OFFICERS AND EXECUTIVE COMMITTEE MEMBERS

Anthony Nestler Chair Hickory Point Bank & Trust

Anthony Nestler Chair Hickory Point Bank & Trust

REGION 1

Miguel Gomez CIBC Bank USA

Maria Tabrizi First Women’s Bank

REGION 2

Peter Brummel Grundy Bank

T. J. Burge Chair-Elect Community Partners Savings Bank

Courtney Olson First Bank Chicago

REGION 3

Lawrence Horvath Heartland Bank and Trust Company

Kathy Williamson Bank of Farmington

Megan Collins Vice Chair Bank of America

Frank Pettaway Treasurer The Northern Trust Company Courtney Olson At-Large Category First Bank Chicago

Amy Randolph At-Large Category Busey Bank

Thomas Chamberlain Immediate Past Chair

Iroquois Federal Savings & Loan Association

Randy Hultgren Secretary Illinois Bankers Association

REGION 4

Scott Bland First Neighbor Bank, N.A.

Brett Tiemann INB, National Association

REGION 5

Ted Macon Farmers State Bank of Hoffman

Bethany Shaw Peoples National Bank, N.A.

ALLIANCE

Ryan Martz Solutions Bank

LARGE

Gustavus Bahr

Member At Large PNC Bank, N.A.

Dave Conterio Hometown National Bank

David Doedtman Washington Savings Bank

Brian Hannon Cornerstone National Bank & Trust Company

Quint Harmon Resource Bank, N.A.

Tom Hough Carrollton Bank

Robert Kelly Old National Bank

Karlie Krehbiel Lisle Savings Bank

Alan Kwasneski Marquette Bank

Amy Randolph Busey Bank

Dalila Rouri BMO Bank, N.A.

Timothy Smigiel Liberty Bank for Savings

Daniel Wujek State Bank of Cherry

Two Offices to Serve You! Springfield Office: 800-783-2265 • Chicago Office: 800-878-2265

To connect with our staff, use this email format: firstinitiallastname@illinois.bank

Executive Administration

Randy Hultgren, President & CEO

Erich Bloxdorf, Executive Vice President and COO/Interim Marketing Projects Manager

Mindy Manci, Executive Assistant & HR Manager

Pam Macha, Springfield Office Coordinator

Finance and Administration

Mark Bennett, CPA

Executive Vice President and CFO

Matthew Keeling, Director

Marie South, Financial Assistant

Law Department

Carolyn Settanni, Executive Vice President & General Counsel

Carly Berard, Associate General Counsel

Jeavon Greenwood, Administrative Assistant

Government Relations

Ben Jackson, Executive Vice President

Aimee Smith, Assistant Vice President Matt Imburgia, Director

Member Relations

Julie Winterbauer, Senior Vice President

Tim Robinson, Director, Bank Relations

Illinois Bankers Business & Education Services, Inc.

Callan Stapleton, CAE, EVP & President of Business and Education Services

Adam Walsh, Vice President, Insurance Services

Robin Lane, Director, Associate Membership

Lyndee Fein, Director, Education & Conferences

Rachel Selvaggio, Director, Business and Education Services

Denise Perez, Director, Education & Training

Amy Sale, Education Assistant

Illinois Bankers

Group Insurance Trust

Erich Bloxdorf, Plan Administrator

Mike Mahorney, Senior Trust Advisor

Hillary Meyers, Trust Manager

Banker is strictly prohibited without written permission of the publisher.

As we navigate through 2024, Illinois banks face economic, industry, and political challenges. An inverted yield curve, rising unemployment, slowing inflation, slumping commodity prices, and rising loan delinquencies are all telltale signs of a potential recession. Industry liquidity, AOCI, and rising funding costs are among the hurdles facing bankers throughout the state. And we endure a polarized political climate in which entrenched factions (on both sides of the aisle) struggle to craft winwin compromises that promote economic growth and long-term stability. In my view, as external conditions become more challenging, membership in the Illinois Bankers Association becomes more valuable.

This value was showcased recently at the IBA’s Ag Banking Conference held in August. Bankers from around the state assembled in Springfield (and virtually) to learn and discuss emerging issues in agriculture, Illinois’ largest industry. The conference provided industry insights and practical risk management tools, including those offered by Dr. David Kohl,

Professor Emeritus, Dept. of Agriculture & Applied Economics, Virginia Tech. With the agricultural industry facing significant headwinds, this event provided members a timely and meaningful enhancement to their businesses.

The value of membership is also displayed by the IBA’s advocacy efforts on behalf of all members. In August, the IBA joined the American Bankers Association and others to challenge the State of Illinois’ Interchange Fee Prohibition Act, which would disallow interchange fees on sales tax, excise tax, and gratuities, and make Illinois the only state in the nation to pass such legislation. We believe our case is compelling, and strengthened by our members who provided real life examples of how this law harms our businesses, customers, and communities. The IBA and its members stand united in our opposition to this law and in our commitment to keeping the wheels of commerce running smoothly in Illinois, as we have for generations. Thank you for your commitment to the Illinois Bankers Association and its mission. Best wishes for continued success.

President & CEO, Illinois Bankers Association

Win-Win-Win

Serving you is why we exist. The Illinois Bankers Association was created 133 years ago by bankers to serve bankers. Not only do we love to advocate for you and your bank in Washington, DC, Springfield, and Chicago, and provide professional guidance on regulatory and compliance issues, but we also love to work with you to solve problems. When our members engage with the IBA and use our services, we believe we are fulfilling our mission of providing advocacy, education, and industry resources for all Illinois bankers. Bankers who have engaged us and have used us fully have seen tremendous results and huge savings.

Doing more with less, finding great talent, and making sure your bank and employees are safe and protected are important

priorities of bankers today. Let us help you find the best people to fill your talent needs by using BankTalentHQ, the premier online banking career center. Talk with Adam Walsh to make sure you are properly protected from cyber threats and have the best insurance for your Board, Officers, and facilities. Adam is quickly becoming the authority on Illinois banking insurance and he would be happy to make sure your future is protected, and you are not paying more than you should. Look at all the providers that we have researched to see if any of them might be helpful to you. Each year bankers save tens of thousands of dollars by using a recommended provider. As you use these offerings, you and your bank win by solving problems, you win by saving money, and you win by strengthening your association and lowering your dues. Win-win-win solutions are the best and they are available to you!

The IBA Law Department

Our bank has a branch that is currently open Monday through Friday from 9:00 a.m. to 5:00 p.m., and Saturday from 8:00 a.m. to 1:00 p.m. We want to eliminate the Saturday hours, so the branch will be closed on Saturdays and Sundays. Can we regularly close on both Saturdays and Sundays? Do we have to wait a certain amount of time before implementing the new hours?

Yes, we believe that a bank branch may regularly close on Saturdays and Sundays, provided that it follows the requirements outlined in the Illinois Promissory Note and Bank Holiday Act, which include publishing a board resolution authorizing the closure in a county-wide newspaper once each week for three successive weeks before the closure.

Under the Illinois Promissory Note and Bank Holiday Act, a bank may close on Sundays and at noon on Saturdays without notice. However, if a branch will remain closed all day on Saturday on a regular basis, the Act requires the bank to take four steps: (1) adopting a board resolution authorizing the closure, (2) recording an officer-certified copy of the resolution, (3) publishing the resolution in a county-wide newspaper once each week for three successive weeks before the closure, and (4)

submitting evidence of the newspaper publication to the IDFPR. Although the Act does not specifically mention branches, we have previously discussed this law with a representative of the IDFPR, and they said the agency’s position is that the Act’s requirements apply to branch closings.

Note that a change in hours may in some instances raise issues under the federal and Illinois Community Reinvestment Act (CRA). One factor in a large bank’s CRA service performance rating is whether its services, “including, where appropriate, business hours,” vary in a way that inconveniences customers in the bank’s assessment area. Consequently, you may wish to document your business reasons for changing a branch’s hours for purposes of the federal and Illinois CRA, although you are not required to do so.

Our bank currently provides an “Application Disclosure Statement” with the Loan Estimate in our initial disclosure packet to all consumer real estate loan applicants. The statement discloses a nonrefundable application fee, credit report fee, and property appraisal fee, and warns that the credit report and property appraisal fees will not be refunded if the loan does not close. Although we do not collect upfront fees, our loan operating system vendor stated that we are required to provide this statement under the Illinois Residential Mortgage License Act’s administrative rules. Is this true? If we decide to collect upfront fees, must we provide this statement? If we do not provide this statement, can we still collect an appraisal fee from the applicant if the loan does not close?

