The Importance of an IIAW Membership

Joining the IIAW is more than just a membership—it's a strategic partnership that can significantly benefit your insurance agency.

This issue was brought to you by our

Joining the IIAW is more than just a membership—it's a strategic partnership that can significantly benefit your insurance agency.

This issue was brought to you by our

Learn about the multitude of benefits that can help independent agencies navigate industry challenges, enhance professional development, and, drive the growth of their agency.

The Importance of Being a Member of The Independent Insurance Agents of Wisconsin

FROM THE ARCHIVES................................................................11-13

Young Agents Conference - Summer 2012

Exclusive Agent E&O Program: Big I and Swiss Re

The Consequences of Misclassifying Risk

Auto Claims Severity Up Significantly Since 2020 With No Sign of Slowing

GOVERNMENT AFFAIRS................................................................22 State Constitutional Referendum Questions On August Primary Ballot

FROM COUNSEL...............................................24 The Evolution and Impact of Third-Party Litigation Funding

INDEPENDENT INSURANCE AGENTS OF WISCONSIN

725 John Nolen Drive

Madison, Wisconsin 53713

Phone: (608) 256-4429

Fax: (608) 256-0170 www.iiaw.com

2023-2024 EXECUTIVE COMMITTEE

President:

Mike Ansay | Ansay & Associates

President-Elect: Joanne Lukas Szymaszek | Risk Strategies Company

Secretary-Treasurer:

Dan Lau | Robertson Ryan Insurance

Chairman of the Board:

Nick Arnoldy | Marshfield Insurance Agency, Inc.

State National Director: Steve Leitch | Leitch Insurance

2023-2024 BOARD OF DIRECTORS

Janel Bazan | Avid Risk Solutions/Assured Partners

Beth DeLaForest | Aspire Insurance Group, Inc.

Mike Harrison | R&R Insurance Services, Inc.

Jason Knockel | Kunkel & Associates, Inc.

Aaron Marsh | Marsh Insurance Services, Inc.

Andrea Nelson | Unisource Insurance Associates, LLC

Brad Reitzner | M3 Insurance Solutions

IIAW Staff

Matt Banaszynski | Chief Executive Officer 608.256.4429 • matt@iiaw.com

Mallory Cornell | Vice President 608.210.2975 • mallory@iiaw.com

Kim Kramp | Accounting Supervisor 608.210.2976 • kim@iiaw.com

Trisha Ours | Director of Insurance Services 608.210.2973 • trisha@iiaw.com

Evan Leitch | Agency Solutions Advisor 608.210.2971 • evan@iiaw.com

Kim Fiene | Marketing & Communications Director 608.210.2977 • kimf@iiaw.com

Jeff Thiel | Director of Agency Success 608.256.4429 • jeff@iiaw.com

Andrea Michelz | Education & Membership Engagement Coordinator 608.210.2972 • andrea@iiaw.com

Diana Banaszynski | Events Coordinator and HR Business Partner 608.256.4429 • diana@iiaw.com

Ali Smeester | Accounting Specialist 608.256.4429 • ali@iiaw.com

Wisconsin Independent Agent is the official magazine of the Independent Insurance Agents of Wisconsin (IIAW) and is published monthly by IIAW 725 John Nolen Drive, Madison WI 53713. Phone: 608.256.4429. IIAW does not necessarily endorse any of the companies advertising in publication or the views of the writers. IIAW reserves the right, in its sole discretion, to reject advertising that does not meet IIAW qualifications or which may detract from its business, professional or ethical standards. © 2024

For information on advertising, contact Kim Fiene, 608.210.2977 or kimf@iiaw.com.

Rob Jacques assumed the role of president and chief executive officer in March 2024. Jacques, who has dedicated more than 24 years to the company, will guide West Bend’s devoted team of more than 1,600 associates into a new era. “West Bend stands on the cusp of a promising future and I have an exceptional team of officers and leaders who are focused and eager to continue West Bend’s legacy of support, for our agency partners, associates, policyholders, and communities.”

West Bend Insurance Company stands out as a noteworthy example of a company committed to fostering strong connections with its independent insurance agents and associates as the cornerstones of its success.

West Bend goes beyond just completing transactions, it believes in the importance of building partnerships. Through personal contact, responsible actions, and genuine concern, West Bend has cultivated a reputation for nurturing valuable industry relationships. With more than 1,600 independent insurance agencies across 14 states, its network speaks volumes about trust.

The associates at West Bend are the heart of the organization, embodying its core values of excellence, integrity, and responsibility. They play a crucial role in delivering exceptional service to policyholders. Whether it’s ensuring fast and fair claim handling, thorough underwriting, or effective loss control services, they go above and beyond to meet customer needs with promptness, compassion, and ethics. In fact, as of the second quarter of 2024, 93% of policyholders who experienced a claim would refer West Bend to family or friends.

The culture at West Bend is shaped by its associates, and it shows. Recognized as a Best Place to Work in Insurance by Business Insurance for 13 consecutive years, West Bend takes pride in creating an environment where every voice is valued. Additionally, West Bend received a special award for Communication and Fortune honored the company as a Best Workplace for Millennials.

