NO ONE KNOWS OKLAHOMA BUSINESSES QUITE LIKE OKLAHOMANS DO.

That’s why our communities have trusted CompSource Mutual for 85+ years. We’re proud to be a premier workers’ compensation carrier o ering your customers the best: top-rated financial strength and first-rate service. CompSource Mutual is rated A (Excellent) by AM Best.

EDITORIAL STAFF

Publisher Denise Johnson, CISR, CIC

Managing Editor Jerri Culpepper

Graphic Designer

Denise Canon

PROFESSIONAL

President/Chief Executive Officer

Denise Johnson, CISR, CIC

Chief of Staff and Operations

Josh Reasnor, MSSL, CISR, CKC

Senior Vice President of Strategic Initiatives

Sara Bradshaw Ray, CIC, CKC

Workers’ Compensation Account Manager

Jeanette Madrid

Director of Member Services

Shania Slavick

Director of Marketing and Communications

Jerry Rappe’

Specialty Lines Service Account Manager

Cindy Munden, CISR

Director of Professional Liability

Cari Senefsky

Education Coordinator Katie Jones

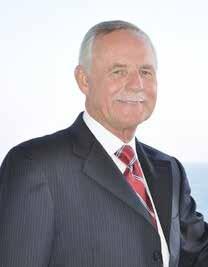

Vicky Courtney, Chairman

Denise Johnson, CISR, CIC

Chris Floyd, CIC, CRM

Sara Bradshaw Ray, CIC, CKC

Meet Your New Leadership: Celebrating 50 Years in the Business

It’s fitting to have the honor of being installed as BIGiOK chair in 2024, my 50th year in the insurance business.

The week after high school graduation, I started with Hanover as a transcriptionist for a summer job. However, this typist role quickly morphed to a desk adjustor position, which transitioned to working in product liability claims. I was fascinated with the industry and decided to attend night school while keeping my insurance day job.

After serving three years as a CSR/ account manager to seven producers at direct writer Wausau Insurance, I was promoted to producer. At the time, it was not a position held by many women. Fortunately, my late husband, Tom Courtney, was an incredible mentor, encouraging me to continue the coldcall battle and negotiate competitive bids with underwriters. It was with his guidance – and some grit – that I was awarded the annual sales reward trip in my first year producing.

Even though I have been a licensed agent since 1981, it was not until 2013 that I attended my first Independent Insurance Agents of Greater Tulsa meeting. A dear friend, Moe Hogan, invited me to the luncheon, and it was at this meeting that he also introduced me as the newest board member! It was more than a wonderful surprise; it was exactly the push I needed to become better connected with my fellow agents.

From 2016 to 2022, I served as president of IIAGT. While I still play an active role with the Tulsa chapter, I’m very grateful to have this opportunity to

serve on the BIGi Board. When Jeff Burton, with Insurica, originally called to discuss the position, I was stunned and honored. I took a couple of days to consider the commitment and what I could bring to the table.

Reflecting upon these last 50 years in the business, it’s exactly this experience that I believe will be the best contribution. The industry faces multiple challenges –particularly with its dwindling dedication to in-person customer service, hyperfocus on technology and inability to retain new agents. I have dug my heels into almost every role you can think of in this profession – from typist to producer (not to forget, 11 years of agency ownership). And with all this, I can confidently say the BIGi is perfectly and uniquely positioned to provide the tools necessary for success. One of the largest assets of BIGiOK is its ability to plug-in on a local level. The agency associations in Tulsa and Oklahoma City have a direct connection to the northeastern and central markets of Oklahoma. Both areas face different challenges and offer different resources. It’s my desire to strengthen the communication between BIGi and these local chapters so we can better address specific needs and grow as a unit. Additionally, enough cannot be said of the significance of our Young Agents, which targets agents with five years or fewer experience. There is so much to learn within those first years – being plugged into a group whose primary function is to educate, connect and encourage the skills and knowledge for success is a must. For us veterans, it’s

continued on page 27

Vicky Courtney Chairman

OSLA was established in 1976 to unite MGAs and Wholesalers in addressing legislative issues concerning the excess & surplus lines marketplace

Excess & Surplus lines are a specialty market that insures things standard carriers won't cover E&S companies react quickly to market changes and play a crucial role in the insurance marketplace:

Coverage for Unique or Unusual Risks

Flexibility and Customization

Market Stability

Innovation and Competition

Over 200 companies are providing surplus lines products in Oklahoma The Oklahoma Surplus Lines Association exists as a way for them to exchange ideas and to support the IIAO regarding legislation relevant to E&S operations I

Capacity for Catastrophic Events

Support for Niche Markets

OSLA Membership is open to licensed surplus lines brokers in the state of OK and Associate membership is available to any person, firm, or company doing business with eligible members. Contact OSLA President, LeAnn Sanderson for an application at lsanderson@youroga.com.

Workers’ Compensation

We distinguish our Workers’ Compensation coverage by providing value-added services before, during, and after a claim.

Upfront loss control measures

Responsive claims handling

Facilitation of quality medical care (when an accident does occur)

We’ve been successfully protecting our policyholders and their employees since 1983.

Our Workers’ Compensation policy is available nationwide except in monopolistic states: ND, OH, WA, and WY.

Denise Johnson, CISR, CIC BIGiOK President/Chief Executive Officer

It’s

Fall at the Association … That’s Code

for Here We Go!

It’s fall at the Association, which is code for here we go!

Although we had a busy summer, we have some exciting things going on now.

First, our Education calendar gets ramped up and classes are back on track. Over the summer, we updated our Conference Center with updated audio/ visual equipment … welcome to 2024!

Second, it’s time for our Young Agent Conference at Grand Lake. We already had great responses and expect it to be a full house. We are joining with Kansas and taking the time to interact with their Young Agent group. The speakers are fantastic and the time spent networking is priceless! As an association, this is one of the many ways we invest in our future!

our Consulting Department, focused on assisting our member agencies to be better! You can take advantage of many of the services offered, including 1) Kolbe Assessments, 2) MyNetwork, 3) targeted workshops and 4) the AgencyWise Webcast, which highlights many aspects of our industry.