No, we do not believe that you must include an “Application Disclosure Statement” in your initial disclosure packet, as banks are fully exempt from the Residential Mortgage License Act of 1987 and its administrative rules.

Instead, your bank should follow the TILA-RESPA Integrated Disclosure (TRID) requirements for disclosing and charging fees, which allow only bona fide and reasonable credit report fees to be charged before providing a Loan Estimate and documenting the consumer’s intent to proceed with the transaction. If you decide to collect upfront credit report fees from loan applicants in the future, you must accurately describe or refer to this fee as a “credit report fee.” However, the TRID rule does not require that the “credit report fee”

disclosure take the form of an “Application Disclosure Statement.”

Additionally, we believe you may still collect an appraisal fee if a consumer real estate loan does not close, if you already have provided the applicant with a Loan Estimate that complies with the TRID rule’s requirements for disclosing appraisal fees and have documented the applicant’s intent to proceed with the transaction. Regulation Z’s “Loan Estimate Model Form,” which is linked in the resources below, discloses such an appraisal fee: “We may order an appraisal to determine the property’s value and charge you for this appraisal. We will promptly give you a copy of any appraisal, even if your loan does not close. You can pay for an additional appraisal for your own use at your own cost.”

The daughter of a deceased customer provided us with a small estate affidavit to access the customer’s safety deposit box. However, she told us that the customer owned a home exceeding $100,000 when she died. After we refused to accept the small estate affidavit, the daughter’s attorney responded that the customer’s house was sold after her death through a bond in lieu of probate. Should we refuse to grant the daughter access to the safety deposit box until we receive letters of office?

We do not recommend granting access to your customer’s safety deposit box based on the small estate affidavit, since your customer’s daughter informed your bank that the customer’s estate includes a home exceeding $100,000 in value. However, if the daughter presents a valid safety deposit box opening affidavit, you may allow her to examine the contents of the safety deposit box, although her rights to remove the contents will be limited to burial documents.

Illinois law limits the use of a small estate affidavit to estates that do not exceed $100,000. Also, while the Illinois Probate Act does not expressly exclude real property from small estate affidavits, and there is no Illinois case law addressing this question, most probate attorneys in Illinois (including the attorneys who co-authored an IICLE treatise on estate planning) interpret the Illinois Probate Act’s small estate provisions to apply only when the estate includes personal property, not real property.

The Illinois Probate Act protects financial institutions acting pursuant to a small estate affidavit if the financial institution acts “in good faith.” While we are not aware of

any cases involving banks that have been found to act in bad faith in relying on a small estate affidavit, your bank has knowledge that the customer’s estate includes a home exceeding $100,000 in value. We do not believe that the sale of a decedent’s real estate after their death would permit the use of a small estate affidavit.

However, the Safety Deposit Box Opening Act provides an avenue for an adult descendant of a sole lessee of a safety deposit box to examine the contents of the box without letters of office, a court order, or a small estate affidavit. The Act allows a bank, at its discretion, to open the box and examine its contents in the presence of an “interested person” (including an adult descendant of a lessee) who presents the bank with a safety deposit box opening affidavit and satisfactory proof of the lessee’s death. The interested person is limited to examining the contents of the box. No contents may be removed from the box, except for burial documents. If the box contains a will or codicil, your bank must deliver it to the clerk of the circuit court for the county in which the lessee resided immediately prior to their death.

Our IBA Law Department provides many resources to help our bank members meet their compliance challenges, including a toll-free Compliance Hotline (1-800-GO-TO-IBA) and a dedicated compliance website (www.GoToIBA.com). We also publish a free weekly e-newsletter highlighting the latest regulatory developments, select recent Q&As, and other useful information –let us know if you want to subscribe!

Note: This information does not constitute legal advice. You should consult bank counsel for legal advice, even if the facts are similar to those discussed above.

By Rob Nichols, President and CEO, American Bankers Association

Since the time of President Lincoln, American consumers have benefited from a dual banking system, made up of both state-chartered institutions and federally chartered national banks.

This system—which can trace its roots back to the U.S. Constitution—allows consumers to have more choices. It offers them a robust marketplace of banks of different sizes and business models to meet their needs. And it enables the nation’s more than 750 national banks to operate safely, soundly and efficiently across multiple jurisdictions under the supervision of the OCC, while at the same time allowing state banks to serve their communities with local supervision.

But this system, which has served our country well for more than 150 years, is now coming under threat, as lawmakers in both red states and blue states have begun to pass laws that will interfere with national bank operations, violate federal preemption and tread squarely on the OCC’s turf.

Just look at the situation currently unfolding in Illinois, with the Interchange Fee Prohibition Act that was signed into law this summer as part of the state’s budget legislation. This misguided law bans banks, credit unions, payments networks and other entities from charging or receiving interchange fees in Illinois on taxes and tips charged as part of a credit or debit card transaction.

This law — which will create unprecedented chaos and confusion for consumers and businesses if allowed to take effect — violates multiple federal statutes, including the National Bank Act and the Federal Credit Union Act, and cannot be enforced against national banks, federal savings institutions or state-chartered banks, as well as federally and state-chartered credit unions.

It also runs afoul of the Electronic Fund Transfer Act, which directly addresses the permissible amount of interchange fees for debit card transactions and does not carve out taxes and gratuities.

This law, a gift to corporate megaretailers as part of a last-minute budget deal, is the first of its kind to pass in the nation. We can’t let it stand and run the risk other states follow, which is why ABA is fighting back.

Together with the Illinois Bankers Association, America’s Credit Unions and the Illinois Credit Union League, we filed a lawsuit challenging the law, and we are seeking a preliminary injunction pausing implementation until the court can rule on the merits of our case.

With top outside lawyers assisting us, we have confidence we will prevail in this case, sending a strong message to other states looking to follow Illinois’ lead.

We’ve seen a different kind of challenge to the dual banking system in other states. Florida and Tennessee have put in place their own safety and soundness tests, encroaching on the OCC’s federal overnight of national banks.

Like ABA, the OCC has taken notice.

We’ve been encouraged by comments from Acting Comptroller Michael Hsu noting that his agency will continue to defend the dual banking system. The acting comptroller pointed out in recent remarks that “increasingly, banks are being asked by states to pick a side in service of performative politics rather than deliberative policy.” This simply shouldn’t be the case, and we will continue to urge the OCC to exercise its authority when states cross the line.

Our dual banking system has served Americans well for decades. ABA will continue to push back against efforts to undermine that system, and we’ll keep pressure on regulators to do the same.

E-mail Rob Nichols at nichols@ aba.com.

As you have no doubt seen by now, in August the Illinois Bankers Association along with the American Bankers Association joined the Illinois Credit Union League and Americas’ Credit Unions in suing the State of Illinois over the interchange law.

The IBA is the lead plaintiff in this federal court case, Illinois Bankers Association v. Raoul. Our lawsuit challenges the validity of the recently enacted Illinois Interchange Fee Prohibition Act, a law that bans interchange fees from being charged on sales tax and voluntary gratuities on retail transactions.

In the filing, the IBA and other plaintiffs assert that the Interchange Fee Prohibition Act would throw the modern and efficient payment system into chaos and undermine the consumer benefits of electronic payments. The filing outlines how the new state law violates multiple federal statutes including the National Bank Act and the Federal Credit Union Act and likewise cannot be enforced against national or state-chartered banks, federal or state savings institutions, federal or state-chartered credit unions, or their service providers.

By Ben Jackson, Executive Vice President of Government Relations and Aimee Smith, Assistant Vice President of Government Relations

Suing the State of Illinois is not to be taken lightly, but this extreme law left us with no other option. As we collected information about implementation from our member banks, it became increasingly evident how cumbersome, unworkable, and expensive this law could be for Illinois banks and thrifts of all sizes. Many community bank members, for example, have detailed soaring direct costs including hiring additional staff, loss of debit card revenue, and civil liability.

Beyond the lawsuit, we continue to educate lawmakers on the law after its passage – and there is growing buyers’ remorse from legislators. We continue to work with partner groups to burn in the media message as well.

You often read about our frequent victories in Springfield. This loss on interchange regulation serves as a reminder that we need to constantly grow our political strength.

