the sales process. We offer superior products that employers love, like payroll-plus-comp, and

make onboarding

and

clients

Omaha National Underwriters, LLC is an MGA licensed to do business in the state of California. License No. 078229. “A” (Excellent) rated coverage through Omaha National Insurance Company, Preferred Professional Insurance Company, and/or Palomar Specialty Insurance Company. 844-761-8400 • omahanational.com

throughout

we

smooth

easy. When you or your

call us, a real live person answers the phone. Simply put, you get the attention you deserve.

Setting Your Agency up for PEAK PERFORMANCE

Account Manager and CSR

Roles and Performance

Coordinating Workloads

How to Demonstrate ROI in Insurance Marketing

Plus

SECURA Insurance and Bedford Underwriters work together to provide a comprehensive insurance program for your nonprofit accounts. From food pantries and homeless shelters, to Boys and Girls Clubs and community centers, we have the coverages and services tailored specifically for these unique organizations. Insurance that cares Interested in learning more? Contact Bedford Underwriters at 800-735-1378 ext. 112 or quotes@BedfordUnderwriters.com

Carey Wallace

CONTENTS Labor Market Overview: Part One

Blowing Up Benchmarks

Are You Monitoring Producer KPIs?

Coordinating Your Account Managers’ Workloads By Daniel

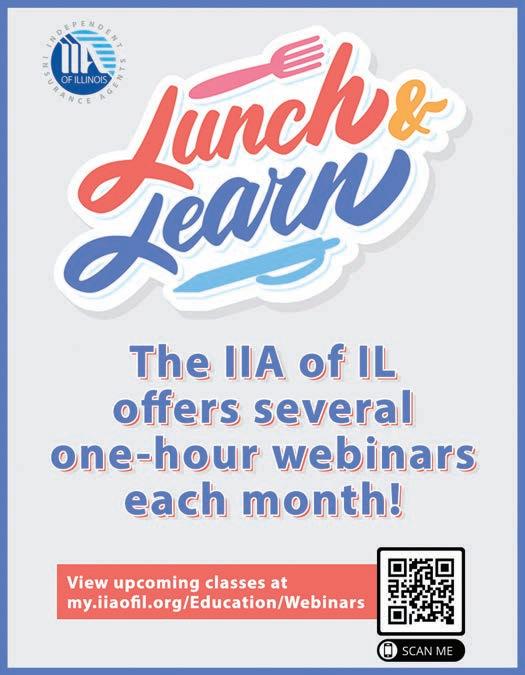

Trusted Choice Hard Market Toolkit Account Manager and CSR Roles and Performance By Catherine Oak & Bill Schoeffler How to Demonstrate ROI in Insurance Marketing By ONEFIRE Selling Insurance in a Hard Market By John Chapin CONVO 2023 Details - Refocus, Connect, Empower IIA of IL Hard Market Solutions for Agencies 12 13 15 16 18 20 23 24 26 32 The Independent Insurance Agents of Illinois (IIA of IL) has been providing members with a sustainable competitive advantage since 1899. Insight is the official publication of the Independent Insurance Agents of Illinois (IIA of IL). The magazine is published monthly for the members of the IIA of IL, with the office located at 4360 Wabash Avenue, Springfield, Illinois 62711-7009; Consumer Website: www.ChooseIndependent.com. The IIA of IL welcomes letters discussing concerns of the insurance industry, articles, editorials, other matters of interest to the membership. The editor reserves the right to edit and select submissions for publication. Address submissions for review to Rachel Romines at rromines@iiaofil.org. For advertising information, contact Tami Hubbell at thubbell@iiaofil.org. In This Issue President’s Message Brett’s 5 Sense e-Insight Associate News 9 10 19 28 info@iiaofil.org | www.iiaofil.org | (217) 793-6660 Editor & Graphic Design - Rachel Romines | Advertising - Tami Hubbell Agency Members in the News Outgoing IIA of IL Board Members Association Update IIA of IL News Classifieds 31 33 35 37 38 September 2023 2009 • 2010 • 2011 • 2012 • 2013 • 2014 • 2015 2016 • 2017 • 2019 • 2020 • 2021 • 2022 • 2023 15 12 16 26

By Susan Pale

By

By Jennifer Becker

Smith

Board of Directors

Executive Committee

Chairman of the Board | Jay Peterson, AFIS, LUTCF

(217) 935-6605 | jay@peterson.insurance

President | Kevin Lesch

(630) 830-3232 | klesch@arachasgroup.com

President-Elect | Allyson Padilla

(618) 393-2195 | allyson@blanksinsurance.com

Vice President | Patrick Taphorn, CIC, CSRM

(309) 347-2177 | ptaphorn@unland.com

Secretary/Treasurer | Cindy Jackman, CIC, CISR

(800) 878-9891 x8745 | cjackman@arlingtonroe.com

IIABA National Director | George Daly

(708) 845-3311 | george.daly@thehortongroup.com

Regional Directors

Region 1 | James Sager

(618) 322-9891 | james@sagerins.com

Region 2 | Ray Roentz

(618) 639-2244 | ray.roentz@hwcrins.com

Region 3 | Christopher Leming

(217) 321-3185 | cleming@troxellins.com

Region 4 | Bart Hartauer, CIC

(815) 223-1795 | hartauer@hartauer.com

Region 5 | Noele Tatlock

(309) 642-6855 | ntatlock@unland.com

Region 6 | Thomas Evans, Jr.

(779) 220-6564 | tom.evans@assuredpartners.com

Region 7 | David Jenk, Esq.

(312) 239-2717 | djenk@nwibrokers.com

Region 8 | Charles Hruska

(708) 798-5700 | chas@hruskains.com

Region 9 | Lindsey Polzin

(630) 513-6600 | lpolzin@presidiogrp.com

Region 10 | Mohammed Ali CS

(847) 847-2126 | mali@aliminsurance.com

At-Large Director | Amiri Curry

(847) 797-5700 | acurry@assuranceagency.com

At-Large Director | Jeff McMillan

(815) 265-4037 | jeff@mcmillanins.com

At-Large Director | Patrick Muldowney (312) 595-7192 | patrick.muldowney@alliant.com

At-Large Director | Luke Sandrock, CIC

(815) 772-2793 | lsandrock@2cornerstone.com

Committee Chairs

Budget & Finance | Cindy Jackman, CIC, CISR

(800) 878-9891 x8745 | cjackman@arlingtonroe.com

Education | Lisa Lukens

(618) 942-2556 | salibainsurance@gmail.com

Farm Agents Council | Steve Foster

(217) 965-4663 | s.foster@ciagonline.com

Government Relations | Dustin Peterson

(217) 935-6605 | dustin@peterson.insurance

Planning & Coordination | Nick Gunn, CIC

(309) 691-1300 | nickgunn@nixonagency.com

Technology | Brian Ogden

(217) 632-2206 | brian@ogdeninsurance.com

Young Agents | Renee Crissie

(224) 217-6577 | renee@crissieins.com

AMERISAFE

APPLIED UNDERWRITERS

BERKSHIRE HATHAWAY GUARD INS. GROUP

FORRESTON MUTUAL INSURANCE COMPANY

GRINNELL MUTUAL

THE

JM WILSON

OMAHA NATIONAL UNDERWRITERS

SECURA INSURANCE

SECURA INSURANCE

SWISS RE CORPORTATE SOLUTIONS AMERICA UFG

Director of Information and Technology Shannon Churchill

- (217) 321-3004 - schurchill@iiaofil.org

Director of Education and Agency Resources Brett Gerger, CIC

- (217) 321-3006 - bgerger@iiaofil.org

Accounting & Admin Services Tami Hubbell, CIC

- (217) 321-3016 - thubbell@iiaofil.org

Director of Human Resources, Board Admin Jennifer Jacobs, SHRM-CP

- (217) 321-3013 - jjacobs@iiaofil.org

Sr. Vice President/Chief Financial Officer Mark Kuchar

- (217) 321-3015 - mkuchar@iiaofil.org

Chief Executive Officer Phil Lackman, IOM

- (217) 321-3005 - plackman@iiaofil.org

Central/Southern Marketing Representative Lori Mahorney, CISR Elite

- (217) 415-7550 - lmahorney@iiaofil.org

Director of Government Relations Evan Manning

- (217) 321-3002 - emanning@iiaofil.org

Office Administrator Kristi Osmond, CISR

- (217) 321-3007 - kosmond@iiaofil.org

Director of Communications Rachel Romines

- (217) 321-3024 - rromines@iiaofil.org

Director of Membership Services Tom Ross, CRIS, CPIA

- (217) 321-3003 - tross@iiaofil.org

Products & Services Administrator Janet White, CISR

- (217) 321-3010 - jwhite.indep12@insuremail.net

Director of Prof. Liability & Ins. Products Carol Wilson, CPIA

- (217) 321-3011 - cwilson.indep12@insuremail.net

IIA of Illinois Staff 34 39 36 28 7 30 22 8 10 25 Cover Tip 4 36 31 40 14

CONNECT EBRM EBRM

INSTITUTES

INSURANCE WEST BEND MUTUAL INSURANCE CO

Find us on Social Media

ADVERTISERS

Independent, Authorized General Agent for An Independent Licensee of the Blue Shield Association

