•

•

•

•

•

•

•

•

•

•

Chairman of the Board - Allyson Padilla allyson@blanksinsurance.com

President - Patrick Taphorn, CIC, CSRM ptaphorn@unland.com

President-Elect - Thomas Evans, Jr. tom.evans@assuredpartners.com

Vice President - Chris Leming cleming@troxellins.com

Secretary/Treasurer - Cindy Jackman, CIC, CISR cjackman@arlingtonroe.com

IIABA National Director - George Daly george.daly@thehortongroup.com

Mohammed Ali - mali@aliminsurance.com

Charles Hruska, IV - chas@hruskains.com

David Jenk, Esq. - djenk@nwibrokers.com

Rebecca Kohn - rkohn@worthyinsurance.com

Lindsey Polzin - lpolzin@presidiogrp.com

Ray Roentz - ray.roentz@hwcrins.com

Noele Tatlock - ntatlock@unland.com

Luis Tayahua - lt@goldenowlinsurance.com

Sharon Waldvogel - sharon@infinitybrokersinc.com

Andrea Wallace - andrea@aadins.com

Amiri Curry - acurry@assuranceagency.com

Kevin Lesch - klesch09@gmail.com

Jeff McMillan - jeff@mcmillanins.com

James Sager - james@sagerins.com

Luke Sandrock, CIC - lsandrock@2cornerstone.com

Budget & Finance | Cindy Jackman, CIC, CISR cjackman@arlingtonroe.com

Education | Lisa Lukens salibainsurance@gmail.com

Farm Agents Council | Steve Foster s.foster@ciagonline.com

Government Relations | Dustin Peterson dustin@peterson.insurance

Planning & Coordination | Nick Gunn, CIC ngunn@envisionins.com

Technology | Brian Ogden brian@ogdeninsurance.com

Young Agents | Cody Imming cody@imminginsurance.com

Follow us on socials.

Insurance Products Administrator

Director of Information and Technology

Director of Education and Agency Resources

Accounting & Admin Services

Director of Human Resources, Board Admin

Sr. Vice President/Chief Financial Officer

Chief

Director

Office

Rebecca Buchanan (217) 321-3010 - rbuchanan@ilbigi.org

Shannon Churchill (217) 321-3004 - schurchill@ilbigi.org

Brett Gerger, CIC (217) 321-3006 - bgerger@ilbigi.org

Tami Hubbell, CIC (217) 321-3016 - thubbell@ilbigi.org

Jennifer Jacobs, SHRM-CP (217) 321-3013 - jjacobs@ilbigi.org

Mark Kuchar (217) 321-3015 - mkuchar@ilbigi.org

Phil Lackman, IOM (217) 321-3005 - plackman@ilbigi.org

Lori Mahorney, CISR Elite (217) 415-7550 - lmahorney@ilbigi.org

Evan Manning (217) 321-3002 - emanning@ilbigi.org

Kristi Osmond, CISR Elite (217) 321-3007 - kosmond@ilbigi.org

Rachel Romines (217) 321-3024 - rromines@ilbigi.org

Tom Ross, CRIS, CPIA (217) 321-3003 - tross@ilbigi.org

Carol Wilson, CPIA (217) 321-3011 - cwilson@ilbigi.org

Have confidence knowing that Grinnell Mutual will provide coverage for what’s important to your customers. We offer the comprehensive insurance they need to protect them from the unexpected. Trust in Tomorrow.® Talk to us today.

The “Brain Drain” is real in all aspects of our industry, from regulations to carriers to our agencies. Many are reaching retirement and leadership styles are evolving. One thing remains a constant, and that is knowledge is power. The more you know about any given subject, the more valuable you become to whatever organization you work for. Too often, this next generation moves from one job to another without ever becoming valuable as a resource. They are a “jack of all trades but a master of none.” Many leave for more money, a fancier title, or even the mere fact that they do not respond well to the type of leadership provided. It is hard for a very young 53-year-old to connect with a 22-year-old fresh out of college due to the fact that what motivates the 53-year-old doesn’t necessarily work for the 22-year-old. I know my articles always circle back around to education but that’s what I do. So, as our workforce churns, we need to be able to pivot our educational needs and desires.

Our new employees need to be educated on our industry, products, coverages, and nuances of all aspects of the insurance world. Whether it be obtaining designations or learning pivotal sales techniques, new employees need to be able to see the value in these early educational components in order for them to become life-long learners, making them extremely valuable to management as well as their stakeholders. Without the refilling of the “Brain Drain,” it will become extremely difficult to train these individuals to become our future assets and/or leaders. Education sets the foundations for all things to be built on. For example, you buy a building and do the bare minimum maintenance, if that, and 20 years down the road you wonder why your building is a piece of excrement. The building will crumble fairly easy if it has a shoddy foundation. Had you not only kept up with the maintenance, but also stayed ahead in the innovation space as well as modernizing the building, you would not be in the position of starting all over. If you do more than just upkeep, your time and effort could go into other things besides starting over from scratch. I always say hiring the right talent is the key to success. Educational commitment is a culture thing and the culture of an organization, carrier or agency, can make or break an organization.

Now that we know to train your people, we have to work on you and your journey in the leadership aspect. A common misnomer is that the leader of every organization is the CEO (no disrespect to Phil, as he is our leader. (Good save there). A person can claim to be a leader of a journey, but if they look back and no one is following them, then they are just on a walk. Leadership is a trait/quality that draws people to believe in and follow them to achieve a common goal. Many studies have shown that leadership is not a trait but can be learned. I agree, and I disagree with this. People way smarter than I have come to this conclusion. I would contend to be a transformational leader (the best thing) that is successful you must have the proper training and the “IT” factor. While leadership skills typically have not changed over the years, the manner in which they are carried out is greatly different. Some of the major tenets of leadership (communication, analytics, adaptability, resilience, authenticity, etc…) are the same while we have transformed or added new skills to the mix (empathy, creativity, curiosity, etc…). While the concepts may be old, what they mean or how they are carried out are different. Communication in the 1970s has a way different meaning than the way that we communicate in today’s business environment. The starkness between those two eras

is only amplified in how different it is to be a successful and transformative leader in today’s world. If you try to lead today by utilizing old leadership concepts, you will find that after a while you are merely walking alone when you look back. Leading by example and

being authentic are two amazing leadership characteristics that will always hold true. They are the toughest to do and you must remember that every individual in your organization will lead something or someone at some point. As a leader, do not sell yourself or your organization short by not keeping up with the latest leadership techniques, which will show the people following you that you are authentic and you practice what you preach. Absorb everything you can about various leadership techniques and see what works best for you and your skill set. Even transformational leaders who do not work on their skills and craft will find that the outcomes don’t meet their vision, as natural ability and education must be combined to be a success. Who knows someone who has an overabundance of natural talent but always falls short due to their inability to put in the extra work? Success and leadership are tethered to each other. It is hard to have one without the other. While you may be an effective leader and not win all the time, your outcomes will have much greater success or much less severe failure than you would have had without effective leadership. Just like you may have great success without effective leadership, but I would contend that the success would have been much greater with effective leadership. The old “a blind squirrel can find a nut” saying. For that example I would contend that the squirrel has good leadership skills in that it doesn’t remember where it buries the nuts but buries so many that it can dig anywhere and find a nut. Part of leadership is identifying your agency’s weaknesses and nullifying them in order to achieve your goals. The squirrels have figured out a work around to their weakness (memory).

Two takeaways from this article are to educate your staff and yourself, and commit to becoming an effective leader while leading your staff to become effective leaders, as well. Imagine you are shark. While in the business world, if you stop swimming (failing to continually learn) you will die(fail). Commit yourself to becoming a better leader, and I bet if you look behind you in 6 months to a year, there will be a whole slew of people behind you unless you are John Blutarsky. To answer his age-old question… it was not over when the Germans bombed Pearl Harbor.

As always, this is just Brett’s 5 Sense (who are we kidding, this is probably the new normal) and I hope it was helpful. You can contact me through my CONNECT and if it is urgent, do not hesitate to reach me through CONNECT. I may be pushing you to CONNECT. If you need any clarification or have any suggestions for future articles please email me at bgerger@ilbigi.org.

We’re better together.