For independent agencies, West Bend offers a distinct contract value. One key aspect is the ease of doing business; West Bend ranked as a top carrier by thousands of agents in a national survey. Furthermore, West Bend’s product offerings span a range of coverages for Personal Lines, Commercial, Specialty, Workers’ Compensation, and Surety. So, the value of delivering a West Bend policy lies in agents’ ability to fulfill their promises to clients. Because the worst brings out our best®. That’s The Silver Lining.

In the rapidly evolving insurance landscape, being part of a professional association can significantly impact the success and growth of your insurance agency. Membership in the IIAW offers a multitude of benefits that help independent insurance agencies navigate industry challenges, enhance professional development, and ultimately drive agency growth.

The IIAW serves as a powerful advocate for independent insurance agents at both the state and national levels. The organization actively works to influence legislation and regulation that affects the insurance industry. By being a member, your agency benefits from having a voice in policy discussions that impact your agency’s operations. This advocacy ensures that your interests are represented and protected, allowing you to focus on serving your clients without undue regulatory burdens.

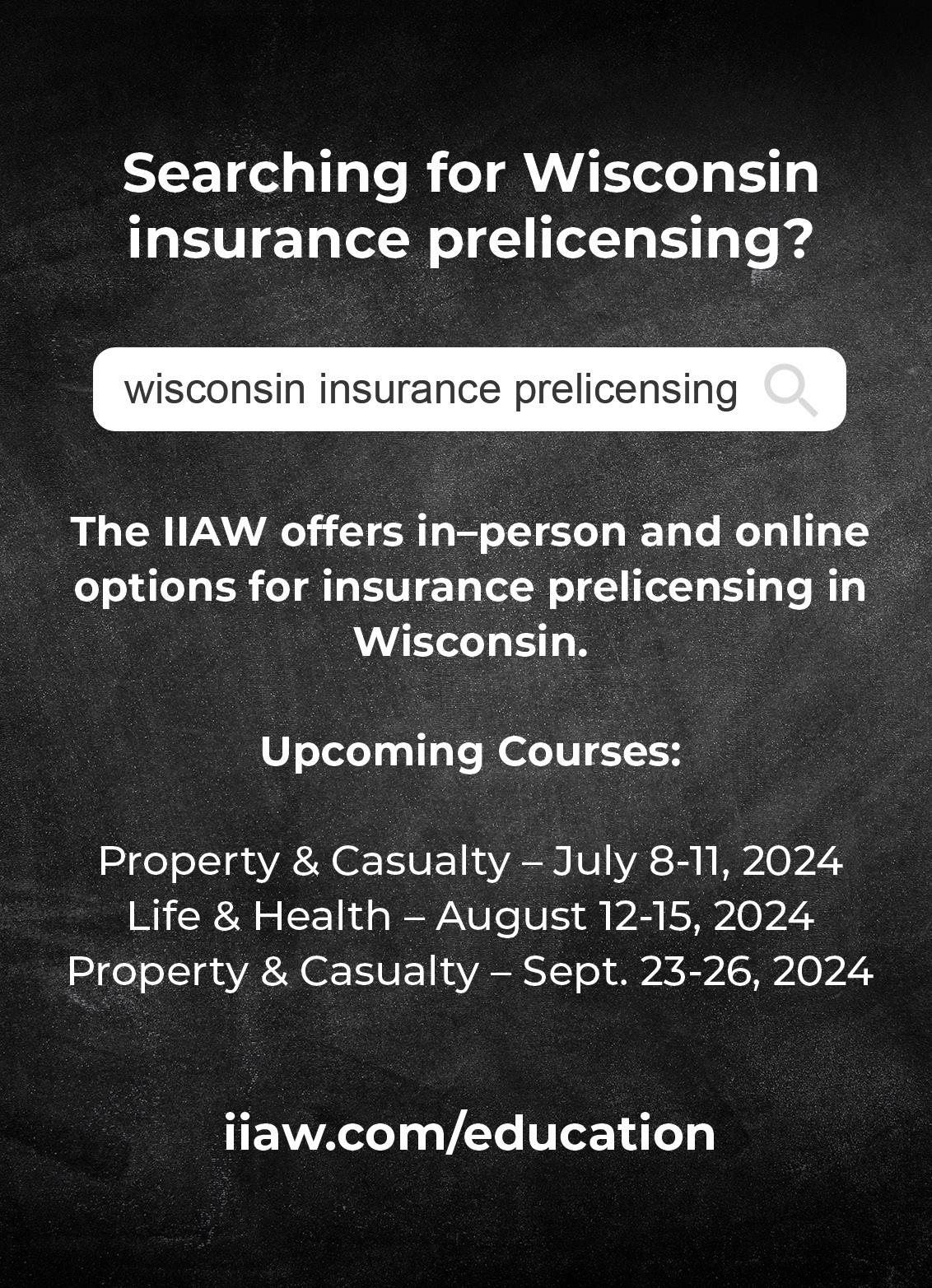

Continuous learning is crucial in the insurance industry due to constantly changing regulations, products, and market conditions. The IIAW offers a comprehensive suite of educational programs, including our new strategic partnership with The Institutes, offering our agency members free continuing education for all licensed professionals they employ. We also offer training resources and courses through My Agency Campus as well as certification programs, webinars, and seminars. These resources help you and your staff stay updated with the latest industry trends and best practices. The IIAW also has one of the largest in-person prelicensing property & casualty, life, and health classes in the state. Enhanced knowledge and skills lead to better service for your clients, setting your agency apart from competitors. Leverage all the educational offerings the IIAW has to offer.

