EXPLORING THE ISSUES THAT SHAPE TODAY’S BUSINESS WORLD

Capitalizing on Cannabis | TCJA: Has the Chance Paid Off?

You ‘Swiped Right ’ on Accounting. Now what? | Making the Case for Making Less Surviving the Second Busy Season

Featuring Columns From:

MARK GILBERT TINA GOLSCH MARTY GREEN TIM JIPPING

ART KUESEL JON LOKHORST ELIZABETH PITTELKOW KITTNER

TODD SHAPIRO KEITH STAATS

FALL 2019 +

SIMPLE ONLINE PAYMENTS FOR CPA FIRMS cpacharge.com/icpas 866-526-7320 CPACharge is proud to be a vetted and approved Member Benefit of the Special offer for ICPAS members

is an easy-to-use practice management tool trusted by more than 60,000 successful professionals, developed exclusively for CPAs to help manage payments and grow revenue in their practice. PCI COMPLIANCE INCLUDED ($150 VALUE) SIMPLE REPORTING AND RECONCILIATION UNLIMITED SUPPORT BY PHONE, LIVE CHAT, AND EMAIL DESIGNED FOR CPAs CPACharge s a reg ste ed agent of Wel s Fa go Bank N A Concord CA and C t zens Bank N A Prov dence R 0%, $2/TRANSACTION eCHECK PROCESSING RECURRING BILLING AND SCHEDULED PAYMENTS SECURE, CUSTOMIZABLE PAYMENT PAGES $1,000 Exp. Card Number CVV **** **** **** 9998 001 Invoice Number 1005 NOV 2021 Payment Detail Submit to Smith Johnson, CPA Pay CPA P O W E R E D B Y

CPACharge

2 INSIGHT | www icpas org/insight FALL 2019 www icpas org/insight CAPITALIZING ON CANNABIS 2 02 3 2 42 7 BALANCING THE ART OF FEEDBACK TCJA : HAS THE CHANCE PAID OFF? spotlights 4 Today ’s CPA Are You Committed to Excellence? By Todd Shapiro 6 Capitol Report Fall Veto Session: A Recipe for Chaos By Marty Green, Esq 8 Seen & Heard Inspiring Women to Take the Lead By Nancy Clarke 42 Gen Next Your Career Is a Journey, Not a Destination By Nicole Presperin, CPA 44 IN Play Q&A With Lee Gould, Managing Member, Gould & Pakter Associates LLC By Eric Scott trends 10 Career Management You ‘Swiped Right ’ on Accounting Now what? By Brad Sargent, CPA/CFF, CFE, CFS, CCA , FABFA 12 Leadership & People Management Making the Case for Making Less By Bridget McCrea 14 Practice Management Surviving the Second Busy Season Scaries By Jeff Stimpson insights 28 Firm Journey Is It Time for You to Go It Alone? By Tim Jipping, CPA , CGMA 30 Corporate Calling Why Every Corporate Accountant Needs Project Management Skills By Tina Golsch, CPA , MBA 32 Leadership Matters 5 Ways to Engage Millennial and Gen Z Talent By Jon Lokhorst, CPA , ACC 34 Practice Perspectives Is Busy Season Killing Your Prospect Pipeline? By Art Kuesel 36 Financially Speaking The Secret to Earning Lifelong Clients By Mark J Gilbert, CPA/PFS, MBA 38 Ethics Engaged Weeding Through the Ethics of Serving Cannabis Clients By Elizabeth Pittelkow Kittner, CPA , CGMA , CITP, DTM 40 Tax Decoded Illinois’ Incomprehensible Sales Tax Law By Keith Staats, JD 1 61 9

careercenter

www.icpas.org/career s

As a benefit of your Illinois CPA Society membership, both job hunters and employers can take advantage of the Career Center:

SHARE your resume with employers (even confidentially)

RECEIVE new job aler ts sent directly to your email

STREN GTHEN your resume with career resources and coaches

POST jobs online quickly and simply (fees apply)

CREATE aler ts for resumes and manage applications

ILLINOIS CPA SOCIET Y

550 W Jackson Boulevard, Suite 900, Chicago, IL 60661

www icpas org

Publisher/President & CEO

Todd Shapiro

Editor Derrick Lilly

Creative Director

Gene Levitan

Copy Editors

Nancy Clarke | Mari Watts

Photography Derrick Lilly

Circulation

John McQuillan

ICPAS OFFICERS

Chairperson

Geoffrey J Harlow, CPA | Wipfli LLP

Vice Chairperson

Dorri C McWhorter, CPA, CGMA, CITP | YWCA Metropolitan Chicago

Secretar y

Thomas B Murtagh, CPA, JD | BKD LLP

Treasurer

Elizabeth Pittelkow Kittner, CPA, CGMA, CITP, DTM

International Legal Technology Association

Immediate Past Chairperson

Rosaria Cammarata, CPA, CGMA | CDK Global Inc

ICPAS BOARD OF DIRECTORS

John C Bird, CPA | RSM US LLP

Brian J Blaha, CPA | Wipfli LLP

Jennifer L Cavanaugh, CPA | Grant Thornton LLP

Jon S Davis, CPA (AZ Ret ) | University of Illinois

Stephen R Ferrara, CPA | BDO USA LLP

Mary K Fuller, CPA | Shepard Schwartz & Harris LLP

Jennifer L Goettler, CPA, CFE | Heinold Banwart Ltd

Jonathan W Hauser, CPA | KPMG LLP

Scott E Hurwitz, CPA | Deloitte LLP

Joshua D Lance, CPA, CGMA | Lance CPA Group

Deborah K Rood, CPA, MST | CNA Insurance

Seun Salami, CPA | Teachers Insurance and Annuity Association of America

Stella Marie Santos, CPA | Adelfia LLC

Andrea K Urban, CPA | ThoughtWorks Inc

BACK ISSUES + REPRINTS

Back issues may be available Articles may be reproduced with permission

Please send requests to lillyd@icpas org

ADVERTISING

Want to reach 25,000 accounting and finance professionals? Advertising in INSIGHT and with the Illinois CPA Society gives you access to Illinois’ largest financial community Contact Mike Walker at mike@rwwcompany com

INSIGHT is the magazine of the Illinois CPA Society Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published four times a year, in Spring, Summer, Fall, and Winter, by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA, 312 993 0407 Copyright © 2019 No part of the contents may be reproduced by any means without the written consent of INSIGHT Send requests to the address above Periodicals postage paid at Chicago, IL and at additional mailing offices

POSTMASTER: Send address changes to: INSIGHT, Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA

Find the tools you need to succeed!

