The Official Publication of the Illinois Bankers Association illinois.bank November-December 2022

to Partner with Customers to Fight Fraud Also in this issue: Parental Access To Data Of Children? The Answer Is Not That Clear BankTech Conference Women in Banking

Ag Banking

ILLINOIS BANKERS ASSOCIATION 3201 WEST WHITE OAKS DRIVE, SUITE 400 SPRINGFIELD, IL 62704 ADDRESS SERVICE REQUESTED

How

Conference

Conference

Our Mission: Advocacy. Education. Industry Resource...for all Illinois bankers.

Our Vision: Connecting Bankers. Advancing Banking.®

Our Core Values: The Illinois Bankers Association will place our members’ interests first, be responsive to their needs, and provide them with the highest level of professionalism and service. The IBA staff is the Association’s greatest asset. We will conduct ourselves with integrity and respect. We will work together as a team, share information, build upon

TABLE OF CONTENTS

ideas,

November-December 2022 • Vol. 107 / No. 6 • illinois.bank 5 Messages from the C-Suite 6 Compliance Corner 16 Future Leaders Alliance 25 Preferred Vendor 40 On the Move 42 Education Calendar 43 News & Notes 39 New Associate Members 41 Ad Index 45 New Member Banks 46 New Associate Members DEPARTMENTS 9 Parental Access To Data Of Children? The Answer Is Not That Clear 12 How to Partner with Customers to Fight Fraud 18 BankTech Conference 28 21st Annual Women in Banking Conference 32 Ag Banking Conference 36 Fall Golf Outing 12 32 28 9 FEATURES

our strengths, embrace new

and recognize and celebrate accomplishments.

OFFICERS AND EXECUTIVE COMMITTEE MEMBERS

Betsy Johnson Chair Solutions Bank, Forreston

REGION 1

Rudy Gonzalez CIBC Bank USA Chicago

Frank Pettaway

The Northern Trust Company Chicago

REGION 2

Peter Brummel Grundy Bank Morris

BOARD OF DIRECTORS

REGION 4

Scott Bland

First Neighbor Bank N.A. Toledo

Brett Tiemann

INB, National Association Springfield

REGION 5

Rick Parks

First National Bank of Waterloo

MEMBERS-ATLARGE

Gustavus Bahr

PNC Bank, N.A. Chicago

Dane Cleven Community Savings Bank Chicago

Megan Collins Bank of America Chicago

Jim Hannon

Michele Petrie

Village Bank & Trust, N.A. Arlington Heights

Amy Randolph Busey Bank Champaign

Steven Rosenbaum Hoyne Savings Bank Chicago

Matthew Smith

First Mid Bank & Trust, N.A. Mattoon

Courtney Olson

First Bank Chicago Highland Park

REGION 3

Lawrence Horvath Heartland Bank & Trust Company Bloomington

Tyler Rouse

First Federal Savings Bank of Champaign-Urbana

Bethany Shaw Peoples National Bank Mt. Vernon

FUTURE LEADERS ALLIANCE BOARD CHAIR

(non-voting member) Kara Austin

Murphy-Wall State Bank and Trust Company Pinckneyville

First Security Trust & Savings Bank Elmwood Park

Quint Harmon Pioneer State Bank Earlville

Karlie Krehbiel Lisle Savings Bank

Richard Mahoney

First Midwest Bank Moline

ILLINOIS BANKERS ASSOCIATION STAFF DIRECTORY

Two Offices to Serve You! Springfield Office: 800-783-2265 • Chicago Office: 800-878-2265 To connect with our staff, use this email format: firstinitiallastname@illinois.bank

T.J. Burge Treasurer Community Partners Savings Bank, Salem

Executive Administration

Randy Hultgren, President & CEO

Erich Bloxdorf, Executive Vice President & COO Mary Curl, Executive Assistant & HR Manager Pam Macha, Springfield Office Coordinator

Finance and Administration

Mark Bennett, CPA, Executive Vice President and CFO Marcia Stratton, CPA, Director Marie South, Financial Assistant

Law Department

Carolyn Settanni, Executive Vice President & General Counsel Carly Berard, Senior Counsel

Michael Schasane, Compliance Counsel

Nick Sladek, Administrative Assistant

Government Relations

Ben Jackson, Executive Vice President

Aimee Smith, Assistant Vice President

Matt Imburgia, Director

Marketing and Member Relations

Julie Winterbauer, Senior Vice President

Tammy Squires, Vice President, Data & Digital Marketing

Robin Lane, Director, Associate Membership

Tim Robinson, Director, Bank Relations

Linda Koch, CAE, Manager, Member/Business Relations

Sarah Cowan, Membership Assistant

Illinois Bankers Business & Education Services, Inc.

Callan Stapleton, CAE, EVP & President of Business and Education Services

Editorial Office

Adam Walsh, Vice President, Insurance Services

Lyndee Fein, Director, Education & Conferences

Rachel Selvaggio, Director, Forums & Future Leaders Alliance

Denise Perez, Director, Education & Training

Dan Wujek State Bank of Cherry Megan

Debbie Jemison, CAE, Director, Financial Literacy Maddison Augustine, Manager, Marketing & Digital Communications Amy Sale, Education Assistant

Illinois Bankers

Group Insurance Trust Erich Bloxdorf, Plan Administrator

Mike Mahorney, Senior Trust Advisor

Hillary Meyers, Trust Manager

3201 West White Oaks Drive Ste. 400 Springfield, IL 62704 217-789-9340 www.illinois.bank

With the exception of official announcements, the Illinois Bankers Association disclaims all responsibility for opinions expressed and statements made in articles published in Illinois Banker. This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is provided with the understanding that the publisher is not engaged in rendering legal or other professional services. If legal advice or other expert assistance is required, the services of a competent professional person should be sought.

Illinois Banker (ISSN 0019-185X) is published bi-monthly and is available at a cost of $45 per year for members and $90 per year for nonmembers. Regular issue single copy price is $8.50. Postmaster, send address change to Illinois Bankers Association, 3201 W. White Oaks Drive, Ste. 400, Springfield, IL 62704. News items from members of the Illinois Bankers Association are invited and are due on the first of the month preceding publication.

© Copyright 2022 by Illinois Bankers Association (unless individual articles list copyright). Reproduction of any material in the Illinois Banker is strictly prohibited without written permission of the publisher.

• 4 • • November-December 2022

Michelle Gross Immediate Past Chair State Bank of Bement

Randy Hultgren Secretary Illinois Bankers Association

Anthony Nestler Vice Chair

Hickory Point Bank and Trust Co., Decatur

Thomas Chamberlain Chair-Elect Iroquois Federal Savings & Loan Association, Watseka

Collins Member-at-Large Bank of America, Chicago Frank Pettaway Member-at-Large The Northern Trust Company, Chicago