Keystone is a network of high-performing independent insurance agencies. Together with Keystone Agency Partners, we can help your agency unlock its full potential with combined experience that fuels growth. Regardless of where you are in your agency journey – just starting out, maturing, or planning to perpetuate, we provide support and guidance while respecting your independence.

This combination is the “secret sauce” that makes it work. Here are just a few ingredients.

Conferences: From marketing strategy to prospecting, developing a niche, to learning how to navigate the age of remote work, we’ve covered it. Our agents serve on panels to discuss what’s working, and not. Combined with our services and mentorship, our agents walk away with the tools and tactics they need to implement strategies that succeed.

Our board of directors is made up of Keystone agents, who we call partners. They influence our direction, services, and offerings to fellow agents. We honor inclusion and perspective – everyone plays a part in where we are headed into the future.

From data and analytics to carrier relations, sales training, and revenue generating solutions, each of our staff brings specialized expertise. With it, Keystone partners can give themselves a raise with new business, benchmark against successful peers, and find solutions to meet recruitment and retention challenges.

“Keystone improves the bottom line for independent agencies with strong, in-house resources and a support network that supports intellectual capital sharing. Agencies retain their identity while benefiting from the collective strength of our community. The result is improved access, relationships, and results for our agents and their clients.”

– Matt Fink, State VP for Illinois

The objectives of the Association shall be to maintain a high standard of integrity and to promote harmony in the insurance business in Illinois; to adopt and enforce such rules as the interest of the public, insurance business and membership may require; to interpret the needs of the insurance public to insurance companies; to sponsor high qualifications for those engaged in the insurance business; to represent the interests of the members before governmental, regulatory and legislative bodies; and to do all things necessary toward the betterment of the profession of the members and the service of their business needs.

Allyson Padilla was born into Blank’s Insurance Agency but began her insurance career full-time in 2008. The agency provides all types of insurance and bonds, including personal lines and commercial insurance. She works in all facets of the agency but is primarily focused on commercial lines, agency marketing, and advertising.

Blank’s Insurance Agency 515 S. Whittle Ave. - PO Box 69, Olney, IL 62450 (618) 393-2195 allyson@blanksinsurance.com

Family: Spouse: Angel Sons: Angel Julian, Bennett & Cruz

Pat Taphorn was hired out of college in 1989 with Unland Insurance & Benefits in an Accounting and Operations position and moved into a sales role in 1994. He took over as President in January of 2016 and still has agent responsibilities, along with overseeing all six agency locations. Unland Insurance & Benefits provides P&C, Life, Health & Employee Benefits and Financial Services.

Unland Insurance & Benefits 2211 Broadway Road, Pekin, IL 61554 (309) 347-2177 ptaphorn@unland.com

Family: Spouse: Lisa Children: Nathan, Carter, Jenna, & Justin

Thomas Evans, Jr. has been in the insurance industry since 1996 starting out at Insure One. He then moved to Esser Hayes Insurance Group, and Crum-Halsted Agency before joining Biglow & Company, Inc. (Assured Partners).

Biglow & Company, Inc. (Assured Partners) 11 Nippersink Blvd, Fox Lake, IL 60020 (847) 587-2155 tom.evans@assuredpartners.com

Family:

Spouse: Rebecca

Daughters: Ashley & Aly

Sons: Tommy (III) & Tyler

Christopher Leming embarked on his insurance journey in 1997. He is currently serving as Senior Vice President at TROXELL, where he offers a full spectrum of services, including Personal and Business Insurance, Group Benefits, Surety Bonds, HR and Safety Solutions, and Individual Health and Life insurance. Beyond his professional expertise, Chris is deeply passionate about the politics and advocacy within the industry, dedicating himself to ensuring that agents in Illinois are effectively represented and their interests championed.

Troxell

214 S Grand Ave W, Springfield, IL 62708 (217) 321-3185 cleming@troxellins.com

Family:

Spouse: Margaret

Son: Christopher Daughters: Annaliese & Mallory

George Daly entered the insurance industry in 1984, working with Allstate and Insure One before joining The Horton Group in 2005, where he’s President of the Personal Insurance Division. The Horton Group started in 1971 and is one of the top 50 largest insurance agencies in the country. Effective August 1, 2024, The Horton Group merged with Marsh McLennan Agency LLC.

The Horton Group, Inc. 10320 Orland Pkwy, Orland Park, IL 60467 (708) 845-3311 george.daly@thehortongroup.com

Family:

Spouse: Margie

Daughters: Katie and Erin Son: George

Cindy Jackman began her career in 1984. After 34 years on the retail agency side, she joined Arlington/Roe and is now the Regional Sales Director for Illinois and Missouri. Cindy has served Big I Illinois in some capacity since the late 1980’s and enjoys helping the independent agents enhance and grow their agencies.

Arlington/Roe PO Box 2614, Carbondale, IL 62902 (618) 201-1265 cjackman@arlingtonroe.com

Family:

Spouse: Jon

Children: Kristin (Ryan), 1 Grandaughter

Troy (Tori)

Bonus Children: Amy (Jim), 1 Granddaughter

Cassie (Jeff), 2 Granddaughters, 1 Great-Grandson

Jessica (Darren), 3 Grandsons

Mohammed started as an intern at Near North Insurance Brokerage in 2000 where he worked until 2003. He then moved to Global Benefits Inc. until 2012 before starting Alim Insurance Brokerage. The agency focuses on personal lines, commercial lines, and professional liability insurance. Outside of the agency, Mohammed serves on the Board of Directors at Evanston Chamber of Commerce, where he was President in 2021.

Alim Insurance Brokerage & Risk Management 820 Davis St Ste 215, Evanston, IL 60201 (847) 847-2126 mali@aliminsurance.com

Family: Wife: Mira Sons: Mikhail, Ibrahim Daughters: Aaliyah, Noura

Charles Hruska, IV started his insurance career in 2011 with internships. In 2014, he joined Seneca Insurance Company as an underwriting assistant, moving up to Senior Underwriter. Charles then joined his family’s agency in 2018 as Executive Vice President. Hruska Insurancenter, Inc. (now Arthur J Gallagher RMS) was started in 1950 by Charles’s grandfather and the agency’s focus is mainly commercial lines supported by personal lines.

Arthur J Gallagher RMS, Inc. 10040 W 190th Pl., Mokena, IL 60448 chas_hruska@ajg.com (708) 719-3770

Family: Wife: Ellese Son: Charlie

David Jenk began his insurance career over 17 years ago while in college. He remained focused on the industry and, after law school, joined Northwest Insurance Brokers, where he is now Chief Operations Officer. Northwest Insurance Brokers was founded in 1956 and offers all lines of personal, professional, and commercial insurance.

Northwest Insurance Brokers

209 W. Jackson Blvd., Suite 800, Chicago, IL 60606 (312) 239-2717 djenk@nwibrokers.com

Family: Spouse: Lucyna Daughter: Selene

Rebecca Kohn is the in-house general council and Principal at Worthy Insurance and has been with the Skokie-based brokerage for 14 years. Founded in 2005 with a focus on skilled nursing facilities, assisted living, and home health, Worthy has expanded to include divisions focusing on commercial real estate, education, and municipalities. Rebecca serves as a Board Member for NHRMA Mutual, and also commits her time to being a member of the Lincolnwood Human Relations Commission.

Worthy Insurance

8130 McCormick Blvd, Skokie, IL 60076 (773) 945-9102 rkohn@worthyinsurance.com

Family: Husband and Four Children

Lindsey Polzin started her insurance career in 2000 working for her family’s agency in the personal lines division. In 2005, she moved over to the commercial side before merging with other local agencies. Lindsey is now Senior Director of Operations - Property & Casualty for Acrisure.

Acrisure

55 Shuman Blvd. Ste 900, Naperville, IL 60563 (630) 513-6600 lpolzin@presidiogrp.com

Family: Spouse: Tim Sons: Nick and Kevin

In 2012, Ray Roentz joined Heneghan, White, Cutting & Rice Insurance Agency providing personal, commercial, life, farm, and crop insurance to clients in Illinois, Missouri, and Colorado. In 2021, Ray purchased a majority ownership of the agency and is now President of Heneghan, White, Cutting and Roentz Insurance.

