When D i v e r s i t y Is the Deal

- Uncovering Unconscious Bias in Business

- COVID-19 Fraud: How to Combat Its Rise

- A Roadmap to Records Retention

- Internal Controls in a Remote World

- The Simple Recipe for a Great Firm

FALL 2020 Exploring the issues that shape today’s business world

2 | www icpas org/insight FALL 2020 www icpas org/insight FRAUD

THE NEW NORMAL WHEN DIVERSITY IS THE DEAL UNCOVERING UNCONSCIOUS BIAS spotlights 4 Today ’s CPA Will You Control Your Future or Will the Future Control You? By Todd Shapiro 6 Capitol Report Graduating to a Graduated Tax Rate By Marty Green, Esq 8 Seen & Heard Mindful Technology: A New Approach in a New Normal By Hilary Collins 42 Gen Next Finding a Higher Purpose in Volunteering By Roxanne Chow, CPA 44 IN Play Q&A With Dorri C McWhorter, CPA, CITP, CGMA By Derrick Lilly trends 10 Practice Management A Roadmap for Records Retention By Annie Mueller 12 Risk Management Internal Controls in a Remote World By Natalie Rooney insights 26 Director ’s Cut Bias and the Board By Kristie P Paskvan, CPA , MBA 28 Ethics Engaged An Ethical Approach to Diversity and Inclusion By Elizabeth Pittelkow Kittner, CPA , CGMA , CITP, DTM 30 Leadership Matters Leading Yourself Through Crisis By Jon Lokhorst, CPA , ACC 32 Firm Journey What Makes Great Firms Great? By

CPA , CGMA 34 Practice Perspectives It ’ s Time to Rev Your Business Development Engine By Art Kuesel 36 Financially Speaking Investing During COVID -19: Stick to Your Principles By Mark J Gilbert, CPA/PFS, MBA 38 Tax Decoded The Dark Side of Illinois Property Tax Law By Keith Staats, JD 40 Inside Finance COVID -19’s Impact on Lease Accounting By Nancy Miller, CPA 14 18 22

IS

Tim Jipping,

ILLINOIS CPA SOCIET Y

550 W Jackson Boulevard, Suite 900, Chicago, IL 60661

www icpas org

Publisher/President & CEO

Todd Shapiro

Editor Derrick Lilly

Assistant Editor

Hilary Collins

Creative Director

Gene Levitan

Copy Editors

Nancy Clarke | Mari Watts | Jennifer Schultz, CPA

Photography Derrick Lilly | iStock

Circulation

John McQuillan

ICPAS OFFICERS

Chairperson

Dorri C McWhorter, CPA, CGMA, CITP | YWCA Metropolitan Chicago

Vice Chairperson

Thomas B Murtagh, CPA, JD | BKD CPAs & Advisors

Secretar y

Mary K Fuller, CPA | Shepard Schwartz & Harris LLP

Treasurer

Jonathan W Hauser, CPA | KPMG LLP

Immediate Past Chairperson

Geoffrey J Harlow, CPA | Wipfli LLP

ICPAS BOARD OF DIRECTORS

John C Bird, CPA | RSM US LLP

Brian J Blaha, CPA | Wipfli LLP

Jennifer L Cavanaugh, CPA | Grant Thornton LLP

Stephen R Ferrara, CPA | BDO USA LLP

Jennifer L Goettler, CPA, CFE | Heinold Banwart Ltd

Scott E Hurwitz, CPA | Deloitte LLP

Joshua D Lance, CPA, CGMA | Lance CPA Group

Enrique Lopez, CPA | Lopez and Company CPAs Ltd

Elizabeth Pittelkow Kittner, CPA, CGMA, CITP, DTM | International Legal Technology Association

Deborah K Rood, CPA | CNA Insurance

Seun Salami, CPA | Teachers Insurance and Annuity Association of America

Stella Marie Santos, CPA | Adelfia LLC

Brian B Stanko, Ph D , CPA | Loyola University

Mark W Wolfgram, CPA | Bel Brands USA Inc

BACK ISSUES + REPRINTS

Back issues may be available Articles may be reproduced with permission

Please send requests to lillyd@icpas org

ADVERTISING

Want to reach 23,000+ accounting and finance professionals? Advertising in Insight and with the Illinois CPA Society gives you access to Illinois’ largest financial community Contact Mike Walker at mike@rwwcompany com

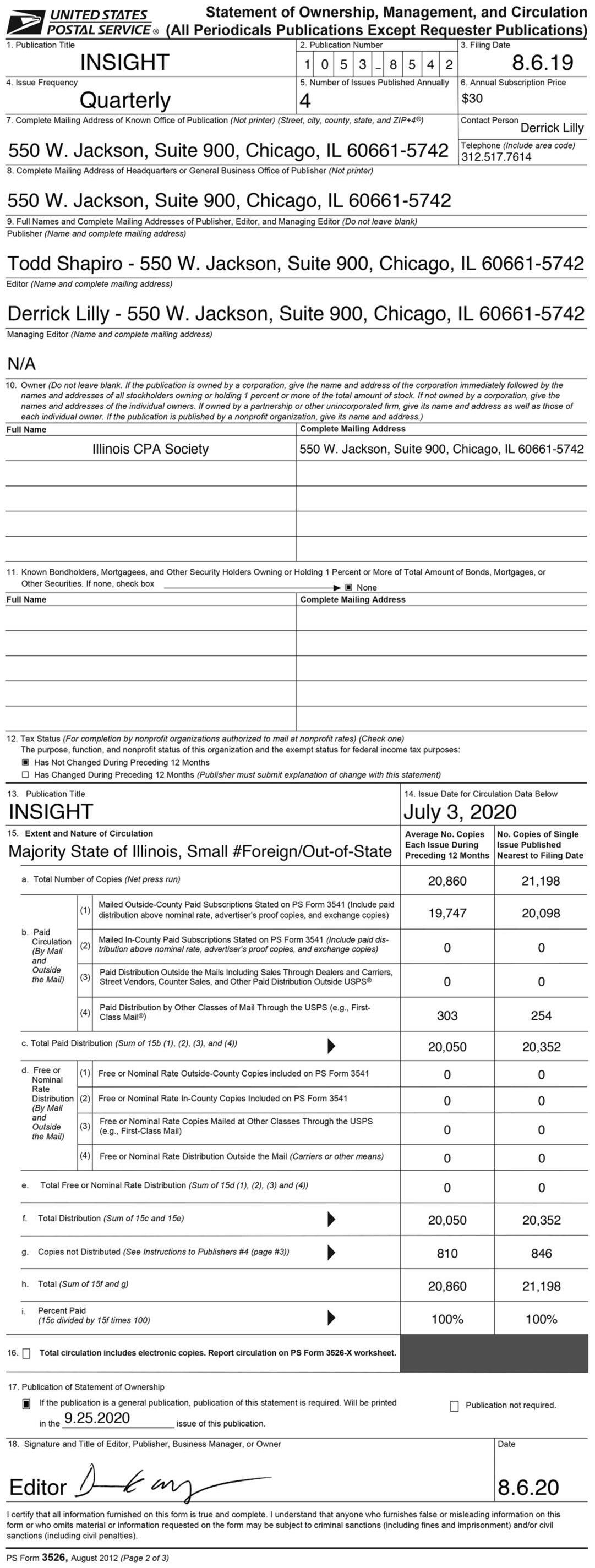

Insight is the magazine of the Illinois CPA Society Statements or articles of opinion appearing in Insight are not necessarily the views of the Illinois CPA Society The materials and information contained within Insight are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is Insight ’ s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet Insight ’ s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within Insight, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for Insight The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering Insight Insight (ISSN1053-8542) is published four times a year, in spring, summer, fall, and winter, by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA, 312 993 0407

Copyright © 2020 No part of the contents may be reproduced by any means

the written consent of Insight Send requests to the address above Periodicals postage paid at Chicago, IL and at additional mailing offices POSTMASTER: Send address changes to: Insight, Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA

without

today’sCPA

INSIGHTS FROM TODD SHAPIRO, ICPAS PRESIDENT & CEO @Todd ICPAS

Will You Control Your Future or Will the Future Control You?