Betsy Johnson President & CEO Solutions Bank, Forreston

MESSAGES FROM THE

Chair, Illinois Bankers Association

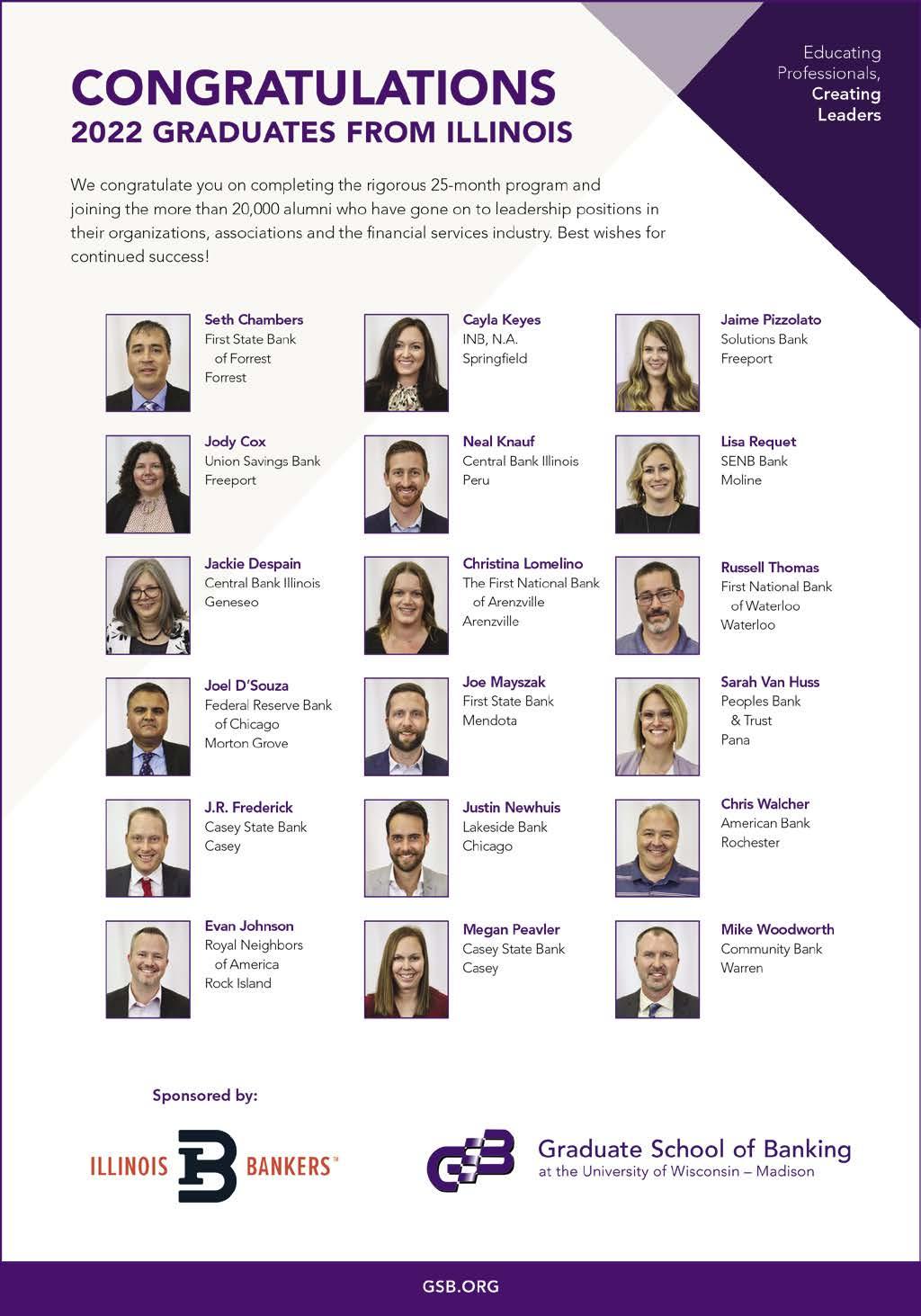

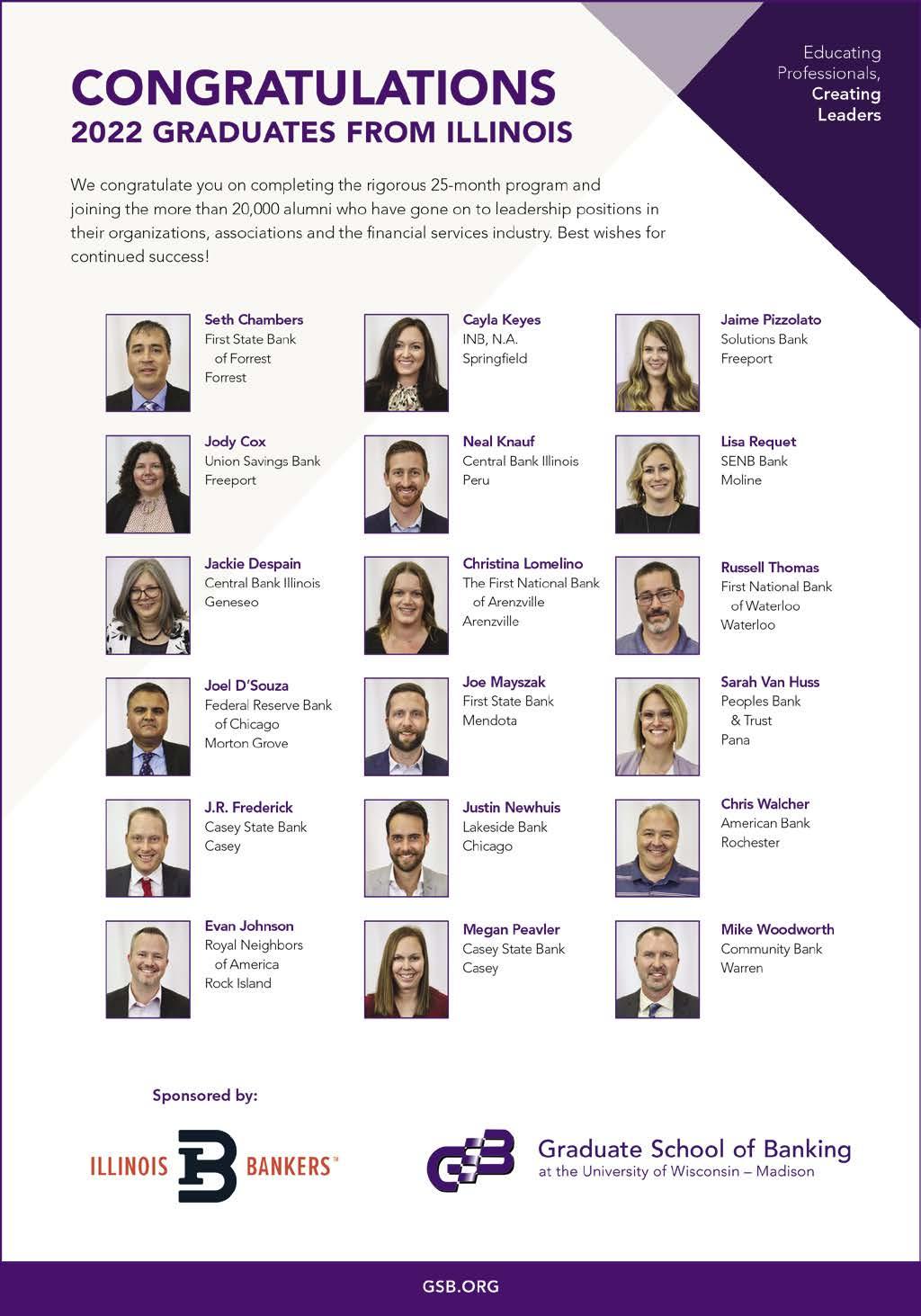

As I visit our members, I continuously hear conversations regarding succession planning, the next generation of bankers, and retaining existing bankers. In August, 148 bankers graduated from the Graduate School of Banking in Madison, Wisconsin, which also includes a Certificate of Executive Leadership from the Wisconsin School of Business Professional and Executive Development, unique to GSB-Madison. As the current chair of GSB Advisory Council, I had the privilege to participate in the graduation ceremonies not only for the Class of 2022 but also the Class of 2021, who returned to Madison to graduate in person since last year was virtual. I was profoundly moved and encouraged by the enthusiasm of these graduates. I can tell you that banking careers are still alive and very desirable. We have the responsibility to support and encourage these graduates’ engagement in the industry

and their careers. GSB is just one example for continued education and engagement. Our future leaders also can benefit from learning more about advocacy so they can gain knowledge of how legislative issues affect our industry and the consequences from both bad and good policy. I cannot think of a better opportunity for bankers to learn than by extending an invitation to join in meetings and conversations with our local, state, and federal legislators and regulators. IBA offers various educational and networking opportunities and events to mentor and nurture the advancement of our future industry leaders. Check out upcoming events and opportunities on the IBA website or contact any or our IBA staff or myself. Your questions, suggestions, and stories are always welcomed. I encourage you to do your part in keeping our shining stars glowing with success and purpose.

