The SW Graduate School of Banking at SMU Cox empowers bankers in all positions, other financial services professionals and affiliates, regulators, bank directors, and aspiring bank directors with knowledge and relationships that strengthen careers, organizations, and communities.

Anthony Nestler Chair Hickory Point Bank & Trust

REGION 1

Miguel Gomez CIBC Bank USA

Maria Tabrizi First Women’s Bank

REGION 2

Peter Brummel Grundy Bank

T. J. Burge Chair-Elect Community Partners Savings Bank

Courtney Olson First Bank Chicago

REGION 3

Lawrence Horvath Heartland Bank and Trust Company

Kathy Williamson Bank of Farmington

Megan Collins Vice Chair Bank of America

Frank Pettaway Treasurer The Northern Trust Company Courtney Olson At-Large Category First Bank Chicago

Amy Randolph At-Large Category Busey Bank

Thomas Chamberlain Immediate Past Chair

Iroquois Federal Savings & Loan Association

Randy Hultgren Secretary Illinois Bankers Association

REGION 4

Scott Bland First Neighbor Bank, N.A.

Brett Tiemann INB, National Association

REGION 5

Ted Macon

Farmers State Bank of Hoffman

Bethany Shaw Peoples National Bank, N.A.

LEADERS ALLIANCE

Ryan Martz Solutions Bank

LARGE

Gustavus Bahr PNC Bank, N.A.

Dave Conterio Hometown National Bank

David Doedtman Washington Savings Bank

Brian Hannon Cornerstone National Bank & Trust Company

Quint Harmon Resource Bank, N.A.

Tom Hough Carrollton Bank

Robert Kelly Old National Bank

Karlie Krehbiel Lisle Savings Bank

Alan Kwasneski Marquette Bank

Amy Randolph Busey Bank

Dalila Rouri BMO Bank, N.A.

Timothy Smigiel Liberty Bank for Savings

Daniel Wujek State Bank of Cherry

Two Offices to Serve You! Springfield Office: 800-783-2265 • Chicago Office: 800-878-2265

To connect with our staff, use this email format: firstinitiallastname@illinois.bank

Executive Administration

Randy Hultgren, President & CEO

Mindy Manci, Executive Assistant & HR Manager

Pam Macha, Springfield Office Coordinator

Finance and Administration

Mark Bennett, CPA, Executive Vice President and CFO

Matthew Keeling, Director Marie South, Financial Assistant

Law Department

Carolyn Settanni, Executive Vice President & General Counsel

Carly Berard, Associate General Counsel

Andrés Sánchez, Staff Attorney Jeavon Greenwood, Administrative Assistant

Government Relations

Ben Jackson, Executive Vice President

Aimee Smith, Assistant Vice President

Matt Imburgia, Director

Member Relations

Julie Winterbauer, Senior Vice President

Tim Robinson, Director, Bank Relations

Illinois Bankers Business & Education Services, Inc.

Callan Stapleton, CAE, EVP & President of Business and Education Services

Adam Walsh, Vice President, Insurance Services

Lyndee Fein, Director, Education & Conferences

Jocelyn Holzmacher, Director of Marketing

Robin Lane, Director, Associate Membership

Rachel Selvaggio, Director, Business and Education Services

Denise Perez, Director, Education & Training

Amy Sale, Education Assistant

Illinois Bankers Group Insurance Trust

Mike Mahorney, Plan Administrator Hillary Meyers, Trust Manager

Ste. 400, Springfield, IL 62704. News items from members of the Illinois Bankers Association are invited and are due on the first of the month preceding publication. © Copyright 2024 by Illinois Bankers Association (unless individual articles

copyright). Reproduction of

material in the Illinois Banker is strictly prohibited without written permission of the publisher.

Congratulations on another strong year for the Illinois banking industry. In 2024, the bankers of Illinois helped businesses of all sizes with loans, treasury management services, and more. We helped individuals and families buy homes and save for the future. We provided crucial financial services to municipalities and not-for-profits, including schools and universities. We supported Illinois’ agricultural economy with reliable financial solutions. We served institutions, foundations, and families as trustees, agents, and financial planners. We provided vital financial and other support for our communities, and our bankers invested countless hours of volunteer time in service to those in need. We did our part to make Illinois a great place to live and work in 2024. Bravo, Illinois banks!

As we embrace a new year, our thoughts turn to plans for the future. Please keep the resources of the Illinois Bankers Association in mind to help you navigate a dynamic industry. The IBA offers robust educational opportunities, ranging from executive education to courses designed for new bankers. Our Regulatory University, a free online platform, keeps your employees informed about changing laws and regulations. The Future Leaders Alliance helps develop the next generation of leadership. The Annual

Conference provides a forum for executives from across the state to come together, share ideas, learn together, and have fun.

If you have not considered the Illinois Bankers Insurance Services (“IBIS”) and Adam Walsh, please be encouraged to do so. The IBIS offers a comprehensive suite of insurance products exclusively for banks. This includes Financial Institution bond, property & liability insurance, worker’s compensation, and a full menu of employee benefits. Adam and his team are proactive and bring profound industry-specific knowledge to the table. My personal experience with Adam and the IBIS team has been positive.

Finally, please be encouraged to continue to support the IBA’s advocacy efforts. This may include contributing to the Illinois Bankers PAC, participating in the IBA’s Lobby Day at the state capital, joining the Washington Fly In, or working with IBA staff to enhance dialogue between you and your elected officials. The voice of Illinois bankers is loudest when we speak together.

Thank you for your commitment to the Illinois Bankers Association, and best wishes for a happy and prosperous new year.

Welcome 2025. We have survived another challenging, frustrating, yet rewarding year as bankers. Serving your customers and communities has never been more important, but also, never more difficult. Through it all, know that your Association is here for you. We are fighting difficult battles daily in Springfield, Chicago, and Washington, D.C.

2024 was one of the most aggressively antibanking legislative years in our state. The IBA brought together banks from every region and of every size to push back against the anticonsumer interchange legislation. As Carolyn Settanni, our fantastic General Counsel and EVP, recently said to a reporter: "this Illinois law is going to unleash chaos on Illinois consumers, small businesses and community financial institutions and it is going to happen in a matter of months unless the court steps in, which we have requested. The special interest here is the mega retailers and they are trying to increase their bottom line by forcing the entire payment industry to make this huge change in a way that will benefit mega retailers but won’t benefit smaller players and certainly not Illinois consumers and community financial

institutions.” No other entity could do what the IBA is doing to fight for your bank and our industry. This is just one of the many ways we serve you, help you solve problems, and deliver significant value to our members.

The Illinois Bankers Association exists to support every banker in our state. 2024 was a very good year for the IBA. We broke attendance records at many of our conferences. Commit now to join us in Bloomington on March 13-14 for The ONE Conference to enjoy great networking and speakers, or to take advantage of our effective education resources.

Many of our members are reaping benefits and cost savings by utilizing recommended bank partners. Reach out to Adam Walsh, who runs our Illinois Bankers Insurance Services, to ensure you are getting the perfect coverage at the best price. Tap into our exceptional legal expertise by ensuring that all your key people are using “gotoIBA.com”. Our passion is to serve you, and our most satisfied banks are the ones who use our services the most. Together, let’s make 2025 fantastic!

The IBA Law Department

QUESTION

What is the retention period for charged-off loans, both paid and unpaid?

ANSWER

We recommend retaining any records related to charged-off loans, whether they are paid or are unpaid, for ten years from the date of charge-off.

The Illinois Code of Civil Procedure imposes a ten-year statute of limitations, meaning that a lender generally must initiate collection proceedings within ten years for written contracts (with some exceptions). The Federal Financial Institutions Examination Council (FFIEC) recommends that banks maintain supporting Call Report documentation, including evidence of charge-

QUESTION

offs and recoveries, for three years after the report date. Also, the IRS requires reporting of debt cancellations over $600 on Form 1099-C (or, for some secured loans, Form 1099-A) and imposes a four-year retention period for the form and related data.

Consequently, you may wish to retain documents related to charged-off loans for ten years in case your bank wishes to initiate a collection proceeding for a loan within the ten-year statute of limitations period.

If we have a joint personal account (JTWROS), can we add two authorized signers (not the owners) to the account? I’m not familiar with this practice and wasn’t sure if this is something that is permitted.

ANSWER

We are not aware of any Illinois law prohibiting joint accounts from having one or more authorized signer.