Heneghan-White-Cutting & Roentz Ins. Agency 200 N. State Street, Jerseyville, IL 62052 (618) 639-2244

ray.roentz@hwcrins.com

Family: Spouse: Karla

Children: Rocho, Robert and Loretta

Noele Tatlock has spent eleven years in the insurance industry and joined Unland Insurance & Benefits in October of 2019 as an agent in Personal Lines and Small Business. She is now the Personal Lines Division Manager. The agency provides Commercial & Personal P&C, Life, Health & Employee Benefits, and financial services.

Unland Insurance & Benefits 2211 Broadway Rd., Pekin, IL 61554 (309) 642-6855

ntatlock@unland.com

Family: Sons: Drew and Dylon

We’re with you every step of the way

Behind every Progressive agent is the support of more than 60,000 Progressive employees. It’s our mission to make sure you have the tools and resources you need to succeed.

From caring field sales reps to dedicated agent service teams, we’re ready to help you grow. Plus, we supplement your counsel and guidance with aroundthe-clock claims and customer service via our mobile app and online servicing.

Whether it’s sales, service, claims or anything in between, you’ve got a partner every step of the way.

TO LEARN MORE

Search for us online at Agents of Progressive, Progressive Connect, or Progressive Appointment.

Proud Platinum Sponsor of the Big I Illinois since 2005.

Luis Tayahua began his career in 1999 working for a State Farm Agent before starting his brokerage in July 2015 where he is President. Golden Owl offers property & casualty, commercial, and liquor liability. Luis is the President of the Summit Chamber of Commerce.

Golden Owl Insurance, LLC

6535 W. Cermak Road, Berwyn, IL 60402 (708) 637-4861 lt@goldenowlinsurance.com

Family: Wife

One son, one daughter

Sharon began her insurance career in 1989 and has held almost every position within the independent insurance agency, including agency owner. She holds state property, casualty, life, and health licenses including designations acquired over her 35 years in the insurance industry. Sharon earned The National Alliance Certified Insurance Service Representative (CISR) designation in 2000 while managing a large team of Account Executives and was part of the first inaugural Professional Insurance Sales Associate (PISA) designation from the Katie School of Insurance at Illinois State University in 2003. She is also serves as a board member for Big I DuPage Illinois. Sharon loves marriage and her maiden name, however called ‘Smiley’ by those who know her best.

Infinity Brokers, Inc.

PO Box 72533, Roselle, IL 60172 sharon@infinitybrokersinc.com (844) 409-1962

Family:

Spouse and a large blended family of adulting youth that range in age from 15-33.

Andrea Wallace began her insurance career in 1996 as the first employee of a 76-year-old captive agent. After spending 13 years in various roles within the captive company, she joined forces with another agent to help establish AAdvantage Insurance. Following several mergers and acquisitions, Andrea now serves as the Director of Operations under the current ownership. The agency specializes in Personal Lines, Transportation, Contractors, Restaurants, Life, and Medicare.

AAdvantage Insurance Group LLC

78 S Main St, Glen Carbon, IL 62034 (618) 692-4440 andrea@aadins.com

Family: Spouse: Andy Children: Alexis, Collin, and Ella

Amiri Curry began his insurance career in 1993 in Life & Health customer service. After leaving the industry to work in financial services, he returned to insurance in 2007, eventually joining Marsh McLennan Agency, a full-service brokerage, in 2016.

Marsh McLennan Agency 20 North Martingale Road, Schaumburg, IL 60173 amiri.curry@MarshMMA.com (847) 463-7280

Family: Spouse: Sandra Children: Four Boys

Kevin Lesch began his insurance career in 2000 when he joined his father’s agency. In 2013 he took over as president and aquired the agency in 2015.

Bartlett Insurance Group, LLC Bartlett, IL (630) 918-9785 klesch09@gmail.com

Family: Spouse: Trisha Sons: Jacob and Gavin

This is your association and as an insurance specialist familiar with the challenges your business faces, your insights and expertise can help shape the future of our association and industry. Your involvement will ensure that Big I Illinois remains a leading resource and advocate for independent agents. Association involvement can help you expand your network, increase your industry knowledge and exposure to developing trends and products, and grow in your profession. Get started by: Interested

Jeff McMillan became licensed in 1989 and started working with Prudential in 1990 selling life insurance and investments. In 1992, he formed McMillan Insurance Services, Inc. and has purchased several agencies through the years. Jeff is a current Farm Agents Council Board Member.

McMillan Insurance Services, Inc.

309 S Crescent St, Gilman, IL 60938 (815) 265-4037 jeff@mcmillanins.com

Family:

Spouse: Lisa Children: Jack & Sam

James Sager founded Sager Insurance Group in 2022. James has also been a producer for Premier Crop Insurance since 2014. Out of the agency, James serves as the fundraising chairman for Salem Community High School Academic Foundation, as a director for Greater Salem Chamber of Commerce, and as a founding board member of Little Egypt CEO program.

Sager Insurance Group, LLC 105 N. 3rd St, Dahlgren, IL 62828 (618) 736-2394

james@sagerins.com

Family: Wife: Amber Children: Edison and Reid

Luke Sandrock began his career in insurance 2009 after graduating from Monmouth College. He joined the family agency, Cornerstone Agency, where he is now Partner. The agency concentrates and specializes in crop, farm and agri-business insurance. Luke is a current Farm Agents Council Board Member.

Cornerstone Agency, Inc. 16255 Liberty St., Morrison, IL 61270 (815) 772-2793

lsandrock@2cornerstone.com

Family: Spouse: Ashleigh Children: Breckon, Jack, and Remrey

Lisa Lukens started in the agency in 1981 working full-time while attending school at SIU. Saliba Insurance, opening the doors in 1963, merged with Yewell Insurance in 1990 and offers both personal and commercial insurance.

Saliba-Yewell Ins. Services

P.O. Box 218, Herrin, IL 62948 (618) 942-2556 salibainsurance@gmail.com

Musso Insurance Agency 136 E. Dean St., Virden, IL 62690 (217) 965-4663 s.foster@ciagonline.com

Family: Children: Tyler & Erin (Cole)

Family: Spouse: Anne Children: Gwen, Kendall, & Kathleen

Dustin Peterson is the 3rd generation member of the agency, joining the agency in December 2003. He currently serves as Risk Manager, covering all lines of insurance for the agency.

Peterson Insurance Services, Inc. PO Box 377, Clinton, IL 61727 (217) 935-6605 dustin@peterson.insurance

Family: Spouse: Jessica Children: Julian & Vivian

Nick Gunn started his career in 2006 at Nixon Insurance Agency, Inc. becoming part owner and Vice President of Commercial Lines. In 2023, Nick transferred to Envision Insurance Group as a Producer as part of the acquisition of Nixon Insurance Agency. Nick is also the Chief Operations Officer of CommonGround Insurance Group, LLC, a crop insurance agency located in Morton, IL.

Envision Insurance

150 B S Main St, Morton, IL 61550 (309) 263-2400 ext. 2407 ngunn@envisionins.com

Family: Spouse: Jessica Children: Tripp and Cash

Brian Ogden is a second generation owner of Ogden Insurance Agency. His father started in the insurance business in 1959 in the same small town. The agency offers Personal Lines, Commercial Lines, Farm, Crop Life and Health.

Ogden Insurance Agency

123 E. Douglas, Petersburg, IL 62675 (217) 632-2206 brian@ogdeninsurance.com

Family: Spouse: Kim

Children: Lauren & Jonathan

After playing golf in college for Kaskaskia Junior College and Rockford University and graduating from SIUE in Edwardsville, Cody began his insurance career in 2015 in the family agency. Celebrating 83 years, the agency focuses on Commercial, Personal, Farm, Bonds, Health, Life, and Medicare.

Imming Insurance Agency

589 9th St, Carlyle, IL 62231 (618) 594-4536 cody@imminginsurance.com

Family:

Spouse: Kylie Children: Daughter Logan and Son Woods

Bill Lawrence received his producer’s license in March of 1999 and bought his first agency in April of that year. He sold that agency in 2003 and purchased P/L/R Insurance Services. The agency joined Gallagher Risk Management Services in March of 2023. The agency is primarily a P&C agency with group and individual life and health accounts.