“Trust in Tomorrow.” and the “Grinnell Mutual” are registered trademarks of Grinnell Mutual Reinsurance Company. © Grinnell Mutual Reinsurance Company, 2023. grinnellmutual.com PERSONAL | BUSINESS | REINSURANCE TRUST US TO PROTECT WHAT THEY’VE BUILT From equipment breakdowns to property damage, our Contractor’s insurance package is an essential tool for those in the business of building. Trust in Tomorrow.® Contact us today.

It’s Been a Pleasure...

As often as people tell you that moments or “terms” will go fast, it still surprises me when I look back and realize how quickly a year can pass. My theory is that as I get older, one year is a smaller percentage of my life than it was when, say, I was 19 (for those of you who are bad at math, this year would be 1/48 of my life and when I was 19 it would have been 1/19 of my life).

So here we are, at the end of my term as President of the IIA of IL during one of the most tumultuous years in our industry (I do not think one has anything to with the other, by the way). It is difficult to look back and wonder if I made a difference or helped our membership in any way. I had a history teacher in high school tell me that you cannot determine the effectiveness of a president until 20 years after they served. Mr. Jim Wallace was definitely talking about the President of the United States, and that statement has absolutely no bearing here. This job is almost impossible to screw up. Being President of the IIA is not difficult. The IIA of IL has an unbelievable staff that works every day to help improve the independent insurance agent distribution channel. What the IIA staff does on a daily basis to serve, promote, and protect you, our membership, is incredible, and I am truly grateful for all that they do and all they have done.

Phil, Jennifer, Evan, Brett, Tom, Lori, Rachel, Mark, Shannon, Tami, Kristi, Carol, and Janet: Thank you for doing everything you can to make me look good. It is a tremendously difficult task, and quite frankly impossible, but I appreciate the effort.

To the Board of Directors: I spoke a great deal about TIME this year. I put a ton of value on time; I want to make sure you value it, but I want to make sure you know I understand the sacrifice you make to be away from your family in order to help give back to our industry. Thank you for being part of the solution. Please continue to give back and support our association and encourage others to do the same.

Finally, I want to thank my family. It is impossible to do this job without missing a soccer game, a swim meet, a basketball game, or just a family dinner. Trisha, Jacob, and Gavin, thank you for all the support these last couple of years.

I have to end this with my book recommendation, but this time, it is not a book. My recommendation is to keep reading our trade journals, particularly Insight magazine from the IIA of IL. The amount of relevant and valuable information my staff receives from dedicating 30 to 60 minutes a month to reading is priceless.

september 2023 insight 9 president's message | INSIGHT

Kevin Lesch - IIA of IL President - (630) 830-3232 - klesch@arachasgroup.com

The Hard Market: A Perfect Storm

We are navigating unprecedented times that challenge agents and carriers alike. We need to have patience with each other in order to navigate the various issues that each of us are tackling every day. Not only do agents and carriers need to be cognizant of each other, but we also need to remember who we are here for - the consumer. Consumers need us more than ever. Inflation is touching every aspect of our lives, and to think that it wouldn’t affect the number two factor (insurance industry) in our economic engine in Illinois is wishful thinking.

What are the factors creating this “perfect storm?”

1. Lack of Reinsurance

Lack of reinsurance is one of the biggest factors as insurers utilize this tool to defray their exposure and ensure that an

4. A Very Stormy Spring and Summer

We experienced a very stormy Spring and Summer. My town has had seven rounds of hail storms, a derecho, and a tornado.

5. Not Collecting Enough Premium for Previous Years

In my opinion, not collecting enough premium in previous years is an issue as some insurers thought that this hard market would be short-lived (18 months or less) like past hard markets. I think that insurers figured that they could take less premium than what their actuaries calculated because the market would correct and be back to some sense of normality within a short period. Insurers who did this were trying to be good stewards and partners of their consumers in order to take on some of the burdens of these times. Unfortunately, they now have to somewhat make

10 insight september 2023

The IIA of IL has partnered with The Institutes to provide additional opportunities for members! BIG NEWS! 10% Off Digital Content 20% Off CPCU Study Materials 35% off CEU's Unlimited Access Program FIND OUT MORE! IIA of IL Members Only www.iiaofil.org/Education Finding the right partner to help you expand your opportunities is vital to career growth. With The Institutes Agent & Broker Group by your side, your opportunities are endless! Take advantage of The Institutes' 100% online knowledge and education program s!

business, and less competition will drive up premiums. The open/competitive market is the reason why Illinois is the 5th largest market but the 25th-ranked State in the amount of premium charged.

This list above is in no way complete, but it is some of the most prevalent factors.

So now we know why this hard market is occurring, how do we navigate it? First and foremost, remember why we are here: to provide our consumers peace of mind and protect their assets and real property. You need to get more creative than ever by insuring them the best you can within their budget. If I could give one piece of advice to consumers, it would be that this is not the time to skimp on insurance coverage. With the increase in storm frequency and severity, it isn’t IF you will have a claim, it’s WHEN you have a claim. When that time comes, how much exposure do they want? I currently have neighbors who cut back on what they had for coverage but are now complaining about their out-of-pocket costs. I asked one of my neighbors if it was worth the $200 a year they saved to have an additional $22,000 in out-of-pocket costs. Their answer was no, but they didn’t realize that their coverage change would affect their claim so severely (they were with a captive). These are the scenarios that we need to convey to consumers so that they make a truly informed decision. One great way to navigate this market is to utilize all the resources we have put out there in CONNECT.

What actions have we seen some of our company partners take? Pausing writing new business, not writing any mono line policies (requiring you to bundle home and auto as an example), altering coverages for wind/hail claims, increasing deductibles, changing coverage for older roofs to ACV or a schedule, stricter underwriting guidelines, just to name a few.

Remember, we are all in this together. Companies are not doing this to be punitive but to remain solvent to ensure they have money to pay claims. We will come out of this hard market and companies will return to “normal” operations, so don’t get frustrated with your companies or company reps. They are facing really hard times just as you are. In the upcoming months, you will be playing the ultimate game of whack-a-mole, trying to stay afloat. Remember, the IIA of IL staff is here, and we should all CONNECT (IIAI Connect (iiaofil.org)) to navigate these times together. Protect your consumers the best you can, utilize all of the tools we provide and come out of this on the other side in a better place than you were before.

As always, this is just Brett’s 5 Sense (hopefully, we get inflation under control and can return to 2). I hope it was helpful. You can contact me through CONNECT, and if it is urgent, do not hesitate to reach me through CONNECT. I may be pushing you to CONNECT. If you need any clarification or have any suggestions for future articles, please email me at bgerger@iiaofil.org.

september 2023 insight 11 Brett Gerger | IIA of IL Director of Education & Agency Resources bgerger@iiaofil.org | (217) 321-3006 5Sense Brett’s (inflation)

An IIA of IL Member Community

Where has 2023 gone? It’s a question I keep asking myself, and I’m guessing many of you are asking the same thing. It seems we were just ushering in a new year. But a lot has happened – inflation rates are going down, fuel prices are $1.00 less than this time last year in many places, and grocery prices dipped in March for the first time since 2020. That’s all good news, right? At the same time, tech, media, finance, and, most recently, retail organizations have announced layoffs of thousands of workers. That’s bad news, right? And the economy has added an average of 341,000 jobs every month during the last 12-month period.

