That’s why our communities have trusted CompSource Mutual for 85+ years. We’re proud to be a premier workers’ compensation carrier o ering your customers the best: top-rated financial strength and first-rate service. CompSource Mutual is rated A (Excellent) by AM Best.

EDITORIAL STAFF

Publisher Denise Johnson, CISR, CIC

Managing Editor Jerri Culpepper

Graphic Designer Denise Canon

PROFESSIONAL

President/Chief Executive Officer

Denise Johnson, CISR, CIC

Chief of Staff and Operations

Josh Reasnor, MSSL, CISR, CKC

Senior Vice President of Strategic Initiatives

Sara Bradshaw Ray, CIC, CKC

Workers’ Compensation Account Manager

Jeanette Madrid

Director of Member Services Shania Slavick

Director of Marketing and Communications Jerry Rappe’

Specialty Lines Service Account Manager Cindy Munden, CISR

Director of Professional Liability

Cari Senefsky

Education Coordinator Katie Jones

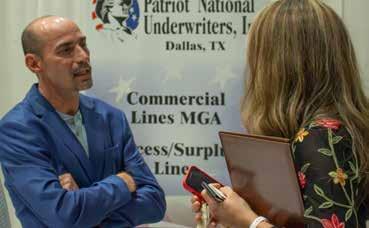

On the cover:

Industry Leaders in Candid Discussion Denise Johnson, president/CEO of BIGiOK, and Todd Jackson, incoming chairman of IIABA, share a moment of collaboration at the 24th BIGiOK Conference Showcase, exemplifying visionary leadership in the insurance sector.

Outgoing Chairman Warns ‘We Can’t Let Our Feet Off the Gas’ Vaughn Graham Jr., CIC, Chairman

BIGiOK: A Mid-year Review and a Look at What’s Ahead

Denise Johnson, CISR, CIC

From Happy Hours to Advocacy Work, Young Agents Get Involved Krista Kautz

Fannie Mae and Freddie Mac Postpone Updated Guidance for Property Insurance Coverage

Chris Floyd, CIC, CRM

Thrive, Connect, Prosper: The Exponential Value of Well-Being Sara Bradshaw Ray, CIC, CKC 19

Strengthen Oklahoma Homes Act: Making Your Home Resilient While Saving You Money Glen Mulready

‘We Can’t Let Our Feet Off the Gas’

You hear the saying all the time, but time REALLY does fly by when you’re having fun. I can’t believe that I am writing my final article as your chairman for Big I Oklahoma. It’s been an honor to serve our great association in this position during the past 12 months.

As I sit and write this last article, I’ve been reflecting on the past year, and many great memories come to mind. First, most members already know this, but I would put our Big I Oklahoma staff up against any other state’s. They are second to none. The work they do behind the scenes often is overlooked and makes the job of the board members so much easier. I appreciate everything that Denise and

Flood Insurance Program, and addressing the insurance hard market crisis regarding lawsuit abuse and risk mitigation factors. I am pleased to report that our delegation was in agreement with us on all points.

In addition, we had some great speakers at different sessions during the week and wonderful fellowship between the nearly 20 attendees from Oklahoma. I mention this a lot when visiting with our membership but if you haven’t been to the legislative conference in D.C., I would HIGHLY encourage you to attend some year. I promise you will not regret the decision.

With all this political talk, it brings me to our annual PAC fundraising. As a board,

I recently attended a Young Agents event in Tulsa, and there were over 60 people in attendance! That makes me excited about our future. Our industry is set up very well for years to come but we can’t let our foot off the gas.

her team have done and will continue to do to make our association thrive and be there to help our members.

Recently, a group of our Oklahoma contingency went to the annual Big I Legislative conference in Washington, D.C. We had great meetings and talks with our Oklahoma delegation and were able to meet face-to-face with all but three of our actual delegates, which is not the norm for most state associations attending the conference.

We fought hard to keep the 20% smallbusiness tax cut deduction that is set to expire at the end of 2025, discussed protecting the Federal Crop Insurance Program, extend and reform the National

we committed this year to stepping up both our state PAC and federal PAC fundraising. If you haven’t already heard from a board member about donating to the PAC, I am sure you will soon. It’s very easy to donate through the BIGiOK website and it’s a small investment into YOUR business and industry. Love it or hate it, politics IS a part of our industry, and we’ll try to do everything we can to protect the best interests of our membership. Please consider donating to both PACs as it will make our industry better for years to come.

I hope everyone enjoyed our annual conference in Oklahoma City at the beginning of May. This is a great few

days to have some fun, listen to some interesting speakers, get some CE, and learn a little bit more about what our Association is doing for our members. Between Sara Bradshaw Ray’s agency consulting workshops and conferences (which have been a HUGE hit), our workers’ compensation and E&O programs, thriving young agent group, and a number of our other services we provide, BIGiOK is really trying to help the membership. I encourage everyone to take advantage of what we have to offer.

As I end my final Policy magazine article, I’d like to say THANK YOU to the Big I staff, my staff and partners at Rich & Cartmill, our board, and many other insurance friends who have helped make our industry better during this past year. I think we are in great hands with our next chairwoman, Vicky Courtney.