To be an organization of the future, you need to be in the future Those are interesting words to live by, but I don’t think the CPA profession has many alternatives Accounting and finance will see significant, if not revolutionary, changes over the next five to 10 years Technology is changing rapidly with the expansion of artificial intelligence (AI), robotic process automation (RPA), and big data We’re also witnessing a changing workforce and, with it, changing expectations as baby boomers rapidly retire and millennials and Gen Zers become dominant in the workplace

We at the Illinois CPA Society have been studying the trends dictating the future, specifically with regards to ensuring the relevance of the CPA profession We’ve looked at the trends mentioned above, as well as those driving hiring at accounting firms, what firms and companies are expecting from their accounting professionals, and who is (and who isn’t) pursuing the CPA credential We’ve previously discussed some of these topics in our Insight Special Feature, “Trust Is Not Enough,” and articles like “Becoming a Firm of the Future ” But what we haven’t yet shared is the outcome of our full-day Illinois CPA Society Board of Directors retreat to discuss all of these trends and more The culmination of our examination to date is the development of our “CPA Profession 2027” outlook, which we hope will serve as a beacon for which we, as a profession, can chart a course to the future We’ll soon issue a new Insight Special Feature with more details behind our outlook, but here are some of our predictions to ponder now:

• Tech takes over – RPA and AI are utilized in every function a CPA performs

• Firms evolve – With audit and tax automated, firms will focus on strategic planning and insight

• Finance evolves – Corporate finance teams will focus on interpreting data to drive profitability

• Workers evolve – The talent pool will be digitally agile, demand greater flexibility, and be socially conscious

• CPA numbers fall – There will be significantly fewer CPAs than in 2019 when there were 650,000

The question firms and finance organizations face now is how to ensure they’re part of the future I’m always struck by the number of prominent Illinois firms that end up being merged into larger outof-state firms The fact is, if we don’t proactively plan for the future, we risk not being part of it I received a call last winter from a firm that asked for help becoming a firm of the future after reading our Insight article Subsequently, we sat down for about 90 minutes to discuss the key trends they’ll be facing That experience got me thinking about how the Society needs to do more than just developing a future vision for the profession We need to help firms and organizations develop strategic plans and roadmaps to become organizations that survive and thrive in the future

Fast forward to the Society’s launch of its new Strategic Planning Service tailored to public accounting firms and corporate finance organizations Using a proven methodology, the Society will work with your organization to develop a bold future vision and strategic roadmap to get you there The day-long process includes facilitated interactive sessions that will help your leadership team reflect on the past, think strategically about the future, and prioritize realistic and actionable steps to move forward together Throughout the session, participants share diverse viewpoints, ask tough questions, challenge assumptions, identify points of insight, and build consensus all with the focus of becoming future ready The outcome is a plan that is strategic, actionable, and achievable Please email me if you’d like to learn more about this new service from your Illinois CPA Society Now, on to the future!

To share your thoughts, email me at shapirot@icpas org or just give me a call 800 993 0407

If CPAs don’t proactively plan for the future, they risk not being a part of it.

4 | www icpas org/insight

LEGISLATIVE INSIGHTS FROM MARTY GREEN, ESQ , ICPAS VP OF GOVERNMENT RELATIONS @GreenMarty

Graduating to a Graduated Tax Rate

Illinois’ voters face a historic decision in a ballot measure amending the state Constitution to introduce a graduated income tax rate.

This November, voters across the U S will make many important decisions about the future direction and leadership of our country, states, cities, and counties But Illinois voters will face a unique decision: whether or not to amend the Illinois Constitution’s Article IX If approved, this amendment would lift the limitations on income taxation and allow the state to move from a flat income tax rate for individuals and corporations to a graduated income tax rate Gov J B Pritzker campaigned on moving to a graduated income tax rate and it has guided his strategic approach in his tenure thus far (For the record, the Illinois CPA Society remains neutral on this ballot question due to the diverse interests of our membership Although neutral, we are available to legislative leaders and their staffs to respond to questions with objective and technical information ) Here’s what to know about this ballot measure:

The History of the Graduated Tax Rate

Illinois’ current Constitution was adopted in 1970 and has been amended 12 times since then The last amendment was approved by voters in 2016 with the approval of the Transportation Taxes and Fees Lockbox Amendment to securitize transportation funds When discussing the 1970 Illinois Constitution, Gov Richard Ogilvie felt that the 1870 state Constitution would not allow for a graduated income tax Instead, he proposed a flat rate for the state income tax, which was passed by the General Assembly The 1970 Constitutional Convention Delegates carried forward the flat rate concept from the 1870 state Constitution which remains in place today

Roughly 50 years later, in 2019, both the Illinois House and Senate passed Senate Joint Resolution (SJR) 1, calling for voters to adopt or reject their proposed amendments to Section 3 of Article IX, which would allow a graduated tax rate The resolution also specifies the wording of Article IX, Section 3 will be changed to read: “The General Assembly shall provide by law for the rate or rates of any tax measured by income imposed by the state ”

At the same time the Illinois House and Senate were passing SJR 1, the General Assembly passed Senate Bill 687 (Public Act 101-0008), which created a schedule of graduated income-based tax rates for individuals, trusts, and estates for taxable years beginning on or after

Jan 1, 2021 The Act also established that corporations would be taxed at a rate of 7 99 percent These propositions for a graduated income tax rate are the ballot measures we ’ re voting on this November and will only be enacted if the ballot measure is approved by voters

The Illinois Constitutional Amendment Act requires the General Assembly to prepare and distribute to the electorate a brief explanation of the proposed amendment and two brief arguments one for the amendment and one against SJR 1 contains this explanation and those arguments, which will be printed and mailed by the secretary of state to each registered voter’s home prior to the general election

The Voters Decide

The General Election will be held on Nov 3, 2020 In order for the graduated tax amendment to be adopted, it must receive a majority vote of the electors voting in the election or three out of five electors voting on the proposed amendment The Constitutional Amendment Act requires the State Board of Elections to certify the election results within 20 days of the election Depending on Illinois voters and the State Board of Election’s ability to certify the general election in a timely manner, the graduated income rate could be effective January 2021

Prior to the emergence of COVID-19, the graduated income tax rate proposal was positioned as a panacea for Illinois’ precarious finances The totality of the lingering economic impact of the pandemic continues to grow, as well as the tremendous impact on state tax receipts As Illinois continues to struggle financially in the wake of the pandemic, it is not certain this ballot measure will be enough to balance the state budget Regardless of the graduated tax outcome, many difficult decisions lie ahead for the governor, the General Assembly, and the voters on state spending, public pension reform, property taxes, and more However, it is necessary to resolve these issues so that Illinois can begin moving forward again

Author’s Note: This column includes my personal observations of the evolution of the legislative environment and are not necessarily the views of the Illinois CPA Society

6 | www icpas org/insight

capitolreport

100% CPA MEMBERSHIP PROGRAM

Arnold, Behrens, Nesbit, Gray P.C.

Baker Tilly

Bansley, Brescia & Co., P.C.

BDO USA, LLP

Benning Group, LLC

Bernard A. Affetto & Co.

Borschnack, Pelletier & Co.

BrookWeiner, LLC

Catalano, Caboor & Co.

The Charneske Group, Ltd.

CliftonLarsonAllen

Coleman & Associates CPA's, Ltd.

Cray, Kaiser Ltd.

Crowe LLP

Cygan Hayes, Ltd.

D Tax People

Daniel P. Vargo & Associates, P.C.

Deborah K. Hannan, CPA, P.C.

Dennis Rose & Associates, P.C.

Desmond & Ahern, Ltd.

Detterbeck Johnson & Monsen

The Dolins Group, Ltd.

Duffner & Company, P.C.

Dunbar, Breitweiser & Company, LLP

Echales, Benjamin & Simkin, LLP

Eck, Schafer & Punke, LLP

FSB&W LLC

Gassensmith & Michalesko, Ltd.

Gilbert, Metzger & Madigan, LLP

Grant Thornton, LLP

Gray Hunter Stenn LLP

GW & Associates, P.C.

Hochfelder & Weber, P.C.

Hoffman & Tranel, P.C.

