KEVIN LESCH 2022-2023 IIA OF IL PRESIDENT Introducing New IIA of IL Board of Directors

Breadth of capabilities

We’ve built a broad portfolio of specialized personal and business coverage products, and continue to invest in new capabilities and innovative solutions.

Depth of expertise

We’ve assembled teams of expert underwriters, risk managers and claims professionals with decades of expertise that are solely dedicated to each of our product lines.

Coordinated approach

We are uniquely positioned to work across the personal and commercial lines enterprises to deliver tailored account solutions in an integrated manner.

701-10617 (8/21)

hanover.com PERSONAL LINES • MIDDLE MARKET • AGENT-CENTRIC FOCUS • SPECIALTY • COMMERCIAL LINES

Brent

Timmerman, CIC, LUTCF Territory Sales Director Cell: 630.200.2382 Email: btimmerman@hanover.com

Lesch

of IL Board of Directors

of IL President

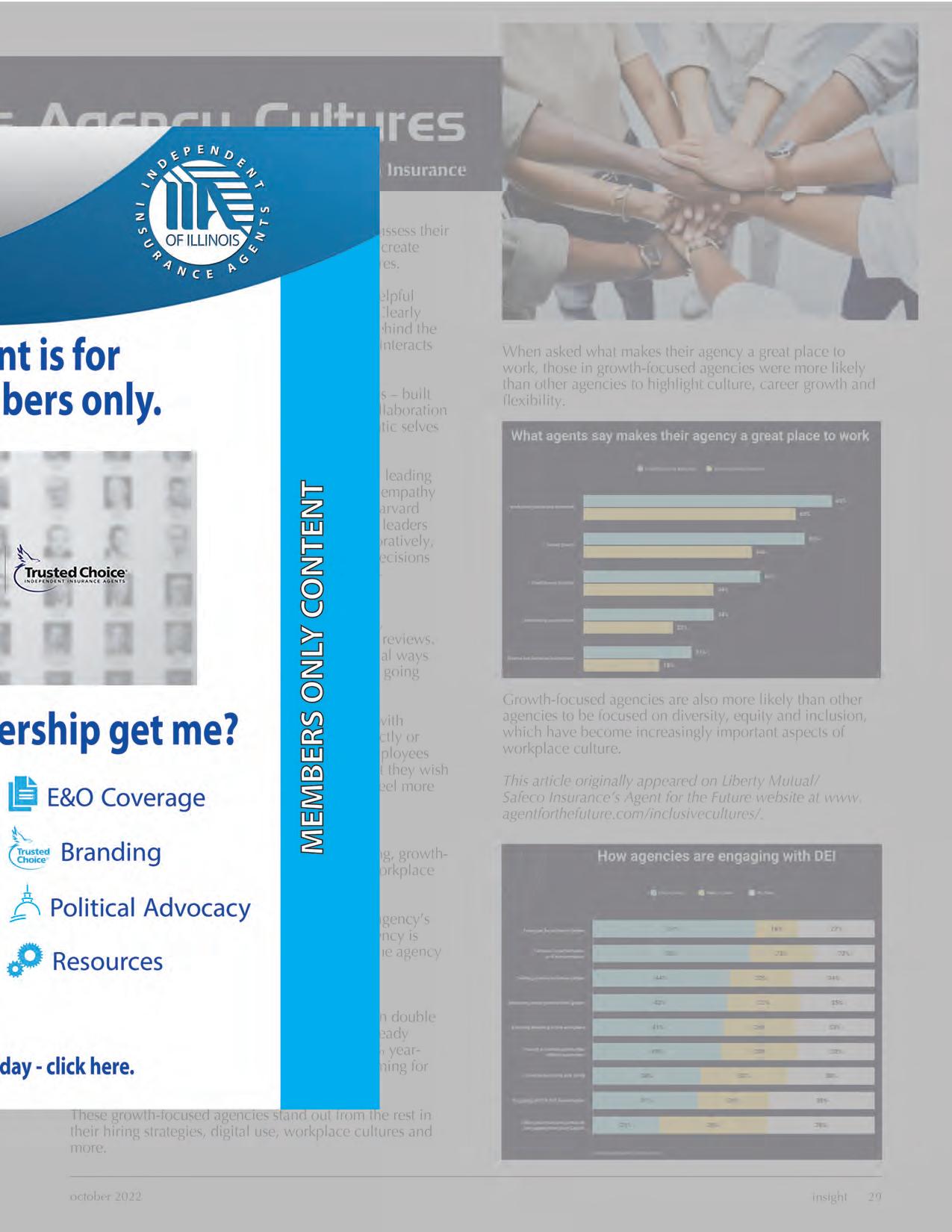

Inclusive Insurance Agency Cultures

By Liberty Mutual and Safeco Insurance

By Liberty Mutual and Safeco Insurance

a Modern Insurance Culture in a Digital Age

By Jay D’Aprile

Who You Are, Not Just What You Sell

By Daniel Smith

CONTENTS 2022-2023 IIA

Kevin

- 2022-2023 IIA

Building

Creating

Marketing

IIA of IL Regional Director and Committee Chair of the Year Award Recipients 10 22 28 30 33 37 The Independent InsuranceAgents of Illinois (IIA of IL)has been providing memberswith a sustainable competitiveadvantage since 1899. Insight is the official publication of the Independent Insurance Agents of Illinois (IIA of IL). The magazine is published monthly for the members of the IIA of IL, with the office located at 4360 Wabash Avenue, Springfield, Illinois 62711-7009; Consumer Website: www.ChooseIndependent.com. The IIA of IL welcomes letters discussing concerns of the insurance industry, articles, editorials, other matters of interest to the membership. The editor reserves the right to edit and select submissions for publication. Address submissions for review to Rachel Romines at rromines@iiaofil.org. For advertising information, contact Tami Hubbell at thubbell@iiaofil.org. In This Issue Message from the CEO Trusted Choice Brett’s 2 Sense e-Insight 7 8 9 21 info@iiaofil.org | www.iiaofil.org | (800) 628-6436 or (217) 793-6660 | Fax: (217) 793-6744 Editor & Graphic Design - Rachel Romines | Advertising - Tami Hubbell Board of Directors Profiles IIA of IL News Classifieds 38 41 42 October 2022 2009 • 2010 • 2011 • 2012 • 2013 • 2014 2015 • 2016 • 2017 • 2019 • 2020 • 2021 • 2022 22 10 2022-2023 28 33

Board of Directors Executive Committee

Chairman of the Board | Jay Peterson, AFIS, LUTCF (217) 935-6605 | jay@peterson.insurance

President | Kevin Lesch (630) 830-3232 | klesch@arachasgroup.com

President-Elect | Allyson Padilla (618) 393-2195 | allyson@blanksinsurance.com

Vice President | Patrick Taphorn, CIC, CSRM (309) 347-2177 | ptaphorn@unland.com

Secretary/Treasurer | Cindy Jackman, CIC, CISR (800) 878-9891 x8745 | cjackman@arlingtonroe.com

IIABA National Director | George Daly (708) 845-3311 | george.daly@thehortongroup.com