If your internal policies and procedures and your account agreements do not discuss adding authorized signers on joint accounts, we recommend deciding

whether it will be your bank’s policy to require all joint account owners to consent to adding an authorized signer to an account (or to remove an authorized signer). We believe that whether you require the consent of all or only one joint owner is a matter of bank policy.

Can you provide some clarity as to banks’ responsibilities with respect to the changes to the beneficial ownership information reporting requirements set to go into effect on January 1, 2025?

ANSWER

There has been a recent flurry of changes related to FinCEN’s beneficial ownership information (BOI) reporting requirements. However, the BOI changes relate to the rule requiring legal entities created or registered to do business before January 1, 2024, to file beneficial ownership information reports with FinCEN on or before January 1, 2025. Banks are subject to separate customer due diligence (CDD) requirements that require collecting and reporting their customers’ beneficial ownership information, and those CDD requirements remain in place, unaffected by the recent BOI changes.

As to the BOI changes, in December 2024, a federal district court had issued a nationwide preliminary injunction against FinCEN’s BOI rule. On December 23, the Fifth Circuit federal appellate court overruled that injunction, but it quickly reversed that decision on December 26. FinCEN has published an alert on its website confirming that “reporting companies are not currently required to file beneficial ownership information with FinCEN and are not subject to liability if they fail to do so while the order remains in force.”

We received an Illinois Department of Revenue tax levy on an account, which requires us to hold the customer’s assets for twenty days, limited to the amount of the levy. If the levy amount exceeds what is in the customer’s account, can we place a hold for the full amount of the levy, since the customer receives a weekly paycheck that we assume will bring the account funds up to the levy amount within the twenty-day period?

No, we do not believe you should hold funds deposited after your receipt of the tax levy. Rather, we believe you should hold only the funds in your customer’s account on the date you receive notice of the tax levy.

The failure to pay taxes due under the Illinois Income Tax Act creates a lien against a person’s property in favor of the Illinois Department of Revenue in the amount of the unpaid taxes. The Illinois Department of Revenue has the right to levy on accounts held by financial organizations to recover unpaid taxes. The Illinois Income Tax Act also authorizes the Illinois Department of Revenue to levy a person’s wages by serving a notice of levy on their employer, and the Act

expressly provides that the “levy . . . is a lien on wages or other payments due at the time of the service of the notice of levy, and such lien shall continue as to subsequent earnings and other payments until the total amount due upon the levy is paid.”

However, no such express language authorizes financial organizations to hold funds deposited into an account after service of a notice of levy. Consequently, we do not believe your bank should place a hold on funds deposited into an account after receipt of the levy. If the Department of Revenue chooses to attach your customer’s wages, it can do so by serving a notice of levy on their employer.

Our IBA Law Department provides many resources to help our bank members meet their compliance challenges, including a toll-free Compliance Hotline (1-800-GO-TO-IBA) and a dedicated compliance website (www.GoToIBA.com). We also publish a free weekly e-newsletter highlighting the latest regulatory developments, select recent Q&As, and other useful information –let us know if you want to subscribe!

Note: This information does not constitute legal advice. You should consult bank counsel for legal advice, even if the facts are similar to those discussed above.

It’s

By Rob Nichols, President and CEO, American Bankers Association

As we welcome 2025, a new presidential administration and a new Congress, it’s time to reset the conversation around banking regulation.

Over the last four years, the banking industry has battled an onslaught of new rules and regulatory changes that have threatened to fundamentally alter how financial institutions in this country operate.

Regulators have taken a de facto “one-size-fits-all” approach to rulemaking — ignoring the diversity of bank sizes, charters and business models within the banking sector, as well as the undeniable trickle-down effects of regulations that are, on paper, only targeted toward larger institutions. For whatever reason, they have also chosen to pursue rulemakings more tied to the past than the present. It’s time to stop fighting the last war and stay focused on the present and the future.

ABA and the state associations have stepped up on behalf of our members, challenging misguided final rules in court wherever warranted and pushing back with facts and data to stop faulty assumptions from underpinning major regulatory changes and bogus claims about our industry from spreading. We’ve had some notable successes over the last four years, but it hasn't been easy.

As we welcome 2025, a new presidential administration and a new Congress, it’s time to reset the conversation around banking regulation.

That effort began right after the election during the transition, as ABA worked to communicate our priorities to the incoming Trump administration. With leadership changeovers anticipated at the regulatory agencies following the inauguration — including at the FDIC, OCC and CFPB — we expect to have the opportunity to share our perspective with the new players and help refocus the conversation around rightsizing the supervision and regulation of the banking sector.

But while we can expect some of the new regulators to pause some proposed rulemakings altogether, and Congress could use the Congressional Review Act to undo some of the most recent regulatory proposals, it’s important to remember that the new administration and new Congress will not wield a magic wand.

Undoing policy changes in a durable way can take just as long as putting new regulations into place, since the Administrative Procedure Act and its notice and comment procedures apply. As we have noted in our many active lawsuits, regulators have frequently flouted the APA in recent years, and partisan agendas have too often driven a rulemaking process that is supposed to be even-handed and fact-based.

We have the opportunity now to get it right — by following a transparent process and by working constructively to engage policymakers of both parties in crafting commonsense regulations that ensure our banking sector remains safe, sound and well-capitalized. That’s how we bring about meaningful, long-lasting change.

At ABA, we are ready to roll up our sleeves and get to work, together with our state alliance partners — and we need your help.

We need every banker in this country to stay engaged on the issues that matter. Reach out to your members of Congress, particularly in states where freshmen lawmakers are taking office. Get to know your representatives, invite them to your bank and introduce them to your customers and your employees. Help them to understand not just the important work banks do each day, but the ripple effect that the provision of credit can have in our cities, towns and neighborhoods.

Finally, I invite every banker in this country to join us in Washington, D.C. April 7-9 for the 2025 ABA Washington Summit. This year’s annual gathering of bank leaders will be critically important in making sure we have a policy environment that will unleash economic growth and allow banks to serve their customers and communities. We need all of you there to make sure our industry’s voice is heard loud and clear.

E-mail Rob Nichols at nichols@aba.com.

By Ben Jackson, Executive Vice President of Government Relations

You no doubt heard a lot about our advocacy efforts in 2024 because of the interchange issue that we fought in Springfield. We took that fight to the federal courts while continuing to engage lawmakers, the media, and consumers.

Our team has deconstructed this situation ad nauseam. Our Springfield and Washington DC lobbying programs are second to none, yet we always strive to perform better on behalf of our members, the bankers of Illinois who work to improve their communities every day.

Our on-the-ground lobbyist team ensures we have a proverbial “seat at the table,” a powerful voice backed by our members to represent our interests.

We like to think of that seat as a three-legged stool, and each leg represents a different part of advocacy.

If we do not have three sturdy legs on our stool, our seat before government is wobbly and unstable, and your association cannot perform at its highest level of representation on your behalf. Instead, we’re diverting our effort towards balancing that wobbly stool.

The first leg of the stool is the direct lobbying that we do as an association on your behalf. We build relationships, ensure we are knowledgeable about a plethora of banking issues, laws, and regulations, and fight hard for your interests.

The second leg is the Illinois Bankers PAC. We were so pleased that all of you, our members, stepped up to help us reach our goal of $300,000 raised in 2024. That is just a start, and we can and will do more with our PAC to support our political giving and help our allies.

The third leg of the stool is grassroots: the direct involvement of bankers. Ideally, this manifests as hundreds of bankers attending our marquee grassroots events in Springfield and Washington, bankers establishing strong relationships with elected officials, and

bankers contacting their lawmakers on key issues throughout the year.

Grassroots engagement is, right now, our wobbliest stool leg. Your IBA team plans to address this in 2025. We will create new ways for you to connect with lawmakers, we will facilitate relationships with your elected officials, and we will increase the number of energized bankers who attend our advocacy gatherings.

And did I mention these events are fun? Bankers from all levels of your organization will enjoy the networking, policy briefings, and economic updates that are always a part of our grassroots efforts. We are confident that you will enjoy getting involved, while our industry will increase its success in Washington and Springfield.

By Jenn Addabbo, Co-Founder & Chief Executive Officer, EngageFI

Now that the election has concluded, Americans have a clearer sense of the country’s direction over the next four years. Banks will need to reassess their strategies, considering potential policy shifts. A Trump-led administration could bring significant changes that impact regulation, tax policy, and economic growth initiatives. Banks must be ready to navigate the changing tide, reevaluating how these changes may affect their future state.