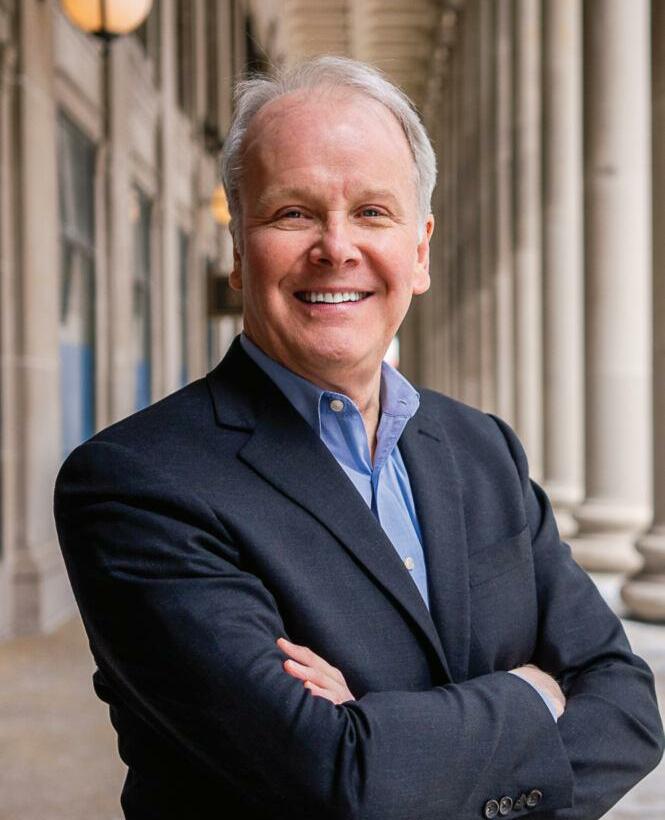

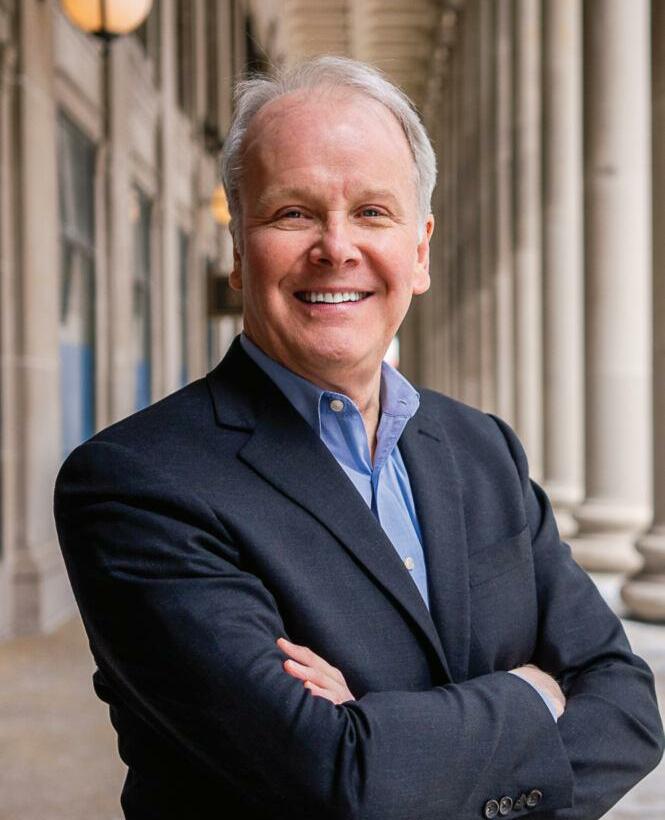

today’sCPA

Are You Committed to Excellence?

In a culture of excellence, these become the norm: accountability, communication, efficiency, innovation, positivity, and quality. Shouldn’t we all strive for that?

Mytime in corporate finance exposed me to how businesses often revel in their mission statements committing them to excellence And while some people dismiss claims of excellence as marketing speak, others argue that true excellence initiatives improve processes and quality, lower costs and, ultimately, positively impact morale Others point to excellence as key to greater client or customer satisfaction, profitability, and sustainability what business wouldn’t benefit from that? For many of us in the business world, striving for excellence is something we hear encouraged all the time But what does excellence really mean when everyone defines it differently? For me, I define excellence as “doing the right thing right the first time ” Let’s break that down

Doing the right thing: How many times do you take on tasks or delegate work to someone and it doesn’t quite hit the mark, which leads to frustration and rework for everyone? If this sounds familiar, I’m guessing you don’t think this is excellent and your colleagues, clients, or customers probably don’t either Excellence means engaging in comprehensive communication to ensure that everyone is on the same page right from the start

Right: When you do something, do you ensure that your work is correct, or do you get it done quickly knowing that time is short and someone up the chain will fix any mistakes? Given the pace of change in our profession and the broader business world, it’s easy to get caught up in being busy and pushing things out as quickly as possible But excellence is equated with accuracy In accounting and finance, we know the implications of computational errors, but even something as simple as a typo or grammatical slip-up can compromise your work, leading to further mistakes, misunderstandings, and miscommunications Excellence demands that, whatever you do, it’s done accurately and with pride and accountability

The first time: Hopefully the work you do or the work you delegate out eventually hits the mark The question is, how many iterations did you go through to accomplish that goal? Excellence requires embracing communication, accountability, and quality to reduce the number of times something must be done and re-done While these might sound like management buzzwords, I promise you that committing to these traits will improve your teamwork, efficiency, innovation, and relationships I’m not saying that even with good communication every

project will go as planned and every work product will hit its mark, but they should be closer and require fewer iterations

We all know the frustration and lost productivity of doing and redoing things I truly believe that embracing a culture of excellence can change this for you and your organization and, ultimately, our profession How does one go about building a culture of excellence? It starts with honesty If we make mistakes or miss the mark, we need to be honest with ourselves and understand our shortfalls If there’s always an excuse or you always think it’s something or someone else’s fault, you’ll struggle with excellence

Once we get past honesty, commitment is critical to achieving excellence Everyone, at all levels, needs to be committed to excellence at all times not just when there’s time We can’t lose our commitment whenever we ’ re overwhelmed or over-worked

One will never achieve excellence without clear, concise, and thorough communication Listening and asking questions are important aspects of doing the right thing right the first time Repeating back what’s expected of you is a method of verifying the expected outcome Finally, there’s accountability We have to hold ourselves and each other accountable to our work product Accountability isn’t fun because it can sometimes result in confrontation However, without accountability, excellence is doomed to fail Having those hard but necessary conversations is just another aspect of being committed to thorough communication

If you ’ re thinking that embracing excellence sounds like a lot of work and requires constant vigilance, it is That said, I think it’s worth it Embracing excellence could be the difference between being a client’s tax-time accountant or being their most valued business advisor; it could be the difference between sitting in the backroom or sitting in the boardroom; it could be the difference between losing relevance in the market or being a market leader

Rest assured, here at the Illinois CPA Society we ’ ve been exploring our own excellence initiative We’re committed to excellence in the work we do serving you, our members, our communities, and the CPA profession Will you make the same commitment?

INSIGHTS FROM TODD SHAPIRO, ICPAS PRESIDENT & CEO @Todd ICPAS

INSIGHTS FROM TODD SHAPIRO, ICPAS PRESIDENT & CEO @Todd ICPAS

4 INSIGHT | www icpas org/insight

Rise above the rest CERTIFICATE PROGRAMS

Today’s business landscape is evolving at war p speed. Shouldn’ t you be doing the same?

Our new Cer tificate Prog rams will help you:

• Rapidly acquire specif ic technical exper tise

• Dif ferentiate your self in your profession

• Open the door to new oppor tunities and higher ear nings

• Become an indispensable asset to your f irm or company

Earn t he Recognition You Deser ve Completed programs ear n you a respected micro-credential (a cer tif icate from ICPAS and the AICPA) along with a digit al badge to proudly display on your resume, e-mail signature and social media

U pskilling Has Never Been Easier

Our on-demand format allows you to complete our Cer tif icate Programs anywhere, anytime.

For more information visit www.icpas.org/cer tif icate

ICPAS NFP (Not-for-Profit) Beginner ICPAS NFP (Not-for-Profit) Advanced ICPAS CyberSecurity Advisory Services ICPAS Data Analysis Fundamentals ICPAS SOC for Cybersecurity ICPAS Blockchain Fundamentals for Accounting & Finance Professionals ICPAS International Financial Reporting Standards (IFRS) ICPAS Cybersecurity Fundamentals for Accounting & Finance Professionals

Current Cer tificate Programs:

Fall Veto Session: A Recipe for Chaos

With landmark legislation needing corrective amendments and a tax on professional services possibly coming to light, the Illinois General Assembly is destined for a chaotic fall.

Gaming expansion Sports betting Recreational cannabis Infrastructure Even a state operating budget? Yes, Governor J B Pritzker and the democratic majorities in the House and Senate scored an impressive legislative tally during the spring legislative session I would add that many of these measures and hundreds of others were passed with bi-partisan support, including the always-elusive state operating budget and a vertical and horizontal capital infrastructure program All told, the final tally stands at 591 bills signed and eight bills vetoed by the governor

The breadth of legislation passed during the spring left state agencies like the Department of Revenue, Gaming Board, and Department of Financial and Professional Regulation, spending their summer months preparing for implementation Unsurprisingly, these preparations have identified several technical issues that need to be addressed and corrections that must soon be made in order for the legislation signed into law to be fully implemented as intended

The General Assembly has six working days scheduled for its fall veto session when it would typically review and consider the governor ’ s vetoes and determine if they, for whatever reason, should be overridden I suspect the General Assembly will spend little time convened over vetoes this fall Rather, legislators will likely reconvene in regular session to consider corrective amendments to legislation recently signed into law

Much of the focus is likely to fall on the technical issues tied to the variety of gaming, tax, and cannabis legislation passed It’s also likely that legislation to close the embattled Sterigenics facility in Willowbrook, Ill will be considered

