game

• Window Clings for Members, 2017-2019 - clings could be purchased to show the agency’s support of St. Jude, with 100% of proceeds going to the charity

• St. Jude Walk, 2022 - Staff participated in a walk for awareness and to raise funds

• Charity Garage Sale Event, 2017 & 2018- as our contribution to the Young Agents Statewide Day of Giving, staff organized a very large Garage Sale Event that included the typical garage sale items, as well as local vendors and food trucks.

• and so much more!

125 14 Insight April 2024

Big I Illinois continues to support both charities, as well as several others.

In partnership with JC Restoration, now BluSky Restoration, for several years, Big I Illinois staff traveled to the Chicago area to help pack meals for Feed My Starving Children (FMSC). Volunteers hand-pack the meals. Meals are donated to FMSC food partners around the world, where kids are fed and lives are saved!

Association Hosts Russian Delegation

In 2004, association member Larry Miller, of Miller Dredge Insurance Agency in Galesburg, Illinois, approached the Big I with a request to assist in hosting and educating a delegation of insurance agents from Russia. The agents were participating in a program organized by the Center for Citizen Initiatives. The purpose of the visit was for the Russian citizens to learn about the insurance industry in America and to hear best practices from US agencies on topics including business structure, sales and marketing and personnel management. Big I Illinois coordinated visits to the Department of Insurance to hear about insurance regulation and the Capitol where the visitors learned about the legislative process. Association staff hosted a cook-out for the delegation where they shared American food and culture.

Big I GIVE Movement

Inspired by the Illinois Young Agents Statewide Day of Giving in 2017, Big I (national) Young Agents created the GIVE Movement. This weeklong movement celebrated independent agent’s community efforts all over the country! Big I collects charitable information via agent submissions throughout the year. For details on the GIVE Movement, go to independentagent.com/youngagents/Pages/Give/give.aspx.

We enjoy sharing our Illinois member’s fundraising and awareness efforts in our publications, at any time of year. Let us know what you are doing! Scan the code or go to https://tinyurl.com/BigICommunity.

125 April 2024 insight 15

From the Archives

Illinois Insurance

Directly Employs

Over 159,397 People

REVENUE

Illinois Collected

From the Insurance Industry in 2022 INVESTMENTS

Illinois Insurers in Bonds

2024 INSURANCE INDUSTRY

ECONOMIC IMPACT STUDY

EMPLOYMENT | REVENUE | INVESTMENTS EMPLOYMENT

The main role of the insurance industry is to offer financial protection that indemnifies policyholders, households, and businesses from financial loss covered under insurance policies.

The insurance industry in Illinois has an exceptional impact on both the economy of Illinois and on the U.S. economy as a whole. The insurance industry offers well-paying, steady employment to thousands of Illinois residents. The Illinois insurance industry’s employment, contribution to state GDP, premiums written, losses paid, and investments places the Illinois insurance industry as one of the top-ranking industries in the nation.

The promise of indemnification offered by Illinois-domiciled property and casualty insurers is one of the country’s most significant ways in which Americans insure losses to homes, autos, and businesses. The insurance industry in Illinois is a flagship industry for the entire country.

In this study, we focused on the supply side of the insurance industry by analyzing insurers as producers of services and employment. This may differ from an approach focused on the demand side of insurance, where the aim is to assess insurance as a consumption good, and the analysis is meant to reflect the behavior of households and businesses.

20 Insight May 2024

BENEFICIAL

Locations of large companies and brokers in Illinois.

THE

ROLE OF THE INSURANCE INDUSTRY IN ILLINOIS

12/2020

88% of all online searches are done through Google. Fully leveraging your free Google Business Profile can be a powerful way to help your agency gain more visibility, traffic, and customers. This comprehensive guide will give you step-by-step instructions on how to strengthen your profile and stand out in this competitive market.

Guide Includes: Profile Set Up Steps to Increase Visibility Additional Must-Try Features Tips to Maximize Online Reviews Take Charge of Your Online Visibility with the Google Business Profile Optimization Guide

www.trustedchoice.independentagent.com/google

ILLIN O I S 40

UNDER Part 3

Recognizing young, bright stars in the insurance industry.

40

Chris Bassler Andrew Denton

Mike Donahue Chas Hruska

Drake Kelly

Rob Levitt

Chris Pumo

Jaye Sanstrom

Bradley Sullivan

Paul Tomshack

40 UNDER 40

CHRIS BASSLER

Bassler & Co. Insurance Agency

Northbrook, IL

Why did you choose to pursue a career in insurance?