Over the last four years, under the Biden administration, the financial sector has experienced a climate of regulatory scrutiny, especially surrounding consumer protection. There have been numerous interest rate hikes to combat inflation, followed by inflation control measures, and increased scrutiny of mergers and acquisitions. Financial equity initiatives and fair lending enforcement have also been key initiatives of the administration.

Changing economic conditions have also affected banks, increasing operational costs and customer sentiment. The economic pressures have reshaped customer

financial priorities. Inflation, the top concern for most voters, has reduced savings capacity for many, while rising interest rates have made borrowing less attractive. These changes have forced financial institutions to get creative to remain both profitable and compliant.

As the new administration takes office, financial institutions must prepare for potential policy shifts that could further impact operational strategies, regulatory responsibilities, the economic environment, and customer relationships.

The Trump administration will likely favor deregulation and take a more hands-off approach to oversight. It is rumored that the administration plans to make as many as eight leadership changes on day one to federal regulatory agencies, including the FDIC, if Biden’s nomination isn’t confirmed by year end. Banks will potentially see reduced restrictions and a reexamination of the Dodd-Frank Act or a relaxation of Consumer Financial Protection Bureau (CFPB) mandates. This move could result in reduced compliance costs and more streamlined operations, likely relieving some of the administrative burden on financial institutions.

There may also be changes to corporate tax policy. If so, this move could open up more capital for financial institutions to reinvest in technology, expand lending portfolios, or enhance customer service. On the flipside, if these policies are not accompanied by stable economic policies, there could be volatility, impacting lending and investments.

The removal of regulatory red tape is not without its challenges; it can lead to increased risk-taking and more vulnerabilities. Banks will need to closely monitor and strengthen their own risk management practices. Deregulation can also increase social responsibility pressures; it is essential to continue fairness and equity in lending. Furthermore, reduced regulatory oversight can pose reputational risks; finding the balance between compliance and consumer trust will be paramount.

Potential deregulation could allow banks to grow their current loan portfolios and develop new loan offerings. More operational freedom and greater support of

fintechs in the banking system could spur innovation, allowing banks to expand services and increase their digital footprints. Additionally, as regulations ease, we may see a surge in mergers and acquisitions across the financial services industry.

If new economic policies can successfully reduce inflation (although some experts believe Trump’s plans may do the latter), consumers’ financial confidence is likely to improve, which could encourage more saving and borrowing. A decrease in inflation could also lead to more favorable interest rates, making borrowing more attractive and accessible. Both create opportunities for financial institutions to expand their services and deepen customer relationships.

While it may be hard for banks to predict exactly what the future holds, it is essential for financial institutions to adopt a proactive approach to potential shifts. Prepare now and have your strategic plan in place so your bank is able to navigate the challenges and opportunities the new administration may bring.

As we step into 2025, we take a moment to reflect on the year we’ve left behind. 2024 tested our resilience and showcased our strength as bankers. Serving Illinois communities and customers remained as vital as ever, even in the face of mounting challenges.

Looking ahead, we are excited about everything the Illinois Bankers Association (IBA) has to offer. From advocacy and lobbying efforts to compliance support and educational opportunities, your association remains the go-to resource. At the IBA, we focus on three key pillars: Education, being an Industry Resource, and Advocacy.

Our education team works closely with bankers across the state, alongside the Education Services Board and numerous committees, to create engaging content and valuable opportunities. With more than 15 peer groups, 50 full-day seminars, five schools, and 10 conferences, we are committed to providing quality education and networking opportunities to help you grow in your careers.

As an Industry Resource, we partner with 16 Preferred Vendors who specialize in helping bankers evaluate and perform due diligence on solutions designed to enhance

profitability, reduce costs, and improve operational efficiency. We are proud to offer two insurance solutions. Illinois Bankers Trust Health Insurance program ensures exceptional care for your team’s health insurance needs. The Illinois Bankers Insurance Services work exclusively with banks offering tailored coverage across all business lines to comprehensively protect your organization.

Another invaluable resource we provide is BankTalentHQ, a nationwide career center. This platform connects banks with top-tier talent for job openings while equipping job seekers with the tools and resources they need to thrive in the banking industry.

Advocacy remains at the heart of our mission. Throughout the year, we stood firmly by your side, advocating for our industry at every turn. In Springfield, Chicago, and Washington, D.C., we tackled some of the toughest legislative battles we’ve ever faced. Among the most pressing issues was the fight against anti-consumer interchange legislation. Banks from every region and of every size came together under our leadership to push back. On December 20, a federal judge issued a preliminary injunction against enforcement of the law. This significant victory marked an important step forward, but the fight is far from over.

One of the most impactful ways to strengthen our advocacy efforts is through the Illinois Bankers PAC, a vital, nonpartisan Political Action Committee created to champion banking interests through political engagement. A strong PAC amplifies our collective voice in shaping government decisions, ensuring the future of banking is safeguarded against unique regulatory challenges.

As we embark on 2025, we are deeply grateful for your membership, partnership, and trust in the IBA. Together, we have demonstrated that unity makes us stronger, enabling us to rise to challenges, seize opportunities, and uphold the values that define and strengthen our industry. We look forward to another year of shared success, progress, and unity!

New Bank Members

Fidelity Bank

Villa Grove State Bank

Heritage Bank of Schaumburg

New Associate Members

All Covered, IT Services from Konica Minolta

Allied Payment Network

Automated Systems, Inc.

BAFS-Business Alliance

Financial Services

BEVYTEC, LLC

Bosch Security Systems LLC

Cathcap

CHAMP Titles

Computershare, Inc.

Consolidated Communications

CorServ, Inc.

Country Banker Systems, LLC

Darling Consulting Group

DefenseStorm

Duane Morris LLP

Finastra

Finzly

Growers Edge

Implemify

Integra Software Systems, LLC

MeridianLink

Midwestern Securities Trading Company

OnBoard

Quantalytix

Quantum

Round Hill Technologies (DBA

Ned)

Security Alarm

Southwestern Graduate School of Banking Foundation

Stephens

Superior Informatics LLC

TechGuard Security

The NBS Group, LLC

Tipton Systems

Rick L. Catt

First Robinson Savings Bank, N.A.

Merle E. Coile

Anchor State Bank

John W. Conrad

The Frederick Community Bank

James R. Eckert

Anchor State Bank

Carol Jo Fritts

First Neighbor Bank, N.A.

Ronald G. Klein

Resource Bank, N.A.

James M. Roolf Old National Bank

Joseph M. Silveri Hickory Point Bank & Trust

Ronald N. Welch INB, National Association

Murphy-Wall State Bank and Trust Company

Pinckneyville

150 Years (1874-2024)

2024 LINDA J. KOCH SCHOLARSHIP RECIPIENTS

Trace Donnan

PORTA High School/Augustana College

Sponsored by Petefish, Skiles, & Co. Bank

Ava Harwood

John Hersey High School/Indiana University, Kelly School of Business Sponsored by The PNC Financial Services Group, Inc.

Streator Home Savings Bank

Streator

130 Years (1894-2024)

2024 ILLINOIS BANKERS SCHOLARSHIP RECIPIENTS

Prospect High School/Indiana University Sponsored by PNC Bank

Bushnell Prairie City High School/ Spoon River College Sponsored by Farmers & Merchants State Bank

by Peoples National Bank

2024 Contributions raised: $328,835

2024 Disbursements made to state, local, and federal candidates: $426,925

Member banks contributed: 40%

ROCKSTAR CONTRIBUTORS

Bank & Trust Company

Central Bank Illinois

Community Savings Bank

Cornerstone National Bank & Trust Company

First National Bank of Steeleville

First National Bank of Waterloo

First Women's Bank

Grundy Bank

Iroquois Federal Savings & Loan Association

Philo Exchange Bank

Solutions Bank

State Bank of Bement

State Bank of Cherry

The First National Bank of Litchfield

FAIR SHARE CONTRIBUTORS

Amalgamated Bank of Chicago

Belmont Bank & Trust Company

Buckley State Bank

Busey Bank

Central Federal Savings and Loan Association

CIBC Bank USA

Community Partners Savings Bank

DeWitt Savings Bank

Farmers & Merchants State Bank of Bushnell

First Mid Bank & Trust, N.A.

First Neighbor Bank, N.A.

First Security Bank

First State Bank

First State Bank of Campbell Hill

FNBC Bank & Trust

Holcomb Bank

Hometown National Bank

Iroquois Farmers State Bank

FAIR SHARE CONTRIBUTORS

Ag Resource Management

BigIron Auctions

Consolidated Communications

Credit Bureau of Muscatine, Inc.