Regional Directors

Region 1 | James Sager (618) 322-9891 | james@sagerins.com

Region 2 | Ray Roentz (618) 639-2244 | ray.roentz@hwcrins.com

Region 3 | Christopher Leming (217) 321-3185 | cleming@troxellins.com

Region 4 | Bart Hartauer, CIC (815) 223-1795 | hartauer@hartauer.com

Region 5 | Noele Tatlock (309) 642-6855 | ntatlock@unland.com

Region 6 | Thomas Evans, Jr. (779) 220-6564 | tevans@crumhalsted.com

Region 7 | David Jenk, Esq. (312) 239-2717 | djenk@nwibrokers.com

Region 8 | Charles Hruska (708) 798-5700 | chas@hruskains.com

Region 9 | Lindsey Polzin (630) 513-6600 | lpolzin@presidiogrp.com

Region 10 | Mohammed Ali CS (847) 847-2126 | mali@aliminsurance.com

At-Large Director | Amiri Curry (847) 797-5700 | acurry@assuranceagency.com

At-Large Director | Jeff McMillan (815) 265-4037 | jeff@mcmillanins.com

At-Large Director | Patrick Muldowney (312) 595-7192 | patrick.muldowney@alliant.com

At-Large Director | Luke Sandrock, CIC (815) 772-2793 | lsandrock@2cornerstone.com

Committee Chairs

Budget & Finance | Cindy Jackman, CIC, CISR (800) 878-9891 x8745 | cjackman@arlingtonroe.com

Education | Lisa Lukens (618) 942-2556 | salibainsurance@gmail.com

Farm Agents Council | Steve Foster (217) 965-4663 | s.foster@ciagonline.com

Government Relations | Dustin Peterson (217) 935-6605 | dustin@peterson.insurance

Planning & Coordination | Nick Gunn, CIC (309) 691-1300 | nickgunn@nixonagency.com

Technology | Brian Ogden (217) 632-2206 | brian@ogdeninsurance.com

Young Agents | Renee Crissie (224) 217-6577 | renee@crissieins.com

ADVERTISERS

Director of Information and Technology Shannon Churchill - (217) 321-3004 - schurchill@iiaofil.org

Director of Education and Agency Resources Brett Gerger, CIC - (217) 321-3006 - bgerger@iiaofil.org

Accounting & Admin Services Tami Hubbell, CIC - (217) 321-3016 - thubbell@iiaofil.org

Director of Human Resources, Board Admin Jennifer Jacobs, SHRM-CP - (217) 321-3013 - jjacobs@iiaofil.org

Sr. Vice President/Chief Financial Officer Mark Kuchar - (217) 321-3015 - mkuchar@iiaofil.org

Chief Executive Officer Phil Lackman, IOM - (217) 321-3005 - plackman@iiaofil.org

Central/Southern Marketing Representative Lori Mahorney, CISR Elite - (217) 415-7550 - lmahorney@iiaofil.org

Director of Government Relations Evan Manning - (217) 321-3002 - emanning@iiaofil.org

Office Administrator Kristi Osmond, CISR - (217) 321-3007 - kosmond@iiaofil.org

Director of Communications Rachel Romines - (217) 321-3024 - rromines@iiaofil.org

Director of Membership Services Tom Ross, CRIS, CPIA - (217) 321-3003 - tross@iiaofil.org

Products & Services Administrator Janet White, CISR - (217) 321-3010 - jwhite.indep12@insuremail.net

Director of Prof. Liability & Ins. Products Carol Wilson, CPIA - (217) 321-3011 - cwilson.indep12@insuremail.net

IIA of Illinois Staff 36 44 14 17 5 43 20 32 Cover Tip 26 34 31 14 2 40 6 AAA INSURANCE APPLIED UNDERWRITERS BERKSHIRE HATHAWAY GUARD INS. GROUP BIG I RETIREMENT SERVICE EBRM FORRESTON MUTUAL INSURANCE CO. GRINNELL MUTUAL IPMG OMAHA NATIONAL UNDERWRITERS PEKIN INSURANCE PROGRESSIVE SECURA INSURANCE SOCIETY INSURANCE THE HANOVER INSURANCE GROUP UNITED FIRE GROUP WEST BEND MUTUAL INSURANCE CO

Find us on Social Media

Independent, Authorized General Agent for An Independent Licensee of the Blue Shield Association

REMEDY FOR WORKERS’ COMPENSATION WEST BEND

West Bend Mutual Insurance has a long history of writing workers’ compensation insurance. Our underwriters are knowledgeable and experienced. Our loss control reps have the expertise and tools to help keep employees safe. And our claims practices are the best in class.

From Main Street-type businesses to specialty businesses like childcare, West Bend has the experience and expertise to protect businesses of many kinds and many sizes. We want to write all of your workers’ compensation business, small to large!

When you select West Bend for your valued customers, you can rest assured you made the right choice. After all, we are the best remedy for workers’ compensation.

THE BEST

Happy fall! As you are reading this, CONVO 2022 is either happening now, or we’ve just wrapped up the event. Insight magazine will feature all the highlights from this year’s event in the November issue.

As Covid has provided many time-saving opportunities to conduct certain business meetings and transactions virtually, the IIA of IL is committed to hosting this in-person event as there is no substitution for meeting face to face with your peers, industry partners, and speakers. If you attended CONVO 2022, I am confident you found the event beneficial to you and your business.

IIA of IL leadership and staff continue to add new benefits and refine existing programs. Our Technology Committee, under the leadership of Brian Ogden and staff liaison Shannon Churchill, provides all members access, at no cost, to Catalyit, the new technology resource center created by Big I state associations specifically for independent agents. Through the initiative of HR Director Jennifer Jacobs, IIA of IL now offers a complete set of resources she has titled “Recruit, Train, Retain.” CareerPlug and Big I Hires can help you find the best talent for your agency. Our Prelicensing Program can get them started, and Jennifer can assist with best practices for creating an inclusive environment that will result in a stable and productive agency. IIABA and the Illinois association have also enhanced our engagement with the Invest program to ensure high school and junior college students are aware of the great job opportunities in the IA system and the insurance industry in general.

Our Communications program, under the leadership of Rachel Romines, has added several new ways for you to engage with your peers and staff, including our new online community platform, CONNECT. In addition, you now have the opportunity to receive notifications of upcoming events and registrations via our new text notification service.

Our advocacy program remains the strongest in the state under the leadership of our Government Relations Committee and Evan Manning. In addition, Brett Gerger’s encyclopedic knowledge of insurance law and regulations, and Brett’s relationship with Department of Insurance staff makes your Association a superior advocate for your agency and clients. Finally, I would be remiss if I didn’t mention Agents Insurance Services under the leadership of Chair Bill Lawrence, Carol Wilson, and Janet White. We offer the best E&O coverage, bond program, personal umbrella, cyber coverage, and so much more.

Whatever you need, the team at IIA of IL is here 24/7 to assist.

While CONVO is a time to welcome new leadership and a new association year, I want to recognize several members who are completing their service with the IIA of IL Board of Directors.

Bennie Jones - Bennie joined the board as an At-Large member in 2013 and served a six-year term as Secretary/ Treasurer before completing one more year as an AtLarge Director. Bennie has been a Chicagoland IIA Board member and has been involved in Invest and several other

initiatives to bring talent into the industry. On a national level, Bennie has served as both a member of and, most recently, Chairman of the Big I Diversity Council and was instrumental in implementing our program with George Daly.

Michael-Charles Hilson - Michael began his service to the Board of Directors in 2014 as a Regional Director and most recently completed a four-year term as an At-Large Director. In addition to his service on the Board, Michael has been a champion for Invest, served as a member of the Young Agents Committee and the Chicagoland Board, and has been involved in state and national legislative events for many years.