Membership in the IIAW connects you with a network of professionals who share similar challenges and opportunities. The organization hosts numerous events, conferences, and meetings where you can meet and interact with peers, industry leaders, and potential business partners. Networking opportunities facilitate the exchange of ideas, foster collaborative relationships, and open doors to new business opportunities. In addition to its nationally renowned conference, InsurCon, the IIAW will be hosting its first ever Tech Summitt, bringing together users of Applied Systems, Vertafore Platforms and Hawksoft agency management systems for hands on learning and training. We will also have speakers covering a variety of topics, including AI, machine learning, Robotic Process Automation, and more.. The IIAW will also be hosting a Women in Insurance mentoring program and event, as well as an Emerging Leaders event (just to name a few). This sense of community can be invaluable for personal growth and business expansion. Be sure to take advantage of these insightful networking opportunities.

The IIAW provides members with access to a wealth of resources designed to support agency operations and growth. Led by Mallory Cornell and Evan Leitch, our agency operations consulting program has helped hundreds of agencies nationwide achieve consistency and uniformity in their workflows, while implementing efficiencies that save time and money. Additional resources offered by the IIAW include market share (intelligence) reports, industry publications, compensation report and proprietary tools that can help streamline your business processes. Additionally, the IIAW offers marketing and branding support to help you effectively promote your agency and build a strong market presence.

The IIAW provides various programs and services aimed at helping members grow their businesses. From lead generation tools to partnership opportunities with insurers and service providers, the IIAW offers practical solutions to help you expand your client base and increase revenue. The organization's commitment to supporting independent agencies ensures you have access to resources that directly contribute to both your business development efforts and the overall operation of your business.

The IIAW offers support and guidance to help members navigate challenges effectively. Operating an independent insurance agency comes with its own set of challenges. Whether you need legal advice, assistance with compliance issues, or strategies for dealing with market changes, the IIAW’s expert staff and resources are there to help. This support can be crucial in maintaining a smooth and successful operation.

Joining the Independent Insurance Agents of Wisconsin is more than just a membership—it's a strategic partnership that can significantly benefit your insurance agency. From advocacy and professional development to networking and business growth, the IIAW offers a comprehensive array of services and resources to help you thrive in the competitive insurance industry. By leveraging these member benefits, your agency can enhance its operations, build stronger client relationships, and achieve longterm success. Don’t miss the opportunity to be part of a dynamic organization dedicated to supporting and advancing the interests of independent insurance agents. Renew your membership in the IIAW today. If you're not a member, please don’t hesitate to reach out to learn more.

Red Ingredients

• 1 cup frozen strawberries

• 1 cup watermelon chunks, frozen

• 2 tablespoons fresh lime juice

• 2 tablespoons white rum

• 1 tablespoon sugar

• 1 cup ice cubes

White Ingredients

• 1 cup coconut sorbet

• 1/4 cup rum

• 2 tablespoons fresh lime juice

• 1 cup ice cubes

Blue Ingredients

• 1/3 cup blue passion fruit liqueur, such as Hpnotiq or Alize

• 1/4 cup fresh lime juice

• 2 tablespoons blue curacao liqueur

• 2 tablespoons white rum

• 2 tablespoons sugar

• 2 cups ice cubes

Begin by making the red layer: Put the frozen strawberries, watermelon, lime juice, rum, sugar and ice in the carafe of a blender. Blend until thick and smooth. Stir in 1 to 2 tablespoons water if the consistency is too thick. Transfer to a large measuring cup or small bowl and place in the freezer while you make the next layer.

For the white layer: Rinse out the blender and add the coconut sorbet, rum, lime juice and ice. Blend until thick and smooth. Transfer to another large measuring cup or small bowl and place in the freezer while you make the final layer.

For the blue layer: Rinse out the blender and add the passion fruit liqueur, lime juice, blue curacao, rum, sugar and ice cubes. Blend until slushy and there are no chunks of ice left.

Pour the red layer into the bottom of six 8-ounce glasses, about 1/3 cup each. Gently spoon 1/3 cup of the white layer over the red layer so they stay separate. Finish by spooning 1/3 cup of the blue layer over the second layer in each glass.