Association

Randy Hultgren IBA President & CEO

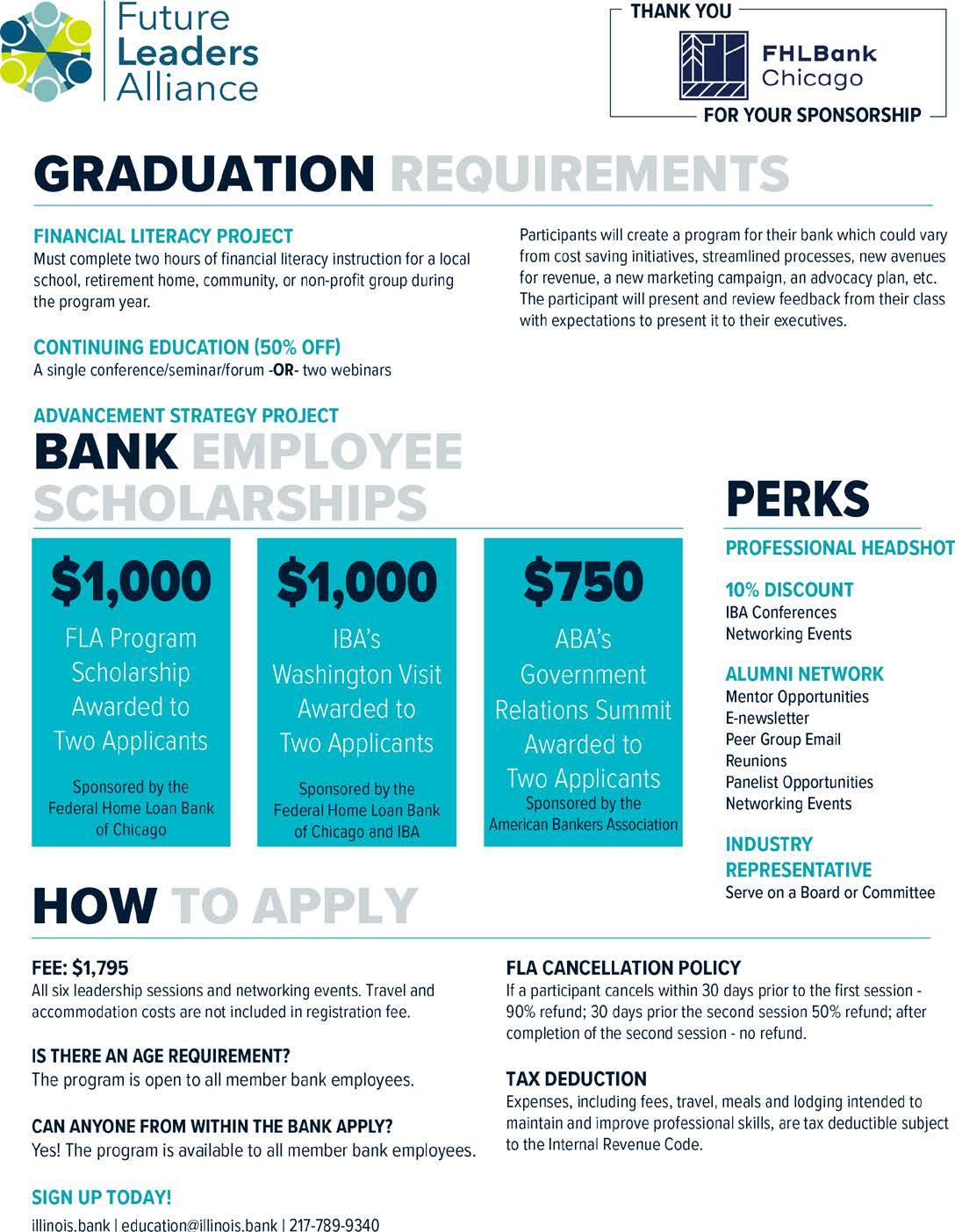

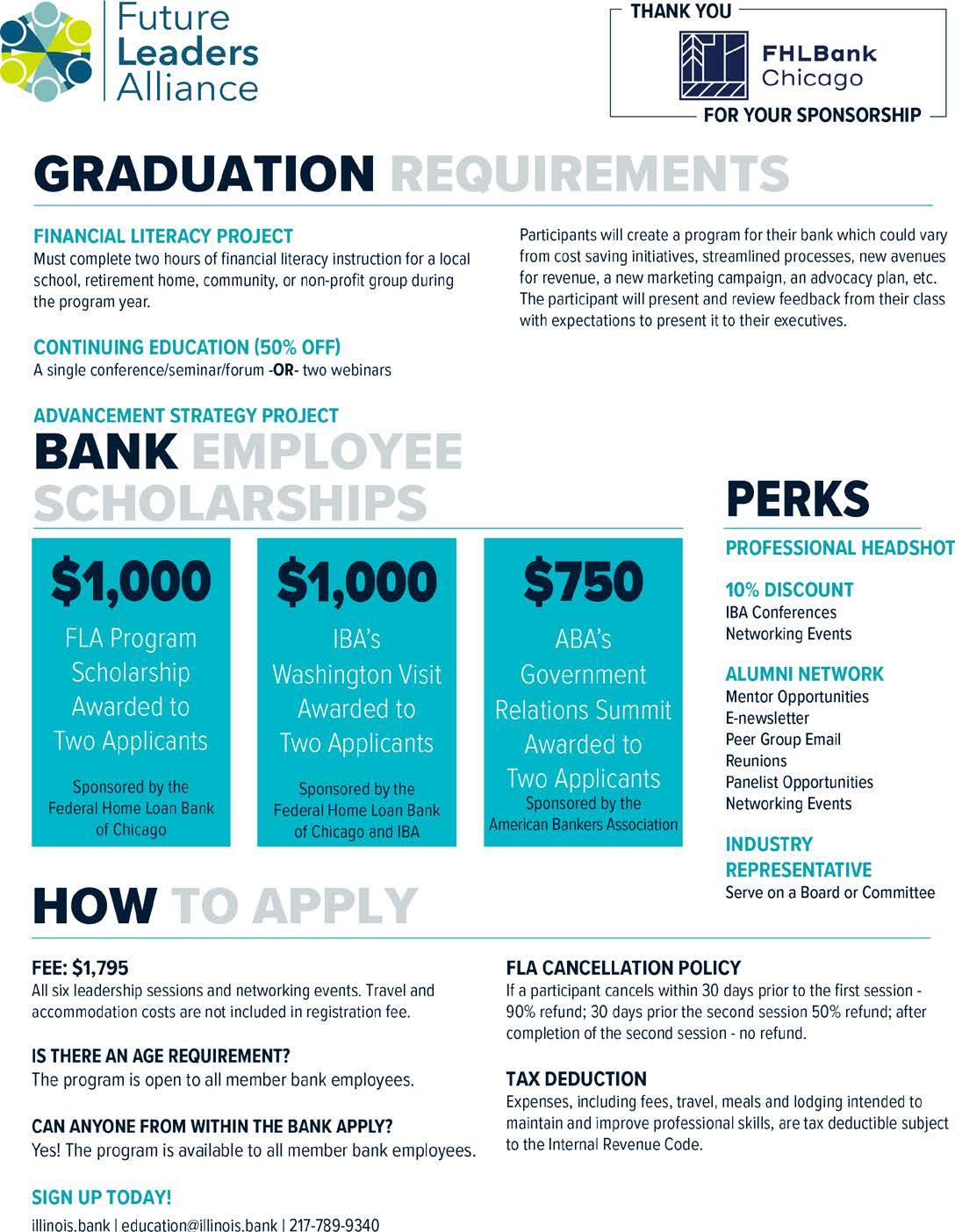

No work is more important than training the future generation to lead beyond where we have gone. A banking career cannot truly be successful if the next generation has not been prepared to excel beyond our achievements. We want to join with you to prepare emerging bankers to lead our great industry for decades to come. Which of your team can you envision as members of the 2023-2024 Future Leaders Alliance (FLA) class?

If you are going to invest in your best and brightest, you must know it is a proven plan. FLA is a 14-month program where bankers spend six 2-day sessions gaining knowledge in accounting, asset

liability, bank profitability, marketing, cybersecurity, fintech, advocacy, leadership, HR, management, and so much more. Over 250 Illinois bankers have graduated from this fantastic program and the training works! FLA graduates are stepping into vital leadership roles in banking. One example is Immediate Past IBA Chair and 2008 FLA graduate Michelle Gross. Michelle not only leads at her bank as the EVP, COO and ISO, she also successfully led the IBA and set the groundwork for our new Strategic Plan!

Now is the time to invest in our industry’s future. Registration is open for the FLA Class of 2024 which will start in February 2023. Scholarships are available! Connect with Rachel at the IBA with any questions at rselvaggio@illinois.bank or go to Illinois.bank to learn more. The training and relationships that your future leaders will receive is truly priceless!

November-December 2022 • • 5 •

C-SUITE

“ Leadership and learning are indispensable to each other.”

– John F. Kennedy

President & CEO, Illinois Bankers

COMPLIANCE CORNER

The IBA Law Department

QUESTION

Regarding the FDIC’s “Supervisory Guidance on Multiple Re-Presentment NSF Fees,” how will the FDIC determine whether our disclosures regarding multiple re-presentment non-sufficient funds (NSF) fees are adequate?

ANSWER

The FDIC’s supervisory guidance regarding disclosures of NSF fees for re-presented transactions focuses on ensuring that they are clear and conspicuous. The guidance suggests that clear and conspicuous disclosures would address the amount of NSF fees and when and how the fees would be imposed, including the following information: “(1) Information on whether multiple fees may be assessed in connection with a single transaction when a merchant submits the same transaction multiple times for payment; (2) The frequency with which such fees can be assessed; and (3) The maximum number of fees that can be assessed in connection with a single transaction.”

We recommend following the FDIC’s suggestion of a “comprehensive review” of your disclosures to ensure that they

QUESTION

cover all three of the specific items mentioned above. Your review also should ensure that your disclosures are clear and conspicuous overall (for example, we might suggest reviewing the wording of your disclosures to ensure that NSF fees cannot be confused with other similar fees, such as overdraft fees).

Note that the FDIC’s guidance suggests reviewing your practices as well as your disclosures. Revised disclosures “may address the risk of deception” but “may not fully address the unfairness risks,” which may arise “if multiple NSF fees are assessed for the same transaction in a short period of time without sufficient notice or opportunity for customers to bring their account to a positive balance in order to avoid the assessment of additional NSF fees.”

Are we required to reimburse our business customer if a check clears their account and is paid, but the intended payee claims they never received payment? The payee is refusing to provide us with an affidavit stating that they did not receive the check, and the bank of first deposit will not reimburse us without it. Additionally, when a customer notifies us of a potential improper payment, do we need to provide them with credit before receiving reimbursement from the bank of first deposit for breach of its presentment warranties? If we have to provide credit during our investigation, what is the time limit?

ANSWER

We believe that whether you need to reimburse your business customer depends on the specific facts of the situation and your agreement with the customer.

The Illinois Uniform Commercial Code (UCC) states that a bank may charge a customer account for an item that is “properly payable,” but it does not provide a specific timeframe for reimbursing a customer for an improper payment. An item is properly payable if it is authorized by the customer and in accordance with any agreement between the customer and bank. If a bank makes an improper payment, the customer can bring an action and have their account recredited. Consequently, whether you must reimburse your business customer depends on if the payment was “properly payable” according to the specific facts of the situation and your agreement with the customer. Because the UCC does not provide a timeframe for reimbursing a customer for an

improper payment, we do not recommend refunding your customer until you have completed your investigation and received reimbursement from the bank of first deposit for breach of their presentment warranties.

Also, we are aware that many account agreements require customers to work with their banks when investigating improper payments, and business account agreements may have even more stringent requirements. For example, Chase’s publicly-available Deposit Account Agreement states that customers must provide all information needed to investigate an alleged error or item and any supporting affidavits and testimony reasonably requested. The agreement also provides that a customer that does not provide the required information forfeits its reimbursement rights and is prohibited from bringing any legal claims related to the check. We recommend reviewing your account agreement for similar provisions.

About the IBA Law Department Our IBA Law Department provides many resources to help our bank members meet their compliance challenges, including a toll-free Compliance Hotline (1-800-GO-TO-IBA) and a dedicated compliance website (www.GoToIBA.com). We also publish a free weekly e-newsletter highlighting the latest regulatory developments, select recent Q&As, and other useful information – let us know if you want to subscribe!

• 6 • • November-December 2022

QUESTION

Are banking personnel required to take off work for five consecutive days? We are an FDIC-supervised bank and would like to remove this requirement from our HR handbook. Also, since our employees can access our system remotely, many sign in even when on vacation to check their email or look something up. How would this impact a requirement to take off work?

ANSWER

We are not aware of any law or regulation requiring bank employees or officers to take vacation, but the federal banking agencies continue to recommend that bank employees take at least two consecutive weeks of vacation each year — along with several alternative recommendations, from rotating duties to having your board of directors review and approve your vacation policy.

The FDIC recommends that banks require their officers and employees “to be absent from their duties for an uninterrupted period of not less than two consecutive weeks . . . in the form of vacation, rotation of duties, or a combination of both activities.” However, the FDIC also recognizes that exceptions to a two-week policy can occur and, in such cases, recommends establishing “adequate compensating controls — such as an effective rotation of personnel — that are strictly enforced,” as well as having your vacation policy annually reviewed and approved by your board of directors.

We also asked the FDIC to confirm that the agency is standing by these recommendations. An FDIC representative confirmed that to safeguard a bank’s assets, banks should have policies in place requiring vacation and/or a rotation of duties to ensure that employees are absent from their normal duties for a two-week period each year.

Regarding access to your bank’s system, the FDIC suggests that “management should consider suspending or restricting an individual’s normal IT access rights during periods of prolonged absence, especially for employees with remote or high-level access rights,” or, at a minimum, monitoring and reporting remote access during prolonged absences.

Additionally, we note that the OCC and Federal Reserve have published similar guidance, and the Federal Reserve has stated that for a required absence policy to be effective “individuals having electronic access to systems and records from remote locations must be denied this access during their absence.”

Note: This information does not constitute legal advice. You should consult bank counsel for legal advice, even if the facts are similar to those discussed above.

November-December 2022 • • 7 •

• 8 • • November-December 2022

Parental Access To Data Of Children? The Answer Is Not That Clear

By John Isaza, Esq., Privacy, Records and Information Governance Partner, Rimon Law

By John Isaza, Esq., Privacy, Records and Information Governance Partner, Rimon Law

Given the growth of on-line access to products and services, including those in banking, who has access to the data collected through the use of such services? Access to and control of data is the centerpiece of several new omnibus privacy laws, such as California’s Privacy Rights Act (CPRA) and similar legislation recently enacted in Colorado, Utah, Virginia and Connecticut. Although adults may control their own data under these laws, the question of who has access to the data of their children is surprisingly murky. This article provides a brief analysis of laws regarding parental access to data of children, with an emphasis on the data of teenagers in the 14-to-17-year range.

Collection of and Access to Data of Children Under 13 Years of Age

Two key factors when it comes to data of children include: 1) the right of an organization to collect the data in the first place, and 2) who has access to that data once collected. As to collection of the data, there is ample regulation that facilitates organizational collection of data of children 13 and under at both the federal and state levels. In California, for example, Cal. Bus. & Prof. Code Sections 22575 and 22580-22582 require organizations to have parental consent to collect the data of those 13 and under. Under the Federal Children’s Online Privacy Protection Act, we have a similar bright line set at the age of 13 (15 USC §§ 6501-6505). Thus, for children 13 and under, processes and policies that include verifiable parental consent for the collection of children’s data have to be established.