Holland & Company CPA’s, P.C.

Honkamp Krueger & Co., P.C.

Insight CPAs & Financial LLC

J.M. Abbott & Associates, Ltd.

J. S. Richter, Ltd.

John Kasperek Co., Inc.

John U. Smyth CPA, LLC

Jonker & Associates

Katz LLC

Kirkpatrick & Dahl, P.C.

KPMG US, LLP

Kutchins, Robbins & Diamond, Ltd.

Larry J Wolfe Ltd.

Lauterbach & Amen, LLP

Leaf Dahl & Company, Ltd.

Legacy Professionals LLP

Lerman, Sweeny & Company, LLP

Lipschultz Levin & Gray LLC

Lucas Group

M. A. Cowin, CPA, P.C.

Mack & Associates, P.C.

Mann Weitz & Associates

Marcum LLP

McCullough Rossi & Company, Ltd.

McGreal & Company, P.C.

MichaelSilver

Mueller & Co. LLP

Northshore Professional Group, Ltd.

O'Neill & Gaspardo, LLC

Ostrow Reisin Berk & Abrams, Ltd.

Pasquesi Sheppard LLC

PBG Financial Services Ltd.

PricewaterhouseCoopers, LLP

Romolo & Associates, LLC

Rub & Brillhart, LLC

RubinBrown LLP

Sassetti, LLC

Selden Fox, Ltd.

SKDO CPAs & Advisors

Tighe, Kress & Orr, P.C.

Topel Forman, L.L.C.

Trimarco Radencich, LLC

West & Company, LLC

Whitlock and Associates, P.C.

Wipfli LLP

For more information on how your firm can be part of the 100% CPA Membership Program, please visit www.icpas.org.

*minimum of 2 CPAs

To thank you for your support... of the Illinois CPA Society and the profession, we are pleased to recognize these Illinois accounting firms with 100% of their CPA staff who are members.*

Mindful Technology: A New Approach in a New Normal

In an increasingly digital world, approaching technology with mindfulness is key to both mental health and business success

BY HILARY COLLINS

Youwake up in the morning to your phone alarm, sign into your work laptop, Zoom with coworkers, FaceTime with friends, grocery shop online, stream movies online, and look up recipes online COVID-19 has only accelerated digitization and the use of technology in every facet of our lives Instead of going to Blockbuster, browsing a bookstore, filling a physical shopping cart, or sitting in a small meeting room with clients, we ’ re interacting with technology

That’s why choosing the technology we use and evaluating how we interact with it is so important Amy Vetter, CPA CITP, CGMA, MBA, has combined her expertise in technological innovation and yogic practices to champion a balanced and intentional approach to our online lives that she calls mindful technology

“During COVID-19, we saw many companies going remote in the blink of an eye, and many had no choice but to make knee-jerk decisions to keep the lights on, ” Vetter says “They implemented technology that would allow them to do the work remotely but didn’t have the time to do so thoughtfully ”

So now what? Vetter says now is the perfect time to step back and reassess what we want from technology

“The mindful piece of this is that we need to balance the need for human connection and a positive human experience with efficiency, ROI, and all the practical things we ’ re looking for from technology,” Vetter explains

The truth is that the tactile experience of working with a technology is a very important part of the overall effectiveness of that technology Some technologies may do what they were designed to do while also creating more stress and less fulfilment, which in the long run

can lead to employee burnout, client frustration, and underutilization of the technological tools a business is paying for

Organizations who want to embrace mindful technology can start by building a team to evaluate the technology the organization is using Vetter stresses the importance of listening to all voices and not just the ones that are happy with the current system

“Technology has really changed over the past 20 years 20 years ago you would find a software package, implement it, and walk away, ” Vetter notes “Today, you should focus on continual improvement and fine-tuning If you can make it 10 percent better, that’s great ”

While embracing mindful technology as an organization is an ongoing challenge, individual team members can start immediately by setting healthy boundaries

“In a remote world, it’s important to make room for the things that matter and that rejuvenate us, ” Vetter emphasizes “We should be thinking through our day and putting guardrails around our time and having the confidence to take time for priorities One complaint I hear is, ‘People put meetings on my calendar even when I have time blocked,’ but the truth is, we each have control to decide whether we accept a meeting ”

As technology becomes an integral part of our lives, approaching our digital lives with mindfulness and care should be important to us as individuals and as organizations

“When we put technology in place mindfully, we should see time freed up so we can focus more on our clients, team members, and creating better human connections,” Vetter says

8 | www icpas org/insight

OUR PROCESS: Illinois CPA Society’s interactive planning sessions will help your leadership team:

• Reflect on the past.

•Think strategically about the future.

•Prioritize realistic actionable steps to move forward together.

OUTCOMES:

Walk away with a tailored roadmap to the future that is:

Strategic | Actionable | Achievable

Are you controlling your future, or is the future controlling you? Dealing with issues like AI, RPA, the future of client services, employee expectations, and firm succession planning, you may be asking yourself: What do we do? Where do we go next? To be a firm of the future, you need to be IN the future! That’s where we can help. The Illinois CPA Society has launched a new, tailored strategic planning service for public accounting firms to help you discover how you can compete in the future, serve your clients, and be a place where people want to work. TO LEARN MORE, CONTACT: Todd Shapiro | shapirot@icpas.org | 312.517.7601 CONSULTANT/ FACILITATOR: Todd Shapiro President & CEO,

CPA Society

top 100 influential

NEW SERVICE!

Illinois

Named

people in accounting by Accounting Today.

A Roadmap for Records Retention

For firms looking to improve document management, these principles serve as a guide to creating and implementing an effective records retention policy.

BY ANNIE MUELLER

BY ANNIE MUELLER

ecords retention may not be the most glamorous area of professional service firm management, but what it lacks in glamour it makes up for in importance The cost of poor documentation, missing records, or regulatory write-ups can be massive A single missing contract, spreadsheet, or email can turn into a messy mistake In fact, poor document management was identified as one of America’s most broken business processes in a 2018 study by Nintex where 49 percent of respondents identified locating documents as a key problem in their organizations

Since records management is integral to successful firm management, it pays to do it well Consistent and secure records retention is essential not only for a firm’s well-being, but also for the well-being of its clients

THE RISKS OF RETENTION DEFICIENCIES

For their own sake, firms must be able to prove exactly what services were provided and actions were taken For their clients, firms may be a source of documentation to help solve business,

legal, or tax disputes Clients should be advised that records are retained on a schedule, preferably in the annual engagement letter, and that they are responsible for keeping their own records independently and securely

Of course, some records have no expiration date “Typically, estate planning documentation, like wills, trusts, gift tax returns, partnership agreements, and life insurance policies, are deemed to be vital records and should be retained permanently,” cautions James A J Revels, a Philadelphia-based CPA and member of the American Institute of CPAs Personal Financial Planning Executive Committee “If a firm is going to destroy estate planning documents, they should return the files to the client, or at the very least inform the client of the scheduled destruction date and provide them the option to object ”

However, sound records retention does not mean serving as document storage for clients There is no point and a lot of risk in retaining records unnecessarily After all, document storage, whether paper or electronic, comes at a cost, and organizing and

10 | www icpas org/insight

P R A C T I C E M A N A G E M E N T

accessing documents becomes more complex and challenging as the number of documents increases And, as Revels says, “The potential for professional liability can be a danger in maintaining records too long ”

One possible risk of holding certain documents indefinitely, or just too long, is creating a bigger honeypot for potential hackers, notes Brian Daly, CPA, a sole practitioner with Bottom Line Solutions Ltd and a member of the Illinois CPA Society’s Taxation Practice & Procedures Committee “If the firm realizes a cybersecurity breach, additional data could be available to criminals which exposes the firm to potential liability The rule of thumb here is to keep records as long as necessary but not any longer,” Daly says

Thorough records management, then, is not just about keeping records A sound records retention system has three key components schedule, policies, and storage and once these components are in place, consistent implementation