One area that we are closely watching is if Chicago Mayor Lori Lightfoot will request the General Assembly to pass legislation authorizing the City of Chicago to tax professional services, such as law firms and accounting firms Lightfoot first floated the idea of a valueadded tax (VAT) on high-end law firms and international accounting firms the weekend before the March 2019 Mayoral Election Now as mayor, Lightfoot is seeking all ways possible to combat Chicago’s hemorrhaging financial situation and municipal pension obligations She has even asked Pritzker to consider consolidating Chicago’s pensions into the state pension systems and taxing retirement income as a mechanism to help fund the pension obligations Pritzker readily rejected Lightfoot on these issues, which seems to have spurred Lightfoot to resort back to talking about taxing “high-end professional services ”

6 INSIGHT | www icpas org/insight

capitolreport

LEGISLATIVE INSIGHTS FROM MARTY GREEN, ESQ , ICPAS VP OF GOVERNMENT RELATIONS @GreenMarty

As of the time of this writing, Lightfoot has not put anything in writing or offered any specifics in the way of percentages, numbers, or scope of a professional services VAT To some relief, the mayor has stated her opposition to taxing consumer services Pending a formal announcement, the Illinois CPA Society is taking Lightfoot’s proposals seriously A professional services tax should be of great concern to all CPAs, lawyers, and other professional service providers not just in Chicago but throughout the state A VAT on professional services in the limited scope of the City of Chicago could quickly morph into a statewide VAT on all professional services ranging from attorneys, consultants, CPAs, realtors, and more

Traditionally, the Illinois General Assembly has recognized the tenants of good tax policy and avoided any consideration of taxing professional services Pritzker made a statement during his gubernatorial campaign that taxing services should be considered but immediately retracted that statement the same day

Recognizing the General Assembly’s reluctance to tax professional services, there are other factors that make a proposal of this nature difficult to achieve First, there are legal impediments The Illinois Supreme Court has previously ruled that a tax of this nature violated the Illinois Constitution’s uniformity clause because it treated similarly situated taxpayers differently (Commercial National Bank of Chicago v City of Chicago, 89 Ill 2d 45 (1982)) Second, Lightfoot’s proposal violates fundament principles of tax policy

Good tax policy requires that a tax system be neutral and promote economic growth The mayor ’ s proposal violates these principals

The tax system should not be used to micromanage the economy or create winners and losers within a group of similar professional competitors There would also be tax pyramiding Accounting and legal services are business inputs and should not be taxed under sales and use tax because of tax pyramiding Neutrality and horizontal equity would be lost because law firms and accounting firms provide services performed by other professional service firms who would not be taxed This would result in similar economic actors being taxed differently Additionally, there are enormous barriers to enforcement to professional services taxation and sound economic arguments as well

We have spent the summer months working with coalition partners, including the AICPA, Taxpayers Federation of Illinois, the Illinois State Bar Association, the Illinois Chamber of Commerce, the Chicagoland Chamber of Commerce, the Chicago Bar Association, and other stakeholders, to prepare a strategy to fight any legislative battles that may arise during the fall veto session

Considering the Illinois General Assembly’s hearty agenda for the fall veto session with the numerous needed corrections in tax, gaming, and cannabis legislation alone, I am predicting a chaotic fall This chaos could prevent Lightfoot from introducing a proposal to tax professional services or not

As we move through the fall months, I may reach out to you through our online advocacy platform to contact your legislator to oppose a tax of this nature I will continue to keep you informed of developments through Capitol Dispatch and other communications In the meantime, if you are talking to your elected legislators, flex your professional expertise and let them know that you oppose taxing professional services

Author’s Note: This column includes my personal observations of the evolution of the legislative environment and are not necessarily the views of the Illinois CPA Society

www icpas org/insight | FALL 2019 7 Join us for an event near you! As technologies can now automate the CPA profession’s core ser vices, it’s time to embrace change and redef ine the CPA’s role. Please join Geof f Harlow, CPA , Chair of the ICPAS Board of Director s and Todd Shapiro, President and CEO, for a conver sation on becoming the strategic business advisor s that your clients and companies seek all prog rams: CPE: 1 5 Credit Hour s Cost: FREE Complimentar y breakfast or lunch included REGISTRATION Please call 800 993 0407 or visit www icpas org 2019

TOWN HALL FORUMS TIME TO REDEFINE 11 8 19 Rockford 12 6 19 Collinsville 11.14.19 Springfield 12.11.19 Chicago 11 15 19 Champaign-Urbana 12 12 19 Oakbrook Terr ace 11.19.19 Bloomington-Normal 12.13.19 Glenview 11.20.19 East Peoria

ILLINOIS CPA SOCIETY

Inspiring Women to Take the Lead

BY NANCY CLARKE

In a 2011 LinkedIn survey of 1,000 women professionals, 80 percent said having a mentor was important, but only 20 percent had a mentor That gap has narrowed some today thanks to Facebook COO Sheryl Sandberg’s efforts to popularize mentoring circles peer-to-peer group mentoring programs enabling likeminded colleagues within an organization to come together in the name of professional advancement but there’s still work to be done, particularly among organizations struggling to advance women into their leadership ranks

This trend is not new to the Illinois CPA Society Recognizing how mentoring could help resolve the underrepresentation of women in the accounting and finance profession’s leadership ranks, the Mentoring Subcommittee was created in 2006 by the thenWomen’s Executive Committee and was tasked with identifying new programs and services that would benefit the Society’s women members enter Women’s Mentoring Circles

Women tend to focus more on their own weaknesses rather than their strengths On the other hand, they are quick to see others’ strengths and desire to support them So, the Circles’ overarching goal is to bring women of all experience levels and backgrounds together to create a safe place for mutual sharing, encouragement, and empowerment Circle members, usually between five and eight women per Circle, choose a topic either personal or professional for a group discussion The Circle leader spearheads the discussion, and the leader role rotates among the group, so all members have a chance to build their confidence, improve their leadership skills, and engage in meaningful career development through lively facilitation

“The Circles are more beneficial than traditional networking With a standard one-to-one discussion, you need to know how to ask the question or frame the problem and then hope that the other

party has the appropriate knowledge,” explains Melody Ragan, CPA, CGMA, controller and finance manager at Schiff Hardin LLP “With multiple opinions and various backgrounds of experience, you get multiple points of view Think of cooking eggs There are a dozen different ways to cook an egg, but in the end, it’s still an egg Accounting and management experiences can be very different, but in the end, we are all trying to be the best we can be ”

Soon, the Circles will widen as the program expands to an online community accessible via the Society’s website The community will allow Circle members to stay connected between meetings and to make inter-Circle collaboration easier An added benefit is that women who are waiting to be assigned to a Circle can start connecting with other members right away, regardless of where they live or work

“I’ve loved my experience with my mentoring circle My greatest takeaway is meeting, getting to know, and being comfortable with the Circle members,” Ragan says “I’m grateful that I’ve been able to support the women in my Circle It may have been with an accounting problem, a resume or job referral, or simply to take a brief break from an over-piled desk I’ve found the members are a wonderful support group to each other, both in a professional and personal sense ”

“Over the past few years, the Society has focused on reinvigorating the relationship between the Mentoring Circle participants, their volunteer coordinators, and Society staff with the goal of making the Circles an invaluable resource for our members,” says Kristin McGill, MBA, CAE, the Society’s senior director of membership “The Circles are open to all ICPAS female members from all stages in their careers The goal is to provide an avenue for participants to gain from the mutual wisdom, learn from the various experiences, and gain unique perspectives from their peers The Circles are convenient and accessible, meeting at least four times per year in Chicago and the surrounding suburbs ”

Mentoring Circles are open to women in all business disciplines and practice areas, including public accounting, corporate finance, tax, internal audit, law, education, not-for-profits, and government, just to name a few Visit www icpas org/mentoringcircles if you would like to join or for more information

8 INSIGHT | www icpas org/insight

In expanding its Women’s Mentoring Circles, the Illinois CPA Society hopes to advance more women into accounting and finance leadership roles.

100% CPA MEMBERSHIP PROGRAM

Arnold, Behrens, Nesbit, Gray PC

Baker Tilly

Bansley, Brescia & Co PC

BDO USA LLP

Benning Group LLC

Bernard A Af fetto & Co

Borschnack , Pelletier & Co

BrookWeiner LLC

Catalano, Caboor & Co

The Charneske Group

Clif tonLarsonAllen

Coleman & Associates

Cray, Kaiser Ltd

Crowe LLP

Cygan Hayes Ltd

Deborah K Hannan CPA PC

Dennis Rose & Associates PC

Desmond & Ahern Ltd

Detterbeck Johnson & Monsen

The Dolins Group Ltd

Duf fner & Company PC

Dunbar, Breitweiser & Company LLP

Echales, Benjamin & Simkin LLP

Eck , Schafer & Punke LLP

FSB&W LLC

Gassensmith & Michalesko Ltd.