When it comes to access, the right of the parent to collect or simply see the data of their children is not as clear. None of the laws give parents specific access, except in a few limited exceptions such as education and medical records. That said, parental access may be presumed at least for those who are 13 and under, since parental consent is necessary to collect it by law. In the absence of specific legislation granting parents access to the data of their children, and to close the ambiguity gap, organizations still may wish to create policies and procedures that specifically grant parents of children 13 and under full access. Such policies may include the right to access and review not only the data but also the chat history of their children.

November-December 2022 • • 9 •

Collection of and Access to Data of Teenagers

Alas, the 14 to 17 age range is a group in no-man’s land. The U.S. patchwork of omnibus privacy regulations coming out of California, Colorado, Connecticut, Utah, and Virginia offer little guidance when it comes to parental control of or access to the data of children in the 14-to-17-year range. In fact, they are silent.

At least one state defines a minor as anyone under 18 (Ga. Code § 20-2-720), so that a parent may have access to a child’s data. However, this definition only applies to academic records. In such limited academic circumstances, a parent would thus have a right to access the academic data of their minor children, including teenagers.

This past September 14, 2022, California also passed into law the California Age-Appropriate Design Code Act (known as the Kids Act), which is regrettably silent as well on the issue of access to the data of

teenagers. On the contrary, the Kids Act requires companies to notify the child if someone is monitoring their online activity, such as a parent or guardian. The crux of the Kids Acts is basically to prohibit companies from: 1) leading children to provide their personal information online and using children’s personal information; 2) collecting, selling or retaining children’s geolocation details; and 3) profiling children. Before offering new online services that are likely to be accessed by kids, businesses also will be required to complete a data protection impact assessment to be provided to the attorney general. Clearly these requirements are targeted at organizations whose online applications are likely to reach children of any age, so banks should be in the clear for the most part, unless for some reason a targeted banking application is created strictly for the use of children.

Outside the U.S., which in theory could apply to any web application open to the public, the European Union’s GDPR recommends strict controls for data of children 16 and under (Article 8.1). However, these are only recommendations, as each individual country has to promulgate its actual law. Most EU countries set the bar lower at 13 and under. Again, for parental access, the data of teenagers abroad ends up in limbo.

Collection of and Access to Data Via Policies and Procedures

To resolve legal ambiguity, organizations need to create policies that are commensurate with general privacy protections and rights. As a general rule, the parents would not have a specified right to request the data

of their children in the 14 to 17 age range, unless the organization makes a business decision to provide for it in its privacy policy and other relevant contractual documents, such as terms and conditions. This analysis would depend on the specific organization and its target audience. As to data of children 13 and under, organizational access to their data is subject to “verifiable” parental consent. By extension, although the law generally is silent on the issue of parental access to their child’s data once collected, it can be inferred from the requirement for parental verification that parents would by extension be entitled to access their children’s data.

When it comes to the data of children in the 14 to 17 age range, in the absence of clear legal guidance, organizations need to assess how much business they might lose when choosing to adopt a similar policy requiring parental consent for older children. To that end, organizations need to consider whether a contract of any sort can be enforced against a minor under 18 (i.e., the minor’s capacity to enter into a contract). Without parental consent, it is arguable that terms and conditions against a minor may not be enforceable, unless the law carves an exception as discussed in the next section for banks.

Impact on the Banking Sector

For banks the capacity to contract argument is exempted under the Illinois statutes. Specifically, Section 45.1 of the Illinois Compiled Statutes states the following:

A state bank may accept deposits made by a minor and may open an account in the name of such minor and the rules and regulations of such bank with respect to each such deposit and account shall be as

• 10 • • November-December 2022

binding upon such minor as if such minor were of full age and legal capacity. The receipt, acquittance or order of payment of such minor on such account or deposit or any part thereof shall be as binding upon such minor as if such minor were of full age and legal capacity.

Although this statute specifically allows a minor to open a bank account and make deposits, a bank may nonetheless create a policy across the board that a parent has access to all data of their child up to the age of 18, not limited to just their bank account information. This policy could be disclosed to the minor when the account is created. Such a policy may include access to chat histories, data of a minor collected through the website, and other such non-account specific applications that a bank may offer.

If the above approach seems too uncompromising as to teenagers, then the unfettered access of the parent can be limited to either a certain age group (e.g., 16 and under) or to certain kinds of online activity (e.g., banking transactions, but not chat history). The good news here is that the financial institution is at liberty to set its own policy based on its relationship with the customers and their demands.

On the whole, to be safe, the organization may simply adopt the same policy and approach across the board for anyone under 18. And, if the parental access to data is a sticking point for those ages 14 to 17, then as a last resort the organization may specify a carve-out from parental access for those in that age group.

About the Author John Isaza is a partner at Rimon Law, where he chairs the privacy, records management, and information governance practice. Mr. Isaza is one of the world’s foremost experts in the field. He has developed information governance and records retention programs for some of the most highly regulated Global 1000 companies. He is co-author of 7 Steps for Legal Holds of ESI & Other Documents, a contributing author to the ABA’s Internet Law for the Business Lawyer, 2nd Edition, as well as Editor-in-Chief and co-author of Handbook on Global Social Media Law for Business Lawyers. Mr. Isaza is past co-Chair of the American Bar’s Social Media Subcommittee, a Fellow of ARMA International, and current coChair of the ABA’s Consumer Privacy and Data Analytics Subcommittee. John may be reached at John. Isaza@RimonLaw.com or on his cell at +1(949) 632-3860.

November-December 2022 • • 11 •

How to Partner with Customers to Fight Fraud

by Matt Herren

The holiday season brings us many joys: delightful presents, special meals, family traditions, new beginnings and more. But the season also is becoming known for a not-so-pleasant surprise—an uptick in the already troublesome issue of financial fraud.

Financial institutions pay the price for such fraud, in more ways than one. Not only do they foot the bill for installing fraud detection tools, but they also eat the dollars lost to fraud and sometimes even lose customers who blame them for breaches or hacks related to their products or services.

In addition to using artificial intelligence, biometrics, behavioral analytics, and other tools to combat fraud this time of year, don’t forget about the greatest non-technical tool in your defensive arsenal: customer communications.

Current Holiday Fraud Scams

The holidays are the ideal time for financial institutions to tackle the thorny issue of fraud with their customers. Financial crimes—cyber and physical—occur year-round, but between Thanksgiving and New Year’s, they tend to spike.

Financial criminals take advantage of increased credit card activity and busy consumers. To exacerbate this issue, the holidays are prime vacation time for bank staff members, leaving institutions short-handed at the very time they face more transactions and more fraud attempts.

Therefore, it takes a concerted effort between institutions and their customers to fight this holiday scourge. Make customers aware of the most popular scams to ensure they don’t fall victim to the con:

u Charity scams: From fake charities to bogus crowdfunding, please, exhort your customers to investigate the legitimacy of anyone asking for donations and encourage them to stick with wellknown charities or causes.

• 12 • • November-December 2022

u Too-good-to-be-true deals: Consumers are bombarded with emails and social media posts about unbelievable shopping and travel deals throughout the holiday season. Caution your customers to be wary, as criminals are adept at creating fake lookalike websites, which lead to non-delivery of items paid for, stolen credit card information, and/or malware on consumer devices.

u Package delivery scams: The Better Business Bureau warns that this type of scam prevails during the busy holiday shopping season. Fraudsters will send phishing texts or emails posing as delivery notices with fake—and malicious—tracking links. Such schemes seek to gain the recipient’s personal information or incite them to download malware. Before taking any requested action, consumers should attempt to confirm the legitimacy of texts, emails, or paper notices about delivery issues or missed deliveries.

u Gift card fraud: Hackers target gift cards by tampering with them in stores or coercing victims to pay for items with pre-paid gift cards. Encourage customers to always purchase gift cards from trusted stores and exercise caution if a seller pressures them to make a payment via gift card.

Encouraging Customers to Actively Participate in Fraud Prevention

Arm customers with ways that they can actively safeguard themselves against fraud during the holiday season and beyond. Sharing these valuable tips also will, in turn, help protect your institution and its reputation.

u Check bank accounts: Remind customers that digital banking makes it possible for them to monitor their bank and credit card accounts at any time between statements, which is a wise thing to do. The quicker they report suspicious activity or unrecognized transactions, the sooner the fraud can be stopped.

u Chip over swipe: According to a report by Visa, over 80% of U.S. merchants now have chip card readers, and for those businesses, EMV technology has reduced point-of-sale fraud by 87%. In fact, nearly 80% of all card present transactions in the U.S. from July 2020 through July 2021 were chip-based. Make sure your customers know that their cards are far less likely to be hacked when they dip their chip instead of swiping their card. Additionally, contactless payments—which offer consumers the opportunity to tap or hover their card over a terminal’s contactless symbol—are just as secure as inserting an EMV card.

November-December 2022 • • 13 •

How to Partner with Customers to Fight Fraud -

u Private, not public: Help customers understand that it is not safe to conduct online shopping or banking when on public Wi-Fi. The only way to ensure that hackers are not eavesdropping on your activity—and pilfering your credit card or personal information in the process—is to use password-encrypted private Wi-Fi or a virtual private network

u Do not take a pass: When consumers use weak passwords, their accounts are vulnerable. Worse yet, if they use the same password for multiple accounts, they are exponentially at risk. Explain to your customers the importance of using a strong and unique password for each account and utilizing multi-factor authentication for important accounts whenever available.

u Get notified: Your customers also can take the proactive step of using available card technology to protect themselves. This includes taking full advantage of On/Off card features and setting up card purchase notification features for both debit and credit cards.

Partnering with Customers to Fight Fraud in 2023

Since fraud can have far-reaching effects, it is worth the time and effort to use all communication vehicles at your institution’s disposal to prevent it including statement and website messages, social media posts, texts, emails, and inperson interactions.

And the messaging does not have to end when the new year begins. Routine cybersecurity dialogue throughout the year benefits everyone. Download CSI’s white paper to learn more about how you can mitigate risk for your institution, its staff, and customers during the holiday season and beyond by prioritizing cybersecurity education.

About the author Matt Herren is the Director of Payment Strategy at CSI. With a strong focus on emerging technologies and how they apply to the financial industry, Matt has led CSI’s effort to drive innovation in the payment space. In his role, Matt has worked to enhance customer experience and helped direct innovative product offerings to increase bank profitability, allowing banks to realize industry-leading results and maximize program performance.

• 14 • • November-December 2022

continued

November-December 2022 • • 15 •

• 16 • • November-December 2022

November-December 2022 • • 17 •

BankTech Conference October 6 Chicago Marriott Southwest at Burr Ridge

The 2022 BankTech Conference was a huge success! Thank you to the bankers, innovators, and sponsors who attended and supported the conference. This event featured fintech experts and innovators who identified innovative products/ services and potential partnerships while considering risk factors in developing Fintech strategy and associated processes. A special thank you to our co-sponsoring state banking associations: the Indiana Bankers, Michigan Bankers, and Ohio Bankers League.