The best methods to reach this goal remain unchanged: connecting bankers with our legislators one-on-one and growing our Illinois Bankers PAC. Just like in the banking industry, politics is an interpersonal business. If you do not already have a relationship with your local state lawmakers and

members of Congress, reach out to our team to learn how to connect.

The recently filed lawsuit was not only the right thing to do for our membership, it also displays our strength as an industry to Illinois’ political class. It shows that we will go to any lengths to right a political wrong. In the same way, the Illinois Bankers PAC is a demonstration of industry unity and strength. A formidable, well-funded PAC allows us to bolster our connections while reminding Illinois lawmakers that our industry understands the importance of being involved.

We have an opportunity to learn from a loss. We displayed incredible political strength in late May when opposing the bill that became the Interchange Fee Prohibition Act. Unfortunately, it wasn’t enough this time. Yet we have the capability to do more to support a healthy banking climate in Illinois. This is attainable by reinforcing the grassroots and political tools we already have!

If you’d like an executive briefing on state or federal issues and regulation, please email advocacy@ illinois.bank or call 217-789-9340.

By Jack Hubbard, The Modern Banker

As they were walking down the hall after the weekly pipeline meeting, Dan Roth asked Robin Mathews if she had a minute to talk. Dan and Robin started their careers as credit analysts at National Bank about the same time.

After three years Robin received a client portfolio and began her business development career. Dan was promoted to the same position two years ago.

Robin always has a solid prospect pipeline, and her referral network is constantly reaching out to provide referrals. She is excellent at cross solving her clients and her portfolio is expanding better than any commercial banker’s. Dan’s frustrated. His portfolio is barely stable, his pipeline is weak, and he continually loses business to the competition. It’s gotten to the point where Dan wants to create excuses to miss the meeting.

“I need some advice, Robin,” Dan began. “As you see every week in the team meeting things are not going well in my world, and I’m concerned. I love the bank, my clients and my job and I’m worried it’s going to all come crashing down around me if I don’t start producing. What’s your secret,” Dan asked.

“There are a few that have worked for me from the get-go, Dan, and I’m happy to share,” Robin suggested. “There’s no magic pill or pixie dust. It’s just practical stuff I learned in training. Let’s start with business cards,” she said. Dan was confused but reached in his pocket and provided his card. Robin shared one of hers also.

“Your card says ‘Vice President, Commercial Lending,’” Robin noted. “That’s what I do,” replied Dan, “but your card says Resource Manager. We both do the exact same job so what’s with your title?”

“I had that printed on my card when I started in business development,” Robin indicated. “It creates great curiosity when I hand it out at community events and on my individual calls. It’s a great conversation starter. When people ask what the title means, I suggest they could get banking services from anyone. My role is to be a resource, a go to banker and someone that provides unique value, available at no other bank.”

“This is a great start, but there has to be more to it than the card,” said Dan.

“So true,” replied Robin. “If this value proposition is not in your heart, you can’t live it every day.” Robin went on to explain to Dan some key activities and behaviors she executes to make the concept come alive.

Before Robin turns out her lights every evening, she finds something of value to send to three people. It might be articles, White Papers, Podcast Replay links or even leads.

When she arrives at the bank the next morning, Robin attaches the value add to prospect, client and COI emails with a simple message; I thought this might be of interest. One day it’s two prospects and a client. The next day it

might be three Centers of Influence. It’s always three and they are all sent before 8:00 AM.

Robin’s reasoning is simple; if she sends them in the evening, they will be at the bottom of the new email stack. Sent in the morning, they will be among the first things the business owner sees.

“What’s your follow up phone call sound like,” Dan wanted to know. “I never make a call, I never follow up with the 3 Before 8,” Robin replied. “I want people to know that I’m a thinking of them and I believe that following up would make the whole process appear manipulative.”

Dan seemed skeptical but Robin continued, “I can’t be everywhere to know when a CEO or a CFO has a need, but I want to have mindshare with many so when something arises, I’m the first person they think of. They call me.”

Robin mentioned that when she sends something she also goes to the CRM system and attaches the value add to the file of the prospect, client or COI. This helps her avoid duplication and provides easy retrieval when someone calls her (which is often) and refers to the email. She has also developed a Share of Heart approach where she learns the birthday, business anniversary, kids, grandkids and dog’s names. It’s on a CRM dropdown and special days are pushed to her email.

“When I started this, I found the CRM started to work for me versus the other way around,” said Robin. “Last year I sent them 240 days. That’s 720 value adds out annually and I’ve got it down to less than 30 minutes a day.”

“Wow,” Dan exclaimed. I never knew and this is a great concept. Where do you find these articles and how do you stay in front of everyone?” “LinkedIn,” Robin shouted.

When she began hitting the streets, Robin realized she needed to be much more active on LinkedIn. Instead of making it just one more thing on her plate, she recognized that while LinkedIn is NOT her sales process, it IS a key part of it and she wanted her personal brand to stand out 24/7.

Robin:

• Had a professional headshot taken and inserted a community landmark on her background

• Changed her headline to: A Resource Manager That Gets Things Done For Businesses from $5 -25 million in revenues in Elgin

• Used her 2600 character About section to tell viewers who she helps, how she helps them and the results they’ve achieved through her partnership

• Created a Featured Section and filled it with photos, videos and PDFs supplied by the marketing department

• Began reaching out to people she was doing business with and asked them to write a recommendation. She now has 38 living testimonials

Robin began with less than 70 Connections, and she knew that would take her nowhere. She sent five personalized connection requests, seven days a week, to key targets. She now has nearly 6,000 connections –colleagues, competitors, clients, COIs and prospects.

She follows key influencers in the vertical industries she sells to as well as other experts in sales, human resources, legislative issues, the environment, and others.

“This is where I get my 3 Before 8 content,” she told Dan. “To be certain, when I see relevant content that might benefit my buyers and referral sources, I ring the bell on key influencers’ profiles. Their articles are pushed to my notifications tab, saving me tons of research time.”

Robin shares content with her network Tuesday, Thursday, Friday, and Saturday between 7:30 and 8:30 AM. Based on her own research, that’s when she has the best engagement. Robin rarely creates her own content. It’s more likely that she reshares what others write. She uses the scheduler to create her posts on Sunday evening after the kids are in bed. That frees up what she calls nose to nose time during the week.

She comments on others posts as well and has stopped the Lazy Likes Syndrome – where people click on “like” and add no value. This has also helped her visibility with key decision makers in the industries she does business in.

“This is amazing,” Dan said. “I’m going to start this today.”

“Start slow to go fast, Dan,” Robin indicated. “You have a day job, and this all takes time. Do one thing a week and build a discipline around it. Becoming a Resource Manager is not an event or a sales campaign. It’s all about discipline. Too much, too soon is a house of cards and soon enough, you’ll be back to your old habits. Ultimately, strive to make your clients success your success. The rest will take care of itself.”

About the author: Named one of the nation’s top 100 most trusted business leaders by Trust Magazine, Jack Hubbard has shared his passion for what it takes to build Performance Cultures in Banking for six decades. With over 80,000 financial services professionals personally trained and coached, Jack is one of banking’s most sought-after facilitators. An author, classroom instructor and thought leader, his expertise and out-of-thebox thinking put him in great demand when the subject matter is bank to business sales and sales leadership.

Hubbard has served 32 years as an awardwinning faculty member of the top banking schools in the nation including Graduate School of Banking in Madison, Stonier School of Banking and ABA’s School of Bank Marketing and Management.

A bestselling author of Conversations with Prospects, his content is regularly featured on LinkedIn as well as industry publications such as The Financial Brand. Jack’s weekly show and Podcast Jack Rants With Modern Bankers was downloaded more than 50,000 times in its first 10 months.

He serves on the Board of Directors of St. Charles Bank & Trust, and is co-founder of The Modern Banker. Jack can be reached at jack@themodernbanker.com.

By Rachel Selvaggio, Director, BankTalentHQ and Business and Education Services

As we continue into the second half of 2024, the banking industry is undergoing profound transformations driven by technology and evolving consumer expectations. These changes are reshaping banking careers, creating new opportunities, and emphasizing specialized skills. Here are the key trends defining the future of banking jobs:

We used findings from surveys, industry research reports, and interviews from recent years to develop eight factors that banks should keep in mind when deciding on the right core banking platform.