I recently attended a Young Agents event in Tulsa, and there were over 60 people in attendance! That makes me excited about our future. Our industry is set up very well for years to come but we can’t let our foot off the gas. THANK YOU for a great 12 months representing our wonderful association.

With roots dating back to 1947, we have navigated other periods of uncertainty and various economic cycles.

For over 75 years, Mid-Continent Group has been committed to providing specialty commercial insurance for the oil and gas industry. Our specialized expertise and entrepreneurial, relationship-driven approach has allowed us to offer solutions which address the unique needs of our agents and insureds.

Policies are underwritten by Mid-Continent Casualty Company, an authorized insurer in all states except AK and NY; Mid-Continent Assurance Company, an authorized insurer in CA, CT, DE, HI, ID, LA, ME, MA, MO, NE, NV, NH, NJ, ND, OH, OK, PA, RI, TX, VT, VA, WV, WI and the D.C.; and Oklahoma Surety Company, an authorized insurer in AR, KS, LA, OK, TX and OH. © 2022 Mid-Continent Casualty Company, 1437 S. Boulder, Suite 200, Tulsa, OK 74119. All rights reserved. 5606-MCG (12/22)

Johnson & Johnson Inc

Ph: 800-800-4007

www jjins com

Jencap Group Inc

Ph: 800-525-7211

www jencap com

RPS, Inc. (Tulsa / OKC)

Ph: 918-742-8496 www.rpsins.com

RT Specialty Group

Ph: 405-726-2800 www rtspecialty com

One General Agency

Ph: 800-299-1951

www YourOGA com

Patriot National Underwriters

Ph: 800-291-6846 www patriotnational com

Specialty Insurance Managers Ph: 800-888-0202 www.simoklahoma.com

Statewide General Agency

Ph: 918-492-1446

www swgen com

HONORARY MEMBER : Denise Johnson, President & CEO of IIAO

Jaeger + Haines, Inc

Ph: 800-632-0342

www jplush com

IIAOK (Associate)

Ph: 405-840-4426

www iiaok com

Imperial PFS (Associate)

Ph: 800-727-1717

www.ipfs.com

To become a member of OSLA please contact Jana Anderson at 405-879-4288 Oklahoma Surplus Lines Association 5100 N Classen Blvd Suite 105 Oklahoma City, OK 73118

Time flies so fast! Our 2024 conference is complete and now it’s summer!

The 2024 Oklahoma Legislature was busy this year. We were watching many bills and found ways to make our industry better through legislation. It’s so important to understand how we need to stay engaged in the legislative process. We have been able to spend time educating legislators in the hard market; whether it’s school insurance or your own homeowners, insurance affects everyone!

Now that session is over, it’s election season. We have many legislators who have been supportive of our cause, and we have new candidates who are probusiness and understand the importance of what our industry does for the state’s economy. Through OKPAC, we can show our support of experienced and new candidates. If you haven’t given to OKPAC, I would encourage you to be a part and have a voice. To find out more you can go to the website at BIGiOK.com/okpac. The board has set a lofty goal of $50,000 this year. Be sure your name is on the list!

The conference was a success and we had some of the best speakers in history. We addressed so many things that affect our industry, including diversity, AI and business practices. We had an incredible attendance and were able to award our outstanding companies, agents and agencies!

Already in 2024, we’ve had a perpetuation workshop, women’s conference, our annual conference and many classes, including podcasts and National Alliance events. If you haven’t had a chance to catch our monthly Agency Wise webinar podcast, be sure to put it on your calendar BIGiOK.com/ AgencyWISE

Being a BigIOK member has many benefits and can make your business better.

• Membership in the Independent Insurance Agents & Brokers of America, the nation's oldest and largest organization that has as its sole purpose to be an advocate for independent insurance agents

• Excellent education programs, including CIC and CISR designation and programs

• Representation on legislative and regulatory matters

• Networking with other agents and company representatives through conventions and conferences

• Industry information through IA Magazine, Policy Magazine, the Oklahoma Agent monthly e-newsletter and weekly legislative bulletins (during the legislative session)

• Access to special insurance products, including Westport and CNA Insurance Agent's Errors & Omissions protection, American Reliable Farm and Ranch Insurance, RLI Personal Umbrella Policies, RLI In-Home Business Policies and Big "I" Markets personal and commercial products

• Benefits associated with membership in the IIABA can be found at their website

• Access to Trusted Choice Resources

• Voting rights at any annual or special meetings of the BIGiOK membership

As you know, BigIOK doesn’t take a break and has summer plans in which YOU can get involved. Our Young Agents have projects, and education is booming, so be sure to check out our website at BIGiOK.com to find out what all’s on the calendar!

