•

•

•

•

•

•

•

•

•

•

- Preserving a Legacy

SECURA’s team of insurance experts is making insurance genuine. They are here to support you and your clients. Our underwriting teams are quick to reply, open-minded, and know their stuff. Plus they are backed by our caring claims group who will get your clients back on their feet.

Interested in building a relationship? Contact us at secura.net/IL-agents

Hear from our experts

Want to learn more about what SECURA has to offer?

Scan the QR code or visit secura.net/IL-agents for more information about the SECURA team.

Chairman of the Board - Kevin Lesch klesch09@gmail.com

President - Allyson Padilla allyson@blanksinsurance.com

President-Elect - Patrick Taphorn, CIC, CSRM ptaphorn@unland.com

Vice President - Thomas Evans, Jr. tom.evans@assuredpartners.com

Secretary/Treasurer - Cindy Jackman, CIC, CISR cjackman@arlingtonroe.com

IIABA National Director - George Daly george.daly@thehortongroup.com

Mohammed Ali - mali@aliminsurance.com

Amiri Curry - acurry@assuranceagency.com

Charles Hruska - chas@hruskains.com

David Jenk, Esq. - djenk@nwibrokers.com

Jeff McMillan - jeff@mcmillanins.com

Patrick Muldowney - patrick.muldowney@alliant.com

Lindsey Polzin - lpolzin@presidiogrp.com

Ray Roentz - ray.roentz@hwcrins.com

James Sager - james@sagerins.com

Luke Sandrock, CIC - lsandrock@2cornerstone.com

Noele Tatlock - ntatlock@unland.com

Budget & Finance | Cindy Jackman, CIC, CISR cjackman@arlingtonroe.com

Education | Lisa Lukens salibainsurance@gmail.com

Farm Agents Council | Steve Foster s.foster@ciagonline.com

Government Relations | Dustin Peterson dustin@peterson.insurance

Planning & Coordination | Nick Gunn, CIC ngunn@envisionins.com

Technology | Brian Ogden brian@ogdeninsurance.com

Young Agents | Renee Crissie rcrissie@acrisure.com

Follow us on socials.

Insurance Products Administrator

Director of Information and Technology

Director of Education and Agency Resources

Accounting & Admin Services

Director of Human Resources, Board Admin

Sr. Vice President/Chief Financial Officer

Chief Executive Officer

Director of Membership Services

Director of Government Relations

Office Administrator

Director of Communications

Marketing Representative

Director of Professional

&

Products

Rebecca Buchanan (217) 321-3010 - rbuchanan@ilbigi.org

Shannon Churchill (217) 321-3004 - schurchill@ilbigi.org

Brett Gerger, CIC (217) 321-3006 - bgerger@ilbigi.org

Tami Hubbell, CIC (217) 321-3016 - thubbell@ilbigi.org

Jennifer Jacobs, SHRM-CP (217) 321-3013 - jjacobs@ilbigi.org

Mark Kuchar (217) 321-3015 - mkuchar@ilbigi.org

Phil Lackman, IOM (217) 321-3005 - plackman@ilbigi.org

Lori Mahorney, CISR Elite (217) 415-7550 - lmahorney@ilbigi.org

Evan Manning (217) 321-3002 - emanning@ilbigi.org

Kristi Osmond, CISR Elite (217) 321-3007 - kosmond@ilbigi.org

Rachel Romines (217) 321-3024 - rromines@ilbigi.org

Tom Ross, CRIS, CPIA (217) 321-3003 - tross@ilbigi.org

Carol Wilson, CPIA (217) 321-3011 - cwilson@ilbigi.org

THE BEST REMEDY FOR WORKERS’ COMPENSATION

West Bend has a long history of writing workers’ compensation insurance. Our underwriters are knowledgeable and experienced. Our loss control reps have the expertise and tools to help keep employees safe. And our claims practices are the best in class.

From Main Street-type businesses to specialty businesses like food trucks, West Bend has the experience and expertise to protect businesses of many kinds and many sizes. We want to write all of your workers’ compensation business, small to large!

When you select West Bend for your valued customers, you can rest assured you made the right choice. After all, we are the best remedy for workers’ compensation.

To find an agent near you, visit thesilverlining.com.

Wait, what?! It’s September? As with most of life, except maybe those long online CE classes, the past 12 months have flown by! Whether you have spent time gazing at the heavens or buckled down at your desk, I’m sure you can agree that this year has, yet again, been one for the record books. Reflecting back, it is easy for me to see now that a great deal has been accomplished and that there is much to celebrate.

In the past year, we went BIG, starting with the state association rebrand to Big I Illinois. To play on words here, we initiated a BIG (I) name change and new website, we have celebrated BIG (I) wins at the Capitol in Springfield. Behind the scenes, the Board of Directors and all of our committees have met, made plans, and executed BIG (I) goals, working hard on behalf of our member agents. The Big I Illinois staff and all of the volunteer members have focused on growing talent in the IA channel, bringing real tangible solutions to our members, and targeting those benefits to the correct groups of member agents. I am proud of the work we have done and look forward to all that can be accomplished in the future. As the landscape of our agencies, our company partners, and our industry as a whole continues to change and evolve, it is ever so important to remember that OUR association is persistently working on OUR behalf to continue to provide us a “sustainable, competitive advantage” for another 125 years!

Many of my non-insurance friends have asked why I chose to take on this role and dedicate my time to this organization. For me, the answer is simple. This industry and association have given so much to my agency, my family, and me that it only feels right that I should give back. Big I Illinois has brought our agency quality education, business solutions, and carrier partner opportunities. They have fought for our industry and on behalf of our clients in Springfield and Washington. Our association makes our industry better, and for that, I am eternally grateful.

As most of you know, my agency has always been very actively involved in the association. Most also know that 25 years ago, my mother held the same role I have been honored to serve for the past year. Because of this, even though I have only been working in insurance for over 16 years, I have attended insurance association events for as long as I can remember. As a young person, I traveled to events and meetings, gaining much knowledge along the way. I have been so fortunate to learn and work alongside some of my best friends and greatest mentors. They have guided me through difficult decisions and conversations. I have been able to celebrate weddings, birthdays, children, and accomplishments with my association family, and they have provided support and comfort in difficult times as well. And, when it really comes down to it, no matter how much AI, technology, and electronic communication there is, insurance is really just a people business, and our association, from its staff to our members, has some of the best people around.

I am better because of my involvement in Big I Illinois, and I don’t think any words I share can truly express how appreciative I am to have had this opportunity. Thank you to the staff, the Board of Directors (past and present), and our member agents. It has been my honor to serve as your President.

With most sincere regards, Allyson Padilla

It’s that time of year. CONVO sign-up time!!! This will be the best yet as we will be celebrating 125 years of existence for the Association. We rebranded this year to Big I Illinois, but the Association is 125 years old. If we were an average life policy, we would have matured 10 years ago. To put this in perspective, the US Open golf tournament held their 124th US Open golf championship this year. The Association is three years older than Kraft Foods (three years is a lot of processed cheese). If you miss this convention, you must hate learning, networking, and having a great time. My EIGHTS people (test whether or not you read my last article) will definitely be there as these are the types of events/situations that they thrive in and derive much value. Be an EIGHTS person, not a FOURS person. First, they are half the person. Second, FOURS stands for – Failing, Ordinary, Uninteresting, Rudimentary, Simple. These are all great qualities we aspire to have (sarcasm).