Fifth, Catalyit is a member benefit allowing all of our members to access “insurance tech” and compare what they have to offer. You can save yourself time by using this important member benefit! Sixth (and last but not least), did you notice the cover of the magazine? Please join me in welcoming our new chair, Vicky Courtney. This is a milestone in our Association – Vicky is only the

This is a milestone in our Association – Vicky is only the second female chairman since 1907.

Third, we just returned from the IIABA Leadership Conference. There are many wonderful things happening on a national level, and it’s an exciting time to be a part of it. One of the many member benefits as a member of BIGiOK is that you are also a member of IIABA, which gives you so many additional benefits. Be sure to watch out for their emails to see all of the advantages of being a Big “I” member!

Fourth, we start our 10th season of MyNetwork – our own insurance version of a Mastermind program. We can now boast of many “tables” across the United States. This is the brainchild of our own Sara Bradshaw Ray, who is in charge of

second female chairman since 1907. This is her 50th year (yes, you read that correctly) in the industry. She has served as an agency owner, producer, Tulsa Association president, and now our state chair. I’m looking forward to working with her this year and continue with the success of BIGiOK!

There are so many things we have to offer our members at BIGiOK… be sure to check out our website to see what you need.

I’m always available should you have any questions or comments – we love to hear from you! Email me at denise.johnson@bigiok.com.

From Happy Hours to Advocacy Work, Young Agents Get Involved

Greetings from southern Oklahoma! As I write this, it is closing in on 100 degrees outside! I hope everyone is staying cool and enjoying their summer. My name is Jase Riggs and I am the agency owner of Riggs & Associates Group in Ardmore. The agency just celebrated its fifth year in business this June, and we have continued to build an amazing team to serve our clients.

My beautiful wife, Brandie, and I will celebrate 15 years of marriage this September. We are blessed with three amazing daughters: Sophia, Nora and Emma. We have had a busy summer, as I am sure you all have as well!

I am passionate about promoting the insurance industry and the great people that make it so amazing.

It is my great honor and privilege to serve as the Young Agent Committee chair for the next 12 months. I am fortunate to have served the last few years on this committee with great agents and company representatives from across the state of Oklahoma. Their love for this industry is inspiring to me. There are too many to thank for their dedication to and passion for the insurance industry. I am grateful for the opportunity and excited to continue serving the young agents of Oklahoma as your chair.

FUTURE INSURANCE LEADERS OF OKLAHOMA (FILO)

I have friends, family and clients ask me all the time, “How do you like owning

your own agency?” My answer is always the same, “It was the best decision I ever made!”

I feel equally as passionate about getting involved with Big I Oklahoma. I can honestly say that getting involved with the Association has made a huge difference for my insurance career. I was introduced to young agents while going through the Future Insurance Leaders of Oklahoma program.

This program is one of my favorite things we oversee as a committee, and the excitement and momentum has continued to build year over year. With modules on Sales & Marketing, Legislative, Underwriting, and others, there is something for everyone. There is something about walking alongside fellow insurance professionals to grow and push each other that makes FILO truly special. I would encourage anyone interested in getting more involved to reach out to me or a committee member for more information.

The Young Agent Committee recently completed a two-day strategic planning retreat where we discussed how best to add value to the young agents across the state. I am excited about our line-up of events throughout the next 12 months, including lunch and learns, happy hours and community service opportunities, as well as our annual Young Agents Conference. Check out the calendar at BIGiOK.com and look for email communications with upcoming events!

Jase Riggs Young Agents Committee Chairman

From the Young Agents Committee

TRAILBLAZING EXCELLENCE CONFERENCE

In my time being involved with the Big I Oklahoma, I have come to appreciate the value of building relationships with peers in the industry. In this spirit of collaboration, we are proud to offer, for the first time, a combined young agents conference! We will be hosting, along with the young agents of Kansas, the conference at Shangri-La Resort in Afton, Oklahoma.

The “Trailblazing Excellence” conference will boast 2 ½ days of engaging sessions, networking, friendly state-to-state competition, and fun activities for all! Shangri-La has a 27-hole, championshipquality golf course, along with a worldclass 18-hole par 3 course. The resort is set on Grand Lake and offers boat and jet ski rentals, guided fishing and parasailing. Shangri-La also has indoor and outdoor pickleball courts, a golf simulator and an indoor shooting range.

In addition to the fun activities, we have a great line up of speakers for our main sessions as well as breakout sessions, including our keynote speaker, Scott Howell of the Insurance Guys Podcast! Additional speakers include our own Ashley Napier of the YAC, Quentin Harris of AM Best, Paul Houska of Holborn Corp. and Protégé winner Derek Hayden!

Whether you are an agency owner, producer or CSR, this conference is sure to offer great tools that you can implement to further your insurance career. Topics will include the hard market, reinsurance, sales, marketing, retention, and personal lines insurance as well as commercial lines insurance. There is truly something for everyone!

The conference will take place Sept. 25-27. Rooms will fill very quickly, so be sure and register as soon as possible to get your spot! Additionally, we are working with our carrier partners to offer scholarships to those who may

not be able to afford the registration, hotel, etc. Please reach out to me directly at (580) 504-1962, and I would be happy to assist in getting you to Shangri-La!

BIGIOK.COM & CATALYT

Lastly, I want to encourage you to check out the BIGiOK.com/YA website. Shout-out to the Big I Oklahoma staff for working hard to bring this great product to our members! As a member of the Big I Oklahoma, there are numerous resources available to you.

I want to highlight one that recently has caught my interest. Catalyt allows you to assess your current technology position for your agency and where you are strong or where you may need improvement. I know that when I started my agency, I spent hundreds of hours researching technological solutions and trying to figure out what works and what doesn’t! The trial-and-error days are a thing of the past with Catalyt.

continued on page 27

We have been committed to providing specialty commercial insurance for the energy industry for more than 75 years. Our expertise and relationship-driven approach has allowed us to offer solutions which address your unique needs, despite economic instability.

From the State National Director

Technology Overload for Independent Insurance Agents

With some of the biggest technological advancements in history comes the biggest challenges in history for the independent agency owner.

These operational challenges include:

Integration of Systems:

• Challenge: Many agents use multiple systems for quoting, customer relationship management (CRM), policy management and claims processing. Integrating these disparate systems can be complex and costly.

• Impact: Inefficiencies and data silos can lead to errors, redundant work and poor customer service.

