The New Post-Pandemic Value Drivers

+

The Business Case for ESG Reporting

Three Ways to Combat the Big Quit

Has Destination CPA Lost Its Appeal?

Taxing Cryptocurrency

Is Your Cybersecurity Strategy Still Relevant?

Surveying SPACs

FALL 2021

the

Exploring

issues that shape today’s business world.

30 Director’s Cut To SPAC or Not to SPAC?

By Kristie P. Paskvan, CPA, MBA

32 Practice Perspectives

Four Ways to Make Remote Business Development Work

By Art Kuesel

34 Ethics Engaged

The Ethics of ESG Investing

By Elizabeth Pittelkow Kittner, CPA, CGMA, CITP, DTM

36 Financially Speaking Surveying SPACs: A Skeptic’s Stance

By Mark J. Gilbert, CPA/PFS, MBA

38 Inside Finance Analyzing Two Accounting Approaches for Cryptocurrencies

By Nancy Miller, CPA

40 Tax Decoded

Reviewing the Revised Uniform Unclaimed Property Act By Keith Staats, JD

FALL 2021 www.icpas.org/insight THE NEW POST-PANDEMIC VALUE DRIVERS

ESG

THE BIG QUIT spotlights 4 Today’s CPA Has Destination CPA Lost Its Appeal? By Todd Shapiro 6 Capitol Report The Two Elephants in the Statehouse By Marty Green, Esq. 42 Gen Next Three Skills I Gained by Stepping Out of My Comfort Zone By Greyson Borden, CPA 44 IN Play Michael Santay Is on a Mission for the Disabled By Hilary Collins trends 8 Cryptocurrency Taxing Cryptocurrency: What CPAs Need to Know