The last few months, we have seen a surge of energy in the Young Agents. Thank you all for attending our events! You continue to spark excitement, and the committee loves watching you all building connections across the state. From fun get-togethers in OKC, Tulsa and Ardmore to important advocacy work at the Capitol, the Young Agents are on the move. For those who missed

on in the industry (and this was their FIRST session of the FILO program). It was a stunning realization that the lawmakers need professionals like us to help explain our industry-related bills, as they receive many bills to review across a large variety of industries. Unless the lawmaker is a previous/current insurance agent, they need to call on somebody for questions or concerns they may have. This day gave us the chance to network with our own lawmakers in hopes that they’ll

From fun get-togethers in OKC, Tulsa and Ardmore to important advocacy work at the Capitol, the Young Agents are on the move.

it, on April 4, the Young Agents gathered at The Vault in Tulsa for a lively happy hour. It was a big turnout, with 61 people showing up. This was a great networking opportunity, and if you missed out, make sure you’re watching your emails from Shania Slavick OR head on over to bigiok.com/YA and check out the calendar. While you’re on the website, please make sure you’re checking out the latest “Oklahoma Young Agents Show” podcasts! If you ever have questions on getting involved, please reach out to a committee member or Shania!

The BIGiOK Capital Day was an incredibly critical day! It gave the Future Insurance Leaders of Oklahoma members a chance to learn about the bills going

think of us anytime they see something insurance-related.

Again, Young Agents are on fire, metaphorically speaking, of course, as there were 30 Young Agents among the 45 people there, and they were eager to be part of it. With help from Denise Johnson, attendees had a clear picture of what we were presenting, and she allowed time for questions before sending everyone off to walk the halls, which was super relieving for those firsttime attendees! It was a day of learning and advocacy. I hope that you, the reader, will take the time to join us next year! Thank you once again to all that have been attending and staying engaged. A BIG shout out to our company partners as well – we most certainly could not do what we do without you!

Krista Kautz Young Agents Committee Chairman[NOTE FROM CHRIS FLOYD: In an exclusive report brought to you by Nathan Riedel from the Big 'I' Government Affairs Team, I'm here to share the latest update: Fannie Mae and Freddie Mac have opted to delay the rollout of their revised guidelines concerning property insurance coverage. Initially slated for June 1, these guidelines would have required mortgagors to secure replacement cost value coverage for their properties, roofs included, while rejecting actual cash value policies. Nathan's keen investigative work has illuminated this pivotal shift in the mortgage landscape, offering essential perspectives for homeowners and industry insiders alike.]

By Nathan Riedel

By Nathan Riedel

Earlier this year, at the direction of the Federal Housing Finance Agency (FHFA), Fannie Mae and Freddie Mac updated their selling and servicing guides to clarify various lender and servicer responsibilities related to monitoring and verifying property insurance coverage.

The updated guidance was set to take effect on June 1 and would have impacted a significant portion of the property insurance market by requiring mortgagors to acquire replacement cost value (RCV) coverage for their property.

Given that the National Association of Realtors estimates that Fannie and Freddie support approximately 70% of the mortgage market, this change would have a real-world impact on the many homeowners who are unable to satisfy the coverage requirements or who are forced to purchase a higher-cost insurance product to do so.

However, on May 7, at the request of the Big “I" and other stakeholders, Fannie and Freddie announced that the June 1 implementation of this updated guidance is being postponed indefinitely. The Big

“I" was the only agent trade association to weigh in on this issue with the FHFA and government-sponsored enterprises (GSEs), communicating with each and submitting a joint letter with the National Association of Mutual Insurance Companies stating that the guidance would exacerbate existing challenges in the property insurance market.

The action taken by Fannie Mae and Freddie Mac to delay implementation of the guidance will allow stakeholders to come together and discuss the issue and the Big “I" appreciates the willingness shown by FHFA and Fannie and Freddie to reconsider the updated guidance.

The guidance would require homeowners to obtain complete RCV coverage for all aspects of their homes and explicitly states that actual cash value (ACV) coverage is unacceptable. Importantly, this mandate includes roofs, even though lenders and servicers in the vast majority of states have long accepted the use of ACV for roofs.

Obtaining adequate coverage for roofs is already incredibly difficult in the current hard market and this would have exacerbated that problem. According

to the updated Freddie Mac guide, “Insurance policies must provide for claims to be settled on a replacement cost basis. Policies that (1) provide for claims to be settled on an actual cash value basis, or (2) limit, depreciate, reduce or otherwise settle losses for less than a replacement cost basis are not eligible."

While FHFA argues that the requirement is not new to the market, the guidance directed FHFA and Fannie Mae and Freddie Mac to more aggressively audit service providers and enforce the mandate without exception.

Additionally, the new requirements would require the RCV to be verified as of the current property insurance policy effective date. Given that the term for most residential property insurance policies is one year, it is likely that such verification would need to occur on an annual basis, creating a whole new set of challenges to verify values and provide documentation.

According to the updated guide from Freddie Mac, “Seller/Servicers must verify the RCV in order to complete the calculation (adequate insurance coverage) ... The verification source may

Chris Floyd, CIC, CRM State National Director

be (1) the replacement cost estimator utilized by the insurance carrier or an insurance risk appraisal; or (2) statement from property insurer, an independent insurance risk specialist, or other professional with appropriate resources to make such a determination."

This reference to replacement cost estimators (RCEs) would likely increase the number of lenders asking for them, which is problematic because RCEs are often prohibited by contract and/or state law from releasing estimators to anyone. Even more concerning is that if the expectation is for agents and insurers to respond to sellers and servicers on a mass scale, this would be a huge administrative task given the volume of such information, not to mention the added liability exposure that this increased role in producing documentation and verification will bring upon agents.