Like many of us, I never expected to work in the Insurance industry. When in college I certainly helped out the family business, but never had true aspirations to join in. I did although start my working carrier in the insurance space, but with an insurance carrier called Unum. After 3 or so years I started to really enjoy Insurance and found myself quickly looking at how I could make a long career out of it. I then joined Bassler & Co. in 2012 and have loved working to grow this company and support our clients needs.

What obstacles did you face when you first started, and how did you overcome them?

When I started I had very little contacts and did not know much. I felt the pressure to not only learn the business the best I could, but also as quickly as possible. Meanwhile, I hit the road and started networking and turning over every rock I could find. I did not let the answer of “no” slow me down. You quickly learn how to grow thick skin and keep chugging on.

What’s something people should know about your generation in the workplace?

Yes, I am a millennial and certain assumptions come with my generation. I can certainly say that is truly not me. I enjoy hard work and do not shy away from getting my hands dirty and putting in the needed hours to succeed. There is nothing better than working hard and helping a current or new account with their insurance needs. I think its in my blood and the competitor in me. I will not allow myself to feel like to was given anything that I did not work for.

How has this industry impacted your life?

This industry is labeled as one of the worst jobs to work in here in 2024 by the Wall Street Journal. I beg to differ! I think this a fantastic industry and could not be happier to be in it. I absolutely love the competition as I mentioned, but even more enjoy my relationships with my clients and assisting them with their needs. If I could rewind to college I would do it all over again and jump into the Insurance Space.

Mike Donahue

ThorntonPowell

Oak Forest, IL

Why did you choose to pursue a career in insurance?

I knew it was a way to have a great career while also being able to enjoy a rewarding work/life balance. In college I had some great professors who came from some large insurance companies and I really enjoyed my risk management classes. Being very family-oriented, I wanted to have a job that I could do while still being able to coach my kids and make it to all of their various events.

What obstacles did you face when you first started, and how did you overcome them?

When I first got my insurance license I was still an undergrad in college, so having credibility at that age can be challenging. I was lucky enough to have great mentors that I was able to learn from early in my career. Finding people who have had success and being able to learn from them was a tremendous boon.

What’s something people should know about your generation in the workplace?

We are a dynamic bunch. I’m about to age out of this “under 40” age group, but many of us grew up along with the internet and (luckily) social media didn’t become prevalent until we were young adults. As such, we know how to create

and foster genuine relationships with people while still being tech savvy enough that we can be adaptable and quick to learn emerging technologies.

How has this industry impacted your life?

I’ve been extraordinarily lucky in that I’ve gotten the opportunity to meet and work with so many amazing people. My colleagues, clients, and carrier relationships mean a lot more to me than any of them probably realize. At the end of the day, this industry has allowed me to have a career that is flexible enough to give me the freedom to spend time with my family while also being able to help people every single day.

26 Insight May 2024

ANDREW DENTON

Green Brook Insurance

Wheaton, IL

Why did you choose to pursue a career in insurance?

Choosing a career in insurance was a matter of providence and purpose, given my family’s history in the industry and my personal mission to empower others to transcend their circumstances through understanding, faith, and action. Despite my initial aspirations to work in the Foreign Service, influenced by my degree in religion, living in the Middle East, and working with the federal government, life’s unpredictable path led me to reconsider my professional goals. When we moved to Wheaton, IL, for my wife’s job, I explored temporary work options, eventually re-introducing me to financial services. After three years at a Fortune 100 Insurance company, I started Green Brook, where our tagline is “Take Hold of Your Tomorrow.” My path allowed me to find a platform where I could implement my mission on a broader scale. Insurance, to me, is more than a profession - it is a medium through which I can foster environments of peace over fear, advocate for equity and understanding, and support individual and community transformation.

What obstacles did you face when you first started, and how did you overcome them?

I’m a perfectionist, and there’s a lot to get right when starting any agency. For example, in the first year and a half, I personally ensured that every client received service that was as close to perfect as possible. This greatly enhanced Green Brook’s reputation, but it was unsustainable for the business. Therefore, I had to hire staff who were as close to perfect as possible. Where I was 98% efficient and incredibly stressed out, the Client Care Team is 92% efficient, corrects mistakes, and has a healthy work-life balance.

What’s something people should know about your generation in the workplace?

I think intentional space should be made for people to be seen, known and enjoyed as individuals. This fosters a sense of community and can promote good teamwork. At Green Brook, we have a weekly 20-30 minute informal meeting where we’ll ask a silly icebreaker question or discuss a topic that builds off of a previous week. It seems cheesy/awkward but people actually love it and it cultivates a culture of humanity, mutual respect, transparency, and using our abilities toward our teams’ purposes.

How has this industry impacted your life?