Gallagher Risk Management Services, LLC

139 N. Williamsburg Dr., Bloomington, IL 61704 (309) 827-0007 bill_lawrence@ajg.com

Family: Spouse: Jan Three Children & Six Grandchildren

To

Formerly known as Big “I” Markets, Big “I” Alliance Blue is IIABA’s FREE online market access placement center program. We provide Big “I” members with access to specialty/niche coverages, program business and hard-to-nd markets. Our top tier carrier partners offer access to the products you need, with new carriers being added in response to member needs.

Affluent Markets

Auto and Home Standard Markets

Flood

Jewelry

Non-standard Homeowner

Umbrella & Home Business

COMMERCIAL

Bonds

Cyber

Commercial Auto

Community Banks

Executive Risks

Habitational

Real Estate Agents/Property Manager E&O

Small Commercial

Product availability varies by state.

After completing our online registration, you can begin submitting business online. Simply answer a few questions and provide banking info, licensing info, tell us about your E&O insurance, and accept the sub-producer agreement. Approval takes about one business day, then you’re off and running and can begin submitting and doing business online 24/7.

•No initial access fees

•No ongoing monthly fees

•No termination fees

•No monthly minimum production requirements

•No obligation to submit other accounts

•Ownership of expirations

•EFT commission payments

You can access the markets you need once a year or multiple times per day; the price to access products through Big “I” Alliance Blue remains the same: zero. Log in and plug in to the power!

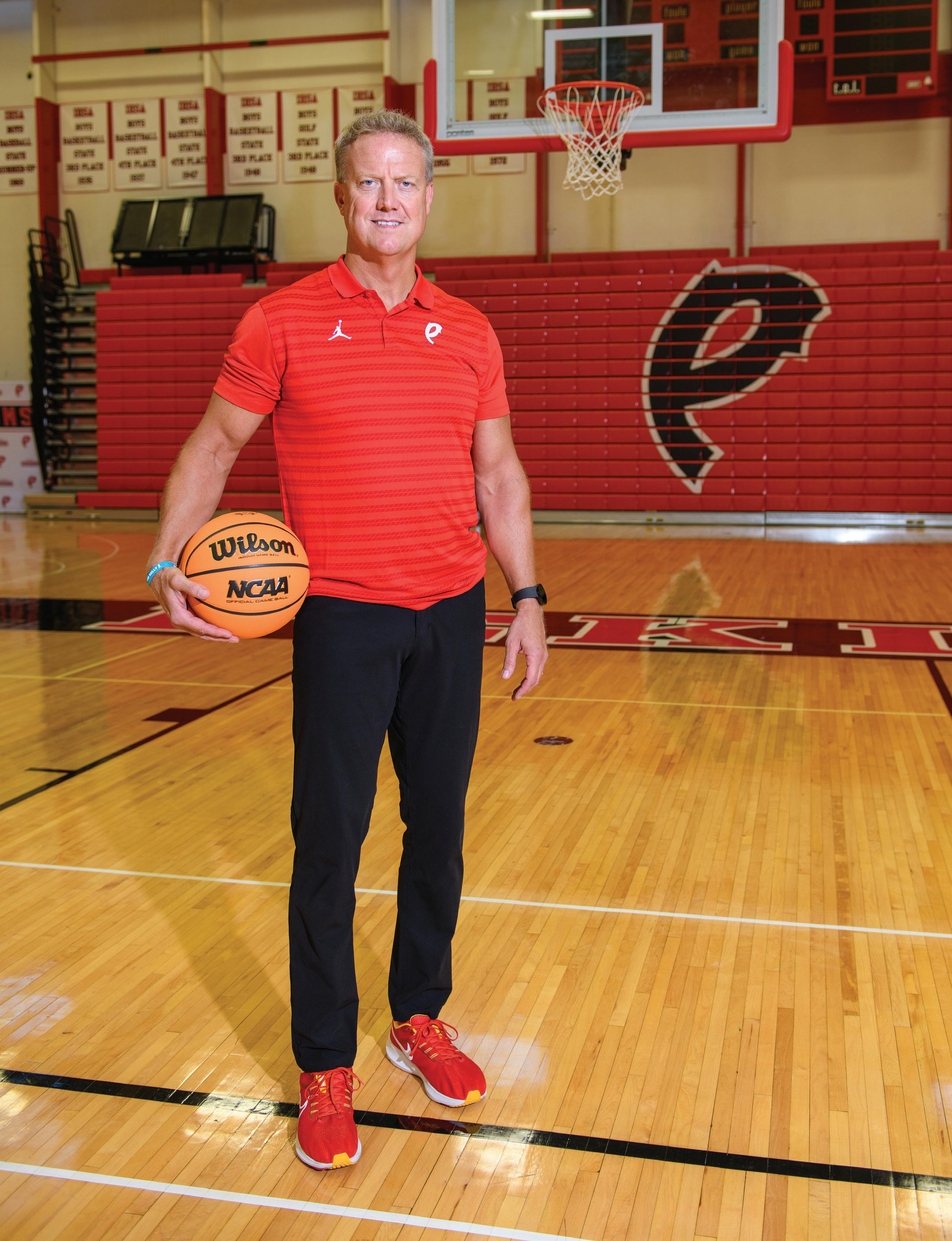

Congratulations on your induction as President of Big I Illinois. Tell us how you first got involved with the association.

The first I remember getting involved in the association was at the local level. The owners and leaders of the agency I joined were very involved in the IIA of IL (now Big I Illinois) at the state and local level. In the late 80s and early 90s, a strong local group in the Peoria area met once a month for lunch to discuss current issues in the industry, along with any concerning and pending legislation that we needed to be aware of. We were encouraged to contact our local legislators to ask for their support in providing our customers the best outcomes. In addition to that, I was encouraged to utilize our association for continuing education classes. From there, I was introduced to The National Alliance and its programs. My boss at the time, Afton Booth, talked with me about it and we agreed to both pursue a Certified Insurance Counselor (CIC) designation and complete all five parts together without taking a break. We did this in 18 months and it was very intense. However, I learned a tremendous amount during that time and it also hit home just how important education was in our field and how much of a “Profession” it really was.

Tell us a little about how you started the industry?

Like many in our industry, I did not plan on getting involved in insurance at the level in which I eventually did. After graduating from college, I did have a few interviews with insurance companies for underwriting, actuarial and claims positions. Our state, specifically in Central Illinois, was extremely strong in that area, with a number of large insurance companies that were hiring at the local and national level. While I preferred to stay in the area, I was open for relocation if it meant the start of a good career. While enjoying my first summer off in a very long time, I was doing various jobs, including some yardwork and landscaping projects for a neighbor up the street. One day, she came to me and said that her friend was President of an insurance agency and needed someone to replace a retiring Accounting/Controller position. I interviewed and noticed that the agency was one I literally passed 2-3 times a day and had no idea what it was. I was offered the job and started in November of 1989. My original duties were accounting, office managerial tasks, and flipping the switch on a new computer system that was still in boxes when I arrived. While I really enjoyed the Operations focus when I first started, I quickly felt like it was an amazing industry and wanted to get licensed. I took my test and was certified in 1990. I later approached the leadership with a desire to sell for the agency, but it was turned down. I left the agency after 3 ½ years for a sales job in the food industry, but was asked to come back as a producer in August of 1994.

What do you find the most fulfilling about being an insurance agent?

The more time I spent in the industry as an agent, I realized how much of a high-profile profession I was involved with. We are asked by our customers to give them the best guidance and direction, based upon the knowledge we have about legal documents and coverage forms. While there was a time when people (including us agents) were going to be able to secure coverage and make decisions about protecting their assets on their own because of the evolving technology offerings, it was quickly discovered that what we do wasn’t transactional, nor should be viewed as a commodity. Many of us have

spent countless hours and years developing an enhanced knowledge of risk management. Over time, our customers appreciate the efforts we’ve put forward in continuing that education and rely on us to protect what means most to them.

Aside from the impact on our customers, I really enjoy the people I am around every day. In my position, I get to choose who I want as part of our organization and I am truly blessed to have such amazing talent who have created a successful agency. We have great leadership here and people who work extremely hard to provide the best solutions and positive experiences for our customers.

What challenges have you faced during your career, and how have you overcome them?