10 Cybersecurity Is Your Cybersecurity Strategy Still Relevant?

Natalie

insights 26 Evolving Accountant The ESG Opportunity for CPAs? Assurance

Andrea Wright, CPA 28 Leadership Matters Three Ways to Combat the Big Quit

CPA, PCC

THE BUSINESS CASE FOR

REPORTING

By Jeff Stimpson

By

Rooney

By

By Jon Lokhorst,

12 16 20 2 | www.icpas.org/insight

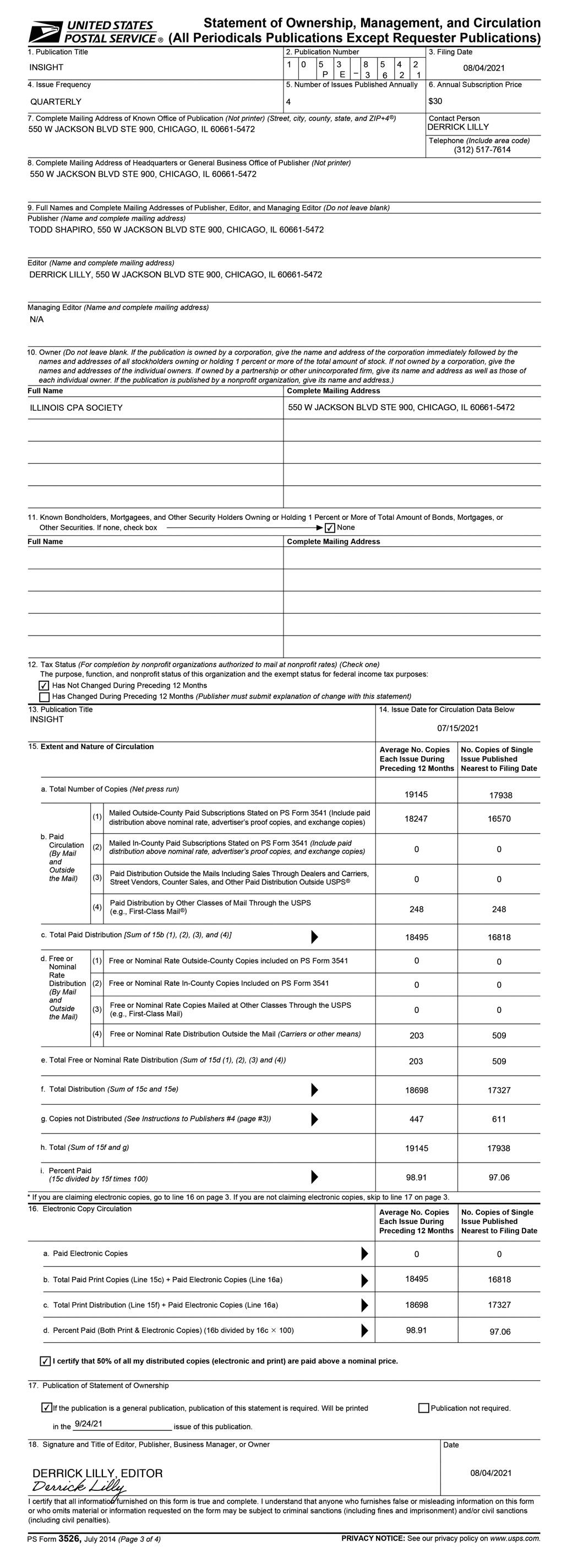

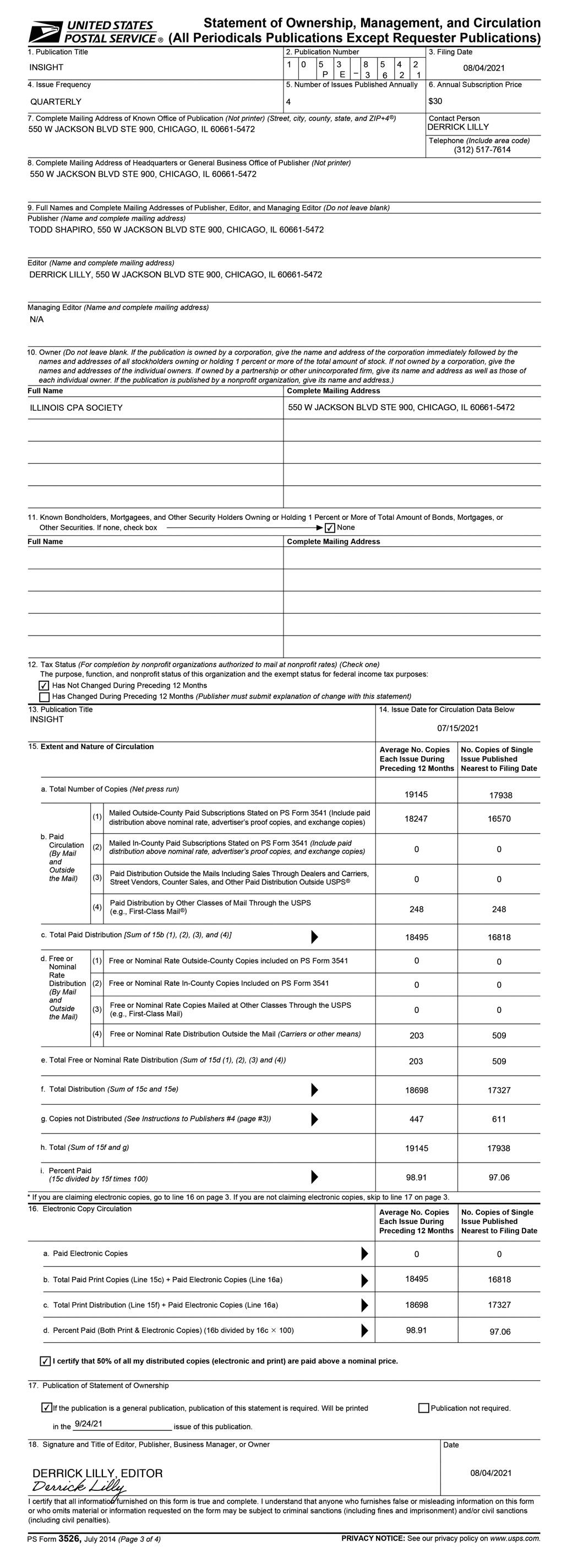

2021 ILLINOIS CPA SOCIETY TOWN HALL FORUMS

State of the CPA Profession

ILLINOIS CPA SOCIETY

550 W. Jackson Boulevard, Suite 900, Chicago, IL 60661

www.icpas.org

Publisher/President & CEO

Todd Shapiro

Editor

Derrick Lilly

Assistant Editor

Hilary Collins

Creative Director

Gene Levitan

Copy Editors

Mari Watts | Jennifer Schultz, CPA

Photography Derrick Lilly | iStock

Circulation

John McQuillan

ICPAS OFFICERS

Chairperson

Thomas B. Murtagh, CPA, JD | BKD CPAs & Advisors

Vice Chairperson

Mary K. Fuller, CPA | Shepard Schwartz & Harris LLP

Secretary

Deborah K. Rood, CPA, MST | CNA Insurance

Treasurer

Jonathan W. Hauser, CPA | KPMG LLP

Immediate Past Chairperson

Dorri C. McWhorter, CPA, CGMA, CITP | YMCA Metropolitan Chicago

ICPAS BOARD OF DIRECTORS

John C. Bird, CPA | RSM US LLP

Brian J. Blaha, CPA | Wipfli LLP

Jennifer L. Cavanaugh, CPA | Grant Thornton LLP

Pedro A. Diaz De Leon, CPA, CFE | Kemper Corporation

Kimi L. Ellen, CPA | Benford Brown & Associates LLC

Stephen R. Ferrara, CPA | BDO USA LLP

Jennifer L. Goettler, CPA, CFE | Sikich LLP

Scott E. Hurwitz, CPA | Deloitte LLP

Joshua D. Lance, CPA, CGMA | Lance CPA Group

Enrique Lopez, CPA | Lopez & Company CPAs Ltd.

Stella Marie Santos, CPA | Adelfia LLC

Brian B. Stanko, PhD, CPA | Loyola University

Richard C. Tarapchak, CPA | II-VI Inc.

Mark W. Wolfgram, CPA, MST | Bel Brands USA Inc.

BACK ISSUES + REPRINTS

Back issues may be available. Articles may be reproduced with permission. Please send requests to lillyd@icpas.org.

ADVERTISING

Want to reach 22,600+ accounting and finance professionals? Advertising in Insight and with the Illinois CPA Society gives you access to Illinois’ largest financial community. Contact Mike Walker at mike@rwwcompany.com.

Insight is the magazine of the Illinois CPA Society. Statements or articles of opinion appearing in Insight are not necessarily the views of the Illinois CPA Society. The materials and information contained within Insight are offered as information only and not as practice, financial, accounting, legal or other professional advice. Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication. It is Insight’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin. The Illinois CPA Society reserves the right to reject paid advertising that does not meet Insight’s qualifications or that may detract from its professional and ethical standards. The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within Insight, and makes no representation or warranties about the products or services they may provide or their accuracy or claims. The Illinois CPA Society does not guarantee delivery dates for Insight. The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering Insight. Insight (ISSN1053-8542) is published four times a year, in spring, summer, fall, and winter, by the Illinois CPA Society, 550 W. Jackson, Suite 900, Chicago, IL 60661, USA, 312.993.0407. Copyright © 2021. No part of the contents may be reproduced by any means without the written consent of Insight. Send requests to the address above. Periodicals postage paid at Chicago, IL and at additional mailing offices. POSTMASTER: Send address changes to: Insight, Illinois CPA Society, 550 W. Jackson, Suite 900, Chicago, IL 60661, USA.

REGISTRATION

www.icpas.org.