Greg Sandrock - After many years of involvement with the Independent Farm Insurance Agents of Illinois and several IIA of IL committees, Greg joined the Board of Directors as Region 6 Director in 2006. Since that time, he has held the positions of Secretary/Treasurer, Vice President, PresidentElect, President, and National Director. In addition to his service on the IIA of IL Board, Greg has been involved both as a member and as Chair of the Big “I” Crop Insurance Task Force, a member of the Big “I” Government Relations Committee, Big “I” Steering Committee and InsurPac Board of Trustees. By the time you read this, Greg will hopefully have won his race to join the IIABA Executive Committee.

I want to thank Bennie, Michael and Greg for their leadership and many contributions to the board and industry.

Two current board members are transitioning to new roles on the board. Government Relations Chair, Pat Taphorn, will serve as Vice President and advance through the chairs of the Executive Committee, and current Chairman of the Board, George Daly, will serve as National Director.

In this issue, we welcome Kevin Lesch, President of the Arachas Group, as the new IIA of IL President. Despite his ever-growing agency and young family, Kevin has devoted many years to serving both local and state associations. During the Executive Committee retreat this summer, Kevin laid out his goals for the upcoming year, which included technology, mentorship, equity, and Invest. The association will return to in-person regional networking events, a mix of in-person and virtual education classes, and staff roadshows next spring. In addition, the Planning & Coordination Committee is working on a proposal that would reconfigure the current regions and increase the number of At-Large Directors to ensure the diverse nature of our membership is represented on the board.

I hope you enjoyed this year’s CONVO and all the events and resources the association offers throughout the year. Despite the many challenges independent agents and the association face, thanks to our leadership and staff, IIA of IL remains one of the strongest and most innovative associations in the state and nation. I hope every agency in the state recognizes the return on investment membership provides!

october 2022 insight 7 message from the CEO | INSIGHT Phil Lackman - IIA of IL CEO - (217) 321-3005 - plackman@iiaofil.org

DIGITAL REVIEW

What’s included in a Digital Review?

Scored Website Report

This qualitative report provides a review of several key factors that influence the marketing effectiveness and usability of your website.

The grade is on a 100-point scale that uses an algorithm based on 70 criteria including search engine data, website structure, site performance and others. Other factors reviewed include overall appearance, design layout, structure, content and imagery.

Each section provides an easy to read grade of either: pass, moderate (problem), fail, or an FYI. We also highlight how each piece directly impacts your site and how hard or easy the problem is to solve offering examples and why each piece is important.

You will receive actionable advice to improve your website's business objectives.

Social Media Review

Your digital presence doesn’t end with just your website. Consumers are doing research and want to get to know your company. The corresponding social media review will ensure your profiles are fully complete and suggest some tactics for increasing engagement. We also provide best practices information to assist with your social media strategy.

TrustedChoice.com Scorecard

An in depth evaluation of your TrustedChoice.com profile that can determine what information you might be missing that online insurance shoppers will be looking for. TrustedChoice.com is visited by 7 million+ shoppers annually!

Bonus!

A free one-on-one consultation to review your custom results is also available upon request.

Request your Digital Review at trustedchoice.com/agents FREE Analysis of your Website and Social Media

2022-2023

IIA of IL Board of Directors

Jay Peterson, AFIS, LUTC

Chairperson

Jay Peterson joined his father’s insurance agency, Peterson Insurance Services, in 1979. He’s currently the President and owner of the agency, which offers a broad range of commercial, personal, life, health, and crop insurance coverages.

Peterson Insurance Services, Inc. PO Box 377 Clinton, IL 61727 (217) 935-6605 jay@peterson.insurance

Family: Spouse: Sarah Children: Dustin & Dexter Grandchildren: 4

Kevin Lesch, CBC

President

Kevin Lesch started in the industry at his father’s agency. In 2013, he took over as President of the agency and then bought out both partners in 2015. Currently, Kevin is COO of Árachas Group, LLC, a Keystone partner.

Árachas Group, LLC PO Box 8152 Bartlett, IL 60103 (630) 830-3232 klesch@arachasgroup.com

Family: Spouse: Trisha Sons: Jacob & Gavin

10 insight october 2022

Allyson Padilla, AAI

President-Elect

Allyson Padilla was born into Blank’s Insurance Agency but began her insurance career fulltime in 2008. The agency provides all types of insurance and bonds, including personal lines and commercial insurance. She works in all facets of the agency but is primarily focused on commercial lines, agency marketing, and advertising.

Blank’s Insurance Agency

515 S. Whittle Ave. - PO Box 69, Olney, IL 62450 (618) 393-2195 allyson@blanksinsurance.com

Family: Spouse: Angel Sons: Angel Julian, Bennett & Cruz

Vice President Patrick Taphorn, CIC, CSRM

Patrick Taphorn was hired out of college in 1989 with Unland in an Accounting & Operations position and moved into a sales role in 1994. He took over as President in January of 2016 and still has agent responsibilities. He oversees all four agency locations. Unland provides P&C, Life, Health & Employee Benefits, HR and Financial Services.

James Unland & Co., Inc. 2211 Broadway Road, Pekin, IL 61554 (309) 347-2177 ptaphorn@unland.com

George Daly

Family: Spouse: Lisa Children: Nathan, Carter, Jenna, & Justin

National Director - IIABA

George Daly entered the insurance industry in 1984, working with Allstate and Insure One before joining The Horton Group in 2005, where he’s President of the Personal Insurance Division. The Horton Group started in 1971 and is one of the top 50 largest insurance agencies in the country.

The Horton Group, Inc. 10320 Orland Pkwy, Orland Park, IL 60467 (708) 845-3311 george.daly@thehortongroup.com

Family:

Spouse: Margie Daughters: Katie and Erin Son: George

Cindy Jackman, CIC, CISR

Secretary/Treasurer

Cindy Jackman began her career in 1984. After 34 years on the agency side, joined Arlington/Roe as the central/southern IL Marketing Manager and enjoys helping the independent agents enhance and grow their agencies.

Arlington/Roe PO Box 2614, Carbondale, IL 62902 (618) 201-1265 cjackman@arlingtonroe.com

Family:

Spouse: Jon Children: Kristin & Troy Bonus Children: Amy (& Jim), 1 Granddaughter Cassie (& Jeff), 2 Granddaughters Jessica (& Darren), 3 Grandsons

october 2022 insight 11

IIA of IL Regional Directors

Region 1 James Sager

James Sager founded Sager Insurance Group in 2022. James has also been a producer for Premier Crop Insurance since 2014. Out of the agency, James currently serves as the fundraising chairman for Salem Community High School Academic Foundation, as a director for Greater Salem Chamber of Commerce, and as a founding board member of Little Egypt CEO program.

Sager Insurance Group, LLC 105 N 3rd St, Dahlgren, IL 62828 (618) 322-9891 james@sagerins.com

Family:

Wife: Amber

Children: Edison & Reid

Ray Roentz, CIC

Region 2

Ray Roentz started his career in insurance with AIG as a Surplus Lines, Pollution Underwriter and then a producer with Farmers Insurance. In 2012, he joined Heneghan, White, Cutting & Rice Insurance Agency providing personal insurance, commercial insurance, life insurance, bonds, and farm and crop insurance to clients in Illinois, Missouri, and Colorado. In 2021, Ray purchased a majority ownership of the agency and is now President of Heneghan, White, Cutting and Roentz Insurance.

