OFFICERS AND EXECUTIVE COMMITTEE MEMBERS

Anthony Nestler Chair Hickory Point Bank & Trust

Anthony Nestler Chair Hickory Point Bank & Trust

REGION 1

Miguel Gomez CIBC Bank USA

Maria Tabrizi First Women’s Bank

REGION 2

Peter Brummel Grundy Bank

T. J. Burge Chair-Elect Community Partners Savings Bank

Courtney Olson First Bank Chicago

REGION 3

Lawrence Horvath Heartland Bank and Trust Company

Kathy Williamson Bank of Farmington

Megan Collins Vice Chair Bank of America

Frank Pettaway Treasurer The Northern Trust Company Courtney Olson At-Large Category First Bank Chicago

Amy Randolph At-Large Category Busey Bank

Thomas Chamberlain Immediate Past Chair

Iroquois Federal Savings & Loan Association

Randy Hultgren Secretary Illinois Bankers Association

REGION 4

Scott Bland First Neighbor Bank, N.A.

Brett Tiemann INB, National Association

REGION 5

Ted Macon Farmers State Bank of Hoffman

Bethany Shaw Peoples National Bank, N.A.

Ryan Martz Solutions Bank

MEMBERS-ATLARGE

Gustavus Bahr

Member At Large PNC Bank, N.A.

Dave Conterio Hometown National Bank

David Doedtman

Washington Savings Bank

Brian Hannon

Cornerstone National Bank & Trust Company

Quint Harmon Resource Bank, N.A.

Tom Hough Carrollton Bank

Robert Kelly Old National Bank

Karlie Krehbiel Lisle Savings Bank

Alan Kwasneski Marquette Bank

Amy Randolph Busey Bank

Dalila Rouri BMO Bank, N.A.

Timothy Smigiel Liberty Bank for Savings

Daniel Wujek State Bank of Cherry

Two Offices to Serve You! Springfield Office: 800-783-2265 • Chicago Office: 800-878-2265 To connect with our staff, use this email format: firstinitiallastname@illinois.bank

Executive Administration

Randy Hultgren, President & CEO

Erich Bloxdorf, Executive Vice President and COO/Interim Marketing Projects Manager

Mindy Manci, Executive Assistant & HR Manager

Pam Macha, Springfield Office Coordinator

Finance and Administration

Mark Bennett, CPA

Executive Vice President and CFO

Tammy Squires, Vice President, Data and Technology

Matthew Keeling, Director

Marie South, Financial Assistant

Law Department

Carolyn Settanni, Executive Vice President & General Counsel

Carly Berard, Associate General Counsel

Michael Schasane, Compliance Counsel

Jaevon Greenwood, Administrative Assistant

Government Relations

Ben Jackson, Executive Vice President

Aimee Smith, Assistant Vice President

Matt Imburgia, Director

Member Relations

Julie Winterbauer, Senior Vice President

Tim Robinson, Director, Bank Relations

Illinois Bankers Business & Education Services, Inc.

Callan Stapleton, CAE, EVP & President of Business and Education Services

Adam Walsh, Vice President, Insurance Services

Robin Lane, Director, Associate Membership

Lyndee Fein, Director, Education & Conferences

Rachel Selvaggio, Director, Business and Education Services

Denise Perez, Director, Education & Training

Debbie Jemison, CAE, Director, Financial Literacy

Amy Sale, Education Assistant

Illinois Bankers

Group Insurance Trust

Erich Bloxdorf, Plan Administrator

Mike Mahorney, Senior Trust Advisor

Hillary Meyers, Trust Manager

Banker

strictly prohibited without written permission of the publisher.

Hickory Point Bank and Trust

It is a pleasure to address the membership of the Illinois Bankers Association as its Chair. As I’m sure so many others have felt over the years, it is humbling to be in a leadership position of an association as robust and historic as the IBA. I will do my best.

A special thank you to our members who attended our 2024 Annual Convention, the IBA staff for their professional coordination, and our many sponsors. The Omni Island Resort was a lovely place to reconnect with old friends and make new ones, each of whom share our commitment to ensuring a vibrant Illinois banking community.

Our trade association is unique in that it creates value for banks of all sizes. For some, the industry resources, such as compliance assistance and professional education, are critical components. For others, the opportunity to connect with banking peers provides great opportunity. For

all of us, the IBA’s advocacy efforts provide an important return on investment.

This year, the importance of our advocacy efforts has certainly been highlighted. In June, the Interchange Fee Prohibition Act was passed into law in Illinois. This Act which would disallow interchange fees on sales tax, excise tax, and gratuities, and make Illinois the only state in the nation to pass such legislation. The IBA has worked extensively with members to understand the potential impact of this law on the financial services industry, small businesses, consumers, and the broader business environment in Illinois. With significant member support, our advocacy team is committed to take the actions necessary to address this matter. We will keep you apprised of the details as they are known.

Thank you for your commitment to the Illinois Bankers Association and its mission. Best wishes for continued success.

You underestimate the power of your voice. No one understands the dynamics and inner workings of a community better than a banker. A banker has the best vantage point of how individuals, families, and small businesses are really doing. When a crisis hits a community, no one responds as quickly as the bankers do to rally around those impacted and find ways to help. Your words resonate with public servants as much or more than anyone else. I say this from my experience of 24 years in elected office and my clear memory of turning to bankers when I wanted to understand the confidence and outlook of my constituents and their communities.

You and your team are diligently working to help your customers achieve their dreams. The service and guidance that a banker provides is of utmost importance and our system of banking is unique in

the world. Know that your great team at the Illinois Bankers Association is fighting for you every day at every level of government. Our advocacy continues to succeed in very difficult environments in Illinois, but we are most effective when bankers are united, and you join us in our conversations with elected officials. Plan now to join us in Washington, DC, on September 9-10, 2024, as we speak with elected officials and regulators.

Also, I am thrilled to have Tony Nestler, President and CEO of Hickory Point Bank, as our newest IBA Chair! Tony is a fantastic banker who leads his team with incredible impact, and he is the right individual at the helm of this great Association! Join Tony and me and many other bankers in DC in September as we advocate for this amazing banking industry that is vital to the future well-being of our nation. Make your voice heard!

The IBA Law Department

We pulled a credit report for a mortgage loan application, and the applicant received a call from a mortgage company within twenty minutes and has received over sixty calls since then. We believe that the credit reporting companies sold our customer’s information as leads to the mortgage companies. Is there anything we can do? Are we required to disclose to our customers that a credit bureau may sell their information before we pull their credit report?

Unfortunately, the Fair Credit Reporting Act (FCRA) permits credit reporting agencies to sell trigger leads without consumers’ consent. Some banks are pushing back on trigger leads by informing their customers about their right to optout of prescreened offers and providing other resources. Additionally, we are not aware of any requirement for banks to disclose to consumers that a credit bureau may sell trigger leads before pulling their credit.

There have been a handful of cases in which consumers or mortgage lenders challenged credit bureaus’ trigger lead sales, but none of those cases were successful — the courts found that the claims, which were based on state laws (such as a Minnesota law) were preempted by the FCRA.

The Illinois General Assembly has attempted to address some aspects of mortgage advertising by amending the Consumer Fraud and Deceptive Business Practices Act to impose new restrictions on “marketing materials from

a mortgage company not connected to the consumer’s mortgage company.” These restrictions are intended to deter mortgage marketing solicitations that deceive consumers into believing that an advertisement sent in the mail is from a consumer’s own mortgage servicer. A separate amendment to the same law modifies existing requirements for postcards and letters sent to recipients in Illinois to require that the postcard or letter “disclaim that it is not a bill and that it is a solicitation” and “disclose or disclaim any and all affiliations or lack thereof.” Both these amendments are directed at “trigger lead” advertising but have the unintended consequence of limiting legitimate bank advertising.