Floodplain Consultants, Inc.

ICI Consulting Inc.

Lisle Savings Bank

Marquette Bank

Marion County Savings Bank

Midland States Bank

Millennium Bank

Nashville Savings Bank

NorthSide Community Bank

Pan American Bank & Trust

Peoples National Bank, N.A.

Quad City Bank and Trust Company

Republic Bank of Chicago

Security Savings Bank

Sterling Bank

Stillman BancCorp N.A.

The State Bank of Pearl City

Washington Savings Bank

CONTRIBUTORS

Alliance Community Bank

American Bank and Trust Company, N.A.

American Community Bank & Trust

Associated Bank, NA

Bank of America

Bank of Belleville

Bank of Farmington

Bankers' Bank

Beardstown Savings, sb

Blackhawk Bank & Trust

Byline Bank

Carrollton Bank

CBI Bank & Trust

Citizens Community Bank

Community Bank of Elmhurst

Farmers National Bank

First Bank Chicago

First Farmers Bank & Trust Company

First Security Trust and Savings Bank

Forest Park National Bank & Trust Company

Heartland Bank and Trust Company

Hickory Point Bank & Trust

Home State Bank, N.A.

Hometown National Bank

Hoyne Savings Bank

INB, National Association

Itasca Bank & Trust Company

Lakeside Bank

Liberty Bank for Savings

Metropolitan Capital Bank & Trust

Midwest Independent BankersBank

Morton Community Bank

North Shore Trust and Savings

Old National Bank

Old Second National Bank

OSB Community Bank

Peoples Bank

Peoples Bank of Kankakee County

Prospect Bank

Sauk Valley Bank & Trust Company

Signature Bank

The Central Trust Bank

The Litchfield National Bank

TIB, N.A.

UMB Bank, n.a.

U.S. Bank N.A.

United Bankers' Bank

Union Federal Savings and Loan Association

Village Bank & Trust, N.A.

Wells Fargo, NA

Wintrust Bank, N.A.

interface.ai

Ironcore Inc

NFP Executive Benefits

Reich & Tang Deposit Networks LLC

RSM US LLP

Tecniflex LLC

Virtual Innovation, Inc.

EVENT SPONSORS

Banc Consulting Partners

BancMac - Community Banc Mortgage Corp

Engage fi

Fiserv, Inc.

Midwest Independent BankersBank

Olsen Palmer LLC

Erich Bloxdorf

Thomas Broeckling

Thomas Chamberlain

John DuBois

Gerald F. Fitzgerald Jr.

James Hannon

Mark Hoppe

Thomas Hough

Suzanne Hough

Thomas Hughes

Randy Hultgren

Betsy Johnson

Robert Koopman

Kenneth Kruse

Chad Kullberg

Dennis Lutz

Rick Parks

Amy Randolph

Matthew Sitkowski

Michael Steelman

Mark Svalina

Maria Tabrizi

Adam Walsh

GOLD CONTRIBUTORS

Doretta Alms

Mark Bennett

Darl Bollman

Peter Brummel

Kathleen Cook

Brian Dao

David Doedtman

Lenus Eggemeyer

Andrew Fehlman

John Greenwood

Brian Hannon

Gary Hemmer

Casey Hicks

Daniel Hollowed

Patrick Horne

Lawrence Horvath

Tom Hough

Eric Johnson

Mark Kleine

John Kozak

Phil Kunz

Jeffrey B. Lang

Mark LaPlantz

David Luther

Daniel Lutz

David Mehrmann

Joshua Miller

Chris Milne

Jared Nobbe

George Obernagel

Denise Olds

Kevin Olson

Shelley Perkins

Kent Redfern

John Richards

Aimee Smith

Daniel Stein

Klay Tiemann

Matthew Wilcox

Kathy Williamson

SILVER CONTRIBUTORS

Samuel Banks

Jeffrey Boundy

Todd Burns

Christopher Breyman

David Brozovich

John Callahan

Michael Cassens

Robert Conrardy

Tami Coss

Trent Cox

Drew Dethrow

Thomas Dunker

Rich Eckert

Philip Elfrink

Cindi Eustice

Steve Gerstenberger

Andrew Gerth

Brian Goebbert

Michelle Gross

Matthew Hladio

Robert Hoffmann

J. Michael Holloway

Dan Iza

Karen Jacobus

Amanda James

Jeff Johnson

Blake Johnson

Alice Jost

Stephen King

Gregory Kistler

Thomas MacCarthy

Mindy Manci

Randy Matravers

Joshua McConachie

Janis Miller

Michael Minton

Gary Nation

Anthony Nestler

Courtney Olson

Elizabeth Otto

William Parks

Samantha Patrick

Annette Pickrel

Jim Roolf

Frank Roth

Douglas Sanders

Michael Schell

Thomas Schlink

Christine Shultz

Timothy Smigiel

John J. Smith

Ashley Speed

J.P. Stein

Scott Swisher

Thomas Tesdal

Bruce Uchtman

Whitney Valdivia

Jeffrey Vohs

Denise Ward

Scott Wehrli

Michael Wickkiser

Kenneth Wright

Mailyn Abella

Eric Adcock

Jaclyn Aldridge

Eran Allan

Andrew Ambrose

Robert Ambrose III

Julie Amundsen

Michael Bagniewski

Amanda Bohlen

Richard Brown

Michelle Carroll

Tom Chester

Erin Cohn

Patricia Colwell

Rhonda Dalton

April Davis

Jeffrey De Bruin

Sarah Dolan

Kelly Dransfeldt

Kerry Duellman

Emily Duncan

Tim Eischeid

Ashley Evans

Sanford Fleck

Alberta Fleming

Nicole Fluhart

Brandy Foster

Konstanze Fowler

Cindy Fultz

Darin Gehrke

Gary Genenbacher

Angelique Gerlock

Mallori Giesegh

Maria Godina

Miguel Gomez

Sharon Gorrell

Cindy Greene

Connor Gross

Craig Gustafson

Lon Haines

Jeff Haycraft

Phillip Hayes

Larry Helling

Patrick Hennelly

Brittany Herman

Linda Hessenberger

Ron Hobson

Jake Hopkins

Rhonda Houzenga

Brandt Hutchcraft

Joshua Ishmael

Teresa Johnson

Wes Johnson

Dawn Kelley

Erin Kennedy

Kristin Kimmel

Kristin King

Chris Knight

Stephen Lear

Mindi Lehman

Tasha Lovelace

Ted Macon

Greg Maher

Ryan Martz

Tom McIntire

Gina Meier

Dirk Meminger

Stefany Mickelson

Elizabeth Miller

David Mitchell

Bob Mizeur

Addie Moranville

Erick Mueller

Georgia Pelletiere

Joan Peterka

Jennifer Pittman

Susan Poling

Rhonda Ranker

Stacy Raven

Amie Ries

Richard Riggins

Kraig Ritter

Kevin Rogers

Dennis Romero

Steven Rosenbaum

Brenda Rupert

Christopher Schneider

Brittney Shepherd

Joseph Silvia

Karen Soll

Debbie Steele

Heather Steger

Robert Stroh, III

Adam Turner

Jack Vainisi

Peter Vogel

Blake Williams

Daniel Wujek

Abigail Yowell

Many financial institution executives spend considerable time thinking about strategies to improve efficiency in order to improve overall profitability.

The efficiency ratio is the ratio of non-interest expenses (less amortization of intangible assets) to net interest income and non-interest income, so it is effectively a measure of what you spend compared to what you make. The very name – “efficiency ratio” – makes us think about how efficient we are with those precious income dollars. If a financial institution has a high efficiency ratio, they are simply spending too much of what they make…right? That is exactly what the name implies (emphasis on the spending side of the equation). But this is just a ratio of two numbers, and as we all know, there are two ways to bring the ratio down – reduce costs or increase revenues.

The focus across industry press and conference best practices is generally aimed at strategies to cut expenses –using technology, looking at staffing levels, increasing productivity, etc. Although this advice is sound, what happens when a financial institution has already cut what can be cut AND

By Dr. Sean Payant

it is still struggling with efficiency? It is sometimes difficult to save your way to prosperity.

For many financial institutions, the focus should also be on the bottom portion of the equation – increasing revenues. Let’s look at an institution that has $500 million in assets, a good return at 1% ROA, and a reasonable efficiency ratio of 60%. Let’s assume the FI can improve its efficiency ratio by 5% through revenue increase or expense reduction.

