BLUE CROSS AND BLUE SHIELD OF ILLINOIS VISION CARE

n 1-800-828-3116

n Pre Authorization Medical 1-800-635-1928

n Pre Authorization for Mental Health or Substance Abuse 1-800-851-7498

n Provider Locator 1-800-810-2583

n 24/7 Nurse Line 1-800-299-0274

n Pharmacy Program 1-800-423-1973

BLUE CROSS AND BLUE SHIELD OF ILLINOIS LIFE, DISABILITY, ACCIDENT AND/OR CRITICAL ILLNESS

n Customer Service 1-800-367-6401

BLUECARE DENTAL CUSTOMER SERVICE

n Claim Status & Questions

n Dentist Questions & Verification

n Benefit Explanations & Eligibility

n 1-800-367-6401

n Locating an Eye Doctor

n Member inquiries about benefits, claims or eligibility

n 1-855-362-5539

BLUE CROSS AND BLUE SHIELD OF ILLINOIS COBRA TEAM HELP LINE

n Cobra Team 1-888-541-7107

n Health Equity 1-800-570-1876

ILLINOIS BANKERS GROUP INSURANCE TRUST

ERICH BLOXDORF, Plan Administrator

n 217-789-9340

n ebloxdorf@illinois bank

MIKE MAHORNEY, Senior Trust Advisor

n 217-836-8580

n mmahorney@illinois bank

HILLARY MEYERS, Trust Manager

n 217-789-9340

n hmeyers@illinois bank

CLEMENS & ASSOCIATES

MICHAEL HASSELBRING, President

n 888-824-2100

n mrhasselbring@clemensins .com

MICHAEL LYNCH, Vice President

n 888-824-2100

n michael@mslbenefits .com

Thank you for your interest in the Illinois Bankers Group Insurance Trust. The Illinois Bankers Group Insurance Trust has been providing group health insurance products to Illinois’ thrifts and banks since 1967. In the last twelve years alone, nearly $245,000,000 in health insurance claims has been paid on behalf of employees covered by health plans offered through the Trust.

You will be pleased to know that the Trustees have completed our negotiations with Blue Cross Blue Shield of Illinois (BCBSIL) for our 1/1/2024 renewal. Our partnership with BCBSIL continues to offer our members competitive rates in addition to access to one of the largest provider networks in the nation. BCBSIL has contracted the deepest provider discounts available in the marketplace while retaining access to the largest number of top facilities in the Chicagoland region and in downstate Illinois.

We invite all organizations (past, present, and future) to look seriously at the Trust’s offerings as we believe they represent the best medical plans available in addition to a complete and comprehensive ancillary benefits portfolio offering! As part of our health insurance plans, we also offer preventative care for members through Wondr (metabolic syndrome reversal program), Hinge Health (musculoskeletal), and Livongo (diabetes and hypertension management). Coming in 2024 will be increased cancer services and support, delivering certified oncology clinicians to help members understand benefits and coordination with specialists; and a Mental Health Hub, a digital one-stop shop for all mental health resources. In addition, Illinois Bankers Group Insurance Trust members will have access (at no cost) to our benefits consultants at Clemens & Associates for advice and assistance regarding regulatory and compliance issues on an ongoing basis.

As we assessed the current market, we are confronted by rising healthcare inflation and increases in challenging conditions for our members due to COVID related delayed screenings. For the 2024 calendar year, the Trust will continue to include benefits mandated by the Affordable Care Act. The renewal premium average increase in 2024 will be 11.12% over 2023 premium levels. We will be renewing all current (8) health plans offerings with BCSBIL. As Trustees, we believe that BCBSIL offers the best long-term benefits in the market today. The key benefit to belonging to a true group health plan is that members enjoy the price stability of the Trust. In fact, over the past 14 years, the average annual increase has been 5.65%.