Mark

• 18 • • November-December 2022

your calendars for the 2023 BankTech Conference on October 5 in the Chicagoland area.

Above: Attendees listened intently as the latest innovative solutions were presented. Below: Vendors were on hand to talk with attendees and answer their pressing questions.

WINDSOR ADVANTAGE’S Q&A CORNER BANKTECH CONFERENCE

A Special Thank You to the BankTech Innovators

Kirk King, CEO, Continuity Programs

Continuity Programs offers CRM software with automated marketing campaigns for companies throughout the U.S. Plus, we sell marketing products that can be purchased online through our storefronts by individuals and small businesses.

Nick Podhradsky, Executive Vice President-Sale, SBS CyberSecurity

SBS CyberSecurity is a premier cybersecurity consulting and audit firm. Since 2004, SBS has assisted organizations with implementing valuable risk management programs and mitigating cybersecurity risks.

Ben Hinc, Senior Solutions Consultant, Baker Hill

Baker Hill, a trusted advisor to financial institutions, provides loan origination, relationship management, and business intelligence/predictive modeling solutions to help banks generate growth, increase profitability, mitigate risk and strengthen customer relationships.

superior online experience that today’s customers expect. We provide software as a service (SaaS) solutions, partnering with lenders to create next-generation digital capabilities that help protect and grow your business.

Megan Sheehan, Director, PMO, Technology Advisors, Inc. Technology Advisors is a global business and technology consulting company that provides services for CRM implementation, project management, sales automation, analytics, and other business functions. Our goal is to help customers drive more revenue by successfully utilizing their software mix for automation, departmental alignment, and streamlined services.

Nellie Szczech, EVP, Institutional Relationships, BHG Financial

BHG Financial is transforming the financial industry, leveraging the power of data, and analytics and cutting-edge technology to become not only the number one source for professional loans but the creator of the largest community bank network in the country.

personal, professional, results-oriented services designed to provide a competitive advantage in an ever-changing industry. We provide Asset Liability Management (ALM/IRR) Reporting and actionable advice, including numerous ALM-related reports.

Jim Quinn, Director of Financial Institution Partnerships, Upgrade, Inc.

Upgrade, Inc. is a marketplace lender, facilitating the origination of ~$3 billion in personal loans since inception. We partner with community banks to give them access to prime consumer assets for income goals, customer base growth, and co-branded digital solutions.

John Gust, Director of Product Management, Promontory MortgagePath LLC

Paul

D.

Lehnert, Director of Business Development, Lenderful Solutions

Lenderful Solutions is an innovative technology company created to help lenders offer a

Dave Prost, Chief Sales Officer, McQueen Financial Advisors

We provide financial institutions with expert,

Promontory MortgagePath offers mortgage technology and end-to-end fulfillment services that help banks build value and expand relationships with their customers. Our solutions give banks a mortgage business that can withstand all market conditions by providing the technology, including a POS and LOS, and end-to-end fulfillment services, such as processors, underwriters, and closers, required to grow their businesses profitably.

November-December 2022 • • 19 •

Event announcements were led throughout the day by event emcee (l) Eric Geiger, Chief Technology Officer for FHLBC. (r) Aditya Menon, Head Product & Strategy for NetXD Inc., presented "Digital Disruption and the Future of Banking.

Thank you to our sponsors!

A Special Thank You to the BankTech Innovators

Har Rai Khalsa, VP, General Manager of Digital Account Opening & Loan Origination, Alkami Alkami Technology, Inc. is a leading cloud-based digital banking solutions provider for banks in the U.S. The Alkami platform enables clients to personalize their digital banking experience and build a thriving digital community poised for growth in a digital-first banking world. In addition to providing a modern and frictionless user experience, Alkami’s clients benefit from a secure and proven system architecture of continuous innovation on a single code base.

Larry Hall, Director, AI Solutions and Partnerships, Finlytica

Finlytica is an out-of-the-box analytics solution that helps banks grow their business quickly and cost-effectively through improved data insights using the institution’s data enriched with external data. The fully managed solution delivers a consolidated view of customers and portfolios, along with pre-built AI and datadriven insights into customer attrition, target customer segments, profitability, revenue growth opportunities, personalized marketing, BSA and AML, customer experience, and operations.

Chris Soyke, Strategic Financial Services Leader, UFS LLC

UFS is a bank technology outfitter with a simple promise to make technology work

for community banks so they can focus on banking. Owned by community banks, partnering only with banks, regulated like a bank, and heavily staffed with former bankers, UFS is accountable for providing purpose-built technology solutions that empower banks to thrive and achieve their own unique goals.

Rob Bradford, Security Operations Manager, Aunalytics

Aunalytics is a data platform company that delivers insights as a service to answer your most important IT and business questions.

Dave Detweiler, Managing Director, SEI Sphere SEI is a financial institution providing technology operations and investment processing solutions to other financial institutions. The business has approximately 4,000 employees and $1B in revenue (Publicly traded, Nasdaq: SEIC). We’ve built cybersecurity and network operations solutions to support this business and are offering them as managed services to community banks.

Todd Koehn, Vice President – Faster Payments Solutions, Bankers’ Bank Bankers’ Bank is the Midwest’s leading provider of banking services to community banks, with offices in the Madison, Chicago, Des Moines, and Indianapolis areas serving the four-state

region and beyond. As an independent source of non-competing financial services, the Bank serves a market of over 700 financial institutions. The Bank does not serve the public, so it never competes with client banks for business.

Matt Janoski, Senior Manager, Wipfli LLP Wipfli LLP ranks among the top 20 accounting and business consulting firms in the nation. For more than 90 years, our financial institutions practice has educated, advised, and assisted financial institutions in successfully navigating the complex and ever-changing environment they face. Let our professionals help you with regulatory compliance, profit improvement, risk management, strategic planning/board development, IT services/cybersecurity, HR consulting, and audit and tax services.

Cara Beth Hunt, Vice President, External Applications and Product Director, FirsTech FirsTech Inc. has been a multi-faceted payment solution and technology firm since 1984. FirsTech’s Financial Institution Technology Solutions include Electronic Payments, Mobile Solutions, Telephone Payments, In-Person Payments, Remittance Processing, Merchant Services, and many more. FirsTech is a leading technology partner that assists clients in achieving their business objectives.

• 20 • • November-December 2022

WINDSOR ADVANTAGE’S Q&A CORNER BANKTECH CONFERENCE

November-December 2022 • • 21 •

Advantage Illinois Helps Lenders and Small Businesses Create Jobs by

to

By Sean Prichard, Assistant Deputy Director Business Development, Illinois Department of Commerce and Economic Opportunity

Enhancing access to capital for Illinois businesses is a top priority. Small businesses are the backbone of the Illinois economy, and by working with the state’s banking community and venture capitalists, the Illinois Department of Commerce and Economic Opportunity (DCEO) and the Advantage Illinois program are here to assist. Through this program, we help entrepreneurs and small businesses start up, expand, and create new jobs at a faster rate.

Advantage Illinois is structured through participating institutions purchasing a portion of the loan, lowering the risk for lenders. Participating lenders accept business applications on a rolling basis and use their own underwriting standards and loan processes to provide financing to small businesses, with the Department’s share being primarily subordinated and at lower interest rates.

To aid our lending partners, the Department assists with loans and projects that have gaps preventing businesses from obtaining financing such as equity and collateral shortfalls, lack of historical cash flow (or startup businesses), low credit scores, and negative net worth. Ultimately, Advantage Illinois is designed to assist

small businesses with gaining access to capital. We are working together for a better Illinois and know that small businesses are the backbone of the Illinois economy.

What

can an Advantage

Loan be used for:

Illinois

• Real Estate (must be 51% or more occupied by the business)

• Inventory Purchases

• Equipment Purchases

• Leasehold Improvements

• Working Capital

• Accounts Receivable

What is not eligible for an Advantage Illinois Loan:

• Non-Profits

• Cannabis

• Investment Real Estate

• Goodwill related to change in ownership

• Tobacco

• Some restrictions on Industries

To date, Advantage Illinois has worked with over fifty lenders to assist businesses with financing, and we continue to add new lenders on a rolling basis. As this is not a direct loan program, we cannot do these participation loans without

the assistance of our participating institutions. There are no fees for lenders to sign up or to utilize Advantage Illinois, nor are there fees from the State on term loans.

In 2021, Advantage Illinois was able to assist 51 business with financing, lending out over $7.8 million. As of Q3 2022, Advantage Illinois has assisted 75 businesses with financing, lending over $16.1 million. As we continuously support small business growth in Illinois, we invite lenders and businesses to reach out to learn more!

Advantage Illinois consists of two programs, the Standard Advantage Illinois Program, and the Fund for the Advancement of Minority Enterprises (FAME) Program.

History of Advantage Illinois: 2010

o Advantage Illinois was funded under the State Small Business Credit Initiative, or SSBCI 1.0.

o The State of Illinois was allocated $78,365,264 and all the allocation was lent out to businesses.

2017 o

Federal Government turned over SSBCI 1.0 to the States.

• 22 • • November-December 2022

Standard Program FAME Program Maximum Participation The lesser of: • 25% of the Project (all sources of funding) • 50% of the Loan • $1.5 Million The lesser of: • 50% of the Project (all sources of funding) • 50% of the Loan • $400,000 Maximum Term Length 10 Year 7 Years Amortization Yes Yes Rate Fixed at 2% below the lender rate with a floor of 2% Rate is fixed at 2% Job Creation or Retention Each $50,000 participated by DCEO: One full time job should be created or retained in the next two years Each $65,000 participated by DCEO: One full time job should be created or retained in the next two years

The

Enhancing Access

Capital

For more information please visit www2.illinois.gov/ dceo/SmallBizAssistance/ AdvantageIllinois/Pages/ default.aspx or contact us at CEO. AdvantageIllinois@Illinois.gov.

o Advantage Illinois became a staterun program and uses recycled funds from the original SSBCI 1.0 to loan to businesses in Illinois. 2021

o SSBCI 2.0 was created with $10 billion set aside under the American Rescue Plan Act of 2021

o Illinois is going through the applications with the federal government to receive another allocation to be used for lending.

o Treasury will disburse funds to the states after approval.

Since its inception, Advantage Illinois has impacted numerous entrepreneurs and small business startups, and we continue to work with the Treasury to receive additional funding. Advantage Illinois will continue its goal of partnering on more loans and projects, reaching more businesses throughout Illinois’ communities.