A CLEARLY COMMUNICATED SCHEDULE

For the records retention schedule, every document is sorted according to class, and each class has its own timeline for retention Some classes are retained indefinitely Others, such as 1099 forms or payroll tax returns, have minimum standards for retention “The firm should determine the type of services that were provided that relied on general financial documentation This will assist in determining the length of time this type of documentation should be maintained Typically, this documentation is kept for six years, ” Revels says Firms which focus on a few specialty services will quickly become familiar with the classes of records they handle most of the time Firms with a wider variety of services and clients may need a broader range of classes

For records which do not clearly fall into a primary records class, research is the only route “Typically, records that are not deemed to be vital should be maintained for 10 years However, various states have different laws and regulations so legal counsel may prove helpful,” Revels notes “Consulting with an attorney to consider the state guidelines related to the statute of limitations is very important in creating a records retention plan ” For firms with clients in multiple states, this can become increasingly complex further reason to speak to an attorney

There is no cookie-cutter data destruction schedule “Each firm may have a different need depending on its client makeup, the services it provides to its clients, and state requirements The firm should contact its professional liability insurance provider and an attorney familiar with these issues for input on the design of the records retention policy,” Daly explains “A schedule could have different dates or a keep-it-simple approach choosing the longest required date across the board for ease of management The point is to have a schedule and adhere to it ”

CONSISTENT AND STRAIGHTFORWARD POLICIES

Firm-wide policies for how documents are named, stored, organized, and accessed keep the system functional Policies should be crystal clear and consistently applied Even smaller firms benefit from documented policies: the fewer hours spent deciding on or explaining how to keep records, the more hours spent on helping clients

A formal naming convention for all records maintains document organization and ensures that all firm members, present and future, will be able to locate needed records Firms should also ensure

that the final version of the document is retained and timestamped Timestamp any other document versions retained to maintain a clear timeline of how the record evolved

These days, many firms rely on paperless records retention exclusively, but some firms retain paper and digital versions of key documents Designate whether electronic or paper versions of records are to be maintained For records with an expiration date, detail each step, including client notification, server erasure, shredding, and use of outsourced document services Daly notes that a certificate of destruction should be obtained if a third party is used for this service

SAFE AND SECURE STORAGE

Since paperless document storage is now standard business practice, the sheer physical space required to maintain records is no longer the issue it used to be However, digital documents still require server space and come with their own set of security considerations Fortunately, there are numerous digital document services which provide servers and security with cloud-based access for firms Firms with in-house IT personnel may prefer to create their own digital storage system: it’s more customizable and may be more budget-friendly over time For smaller firms without an IT expert on hand, an all-in-one digital document management service may be best

“When considering service providers, make sure they maintain policies and procedures that comply with industry regulations Data should be encrypted, and consideration should be given to who is granted permission to access documents and more importantly, who has actually accessed the documents,” Daly says

It’s wise to give special consideration to how firm members deal with email “Some firms have been injured in the defense of professional liability claims and may maintain a separate retention policy for emails,” Revels says “Electronic documents should be stored in client files and not just kept as an attachment to an email Likewise, emails that provide vital information should be saved in the client’s engagement file ”

EFFECTIVE IMPLEMENTATION

Once the organization has created a schedule and policies, set up a storage system, and consulted with an attorney, the final step is firm-wide implementation Inform employees of the schedule and policies It’s a good idea to create “cheat sheets” that serve as guides and easy reference points

It’s also important to appoint accountable staff members to oversee implementation and education in various areas of the firm These people will also act as knowledge hubs to help answer any complex questions employees may have about records retention going forward These in-house experts should schedule regular meetings to identify and solve issues, maintain consistency, and update the records retention system as needed over time

Records retention may not be particularly exciting, but it is foundational to every firm Ensuring your firm’s system is secure, effective, and up-to-date is key to remaining a trusted and relevant resource to your clients

If you need a cheat sheet, check out the one compiled by the Illinois CPA Society’s Tax Practice & Procedures Committee at www icpas org/recordsretention

www icpas org/insight | FALL 2020 11

Internal Controls in a Remote World

As remote work takes hold at CPA firms and organizations, getting a grip on internal controls is essential for overcoming the security risks of an at-home workforce

BY NATALIE ROONEY

BY NATALIE ROONEY

efore COVID-19, working from home full time was the exception rather than the rule According to a June 2020 survey by IBM Security and Morning Consult, 83 percent of respondents said that prior to the pandemic they worked from home either rarely or not at all In face-to-face, pre-pandemic office settings, employers and IT teams managed, implemented, and monitored security measures and protocols from a central location Now those systems are upended

“Managing internal controls in an office setting is one thing Managing internal controls when everyone is working from their kitchen tables is another thing altogether,” says Bob Dohrer, CPA, CGMA, chief auditor for the AICPA

As pandemic concerns remain high, many workplaces plan to continue remote work into 2021 and beyond, and organizations may find themselves playing catch-up as they try to manage potential security risks in a world where in-person oversight is impossible and traditional controls are ineffective The pandemic has exacerbated the usual risks, with remote work, furloughs, and

layoffs all creating new weaknesses “Suddenly there may be fewer people available to process financial transactions, and that creates pressure, ” Dohrer says “Combine all of this with issues surrounding the segregation of duties, and teams that aren’t interacting in a live setting, and problems can develop quickly Controls designed for the office just don’t work as well in a virtual environment We have a new level of consideration that has to take place ”

If you haven’t revisited your internal controls lately, now is the time, says Jenny Deloy, CPA, MBA, Marcum LLP’s Chicago office managing partner and Illinois region partner in charge of assurance services “Change, anxiety, and uncertainty are creating an environment where fraud proliferates, and fraudsters are out there with new scams to convince people to do things they wouldn’t normally do,” she explains

As a result, companies need to be very aware of the steps they can take to avoid the opportunity for fraud, advises Elizabeth Sloan, CPA, managing director in Grant Thornton’s Chicago audit methodology and standards group: “Since we ’ re not all physically

12 | www icpas org/insight R I S K M A N A G E M E N T

together, we need to think about the basics What changes have occurred to the control environment because of remote work? We need to be sure we ’ re thinking about the right things and not becoming complacent ”

Here’s how to ensure your internal controls remain relevant in a remote environment

TEN STEPS TO DEVELOPING ROBUST REMOTE INTERNAL CONTROLS

Step zero, Sloan says, is to embrace the change: “Think of this as an opportunity to improve and build a more effective structure of internal controls rather than just having an interim structure ” After that, take these steps:

#1: Reexamine segregation of duties Look for gaps or dead ends in workflows created by virtual work How might duties need to change or be restructured? If signoffs were previously handled manually, how are they handled now? Has there been a loss of checks and balances?

#2: Take advantage of technology. Use secure portals to transmit documents, leverage the cloud, and embed timestamps on files to tighten security

#3: Track, document, and confirm. These steps are so basic that they’re often overlooked, Dohrer says Reach out to the information sender Confirm they sent it, and it’s what you received Track and document any changes made to approval levels, access rights, procedures, or responsibilities

#4: Know your data. What data do you have? Who can access it? Verify that data, including something as simple as a videoconferencing link, is not publicly accessible or open to more internal access than necessary

#5: Find new lines of communication. “Casually passing someone ’ s office used to spark conversations,” Deloy says “Now that you ’ re not in front of someone, you might not hear about problems Initiate conversations on a regular basis and in a collaborative way Make sure you ’ re on the same page and pursuing the same goals ” Consider checking in daily with your team and using video more often than telephone or email

#6: Assess cyber risk. IBM’s report found that fraud has risen dramatically since March “Cyber risk assessment is crucial right now, ” Deloy cautions “Provide teams with training and awareness of cyber-related matters so they recognize current scams ” Now is a good time to confirm your IT systems are in place and working securely and that proper passwords, encryption services, and multifactor authentication are in place

#7: Get leaders involved. “Those charged with governance need to remain visible to employees, particularly in the accounting function,” Deloy stresses She suggests using live video for meetings “Your team needs to see leaders involved, monitoring, and supporting positive behaviors People want to do the right thing Provide the support they need to do so ”

#8: Draw attention to ongoing monitoring Continuously discussing processes demonstrates to team members that someone is always assessing the situation, and that can be a real fraud deterrent “If someone is considering bad behaviors, just knowing someone is watching is helpful, even if they’re watching from home,” Deloy says