At the federal level, two bills have been filed — the Protecting Consumers from Abusive Mortgage Leads Act and Homebuyers Privacy Protection Act — limiting the use of trigger leads. The bills have not passed out of committee as of this writing, but a hearing was held on the Senate version of the Homebuyers Privacy Protection Act on March 12, 2024.

Are we required to send a credit applicant the appraisal notice required by Regulation B if their loan application is denied on the same day it is received?

Yes, we believe the appraisal notice required by Regulation B must be sent to the credit applicant, even if their loan application is denied on the same day it is received.

Regulation B requires creditors to notify an applicant for credit secured by a first lien on a dwelling of their right to receive copies of appraisals that may be developed in connection with their application no later than the third business day after the creditor receives an application for credit. As noted in a CFPB factsheet, “if a creditor denies,

or an applicant withdraws, an application for credit . . . within three business days of receipt of the application, the creditor is still required to provide in writing a notice of the applicant’s right to receive a copy of all written appraisals prepared in connection with the application.”

Note that a creditor “may choose to modify the notice of right form to make clear to the applicant that the credit application has been denied.”

Funeral homes sometimes provide us with small estate affidavits for payments of funeral services. The funeral homes sign these affidavits as affiants. This seems incorrect, as the funeral home would have no way of verifying our customers’ estates or debts. Should we be releasing funds to these funeral homes pursuant to these small estate affidavits, or is there some other form of documentation we should be receiving?

We believe that your bank should make payments as specified in the small estate affidavit if the affidavit is “substantially in compliance” with the form small estate affidavit provided in the Illinois Probate Act.

The Illinois Probate Act requires financial institutions “indebted to or holding personal estate of a decedent” to pay as “specified in the affidavit” when “furnished with a small estate affidavit in substantially the form hereinafter set forth.” The Act protects financial institutions acting in good faith “upon payment . . . pursuant to such a document to the same extent as if the payment . . . had been made or granted to the representative of the estate.” Also, the small estate affidavit form should include the affiant’s notarized signature under penalty of perjury and

a statement requiring the signer to indemnify any financial institution that relies on the affidavit and “incur[s] any loss because of reliance on this affidavit.”

We are not aware of any cases involving banks that have been found to act in bad faith in relying on a small estate affidavit. We believe that in the absence of evidence of bad faith — such as a customer holding more than the $100,000 limit on small estates or knowledge of other information that directly contradicts statements in the small estate affidavit — your bank may rely on and make payments as specified in the small estate affidavit, provided the affidavit is substantially in the form provided in the Illinois Probate Act.

Our IBA Law Department provides many resources to help our bank members meet their compliance challenges, including a toll-free Compliance Hotline (1-800-GO-TO-IBA) and a dedicated compliance website (www.GoToIBA.com). We also publish a free weekly e-newsletter highlighting the latest regulatory developments, select recent Q&As, and other useful information –let us know if you want to subscribe!

Note: This information does not constitute legal advice. You should consult bank counsel for legal advice, even if the facts are similar to those discussed above.

By Ben Jackson, Executive Vice President of Government Relations and Aimee Smith, Assistant Vice President of Government Relations

As we author this article in mid-June, the IBA is working closely with our member banks to finalize an action plan on the recently signed state Interchange Fee Prohibition Act. As you know by now, passage of this act as part of the yearend state budget package was cooked up as part of a deal between Governor Pritzker, legislative leaders, and the retail merchant trade group.

The deal permanently capped bigbox merchants’ revenue for remitting sales taxes, and one of several sweeteners for the merchants to dull the impact on mega-retailers was the interchange restrictions. The act prohibits charging interchange fees on the gratuity, sales tax, or excise tax portions of a retail transaction. It applies to all banks and enforces its restrictions through civil penalties.

Though the governor’s office told our team that the legislation was an ironclad deal, we nonetheless mobilized an opposition coalition immediately that persisted through the final days of session. Despite the odds, our industry was able to directly lobby legislators, testify in both the House and the Senate against the proposal, sow doubt among lawmakers, and ultimately delay the act’s effective date until next July, giving our industry time to strategize ways to overcome the law.

We immediately worked the media circuit to turn public sentiment against the proposal. We explained its negative effects on consumer transactions in Illinois. We earned favorable editorials in Crain’s and the Chicago Tribune, and

we authored a separate op-ed with the credit union industry (yes, the credit unions) to explain the problems with the law.

This bad deal affects all of our member banks. It makes consumer payments difficult or impossible to complete, suppresses interchange revenue, requires banks to hold transactions open for months, and subjects banks, payment processors, and other parties in the payments stream to crippling civil liability --- all to support a wealth transfer enriching only the largest of the large big-box retailers.

Our members know that Illinois is a tough political environment that is often unfriendly to banks. But we are used to the IBA winning – despite the odds. Unfortunately, under this back-room deal, the merchants lost a plumb state revenue source and they demanded that other industries lose, too. The governor and leaders took the trade without fully considering the consequences.

This rare and stunning loss shows that our industry cannot afford to sit on the sidelines, confident that our lobbyists can win in perpetuity. And it’s not enough to be liked or disliked by individual lawmakers. We must be formidable to avoid future outcomes like this one.

How do we achieve that? Through sustained engagement by bankers throughout our state. This year, only about one quarter of our state’s banks were represented at our lobby day in Springfield. Even fewer – less than ten

percent – joined us in D.C. Numbers matter and connections with our lawmakers (still!) matter.

Equally important is our Illinois Bankers PAC. Nothing makes us more formidable than combining our grassroots numbers together with bigger numbers in our political giving fund. Yet today, less than one-third of our members contribute even a dollar.

It’s easy to give through our PAC fundraisers and through annual contributions (and a huge thank you to our wonderful annual contributors!). Contributions can be made online at my.illinois.bank/About/GivingGuide or by mailing a check to Illinois Bankers PAC; 3201 W. White Oaks Drive, Suite 400; Springfield, IL 62704.

Now forward we go. We will share our action plan with you soon on interchange, and in the meantime, let’s talk about some of our successes in Springfield.

u The IBA passed SB 3696, a bill that adopts important amendments to the Uniform Commercial Code (UCC) concerning the handling of emerging technologies and digital assets. These important changes reinforce and protect the rights of secured creditors and establish procedures for handling digital assets and documents.

u We introduced and will continue working in the fall on a large-scale reworking of the Illinois Banking Act and Savings Bank Act. This member-driven project is the first

of its kind in over two decades, and it seeks to help our thrift members thrive while providing parity between state and national commercial banking laws. We worked for months to negotiate a compromise with state regulators, and the bill passed the Illinois House unanimously. We ran out of time in the Senate, but we will resume our progress in the fall veto session.

u We defeated legislation that would regulate “junk fees” –including interchange fees – via state legislation. This legislation would have applied to both state and national banks and it echoed federal agency crusades against banking fees.

u We successfully negotiated the banking provisions out of a bill that would have subjected banks to new civil liability when using algorithmic underwriting tools; ensured that banks will be reimbursed for costs when entering voluntary agreements with the state to seek out delinquent taxpayers; and once again defeated several bills to expand governments’ powers to compete with private banks for lending and deposit accounts.

One more thing – our advocacy team loves to visit banks and to talk about our grassroots and PAC programs. If you’d like an executive briefing on state or federal issues and regulation, please email advocacy@illinois.bank or call 217-789-9340.

OnBoard, an Associate Member of the Illinois Bankers Association, recently published its fourth annual Boardroom Insights Survey, which surveys board professionals and stakeholders about the dynamics and trends impacting board effectiveness. This year’s survey included more than 350 responses, including a significant segment of board professionals in the finance sector. Professionals surveyed included CEOs, board presidents, C-suite and other executives, general counsels and corporate secretaries, and board administrators.

Which trends will impact your organization or board's effectiveness most this year?