The industry has impacted my life on many levels. One thing I enjoyed about working in the federal government was the interesting people I got to meet. Some of my Green Brook clients are extremely interesting. Two of my clients who are under 50 could be billionaires soon. I have clients who have fought in wars, clients who have faced and fought all types of discrimination, clients who are religious leaders, professors and authors and one client who is a public intellectual. The relationships are incredible.

CHAS HRUSKA

Arthur J Gallagher

Downers Grove, IL

Why did you choose to pursue a career in insurance?

Having grown up with parents who had their own agency I was able to see the industry from a different perspective. Over time I learned that insurance was a very unique way of helping people. At the end of the day that is what we do, we help protect people. That is something that has always stuck with me and it’s why I wanted to work in insurance.

What obstacles did you face when you first started, and how did you overcome them?

Oddly enough, having a family with an agency was a detriment to my ability to obtain an underwriting position out of college. I was consistently rejected because people thought of me as a wasted investment that would leave in a few years to join the family agency. That did end up happening, but it was not my plan at the time. It was only through persistence,

a trait I think most agents share, that I was able to find a company that viewed my family’s situation as an asset rather than a liability. I took that persistence and learned as much as I could, as quickly as I could, and I’ll probably never stop learning.

What’s something people should know about your generation in the workplace?

The individuals in our generation are not defined by the stereotypes of our generation. Contrary to the generalities that are spoken about Millennials, there are a lot of people in our generation that are hardworking, loyal, and caring. Hardworking for a vision we believe in, loyal to those who have earned it, and caring for the customers we work with... We just might be hard to find.

How has this industry impacted your life?

This is a hard question to answer. To a certain extent the industry is my life, I never got out of it from the time I was a part time janitor almost as soon as I could walk. The biggest impact on my life has been the wonderful people I’ve met along the way. Coworkers, fellow agents, competitors, and customers alike.

May 2024 insight 27

continued...

40 UNDER 40

DRAKE KELLY

Valley Insurance Group

Naperville, IL

Chris Pumo

Pumo Insurance Agency

Chris Pumo

Pumo Insurance Agency

Macomb, IL

Why did you choose to pursue a career in insurance?

I love people and this job gives me the opportunity to work directly with people each day.

What obstacles did you face when you first started, and how did you overcome them?

Learning the “insurance language” was tough for me as I had no familiarity with insurance whatsoever. I overcame this by being blessed with an amazing mentor, Dave Schmitt, who encouraged me not to give up and told me that I was born to do this.

What’s something people should know about your generation in the workplace? It is still all about in person meetings and relationships that extend beyond the insurance piece.

How has this industry impacted your life?

It has allowed me to provide a great life for my wife and kids yet still coach my kids while being a present husband/father. There are many successful people in sales who need to jump on an airplane to get their deals. Those of us who have found insurance generally can be home for dinner most nights with our families which I consider to be one of the greatest blessings this industry has to offer.

Why did you choose to pursue a career in insurance?

Insurance has always been a part of my life. My grandfather started as a partner in an independent insurance agency in the 1950’s and my father continued the agency until 2013 when I took over. Both my father and mother both worked in the agency. I started with the odd jobs around the office like putting away files as a young teenager.

As I went through college, I started to understand that it was a great opportunity. Most young people don’t get excited about joining the insurance industry but if they look closely they should. I enjoyed studying business and when presented with the opportunity to take over a successful agency I couldn’t pass it up.

What obstacles did you face when you first started, and how did you overcome them?

Very few people come into the insurance industry with an idea of exactly what they are walking into. Being around it my whole life I had more background than most but couldn’t appreciate everything that goes into the day to day.

Technical knowledge is an obstacle for everyone, I think. Getting your license doesn’t give you everything you need to sell to and care for clients on day 1. Early on I got my CIC designation which helped me get start to get a handle on the technical side.

Another challenge as a young person was to create trust with prospects and clients. Showing people that even though I was young I had the knowledge to secure their financial future was a challenge. That was different with everyone but explaining fully and listening to their concerns were the biggest help.

Every day is different, and a lot comes with experience. You do truly learn by doing.

What’s something people should know about your generation in the workplace?

I think our generation is comfortable in the traditional ways of doing business but wants to be backed by great technology. I would love to sit down with a customer, schedule a phone or video call so that I can have a productive conversation and understand their needs. Then when the time comes to put together coverage options, I want the best platform I can find to deliver the solution.

How has this industry impacted your life?

The insurance industry has certainly been a positive force in my life. It provided a good life for me as a child and is helping me do so for my family. I see local agencies like us being a force for good in the community as well. We are happy to and proud to support organizations that help the people around us prosper. It has also helped give me perspective. I get the chance to talk with a lot of different people in different situations and appreciate where they come from. Life would look a lot different without insurance in it.

28 Insight May 2024

Rob Levitt

Levitt Insurance Agency Washington, IL

Why did you choose to pursue a career in insurance?