IIAW members get access to our extensive list of benefits. Learn more and take advantage of our benefits at iiaw.com

Agency Solutions - Free Evaluations

• Operational Reviews

• Workflow Mapping Technology Consultation

• Financial Consultation

• Strategic Consultation

• Agency Compensation Communications

• WI Independent Agent Magazine (Monthly Publication)

Big I Buzz (Weekly E-Newsletter)

• Interest Area Newsletters (Monthly - Personal Lines, Commercial Lines, Employee Benefits and Industry Relations & Operations) IIAW Publications

Reports

Industry Research

• Marketing Guides

• Compensation Report Monthly Market Share and Data Report

• ACORD Forms

• Agency Universe Study

• ACT - Agents Council for Technology Ask an Expert

• Best Practices Study

• Big “I” Business Resources

Big “I” Hires

• Market Access

• Diversity Task Force E&O Risk Management Website

• Agents E&O Insurance

• Association Health Plan

• Carrier Contract Reviews

• Data Breach Insurance Employment Practices Liability Insurance

• Employee Benefits Insurance

Education

• Prelicensing

FREE Online & Classroom CE

• Employee Training with MyAgencyCampus

Emerging Leaders

Professional Development

• Networking Events

• Opportunity to Attend National Leadership Conference

• Volunteering & community involvement

Events

Annual Convention (InsurCon)

• Technology Summit

• Emerging Leaders Events

Joint Legislative Conference

• Women in Insurance Mentoring Program

Legal Briefs and Guidance

• Free Quarterly Consultation

• Legal Publications & Guidance

• Government Affairs

• Guaranteed Income Program

• Independent Agent Magazine IndependentAgent.com

• InsurPac

• Large Agents & Brokers Council Legal Advocacy & Services

• Social Jazz

• Marketing & Branding Materials and Content

Government Affairs

• Political Advocacy at the State & National Level

• News & Updates Services

• Agency Accounting Services

Agency Operational Consulting

• Agency Technology Consulting

• HR Consulting

Virtual Operational Improvement Reviews

Task Forces & Councils

• 3 Virtual Meetings Per Year Free CE Credits and Seminars

• Networking Opportunities

Technology

• Cybersecurity Compliance Bundle

• Catalyit (FREE Full Access Subscription)

• Media Relations

• Trusted Choice Disaster Relief Fund

• Trusted Choice® Virtual University

• Young Agents – Professional Development

National Market Share Report

• Hard Market Toolkit

• ePayPolicy

• Flood Insurance Program

• Guide to Agency Perpetuation

• Home Business Insurance Independent Market Solutions (IMS)

• InsurBanc

• InVEST

• Retirement Plans

• Rough Notes Advantage Plus (VRC)

• TrustedChoice.com

• Umbrella Insurance Catalyit Subscription (comprehensive agency technology guidance)

We are excited to announce an exclusive new benefit for our valued agency members!

Starting September 1, 2024, IIAW member agencies and their licensed employees will gain free, full access to unlimited on-demand CE courses and live CE webinars through CEU and The Institutes.

As part of your agency membership, the IIAW is covering the cost of this fantastic new offering. Here’s how you can take advantage of this new benefit:

1. Renew your IIAW Membership by September 1

2. Complete the request for employee information

3. Start enjoying FREE unlimited CE

More information on this valuable new benefit is coming soon—stay tuned and learn more about CEU's course offerings at web.theinstitutes.org/ceu

Contact us at info@iiaw.com to schedule a 30 minute meeting with one of our staff to discuss your access to specific member benefits.

The IIAW is your leader in insurance CE, prelicensing and employee training. Join us and other agents at our annual convention and other events throughout the year.

An IIAW membership entitles you to exclusive products and consultative services. We offer E&O, Data breach, EPLI and Association Health Plan for Wisconsin independent insurance agents.

The IIAW and InsurPac, our state and national Political Action Committees, ensure our industry is present and heard in Wisconsin and Washington D.C.

An IIAW membership helps navigate your agency toward success. Members receive access to a full suite of tools and resources to help your agency succeed. Reach out to info@iiaw.com for help in navigating your benefits.

We offer technology, operational, accounting and human resources support to meet the needs of your agency.

The boat cruise is an opportunity to network and have a great time.

Derek Wickhem (John Wickhem Agency), chair of the Young Agents Committee, welcomes attendees to the Upper Dells boat cruise. The cruise has become a tradition at the conference.

Weimer, Banaszynski Executive Tracy Larson (Thompson-Nelson Insurance), and the boat.

Morrison E&O Administrator) Allison should loosen up little. You can that they weighed down by stress.

From July 12-14, 2012, Wisconsin and Minnesota agents, family and friends came to the Kalahari Resort in Wisconsin Dells for the Midwest Young Agents Conference. Education, networking and the boat cruise are hallmarks of the conference and the 2012 edition provided more of the same.

a

The IIAW's E&O program has a long history and has undergone many changes over the last five years. Our goal has always been to deliver the quality and service our members expect and deserve while being forward-thinking and asking ourselves, "What more can we do?" In 2018, we started doing more. We created an E&O Risk Management program designed to proactively identify E&O exposures and work directly with independent agents to improve operational workflows. This program has expanded, and we now have two Swiss Re-approved auditors on the IIAW team—making us the only Big I state that can say this!

The Swiss Re policy is one of the strongest policy forms for agents E&O. Add in top-notch claims advisors, experienced underwriters, up to 30% in available premium credits, and a local team of professionals, its no wonder why Wisconsin’s top agents choose the IIAW and Swiss Re for their E&O needs.

If you are already a Swiss Re policyholder, we invite you to review your premium credit eligibility before the next renewal. There are several opportunities to work directly with the IIAW staff. Agencies should consider an E&O Risk Management Class, E&O Website Review or an Operational Improvement Review. These proactive risk mitigation options will help reduce your E&O exposure, build your agency culture and save you up to 30% on your E&O premium.