In addition to our broad and stable medical offering, we also have positive news on the rates concerning our ancillary product portfolio for 2024:

•

•

•

• Critical Illness carrier for 2024 will be BCBSIL

BCBSIL

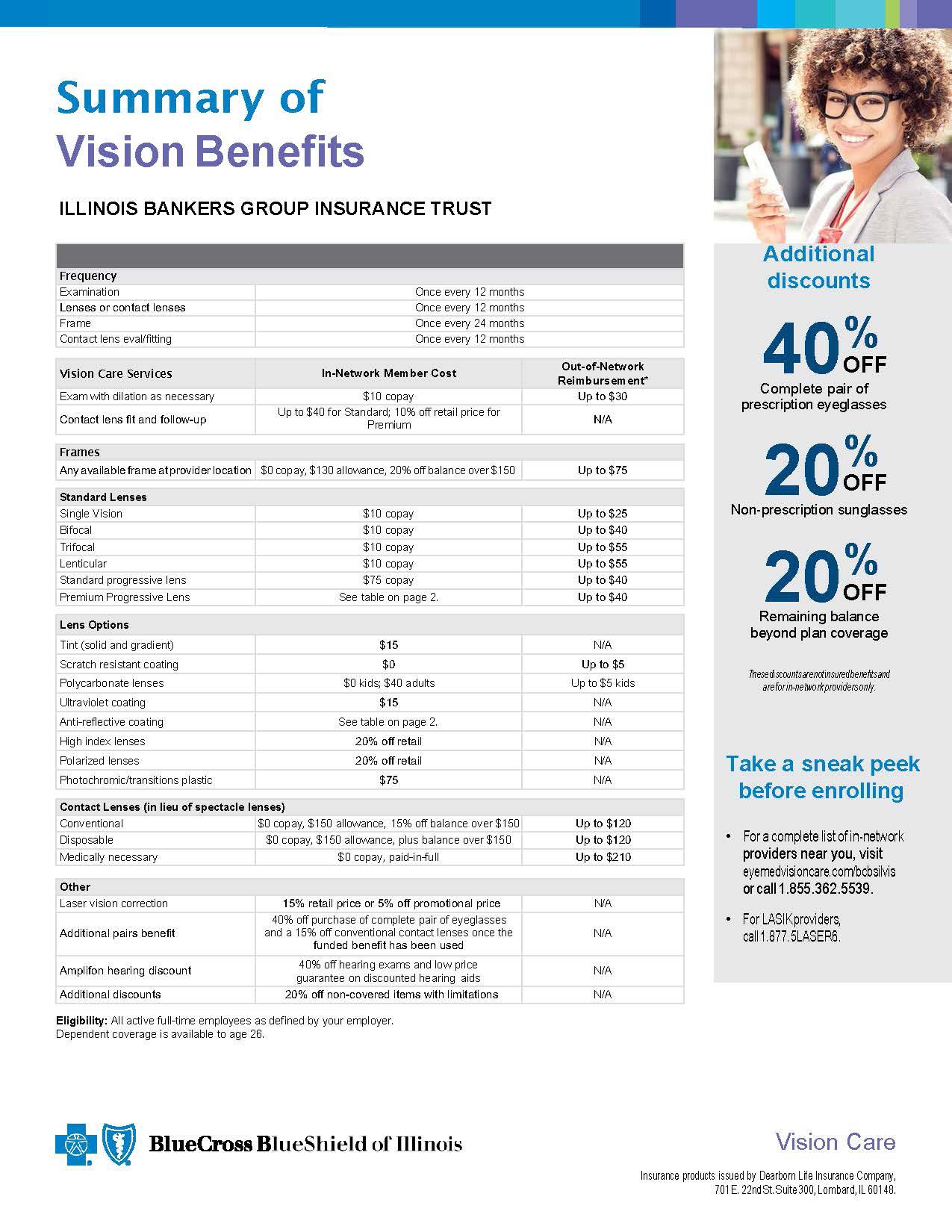

• The vision carrier for 2024 will be BCBSIL powered by EyeMed

• The basic life carrier for 2024 will be BCBSIL

• The short-term disability carrier for 2024 will be BCBSIL

• Accident carrier for 2024 will be BCBSIL

No change in rates

No change in rates

No change in rates

No change in rates

No change in rates

No change in rates

As a reminder, we have contracted with WEX Health’s BenefitsConnect System to assist our members with online benefit management and eligibility enrollment. Not only will this tool assist your organization in managing your benefit offerings it will also serve to help your institution stay in full compliance with the dictates of the Affordable Care Act Details and education on its use will be provided at our member seminar scheduled for the first full week of October.

We encourage you and your organization to utilize all the Illinois Bankers Group Insurance Trust’s expertise and services to plan your institution’s future strategies in efforts to provide the best possible benefits options to your employees. All the Trust’s contact information can be located on page 3.

Sincerely,

Dane H. Cleven, Chairman

Dane H. Cleven, Chairman

As a valued member of the Illinois Bankers Group Insurance Trust you will have direct access to our benefits consultants at Clemens and Associates who have been retained by the Trust at no additional cost to our members .