Cybersecurity:

• Challenge: With sensitive customer information at stake, protecting against cyber threats is crucial. Independent agents may lack the resources and expertise to implement robust cybersecurity measures.

• Impact: Data breaches can result in severe financial and reputational damage.

Keeping Up with Technology Trends:

• Challenge: Rapid advancements in technology, such as artificial intelligence (AI), machine learning and blockchain, require ongoing education and adaptation.

• Impact: Falling behind can make agents less competitive and reduce their ability to offer innovative solutions to clients.

Digital Customer Experience:

• Challenge: Customers increasingly expect seamless digital experiences, including online quotes, policy management and claims processing.

• Impact: Failure to meet these expectations can result in lost business to more tech-savvy competitors.

Cost of Technology Adoption:

• Challenge: Investing in new

technology can be expensive, and independent agents may struggle with the upfront costs and ongoing maintenance.

• Impact: Budget constraints can limit access to the latest tools and platforms.

Data Management and Analytics:

• Challenge: Effectively managing and leveraging data for better decisionmaking and customer insights is a complex task.

• Impact: Poor data management can hinder marketing efforts, risk assessment and customer service.

Regulatory Compliance:

• Challenge: Navigating the evolving landscape of regulatory requirements related to technology use, data privacy and cybersecurity can be daunting.

• Impact: Non-compliance can lead to legal issues and fines.

Training and Support:

• Challenge: Ensuring that all staff are adequately trained to use new technology and have access to ongoing support can be challenging.

• Impact: Insufficient training can lead to underutilization of technology and decreased productivity.

Mobile Accessibility:

• Challenge: Providing mobilefriendly platforms and applications for both agents and customers is increasingly important.

• Impact: Lack of mobile accessibility can reduce efficiency and customer satisfaction.

Vendor Management:

• Challenge: Selecting and managing technology vendors, ensuring they meet the agency's needs, and negotiating favorable terms can be difficult.

• Impact: Poor vendor relationships can lead to suboptimal technology solutions and higher costs.

Addressing these challenges requires

Chris Floyd, CIC, CRM State National Director

a strategic approach, investment in the right technologies, and ongoing education and support for agents and their staff.

As daunting as this may seem, you don’t have to do it alone. The Big “I” can help with all of these challenges and help make your agency run smoother and allow you to be more successful while spending time where you need to focus such as on your customers and clients.

The Independent Insurance Agents & Brokers of America (Big "I") offers various technology resources to its members aimed at helping them stay competitive, efficient and secure. Here are some of the key technology resources available:

ACT (Agents Council for Technology):

• Description: ACT provides members with insights, tools, and resources to help them leverage technology effectively. This includes webinars, best practices, guides, and industry trends.

• Key Offerings:

Webinars and educational sessions on emerging technologies and best practices.

∙ Resources on cybersecurity, digital marketing and agency management systems.

Guides on technology implementation and optimization.

Technology Solutions:

• Description: The Big "I" partners with various technology vendors to offer members discounted access to a range of tools and services.

• Key Offerings:

• Discounts on agency management systems, CRM tools and digital marketing platforms.

∙ Access to technology solutions that streamline operations, improve customer engagement and enhance data security.

Virtual University:

• Description: An educational platform that offers courses, articles and webinars on various aspects of insurance, including technology.

• Key Offerings:

∙ Courses on how to use technology to improve agency operations and customer service.

Articles and resources on

From the State National Director

technology trends and best practices.

Cyber Liability Resources:

• Description: Resources to help members understand and manage cyber risks.

• Key Offerings:

∙ Information on cyber liability insurance policies.

∙ Best practices for cybersecurity and data protection.

Tools and checklists to help agencies assess their cyber risk and implement protective measures.

Digital Marketing Resources:

• Description: Tools and resources to help agencies improve their online presence and marketing efforts.

• Key Offerings:

∙ Guides on search engine optimization (SEO), social media marketing and email marketing.

Access to digital marketing platforms and services at discounted rates.

∙ Tips and strategies for leveraging digital marketing to attract and retain clients.

Networking and Peer Support:

• Description: Opportunities for members to connect with peers and

industry experts to share knowledge and experiences.

• Key Offerings:

∙ Access to forums, discussion groups and events focused on technology. Opportunities to learn from other independent agents who have successfully implemented technology solutions.

Other Industry Resources: Catalyit

• Description: An independent agent Technology resource firm developed for and by independent insurance industry experts.

• Key Offerings:

∙ All Technology Resources in one place.

These resources are designed to help Big “I” members navigate the complexities of technology in the insurance industry, enhance their operational efficiency and provide better service to their clients.

The Choice is yours: Continue to be frustrated climbing the technological mountain on your own; sell your agency to the next private equity firm (Or) utilize the exclusive Big “I” technology resources and connect with industry experts like Catalyit so you can get back to doing what you do best. Serving your clients.

OKPac is BIGiOK’s state political action committee. It provides financial support for state elected officials who will provide support for or have shown support of issues affecting the insurance industry and to those who share our business philosophies. Only individuals or partnerships can make contributions to OKPac. Under Oklahoma law, OKPac can accept no contributions from corporations.

2024 Contributors

Stewart Berrong

Kent Bradford

Travis Brown

Deborah Burton

Michael Cole

Jerrad Coots

Vicky Courtney

Jennifer Dotter

Scott Dull

Chris Floyd

Patricia Gillespie

Vaughn Graham Sr.

Vaughn Graham Jr.

Guy Griggs

John Casey Harper

C. Ross Harris

Denise Johnson

Krista Kautz

Pat Mandeville

Michael T. McCullough

Avery Moore

Brad Owens

Thomas Perrault

Rob Piearcy

Sara Bradshaw Ray

Kathy Reeser

Arthur Rickets

Michael Ross

Scott Selman

Trent Willis

InsurPac is BIGiOK’s national political action committee. It pools the voluntary and individual financial contributions of thousands of independent insurance agents to help elect candidates to Congress who share BIGiOK’s business philosophies. InsurPac is the largest property-casualty insurance industry PAC in the country.

2024 Contributors

Stewart Berrong

Travis Brown

Debbie Burton

Michael Cole

Jenny Dotter

Jay Eshelman

Vaughn Graham Sr.