Please call 800.993.0407 or visit

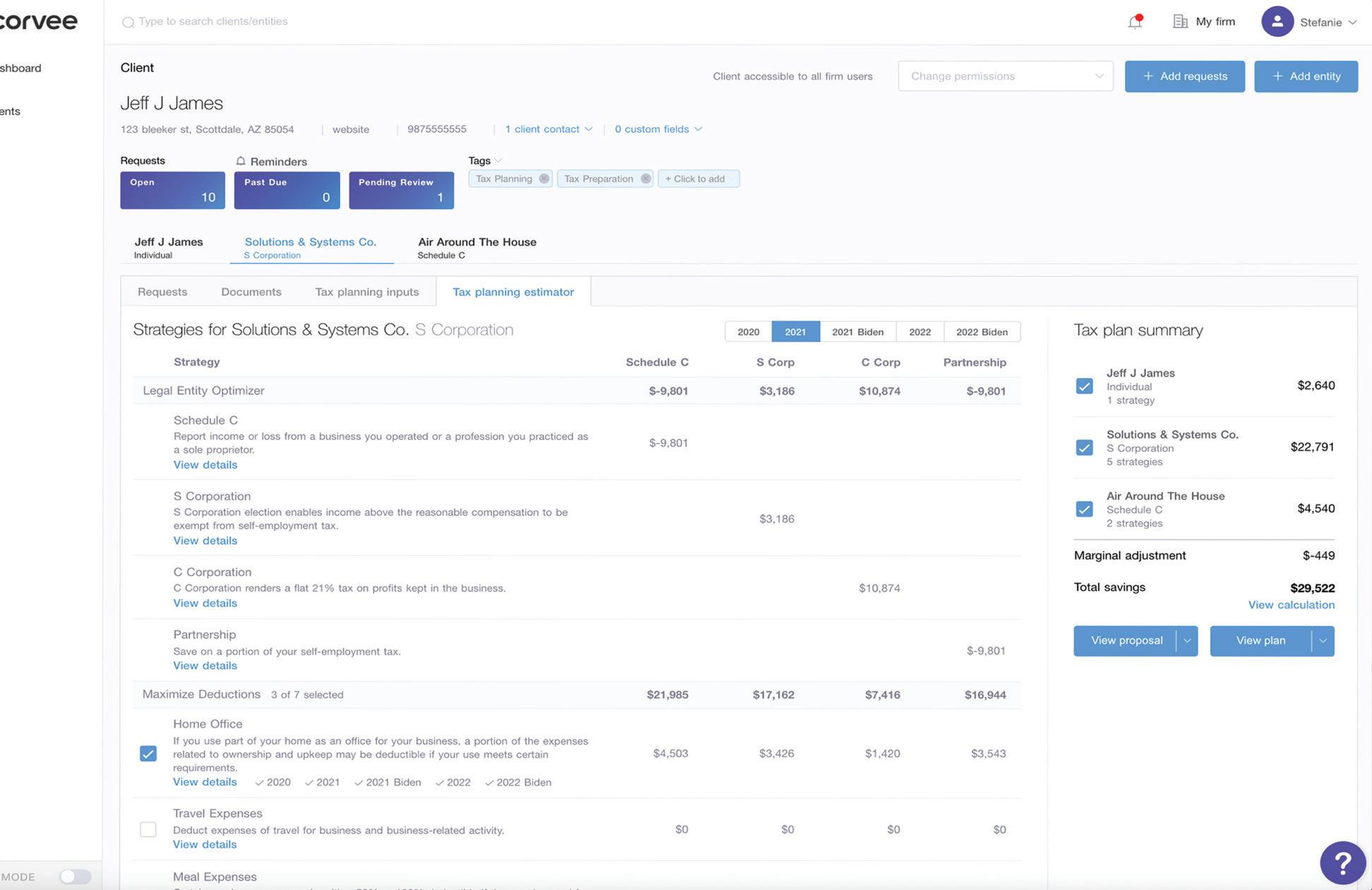

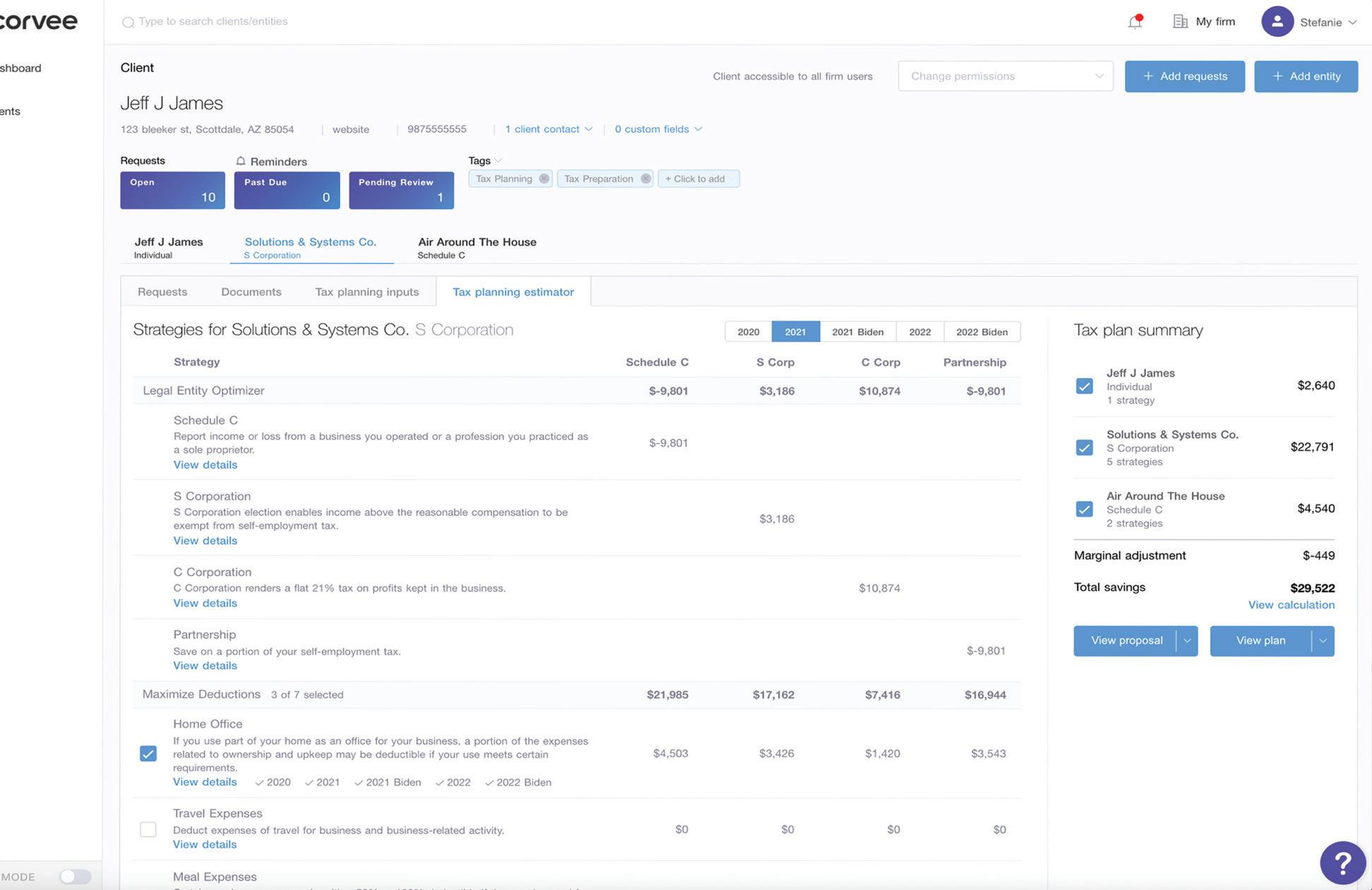

Today and Tomorrow Join us for an event near you! As technology continues to impact our core services, we must ensure our relevance by becoming strategic business advisors.

Thomas B. Murtagh, CPA, MBA, JD, LLM, Chair of the ICPAS Board of Directors and Todd Shapiro, President and CEO, for a candid conversation on the many issues impacting the CPA profession today, including changes in the CPA exam, the declining number of new CPAs, challenges with diversity and inclusion, and much more! all programs: CPE: 1.5 Credit Hours Cost: FREE Complimentary breakfast or lunch included. 10.27.21 Bloomington-Normal 12.9.21 Glenview 10.28.21 East Peoria 12.10.21 Virtual 11.9.21 Rockford 12.14.21 Oakbrook Terrace 11.15.21 Champaign 12.16.21 Collinsville 11.17.21 Springfield 12.17.21 Chicago 11.30.21 Orland Park

Join

Has Destination CPA Lost Its Appeal?

ne of the things we’re constantly monitoring at the Illinois CPA Society is the new CPA pipeline, which has become more important than ever given the aging of our profession. To put it in perspective, 44 percent of ICPAS members are over age 55—with 30 percent over age 60—and, as such, we expect to see significantly more retirements in the upcoming years. In fact, during his ICPAS SUMMIT21 keynote, BMO Global Asset Management Senior Investment Strategist Derek Sasveld, CFA, pointed out that the ongoing pandemic and strong equity market returns during the last 18 months have led many workers in their 50s and older to choose to leave the workforce even earlier than expected.

So, it should go without saying that attracting new CPAs will be critical to replenishing the pipeline—but therein lies a disturbing trend. The AICPA issues a Trends report every two years, the last in 2019, in which they track first-time CPA exam takers. After steadily increasing during the early 2000s and then flattening out from 2012-2015, there was a steep decline of first-time exam takers in 2017 and again in 2018, reaching levels not seen in a decade or more. Coupled with this data point are increasing concerns as to the CPA credential’s relevance. According to the 2019 Trends report, U.S. CPA firm hiring of accounting graduates fell almost 30 percent from 2014 to 2018, while hiring of non-CPAs increased to 31 percent of total hires (up from 20 percent in 2016). Expanded use of technology, which is replacing tasks previously performed by people, is driving this decline. As a result of the declining demand, accountants’ starting salaries have been flat and lagging other careers for years.

To better understand the other factors driving the above trends, we launched a research project and issued our findings in the Insight Special Feature, “A CPA Pipeline Report: Decoding the Decline.” We felt it was important to get hard data by surveying students and young professionals and dispensing with supposition. After all, everyone has their own theories about the pipeline’s decline, the most often given reason being the 150-credit hour requirement to become a CPA.

What did we learn? The top reason for not pursuing the CPA credential was the time commitment. Other leading reasons for not sitting for the CPA exam included a lack of relevance for the work respondents were doing or intended to do, employers aren’t requiring or supporting it and, overall, credentials weren’t viewed

as desirable. The 150-credit hour requirement didn’t even make the top four reasons, which shouldn’t be a surprise since it’s been in place for more than 20 years (and we saw increasing or steady firsttime exam takers during most of that period).

We also asked who most influenced one’s decision to pursue the credential or not. Historically, we always thought that one’s employer was the most influential. What we heard in the survey was “self” was the top influencer, and “self” incorporated many factors, including a lack of desire to work in public accounting for most of one’s career. Survey respondents also told us that audit, accounting, and tax are the words most associated with the CPA credential.

So, how do we reverse this trend? I think we need to become more employee-centric and focus on work that appeals to a socially conscious generation that values society and work-life balance like no generation before. I also think we need to make the work more engaging and personally fulfilling. The adoption of artificial intelligence and automation solutions—which has only accelerated during the pandemic—is already changing the way work is done in most large firms, eliminating task-based compliance activities. By empowering employees to become the “most trusted and strategic business advisors,” we can give them purpose and allow them to help make the world a better place by helping our clients and Main Street businesses be successful, which ultimately leads to more job opportunities and a positive economic impact on the communities we serve and live in.