- Failing – unsuccessful, doesn’t achieve goals, neglectful;

- Ordinary – normal, customary, routine (if I wanted ordinary, I would purchase insurance online)

- Uninteresting – no interest, boring, uneventful (definitely not CONVO 2024);

- Rudimentary – basic, minimum effort

- Simple – plain, insignificant, trivial

Be the full EIGHTS (read last month’s article), and don’t be half the person. FOURS that attend CONVO secretly want to be EIGHTS. Go ahead and take the necessary steps to become full-blown EIGHTS.

Hiring/Talent acquisition will be one of the focus areas at CONVO. When hiring, shoot for the EIGHTS, accept the SIXES (not quite an EIGHTS, but will do), settle for the FOURS, and stay away from the TWOS.

SIXES:

- Strive for growth

- Inquire to grow and become valuable

- Xenial, which is friendly and hospitable towards strangers and guests (must have to be in sales)

- Engaged in the day-to-day business

- Service of your client’s needs which is the bare minimum needed in our industry.

Lastly, TWOS:

- Timidity in which the candidate lacks confidence (terrible for sales)

- Wanting is where the candidate falls short of your established standards

- Overwhelmed where the job far exceeds the candidate’s capabilities (not everyone is meant to be an agent)

- Struggling in which the candidate cannot produce the desired effect. Not all struggle is bad, but I would call the good struggle a “challenge” and the bad struggle is where the candidate will never be effective as the task or concept is outside their skill set.

The fewer TWOS you can hire, the better and the more EIGHTS and SIXES you hire, the better off your agency will be. After this article, we will have to re-write the “March of the Acronyms” or publish “March of the Acronyms 2.”

Back to CONVO 2024. This convention will be epic in all facets, from the educational programs to the parties. If there is one thing that agents do really well, it is party. CONVO 2024 will dive into emerging market trends, hiring, the state of the auto market, vital E&O homeowners education, as well as a very competitive game session that will test your knowledge regarding various coverages. Illinois is always a convention that provides one of the best experiences in the country. However, I think Shannon and crew have outdone themselves for the 125th Anniversary. Don’t be the person who has to listen to all of the amazing stories on Monday, October 21, 2024. Be the person telling all of the amazing stories. A 125th anniversary comes along once, so don’t miss out, as you will truly regret not coming. Don’t think about what else you have those days, just go to ILConvention. com and REGISTER. Go ahead and reschedule what you had planned so there will be no regrets. Those appointments will understand and be better served by what you take away from CONVO 2024. There never has been a more important CONVO due to the state of our industry. It just happens to be very timely and cool that it lands on our 125th Anniversary. Yes, you read that right, I said cool. Depending on your generation, I could have said Fire, Hip, Trendy, Groovy (Phil), Killer, In, Awesome, Prime, Epic (personal favorite), or Golden. I know I missed some, but CONVO 2024 will be EPIC.

Failing to sign-up for this convention will ensure that your hard market lasts another two years, but those who DO attend will have their hard market shortened by six months. It’s kind of like the ground hog’s shadow. As per everything to do with my articles, the opinions expressed are not the opinions of the Association and are those of the author. If the opinion is too extreme, the author will blame AI. The moral of the story is to attend the 125th Anniversary and help us celebrate and network. The bigger the party, the better. The law of Large Numbers is an insurance concept, and the key to success is large numbers.

As always, this is just Brett’s No Sense (the concepts put forward by our current politicians clearly indicate that they do not know what causes inflation) and I hope it was helpful. You can contact me through my CONNECT and if it is urgent, do not hesitate to reach me through CONNECT. I may be pushing you to CONNECT. If you need any clarification or have any suggestions for future articles please email me at bgerger@ilbigi.org.

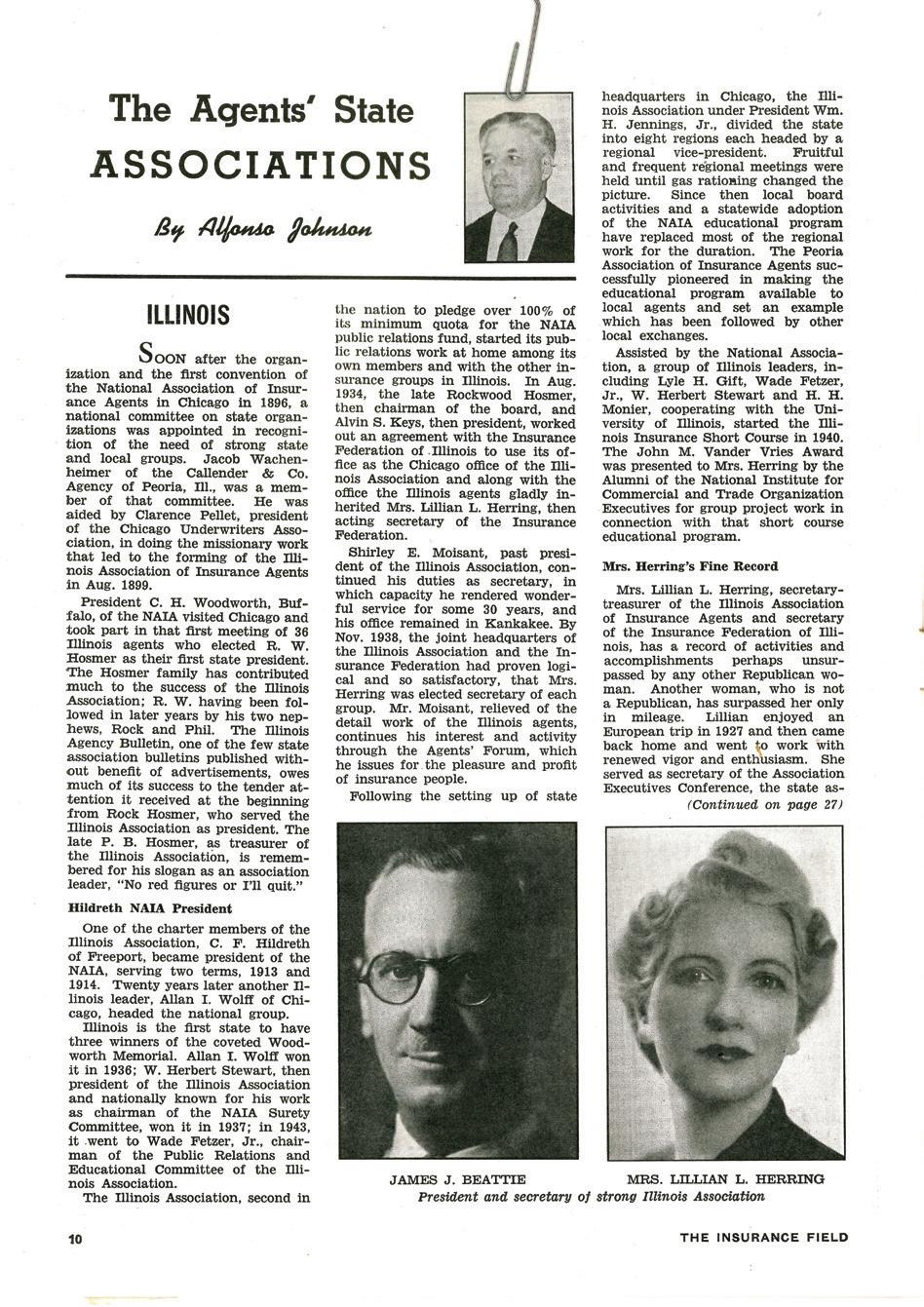

From its humble beginnings as a volunteer-run association operating out of an insurance agency, to an association guided by volunteers and staffed by professionals in its headquarters office, the association has undoubtedly seen many changes in the last 125 years. But if there has been one constant, it is that talented and dedicated people have cared enough about the industry and its cause to fight for fair and sound legislative proposals, preserve professionalism in the business, provide a competitive advantage for association members, and preserve the legacy of this organization.