Traditional banks are increasingly collaborating with fintech startups to innovate and enhance services. This partnership accelerates technological advancements and creates demand for professionals skilled in both finance and technology. Reports from KPMG and Finance Magnates highlight the growing importance of fintech integration in shaping the banking sector's future.

Automation and Artificial Intelligence (AI) are revolutionizing banking operations by streamlining processes and reducing costs. The rise of AI, Machine Learning (ML), and Robotic Process Automation (RPA) is driving demand for specialists who can implement and manage these technologies. Companies like LeadSquared emphasize the critical role of AI in improving customer experiences and operational efficiencies.

Consumer preferences for personalized, digital-first banking experiences are driving the adoption of digital banking solutions. This trend forces cybersecurity experts to ensure data protection and UX/UI designers to create intuitive digital interfaces. Insights from KPMG

and Finance Magnates underscore how digital transformation is reshaping job roles within banking institutions.

Open Banking initiatives are fostering a more interconnected financial ecosystem, enabling thirdparty developers to build applications around banking services. This shift is creating opportunities for developers and IT professionals skilled in API integration and management. Finance Magnates reports on the transformative impact of Open Banking on job opportunities in the banking industry.

Environmental, Social, and Governance (ESG) considerations are becoming integral to banking strategies. Banks are increasingly focusing on sustainable finance practices such as green lending and ESG investing. Professionals with expertise in sustainable finance are in high demand as institutions align with global sustainability goals. Insights from Finance Magnates highlight the growing importance of ESG criteria in shaping banking careers.

Advancements in digital identity verification technologies, including blockchain and biometrics, are enhancing security and efficiency in banking operations. There is a rising demand for specialists who can implement secure digital identity solutions to protect customer data and streamline authentication processes. Finance Magnates discusses the transformative potential of digital identity solutions in banking jobs.

Customer experience (CX) has become a competitive differentiator for banks. Institutions are leveraging data analytics and customer feedback to enhance service delivery and retention rates. Roles such as data analysts and CX managers are critical in interpreting customer insights and driving improvements in banking services. LeadSquared highlights the pivotal role of CX metrics in shaping job roles within the banking industry.

The evolving trends in banking highlight a dynamic job market where digital fluency and customer-centricity are crucial. Professionals looking to excel in banking careers should focus on developing skills in fintech integration, AI and automation, digital banking, sustainability, digital identity solutions, and customer experience management.

In conclusion, the future of banking jobs promises abundant opportunities for those who adapt to technological advancements and evolving consumer expectations. By staying informed and proactive in acquiring relevant skills, individuals can position themselves for success in the ever-changing landscape of banking careers.

This article draws insights from authoritative sources such as KPMG, Finance Magnates, and LeadSquared, providing a comprehensive look at the transformative trends shaping banking careers.

For further exploration of banking careers and industry trends, visit Bank Talent HQ: BankTalentHQ.com.

Rachel Selvaggio, with over 7 years in the banking industry, leads strategic development and stakeholder management as Director at BankTalent HQ and the Illinois Bankers Association. She drives impactful initiatives and fosters key partnerships, leveraging her MBA and recognized leadership.

Illinois Bankers Association Unveils New Online Forum Platform in Soft Launch

The Illinois Bankers Association (IBA) is thrilled to announce the soft launch of its Online Forum platform, designed to transform communication, collaboration, and networking among its members. This digital space aims to facilitate meaningful discussions, provide timely advice, and foster the exchange of best practices among Illinois banking professionals. With its user-friendly interface, realtime discussion capabilities, and a resource library, the Forum is set to become an indispensable tool for industry professionals. Members can easily navigate the platform, engage in topic-specific threads, and access valuable resources.

Whether you're looking to solve a complex banking issue, stay updated on regulatory changes, or simply connect with like-minded professionals, the Forum provides a versatile and dynamic environment to meet your needs. Key features of the IBA Online Forum include:

1. User-Friendly Interface: The platform boasts an intuitive design, making it easy for users of all tech-savviness levels to navigate. The clean layout ensures that members can find relevant discussions and resources quickly.

2. Real-Time Discussions: Engage in live conversations with peers. The Forum supports real-time messaging, allowing for instantaneous feedback and collaboration.

3. Work-Specific Threads: Discussions are organized into various threads based on specific work areas, ensuring that information is well-organized and easily accessible. Members can follow threads of interest and contribute their expertise.

4. Member Directory: Connect with other IBA members through a comprehensive directory. This feature facilitates networking and helps members find and reach out to colleagues with specific expertise or shared interests.

5. Anonymous Posting: Designed to promote open and honest discussions among members. This feature allows users to share their thoughts, ask questions, and seek advice without revealing their identity.

6. Email Responses: Users can choose to respond to threads via email, similarly to previous methods. This feature is designed to enhance convenience and accessibility, allowing members to keep up with important conversations without having to constantly check the Forum.

7. Digests: The digest feature provides members with a convenient summary of the Forum's activity, delivered directly to their inbox. Users can customize the frequency of these digests, opting for daily, or weekly summaries based on their preferences.

The new Online Forum platform offers numerous benefits to Illinois banking professionals. By engaging with the Forum, members can stay at the forefront of industry developments, gaining insights from industry leaders and experts. Access to a supportive community of professionals who understand the unique challenges of the banking industry is another key benefit, fostering a culture of mutual support.

In addition to the new Forum, the IBA continues to offer a variety of specialized peer groups that cater to specific roles and interests within the banking industry. These peer

groups include CEO, CFO, HR, marketing, lending, technology, retail, cash management, compliance, education and training, and operations groups, each providing targeted networking and knowledge-sharing opportunities. By joining these groups, members can engage in discussions on relevant issues, gain insights from colleagues in similar roles, and participate in exclusive events such as expert-led roundtable discussions.

The IBA hosts various peer groups that offer specialized networking and educational opportunities. Here’s a closer look at some of the key peer groups available:

1. CEO Peer Group: These groups provide a platform for CEOs to discuss strategic issues, share experiences, and gain insights into best practices for leading their organizations. These peer groups are organized by asset size to tailor the learning experience for maximum impact.

2. CFO Peer Group: CFOs can connect with peers to discuss financial strategies, regulatory compliance, and other critical issues affecting the financial health of their institutions.

3. HR Peer Group: HR professionals can share knowledge on talent management, regulatory changes, and employee engagement strategies. This group is particularly valuable for those looking to stay ahead of HR trends in the banking sector.

4. Bank Marketing Peer Group: Marketing professionals can exchange ideas on branding, customer acquisition, and digital marketing strategies. These groups offer a creative space for discussing innovative marketing approaches.

5. Lending Peer Group: Focused on lending practices and regulations, these groups provide a forum for lenders to discuss market trends, risk management, and loan portfolio management.

6. Technology Peer Group: Technology leaders can collaborate on the latest advancements in banking technology, cybersecurity, and digital transformation. These groups provide a critical space for discussing innovations that can drive efficiency and competitiveness.

7. Senior Retail Officers Peer Group: Senior retail officers can exchange strategies on branch management, customer service excellence, and retail banking trends. This group is tailored for those looking to strengthen their retail banking operations.

8. Cash Management Peer Group: Cash management professionals can discuss best practices in liquidity management, cash flow forecasting, and payment systems. These groups are essential for those managing the financial logistics of their institutions.

9. Compliance Peer Group: Compliance professionals can share insights on navigating regulatory changes, ensuring adherence to laws, and managing risk. This group is indispensable for those responsible for maintaining regulatory compliance within their organizations.

10. Education and Training Peer Group: Professionals focused on education and training can collaborate on developing effective training programs, onboarding processes, and continuous learning strategies. This group is vital for those dedicated to enhancing the skills and knowledge of their institution’s workforce.

11. Operations Peer Group: Operations professionals can benefit from discussions on process improvements, technology integration, and operational efficiencies. This group is ideal for those looking to enhance their institution’s operational performance.

The benefits of participating in the IBA’s Online Forum and Peer Groups are substantial. Enhanced collaboration, professional development, and networking opportunities are just a few of the advantages. The Forum offers a 24/7 accessible environment where members can seek advice, share experiences, and stay updated on industry trends. The peer groups, on the other hand, provide a focused setting for discussing role-specific challenges and best practices, promoting professional growth and development.

To join the IBA’s new Online Forum and Peer Groups, members are encouraged to visit the Illinois Bankers Association website, or reach out directly to our education team – education@illinois.bank. The IBA is committed to continually improving the Forum and our Peer Groups based on member input, ensuring it meet the needs of all users.