It shouldn’t be surprising that increasing revenues provides better performance even though this sometimes seems like a counterintuitive approach. Because many financial institutions need to increase investments for growth in order to significantly grow their revenues, thereby increasing the expense side of the equation, and because of their excess capacity, this will actually make them more efficient over time. Many financial institutions have cut expenses almost to the bone and can’t materially improve their efficiency ratio by further reducing costs. They need to take a step back and realize some fundamental business dynamics that are often ignored in our industry.

Most community financial institutions still have tremendous excess capacity, meaning they could serve significantly more customers without significantly increasing expenses. The answer to improving the efficiency ratio is to fill excess capacity with brand NEW profitable customers.

How do other businesses look at the issue of excess capacity – for example a manufacturing company?

• The facility is running at 50% of the capacity it was built to produce;

• The factory has done everything it can to be as efficient as possible – evaluate staffing levels, implement technology solutions, etc.; and

• Management’s major goals and objectives are still focused on improving profitability by further evaluating already efficient processes and selling more to current customers.

Given the excess capacity at the manufacturing company, wouldn’t it also make sense to evaluate if more widgets can be run through the facility? Would the market support providing more products to more people in order to increase net income without substantially increasing expenses?

The manufacturing company analogy is very similar to the situation being faced by community financial institutions. They have branches currently attracting 30% - 50% of the new customers they were built to serve each year and it is getting worse as transaction volume continues to decline in branches.

Most financial institutions have used technology and staff reductions to become more efficient; however, they still spend much of their time, effort and energy focusing on cost reductions and additional efficiency enhancement.

When a community financial institution starts welcoming significantly more new customers per year, fixed costs do not substantially change – no new branches have been built, no additional employees have been hired. Actual data from hundreds of community financial institutions illustrates the impact on actual expenses is just the marginal costs – generally an additional $30 - $50 per account per year (even if we must mail a paper statement). Conversely, the same data base shows the average annual contribution of each new account per year is between $250 - $350.

When comparing clients that have embraced this strategy to the overall industry over a three-year period of time (2014 to 2017), their improvement in efficiency ratio was 63% better. This has been accomplished by significantly increasing the number of new customers coming in the front doors of existing branches.

There is only so much blood in a turnip. Controlling costs, embracing technology to reduce process costs and evaluating staffing are all things financial institutions should be doing; however, if they have already become very efficient in these areas, the focus must shift to driving revenue. Most financial institutions have tremendous excess capacity in their existing branches today. The solution is to start filling them up.

Sean C. Payant, Ph.D., is Chief Strategy Officer at Haberfeld, a data-driven consulting firm specializing in core relationships and profitability growth for community-based financial institutions. Sean can be reached at 402.323-3614 or Sean@haberfeld.com.

By Jackie Marshall, CISM

For financial institutions (FIs) of all asset sizes and complexity of products and services, maintaining cyber preparedness is a daunting task against increasing cyber threats, reliance on third-party vendors, and ongoing personnel changes. Information Security Officers (ISOs) are tasked with augmented duties to enhance visibility and accountability in protecting non-public information and financial transactions across all business lines.

This article highlights some of the evolving complexities of the ISO role, including the heightened management of third-party relationships, improved reporting to boards and stakeholders, and thorough risk assessments of projects and third-party entities.

In response to the evolving reliance on trusted third-party service providers, federal bank regulatory agencies released new third-party risk management guidance in June 2023. This guidance is intended to help FIs manage risks associated with third-party relationships more effectively, including those involving key technology service providers like financial technology (FinTech) partners. It emphasizes risk management throughout the life cycle of third-party relationships, from planning and due diligence to contract negotiation, ongoing monitoring, and termination.

Since the life cycle includes the preengagement stage, institutions need to

place more emphasis on scrutinizing potential third parties because auditors and examiners will be looking more closely at what happens prior to engagement. The scrutiny should start at the early phase when bank management begins to consider a project, initiative, or even a concept.

Financial institutions also need to understand the strategic basis or purpose of a proposed business arrangement. They should identify and assess the benefits and risks associated with the arrangement and then verify that they align with their strategic objectives. They also must consider other crucial areas, including the institution’s ability to manage and oversee the relationship, the legal and regulatory compliance implications of the relationship, along with the third party’s financial

condition, business experience, expertise of key personnel, and operational resilience. Additionally, institutions need to be cognizant of how third parties are managing their own subcontractors, which could ultimately impact the delivery of their services.

The heightened regulatory emphasis on third-party risk management requires additional time and attention to vet and oversee these relationships effectively. Therefore, many institutions are increasingly adopting automated third-party management tools as a strategic solution to aid the Information Security Officer and other management personnel. These application-based tools facilitate tasks such as risk ranking, control assignment, and due diligence reviews to designated "vendor managers" within particular departments or functions. Utilizing these tools is advantageous in facilitating a consistent approach among stakeholders to manage the risk of third-party relationships.

The Gramm-Leach-Bliley Act (GLBA) first brought to the forefront the importance of establishing the role of an ISO for financial institutions. However, the significance of this role has only magnified as information technology has become essential to every department and business function within an FI. The exposure of customer non-public information (NPI) has exponentially increased with the widespread adoption of online transactions, mobile banking, and third-party relationships.

Managing information security risks effectively requires collaboration. Each stakeholder group, including end-users, IT management, IT Steering Committee, Executive Management, Risk/Audit Committees, and the Board of Directors, plays a crucial role in supporting and executing information security standards. Segregating duties between IT management and the ISO is one of the biggest challenges for many FIs. For those that lack a formal infrastructure, the FFIEC provides guidelines showing how an ISO can and should collaborate with IT management.

In addition, ISOs must break down silos and communicate clearly with all the various stakeholders. This effort requires access to relevant, actionable, and up-to-date information that aligns with each group’s distinct reporting needs, engagement level, and technical understanding.

ISOs may also need to broaden the scope and frequency of their communications. For instance, it is a good best practice to meet with the Board more frequently than once a year. Board members will benefit from periodic discussions with the ISO and IT management to accurately and quickly identify potential issues related to risk

such as inconsistent server backups, software patches, and systems nearing EOL. A comprehensive understanding of Human Resources standards and their impact on information security is also important to ensure that policies and procedures are consistent across the organization.

To facilitate and ensure these meetings and conversations are effective, ISOs should rely on industry-standard frameworks that can be customized for audiencebased agendas and repeatable tasks. Essentially, ISOs should be transparent in communicating changes that could result in increased risk to NPI.

Overall, this can be a challenging effort, especially for smaller banks who may not have the expertise or the time to ensure a consistent approach to governance and communication. For this reason, many FIs choose to partner with a reliable Virtual Information Security Officer (VISO) service. These third-party services provide strategic guidance and the necessary oversight to ensure comprehensive information security management.

IT auditors and federal and state examiners are scrutinizing strategic changes and verifying that FIs sufficiently plan for and execute new service delivery channels and technology initiatives. Therefore, the ISO must play a role in the institution’s strategic IT planning to ensure change and

project management are taken from a consistent risk-based perspective. They should be involved early in assessing risks associated with new initiatives and third-party services, ensuring alignment with overall business goals and adequate preparation for potential cyber threats or operational disruptions.

It is important to note that much of the discussion around recent and future guidance stems from inadequate due diligence of fintech relationships and the lack of overall understanding of how FI customers may be exposed to a breach of thirdparty partner systems.

As institutions navigate these increasingly complex regulatory and cyber landscapes, the role of the ISO has never been more critical. They are now more pressed to proactively manage critical thirdparty relations, improve reporting structures, and execute risk-based assessments of potential projects and strategic initiatives. To meet these expectations, ISOs must increase strategic engagement and delegate tactical work to other resources, which has encouraged many institutions to implement automated applications or VISO services. These solutions can be effective in supporting ISO’s success and ensuring the long-term cyber and operational resilience of the institution.

Join us at the ONE Conference, the premier professional development event for Illinois bankers!

With seven dynamic tracks, a bustling marketplace, and endless networking opportunities, the stage is set for you to learn, connect, and shine alongside industry leaders.

Earn a FREE registration when you register three!

Bloomington-Normal Marriott Hotel & Conference Center | 201 Broadway, Normal, IL Rate: $159 | Deadline: Feb. 21

Consider traveling with Amtrak! The station is conveniently located one block from the conference center.