Heneghan-White-Cutting & Roentz Ins. Agency 200 N. State Street, Jerseyville, IL 62052 (618) 639-2244 ray.roentz@hwcrins.com

Family: Spouse: Karla

Children: Rocho, Robert and Loretta

Region 3 Chris Leming

Christopher Leming began his insurance career in 1997. He is the Senior Vice President at TROXELL, which provides an in-house claims department to ensure all insurance claims are handled with fairness and efficiency. TROXELL offers Personal and Business Insurance, Group Benefits, Surety Bonds, HR and Safety Solutions, and Individual Health and Life insurance.

TROXELL

214 S Grand Ave W, Springfield, IL 62708 (217) 321-3185 cleming@troxellins.com

Family: Spouse: Margaret

Son: Christopher

Daughters: Annaliese & Mallory

12 insight october 2022

2022-2023

Region 4 Bart Hartauer, CIC

Bart Hartauer joined the Hartauer Insurance Agency in1985. He is now the owner of the full lines independent agency, which represents over 20 companies. The agency is a member of the ISU Insurance Group.

Hartauer Insurance Agency

613 First Street, La Salle, IL 61301 (815) 223-1795 hartauer@hartauer.com

Noele Tatlock

Family: Spouse: Katie Daughter: Catherine Son: Luke

Region 5

Noele Tatock has spent eight years in the insurance industry and joined Unland in October of 2019 as an agent in Personal Lines and Small Business. The agency provides Commercial & Personal P&C, Life, Health & Employee Benefits, and financial services.

James Unland & Co., Inc.

2211 Broadway Rd., Pekin, IL 61554 (309) 642-6855 ntatlock@unland.com

Family: Sons: Drew and Dylan Dog: English Bulldog, Sarge

Region 6 Thomas Evans, Jr.

Thomas Evans, Jr. has been in the insurance industry since 1996. He spent time at Franklin Life, Insure One and Esser Hayes Insurance Group before joining the CrumHalsted Agency. The agency offers personal, commercial, life, and health needs.

Crum-Halsted Agency, Inc

407 E Congress Parkway, Suite C, Crystal Lake, IL 60014 (779) 220-6564

tevans@crumhalsted.com

David Jenk, Esq.

Family: Spouse: Rebecca Daughters: Ashley & Aly Sons: Tommy (III) & Tyler Dog: Cody

Region 7

David Jenk began his insurance career over 17 years ago in while in college. He moved on to earn a degree in law, staying focused on the insurance industry. David is now the Executive Director of Northwest Insurance Brokers. The firm was founded in 1956 and offers all lines of personal and commercial insurance.

Northwest Insurance Brokers

209 W. Jackson Blvd., Suite 800, Chicago, IL 60606 (312) 239-2717

djenk@nwibrokers.com

Family: Spouse: Lucyna Dog: Fozzie Bear

october 2022 insight 13

You know as well as anyone that today’s cut corner can easily turn into tomorrow’s missing piece. With our forty years of experience in specialized coverage and policies developed alongside actual restaurant and bar owners, you can rest assured that your policyholders are protected against the unique risks they face every day.

If you agree that details like these make a big difference, give us a call at 1-888-5-SOCIETY or visit societyinsurance.com

Focus on Professional Offices Workers’ Compensation

We distinguish our Workers’ Compensation coverage by providing value-added services before, during, and after a claim.

Upfront loss control measures

Responsive claims handling

Facilitation of quality medical care (when an accident does occur)

We’ve been successfully protecting our policyholders and their employees since 1983.

Browse all of our products at www.guard.com.

© 2020 Society Insurance

Filling them up now so they won’t be hungry later. Small detail. Big difference.

APPLY TO BE AN AGENT: WWW.GUARD.COM/APPLY/ Our Workers’ Compensation policy is available nationwide except in monopolistic states: ND, OH, WA, and WY.

IIA of IL Regional Directors

(Continued)

Charles Hruska, IV, AU, AINS

Region 8

Charles Hruska, IV started his insurance career in 2011 with internships. In 2014, he joined Seneca Insurance Company as an underwriting assistant, moving up to Senior Underwriter. Charles then joined his family’s agency in 2018 as Executive Vice President. Hruska Insurancenter, Inc. was started in 1950 by Charles’s grandfather and the agency’s focus is mainly commercial lines supported by personal lines.

Hruska Insurancenter, Inc.

4541 N Lincoln Ave, Chicago, IL 60625 chas@hruskains.com (708) 798-5700

Family:

Parents: Chuck and Jodi

Sisters: Ashley, Haley, and Hope

Region 9 Lindsey Polzin, CIC

Lindsey Polzin started her insurance career in 2000 working for her family’s agency in the personal lines division. In 2005, she moved over to the commercial side of the agency. Her family’s agency merged with other local agencies to form Presidio, an Acrisure Agency Partner where Lindsey currently serves as Executive Vice PresidentOperations.

Presidio

55 Shuman Blvd. Ste 900, Naperville, IL 60563 (630) 513-6600 lpolzin@presidiogrp.com

Family: Spouse: Tim Sons: Nick and Kevin

Mohammed Ali

Region 10

Mohammed started as an intern at Near North Insurance Brokerage in 2000 where he worked until 2003. He then moved to Global Benefits Inc. until 2012 before starting Alim Insurance Brokerage. The agency focuses on personal lines, commercial lines, and professional liability insurance. Outside of the agency, Mohammed serves on the Board of Directors at Evanston Chamber of Commerce, where he was President in 2021.

Alim Insurance Brokerage & Risk Management

820 Davis St Ste 215, Evanston, IL 60201 (847) 847-2126 mali@aliminsurance.com

Family:

Wife: Mira

Sons: Mikhail, Ibrahim

Daughters: Aaliyah, Noura

october 2022 insight 15

2022-2023

At-Large Board Members

Amiri Curry, ARM, AIS, AINS

Amiri Curry began his insurance career in 1993 in Life & Health customer service. After leaving the industry to work in financial services, he returned to insurance in 2007, eventually joining Assurance, a full-service brokerage, in 2016. Assurance is a Marsh & McLennan Agency LLC.

Assurance Agency, Ltd. 20 North Martingale Road, Schaumburg, IL 60173 amiri.curry@MarshMMA.com (847) 463-7280

Family: Married with four sons.

Jeff McMillan, LUTCF

Jeff McMillan became licensed in 1989 and started working with Prudential in 1990 selling life insurance and investments. In 1992, he formed McMillan Insurance Services, Inc. and has purchased several agencies through the years. Jeff is a current Farm Agents Council Board Member.

McMillan Insurance Services, Inc. 309 S Crescent St, Gilman, IL 60938 (815) 265-4037 jeff@mcmillanins.com

Family: Spouse: Lisa Children: Jack & Sam

This is your association and as an insurance specialist familiar with the challenges your business faces, your insights and expertise can help shape the future of our association and industry. Your involvement will ensure that the IIA of IL remains a leading resource and advocate for independent agents. Association involvement can help you expand your network, increase your industry knowledge and exposure to developing trends and products, and grow in your profession. Get started by:

16 insight october 2022

2022-2023

• Participating • Sharing • Advocating • Volunteering • Interested in getting involved? Find out more at www.iiaofil.org/about-us/get-involved or scan this code.

Patrick Muldowney, JD

Patrick Muldowney began his career at Kemper Insurance Companies in 1993. Seven years ago he joined Alliant Insurance Services where he is currently a Senior Vice President and Deputy General Counsel. The agency is the largest specialty brokerage in the U.S., focused on construction, public entity, education, real estate, healthcare, tribal nations, and legal professionals.