According to respondents, two factors tied for the title of “most impactful” to boards and organizations’ effectiveness in 2024: Changes to regulation and compliance rules and the increasing pace of technological change. Rounding out the top three concerns was increased risk due to cybersecurity concerns.

Within the banking sector, 85% of respondents said regulatory compliance will have the greatest impact on effectiveness this year.

Lastly, 74% of top board leaders like CEOs, presidents, C-suite leaders, and executives cited rapid accelerating tech advancements, cyber threats, and the advent of the AI (Artificial Intelligence) era as the most trends expected to most impact board and organizational effectiveness.

Continuing in the cybersecurity vein, this year’s survey revealed a downward trend in the board professionals’ confidence in cybersecurity. Just 54% of survey respondents said they became more confident in board security over the past 12 months. That’s down from 71% in the 2023 survey, while 89% felt more confident in security two years ago.

Board members who are more confident in security

Engagement in meetings

Board preparation

Onboarding new directors/meetings

Asked to identify their boards’ biggest strengths, survey respondents identified the top three as meeting participation, preparation, and onboarding.

Nearly nine in 10 directors said high levels of engagement in board meetings was their primary strength, while more than three-fourths (77%) said their boards are moderately or highly effective at preparing for meetings. Notably, board professionals from the banking sector were more likely than their counterparts in other industries to say that better preparedness led to increased board success.

Nearly two-thirds of respondents (66%) also said their boards are effective at onboarding new members and establishing new meetings.

Even with recent successes, many survey respondents — including board members and administrators — identified limited time as a constant challenge in effectively executing their board responsibilities.

For administrators, the challenges center on tootight time frames to gather board materials from various stakeholders across the organization, and to distribute those materials to directors.

1 in 5 think board directors/members are not given adequate time to prepare for meetings

Nearly 60% of administrators said they distribute materials to board members less than a week in advance of meetings, and about half of those send them less than four days in advance.

As a result, board members often must do marathon cram sessions to prepare for meetings as many juggle board duties with careers and other responsibilities. Forty-one percent of respondents said they spend four to six hours prepping for meetings, while 50% said they spend more than six hours. Only 9% said they spend less than two hours preparing for meetings.

Hours spent preparing for meetings

In addition to their boards’ strengths, survey respondents also identified their key weaknesses. Not surprisingly, many see a need to bolster cybersecurity and make better use of technology.

About four in 10 boards indicated there is significant room for improvement when ensuring cybersecurity relative to board information and meetings and to facilitating effective board communication outside of meetings.

About one-third of survey respondents (32%) said their organizations are not effective at utilizing technology. In addition, 31% said their boards could do a better job of staying informed and on top of industry trends.

As board leaders and administrators work to navigate evolving technology, regulatory demands, and economic and social pressures, many remain frustrated about what they see as inept board members. Such individuals contribute to inefficiencies and can drag down overall board effectiveness.

On average, survey results suggest that approximately 17% of board members are ineffective, down from 25% in 2023.

Banking sector respondents cited the lowest number of ineffective board members at 11% on average.

More than 70% of survey respondents said they could identify at least one ineffective board member sitting on their board today, and more than half said at least 1 in 10 board members are ineffective. While still too high, that is down from two-thirds who said at least 10% of board members were ineffective in the 2023 survey.

On average, survey results suggest that approximately 17% of board members are ineffective, down from 25% in 2023. In what could be a silver lining, respondents from the banking sector cited the lowest number of ineffective board members at 11% on average.

Asked how board members could be more effective, the top five responses were:

1. Increased engagement and preparation

2. More utilization of better technologies

3. More efficient governance practices

4. Improved training and education

5. More communication and clearer expectations

The results of this year’s Boardroom Insights Survey illustrate the many challenges boards face in today’s rapidly evolving environment. Boards and board leaders have a lot to contend with, from cybersecurity to time constraints, disengaged peers, technological difficulties, and other persistent pressures such as increased compliance requirements for new regulations.

At the same time, their survey responses demonstrate ongoing progress amid tremendous challenges by individuals and boards dedicated to serving our core organizations and communities. Board management solutions, such as OnBoard, offer a number of capabilities and benefits to help organizations streamline processes and better protect vital board information and communications.

The Illinois Bankers Association is proud to announce the recipients of the 2024 Illinois Bankers and Linda J. Koch Scholarships. These prestigious awards support high school graduates and college students pursuing degrees in the financial services sector. Eligible applicants must be sponsored by an IBA member financial institution and show a keen interest in a banking career. Additionally,

2024 Linda J. Koch Scholarship Recipients

Trace Donnan

PORTA High School/ Augustana College Sponsored by Petefish, Skiles, & Co. Bank

Ava Harwood

John Hersey High School/ Indiana University, Kelly School of Business Sponsored by The PNC Financial Services Group, Inc.

candidates for the Linda J. Koch Scholarship must demonstrate exceptional leadership, and service attributes, while meeting other specified criteria.

This year, four students have been selected for the distinguished Illinois Bankers Scholarship, and two were awarded the esteemed Linda J. Koch Scholarship. “These scholarships are not only a recognition of the

academic accomplishments of our recipients but also celebrate their enthusiasm and dedication to the financial services industry,” said Callan Stapleton, EVP & President of Education Services. “We are thrilled to support these students as they develop into the future leaders of banking.”

Join us as we congratulate our 2024 IBA Scholarship recipients.

2024 Illinois Bankers Scholarship Recipients

Peter Anast

Prospect High School/ Indiana University, Bloomington Sponsored by PNC Bank

Peyton Bowman Bushnell Prairie City High School/ Spoon River College, Macomb Sponsored by Farmers & Merchants State Bank of Bushnell

“These scholarships play a crucial role in encouraging the next generation of financial professionals. By investing in these students, we are investing in the future of banking,” added Stapleton. We invite you to make a difference by donating to the Scholarship Fund today. Your support is crucial in advancing the financial services industry and nurturing the next generation of leaders. Join us in fostering talent and driving the future of banking forward. Donate now and be a part of this transformative journey.

Ashton McPherson Mt. Vernon High School/ Southern Illinois University Sponsored by Peoples National Bank

Colleen Roberts

Stillman Valley High School/ Northern Illinois University Sponsored by Stillman BancCorp, N.A.

my.illinois.bank/About/Giving-Guide

*All donations to the Illinois Bankers Scholarship Fund will be paid into and held in a segregated fund within Illinois Bankers Education Services, a notfor-profit subsidiary, EIN 36-4271815, of the Illinois Bankers Association, and will be used exclusively for the purpose of granting scholarships under this program to further professional careers in banking. Donations paid into and held in this fund may be tax deductible as charitable contributions to the extent permitted by law. No proceeds from this fund will be used for government advocacy or other purposes.

• July-August 2024

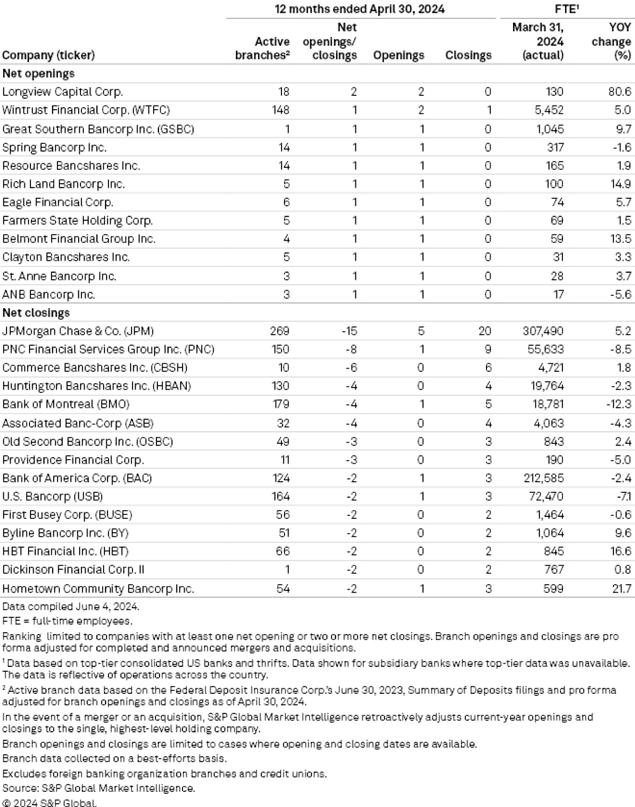

by Rica Dela Cruz and Zuhaib Gull, Market Intelligence

US banks continue to close more branches in Illinois than they are opening, with JPMorgan Chase & Co. and PNC Financial Services Group Inc. leading the most active net closers.