Vaughn Graham Jr.

Austin Greenhaw

Rich Haverfield

John Hester

Tony Holmes

Clayton Howell

Denise Johnson

Krista Kautz

Mark Long

Patrick Mandeville

Michael McCullough

Avery Moore

Stephen Poleman

T.J. Riley

Michael Ross

Ryan Teubner Is your name not on the list? Make contributions today

See more information and quantifiable examples of contributions by going to: OKPac - BIGiOK.com/OKPac InsurPac - BIGiOK.com/InsurPac

Contributions as of 7/19/2024. Only gifts of $100 or more are listed, except for Young Agents, whose contributions of any amount are listed.

BIGiOK LEADERSHIP

Chairman

Vicky Courtney Ricketts Fennell & Assoc.

Tulsa

Chairman Elect

Kathy Reeser VIP Insurance Edmond

Treasurer

Scott Dull Omega Insurance Agency Choctaw

Secretary Guy Griggs INSURICA

Tulsa

Director at Large

Rob Piearcy Arnett Insurance Agency

Durant

State Director

Chris S. Floyd, CRM, CIC

Brown & Brown Insurance

Pryor

Director at Large

Trent Willis

Cornerstone Insurance Group

Oklahoma City

Immediate Past Chairman

Vaughn Graham Jr., CIC

Rich & Cartmill Inc. Oklahoma City

Director at Large

Helen Kasper

Dillingham Insurance Oklahoma City

Company Liaison

Traci Madole

Liberty Mutual

Oklahoma City

MGA Liaison

Rebecca Easton CompRisk Management Inc.

Oklahoma City

BIGiOK MISSION STATEMENT

YAC Chairman Jase Riggs Riggs & Associates Ardmore

As the new voice of the independent agents of Oklahoma, BIGiOK promotes and provides education, legislative advocacy, innovative concepts and practical solutions, and community and career opportunities.

ABOUT BIGiOK

BIGiOK is the largest insurance trade association in Oklahoma. With more than 475 independent insurance agencies, we represent nearly 3,000 independent insurance agents and their employees and more than 100 company members. BIGiOK member agencies range in size from one person to some of the largest agencies in the region.

Founded in 1906 as the Oklahoma Association of Local Fire Insurance Agents, BIGiOK is a result of the consolidation of the Independent Insurance Agents of Oklahoma, Inc. (IIAO) and the Oklahoma Association of Professional Insurance Agents (OAPIA) on Jan. 1, 1992.

BIGiOK policy is set by a board of directors elected at the annual conference. Policy is implemented by a professional

staff located in Oklahoma City. BIGiOK’s mission is carried out through a variety of programs designed to enhance the business of independent insurance agencies.

BIGiOK is an active advocate on behalf of independent agents before legislative, regulatory and judicial groups in Oklahoma and at the federal level.

BIGiOK is affiliated at the national level with the Independent Insurance Agents and Brokers of America with offices in Alexandria, Virginia, and Washington, D.C.

BIGiOK is an excellent source of information through POLICY magazine, published quarterly, and the Oklahoma Agent, a monthly newsletter of time-sensitive material for its members.

From Strategic Initiatives

Uniting for Impact: How Virtual Agency Solutions Is Transforming Consulting

As the senior vice president of strategic initiatives at BIGiOK, I have the unique privilege of leading a consulting practice that stands out in the insurance industry. What makes our role particularly special is that Oklahoma is one of only five states nationwide with in-house consulting expertise dedicated to serving independent insurance agents. This distinction underscores our commitment to elevating the standards of excellence and leadership within our community.

In a groundbreaking effort to extend our reach and impact, we have joined forces with our counterparts in these select states to form Virtual Agency Solutions. This innovative collaboration is designed to bring our top-tier consulting services to Big I members across the country, particularly those in states that do not have access to such specialized expertise.

Through Virtual Agency Solutions, we are not just making our premier services available, but we are equipping our members with the tools they need to thrive in a competitive marketplace, including Strategic Planning, Kolbe Strengths Coaching and Training, Executive Coaching, Operational Improvement, Website Reviews and Agency Technology Consulting.

In this article, I am excited to share more about the unique offerings, our BIGiOK pivotal role in Virtual Agency Solutions, and how these

services can empower insurance agencies to achieve their full potential. [virtualgencysolutions.com]

The Formation of Virtual Agency Solutions

The creation of Virtual Agency Solutions represents the epitome of collaboration and mutual support within our industry. Recognizing the unique strengths and expertise housed within our five states — Oklahoma, Texas, Wisconsin, North Carolina, and New York — we saw an opportunity to combine our resources and knowledge to create something truly exceptional.

Virtual Agency Solutions was born out of a shared vision: to elevate the standards of the insurance industry by providing unparalleled consulting services to Big I members across the nation. This initiative is not just about extending our reach; it’s about fostering a culture of continuous improvement and collective growth.

Each state brings its own set of specialized skills and insights to the table. For instance, our BiGOK Consulting strengths lie in Strategic Planning, Kolbe Strengths Coaching and Executive Coaching, while our state partners contribute their expertise in Operational Improvement and Website Reviews. By uniting these diverse areas of proficiency, we have created a comprehensive suite of services that

Sara Bradshaw Ray, CIC, CKC BIGiOK

Senior Vice President of Strategic Initiatives

address the multifaceted needs of insurance agencies.

This collaborative approach ensures that every BIGiOK member now has access to the highest caliber of consulting expertise regardless of geographical location. Virtual Agency Solutions is more than a service provider; it is a testament to the power of working together to achieve a common goal. We are committed to lifting each other up and, in turn, lifting the entire industry to new heights.

Key Resources available through Virtual Agency Solutions

Virtual Agency Solutions offers a comprehensive suite of consulting

From Strategic Initiatives

services designed to address the diverse needs of insurance agencies. Here’s a closer look at each of the six key areas:

1. Strategic Planning

Strategic planning is essential for any organization aiming to thrive in a competitive market. Our strategic planning services help agencies define their vision, set achievable goals and create actionable plans to reach those objectives. By leveraging our extensive experience, we guide agencies through a structured process that includes market analysis, SWOT assessments and roadmap development. The result is a clear and cohesive strategy that aligns with the agency’s long-term vision and operational capabilities.