Clemens and Associates provides the Illinois Bankers Group Insurance Trust an unparalleled advantage of local market knowledge, cost-efficient methods and access to experts on innovation and compliance Today’s health and benefit solutions require in-depth knowledge of global and local markets that can be leveraged by access to innovative solutions, support for legislative compliance and an efficient operating platform . Whether your organization is located in one market, multiple regions or spans the United States, Clemens and Associates delivers health, financial security, work/life, voluntary and other benefits programs that are modern and cost-effective . As one of the largest consulting/brokerage firms in the State of Illinois, Clemens and Associates is uniquely positioned to study and comprehend the intricacies of the Illinois Bankers Group Insurance Trust and design a benefit strategy matching your bank’s needs to the array of options the Trust provides

• Our strategies always start from the most essential element, people . Each member of our benefits team is an experienced consultant, drawing upon years of experience working with a diverse set of clients We are familiar with issues common within the financial services industry bringing innovative solutions to the table derived from our experiences in other industries . We pride ourselves in identifying, often overlooked, details that can make a difference in your benefit strategy

• In addition, our firm has retained the services of one of the states most respected ACA and ERISA attorneys His consultation is also included at no additional cost to the Trust members .

• All health and benefit programs require an annual performance assessment, benchmarking against best practice, pricing, program marketing and renewal, communication, compliance and financial reporting . Clemens and Associates provides a comprehensive approach to all aspects of plan management Where appropriate, we bundle this solution with administrative support for enrollment, billing and customer service . In other instances, we provide a project-based approach

• The Illinois Bankers Group Insurance Trust invites its members to be more engaged in understanding and managing their health risks, choosing the best plans and products offered by the Trust, participating in care management programs and managing their current post-retirement benefit decisions while understanding the significant investment the Illinois Bankers Group Insurance Trust makes in them Clemens and Associates provides a full range of assistance from standardized programs for smaller employers to highly customized programs that match the Illinois Bankers Group Insurance Trust’s particular products

WEX Health’s BenefitsConnect System (online enrollment and benefits administration) – The Illinois Bankers Group Insurance Trust wants you to have access to the most efficient way of enrolling employees, managing employee life event changes and reporting eligibility to carriers . The convenient on-line access is available 24 hours a day, seven days a week . Timeliness and accuracy are critical to ensuring that claims are paid correctly for participants who are truly eligible for the plan

Clemens and Associates will aid the Illinois Bankers Group Insurance Trust members with planning, strategy, benchmarking, design, communication, compliance and administration

The Illinois Bankers Group Insurance Trust has joined with Blue Cross / Blue Shield of Illinois to provide a stable, high-quality group health insurance program for any federally insured IBA member financial institution in the state and also its affiliate members.

In January 2024 the Trust will partner with BlueCare Dental to provide dental insurance, Blue Cross Blue Shield of Illinois Vision Care to provide vision insurance, and Blue Cross Blue Shield of Illinois to provide life, disability, critical illness and accident coverage benefits to its membership.

The Trust exists solely to provide IBA members with a reliable source of competitively priced, quality group insurance products This means:

n Lower overhead expenses

n Plan flexibility

n Individualized attention

n Quality and timely claim administration

n COBRA and HIPAA administration for participating member institutions

n Coverage that can be offered not only to employees but also retirees

The Trust group insurance program for member institutions offers a broad portfolio of products and services including:

n Major Medical with prescription coverage

n High Deductibe Health Insurance Plans

n Dental/Vision care

n Life and AD&D

n Short/Long term disability

n Critical Illness and Accident

n Access to Health Savings Accounts

n Access to Flexible Spending Plans

n All plans comply with the Affordable Care Act

The Trust provides members with dedicated field service executives to review plan updates, meet with employees/management to answer the inevitable insurance coverage questions .

Annual seminars are conducted, and mailings are sent to members to communicate any changes well in advance of renewals There are no last-minute surprises

The Trust insurance plans are easy to understand, with services that support your efforts to keep employees healthy and protect their families . Healthier employees tend to be more productive and spend fewer health care dollars, resulting in health care professionals having more time to focus on patients with serious needs . In general, the whole system simply works more smoothly and effectively .