In the 12 months to April 30, banks logged 61 net closings in the state against 13 net openings, S&P Global Market Intelligence data shows. Combined, JPMorgan and PNC closed 29 branches and opened six branches.

JPMorgan is consolidating branches “where there’s logic” while continuing to open new branches across the US and planning to add over 500 branches by 2027, Chairman and CEO Jamie Dimon said.

“We like our branch strategy ... and the branches, of course, have changed their nature over time, more advisory than operational, etc. And we can always adjust the fleet,” Dimon said at a May 29 conference.

PNC Chairman and CEO William Demchak, meanwhile, said most of the bank’s branch build is in Texas; Denver, Colo.; and “hot markets of transient communities that are growing quickly.” PNC previously announced

its commitment to spending roughly $1 billion toward opening over 100 new locations through 2028.

“At the same time, by 2028, we will have finished refurbishing 100% of our own branches. And then, of course, we’ll continue the process of thinning and optimizing where we’ve had legacy branches over time,” Demchak said. “So none of that changes, by the way, any of our expense guidance or anything else. It’s just part of how we run the bank, but we’re going to have to invest into these markets.”

Commerce Bancshares Inc. ranked as the third-most active net branch closer with six net closings, followed by Huntington Bancshares Inc., Bank of Montreal and Associated Banc-Corp with four net closings each.

Bank of America Corp. also landed on the most active net branch closers list with its two net closings in Illinois.

BofA Chairman, CEO and President Brian Moynihan believes that branches and a digital presence are both important given that “half the sales are digital, which means the other half are not digital.”

“Even though it looks like you’re down 2,000 branches ... there’s a massive change underneath that. And so that’s what the team has been optimizing, and that allows us to invest in the future,” Moynihan said at a May 30 conference. “So what are we doing? If you look down the top 100 markets ... we plan to get to a top position in all those markets, and that’s a lot of work

ahead of us.”

On the other hand, Longview Capital Corp. was the most active net opener of branches in Illinois in the last 12 months, with two branches opened. Eleven companies, including Wintrust Financial Corp. and Great Southern Bancorp Inc., followed with one net branch opening each.

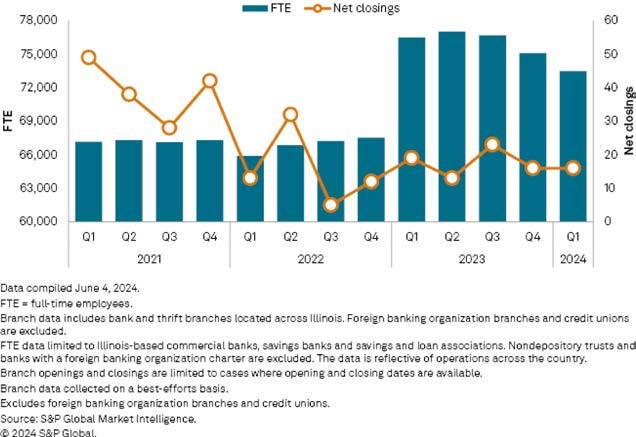

In the quarter ended March 31, Illinois recorded 16 net bank branch closings, unchanged from the previous threemonth period and down from 19 a year ago, Market Intelligence data shows.

Banks across the US logged 229 net branch closings in the first quarter, reducing the total active branches to 77,916. Following record-shattering

closures, overall US bank branch closings have been slow since mid-2022 as institutions realized they needed to strike a balance between accelerating digital adoption and keeping a physical footprint for competition.

Amid continued branch closings, the number of full-time employees (FTEs) at banks in Illinois dropped 2.1% quarter over quarter and 3.9% year over year to 73,496 as of March 31.

The FTE count had a big sequential jump in the first quarter of 2023, mainly due to Bank of Montreal’s acquisition of Bank of the West during the period. BMO’s unit, Chicago-based BMO Harris Bank, took over Bank of the West’s operations across the US.

APPI ENERGY

Jamie Polend

302-228-6937

appienergy.com

ASCENSUS

Michael Bush

218-825-5220

ascensus.com

BANC CONSULTING PARTNERS

Lon Haines

856-577-7305

bancconsultingpartners.com

BANKMARKETINGCENTER. COM

Neal Reynolds

404-943-1632

BankMarketingCenter.com

BANKTALENTHQ

Rachel Selvaggio

217-789-9340

banktalenthq.com

DELUXE

Bob Reid

574-261-9333

deluxe.com

DELUXE BANKER’S DASHBOARD

Bob Reid

574-261-9333

deluxe.com/businessoperations/bankersdashboard

EPIC RETIREMENT PLAN SERVICES

Ian Bernhard

314-339-3935 epicrps.com

EVOLV

Nellie Schlachter

888-311-7248x3009 poweredbyevolv.com

FLOODPLAIN CONSULTANTS, INC.

Craig Callahan

800-945-0246 floodplain.com

ILLINOIS BANKERS INSURANCE SERVICES

Adam Walsh

217-789-9340

illinois.bank/solutions/ insurance

INTERFACE.AI

Mike Rogers

864-275-8975 interface.ai

INVESTORS TITLE INSURANCE COMPANY

Dana Lyons 217-622-0299 invtitle.com

KEYSTATE RENEWABLES

Bill Hoving 702-598-3738 key-state.com

ODP BUSINESS SOLUTIONS

Andre Riedl 512-768-6701

odpbusiness.com/banksignup

SBS CYBERSECURITY

Chris Damato 224-297-1557

sbscyber.com

STRATEGIC RESOURCE MANAGEMENT

Scott Eaton 952-412-9552 srmcorp.com

UFS

Jamie Just - Northern IL 262-376-3000

Rick Bailey - Central & Southern IL 314-322-2550 ufstech.com

VOYA INVESTMENT MANAGEMENT

Randy Cameron 385-715-2513

institutional.voya.com

ACCOUNTING / AUDITING

Anders CPAs and Advisors anderscpa.com

CLA claconnect.com

Crowe LLP crowe.com

FIPCO fipco.com

Fiserv, Inc. fiserv.com

Forvis Mazars, LLP www.forvismazars.us

Genesys Technology Group genesystg.com

Kerber, Eck & Braeckel LLP kebcpa.com

Macha macha.org

Pehlman & Dold, P.C. p-dcpas.com

Plante Moran plantemoran.com/banks

RSM US LLP rsmus.com

SBS CyberSecurity sbscyber.com

Scheffel Boyle scheffelboyle.com

Selden Fox, Ltd. seldenfox.com

Wipfli LLP wipfli.com

ARCHITECTS / INTERIOR DESIGN

Bancare, Inc. bancare.net

Charles Vincent George Architects cvgarchitects.com

Federal Protection Inc. federalprotection.com

NewGround newground.com

The Redmond Company theredmondco.com

ATM SERVICES / SUPPLIES / EQUIPMENT

Cennox cennox.com

DBE - Data Business Equipment, Inc. databusinessequipment. com

Edge One edgeone.com

Federal Protection Inc. federalprotection.com

Fiserv, Inc. fiserv.com

PULSE, a Discover Company pulsenetwork.com

QSI qsibanking.com

Titan Armored titanarmored.us/1

Visa usa.visa.com

AUCTION HOUSE

BigIron Auctions bigiron.com

Farmers National Company farmersnational.com

Purple Wave Auction purplewave.com

BROKERAGE SERVICES

BOK Financial Institutions Group bokfinancial.com

Farmers National Company farmersnational.com

FHN Financial fhnfinancial.com

First Bankers’ Banc Securities, Inc. firstbankersbanc.com

Hovde Group LLC hovdegroup.com

Midwestern Securities Trading Company midwesternsecurities.com

Performance Trust Capital Partners, LLC performancetrust.com

Raymond James raymondjames.com

The Redmond Company theredmondco.com

CANNABIS DISPENSARIES / GROWERS

Shield Compliance shieldbanking.com

CASH MANAGEMENT EQUIPMENT

Cennox cennox.com

Fiserv, Inc. fiserv.com

R&T Deposit Solutions rnt.com

SimpliCapital simplicapital.ai

Tipton Systems tiptonsystems.com

CHECK (PRINT / E-RECOVERY / IMAGING)