JOHNNY CROWDER

Johnny Crowder, founder and CEO of Cope Notes, is a mental health advocate and entrepreneur dedicated to employee wellbeing. A trauma survivor and Certified Recovery Peer Specialist, he shares practical self-care tools and strategies to enhance emotional health. Recognized by Upworthy, CNN, and Forbes, Crowder inspires through TEDx talks, public speaking, and his metal band, Prison.

APRIL LEWIS

April Lewis, President and CEO of A. Lewis Academy, Inc., champions employee experience and leadership development. Guided by her mantra “Human first, Employee second,” she prioritizes well-being and transformative change. A combat Army veteran of Operation Iraqi Freedom, April embodies resilience and adaptability. As a keynote speaker and consultant, she has impacted Fortune 100 companies across healthcare, banking, and more.

& adjust models if needed for a declining rate environment

By John McQueen

In a declining market interest rate environment, financial institutions should monitor income models’ non-maturity deposit assumptions and thoroughly review the betas and lag factors assigned to each non-maturity deposit account. Otherwise, history suggests the model may be substantially inaccurate.

Time deposits are way up

Total time deposits as a percent of total deposits nearly doubled from the second quarter of 2022 to the first quarter of 2024. Negotiable order of withdrawal and other transaction accounts as a percent of total deposits increased during 2022 but decreased in 2023 and 2024. Money market and savings accounts as a percent of total deposits declined steadily from 2022 to the first quarter of 2024.

This migration of deposit balances out of non-maturity deposits and into time deposits altered many banks’ repricing and cash flow characteristics. This alteration ultimately impacted the interest rate risk measurement.

If the interest rate risk model did not accommodate the shift in deposit balances, the model estimates did not fully account for that risk.

Adjust income simulations if appropriate

Institutions must now consider how a decrease in short-term interest rates will alter the mix of their deposits. If an institution is apt to cut offering rates on CDs in step with a reduction in market interest rates, will CD balances leave the institution? If so, how much will they leave, and when will they leave? Conversely, if an institution maintains above-market rates on CDs, will there be a “surge” of new deposits from other institutions? If so, how much will CD balances increase, and how will that impact the net interest margin?

We recommend thoroughly reviewing:

• All CD accounts, particularly those accounts that are new to the institution and where the depositor has no other relationship with the institution.

• All deposit balances over the FDIC insurance limit of $250,000. Those balances should be considered volatile and should be modeled separately.

Then, adjust your income simulations to consider the possible runoff of at least a portion of those balances. If your institution’s strategy is to offer above-market rates to increase deposits, income simulations should consider the change in beta and balance decay brought on by these new deposits.

Also, ask yourself, do the beta assumptions in the declining market interest rate scenarios match the bank’s current practices or expectations for adjusting deposit offering rates? Suppose the beta assigned to an institution’s money market accounts in the declining market interest rate scenarios is 0.50 with a lag of 90 days. That means if market interest rates decline instantaneously by 100 bps, money market account offering rates will decrease by 50 bps 90 days after market interest rates change. If the institution plans to cut its money market account offering rates by more than 50% of the change in market interest rates as soon as those rates change, then the beta and lag assumptions used in the model are inaccurate.

Conversely, if the institution plans to delay cutting the offering rates on money market accounts for fear of

sparking a runoff in account balances or migration of account balances into higher-costing deposit accounts, those beta and lag assumptions are also inaccurate.

Like loan prepayment assumptions, stress-testing the nonmaturity deposit beta and lag assumptions lets you gauge the model’s sensitivity. The results of these stress tests can be used to make recommendations for any possible changes in beta and lag assumptions.

Disclosure: This communication is provided for informational purposes only. UMB Bank, n.a. and UMB Financial Corporation are not liable for any errors, omissions, or misstatements. This is not an offer or solicitation for the purchase or sale of any financial instrument, nor a solicitation to participate in any trading strategy, nor an official confirmation of any transaction. The information is believed to be reliable, but we do not warrant its completeness or accuracy. Past performance is no indication of future results. The numbers cited are for illustrative purposes only. UMB Financial Corporation, its affiliates, and its employees are not in the business of providing tax or legal advice. Any materials or tax‐related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. The opinions expressed herein are those of the author and do not necessarily represent the opinions of UMB Bank or UMB Financial Corporation.

Products, Services and Securities offered through UMB Bank, n.a. Capital Markets Division are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED

By Carl White

Cybersecurity, regulation, and technology and funding costs are community bankers’ most pressing current concerns, according to an annual survey that covers the economic, regulatory, competitive and operational challenges they face.

The findings are part of the 2024 Conference of State Bank Supervisors (CSBS) Annual Survey of Community Banks (PDF). The survey, conducted by CSBS and state bank regulators, aims to take the pulse of the nation’s community banks—institutions with less than $10 billion in assets. This year, nearly 370 community bankers from 38 states participated; about two-thirds of participants represented banks with assets between $100 million and $1 billion. The report also contains wide-ranging comments on survey topics from five selected community bankers.

As in last year’s survey, cybersecurity was the top challenge for surveyed community bankers, with 96% of respondents naming it as an “extremely important” or “very

important” risk; that share was up slightly from 93% in the 2023 survey. Funding costs and regulation followed with 89% of respondents reporting them “extremely important” or “very important.” The funding costs percentage was similar to last year’s total, but regulation rose from 81% in the previous year’s survey. Net interest margins and core deposit growth were other top risks linked to the highinterest rate environment of the last two years.

Technology implementation and costs were cited as high risks by 80% of bankers. Liquidity still ranked as a top risk with 78% of respondents indicating that it was either an “extremely important” or “very important” risk, but that was down from 84% in 2023. Still, liquidity was considered a top risk by just 35% of respondents in 2022, evidence that the economic environment weighs prominently in perceptions of risk.

The 2024 survey revealed that community banks are more frequently partnering with fintech firms to provide services

to their customers. In 2023, 59% of respondents reported they had no relationship with a fintech firm, but in 2024, that proportion had declined by nearly half, to 32%. Bankfintech partnerships are most common for services such as mobile banking support, loan origination and underwriting, and other process improvements, including fintech hubs.

Although community banks were largely able to keep deposit balances stable in 2024 after a turbulent 2023, stiff competition meant the costs of those deposits—both transaction and nontransaction—spiked. Bankers reported that other community banks are still their primary competitors for transaction (e.g., checking accounts) and nontransaction accounts, but regional and national banks and credit unions have made inroads in competing for transaction accounts.

Bankers have relied more on wholesale funding, such as brokered deposits, Federal Home Loan Bank advances, other borrowings and reciprocal deposits as deposit competition has

While 40% of respondents said that use of the Federal Reserve’s emergency facilities, such as last year’s Bank Term Funding Program, carried “high” or “very high” stigma, that percentage dropped to 25% for the Fed’s discount window advances. The Fed has made a number of changes to discount window operations over the past 20 years to lessen stigma, and the federal financial institution regulatory agencies have updated guidance (PDF) encouraging depository institutions to incorporate the window as part of their contingency plans.

The CSBS Annual Survey of Community Banks provides valuable insights into the opportunities and challenges facing the nation’s community banks—insights that are valuable to bankers, their regulators, and the business and academic communities. In addition to the survey, CSBS produces the quarterly Community Bank Sentiment Index, which tracks community bankers’ outlook on the economy. While the results for the third quarter of 2024 marked the first positive reading since the fourth quarter of 2021, the industry faces several headwinds that will keep regulators closely monitoring credit quality, liquidity and overall profitability in the months to come.

This post is part of a series titled “Supervising Our Nation’s Financial

Make informed financial decisions with ease with our depository interest rates data and to source for branch level rates for over 75% banks and credit unions in the U.S., offering insight into local competitors, market rate national pricing trends.

By Rica Dela Cruz and Hussain Shah, Market Intelligence

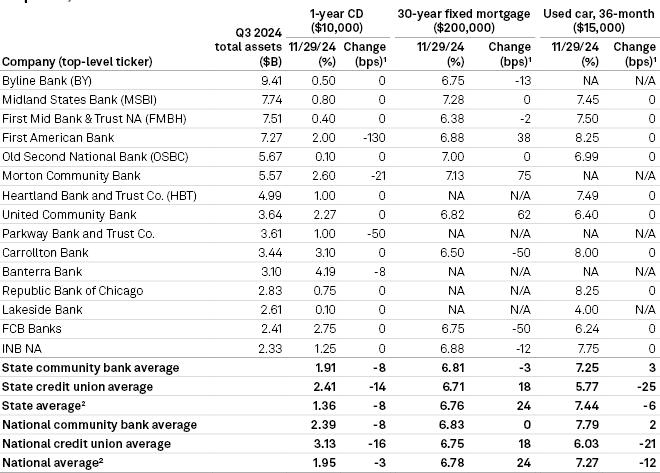

Illinois community banks reduced the rate they pay on one-year certificates of deposits at the same pace as their US peers following the Federal Reserve's interest rate cuts.