While the IBA’s new Online Forum platform is currently in its soft launch phase, the Association is already looking ahead to the hard launch scheduled for later this year. This upcoming milestone will introduce additional Forum topics and improvements based on member feedback collected during the soft launch. The hard launch will mark the official unveiling of the platform, solidifying its place as a vital tool for Illinois banking professionals. Members can expect enhanced functionalities, expanded resources, and an even more robust community engagement experience.

As the hard launch approaches, the IBA will provide regular updates and information on new features and improvements. Members are advised to keep an eye on the IBA website and communications for the latest news and announcements. The Association is committed to making the hard launch a significant event that will further enhance the value and utility of the Online Forum for all members.

In conclusion, the Illinois Bankers Association’s new Online Forum and in person peer groups platform is poised to become an essential resource for banking professionals across the state. With its array of features, benefits, and the support of specialized peer groups, the Forum offers unparalleled opportunities for networking, professional development, and collaboration. The IBA invites all members to get involved with both solutions. For more information and to join the Forum, visit the Illinois Bankers Association website, or contact us education@illinois.bank.

1. Encourages financial awareness in all ages.

2. Provides interactive financial education, free to schools and communities.

3. Presents your institution as a leading financial expert.

Scan QR code to schedule a demo

Access essential intelligence to see your bank’s lending position in different markets

Survey lending activity within a given footprint and gain transparency into your market’s competitive landscape. Our platform provides access to data on lending activities as reported under the Home Mortgage Disclosure Act (HMDA) This includes applicant/borrower characteristics, any action taken on the application, and amount.

Utilize our M Mortgage Analytics tool to assess monthly residential and commercial mortgage origination data, which is directly sourced from over 75% of U.S. counties. Understand your portion of business in target markets, analyze the composition of closed loans, or evaluate mortgages based on CRE designations through data visualization tools like Maps

By Rica Dela Cruz and Zuhaib Gull, Market Intelligence

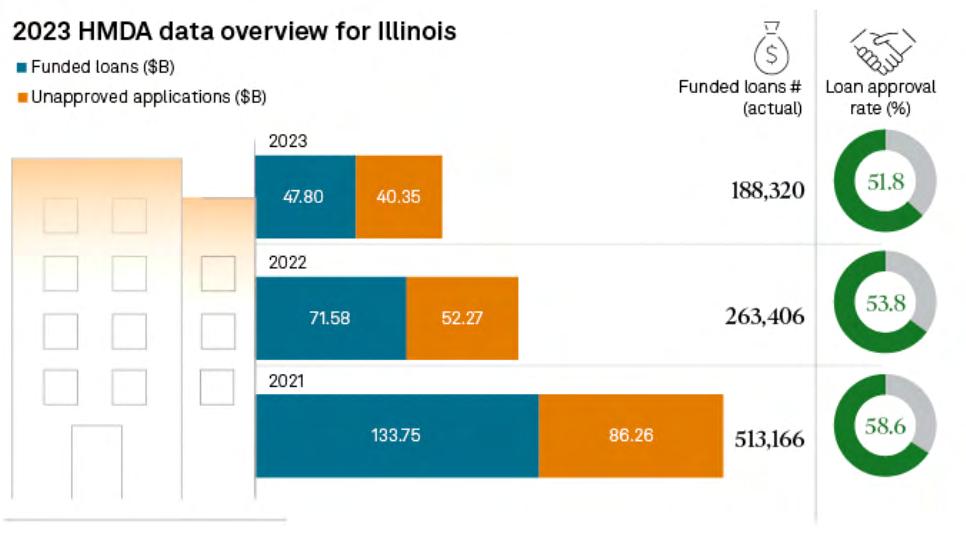

US lenders' funded mortgages in Illinois again dropped in 2023 as high interest rates continued to drive a broader decline in funded mortgages.

In the Prairie State, institutions funded 188,320 mortgages totaling $47.80 billion, compared to their funded 263,406 mortgages amounting to $71.58 billion in 2022, according to the Home Mortgage Disclosure Act data, collected by S&P Global Market Intelligence.

The mortgage loan approval rate in Illinois also fell to 51.8% in 2023 from 53.8% in 2022, and the unapproved applications totaled $40.35 billion, versus $52.27 billion in the prior year.

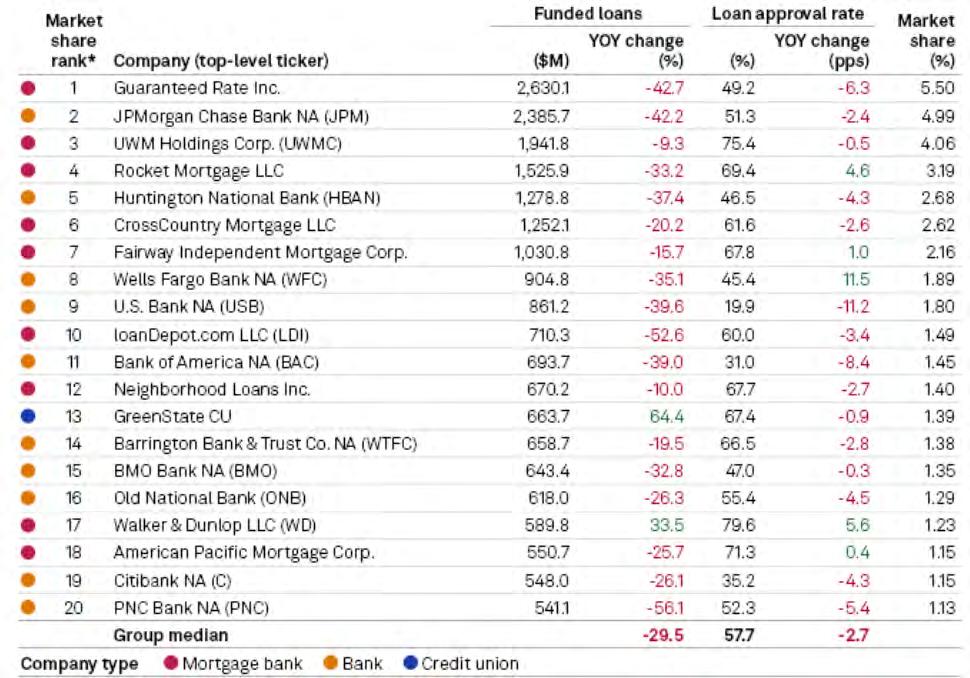

The value of funded mortgages across the US fell 37.6% to $1.777 trillion year over year, with the majority of mortgage lenders recording steep declines in lending activity. Overall, nonbanks expanded their mortgage lending market share while commercial banks lost ground. In Illinois, all but two of the top 20 mortgage originators reported lower funded loans from the prior year.

Guaranteed Rate Inc. continued to lead the top 20 mortgage originators in Illinois even as its funded mortgages in the state in 2023 dropped more than 42% year over year to $2.63 billion. The company's loan approval rate slipped 6.3 percentage points to 49.2%, and its market share was 5.50%.

JPMorgan Chase Bank NA ranked second with $2.39 billion of funded mortgages in Illinois, down 42.2% from the prior year.

UWM Holdings Corp., the overall top mortgage lender, took the No. 3 spot in Illinois with $1.94 billion of funded mortgages, a 9.3% drop from the previous year.

Rocket Mortgage LLC was No. 4 as it logged $1.53 billion in funded Illinois mortgages in 2023, down 33.2% year over year. Meanwhile, the Rocket Cos. Inc. unit's loan approval rate rose 4.6 percentage points to 69.4%.

On an Aug. 1 call to discuss Rocket's most recent financial results, CEO Varun Krishna said home affordability is

still at historic lows because of high mortgage rates and increasing home prices.

"This past spring, the industry experienced a weak home buying activity with purchase applications dropping to their lowest levels in over three decades," Krishna said. "Macro uncertainty and affordability issues are keeping potential buyers on the sidelines while consolidation continues with smaller players being acquired or exiting the market."

Aside from JPMorgan, other members of the Big Four were also among the top mortgage originators in Illinois. Wells Fargo Bank NA's funded mortgages in Illinois fell 35.1% to $904.8 million; Bank of America NA's dropped 39.0% to $693.7 million; and Citibank NA's declined 26.1% to $548.0 million.