Gilber t, Metzger & Madigan LLP

Goettsche, Tranen, Winter & Russo

Grant Thornton LLP

Gray Hunter S tenn LLP

GW & Associates PC

Hochfelder & Weber PC

Hof fman & Tranel PC

Honkamp Kr ueger & Co PC

Insight CPAs & Financial LLC

J M Abbott & Associates Ltd

John Kasperek Co Inc

John U Smyth, CPA LLC

Katz LLC

Kerber, Eck & Braeckel LLP

Klein Hall CPAs

KPMG US LLP

Kutchins, Robbins & Diamond Ltd

Larr y J. Wolfe Ltd.

Lauterbach & Amen LLP

Legacy Professionals LLP

Lerman, Sweeny & Company LLP

LICCAR

Lipschultz, Levin & Gray LLC

Lucas Group

Mack & Associates PC

Mann Weitz & Associates LLC

Marcum LLP

McCullough, Rossi & Co Ltd

Mueller & Co LLP

O'Neill & Gaspardo LLC

Ostrow Reisin Berk & Abrams Ltd

Pasquesi Sheppard LLC

Paul M Rober ts LLC

PricewaterhouseCoopers LLP

Rub & Brillhar t LLC

RubinBrown LLP

Sassetti LLC

Selden Fox Ltd

Smith, Koelling, Dykstra, & Ohm PC

Tighe, Kress & Orr PC

Trimarco Radencich LLC

West & Company LLC

Whitlock and Associates PC

Wipfli LLP

For more information on how your firm can be par t of the 100% CPA Member ship Program, please visit www.icpas.org.

*minimum of 2 CPAs

To thank you for your suppor t... of the Illinois CPA Society and the profession, we are pleased to recognize these Illinois accounting f ir ms with 1 00% of their CPA st af f who are member s *

You ‘Swiped Right ’ on Accounting. Now what?

There’s no ghosting when it comes to your career So, go straight to the heart of it to find out what brings passion into your work.

BY BRAD SARGENT, CPA/CFF, CFE, CFS, CCA, FABFA – THE SARGENT CONSULTING GROUP

Yeah, right How many times have you heard this and reacted with rolled-eye skepticism? I once had a potential intern tell me during an on-campus interview that they were passionate about my field of work and two questions later they acknowledged they had no real idea what it was that I do!

I am here to tell you that I truly do love what I do now I didn’t love work when I first started my career I had many moments that I was not sure I was on the right course By pure serendipity, I encountered people along the way who found meaning in their work and appreciated what they did I grew to appreciate my work more each day simply by surrounding myself with these folks Then, by layering in time I am talking years, not days that appreciation grew, and I suddenly realized that I loved my career This was no small feat; I had many years of unhappiness at work But today I am confident that sharing some of my experiences can help you shortcut your path to fulfillment at work and have a healthy relationship with your career

The first thing you have to do is plant yourself in the right environment A business culture that fosters growth, is positive, and supports your individual goals creates fertile soil But even in such a great setting, you may not find value in your work I encourage you, whether you ’ re an accounting student or a managing partner, to examine your situation and ask, “Do I appreciate what I do?” The term appreciation comes with an explicit acknowledgement not only of the value of the work but the true impact of the work If a job applicant at your organization directly posed this question to you today, how would you answer? Try asking a trusted peer or colleague It takes courage at any point in your career to ask this question But ponder this: Why wait? Everyone deserves to feel a sense of fulfillment and dignity in their work

Now, have you ever really tried to find the value in what you do? One of the things I love most about the accounting profession is that there’s truly something for everyone I believe that we accounting professionals crave accuracy, clarity, and consistency, and every task in accounting revolves around one, if not all, of these principles But so many career paths in accounting involve experiential learning, which can translate into working on less challenging but critical-to-master tasks during the first few years of one ’ s career

10 INSIGHT | www icpas org/insight C A R E E R M A N A G E M E N T

“I am passionate about my work.”

During the first few years of my career, I grew frustrated and bored at times When well-intentioned colleagues told me to hang in there and that I was just paying my dues, it only made things worse In my resentment, I allowed myself to stop doing my best I proceeded to create work that one day put my partner who I liked, admired, and respected in a very bad light Being the leader he was, he covered for me and only spoke to me about my errors in private afterward That very day, I realized that this grunt work mattered and that my partner relied on me to do my best I started to see the value in what I was doing I began working harder, faster, and more accurately I realized that my relationships with colleagues were becoming better because I was helping them and their work When I saw the value in what I had considered mind-numbing data entry, everything changed

A fertile environment for growth is great, but also accept that no workplace is full of 100 percent happy and fulfilled people

The people around you will span the spectrum I saw people on a daily basis who seemed just miserable with their jobs

They came to work every day with the “punch clock” mindset and counted the hours until it was time to head home The truth be told, I was in danger of following this path I was often that person as well and a negative influence on others I had the perspective that others were to be credited for my happiness and blamed for my unhappiness I was truly afraid of the dark place I saw this leading toward

Only now, years later, am I realizing that I have no control over others and what happens externally Looking back, I can now thank the negative, unhappy coworkers I encountered over the years; they were great examples of who I did not want to be

It takes personal and professional maturity to accept that we are all responsible for our own happiness and fulfillment and that any job offers dignity and worth A determined commitment to finding the value in what you do as often as you can and just being open to seeing the impact of your work can lead to lasting contentment, appreciation and, dare I say it, passion

Many, many years ago, I made the decision to “swipe right” on accounting as a career and, like any relationship, we ’ ve had our ups and downs and it requires a lot of work But we are happily married and truly in love You swiped right on accounting for a reason Now it’s time for you to make it a meaningful relationship

Committee, Advisor y Council or Chapter

We need your exper tise and leader ship skills to help guide and govern the work of your Illinois CPA Society

Volunteering is a great way to connect with other s, learn new skills, advance your career and directly enhance the accounting profession

Illinois CPA Society member s are encouraged to apply to these oppor tunities for the term April 1, 2020 - March 3 1, 202 1

Application Deadline is December 6, 20 19.

Committees

Accounting Pr inciples

Audit & Assurance Ser vices

Awards

CPA Exam Award

Employee Benef its Ethics

Gover nmental Executive

Gover nmental Repor t Review

Taxation Business

Taxation Estate, Gif t & Tr usts

Taxation Flow -Through Entities

Taxation Individual

Taxation Inter national

Taxation Practice & Procedures

Taxation S tate & Local

Women’s Committee Advisor y Councils

www icpas org/insight | FALL 2019 11

Ser ve on an Illinois CPA Society

Diver sity

Leader s

s

f icer s

Senior Committee Apply today at www.icpas.org/volunteer Give a little, get involved!

Young

Chapter

Of

=

Making the Case for Making Less

Setting your focus on profits aside might be key to motivating your talent and unlocking your firm’s long-term potential.

BY BRIDGET McCREA

Keepingteams lean and squeezing as much as you could out of every single staffer in the name of profitability was once the goal After all, there was a time when talent was plentiful, unemployment rates were high, the economy was weak, and people generally just accepted the fact that being employed especially being employed as a CPA in a firm or corporate setting required long hours and extra effort

Fast-forward to 2019 and the recruiting and retention landscape looks a lot different for accounting and finance than it did, say, 1015 years ago Illinois CPA Society member Russell Romanelli, CPA, managing partner at BKD CPAs & Advisors in Chicago, says that staffing is a primary concern among most accounting firms right now It turns out that the industry’s long-standing reputation as a place that requires long hours behind a desk isn’t doing the profession any favors

“I actually fear for the industry going forward,” Romanelli says “If this industry is going to attract talented professionals, we have to make it more appealing We really need to get this resolved; there are just too many other industries that have tackled this issue better than we have We’re losing ”

About a year ago, BKD decided to start operating differently its “ new normal” would be putting a bigger emphasis on helping employees achieve better work-life balance This move was

important to the firm for two reasons First, the profession isn’t attracting the number of college students and graduates it once did “There’s a stigma associated with public accounting,” he says, “ so the pipeline is growing thin ”