I have hope that we can turn the trend of declining new CPAs, but it won’t happen by itself or through osmosis. It will take us looking at the world, not through our lens but through the lens of those who work for us. We must embrace the oncoming technological revolution, but instead of using the newfound efficiency to add another audit or tax return, we must start to think proactively about how we can help our clients and companies be successful and ensure our employees can have both balance and career advancement. We can make becoming a CPA a desired destination again.

It used to be that if you earned an accounting degree, earning your CPA credential was your next destination. Here’s how we get the CPA credential back on candidates’ maps.

today ’sCPA 4 | www.icpas.org/insight

INSIGHTS FROM TODD SHAPIRO, ICPAS PRESIDENT & CEO @Todd_ICPAS

WHAT’S BETTER THAN CALLING ANY TIME YOU NEED ADVICE ABOUT PRACTICE SUPPORT AND RISK MANAGEMENT?

CAMICO ® policyholders know that when they call us, they’ll speak directly with in-house CPAs, JDs and other experts. We have dedicated hotlines for loss prevention, tax, and accounting and auditing issues. You can call as often as you need and consult with experienced specialists — all at no additional cost. No one knows more about the profession, because we provide Professional Liability Insurance and risk management for CPAs only — it’s all we’ve done for 35 years and why more than 8,000 CPA firms insure with CAMICO.

To learn about CAMICO or to receive a coverage quote, please contact Harris Hauptman.

See

CAMICO. Visit www.camico.com/testimonials

Harris Hauptman Senior Account Executive

T: 800.652.1772 Ext. 6727

E: hhauptman@camico.com

W: www.camico.com

what other CPAs say about

Accountants Professional Liability Insurance may be underwritten by CAMICO Mutual Insurance Company or through CAMICO Insurance Services by one or more insurance company subsidiaries of W. R. Berkley Corporation. Not all products and services are available in every jurisdiction, and the precise coverage afforded by any insurer is subject to the actual terms and conditions of the policies as issued. ©CAMICO Services, Inc., dba CAMICO Insurance Services. All Rights Reserved.

REACHING KNOWLEDGEABLE EXPERTS.

capitolreport

The Two Elephants in the Statehouse

Even after an extraordinarily productive spring legislative session, two big problems face Illinois: funding public pensions and the unemployment insurance trust.

WhileIllinois’ spring legislative session typically sees 300-400 bills passed and sent to the governor, an unprecedented 652 bills made their way to Gov. J.B. Pritzker this year. Still, two massive elephants are roaming under the statehouse dome that no one wants to address: the state’s public pension problem and the estimated $5 billion deficit in the unemployment insurance trust fund.

THE PUBLIC PENSION PROBLEM

Illinois has long struggled with funding its public pensions and aligning the pension system with contemporary economic and workplace realities. In fact, public pensions weren’t even discussed during the spring legislative session, nor do they appear to be a priority. The last substantive attempt at pension reform was in 2014 with Public Act 98-599, which among other things reduced retirement annuity benefits for individuals who first became members of one of Illinois’ five state-funded pension systems prior to Jan. 1, 2011. However, the Illinois Supreme Court invalidated the act in its entirety for violating the pension protection clause embedded in the Illinois Constitution.

Unsurprisingly, the situation has only grown more dire. Earlier this summer, the Illinois General Assembly’s nonpartisan fiscal unit, the Commission on Government Forecasting and Accountability (COGFA), released a report highlighting the financial instability of our public pension systems. According to the report, the unfunded pension liability for the state’s five retirement systems increased by $7 billion in fiscal year 2020 to reach a total liability of $144.2 billion. To put that in perspective, taxpayer contributions to the pension systems are scheduled to increase by $500 million to a total of just $9.76 billion in 2021.

The COGFA report provides two reasons for the deepening pension debt: First, even with the $9.76 billion taxpayer contribution, the state still isn’t paying what actuaries say is needed to hit the goal of 90 percent funding by 2045. Second is the faulty assumption that investments would yield returns of 6.5-7 percent, which has not happened. The Teachers’ Retirement System, for instance, only achieved a 0.6 percent return on investments.

While Gov. Pritzker suggests that we’re approaching a pivot point as more Tier 1 workers with higher retirement benefits are replaced by Tier 2 workers hired after 2011, the COGFA report illustrates that Tier 2 worker contributions will slowly rise over the next 10 years, moving from 47 percent to 54 percent—leaving a substantial funding gap to close.

Admittedly, the pension systems don’t have to come up with cash to satisfy their liabilities all at once. However, the numbers show that the gap is widening, not narrowing, necessitating action for long-term fiscal sustainability. It’s clear that something needs to be done. If not, pension obligations will continue to absorb ever-larger portions of the state budget and discretionary spending, edging out other important programs and services for Illinois’ citizens.

THE UNEMPLOYMENT INSURANCE TRUST FUND FALLOUT

Each state has an unemployment insurance trust fund maintained by the U.S. Department of the Treasury that’s funded by the state’s employers through insurance premiums collected via payroll taxes. The rates that employers pay into Illinois’ fund are determined by a

LEGISLATIVE INSIGHTS FROM MARTY GREEN, ESQ., ICPAS VP OF GOVERNMENT RELATIONS @GreenMarty

6 | www.icpas.org/insight

complex formula using unemployment rates, the balance of the trust fund, employer experience, number of employees, and other factors.

During normal economic times, incoming funds outpace the amount of outgoing unemployment benefits, keeping the trust fund solvent. The devastating economic impacts of COVID-19 and the sustained high unemployment rate have taken a toll on the fund that cannot be fixed by the reimbursable benefits of the federal pandemic relief measures.

Business and labor groups have sounded the alarm to legislators about the mounting deficit, which now stands at an estimated $5 billion, and the potential for payroll tax increases and cuts to unemployment benefits if the growing deficit isn’t addressed. The current fiscal year state operating budget allocates $100 million to the fund, but it’s earmarked to cover expanding unemployment insurance benefits, non-instructional education employee claims, and the excess unemployment money sent to some Illinoisans through no fault of their own.

Worse, Illinois is set to pay hefty interest payments on the $5 billion deficit as the state “borrowed” from the Title XII advance to pay unemployment insurance claims. As a part of the COVID-19 relief packages, Congress imposed a moratorium on Title XII interest payments, but that expired on Sept. 6, 2021. Illinois has allocated $10 million for interest payments in the current fiscal year, with the first payment due on September 30. There are estimates that interest payments could be as high as $14 million for the fourth quarter of 2021 and up to $60 million annually while the deficit remains.

So far, the governor and legislative leaders have been reluctant to use the remaining unallocated $5 billion of the $8.1 billion the state

received from the American Rescue Plan for this purpose. This money can be used through 2024 as long as expenditures fall within the four categories allowed under the Treasury’s rules—using federal relief funds for pension fund deposits and directly or indirectly offsetting tax revenue is specifically prohibited. However, one of the broad categories of authorized expenditures is responding to negative economic impacts. It would seem that the payment of unemployment benefits would fall within the category of a necessary measure due to the economic hardships caused by COVID-19.

Gov. Pritzker hasn’t publicly addressed the enormity of the situation and its potential impact on employers other than saying he’s seeking further federal aid. Unless there’s yet another federal stimulus package, or a significant portion of the remaining $5 billion from the American Rescue Plan is allocated to the unemployment insurance trust fund, ultimately employers are looking at higher payroll tax rates coupled with a reduction in benefits—and kicking the can down the road will only exacerbate the problem.

Oddly enough, the three major credit rating agencies surprisingly upgraded Illinois’ bond ratings over the summer due to an improved fiscal situation, which could lower the cost of Illinois’ debt. But while Illinois’ leaders have focused on paying down the state’s remaining debt with the Federal Reserve, these two looming issues continue to threaten our economic recovery and degrade the state’s long-term fiscal viability. As former Illinois Senate Majority Leader W. Russell Arrington once said in response to an impasse on critical legislation: “We’re here to solve problems, and we didn’t solve the problem.” Perhaps we should take note of Arrington’s wisdom now and turn our focus toward the two elephants stuck in the statehouse.

www.icpas.org/insight | FALL 2021 7

Taxing Cryptocurrency: What CPAs Need to Know

In a loosely regulated and rapidly changing cryptocurrency world, CPAs must build valuable expertise in helping clients decrypt the use and taxation of digital currencies.