A service for members of the Illinois Bankers Association, the Trust is the only banker-led program in Illinois that offers its member institutions and affiliates the benefit of true-quality group insurance . Through the Trust, you can provide your employees with a strong plan that offers stable rates and minimized risk

Joining the Trust, your institution becomes part of a larger insured group made up of banks and affiliates throughout Illinois . In larger groups, risk is spread evenly, allowing premiums to stabilize and protecting the individual members from a large, catastrophic claim

The Trust has been providing group health insurance products to Illinois banks since 1967 A formal Trust Agreement was adopted in 1967 and has since been amended to meet all the requirements of the Employee Retirement Income Security Act of 1974 (ERISA) The Trust is a separate legal entity and the policyholder for the various group insurance policies offered to all IBA members The Trust enjoys a tax-exempt status under Section 501 (c) (9) of the Internal Revenue code . Some important facts about the group insurance programs available through the Trust include:

n The Trust is a not-for-profit entity, existing solely for the purpose of affording IBA members a source for purchasing quality and competitive group insurance products and services .

n The Trust is governed by a Board of Trustees made up of executive officers from our member banks and affiliates

n The Trust’s policies and products are all fully insured by one of the nation’s top carriers

n The Trust employs an ERISA attorney . The Trust also employs the consulting services of Clemens & Associates

n IBA members who participate in the group insurance program enjoy the security, protection and other advantages of being insured as part of a larger group .

n Member groups receive individual attention from the staff of the Illinois Bankers Group Insurance Trust on any questions or assistance they need .

Get information about the cost of procedures, or find a doctor, anytime, anywhere. Use your mobile phone, tablet or computer to access the Blue Cross and Blue Shield of Illinois (BCBSIL) secure member website, Blue Access for Members (BAMSM).

With BAM, you can:

• Locate a doctor or hospital in your plan’s network

• Find Spanish-speaking providers

• Visit Health Care School to see informative articles and videos to help you make the most of your benefits

Any covered dependent age 18 and older can have his or her own BAM account.

From your mobile phone, tablet or computer*:

1 Go to bcbsil.com/member.

2 Click Register Now.

3 Use the information on your BCBSIL ID card to complete the registration process.

*

1 My Coverage: Review your coverage information.

2 My Health: Make more informed health care decisions by reading about health and wellness topics and researching specific conditions.

3 Doctors & Hospitals : Use Provider Finder ® to locate a network doctor, hospital or other health care provider and get driving directions.

4 Forms & Documents: Use the form finder to get medical forms quickly and easily.

5 Message Center: Receive general health information via secure messaging.

6 Quick Links: Go directly to some of the most popular pages, where you can find out about the member discount program, manage preferences and more.

7 Cost Estimator: You may be able to save money on your next visit by comparing costs before you go. Find out how much tests, treatments and procedures may cost at different locations to help you make an informed choice.

8 Settings: Set up notifications and alerts to receive updates via email, review your member information and change your secure password at any time.

9 Contact Us: Learn how to reach BAM technical support if you have issues with the website.

A home delivery (mail order) pharmacy service you can trust.

Express Scripts® Pharmacy delivers your long-term (or maintenance) medicines right where you want them. No driving to the pharmacy. No waiting in line for your prescriptions to be filled.

• Express Scripts® Pharmacy delivers up to a 90-day supply of long-term medicines.1

• Prescriptions are delivered to the address of your choice, within the U.S., with free standard shipping.

• You can order from the comfort of your home — through your mobile device, online or over the phone. Your doctor can fax, call or send your prescription electronically to Express Scripts® Pharmacy.

• Tamper-evident, unmarked packaging protects your privacy.

• You can receive notices by phone, email or text — your choice — when your orders are placed and shipped. You will be contacted, if needed, to complete your order. To select your notice preference, register online at express-scripts.com/rx or call 833-715-0942

• 24/7 access to a team of knowledgeable pharmacists and support staff.

• Choose to receive refill reminder notices by phone or email.

• Multiple pharmacy locations are located across the U.S., for fast processing and dispensing.

Medicines may take up to 5 business days to deliver after Express Scripts® Pharmacy receives and verifies your order.

Specialty drugs are often prescribed to treat complex and/or chronic conditions, such as multiple sclerosis, hepatitis C and rheumatoid arthritis. Specialty drugs often call for carefully following a treatment plan (or taking them on a strict schedule). These medications have special handling or storage needs and may only be stocked by select pharmacies.