GreenState CU was the only credit union on the list, with $663.7 million in funded mortgages in Illinois, up 64.4% from a year earlier. The credit union and Walker & Dunlop LLC were the only lenders that reported higher funded mortgages year over year.

IBA’s Annual Convention • Amelia Island, Florida • June 24-27, 2024

A wise person once said, “If you can connect with people, you can create the future.” Well, a bright future was certainly created based upon the connections made at the IBA’s Annual Convention. Hosted on beautiful Amelia Island, the 2024 gathering of bankers from across Illinois and Ohio was a wonderful opportunity to network with fellow bankers, acquire knowledge, and connect with outstanding vendors.

A hallmark of our Annual Convention is bringing in nationally recognized speakers, to share their views and perhaps to even peer into the future. This year was no exception. Joan Woodward, Executive Vice President of Public policy, Travelers got the program started with her compelling presentation covering economic, public policy, and political outlooks.

Did you ever wonder what your peers are focusing on in 2024 and beyond? Lee Wetherington, Senior Director, Corporate Strategy at Jack Henry had some ideas. He shared a revealing look at where your banking peers are headed, and new opportunities presented by the ecosystem disruption reshaping financial services.

Influencing bankers lives every day, it is important to get a regulators perspective. Travis Hill, Vice Chairman, Board of Directors of the FDIC presented updates on the agency’s rulemaking agenda, as well as other regulatory and market developments.

Unique to our 2024 convention was pulling together bankers from Illinois and Ohio to share our collective experiences, which helps everyone become better. We focused on Executives and Directors and held breakout sessions for CEO’s that focused on what keeps us up at night. In short, there was something for everyone to learn – to influence and be influenced.

The Convention Marketplace was sold out to a group of outstanding vendors, focused on serving the banking industry’s unique needs. Their offerings sparked new ideas for serving customers and becoming more efficient. And the vendors were super creative in their approach to meeting our bankers.

As the longest tenured trade association serving banks in Illinois, we are member focused. And nowhere was this more evident than at our Annual Salute to IBA Leadership. We take time to show gratitude to our past Board members and install our new leadership team. But we also recognize one special banker and several banks for their support of the industry and their communities.

A big thank you to Tom Chamberlain, Immediate Past Chair of the IBA, and Betsy Johnson for their years of service to the IBA. A special shout out to Kevin Rogers, President and CEO at Philo Exchange Bank for receiving the prestigious Banker of the Year Award. Kevin was not only surprised with his nomination, but many of his staff traveled from Illinois to surprise him at the awards ceremony.

And a heartfelt congratulations to Metropolitan Capital Bank & Trust, Peoples Bank of Kankakee County, First National Bank of Steeleville for receiving the Illinois Bank Community Service Award. And finally, Grundy Bank for receiving the Illinois Bankers Bank PAC of the Year Award.

One great aspect of the IBA’s Annual Convention is the opportunity to build a stronger network of peers. There were events and opportunities to garner new friendships and strengthen current friendships every day. Live music, great food, s'mores(!), and good friends made this event one to put on your calendar every year.

Annual Convention 2025

The 2024 Annual Convention was one for the ages. And you don’t want to miss the 2025 version.

Mark your calendars for the 2025 Annual Convention!

June 23-25, 2025

Grand Geneva Resort and Spa Lake Geneva, Wisconsin

We will see you there!

1720 Windward Concourse Ste 275 Alpharetta, GA 30005-2289

Website: defensestorm.com

Contact: Callicutt, Mia mia.callicutt@defensestorm.com

Facebook: facebook.com/defensestorm

Twitter: x.com/defensestorm

LinkedIn: linkedin.com/company/defensestorm

DefenseStorm provides an integrated platform of cyber risk assessment, governance, security, and fraud solutions that ensure financial institutions achieve and maintain cyber risk readiness. The only system specifically built for banking, it accounts for all the daunting challenges, regulations, and technology requirements financial institutions face. Their intelligent data engine, GRID ACTIVE, ensures real-time access, analysis, and action on all critical threat data. The Cyber Threat Surveillance Operations (CTS Ops) team offers access to managed resources 24x7x365, providing the help and expertise needed by financial institutions.

2815 Coliseum Centre Dr Ste 240 , Charlotte, NC 28217-0137

Website: www.finzly.com

Contact: Littlejohn, Emily emily.littlejohn@finzly.com

Twitter: x.com/finzly

LinkedIn: linkedin.com/company/finzly

Finzly offers an operating system for banks that is modern, cloud-based, real-time, and API-enabled. The digital core readily integrates to a bank’s existing core, saving the bank time and money and allowing it to focus on innovation. With an array of readymade solutions including an award-winning multi-rail payment hub (ACH, wires, RTP, FedNow, and SWIFT), foreign exchange, multi-asset deposit core,

account opening, KYC, risk, compliance, and a suite of customer experience components, banks can offer cutting-edge solutions to the connected economy.

6300 Ridglea Pl Fort Worth, TX 76116-5704

Website: cathcap.com/

Contact: Klint, Allison Allison@cathcap.com

Facebook: facebook.com/CathcapCFO/

Twitter: @cathcapCFO

LinkedIn: www.linkedin.com/company/cathcap

Cathcap offers fractional CFO services to businesses, helping them achieve financial goals through strategic guidance and comprehensive financial management. Their services include financial strategy optimization, cash flow management, risk management, and forecasting. Cathcap's team of experienced CFOs, controllers, and analysts work closely with clients to develop customized financial solutions that drive profitability and growth. This partnership approach ensures businesses receive high-level financial insights without the cost of a full-time CFO.

Heritage Bank of Schaumburg is a communityoriented, independently owned financial institution that opened its doors for business on August 8, 1974. As one of the first financial institutions in the Schaumburg area, Heritage Bank services an established customer base, many of whom have banked with their institution for over ten years. They are a full-service bank offering financial services to area businesses and residents alike, including a wide range of deposit and loan products.

Their independent status provides them with opportunities that some of their competitors cannot provide. They can tailor products and services based on the needs of their local patrons, rather than being restricted by service offerings that are created in a home office located out of state or out of the country. And, most importantly, they are rewarded with the loyalty of customers who appreciate being greeted by name and served by a personable staff they know.

As a locally owned and managed bank in Schaumburg, they understand the importance of giving back to the community they serve. They are well respected for the support they provide to various civic, educational, and community organizations by sponsoring activities that contribute to the continued prosperity of the village and its residents. They also provide their customers an opportunity to give back by hosting food and school supply drives throughout the year right in the branch.

At Heritage Bank of Schaumburg, they believe their customers are their most important asset. That's why their employees take a personal interest in you and take

the time to listen to you to determine the services that will best assist you in achieving your goal. They invite you to explore their website to see for yourself all their bank has to offer. When you choose Heritage Bank of Schaumburg, you receive the expertise of a full-service bank with a personal touch. Welcome to the IBA!

Villa Grove State Bank opened for business on November 1, 1919. Their story began at 10 N. Main Street in Villa Grove, in what was then known as the Combs building and had been previously occupied by the Morrison Grocery Store. They are still there today to serve their customers and community. As the bank continued to grow, they expanded their facility to the south into what had formerly been the P.N. Hirsch building.

On December 18, 1989, the First National Bank of Villa Grove was merged into Villa Grove State Bank, allowing them to serve an even larger part of the community. At this same time, they built their drive-up facility within the same city block, to better serve their expanded customer base with welcoming customer service and convenience. They are proud to serve the community of Villa Grove and the Douglas and Champaign County communities.

Villa Grove State Bank takes great pride in being “Your Hometown Community Bank Since 1919.” They are a full service, customer-oriented financial institution. They are locally owned and operated, with an enormous investment in the community that their Directors, Officers and Employees all live and raise their families in. Welcome to the IBA!

First Mid Bank & Trust recently announced the promotion of Coleman Engelkes to Charleston Community President. In this role,

Engelkes will be responsible for business development, community engagement initiatives, and supporting and strengthening lending relationships in the Charleston community. He will also continue to carry out his Commercial Lender responsibilities, managing the operations of commercial and ag lending.

“We are thrilled Coleman has stepped into this leadership position,” says Lisa Fowler, Regional Community President at First Mid. “His extensive knowledge and expertise in banking, along with the relationships he has formed in the community, showcase his ability to be an outstanding leader. We are confident Coleman will further strengthen our presence in Charleston and continue providing exceptional financial services to our valued customers.”