I’ve always been drawn to industries where I can make a difference in people’s lives. Insurance offers a unique opportunity to provide peace of mind and financial protection to individuals and businesses during times of uncertainty. I’m deeply passionate about helping others navigate complex situations while mitigating risk and insurance allows me to do just that. Additionally, the evolving landscape of the insurance industry provides constant learning opportunities and unique challenges that keep me fully engaged and motivated as a professional. Overall, I chose to pursue a career in insurance because it aligns with my core values of helping others, making a positive impact, and continued personal and professional growth.

What obstacles did you face when you first started, and how did you overcome them?

When I first started working in insurance, the two main obstacles I faced were the complexity of the industry itself and building credibility and trust with those I would interact with. Insurance involves a multitude of policies, regulations, and terminology that can be overwhelming to navigate, especially for someone new to the field. To overcome these obstacles, I have dedicated myself to continuous learning. I immersed myself in many different training programs, sought guidance from experienced colleagues, and made a conscious effort to stay up to date on industry developments that directly related to my job. I also attend seminars, workshops, and utilize online resources to continue to learn and improve.

JAYE SANSTROM

Honest

Abe Territory Insurance Services

Newman, IL

Why did you choose to pursue a career in insurance?

One might say insurance sort of chose me or at least one local business man did. I was between careers and a local businessman; Jay Hageman had recently bought out his partner at the Newman location. Hageman was looking for new agents. Lucky for him, I was not afraid of a challenge, so I jumped in with both feet. I originally thought I would be just selling insurance. On day one, I was acquiring contracts with carriers, writing our E & O application, speaking with carrier representatives, and completing carrier contracts. And the rest they say is history.

What obstacles did you face when you first started, and how did you overcome them?

Opening a new insurance agency is no small task, and for me not coming from the insurance industry, first I had to understand and learn what we needed to maintain the book of business that was purchased, before I build anything from that foundation. I knew I had to get those contracts established first, before anything else. Many long hours of writing contracts and making phone calls to get those contracts, but the process was all worth it and the knowledge I learned was irreplaceable.

What’s something people should know about your generation in the workplace?

Millennials should be called the “pivot generation.” I, along with others my age, have become so good at pivoting with

What’s something people should know about your generation in the workplace?

Our generation has a high aptitude for technology, having grown up alongside the digital boom. Growing up being immersed in technology has equipped us with a solid grasp of various digital tools and platforms, making us highly sought after in technology-driven environments. In the insurance industry, embracing technology is crucial for staying competitive, improving operational efficiency, customer experiences, and fostering innovation. My generation is well-positioned to lead the charge when integrating new technologies into the insurance industry.

How has this industry impacted your life?

Working in the insurance industry has really made a difference in my life. It’s helped develop a deep understanding of risk management and financial planning, which has been incredibly valuable personally. The ever changing nature of the industry keeps me engaged and constantly learning, allowing for a tremendous amount of personal and professional growth. So far in my journey, I have met a lot of great people along the way– from new clients to colleagues, I have formed many lasting friendships and relationships. The most meaningful impact of this industry is the unparalleled work-life balance it offers. I’m able to be present with my family and never miss out on important moments with my kids or spouse.

what life has thrown at us. Many of us went to college, but are now in different careers further away from our studies. We manage numerous tasks at a time, not only in the workplace, but many of us are at a point in life where we are juggling parenthood, aging parents, death, etc. Our generation’s determination can be unmatched when we set our minds to a project.

How has this industry impacted your life?

The insurance industry has changed my life. One man’s faith in me to build his independent insurance agency came at a time when I needed someone to believe in me. After his sudden passing in October 2018, I was more determined to see our dream come true. And in March 2019, I was finally able to purchase the agency. The agency has grown over the last 5 years, and it is standing all on that initial effort and diligence I experienced during that first year of the agency.

May 2024 insight 29

40 UNDER 40

BRADLEY SULLIVAN

Arachas

Bartlett,

IL

Group, LLC

Why did you choose to pursue a career in insurance?

I’m a third-generation insurance agent. My Grandfather started what was called Sullivan & Associates Insurance Agency in the 1970’s. Initially I started at the agency as a temporary and seasonal job while I was attending college, but as time went on it didn’t feel right pursuing other fields. The agency was my home, and that’s where I belonged. These days, I’m very happy I went with my heart. The insurance industry has opportunity around every corner. Especially for young hard-working individuals who are willing to walk the road less traveled.

What obstacles did you face when you first started, and how did you overcome them?