2. Kolbe Strengths Coaching and Training

Understanding and harnessing the innate strengths of your team can significantly enhance productivity and job satisfaction. Kolbe Strengths Coaching and Training focuses on

identifying individual and team strengths using the Kolbe Index. This insight allows leaders to align tasks and roles with the natural abilities of their team members, fostering a more efficient and harmonious work environment. Our coaching sessions provide practical strategies for leveraging these strengths to improve collaboration, decisionmaking and overall performance.

3. Executive Coaching

Effective leadership is the cornerstone of any successful organization. Our Executive Coaching services are designed to support leaders in refining their skills, enhancing their strategic thinking and overcoming personal and professional challenges. Through personalized coaching sessions, we help executives develop greater selfawareness, improve their communication skills and cultivate a leadership style that inspires and motivates their teams. Our goal is to empower leaders to drive their organizations forward with confidence and clarity.

From Strategic Initiatives

4. Operational Improvement

Operational efficiency is critical for sustaining growth and profitability. Our Operational Improvement services focus on identifying and eliminating inefficiencies within an agency’s processes and workflows. We conduct thorough assessments to uncover areas for improvement, recommend best practices and implement solutions that streamline operations. For SwissRe E&O policyholders, this service also offers risk management credits, providing an additional incentive to enhance operational performance and mitigate potential errors and omissions exposures.

5. Website Reviews

In today’s digital age, an effective online presence is crucial for attracting and retaining clients. Our Website Review service evaluates an agency’s website from a user experience and compliance perspective. We identify potential issues that could lead to errors and omissions exposures and provide actionable recommendations to enhance the site’s functionality, accessibility and overall user experience. Like our Operational Improvement service, Website Reviews are eligible for SwissRe E&O risk management credits, making them a valuable tool for safeguarding against potential liabilities.

6. Agency Technology Consulting

Staying ahead of technological advancements is vital for maintaining a competitive edge in the insurance industry. Our Agency Technology Consulting services, provided by Catalyit, the result of another IA collaboration, helps agencies assess their current technology infrastructure, identify gaps and implement cutting-edge solutions to enhance efficiency and service delivery. From cybersecurity measures to software integration and digital transformation strategies, we provide comprehensive support to ensure agencies leverage technology effectively to meet their business goals.

We invite all BIGiOK members to take advantage of the unique opportunities available through Virtual Agency Solutions [virtualagencysolutions.com]. Whether you are looking to refine your strategic vision, optimize your operations

or harness the power of technology, our team of experienced consultants is here to support you every step of the way.

Remember that with BIGiOK Consulting by your side, the path to becoming an exemplary leader in the insurance industry is clear. The journey toward excellence starts with a single step; the choice is yours. Your commitment to growth today can prepare you for the success of your agency tomorrow.

For more information on any of these programs and just to talk about where your organization could be growing, use the QR code to add me to your smartphone and grab a spot on my calendar for a visit. I look forward to connecting with you.

Don’t forget that other professional growth and development opportunities are also available through BIGiOK Consulting. 1:1 coaching, female leaders of all ages and stages are welcome to join the wait list for a seat at the MyNetwork table for Season 10"The WHOLE Leader" or enroll your managers or up-and-coming leaders in The Manager’s Bootcamp coming in January ‘25. Wherever your needs are, take that step with us, and together, let's shape the future of leadership in the insurance world.

Links:

Virtual Agency Solutions: virtualagencysolutions.com/ MyNetwork Info: mynetworkins.com/

MyNetwork Wait List: app.smartsheet.com/b/ form/4aa7148701ba4eeab09167ca92d7c657

SBR General Scheduling Page: connectwithsara. as.me/

The Manager's Bootcamp

The Manager’s Bootcamp is a seven-session virtual training series encompassing key leadership aspects of workplace management in the insurance industry. Each weekly three-hour session is designed to help supervisors develop a set of foundational skills that will make them more effective leaders in a supervisory role. Topics will include thinking styles, motivation, change, feedback, communication, coaching, handling conflict and teamwork.

This series is focused on new supervisors and managers, as well as leaders who have been in management for quite some time but can benefit from a fresh perspective on their leadership. The curriculum includes lecture- and participant-centered activities. In addition to the actual class time, participants are also responsible for weekly homework and reading assignments required to utilize the principles discussed in each class.

Below are the topics that are covered over the seven weeks:

Essentials of Modern Supervisory Practices:

• Characteristics and traits of an effective supervisor

• How managing has evolved

• Rethinking management

• The 4 Questions every leader must answer for employees

• The management team hierarchy

Maximizing Managerial Effectiveness through SelfAwareness:

• The world according to me (thinking style)

• As I think, so I behave

• Leadership and management style

Enhancing Agency Performance Through Effective Team Management:

• Personal energy

• Pattern learning

• Beliefs and values

• The law of clarity

• Motivators and de-motivators

• Employee engagement

• The dynamics of change

Enhancing Team Performance with Effective Communication and Feedback Strategies:

• Feedback definition

• Feedback process

• Communication/feedback model

• Listening to understand

• Assertiveness

• Manager as coach

• Worker maturity cycle

• Competency/willingness model

Building Trust to Enhance Agency Effectiveness:

• Definition of trust

• The economics of trust

• Self-trust

• Relationship trust

• 13 behaviors of high-trust leaders

• Extending trust

Effective Conflict Management for Insurance Professionals:

• The world, according to ME

• When emotions take charge

• Responding to conflict situations

• Conflict resolution strategies

• Naming the conflict behavior Mastering Team Dynamics for Insurance Professionals:

• What makes a team?

• Stages of team development

• What team leaders do

• Team dynamics

• Sustained growth through mentorship

• Accountability for lasting impact Each course participant receives a 250+ page guide that includes personal assessments, application activities, and on-the-job assignments to help them connect the information with their workplace experience.

Base BIGi Member Program Fee: $850 Non-BIGi Member Program Fee: $1065 (3- and 5-session private coaching bundles are also available upon request for an additional fee.)

7-week weekly schedule to begin Jan. 21, 2025 – 1:00 PM CT Licensed participants in approved states will be eligible to receive up to 21 hours of general CE credit with full attendance validation.