Contact Trisha Ours, trisha@iiaw.com, to learn more about these credit opportunities or to complete an application for your agency’s E&O coverage!

Big "I" Professional Liability program and Swiss Re Corporate Solutions pride ourselves on offering the strongest coverage form in the marketplace that continues to evolve to meet the changing needs of the agents. Review the preferred policy form and you will find that these are just a few of the coverage benefits:

• Rated A+ by A.M. Best

• Claims-made coverage with full prior acts available

• Limits of liability up to $25 million

• Broad definition of covered professional services and activities

• Comprehensive definition of insured

• Aggregate deductibles available

• Defense cost outside the limit

• $25,000 1st Party Personal Data Breach

• $1,000,000 3rd Party Personal Data Breach sublimit available

• 60/40 consent to settle clause

• Crisis Management coverage; up to $20,000 per policy period for fees, costs and expenses incurred within 6 months of a crisis event

• Deductible reduction up to $25,000 per claim with proper documentation, no limitation to the number of claims

• Catastrophe expenses $25,000 per incident, $50,000 per policy period

• Regulatory defense $100,000 per policy period in addition to the limit of liability

• Several options to earn premium discounts up to 30%

As an insurance agent, you understand the importance of providing accurate insurance quotes for your clients. However, misclassifying risks can lead to significant consequences for both you and your clients. From inadequate coverage to unexpected costs and lawsuits, the risks of misclassification are real and can have a lasting impact.

The key to avoiding misclassification starts with a thorough understanding of your clients' businesses and the risks they face. By taking the time to gather detailed information and asking the right questions, you can accurately assess the risks involved and provide an insurance quote that offers comprehensive coverage.

It is also a good idea to review your client's website, social media profile and online reviews. If your client mentions a service online, those services must be considered when determining the appropriate class code and answering underwriting questions.

Additionally, staying up to date with industry trends and regulations will help you navigate the complexities of risk classification and ensure compliance with legal requirements.

Here are five reasons why accurate classification is important—and the impacts of getting it wrong:

1. Claim coverage. By accurately classifying risks, you can ensure your client has insurance

coverage that is specifically designed to protect their business needs. If their business is misclassified or does not have adequate coverages based on their operations, they may be forced to pay out of pocket for any liability and damages.

2. Cost impacts. Misclassifying risks can result in your clients overpaying for insurance they do not need; being underinsured or carrying inadequate limits; or even underpaying for insurance— resulting in your client being required to pay additional premium following an audit of payroll and operations. By avoiding misclassification, you can help your clients get the coverage they need and the carrier gets the appropriate premium for the risk characteristics.

3. Reputation. If your client's business is misclassified, any bound policies are potentially not viable and could be canceled by the carrier, putting your client's business at risk. By consistently providing accurate insurance quotes, you build a reputation as a trusted and reliable insurance agent. This reputation will not only attract new clients but also foster long-term relationships with existing ones.

4. Legal risks. Misclassification can lead to legal issues and potential lawsuits. By accurately assessing risks and providing appropriate coverage, you can help your clients avoid legal pitfalls and protect their businesses from costly

litigation. Furthermore, misclassifying a client's business and selling a policy that does not cover their unique risks could lead to legal issues and a potential errors & omissions claim for you, the insurance agent.

5. Good standing. By consistently using the incorrect class code when securing quotes for your client, you are at risk of being prohibited from using specific platforms and losing your carrier appointments. Providing correct class codes ensures you remain in good standing with carrier and underwriting partners.

In the fast-paced world of insurance, accuracy and attention to detail are paramount. By avoiding the risks of misclassifying risks, you not only protect your clients but also safeguard your own reputation and business.

The high claims severity that plagued the personal auto insurance market in 2023 shows no signs of abating, according to the “2024 LexisNexis® U.S. Auto Insurance Trends Report," [released June 20], which offered various other insights into the auto insurance market.

Bodily injury severity has risen 20% from the end of 2020 to the end of 2023, according to the report, while severity for all material damage coverages has increased 47%. Contributing factors include parts and labor shortages, storage costs, attorney involvement and increases in medical treatment costs.

In a separate study in 2023, LexisNexis commissioned a market research study to learn about third-party claimants who hired an attorney in auto claims—a major contributor to claims cost increases.

Following an auto accident, 85% of claimants were approached by one attorney while about 60% heard from two or more. Among the claimants who hired an attorney, 51% received a higher settlement amount, the study found, and of the claimants who used legal counsel, nearly twothirds would definitely do so again, with another quarter saying they probably would.

Further, total loss claims have increased 29% since 2020, with more than 1 in 4 collision claims in 2023 deemed total losses. In cases of total loss, 46% of consumers were dissatisfied with their claims experience, with 40% of all respondents said it took a month or longer to obtain the full payment for their claim.

As total miles driven returned to 2019 levels in 2023, the risky driving patterns that emerged during the COVID-19 pandemic continued to rise, with all moving and nonmoving driving violations increasing 4% year-over-year in 2023. Major speeding violations were up 10% from 2022 to 2023—and up 36% from 2019. Additionally, driving under the influence (DUI) violations grew 8% from 2022 to 2023.