On July 6, the United States Department of Labor (USDOL) issued its Job Openings and Labor Turnover Survey (JOLTS report) for May 2023. During this 5-month period, the largest decreases in job openings occurred in the healthcare, finance and insurance, and other services sectors.

The US also added 209,000 new jobs in June 2023. While this is a more modest number than in the past few months, it remains significantly high. As does the unemployment rate, which remains quite low at 3.6%.

As always, unemployment varies significantly by geographic area. Right now, the areas with the lowest unemployment rate (under 1.5%) are all located in Vermont and New Hampshire. And, not so unusually, El Centro, California tops the list with a 16.0% unemployment rate.

We’ve all been hearing about layoffs in the last several months. Some of the numbers are big, but it’s important to understand the context. A lot of organizations really ramped up hiring during COVID and post-COVID and are now shedding some of those hires. For example, Microsoft announced it would lay off 10,000 employees earlier this year. That sounds like a huge number, but Microsoft hired almost 60,000 employees during the last three years. So they still end up with 50,000 more employees than three years ago.

Labor Market Overview

Part One

By Susan Pale

HR Brew reported back in May that several states, in an attempt to address labor shortages, have passed legislation to allow minors to work later and longer hours. In Ohio, the 7 p.m. work limit will be eliminated for children aged 14 and 15 during the school year, and in Iowa children aged 16 and 17 will be allowed to serve alcohol with a parent’s permission. All this comes at the same time as the USDOL is reporting that child labor law violations have increased 69% since 2018.

What employers need to do:

• Don’t assume that a decreased number of job openings and possible layoffs mean that recruitment will be easier in 2023. This remains a volatile labor market

• If you recruit for entry-level positions, anticipate continued high demand for candidates

• Identify the best resources to help you stay informed about labor market activity in the market(s) where you operate and consult those resources regularly

• Regularly review and update your application process. Consider mobile-optimized applications, submissions via LinkedIn and other social networks, and one-click job applications if you don’t already have them

• Be respectful of your applicants and their investment in the application and interview process

Susan Pale is Vice president of Compensation for Affinity HR Group, a full service human resources consulting firm specializing in advising small and medium-sized enterprises. Visit www.affinityhrgroup.com for more information.

View part two in the October issue of Insight.

12 insight september 2023

Blowing up the Benchmarks

There are several key benchmarks that independent insurance agencies use to measure their success. They include retention rate, sales velocity, profitability, and revenue per employee – just to name a few.

In many cases, the historic metrics for each of these benchmarks are being redefined by agencies that are thinking differently about how the work within each role inside an agency is accomplished. Those that are able to rethink “the way we have always done it” at the task level are finding ways to drive efficiency, unlock capacity, and drive up the profitability inside their agency.

The core metric that measures efficiency is revenue per employee, and the following are some examples of how thinking differently is blowing up this metric. The revenue per employee ranges from $135K-$257K according to the 2022 Best Practices Study published by IIABA and Reagan Consulting. This metric varies based on the agency’s size, book of business makeup, staffing, technology, and infrastructure.

There are three main roles within an agency – sales, service, and administration. How can new metrics have impacts in each of these roles?

Sales Roles

Agencies that think through the tasks required to complete the sales process are identifying the repetitive tasks that can be automated, eliminated, or transferred to another person in order to increase the capacity and overall productivity of their producers. This includes the data entry that is required to set up a new customer in their system, data collection to quote a new prospect, appointment setting, and remarketing legwork just to name a few.

Leveraging technologies like InsurGrid to collect accurate policy data for prospects or utilizing virtual assistants to complete administrative tasks that are embedded in the sales process is a game changer. Utilizing commercial raters or tools like SALT to streamline the personal lines quoting process are all examples of how technology can drive efficiency into the sales process. Knowing what resources and technology will drive the best results for your agency is key, as it is not a one-size-fits-all but instead depends on your agency’s makeup.

Service Roles

Everyone knows that being responsive to our customer’s needs - especially in a claim situation - is critical to the success of any agency’s performance. Providing great service to customers is what drives high retention rates and customer satisfaction scores, so this is a huge area of need.

Leveraging tools like Ask Nicely that provide a Net Promoter Score and insights into which customers need extra time and attention to maintain a high retention rate is incredibly impactful for your service staff. As an agency, we want to be proactive in our efforts and this is one example of how to find ways to determine the best way to allocate our limited resources. Utilizing tools like

By Carey Wallace

Glovebox allows your customer to self-serve, access their insurance documents, and answer common service and administrative requests when they want to and how they want to. This improves the customer experience and also creates internal capacity.

Administrative Roles

Streamlining parts of the administrative process can be accomplished with RPA automation or bots to perform repetitive tasks such as downloading carrier reports, reconciling statements, and entering information into your agency management system. In situations with agency billed policies, solutions like Ascend can help automate labor intensive and costly financial operations such as collections, financing, carrier and commission payables allow agencies to operate without incurring large back office associated costs. It also reduces the chances of human error by relying on software to handle these repetitive and manual tasks while increasing the speed at which carriers are funded and commissions are received.

Rethinking these kinds of tasks can be most impactful as agencies grow and these costs build up (whether via hiring additional headcount to manage or through increases in external bookkeeper hours) as you sell more policies, eating away at your margins. In every role inside an agency, there is an opportunity to think differently about how to go about completing specific tasks that are only small parts of each role but have a massive impact on the performance of the agency when you add up all of the time they require to complete those tasks. By removing, eliminating, and/or automating these types of tasks you will create the capacity to focus on the high-impact tasks that require expertise and drive performance, growth, and profitability inside the agency.

Agencies that are doing this have higher retention rates, growth, profitability, and revenue per employee metrics. In addition, they also tend to have higher staff retention. No one enjoys completing monotonous work, so identifying and minimizing those parts of the process can make a significant difference in the overall job satisfaction of your team.

Time is money.

There is no question about it, there are tasks inside every role that can be optimized. These are just a few examples of how thinking differently and utilizing technology, tools, and alternative staffing resources can have an incredible impact on the agency’s performance, capacity, profitability, and VALUE.

By talking to your staff to find out what tasks they do each and every day that are time-consuming, repetitious, and low impact, you can identify the right options for you to consider. Every agency is estimated to spend 60% of its time on administrative and repetitive tasks, reducing the time, and cost, and redirecting that time will change your performance, efficiency, and the value of your agency.

Carey Wallace is the founder of Agency Focus. Find out more at agency-focus.com.

september 2023 insight 13

We’ll keep the kitchen rolling.

Running a successful food truck business is hard work, but finding the right insurance program for your client is easy with West Bend.

Our business insurance program covers liabilities and expenses specifically for food truck professionals and their operations.

• Great pricing and exceptional coverage

• Experienced claim representatives

• Convenient options for reporting losses - available 24/7

Learn more about the variety of business line coverages available through West Bend by visiting thesilverlining.com.

The worst brings out our best.®

Are You Monitoring Producer KPIs?

The 2022 Best Practices Study (available at www.independentagent.com/best-practices/Pages/ Products/2022-BestPracticesStudy.aspx) provides dozens of key performance indicators (KPIs) to assess overall operating efficiencies, a major influencer of profitability, growth and valuation. A solid understanding of how these metrics are calculated and why they are important is essential to creating a high-value agency.

Big “I” Best Practices staff recently released the Producer Hiring Calculator to help agencies identify a target number of producers to hire to meet their growth goals. Go to the Measure Agency Performance page at www.independentagent.com/best-practices/pages/ agencyperformance to download the calculator in the Organic Growth column.

While there are many places to begin in Best Practices, starting with operational foundations can validate areas of efficiency or identify improvement opportunities.

Here are some key areas your agency should be monitoring:

1. Revenue per employee.

One of the single most critical KPIs is simply an agency’s revenue divided by its full-time equivalent employees. An agency operating at below-average revenue per employee is likely to generate a lower level of profitability than its potential, and it may indicate your agency is over staffed, poorly structured or in need of improved technology, systems and procedures.