Midland States Bank is pleased to announce that Tom Ormseth has joined as Chief Deposit Officer. Ormseth brings over 30 years of commercial banking and treasury management experience, including 17 years of executive leadership at Wintrust Financial Corporation. He specializes in digital products for commercial and retail, treasury management sales and implementation, international banking, card services, derivatives, and government banking.

"We are thrilled to welcome Tom Ormseth as our Chief Deposit Officer," said Jeff Mefford, President of

After earning a Bachelor of Science degree in Agricultural Business from Illinois State University in 2018, Engelkes started his career in banking. Prior to joining First Mid in 2022 as a Commercial Lender, he held the same position at Prairie State Bank & Trust.

Born and raised in Charleston, Engelkes demonstrates a deep commitment to community engagement. He currently serves as Treasurer for the Coles County 4-H Extension Foundation Board, President-Elect of the Charleston Area Chamber, and Co-Chair of Charleston CAN. He is a past member of the Lake Land College Alumni Association Board of Directors. Engelkes devotes his time to various volunteer organizations including Mattoon Emerging Leaders and Half Hour Heroes to name a few.

Midland States Bank. "His wealth of experience will be a valuable asset for our business customers as we continue to innovate and serve them with excellence.”

Ormseth will lead the Commercial Services Team in providing service and support to help customers achieve their business financial goals.

He earned his Bachelor of Arts in Finance from the University of Northern Colorado and has been previously acknowledged by the American Banker as a Digital Banker of the Year.

Shaping Tomorrow's Banking Leaders Today

Transform talented employees, new or seasoned, by cultivating the next generation of bank leaders through the dynamic Future Leaders Alliance Program (FLA). This unique program builds employee confidence, creates a positive environment, and strengthens the organization’s performance. The FLA leadership framework contains an emphasis on personal and professional development, community service, and networking.

Accounting

Asset Liability Management

Bank Marketing

Bank Profitability

Bank Simulation

Collaboration Skills &

Team Building

Consumer Age

Cybersecurity

Diversity, Equity, & Inclusion

Economic Investment Day

Economic Update

Everything’s a Presentation

Executive Coaching

FHLB Overview and Public

Policy Issues

Fintech

IBA Legal Staff Function

Human Resources

IBA Engagement & Involvement

Importance of Advocacy

Investment, Bonds, & Portfolios

Lead for Success

Leadership & Influence

Management

Money Ball for Bankers

Trends in Bank Tech

Staying ahead of the curve in today's competitive banking environment is more important than ever, and BankTalentHQ is a valuable tool that can help your bank do just that!

Whether you are looking to attract and retain top talent, improve your employees' skills, or stay ahead of the curve in talent acquisition, BankTalentHQ.com is an excellent tool to help you achieve your goals.

BankTalentHQ offers an all-encompassing job platform tailored specifically for the banking sector. Discover exceptional talent to propel your banking operations to success through BankTalentHQ.

BTHQ's new partner, Whistle, aids employers in boosting employee engagement, reducing turnover, and enhancing retention It is a discounted platform to complement BTHQ's recruitment services.

After 37 ½ years in banking, Steve Rosenbaum, President and CEO of Hoyne Savings Bank retired in July 2024. Rosenbaum started at Prospect Federal Savings Bank in 1987 and was elected to the Board of Directors in 1996. In 1998 he was appointed its President and CEO. In 2017 Mr. Rosenbaum was appointed President and CEO and Director of Hoyne Savings Bank. He played a key role in the merger between Prospect Federal

Savings Bank and Hoyne Savings Bank as well as orchestrating the merger with Hoyne Savings Bank and Loomis Savings Bank.

Rosenbaum devoted significant time to the banking industry. He served as Director and Chairman of the Board of the Federal Home Loan Bank of Chicago and Chair of the Council of Federal Home Loan Banks. He served on the American Bankers Association Membership Council, was a Board member and Past Chair of the Illinois League of Financial Institutions, Chicagoland Association of Savings Institutions, Chicagoland Association of Financial Institutions, and served as a Board member of the Illinois Bankers Association.

Mr. Rosenbaum’s influence extended beyond the banking industry. He served on the Parish Pastoral Council of St. Germaine Parish, Brother Rice Board of Directors, Trustee for the Village of Oak Lawn, member of the Oak Lawn Planning and Development Commission, and the Neighborhood Housing Service of Chicago.

On July 5th, First Bank Chicago celebrated the retirement of Lenore Erickson, Chief Human Resources Officer. After Lenore joined First Bank Chicago in 2013, she doubled the size of the HR team and spearheaded many initiatives such as the adoption of new technology, the efficient expansion of programs and benefits as well as playing a vital role in their 2022 rebrand.

Her unwavering commitment and dedication to excellence has brought First Bank Chicago recognition by Crain’s as one of the “Best Places to Work” in Chicago for 6 consecutive years and by American Banker

He was recognized throughout his career for his leadership and service to many including, but not limited to, the Arnold Rauen Legislative Award for Outstanding Legislative Service to the Savings Business in Illinois, Chicagoland Association of Financial Institutions Award for Outstanding Service, Metro Southwest Alliance Award, Illinois Chamber of Commerce Award, St. Germaine Holy Name Society Award for Outstanding Leadership, and induction into the Brother Rice Hall of Fame.

At his retirement celebration, he was presented with a Board Resolution, recognizing his years of service to the Banking industry by the Illinois Bankers Association.

Mr. Rosenbaum will remain on the Board of Directors of Hoyne Savings Bank and intends to spend more time with his family. The Illinois Bankers congratulates Mr. Rosenbaum on a stellar career and wishes him a wonderful retirement!

Magazine as one of the “Best Banks to Work For” nationwide for 2 consecutive years.

Lenore has also provided her guidance and leadership outside of the bank by serving on the Illinois Bankers Scholarship Committee, the Education Services Board and served as a panelist on the FHLBC’s DEI series. In March of 2022, Lenore was recognized by the IBA at The ONE Conference as the 2021 Volunteer of the Year. She has been an invaluable asset to First Bank Chicago and the Illinois Bankers, and we all extend our heartfelt gratitude and well wishes to Lenore.

Family, friends, and colleagues gathered on Thursday evening, August 8, during the annual Graduate School of Banking to celebrate Kirby Davidson, who will be retiring December 31, 2024. This was Davidson’s 25th session, and he was honored for his longtime service to the banking industry and his commitment to and leadership of the school over many years.

Representatives of the GSB professional staff, faculty, Banker Advisory Board, and Board of Trustees shared some of their favorite memories of working with Kirby. His wife, Amy Davidson, was also honored for her support of Kirby during his long tenure at the school.

Davidson joined GSB/PEF in 2000 as the vice president of marketing & banker relations. He was promoted to president & CEO in 2008. During Davidson’s tenure as president & CEO, the School expanded its programming, adding four additional specialty schools (IT Management, Cybersecurity, Strategic Marketing and Digital Banking), in addition to the HR and Financial Managers Schools that were introduced in the early 2000s. Davidson, along with key faculty leaders, also worked closely with the Wisconsin School of Business so that graduates of GSB’s primary Graduate Banking School now receive the prestigious Executive Leadership Certificate from the Wisconsin School of Business – the one of the highest level certificates available from UW – in addition to their GSB diploma. Davidson oversaw the research and development of the web-based bank management simulation software, FiSim, that replaced the previous BankSim model the school had used for decades. This state-of-theart platform was launched in 2019 and is exclusive to GSB. It provides graduating seniors with a robust simulation model that incorporates modern, real-world approaches to banking and leadership within the model.

"Under Kirby Davidson's leadership, the Graduate School of Banking has expanded its educational offerings and built on the school’s reputation for excellence and academic rigor. He has established a solid foundation for his successor and GSB is very well-positioned to continue creating leaders and educating professionals in our dynamic industry,” said Randy Hultgren, President and CEO of the Illinois Bankers Association, and immediate past chair of the GSB Board of Trustees.

“We have an outstanding and experienced professional staff that has an average tenure of more than 15 years with GSB,” Davidson said. “This experience and passion for offering the best and most progressive educational programs, student/ faculty experience, and expanded learning platforms – both residential and online – combined with having the best faculty in the industry, is key to GSB’s stellar reputation in the industry. This year marks my 25th year at GSB and I’m so thankful and appreciative to the Board for having this opportunity, the friendships that have been formed, and the numerous successes we’ve achieved.”