As the leading insurance agent association in the U.S. — and the only one to have voiced concerns over this updated guidance — the Big “I" will continue to engage with FHFA, Fannie Mae and Freddie Mac, and work to positively impact any kind of guidance that is put forth moving forward.

OKPac is BIGiOK’s state political action committee. It provides financial support for state elected officials who will provide support for or have shown support of issues affecting the insurance industry and to those who share our business philosophies. Only individuals or partnerships can make contributions to OKPac. Under Oklahoma law, OKPac can accept no contributions from corporations.

Stewart Berrong

Kent Bradford

William Briggs

Travis Brown

Deborah Burton

Kennetha Caldwell

Michael Cole

Jerrad Coots

Vicky Courtney

Jennifer Dotter

Scott Dull

Carol Edwards

Chris Floyd

Patricia Gillespie

Efrain Gonzalez

Vaughn Graham, Sr.

Vaughn Graham, Jr.

David Gray

Guy Griggs

John Casey Harper

C. Ross Harris

Denise Johnson

Adriane King

Pat Mandeville

John McClellan

Michael T.

McCullough

Avery Moore

Mike Mosley

Brad Owens

Thomas Perrault

Rob Piearcy

Sara Bradshaw Ray

Kathy Reeser

Arthur A. Rickets

Michael Ross

Stephen Scace

Scott Selman

Michael Sourie

Belynda Tayar

Kristoffer Williamson

Trent Willis

InsurPac is BIGiOK’s national political action committee. It pools the voluntary and individual financial contributions of thousands of independent insurance agents to help elect candidates to Congress who share BIGiOK’s business philosophies. InsurPac is the largest property-casualty insurance industry PAC in the country.

Stewart Berrong

Travis Brown

Debbie Burton

Mark Carlin

Jenny Dotter

Jay Eshelman

Vaughn Graham, Sr.

Vaughn Graham, Jr.

Rich Haverfield

John Hester

Tony Holmes

Clayton Howell

Denise Johnson

Krista Kautz

Mark Long

Avery Moore

T.J. Riley

Michael Ross

more information and quantifiable examples of contributions by going to: OKPac - BIGiOK.com/OKPac InsurPac - BIGiOK.com/InsurPac

In the ever-evolving landscape of insurance, where unpredictability is part of the daily routine, the well-being of every member of your team (including you, the reader) isn’t just a “when I get time” kind of thing; it's THE cornerstone of business success. Groundbreaking insights from Gallup's "Well-being at Work" have illuminated the path to not only thriving in this competitive field but also fostering a culture of growth, resilience and innovation. Leveraging decades of research through millions of employee interactions, Gallup’s single biggest discovery ever made is this: What the whole world wants is a good job. People want a job that uses their God-given strengths every day with a manager who encourages their development! For leaders, understanding and leveraging these five key elements –Career, Social, Financial, Physical and Community well-being –is not just beneficial; it's imperative to thrive in the new workplace, to retain top talent and reach the success goals you’re striving for.

lies in career well-being. Embracing tasks that align with your strengths and values elevates your sense of purpose and inspires your team. It’s about creating an environment where everyone is encouraged to contribute their best work, fostering a sense of ownership and pride in the collective mission.

Leaders are no strangers to the pressures and rewards of their chosen path. However, the difference between viewing work as a mere job and a calling

In an industry built on trust and relationships, the importance of social well-being cannot be overstated. Strong relationships with colleagues and clients act as a buffer against stress and burnout. For leaders, investing in

team-building activities and open lines of communication is not just about camaraderie; it's a strategic move that enhances loyalty, satisfaction and performance. Remember, a connected team is a resilient team.

Financial well-being extends beyond the balance sheet. For principals and owners, it means creating a business model that ensures stability for themselves and their employees. This involves prudent financial planning, risk management and the development of a robust contingency plan. Educating your team on financial literacy and offering support for their financial wellness contributes to a culture of security, reduces anxiety and enables a focus on growth and innovation.

The demands of leading your organization can take a toll on one’s physical health, especially today in the continued hard market. Yet physical

well-being is the bedrock upon which all other aspects of well-being rest. Implementing policies that encourage work-life integration, physical activity and mental health breaks is crucial for everyone. A healthy team is more energized, focused and productive, translating to better service for your clients and a stronger bottom line for everyone.

Finally, community well-being ties personal satisfaction to the larger world around us. For your organization, engaging in community service and supporting local initiatives not only enhances your brand’s reputation but also instills a sense of purpose and connection among your team. It’s about recognizing that your success is interwoven with the well-being of the community you serve.

Embracing these insights into wellbeing and weaving them into your organization's fabric can transform not just your business but the industry at large. BIGiOK Consulting stands at the forefront of this revolution, offering targeted strategies that merge the science of well-being with the art of leadership to unlock exponential growth and resilience.