Second, the people who are coming into the profession are being worked to death “If we keep giving them tons of hours without accommodating their personal needs or giving them the job flexibility that they’re looking for, we ’ re just going to scare them away, ” Romanelli says, noting that three-to-five-year talent is particularly hard to hold on to in recent years

“They’re the ones who stay a few years and leave just when we ’ ve been able to indoctrinate them into the business,” Romanelli shares “If the work-life balance isn’t right, they move on to look for greener pastures ”

This year, the firm took an “all-hands-on-deck” approach to solving this retention issue by hiring an additional 10-12 employees on similar revenue In other words, the firm is setting profits second to its people “We’re trying to attack it,” Romanelli states, explaining that BKD is concurrently taking a closer look at the clients that don’t necessarily fit its business model

In return, Romanelli is hoping to create a better work environment for BKD staff, managers, and partners “In offices where we ’ ve

12 INSIGHT | www icpas org/insight

L E A D E R S H I P & P E O P L E M A N A G E M E N T

added people and thinned out the client ranks, morale has definitely improved,” he says “Our team members now have the capacity to really focus on the clients and can even look for new ways to provide them with value versus focusing on compliance ”

PROFITING ON PEOPLE PROBLEMS

CPA firms are in the people business If you track partner income, for example, you’ll see that there’s a direct correlation between the number of employees and the amount of money that a firm makes “Every time you add a team member, you ’ re adding more profit,” says Bill Reeb, CPA, CITP, CGMA, CEO of Succession Institute LLC and the 2019-2020 chair of the American Institute of CPAs Board of Directors

Still, as he looks around at the accounting profession, Reeb sees a lot of understaffed firms That’s because many of them are simply unrealistic about the number of people they need, not only to handle the firm’s current capacity but also to respond to the firm’s growth, the good employees leaving unexpectedly, and the marginal employees leaving at the firm’s direction

“When you factor all of that together, you’ll find that most firms are understaffed and have a hiring plan that has no chance of rightsizing staff capacity,” Reeb states “It’s not like they are better off using this strategy due to the negative morale created, staff dissatisfaction with their jobs, and paying the higher compensation required to console the workers for their extra efforts There is a higher cost to overworking people than most firms consider ”

Some of these problems date back decades to a time when accounting firms (and other businesses) ran on the belief that once they got the business, they’d go out and find the talent to serve it “The fact is that you ’ re not going to be able to hire a bunch of good experienced workers in today’s job market,” Reeb warns “A lot of companies tell me that they have a hiring plan to bring in several five-, seven-, or eight-year people; I tell them that’s not a hiring plan it’s a pipe dream ”

A plan must be something you can execute, after all, like hiring people out of school and developing them, Reeb continues “If you actually find the number of experienced qualified people you are looking for, it’s more about luck ”

GETTING DOWN ON DEVELOPMENT

Reluctance to “push work down” to non-partners also comes into play here, Reeb says, who sees too many CPA firm leaders hoarding work at the top, which leaves less experienced employees sitting with too little challenge to keep them engaged “It is common to find people, at every level, regularly working below their levels,” he says, stressing that there’s simply not enough time under current practice for partners and managers to even do the work that only they can do

Reeb suggests accounting firms can reverse this problem by hiring more workers, training them, and giving them more meaningful work For example, firms can fast-track training by setting up 20 different sample tax returns of increasing difficulty Anytime a worker has 15-20 minutes available, have him or her start working through the next level of tax return in the hierarchy And at various intervals, or upon completion of each return, every mistake made is an opportunity for the staff member to learn and get better This will give them hands-on experience making them ready more quickly for more complicated work to be passed down to them

“As a profession, we have to change our attitude about pushing work down,” Reeb says “Then, we have to change our attitude about realization It is a good management tool, but used as a key

operating metric, it can create more baggage than value There’s no reason why a new person can’t be billable all the time if we just change the way we think about our business ”

RETHINKING STAFFING OPTIONS

“Firms that want to offset the burden of employee burnout need to rethink their business models There are all types of jobs in public accounting firms that can be reimagined,” adds Jennifer Wilson, partner and co-founder at ConvergenceCoaching LLC in Omaha, Neb

“Firms get caught in the same paradigm and aren’t taking advantage of the different staffing options at their avail,” she suggests For example, firms could consider hiring customer service representatives to serve as client liaisons who manage data entry and handle myriad other administrative tasks Outsourcing is another option that can help ease some of the burden of compliance work

“Ultimately, if it feels like you ’ re operating with a maximize-myearnings business model mindset, the people who stick around probably aren’t the kind of people you want on your team,” Wilson says “If your firm has historically been focused on maximizing profits at the expense of employee work-life balance, at some point, corporate greed is going to become a very unattractive quality in your firm ”

Every firm is grappling with ways to raise revenues, improve productivity, and reduce employee burnout While adding more people to your team may seem counterintuitive to those who are solely profit minded, giving staff the capacity to do more meaningful work, and consciously cultivating their success, could yield dividends that surprise you

www icpas org/insight | FALL 2019 13

Imagine... a chair without a desk Trent Holmes 800-397-0249 Trent@APS.net www.APS.net D e l i v e r i n g R e s u lt s - O n e P r a c t i c e At a t i m e

Surviving the Second Busy Season Scaries

Between late documentation and procrastinating clients, it ’ s no wonder the April tax deadline is ghastly. But why does a second busy season haunt CPAs in October?

BY JEFF STIMPSON

Thesix months between Tax Day and fall pass sweetly enough: slackening of the brutal hours, some time to clear the desk and the mind, evenings to spend with almost-forgotten family and friends, longed for summer vacations But despite a whole year before the next April 15 tax deadline, the pressure soon begins to build again Extended tax returns, a salve for CPAs stretched thin leading up to the April filing deadline, lurk in the shadows of spring and summertime fun

Preparers attribute the scaries of a second busy season leading up to the October tax extension deadline to two keystones of human nature procrastination and avoidance

“The sense of urgency for all parties goes away after a tax return has been extended,” says Illinois CPA Society member Ben Ralston, CPA, director in the Chicago office of CBIZ MHM

“It’s easy for staff, managers, and clients to deprioritize extended returns,” says Neil Keller, CPA, ABV, CVA, tax partner-in-charge in the Milwaukee office of Sikich LLP “Things get put off until there’s a more looming deadline ”

“You have a few other things happen after the first tax season, ” adds Illinois CPA Society member Mark Dalbey, tax principal in CLA’s Peoria, Ill office “A lot of younger staff have kids who get out of school around that time and you ’ ve got a lot of pent-up demand for vacations You almost lose the whole month of June Then you ’ ve got holidays like July 4, and we ’ re finding that any time you get a holiday in the middle of the week, people tend to take the whole week off This all compresses the timeframe ”

While burned out CPAs savoring spring break and summertime fun certainly contribute to a compressed fall busy season, they surely aren’t solely to blame

“Generally, the extended tax returns are the complex ones, and tax reform added to that complexity With several technical issues that need to be addressed, a lot of time and focus is put on coordinating client information,” says Matthew Denman, CPA, MST, a partner in the Schaumburg, Ill office of Plante Moran

In fact, the waiting game that’s played with clients and their thirdparty documentation delays are prime suspects in the case for a second busy season

Illinois CPA Society member Jim Linehan, CPA, a sole practitioner in Peoria, Ill , says clients often file late because they receive K-1s or 1099s deep into the season Clients used to get these documents by the end of January Now, delivery is often toward the end of February And yes, “ some filers are procrastinators,” Linehan adds “If they know there’s an extension deadline in October, they’re going to wait to get you stuff at the last minute Staying on top of procrastinators is the only way to remedy that ”

BUSTING THE SECOND BUSY SEASON

A second busy season is a burden on CPA firms and their staffs that doesn’t come without risks “A rushed return prepared in a compressed timeframe is a risk for the firm,” Dalbey says matter-offactly From burnout to botched returns and client conflict, there’s much to fear and be on watch for But there are ways to put the second busy season scaries to bed

14 INSIGHT | www icpas org/insight P R A C T I C E M A N A G E M E N T

Keller, who has been working on an initiative to smooth out workloads and better manage the second busy season, says the best solution for clients that are the root of work not getting completed is continuous communication

Despite our high-tech age, Dalbey says “nothing’s better than picking up the phone it strengthens your relationship and the contact becomes personal ”