Powered by:

Education at BIGiOK

AUGUST

Aug. 8 - AgencyWise Reminder Notification: Sales Evolution: Crafting Your Unique Narrative for Ultimate Success

Aug. 13 - KOLBE Strengths Workshop

Aug. 16 - Episode 6: Free Friday Ethics Webinar

Aug. 20 - CISR Other Personal Lines Solutions

Aug. 21 - CIC Personal Lines

SEPTEMBER

Sept. 12 - AgencyWise Reminder Notification: Agency Planning Doesn't Have to Be That Hard!

Sept. 17 - CISR Elements of Risk Management Webinar

Sept. 18 - CIC Agency Management

Sept. 20 - Episode 6: Free Friday Ethics Webinar

OCTOBER

Oct. 9 - James K. Ruble Graduate Seminar

Oct. 10 - AgencyWise Reminder Notification: Hiring Top Performers in a Candidate-Driven Market

Oct. 18 - Episode 6: Free Friday Ethics Webinar

NOVEMBER

Nov. 12 - CISR Commercial Casualty 2

Nov. 13 - CIC Commercial Property

Nov. 14 - AgencyWise Reminder Notification: What We Can Learn from Looking at our Operations

Nov. 15 - Episode 6: Free Friday Ethics Webinar

DECEMBER

Dec. 4 - CISR Insuring Commercial Property Webinar

Dec. 12 - AgencyWise Reminder Notification: Agency Funding Ideas Beyond the Norm

Dec. 20 - Episode 6: Free Friday Ethics Webinar

You are...

Promote the value you bring to your local community.

Access our new campaign that puts your unique value in the forefront.

Provide your current and prospective clients with a snapshot of the added benefits of working with a Trusted Choice® Independent Insurance agency.

Customize these materials today!

cobrand.iiaba.net/made-for-you/i-am

Strengthen Oklahoma Homes Program: What You Need to Know

In May, Gov. Kevin Stitt signed House Bill 3089, the Strengthen Oklahoma Homes Act, into law and kick-started the Oklahoma Insurance Department into organizing the program to help Oklahomans fortify their homes and reduce homeowners’ insurance rates. The Strengthen Oklahoma Homes Program is set to begin early next year, and I want to share some key information about the program’s timeline and criteria.

The law will go into effect on Nov. 1, 2024, and the application will open in early 2025. OID has already begun our implementation process, which includes creating consumer information materials, building the grant application, and providing resources for evaluators and contractors. We will announce when the application opens and continue to update consumers.

The program is open to homeowners in Oklahoma’s 77 counties. Homes must be in good repair unless they’ve sustained damage from a tornado, windstorm, hail or other catastrophic event. In addition, consumers must provide proof of active homeowners’ insurance policies with wind coverage and in-force flood insurance policies if homes are in a particular flood hazard area. After completing the application, homeowners will secure a home evaluator from our list of approved evaluators. If consumers are chosen for a grant, OID will pay the roofing contractor directly after the completion of the project.

After OID evaluates applications and determines whether homes are eligible for mitigation, the grant funds will go

toward outfitting homes to the Insurance Institute for Business & Home Safety standards, specifically IBHS FORTIFIED Home – Roof™ – High Wind designation with the Hail Supplement. Mitigation under this standard includes enhanced roof deck attachment, sealed roof deck, locked down roof edges, impact-resistant shingles by IBHS, and wind and rainresistant attic vents.

Insurance companies offer discounts for Homes with a FORTIFIED Home™ Designation on the wind portion of their homeowner’s insurance premium. In making these enhancements, Oklahomans could qualify for up to 42% in discounts. OID has a list of discounts posted on our website. Each company is different, and discounts vary, so consumers should check with their carriers to see which ones are available.

To participate in the program, contractors must become Certified FORTIFIED service providers. This certification requires specific training and an examination. Once certified, contractors will submit their information to OID for final review and approval to be added to the list of approved contractors. The FORTIFIED Homes service provider certification process is on the FORTIFIED Home website.

I’m looking forward to this pivotal new program launching next year, which will help Oklahomans make their homes more resilient to disasters and bring some relief amid rising prices. To find more information about the Strengthen Oklahoma Homes program and to get the latest updates, visit oid.ok.gov/ okready and follow OID on social media.

Glen Mulready State Insurance Commissioner

Insurance Agency Perpetuation in Stages: A Lesser-Known Strategy

How transferring ownership in phases works

By Scott Freiday

The need for independent insurance agency leaders to plan their exit from the business combined with the desire of up-and-coming producers to take over ownership creates a rich environment for a succession plan. One lesser-known strategy—a staged perpetuation—can spread out the need for capital over time, rather than all at once. Longtime owners seeking to ease into retirement while still influencing the culture and direction of their agency can stay involved via a wellmapped plan that transfers ownership of the agency in phases, rather than selling in its entirety.

The use of staged perpetuations is accelerating in the insurance

marketplace for several reasons.

According to the 2022 Future One Agency Universe Study, conducted by the Big “I” in collaboration with independent agency companies, the average agency principal is 54 years old, and 17% are age 66 or older. Ownership in independent insurance agencies is a reflection of those statistics.

In addition, 40% of those agency principals expect some level of ownership change in the next five years, and the number of agencies with in-family perpetuation plans declined by 10% between the 2020 and 2022 studies. Owners who may have imagined gradually stepping back as a family

member was groomed to succeed them may be forced to rethink their retirement options.

Stocking up

Staged perpetuations, planned carefully well in advance of the agency owner’s retirement or withdrawal, enable owners at or nearing retirement age to leave gradually and on their own terms. They also offer ownership opportunities to valued producers within the agency or talent identified elsewhere.

Selling shares in the agency maintains continuity and stability. Agents with stock are not only likely incentivized to grow the agency to increase their

investment, but are less likely to leave. This diversified ownership reduces agency risk by spreading ownership and investment beyond the business. At the same time, the agency’s legacy and culture are preserved.

Structuring an exit plan also avoids “buyer’s remorse.” Some lenders have worked with owners who sold their agency in its entirety then approached the lender a year or two later because they weren’t ready to be fully retired. They were looking for financing to buy their agency back. Perhaps that child who showed little interest in taking over the firm had a change of heart. Or the owners did not enjoy retirement as much as they thought they would. Or, if they continued to work for the firm after selling, they didn’t like the direction or culture new ownership put in place. The owners may find the buyback to be more costly than if they had sold shares of the company while maintaining majority ownership.