Deluxe deluxe.com

Fiserv, Inc. fiserv.com

Main Street, Inc. mainstreetinc.com

Quantum quantumobile.com

Voluforms voluforms.com

COMPLIANCE SERVICES

Abrigo abrigo.com

Anders CPAs and Advisors anderscpa.com

Armstrong Teasdale LLP armstrongteasdale.com

Ascensus ascensus.com

CLA claconnect.com

Crowe LLP crowe.com

CSI csiweb.com

Empyrean Solutions empyreansolutions.com

FIPCO fipco.com

Fiserv, Inc. fiserv.com

Forvis Mazars, LLP www.forvismazars.us

HR Source hrsource.org

Huron Consulting Group huronconsultinggroup.com

Macha macha.org

MeridianLink meridianlink.com

Nasdaq Verafin verafin.com

Passageways, Inc. DBA OnBoard onboardmeetings.com

Plante Moran plantemoran.com/banks

Quantum quantumobile.com

QwickRate/IntelliCredit qwickrate.com

Scheffel Boyle scheffelboyle.com

Shield Compliance shieldbanking.com

TCA Compliance tcaregs.com

The Kafafian Group, Inc. kafafiangroup.com

UFS Tech ufstech.com

Wipfli LLP wipfli.com

Wolf & Company, P.C. wolfandco.com

CONSULTING SERVICES

CoNetrix conetrix.com

forbinfi forbinfi.com

Synchrony Financial synchrony.com

The Kafafian Group, Inc. kafafiangroup.com

The Redmond Company theredmondco.com

CORE / DATA PROCESSING

Alkami Technology alkami.com

Allied Payment Network alliedpayment.com

Automated Systems, Inc. asiweb.com

CSI csiweb.com

Engage fi engagefi.com

Finastra finastra.com

Finlytica Corporation finlytica.ai

Fiserv, Inc. fiserv.com

Genesys Technology Group genesystg.com

ICI Consulting Inc. ici-consulting.com

Jack Henry jackhenry.com

Mindsight gomindsight.com

Quantalytix quantalytix.com

R&T Deposit Solutions rnt.com

S&P Global Market Intelligence spglobal.com

UFS Tech ufstech.com

Visa usa.visa.com

CREDIT / DEBIT CARD PROCESSING

Banc Card of America Inc. BancCard.com

CorServ, Inc. corservsolutions.com

Evolv poweredbyevolv.com

FirsTech Inc. firstechpayments.com

Fiserv, Inc. fiserv.com

Visa usa.visa.com

Automated Systems, Inc. asiweb.com

Federal Protection Inc. federalprotection.com

Fiserv, Inc. fiserv.com

Ironcore Inc. ironcore-inc.com

Jack Henry jackhenry.com

Mindsight gomindsight.com

UFS Tech ufstech.com

Virtual Innovation, Inc. vi-mw.com

EDUCATION / SCHOOLS

Association House of Chicago associationhouse.org

BankWork$ bankworks.org

Graduate School of Banking gsb.org

Grow UP Sales Consulting growupsales.com

ISL Education Lending iowastudentloan.org

Macha macha.org

National Notary Association nationalnotary.org

FACILITIES MANAGEMENT

APPI Energy appienergy.com

Farmers National Company farmersnational.com

ODP Business Solutions odpbusiness.com/ banksignup

Alkami Technology alkami.com

Allied Payment Network alliedpayment.com

Backbase USA inc. backbase.com

BAFS-Business Alliance Financial Services bafs.com

Banc Card of America Inc. BancCard.com

BancAlliance, Inc. bancalliance.com/ bank-network

CBMS cbmsonline.com

Cennox cennox.com

Computershare, Inc. computershare.com/us

CorServ, Inc. corservsolutions.com

CSI csiweb.com

Empyrean Solutions empyreansolutions.com

Engage fi engagefi.com

Federal Protection Inc. federalprotection.com

FintechOS Fintechos.com

FirsTech Inc. firstechpayments.com

Fiserv, Inc. fiserv.com

Glia glia.com

Growers Edge growersedge.com

interface.ai interface.ai

MeridianLink meridianlink.com

Onovative onovative.com

OpenLending openlending.com

Quantalytix quantalytix.com

Quantum quantumobile.com

QwickRate/IntelliCredit qwickrate.com

Round Hill Technologies DBA Ned nedhelps.com

SimpliCapital simplicapital.ai

Superior Informatics LLC homestat.org

Tipton Systems tiptonsystems.com

UFS Tech ufstech.com

Whistle Systems Inc. wewhistle.com

FLOOD DETERMINATION

CBMS cbmsonline.com

Floodplain Consultants, Inc. floodplain.com

GOVERNMENT AGENCIES

Comptroller of the Currency occ.gov

Farmer Mac farmermac.com

Federal Deposit Insurance Corporation fdic.gov

Federal Reserve Bank of Chicago frbservices.org

Federal Reserve Bank of St. Louis stlouisfed.org

Freddie Mac freddiemac.com

Illinois Department of Financial & Professional Regulation idfpr.com

Angott Search Group asgteam.com

Armstrong Teasdale LLP armstrongteasdale.com

Association House of Chicago associationhouse.org

Bank Compensation Consulting bcc-usa.com

BankTalentHQ banktalenthq.com

Blanchard Consulting Group blanchardc.com

ChaseCompGroup, LLC chasecompgroup.com

HR Source hrsource.org

Willing to Hunt, LLC willingtohunt.com

INSURANCE PRODUCTS / SERVICES / BOLI

ABA Insurance Services Inc. abais.com

Banc Consulting Partners bancconsultingpartners. com

Bank Compensation Consulting bcc-usa.com

Berkley Financial Specialists BerkleyFS.com

Chatham Financial chathamfinancial.com

Glia glia.com

Illinois Bankers Insurance Services illinois.bank/solutions/ insurance-products/ insurance