Of course, direct, personal emails can also be very effective for communicating what you ’ ve done for your client and what you need from them Dalbey recommends using progressive language when clients need prodding: “In the first email, say you ’ re just checking in In the second, say you ’ re checking in again and ask if the client can get the information in soon In the third, say you ’ ve received no response yet, and let the client know that if the information isn’t in by a set deadline, you can’t guarantee getting their return done by the filing deadline ”

CBIZ meets clients after the first due dates to “discuss the expectation regarding the timeline for filing returns on extension,” Ralston says “One way to get a client’s buy-in for more timely filing is to agree to a timeline where the client provides the missing information well before getting deep into August or September It is important to follow up to make sure everyone sticks to the timeline ”

Setting milestone dates and making clients stick to them isn’t always easy, so Denman offers a different tactic: “Create a feebased approach, offering clients a different fee schedule depending on when they provide information It’s important that clients understand that if milestone dates are missed, it could impact their fee ”

Another approach: “Over-communication can minimize the impact of client delays,” Denman says “Have regular meetings with clients to make sure they’re aware and on top of the information they need to provide If they’re struggling to get information, these meetings provide a great opportunity to guide them ”

“As accountants, we ’ re so scared we ’ re going to lose clients,” Dalbey says, “but if you have a difficult client, you have to be willing to have difficult conversations ”

“If a client continues to cause unnecessary delays, it may be worth evaluating if they’re a good long-term client,” Denman says

On the other hand, the importance of evaluating the morale of your good long-term staff is easy to overlook when everyone in the firm is busy, but CPA firm leaders should be as worried about losing staff over poorly managed expectations as they are about losing clients and sometimes that requires difficult conversations as well

“We set the expectation with staff early in the year that there will be a second busy season in the fall so there are no surprises,” Ralston says, “but we also offer summer hours between May and July as a way to manage potential burnout ”

“In November and December, we ask staff to think about the coming year, ” Dalbey shares, explaining that CLA’s schedules are built out by in-house, individual coaches who budget time for chargeable hours, vacations, training, and volunteering well in advance of crunch periods

At Sikich, teams have weekly scheduling meetings to discuss which clients they can work on and what can be done to move returns along “We’ve found that if you ’ re proactive from both the staff and client perspective, you can, to an extent, smooth out some of the work,” Keller says “While you might not be able to completely avoid a second busy season, you can make it much less daunting ”

WOMEN’S MENTORIN G CIRCLES

A new twist on traditional mentor ing!

Make a dif ference in your career… and those of other s.

This fresh take on mentoring brings together women of all experience levels and backgrounds to form a place for mutual sharing, encouragement, and empowerment.

Why Join?

• Lear n from the challenges and successes of other s

• Expand your professional and per sonal suppor t network

• Gain multiple per spectives, unique advice, and a diver se array of ideas

• Increase your conf idence and develop your leader ship skills

How they wor k:

• Each Mentor ing Circle is compr ised of 8-10 women with var ious levels of exper ience from a wide range of practice areas and industr ies

• The Mentor ing Circles meet at least four times per year in Chicago and the suburbs

www icpas org/insight | FALL 2019 15

www.icpas.org/mentor

To register online or for more information, visit

ingcircles

16 INSIGHT | www icpas org/insight

BY CLARE FITZGERALD

Mom-and-pop shops aren’t driving the U S cannabis market anymore Big domestic and international players have rolled those businesses into their own as the cannabis industry has rapidly grown and evolved over the past few years Today’s market leaders are large, complex, capital hungry, high-revenue-generating entities, and according to CPAs working in the field, they’re in desperate need of high-quality accounting and finance expertise and guidance

Professional service providers ranging from plumbers to soil experts and lawyers to real estate agents have jumped to meet the needs of emerging cannabis growers, sellers, and distributors, but the accounting and finance industry has been much slower to engage

That’s starting to change, according to Andrew Hunzicker, CPA, co-founder and owner of DOPE CFO, a Bend, Ore -based provider of education and tools designed to help accounting and finance professionals enter the cannabis industry. As more states legalize both medicinal and recreational cannabis production, sales, and use, and acceptance of cannabis as a legitimate business industry grows, small accounting firms are planting their seeds and many mid-market firms are growing full-fledged specialized cannabis divisions Hunzicker also predicts the Big Four will enter the sector if cannabis is ever legalized at the federal level

For now, cannabis is still classified as a Schedule 1 drug at the federal level It’s equated with heroin and is considered to have no medical value despite studies suggesting otherwise. But even with the stigma that classification carries, cannabis is growing into a massive market domestically and internationally, and the rush is on to grow with it.

CPAs willing to wade through the weeds of evolving regulations and risk can find growing opportunities in the medicinal and recreational marijuana markets.

www icpas org/insight | FALL 2019 17

A Maturing Market

According to Illinois CPA Society member Taylor Schuck, cannabis industry specialist and accounting services supervisor at Mueller CPA in Elgin, Ill , the cannabis industry has moved well beyond its infancy stages It’s evolving, maturing, and driving global economic growth and development

Here in the U S , cannabis is gaining mainstream momentum So far in 2019, 27 state legislatures have considered bills to legalize cannabis for adults, according to the Marijuana Policy Project, a cannabis policy reform group Illinois where legal recreational cannabis sales are expected to start Jan 1, 2020 is one of 10 states that have legalized both medicinal and recreational cannabis use Medicinal cannabis is legal in some form in 33 states, and possession of small amounts of cannabis has been decriminalized in 26 states

On the national level, the U S House of Representatives this summer held its first hearing on whether to end or reform federal marijuana prohibition The U S Senate Committee on Banking, Housing, and Urban Affairs also held a hearing to discuss financial challenges facing the cannabis industry and considered legislation that would prevent federal financial regulators from punishing financial institutions that provide services to state-legal cannabis businesses The Farm Bill that President Donald Trump signed into law last December legalized hemp a strain of cannabis grown specifically for industrial uses of its derived products

As policy and legislative discussions continue in the political arena, public support for cannabis is growing In a recent Marist College poll conducted for NPR and PBS NewsHour, 62 percent of registered voters said legalizing recreational cannabis is a good idea In a 2010 Gallup poll, only 46 percent of Americans supported legalization

More states are moving to legalize recreational cannabis via ballot instead of referendum, which could increase momentum for national legalization in the coming years, according to the 2019 Cannabis Market Report from Brightfield Group, a predictive analytics and market research firm for the cannabis and CBD industries As more markets open, the industry’s value is expected to explode The total U S cannabis market is predicted to reach $22 7 billion in 2023, according to the report, and the majority of that is expected to be driven by recreational sales, particularly from newly opened, fast-growing Midwest and East Coast markets

The Brightfield Group also reports that the hemp-driven CBD market (think edibles and other infused products) is growing even faster than cannabis in the U S and will soon be a $22 billion industry Cannabis companies are increasingly pushing into the CBD space through mergers and acquisitions as a precursor to THC legalization THC, or tetrahydrocannabinol, is the chemical responsible for most of marijuana's psychological effects

The cannabis and CBD industries also are driving job growth

According to cannabis information hub Leafly’s 2019 Cannabis Jobs Count, the cannabis industry added more than 64,000 jobs in 2018, and it now directly employs more than 211,000 full-time workers in the U S

Weighing Cannabis’ Complexities

Producers, sellers, and distributors operating in the rapidly evolving cannabis marketplace face complex challenges and they need solid expertise to help guide them Many cannabis businesses have operations in several states, and the legal and regulatory environment is changing quickly in each According to Schuck, that complexity offers plenty of opportunities for CPAs to provide a variety of accounting, tax, and consulting services

However, anyone interested in serving the cannabis industry has to be well versed in relevant court cases, committed to staying on top of legislative changes, and highly knowledgeable on Section 280E of the Internal Revenue Code, which forbids businesses from deducting otherwise ordinary business expenses from gross income associated with the “trafficking” of Schedule I or II substances as defined by the Controlled Substances Act Helping cannabis businesses evaluate what is deductible and what isn’t under Section 280E is one of the main areas where CPAs can guide cannabis clients

“Cannabis businesses need qualified accountants who know how to do 280E right,” Hunzicker says, adding that experienced CPAs shouldn’t try to take an overly aggressive approach to interpreting the code

In addition to providing 280E-compliant tax returns, CPAs also are being called on to develop tax strategies, provide M&A and due diligence services, and advise cannabis clients on entity choice and how to structure their businesses Valuation is another challenging area “Cannabis businesses need to be well capitalized, because they have high operating costs and high volatility in revenues related to commodity price swings,” Hunzicker says, citing high start-up costs, rents, payroll expenses, and complex tax burdens as other pressing expenses