2. Renewal business.

By Jennifer Becker

A measure of account retention, renewal business is the percentage of prior period commission and fee income that renewed in the current period. Since organic growth is materially influenced by renewal business, poor results will make meaningful organic growth difficult. Sub-par results may mean an agency has serious servicing issues.

3. Book serviced per producer.

This measures the average annualized commission and fee income coded to validated producers. The higher the number, the better. If your agency is considering adding producers as part of growth goals, take a look at the Producer Hiring Calculator mentioned above.

4. Revenue per support staff employee.

The Best Practices Study also provides benchmark data to assess departmental support staff efficiency. A comparison of departmental revenue serviced per staff employee versus peer agencies is an important way to ensure your agency is rightsized. If not, it may be an indication that your agency’s systems and procedures need attention.

The 2022 Best Practices Study, formulas to measure agency performance, and educational webinars can be found online. Go to www.independentagent.com/best-practices for more information.

september 2023 insight 15

COORDINATING YOUR ACCOUNT MANAGERS’ WORKLOADS

By Daniel Smith

By Daniel Smith

We all know that finding quality service staff is both a point of emphasis and a struggle in our industry. Part of the key to attracting and retaining talented staff for these roles is making sure they have the right workload.

Whether your service team is account managers, customer service representatives (CSRs), client associates, or any other titles or combinations – how do you determine how much of your book of business they should be working to service?

In addition, is it based on policy count, premium, revenue, or what? All these answers and factors may be different, but let’s examine some of what the industry data can tell us on workload.

WHAT DO THE NUMBERS SAY?

If you do some research on forums, in articles, and for industry surveys, you’ll typically find “answers” that fall in range of these numbers1:

Policy count: 1,500 per service staff member

Revenue volume: $150,000 per service staff member

Premium volume: $1,000,000 per service staff member

I guess we’re done then, right? Not so fast... Generalizing those numbers leaves out some very important factors:

• Are these personal or commercial lines accounts?

• How big is the average policy?

• What is the average policy count per account?

• What level of experience does the service team member have?

• What workflow and technology does the agency have in place for service?

All these factors can completely change the perspective. For example, a large commercial account may be a significant amount of work and include a myriad of policies. This is part of the reason that many resources stopped providing this data – it was too hard to adjust for the outliers.

DEVELOP YOUR OWN FORMULA

Determining your account manager workloads is best defined using your own unique agency data. That will likely include some ratio of revenue managed and accounts (not policies) managed.

It will also include another factor that isn’t found in most (maybe any) industry surveys and reports – time. How much time does your median average personal and commercial lines account take to service? In addition, how much time do your account managers spend on service, cross-selling, claims, development, new business, etc.?

These answers will have a major impact on workload. Instead of comparing account managers based on static numbers that may not be equitable, consider setting benchmarks around retention, growth, and customer experience/satisfaction.

And while revenue may seem like the more obvious measurement tool, there are such things as high revenue accounts that don’t require much service (not as many as we’d like), and there definitely low revenue accounts that require a lot of service (unfortunately more than we’d like). So, take a few steps to develop your own guides:

1. Study your agency numbers and account data

2. Review the customer feedback on their experience with each account manager

3. Get input from your account managers on their own workload

4. Compare other data including policy count per account serviced

You may find you already have a “formula” in place, or you may find you need to make some adjustments to get the right balance for your agency.

Daniel Smith, CAE, is Chief Marketing Officer and cofounder of Market Retrievers, a digital marketing firm focused on building and implementing strategies for independent insurance agencies. He can be reached at dsmith@marketretrievers.com.

september 2023 insight 17 See Daniel Smith in Peoria, IL on October 11! Building Relationships and Referrals in a Digital World ILConvention.com

Instead of comparing account managers based on static numbers that may not be equitable, consider setting benchmarks around retention, growth, and customer experience/satisfaction.

Looking for Support on How to Communicate in this Market?

During these challenging times of rising premiums in a hard market, independent insurance agents are more important than ever. Go

RESOURCES INCLUDED:

1. An Overview of Market Conditions

2. Expert Advice for Surviving a Hard Market from Savvy Independent Agents

3. Talking Points for Clients

4. Client Email Templates

5. Frequently Asked Questions from Clients

6. A General Communication Timeline to Keep Your Agency on Track

7. Remarketing Strategy Including Standards Document (Fill-in Template)

8. Renewal Process Outlines and Strategy

9. Personal Lines and Commercial Lines Renewal Forms

10. Creative to Help Your Agency Stand Out (Customizable Videos and Graphics)

out the Hard Market Toolkit brought to you by Trusted Choice

Check

to: TrustedChoice.independentagent.com/hardmarket

september 2023 insight 19 online journal at www.iiaofil.org/Resources/Insight INSIGHTeAccount Manager and CSR Roles and CoordinatingPerformance Workloads How to Demonstrate ROI in Insurance Marketing Setting Your Agency up for PEAK PERFORMANCE Plus In this month’s e-Insight. What Is ROI, and How Do I Calculate it for my Insurance Agency? By Trusted Choice

Account Manager and CSR

Roles and Performance

By Catherine Oak and Bill Schoeffler

Account managers are the backbone of an agency. Account managers (AM) are also called customer service representatives (CSR) and are critical to the agency’s reputation. Many are the key to retention, and clients look to them to get their needs met. Producers are very dependent on them to not only service the accounts but often to help close the sale.

The question for most agency owners is how to grade account manager performance and determine productivity and appropriate roles?

It is often quite hard to find or develop good account managers. Agencies tend to “steal” the good ones from each other. Current low unemployment rates exacerbate the lack of AMs available on the open market. Scarcity of quality employees has a profound impact on agency performance and profitability, since less qualified employees often are filling the void.

Account managers make up roughly half of all employees in an agency. Keeping in mind that payroll is the largest expense in any agency, the productivity of the account managers is directly related to the profitability of the agency. The hiring and retention of good AMs, including establishing fair and motivating compensation, is a key to increasing profits and agency value.

Job Fundamentals

The role of the account manager boils down to the collection, processing and distribution of information. The collection of information aspect tends to be the most significant skill. The AM needs to know what

information to gather (technical skills) and how to ask for it (interpersonal skills).

In some agencies, the AM is also becoming a good salesperson, selling additional coverages the client needs, like business interruption, EPLI and umbrella policies. The account manager also needs to be a “people” person. Good social skills and the ability to act as a go-between for the different parties - clients, producers, underwriters and agency owners - are a must.

Good time management skills are important for AMs. The typical account manager spends about half of her/his time talking to clients or insurance company personnel, gathering and distributing information and problem solving. The balance of her/his time is spent on paperwork and computer input. The latter items are tasks that an AM/ CSR could often delegate to an assistant or clerical person, so they have time to cross sell, explain coverages, handle claims and keep the relationship strong. This improves profitability and productivity. The delegation is called “staff stratification” and is the delegation of clerical tasks to the least costly QUALIFIED employee!

Job Performance

The first step to evaluating job performance is to write a job description spelling out the account manager’s tasks and responsibilities and making sure both parties agree to it. It is best to have the AM draft the list of tasks they do and then show those to the manager to create their job description.

20 insight september 2023

It is important to include predetermined performance standards. An account manager needs to know what size book management expects her/him to handle. Management, on the other hand, needs to offer proper training and support to allow the account manager to get to the productivity level expected.

There are several ways to objectively measure job performance. Many automation systems allow the tracking of transactions by account manager. These automated reports reflect the information recorded on the agency database as the AMs move through their daily work. This allows management to review the volume of work performed by each account manager. Transactions required will vary based on the composition of the book of business handled. Some types of business are more labor intensive than other types, for example contractors require a fair amount of hands-on work for certificates and changes to the policy.

Another method is to compare the number of accounts and commission dollars handled by each account manager. It is important, however, to compare apples to apples. Breakdown the AM’s books of business by line of business (personal, commercial, life and health). Then determine the average size account in each line (commission dollars divided by number of accounts).

The last step is to compare performance to a benchmark. This method provides a clear indication about the profitability of an account manager and the book of business that they handle.