Since September, the Fed has lowered the federal funds rate by a total of 75 basis points to 4.75%. The average one-year certificate of deposit (CD) rate at Illinois community banks declined 8 bps from Sept. 13 to Nov. 29, the same as the national community bank average, according to S&P Global Market Intelligence data.

Despite the similar pace of reductions, the average rate that community banks in Illinois paid on one-year CDs, at 1.91%, was lower than the national community bank average of 2.39%.

Given the Fed rate cut and an improvement in the quality of deposit inflows, US banks reported a deceleration. Market Intelligence research projections in funding cost increases in the third quarter showed that community banks' funding costs likely peaked in the same period, though institutions will find it challenging

to quickly lower deposit costs because of their reliance on CDs for funding.

Byline Bank, the largest community bank in Illinois in terms of assets, kept its one-year CD rate unchanged at 0.50% as of Nov. 29. The Byline Bancorp Inc. subsidiary expects a period of adjustment on the CD rate-changing front based on the Fed's next move.

"Our CD book is roughly five months ... so we're going to have a little lag depending on what the Fed does," CFO Thomas Bell III said during an Oct. 25 earnings call. "Obviously, if they do 25 basis points, [it is] more gradual for us and that will be less painful. But when we have a 50 basis point cut, it's going to take a while for us to catch up on that on the CD front."

Among the 15 largest community banks in Illinois, First American Bank reported the biggest drop in one-year CD rate, a decrease of 130 bps to 2.0%. Banterra Bank, meanwhile, marketed the highest rate of 4.19%, while Old Second National Bank and Lakeside Bank offered the lowest at 0.10%.

On 36-month used car loans, Illinois community banks were offering an average rate of 7.25% as of Nov. 29, up 3 bps from Sept. 13. The national community bank average rose 2 bps to 7.79%.

US banks' auto loan delinquency ratio was 3.13% in the third quarter, up from 3.05% in the prior quarter, according to Market Intelligence data. So far in the fourth quarter, new and used car industry sales have been resilient, but macro and industry developments could affect auto affordability, J.P. Morgan analyst Rajat Gupta wrote in a Dec. 2 note.

First American Bank and Republic Bank of Chicago offered the highest rate on 36-month used car loans among the 15 largest community banks in Illinois at 8.25% each. Lakeside Bank had the lowest rate at 4.0%.

The average 30-year fixed mortgage rate at Illinois community banks declined 3 bps from Sept. 13 to Nov. 29 to 6.81%. The rate is lower than the national

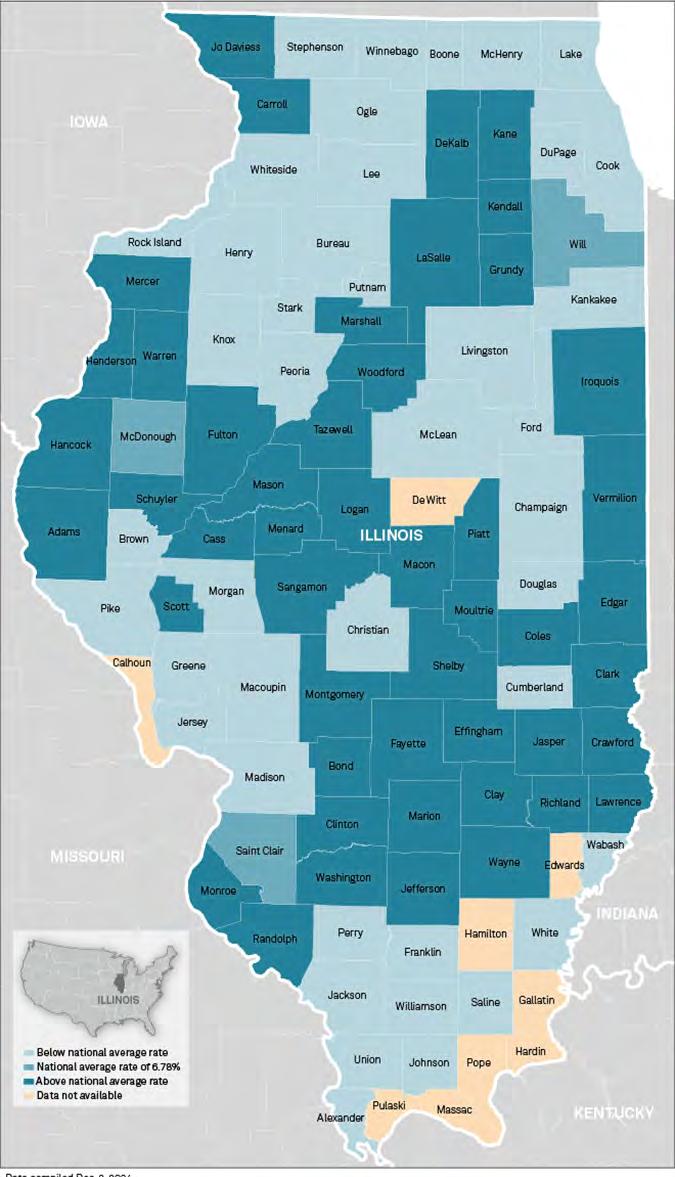

community bank average of 6.83% but higher than the US average of 6.78%. Potential homebuyers are facing increased pressure as US mortgage rates climbed throughout November and remain elevated, a separate Market Intelligence analysis found.

Midland States Bank offered the highest rate on a 30-year fixed mortgage among the largest Illinois community banks at 7.28%, unchanged from Sept. 13, while First Mid Bank & Trust NA was marketing the lowest rate at 6.38%.

During the week ended Nov. 29, the 30-year fixed mortgage rate offered in Jasper was the highest among the counties in Illinois at 7.38%. The rate marketed in Wabash, Cumberland and White was the lowest at 6.38%.

For 15-year fixed mortgage rates, the one offered in Lawrence was the highest among the Illinois counties at 7.0%. Wabash offered the lowest rate at 5.94%.

The national average 15-year fixed mortgage rate during the period was 6.17%, the same rate marketed in Moultrie, Illinois.

On December 5, the Chicago Area Chapter hosted its annual Holiday Breakfast in Lombard, bringing members together to celebrate the season and explore a critical topic shaping the future of banking. The event combined networking, Chapter business updates, and an engaging keynote presentation.

The morning started with a delicious breakfast buffet, offering attendees the chance to connect with colleagues and industry peers. Following breakfast, the chapter's business meeting provided updates on initiatives, upcoming events, and opportunities to engage with the group.

The highlight of the morning was the keynote address delivered by Chad Knutson, CEO and Co-founder of SBS CyberSecurity and the SBS Institute. As a certified expert in cybersecurity and risk management, Knutson presented on the transformative potential of artificial intelligence (AI) in the banking industry. His talk outlined the strategic opportunities AI presents while addressing its inherent risks. Knutson emphasized that AI has the potential to revolutionize banking operations, fraud detection, and customer experience, but organizations must carefully navigate its adoption to ensure security and ethical use.

The Chicago Area Chapter Holiday Breakfast successfully blended camaraderie, professional growth, and thought leadership. Attendees departed not only with holiday cheer but also with valuable knowledge to navigate the future of banking.

Mark your calendars for the 2025 Chicago Area Chapter Holiday Breakfast on December 4!

The Illinois Bankers Association is pleased to offer scholarship opportunities to its member bankers through the Herbert V. Prochnow Educational Foundation, a supporting organization to the Graduate School of Banking at the University of Wisconsin –Madison. The GSB Prochnow Foundation offers more than $175,000 dollars in scholarships every year to bankers who want to improve their careers and organizations through education.

Scholarships are distributed through the IBA for the Graduate School of Banking and the GSB Human Resource Management School.

Apply today for a scholarship to attend a program at the nation’s leading and most progressive banking school. For details, contact Denise Perez at the Illinois Bankers Association at dperez@illinois.bank.

SPONSORED BY:

On November 14, Illinois bank executives gathered in Chicago for the highly anticipated Midwest Bank Leaders Conference. The day kicked off with a light lunch and networking, allowing attendees to connect and exchange ideas before diving in.