For the trailblazing women in the insurance space, we’re excited to extend an invitation to the virtual facilitated mastermind tables of MyNetwork’s upcoming season, “The WHOLE Leader.” This transformational program, set to launch its 10th season in October, can be a catalyst for women who aspire to harness their full leadership potential by focusing on holistic well-being. It’s more than a mastermind group; it’s a

movement towards becoming leaders (at all levels) who thrive in every aspect of their lives.

And as the new year begins, we'll be introducing another transformative program: The Manager’s Bootcamp. Launching during Q1 ‘25, this transformational programming is intentionally designed to tackle the engagement and performance crisis head-on by addressing its core issue – the gap in managerial skills. Gallup’s research showed that poorly skilled managers are the single most important factor in the engagement and performance of our workforce. The Manager’s Bootcamp is an immersive experience aimed at equipping managers with the essential skills and insights needed to lead with empathy, drive engagement and foster a culture of high performance. In a landscape where the competence of managers is the linchpin of team success, this program

is your opportunity to set a new standard of leadership excellence.

With BIGiOK Consulting by your side, the path to becoming an exemplary leader in the insurance industry is clear. Join us in these pioneering initiatives to not only elevate your leadership skills but also to be part of a community dedicated to creating impactful change. The journey towards excellence starts with a single step; the choice is yours. 1:1 coaching, female leaders of all ages and stages are welcome to join the wait list for a seat at the MyNetwork table for Season 10 - "The WHOLE Leader" or enroll your managers or up-and-coming leaders in The Manager’s Bootcamp coming soon. Wherever your needs are, take that step with us, and together, let’s shape the future of leadership in the insurance world. Your commitment to growth and well-being today can prepare you for the success of your agency tomorrow.

For more on any of these programs and just to talk about where your organization could be growing use the QR code to add me to your smartphone and grab a spot on my calendar for a visit. I look forward to connecting with you.

Links:

MyNetwork Info: mynetworkins.com

MyNetwork Wait List: BIGiOK.com/mynetwork-waitlist

SBR General Scheduling Page: connectwithsara.as.me

Chairman

Vaughn Graham Jr., CIC

Rich & Cartmill Inc.

Oklahoma City

Secretary Scott Dull

Omega Insurance Agency Choctaw

Director at Large

Guy Griggs INSURICA

Tulsa

Chairman Elect

Vicky Courtney

Ricketts Fennell & Assoc.

Tulsa

Treasurer

Kathy Reeser

VIP Insurance Edmond

State Director

Chris S. Floyd, CRM, CIC

Brown & Brown Insurance

Pryor

Director at Large

Rob Piearcy

Arnett Insurance Agency

Durant

Immediate Past Chairman

Jerrad Van Coots

Burrows & Burrows Agency

Claremore

Director at Large

Trent Willis

Cornerstone Insurance Group

Oklahoma City

Company Liaison

Jennifer Dotter

One General Agency

Oklahoma City

Company Liaison

Brad Owens

CompSource Mutual

Oklahoma City

YAC Chairman

Krista Kautz

Ed Berrong Insurance Agency Edmond

As the new voice of the independent agents of Oklahoma, BIGiOK promotes and provides education, legislative advocacy, innovative concepts and practical solutions, and community and career opportunities.

BIGiOK is the largest insurance trade association in Oklahoma. With more than 475 independent insurance agencies, we represent nearly 3,000 independent insurance agents and their employees and more than 100 company members. BIGiOK member agencies range in size from one person to some of the largest agencies in the region.

Founded in 1906 as the Oklahoma Association of Local Fire Insurance Agents, BIGiOK is a result of the consolidation of the Independent Insurance Agents of Oklahoma, Inc. (IIAO) and the Oklahoma Association of Professional Insurance Agents (OAPIA) on Jan. 1, 1992.

BIGiOK policy is set by a board of directors elected at the annual conference. Policy is implemented by a professional

staff located in Oklahoma City. BIGiOK’s mission is carried out through a variety of programs designed to enhance the business of independent insurance agencies.

BIGiOK is an active advocate on behalf of independent agents before legislative, regulatory and judicial groups in Oklahoma and at the federal level.

BIGiOK is affiliated at the national level with the Independent Insurance Agents and Brokers of America with offices in Alexandria, Virginia, and Washington, D.C.

BIGiOK is an excellent source of information through POLICY magazine, published quarterly, and the Oklahoma Agent, a monthly newsletter of time-sensitive material for its members.

June 4 - CISR Agency Operations

June 5 - CIC Insurance Company Operations

June 12 - Agency Plan in a Box - onsite workshop and follow-up coaching

June 13 - AgencyWise Reminder Notification: AI Friend or Foe? How to Leverage the Power for Good

June 19 - Performance-based Compensation: A "Must Have" Not Just a Hot New Trend

June 21 - Episode 6: Free Friday Ethics Webinar

JULY

July 11 - AgencyWise Reminder Notification: Kolbe: It Really Does Work!

July 19 - Episode 6: Free Friday Ethics Webinar

AUGUST

Aug. 8 - AgencyWise Reminder Notification: Sales Evolution: Crafting Your Unique Narrative for Ultimate Success

Aug. 13 - KOLBE Strengths Workshop

Aug. 16 - Episode 6: Free Friday Ethics Webinar

Aug. 20 - CISR Other Personal Lines Solutions

Aug. 21 - CIC Personal Lines

September

Sept. 12 - AgencyWise Reminder Notification: Agency Planning Doesn't Have to Be That Hard!