When I started in the industry I had been struggling with physical and mental health issues for years. While I was still able to get my work done, it was evident that they were holding me back from putting in my best effort. By making the improvement of my mental and physical health a constant focus and concentrating on proper diet and exercise, I have made those issues a thing of the past. Nowadays, I feel free to put my full self in my career and push past whatever limits I thought I had before.

Another major obstacle, which I believe is a common problem for my generation, was the phones. When I started in the industry talking on the phone actually scared me. I couldn’t get through a voicemail without stuttering. It was extremely uncomfortable talking to customers or carriers this way because it was not something I was used to. My normal communications were texts, and so I gravitated towards emails, trying to avoid a phone call at all costs. However, I realized this was not going to be enough if my career was going to be in insurance. Too many situations arise where a phone call is necessary or advantageous. To fix the situation, I made a very conscious effort to make as many calls as possible. Instead of finding reasons not to make a call, I found reasons to pick up the phone. Practice makes perfect, and repetition causes comfort.

What’s something people should know about your generation in the workplace?

I fall into the younger millennials/older gen Z crowd, and one thing I would tell employers about dealing with this group is not to listen to the media so much. Instead think more about yourself at that age and what would have helped you in that situation. Too often do people put more time and energy at categorizing and looking at differences rather than taking advantage of similarities. Stop paying so much attention to the noise around work/life balance, starting pay, and motivation. From what I’ve heard, those have always been problems. While there may be some merit to these issues, the younger generations truly need what they’ve always needed. Direction, encouragement, and a good example to follow.

One thing I would tell others in my cohort, is they should avoid the allure of work-from-home opportunities. While working from home may seem glamorous on the surface, you are absolutely cutting off important social interactions that would allow you to build rapport with your company more quickly and expand your knowledge of the industry. Remember, the easy choice is not the one that often leads to success.

How has this industry impacted your life?

After being in the industry for over a decade at this point, I could probably write a book on how it’s impacted my life. One thing that stands out is the general knowledge it’s given me of the world and how things work. The insurance industry is tied to just about every other industry out there, and as a result, it gives us the opportunity to learn and be a part of just about everything. It’s a diverse feast of information and social interactions for those who are looking for it.people.

30 Insight May 2024

Paul Tomshack

Tomco

Insurance Agency, Inc.

Charleston, IN

Why did you choose to pursue a career in insurance?

My father-in-law built up a successful independent agency over 40 years, and the idea of taking over the family business had a powerful allure. After 8 years in the Navy, I was drawn to the ability to live closer to family and control my own schedule. Plus the sales and ownership aspects offered unlimited growth opportunities that cemented the choice for me.

What obstacles did you face when you first started, and how did you overcome them?

It was an immense boon to be able to step into an established agency with a multitude of proven processes and experienced staff in place. At the same time, it was clear to me that many of the processes they’d been relying on – like extensive and bulky paper files, for example – would need to be modernized to really make the agency more efficient going forward.

It was tricky, especially at first, to convince everyone of the need to make changes, and then to make sure the modernizations we tried were truly more efficient. Sometimes we made changes that had to be reassessed later on, and I made sure to acknowledge when something didn’t work and be open to suggestions for better options. It wasn’t a perfectly straight and easy path from where we started to where we are today, but through perseverance and dedication to open-mindedness, we have been able to grow the agency into a modern, efficient business

What’s something people should know about your generation in the workplace?

Millennials tend to be most efficient and driven when engaged in projects they’re passionate about. They like to be part of something bigger than themselves and feel like they’re making a positive impact in the world. Give them that, and they will take on the world to achieve their dreams.

How has this industry impacted your life?

Growing my knowledge of insurance has allowed me to become a nerd about a topic I didn’t know I loved, and it’s so rewarding to get to share the nuances of that knowledge with my clients. Also, insurance is a very customer-focused field, and it’s been a treat to come back to my hometown and connect with the community I was raised in. Working in insurance has allowed me to build relationships with customers, businesses, and farmers throughout the area, and I feel like everywhere I go, I see someone I’ve worked with – just ask my kids, who are constantly asking, “Dad, do you know them? I bet you write their insurance, don’t you?” That feeling of community and connectedness can’t be quantified. It’s priceless.

May 2024 insight 31

Look for the next group in the June issue of Insight!

32 Insight May 2024 Browse all of our products at www.guard.com. Workers’ Compensation Our Workers’ Compensation policy is available nationwide except in monopolistic states: ND, OH, WA, and WY. We distinguish our Workers’ Compensation coverage by providing value-added services before, during, and after a claim. Upfront loss control measures

claims handling

of quality medical care (when an accident does occur) We’ve been successfully protecting our policyholders and their employees since 1983. Boost profits, delight customers with DocuSign eSignature. To learn more, visit docusign.com/IIABA IIABA members receive special pricing and offers Securely send and sign policy or claims agreements and disclosures electronically, and maintain a complete audit trail. Reach policyholders faster with SMS notifications and simplify claims submissions with drawing and mark-up capabilities to document damage. — Delight customers with mobile-friendly signing — Enhance agent productivity with faster turnaround times — Ensure legally binding and secure agreements DocuSign is the endorsed eSignature provider for IIABA members.