Our conference emcee Mick O'Rourke, CEO of Signature Bank, set an optimistic tone for day’s discussions. The first presentation featured an engaging update from Van Dukeman, Chairman and Chief Executive Officer of First Busey Corporation and Busey Bank, who shared his insights on trends, challenges, leadership and strategic growth.

Next, Tony Scavuzzo from Castle Creek Capital explored investment philosophies and partnership strategies. He shared insider perspectives on mergers and acquisitions, emphasizing the critical role fintech plays in shaping the future of community banking.

Jim Morrissey, Shareholder and Co-Chair of the Financial Institutions Group at Vedder Price, provided a timely post-election analysis of bank mergers and acquisitions (M&A) and regulatory matters, particularly focusing on community banks. His insights into how

recent election outcomes could influence the banking landscape were both informative and thought-provoking.

Mischa Fisher then took the stage to analyze changes in microeconomic factors resulting from the last economic cycle. His presentation highlighted what remains unchanged in consumer conditions and the housing market while offering forward-looking advice to help attendees navigate future economic challenges.

The day concluded with an engaging session led by Peter Roskam, former U.S. Congressman. He discussed the implications of recent elections for the banking sector, providing valuable insights into anticipated policy changes and regulatory shifts that could impact institutional strategies.

We extend our gratitude to our speakers and attendees who prioritize knowledge sharing within the banking community and foster strengthened relationships through their participation in this conference.

Mark your calendars for the 2025 Midwest Bank Leaders Conference on November 6 at the Gleacher Center in Chicago!

The 2024 Bank Counsel Conference, held on December 6 at the iconic Drake Hotel in Chicago, once again proved why it remains the premier gathering for Illinois banking law professionals. After a year marked by regulatory shifts and economic challenges and a presidential election promising seismic changes for banking regulation, the conference delivered a wealth of insights, robust discussions, and valuable networking opportunities.

The event began with Carolyn Settanni, Executive Vice President and General Counsel at the IBA, presenting her annual Illinois Update on recent developments in Illinois (and federal) banking law. Topics included new interchange fee restrictions, a Uniform Commercial Code (UCC) rewrite for digital assets, and administrative rules implementing the Illinois Community Reinvestment Act (Illinois CRA), among many other topics on Illinois and federal laws, regulations, cases, and guidance.

The Regulatory Roundtable featured senior representatives from the IDFPR, Federal Reserve Bank of Chicago, OCC, FDIC, and CFPB, addressing issues such as the recent U.S. Supreme Court decisions on National Bank Act preemption and the relationship between Congress and federal regulatory agencies, Illinois CRA exams, electronically signed loan documents, check fraud, and more. Panelists also provided valuable agency updates, forecasting potential changes with the new presidential administration.

Margaret Liu of the Conference of State Bank Supervisors led a compelling session on how banks can plan for the future amidst federal administrative law challenges and recent financial services and administrative Supreme Court decisions. Ryan D. Israel of Meeks, Butera & Israel PLLC followed with a timely discussion on how the new presidential administration could reshape banking agency priorities, regulatory frameworks, and compliance requirements.

Robert J. Lewis of Sidley Austin LLP explored trends in commercial lending, covering several recent court decisions, UCC legislation, lien creation and perfection, documentation practices, and more. Marc P. Franson of Chapman and Cutler LLP concluded the day with a session on recent developments in consumer financial services, distilling trends and identifying takeaways

in current and proposed consumer regulations, enforcement, and litigation trends.

The 2024 Bank Counsel Conference equipped attendees with tools and knowledge to address the coming year’s challenges. With expert speakers, timely topics, and vibrant networking, it remains a must-attend event for bank counsel in Illinois.

Plan to attend the 2025 Bank Counsel Conference on Friday, December 5!

BEVYTEC, LLC

5075 Peachtree Pkwy, Ste 107-168 Norcross, GA 30092-6506

770-840-2700

www.bevytec.com

Contact: John Collins, john@ bevytec.com

BEVYdoc provides transparency and insights throughout the loan process by improving communication and efficiency for all stakeholders from application to closing. With better tools including dashboard views of real-time data, management has the ability to make better decisions.

Consolidated Communications

2116 S 17th St. Mattoon, IL 61938-5973

217-235-4424

www.consolidated.com

Contact: Jason Hanlon, jason. hanlon@consolidated.com

Consolidated Communications provides data, internet, voice, cybersecurity, managed and hosted cloud and IT services to business customers.

Implemify

651 S Sutton Rd., Ste 180 Streamwood, IL 60107-2366

847-800-1902

www.implemify.com

Contact: Tarang Gandhi, tarang@ implemify.com

Implemify is an IT strategy consulting firm specializing in digital transformation, workflow automation, and CRM services. Their goal is to streamline business operations through no-code and low-code solutions, enabling companies to enhance efficiency and productivity. Implemify offers a variety of services, such as IT managed services, strategic consulting, and IT staff augmentation. A key focus is helping businesses adopt digital technologies, leveraging platforms like Salesforce and Creatio, a no-code solution that allows organizations to build custom workflows and applications without needing extensive technical expertise. This partnership enables clients to maximize the flexibility and functionality of their business systems, fostering innovation and growth. Implemify primarily serves small and midmarket businesses but also caters to larger enterprises, providing tailored solutions to meet diverse business needs.

Gone are the days of needing separate software for each type of lending. The Integra 3-in-1 platform “Epic”, covers the lending process from A-Z for Mortgage, Consumer, and Commercial loans on one, single platform. Epic also provides you with a tailored, borrower Point of Sale (POS) for all loan types on your institution website.

Southwestern Graduate School of Banking Foundation

3150 Binkley Avenue, Suite 324 Dallas, TX 75205

214-768-2991

www.swgsb.org

Contact: David Davis, ddavis@smu.edu

Integra Software Systems, LLC

117 Seaboard Ln., Ste F290 Franklin, TN 37067-2857

615-595-0900

www.integraloantech.com

Contact: Adelaide Farrar, afarrar@ integraloantech.com

Integra Software Systems is a Lending Platform Provider providing loan automation for community banks and credit unions since 1996.

Since 1957, the SW Graduate School of Banking at SMU Cox has empowered executives with learning that extends far beyond the classroom. They offer exceptional educational experiences for bank leaders, regulators, and directors of all levels. Through ever-evolving curricula and programming, SWGSB at SMU Cox gives graduates the necessary connections, insights, and expertise to support thriving careers that advance the banking industry.

TechGuard Security

1722 Corporate Xing Ste 1 O’Fallon, IL 62269-3744

636-489-2230

www.techguard.com

Contact: Sarah Illig, sarah.illig@ techguardsecurity.com

For your comprehensive protection in today’s cybersecurity landscape, a dual approach is crucial. Proactive services identify vulnerabilities before exploitation, while defensive services offer continuous protection against emerging threats. TechGuard Security combines these strategies to provide a comprehensive solution that safeguards against breaches and ensures rapid response.

This holistic approach is vital for educational institutions facing sophisticated cyber threats and complex compliance requirements. Cybersecurity built for banks and finance, TechGuard’s clients enjoy a clear roadmap with solutions specific to their needs identified through our assessment process. With a tailor-made roadmap outlining the steps to continued integrity of your cybersecurity, you can be confident in your infrastructure, customer data, and business operations.

Experience: With years of experience serving the banking and finance sector, they have a proven track record of delivering top-notch cybersecurity solutions.

Expertise: Their team of cybersecurity experts stays ahead of emerging threats and trends, ensuring that your institution remains protected against evolving risks.

Partnership Approach: Your trusted partner in cybersecurity, working closely with you to address your unique challenges and objectives.

CBI Bank & Trust Welcomes John Clark as Executive Vice President, Private Wealth Group

CBI Bank & Trust is pleased to welcome John Clark as Executive Vice President, Private Wealth Group, effective November 1, 2024.

Clark brings a deep expertise to his new role, having spent over 35 years in the banking and financial services industry. Most recently, he served as Executive Vice President, Cogent Private Wealth for Cogent Bancorp, Inc.

A graduate of the University of Missouri-Columbia, Clark holds a Bachelor of Science in Finance.

“We are thrilled to welcome John to our team. With his extensive experience leading Private Wealth, he brings a fresh perspective that aligns perfectly with our goals for growth and innovation” said Doug Sanders, Executive Vice President, Chief Operating Officer, CBI Bank & Trust.