Sept. 17 - CISR Elements of Risk Management Webinar

Sept. 18 - CIC Agency Management

Sept. 20 - Episode 6: Free Friday Ethics Webinar

OCTOBER

Oct. 9 - James K. Ruble Graduate Seminar

Oct. 10 - AgencyWise Reminder Notification: Hiring Top Performers in a Candidate-Driven Market

Oct. 18 - Episode 6: Free Friday Ethics Webinar

Nov. 12 - CISR Commercial Casualty 2

Nov. 13 - CIC Commercial Property

Nov. 14 - AgencyWise Reminder Notification: What We Can Learn from Looking at our Operations

Nov. 15 - Episode 6: Free Friday Ethics Webinar

Dec. 4 - CISR Insuring Commercial Property Webinar

Dec. 12 - AgencyWise Reminder Notification: Agency Funding Ideas Beyond the Norm

Dec. 20 - Episode 6: Free Friday Ethics Webinar

Promote the value you bring to your local community.

Access our new campaign that puts your unique value in the forefront.

Provide your current and prospective clients with a snapshot of the added benefits of working with a Trusted Choice® Independent Insurance agency.

Customize these materials today!

cobrand.iiaba.net/made-for-you/i-am

As Insurance Commissioner, I understand the pressing issue of high insurance rates voiced by the Oklahoma consumer, particularly in homeowners’ insurance, brought about because of increased severe-weather events and rising costs to rebuild.

Unfortunately, I can’t do anything about the weather, but I can help Oklahomans fortify their homes. I'm pleased to announce that the Oklahoma Insurance Department is actively addressing this with initiatives aimed at consumer relief. We are focusing on the Strengthen Oklahoma Homes Act (HB 3089), which just passed in the Oklahoma Legislature. This legislation seeks to improve disaster resilience and lower homeowners’ insurance rates. Let's explore how this program can benefit Oklahomans and create a more secure future for all.

is the Strengthen Oklahoma Homes Act?

The Strengthen Oklahoma Homes Act is legislation that, if it becomes law, will create a grant program to help Oklahomans strengthen roofs with impact-resistant materials that meet FORTIFIED standards set by the Insurance Institute for Business and Home Safety (IBHS). OID would use existing budgeted funds and redirect these dollars to provide grants to Oklahoma consumers.

How will this program lower premiums?

The grant funds would assist consumers in constructing or retrofitting their homes with impact-resistant shingles and other enhancements. Many insurance companies reduce premiums when these types of modifications are made to homes.

How will this program work?

Consumers would submit a formal application with OID. The program would be first-come, first-serve, so once the application is open, it’s crucial to apply as soon as possible. It will be open to consumers in all 77 counties, and grant awards will be disbursed with priority given to lower-income applicants, as well as applicants who live in locations that, based on historical data, have a higher susceptibility to catastrophic weather events. Once approved, grantees must make the retrofits and renovations using an IBHS-approved contractor within a set period of time.

If I don’t qualify for a grant, is there any way I can get help with my rising premiums?

If you don’t qualify for a grant, there are other ways you can save. Discounts are available to consumers who construct or retrofit their homes to IBHS

Glen Mulready State Insurance CommissionerFORTIFIED standards. These discounts, ranging from 3% to 42% depending on the insurance company, can make a big difference on your insurance bills. Additionally, fortifying your roof can reduce the number of future claims and deductibles that result from severeweather events by resisting damage that an unfortified roof would sustain.

The current insurance market is tough, and Oklahomans, as well as Americans across the country, are feeling the frustration with higher insurance premiums. I’m excited about the Strengthen Oklahoma Homes Act and look forward to helping Oklahomans make their homes more resilient to disasters and bringing some relief amid rising prices. To find more information on homeowners insurance or request assistance, please visit oid.ok.gov or call OID at 800-522-0071.

Jacquelyn “Jackie” Bridges

Cherokee Strip Insurance Agency

With four years in insurance, in 2023, Jacquelyn “Jackie” Bridges was named the Associate of the 4th Quarter award and became a top producer at Cherokee Strip Insurance Agency. Passionate about reshaping insurance perceptions, she prioritizes client education for comprehensive protection. Transitioning from medicine to insurance, Jackie excelled as a top producer and office manager. Joining Cherokee Strip Insurance Agency marked a pivotal shift toward independent work, cherished for its potential for career growth. Beyond work, she enjoys cooking, outdoor adventures and sports, while being a devoted mother to two children. Congratulations, Jackie, for being named Agent of the Year with Cherokee Strip Insurance Agency!

Stacie Thomas

One General Agency

Starting as a receptionist in 1993, Stacie Thomas's curiosity and work ethic propelled her to become a specialty underwriter in 2007. Noted for her knowledge, service and responsiveness, she enjoys educating agents and cherishes industry friendships. Outside work, she delights in concerts, dining out and dancing alongside

her family and faithful companion, "Bo." Stacie attributes her success to her Christian values of kindness and compassion. Congratulations to Stacie with One General Agency for winning our underwriter of the year award.