Join us in wishing Kirby all the best in his retirement!

The Illinois Bankers Association recognizes Joseph M. Silveri, Senior Vice President of Hickory Point Bank & Trust as an inductee into the IBA’s 50-Year Club. The 50-Year Club recognizes and celebrates bankers who have achieved 50-plus years in the industry! A 50Year Club nomination is a capstone event for a banker filled with rewarding experiences and achievements.

Silveri began his career in 1970 at Town and Country Bank of Springfield and reached the position of Senior Vice President.

In 2002 he joined Illinois National Bank as Senior Vice President and in 2015 he joined Hickory Point Bank & Trust as Senior Vice President.

Debbie Jemison, longtime Communications and Marketing Vice President and editor of the Illinois Banker magazine, has fully retired from the IBA after 25 years of service. She began her IBA career in 1999, following several years at the Illinois Association of REALTORS and the Franklin Life Insurance Company. For the last three years, Jemison has

served as an independent contractor for the IBA, overseeing the SIFMA Foundation’s Stock Market Game in the state of Illinois and working with teachers and students to further their financial literacy.

Throughout her IBA career, Jemison was instrumental in creating and managing the Women in Banking Conference and growing it to be one of the largest and longestrunning conferences of its kind in the country. She also helped develop and manage the Banker of the Year and Illinois Bank Community Service Awards and served as liaison for the Communications and Marketing Committee and Women in Banking Committee for more than two decades. She earned national recognition for her work with Illinois first lady Lura Lynn Ryan on Pennies for Lincoln where Illinois banks partnered with the schoolchildren of

Recently appointed to Chair of the Illinois Society of Association Executives (ISAE), a chapter of the Association Forum

Illinois to raise money for a special exhibit for children at the Abraham Lincoln Presidential Library and Museum. Under Debbie's leadership, Illinois Banker magazine was recognized with several awards. She was heavily involved in the Illinois Society of Association Executives (ISAE), serving on their Board of Directors for many years. She earned her Certified Association Executive designation in 2005. In 2016, she was honored with the ISAE President’s Award for exceptional service, dedication and significant contributions to ISAE and the association community.

She intends to spend time enjoying life with family and friends while traveling and working on improving her golf and pickleball skills. Congratulations, Debbie, on a wonderful career and your retirement! The Illinois Bankers salute you!

David Mark Mecklenburg, 56, of Rockford, went to be with his Lord, on June 13, 2024, following a hiking accident at St. Mary’s Glacier, while on vacation in Colorado with his family. He was born in Montgomery, Alabama on Feb. 9, 1968.

He married Nanette Law of Stillman Valley, on March 16, 1991 at First Evangelical Free Church of Rockford. They lived their entire married lives and raised their children in Rockford.

David moved to Rockford in 1981 with his parents and brother, after living in Troy, Alabama; Pensacola, Florida; DeKalb, Illinois; and Canton, Missouri.

In high school, David was a track and cross-country standout, earning a state cross-country second place team medal in 1984, for which he was later inducted into the Guilford Sports Hall of Fame.

David graduated from Rockford Guildford High School as Salutatorian of the Class of 1986. He earned his BA in Economics (with honors) from the University of Illinois in 1990.

Upon graduation, he worked at Home Bank, of Rockford, then completed his MBA from Northern Illinois University in 1993. In 1994, David embarked on a stellar 30-year career with Stillman Bank, rising from Marketing Coordinator to Executive Vice President & Chief Operating Officer at the time of his death. He also served on the Stillman Valley Economic Development Committee and was pursuing certification from the University of Wisconsin Graduate School of Banking.

A deep and devout Christian, David accepted the Lord early in life, at age 8, at home, and walked his Lord’s path daily as a husband, father, son, brother, uncle, businessman, and community citizen.

Six years of scouting instilled in him a tremendous love of the outdoors, trail hiking and family excursions. He also loved the beach, a good steak and any and all time with his family.

Because of his Alabama roots, David was an avid Crimson Tide supporter and fan. When his two sons graduated from the University of Alabama earning their bachelors and master’s degrees, his love of UA only intensified.

As Tom Hughes, CEO & President of Stillman Bank noted:

“David started at the bank in April of 1994 and recently celebrated 30 years of service. He most recently held the position of Executive Vice President and Chief Operating Officer, working out of our Stillman Valley location. He has also held the roles of Marketing Coordinator, Marketing Director, Loan Review Officer, and Chief Credit Officer during his time at the bank. David has been a valued member of the team for the past 30 years, and will be deeply missed. He exhibited all of our core values on a daily basis and played a big part in the Bank’s success over the years. His impact on the organization will be felt for years to come.

David had a tremendous work ethic and a desire to always keep learning new things. Those traits served him well as evidenced by all the different leadership positions he held over the years and is a large reason he enjoyed much success.

Despite his accomplishments he was always most proud of the relationships he established over time with co-workers and customers. He got great satisfaction in watching them grow and accomplish their goals and dreams. In all respects he was the consummate bank professional but was an even better friend, husband, father, and person.

The source of his greatest joy was family. He was so proud of his wife, Nanette, and their two sons, David and Will. He was passionate about everything that involved his family which included all things related to the University of Illinois and all things involving Alabama Crimson Tide football.”

He is survived by his wife Nanette; sons, David Matthew of Birmingham, AL and William John of Jackson, MS; parents John and Kathy of Rockford; brother Brian Aphrodite of Rockford; and numerous nieces and nephews.

When telling the story of INB’s origins, you need to go back to the 1980s. That’s the era of big banks buying smaller banks. The original Illinois National Bank – established in 1886 – was bought by First of America, sold to National City, and later sold to PNC Bank. The employees who were part of these transactions were unhappy because they couldn’t provide customer service like they had when working for a local bank. Some of these employees worked with a group of local investors to open a new community bank -- using a name with great recognition in Springfield -- Illinois National Bank. That was 1999. In 2019, the bank name was officially changed to INB, N.A, but many original employees remain.

25 years after its rebirth, INB is celebrating its history. Sarah Phalen, INB President and CEO, recently sat down with some of her “OGs” (the “Originals,” as she calls them) to

reflect on the earliest days of INB. Both Debbie Shelton, recently retired, and Kathy Greer, SVP, retail operations, came to INB from the same employer. They’d met years before; their distinct personalities made them fast friends. Debbie says, “When I first met Kathy, I saw her bright red hair and told her, ‘I think you’ll break out in singing "The Sun Will Come Out Tomorrow,’” a reference to the red-headed Annie. Since that first meeting, they’ve been quite the team.

When they started at INB in spring 1999, the bank was 60 days from opening. Their first day of work was in an office building on MacArthur Boulevard and Outer Park Drive. Tom Gihl – now INB’s chief revenue officer -- put computers on folding

table desks, and everyone went to work. Debbie called vendors to establish accounts. Kathy wrote policies and procedures. Shortly after, all the original employees made the move to 322 E. Capitol Ave., INB’s headquarters.

Sarah says of the transition,“When we did move into the old Central Illinois Light Co. building near the Illinois State Capitol, there were only about 20 of us, and we were only on the first floor. CILCo continued to use the second and third floors.”

The team was elated about the space. As part of the property transaction, INB purchased a separate, but available, vacant bank drive-up located right next door.

In the early days, impromptu meetings were easy to organize because everyone was in one place, says Kathy. “We could focus on any issue and quickly come up with a solution.” Sarah adds, “Even with growth, INB is known for getting things done in record time. From loan decisions to finding and using the latest technology, we’ve known speed is a differentiating factor that we still emphasize with our employees.”

Reflecting on the move to the Capitol Avenue address, Jenny Broughton, INB’s Deposit Operations Officer, recalls the building on Capitol wasn’t

The INB “blimp” was used at many community events in the bank’s first decade. After unexpectedly taking flight, the blimp was retired.

quite the office she had anticipated. "It was a mess! The place was dusty and filled with old furniture." The team got right to work right, scrubbing, dusting and getting scotch tape marks off the windows. The utility company’s payment windows

UFS Empowers Bank First with Successful Implementation of Empowered Core Banking Application Platform

UFS, the leading technology outfitter for community banks, proudly announces the successful implementation of its Empowered Core banking technology platform for Bank First, a Wisconsin bank with $4.2 billion in assets. This core transformation supports Bank First's growth strategies by offering greater flexibility, speed to market, Fintech enablement, and enhanced acquisition capabilities.