IntraFi Network IntraFi.com

Investors Title Insurance Company invtitle.com

Kestner Insurance kestnerinsurance.com

KeyState Captive Management key-state.com

Mid America Banking Insurance Services, Inc. bankers-ins.com

National Notary Association nationalnotary.org

Newcleus, LLC newcleus.com

NFP Executive Benefits executivebenefits.nfp.com

IT SERVICES / PRODUCTS

Allied Payment Network alliedpayment.com

Aunalytics aunalytics.com

Automated Systems, Inc. asiweb.com

CoNetrix conetrix.com

CSI csiweb.com

Deluxe Banker’s Dashboard deluxe.com/business-operations/bankers-dashboard

Fiserv, Inc. fiserv.com

forbinfi forbinfi.com

Glia glia.com

Integrity Technology Solutions integrityts.com

interface.ai interface.ai

Ironcore Inc. ironcore-inc.com

IT Resource itrw.net

Mindsight gomindsight.com

Passageways, Inc. DBA OnBoard onboardmeetings.com

QSI qsibanking.com

Quantalytix quantalytix.com

Quantum quantumobile.com

Remedy Consulting remedyconsult.net

S&P Global Market Intelligence spglobal.com

SBS CyberSecurity sbscyber.com

SEI Sphere seic.com/sphere

SimpliCapital simplicapital.ai

Technology Advisors Inc. techadv.com

Tipton Systems tiptonsystems.com

UFS Tech ufstech.com

Virtual Innovation, Inc. vi-mw.com

INVESTMENT SERVICES / PRODUCTS

Artisan Advisors, LLC artisan-advisors.com

Bankers’ Bank bankersbankusa.com

BOK Financial Institutions Group bokfinancial.com

Computershare, Inc. computershare.com/us

Farmer Mac farmermac.com

FHN Financial fhnfinancial.com

Financial Shares Corporation financialshares.com

First Bankers’ Banc Securities, Inc. firstbankersbanc.com

Hovde Group LLC hovdegroup.com

HUB – Taylor Advisors tayloradvisor.com

IntraFi Network IntraFi.com

KeyState Renewables, LLC key-state.com

Midwest Independent BankersBank mibanc.com

Midwestern Securities Trading Company midwesternsecurities.com

Northland Securities NorthlandSecurities.com

Olsen Palmer LLC olsenpalmer.com

Performance Trust Capital Partners, LLC performancetrust.com

Raymond James raymondjames.com

Stephens stephens.com

The Kafafian Group, Inc. kafafiangroup.com

United Bankers’ Bank ubb.com

Voya Investment Management institutional.voya.com

LAW FIRMS

Amundsen Davis, LLC salawus.com

Armstrong Teasdale LLP armstrongteasdale.com

Barack Ferrazzano Kirschbaum & Nagelberg LLP bfkn.com

Chapman and Cutler LLP chapman.com

Dickinson Wright PLLC dickinson-wright.com

Giffin Winning Cohen & Bodewes PC giffinwinning.com

Godfrey & Kahn, S.C. gklaw.com

Hinshaw & Culbertson LLP hinshawlaw.com

Quarles & Brady LLP quarles.com

Ruff Breems LLP

Schiff Hardin LLP schiffhardin.com

UB Greensfelder UBGlaw.com

Vedder Price P.C. vedderprice.com

Weltman, Weinberg & Reis Co., LPA weltman.com

LENDING SERVICES / SOFTWARE

BAFS-Business Alliance Financial Services bafs.com

BancAlliance, Inc. bancalliance.com/ bank-network

BancMac - Community Banc Mortgage Corp bancmac.com

BHG Financial BHGBank.Network/ILBA

CBMS cbmsonline.com

Cinnaire Corporation cinnaire.com

CSI csiweb.com

Howard & Howard Attorneys PLLC h2law.com

Lawler Brown Law Firm lblf.com

Lewis Rice LLC lewisrice.com

Luse Gorman, PC luselaw.com

Marwedel Minichello & Reeb, P.C. mmr-law.com

Momkus LLP momkus.com

Noonan & Lieberman, Ltd. noonanandlieberman.com

Federal Home Loan Bank of Chicago fhlbc.com

Finastra finastra.com

FIPCO fipco.com

Fiserv, Inc. fiserv.com

Glia glia.com

Growers Edge growersedge.com

Haberfeld haberfeld.com

ISL Education Lending iowastudentloan.org

MeridianLink meridianlink.com

OpenLending openlending.com

Petefish, Skiles & Co Bank petefishskiles.com

Quantalytix quantalytix.com

QwickRate/IntelliCredit qwickrate.com

Round Hill Technologies DBA Ned nedhelps.com

Finlytica Corporation finlytica.ai

forbinfi forbinfi.com

Grow UP Sales Consulting growupsales.com

ICI Consulting Inc. ici-consulting.com

LKCS lk-cs.com

Mills Marketing millsmarketing.com

NewGround newground.com

ODP Business Solutions odpbusiness.com/ banksignup

Onovative onovative.com

Plansmith Corporation plansmith.com

Quantum quantumobile.com

SomerCor somercor.com

MARKETING / WEB / GRAPHIC DESIGN

Abrigo abrigo.com

Alkami Technology alkami.com

BankMarketingCenter. com BankMarketingCenter.com

Banzai Inc. teachbanzai.com

BHG Financial BHGBank.Network/ILBA

Deluxe deluxe.com

Evolv poweredbyevolv.com

Financial Shares Corporation financialshares.com

Rivel, Inc. rivel.com

Systemax systemaxsolutions.com

Technology Advisors Inc. techadv.com

Visa usa.visa.com

Voluforms voluforms.com

Works24 works24.com

OFFICE SUPPLIES

Cennox cennox.com

ODP Business Solutions odpbusiness.com/ banksignup

Voluforms voluforms.com

OVERDRAFT PROTECTION

Fiserv, Inc. fiserv.com

REAL ESTATE SERVICES

BigIron Auctions bigiron.com

Community Investment Corporation cicchicago.com

Farmers National Company farmersnational.com

Growers Edge growersedge.com

Investors Title Insurance Company invtitle.com

Petefish, Skiles & Co Bank petefishskiles.com

Technology Advisors Inc. techadv.com

The Redmond Company theredmondco.com

Wool Finance Partners LLC woolfinance.com

RETIREMENT SERVICES

Ascensus ascensus.com

Bank Compensation Consulting bcc-usa.com

BigIron Auctions bigiron.com

EPIC Retirement Plan Services epicrps.com

Forvis Mazars, LLP www.forvismazars.us

NFP Executive Benefits executivebenefits.nfp.com

RISK MANAGEMENT SERVICES

Abrigo abrigo.com

Ag Resource Management armlend.com

Artisan Advisors, LLC artisan-advisors.com

CoNetrix conetrix.com

CSI csiweb.com

Farmer Mac farmermac.com

Farmers National Company farmersnational.com

FHN Financial fhnfinancial.com

Howell Financial Services, Inc. howellfinancialservices.com

KeyState Captive Management key-state.com

Macha macha.org

Mid America Banking Insurance Services, Inc. bankers-ins.com

Mindsight gomindsight.com

Passageways, Inc. DBA OnBoard onboardmeetings.com

Plansmith Corporation plansmith.com

Quantalytix quantalytix.com

QwickRate/IntelliCredit qwickrate.com

RSM US LLP rsmus.com

S&P Global Market Intelligence spglobal.com

SBS CyberSecurity sbscyber.com

Tipton Systems tiptonsystems.com

UFS Tech ufstech.com

Wipfli LLP wipfli.com

Wolf & Company, P.C. wolfandco.com

SECURITY SERVICES / PRODUCTS

Bancare, Inc. bancare.net

Federal Protection Inc. federalprotection.com

Mindsight gomindsight.com

QSI qsibanking.com

Security Alarm securityalarm.com

UFS Tech ufstech.com

Virtual Innovation, Inc. vi-mw.com

TITLE AGENCY

CBMS cbmsonline.com

Investors Title Insurance Company invtitle.com

UCC SEARCH

CBMS cbmsonline.com

UTILITIES / TELECOMMUNICATIONS / ENERGY

APPI Energy appienergy.com

Consolidated Communications consolidated.com

VENDOR CONTRACT SERVICES/ PRODUCTS

ICI Consulting Inc. ici-consulting.com

Remedy Consulting remedyconsult.net

Strategic Resource Management srmcorp.com

Alliance Community Bank is pleased to announce the promotion of Austin Hemberger to Senior Vice President –Lending.

Austin began his career in 2003 with Alliance Community Bank (formerly Athens State Bank) and states, “It’s surreal to me that what I thought was merely a part-time job after school has turned into a career that I never imagined.” In his 21 years with the bank, Austin has served in the roles of Teller, Lending Assistant, Assistant Loan Officer, Assistant Branch Manager, Branch Manager, Loan Officer, Assistant Vice President – Lending, Vice President – Lending, and now joins the Executive Management team as Senior Vice President – Lending.