#9: Remember the human element. Don’t forget about the people behind the processes “Make sure team members are engaged and not burned out,” Sloan recommends “Working virtually in a

pandemic means the opportunity and pressure to potentially commit fraud are already there If people lose their engagement, they can easily rationalize things they usually wouldn’t do ”

#10: Communicate with your clients. A review of internal controls presents a perfect opening for firms to reach out to clients “Help them think about these matters within their organizations, because their attention is definitely elsewhere,” Deloy urges “Take advantage of this opportunity to advise, guide, and help your clients revisit, refresh, and improve their internal controls ”

DIFFERENT CAN BE BETTER

Do you really need to think about internal controls differently in a virtual world? Yes Do organizations need to panic? No Remember: The fundamental principles don’t change “You don’t need to adopt a new framework and change everything,” Dohrer says “Think about a control objective in the manual world, and then consider how that can be accomplished in the virtual world Most businesses and auditors will find that a good understanding of fundamental principles will go a long way in this environment ”

Rather than dragging organizations down, virtual work and rethinking internal controls and processes should be propelling organizations forward, Sloan suggests “At Grant Thornton, we ’ re focusing on quality and are working smarter by utilizing more advanced data Examining data analytics has allowed us to be more precise and to home in on specific risks,” she shares “From a technology perspective, remote work has helped us improve our communication and use more tools to facilitate collaboration We’re not just doing what we ’ ve always done Even when we ’ re back in the office, we won’t go back to the way things used to be ”

www icpas org/insight | FALL 2020 13

Trent Holmes 800-397-0249 Trent@APS.net www.APS.net Whatever stage you’re in... STARTING your practice? GROWING your practice? SELLING your practice? O u r B e s t- i n - c l a s s B r o k e r s w i l l h e l p yo u a c h i e v e YO U R g o a l ! $1 Billion+ in Deals Closed

IS THE NEW NORMAL

Fraudsters are taking advantage of the upheaval and anxiety of the COVID-19 crisis—here’s how to protect yourself and your organization.

BY CAROLYN KMET

14 | www icpas org/insight

www icpas org/insight | FALL 2020 15

In the age of COVID-19, fear, desperation, and uncertainty are fueling fraud in every sector public, private, and government and anyone can be a victim According to the Federal Trade Commission, Americans have lost more than $77 million in COVID-19-related fraud Just within the past six months, there have been several highly visible hacks: In April, hackers infiltrated the U S Small Business Administration, gaining access to the personal information associated with nearly 8,000 Paycheck Protection Program applicants, including Social Security numbers, addresses, and phone numbers In June, hackers used malware to extort $1 14 million from the University of California, San Francisco And in July, hackers hijacked the Twitter accounts of Barack Obama, Joe Biden, Bill Gates, Elon Musk, and other prominent figures, leveraging their followers to net almost $116,000 in bitcoin

“When there is a major change in business like the current pandemic, typically we see an increase in external frauds being reported,” observes Illinois CPA Society member Sean Kruskol, a principal at Cornerstone Research, an international economic and financial consulting firm “Recent reports of layoffs and furloughs across multiple industries have led to a rise in the number of unemployed and potentially disgruntled individuals, as well as frustrated employees, who may now have the motive and time to commit fraud ”

Fraud in the Workplace

The fraud triangle, a model created by criminologist Donald Cressey in the 1950s, remains relevant today The triangle explores the circumstances that motivate fraud: opportunity, pressure, and rationalization Cressey believed that for fraud to occur, all three elements must be present

“When we look at the fraud triangle, the current pandemic exacerbates two of the three sides: pressure and opportunity,” Kruskol says “The perceived pressures and opportunities to commit fraud are encountered on a daily if not hourly basis ”

The financial pressures on organizations and individuals due to COVID-19’s economic impacts have become crushing

Unemployment and unrest have seen historic highs Cash flows have slowed to a trickle The pace of business has turned to a limp Established, dependable processes have been completely

upended With no visible end to our current uncertainty, many business owners are desperately struggling to make ends meet This pressure builds and builds, and eventually engulfs the business’ suppliers, employees, and partners, continuing the cycle

Today’s environment also exponentially increases the opportunities for fraud Given the almost instantaneous abolishment of standard operating procedures, businesses are scrambling to rebuild internal checks and balances in a remote environment A dispersed workforce and the absence of centralized oversight combined undoubtedly create an environment ripe for fraud

“With more remote work arrangements and fewer face-to-face interactions, the lack of human interaction could lead certain individuals to feel more anonymous With an increased level of anonymity comes an increased perception that they will not be caught,” Kruskol explains “Some people need routine to hold them accountable Some people need other people to hold them accountable The current pandemic has altered those systems of accountability ”

The combined presence of opportunity and extreme pressure can lead to rationalization, the third element in Cressey’s fraud triangle Justifying fraudulent activity in today’s environment comes easy: I need to provide for my family; I’ll pay it back later Or: I pay taxes every year, and I just need to pay my bills I deserve the help

Unfortunately, regardless of the urgency of need or the intent, fraud is still fraud “It may be harder for employees to resist the temptation to sell confidential information or access to internal systems, particularly if the pandemic has reduced their household income or the future of their position is in doubt,” observes Stephen Cobb, an independent security and risk management researcher “Ironically, employees may have greater system access in order to work at home during the pandemic, and home is an environment where norms of behavior may be less of a deterrent to criminal activity ”

Victims of Fear

Fear of the unknown operates as both motivation and hook, not only driving people to commit fraud, but to be more susceptible to fraud themselves

“Fraud thrives on the effects that a disruptive phenomenon like a pandemic can produce: urgent need, suffering, fear, economic stress, resource diversion, and regulatory distraction,” Cobb notes Cobb has seen increased incidences of fraud during other times of disruption, such as wars, terror campaigns, and recessions “The financial pressures of the Great Recession led some people, who in less stressful times would know better, to fall for get-rich-quick schemes,” he says

Today, those get-rich-quick messages might be replaced with miracle COVID-19 cures or free antibody tests By playing to people’s fears, scammers are able to pocket some cash or obtain personally identifiable information, such as names, birth dates, and Social Security numbers Personal information can then be used for further defrauding: This July, the FBI reported a spike in fraudulent unemployment insurance claims involving the use of stolen information

“The pandemic is creating uncertainty, and uncertainty is fertile ground for fraud,” says Aviram Jenik, CEO at Beyond Security, a global provider of network and application security solutions “What outrageous or unbelievable things have we heard in the last six months that ended up being true? Each time that happens, we

16 | www icpas org/insight

gradually condition our brains to accept outrageous claims as possible truths, which makes it easier to fall for fraud ”

Businesses are no less susceptible to these hoaxes The pandemic has forced many businesses to change their focus from excellence to survival For example, the rapid breakdown of supply chains triggered widespread shortages across multiple industries and regions As businesses scrambled to identify new suppliers, corners were cut and acceptable standards lowered in favor of a quick solution Many companies placed orders for masks and other personal protective equipment from unknown suppliers that either sent defective products or pocketed the money and sent nothing at all

Supply chains aren’t the only system that’s suffered under COVID19 Workflows and internal controls have also been compromised

“Companies have been forced to recreate entire business processes and related workflows When the pandemic hit, some organizations were prepared for a virtual working environment Others were thrown into it without careful transition of the internal controls that once protected these business processes, ” Kruskol explains “For example, signatures for the review and approval of account reconciliation may be electronic now Unless a verifiable and secure control is in place for signoffs, the risk of forgery via copying and pasting an electronic signature is increased ”

Fraud Inside and Out

Clearly, in this environment both internal and external fraud are rampant Perpetrators of internal fraud can be low on the totem pole or high in the C-suite, including employees, managers, officers, and owners of the company Jenik says that today’s remote work environment only exacerbates the potential for fraud “We have sixfigure financial transactions that need to be done from home, where the CFO handling the transaction is unable to walk over to the relevant manager to confirm the transfer face-to-face,” Jenik explains

In other situations, internal employees might submit false or inflated invoices, issue payment for fictitious goods or services, or contract with shell companies Expense reports with claims for personal purchases can be tampered with