Distracted driving violations increased by 10% from 2022 to 2023. Young drivers are most susceptible to distraction, with distracted driving violations by Generation Z increasing 24% from 2022, and 66% from 2019. The same violation increased 9% from 2022 among millennials.

Although risky driving behavior persists, many insurers haven't updated their pricing models to reflect those changes, the report warned.

As carriers seek to alleviate the inflation and high claims costs that contributed to a property & casualty combined ratio of 105% in 2023, significant rate increases of 14% reduced pressure on profits but also led to a drop of three percentage points in retention from 83% to 80%, LexisNexis found.

Among respondents with auto insurance at the end of 2023, 41% had shopped at least once for a new policy in 2023. Many ended up switching, causing the number of new policies to rise 6.2% in 2023. Meanwhile, insurance industry advertising spending decreased roughly 45% from its height in 2021.

With low-risk customers prompted to jump to better options in the market, insurers may be retaining policies with higher risk at the wrong price, the report points out. “Insurers who are not actively engaged in managing the change in risk in their renewals may find it difficult to maintain profitability. The lack of a consistent renewal strategy could also threaten new business rate competitiveness. Insurers can update renewal underwriting strategies by leveraging predictive internal and external data and models to help maintain price to risk."

Meanwhile, electric vehicles (EVs) are another emerging factor in personal auto. As the EV market continues to emerge, with a 54% increase in EV sales in 2023 over 2022, insurance risks also continue to grow. Claim frequency and severity for EVs were respectively 17% and 34% higher than for private passenger autos overall. And while EVs still only comprise 1.5% of all private passenger autos, they accounted for 2.3% of the total claims payment among all personal autos in 2023.

This article was originally featured on iamagazine.com in June 2024.

> Annemarie McPherson Spears, IA News Editor

In 1919, A group of Pennsylvania farmers founded Penn National Insurance to provide affordable workers’ compensation insurance.

Today, Penn National Insurance sells property-casualty insurance in 12 states by partnering with more than 1,200 independent agency operations. In 2012, we affiliated with Wisconsin-based, Partners Mutual Insurance Company. As one company, we bring the personal attention and local focus of a regional carrier, along with the quality of products and services of national carriers.

Interested in partnering with a thriving insurance carrier with superior customer experience? We are looking for seselect commercial lines-oriented agencies in Wisconsin.

Contact:

Vicki Lentz

262-432-3420

vlentz@pnat.com

Contact: Clayton Zogata

715-383-5454 czogata@pnat.com

• Strong financial performance and A.M. Best Financial Strength Rating of A (Excellent) Positive Outlook

• Expanded Commercial Lines products and services with competitive pricing and comprehensive coverages to help our agents grow profitably

• Comprehensive Personal Lines product offerings, including Homeowners Equipment Breakdown and additional protection plans

• State-of-the-art quoting, processing and self-service tools, making it easier and faster to meet your customers’ needs

• Local, experienced underwriting, claims and management staff

The August 13 primary ballot in Wisconsin will feature two significant constitutional referendum questions related to the state's fiscal management and the allocation of federal funds. Here is a breakdown of the questions voters are being asked and the implications:

Text: “Shall section 35 (1) of article IV of the constitution be created to provide that the legislature may not delegate its sole power to determine how moneys shall be appropriated?”

• Yes Vote: Prevents the legislature from delegating its authority to appropriate funds. Only the legislature would have the power to decide on the allocation of state funds.

• No Vote: Maintains the current system, allowing some delegation of appropriation powers.

Text: “Shall section 35 (2) of article IV of the constitution be created to prohibit the governor from allocating any federal moneys the governor accepts on behalf of the state without the approval of the legislature by joint resolution or as provided by legislative rule?”

• Yes Vote: Requires legislative approval before the governor can allocate federal funds. This could potentially slow down the distribution, but ensures legislative scrutiny and oversight of taxpayer dollars.

• No Vote: Allows the governor to continue allocating federal funds without legislative approval, enabling quicker allocation and disbursement, especially during certain emergencies.

These amendments stem from ongoing political tensions between the Republican-controlled legislature and Democratic Governor Tony Evers. The amendments aim

to balance power more heavily towards the legislature in terms of fiscal decisions, particularly around federal funds allocation. Proponents, being led by legislative Republicans, argue that this ensures greater transparency and accountability over how taxpayer dollars are spent, while opponents, being led by legislative Democrats and Governor Evers, warn it could impede swift responses to emergencies, as well as slow down or jeopardize certain state infrastructure projects.