Austin holds a Bachelor’s Degree in Business Administration from the University of Illinois – Springfield and

Itasca Bank & Trust Welcomes Montgomery

Itasca Bank & Trust is pleased to announce the appointment of Renee Montgomery as the new Vice President, Director of Marketing. With an impressive 25 years of marketing experience, including 15 years dedicated to bank marketing, Montgomery is set to bring innovative strategies and a wealth of knowledge to the Itasca Bank & Trust Co. marketing team.

Montgomery will be succeeding Ginny Wagner, who is retiring after a distinguished career with Itasca Bank & Trust Co. Wagner has been instrumental in shaping the bank’s marketing efforts, and her contributions have set a high standard for excellence. Itasca Bank & Trust Co. extends its deepest gratitude to Ginny Wagner for her dedication and service.

“We are thrilled to welcome Renee Montgomery to our team,” said James R. Mensching, President of Itasca Bank & Trust Co. “Her extensive experience in marketing, especially within the banking sector, makes her the ideal candidate to lead our marketing department. We are confident that Renee will continue to build on the strong foundation established by Ginny Wagner and drive our marketing initiatives to new heights.”

Throughout her career, Montgomery has demonstrated a remarkable ability to develop and execute effective marketing strategies that drive growth and enhance

is a 2019 graduate of the Graduate School of Banking in Madison, Wisconsin. He also holds a Certificate of Executive Leadership – the highestlevel certificate available through the Wisconsin School of Business.

Austin states that what he loves about his job, “is being able to say I work for an organization that truly cares about its staff and the communities it serves.

I’m thankful for the many customers who have become friends, and the many friends who have become customers.

I am honored to serve the customers of Alliance Community Bank and the community in which I grew up in.” Congratulations Austin!

brand presence. Her expertise spans digital marketing, customer engagement, and market analysis, making her well-equipped to navigate the evolving landscape of the banking industry.

“I am honored to join Itasca Bank & Trust Co. to lead the marketing team,” said Montgomery. “I look forward to working with such a talented group of professionals and contributing to the bank’s continued success. Together, we will explore new opportunities to connect with our customers and strengthen our community presence.”

“Itasca Bank & Trust Co. has a longstanding commitment to providing exceptional financial services and fostering strong relationships within the community,” said John Hunt, Executive Vice President, Chief Loan Officer.

“With Renee at the helm of marketing, the bank is poised to enhance its outreach efforts and further solidify its position as a trusted financial partner.”

Erich Bloxdorf took a trip up state route 157 to Clinton Illinois to visit Justin Fentress, President and CEO of DeWitt Savings Bank and Trustee of the Illinois Bankers Group Insurance Trust. Fun fact about DeWitt Savings: they were chartered in 1887 – nearly 140 years ago! Way to go DeWitt Savings!

Southern Illinois is a beautiful part of the state! Erich Bloxdorf headed to Effingham to meet with David Doedtman, President and CEO of Washington Savings Bank and member of the IBA Board of Directors. Fun fact about Washington Savings Bank: It was chartered in 1883 and the Current President and CEO, David Doedtman, is only the 7th President and CEO in the bank’s history! Wow!

Tom Chamberlain and Randy Hultgren traveled out of the State of Illinois – to Missouri actually – to visit with Tom Hough, Executive Vice President of Carrollton Bank. Fun fact about Carrollton Bank: they are the largest small business lender in the St. Louis Metropolitan Statistical Area!

Edwardsville is a bustling community! Tim Robinson headed south to present a check for 2nd place in the Spring golf outing to Chris Beard and to get insights on their bank. Tim really likes their motto: “Small enough to know you, big enough to serve you.”

The IBA is always looking for the right products and services to help our members! Adam Walsh, Vice President of Illinois Bankers Insurance Services, recently traveled to Kentucky to meet with KBA Insurance Solutions leadership Chuck Maggard and Lisa Mattingly. KBA Insurance Solutions is the Insurance entity of the Kentucky Bankers Association. In addition to spending time in the great outdoors, Adam spent time with them in Louisville discussing our future partnership and the processes we will be using moving forward to deliver outstanding insurance products to our members.

Mike Mahorney, Plan Administrator of the Illinois Bankers Group Insurance Trust and Adam Walsh, Vice President of Illinois Bankers Insurance Services paid a visit to Kathy Williamson, Executive Vice President, Human Resource Manager of the Bank of Farmington and Board member of the IBA. Fun fact: The Bank of Farmington was chartered in January 1903 after being organized by a small group of investors who recognized the need for a local bank. Descendants of those original investors still have the majority of the stock ownership in the Bank of Farmington, giving true meaning to the term, “independent, locally-owned community bank.”

Randy Hultgren, Carlyn Settanni, and Ben Jackson stopped by to meet with Dane Cleven, President of Community Savings Bank. Dane is a big supporter of the IBA and currently serves as the Chair of the Illinois Bankers Group Insurance Trust Board of Trustees. Fun fact: The bank vault door weighs over 20 tons and is over 93-years old!

Hill Technologies (DBA Ned)

150 E 18th St #5E

New York, NY 10003-2448

Website: www.nedhelps.com

Contact: Silverstein, David

david@nedhelps.com

Facebook: www.facebook.com/nedhelps

Twitter: x.com/nedhelps

LinkedIn: www.linkedin.com/company/ nedhelps

Ned provides the rails and underwriting engine so small business and commercial lenders can deploy trillions across new financial products. Lenders today are turning to Ned to design and launch new cash flow lending products that expand capacity and make it easy to qualify borrowers who might not have credit or collateral. The white label platform makes applications quick and easy, while the lender dashboard speeds approval and disbursement with unique scoring IP. On the back end, Ned’s first-of-its kind revenue-based repayments and loan monitoring systems drive timely completion.

3560 Hyland Ave, Suite 200

Costa Mesa, CA 92626-1438

Website:www.meridianlink.com

Contact: Ray, Karen karen ray@meridianlink.com

Facebook: www.facebook.com/ MeridianLink

Twitter: x.com/meridianlink

LinkedIn: www.linkedin.com/company/ meridianlink

MeridianLink empowers financial institutions to develop lifelong financial management relationships to support a consumer’s entire financial journey. Our platform of innovative products spans the entire digital lending journey from deposit account opening, consumer and mortgage loan origination, credit reporting, data access and verification, business consulting, analytics, collections, and scoring. Each product and service is sold separately, but you can connect our time-tested and trusted products into one powerful platform to turn lending automation, cross-selling, and loan optimization into transformational experiences for staff and consumers. Our seamless integrations eliminate the need to seek out disparate financial offerings and eliminates silos, while increasing efficiencies and improving the overall buyer and loan officer experience.

333 N Alabama St Ste 300 Indianapolis, IN 46204-2151

Website:www.onboardmeetings.com

Contact: Tinsley, Collin ctinsley@onboardmeetings.com

Facebook: www.facebook.com/ OnBoardMeetings

Twitter: twitter.com/onboardmeetings LinkedIn: www.linkedin.com/company/ onboardmeetings/

OnBoard streamlines governance with a secure board portal that features userfriendly design, intuitive meeting creation tools, insightful analytics, and real-time collaboration.

Finastra

555 SW Morrison St Ste 300 Portland, OR 97204-1442

Website: www.finastra.com

Contact: Fernandez, Joel joel.fernandez@finastra.com

Facebook: www.facebook.com/ FinastraCareers

Twitter: twitter.com/FinastraFS

LinkedIn: www.linkedin.com/company/ finastra

Formed in 2017 by combining Misys and D+H, Finastra builds and deploys innovative, next-generation technology on our open Fusion software architecture & cloud ecosystem. Our scale and geographical reach mean that we can serve customers effectively, regardless of their size or location. We have $2.1 billion in revenues, 10,000 employees & over 9,000 customers.