Jenik advises companies to revise their policies and update their protection strategies under the assumption that the current situation is permanent, or that it will at least last for many more months “This means putting in place additional channels for verification to replace the foolproof face-to-face conversation,” Jenik says He suggests that email requests should be confirmed by another communication method like chat or phone call; any critical process should have additional authentication and verification steps; and all information should be considered in-question until proven

Financial pressure or uncertainty can also drive employees to falsify timecard data and alter the number of hours worked Data can be used to detect these situations as well Running a simple trend report to spot spikes in hours worked or pay received would help identify employees who might be taking advantage of the system

Companies are also vulnerable to fraud instigated by external players With less effective monitoring in place, and cybersecurity diffused across home offices and personal devices, hackers have more opportunities to gain access to corporate networks

“Companies need increased cybersecurity vigilance in order to combat the many new opportunities hackers might take advantage of thanks to remote work,” says Darren Deslatte, vulnerability

operations leader at Entrust Solutions “Telework increases the number of possible endpoint devices, such as laptops or routers, that cybercriminals can use as entry points into an enterprise’s network In addition, many employees do not have the same cybersecurity measures set up in their homes as their company may have implemented at their office ”

Deslatte urges companies to ensure that all employees, regardless of whether they work in IT or not, are trained in basic cybersecurity methods “These staff trainings should include how to encrypt WiFi routers, how to identify and report phishing scams, and how to create strong, unique passwords for all accounts,” Deslatte advises Phishing scams have also intensified as of late, with Google reporting more than 18 million daily malware and phishing emails related to COVID-19 over the course of a single week

“In many cases, scammers will pose as someone you trust, whether that be a family member, your bank, a government official, or a company you purchase products or services from,” explains Todd Kartchner, an attorney and director of business litigation with law firm Fennemore Craig PC “And while each category of fraud presents its own unique challenges, in nearly every instance fraudsters are seeking either money or personal information You should automatically be on your guard when asked for either one ”

Kartchner advises that anyone receiving a strange or unexpected request from someone they know should contact that person directly through another channel to verify the request “If you ’ re feeling pressured to make a decision in a hurry, that’s also a red flag Scammers want to pressure you into acting quickly If you ’ re feeling pressured, slow things down,” Kartchner says “Look the company up online to see what you learn If nothing else, talk to a friend or family member to gain their perspective The more time you take to think something through, the more likely it is that you’ll be able to spot problems with what you ’ re being told ”

Both internal and external fraud are fueled by fear, and so it behooves businesses to assuage employee fear through open communication channels and clear strategies “The tone at the top during these trying times is key,” Kruskol advises “Management’s message should be one of solidarity and a shared sense of responsibility for getting through the pandemic and its aftermath ”

After all, fraud may be the new normal, but with clear heads and a spirit of camaraderie, we can leave the fraudsters empty-handed

www icpas org/insight | FALL 2020 17

18 | www icpas org/insight

When Diversity Is the Deal

Planning for the growth, sale, or succession of any accounting firm is challenging, but minorityowned firms require special attention to future leadership, mission, and cultural preservation years before decisions get made.

BY LISA WILDER AND HILARY COLLINS

BY LISA WILDER AND HILARY COLLINS

www icpas org/insight | FALL 2020 19

What’s next for your firm? At some point, every firm leader must make that decision whether it’s about how to grow or who will take the reins next Mergers, acquisitions, and succession planning take on new dimensions and only grow more challenging when the firm is diverse, minority-owned, and hoping to maintain its unique culture

For Kimi Ellen, CPA of Benford Brown & Associates, caring about diversity is just a part of who she is During her time at a Big Four firm, she met her future business partner, Alyssia Benford, CPA They bonded over being the only Black people in the room

“That firm was just not interested in recruiting from places with diverse students,” Ellen says “So I actually changed that for them ” Ellen went to HR and told them that being the only Black person in the room was challenging and that she was sometimes put in uncomfortable situations when her peers didn’t recognize her ethnicity

“They asked me where they could find more diverse students,” Ellen says “I took them to the National Association of Black Accountants conference and showed them how to recruit there The next starting class had 13 new Black hires That was all because I wasn’t afraid to use my seat at the table We always say, if you don’t have a seat at the table, you ’ re on the menu ”

Ellen and Benford left that firm and started their own in 1996 They created the name to sound more like the older white men who dominated the profession at the time “Her maiden name was Lee and of course my last name is Ellen,” Ellen laughs “When people think of firm partners, they don’t think of two Black women in their twenties We came up with the name Benford Brown & Associates to kind of get our foot in the door ”

In the 24 years since, their firm has thrived, adding a third partner, Tim Watson, CPA, whose father was one of the first 100 Black CPAs, opening a satellite office in Bolingbrook, Ill and specializing in audits, landing major federal clients

Building a Business From the Ground Up

Like Ellen and Benford, when Enrique Lopez, CPA founded his firm, Lopez & Co , in 2007, he knew diversity would be woven into every element of the culture

“Since I founded this firm, it’s grown to a team of seven, ” he says “What makes us unique is that we ’ re not just diverse in the makeup of our staff, we ’ re also very diverse in the clients we serve and the business we pursue Obviously, with most of us being of Latino background, we have the ability to connect with clients who speak Spanish or share our culture But being diverse is also being open-minded and knowing that mainstream America is the biggest market ”

Edilberto Ortiz, CPA also knows the benefits of a small, diverse firm with a warm culture He emigrated to Chicago from the Philippines and founded E C Ortiz & Co in 1974, eventually building the firm into a team of more than 40 staff members, including 11 CPAs Ortiz’s firm has served closely-held business clients in addition to providing financial audits, single audits, and compliance examinations for state government for the past 30 years Over that time, the firm has built a “family environment” that Ortiz didn’t want to lose as he received offers over time

This June, he accepted an offer from New York-based Roth&Co The expanding East Coast firm will allow Ortiz’s team to stay in place and be able to invest more in technology and professional development, while giving Roth&Co a chance to gain a market in the Midwest

Ortiz adds that many minority firms have niches and relationships on the ground that expanding firms can benefit from “All these years, I’ve been looking for a firm I wanted to buy, but we were able to secure no change in leadership and continue doing the same thing we are supposed to do,” Ortiz says, who will stay with the firm

The State of Diversity

Minority-owned firms with specialized experience and diverse teams will be attractive in a consolidating CPA industry where mature leadership is getting closer to retirement A landmark 2014 Global Accounting Alliance report noted that about half of all U S CPA firms would likely lose at least one partner or principal to retirement over the next five years

Diverse firms with deep experience might find themselves in an attractive position as a result, says Dan McMahon, CPA, managing partner of Integrated Growth Advisors, which assists accounting firms with expansion and succession plans

20 | www icpas org/insight

Being able to demonstrate hiring and promotion patterns for diverse teams will increasingly be a plus that majority- and minority-owned firms can take advantage of either independently or with partners “It’s all about building a more competitive and valuable firm,” he says “Over the course of my career, I’ve learned that public accountants truly do serve the unique communities they work within That’s why you ’ re a certified ‘public’ accountant And, for this reason, it’s important to be reflective and representative of the communities we ’ re part of ”

According to the AICPA, in 2018 minorities represented 29 percent of all professional staff in public accounting firms, a significant jump from 1995’s 8 percent And today more than half of all accountants and auditors are women, according to a June 2020 report by Catalyst Additionally, people of color made up close to half of graduates with accounting degrees, according to that same report, with 41 percent earning bachelor’s degrees and 46 percent earning master’s degrees But this increasingly diverse workforce has not yet made it into firm leadership

When senior firm leaders start thinking about M&A or succession planning, McMahon says preserving or increasing team diversity is more than a deal point: It’s simply a good business idea Yet he notes that the industry still needs to make significant improvement in minority recruitment in firms large, small, and independent According to the AICPA, 84 percent of CPAs employed by CPA firms in 2018 were white, as well as 91 percent of the partners “We have a long way to go in bringing diversity to leadership roles in the profession,” he stresses

For minority-owned firms, it’s not about bringing diversity to leadership roles, but maintaining it Leaders of diverse firms have to keep diversity in focus in every strategic decision they make