Following is a profile of those who have been instrumental in leading and preserving the Big I Illinois legacy, and a snapshot of where they were headquartered.

Shirley Moisant

Though not a paid employee of the association, Shirley Moisant was Past President of the Illinois Association of Insurance Agents in 1913-1914, and then served for many years as the Secretary. He was the first Editor and Publisher of Association News which he produced monthly in the 1920s for approximately 1500 subscribers. In 1935, the name of was changed to The American Agency Bulletin and all association members received a complimentary copy. From 1914 to 1934, Shirley Moisant’s Insurance Office, Kankakee, IL served as the first association headquarters.

Lillian Laurie Herring

In 1934, guided by President Alvin S. Keys of Springfield, an agreement was made with the Insurance Federation of Illinois, to use its office in the Insurance Exchange Building in Chicago as the headquarters of the Illinois Association of Insurance Agents. The association headquarters remained in room 616 Insurance Exchange Building until 1957.

Lillian Herring, Acting Secretary of the Insurance Federation of Illinois, was named Secretary of the Illinois Association of Insurance Agents in 1938 and became the organization’s first paid Secretary. In 1942, Lillian Herring took over publication of the Bulletin from Shirley Moisant.

William H. Hamilton

In 1947, William H. Hamilton, Manager of the Chicago Board of Underwriters, was chosen to be Executive Secretary of the Illinois Association of Insurance Agents and he continued in a dual role for a brief period of time. Hamilton passed away in December of 1952 and his successor as Manager of CBU, Bill Krom, served as Interim Executive Manager until a permanent successor could be found.

Edward J. Dirksen

Edward Dirksen was named Executive Secretary in 1953 and he also served as general council for CBU. Dirksen spearheaded the association’s move from Chicago to the Ridgely Building in Springfield to better facilitate the focus on legislative matters. Upon his retirement in 1957, he returned to Springfield where he served briefly with the Illinois Department of Insurance. He had previously been Assistant Director of Insurance for the State of Illinois prior to taking the position at the Illinois Association of Insurance Agents.

George Nicoud

Nicoud was selected to succeed Edward Dirksen in October of 1958. In 1967, Nicoud was honored as President of ISAE (Illinois Society of Association Executives) and in the fall of 1971, Nicoud was the first individual to receive the prestigious Cartwright Merit Award who was not an agent. He served as Executive Director at the association headquarters in the Ridgley Building in downtown Springfield until his untimely death in 1972.

Roy Robinson

Roy Robinson was hired on as Education Director in 1971 and was soon chosen to succeed George Nicoud as Executive Director in 1972. Robinson served in the role until his retirement in 1990. Robinson was passionate about insurance education and received his CPCU designation (Chartered Property and Casualty Underwriter) in 1960 and later served as President of CPCU Chapters in his hometown of Syracuse, NY, and later in Bloomington, IL. He and his wife, Harriett, were proud sponsors of a college scholarship for students interested in insurance careers.

Robinson earned his CAE (Certified Association Executive) in 1975 and served as President of ISAE (Illinois Society of Association Executives) and President of IAAE (Independent Agents Association Executives). Robinson was honored with the Cartwright Award after his retirement.

During Robinson’s tenure at the association, the association staff had outgrown the office at the Ridgley Building, which was described by Past President Jack Payan as “cramped” and “antiquated” and a location one might expect to “see Abraham Lincoln”. During Payan’s presidency, the association leased space in the newly-constructed Realtors Building located just off I-55 at Stevenson Drive.

Michael Tate

Mike Tate joined the association as Chief Operating Officer in 1990. Tate had been elected the youngest State Representative in Illinois and in that capacity served as Assistant Minority Leader and as Spokesman for the Appropriations Committee and Insurance Committees. As a legislator, Tate received numerous awards in recognition of his sound economic policies and ability to effectively represent the concerns of his constituents.

During his tenure with the association, he oversaw the move from the Realtors Building to another leased space, and then the construction of the current building in 1993. He also facilitated the merger of IIAI and PIA, and the ultimate disaffiliation with PIA. In 2003, Tate served as President of the Independent Agent Association Executives (IAAE) association.

Phil Lackman

Mike Tate is pictured first row, far right with association staff in 1993.

Two of these employees in 1993 are still part of association staff today. Can you spot them below?

In 2015, Phil Lackman was named CEO after serving 20 years as the Vice President of Government Relations for the association. He also lobbied for industry organizations including the Illinois Association of Insurance and Financial Advisors (NAIFA IL), Illinois State Association of Health Underwriters (ISAHU) and the Illinois Association of Mutual Insurance Companies (IAMIC). Prior to joining the Big I Illinois, Lackman was Director of Legislative Affairs for the Illinois Life Insurance Council, served as Secretary of State Jim Edgar’s Deputy Director of Legislative Affairs and served as Legislative Analyst with the Senate Republicans.

In 2011, Lackman was elected to a one-year term as Speaker of the Illinois Third House, the professional organization for registered lobbyists in Illinois. In 2016, he was inducted into the Samuel K. Gove Illinois Legislative Intern Hall of Fame, which honors former legislative interns whose careers have exemplified distinguished public service. Most recently, Lackman served as President of the Independent Agent Association Executives (IAAE) association.

From our beginning in 1899 to the present, the great legacy of the association is our members, from presidents to board members to committee and task force members to those who contributed in special ways to our programs and political action committees. They provided the vision for the dedicated staff to carry out.

As we celebrate our association’s 125th anniversary, we want to express our deepest gratitude to all our members. Your unwavering support, dedication, and contributions have been instrumental in making our organization what it is today. Your commitment to our mission has helped us achieve significant milestones and positively impact Illinois’ insurance marketplace and our local communities. Thank you for being a part of our rich history and for continuing to shape our bright future.

- Phil Lackman, CEO

By Nikki Brandt

Insurance industry hiring struggles: aging workforce, lack of training & remote work expectations clash. Discover how agencies can adapt to attract top talent.

It’s no secret that hiring in the insurance industry is currently a difficult proposition. Overlapping trends such as the large number of professionals retiring, a shortage of talent entering the industry, a cultural shift in workplace expectations, and a seeming lack of willingness to train are placing a strain on hiring.

• A McKinsey study places the median age of insurance agents at 59;

• 75 universities offer insurance and risk management majors in the U.S., limiting the supply of fresh talent;

• An Owl Labs survey found that 92% of respondents expected to work from home at least one day per week, and 80% expected to work at least three days from home per week.

We also surveyed agents and then talked with industry recruiting expert Nikki Brandt of NB Talent to get some perspective on what impacts recruiting, hiring, and training in insurance.

Our survey found that 66% of respondents use recruitment agencies to identify new hire prospects, while 33% looked to internal referrals. Surprisingly, none said they had used career fairs or college programs in their search.

In addition, the survey showed that “Lack of industry knowledge and terminology” and little “Time and resources invested in training” were identified as the top challenges in hiring new account managers.