Even businesses that have their own accounting departments still need help “These companies have been in need of quality accounting services for years, ” Schuck says

“Cannabis companies have been massively underserved by the mainstream accounting industry,” Hunzicker exclaims “Cannabis

18 INSIGHT | www icpas org/insight

companies have a lot of compliance needs States are coming up with their own sets of rules and then changing them Keeping on top of those very detailed and complex rules requires someone who is very heavily compliance oriented Cannabis CEOs are too busy running their businesses to do it ”

Unique Market, Unique Risks

Although cannabis is a large and somewhat untapped market offering a variety of service opportunities, CPAs and their firms also need to be aware of the unique professional risks the industry presents Legal, regulatory, ethical, reputational, and practice management considerations all arise if you ’ re providing services to businesses that produce, sell, or distribute a substance that is still illegal under federal law

Cash management is one issue, according to attorney Stan Sterna, vice president and accountants’ professional liability risk consultant for Chicago-based insurance broker, Aon, the national administrator of the AICPA Member Insurance Program “Federally insured banks may not accept deposits from federally illegal enterprises because of potential money-laundering or aiding-and-abetting charges,” he explains “As a result, cannabis clients deal primarily in cash, increasing the risk of both unreported revenue and defalcation, which increases a CPA’s professional liability risk ”

Cash transportation also is an issue, according to Schuck, but he expects some of the industry’s banking woes to be eased by new regulations And although it can still be difficult to find a bank in some states, Schuck says many financial institutions are confidently banking cannabis clients without any federal enforcement

Sterna encourages CPAs to be aware of other risks He explains that many cannabis businesses struggle financially or fail, and their ability to discharge or restructure debt is limited because they have limited access to the U S judicial system, including the bankruptcy process Also, the Section 7525 tax preparer-client privilege may not apply to cannabis clients “If the client is under investigation, the CPA may be placed in the awkward position of being required to testify against that client,” he says

The complexity of the business also can create the potential for CPAs to make mistakes “Multiple taxing authorities may impose taxes or fees on the product With so many returns to prepare, the likelihood that a return could be audited or that the CPA could make an error or omission increases,” Sterna cautions

But as Schuck sees it, the big risks, such as a client breaking the law or taking an unreasonable tax position, could happen with any client in any industry, and the risks can be mitigated through proper onboarding and due diligence procedures And as for the federal versus state law gap, Schuck says CPAs are licensed by the states, and they have a right and responsibility to provide services for cannabis businesses operating legally in them “CPAs are actually helping cannabis companies comply with state laws and statutes,” he says, which is why he doesn’t give much weight to the idea that a firm’s reputation would suffer or a firm would lose clients simply because it provides services to the cannabis industry

At this point, Schuck says many small practitioners are quietly serving the cannabis market and continuing to move forward confidently “Those firms are signing tax returns without facing any repercussions If you take proper steps, exercise normal due diligence, and have strong client acceptance procedures, you don’t have anything to worry about,” he says

Hunzicker advises CPAs to treat cannabis businesses as they would any other client “If you apply the same risk management standards, you ’ re highly unlikely to encounter trouble,” he says

Connecting With Cannabis

For those willing to take on the risk, there’s a high potential for reward According to Hunzicker, with average dispensaries hitting $1 million in sales per year, and many in the $4 million to $5 million range, accounting and bookkeeping needs alone can reach several thousand dollars per month in billing for CPAs Providing other CFO, HR, payroll, and consulting services can create additional billing opportunities “Cannabis companies have intense, complex needs, and they understand that they need our services,” he says

The clients certainly aren’t hiding, either With all the media attention surrounding the industry, Hunzicker says cannabis CEOs and investors are easier to find than clients in other industries Schuck agrees that meeting people and getting involved in the industry is relatively easy He suggests attending municipal meetings where local governments are considering the entry of cannabis businesses, finding educational resources and training programs, and staying current on industry changes by joining industry groups (like the Illinois CPA Society’s Cannabis Industry Member Forum) and subscribing to email distribution lists

For CPA firms serious about developing cannabis as a specialty area, Hunzicker also recommends jumping in and participating in the marijuana movement He notes that many industry groups are welcoming and communicate daily about constantly changing issues and regulations “Cannabis is an exciting industry and offers an amazing opportunity to grow your success by building a niche,” he says “It’s also a fun time to get involved You will meet interesting people and find very appreciative CEOs ”

www icpas org/insight | FALL 2019 19

20 INSIGHT | www icpas org/insight

BY ANNIE MUELLER

Every manager has experienced it at one time or another: the feedback void. A careful delivery of pertinent feedback is answered by silence.

“A lot of people become what I call ‘blank starers,’” quips Brad Karsh, founder and CEO of JB Training Solutions and author of “Manager

3 0 ” “You give feedback, and you get someone sitting there blankly.” Further discussion leads to defensiveness or more awkward silence. Finally, the meeting is over. Both manager and employee part ways and breathe a sigh of relief. What, exactly, has been accomplished?

www icpas org/insight | FALL 2019 21

“Feedback is very difficult for people to deliver and it’s even harder for people to receive,” Karsh states Steven Stosny, Ph D , founder of CompassionPower and author of “Soar Above,” notes that feedback often fails because it’s based on criticism, which calls for submission and makes people feel devalued The human drive for autonomy makes submission to others unpleasant, even when warranted Of course, no one enjoys feeling devalued, and the instinctive response is to argue for one ’ s value, defending against criticism rather than accepting it passively

“A big part of the problem is that we have not been socialized to have these conversations,” states communication expert Gregory Tall “We’re not comfortable, so we avoid them A lot of issues start with that avoidance ”

Feedback is often delayed until it can’t be avoided Then an already on-edge employee reacts defensively, a stressed manager feels resentful of the whole process, and nothing actually changes It’s no wonder many of us would drop feedback altogether if we could

Here’s where things get trickier: “Nine out of 10 people want the feedback,” Tall affirms “If there’s something they can do differently to be more successful, they want someone to tell them ” What employees don’t want is meaningless criticism or micromanagement, which engenders a back-and-forth of defensiveness and frustration

Too little, too late

Typical feedback provides too little: it is vague or generic, too specific for application, or too focused on managerial preference rather than meaningful change Employees don’t know how to respond to directives like “You need to be better at interpersonal relationships in the office,” or “You were too harsh in this one client email ” Instructing a direct report to “have a more positive attitude in meetings” sounds nice but overlooks two essential points: First, why does it matter? And second, how will anyone know when it’s been accomplished?

Feedback also fails on timing: Annual reviews present feedback weeks or months after an incident has occurred Directives become retroactive rather than proactive, bringing up behavioral issues too far in the past to be relevant The employee leaves with the justifiable sensation of having been kept in the dark

“Just-in-time feedback is important,” Karsh says “It’s not helpful to say, ‘Hey, remember that meeting we had months ago? You said that one thing Don’t say that thing again ’”

Removing resistance

Some essentials must change to make feedback welcome and effective: timing, delivery, and support

Stosny points out a key to making feedback work: Humans like to cooperate “Partnership is a big part of successful feedback,” Tall adds If supervisors offer feedback in a way that asks for cooperation rather than submission there can be better conversations, creative solutions, and effective behavior change In the long term, building an organization with a culture of cooperation rather than an authoritarian lead-and-follow hierarchy leads to more autonomous and happier employees This doesn’t mean that organizations must dismantle their hierarchy, only that leaders seek to establish their leadership through relationship rather than rule “It’s acting more as a coach,” Karsh suggests

In general, more feedback is also better But this doesn’t mean a more detailed quarterly review It means giving feedback more often, even daily Karsh calls it “just-in-time feedback”: When the undesired behavior occurs, address it immediately, or as soon as possible after The moment is now, always now Don’t wait for a prescheduled meeting In fact, there’s no need to make a meeting out of it in most cases The key is conversation When you ’ re delivering help in the moment, or immediately after, feedback is much easier to deliver and to receive ”

“Aim for simplicity,” Tall advises “You don’t need graphs and charts ” Ensure that there’s adequate privacy and say what needs to be said Immediacy has benefits for everyone: employees aren’t left wondering how many unspoken mistakes are hanging over them; supervisors aren’t carrying a laundry list of frustrations and corrections Further, it’s easier to measure feedback efficacy: Does the behavior change, or does it repeat? You might not know today, but you will know by tomorrow