Lastly, we want to invite anyone who is interested in learning more about Advantage Illinois to reach out to the Department of Commerce & Economic Opportunity. This program is an extremely useful tool for Illinois businesses and the banking and lending community. We offer training seminars, presentations to both lenders and businesses, and are always excited to speak with those who are interested in learning more. Advantage Illinois is not possible without our lending partners, and we look forward to working with new participating institutions as we enhance access to capital for Illinois businesses.

November-December 2022 • • 23 •

• 24 • • November-December 2022 PREFERRED VENDOR

November-December 2022 • • 25 •

VENDOR

PREFERRED

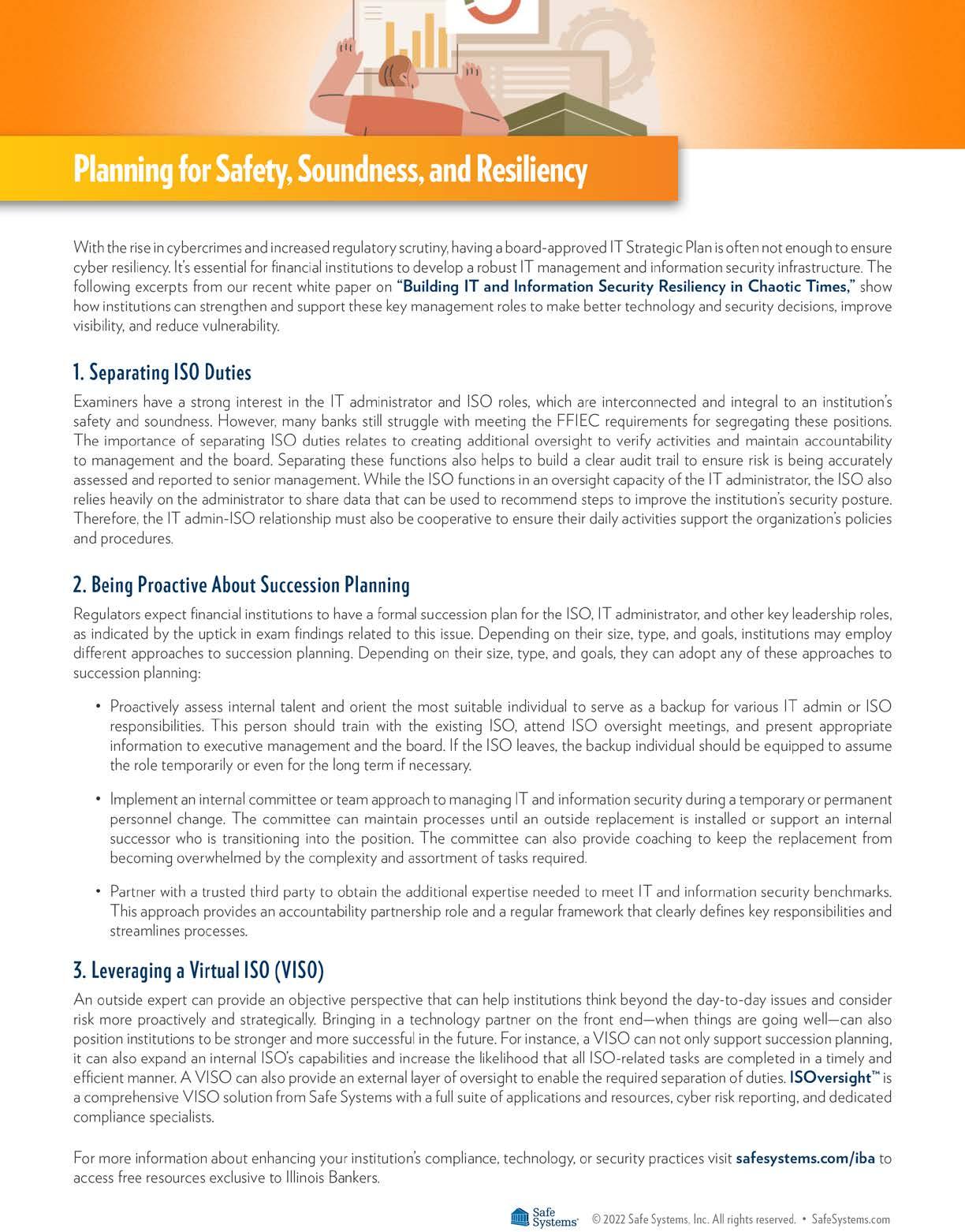

Understanding balance sheet impacts in uncertain times

Uncertain economic times lead to market volatility and shifting rates, calling for an active, tailored and disciplined approach to balance sheet management. BOK Financial Capital Markets works with community banks and credit unions, providing guidance to meet the unique needs of institutions, their goals, and risk profiles. Trusted financial experts should provide actionable insight that helps keep senior management focused on what matters most—our goal is to help clients formulate a strong, flexible strategy to avoid impacts to earnings and maximize performance.

Kent Musbach, SVP and team lead, as well as Marc Gall, VP and A/L strategist, share a glimpse of recent client discussions.

Rising interest rates

As expected, the Fed recently began tightening monetary policy, projecting a significantly higher target rate ahead. As this cycle ages, it’s important to monitor the shape of the curve, as well as the relative performance across spread and risk assets. A key topic with clients involves how potential rate changes impact the balance sheet and investment portfolio, with Musbach and his team helping

institutions anticipate and plan for all rate scenarios. Among considerations are effects of a flatter curve or depositto-loan pricing adjustments. Musbach said, “We ask if clients have a forwardlooking, adaptable strategy to perform best in differing rate environments, as relying on current projections may prove costly.”

Persistent inflation

Long considered stable, and recently “transitory,” inflation persists at 40year highs. Though assumed to recede, variables for consideration include:

-Will interest rate expectations change?

-Will supply chain issues ease?

-Will hiring accelerate?

As Musbach observes, the stock market or housing could react negatively, and an economic slowdown may occur. Alternatively, consumers may tap savings, heating up inflation.

Compressed net interest margin

Financial institutions also must counter shrinking margins, as pandemic-related activity and fees only softened the blow of a worsening industry trend—and it’s important to consider any longer-term margin levers to pull.

“Our goal is to understand each individual institution, provide actionable insight and strategy, ultimately leading to decisions that suit the client, their goals and objectives best.” -Marc Gall.

Securities, Inc.,

November-December 2022 • • 27 •

Advertorial

Sign up to receive invitations to upcoming webinars bokfinancial.com/webinars | 866-440-6514 www.bokfinancial.com/institutions

Bank dealer services offered through Institutional Investments, Bank of Oklahoma, which operates as a separately identifiable trading department of BOKF, NA. Services may be offered under our trade name, BOK Financial Institutions Group. BOKF, NA is the bank subsidiary of BOK Financial Corporation. Some services may be offered through BOK Financial

member FINRA/SIPC, and an affiliate of BOKF, NA. Investment products are: NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

WOMEN IN BANKING CONFERENCE

Women in Banking September 13-14

Crowne Plaza Springfield

We were thrilled to join women peers from across Illinois on September 13-14 for the 21st Annual Women in Banking Conference in Springfield. The last two years have been challenging and rewarding in many ways. This conference allowed women leaders from all positions to gain strategies for personal and professional career growth, learn new ideas to help their banks thrive, and network with fellow peers. A special thank you to our emcee and speaker Dianne Barton. She was instrumental in guiding us to leave the conference REFRESHED, RENEWED, and HEALED. This unique conference is one that every female banker should attend.

We raised $1,200 for this worthwhile cause benefitting Wooden It Be Lovely. Margaret Ann Jessup, WIBL Executive Director, was a special guest to answer any questions about this program. Marcia Stratton, IBA's Director of Finance, helped sell tickets for the silent auction event.

Now is the time to etch in your calendar the 2023 date of September 13-14 at the Crowne Plaza in Springfield.

•28 • • November-December 2022

The banker panel, led by emcee Dianne Barton, was a huge hit with attendees! (list panelists)

Everyone had a great time participating in the silent auction with proceeds benefiting Wooden It Be Lovely.

IBA's Debbie Jemison and Robin Lane along with Cindy Fultz, Hoyne Savings Bank, and Betsy Johnson, IBA Chair and President & CEO of Solutions Bank, greet attendees at the registration desk. Attendees enjoyed the many opportunities to network!

Thank you to our sponsors!

Jan Schramm Received 2022 President's Award

Congratulations to our 2022 IBA President's Award recipient, Jan Schramm! The award presentation was presented to Jan at her workplace, Hickory Point Bank & Trust, as a surprise on Friday, September 2nd. The award is presented annually to an individual who has been a champion for women in the banking industry.

“Being a mentor to women is high on my priority list because I want them to excel farther than I have in my banking career. And that’s my goal, always has been. If you lend a hand out, you can lift the next person up.”

Jan Schramm, Senior Vice President Treasury Management Services, Hickory Point Bank & Trust 2022-2023 Chair, IBA Women In Banking Committee

November-December 2022 • • 29 •

Keynote speaker Joyce Marter, National Public Speaker and Mental Health Expert, presented many tips and ideas to improve your mental and financial health.

Randy Hultgren, IBA President & CEO, presents Jan with the 2022 President's Award.

The food trucks were a huge hit with WIB attendees!

(far left) Tony Nestler, IBA Vice-Chair, President and CEO of Hickory Point Bank & Trust, and colleagues congratulate Jan on this special accolade.

Utility Prices on the Rise

According to the Energy Information Administration (EIA), the cost of natural gas for power generation more than doubled in 2021, accounting for much of the rise in electricity prices. A variety of factors have contributed to the rise in natural gas (and subsequently electricity) prices, and while no one can predict where prices will go in the coming months, what you can do is take the right steps to have an effective energy management plan in place.

What’s behind the increases?

A combination of Russia’s war in Ukraine and weather are driving U.S. natural gas prices to some of the highest points in years. Low natural gas storage levels, paired with the increased demand both domestically and overseas are contributing, and while a mild winter and an end to the war in Ukraine could bring prices back down, the current landscape has been yielding high power prices.

A key factor to keep top of mind is the fact that electricity is closely tied to natural gas. The general rule of thumb is that where natural gas prices go, electricity prices follow. Retail electricity prices are largely driven by natural gas prices, which are driven by several related factors, including supply & demand. We are currently experiencing both rising demand AND a tighter supply.

For example, in Illinois, MISO capacity rates jumped nearly

fiftyfold after multiple coal plant operators announced early closures.

The Midwest sub-region cleared at $236.66/MWd vs. $2.88/MWd in the South region.

What does it mean for businesses in deregulated states?

As a business in a deregulated state for electricity and natural gas, you have options, including shopping for a more competitive supply agreement.