It must be noted that even a good AM could be stuck with a troublesome book of business and appear to be unproductive. Management needs to use the performance numbers in their proper context. Even if each account manager in an agency is measured relative to each other, a problem may occur if each AM handles a vastly unique book of business. For example, one AM may have a larger number of contractors that could require more labor than another account manager’s book, which is mostly retail businesses or even BOPs.

Sometimes, the producer that works on the account with the account manager does not do their job and delegates a lot of their work to the AM. In other cases, producers may be controlling and not delegate enough of the service work to the AM. When looking at the agency’s results by department and by AM, these questions need to be asked if the AM workload results seem too high or too low compared to the standards.

Performance should also be based on subjective measurements. Once a year, key clients handled by each account manager should be surveyed to see what they think of the service they are receiving. Underwriters of the key markets should also be asked for input on the performance of each AM.

Performance rating should be a combination of subjective and objective criteria. An account manager’s strength (and value to the agency) may be partially hidden if performance is graded on only one type of input. A good performance review form for the AM to complete on their performance should also be used and completed on their anniversary date. The manager and the producers who work with the AM should look over the review and provide their input.

AM Role Path to AE

The AM position can also be a path to a newly created position in many agencies called the account executive (AE). This role is a hybrid between an AM and a producer since agencies have a very hard time finding good producers. One solution is to move good, long term account managers into this AE role. This is essentially a producer role to maintain and handle existing accounts without a focus on new sales. Often, some of the smaller accounts of the owner and key producers are placed with the AE. If producers retire and their accounts cannot be made “house” accounts, an AE can be assigned instead. The AE is usually paid 15% to 25% of the book of commissions handled and should have an AM or CSR to delegate the clerical service work to.

Job Compensation

The next big question is what is fair compensation? The first criterion is to make sure it is affordable compensation. Hiring the world’s best account manager is not a good idea if the cost will sink the company. Compensation needs to be in line with job duties and responsibilities.

A good way to look at compensation is to do a quick reality check. Simply take the commission dollars to be handled by an account manager and subtract compensation costs (include taxes and benefits) to determine what the “spread” is for that specific position.

The next step is to evaluate if the remaining dollars are enough to cover producer compensation, overhead and provide a fair return to the owners. This analysis will have to rely on a “gut feel” rating. Unfortunately, there are many variables from agency to agency. However, some benchmarks show a net spread (after all expenses are factored) of around $50,000 in average agencies and $85,000 in high-performing agencies to be a good marker.

The bottom line for this process is to see if there is a fair return to owners after expenses are taken out. A low return or loss will require an adjustment to compensation (AMs or producers), a decrease in overhead costs, or an increase in the book size. If adjustments are not feasible, then management must think about rehabilitating or getting rid of that specific book of business, especially small commercial accounts. The analysis of affordable compensation is important, however, what an owner may feel is appropriate may not be the same as what they will need to pay.

Today’s strong economy has a tremendous impact on what the prevailing wages are. A recent Insurance Journal survey shows the average salary of PL AMs/CSRs ranges from a low in the Midwest of $43,273 to a high in the West of $76,667. Salaries for CL AMs/CSRs seemed to range from $50,061 in the Southeast to $85,561 in the West. Quite a bit of additional good compensation information for various other agency positions and for producers was in this survey.

september 2023 insight 21

continued...

What must be noted is that salaries have gone up in recent years but there has not been a corresponding increase in the commission dollars handled. Major reasons for the stagnant size of the account manager’s book of business are often soft market conditions and lower commissions paid by the carriers. It also seems that automation has increased the account manager workload, because everyone expects more and more information and service. Also, carriers expect the agencies to do more of the insurance companies’ work without getting paid for it.

Incentive Compensation

Many agencies today do not want to just keep giving annual raises, especially with long-term employees that are at the top of the compensation level in their area. The way to do this and provide motivation is to give bonuses or other incentives when extraordinary work has been done, or when additional sales through cross selling are achieved, as well as great retention. All of these areas can give the AM/CSR additional compensation or incentives, like time off, a company trip, childcare and the like.

Some agencies regularly give their service employees rewards when they have increased sales or send cross sell leads to other departments.

Outside Services for AM Duties

There are various sources that agencies can use to provide support to the AMs, such as Patra, ResourcePro, Insuserve-1, Virtual Insurance Pro, WAHVE and eDesk (Nationwide). These are for-hire services for agencies that handle clerical items, like policy checking, certificates, endorsements and the like for a very affordable rate. Some offer full backroom support as well. Services and prices vary greatly, so research for the best fit and cost effectiveness. These services can provide relief to agencies that can’t find the great service employees they need, especially for commercial lines.

A Final Thought

Hiring and keeping a good account manager requires management practice, which is both art and science. Review the numbers to make sure all of the statistics are in line, but make sure the subjective side is also included in the process.

It often proves true that it is better to hire a well-qualified AM and pay them more than to just fill the

position with a low paid, not-so qualified person. Highly productive account managers/CSRs handle more work with less supervision and thereby can save expenses in the long run.

For the typical agency, the quality of the account manager determines the quality of the service and the quality of the agency overall. The path to reaching top performing agency status is not easy, but the right account managers are necessary for the journey.

This article originally appeared on Insurance Journal’s website at https://www.insurancejournal.com/magazines/ mag-features/2020/03/23/561856.htm.

Catherine Oak is the founder of the consulting firm, Oak & Associates and can be reached at catoak@gmail.com.

22 insight september 2023

Manufactured Homes Rental Dwellings We seek to increase our presence in the manufactured home (1977 or newer) and rental dwelling insurance markets. If you are interested in learning more, please contact us. • No supporting business requirements • Competitive pricing • Attractive commission and contingency schedules • Fast, friendly claims service 208 S Walnut Ave · P.O. Box 686 · Forreston, IL 61030 (815) 938-2273 · (800) 938-2270 (309) 303-1490 · (815) 938-2273 Fax (815) 938-2785 · Email info@forrestonmutual.com www.fmic.org Contact: Carl Beebe 309-303-1490 Agents For Unique Opportunities!

HOW TO DEMONSTRATE

IN INSURANCE MARKETING

By ONEFIRE

The return on investing (ROI) in your insurance marketing is powerful information that can help you launch highly effective marketing strategies. The challenge is that insurance marketing ROI goes beyond the data itself; it’s a result of knowing how that data interacts, and what it means for your business.

Here are some steps for determining the ROI of your insurance marketing efforts:

Understanding the Customer Lifetime Value

The Customer Lifetime Value, or CLTV, measures how much a customer relationship is worth to your company, from beginning to end.

But how do you determine the overall value of a single customer relationship over time? There is a formula to estimate what that might be for your business and clientele, and it’s pretty simple.

All you need to do is figure out the average purchase amount per client, and multiply that by the average number of purchases your clients make.

CLTV = Average customer value X Average # of purchases

Having that number is an important piece of the insurance marketing puzzle. Once you have it, you can compare it to what you spend on marketing, and how many customers you’ve signed on from those marketing efforts.

The Untapped Potential of Your Customer Base

In the insurance industry, you are especially poised to establish enduring relationships with your customers. One of the biggest mistakes that many companies make is that they focus their marketing dollars on signing up new customers. It’s worth the time and money to figure out how to continue engaging with those customers, and how you can continue to serve them over time.

The idea is that it’s more profitable to keep an existing customer than it is to seek out new ones, so it’s worth marketing to and upselling your current client base.

Remember that your existing customers have already jumped through the hoops to become a paying customer, so it costs less to upgrade them to better offers. That will help you increase your CLTV over time.

Demonstrating ROI in Your Marketing

Once you have your CLTV, you can begin to demystify the value of your marketing campaigns. It can take awhile for solid marketing efforts to take hold. Building a lasting relationship takes time, and when you’re selling insurance, that trust is a key component of signing up new clients. Because it takes time to build those relationships, it can be difficult to prove the worth of your marketing investments. That’s where knowing key metrics comes in handy.

According to the Insurance Marketing and Communications Association, some of the major metrics for measuring your marketing ROI include website traffic, email marketing, social media, SEO and event marketing.

But not all of these metrics are created equal. You need to determine, based on your business and your marketing efforts, which data carries the most weight.