Dillon Rosenhamer, CRIS, INSURICA, has been an invaluable asset to his agency, actively engaging with local construction associations and serving as the finance committee chairman on the AGC Board of Directors. Recognized as one of the top 90 producers nationwide by Insurance Business America, Dillon brings a wealth of expertise to his work. A graduate of Oklahoma State University, he calls Edmond/northwest Oklahoma City home. Outside his professional endeavors, Dillon is deeply committed to various civic organizations, including Wings (a special needs community in Edmond). Congratulations to Dillon for being named 2024 Agent of the Year!

In 2023, Brandy Akbaran earned the Certified Digital Marketing Professional (CDMP) credential, enriching her expertise in insurance and digital marketing.

Brandy's dedication shines through as she provides crucial marketing education and support to colleagues, empowering producers in the industry. With a background in graphic communications, she seamlessly transitioned into her role as marketing communications manager, enhancing INSURICA's marketing endeavors. Outside work, Brandy enjoys family time, music and outdoor adventures, drawing creative inspiration from garage sales and art festivals. Congratulations to Brandy for being named Agency Management Staff of the Year!

With 15 years of experience, Amber Warden, CISR, Dillingham Insurance, excels in personalized risk management, ensuring client satisfaction and strong relationships. Her expertise stabilizes the insurance market by mitigating risks for clients and insurers. As a Commercial Lines Senior Account manager, she brings extensive knowledge from the mortgage industry, specializing in large and complex commercial accounts. Outside work, Amber cherishes family time and supports her youngest in sports. Congratulations to Amber for her selection as CSR of the Year!

With 23 years of experience, Nancy Lyons, CIC, AIM, transitioned from customer service to underwriting before excelling as a marketing representative. Passionate about agent empowerment, she constantly innovates to foster growth. Relocating to Oklahoma, she thrived as an AARP sales representative at The Hartford and as a senior territory manager at Safeco for 17 ½ years. Outside work, Nancy enjoys being a cat mom, diving into books and tackling jigsaw puzzles. Congratulations, Nancy, for being named Marketing Representative of the Year!

Congratulations to EMC Insurance, selected as our 2024 Company of the Year! Ranked among the top 60 property/casualty organizations nationwide and one of Iowa's largest, EMC has stood strong since its founding in 1911. With over 110 years of service to policyholders and independent agents, they remain financially sound and committed to excellence. Employing approximately 2,200 professionals across 40 states, EMC exclusively partners with independent insurance agencies, delivering personalized service and fostering lasting relationships.

Congratulations, One General Agency (OGA), for being named as our 2023 Brokerage of the Year! Since 1951, this Oklahoma-based MGA has thrived on trust and strong relationships. They prioritize being strategic partners, valuing timeless trust over transactions. OGA is expanding, enhancing capabilities with experienced underwriters and additional markets. Specializing in Garage, Cannabis, Professional Lines and more, they operate from offices in Oklahoma City and Fayetteville, Arkansas, with a dedicated remote workforce of 78. Committed to exceptional service and people-first values, OGA exemplifies excellence in brokerage.

Congratulations to Covenant Insurance Services LLC, selected as our 2024 Small Agency of the Year! Established in 2018, Covenant specializes in commercial independent insurance, focusing on trucking, manufacturing and artisan contractors. Their mission centers on serving others and fostering achievement, driven by a commitment to quality coverage and exceptional service. With a philosophy rooted in long-term client relationships and personalized care, they prioritize ethics and values in their company culture. Through tailored technology and industry involvement, Covenant aims to enhance safety and financial security, positively impacting lives for the better.

Established in 1963 by W.H. “Bill” Dull Jr. as the Dull Insurance Agency, Omega Insurance Agency began in downtown Harrah, Oklahoma. Bill's wife, Barbara, joined in the late 1960s, diversifying into real estate and homebuilding before focusing solely on insurance. Through mergers and acquisitions, they relocated to Choctaw in 1983 and rebranded. Upon Bill and Barbara's retirement in 1997, the business passed to their sons, Russell, Scott and Dean. Today, guided by the Dull brothers, Omega maintains its family and business values, thriving within the community and the Big I Oklahoma. Congratulations to Omega Insurance Agency, our 2024 Medium Agency of the Year!

Since 1978, George and Kay Tedford 's agency has provided comprehensive insurance solutions to individuals and businesses in their community. Growing from two members to over 60 across seven Oklahoma offices, they prioritize staying updated while offering personalized service. At Tedford Insurance & Associates, superior service is a commitment, ensuring every client receives personalized care, earning them a trusted leader reputation. Congratulations to Tedford Insurance & Associates, our 2024 Large Agency of the Year!

In what can only be described as a resounding success, the 2024 BIGiOK Conference – under the theme Unleashing Potential: Embracing Success! – brought together a recordbreaking attendance of over 550 enthusiastic participants. Held against the vibrant backdrop of innovation and camaraderie, this event transcended expectations, leaving an indelible mark on all who attended.