Tall also recommends customizing how often feedback is delivered Employees of the millennial generation prefer feedback on a daily or near-daily basis Others, particularly those from Gen X or prior, prefer a hands-off approach: Let them know if there’s a mistake or

22 INSIGHT | www icpas org/insight

an incident to correct, otherwise leave them to the work “Managers need to pay attention to their employees and where they fit on this spectrum,” Tall advises “When the communicator considers what’s going to work best for the other person, everything works better ”

Karsh subscribes to monthly sessions of informal feedback “No forms, no numbers, nothing even needs to be written,” he says Sit down and talk about how things are going Ask questions “These are the conversations that create a culture of feedback,” Karsh states

And does it really take too much time to customize one ’ s feedback approach for each employee? “It’s a choice between prevention and treatment,” Tall suggests “You invest time up-front to be thoughtful and intentional about what’s going to work well for your people Or you let things deteriorate into turmoil and deal with it then ” Prevention is less painful and time-consuming than dealing with an escalated, emotional situation Urgency adds both stress and complication On the other hand, proactive, customized feedback allows small incidents to remain small

Delivery without drama

The now-infamous “feedback sandwich” approach smushing a negative between two positives is too well-known (and universally disliked) to be respected or effective Frameworks inevitably become formulaic Pulling a ho-hum framework out of the supervisorial pocket sends a clear message: Dear Employee, I need you to change, but you ’ re not worth my individual attention It’s difficult for employees to hear anything else over the noise of nonchalance

The ideal feedback framework is no framework Instead, managers can rely on values of honesty, respect, and cooperation to guide them through each situation Honesty is essential, as there’s no trust in a relationship without it “We need to be more direct when we deliver feedback,” Karsh encourages “Avoid weak words You can be both assertive and nice When we deliver feedback in a passive, indirect way, it leads to miscommunication and frustration ” The value of respect helps leaders to keep their own egos in check, and to choose carefully what merits feedback and what does not “As a leader, you have to be objective,” Karsh continues “Am I giving feedback because I want them to do something the way I do it, or am I giving feedback because fundamentally there’s a mistake or behavior needs to change?”

Tall uses a simple formula to evaluate what needs to be communicated: “Expectations minus actual outcomes equals feedback,” he explains “If the result is as expected, we finish with zero feedback needed and move to praise or recognition But if the results fall short of the expectations, we have a deficit ” It’s good to create a set of criteria to help anyone in a managerial role determine what should be addressed Depending on how important something feels in the moment is the downfall of the immediacy approach Immediacy can become an excuse for unnecessary urgency; objective criteria provide a counterbalance “Specificity is so important We don’t want to waste our time on things that don’t matter,” Tall adds

Support systems

A culture of open, ongoing feedback must be supported from the top or it won’t last, Karsh says Leaders can demonstrate their commitment by asking to receive as well as give feedback Specific requests will help when employees are reticent: “Tell me three things I could improve in meetings” is more likely to get a response than “Let me know if you have any suggestions about my leadership style ”

Of course, anyone delivering feedback must also learn to anticipate defensiveness Karsh prescribes a slow approach “Do a little bit more listening as opposed to a little bit more talking,” he says “You want to find out their perspective on things ” Take an inquirybased approach The point is to get to the core, the reason for defensiveness; once that’s done, future moments of feedback become easier

In the end, feedback that’s delivered well but instigates no change is as useless as too little, too late feedback “The ultimate proof as to whether the feedback got through is whether the behavior changes,” Karsh says Leaders who commit to delivering feedback that can be measured specifically and objectively via adjusted behavior create a safeguard against micromanagement and preferential directives Focusing on feedback that gets desired results frees everyone to focus on what matters “It feels great to get feedback with a specific thing you can track, then improve, and see yourself becoming better,” Karsh states “That’s a victory for everyone ”

www icpas org/insight | FALL 2019 23

Has the Chance Paid Off?

Two years in wit h t he new tax law, t here’s still muc h uncer tainty about its benef its.

BY CAROLYN KMET

In December 2017, the Tax Cuts and Jobs Act (TCJA) was enacted as part of a domestic growth strategy designed to fuel job growth, wages, and capital spending The Act lowered the statutory corporate income tax rate from 38 9 percent to 25 7 percent, bringing the U S corporate income tax rate more in line with the Organization for Economic Co-operation and Development (OECD) average of 23 8 percent

“The Congressional Budget Office (CBO) projected that GDP would grow about 0 3 percentage points faster in 2018 and 2019 due to the TCJA,” explains Kyle Pomerleau, chief economist at the Tax Foundation, an independent tax policy non-profit based out of Washington, D.C.

U S GDP did grow in 2018, at a rate of 2 9 percent about 0 1 percentage points shy of the CBO’s projection Some analysts believe that lowering the tax rate was not enough, as there are still 22 OECD countries that have statutory corporate income tax rates below that of the United States Further, due to escalating geopolitical uncertainties over the past two years, it remains challenging to identify the actual impact of the TCJA

24 INSIGHT | www icpas org/insight

www icpas org/insight | FALL 2019 25

“It’s hard to tell if the TCJA was underperforming, or if the Trump administration’s tariff policies had a negative impact,” Pomerleau says “Investment did accelerate in 2018 but has since gone back down in 2019 This could have been in response to the TCJA, but it is probably too early to tell ”

Jeff Glenzer is the executive vice president of the Association for Financial Professionals (AFP) He acknowledges that increased risk associated with today’s global uncertainties makes it even more challenging to measure the true impact of the TCJA

“Consider all the hostility in Washington, the ebb and flow of the relationship with North Korea, the continuing escalation of tariffs, and now China being flagged as a currency manipulator,” Glenzer says “Each one of these factors creates a new source of real or perceived risk for corporate decision makers ”

Corporate spending, one of the elements the TCJA was designed to spur, is depressed by increased risk and an uncertain environment A March 2019 AFP liquidity survey indicates that companies may still be hesitant to reap the benefits of the TCJA

In the 12 months to March 2019, about half of the 496 finance and treasury professionals the AFP surveyed said the size of their cash hoards had not changed much, either domestically or overseas Fifty-seven percent of survey respondents had not made changes in their spending or allocation patterns, and those that are spending, aren’t spending it on what they were expected to

“What’s most troubling to me, is that even when companies are drawing down corporate liquidity, the way they’re deploying that corporate cash is not the most beneficial for either the company or the economy, ” Glenzer says

Instead of investing in new products or in building new factories, companies are taking a more cautious approach to their spending strategy by focusing on non-infrastructure investments such as share buybacks and debt reductions

“If you take your cash and move it into a longer term financial instrument, those decisions are easier to undo as compared to more permanent decisions such as investing in a factory or an acquisition,” Glenzer says

Glenzer’s bigger concern though, is that due to economic and geopolitical uncertainty, companies are more likely to keep sitting on large pools of corporate cash “When the market’s psyche changes to where it’s perceived as safe to start drawing down corporate cash, there’s going to be an awful lot of corporate cash chasing a limited number of really strong opportunities Companies are going to have to be very careful about overpaying for target assets,” Glenzer explains

The TCJA was also expected to have a positive impact on repatriation of corporate profits through the effective elimination of taxes on repatriated earnings of U S multinationals from their foreign affiliates Indeed, U S corporations did repatriate funds in record numbers in 2018, bringing back almost $777 billion, though this was a far lower number than the anticipated $4 trillion expected by President Donald Trump

According to the AFP survey, only 16 percent of respondent companies repatriated funds Of the companies that did shift funds domestically, over half moved less than 25 percent of their offshore earnings “The TCJA probably slowed the growth of the percentage of company funds that are held offshore,” Glenzer surmises

Glenzer also points out that tax strategy is not the only reason companies keep funds offshore “There are a lot of companies who have said that they didn’t care about taxes they cared about the opportunity to use those funds to invest overseas The TCJA did not change the economic potential of various markets where companies were investing those funds ”

For small businesses, the 20 percent pass-through deduction may have had more of an impact than the tax cut Under the TCJA, passthrough entities such as partnerships, limited liability companies, S corporations, and sole proprietorships can deduct up to 20 percent of the first $315,000 of qualified business income, or QBI

“This pass-through deduction has freed up cash for hiring and expansion,” says Tom Wheelwright, CEO of WealthAbility, a tax strategy service provider based in Tempe, Ariz

As a result of increased liquidity provided by the TCJA, Wheelwright has invested in growing his business this past year