Blue Cross and Blue Shield of Illinois (BCBSIL) supports members who need selfadministered specialty medication and helps them manage their therapy. Accredo® is the specialty pharmacy chosen to do just that.1

Some specialty drugs must be given by a health care professional, while others are approved by the FDA for self-administration (given by yourself or a care giver). Medications that call for administration by a professional are often covered under your medical benefit plan. Your doctor will order these medications. Coverage for self-administered specialty drugs is usually provided through your pharmacy benefit plan. Your doctor should write or call in a prescription for self-administered specialty drugs to be filled by a specialty pharmacy. Your plan may require you to get your self-administered specialty drugs through Accredo or another in-network pharmacy. If you do not use these pharmacies, you may pay higher out-of-pocket costs.2 Your doctor may also order select specialty drugs that must be given to you by a health professional through Accredo.

Virtual

at

Getting sick is never convenient, and finding time to get to the doctor can be hard. Blue Cross and Blue Shield of Illinois (BCBSIL) provides you and your covered dependents access to care for nonemergency medical issues and behavioral health needs through MDLIVE.

Whether you’re at home or traveling, access to a board-certified doctor is available 24 hours a day, seven days a week. You can speak to a doctor immediately or schedule an appointment based on your availability. Virtual visits can also be a better alternative than going to the emergency room or urgent care center.1

General Health

• Allergies

• Asthma

• Nausea

• Sinus infections

Pediatric Care

• Cold

• Flu

• Ear problems

• Pinkeye

Behavioral Health

• Anxiety/depression

• Child behavior/learning issues

• Marriage problems

Connect 2 Computer, smartphone, tablet or telephone

Website: Visit the website MDLIVE.com/bcbsil

• Choose a doctor

• Video chat with the doctor

• You can also access through Blue Access for MembersSM

Interact

Real-time consultation with a board-certified doctor or therapist

Mobile app:

• Download the MDLIVE app from the Apple App StoreSM, Google PlayTM Store or Windows® Store

• Open the app and choose an MDLIVE doctor

• Chat with the doctor from your mobile device

Get connected today!

Diagnose

Prescriptions sent electronically to a pharmacy of your choice (when appropriate)

Telephone:

• Call MDLIVE (888-676-4204)

• Speak with a health service specialist

• Speak with a doctor

To register, you’ll need to provide your first and last name, date of birth and BCBSIL member ID number.

1 In the event of an emergency, this service should not take the place of an emergency room or urgent care center. MDLIVE doctors do not take the place of your primary care doctor. Proper diagnosis should come from your doctor, and medical advice is always between you and your doctor.

2 Internet/Wi-Fi connection is needed for computer access. Data charges may apply when using your tablet or smartphone. Check your phone carrier’s plan for details. Video on-demand consultations for behavioral health are available by appointment. Service is limited to interactive-audio consultations (phone only), along with the ability to prescribe, when clinically appropriate, in Texas. Service is limited to interactive-audio/video (video only), along with the ability to prescribe, when clinically appropriate, in Idaho, Montana, New Mexico and Oklahoma. Virtual visits are currently not available in Arkansas. Service availability depends on member’s location. Virtual visits may not be available on all plans. MDLIVE is not an insurance product nor a prescription fulfillment warehouse. MDLIVE operates subject to state regulations and may not be

and

be

App

Google Play Store is a trademark of Google Inc. (“Google”).

Windows

Note:

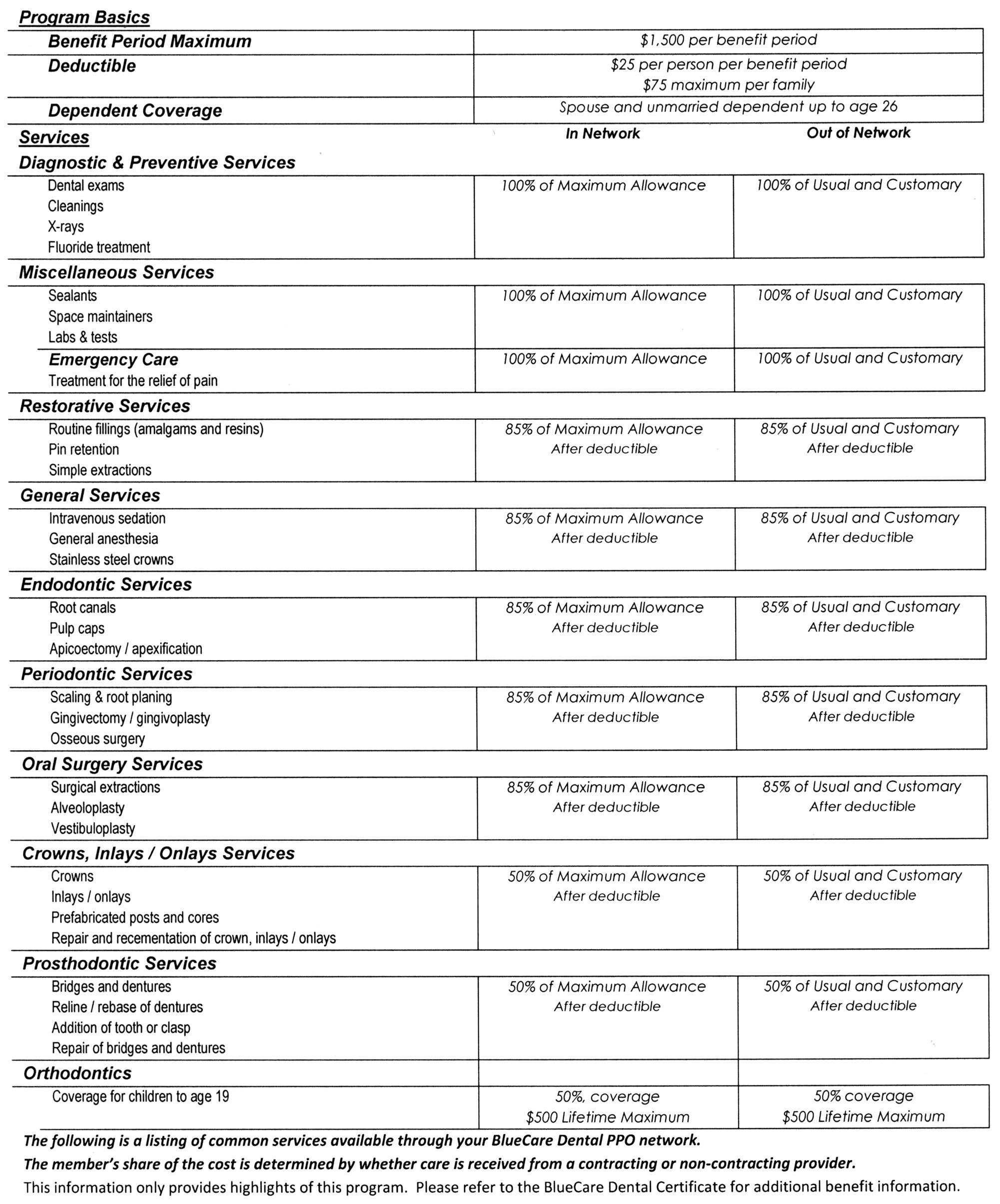

As a current BCBSIL member, you are familiar with the level of service our organization provides. With BlueCare Dental, you and your family have access to one of the largest dental PPO networks of general and specialty dentists in Illinois, as well as across the country. You have the option to choose any dentist you wish, but you will reduce your out-of-pocket costs and extend your benefits when you use a dentist who participates in the BlueCare Dental PPO network. You and your dependents will receive benefits based on the BCBSIL allowable amount and there is no balance billing when using a Network dentist. You are not billed for costs exceeding the allowable amount (except copayments, coinsurances and deductibles).

Below is an example showing the difference between utilizing a BlueCare Dental PPO network dentist versus a non-PPO network dentist.

*The dollar amount shown is for illustrative purposes only, check your benefit booklet for deductible, coinsurance and dollar maximums that may apply.

Finding a Dentist is Easy

For a complete list of contracting general and specialty dentists, go to bcbsil.com and use the Provider Finder tool. You can search for a contracting dentist near your home, school or office, and conveniently download a map with driving directions.

BlueCare Dental ConnectionSM

As an enhanced service, BCBSIL offers you access to BlueCare Dental Connection. This service offers educational information and other resources to help you make important decisions about your dental care – at no additional cost.

To help you understand the importance of maintaining good oral/periodontal health, BlueCare Dental Connection provides:

• Educational mailings

• 24-hour online access to the Dental Wellness Center* which offers current educational articles and special tools to assist members with their oral care

BlueCare Dental Connection features allow you to:

• Ask dental-related questions through Ask a Dentist

• Locate a contracting primary care dentist using Provider Finder®

• Determine approximate dental fees in the marketplace with the Dental Cost Advisor*

• Search the Dental Dictionary of common clinical term

• View animations on various dental topics in the Treatment and Procedure tool

Dedicated Customer Service

After enrollment, you will receive more specific information regarding your plan. The Dental Customer Service center is also available to answer questions about eligibility, claims, coordination of benefits and provider information. Call Customer Service from 7:30 a.m. to 6 p.m. (CT), Monday through Friday, at 800-367-6401.