The Bottom Line

Having data is great, but until you put it into perspective, it’s not going to be very useful to you.

When you know what you’re spending on marketing and how much it costs to sign one customer, you can compare that to the overall value of one customer relationship. Having that information gives you the power and the confidence to invest in quality marketing that works for your insurance company.

Ultimately, it will help you invest your marketing budgeting in signing - and keeping - those quality, long-term client relationships.

This article orginally appearred on ONEFIRE’s blog at https://blog.onefire.com/how-to-demonstrate-roi-ininsurance-marketing.

september 2023 insight 23

Selling Insurance in a Hard Market

Lately I’ve been talking to and working with a lot of agencies and companies regarding selling in the hard market. Although we’ve had a few short, minor hard markets over the years, this is the first “real” one since about 1990. Many of you reading this weren’t even selling insurance back then and those of you that were, are probably a little rusty on selling in a hard market, so I’ve written this article to provide some guidelines on selling insurance in a hard market.

The first step is to get your head on straight. Begin by setting your mental compass, your North Star. Your North Star in this case is helping and serving your customers. Guiding them through the time ahead. You have an obligation first and foremost to them; to protect them, their families, their assets, and their businesses. You’re in the people business first and foremost. It’s simple, no people no business, so people first.

Next, we need to put ourselves in the best mental state possible, which can be challenging in difficult times. One way to do this is to flip the current situation on its ear and to ask what’s actually good about it? What are the advantages? There are a few.

First, higher premiums mean you make more money. As the premiums go up, your business automatically goes up, assuming, of course, that you keep the accounts. But again, if you are able to keep them, your business will grow as rates increase.

By John Chapin

Another advantage is that it’s easier to get competitive business because the average agent cuts back during difficult times, some incumbent agents are even afraid to break the news to customers about the price increases, so they avoid the conversation altogether. Still other incumbent agents have been taking customers for granted for years, never stopping by to see them, and simply sending out renewals in the mail every year.

A third advantage is that it’s easier to stand out from other agents. The average agent is going to have a negative attitude about the hard market. In this case all you have to do to stand out from other agents is to simply have a good attitude. People like to do business with positive people, they don’t like to do business with or hang out with negative people. I’m not saying to pretend there is no hard market, no price increases, etc., or not to have those conversations, I’m saying not to be all doom and gloom about the situation; be upbeat and have positive energy when interacting with customers and prospects.

Overall, you want to have the contrarian mindset. This applies to life in general. In almost any situation, if the crowd is running in one direction, you want to be running in the other. In this case, have a positive attitude and make more calls at a time when most other agents are negative and making fewer outreach calls. Again, tough markets are a great time to go get competitive business.

24 insight september 2023

Next, you want to mentally prepare for the disadvantages of the hard market. One disadvantage is that many customers and companies are focused on their higher premiums and are looking elsewhere for the first time in a while. If you’re an incumbent agent, especially if you’ve been taking customers for granted, as we talked about earlier, this is a big disadvantage. On the flip side though, as also mentioned earlier, this is an advantage for outside agents trying to get into that account.

Probably the biggest disadvantage is that most agents have never had to deal with a hard market before and even those that have, haven’t had to for a long time. So, you’re going to have to be prepared to explain the current situation and how it occurred, along with answering some questions and objections you don’t typically run into. So, begin by working on a solid explanation as to why rates have increased. Next, prepare for questions such as: “Why are my rates going up when I’ve never had a claim?” “How much are my rates going to increase?”

“I’ve heard that the hard market is just another opportunity for insurance companies to make more money. Is that true?” Also, whether people openly say it or not, they may be thinking why they should stay with you versus going elsewhere. Another situation you may run into is one in which a customer can’t afford the price increase, so you’ll want to have some solutions for people who find themselves in that situation. From an objection standpoint, because the primary effect of a hard market is higher prices, you want to get really good at answering the price objection.

All of the above will be handled more effectively by improving your sales skills. By the way, great sales skills are the second-best defense against a hard market. What’s the first? Having solid relationships. If you’ve been working hard on building strong relationships over the years, the impact of the hard market will be minimal. The only issue you may have is people who can’t afford the price increases. By the way, in addition to strong customer relationships, you want to have strong relationships with carriers… underwriters, marketing people, executives, etc.

So, if you haven’t been honing sales skills and working on building relationships, those are two areas you absolutely want to put major focus on. Even if you have focused on them, you want to make sure those two areas are extremely strong. If they are, very little can negatively impact your business, now and in the future.

In addition to the above remember that everything goes in cycles, change is the one constant in the universe, and this too shall pass. The faster we can accept the current reality and embrace and respond to it, the faster we’ll be able to adapt and deal with the situation at hand. Also remember, it can always be worse. Accept it, embrace it, decide how to best respond, and take action doing the best you can.

Finally, one of the most important keys here is to take massive action not only reaching out to and helping your customers but also chasing new business at a time when most agents are backing off.

John Chapin is a motivational sales speaker, coach, and trainer. Go to www.completeselling.com for more information.

september 2023 insight 25

2023 JM Wilson Insurance Insight OUTLINES.indd 4 1/12/23 10:52 AM

October 10-12

Marriott Pere Marquette & Peoria Civic Center, Peoria, IL

Schedule

All of our general sessions will be highlighting the common thread that is impacting our industry – the hard market! Additionally, you will find our breakout sessions will have components woven into each of the topics.

Tuesday, October 10

10:00 a.m. – 4:00 p.m.

- Independent Agent Invitational Golf Outing (Weaver Ridge Golf Club - Separate Registration)

1:00 – 4:00 p.m.

- E&O/Ethics (CE)

- Insurance Game of Games (CE)

5:00 – 6:00 p.m.

- Welcome Reception with hors d’oeuvres

6:00 – 8:00 p.m.

- Dinner Break

- Dutch Dine Arounds

- New & Young Agents

8:00 – 11:00 p.m.

- Game Night

EMPOWER yourself & your team.

REFOCUS on what matters most.

CONNECT with your peers.

Wednesday, October 11

7:00 – 8:00 a.m.

Breakfast

8:00 – 11:30 a.m.

General Session (CE)

- Four Ways to Define and Enhance Your Agency Culture

- IIA of IL Award Presentations

11:30 a.m. – 12:45 p.m.

- Lunch & Networking

1:00 – 4:00 p.m.

- Breakout Sessions (CE)

3:30 – 6:30 p.m.

- Tradeshow - 120+ Vendors

6:30 – 11:00 p.m.

- Big Party: Dinner, Dancing, Music, Drinks

Thursday, October 12

7:00 – 8:30 a.m.

Breakfast

8:30 – 11:30 a.m.

Keynote Session (CE)

- State of the Association Address

- Refocus, Connect, and Empower Your Agency for the Future

Education

Earn Up To 12 Hours CE!

We believe investing in yourself as an insurance professional is the best way to ensure career growth and expand your knowledge base. Depending on what you are looking for, either learning more about the industry’s top trends and issues, or meeting your CE requirements for the year (or possibly a little bit of both), CONVO education sessions will meet your needs. Learn about the latest topics and news that matter most to you from leading experts and your peers while earning up to 12 hours of IL continuing education credit.

iia of il

26 insight september 2022

General Sessions

Four Ways to Define and Enhance Your Agency Culture, by April Simpkins (Wednesday)

According to a recent survey, 46% of job seekers said culture was one of the deciding factors in the application process. In recent years, workplace cultures have undergone a dynamic shift. For many organizations, culture has been redefined by remote work, the talent shortage, increased mental health awareness, and a multi-generational workforce. We have five generations in the workplace, four of which dominate this space. Understanding each generation’s perspective on the changes in culture and leadership can create an engaged team that attracts top talent.

State of the Association Address and Refocus, Connect, and Empower Your Agency for the Future, by Chris Cline, Panel of Industry Professionals, & Association Leaders (Thursday)

Learn about trends and challenges facing the independent agency system during the State of the Association Address. Association leaders will empower you with news on legislative and regulatory issues impacting your business and your clients, connect you with tools and resources to navigate the changing market and challenge you to refocus on what matters most to keep your agency ahead of the curve.