Early in my sales career, there was much doubt as to my decision to commit to being an agent. For those not previously involved in sales, there are days when we may want to re-think what we’ve committed to pursuing. It is a daily grind with trying to find new customers and learning to deal with rejection, but the successes very much outweigh the efforts in getting to the position where people and businesses believe in you as their professional advisor and place trust in you with their insurance needs.

Once I moved into a managerial and ownership role, the challenges became different. For me personally, Challenges don’t necessarily bring a negative connotation. I get excited when presented with challenges. It certainly isn’t easy by any means. Decisions about the direction of the agency, investing in new talent, purchasing agencies and growing the top level revenue and bottom line profit to enhance the future of the agency are always going to be a challenge that many have to approach head on.

What other professions have you had?

The only profession that comes to mind is that of a “Coach.” I’ve been coaching High School Basketball at Pekin High for 30 years now. While some may not consider coaching a profession, what coaches and teachers do on a daily basis to mentor and educate young men and women should certainly be viewed as professional. Students and Student-Athletes are looking for mentorship and guidance from those who have experience and a genuine desire to help them excel in whatever field and/or sport they are pursuing.

What made you want to go through the Executive Committee Chairs?

After a number of years of being involved in the association and serving on the board, I truly admired those who chose to lead our board and our association membership. I always looked up to them and felt I would like to be part of that leadership at some point in my career. I never felt like I had enough time in the day to do the positions justice, but was encouraged by many who I respect to commit to serving further. I was always impressed to be around people with more experience and more on their plate than I did, but chose to sacrifice their professional personal time for the betterment of the association. That commitment truly hit home and showed me that we owe it to our peers and thosewho will come after us to make our organization a great one that agents in the future can lean on like I did.

We all know the industry has faced many changes in the last two decades, especially the last few years. What do you see as some of the major industry issues in the immediate future?

Our aging workforce continues to be a focus of ours. While we are continually looking for younger talent and developing their knowledge and skill sets, we shouldn’t look past the great agents and support staff that we all have in place now. We have a GREAT profession that we all work in and many experienced employees are choosing to stay longer. Some will continue with their current roles and structured work weeks, while others want to stay involved

with their agencies and customers, but want to scale back their hours and possibly work a hybrid remote schedule until they fully retire. We know how hard it is to find talent and train them. We can’t forget that the experienced and knowledgeable team members we have now can still play a vital role in the growth of our agencies.

Our carrier partners are facing profitability challenges, specifically with weather-related claims and payouts. The profitability for some hasn’t been great in the last five years, which has resulted in some tough decisions that have adversely impacted our member agencies. Not only have some of the carriers limited or reduced the ability to write and retain business, others have also reduced the compensation paid to those agencies. This puts stress on the financial health of some and forces us to continue to find better and more efficient ways to serve our customers.

Looking down the road five, ten years, what other issues do you see independent agents facing?

In the very near future, the continued development and usage of Artificial Intelligence will be at the forefront of discussion for many. We are now realizing that AI can be used for contract and policy reviews, sales and marketing, risk management and loss prevention, among many others. Our industry needs to become more educated on how to utilize these tools and pass that down to our member agencies. I also feel like there is a struggle with many agencies to figure out the best structure between working in the office, working remotely, or a combination of both. Our industry is so dependent on relationships. What some are finding out is that it is more difficult to establish and grow those relationships if people aren’t working face-toface or interacting with customers in-person. There was initial push a few years ago to do that, but I see that trend slowing down and heading in a different direction. It will certainly be interesting to see what that looks like in the next 5-10 years, but agencies will closely monitor the impact of both options and see what works best for them.

What about issues Big I Illinois will have to address?

As many of our members know, the M&A activity in our industry isn’t slowing down. This isn’t necessarily a bad thing, but rather creates an opportunity for us to find different ways to show the larger agencies that our association is just as impactful in our capabilities to that of smaller ones. While some challenges within those organizations may be different, there are still many similarities and issues that the association can assist in resolving. Another crucial and indirect impact is that of association dues revenue. As the number of member agencies declines, so does the associated revenue. The work that our staff in Springfield does isn’t slowing down, inclusive of the advocacy and lobbying efforts on behalf of our members. We need to continually promote the tremendous work being done for our membership and make sure our members see the value of the dues they pay on an annual basis.

How has your involvement with the association impacted you both personally and professionally?

As many have said, our business is one of the greatest to be involved with. This really gets magnified when interacting and networking with fellow colleagues who share the same passions and challenges associated with the insurance industry. When getting involved with the various events, education classes, lobbying opportunities and celebrations, it really hits home just how far reaching our business can be and also creates many long-lasting and strong relationships with others. I’ve met so many tremendous people and look forward to attending the various events throughout the year, knowing that I will get to see them again. While you get to know them as regular people and hear about what is going on with them and their families, you also get to realize just how sharp they are and how impactful they are with their customers and communities.

In your opinion, what are the key benefits of Big I Illinois membership?

Professional Development

Educational Opportunities

Technology Offerings

Advocacy

Legislative Updates

Networking Events

Agency Management Assistance

What do you like to do in your spare time (hobbies, personal interests)?

For much of the last 30 years, my time away from work has been spent with my Family. My four kids have been extremely active in sports and other activities and we hardly missed any of that as they grew up. We’ve been to a number basketball games, baseball games, football games, golf matches, dance competitions, volleyball matches, athletic and scholastic awards banquets…and more. Aside from that, I enjoy exercising and outdoor activities, golf and traveling. The other personal interest I have outside of work is coaching. While I did coach many of my kids’ teams while they were growing up (baseball, basketball), I have been coaching at Pekin High School for 30 years as an Assistant Coach. When I first started out of high school, I was asked if I would coach the Freshman team. The President and Vice

President of our agency at the time were very supportive of my involvement with the high school and the community. I did this for three years. After a year off, a new head coach, Joe Stoner, was named and he asked if I would be his varsity assistant. It was a very tough decision because of time away from work and family, but it was something I wanted to do and felt like I could bring some value to the kids on the teams over the years. I coached with him for 10 years, two more head coaches for seven years each and have now been coaching with Jeremy Crouch for four years. I am thankful for my employer originally allowing me to do that and for the various coaches throughout the years and the school district to also allow me to work with kids. Over the years, it has been more challenging to commit to the activities every day, but I’m blessed to be around those who understand that and will take what they can when I’m there. Coaching young men is very rewarding and brings an appreciation for what young kids go through in their lives. I also feel like I can bring some value to them and have an impact on their lives. They may not exactly like me during the time I’m coaching them, but I think they realize over time the reason why I do it and ultimately want to help them develop as young men on and off the court. Many of the traits and characteristics that we try and instill upon them are those that will be appreciated after their playing days. It is very rewarding to see them excel in college, get married, have kids and want to call or text me and tell me about it. That makes it all worth it.

Tell us about your family? How do they feel about your new role with Big I Illinois?

My Family is one of the most important things in my life and has been at the center of why I do most of the things I do. Lisa and I have been married for 32 years now and have four tremendous kids. She has been very instrumental in the success of my career personally, but also that of our kids. Aside from her current role as an Executive Recruiter for the last 17 years, she has also managed everyone’s schedule and made sure our family had everything they needed continued...

and when they needed it. Nathan (30) lives in Chicago. He graduated from Northwestern in 2017, is now a producer for HUB International and is doing very well. Carter is 25 and lives in Indianapolis. He graduated from Illinois State University in 2021, is a Senior Business Development Associate for Arlington Roe, and loves the agents and people he works with. Jenna (23) graduated from Southern Illinois University – Edwardsville in December of 2023 and is in the medical field. She has applied to some P.A. schools and is waiting to see where the next few years of education will take her. Justin (23) graduated from the University of Wisconsin-Madison this spring of 2024 and is now a Graduate Assistant Basketball Coach at the University of Tulsa. They all have brought so much excitement and joy to my life and are one of the reasons I get up every day to take on whatever is in front of me. I asked my family for their thoughts on my year as Big I Illinois President.

“My husband has been volunteering ever since he started his first job after college. In volunteering, his leadership skills have always been exhibited in every role that he has had. The roles he accepts are taken seriously and with every effort to enhance the role he is in and work with those he is serving. Pat has also donated time in organizing our fundraising efforts at St. Joseph Catholic Church. Throughout it all, his belief has been to share his talents with others in an effort to give back to God in thanks for all that he has blessed us with.