Attendees were treated to a kaleidoscope of experiences, ranging from the exhilarating Golf Tournament and the highstakes Casino Night to the captivating MPowered Happy Hour and the much-anticipated Annual Partner Showcase. These diverse events ensured that every moment was infused with excitement and opportunity.

The heart of the conference lay in its power-packed sessions, where industry luminaries delved into an array of compelling topics. From cutting-edge technology discussions featuring Cataylit, ChatGBT and AI to insightful sessions on staffing strategies, recruiting tactics and sales mastery, attendees were immersed in a wealth of knowledge and innovation.

A highlight of the conference was the lineup of distinguished speakers who graced the stage with their electrifying insights. From diversity maven Kelly McDonald to AI virtuoso Andrew Davis, from insurance industry technology guru Steve Anderson to leadership expert Dustin Wambsgans, and from state leadership Glen Mulready to business strategist Todd Jackson and staffing visionary Nolan Duda, each speaker left an indelible impression, inspiring attendees to reach new heights of achievement.

The trade show, featuring 80 Partner Companies, provided a bustling hub for networking and exploration. Attendees seized the opportunity to forge valuable connections, explore new products and services, and lay the groundwork for future collaborations.

As the curtains close on the 2024 BIGiOK Conference, we reflect with gratitude on the shared experiences, invaluable insights, and lasting connections forged during this extraordinary event. Here's to unleashing potential, embracing success, and charting new horizons together!

The 2024 Future Insurance Leaders of Oklahoma program has begun with an incredible start, welcoming a class of 17 enthusiastic participants.

The kickoff event featured a "Day at the Capitol," where the participants engaged with legislators, discussed the impacts on the insurance industry, and lobbied on behalf of independent agents. This immersive experience provided invaluable insights into the legislative process and the role of advocacy in shaping industry regulations.

The day concluded with a lively mentor/mentee kickoff event at Chicken & Pickle. This gathering offered a relaxed environment for networking and set the stage for the mentoring relationships that will flourish throughout the year.

We are excited about the journey ahead for this year’s FILO class and look forward to the growth and achievements they will bring to the future of the insurance industry in Oklahoma.

For more information, please contact:

Shania Slavick Director of Member Services Shania.slavick@BIGiOK.com

Mike Loftis, CEO of Lotis & Wetzel Insurance, was inducted into the Blackwell School Foundation’s Hall of Fame at its annual banquet March 28. Mike Loftis was described by the foundation as a community leader in areas from energy to health care as well as a tireless education advocate. He graduated from Oklahoma State University in 1976. His insurance career began in Blackwell with his father in Don Loftis Insurance Agency. Mike purchased the business, which transitioned to Loftis Insurance in 1982. A merger created Loftis & Wetzel Insurance in 2002. The business has grown to four locations, Blackwell, Ponca City, Stillwater and Edmond, employing 40 people.

In 2012, as a partner in L&S Energy, Mike persuaded OSU to purchase wind power from Kay County’s first wind farm. Since then, there have been multiple projects in north central Oklahoma generating renewable energy, jobs and royalty income to landowners.

His business successes have been matched by his determination to improve his community.

He was part of the formation of the Blackwell Public School Foundation, one of the best-funded foundations in the state. It gives out thousands of dollars to school personnel every semester to augment student success. As a trustee/ officer of the Blackwell Hospital Trust Authority, he oversaw the construction financing of a new $20,000,000 Blackwell hospital. He is a long-term Trustee of the Blackwell Public Trust, Blackwell Industrial Authority, and Blackwell Economic Development Authority. His talent and energy have also focused on NOC, serving as a member of their foundation since 1996. Their assets have grown from $425,000 to $14 million. He was inducted into the NOC Hall of Fame in 2016.

In 2023, he was appointed to the NOC Board of Regents. To ensure that

Blackwell High School students can take concurrent classes at NOC, Mike and Kim Loftis established Loftis Access to Success for Blackwell High School concurrent students. All the Agency Tech Guidance You Need, In One Place. is Your Agency at Risk of a Cyber Attack?

Catalyit’s Tech Assessment helps you understand where you are, where you need to be, and how to bridge the gap.

Pronounced: cat-a-lit

Recently, the Young Agents of Oklahoma rallied together for a group service project benefiting Peppers Ranch Foster Care Community, the chosen charity of the year. Armed with enthusiasm and a desire to give back, this dynamic group set out to make a tangible difference in their community.

The day kicked off with a guided tour of Peppers Ranch, offering participants a firsthand glimpse into the challenges faced by foster care families. From the stories shared to the interactions with residents, the experience left a lasting impression, fueling the group's determination to lend a helping hand.

Diving into various projects, the Young Agents rolled up their sleeves and got

to work. Whether it was sprucing up the landscaping, tackling maintenance tasks or organizing engaging activities, each volunteer contributed their time and talents to improve the lives of those at Peppers Ranch.

Reflecting on the day's events, Ashley, a member of Young Agents, shared her thoughts, saying, “It's always touching and encouraging to see families doing what they can to be the best family for those who need them, while allowing us to come beside them and do what we can to make their lives better.” Her sentiment encapsulates the spirit of camaraderie and compassion that drives the Young Agents in their mission to make a positive impact.