Responsive

Facilitation

Unifying Voices Empowering Diversity in Insurance

United Insurance Networks hosted its first ever joint industry event in Chicago on April 11, 2024. Organized and sponsored by RT Specialty, the event brought together industry organizations representing diverse voices including:

APIW- Association of Professional Insurance Women www.apiw.org

AAIN – Asian American Insurance Network www.aainsurance.org

LAAIA – Latin American Association of Insurance Agencies www.laaia.com

Link USA – the LGBTQ+ Insurance Network www.lgbtinsurancenetwork.com/usa-chapter

NAAIA – National African American Insurance Association www.naaiachicago.org

These groups share a commitment to advancing diversity, equity and inclusion within the insurance industry and also support the effort to bring new talent into the industry. Representatives of each organization shared the history of the group, whether the organization has a chapter or plans to grow one in Chicago, what programs and initiatives they have on the horizon and how they are working to attract new talent into the industry. The key takeaway on recruiting was that the representatives are always sharing what they do and why they enjoy working in the industry. Jeff Chen, VP at EMC Insurance Companies, shared that he will scour LinkedIn for connections that have the skills necessary for the positions that need to

By Jennifer Jacobs

By Jennifer Jacobs

be filled. Brett Carter, VP of The Jacobson Group, shared the analogy that finding talent is a lot like finding the big scissors in the drawer – at first you may open the drawer and not see them, but sure enough, they are right there if you just take a closer look.

Whitnee Dillard, Executive Director of the Big I Invest Program, moderated a panel featuring industry professionals and students from the Katie School of Insurance and Risk Management. The students shared what drew them in to the industry and what might also attract them to a future employer. They said that insurance was:

- Inclusive – it allowed them to be themselves and also made them feel welcome

- Social – They had participated in networking events through Gamma Iota Sigma and had been invited to industry events and really enjoyed connecting with people!

- Analytical – An actuarial student enjoyed focusing on the numbers and data

- Interesting/Varied - Students like they can help individuals through selling personal insurance, but also find the concept of commercial insurance and working with businesses appealing.

Organizers of this United Insurance Networks event hope that it will be the first of many to come.

Jennifer Jacobs, SHRM-CP, is Director of HR for Big I Illinois and can be reached at jjacobs@ilbigi.org.

May 2024 insight 33

Thank you to our Associate Members.

Diamond Level

Platinum Level

Progressive Surplus Line Association of Illinois

Silver Level

IMT Insurance

Gold Level

Arlington/Roe

Blue Cross/Blue Shield of IL

Pekin Insurance

Keystone Insurance Group, Inc.

SECURA Insurance

Bronze Level

A. J. Wayne & Associates

AAA, The Auto Club Group

AMERISAFE

AmTrust Insurance

Amwins

Auto-Owners Insurance Co.

Berkley Aspire

Berkley Management Protection

Berkley Small Business Solutions

Berkshire Hathaway GUARD Insurance Companies

BluSky Restoration Contractors, LLC

BriteCo Jewelry & Watch Insurance

Central Illinois Mutual Insurance Company

Chubb

Columbia Insurance Group

Cornerstone National Insurance Company

Cowbell Cyber

Donald Gaddis Company, Inc.

Donegal Insurance Group

EMC Insurance

Encova Insurance

Erie Insurance Group

Foremost Choice Property & Casualty

Forreston Mutual Insurance Company

Frankenmuth Insurance

Grinnell Mutual Reinsurance Company

IA Valuations

Illinois Mine Subsidence Ins Fund

Illinois Public Risk Fund

Independent Mutual Fire Insurance Company

Indiana Farmers Insurance

Insurance Program Managers Group (IPMG)

J M Wilson

Liberty Mutual/Safeco Insurance

Madison Mutual Insurance Company

Main Street America Insurance

Maximum Independent Brokerage, LLC

Mercury Insurance Group

Method Workers Comp

Midwest Insurance Company

Nationwide

NHRMA Mutual Workers’ Compensation

Pinnacle Minds, Inc.

Previsor Insurance & Missouri Employers Mutual

Rhodian Group

Rockford Mutual Ins. Co.