When discussing this role with Big I Illinois, we were still traveling a great deal to follow our twins in their respective college sports. I wasn’t quite sure how he was going to be able to juggle it all. However, just as he has in the past, he has donated his time and taken his role seriously to exhibit his beliefs of how important he feels the Big I is for the insurance business not only in the State of Illinois but throughout the country. He handles all matters seriously, looking at the implications of the decisions made in the Association from all sides and believes strongly in the work the organization is doing. Personally, and as always, I feel pride in all that he has accomplished with all that he juggles; and I find his depth of knowledge in the industry unmeasurable and invaluable. In all decisions, he wishes to represent his state and support his customers with only the best products and service he can provide. As President he will act with honesty and integrity and provide great insight to the industry that he loves.” -

Lisa

“Growing up, these groups were all the same to me. Associations, boards, Independent Agents groups - I didn’t know what they were nor what their purpose was. Now that I am in the industry, I understand the influence and how much impact the Big I has in the workplace today. Because the majority of people reading this understand my dad’s working resume, I feel I should focus my answer on something that people will not have seen on that piece of paper.

A discussion with my dad happened in my bedroom one late night when I was in 8th grade, headed to high school. The Pekin Community High School Head Basketball Coach was stepping down after a long tenure. My dad was an assistant coach for the high for almost my whole life whilst working in the daytime -first at Unland, then Nabisco, and back to Unland. The conversation was short, but meaningful in the same moment as he asked me whether he wanted me to have him as a head coach for my High School Basketball team for the next four years. Of course, I explained how great that would be to play for my dad without knowing the caveats to what that meant. It would require more time in the gym, away from family, his job, and away from home and for him to miss a lot of what was my goal after high school. It made me really think about my answer and what that meant for the six of us - the real team.

Ultimately, he decided to hold back and remained as an assistant coach for the high school team while moving up the ladder at Unland to his top rank now. He put his family first, realizing that this idealistic picture would maybe be just a distraction to not only continuing as a great father and husband, but also as someone who will lead on a greater level. The workplace and community is better off because of that decision. I have no doubts that these crossroads came about more than we are aware - to move somewhere, lead another company, work for a larger agency, make more money... Whatever it was, he knew that pulling him one way was a detour for our “real team” and maybe one that would disrupt all of the things we had going on in our lives.

I want to share one stat that isn’t in any record book nor will be in any newspaper. My parents and my family made sacrifices big enough for me to spend my high school summers playing basketball just about everywhere in the US. All of these sacrifices then led to me having the chance to play at the collegiate level in the Big Ten at Northwestern. As I looked back at all of the games, 6-hour round trips to practice on Thursdays and Sundays, and tournaments in remote locations, my parents didn’t ever give themselves the option to not go.

My mom and dad missed a total of five basketball games in eight years. With three other kids at home. Home or away. Evanston, Las Vegas, Cancun, Columbus, Philadelphia, Minneapolis in a blizzard, West Lafayette at 9 Central time, Ann Arbor with a 12-hour car ride through a snowstorm, Raleigh, Los Angeles - the list goes on. Whether I played or not, they ALWAYS showed up. I will never forget that.

I can go on for pages about what my dad means not just to me and my family, but everyone around him. The question was “How do I feel about your Dad’s new role with Big I Illinois?” The answer isn’t one that is hard to find. I feel that this role was earned, not given. If you have the chance to spend five minutes with my father, you will quickly understand that family and community have always come first. To personally see the impact in both, I will say that he will always show up, no matter how many balls are in the air. I feel that the Big I will soon come to find the true impact

of my dad’s presence and everyone that has the chance to spend time working with him will realize it isn’t one to take for granted. The Big I is extremely lucky to have him in this role and at the head of its community.

The roles are now reversed - I am the one that gets to sit on the sidelines to watch. I don’t plan on missing a game and I am eager to see what is next.” - Nathan

“I am very excited for my father to take on this new role, selfishly. This comes from the admiration and joy of being able to follow in his footsteps. Like my brother, Nathan, I am also in the insurance industry and intertwined through the wholesale avenue.

How we got to this point is another story in itself. Growing up, he embraced the parental role of molding my siblings and me to be the best people we could be. He was there as the best dad, teacher, coach, and leader possible. Friendship came a little later. I have an incredible amount of respect for my father for raising such a stubborn kid… Justin was a handful.

When I graduated high school, my Dad and I started to become more of friends. Geographically, work and school had pushed me further from home, but personally much closer to my father. The industry has provided us the opportunity to attend events together and I am very blessed and grateful for that opportunity.

In the spring of 2022, we attended our first Young Agents Conference together in the Chicagoland area. I was about three months into the industry and probably didn’t know how to spell insurance. Today, I am on the Young Agents Committee and have the pleasure of working with my dad within the association. This year, we attended our first Big I National Convention together in Indianapolis. I am incredibly blessed to watch my dad prepare to take on this role firsthand and yes, selfishly, excited because business has brought us together in another way and allowed us to be friends as well as family.” - Carter

“It is rare that my father steps into a room and doesn’t know anyone. Growing up, I would watch as my dad could not leave a building without stopping to speak to a few groups of people. He never missed an opportunity to introduce his kids or to share what was going on in our lives. He never failed to make that person feel heard and seen, as he intentionally remembered vital moments of their own life. When I think about what my dad has done in this industry, I don’t think about all the awards he has received or the things he has accomplished. I think about how many people have been impacted by my father’s friendship. I think about the long term connections that he has created. I think about the heart he has behind it all, which is a heart to serve his community and his family.

My father really does it all and he has worked extremely hard to have had this much success. I couldn’t be prouder to call him my dad and I’m so excited to see the direct impact he will make with this new role.” - Jenna

I will piggy back off of what Nathan had said. My parents have always been “Family First.” In the same boat, my parents maybe missed a handful of games in my three-year career at The University of Wisconsin-Madison. They both work very hard to provide us four with a great opportunity at success.

I also can say that I know very little about what my Dad does day in and day out. I have always wanted to be around Sports, so I had little interest in going into insurance. But, some might see it as a negative thing that I didn’t really get to know what he does at work. I see this as him putting work aside when he comes home from work. When he comes home, he is a Father, and tries his hardest to keep the two apart.

We are very fortunate to have a great role model to look up to. How do I feel about his new role with Big I Illinois? I think he deserves all the credit he can get, and anyone who works with him will know that he will take care of his people around him first.” - Justin

What lessons from your personal life have you incorporated into your business career?

I had a great childhood and upbringing in Pekin, IL and was blessed with great parents and siblings to grow up with. I wasn’t given anything and had to work for any achievement or accolade. I was taught humility in many experiences I had throughout high school and college and I try to carry that trait in my work life. I also feel like a leader should be a humble servant in many ways and demonstrate the willingness and ability to do the work that you expect others to do and show by example. I was also taught at a young age to respect those you are around and know that everyone is different. On a daily basis, you don’t know what others are going through. You may think the problems or challenges you are facing are critical, but become trivial once you find out what those around you are experiencing. I also incorporate some aspects of my coaching experience and further involvement with teams over the years. Our agency certainly has similarities with any “Team .”Everyone has a role, everyone has different capabilities and skill sets, everyone needs to be accountable to the other team members. We all need to learn from our mistakes, but certainly celebrate the wins we have throughout the year and recognize achievements when they happen.

Finally, when all is said and done, what is the most important message you hope members take away from your Presidency?

I hope that after my year as President, members continue to feel good about the impact they have on their customers and that they have an association that continues to fight for our livelihoods while providing all the tools and resources necessary to be successful. I also hope they feel like I continued the strong leadership that the association has been accustomed to over the years from those who served before me.

Leadership forms the core of a successful business. Leaders are in charge of inspiring employees and maintaining morale. They solve problems and get results. Without effective leadership, a company would be directionless and without vision. Poor leadership leads to a breakdown in internal communication and affects the business’ bottom line.

As the leader of your insurance agency team, you are responsible for the team’s success. You play a vital role in taking your insurance agency to new heights and inspiring your employees to achieve their goals.

The following tips will help you fulfill this role to the best of your ability.

Too many business owners and leaders view their employees only as a means to make money. Your insurance agency should be the difference you want to see in the business world. You can set an example by protecting your team from demotivation, burnout, and stress.