Alliant Insurance Services

353 N Clark Street, 11th Floor Chicago, IL 60654

(312) 595-7192

patrick.muldowney@alliant.com

Family:

Spouse: Lisa

Son: Sean

Luke Sandrock

Luke Sandrock began his career in insurance 2009 after graduating from Monmouth College. He joined the family agency, Cornerstone Agency, where he is now Partner. The agency concentrates and specializes in crop, farm and agri-business insurance. Luke is a current Farm Agents Council Board Member.

Cornerstone Agency, Inc. 102 W. Main St., Morrison, IL 61270 (815) 772-2793

Family:

Spouse: Ashleigh

Children: Breckon, Jack, and Remrey

october 2022 insight 17

lsandrock@2cornerstone.com

If you have 100 employees or less and want a retirement savings plan that is straightforward and virtually effortless, the lesser known Simple IRA plan its the bill. Our programs are designed to meet the needs of Big “I” members with maximum lexibility at a competitive cost. Reach out today to see how easy peasy it can be! RETIREMENT SAVINGS MADE EASY, PEASY LEMON SQUEEZY... RETIREMENT SERVICES . Visit www.independentagent.com and click on “Retirement.” Contact IIABA’s Christine Munoz at christine.munoz@iiaba.net.

IIA of IL Committee Chairs

Education Lisa Lukens, CISR Elite

Lisa Lukens started in the agency in 1981 working full-time while attending school at SIU. Saliba Insurance, opening the doors in 1963, merged with Yewell Insurance in 1990 and offers both personal and commercial insurance.

Saliva-Yewell Ins. Services P.O. Box 218, Herrin, IL 62948 (618) 942-2556 salibainsurance@gmail.com

Family: Children: Tyler & Erin

Steven Foster

Farm Agents Council

Steven Foster received his Bachelors Degree from Blackburn College. He started his insurance career in 2006 with a captive company, then joined Musso Insurance Agency in 2011 where he is now an agency owner. The agency has locations in Virden, Waverly, and Springfield.

Musso Insurance Agency 136 E. Dean St., Virden, IL 62690

965-4663

Family: Spouse: Anne Children: Gwen, Kendall, & Kathleen

Government Relations

Dustin Peterson is the 3rd generation member of the agency, joining the agency in December 2003. He currently serves as Risk Manager, covering all lines of insurance for the agency.

Peterson Insurance Services, Inc. PO Box 377, Clinton, IL 61727 (217) 935-6605 dustin@peterson.insurance

Family: Spouse: Jessica Children: Julian & Vivian Dogs: Dino & Aggie

18 insight october 2022

2022-2023

(217)

s.foster@ciagonline.com

Planning & Coordination Nick Gunn, CIC

Nick Gunn started his career in 2006 at Nixon Insurance Agency, Inc. After a brief stint at another agency, he made his way back to Nixon and became part owner and Vice President of Commercial Insurance in 2018.

Nixon Insurance Agency

4701 N. University, Ste B, Peoria, IL 61612 (309) 691-1300 nickgunn@nixonagency.com

Family: Spouse: Jessica Children: Tripp and Cash

Technology Brian Ogden, CIC, AFIS

Brian Ogden is a second generation owner of Ogden Insurance Agency. His father started in the insurance business in 1959 in the same small town. The agency offers Personal Lines, Commercial Lines, Farm, Crop Life and Health.

Ogden Insurance Agency 123 E. Douglas, Petersburg, IL 62675 (217) 632-2206 brian@ogdeninsurance.com

Renee Crissie

Family: Spouse: Kim Children: Lauren & Jonathan

Young Agents

Renee joined the family business right out of college and has worked side by side with her family to learn all areas of the business and help grow the agency. She began her career in Commercial Lines and took on to Employee Benefits in 2010 as Health Care Reform took off.

Crissie Insurance Group

6400 Shafer Ct, Suite 600, Rosemont, IL 60018 (224) 217-6577 renee@crissieins.com

Family:

Youngest of three 4 Nieces and 1 Nephew

AIS Board Bill Lawrence, CIC

Brian Ogden is a second generation owner of Ogden Insurance Agency. His father started in the insurance business in 1959 in the same small town. The agency offers Personal Lines, Commercial Lines, Farm, Crop Life and Health.

P/L/R Insurance Services

139 N. Williamsburg Dr., Bloomington, IL 61704 (309) 827-0007 blawrence@plrinsurance.com

Family: Spouse: Jan Three Children & Six Grandchildren

october 2022 insight 19

TRUST

MAKE THEM A BIG DEAL

“Trust in Tomorrow.” and the “Grinnell Mutual” are registered trademarks of Grinnell Mutual Reinsurance Company. © Grinnell Mutual Reinsurance Company, 2022. AUTO | HOME | FARM | BUSINESS grinnellmutual.com

US TO

Your customers have big dreams for their small businesses. Our Businessowners policies combine the property, liability, and business-interruption coverages they need to help them grow. Trust in Tomorrow.® Contact us today.

october 2022 insight 21 online journal at www.iiaofil.org/Resources/Insight INSIGHTeKEVIN LESCHIIA2022-2023 OF IL PRESIDENTIntroducing New IIA of ILBoard of Directors In this month’s e-Insight. The Professional Benefits of Volunteering

KEVIN

22 insight october 2022

2022-2023 IIA of IL President

We can’t let a lizard commoditize our product our process by telling the world what we do is minutes of their time. Our clients are worth morewe are worth more than that.

KEVIN LESCH and devalue is only worth 15 more than that –

Congratulations on your induction as President of the IIA of IL. Tell us how you first got involved with the IIA of IL.

My first experience with the IIA of IL was on the board of the DuPage IIA because my buddy Tom Evans invited me to a board meeting after I expressed to him that I felt I needed to “get involved.” My second year on that board coincided with Tom Walsh being president of the IIA of IL. He invited me to the convention, and I have not missed a convention since. I continued to stay involved, and I was eventually asked to join the board as a Regional 10 Director by Cindy Jackman, Greg Sandrock, and Rick Sutton.

What made you want to go through the Executive Committee Chairs? It is difficult to turn George Daly down, but truthfully it has always been my goal to be just like Brian Konen and Ken Samson.

What new ideas and initiatives are you looking forward to setting forth?

I am excited about the steps our Technology Committee has taken under the leadership of Brian Ogden and Shannon Churchill. I feel that with the amount of M&A that has taken place and the lack of qualified personnel in the workforce, our members are being pushed to take on more. Technology is definitely a way we can help our members work smarter and more efficiently instead of longer hours. Our goal is to help our members connect with the right solution and create more time for them to take on more business.

Tell us a little about how you started the industry?

Like many of my peers, my father owned an agency in Bartlett and asked me to join the firm in 1999. He and his partner started me out in personal lines, then after a few years, I forayed into commercial, then onto employee benefits.

What do you find the most fulfilling about being an insurance agent?

I enjoy being a trusted advisor and providing counsel to clients and members of my community. We get to protect what is important to people, and hearing them speak about that is interesting and humbling.

What challenges have you faced during your career, and how have you overcome them?

I am not sure I should ever use the word challenging when referring to my career or life. I am sure I have had obstacles, yes, but I have always had a good support system around me to help me through. Family, friends, and staff have always been by my side to pick me up when I needed it.

What other professions have you had?

As a teen, I was a lifeguard. In college, I worked soccer camps in the summer and watered grass during the season (the field had an automatic sprinkler system). After college, I coached youth soccer for the club I grew up playing for, Sockers FC, out of Palatine, IL. I still tell people that I am currently on hiatus from coaching.

october 2022 insight 23

continued...