Brandt says what she sees supports these concerns: “Every agency wants experience. Many of them don’t have the capacity or structures in place to train effectively, so rather than hiring someone brand new and training them for the role, they are competing with everyone else for the experienced people.”

She added, “Employees want remote work, and most companies are still clinging to in-office presence.”

Those we surveyed also seemed to believe that what differentiates their agency is a “Positive company culture and work environment,” while some said that “Opportunities for advancement within the agency” were a key factor.

Brandt summed up what she has found candidates are prioritizing, “More flexibility, remote work, and more competitive salaries are topping the list.”

And what role does technology play in finding talent? The agent responses we received showed that it does not rank highly on what they feel best promotes their agency to candidates. It’s crucial to note that user-friendly technology and documented processes play a significant role in shortening the onboarding process of new hires and improving their long-term success once they are hired.

Brandt reiterated this by stating that the agency’s existing technology plays less of a role than one might think. “Potentially for the newer folks entering the industry who are younger and demand more tech, but for employees who have been in the industry for 5-10+ years,” she continued. “About 80% of them I talk to are not going to make a decision based on technology at the agency – it’s on flexibility, culture, opportunity, money… I would say the systems/technology in place is important but not as high on the list.”

And what about her own experience in the industry? “When I was a producer, I was completely eaten alive by all the amount of data we had to enter/track – one spot for clients, one spot for prospects, a system to track those getting paid on commissions, etc. It’s a lot! Our account managers had a similar dilemma – maybe not the expenses but had a system for COIs and various carrier portals they had to use.”

So, could tech that streamlined workflow help provide a more attractive environment for recruiting? Brandt summarized, “I think simplifying the amount of entry and grunt work people in producer and account manager roles would probably help with recruitment and retention IF all the other things I mentioned are in place.”

Technology might not be the final answer for your recruitment, but an improved work environment is needed, and technology may play a role.

Candidates are prioritizing: More flexibility, remote work, and more competitive salaries are topping the list.

Nikki Brandt is the founder of NB Talent, a self-proclaimed people connector and insurance nerd. She is a former commercial producer with a top 100 broker, and also worked with a carrier in underwriter and field production roles.

By Claudia St. John, Affinity HR

So you’ve made a great hire and you are looking forward to onboarding your newest insurance agent/broker. Expectations are high and optimism abounds. But before you rely too heavily on those positive feelings, here are some sobering statistics to consider:

• Up to 20 percent of turnover happens within the first 45 days of work.

• Nearly 33 percent of new hires look for a new job within their first six months on the job.

• 23 percent of new hires leave before their first anniversary.

• 60 percent of companies fail to set milestones for new hires.

• It typically takes eight months for a newly hired employee to reach full productivity.

• Organizations with strong onboarding processes experience 50 percent greater retention of their new hires.

These statistics should be especially unsettling to you if you do not have a formal, structured onboarding process. Onboarding – the process by which new employees acquire the necessary knowledge, skills and behaviors to become effective organizational members and insiders – does not have to be complicated, burdensome or expensive. It just needs to be planned and executed well.

1. Start Onboarding Before the First Day. After the job offer has been accepted and before your new employee has started, stay in touch and communicate often. Check in frequently before the start date. Ask if there are any questions. Make sure your new employee has all the information needed to be prepared for day one. Not only will this help make the new hire feel valued and appreciated, but it will help to deflect any competing interest from other employers.

2. Make the First Day Special. The good news is that, chances are, your new hire is excited about his or her new job. Make that first day special – be as excited about your new hire as he or she is about the new job! Have a special welcome ready, have your new hire’s workspace ready, and if possible, have business cards ready. Make your new hire feel like he or she is expected and welcome in the new job. The goal is to show your new hires that you are as excited about them joining your company as they are!

Of course there are the formal things one does to orient a new employee on the first day(s) on the job. Be sure to:

• Provide the employee handbook and obtain acknowledgment that the handbook has been read and understood.

• Collect all payroll and benefit information.

• Process all necessary I9 paperwork.

• Highlight specific policies and procedures that are important on the job.

• Discuss appropriate workplace safety and health topics.

• Make sure new employees have access to your digital platforms and provide login credentials when possible.

• Provide training on equipment, technology platforms and procedures.

• Cover any position-related topics such as supervisory responsibility, duties and responsibilities and expectations of the new hire.

And don’t stop there – the informal things are just as critical. Take the time to talk about the unique aspects of your company’s culture. For example, how important is the matter of being on time? Are there unwritten rules about meeting attendance, dress, voicing opinions? And don’t forget to cover smart-phone usage and social media access while at work. Talk about it!

3. Plan Your New Employee’s First Few Weeks. When it comes to onboarding your new hire, it is likely that there are many people responsible for the learning that will ensure that the employee is properly trained and ready for work. Before his or her first day, map out what the learning objectives are for the first 4–6 weeks and who is responsible for ensuring that the learning takes place.

A clearly structured roadmap for your new hire will help the employee know what is expected and know who she or he can go to for help and support in the early days. A structured plan also puts the person responsible for training the new employee on notice that it is his or her responsibility to make sure the new hire has all of the time, tools and support necessary to accomplish those learning objectives. A sample of what the first week’s learning plan template might look like is below.

4. Foster Feedback Early On. According to the Gallup Organization’s 12 Elements of Great Managing, key to employee engagement is the knowledge of what is expected of the employee at work, having the equipment to do the work right, and getting the feedback and encouragement necessary for professional development and personal growth. All of these elements require ongoing, formal and informal feedback.

Especially in the early days, providing employees with an equal balance of positive and corrective feedback enables them to truly understand what is expected and how they can make changes to satisfy your expectations. This type of informal feedback is critical to ensuring employee engagement. Be specific about what the employee is doing well and why it is critical to the organization. And be just as specific about the areas where the employee needs to focus his or her energy during the onboarding period.

5. Make Onboarding a Year-Long Effort. Make sure you schedule periodic check-ins in the weeks and months that follow. Remember, the learning curve for most positions is almost always longer than anyone ever expects. If your new hire feels supported in the first six to 12 months, you will improve the likelihood that he or she will stay engaged and committed. Consider a formal 45-day or 60-day performance evaluation plan during the first year of hire. You can never give new employees too much feedback or attention.

By following the tips above and seeing the new employee as a business investment, you will recognize that your dedication of time and attention to these matters is a business investment that will pay measurable returns, particularly by enabling new employees to more quickly get up to speed and deliver value to the company.

This article originally appeared on the Applied Client Network website at www.appliedclientnetwork.org/Connections/5-tipsfor-new-employee-onboarding-at-your-insurance-company.

Employee Name: John Doe

Hire Date: 11/02/17

Managing Supervisor: Kelly B.

Position: Sales Associate Learning Objectives Trainer/Developer

Week 1

Day 1

Objective 1

Objective 2

Objective 3

Objective 4

Objective 5

Week 1 Performance Feedback:

Orientation (see Orientation Plan)

Get training on CRM and Applied systems services – Be able to access client data and update as needed Tracy & Steve

Learn the key selling points of our insurance services

Sit with customer service to get familiar with back office

Learn the quarterly goals and budgets with CEO/CFO CEO/CFO

Go on sales calls to call on local customers Lydia

Obj. 1: John is familiar with CRM – Expand training to Leads.

Obj. 2: Need some more training; send him additional sales resources.

Obj. 3: Great job establishing relationships. Sit again next week.

Obj. 4: Establish personal sales goals

Obj. 5: Had 3 great calls. ID ways to be more effective for calls next week.