ServiceMaster DSI

Society Insurance

SPRISKA - Specialty Risk of America

Steadily

Summit, A Member of the Great American Insurance Group

Travelers

UFG Insurance

Universal Property & Casualty

W. A. Schickedanz Agency, Inc./Interstate Risk Placement

West Bend Insurance Company

Western National Insurance

Westfield

34 Insight May 2024

Associate Member News

Madison Mutual Insurance Company

Announces Retirement of Chairman

Bennett W. Dickmann

Madison Mutual Insurance Company was founded in 1921 and is a regional insurance company providing Auto, Home, Farm and Business insurance products in Illinois, Indiana, Missouri and Wisconsin. But that’s not all that defines our company. Madison Mutual is also known for its passion for the communities we serve. No one exhibits this more than our Board Chairman, Bennett (Ben) W. Dickmann. Since 1999, Madison Mutual Insurance Company has been fortunate to have Mr. Dickmann as a member of our Board of Directors. In 2008, he was appointed Chairman of the Board where he carried his passion for the community into our company.

With Mr. Dickmann being a fixture at MMIC for many years, it’s with mixed emotions that we announce he will be retiring from the Board of Directors and Chairman role effective March 4th, 2024. We wish Ben the best in his retirement and will miss his dedication to Madison Mutual Insurance Company, its policyholders and employees.

Current board member, Dennis Terry, will be assuming the role of Chairman of the Board of Madison Mutual Insurance Company upon Ben’s retirement. Dennis has been a member of the Board of Directors since 2012. He is the retired Director of Market Relations at First Mid Bank and Trust and previously served as the President/CEO of First Cloverleaf Bank in Edwardsville IL.

Additionally, during the March 4, meeting, the policyholders of Madison Mutual Insurance appointed Darlene “Dee” McDonald to fill the unexpired term left by Bennett W. Dickmann’s retirement. Dee is the Exeutive Vice President at JF Electric/Utilitra where she has served since 2017. Prior to this role, Dee was the Chief Financial Officer at First Clover Leaf Bank in Edwardsville IL.

JM Wilson Welcomes Rice as Finance & Reporting Accountant

JM Wilson has welcomed Maria Rice as Finance & Reporting Accountant. In this role, Maria is responsible for monitoring all financial data, ensuring accuracy in reporting, and executing essential tasks such as month-end close procedures, financial statement preparation, and overall cash management.

Prior to joining JM Wilson, Maria honed her skills in tax accounting, gaining valuable experience in the field. An alumna of Western Michigan University, Maria holds a bachelor’s degree in accountancy.

Founded in 1920, JM Wilson is a family owned and operated Managing General Agency and Surplus Lines Broker providing independent insurance agents access to A rated specialty markets. JM Wilson offers coverage for standard and hard-to-place Commercial Transportation, Property & Casualty, Brokerage, Marine, Personal Lines and Surety accounts in 47 states across the U.S.

May 2024 insight 35 Associate Member News

2023 JM Wilson Insurance Insight OUTLINES-v2.indd 1 11/28/23 9:08 AM

Troxell Named Best places to Work in Springfield Agency member, Troxell, has been named as one of Springfield Business Journal’s Best Places to Work 2024.

Troxell opened its doors in 1887 and still remains locally owned and operated today. Although there are branches all over Illinois, Troxell is based out of Springfield. The company has grown significantly over the years but has not lost the touch of a small business. “Troxell is a group of individuals who enjoy each other and have each other’s backs,” said Alysse Hewell, chief experience officer. “Our team works hard together, and we can all lean on each other when needed.”

In Memoriam

Cook County Clerk Karen Yarbrough passed away April 7, 2024 following a brief illness. As Recorder of Deeds and County Clerk, Yarbrough served the people of Cook County for 12 years. Prior to that, she was a State Representative representing Maywood and near west suburbs. Many Big I Illinois members know that Karen was an independent agent in Maywood prior to getting elected to the Illinois General Assembly and her daughter owns the Hathaway Agency today.

“Karen was not only a trailblazer in state politics as the first African American female elected to a Cook County office, she was also a trailblazer in the insurance industry as an African American female agency owner in a profession long dominated by males,” said Phil Lackman, CEO of Big I Illinois. “I had the pleasure of working with Karen as soon as she was elected in 2000. She served on the House Insurance Committee and provided leadership and insight on insurance issues before the Illinois House of Representatives.”

On behalf of the Board of Directors, members, and staff of Big I Illinois, I extend our deepest condolences to her husband Henderson and family.

Springfield Business Journal holds a variety of awards programs throughout the year, but Best Places to Work is unique because it requires employees to nominate their own company for recognition. Instead of simply trading their time for a paycheck, these employees realize that their work is serving a larger purpose and they feel valued and appreciated for it, thanks to the culture created by the company’s leadership.

Read the feature article at springfieldbusinessjournal. com/special-issues/troxell-15183375.

Congratulations to the team at Troxell!