1201 Libra Dr Lincoln, NE 68512-9331

Website: www.asiweb.com

Contact: Segneri, Tony tony.segneri@asiweb.com

Since 1981, Automated Systems, Inc. (ASI) has been a leader in providing innovative core banking, digital banking, and data processing solutions to community banks nationwide. An array of integrated applications provides partnered banks with competitive choices. ASI delivers industry-leading technology backed by unparalleled in-house conversion, training and support teams.

Two community-focused banking organizations are joining together! Guardian Savings Bank (GSB) will merge into and become part of Community Partners Savings Bank (CPSB) this fall. Community Partners Savings Bank is headquartered in Salem, IL and has locations in Pekin, IL and Flora, IL. “The best strategy to keep community banks alive and strong in small communities is to join forces so we can share resources and strengths,” stated Community Partners Savings Bank President and CEO, T. J. Burge. “We are very excited to add Guardian Savings Bank to our family of community banks,” mentioned Mr. Burge.

CPSB’s goal is to protect the mutual community banking philosophy, which

is to make serving customers and community a priority, while keeping profits at a reasonable level. Most banking organizations that are owned by shareholders expect a return on their investment, and rightfully so. As a mutual organization, Community Partners will continue to be owned by its customers who benefit because the bank does not need to pay shareholder dividends. The desire of both these banking organizations is to be a bigger presence in their communities and to continue the personalized, unique service that customers enjoy with community banks.

“We are glad to join Community Partners, as we searched for a great partner who will continue our long commitment

to the Granite City community. They are a perfect solution,” stated Mark Kleindorfer, Chairman of the Board of Guardian Savings Bank. “Guardian has been a pillar in the Granite City community for over 105 years and values personalized customer service the same way CPSB does! We answer our phone calls in person and service the loans we make. Combining will provide the overall organization to have a larger lending limit, which will allow the Bank to better serve the loan needs of local businesses. Additionally, GSB customers will enjoy many new digital banking and expanded business services. Best of all, you’ll see the same friendly faces when you come into the branch,” stated Mr. Burge.

For now, GSB customers will continue to transact business at Guardian Savings Bank and CPSB customers will continue to transact business at CPSB’s locations. All customers will be notified of the date when they will be able to transact business at all locations. Going forward, GSB will operate as Guardian Savings Bank, a division of Community Partners Savings Bank.

The First National Bank and Trust Company’s in-school student-led banks have celebrated the culmination of another rewarding year. Established in 2018 as part of First National Bank Trust Company’s ongoing commitment to financial wellness, these programs have been instrumental in shaping the financial wellness landscape in central Illinois.

First National Bank and Trust Company’s two local student-led banks at Clinton Elementary Maroons Branch and DeLand-Weldon Community Unit School District Eagles Branch, have continued to thrive since their openings in January 2023. Nearly 790 deposits were made by students this year, contributing

to the financial education of over 1,000 students annually.

The approach goes beyond traditional banking. Students are introduced to financial concepts through hands-on training, empowering them to make sound money decisions from an early age.

“It’s encouraging to see the next generation understand how saving money can benefit their future. I also love watching the student bankers teach younger kids about making deposits and counting money. It’s been a wonderful year seeing all the students grow,” said Sabrina Brough, First National Bank and Trust Company Universal Banker.

Beyond school partnerships, First National Bank and Trust Company continues to champion financial wellness within the community and is dedicated to empowering individuals to make informed decisions and secure their financial future.

“My favorite part of the Clinton Elementary School Maroons Branch is how I get to help and work with the students,” added Avery Brady, Maroons Branch Student Banker.

In reflection on another successful year, First National Bank and Trust Company remains committed to building a brighter, more financially savvy future for our community. Well done!

After a memorable 33-year career in Commercial Loan Administration, the last 11 years with Grundy Bank, the announcement of Becky Brown’s retirement was made public, marking the end of an era. Known for her exceptional skills and dedication, Becky has left an everlasting mark in her field. Her compassion with clients has been a hallmark of her career, fostering trust and loyalty among those she serves.

“Becky has served many commercial and agricultural clients during her banking tenure in Morris. I witnessed the professional manner in which she approached her job each and every day, and it has been a privilege to work aside her. She can retire knowing she has a great number of clients and friends who wish to thank her for years of friendly, capable service. She also brought humor into our workplace which will definitely be missed,” said Pete Brummel, Senior Vice President at Grundy Bank.

Tom Chamberlain, 2023-2024 Chair of the Illinois Bankers Board of Directors came up with the unique idea to recognize all the past Chairs with a special commemorative pin. Tom has been traveling all over to

For over 30 years, Becky has dedicated her career to Business Banking, specializing as a Commercial Loan Administrator. Throughout these decades, Becky has not only demonstrated exceptional professional skills, but also cultivated lasting friendships, becoming a cherished and dependable colleague. Brown has also demonstrated her commitment to community involvement through her roles in local sports organizations. She served as the Treasurer of the Morris Football Quarterback Club, where she managed financial responsibilities and contributed to the club’s operations. In addition, Becky has previously held the position of Treasurer for the Morris Soccer Association, further showcasing her dedication and leadership in supporting youth and community sports programs.

“I am looking forward to relaxing in the morning, going for a walk or an exercise class, helping out with my grandkids in Schaumburg, spending more time with my family, and last but certainly not least, traveling the country with my husband, Don, in our motorhome. I will miss my “work family” more than I want to think about, so I will definitely be calling for lunch dates, visits and more,“ said Brown. Grundy Bank and the IBA would like to extend warm wishes to Becky as she embarks on this new chapter in her life!

Ginny Wagner’s retirement was recently announced by Itasca Bank & Trust Co.

She has had a distinguished career as the

Vice President/Director of Marketing for the past 12 years and has been instrumental in shaping the Bank’s marketing efforts. “Ginny’s contributions have set a high standard for excellence and her expertise has helped the Bank grow and prosper,” said James R. Mensching, president. Renee Montgomery has been appointed as her successor.

Wagner got her start in community bank marketing when she learned that a de novo bank was opening in her town of Lake Zurich, Illinois. She approached the president about his marketing and branding plans, and he asked her to put together a marketing proposal. That was 1996, and her career as a community bank marketing director took flight. The de novo bank was purchased after a successful ten-years and Wagner continued as the Marketing Director with the newly formed bank until she joined Itasca Bank & Trust Co. in 2012.

bestow this wonderful recognition. In this issue, Tom caught up with Mark Hoppe, 2000-2001 Chair and Bruce Taylor, 1996-1997 Chair. Congratulations and thank you for your service!

“I have had an amazing career. The past 29 years in community bank marketing have just flown by,” Wagner said. “One of the highlights of my banking career was the opportunity to attend the three-year ABA Stonier Graduate School of Banking and Leadership at the University of Pennsylvania, graduating in 2016, where I had the opportunity to meet so many wonderful, heart-centered bankers on a national level.”

Wagner graduated from Kent State University in Kent, Ohio, in 1975 with a degree in Journalism and Advertising. She then held several positions in private business organizations and ad agencies in the Cleveland area before moving to Illinois in the early ‘80s, where she

continued to work in marketing and communications. During this time, she had the opportunity to work with community banks as their account executive and gained a lot of insight into what they needed. That’s why her move to work as Marketing Director for a community bank was so seamless – she already knew what a community bank needed and was able to thrive in her new career direction.

In addition to leading marketing efforts for community banks, Wagner was involved in the banking industry in a variety of ways. Wagner was a member of the IBA Communications and Marketing Committee since 2017 and served as the chairperson of the Committee in 2023. She has also demonstrated her commitment to community service serving on local Chamber of Commerce boards; teaching Junior Achievement classes; and volunteering in a variety of positions with her kid’s schools and sporting organizations and her church throughout the years.

Wagner looks forward to traveling and relaxing with her husband and family.