Planning Ahead

Ellen sighs when asked about how she wants to hand her firm off “I think about that every day I literally have a 20-year plan starting this year, ” she says “I’m watching some older firms who are just not handling it well I’m really focused on grooming my team and growing the next generation, but I’m open to a merger if it’s right ”

For diverse firms who are looking to maintain what makes them unique as they expand, grow, and possibly sell or merge, it’s essential to have a clear vision for the future Like Ellen’s 20-year plan, Lopez says it’s important to have a vision for how your firm will be marketable in the future

“In five, 10, 20 years, what advantages are you going to have? For us, we ’ re a diverse firm and beyond that, we ’ ve found our specialties and really pursued those Rather than becoming okay at a lot of things, we ’ ve focused on being really good at a few things,” he explains

How should a leader at a unique firm like these approach succession planning or a sale or merger? “Start thinking about it when you start the business,” says Maria Prado, CPA, co-founder of Chicago-based Prado & Renteria The story of the founding of her firm is similar to Ellen and Benford’s Prado and her business partner Hilda Renteria, CPA were college friends at the University of Illinois at Chicago and decided to form their partnership early in their careers while working in the audit department at the First National Bank of Chicago (now part of JPMorgan Chase) The firm, at its 30-year anniversary, now has a staff of more than 25 that serves private companies, government agencies, and nonprofits “Some of the work we love to do best are the challenging projects, working with organizations in the middle of change who may have had changes in their accounting staff,” Prado says “We can support them and put the puzzle back together in a way that will give them greater confidence in their financial stability ”

But Prado laughingly admits that she and Renteria didn’t exactly take their own business advice when they started their firm, and the deep succession discussion they’re having with their team that takes everything they’ve built over the history of their firm into consideration is a puzzle that’s still a work in progress

“We’re examining how we can distinguish ourselves, not just for our external clients, but for our internal team,” Prado explains “Because one of the characteristics that’s really important for us to maintain is our corporate culture, which includes continuing the focus on team leadership development, creating internal and external trust-based relationships, and achieving outcomes as a result of integrity ”

Growing and Grooming the Firm

For minority-owned firms, planning for the future while retaining what makes them unique can be a challenge

Lopez says that developing internal talent at his firm has been incredibly rewarding for him and is his first choice for firm transition when he retires “I love developing my own people I love seeing them grow and achieve their ambitions and goals, but I also remain open to outside opportunities,” he says

“To really grow, you can’t limit yourself to people who share your cultural background,” Lopez admits “Don’t close your eyes to the diversity that’s outside of your heritage Don’t get too comfortable in that place Diversity means being truly open to other groups that you ’ re not so comfortable with and learning more about them That will give you a wider appeal ”

That “wider appeal” could be critical in the future “There’s going to be more consolidation, more acquisitions and mergers in these next few years, ” Lopez predicts “I’m open to that I don’t want to limit our potential ”

Like Lopez, Ellen is extremely focused on growing her practice and expanding into new areas that will make her firm extremely desirable to potential buyers “I have a strategy that touches a lot of different areas in the hopes it will grow my practice into something really great when it’s time for us to exit,” she says One aspect of that strategy is developing the next generation in and outside of her firm “I didn’t have a mentor when I was coming up in the profession, so I really focus on growing the next generation of Black accountants,” Ellen shares “I talk to young CPAs and tell them to go and get all the experience they can now and come back in 10 years and maybe we can talk about you buying my practice I don’t want to die at my desk!”

On a serious note, Ellen says her team is committed to only merging if the relationship is right They have entered serious discussions about merging with other Black-owned firms several times over the years, but it’s never been a good match “I think you have to be very thoughtful about M&A and make sure the culture is going to mesh,” she says “One of the most important things for diverse firms facing M&A is knowing when to say no ”

www icpas org/insight | FALL 2020 21

UNCOVERING UNCONSCIOUS BIAS IN BUSINESS

Finding ways to uncover and combat implicit biases is the only way to build a diverse, inclusive, and successful organization in today’s business world.

BY CASSANDRA MORRISON

22 | www icpas org/insight

www icpas org/insight | FALL 2020 23

Evolution has left the human body with parts that no longer serve it like the appendix, embryonic tails, and tonsils Some of these features evolve out of existence over time; others are removed with a minor surgery Similarly, evolution has also left the human brain with instincts that were necessary for survival for centuries but are no longer useful and can often be harmful like bias

Quickly categorizing things, people, and situations was vital to early humans They relied on their ability to make near-instant decisions about what was safe and unsafe to distinguish the footstep of a friend from a foe in the blink of an eye, faster than they could logically respond And today, we still have that instinct for knee-jerk judgment Our brains can only consciously process around 40 items per second, but as many as 11 million unconsciously To cope with this overload of information, we sort through these millions of factors using shortcuts our brains have developed over time Additionally, research has found that we ’ re more likely to make biased decisions when we make those decisions quickly findings that have serious implications for today’s rapidly evolving business world

By unknowingly allowing our unconscious biases to influence our fast-paced decision-making, we end up excluding certain groups, perpetuating certain stereotypes, and relying on faulty reasoning to make important choices It’s only by committing to uncovering and combating our unconscious biases, personally and in the workplace, that we can interrupt these mental shortcuts and make better, more equitable decisions

“If You Have a Brain, You Have a Bias”

Implicit biases are different from explicit biases in that we know our explicit biases exist, but our subconscious holds many biases that we may not be aware of, spanning race, gender, appearance, age, wealth, and much more Implicit biases can be more damaging than explicit biases because they often influence our decisions without our knowledge These insidious attitudes impact the workplace in many ways: From job listings to performance reviews to promotions, implicit bias pervades the decision-making process

“If you have a brain, you have a bias It’s human Our brains are hardwired to take shortcuts and bias is a form of helping us make those shortcuts Bias is a threat protector,” explains Michele MeyerShipp, Esq , principal and chief diversity and inclusion officer at KPMG “It’s real and we have to take steps to interrupt it ”

To interrupt and unlearn these biases, first we must acknowledge they exist and can impact anyone Defensiveness often creeps into conversations about ageism, sexism, or racism, but many who don’t consciously hold those views can still be influenced by them When it comes to unconscious bias, it’s important to lead the conversation to a place that acknowledges that everyone has biases implicit and explicit and it’s what we do about this fact that matters

Diversity and inclusion expert Gregory Tall, MBA, leads workshops and conferences to encourage this openness and communication

“The hard part is no one ever wants to be called out no organization wants to be accused of being biased against anyone, ” he explains “So, it starts with asking how we get everyone feeling comfortable enough to engage in an uncomfortable conversation, how we get them to the table, and how we get to the real action ”

Biases That Block the Door

Most experts agree that recruitment offers the most transparent accounts of bias in the workplace, from the wording in job descriptions to the filtering of resumes based on names Tall saw this a lot during his time in human resources “A job posting encouraging 'recent grads' to apply might be coded language

suggesting younger candidates are preferred Bias tends to operate covertly One study showed that job applicants with traditionally White-sounding names were 50 percent more likely to be contacted for an interview than applicants with traditionally African-American-sounding names, ” Tall adds

Learning more about the types of biases helps identify and interrupt them A 2019 study by Korn Ferry found the financial market has the highest percentage of women in C-suite positions with 31 percent When almost 70 percent of leadership in the financial sector is made up of men, the affinity bias can explain why it’s difficult for women to reach the C-suite in this sector and others: Those who are in charge of these decisions are drawn to those most similar to them

Meyer-Shipp says that affinity bias is one of the most pervasive forms of bias that she sees show up on a day-to-day basis “It shows up all of the time and it's not just the type of bias that happens around race or gender,” she says “For example, in a job interview, you form these points of affinity, points that you find you have in common with an interviewee, so that before you know it you ’ re halfway through the interview and you ’ re like, wait a minute, we haven’t even talked about the job ”

Besides affinity bias, research has uncovered many biases women face in the workplace, making it more difficult for them to enter organizations and ascend at the same rates as their male peers Joan Williams, JD, a 40-year veteran researcher and founding director of the Center for WorkLife Law at the University of California Hastings College of the Law, has spent her career exploring the interplay between work, class, and gender