Harriet Robinson, married to past association CEO Roy Robinson for 72 years, passed away on April 7, 2024. Roy preceded her in death in February of this year. The couple served as hosts for many association events throughout the years and attended Past Presidents Dinners as frequently as they could.

Our thoughts and prayers go out to the family.

Shirley A. Evans-Wofford of Lincoln Park passed away on April 14, 2014. Shirley began her 25 year career with Marsh and McLennan, and was employed with AON Brokerage Insurance Firm with many years of dedicated service. In 2001, Shirley founded Lambent Risk Management Insurance Brokerage Firm. She served on the Big I Illinois Board of Directors from 2009 to 2011.

We extend our condolences to those who knew Shirley.

36 Insight May 2024 Agency Member News

May 2024 insight 37 Big I Illinois News For information regarding Big I Illinois membership or company sponsorship, contact Lori Mahorney, Director of Membership Services, at (217) 321-3008, lmahorney@ilbigi.org. Dakota Insurance Group Lake Forest, IL Komperda Insurance Group Palos Park, IL June 11-12 Virtual Class Wednesday, May 22 NORTHERN ILLINOIS GOLF INVITATIONAL Bartlett, IL Bartlett Hills Golf Club ilbigi.org/events/northern-il-golf-outing

OPPORTUNITIES/SPACE AVAILABLE/ RETAIN OWNERSHIP

13. We are a 100 year old Northbrook agency looking to discuss any mutually beneficial opportunity. Our producers, mergers, clusters and agency purchases receive 50% commissions on new and renewal business without any expenses. We can provide: office space, phones, agency management system, service renewals and changes. The companies we represent are: Badger Mutual, Employers Mutual, General Casualty, Guide One, Hartford, Kemper, Progressive, Rockford Mutual, Safeco, State Auto, Travelers and Met Life. Contact:

Nancy Solomon Martini, Miller & Schloss, Inc. (847) 291-1313 Ron@martini-miller.com

AGENCY WANTED

20. Since 2004, Central Illinois Agents Group LLC has been providing independent agents with a variety of markets with contingency opportunities. Agents have availability to several markets that they may not be able to sustain or maintain on their own. We have markets for personal, commercial, agricultural and crop insurance lines. Let us help you get to the next level.

Visit www.ciagonline.com for contact information.

LOOKING FOR AN EXIT STRATEGY?

23. Are you looking for an exit strategy while still continuing to produce for a few years or are you ready to sell now? Paczolt Insurance would like to talk with you! We are an independent agency dating back to the 1970s that is located in the western suburbs. Our focus is on mid-to-small commercial accounts and personal lines. Our companies include EMC, Badger Mutual, Safeco, Progressive, and Travelers. We have the flexibility and capital to get a deal done. Contact:

Susan Troppito Paczolt Insurance susan@piaigroup.com (708) 215-5202

AGENCY/AGENTS/PRODUCERS WANTED

02. Forest Park/Oak Park agency for over 60 years, will meet your needs by providing space, markets, marketing & sales support, automation, merging with or purchasing your agency. Perpetuation/ Succession Plans, Buy-Sell Agreements also available. We have experienced, educated and dedicated staff for you and your clients. Have access to our numerous companies, office services and many other resources. Retain ownership in your book with contingency. Please look closely at us- we are an agency you want to do business with! We’ve done it before, we know howwe make it easy! Visit our website at forestagency.com/ agents.html, or call for a confidential discussion and a list of Agency benefits.

Dan Browne will provide an agency evaluation/ appraisal at little cost to you. Please call:

Dan Browne or Cathy Hall Forest Insurance (708) 383-9000 www.forestinsured.com/mergers-acquisitions

38 Insight May 2024

The next step in your insurance career is a few clicks away. INDUSTRY JOB BOARD LISTING ilbigi.org/careers Classifieds

Commercial | Specialty | Agribusiness | Farm

B. Illinois Sales Manager

V. Specialty Lines Underwriter Brian R. Farm Lines Underwriter Betsy V. Commercial Lines Underwriter Interested in building a relationship? Contact us at secura.net/IL-agents. Hear from our experts. Want to learn more about what SECURA has to offer? Scan the QR code or visit secura.net/IL-agents for more information about the SECURA team.

Matthew

Jamie

Risk is everywhere. In everything. With Applied Underwriters by your side, the gears of commerce, innovation, and exploration keep turning. Experience the unrivaled heart and unwavering service that only Applied delivers. Learn more at auw.com or call (877) 234-4450. ©2024 Applied Underwriters, Inc. Rated A(Excellent) by AM Best.

Chris Pumo

Pumo Insurance Agency

Chris Pumo

Pumo Insurance Agency

By Jennifer Jacobs

By Jennifer Jacobs