To start, consider:

• Locking in sooner rather than later: One approach is to get out ahead of the market. Generally, we recommend that our clients at least test the waters of the market 12 to as much as 24 months before their existing contract ends. While we do not know if prices will be higher or lower in the future, what we do know is energy market volatility increases as the start date gets closer, primarily due to the impact of weather.

• Looking to the future: Additionally, looking further out can be beneficial as well. The “outer years” still represent a good buying opportunity and an effective way to combat higher near-term prices.

Besides securing the best price, what other factors should I consider?

As an organization in a deregulated state with energy choice available to you, the first place to start is by

Contact the IBA’s dedicated energy consultant, Jamie Polend, today at: jpolend@appienergy. com or 667.330.1158.

assessing your current power supply contract and pricing. A few questions to start with are:

1. Are your contract terms favorable?

2. Are you seeing unexpected charges or line items on your invoice?

3. Are you hedging against market volatility?

4. Have you secured the best pricing and/or contract length?

What if energy choice is not available to my business?

By taking steps to reduce your usage and demand, you can lower your overall energy expenses. Local distribution costs are impacted by your peak demand levels so reducing the peaks can bring significant savings. Additionally, you can:

• Reduce demand: The lowest priced kilowatt hour is the one you don’t use. By reducing your usage and reducing your demand, you can take more control of your future energy expenses even though prices are high.

• Explore efficiency and sustainability projects: Taking steps to increase energy efficiency provides a viable path to reduced energy usage. Energy optimizations include HVAC upgrades, lighting retrofits, advanced metering technology, weatherization of facilities, and peak load scheduling.

A great place to start is by talking to our team at APPI Energy. Our data-driven approach coupled with our proven, 26year history and extensive experience working with banks in Illinois, allows us to provide custom solutions for navigating the ever-changing energy markets.

November-December 2022 • • 31 •

Advertorial

AG BANKING CONFERENCE

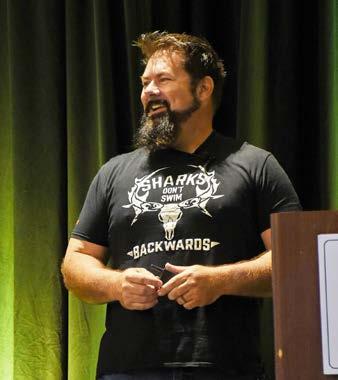

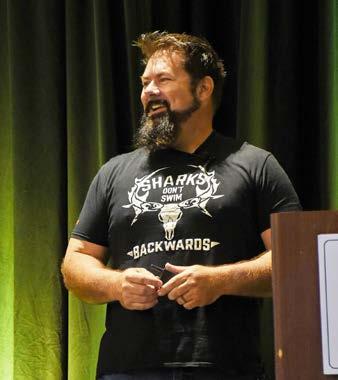

Ag Banking Conference

August 24-25

Crowne Plaza Springfield Day 1 of the Ag Banking Conference kicked off with an amazing presentation by Rob Sharkey, known in digital circles as The Shark Farmer! Rob shared his story of becoming an agricultural media giant! This was an emotional and challenging presentation as Rob expressed his sadness of the recent passing of his son, Eian. Attendees were moved by his strength and will never forget this event. Attendees on Day 2 of the conference were greeted by a presentation from Illinois State Treasurer, Michael Frerichs, on the Ag Invest program. Ag Invest is the nation’s most expansive agriculture deposit program, helping financial institutions serve their clients in the agricultural industry by providing below-market rate loans to start, expand or add value to their farm operations.

• 32 • • November-December 2022

Tim Ohlde, CEO, Country Banker Systems, engages the audience during his presentation, Effective Balance Sheets Lead to Uniformity and Consistency.

Illinois State Treasurer Michael Frerichs provides an update to the attendees.

Ink in your calendars the 2023 Ag Banking Conference for August 23-24 at the Crowne Plaza in Springfield.

November-December 2022 • • 33 •

The Shark Farmer Rob Sharkey shares his industry perspectives and deeply emotional story of the recent loss with the audience.

Ed Elfmann, ABA’s Senior Vice President of Agriculture and Rural Banking Policy, presents a Washington D.C. update on federal policy and redistricting.

Plow Forward with Competitive Loan Strategies was presented by Travis Schroll, Institutional Sales Director for the Federal Home Loan Bank of Chicago.

• 34 • • November-December 2022

Advertorial

Fall Golf Outing September 29 Pekin Country Club

A gorgeous fall day was the backdrop for this annual membership event. More than 80 players and staff members were in the clubhouse and on the greens to wind down their golf season. A day out of the office to enjoy meeting new friends and reconnecting with others made for a perfect day. We thank everyone for their participation!

• 36 • • November-December 2022

WINDSOR ADVANTAGE’S Q&A CORNER FALL GOLF OUTING

We look forward to seeing you on the first tee at the 2023 Fall Golf Outing. A date and location to be announced in the new year!

November-December 2022 • • 37 •

November-December 2022 • • 39 •

Belvidere

FIRST NATIONAL BANK OF OMAHA HIRES SCOTT BLOOM AS FINANCIAL ADVISOR

First National Bank of Omaha’s (FNBO) First Investments & Planning (FIP) group has hired Scott Bloom as Financial Advisor, announced Jennifer Benson, vice president, Financial Advisory Services. In his role, Bloom will provide comprehensive financial planning, investment management, and insurance services to clients and customers. He joins Sue Appleby, Financial Advisor, at the First Investments & Planning office. Appleby is the former owner of Compass Wealth, an independent Raymond James advisor practice, which FIP acquired earlier this year. Bloom will work with Appleby as she transitions existing customers to FIP while continuing to build her successful business, Benson said.

Bloom has more than 20 years of experience in the financial services industry and joins FNBO from PNC Investments, where he served as a financial advisor. Bloom holds Series 7 and 66 securities registrations along with Life, Health, and Annuities insurance licenses. He earned a bachelor’s degree from Loras College in Dubuque, Iowa.

Chicago

BYLINE BANK

Byline Bank welcomes Robert Baitler as Vice President, Business Banking. Baitler’s banking career spans nearly 30 years working for multiple regional financial institutions. Originally from Michigan, he relocated to Illinois in 2003 and is passionate about working with small business owners. As part of the recently-expanded business banking team, his primary objective at Byline is to help businesses grow and maximize their cash flow position.

Itasca

ITASCA BANK & TRUST COMPANY

Angela Bowen has been promoted to Assistant Vice President, Loan

Operations Manager. She began her career with Itasca Bank & Trust Co. in April of 2021 as the Loan Operations Officer and Assistant Manager. Bowen holds a bachelor’s degree in Economics and Business from Monmouth College and a master’s degree in Economics from the DePaul Kellstadt Graduate School of Business. She has close to two decades of loan operations and credit experience.

Thomas Hatzis has joined Itasca Bank & Trust Co. as Vice President, Commercial Loan Officer. He has over 20 years of banking experience in both underwriting and commercial lending, which will serve the commercial customers well. He was most recently employed by a large Chicago area bank.

Michael Pallares has been appointed Vice President, Real Estate Lending at Itasca Bank & Trust Co. With over 25 years of combined banking and mortgage industry experience, he will focus his efforts on providing financing for owner-occupied and non-owner occupied residential and commercial real estate properties, along with small business and consumer loan requests. Pallares holds a bachelor’s degree both in Finance and Economics from Lewis University and an Executive MBA from Northern Illinois University.

Brian Severson has been appointed Senior Accounting Officer. This is a newly created role within the Administrative Services Department. Severson holds a bachelor’s degree in Finance from the University of Iowa. He has over 25 years of experience in accounting, most recently with a large Chicago area bank. Severson resides with his family in Western Springs, IL.

Claribel Veslino has been appointed to the position of Operations Officer, Customer Service Manager at Itasca Bank & Trust Co. With over twenty years of management experience in the banking industry, she most recently served as the Branch Manager at a Chicago area bank. Veslino holds a bachelor’s degree in Business Management and Computer Information Systems from DePaul University.

• 40 • • November-December 2022

ON THE MOVE

Severson

Veslino

Whitaker

Walker

Shifrin

Bloom

Baitler

Bowen

Hatzis

Pallares

Lena B. Whitaker has joined Itasca Bank & Trust Co. as the Trust Operations Officer in the Trust Department. She has over 15 years of Wealth Management Operations experience. She was most recently employed by a regional bank in the Chicago area. Whitaker has a Bachelor of Arts Degree in Business Administration and Management from Illinois Wesleyan University and a master’s degree in Business Administration from the University of Pittsburgh Katz Graduate School of Business. She is licensed as an accredited Trust Operations Professional.

Waukegan

NORTH SHORE TRUST AND SAVINGS

In July, North Shore Trust and Savings announced the promotion of Nathan E. Walker to Chief Executive Officer. Walker has been with the Bank since 1996 and served as President and Chief Operating Officer since November 2020. He received a BS Degree in Finance and Business Management from the University of WisconsinParkside and received an MBA in Business Administration from Cardinal Stritch University. He is a graduate of the Graduate School of Banking at the University of Wisconsin-Madison.

Springfield

TOWN AND COUNTRY FINANCIAL CORPORATION

Town and Country Financial Corporation (OTC: TWCF) is happy to announce that Denise Skiles has been promoted to Executive Vice President, Chief Financial Officer, following the retirement of Ed Depenbrok as of September 30, 2022.

Skiles joined Town and Country Bank in 1982 and has decades of experience in financial management, accounting and reporting, bank operations, and business analysis. Throughout her tenure at Town and Country Bank, Skiles has seen the company grow from $51 million in assets to approximately $900 million and expand throughout Central and Southern Illinois.

Town and Country Financial Corporation previously announced on August 23, 2022, an agreement to merge with HBT Financial, Inc. The transaction is expected to close in the first quarter of 2023, subject to regulatory approvals and other customary closing conditions.

Depenbrok joined Town and Country Bank as the interim Chief Financial Officer in 2020, bringing over 40 years of banking and leadership experience to the company. Using a combination of strategic planning, financial reporting, and business analysis skills, Ed has significantly contributed to the growth and success of Town and Country Financial Corporation.

Woodstock

AMERICAN COMMUNITY BANK & TRUST

American Community Bank & Trust welcomes Jane F. Shifrin, a banking industry veteran, as Vice President of Commercial Lending. Jane joins the bank with a twenty-five-year track record in the Chicago market. Jane has built strong connections throughout Chicagoland, helping businesses meet their financial and investment goals, providing customized lending solutions, and offering expert guidance at critical times. In addition to her commitment to community service, Jane is committed to the growth and success of each client relationship. Jane resides with her husband and three children in Buffalo Grove, Illinois.