BY JEFF STIMPSON

n the 12 years since Bitcoin’s release, it and other cryptocurrencies, like Ethereum, Litecoin, and Dogecoin, have evolved from theoretical flashes in the pan to monetary vehicles with staying power and growing influence. And as cryptocurrencies, which are also referred to as digital or virtual currencies, become mainstream, understanding the evolving tax requirements and helping clients navigate their uses may soon be imperative for every CPA.

“Though the digital assets space is still very much in the early stages, it has enough momentum and real-world usage that the industry is here to stay,” says Illinois CPA Society member Curt Mastio, CPA, managing member of Founder’s CPA in Chicago. “It will evolve over time—similar to the internet.”

“Cryptocurrency is here to stay for multiple reasons,” adds Shehan Chandrasekera, CPA, head of tax strategy at CoinTracker.

“Blockchain technology has a lot of applications in a lot of industries—cryptocurrency is just one of them. Institutions and publicly traded companies are also getting into cryptocurrency by offering crypto-related services and holding Bitcoin on their balance sheets.”

“Cryptocurrency is now front and center,” says Andrew Gordon, CPA, attorney with the Gordon Law Group Ltd. in Northfield, Ill. and a director of the Blockchain Institute. “You now have to ask all

clients if they have received, sold, sent, exchanged, or otherwise acquired any financial interest in any cryptocurrency.”

MILLIONS OF OWNERS—AND COUNTING

So, what exactly is cryptocurrency? Put simply, it’s digital currency that’s created, tracked, and traded via decentralized virtual ledgers powered by blockchain technology. Owners manage their cryptocurrencies inside digital wallets that store the keys to decrypt currency and allow it to be used, transferred, or converted into cash. A recent Finder survey indicates about 59 million Americans own some form of cryptocurrency, a number that has risen steadily over the past decade.

“As more individuals and businesses become involved with cryptocurrencies and as avenues for using cryptocurrencies expand, CPAs are beginning to field more questions on this topic,” says Jim Brandenburg, CPA, tax partner at Sikich in Milwaukee. “It’s a rapidly developing area that CPAs should become familiar with.”

“Many in the accounting industry hold a misconception that while cryptocurrency might be growing in popularity, their clients are not involved with it,” says Stephen Eckert, a Chicago-based senior manager in Plante Moran’s national tax office. “Many CPAs are surprised by the number of their clients that are maintaining cryptocurrencies.”

8 | www.icpas.org/insight

CRYPTOCURRENCY

In other words, you’d better make sure if any of those 59 million cryptocurrency holders are your clients—especially as the IRS is targeting cryptocurrency tax evasion more intensely. Although, critics are quick to say the agency is moving too slowly to enforce compliance.

THE TAX OUTLOOK

“Digital asset technologies are evolving at lightning speed, while tax and accounting guidance is moving at a methodical pace,” Eckert says. “The current amount of tax guidance related to cryptocurrencies is fairly limited. The IRS is convinced that cryptocurrency transactions are a source of significant underreported income and are aggressively looking for taxpayers who fail to report such transactions.”

The IRS addressed “how existing general tax principles apply to transactions using virtual currency” in Notice 2014-21 and has since created a virtual currency FAQ page. “The IRS is trying to get its arms around the expansion of cryptocurrencies and is focusing on the potential for fraud and abuse,” Brandenburg says. “It’s important to understand what transactions need to be reported. Not all cryptocurrency transactions are illegal, as some assume, but even legitimate transactions could trigger IRS scrutiny if not properly reported.”

“Some people think that cryptocurrencies are mainly used for illegal activities and tax evasion, but cash is used for more illicit activity than cryptocurrency,” Chandrasekera says. “Plus, cryptocurrency is the worst asset to evade taxes on because there’s a permanent record of your transactions on the blockchain.”

Another misconception to debunk: Taxation actually kicks in on a variety of transactions, not just when cryptocurrency owners cash out.

“A lot of folks believe that taxes are only triggered when digital assets are exchanged for fiat currencies, such as selling Bitcoin for the U.S. dollar,” Mastio adds. “Not true. Trading one digital asset for another— Bitcoin for Ether, for example—is a taxable event. In addition, receiving digital assets either as payment for services or through an airdrop or fork is also taxable.” (An airdrop is a promotional distribution of a new cryptocurrency. A fork is when there are software updates or other changes to the protocol of a cryptocurrency.)

The IRS isn’t the only institution looking to clarify and regulate the cryptocurrency markets. A recent proposal by the Biden administration to expand brokerage tax information reporting related to cryptocurrencies is “a clear sign of things to come,” Eckert says. All the more reason for CPAs to prioritize understanding when and how cryptocurrency is taxed.

“In some respects, cryptocurrency reporting is similar to the reporting of foreign bank and financial accounts,” Brandenburg says. “Both foreign accounts and cryptocurrencies are top priorities for the IRS. It’s not illegal to have these accounts, but one must be diligent when reporting.”

For instance, cryptocurrency is treated as “property” for tax purposes under current guidance, similar in many respects to a share of stock. “Imagine what would happen if you exchanged a share of Apple for a share of Amazon, or if you used that share of stock to buy a pizza. You’ll often get the same answer if you used cryptocurrency to do the same thing,” Eckert says. “Complexities begin when you realize the variety of transactions that cryptocurrencies are now a part of.”

Cryptocurrency activities can incur capital gains, and holders of cryptocurrency—who may keep crypto on multiple platforms—might also receive reward payments for holding their crypto on a certain platform (aka “staking”). Such payments, according to Gordon, are “akin to receiving interest on a bank account” and are taxable.

Tactics to minimize cryptocurrency taxes resemble general tax strategies: holding long enough to incur a better capital gains rate; offsetting gains with losses; and gifting, donating, or bequeathing. Despite these comparison points, the tax challenges of cryptocurrencies are unique.

“The hardest part about preparing returns for cryptocurrency clients is calculating the gains and losses from the cryptocurrency activity,” Mastio says. “This is a problem unique to cryptocurrencies because, unlike with stocks, the taxpayer won’t receive a 1099.”

CAPITALIZING ON CRYPTOCURRENCIES

Cryptocurrency tax troubles seem to be on the rise, but the challenges also present an excellent opportunity for CPAs who are willing to dive into the cryptocurrency world and become subject matter experts.

“We’re seeing it becoming more of an issue for taxpayers, especially with CP2000 mismatch notices,” Gordon says. “CPAs need to ask about cryptocurrency, especially considering that most professional tax preparation software will default to ‘no’ concerning whether an individual client acquired cryptocurrency. There’s now an argument for ‘willfulness’ if the box is checked no.”

He recommends asking clients these questions:

• Do they hold cryptocurrency now?

• Did they own any in the past and, if so, when did they first acquire the cryptocurrency?

• Have they ever exchanged one cryptocurrency for another or used it for a purchase or payment?

• Did they ever sell cryptocurrency for cash?

• Did they ever give or receive cryptocurrency as a gift?

Gordon’s firm starts billing for cryptocurrency-related services at $250 hourly. “If you have a business come to you with a box full of statements, it’s tough to tell how long it’s going to take,” he says. “The level of expertise needed is also much higher than typical accounting: We train our staff for two months. We do a lot of work for CPA firms that can’t do it themselves.”

For CPAs eager to learn more about this area, there are plenty of resources. “Read up on cryptocurrencies and look for continuing professional education opportunities,” Brandenburg advises. “Learn how cryptocurrencies operate and try to compare them with other products you may be more familiar with.”