How a staged perpetuation works

Various approaches can be taken depending on the agency, such as working with lenders or consultants, to create a shareholder-loan program. This program could involve a formal agreement solely between the owner and the successors whereby shares are sold over time, providing the owner with income while retaining ownership in the agency.

Meanwhile, with the energy and effort provided by these incentivized new owners, the agency’s value is expected to grow along with the value of the owner’s remaining shares. This allows the owner to sell another fraction or percentage to current or new employees, thus perpetuating the agency’s growth and value while expanding ownership.

What is “early?”

It’s crucial to identify potential equity investors within the agency as early as possible and initiate these discussions

Insurance Agency Perpetuation in Stages

sooner rather than later. The potential investors might be family members, producers, or key employees in nonsales roles such as accounting. Until the question is posed, it may not be apparent which employees are interested in equity ownership.

In general, these conversations should start at least a year or two in advance of stepping back, but the exact timing depends on the owner’s circumstances and the agency’s trajectory. An owner 15 years or more from retirement could start diversifying ownership over the next decade by initiating these conversations.

Conversely, an owner who is closer to retirement and didn’t engage in such discussions earlier may be in a more reactive than proactive position.

The number of agencies with in-family perpetuation plans declined by 10% between the 2020 and 2022 [Future One Agency Universe] studies. Owners who may have imagined gradually stepping back as a family member was groomed to succeed them may be forced to rethink their retirement options.

Staged Perpetuation Benefits

Example 1: A $4 million commission agency with a $1.6 million cash flow receives an outside offer to purchase it for $12 million, which is 7.5 times its cash flow. It seems too good to pass up. But here are some things to consider:

• Are the earnout targets achievable?

• What is the seller’s timeline?

• Are there experienced and qualified buyers internally?

• What will the impact be to the agency’s legacy and culture?

Example 2: What if, rather than selling to an outside buyer, the ownership of the agency is restructured by selling 30% to three valued producers, discounting the value of the shares to accommodate the partial interest sold internally?

The owner receives $2.4 million in cash at closing (which the three investors could finance) and still owns 70% of the agency. Assuming modest annual growth of 2%, maintaining expenses and staff levels, the agency is projected to

achieve top-line revenue of $4.4 million over five years, valuing the 70% interest at $6.2 million. With a 5% annual growth rate, the total investment over five years would amount to $16 million, with the investment breakdown as follows:

• Cash Down Payment: $2.4 million

• 5-Year Cash Flow: $6.0 million

• 70% Interest: $6.2 million

• Total Investment: $14.6 million

Retention tool

From the buyer’s perspective, there are many benefits, too. An opportunity for equity ownership often changes the way the staff thinks. When an employee has the opportunity to buy into the agency, it greatly improves business growth and allows agencies to compete for talent. Stock opportunities can be a good retention tool, keeping key performers grounded within an agency rather than moving place to place.

Younger agents hungry for equity ownership may seek out an agency that offers the possibility of such equity. Once those newer or younger agents arrive, they’re going to work as hard as possible to grow the agency because they’re investing in themselves.

There is a lot of value in bringing either key employees, producers, or family members under the mentorship of the owner so that they can be trained to run the agency properly. In smaller firms that could be one or two people. For larger agencies, there may be stockholder loan programs in place that reward individuals who meet certain targets. Not all producers are cut out to be business owners, however. They might be good at selling, but they may not necessarily have the fundamentals to operate a business.

The current employment market is quite competitive, so it’s challenging to hire the right people. A little bit of ownership, in addition to having access to good markets, could make the difference to the job candidate and allow the agency owner to mentor the next generation of owners as well.

continued on page 27

Incoming Chair’s Mantra to Be ‘Connect and Communicate’

By Jerri Culpepper

The Road Thus Far

From typist to account manager, and agency owner to producer, Vicky Courtney has donned just about every hat worn by independent insurance agents in contemporary times.

The Wichita, Kansas, native moved to Tulsa with her family in 1968, attending Nathan Hale High School, then Tulsa Junior College (now Tulsa Community College), where she studied psychology and political science.

Before launching what was to become a successful 50-year career (this year) in the independent insurance field, Vicky considered pursuing a career as either an attorney or psychologist.

“But it turns out the insurance profession satisfies both!” she observed, laughing.

Vicky’s career path was actually launched a week following high school graduation, when a friend who had taken a job at Hanover recommended her to fill an opening for transcriptionist.

“It offered double the income I had made as a pastry chef at a steakhouse, so I was on board!” Vicky exclaimed with characteristic good humor.

“My first role in the profession was officially the typist position, but it was when I was moved to the CNA claims unit and sent to Chicago for a week of training that I became hooked on the

business,” she recalled. “I attended night school, while enjoying my daytime education within the insurance industry.

After three years as CSR to seven producers at Wausau Insurance, I was promoted to producer. In 1982, I moved to the Independent Agent system.”

Vicky credits her late husband, Tom Courtney, as being her No. 1 mentor.

“Tom encouraged me to take the producer position, guided me through successful selling approaches and taught me how to communicate effectively with insureds and underwriters,” she recalled, noting that she credits him with helping her qualify for the annual sales reward trip in her first year as producer. She was

Getting to Know Vicky Courtney

only the second person in the company to earn this recognition in their rookie year as producer.

Vicky joined Rickets Fennell & Associates in 2011 as a producer in the Tulsa branch office.

“The principal, Drew Rickets, is always encouraging, and my support staff is one of the best with which I’ve ever worked,” she noted.

Vicky also offered some thoughts on various issues facing the industry and those working in it, as well as her priorities as chair.

Continuing Education

“I’ve mastered several certifications over my 50 years, and I am a huge proponent of continuing to learn more of the trade,” Vicky said.

“That being said … more than specific certifications, I encourage a broad scope of education. Learn from other experts in the field, connect with other BIGiOK members, attend seminars, read articles and dedicate yourself to staying informed.”

Issues Facing the Industry

“The three largest problems of our industry are intertwined: the growing popularity of ‘fast insurance apps,’ the rise of service centers and retaining new agents. Each of these unfortunately feeds into the other,” she says.