By Nicholas Lamparelli

“Right People, Right Seats” is not merely a hiring strategy, but a holistic approach to talent management that fosters a win-win situation for both employees and the organization. By prioritizing cultural fit, aligning skills with roles, and fostering a culture of continuous learning and development, companies can create a high-performing workforce that drives innovation, achieves strategic objectives, and secures a sustainable competitive advantage in the ever-evolving business landscape.

The upper echelons of academia require not just intellectual prowess, but the ability to translate knowledge into action. Similarly, successful organizations don’t simply hire talented individuals; they place those individuals in roles that maximize their contributions. This article explores the concept of “Right People, Right Seats,” a strategic talent management approach that optimizes performance by aligning employee strengths, values, and aspirations with organizational needs.

The Flawed Hiring Paradigm: Traditional hiring practices often rely heavily on resumes and interviews, primarily assessing technical skills and past experiences. While these factors hold value, they paint an incomplete picture. A candidate with a stellar track record might struggle to adapt to a company culture that fosters risk-taking, or an individual with exceptional technical expertise might find themselves disengaged in a purely analytical role. In short –how complimentary are talented individuals when placed in a group with other talented individuals? Do they lift each other up…or tear each other apart.

The Right People: The “Right People” in this equation are those who possess not just the requisite technical skills, but also the cultural fit and intrinsic motivation to thrive within the organization. Cultural fit refers to the alignment between an individual’s values, behaviors, and working style with the company’s core beliefs and operational ethos. A highly motivated individual who thrives in a collaborative environment might find themselves stifled in a rigidly hierarchical structure, while someone who enjoys independent problem-solving might struggle to adapt to a team-driven approach. Some talented individuals see other talented individuals as a threat, while some see it as a way to challenge themselves. You need to know who you are dealing with before you acclimate them to your team.

Beyond the resume, in-depth interviews that delve into a candidate’s motivations, communication style, and past experiences in team dynamics can offer valuable insights. Behavioral interviewing techniques, which focus on past actions and problem-solving strategies, can provide a clearer picture of how a candidate might handle future situations. Additionally, incorporating a panel interview with diverse team members can offer perspectives on how a candidate’s personality and work style might mesh with the existing team. You may also want to think about using asynchronous video to create a profile to share with everyone BEFORE the candidate is actually going to be interviewed. Warm up the seat a little, and allow your staff to get a feel for someone before they speak to them instead of the awkwardness that often comes from interviews.

The Right Seats: Identifying the “Right Seats” requires a thorough understanding of the roles within the organization. This involves a detailed analysis of responsibilities, required skills, and the specific challenges and opportunities associated with each position. Additionally, an evaluation of the team dynamic is crucial. Does the role require someone who thrives in a leadership position, or would a collaborative team player be a better fit?

Once the “Right People” are identified, the focus shifts to placing them in roles that capitalize on their strengths and intrinsic motivations. Ideally, the role should provide opportunities for the individual to not only contribute

meaningfully but also feel challenged and fulfilled. Consider an individual with strong analytical skills and a passion for innovation. Placing them in a purely administrative role might utilize their skills but stifle their creative drive. Conversely, entrusting them with a project that requires data analysis and allows for the development of new solutions would be a more optimal fit.

“Right People, Right Seats” doesn’t end with successful recruitment. Onboarding and ongoing development are crucial for ensuring long-term success. Effective onboarding programs that provide new hires with clear expectations, opportunities to shadow colleagues, and mentorship can help them integrate into the team and adjust to new responsibilities. Similarly, offering opportunities for ongoing skill development and career advancement motivates employees and fosters a sense of loyalty towards the organization.

A Continuous Journey: The talent landscape is dynamic. Individual aspirations and skills evolve, and organizational needs can shift. Therefore, “Right People, Right Seats” is a continuous process. Regular performance evaluations, coupled with open communication between employees and managers, allows for the identification of potential misalignments and opportunities for growth. Perhaps an individual who initially thrived in a specific role now yearns for more responsibility, or a change in the organizational structure might necessitate a shift in certain roles. Recognizing these changes and offering opportunities within the company allows for a continued alignment of individual and organizational goals.

While the core principles of “Right People, Right Seats” remain constant, several advanced considerations can further enhance its effectiveness:

• Leveraging Technology:

o Applicant tracking systems (ATS) can be configured to prioritize candidates whose resumes align with pre-defined cultural fit criteria. Additionally, online assessments can be used to evaluate personality traits and cognitive abilities, providing data beyond traditional interviews.

o Knowledge Management Systems (KMS): There is nothing worse as an employee than sputtering. You get into your new role and you don’t know where anything is, if you do know where it is, you can’t easily get access to it, and if you get access to it, can you actually find what you are looking for? KMS (especially those that use AI) can take a fuzzy query from an employee and get them what they need faster. How do I get access to the database? Who can provide me a password? What table(s) is this piece of information?

Traditional hiring practices often rely heavily on resumes and interviews, primarily assessing technical skills and past experiences. While these factors hold value, they paint an incomplete picture.

To

• Succession Planning: Identifying high-potential employees early on allows for targeted development opportunities that prepare them for future leadership roles. This not only ensures a pipeline of qualified internal candidates but also fosters a culture of career advancement.

• The Evolving Workplace: The rise of remote work and the gig economy necessitate a more flexible approach to talent management. Skills-based hiring practices, where specific skillsets are prioritized over traditional job titles, can help organizations identify and engage the right talent regardless of location or employment model.

Investing in a “Right People, Right Seats” approach goes beyond simply filling vacancies. By strategically aligning talent with organizational needs, companies can reap significant benefits:

• Enhanced Performance: When employees are placed in roles that leverage their strengths and interests, they are more likely to be productive, engaged, and deliver superior results. Studies have shown that companies with strong talent management practices experience higher employee satisfaction, lower turnover rates, and increased profitability.

• Innovation and Creativity: Matching individuals with a passion for problem-solving with the right opportunities fosters a culture of innovation. Diverse perspectives and a willingness to challenge the status quo can lead to the development of groundbreaking ideas and solutions.

• Employer Branding: A reputation for attracting and developing top talent strengthens a company’s employer brand. This, in turn, attracts high-caliber candidates who are motivated by the prospect of working in a stimulating environment where their contributions are valued.

In conclusion, “Right People, Right Seats” is not merely a hiring strategy, but a holistic approach to talent management that fosters a win-win situation for both employees and the organization. By prioritizing cultural fit, aligning skills with roles, and fostering a culture of continuous learning and development, companies can create a high-performing workforce that drives innovation, achieves strategic objectives, and secures a sustainable competitive advantage in the ever-evolving business landscape.

Nick Lamparelli is a 20+ year veteran of the insurance wars and is Managing Partner at Insurance Nerds. Find out more at insnerds.com.

The traditional coverage your clients need.

The customized options your clients desire.

The affordable price your clients deserve.

We’ve been successfully protecting small businesses since 1983.

Your team works hard for you. So protect them with employee bene ts that work hard for them, available exclusively through your membership to the Big I.

By WAHVE

When Business Insurance published its list of the Best Places to Work in Insurance, readers saw some familiar names. It seems the same companies tend to perpetually find their way onto the list thanks to their employees.

What does it take to be called one of the Best Places to Work in Insurance? Several attributes set apart the companies on the latest list:

• An entrepreneurial culture and plenty of support

• A flexible and fun work environment

• A people-first focus

• Employee ownership

• Charitable support

• Work-from-home options and flexible start times

• Team-building programs that include employees and families

What can your company learn from this list? Plenty, starting with how to attract and retain top talent.