General benefit information is available at bcbsil.com.

Finding a provider and scheduling an appointment is AS EASY AS …

At Blue Cross and Blue Shield of Illinois, we’ve made it easier than ever to access your vision benefi t information and schedule your annual eye exam. Everything you need is available through our member portal.

Register and log in to the member portal at eyemedvisioncare.com/bcbsilvis .

Review your vision benefit information.1 Our member portal gives you access to benefi t details, claims, provider locations and more. And since many providers offer extended evening and weekend hours, you can get care when it works for you.

Find a provider near you:

Log in to eyemedvisioncare.com/bcbsilvis , and then select “Click here to find a provider.” Enter your zip code to be connected with eye health experts near you.

Still have questions?

Feel free to contact our award-winning 2 Customer Care Center at 855-362-5539. You can also learn more by visiting eyemedvisioncare.com/bcbsilvis

All in-network providers can look up eligible members in the EyeMed system with a name and date of birth to verify benefits. ID cards are not required for eligible members to use their vision benefits.

Blue Cross and Blue Shield of Illinois Vision Care ID Cards

• You will receive a one-time welcome packet, containing two ID cards and a member brochure.

• You do not need ID cards to receive services.

• Mailed ID cards will only have the employee’s name listed (but any covered family member may use the card).

• Additional ID cards can be downloaded or printed by registering at eyemedvisioncare.com/bcbsilvis or by using the EyeMed App.

We listen to our customers so we can better understand and anticipate their needs.

Each year, we:

• Survey our various customers

• Implement innovation projects to enhance our customers’ experience

• Recognize innovative employees for finding ways to better serve our customers

We handle more than:

114,000

105,000

• A (Excellent) by A.M. Best Company2

• A+ (Stable) by Standard & Poor’s3

Proud ancillary subsidiary of Health Care Service Corporation (HCSC), the largest customer-owned health care insurance company in the United States and the fourth largest overall.

Founded in 1969, we are among the leading providers of group insurance benefits in the United States.

• $117.0 billion of life insurance in force4

• $1.7 billion in assets4

Currently serve nearly 3 million customers4 —including some of the largest and most recognized companies in the United States.

providing the necessary security while away from home, enhanced product services from Blue Cross and Blue Shield of Illinois are there for you and your family when the need arises. Below is a brief description of the enhanced product services.

DearbornCares1 provides an advance payment of the life insurance benefit to help beneficiaries cover their immediate expenses, such as funeral costs and medical bills.

• Pays up to a total of $50,000 of employer-paid basic life insurance benefi ts

• Applies to claims with 1, 2 or 3 named beneficiaries

• Available for covered employees and retirees

• No death certificate required

• Employer is required to submit the claim form with all required information

Contact your human resources representative to learn more.

Employees or their families who experience the loss of a loved one can face complex issues, ranging from coping with grief to financial or legal questions. Beneficiary Resource Services is a program that combines grief, legal and financial counseling provided by Morneau Shepell3 Morneau Shepell has a network of counselors and advisors who provide unlimited phone contact, five faceto-face working sessions, and referral and support services.

Beneficiary Resource Services

800-769-9187

beneficiaryresource.com

Username: beneficiary

When personal problems arise, many people may choose to cope alone. The consequences at home and the workplace can be negative. ComPsych®2 Corporation offers Disability Resource Services to employees covered by our longterm disability policy and their immediate family. Disability Resource Services provides convenient resources to help address emotional, legal and financial issues. Disability

Travel Resource Services™

Whether traveling for business or pleasure, a trip can be disrupted by a medical emergency, a lost prescription or instability in a foreign country. Generali Global Assistance, Inc. (GGA) 4 offers employees a way to get the assistance they need should the unexpected happen. GGA provides 24-hour services that can help an employee access emergency assistance when traveling 100 or more miles from home, including medical monitoring, medical evaluation, traveling companion assistance, dependent children assistance and visits by family members or friends.