Your insurance agency team looks to you for help and guidance. Provide your agents with the support they need by doing the following:

• Provide them with all the necessary tools to perform their job efficiently.

• Check up on their well-being regularly, and allow them to take a break when they feel overwhelmed.

• Create career opportunities and encourage them to work towards personal career goals.

Use all the available tools at your disposal to manage and lead your team. Doing this means leaving the old way of doing business behind and equipping your employees with digital tools to make their jobs easier. Give your team members equal opportunity to use technology to improve their work skills and incentivize hard work.

Place enough trust in your employees to allow them to work from home if they choose to do so. Discuss the possibility of

By Jenna Kleiber

hybrid and remote working hours, and implement flexible hours where possible. The world is not the same place it was before the pandemic. Thousands of people work from home, and this has not negatively impacted their performance.

To be a great leader, you must have incredible communication skills. Refrain from communicating with your employees exclusively through emails or video presentations. If you want to inspire and motivate your team, you must be approachable. That means being available to listen to your team when they want to bring potential issues to your attention. It also means responding in a manner that makes employees feel heard and appreciated.

Good communication between a leader and a team eliminates misunderstandings and keeps the wheels of the organization spinning toward success.

You’re in the insurance business to provide a service and turn a profit. Along the way, you’re guiding your team to new heights and teaching them new skills. However, as technology improves and insurance processes become digital, coaching is often a missed opportunity to strengthen sales teams.

Sometimes, leaders replace coaching with stern feedback, which may lead to conflict. Think of it this way: if you’re constantly harping on your team’s mistakes, they’re not learning anything. If you take the opportunity to show them where the issues creep in and how they can prevent them, you’ve helped your team grow.

Coaching your team helps bring out the best of their skills. You can use coaching to build strong relationships with your team while celebrating their wins.

It’s true that if you can’t lead your own path to success, you can’t lead anyone else’s.

Self-leadership allows you to fulfill your objectives while motivating your team to reach their goals.

The principles of self-leadership include the following:

• Dedication

• Communication

• Motivation

• Influence

• Responsibility

• Self-awareness

• Emotional intelligence

• Physical health

Leading yourself means becoming accountable for your actions while inspiring team members to follow your example. Aside from helping build stronger relationships with your team, self-leadership also helps you become more motivated to reach business targets.

You should set the standard of excellence for your insurance agency and guide your team to model this behavior. Setting the pace provides an example to your team of how and when you want things done.

You also need to identify areas in your agency where change is needed and initiate a plan to implement that change. Doing this will not only allow you to set the pace for achieving excellence, but you’ll also take the lead in transforming your agency into a harmonious space where your team can work on accomplishing collective business goals.

The success of your insurance agency relies on your leadership skills and how they translate to your team. You are the driving force behind your achievements and those of your team. Effective leadership is essential not only to your insurance business but to the insurance industry at large. The more influential leaders in the industry, the better the outlook for the insurance sector of the future.

Jenna Kleiber is the Marketing & Sales Manager at Jenesis. Find out more at jenesissoftware.com.

Rather than attempt to be all things to every kind of business, we focus on the ones we know best—restaurants and bars, grocery and convenience stores, medical clinics and auto service shops—to deliver outstanding property, casualty and workers compensation insurance. Deep niche expertise, with insight into unique business risks, is how we cover the details that make the biggest difference to our policyholders.

To discuss an agency appointment, give us a call at 888.5.SOCIETY or visit societyinsurance.com

“We’ve Always Done It This Way”

By ReFocusAI

Discover how Chris Cline, Executive Director of Agents Council for Technology (ACT), challenges the “We’ve always done it this way” mindset in insurance, emphasizing innovation, change, and growth.

While cliché at this point, the “We’ve always done it this way” crowd does still exist. In insurance, the drumbeat of resistance is perceived to be louder than in other industries. Why? Success can breed complacency, and in a market flush with cash, large M&A acquisitions, and record job stability, we don’t often stop to wonder what we could do better.

But things change, and those who are not innovating, growing, and developing get left behind. So, how do we approach a change mindset when things are going well? How do we prepare for change without doing things just for the sake of change? We talked with Chris Cline, Executive Director of the Agents Council for Technology (ACT) and author of The Inertia of Legacy, about his thoughts on the “how and why” of change in our industry.

ReFocus AI: Why should any of us be focused on change, either professionally or personally?

Cline: There is no arguing that change is necessary and inevitable in almost literally every facet of life. And while every generation through each of society’s most significant transformations will attest that their cycle of change was the most dynamic, I think there is an objective case to be made that right now is the fastest and most significant amount of change humankind has ever seen – and with AI still in its infancy it will likely only get faster.

ReFocus AI: But why in insurance? This is an industry some call “recession-proof” and has often been exceedingly successful without changing as rapidly, while other industries have been forced to change.

Cline: Many will posit that we must change in our industry to keep up with the consumer expectation set by innovative companies like Amazon. We’ve heard it and likely agree with much of it – 24/7, anywhere and anyhow, immediate shipping,

free returns, maybe even some recommendations for other items we might like. Huge stuff, hard to argue, and we must learn from all of this. In fact, we can all name insurance entrants who aimed to displace agents, carriers, and tenured tech all through the Amazonian lens. Let’s save that debate for another time, but I think many would agree that their experience and learning has pointed back to the value offered from within the very model they were looking to disrupt. Thus, the why?

Viewing insurance products through the lens of an identical, repeatable, and predictable product like a simple blender, they are right. But insurance is not a blender. In fact, every single customer is different. Every agency is different. And, every carrier is different. Though there are some customers that will absolutely buy our product as though it was a blender, when considering the change(s) you want or need to make in your firm (agency, insurer, vendor partner), it’s critical to assess if that is your target customer. Without a clearer identification of who your target customers are, it is very difficult to define and build a customer experience for them. And lack of clarity here can send an organization down some unnecessarily frustrating paths whether talking about technology, people, or even trading partners. This is your why.

ReFocus AI: That absolutely makes sense. And if that is the “why” then how about the “what”?

Cline: In my mind, “what” is like saying “the fundamentals”. And while it is not always a popular thing to say, this is a fundamentals heavy industry. And I’d be so bold to say that some of the challenges we face, or even create, happen by losing some focus on these fundamentals. Afterall, doesn’t everything that all of us do every day ultimately lead to making certain that there is a financially sound insurer available to uphold its contractual obligation to indemnify a policyholder at the time of a covered loss? Everything. Yes,

a lot goes into that, but that is why our industry exists and what makes it complex. Afterall, if we cannot uphold our policyholder obligations, we don’t exist – for long.

These are not excuses to dismiss innovation and change. Rather they are a challenge to make sure we are focused on what needs to change and why. Some may not agree initially, but I submit that even over hundreds of years in our industry (in which a lot really has changed!), many fundamentals, many “whats” do and will remain. Though not intended to be an exhaustive list, since day one hasn’t the industry needed to prospect, quote, underwrite, price, sell, transfer risk, service, bill, settle claims, and you could argue compliance? There are certainly others, but many are captured within the spirit of this abbreviated list.

ReFocus AI: Technology is certainly an avenue for the “how” of some change in this industry, but not all of it. When agents approach “how” for their own change, what steps do you suggest for them?

Cline: This is where we explore the notion that “we’ve always done it that way isn’t working”. Afterall, without alignment about what you are doing and why you are doing it (and how you are measuring it), it’s very difficult to assess if how you are doing it is working or not.

All that said, I do believe most would agree that one of the more harmful expressions in business and life is “we’ve always done it that way.” Hearing it shuts down dialog, stifles creativity, and is a barrier for any form of meaningful innovation. And, in reality, it’s also usually wrong. Afterall, if we are honest and set hyperbole aside, our industry has gone through a continuous cycle of changes in how we do things… in nearly every facet of every role for as long as any of us have been involved. In other words, let’s give ourselves some credit. Any remotely successful business that has been around for a while “hasn’t always done it that way”… or at least not most things.