“Many claim that the wage gap between men and women stems not from discrimination, but from the fact that men negotiate their salaries whereas women don’t,” Williams writes in “Double Jeopardy? An Empirical Study With Implications for the Debates Over Implicit Bias and Intersectionality,” published in 2014 in the Harvard Journal of Law and Gender “But a deeper look at the ‘ women don’t ask’ literature reveals a study that finds that when

24 | www icpas org/insight

women do negotiate their starting salaries, they are seen as less likable and they are less likely to be hired I suggest that the reason women do not ask is that they correctly sense that they will be penalized if they do ”

Williams calls this bias, where women are punished for behavior that men are rewarded for, “the Tightrope ” She also notes that women face a bias she calls “Prove-It-Again!” where women must show more evidence of competence than men to be seen as equally competent Black women face the Prove-It-Again! bias to an even greater degree

With such barriers to entry for women and other minorities, unconscious biases can effectively block the door at any organization For a workplace hoping to overcome unconscious bias, identifying types of bias and being able to recognize their impact is a good way to start correcting course

uncovering unconscious bias

Addressing the systemic issues behind biases is not easy Historical examples and research have shown that systems that hold minorities down do not disappear without deep, complex work and long-term commitment

“A one-shot bias training is a good start, but it is not a solution Systemic biases are built on unfair systems and cultures You can’t change culture by doing something once, right? That’s not how cultural change works,” Williams says

This is why Williams has developed the open source website biasinterrupters org, which offers free toolkits to help organizations evaluate their systems and implement small changes “Bias interrupters” are tweaks to basic business practices, like hiring, performance evaluations, assignments, promotions, and compensation, that combat implicit bias in the workplace

“If a business had a problem with sales, leaders would not just have these deep conversations about how much they care about sales, they would look at the evidence,” Williams says “They would see where things are going wrong and why sales are falling off and try

everything until they met their goals Why don’t we do the same with our bias problems?”

There are a multitude of evidence-based actions organizations that are serious about overcoming implicit bias can take In addition to using the bias interrupter tools that Williams has built, or hosting the kinds of workshops that Tall leads, many organizations are hiring diversity and inclusion officers, like Meyer-Shipp In 2019 alone, diversity and inclusion roles posted on Glassdoor rose 30 percent over the previous year

Having a diversity and inclusion officer is a great idea, but again, it can’t end there “If an organization is going to hire a diversity and inclusion leader, they should ensure they’re giving that person both a seat at the table where decisions are being made and power to make real change, including the budget and the staff they need,” MeyerShipp says “Without those things the diversity and inclusion leader is just sharing ideas that leadership may or may not put into place ”

Williams has seen this issue time and again in large organizations: “If you hire a chief diversity officer and give that person no ownership over the systems that create systemic bias, you should not be surprised that that person does not achieve your goals You have structured that position to be unable to achieve the systemic change that’s needed ”

hope for a bias-FREE WORLD

Biases in the workplace can have far-reaching effects If employees don’t feel accepted, valued, and understood, then productivity, retention, and organizational culture suffer This is supported by data: A 2018 McKinsey report on 366 public companies found that those in the top quartile for ethnic and racial diversity in management were 35 percent more likely to have financial returns above the industry mean, and those in the top quartile for gender diversity were 15 percent more likely to have returns above the industry mean Organizations that have successfully interrupted their biases also enjoy other benefits that their competitors may not Meyer-Shipp shares that at a recent global Pride conference KPMG hosted, LGBTQIA+ employees noted how far the business had come, with some finding it hard to imagine even coming out in their workplace not that long ago

Besides the benefit of a happy team, Meyer-Shipp notes that a diverse workforce can open doors to a diverse client base and exciting new ideas, but after 40 years of studying these issues, Williams is not convinced that making the business case makes an impact: “People always find a reason why they’re different, why it wouldn’t apply to their business It comes down to fixing a systemic issue ”

aN unbiased view

Williams writes in the Harvard Journal of Law and Gender, “Disrupting these automatic associations this implicit bias may well be very difficult But the issue on the ground is not whether automatic associations occur but whether, once made, the stereotyping that results can be overridden Stereotypes are reversed all the time ”

Throughout history, different biases protected our ancestors from a variety of predators and dangerous situations As society has matured, these biases no longer serve humanity But because of how deeply and precisely they’re rooted, they’re incredibly difficult to dismantle It is not hopeless, though With many conscious steps and conversations, organizations and the CPA profession can continue the long climb to becoming truly diverse and inclusive

www icpas org/insight | FALL 2020 25

Kristie P. Paskvan, CPA, MBA

Bias and the Board

Bias [ˈbīəs]

Prejudice in favor of or against one thing, person, or group compared with another, usually in a way considered to be unfair.

"There was evidence of bias against foreign applicants."

Board Bias [bôrd bīəs]

Prejudice in favor of or against one thing, person, or group compared with another, usually in a way considered to be unfair, which results in a deterioration of governance best practices and is a detriment to shareholder value.

Yes, it’s true I made up that second definition But after reading the existing research on the effects of various types of bias on decision-making, the threat to board governance is clear Bias can erode corporate governance standards and processes specifically put in place to ensure independence and objectivity Even when a board has separate committees for nominating, governance, audit, risk, and compensation, keeping those committees functioning properly requires taking bias concerns seriously Since boards represent the shareholders of the organization, their decisions cannot be made lightly Important ideas and initiatives are expected to be objectively assessed: information gathered, experts consulted, data reviewed, and perspectives debated before recommendations are voted on If objective measures are not taken for decision-making, and sometimes even when they are, bias comes into play When bias enters the process, decisions can more easily be influenced by conflicts of interest, peer pressure, deference to authority, reliance on unconfirmed data, and personal unconscious bias These various biases can impair even the most well-intentioned and responsible board

In the past, one root of implicit bias has been a lack of diversity in the makeup of the board

In an earlier column, I noted that many countries and a few U S states passed quotas for female corporate directors, greatly increasing gender diversity at the board level But many boards still suffer from a lack of diversity In 2019, Black Enterprise reported that 37 percent of S&P 500 companies did not have a single Black board member, down from 39 percent in 2018 Since the sum total of the board’s experience is a significant persuasive influence on critical board conversations, having diversity of thought and experience when choosing independent board members is one way to help mitigate some of the bias risk While bias may still exist, it is diluted, less of a laser with only one focus, and more of a kaleidoscope of ideas and opinions While it might seem counterintuitive that a wide array of different

26 | www icpas org/insight

D I R E C T O R ’ S C U T STRATEGIES FOR TODAY’S CORPORATE FINANCE

LEADERS

When bias goes unnoticed and unchecked, it can deteriorate governance best practices, derail solid decision-making, and depreciate shareholder value.

Board Director, First Women’s Bank and SmithBucklin

Leadership Fellow, National Association of Corporate Directors kppaskvan10@gmail com | ICPAS member since 1984

and sometimes dissenting opinions leads to better decisionmaking, research shows that organizations with greater ethnic, racial, and gender diversity saw higher financial returns My guess as to why is that diversity leads to more creative problem-solving, fewer blind spots, and more innovation Based on my conversations with fellow board p broader pool of cand and diversity to orga example of how to thoughtful initiatives

Here are four of the affect decision-mak actions I suggest to

Attribution bias: You of others without any motivations to your o

ACTION: Work on the benefit of the as generous and prevent misunderst communication take If someone is late to remind yourself tha not intentional or d motivations allows y yielding better board

Anchor bias: You re gathered when mak view following inform

ACTION: Understan basing too much of that you need to ve mentioned in negoti Board members sho about all the relevan

Confirmation bias: Y supports your belief

ACTION: The board when making decisi because you disagre as successful ones a

Groupthink: You fee or disagreeing with you say nothing or you look for those th

ACTION: Energetic d not something to be and question the sta uniform agreement i

As many opportunit there are even more that is key to the board s efficacy can break down entirely if bias creeps in Understanding and confronting bias allows boards to identify where their decisions could go awry While confronting bias can be uncomfortable, just as self-awareness builds an individual’s character, honesty about interactions at the board level can build a stronger and more effective team, adding value to the organization and its shareholders

Register

Featuring: 2020 Women to Watch Award Recipients