24 insight october 2022

The IIA makes me proud to be an insurance agent and holds me accountable to represent my profession and my peers as best I can.

We all know the industry has faced many changes in the last two decades, especially the last two years. What do you see as some of the major industry issues in the immediate future?

Where do I start? The industry continues to get more and more complex. We have seen nuclear verdicts produce some of the largest liability claims our industry has ever seen. Umbrella capacity has been limited making it difficult for agents to obtain coverage. Agents are being forced to layer limits (sometimes unsuccessfully) in order to satisfy requirements that our clients have on contracts they have already signed. Furthermore, I sit across the table from a client and show him a proposal that has large increases in cyber insurance and large increases in property insurance. If they could only afford one of those policies, I would tell them to take the cyber policy because my gut tells me they are more likely to have a cyber claim than a property claim. These complexities are not just for the large companies. They extend down to every level, and that is what makes this even more difficult to navigate.

Looking down the road five, ten years, what other issues do you see independent agents facing?

What does the new generation of insurance agents and insurance professionals look like, and how are they learning and being mentored via a work-from-home environment?

Can this sustain? 75% of our job is managing relationships. How do we do that sitting at our desks?

What effect will all the M&A have on the independent channel down the road? It seems as if private equity has put a strain on the captive market, pushing some of them to take a peak over into the independent channel, but once these acquisitions settle down, there is bound to be branches of agencies that split off and go their own way.

What about issues the IIA of IL will have to address?

The political landscape will continue to be a roller coaster of emotions. In our state alone, we deal with a multitude of insurance bills every year that need to be dealt with and discussed with our state legislators.

How has your involvement with the IIA of IL impacted you both personally and professionally?

Personally, I have made friendships that I know will last me a lifetime. Professionally, by attending conventions, and board meetings, interacting and discussing issues with other agents, one can’t help but become better at their craft. The IIA makes me proud to be an insurance agent and holds me accountable to represent my profession and my peers as best I can.

In your opinion, what are the key benefits of membership with the IIA of IL? Being able to hang out with the other agents and collaborate is number one in my book. I am always humbled by some of the great minds and people we have in our association. Political Advocacy is a close second, and our government affairs staff is tops in the country. Finally, what our staff does to educate our membership is a great benefit. Whether it is through designations, seminars, conventions, technology conferences, they are constantly at the forefront of what is relevant and meaningful to our members.

october 2022 insight 25

continued... 2015 Young Agent of the Year

BECOME AN AGENT Seasons change, butOUR COMMITMENT TO YOU DOESN’T WHY WE DO WHAT WE DO

Do you have a personal motto or creed by which you live?

Creed: Do the opposite of Konen

Slogan: Let’s go White Sox!

Motto: “More Jameson, please!”

Tell us about your family? How do they feel about your new role with the IIA of IL?

My two boys have no idea what I am doing.

They are 13 and 15, and my goal is to embarrass the hell out of them by leaving this magazine out all around town and in their school. My wife will be happy when the stress of all this is over for me, and we can go back to normal.

She knows how passionate I am about the IIA and how much I want to give back to my industry, so this means a lot to both of us. She carries a heavy load working full time as well, so time is valuable to us, and we treasure what time we have together as a family. So when we choose to dedicate time to being away from the family, we want to make sure it is worth it. We both believe the IIA of IL is worth it.

Tell us about your hobbies and/or personal interests.

I am a geek – I love puzzles, and I collect coins which has become increasingly difficult since my eyes have quit on me in the last six months. I follow my boys around, watching their sports. Jacob is in cross country, swimming, and track. Gavin is in soccer, basketball, and baseball. I am now an assistant 14u basketball coach because Hall of Famer Pat Taphorn is now on as Vice President of the IIA of IL, I figured he could give me some pointers. I am still on hiatus as soccer coach.

What lessons from your personal life have you incorporated into your business career?

I never put anything in writing that I won’t say over the phone.

What is one fact about you that people would find surprising?

At age 25, as a pedestrian I was hit by a car going 60 mph. Walked out of the hospital the same day

Finally, when all is said and done, what is the most important message you hope IIA of IL members take away from your Presidency?

We are valuable and what we provide to our customers is an asset.

We can’t let a lizard commoditize our product and devalue our process by telling the world what we do is only worth 15 minutes of their time. Our clients are worth more than that – we are worth more than that.

october 2022 insight 27

IN THE WORLD OF INSURANCE, CLAIMS DO HAPPEN.

SERVICES AND RESOURCES:

INTERNAL QUALITY CONTROL AND COST CONTAINMENT PRACTICES:

MIKE CASTRO

BOB SPRING

» Workers’ compensation claims management » Property and liability claims management » Auto liability and physical damage claims management » Professional liability claims management » Strong emphasis on public entity and long-term care sectors » Nurse case management » Risk management/loss control » Medical bill review » Pharmacy benefit management » Aggressive litigation management » Utilization review » Electronic claim reporting with immediate acknowledgment and adjuster assignment » 4-hour assigned adjuster contact on every claim » Online claim review including adjuster notes and financials » Industry leading analytics with national database for benchmarking purposes For more information please contact:

Sr. VP, Claims Management Services Mike.Castro@ipmg.com 630.485.5895

VP, New Business Development Bob.Spring@ipmg.com 630.485.5885 INSURANCE PROGRAM MANAGERS GROUP CLAIMS MANAGEMENT SERVICES

IPMG’s Claims Management Services division (CMS) is that partner. As a full-service claims management company, IPMG CMS accepts the responsibility and expects to be held accountable for the results we achieve on behalf of our clients.

» Adjuster book of business analysis – to ensure workload does not affect service levels » Closing ration analysis – a monthly review to ensure adjusters are achieving maximum production » Claims diary tracking » Formal litigation handling guidelines and practices » Comprehensive medical bill review – average 59% cost reduction » Pharmacy benefit program – average 35% cost reduction » ISO claims search » Medicare section 111 data reporting and compliance

ALL

FOUR WHEELS, TWO WHEELS OR NO WHEELS AT ALL, WE CAN HELP YOUR CUSTOMERS INSURE ANYTHING

It’s no secret why drivers use independent agents. You offer quality service, and expertise that’s second to none. But Progressive can help too. We’re not only a leader in auto insurance, but also truck, boat, motorcycle and RV. Plus, our claims service keeps the promises we make to your customers. So no matter what you’re helping your customers insure, together — we can provide peace of mind.

Choice and service made simple… now that’s Progressive.

Proud Platinum Sponsor of the IIA of Illinois since 2005!

WHEELS WELCOME. Progressive Casualty Ins. Co. and its affiliates. 12A00257.05 (07/12)

Thank you to our Associate Members.

Diamond Level

Platinum Level Progressive

Surplus Line Association of Illinois

Gold Level

AAA Insurance Arlington/Roe

BlueCross/Blue Shield of IL

Grinnell Mutual Reinsurance Company

Keystone Insurance Group, Inc. Pekin Insurance

Silver Level

Imperial PFS

IMT Insurance

West Bend Mutual Insurance Co.