The companies that are considered the best places to work share one key attribute: they understand the value of building a strong workplace culture.

Top companies understand that their people are their greatest asset. While many companies say that, few put that thought into action.

Fortunately, creating a company culture that vastly improves morale and employee retention is not hard. With a few changes to how your company operates, you can deliver a better employee experience.

You should want to, too. A Gallup poll shows that companies with employee engagement programs see a 20% increase in employee engagement, a 41% reduction in absenteeism, a 21% profitability boost, and a 59% reduction in turnover rates.

To see improvements in your employee morale and retention, try these changes:

Put employees in charge. Let your employees take the lead on projects and encourage them to be active participants in meetings and brainstorming. Employees who feel part of the overall success of the company are more engaged and more satisfied.

Make well-being part of the culture. Focusing on well-being – both physical and emotional – means that your employees feel their company cares. It does more than that; putting employee well-being at the core of your business builds stronger relationships, telegraphs that management values employees, and helps employees be their most productive.

Build a flexible, hybrid work culture. You can improve productivity by giving employees the option to work from home – and to do so at times when they know they are most productive. Not every employee can give 100% between the hours of nine and five. Trust your employees to get the work done in a way that best fits their approach and lifestyle.

Create cohesive teams. Even in hybrid cultures, teams can be established and nurtured. We at WAHVE schedule team-building activities within our workday, such as virtual happy hours, virtual celebrations of milestones, games, and shoutouts for a job well done. We also plan an annual retreat so we can relax and build stronger work connections.

Communicate, communicate, communicate. Keep open channels of communication in various forms – video, chat apps, email, and phone, to name a few. Make sure to check in with each employee regularly. Find out what’s new in their lives at work and beyond work. Review accomplishments and roadblocks. Ask if they need further training or assistance with any issues that arise. Be the support, not the authority.

Each of these changes takes a shift in focus but all are manageable. Moreover, they are changes that will be wellreceived by your employees and job seekers. With just a few changes to how you manage your workforce, your employees can experience a better work-life balance that translates into happier workers and better productivity.

Find out more about WAHVE at wahve.com.

By Craig Niess

Staffing your agency with an effective, experienced, and professional staff is one of the most important components of maintaining and growing your agency value. It is a key risk factor in completing an agency valuation, and typically the first question a prospective buyer will inquire about when considering an acquisition.

To better understand the impact revenue per employee plays on agency value, we reviewed the data from our IA Valuations clients to see how they stacked up against the Reagan Consulting – Big I 2022 Best Practices Study Our goal was to establish the correlation between profitable, high performing agencies across the board, whether they were Best Practices agencies or not.

We began by looking at the revenue per employee metrics for every agency that has completed a valuation in the past 5 years. Historically, this was the gauge for measuring how productive and efficient independent insurance agency employees were. At first blush, we saw that our clients stacked up favorably against the Best Practices Study participants. The average gap between each group was only 3.5%.

We wanted to dive deeper to see if this measure was meaningful by itself, or if we needed to consider other factors. For instance, as the market hardens and we see increases in P&C rates, agencies are seeing revenue growth without substantial changes to the servicing staff. The result is an increased revenue per employee, without any fundamental changes to the agency itself.

Furthermore, when comparing your agency to peer agencies, this measure would only have meaning if premiums, commissions, and employee wages were relatively the same throughout the market. We know this is not true, as an agency’s location – rural, urban, or suburban – can impact each of these items.

So, how do we get a better understanding of an agency’s productivity and efficiency? We need to compare revenue per employee to compensation per employee to get a better idea. Spread per employee measures the difference between revenue per employee and compensation per employee. It is the best determination of productivity for agency staff, and the best measure when comparing your performance to peer agencies. To illustrate this point, we compared the spread of IA Valuations agencies to the Best Practices Agencies.

To illustrate the point, we compared the spread of IA Valuations agencies with the Best Practices agencies.

Whereas the revenue per employee numbers were closely aligned, we see that the Best Practices agencies are much more efficient based on the spread. On average, they are outperforming our clients by 22.2%.

What conclusions can we draw from this analysis? This type of control of their agency expenses is likely another attribute that makes them a Best Practices agency. Agencies operating outside of Best Practices, are likely operating in a less profitable manner than the BP peers.

Every agency owner must decide how they want to allocate expenses to enhance the value of their agency. In lower spread agencies, it is likely that owners are consciously making the decision to operate with higher payroll expenses and take less in operating profits. In an effective business planning exercise, it is important that owners understand these non-compensation expense dollars are available to an agency to be deployed on profits or overhead, and they are choosing overhead. Operating at a 22.2% less profitable margin could have a meaningful single-digit impact on the value of an agency, which in many instances, could be tens to hundreds of thousands of dollars to the agency’s valuation.

While our database inevitably contains a handful of Best Practices agencies, the bulk of them are not part of that study but are yielding similar results when looking at revenue per employee by agency size. This is an encouraging sign as it signals most agencies are operating in a fairly efficient manner as it relates to payroll expenses. However, the main difference between the groups can be determined only by looking at the spread, which is an important business planning tool and should be utilized by agency owners.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@ iavaluations.com to discuss your personal situation.

Craig Niess, MBA, CVA, is Director of Business Planning & Valuation for IA Valuations and can be reached at craig@iavaluations.com.

15-17

Marriott Pere Marquette & Civic Center

CONVO is the premier annual event of the Big I Illinois and includes the Midwest’s largest industry tradeshow. The event is designed for agents to come together for connections, networking, education, industry trends, and of course, fun.

Earn high-quality Illinois CE credit with industry-driven educational programming. You’ll hear from leading experts and your peers about the latest topics and news that matter most to you. We know you have questions about the event. Let’s go beyond the What, When, and Where and dig deeper into the event.

(Times Subject to Change)

Tuesday, October 15

10:00 – 4:00 pm Independent Agent Invitational Golf Outing

1:00 – 4:00 pm Concurrent Education Sessions (CE)

5:00 – 6:00 pm Welcome Reception and Meet & Greet

6:00 – 8:00 pm Dutch Dine Arounds/Company Dinners

6:00 – 8:00 pm Past President’s Dinner (Invite Only)

8:00 – 11:00 pm Casino Night

Wednesday, October 16

7:00 am Breakfast

8:00 - 11:00 am Keynote General Session (CE)

11:00 am – 2:00 pm Tradeshow and Lunch ** NEW TIMING

2:00 – 2:50 pm Concurrent Education Sessions (CE)

3:00 – 3:50 pm

4:00 – 5:00 pm

Concurrent Education Sessions (CE)

Closing Keynote General Session (CE)

6:00 – 11:00 pm Champagne Celebration - Dinner, Dancing, and Drinks

Thursday, October 17

7:00 – 8:30 am Breakfast

8:00 – 11:30 am State of the Association Address and Keynote (CE)

CONVO is designed for everyone in the agency, regardless of role. Our exclusive education sessions offer custom-built training you won’t find anywhere else, giving you and your team a competitive edge.

Agency Owners/Principals, Producers, Account Executives, CSRs, HR Professionals, Technology Gurus, and Marketing Managers - we mean everyone in the agency!

What exactly can you get out of CONVO 2024? A lot. Starting with up to 12 hours of IL CE credit. We believe investing in yourself as an insurance professional is the best way to ensure career growth and expand your knowledge base. Depending on what you are looking for, either learning more about the industry’s top trends and inssues, or meeting your CE requirements, CONVO education sessions will meet your needs.