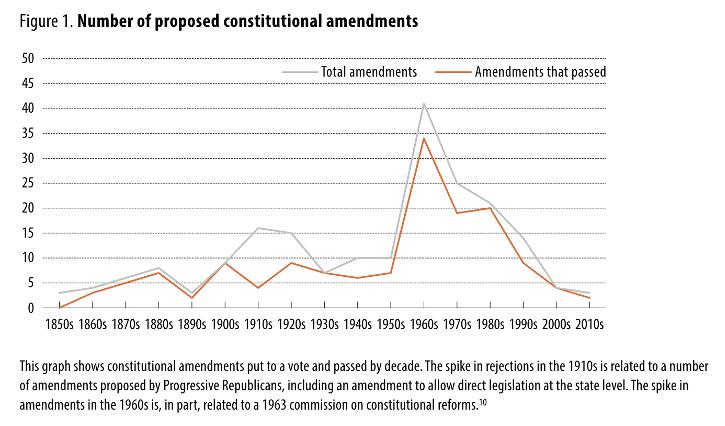

The process for amending the state Constitution involves passing a proposed amendment in two consecutive legislative sessions before it is presented to voters for ratification in a statewide referendum. Historically, the electorate has approved 145 out of 197 proposed amendments since 1848 (Note graph above from the nonpartisan Legislative Reference Bureau).

These amendment questions represent a crucial decision point for Wisconsin voters on how they want their state government to handle the allocation of funds and the balance of power between the legislative and executive branches.

Be sure to make your voices heard on these important constitutional amendments and vote on Tuesday, August 13.

> Misha Lee IIAW Lobbyist

If you were at InsurCon this year (and I hope you were—it was an incredible celebration of 125 years of the IIAW!), you heard IIABA President and CEO Charles Symington’s comments on a host of important issues and initiatives that the IIABA and IIAW are watching at the national and state level. One issue he mentioned is the proliferation of third-party litigation funding, something relatively new in the United States and likely unfamiliar to most independent agents. A few members have asked me about it since then so I thought I would use this column for a quick summary of what it is.

Litigation can be, and often is, an unavoidable path to resolve disputes. However, litigation—particularly largescale, high stakes litigation—is extremely expensive. The cost of investigation, discovery, attorneys’ fees, and expert witnesses can quickly accumulate. In recent years, many parties, particularly on the plaintiff’s side, have turned to third-party financing for their litigation. However, this new funding mechanism has not been without controversy as the it has grown into a multibillion dollar industry.

Third-party litigation financing involves a third-party, i.e., a person or entity not involved as a plaintiff or defendant in a case, funding a lawsuit in exchange for a share of the monetary recovery. This type of agreement is typically structured as either a multiple of the original investment, or a percentage of the total recovery. According to the U.S. Government Accountability Office, third-party litigation financing first gained foothold in the United States in 2010. The practice had been well established for decades in some other countries, such as Australia and England.

Historically, third-party litigation financing was limited by common law prohibitions against maintenance, champerty, and barratry. However, many states have begun to relax these prohibitions, contributing to third-party litigation finance’s increased acceptance and growth. In 2022, an estimated $3.2 billion was spent by litigation funders in civil suits.

Proponents of third-party litigation financing identify several benefits to the legal system, such as providing more equitable access to the legal system and the ability to litigate without the risk of significant financial losses. Critics have raised concerns about the potential conflicts

of interest and weakening of attorney-client privilege, as well as the promotion of marginal or frivolous litigation and discouragement of settlements.

In 2018, Wisconsin became the first state to mandate disclosure of third-party litigation funding by the passage of Wisconsin statute § 804.01(2)(bg). The statute requires parties, without any discovery requests, to disclose any third-party litigation funding deals to clients and to the other parties in a case, excluding contingency fee agreements. “Wisconsin’s law brings litigation funding out of the shadows, so that funders in the state can’t anonymously ‘pull the strings’ of a lawsuit without other parties’ knowledge,” Lisa A. Rickard, president of the U.S. Chamber of Commerce’s Institute for Legal Reform, said in a press release.

Since Wisconsin’s passage of the third-party funding disclosure statute, other states have passed similar laws, rules and regulations addressing third-party litigation financing. Other state courts have taken direct action and issued court rules addressing required disclosure of third-party litigation financing.

In early June, federal legislators debated litigation finance disclosure at a judiciary hearing. Testimony received by the U.S. judiciary committee demonstrated clear disagreements of whether the presence of litigation finance should be disclosed. Witnesses disagreed on the extent of the disclosure and others expressed concerns regarding national security due to the involvement of international litigation funders. The committee hearing ended with Representative Darrell Issa (R-CA), promising to draft a litigation finance disclosure bill within ten days. Stay tuned to see if the federal government will take any further action.

> Josh Johanningmeier, IIAW General Counsel

The IIAW Emerging Leaders is a statewide network of insurance professionals striving for professional growth through education, leadership development, legislative involvement and insurance career perpetuation. The group hosts a variety of in-person and virtual events throughout the year to allow members to learn, network and grow professionally.

The IIAW Emerging Leaders is committed to offering best-in-class professional development and networking opportunities for insurance professionals across the state.

Young insurance professionals who are looking to enhance their career and build relationships within the industry.

We create experiences to help members build their careers and integrate best practices.

We develop meaningful relationships between agents, carrier representatives and association members.

We provide unique professional development opportunities (industry simulations, personal development, speakers, webinars, etc.).

We engage future industry decision-makers in events and volunteer roles.

Members in the

WILSON

PORTAGE, MICHIGAN, MAY 2024 – JM Wilson is pleased to announce the addition of Bruce Haney as Accounting and Finance Specialist. Bruce’s responsibilities include a variety of accounting duties including invoice processing, collections, cash management, month-end closing, and customer support for all JM Wilson offices.