Bronze Level

A. J. Wayne & Associates

AMERISAFE

AmTrust North America Auto-Owners Insurance Co. Badger Mutual Insurance Company

Berkley Management Protection Berkshire Hathaway Guard Insurance Companies

BluSky Restoration Contractors Chubb

ClickVSC

Columbia Insurance Group Continental Western Group Cornerstone National Insurance Company Cowbell Cyber CRC Group

CRDN of Chicago (formerly Restoronics) Donald Gaddis Company, Inc. Donegal Insurance Group

EMC Insurance Encova Insurance

Family Financial Solutions Group Forreston Mutual Insurance Company Frankenmuth Insurance Grange Insurance

Homeowners of America Insurance Company Illinois Mine Subsidence Ins. Fund

Illinois Public Risk Fund Indiana Farmers Insurance Insurance Program Managers Group

J M Wilson

Liberty Mutual/Safeco Insurance Madison Mutual Insurance Company Main Street America Insurance Marble Box MarshBerry

Maximum Independent Brokerage, LLC Mercury Insurance Group Method Workers Comp Midwest Insurance Company

Nationwide

NHRMA Mutual Workers’ Compensation Pouch Insurance Previsor Insurance & Missouri Employers Mutual PuroClean Emergency Restoration Services Rockford Mutual Insurance Company

RT Specialty - Naperville Sensa, Inc. ServiceMaster DSI Society Insurance

SPRISKA - Specialty Risk of America Synergy Select

The McGowan Companies Travelers

UFG Insurance

UIG - The Agent Agency Utica National Insurance Group

W. A. Schickedanz Agency, Inc./Interstate Risk Placement Western National Insurance Westfield

october 2022 insight 35

associate news | INSIGHT

sale has a beginning and an end. AAA can help your independent agency with both.

AAA to your product mix and grow your bottom line by selling quality insurance through AAA and providing the extensive benefits of AAA Membership — an unbeatable combination of security and savings.

you’re ready to grow, we’re here to help with the products and support that can help you earn more.

Every

Add

If

More than a trusted brand, AAA ls the perfect lead — and close. n Quality insurance with competitive rates n Powerful brand recognition n Field leadership support n Product training n Extensive marketing co-op program n Competitive commission on insurance and membership Contact me to learn more. Insurance underwritten by one of the following companies: Insurance underwritten by one of the following companies: Auto Club Insurance Association, MemberSelect Insurance Company, Auto Club Group Insurance Company, Auto Club Property-Casualty Insurance Company, Auto Club South Insurance Company, Auto Club Insurance Company of Florida, or non-affiliated insurance companies. ©2021 The Auto Club Group. All rights reserved. 22-RM-0677- LC 8/22 SteveLager (708)821-4747 splager@acg.aaa.com

Congratulations!

Congratulations to the IIA of IL Regional Director and Committee Chair of the Year! Thank you for your service to our great Association.

Sandrock Elected to National IIABA Leadership Team

The Independent Insurance Agents & Brokers of America (IIABA or the Big “I”) installed Greg Sandrock, CIC, AFIS, of The Cornerstone Agency in Tampico, Illinois as the newest members of the association’s executive committee at the recent Big “I” Leadership Conference in Niagara Falls.

“IIABA and independent agents throughout the country are fortunate to have Greg serving on the IIABA Executive Committee. He is the country’s leading authority on crop insurance but more importantly Greg represents the core of our membership, a family-owned independent agency serving their clients and community,” said Phil Lackman, CEO of IIA of IL. “We will miss Greg’s leadership in Illinois and wish him the best as he begins his new role.”

Sandrock has served the Independent Insurance Agents of Illinois as National Director since 2015 and has served as a member of the Illinois Executive Committee since 2010. Additionally, he has served as both a member of and as Chairman of the IIABA Crop Task Force and as a member of the InsurPac Board of Trustees, the IIABA Steering Committee and the IIABA Government Affairs Committee.

Sandrock has attended and spoken at several Big “I” State Conferences and Crop Insurance Company Meetings and has developed close relationships on Capitol Hill to ensure the Farm Agents’ concerns are heard when the Farm Bill is negotiated.

Sandrock began his service to the insurance industry and the association as a member of the Farm Agents Board, a member of the IIA of IL Education Committee and a volunteer for the junior golf tournament. He joined the Board of Directors as Region 6 Director.

october 2022 insight 37

James Sager Region 1 Regional Director of the Year

Nick Gunn Planning & Coordination Committee Chair of the Year

Board of Directors Profiles

Luke Sandrock

At-Large Board Member

Cornerstone Agency, Inc., Morrison, IL Partner

Number of Years with Agency: 14

Year You Started in Insurance: 2009

Education: Monmouth College Bachelors Degree in Business Administration and Economics

Current or Past Civic, Political, or Community Service Activities:

- IL Farm Agents Council

- Member of the Big I Crop Insurance Subcommittee - IIA of IL Young Agent of the Year - Volunteer Youth Sports Coach - Host Annual St. Jude Golf Outing - Church Council - Various Other Community Boards

What do you feel are the major challenges facing our Association today?

I think M&A activity still is one of the main tests the Association faces. As I talk to peers in the industry a lot of us face similar challenges. Staffing, day to day managerial duties, technology, company volume requirements. There are tremendous opportunities as an Independent Agent, but it’s easy to see why we’re in an environment that’s conducive to M&A activity.

What suggestions do you have to respond to these challenges?

The IIA of IL already offers a comprehensive toolbox to help Independent Agents mitigate some of these challenges. I think it’s important to build on these tools, and just as significantly, make sure members are aware of them.

Mohammed Ali Region 10 Director

Alim Insurance Brokerage & Risk Management, Evanston, IL Principal

Number of Years with Agency: 10

Year You Started in Insurance: 2012

What do you see at the greatest benefit to IIA of IL membership?

Greatest benefit of IIA of IL is political advocacy. IIA of IL works hard to protect independent agents from unscrupulous acts by insurance companies and government. Having an ally like IIA of IL advocate and protect independent agents is absolutely priceless.

What do you see at the greatest benefit to IIA of IL membership?

10 years ago my answer to this question would’ve been, the networking events are a blast. However, there is so much more to it. I think the most overlooked benefit is the political advocacy done on behalf of the Independent Agent. Education is another area that sticks out and one of the benefits our agency uses the most often. The IIA of IL has a tremendous staff… get to know them, they can be a fantastic resource!

What prompted you to get involved with the Association?

Peer pressure. All joking aside, I really appreciate volunteering alongside peers and mentors who I have a great deal of respect for in this industry. There has been a huge benefit for me to be a part of this association and I hope to be able to give something back in return.

What prompted you to get involved with the Association? Insurance industry allows me to help my clients (individuals and businesses). I want to be able to give back by helping new agents to the industry by mentoring and teaching. Therefore, I asked to get involved with the Association to help new agents looking to join the independent agent world.

38 insight october 2022

Profiles

Dustin Peterson

Government Relations Chair

Peterson Insurance Services, Inc., Clinton, IL Risk Manager

Number of Years with Agency: 19

Year You Started in Insurance: 2003

Education: College of Business-Northern Illinois University

Current or Past Civic, Political, or Community Service Activities:

Current Board member of the Clinton Community YMCA, serve on the finance committee currently. Current Chairman of the Dewitt County Republican Party, just started my 4th term as Chairman. Coach various youth sports teams that my children participate in.

What do you feel are major challenges facing our Association today?

Current challenges include replenishing the talent pool of young diverse agents as many long time agents have began retiring. Another challenge is implementing technology within the agency and being effective/determining what will work for your client base while maintaining the value of having a trusted insurance professional.

What suggestions do you have to respond to these challenges?

IIA has began to tackle technology I believe with the Technology committee. Young agents continue to work on growing the talent pool. Agency principals need to be aware of what their plans are for succession, reach out/communicate with potential talent to take over their business. The right person may not be working for them now or may even work for a competitor.

What do you see at the greatest benefit to IIA of IL membership?