General Sessions

Overview and Outlook for the P&C Insurance Industry: Trends, Challenges and Opportunities

Wednesday, October 16 - 8:00 am

Dr. Bob Hartwig will present an overview of the Property and Casualty insurance industry, focusing on trends, challenges, and opportunities in Illinois. The presentation will cover topics such as financial performance, economic outlook, the impact of inflation, and the challenges posed by legal system abuse. This session also features an update from the DOI Director and Big I (National) Chairman-Elect.

Closing Keynote with Ben Zobrist, former Chicago Cub and 2016 World Series MVP

Wednesday, October 16, 4:00 pm

Drawing on his extensive experience in professional sports and life, Ben Zobrist discusses the importance of leadership and teamwork, sharing insights on how to foster a collaborative and supportive team environment and how to persevere in the face of adversity.

State of the Association Address & Keynote

Thursday, October 17, 8:00 am

Learn about trends and challenges facing the independent agency system during the State of the Association Address. Join us for a transformative journey through the rich history and future of the insurance industry. Hear inspiring insights from Pat Taphorn, incoming Big I Illinois President, as he shares the influence keynote speaker, Charlie Lydecker, President & CEO of Foundation Risk Partners, had on him and how it has impacted his leadership. Hear directly from Charlie on why he believes our industry is the greatest in the history of the world, and how we can all work together to build a strong foundation by perpetuating our future through sharing of knowledge, information, and our love of people.

Breakout Sessions

• E&O: Introduction to Homeowners

• Insurance Game of Games

• Hacking the Talent Crisis

• Developing and Retaining Talent

• Ownership Transition Planning

• Maximizing Your Carrier Relationships

• Navigating Challenges in Regulation: Government Interference in Your Agency and Association Resources to Help

• State of the Auto Market (AM Best Perspective)

• Anatomy of a Cyber Attack

• Sales Strategies for Cyber Insurance

A lot. We pack as much as possible into just 48 hours, allowing every attendee to customize their schedule to fit their needs. Networking is the #1 reason people attend CONVO, and there are several opportunities.

Join us for a round of golf complete with food and beverages, friendly competition, and a great opportunity to network with agents in advance of CONVO.

Tuesday, October 15 - 10:00 am Shotgun Start

Weaver Ridge Golf Club, Peoria, IL

See for yourself the Midwest’s Largest industry tradeshow featuring over 120 vendors. Look for markets, VAs, technology and more to benefit your agency.

CONVO offers several opportunities to build your community of knowledgable professionals, make new friends and contacts, and find out what your old friends and peers have been up to!

Welcome Reception - Dutch Dine Arounds

Casino Night - Tradeshow - Champagne Celebration

Why should an agency owner network?

This is a great opportunity for you to meet with friends of the past on the agency, carrier & vendor side. Discuss the challenges you are facing, and make connections to solve those issues.

Why should agency employees network?

The social events are a great way to learn the resources available in the industry, did you know that carrier had that product line available? How about that vendor who can assist with that hard to place piece of business? It is a great way to learn more about the company partners your agency works with, and meet the people on the other end of the phone/email. You will also get to meet with peers and form a network of “your people” to call. The insurance industry is really all about the people, and CONVO is a great place to build those relationships.

Thank you to our Associate Members.

Progressive Surplus Line Association of Illinois

Silver Level

IMT Insurance

Arlington/Roe Blue Cross/Blue Shield of IL Pekin Insurance

Keystone Insurance Group, Inc.

SECURA Insurance

Bronze Level

A. J. Wayne & Associates

AAA, The Auto Club Group

AMERISAFE

AmTrust Insurance

Amwins

Auto-Owners Insurance Co.

Berkley Aspire

Berkley Management Protection

Berkley Small Business Solutions

Berkshire Hathaway GUARD Insurance Companies

Bliss McKnight

BluSky Restoration Contractors, LLC

Boundless Rider

BriteCo Jewelry & Watch Insurance

Central Illinois Mutual Insurance Company

Chubb

Columbia Insurance Group

Cornerstone National Insurance Company

Cowbell Cyber

Donald Gaddis Company, Inc.

Donegal Insurance Group

EMC Insurance

Encova Insurance

Erie Insurance Group

Foremost Choice Property & Casualty

Forreston Mutual Insurance Company

Frankenmuth Insurance

Grinnell Mutual Reinsurance Company

IA Valuations

Illinois Mine Subsidence Ins Fund

Illinois Public Risk Fund

Imperial PFS

Independent Mutual Fire Insurance Company

Indiana Farmers Insurance

Insurance Program Managers Group (IPMG)

J M Wilson

Liberty Mutual/Safeco Insurance

Limit

Madison Mutual Insurance Company

Main Street America Insurance

Maximum Independent Brokerage, LLC

MEM

Mercury Insurance Group

Method Workers Comp

Midwest Insurance Company

Nationwide

NHRMA Mutual Workers’ Compensation

Pinnacle Minds, Inc.

Rhodian Group

Rockford Mutual Ins. Co.

ServiceMaster DSI

Society Insurance

SPRISKA - Specialty Risk of America

Steadily

Summit Insurance

Travelers

UFG Insurance

Universal Property & Casualty

Utica National Insurance Group

W. A. Schickedanz Agency, Inc./Interstate Risk Placement

West Bend Insurance Company

Western National Insurance

Westfield

Arlington/Roe Celebrates 60th Anniversary

Over 200 Arlington/Roe associates from across the country gathered in Indianapolis, IN, to celebrate the company’s 60th anniversary. Since Frances Roe founded the company in 1964, Arlington/Roe has experienced tremendous growth and achieved many significant milestones by following its core values of honesty, integrity, and trust.

The celebration began on Wednesday, August 14, with a casino night, followed by a full day of staff meetings and learning sessions on Thursday, August 15, and the day concluded with a gala at the Children’s Museum of Indianapolis. The celebration wrapped up on Friday, August 16, with breakfast at the Sheraton and an office open house for our associates visiting from outside of Indianapolis.

Arlington/Roe has been a long-time Associate member of Big I Illinois and sponsors and actively participates in educational & networking events throughout the state.

SECURA Insurance earns Platinum Well Workplace Award from Wellness Council of America

SECURA Insurance earned the Platinum Well Workplace Award from The Wellness Council of America (WELCOA). This is SECURA’s fourth time obtaining the Platinum Award, which is the highest award level recognizing the company as one of “America’s Healthiest Companies.”

By achieving the Well Workplace Award, SECURA has made a long-lasting commitment to the health and well-being of its associates.

“We are honored to achieve the Platinum Well Workplace Award from WELCOA once again,” said Sarah Krause, SECURA Vice President–Human Resources. “The health and well-being of our associates are top priorities, and receiving this award is recognition of our commitment to our associates’ health.”

The Wellness Council of America is one of North America’s most trusted voices on the topic of workplace wellness. WELCOA has an impeccable reputation for helping business and health professionals improve employee well-being and create healthier organizational cultures. The Well Workplace Awards initiative is driven by a rigorous set of criteria outlined in WELCOA’s seven benchmarks to a result-oriented Well Workplace.

SECURA Insurance, headquartered in Neenah, Wis., is a regional group of property-casualty insurance companies operating in 13 states.