But perhaps the best way to learn is hands-on: Buy some cryptocurrency yourself and learn the tax mechanics of it firsthand. Seek out consultants and specialized software—and recognize how the entire tax industry faces a global and fast-moving issue that can easily ensnare clients.

“Existing guidance for cryptocurrency taxation has struggled to keep pace with the evolution of the industry,” Mastio says. “There are a lot of uncertainties with the current regulations, but the worst thing a taxpayer can do is not report cryptocurrency activity at all.”

That’s where CPAs come in: We can—and should—strategically guide clients through the process of cryptocurrency use and reporting to get ahead of the challenges and changes of taxing a new currency.

Jeff Stimpson is a writer based in New York. He has covered tax concerns for more than 20 years for various industry publications, including Accounting Today and Financial Advisor.

www.icpas.org/insight | FALL 2021 9

Is Your Cybersecurity Strategy Still Relevant?

Organizations must continually update their risk management strategy to protect against the constantly evolving world of cybercrime. Here are some of the latest cyberthreats—and ways you can fight back.

BY NATALIE ROONEY

he cybersecurity landscape is always changing: Between 2019 and 2020, ransomware attacks rose by 180 percent in North America alone, according to a 2021 report by cybersecurity firm SonicWall. The total global cost of damages from ransomware attacks is projected to exceed $20 billion in 2021, and total global cybercrime damages are predicted to soon cost the world $6 trillion annually.

For organizations and individuals, creating protections against everevolving, ever-multiplying, faceless criminals that can steal your identity or shut down your business remains a challenge. The meteoric rise of ransomware attacks is just one part of the rapid proliferation of cybercrime in the pandemic era, creating an environment where even recently developed cybersecurity risk management strategies may already be outdated.

Charles Seets Jr., partner and principal with EY, says the cyberthreat landscape will never stop evolving. “If we’re connected to the internet, we’re vulnerable, and threat actors know that,” he notes. “They’re operating relatively anonymously and often outside the reach of the law. It’s a complicated environment in which to defend ourselves.”

For CPAs and finance professionals, the threat is especially ominous: You hold the key to troves of very important, very private financial data. It’s therefore essential to do all you can to stay ahead of the cybercriminals for as long as possible.

YOUR CYBERCRIME GUIDE

The first step toward protecting yourself and your organization is understanding what you’re up against. Here’s a glossary of some of the most common cyberattacks:

Malware: This terms stands for malicious software, which includes spyware, ransomware, and viruses. Malware breaches a network through a vulnerability, typically when a user clicks a dangerous link or opens an email attachment that opens the door. Once inside the system, malware can block access to key components of the network (ransomware), install malware or additional harmful software, covertly obtain information by transmitting data from the hard drive (spyware), disrupt certain components, and even render the entire system inoperable.

Phishing: Sending fraudulent communications that appear to come from a reputable source, usually through email. The goal is to steal sensitive data like credit card and login information or to install malware on the victim’s machine.

Man-in-the-middle (MitM) attack: Also known as eavesdropping attacks, MitMs occur when attackers insert themselves into a twoparty transaction. Once the attackers interrupt the traffic, they can steal data. Unsecured public Wi-Fi is a common point of entry.

Denial-of-service attack: This kind of attack floods systems, servers, or networks with traffic to exhaust resources and bandwidth. As a result, the system is unable to function normally. Attackers can also use multiple compromised devices to launch this attack; this is known as a distributed-denial-of-service attack.

Zero-day exploit: This attack hits after a network vulnerability is announced but before a patch or solution is implemented, targeting the disclosed vulnerability during this window of time.

“If you’re not following breaches in the news and then conducting case studies and tabletop exercises about those cybercrime

10 | www.icpas.org/insight CYBERSECURITY

strategies, you’re not getting crisis-ready,” says Jonathan Marks, CPA, CFF, CITP, CGMA, CFE, partner and firm practice leader of global forensic, compliance, and integrity services for Baker Tilly US LLP. “If the smoke is ultimately a fire, what do you do? What’s the plan and protocol? If you need remediation, who do you call? These are all keys to avoiding a business interruption.”

IT COULD HAPPEN TO YOU

One of the biggest risks in cybercrime is the common belief that it won’t happen to your organization—a mindset called “perfect place syndrome.” But from the smallest nonprofit organizations to the largest corporations, criminals aren’t discriminating.

“Our increasing dependence on networks and the growing pools of personal financial information being stored online exposes individuals to privacy violations and institutions to huge liabilities when a data breach occurs—that’s when a breach occurs, not if,” Marks emphasizes.

Smaller organizations in particular shouldn’t fall victim to perfect place syndrome and slack off on cybersecurity. “Small businesses might not be able to afford the best technology or an in-house IT team, but everyone can take certain steps and measures,” Marks says. “Outsource some of your infrastructure. Get someone to help you.”

“Experts have been saying for years that cyberattacks will increase in number and sophistication despite what we do to protect ourselves,” says Donny Shimamoto, CPA, CITP, CGMA, founder and managing director of IntrapriseTechKnowlogies LLC. “Advances in technology make it even easier for criminals. It’s going to continue to evolve.”

The only choice organizations have is to evolve faster.

THE LAYERS OF DEFENSE

There’s no single best cybersecurity strategy, but all organizations should shore up both their technological and human defenses. Shimamoto compares good cybersecurity strategy to an onion: multiple layers of protection that deter criminals as they encounter obstacle after obstacle. A firewall, the outermost layer, will check emails and attachments for phishing links and viruses. These days, antivirus software can actually detect if a virus is starting to encrypt files and if so, roll the virus back.

Too often, however, organizations rely solely or primarily on technological protections, incorrectly thinking a firewall and antivirus software are enough, while leaving the humans within the organization uneducated and unprepared.

One of the most critical layers to cybersecurity is training people to spot red flags. It sounds simple, and yet a survey of more than 1,000 IT professionals by automation company Ivanti revealed that 74 percent of companies have fallen prey to a phishing attack in the past year. More than one in three respondents said that a lack of technology and understanding among employees was the main cause for the increase in successful phishing attacks.

“Whether we want to admit it or not, our own employees are constantly and inadvertently opening the door to cyberthreats,” Seets says.

Even organizations that train employees on cybersecurity likely aren’t doing it frequently enough. Shimamoto notes that the rapid and constant evolution of cybercrime makes quarterly or even monthly mini-training sessions necessary to keep awareness high. After all, one of the most effective protective measures against cybercrime is not the latest technological gadget but training all employees to have good cyber hygiene.

Cyber hygiene is a term for our daily technological habits, from browsing Instagram on our phones to opening work emails in our

offices. Having good cyber hygiene means following best practices for cybersecurity, paving the way for not only more secure information streams, but also a more effective response and recovery after a breach.

Good cyber hygiene practices for all organizations include:

• Knowing where critical data is stored and housed.

• Building and maintaining a secure network, including a firewall and strong password requirements.

• Encrypting data.

• Maintaining a vulnerability management program that includes regularly updating antivirus software and other types of preventive software.

• Utilizing controls to restrict data access based on roles and identification.

• Having an information and security policy that covers employees, contractors, and third parties.

• Implementing software patches and updates as soon as they’re released.

Organizations must use technological protections effectively while also keeping their employees educated on what cybercriminals’ latest schemes are. Balancing technology with the human element is the best way for organizations to keep their cybersecurity strategies relevant and effective.

BEYOND IT

If Shimamoto could offer one piece of advice, it would be to think about cybersecurity as a business issue rather than just an IT responsibility. “This is really about your business, your customers, and your employees,” he says. “The impact of a cyberbreach reaches far beyond the scope of IT.”

While there may be fines and regulatory matters to address after a breach, the biggest loss at stake is trust, Seets says: “Trust is fundamental to any organization regardless of size. We need to inspire trust in our customers, regulators, insurers, and employees. If we can’t trust each other, it’s going to be more difficult to do business going forward.”