In a world with no shortage of options, risks, and distractions when it comes to technology, it’s important to be nimble but also act with intent. Chris Cline will begin this session by challenging you to slow down to speed up when planning your business strategy for the future.

Cline will moderate a panel of experts with various technology backgrounds who will explore industry and tech space trends including artificial intelligence, data, best practices, virtual assistants, and what’s coming next. Finally, we will look at where we go next. You and your agency are leaving a legacy whether you are managing it or not. We’ll close with a powerful discussion on the significance of legacy and taking control of your most personal and valuable asset as Chris Cline shares insights from his new book, The Inertia of Legacy

Breakout Sessions

Insurance Game of Games (Nicole Broch & Luke Praxmarer)

E&O Roadmap to Cyber and Privacy Insurance (Sam Bennett)

Building Relationships and Referrals in a Digital World (Daniel Smith & Abby Wheeler)

How to Communicate Your Value in a Hard Market (Brandon Hardesty)

Four Key Business Income Concepts (Chris Boggs)

Demystifying the Business Income Report/Worksheet (CP 15 15) (Chris Boggs)

Brett’s 2 Sense Nonsense (Brett Gerger)

Attracting Your Ideal Client in a Hard Market Through Podcasting (Derek Hayden)

Avoiding Legal Concerns Due to Emerging Trends (Rick Pitts)

Managing a Remote Workforce (April Simpkins)

Business Planning to Improve Your Agency Valuation (Jeff Smith)

Best Practices in Agency Compensation (Brian Lawrence)

View all session descriptions on the website!

Details & Registration at ILConvention.com

september 2022 insight 27

Pekin Insurance Chief Risk Officer Receives C100 Award

Greg Bee, Vice President and Chief Risk Officer at Pekin Insurance, was the recipient of the C100 award from the CISO Connect Organization. He was recognized as one of the Top 100 CISOs (Chief Information Security Officers) in North America.

The C100 recognition honors the top 100 CISOs across many industries who are proven leaders with great expertise, which they share with others to give back to the industry as a whole. By sharing their expertise, they create a safe, more secure future for all of us.

Greg is responsible for the implementation and governance of the Pekin Insurance enterprise risk management and information security programs, business and IT risk, and security operations. He has 38 years of Information Technology experience, with the last 23 years leading three different organizations’ information security programs as CISO.

Greg has a bachelor’s degree in computer science, a bachelor’s degree in economics, and a master’s degree in business administration, all from Illinois State University. He has the C|CISO designation from EC-Council and the CISM, CISA, CRISC, and CGEIT certifications from ISACA. He has the ARM designation from The Institutes, along with FLMI, CLU, ChFC, and CPCU designations.

Greg teaches cyber security classes at Illinois State University and is the Chair for the cyber security board at Illinois State. He actively presents at CISO forums and events and is recognized across CISO groups for his overall cyber security expertise. Greg has mentored many security professionals who have progressed their careers to become CISOs for several organizations.

SECURA Insurance donates $38,700 to Feeding America

SECURA Insurance donated $38,700 to Feeding America food banks in Arizona, Colorado, Illinois, Indiana, Iowa, Michigan, Minnesota, Missouri, North Dakota, Pennsylvania, and Wisconsin as part of a campaign with their farm and agribusiness insurance agents.

All new farm or agribusiness accounts written with SECURA from April 1, 2023 through July 31, 2023 equaled a donation, which totaled $38,700.

Feeding America is a nationwide network of food banks, food pantries, and meal programs that provides food and support to more than 40 million people annually.

28 insight september 2023 INSIGHT | associate news

Check out the community - for members only! Here you can share, discuss, ask questions and more! connect.iiaofil.org Join the conversation! See what other members are experiencing in their agencies and chat about it!

Thank you to our Associate Members.

Diamond Level

Platinum Level

Progressive

Surplus Line Association of Illinois

Gold Level

Arlington/Roe

Blue Cross/Blue Shield of IL

Keystone Insurance Group, Inc.

Pekin Insurance

Silver Level

Imperial PFS

IMT Insurance

SECURA Insurance

West Bend Mutual Insurance Co.

Bronze Level

A. J. Wayne & Associates

AAA Insurance

AMERISAFE

AmTrust North America

Auto-Owners Insurance Co.

Badger Mutual Insurance Company

Berkley Management Protection

Berkshire Hathaway Guard Insurance Companies

BluSky Restoration Contractors

BriteCo Jewelry & Watch Insurance

Central Illinois Mutual Insurance Company

Chubb

Columbia Insurance Group

Continental Western Group

Cornerstone National Insurance Company

Cowbell Cyber

Donald Gaddis Company, Inc.

Donegal Insurance Group

EMC Insurance

Encova Insurance

Erie Insurance Group

Foremost Choice Property & Casualty

Forreston Mutual Insurance Company

Frankenmuth Insurance

Grinnell Mutual Reinsurance Company

IA Valuations

Illinois Mine Subsidence Ins. Fund

Illinois Public Risk Fund

Indiana Farmers Insurance

Insurance Program Managers Group

J M Wilson

Liberty Mutual/Safeco Insurance

Madison Mutual Insurance Company

Main Street America Insurance

Maximum Independent Brokerage, LLC

Mercury Insurance Group

Method Workers Comp

Midwest Insurance Company

Nationwide

NHRMA Mutual Workers’ Compensation

Previsor Insurance & Missouri Employers Mutual

PuroClean Disaster Services

Rockford Mutual Insurance Company

ServiceMaster DSI

SERVPRO of Gurnee

Society Insurance

SPRISKA - Specialty Risk of America

Travelers

UFG Insurance

UIG - The Agent Agency

Utica National Insurance Group

W. A. Schickedanz Agency, Inc./Interstate Risk Placement

Western National Insurance

Westfield

september 2023 insight 29

associate news | INSIGHT

Independent, Authorized General Agent for An Independent Licensee of the Blue Shield Association

Susan Vance Named 2023 Illinois Outstanding CSR of the Year

The National Alliance for Insurance Education & Research has announced that Susan Vance is the 2023 Outstanding CSR of the Year recipient for the state of Illinois.

To qualify for this top state honor, Ms. Vance submitted the winning essay on the topic,

“Empathy is an important aspect of customer-facing jobs, and it will only become more important as companies place a greater emphasis on making customer interactions feel natural and effective. Explain how empathy has helped you become a better CSR. Give three examples of how you’ve used empathy in your role and describe the positive effects it’s had on your organization.”

Additionally, Ms. Vance was selected for having demonstrated outstanding service and professionalism within the insurance community.

Ms. Vance has spent the past 10 years as an CSR/Agent at Abbe Insurance Agency in Buckley, IL. She is licensed in Property, Casualty, Health and Life insurance. Susan is an Ohio State University alumni and resides in rural Buckley with her husband and two children.

“Susan Vance was chosen as a state winner for exemplifying the characteristics and qualifications required to be eligible for the prestigious award,” stated William J. Hold, MBA, CRM, CISR, President & CEO of The National Alliance.

“Ms. Vance represents the backbone of the insurance community, those customer service representatives distinguished for providing exceptional service on a daily basis.”

The National Outstanding CSR of the Year Award carries a $2,000 cash prize and a scholarship for the recipient’s employer to any program offered by The National Alliance. The National winner also receives a distinctive gold and diamond lapel pin cast with the Outstanding CSR of the Year emblem. Additionally, the winner’s name will be inscribed on a sculpture permanently displayed at the national headquarters in Austin, Texas.

september 2023 insight 31

members in the news | INSIGHT

agency

Hard Market Solutions for Agencies

Resources and tools to help agents navigate the hard market.

Tools

Equip yourself and your team with the expertise needed to support clients during this demanding time. Download the Trusted Choice Hard Market Toolkit.

Talking Points

Email Scripts Client FAQs

Remarketing & Renewal Strategies

Customizable Videos & Graphics

Sharpen Skills

Set yourself apart from the competition. Enhancing your knowledge on coverages and products will ensure your clients are getting the best possible partner for their insurance needs.

Over 40 CE Classes Monthly Designation Programs

New Monthly Virtual Town Hall Meetings

Support

You aren’t in this alone. Let’s navigate the Hard Market together!