Travel Resource Services

In the US and Canada call

877-715-2593

From other locations (call collect) +1-202-659-7807

Email ops@us.generaliglobalassistance.com

Basic Life and AD&D

• Option 1: Flat $25,000

• Option 2: 2 Times Earnings with a $250,000 maximum

* Life Rate- $0 .13 per $1000 / AD&D- $0 .02 per $1000

Retired Life

50% of Coverage at Retirement - $2 94 per $1,000

STD (Employer or Employee Paid)

• Option A: 60% Benefit Percentage, 1st Day Injury & 8th Day Sickness Benefit, $750 Weekly

Maximum and 13 Week Benefit Duration

* STD Rate Option A- $ 63/$10 Weekly Benefit

• Option B: 60% Benefit Percentage, 1st Day Injury & 8th Day Sickness Benefit, $750 Weekly

Maximum and 26 Week Benefit Duration

* STD Rate Option B- $ 71/$10 Weekly Benefit

LTD (Employer or Employee Paid)

Option A: 50% Benefit Percentage with a $5,000 Maximum and Two Year Own Occupation Definition of Disability and 3 Month Survivor

Benefit- 90 Day Elimination Period

* LTD Plan Option A- $ 19/$100 Covered Monthly Payroll

Option B: 50% Benefit Percentage with a $5,000 Maximum and Two Year Own Occupation Definition of Disability and 3 Month Survivor

Benefit- 180 Day Elimination Period

* LTD Plan Option B- $ .15/$100 Covered Monthly Payroll

Option C: 60% Benefit Percentage with a $10,000 Maximum and Two Year Own Occupation Definition of Disability and 3 Month Survivor

Benefit- 90 Day Elimination Period

* LTD Plan Option C- $ 24/$100 Covered Monthly Payroll

Option D: 60% Benefit Percentage with a $10,000 Maximum and Two Year Own Occupation Definition of Disability and 3 Month Survivor

Benefit- 180 Day Elimination Period

* LTD Plan Option D- $ 19/$100 Covered Monthly Payroll

Supplemental Life

• Employee: 25,000 increments to a maximum of $400,000 Guaranteed Issue amount is $200,000

• An employee who is currently enrolled in the Voluntary Life/AD&D may increase their current coverage by one $25,000 increment at annual enrollment (up to the Guaranteed Issue amount) without going through medical underwriting

• See Chart Below for Rates

Spouse Life

• Option 1 – Flat $10,000

• Option 2 – Flat $20,000

• See Chart for Rates

Supplemental Employee & Spouse Life Rates: age range per $1000

Under 19 $0 050

20-24 $0 042

25-29 $0 050

30-34 $0 063

35-39 $0 085

40-44 $0 126

45-49 $0 194

50-54 $0 307

Child Life: $0.10 per $1,000

• Option 1 – Flat $5,000

• Option 2 – Flat $10,000

55-59 $0 485

60-64 $0 586

65-69 $0 .854

70-74 $1 .791

75-79 $3 .991

80-84 $6 384

85+ $9 228

Voluntary AD&D Rates: Employee Only: $0.02 per $1,000 of employee coverage / Family Plan: $0.03 per $1,000 of Coverage

Critical Illness Coverage

Critical Illness insurance pays a lump sum of money directly to you if you or one of your covered dependents suffers one of the covered Critical Illnesses including cancer, stroke and heart attack This benefit is in addition to and independent of any other benefits you may be eligible for You can use the money as you wish— to help cover your medical plan deductible and coinsurance, pay for uncovered medical treatment, or use it for your regular day-to-day living expenses The choice is yours!

• Benefit Amounts

Employee: $5,000-$50,000 in $5,000 increments

–

– Spouse and children: $2,500- $25,000 in $2,500 increments

– Dependent amount cannot exceed 50% of employee amount

• Guarantee Issue

– $20,000 Employee – $10,000 dependents

Critical Illness Rates: age range per $1000

40-49

$1 .82

50-59 $2 75 50-59 $3 12

60-64 $4 64

65+ $7 18

60-64 $5 01

65+ $7 80

Child Critical Illness Rate: $.37 per $1,000 monthly

Accident Coverage

Accident insurance pays a lump sum of money directly to you if you or one of your covered dependents suffers an accidental injury This benefit is in addition to and independent of any other benefits you may be eligible for You can use the money as you wish—to help cover your medical plan deductible and coinsurance, pay for uncovered medical treatment, or use it for your regular day‐to‐day living expenses You have the freedom to choose how you use it!

ERICH BLOXDORF Plan Administrator

n 217-789-9340

n ebloxdorf@illinois .bank

MIKE MAHORNEY

Senior Trust Advisor

n 217-836-8580

n mmahorney@illinois .bank

HILLARY MEYERS Trust Manager

n 217-789-9340

n hmeyers@illinois .bank