Prior to joining JM Wilson, Bruce gained valuable experience in accounting where he held roles as Finance Associate and Manager of Accounting. A Southern New Hampshire University graduate, Bruce earned a Bachelor of Science in Accounting.

WILSON

PORTAGE, MI, MAY 2024 - J.M. Wilson is pleased to announce the promotion of Ebonie White to Senior Property & Casualty Technician. Ebonie joined JM Wilson in 2022 as a Property & Casualty Technician with over six years of customer service experience. With her promotion, Ebonie is responsible for processing commercial property and casualty and personal lines policies and endorsements, assisting JM Wilson underwriters, training teammates, and serving independent insurance agents in all states.

JM WILSON PROMOTES FARRELL TO EXECUTIVE SURETY

PORTAGE, MI, MAY 2024 - JM Wilson is pleased to announce the promotion of Stephanie Farrell

to Executive Surety Underwriter. In this new role, Stephanie is responsible for underwriting new and renewal commercial and fidelity bonds, corresponding with carrier underwriters, and assisting independent insurance agents in all states that JM Wilson writes. With an increased level of product knowledge, Stephanie is a leader and resource to other underwriters in her department.

Stephanie joined JM Wilson in 2006 as a receptionist and was later promoted to Assistant Underwriter in 2009, Surety Underwriter in 2014, and Senior Surety Underwriter in 2019. Stephanie holds a degree in Commercial Art and previously managed an art studio in New York.

Founded in 1920, JM Wilson is a family owned and operated Managing General Agency and Surplus Lines Broker providing independent insurance agents access to A rated specialty markets. JM Wilson offers coverage for standard and hardto-place Commercial Transportation, Property & Casualty, Brokerage, Marine, Personal Lines and Surety accounts in 47 states across the U.S.

For more information about J.M. Wilson, call (800) 666-5692 or visit www.jmwilson.com.

Are you an IIAW Supporting Company Member?

Send your press releases to kimf@iiaw.com to be featured in our monthly Members in the News section.

Not a member? Become one today at iiaw.com

•Day-to-Day Bookkeeping

•Payroll Processing

• Direct & Agency Bill Reconciliations

• Financial Statement Preparation

• Annual Budget Preparation

• Work With Your External Accountants For Tax and Auditing Needs

Our services are best fit for agencies lacking financial acumen on staff, agencies with mature staff looking forward to retiring and agencies looking for additional bookkeeping knowledge and support.

Our team of dedicated agency accounting specialists are ready to assist you!

Kim Kramp Agency Supervisor kim@iiaw.com

Ali Smeester Agency Accounting Specialist ali@iiaw.com

7/15

7/15

7/15

7/15

7/16

7/16

7/16

7/16

7/16

7/16

7/17 7/17 7/17 7/19 7/23 7/23 7/23 7/23 7/24 7/24 7/24 7/24 7/24 7/25

SEE

7AM-9AM

8AM-10AM

8AM-11AM

9PM-11AM

7AM-10AM

7AM-10AM 9AM-11AM 10AM-12PM 11AM-1PM 2PM-4PM 7AM-10AM 10AM-1PM 12PM-3PM 12PM-3PM 7AM-9AM 9AM-10AM 12PM-2PM 1PM-3PM 7AM-9AM 10AM-12PM 10AM-12PM 12PM-2PM 12PM-1PM 10AM-12PM

Builders Risk and Contractors Equipment

To Be or Not to AirBnb - Sharing Exposures and Insurance

Adding Value In Personal Lines

Business Auto Claims That Cause Problems - UPDATE

Understanding (and Managing) the Largest Govt Benefits: Social Security

Watch Your Six - A Half Dozen Ethics Scenarios for Insurance Professionals

Why Business Income is the MOST Important Property Coverage

Why Certificates of Insurance - Just Why?

Farm and Insurance Issues – Top Ten Cases of the Last Decade (Or So)

Gigs and Side Hustles - The Insurance Issues

Commercial Lines Claims That Cause Problems - UPDATE

Agency Management Based E&O and Ethics - UPDATE

E&O - Commercial Property Coverage Gaps & How To Fill Them - Part 1

E&O - Roadmap to Homeowners Insurance - Part 1

Understanding the Importance of Ordinance or Law Coverage

E&O Exposures: Websites & Social Media

Properly Calculating & Insuring the Business Income Exposure

Rules for Developing the Correct Premium

9 Rules for Reading an Insurance Policy Based on the Law of Insurance Contracts

Insight on Modern Day Cyber Exposures & Risk Mitigation

3 Keys to Getting the Named Insured Correct

4 Key Personal & Commercial Lines Exposures Every Agent Must Understand Claims - Made Policies - The Most Dangerous Insurance Policies in our Industry

Those Kids and Their Cars - UPDATE

We distinguish our Workers’ Compensation coverage by providing value-added services before, during, and after a claim.

Upfront loss control measures

Responsive claims handling

Facilitation of quality medical care (when an accident does occur)

We’ve been successfully protecting our policyholders and their employees since 1983.

Our Workers’ Compensation policy is available nationwide except in monopolistic states: ND, OH, WA, and WY.