“Clients are being pushed toward apps and then shuffled off to mass service centers, diminishing the personal touch to customer service. In this type of quick pass-off environment, it’s difficult to attract and retain new agents.

“Fortunately, the BIGi is in a fantastic position to connect new (and veteran) producers with the tools to combat these obstacles and achieve successful careers. I look forward to working more closely with the Young Agents and our local chapters in OKC and Tulsa, so BIGi can provide targeted education, opportunities for mentorship and effective networking connections.”

Primary Goals as Chair

“Connect and communicate – this is going to be my mantra,” she stated.

“I’d like to strengthen the communication lines between BIGiOK and Young Agents and the local chapters in OKC and Tulsa. The goal is to establish a regular presence within these smaller groups so we can stay more informed of the individual and specific challenges

Getting to Know Vicky Courtney

they face. I want them to know we are here, we are a credible resource, and we truly can benefit from each other.”

Asked to describe her leadership style, she replied: “I am very hands-on, positive and eager to be as involved and available as possible.”

On a Personal Note…

Tell us about your family. I have three incredible adult children and five grandchildren (so far), and two cats to keep me company (and busy combating fur).

Favorite book/podcast/movie genre? Historical fiction and mystery

Favorite music? My favorite bands are tropical and blues rock such as Jimmy Buffett, Joe Bonamassa, Stevie Ray Vaughn and BB King.

Favorite ethnic food? Mexican – I could eat it every day – with sushi as a close second.

Your dream vacation? A month in Europe exploring the historical sites from the Roman Colosseum to Irish castles.

continued from page 4

essential we be a part of this education. Remember, it’s not that you are building up competitors, but rather you are establishing your own credibility, strengthening the industry and ensuring good, reliable relations across territory lines.

I personally have greatly benefited from the opportunities within this fantastic organization. I encourage you all to stay tuned in for upcoming BIGiOK, IIAOKC, IIAGT and YAC events. This BIGi team is experienced and creative, showing an unmatched dedication to supporting independent agents across the state. Don’t delay the chance to grow professionally while making some great friends along the way.

Finally, it must be said this role of chair is one I take very seriously and with great honor. I pledge to do my best for our organization, our industry, the consumers and our carriers. I look forward to seeing many new faces and working with each of you. Thank you!

continued from page 10

They have compiled data around almost any technology that you would use in an insurance agency. Catalyt gathers data from independent agencies about management systems, rating products, cyber issues, phone system, and much more. This allows you to make an informed decision for the agency with agent compiled data.

We have taken a Tech assessment for my agency and plan to implement improvements to hopefully operate more efficiently in the office to better serve our clients.

There is much to be optimistic about if you are a young agent in Oklahoma. With events going on at least monthly, there are numerous opportunities to get involved. We would love to meet you and learn your story! Please reach out and let’s go grab coffee or lunch sometime! We are here to serve you!

Sincerely,

Jase Riggs | (580) 504-1962 Jase@riggsinsgroup.com

continued from page 23

Staged perpetuation also preserves an agency’s legacy and culture, and it nurtures intangible values, such as quality of life and future investments. These factors, along with the potential for increasing agency value over time, can make staged perpetuation more valuable than an outright sale.

The author

Scott Freiday is senior vice president and division director of InsurBanc, a division of Connecticut Community Bank, N.A. He oversees the bank’s commercial lending and cash management operations and has nearly a quarter century of experience in domestic and international banking and financial services. InsurBanc specializes in financial products and services nationally for the independent insurance distribution community. Started in 2001 as a vision of the Big “I,” InsurBanc finances acquisitions and perpetuations and helps agencies become more efficient by providing cash-management solutions.

Join BIGiOK for a day of empowerment and celebration at "EmpowerHer: Inspiring Excellence in the Insurance Industry." This event brings together women across all levels of the insurance sector, fostering connections, learning, and growth. Connect with like-minded professionals, expand your network, and gain insights from industry leaders through interactive sessions and panel discussions. We'll tackle the unique challenges faced by women in insurance, providing strategies to overcome them. Our influential speakers will inspire you to reach your full potential. Don't miss this transformative day to celebrate women's achievements, build connections, and unlock new possibilities at EmpowerHer.

March 6, 2025 Cole’s Garden, OKC BIGiOK.com/women

Thank You!

A huge thank you to CompSource Mutual for presenting our Claims & Underwriting Module for the 2024 Future Insurance Leaders of Oklahoma (FILO) Program. Special shout-out to Brad Owens, director of underwriting, and Adam Hughes, director of safety & loss prevention, for their outstanding presentations

In Memoriam

David Dutton, who enjoyed a 50-year career with INSURICA, passed away, surrounded by family, on July 14. David graduated from the University of Central Oklahoma in 1972, leaving

immediately for basic training in the Air Force Reserves. He served for eight years.

Upon returning to Oklahoma City after training, David met Gene McCrory, a USAF lieutenant colonel and president of North American Insurance Agency, which would later become INSURICA. Gene recruited him away from owning a Tastee Freeze restaurant and into the insurance industry. That was the beginning of David’s 50 years with INSURICA.

David was a past president of the Independent Agents Association of Greater OKC. He was member of the Board of Directors of the Oklahoma Association of Insurance Agents. David was also an Oklahoma City branch manager for INSURICA. Later, he earned numerous sales awards. Through sales he received many invitations to Eagle Squadron trips and most recently, Partner Club celebrations. He was a Vice President of INSURICA.

During his 50 years with INSURICA, David developed a large client base and earned the respect and friendship of many. He was loyal to his employer., He loved his clients and fellow employees. David loved to work. David never retired! David loved to say, “I have had one city, one wife and one employer!” BIGiOK.com/daviddutton

Young Agents Committee Holds Annual Retreat

Our Young Agents' committee held their third annual retreat at Cedar Gate to plan for the upcoming year. The retreat featured team-building activities like a scavenger hunt. The next day, the group used Kolbe to understand each other's strengths and spent the day planning for the coming year.

We also recognized Ryan Smith with Smith & Sons Insurance Agency for his dedicated service on the committee as he rolls off, having served as podcast chair, vice chairman, chairman and past chair.

We can't wait for you to see the exciting new events we have in store, and hope to see you at our upcoming Young Agents’ conference in September!