November-December 2022 • • 41 •

Stephen G. Lear, who previously served as Chief Executive Officer of the Bank continues as Chairman of the Board of Directors of the bank.

ADVERTISING INDEX Advantage Illinois 217-522-5687 CEO.Advantageillinois@illinois.gov 21 Bankers’ Bank 800-388-5550 bankersbank.com 30 Howard & Howard Attorneys PLLC 312-372-4000 www.h2law.com 15 IntraFI Network 703-292-3423 www.IntraFi.com 26 LKCS 866-552-7866 lk-cs.com 2 MIB – Midwest Independent BankersBank 800-347-4642 mibanc.com 48 SEI Sphere 610-676-3541 www.seic.com/sphere 14 Wipfli, LLP 800-486-3454 wipfli.com 11

SEMINARS, CONFERENCES AND FORUMS

1-2 Future Leaders Alliance Class of 2024, Session 1 Scan the code to learn more > Or visit my.illinois.bank/ Education-Events/Upcoming-Programs

7 EDUCATION CALENDAR

Branch Leadership Series, Session 1 9 Brand Awareness vs. Conversion: How to Effectively Allocate Your Digital Marketing Budget 9 Emerging Customer Experience 15 CEO Forum 16 Essentials of Banking, Session 2 16-17 Sales Excellence Bootcamp 23 & 24 Call Report Preparation 28 Ag Lending Update

MARCH 2-3 The ONE Conference

Cash Management / Treasury Forum

9

30

General

Legal Foundations

• 42 • • November-December 2022

2

6

7-8

13

15

DECEMBER 1 Education and Trainers Forum

Bank Counsel Conference

Advanced Collection Tools

BSA/AML Yearend Wrap Up

How to Create a Bank Culture that Helps You Attract, Develop & Retain Bank Talent

Midwest CEO Forum JANUARY 25 & 27 Hot Topics in Compliance 26 Essentials of Banking, Session 1

ABA ONLINE TRAINING COURSES DECEMBER 5 Analyzing Financial Statements JANUARY 2 The Banking Industry 9 Marketing in Banking 17 Introduction to Agricultural Lending 23 Analyzing Bank Performance 23 Bank Lines of Business 23 Managing Funding, Liquidity, and Capital 30 Building Customer Relationships 30 Money and Banking FEBRUARY 6 Commercial Lending 20 IRA Online Institute 13 Marketing Planning MARCH 6 Bank Lines of Business 6 Consumer Lending 13

Accounting 13

to Mortgage Lending 20

in Banking 20

FEBRUARY 20 Marketing Management

7

Education Trainers Forum, Session 1 14-17 Commercial Credit Analysis Series 23 Essentials of Banking, Session 3 23 & 24 Touring the ACH Rules Updates 28-29 BSA/AML Fundamentals Bootcamp

Retail Banking Forum, Session 1

Introduction

Managing the Bank’s Investment Portfolio

Article Correction

Regulatory University: 13 New Courses Recently Announced

Powered by FIS - An Exclusive

Powered by FIS - An Exclusive

Benefit

for IBA Member Banks and Thrifts

In today’s labor market, employers look for ways to provide retention incentives. At the IBA, we can assist your organization by offering access to Regulatory University (Reg U), where your team can earn complimentary CRCM credits towards their ABA CRCM certification. In addition, IBA members that enroll in this complimentary training have access to 100 interactive courses in key regulatory areas. Your in-house program administrator can enroll employees, assign customized course programs, and run sophisticated management reports to monitor each employee's progress.

November-December 2022 • • 43 • NEWS & NOTES

Connect with the Illinois Bankers to enroll your organization!

In the IBA's July-August magazine, the article "Notes of Interest" listed the top SBA lenders. The list inadvertently did not consolidate all the Wintrust Community Banks. In doing so now, Wintrust was the #1 SBA lender in Illinois.

IBA’s Mary Curl to Retire in December

What was your happiest IBA experience? I have so many, but I remember my first IBA Conference which was in Wisconsin. I have never experienced such a large conference that I actually wasn’t a participant, but rather a planner. I was in awe at how things all came together and the hard work of the staff to pull it off. And now – our conferences just get better and better every year.

better than Napa Valley!

Besides family, what will you miss the most about Illinois? Oh gosh, I have lived in Springfield all of my life and I am going to miss traveling the state, especially the southern Illinois region.

When you have worked with someone for 20 years, they become family. Mary has been a deeply valued and loved family member for all of us at the IBA and for many of our member bankers. Our Board members rely on her to get them the information they need for their work. The IBA HR Peer Group relies on her to maintain the utmost professionalism while creating an expectation of results and timely feedback that is deeply appreciated by the 120+ members. IBA staff rely on Mary for her wealth of HR knowledge, responsive follow-up, and blunt candor. And all of us who call her “friend” – whether co-workers, bankers, or vendors – will deeply miss her as she moves on to her next phase. Mary, we have been honored to have worked with you. You made a difference and created a lasting legacy. Enjoy Arizona and stay in touch!

What is the most satisfying achievement of your career so far or what are you most proud of? This is easy! My HR Peer Group! I started this back in 2012 with only 15 participants (mostly my HR Committee members) and now it has grown to over 150 members representing 112 member banks. On average, I email questions to the group three times per week and the responses are so beneficial to our HR professionals.

What are you most looking forward to in retirement? Relaxation and exploring Arizona, especially if there are wineries around, which I’ve discovered Sedona is even

Honestly—will you miss us? I am so going to miss my IBA family. We’ve been through the ups and downs together whether it be personal challenges or professional ones. It never ceases to amaze me how much we as a staff really care for one another.

What was the craziest HR request you received? I had an applicant/interviewee ask for unlimited PTO! I had heard about it and that concept but never thought someone would actually ask.

What tips would you like to share as you enter retirement? Downsize, and then downsize again! We did it four times so we could build our dream home with a backyard oasis in Florence, AZ.

• 44 • • November-December 2022 NEWS & NOTES

Earl W. Charneske Jr.

Earl W. Charneske Jr., 61, passed away much too soon but peacefully surrounded by his loving family on Tuesday, August 23, 2022.

Loving husband of Suzette Charneske, (nee Gardner); loving father of Earl W. Charneske III, Christina Cox (Christopher) Cherished son of Irene Charneske and the late Earl W. Charneske Sr. Loving grandfather; Landen, Anieka, Layli, Cooper, Carson & Christopher

Favorite brother to Mary Ann (the late George) Mueller, William (Lisa) Charneske, Richard (Eva) Charneske, Judy Charneske Meyer, Mark (Laurie) Charneske, Therese (Roger) Barrette, Joseph (Tara) Charneske, Carol (Brian) Davis and James (Helena) Charneske & his new found sister Lori (Michael) Burns

Favorite uncle to many nieces & nephews. Earl was a long-time correspondent banker for PCBB and Bank of America.

Jerry Vainisi

Former Chicago Bears executive Jerry Vainisi, the general manager when the team won Super Bowl XX in January 1986, died Tuesday, October 4th at age 80.

Vainisi served as Bears GM for four seasons, promoted to that post by franchise founder and owner George Halas in summer 1983. Vainisi remained in that role through the 1986 season, and during that span, under the guidance of coach Mike Ditka, the Bears won 47 games plus three NFC Central championships and put together an iconic season in 1985. They went 15-1 during the regular season, then steamrolled three opponents in the postseason by a combined score of 91-10 en route to their only Super Bowl title and first NFL championship since 1963.

Vainisi was in the Bears GM role for three drafts. And among the notable players the team selected during that time were 1985 starters Wilber Marshall, Shaun Gayle, William Perry, and Kevin Butler. Others drafted by the Bears under

Vainisi’s watch included Neal Anderson and Ron Rivera.

Vainisi joined the Bears as controller in 1972 after leaving the accounting firm Arthur Andersen. He also served as club treasurer and counsel before being named general manager. He replaced Jim Finks, who had resigned.

After leaving the Bears, Vainisi spent three seasons as vice president of player personnel for the Detroit Lions before working in operations for what started as the World League of American Football and later was retagged NFL Europe. Vainisi was with the Lions in 1989 when they used the No. 3 pick to draft Hall of Fame running back Barry Sanders.

Vainisi, a Chicago native, worked as a ball boy in the 1950s at the summer camp of the Green Bay Packers. After getting an accounting degree at Georgetown University and a law degree at Kent College in Chicago, Vainisi was a sports announcer in Monmouth in westcentral Illinois.

In 2010, Vainisi was inducted into the Chicagoland Sports Hall of Fame. In 1999 he became president and sole owner of Forest Park Bank and also served as its chairman and CEO.

American Bankers Association (ABA) is on the Move!

After spending more than two decades at their current location, ABA is in the process of departing the Bender Building at 1120 Connecticut Ave NW in Washington DC. Beginning November 1, 2022, their new address will be 1333 New Hampshire Ave NW, Washington, DC 20036, which is the Robert S. Strauss Building in Dupont Circle.

NEW MEMBER BANKS

American

Devon Bank

6445 North Western Avenue Chicago, IL 60645

David Loundy, Chairman and CEO

Cheryl Wignes, Human Resources Officer

When

Metropolitan Capital Bank & Trust

9 E Ontario St Chicago IL 60611-2709

Frank Novel, President & CFO

November-December 2022 • • 45 •

IN MEMORY

&

PO Box 657

Commercial Bank

Trust, National Association

Ottawa IL 61350-0657

your bank’s a member, you’re a member!

NEW ASSOCIATE MEMBERS

Creatio, Inc.

280 Summer St Fl 6 Boston, MA 02210-1131 www.creatio.com Kateryna Samoilenko k.samoilenko@creatio.com

Creatio is a global vendor of one platform to automate industry workflows and CRM with no-code and a maximum degree of freedom. Millions of workflows are launched on our platform daily in 100 countries by thousands of clients. Genuine care for our clients and partners is a defining part of Creatio DNA.

Creatio offerings include a nocode platform (Studio Creatio), CRM applications (marketing, sales and service), industry workflows for 20 verticals and marketplace add-ons. We help our customers digitize workflows, enhance customer and employee experiences, and boost the efficiency of commercial and operational teams.

(as of 10/07/2022)

Creatio is recognized as a Leader and Strong Performer in multiple Gartner and Forrester reports. Creatio products receive raving end-user reviews on peer-to-peer portals. Our customers enjoy the freedom to own their automation. Freedom is provided through unlimited customization, the ability to build apps without a line of code and a universe of readyto-use templates and connectors. Our platform empowers knowledge workers to build applications with nocode while increasing organizational capacity.