Knowledgable Association Sta

CONNECT with sta , board members, and your peers

Latest News Advocacy

Market Access

With many carriers implementing restrictions, it’s important to explore all avenues to support your clients and potential clients.

Big I Markets

Independent Market Solutions (IMS)

Additional Markets List (Workers’ Comp, FAIR Plan, Wholesalers and More)

Attract & Retain Employees

Whether you are hiring, need temporary help, or want to make sure you have the best team in place, there are solutions for you.

CareerPlug/Big I Hires

Recruiting Services

Virtual Assistant Guidance

Talent Assessment

HR Support

CONNECT is the community created to give agency members the opportunity to exchange and share information, ideas, resources, and experiences pertaining to the issues impacting them.

CONNECT gives you access to your peers, plus IIA of IL sta . This is the perfect place to ask questions, share best practices, and more!

An IIA of IL Member Community www.iiaof il.org/connect

for your many years of service.

Board service is one of the toughest volunteer roles and these outgoing board members performed their responsibilities with dedication and tenacity. They have tirelessly given their time and resources to help make the association what it is today.

The IIA of IL staff appreciates their contributions and wishes them nothing but the best in their future endeavors.

Jay Peterson Chairman of the Board Peterson Insurance Services, Inc. Clinton, IL

Jay has been active with the Independent Farm Insurance Agents for a number of years and in 2015, he joined the IIA of IL Board of Directors as Region 3 Director where he served until joining the Executive Committee as Vice President. Jay has been instrumental in initiatives such as the merger of the Independent Farm Insurance Agents with the IIA of IL and the development of the IIA of IL Technology Committee. Jay’s term as President began in October of 2020 during the association’s virtual CONVO and we appreciate his leadership during a challenging time of uncertainty that necessitated both virtual and hybrid events.

Bart Hartauer

IIA of IL Region 4 Director Hartauer Insurance Agency LaSalle, IL

Bart Hartauer was active with the Farm Agents group and has completed his four-year term as IIA of IL Region 4 Director. We appreciate his service and look forward to his continued input as a member of the Education Committee.

Chris Leming

IIA of IL Region 3 Director

TROXELL Springfield, IL

Chris Leming has completed his four-year term as IIA of IL Region 3 Director. Chris has been an active supporter of the association’s advocacy efforts and will continue to serve as the Vice-Chair of the Government Relations Committee.

september 2023 insight 33

Thank You

This is your association and as an insurance specialist, your insights and expertise can help shape the future of our association and industry. Get started by:

Participating

Sharing

Advocating

Volunteering GET INVOLVED! www.iiaofil.org/About-Us/Get-Involved

-

-

-

-

amerisafe.com • 800.256.9052 • asksales@amerisafe.com © 2023 AMERISAFE, Inc. AMERISAFE, the AMERISAFE Logo, and SAFE ABOVE ALL are registered trademarks of AMERISAFE, Inc. All rights reserved. When you only do one thing, you better do it well and workers’ comp is all we’ve ever done for over 30 years. WORKERS’ COMP IS ALL WE DO.

Association Update

July/August Wrap-Up

IAMIC Annual Convention

The IIA of IL Board of Directors met in Springfield on August 17 for the Fourth Quarterly Board Meeting. The Board voted to approve the 2023-2024 FY Budget, recommended that By-Laws changes regarding the association name change to Big I Illinois and the board position restructure be sent to the membership for approval. The Young Agents committee held a planning meeting and Agents Insurance Services (AIS) Board met in conjunction with the board meeting. During the meeting, Brian Ogden, left, received the Chairman of the Year award for his efforts in leading the Technology Committee. Mohammed Ali, right, received the Regional Director of the Year award. Being a first-year board member, he hit the ground running and made a big impact in his area.

Shannon Churchill attended the American Society of Association Executives (ASAE) meeting in Atlanta, GA. ASAE is the premier source of learning, knowledge, and future-oriented research providing resources, education, ideas, and advocacy to enhance the power and performance of the association community.

Southern Illinois was host to two events: Wine Tour Cardinals/Cubs Baseball Outing

Sponsored by WA Schickedanz/Interstate Risk Placement

PuroClean

Arlington/Roe

for their

Phil Lackman has been named President of the Independent Agent Association Executives (IAAE). He will serve a one-year term in the role, leading the group’s collaboration calls and meetings.

Lori Mahorney served on a panel at a recent IAAE state association collaboration meeting to share information, ideas and resources with the other Big I state associations.

september 2023 insight 35

Evan Manning participated in a panel presentation during IAMIC’s annual convention in Peoria in August. Manning is pictured on right with Lyle Bruning, IAMIC Government Relations Chair, and Jackie Rakers, IAMIC Executive Director.

Brett Gerger also led an Ethics session during the event.

Volunteers from NAAIA Chicago partnered with the DuPage NAACP

summer STEAM Camp. Tom Ross attended the event.

Workers’ Compensation

We distinguish our Workers’ Compensation coverage by providing value-added services before, during, and after a claim.

Upfront loss control measures

Responsive claims handling

Facilitation of quality medical care (when an accident does occur)

We’ve been successfully protecting our policyholders and their employees since 1983.

Browse all of our products at www.guard.com.

Our Workers’ Compensation policy is available nationwide except in monopolistic states: ND, OH, WA, and WY.

Honest relationships

SECURA’s team of insurance experts is making insurance genuine. They are here to support you and your clients. Our underwriting teams are quick to reply, open-minded, and know their stuff. Plus they are backed by our caring claims group who will get your clients back on their feet.

Interested in building a relationship? Contact us at secura.net/IL-agents.

Want to learn more about what SECURA has to offer? Scan the QR code or visit secura.net/IL-agents for more information about the SECURA team.

TO BE AN

APPLY

AGENT: WWW.GUARD.COM/APPLY/

Hear from our experts.

Commercial | Personal | Farm | Agribusiness | Specialty

September 13-14

Virtual Event

16 hours of IL CE credit

CE Available in other States, contact IIA of IL for details

In order to maximize coverage and protect your increasingly complex commercial property accounts, it is important to have a detailed understanding of Commercial Property coverages and endorsements, as well as the concepts used when correctly writing this business. Equally important is a familiarity with other coverages such as Time Element (Business Income), and Equipment Breakdown. At this institute you will learn to help provide your customers with the advice and protection they need.

www.iiaofil.org/education

New Members member agency

Illinois Bankers Business Services, Inc.

Springfield, IL

Rosenberg Insurance & Financial

St. Charles, IL

SB Insurance & Company, Inc

Virden, IL

copper associate member

Honeycomb Insurance

Chicago, IL

For information regarding IIA of IL membership or company sponsorship, contact Tom Ross, Director of Membership Services, at (217) 321-3003, tross@iiaofil.org.

september 2023 insight 37 iia of il news | INSIGHT

for the insurance professional by the insurance professional

LOOKING FOR AN EXIT STRATEGY?

23. Are you looking for an exit strategy while still continuing to produce for a few years or are you ready to sell now? Paczolt Insurance would like to talk with you! We are an independent agency dating back to the 1970s that is located in the western suburbs. Our focus is on mid-to-small commercial accounts and personal lines. Our companies include EMC, Badger Mutual, Safeco, Progressive, and Travelers. We have the flexibility and capital to get a deal done. Contact:

Susan Troppito Paczolt Insurance susan@piaigroup.com

AGENCY OR BOOK OF BUSINESS FOR SALE

34. Small established agency in southern Illinois for sale. Can be sold as just the book of business or the physical location. The book of business includes personal and commercial P&C as well as individual and group medical. The physical location includes the building as well as furniture.

For details, contact Tami Hubbell at the IIA of IL: thubbell@iiaofil.org or (217) 321-3016 and reference blind ad #34.

INDEPENDENT INSURANCE AGENCIES WANTED

17. We are an Independent family-owned agency located in the Chicago area. We are looking to expand through growth and acquisition. If you have a small to medium sized agency and are looking to sell, call or send us a message. We are strictly looking for Personal Lines and Small Commercial accounts with preferred companies.

GALO Insurance Agency, Inc

(847) 832-0888

steve@galoagency.com

We Make Hiring Easier +