Starting now, any new services or products should have a cybersecurity risk management approach built in from the outset. “Anything a company intends to do proactively, whether that’s a new product or service, entering a new market, executing a transaction, or upgrading technology, has to incorporate cybersecurity in development and buildout,” Seets explains. “It’s difficult to bolt cybersecurity on after the fact, and threat actors will take advantage of that. Those who can infuse security at the beginning stand a better chance of executing a successful rollout.”

As cybercrime continues to mature, and criminals become bolder, everyone must chip in to protect themselves and their organizations against cybercrime, and CPAs can play a special role in the cybersecurity world.

“This isn’t just about IT risk—it’s about enterprise risk, and all of us connected to the enterprise play a part,” Seets says. “CPAs understand systems, processes, and roles. We can lean into the conversation and contribute to corporate America raising its cybersecurity game in a collective effort to defend what we’ve created.”

www.icpas.org/insight | FALL 2021 11

Natalie Rooney is a freelance writer based in Eagle, Colo. A former vice president of communications for the Ohio Society of CPAs, she has been writing for state CPA societies for more than 20 years.

The fallout of COVID-19 proved that the old ways of building and measuring business value are outdated. Four experts share their insights into what’s driving organizational value for CPA firms today.

BY KASIA WHITE

BY KASIA WHITE

12 | www.icpas.org/insight

www.icpas.org/insight | FALL 2021 13

After a crisis, we often look back at the way things were before and find them … well, quaint. Looking back at the ways we measured performance and value before March 2020, they seem a little outdated. Historic drivers like scope, scale, and efficiency are rapidly being replaced by new and transformative value drivers like human capital, innovation, and strategic technological upgrades.

Holding onto the old value drivers for too long could be catastrophic for CPA firms and the businesses they advise. After all, measuring yourself against an outdated metric for success means you could be failing without realizing it. Updating and upgrading the way you view value is a valuable exercise for any leader or organization.

“Times of disruption, like the COVID-19 pandemic, present critical opportunities for organizations to innovate and become more resilient,” says Carlos Leal, senior manager of business transformation and innovation at EY Canada. “Navigating unprecedented challenges requires leaders to adopt a transformative mindset and a structured approach to embracing change, refocusing efforts, and empowering people to lead boldly.”

The new way to drive value for firms and their clients includes empowering people, intelligently investing in technology, and focusing on invisible factors like innovation and intellectual capital— and it starts with a fresh look at strategy.

Building a New Strategy

While strategy isn’t exactly a new value driver, determining your organization’s post-pandemic strategy necessarily precedes developing key performance indicators (KPIs) that will help you measure your organization’s—or your clients’—success.

“Developing new KPIs should always begin with understanding the organization’s business strategy,” says Mark Frigo, Ph.D., CPA, CMA, CGMA, founder of the Center for Strategy, Execution, and Valuation in the Kellstadt Graduate School of Business at DePaul University and lead instructor in the Illinois CPA Society’s new Strategy Academy. “Without a clear, articulated strategy, KPIs can become disconnected, irrelevant, and in some cases even work against value creation. During the pandemic I recommended CPA firms conduct KPI reviews with the express purpose of achieving better alignment with long-term value drivers.”

Leal notes that EY has developed a strategic framework to help leaders navigate their post-pandemic recovery and re-strategize for their imminent business revival. “This framework was informed by the efforts of business leaders across a variety of organizations with a focus on their abilities to pivot and adapt their business models in response to the disruptions created by the pandemic,” Leal says. Here are the four steps they identified:

1. Scenario plan your post-pandemic recovery: Define a few focal questions and construct relevant scenarios, data-driven analytic goalposts, and concrete resource allocation choices. “Prepare to move with or ahead of change,” Leal says.

2. Prioritize adaptability: In line with your scenario plan, prioritize the operational and market-facing tactics available to your organization as clients and businesses slowly return to prepandemic habits and activity levels.

3. Execute your reinvention: Despite the importance of agility and experimentation, the ability to create and successfully execute bold transformation initiatives are still essential to value creation, particularly in a changing environment.

4. Make reinvention a core competency: Change is constant and accelerating, but organizations can and should be resilient in the face of it. “We need to embed a culture of lifelong learning to ensure our teams and organizations continue to thrive and unlock long-term growth,” Leal notes.

Once the strategic framework is built, it’s time to look at the new value drivers.

Empowering People

People’s habits and expectations have changed since the pandemic. Months upon months of remote work and modified business practices have changed both employee and client behaviors. With such new and different expectations hitting businesses from both sides, fostering long-term human connection has become perhaps the most important of the new value drivers.

“The pandemic created major disruptions in supply chains, employee engagement, and—maybe most importantly—client needs, a primary value driver for every business,” Frigo explains.

“When client needs change, organizations must move quickly to fulfill those needs before competitors do. This requires understanding how what you offer actually creates value for your clients, since developing value for the client or customer is how you drive the value of your business.”

Traditional financial value drivers such as cash flow, revenue growth, profitability, and return on investment (ROI) are still valid but Frigo stresses the need to remember that these are driven by client value creation. “Let’s not forget that employees are the primary value creators in any company—companies who treat their employees as valued clients create greater long-term value,” Frigo says.

With workers quitting in record numbers as the economy rebounds, organizations that prioritize their employees and their needs will enjoy greater value, while those who fail to take worker demands seriously will likely end up seeing their long-term value plummet.

“Talent is at the forefront of our strategic plan,” says Brian Blaha, CPA, growth partner with Wipfli LLP and a member of the Illinois CPA Society’s board of directors. “When we focus on the individual and really care about them, we are able to work to accommodate both their needs and the needs of the firm. Because of this, we see turnover rates below industry averages.”

Post-pandemic, Wipfli is embracing the hybrid work schedule, allowing employees to choose between working at home or at the office without mandating how many days they should spend in either place. Blaha notes that even so, they have seen an uptick in

14 | www.icpas.org/insight

the number of employees returning to the office. “The future of work will be a hybrid of in-person and remote, where in-office work will be encouraged when collaboration and face-to-face relationship building is required,” he says.

CPA firms and the businesses they advise must prioritize changing client needs and shifting employee demands if they hope to build long-term value. “At Wipfli, we emphasize seeing each associate, client, and referral source as the individual they are, focusing on our collective results versus strictly our own,” Blaha explains. “We really seek to focus on each person.”

Intelligently Investing in Technology

Resource allocation is the name of the game when it comes to the second new value driver: the intelligent deployment of technology. Technology is unavoidable, expensive, and can be a game changing value driver or value destroyer for any organization.

“By upgrading existing technology, CPA firms can not only increase efficiency and improve productivity, but also begin serving new groups that were either not geographically available to them before or that required additional resources,” says Matt DiLiberto, BDO USA’s modern workplace practice leader. “The pandemic showed us that by investing in technology that allows auditors to do their jobs remotely—like video conferencing services and online file sharing programs—you can serve clients from afar without spending money on travel. Technological tools are only going to keep growing in scope, so CPA firms that invest now will be ahead of the curve.”

Technology can also help firms retain employees by eliminating the annoying minutiae that often leads to burnout.

“Firms should continue to evaluate existing business processes to reduce inefficiencies, eliminate scenarios where employees are doing manual tasks, identify systems that are not accessible from all devices, and enhance tools and training that support the employee experience,” DiLiberto advises.

Blaha says he has seen huge improvements in the technologies available to supplement the employee experience, from leveraging social media for recruiting to utilizing digital channels and microlearning for employee development. “We are implementing many new technologies, participating in the AICPA’s dynamic audit system, utilizing robotic process automation, and investing in our data structure and enterprise systems for marketing, sales, finance, human capital, and customer service,” he says. “Many of the enterprise systems have AI components, and we are also researching other advanced technologies, such as blockchain and augmented and virtual reality.”