The annual Best Practices Study (BPS) originated in 1993 as an initiative by the Independent Insurance Agents & Brokers of America (or Big I) to help its members build and maintain the value of their most important assets, their agencies. By studying the leading agencies and brokers in the country, the information provides member agents with meaningful performance benchmarks and business strategies that can be adopted or adapted for use in improving agency performance, thus enhancing agency value. Over 31 years later this work continues in partnership with Reagan Consulting providing important financial and operational benchmarks and the Study is recognized as one of the most thoughtful, effective and valuable resources made available to the industry. Go to independentagent.com for the latest study.

Congratulations to the Illinois member Best Practices Agencies:

The Horton Group

R.W. Troxell & Company

The Plexus Groupe LLC

Dansig, Inc.

Aleckson Insurance Agency

First Mid Insurance Group

Insurance World Agency Inc

By Ashley Gallegos

The insurance industry is on the brink of a significant transformation. With nearly 50% of the current workforce set to retire by 2036, the industry faces the challenge of filling hundreds of thousands of job vacancies. Tom Krug, CEO of J. Krug, is at the forefront of this shift, focusing on nurturing and recruiting top talent from Illinois State University’s Katie School of Insurance and Risk Management.

Recently appointed to the advisory board of the Katie School, Tom joins a group of corporate and professional leaders who meet several times a year to provide development insights and industry guidance. As a proud alumnus of the Katie School, Tom’s passion for coaching and mentoring young insurance professionals is evident. Under his leadership, J. Krug has hired 15 graduates and interns from the Katie School over the past few years.

Tom’s commitment to preparing future industry leaders is exemplified through J. Krug’s internship program. Offering paid internships to juniors and seniors, the program provides interns with hands-on experience in day-to-day agency operations and exposure to both the carrier and broker sides of the Property and Casualty industry. Interns rotate within the organization, assisting Account Managers and the Sales team, gaining a broader understanding of the Independent Agency channel. Additionally, they participate in formal training and mentorship with the leadership team.

When asked about the obstacles he faced when he first started in the industry, Tom said, “Like any typical young producer, getting over the age factor took some time, and at times it felt like things would never improve. After a few wins, much learning, and some increased confidence, the tides started to turn. Even to this day, the peaks and valleys of our business can be challenging at times, but remembering those successes really helps the confidence when it might be lacking.”

Tom is also excited about the specific initiatives and changes he aims to implement at the Katie School. “One key focus is integrating more technology-driven courses, such as InsurTech and data analytics, to ensure our students are well-versed in the latest industry innovations. Additionally, we’re placing a strong emphasis on experiential learning. Beyond traditional internships, we’re developing simulation-based learning experiences where students can tackle real-world challenges in a controlled environment. This hands-on approach will give them the practical skills and confidence they need to hit the ground running after graduation.”

As an active board member, Tom will contribute to the school’s curriculum and provide guidance on navigating the ever-changing job market. His goal is to raise awareness about the urgent need to attract more young talent to the insurance industry. Tom Krug and his leadership team are dedicated to recruiting and cultivating the next generation of insurance professionals over the next decade.

Ashley Gallegos is the Director of Marketing for J. Krug and can be reached at agallegos@jkrug.com.

Board service is one of the toughest volunteer roles and these outgoing board members performed their responsibilities with dedication and tenacity. They have tirelessly given their time and resources to help make the association what it is today.

The Big I Illinois staff appreciates their contributions and wishes them nothing but the best in their future endeavors.

Renee Crissie

Young Agents Committee Chair

Acrisure Midwest Rosemeont, IL

Renee has completed her four-year term as Chair of the Big I Illinois Young Agents Committee. During her tenure, the committee experienced a generational shift as many valued members reached the age limit, and a vibrant group of young individuals joined. We appreciate Renee’s service to the Board of Directors and the Young Agents Committee.

At-Large Board Member

Alliant Insurance Services, Inc Chicago, IL

Patrick Muldowney joined the Board of Directors as an At-Large Director in 2013 and served in that role until 2016 when he joined the Executive Committee (EC). Patrick advanced through the chairs of the EC, culminating in his service as Chairman of the Board in 2020. Upon completion of his role on the EC, he served four one-year terms in an At-Large position.

July 23 - Wheaton, IL

Big I Illinois staff participated in the Big I Dupage Golf outing, sponsoring a hole and visiting with golfers. It’s always a great outing!

July 31 - Oak Brook, IL

The Big I Illinois Technology Committee and Chicagoland group joined forces on July 31 in Oak Brook for the 2024 Tech Event: Anatomy of a Cyber Attack. Special thanks to our presenters and sponsors: CRDN of Chicago, RLS Consulting, Rhodian, Echelon, Arlington/Roe, and Agents Insurance Services (AIS).

For those that missed the event, check out the sessions at CONVO presented by Ryan Smith of RLS Consulting.

August 2 - Chicago, IL

The Big I Illinois Chicagoland group hosted an afternoon at Wrigley Field on August 2. Thanks to our sponsors: Summit, West Bend, and Arlington/Roe!

24. Come join our team! Madison Mutual has an opening for a licensed professional insurance agent in our Midwest Preferred Insurance Services office located in Collinsville, IL. The individual must currently hold an insurance producer’s license and have 3+ years of insurance agency experience. Visit the MMIC website Careers page for additional information: madisonmutual.com/careers. Also, explore our social media pages to see for yourself why MMIC is a great place to work!

Send your salary requirements and resume to: careers@madisonmutual.com

23. Are you looking for an exit strategy while still continuing to produce for a few years or are you ready to sell now? Paczolt Insurance would like to talk with you! We are an independent agency dating back to the 1970s that is located in the western suburbs. Our focus is on mid-to-small commercial accounts and personal lines. Our companies include EMC, Badger Mutual, Safeco, Progressive, and Travelers. We have the flexibility and capital to get a deal done. Contact:

Susan Troppito

Paczolt Insurance

susan@piaigroup.com (708) 215-5202

13. We are a 100 year old Northbrook agency looking to discuss any mutually beneficial opportunity. Our producers, mergers, clusters and agency purchases receive 50% commissions on new and renewal business without any expenses. We can provide: office space, phones, agency management system, service renewals and changes. The companies we represent are: Badger Mutual, Employers Mutual, General Casualty, Guide One, Hartford, Kemper, Progressive, Rockford Mutual, Safeco, State Auto, Travelers and Met Life. Contact:

Nancy Solomon Martini, Miller & Schloss, Inc. (847) 291-1313 Ron@martini-miller.com

20. Since 2004, Central Illinois Agents Group LLC has been providing independent agents with a variety of markets with contingency opportunities. Agents have availability to several markets that they may not be able to sustain or maintain on their own. We have markets for personal, commercial, agricultural and crop insurance lines. Let us help you get to the next level.

Visit www.ciagonline.com for contact information.

02. Forest Park/Oak Park agency for over 60 years, will meet your needs by providing space, markets, marketing & sales support, automation, merging with or purchasing your agency. Perpetuation/ Succession Plans, Buy-Sell Agreements also available. We have experienced, educated and dedicated staff for you and your clients. Have access to our numerous companies, office services and many other resources. Retain ownership in your book with contingency. Please look closely at us- we are an agency you want to do business with! We’ve done it before, we know how- we make it easy! Visit our website at forestagency.com/agents.html, or call for a confidential discussion and a list of Agency benefits.

Dan Browne will provide an agency evaluation/appraisal at little cost to you. Please call:

Dan Browne or Cathy Hall Forest Insurance (708) 383-9000 www.forestinsured.com/mergers-acquisitions