Aging myself here, I can recall being a carrier field rep delivering rates on floppy disks. Some agents loved it, some hated the change, as it wasn’t much earlier that agents and carriers were rating with pencils. Then carriers built quoting portals. Then the portals underwrote and ultimately allowed submissions and binding. Comparative rating grew. We had “real time”. And we are getting to more direct integrations. At each point, the role of the agent, underwriter, processor, IT professional, actuary, etc. - changed as did how they did the thing. Some resisted and others asserted we weren’t moving fast enough. We can debate the pace and effectiveness of this journey over 25+ years, but using this fairly broad scale example, we can honestly say we haven’t always done it the same way. Perhaps it’s naïve or optimistic, but I think we can use this example as an illustration to support the notion that saying “we’ve always done it that way” is not only counter to progress, but it is often incorrect. In the moment it is almost natural to focus on the discomfort or pain associated with something. It’s also hard, but crucial, to look at an overall trajectory of where we are going. It takes both perspectives to think though, inspire, and fuel change.

If something is wrong and counter to moving forward, it’s hard to fathom why people say it. I believe when people say this, it is largely rooted in fear of uncertainty and change. And we can address that with intentional change management efforts, by recognizing progress and impact that has already been made and use that to build upon with new concepts, tools, capabilities, and… results. In fact, we don’t recognize progress enough and we should - if just as a mechanism to inspire future innovation and thought. Believing we can

and have is very powerful. So, it’s not entirely clear why (or motivating) to dismiss the past and what can be learned about how and why we are where we are on any change curve. Afterall, where we are is not likely to be where we were even just a few years ago. Again, we haven’t always done it that way and we should continue to embrace not doing it the same way in the future.

Whether someone appears to be reluctant to change OR is pushing change very hard they may feel compelled to reference the “we’ve always done it” sentiment. Though those are very different starting points in your change management efforts, it’s a very powerful opportunity to remind the fearful or the optimistic that we need to always assess our “why”, our “what”, and our “how” and remind them that we really haven’t always done it the same way – and that we cannot continue to do it the way you are today.

ReFocus AI: You address many of these as more philosophical concepts in your book, correct?

Cline: Absolutely. Much has been written, spoken about, and trained to help work through this in a traditional change management context. But, as I am now often prone to do, I quickly saw a correlation between the concepts laid out in my book The Inertia of Legacy.

I started it all with a quick look at the definition of Inertia from Newton’s laws of motion.

“An object at rest remains at rest, and an object in motion remains in motion at a constant speed and in a straight line unless acted upon by an unbalanced force.”

Regardless of your perspective and how you view yourself or business, whether you are at rest or in motion, you are doing so by way of a combination of how external forces and your effort are working together. Much like an airplane, there are always changing conditions that must be accounted for preflight and while in-flight. For example, how far they are going, the amount of fuel needed, number of passengers and how they are seated, the amount of luggage, weather conditions, turbulence, other flights… all are external forces working against the flight path and plan that initially guided the plane upon take off. And each requires adjustment to the flight plan and adjustments to be made in real time. It may go without saying that they simply can’t safely execute every flight the way they always have.

In life and in business all of this holds true as well. Even if we are pleased and comfortable with where we are, we cannot simply keep doing the exact same things and expect the same levels of results. There are just too many external forces working around us that can and will alter our trajectory if we don’t take note and address them as needed.

In the book I explore the intersection between inertia and the more esoteric concept of one’s personal or professional legacy and offer several practical tools to help any person or business define, manage, and leave their best possible legacy.

ReFocus AI: Thank you so much for these incredible insights, Chris! We hope our readers will check out more about the innovations in our industry that ACT discusses and dissects, and we’d encourage them to check out your book, The Inertia of Legacy, as well. (Found on Amazon)

Find out more about ReFocus AI at refocusai.com.

Leadership isn’t just a title; it’s the driving force behind the growth and success of any insurance agency. For independent agents, having supportive and dynamic leaders can be a game-changer for their training and career development.

This article will show how strong leadership can shape the training and development of independent agents, turning them into top performers and valuable assets to their agencies.

We’ll look at the key role of leadership in training, the essential parts of effective training programs, powerful leadership strategies, the importance of mentoring, and ways to overcome common challenges. By the end, you’ll understand how focusing on leadership can greatly improve agent performance and agency success.

Defining the Role of Leadership

Leadership in an insurance agency goes beyond just managing daily tasks; it’s about inspiring and guiding agents to do their best. Leaders set the tone, culture, and expectations that create a positive environment for training independent insurance agents.

• Better Outcomes: Effective leadership ensures agents receive the guidance and support they need to excel, leading to enhanced performance and higher client satisfaction.

• Positive Environment: A robust leadership presence fosters a supportive and motivating training environment, encouraging agents to engage and learn effectively.

• Retention and Growth: Agencies with strong leadership often see better retention rates and more consistent growth, as agents feel valued and well-prepared for their roles.

Creating a strong training program requires a comprehensive and adaptable approach. Here are the key components that make training insurance agents effective:

• Structured Curriculum: A well-organized training plan covering all necessary skills and knowledge, designed to be replicable and engaging.

By Stephen Harrington-Descouteaux

• Hands-On Learning: Practical experience through roleplaying, simulations, and real-world scenarios. Cater to different learning styles with a variety of hands-on activities.

• Ongoing Education: Continuous learning opportunities to keep agents up-to-date with industry changes and new technologies.

Leaders are pivotal in developing and implementing these training components:

• Setting Standards: Ensure the curriculum meets industry standards and agency goals, creating a robust yet engaging learning experience.

• Encouraging Participation: Promote active engagement and participation in training activities by asking open-ended questions to gauge understanding and retention.

• Providing Resources: Equip agents with the necessary tools and resources for effective learning, such as headsets, multiple monitors, mentors, online resources, checklists, and schedules.

To supercharge agent training and development, leaders can use several effective strategies:

• Clear Expectations: Set clear, achievable goals and expectations for agents.

• Regular Feedback: Provide consistent, constructive feedback to help agents improve.

• Personalized Training Plans: Tailor training to meet the individual needs and strengths of each agent.

• Continuous Support: Offer ongoing support and encouragement to foster confidence and growth.

• Be Approachable: Create an open-door policy where agents feel comfortable seeking advice and feedback.

• Lead by Example: Demonstrate the behaviors and attitudes you want to see in your agents.

• Celebrate Successes: Recognize and reward achievements

to motivate and inspire your team.

Mentoring is a powerful tool in training for insurance agents, offering:

• Personalized Guidance: One-on-one support to guide agents in their careers.

• Knowledge Transfer: Sharing valuable industry insights and experiences.

• Increased Confidence: Boosting agents’ confidence through continuous support and encouragement.

• Match Wisely: Pair mentors with mentees based on compatibility and goals.

• Set Clear Objectives: Establish specific, measurable goals for the mentoring relationship.

• Regular Check-Ins: Schedule consistent meetings to discuss progress and challenges.

Training independent agents can present several challenges:

• Resistance to Change: Agents may be hesitant to adopt new methods or technologies. To overcome this, emphasize the personal and professional benefits of new methods or technologies through real-life success stories and hands-on demonstrations.

• Knowledge Gaps: Inconsistent skill levels can make standardizing training difficult. Implement individualized learning plans and regular skill assessments to tailor training to each agent’s specific needs.

• Time Constraints: Balancing training with daily responsibilities can be challenging. Try integrating small learning sessions and flexible training schedules to

accommodate agents’ routines without overwhelming them.

• Emphasize Benefits: Clearly communicate the advantages of new methods or technologies.

• Adapt Training: Customize training programs to address varying skill levels and learning styles.

• Prioritize Training: Allocate dedicated time for training to ensure it remains a priority.

• Incorporate Flexibility: Offer flexible training schedules to accommodate busy agents.

• Use Technology: Leverage online training modules and virtual resources for convenient learning.

• Provide Support: Ensure agents have access to resources and support when they encounter difficulties.

In conclusion, leadership is crucial in guiding the training and growth of independent agents. By creating a supportive training environment, using effective strategies, and tackling common challenges, leaders can greatly improve agent performance and agency success.

As an agency leader, take active steps to invest in your agents’ development. Promote continuous learning, offer steady support, and celebrate their achievements. By doing so, you’ll not only improve individual performance but also drive your agency towards greater success.

Stephen Harrington-Descouteaux is a Performance Partner with Agency Performance Partners. Find out more at agencyperformancepartners.com.

We’ve been successfully protecting small businesses since 1983.