I’ve really enjoyed learning the complete role of the assocation to its members and also the relationships I’ve developed over the years with other agents throughout the state. Without the IIA our paths wouldn’t have crossed. These industry friends are what makes the association great in my opinion.

What prompted you to get involved with the Association?

My interest in politics/government affairs in relation to the insurance industry prompted me to get involved with the Government relations committee. I was already involved with the Farm Agents prior to the merger and it really just deepened my involvement and showed me how valuable the association is to our membership.

october 2022 insight 39

“I love spending hours trying to quote online.”

SAID NO AGENT EVER.

No agent ever said they enjoy wasting time. But they have said fast online quoting with a clear understanding of appetite is key to a successful partnership. UFG Insurance listened.

Welcome to a better way to work online — because you deserve it.

BOP-Pro

Get down to (small) business with this robust businessowners policy, including select endorsements to take coverage to the next level.

Pro-Quote

Get from start to bind with fast efficiency thanks to smart tools and straight-forward appetite within this enhanced quoting experience.

Simple

for

times

UFG’s rejuvenated online experience isn’t about being better than others — it’s about being better for agents like you. Explore our simple solutions for complex times and experience service aimed to exceed expectations.

40 insight october 2022

ufginsurance.com/online

© 2021 United Fire & Casualty Company. All rights reserved.

solutions

complex

E&O-Roadmap to Homeowners Endorsements Webinar

E&O Roadmap to Personal Auto Webinar

E&O Roadmap To Cyber & Privacy Insurance Webinar

CISR-Agency Operations Virtual Class

Pre-Licensing-Property & Casualty Virtual

Pre-Licensing-Life & Health Virtual

E&O: Identity Theft, Red Flags, and Money Laundering Webinar

CISR-Commercial Casualty 1 Virtual Class

Flood Insurance, FEMA, and the NFIP Webinar

Why Good People Do Bad Things: Agency Ethics Webinar

CIC-Commercial Casualty Virtual Class

E&O - Roadmap to Policy Analysis Webinar

E&O: Duties, Best Practices, Operations, Workflows Webinar

Pre-Licensing-Property & Casualty Virtual

Ethics: Essentials for the Insurance Producer Webinar

E&O Roadmap to Personal Auto Webinar

E&O-Roadmap to Homeowners Endorsements Webinar

CISR-Commercial Casualty 2 Springfield & Virtual

CIC-Commercial Property Springfield & Virtual

E&O Roadmap To Cyber & Privacy Insurance Webinar

Pre-Licensing-Life & Health Virtual

E&O: Identity Theft, Red Flags, and Money Laundering Webinar

E&O: Defenses, Preventions for the Ins. Professional Webinar

CIC-Ruble Virtual

october 2022 insight 41

Education Classes

october iia of il news | INSIGHT 1 1 2 7 8 9 9 15 16 17 30 november 3 10 12 13 17 19 19 25 25 25 26 26 27 In-Person and Virtual! Drop Ticket Life/Midwest Life Brokerage Naperville, IL Glatfelter Public Entities York, PA copper associate members For information regarding IIA of IL membership or company sponsorship, contact Tom Ross, Director of Membership Services, at (217) 321-3003, tross@iiaofil.org. Family Financial Solutions Group St. Charles, IL bronze associate member D&D Insurance Agency, Inc. Chicago, IL Kaizen Risk Management, LLC Antioch, IL Winston Taylor Ins., LLC Decatur, IL New Members member agency

for the insurance professional by the insurance professional

AGENCY WANTED

20. Since 2004, Central Illinois Agents Group LLC has been providing independent agents with a variety of markets with contingency opportunities. Agents have availability to several markets that they may not be able to sustain or maintain on their own. We have markets for personal, commercial, agricultural and crop insurance lines. Let us help you get to the next level.

Visit www.ciagonline.com for contact information.

OPPORTUNITIES/SPACE AVAILABLE/RETAIN OWNERSHIP

13. We are a 100 year old Northbrook agency looking to discuss any mutually beneficial opportunity. Our producers, mergers, clusters and agency purchases receive 50% commissions on new and renewal business without any expenses. We can provide: office space, phones, agency management system, service renewals and changes. The companies we represent are: Badger Mutual, Employers Mutual, General Casualty, Guide One, Hartford, Kemper, Progressive, Rockford Mutual, Safeco, State Auto, Travelers and Met Life. Contact:

Nancy Solomon

Martini, Miller & Schloss, Inc. (847) 291-1313 Ron@martini-miller.com

AGENCY/AGENTS/PRODUCERS WANTED

02. Forest Park/Oak Park agency for over 60 years, will meet your needs by providing space, markets, marketing & sales support, automation, merging with or purchasing your agency. Perpetuation/ Succession Plans, BuySell Agreements also available. We have experienced, educated and dedicated staff for you and your clients. Have access to our numerous companies, office services and many other resources. Retain ownership in your book with contingency. Please look closely at us- we are an agency you want to do business with! We’ve done it before, we know how- we make it easy! Visit our website at forestagency.com/agents.html, or call for a confidential discussion and a list of Agency benefits.

Dan Browne will provide an agency evaluation/appraisal at little cost to you. Please call:

Dan Browne or Cathy Hall Forest Insurance (708) 383-9000 www.forestinsured.com/mergers-acquisitions

INDEPENDENT INSURANCE AGENCIES

WANTED

17. We are an Independent family-owned agency located in the Chicago area. We are looking to expand through growth and acquisition. If you have a small to medium sized agency and are looking to sell, call or send us a message. We are strictly looking for Personal Lines and Small Commercial accounts with preferred companies.

GALO Insurance Agency, Inc (847) 832-0888 steve@galoagency.com

We Make Hiring Easier

CareerPlug’s hiring software helps agents attract more qualified candidates, identify the right candidates with confidence, and improve hiring results.

CareerPlug will provide IIA of IL members access to a free account that can be used to post jobs, manage applicants, and improve the organizations’ employment brand. Association members can also access a “Pro” version of CareerPlug for a special rate to take hiring to the next level.

Learn more about CareerPlug and check out the brand new IIA of IL job board at

42 insight october 2022

INSIGHT | classifieds

+

www.iiaofil.org

Manufactured Homes Rental Dwellings We seek to increase our presence in the manufactured home (1977 or newer) and rental dwelling insurance markets. If you are interested in learning more, please contact us. • No supporting business requirements • Competitive pricing • Attractive commission and contingency schedules • Fast, friendly claims service 208 S Walnut Ave · P.O. Box 686 · Forreston, IL 61030 (815) 938-2273 · (800) 938-2270 (309) 303-1490 · (815) 938-2273 Fax (815) 938-2785 · Email info@forrestonmutual.com www.fmic.org Contact: Carl Beebe 309-303-1490 Agents For Unique Opportunities!

Workers’ Compensation • Transportation – Liability & Physical Damage • Construction – Primary & Excess Liability Homeowners – Including California Wildfire & Gulf Region Hurricane • Fine Art & Collections • Structured Insurance Financial Lines • Aviation & Space • Environmental & Pollution Liability • Property • Warranty Fronting & Program Business • Reinsurance ...And More To Come. MORE TO LOVE FROM APPLIED.® MORE IMAGINATION. ©2022 Applied Underwriters, Inc. Rated A (Excellent) by AM Best. Insurance plans protected U.S. Patent No. 7,908,157. It Pays To Get A Quote From Applied.® Learn more at auw.com/MoreToLove or call sales (877) 234-4450

By Liberty Mutual and Safeco Insurance

By Liberty Mutual and Safeco Insurance