“We are seeing clients in the manufacturing space express interest in augmented reality tools, which can be useful for on-site inspections to capture information that may otherwise be missed,” DiLiberto notes. “Ultimately, adopting the right technologies and tools for your firm will allow your employees to focus on more complex, strategic problems. This can help the firm save time and money by increasing efficiencies and quality control and reducing administrative overhead and turnover.”

Only by keeping a finger on the pulse of technology and making strategic choices that support both employees and clients can firms innovate and build value moving forward.

Innovating for the Future

Innovation was a buzzword long before COVID-19 hit, but the pandemic made it clear: Organizations that cannot move quickly and imaginatively to new ways of doing business will not survive in a post-pandemic world.

“My fellow CPAs should recognize that the business environment today is changing at an accelerating rate of speed, and the pace of change will continue to accelerate,” Frigo says. “Strategic risktaking and strategic thinking are core competencies every firm needs to get better at. Look back and ask: What have I learned during the pandemic? How can those lessons drive my firm and my clients to greater value in the future—and greater resiliency when the next shock hits our economy?”

As we have seen, the firms that used the pandemic as an opportunity to learn how to move quickly and be open to experimentation saw the payoff in added business value.

“Try new things and learn to fail fast and adjust course,” Blaha exhorts.

Driving Value Now

COVID-19 spurred a great test run for innovation in a globalized world where climate change, shifting cultures and demographics, and constantly accelerating technological advances will make future disruptions increasingly common. For many firms and their clients, the pandemic shined a spotlight on the fault lines in the old ways of doing things—and the old value drivers. These three new value drivers—empowering people, using technology intelligently, and foregrounding innovation—are all interwoven and offer big lessons for both CPA firms and the business clients they advise. Starting to effectively focus on just one of these value drivers will likely soon begin to bear fruit in the other two areas.

“CPAs are equipped with the knowledge base and tools necessary to help spearhead the transformation of their own firms and their clients’ businesses,” Leal says. “As leaders with a pulse on organizations’ financial outcomes, CPAs must be part of this value transformation and provide leadership and support in projecting the different future scenarios and their implications; collaborating with functional area leaders to identify the relevant value drivers; and monitoring and regularly reporting on business performance as strategies are implemented.”

In other words, the CPAs who embrace the new value drivers will bring huge growth to the businesses they serve and also see exponential value growth at their own firms—long after March 2020 and COVID-19 are distant memories.

Kasia White is a freelance writer who specializes in profiling small businesses and leaders of global companies.

www.icpas.org/insight | FALL 2021 15

The Business Case for ESG Repor ting

BY CAROLYN TANG KMET

BY CAROLYN TANG KMET

16 | www.icpas.org/insight

With social and regulatory momentum building behind environmental, social, and governance reporting, business leaders and their advisors should make meaningful ESG practices an immediate priority.

www.icpas.org/insight | FALL 2021 17

Environmental, social, and governance—more commonly known as ESG—reporting is having a moment. As investors, employees, supply chain partners, and stakeholders of all stripes turn to ESG reporting to inform key business decisions, business leaders and their advisors are struggling to establish and prioritize ESG efforts. The challenge is that while ESG reporting becomes increasingly popular and valuable, the lack of formal regulations and standards stymies leaders looking to make meaningful changes to how they do business.

Part of the problem is that ESG reporting examines a wide variety of factors, both tangible and intangible. Put simply, ESG reporting is an examination of an entity’s involvement in environmental, social, and governance issues. Environmental factors could include an organization’s impact on climate change, natural resource scarcity, pollution, and waste. Social factors commonly explore an organization’s values and practices around issues such as labor and supply chain standards; diversity, equity, and inclusion efforts; and customer privacy. Governance factors often delve into issues like oversight and management structures, diversity within the board of directors, executive compensation, and crisis response. While some issues like diversity within the board may be easier to quantify, other factors like sustainable supply chain measures or the effectiveness of oversight aren’t immediately apparent in financial statements—yet the appeal and influence of these standards are undeniable.

“Investors, executives, and consumers increasingly understand that a company’s value is largely intangible and consists of more than just assets and products,” explains Marcy Twete, CEO and founder of ESG consultancy firm Marcy Twete Consulting. “How a company interacts with its stakeholders, community, and the planet is a value driver that directly impacts its bottom line.”

The Bottom Line for ESG

The COVID-19 pandemic is an active example of how ESG factors impact the bottom line. Organizations with solid lines of support for employees, nimble business operations that were able to pivot to serve rapidly changing needs, and adaptable strategies for successfully navigating uncertain times were more likely to survive—or even thrive—during the pandemic.

Mary Adams, founder of Boston-based Smarter Companies, believes that the pandemic’s impact on ESG investment activities proves that ESG is more than just a passing fad. “If it was a fad, then everyone would drop it in a crisis,” Adams explains. “What happened during the pandemic is that companies that had the trust and confidence of their employees and customers performed better through the disruption. We know there’s a link between ESG and a company’s performance. It may not be easy to pin down, but there’s definitely a connection.”

Even if we can’t see the impact of ESG on the bottom line, we can definitely see it in the flow of investment dollars. According to Moody’s Investors Service, investments in ESG products increased 140 percent in 2020. Similarly, Morningstar reported that ESG-rated funds took in $51.1 billion in new investments in the same year.

Chirag Shah is chairman of Simfoni, a company focused on leveraging spend analytics to help companies achieve supply chain sustainability. In July 2021, he successfully raised $15 million in Series B funding. “ESG goals are a moral and ethical necessity. As responsible corporate citizens, it’s our duty to take care of the future of our society,” he emphasizes.

Shah believes that product and technology innovations have progressed to the point where companies are able to achieve both ESG goals and business benefits. He says that raising the bar on ESG efforts not only mitigates risks but improves corporate performance.

“Focusing on ESG can reduce unnecessary costs,” Shah says. “Additionally, with social media enabling customers to have more of a collective voice, it’s evident that making responsible choices can result in higher brand value. Corporations that make a positive impact can increase their appeal to existing and potential customers and attract new market opportunities.”

Corinne Dougherty, audit partner with IMPACT, KPMG’s sustainability program, and a member of the AICPA Sustainability Assurance and Advisory Task Force, agrees that there are measurable business benefits: “Implementing an ESG strategy and reporting on progress will help companies unlock new value, build resilience, and drive profitable and measurable growth today and in the future,” she says.

Dougherty adds that ESG reporting further benefits the bottom line by helping business leaders understand and address emerging risks that threaten profitability; attracting a new investor base while meeting the ever-changing and increasingly stringent requirements of institutional investors; gaining access to capital; competing for top talent; and building a loyal customer base.

The Momentum Behind ESG

The motivation to implement ESG practices is driven by both external and internal factors. Externally, investors, customers, and regulators are calling for increasingly rigorous and sophisticated ESG reporting to help inform investment decisions and to hedge systemic risks in their portfolios.

“There’s no way you can hedge against climate change, right? You have to start advocating for a systemic solution,” Adams explains. “Additionally, during a time of great disruption, we often see exciting and innovative solutions, so that could be driving external interest in ESG efforts as well.”

According to a November 2020 report issued by the Forum for Sustainable and Responsible Investment, 33 percent of total U.S. assets under professional management are using sustainable investment strategies. By their count, those assets grew from $12 trillion at the start of 2018 to $17.1 trillion at the start of 2020—an increase of 42 percent.

But there are also internal pressures driving companies to implement ESG best practices. “In both public and private companies, employees are demanding better supply chains, carbon footprints, and labor practices, leading companies to prioritize their ESG efforts,” Adams explains.

18 | www.icpas.org/insight

Bryan English is the CFO of Elkay, a global manufacturer headquartered in Downers Grove, Ill. He says the momentum toward ESG practices goes further than the financial or branding concerns, with much of it driven by societal expectations and the innate need to “do the right thing.”

“Today’s consumers and workforce, who are really one and the same, expect companies to do right by their employees and their customers, to do good within their communities, to be good stewards of the planet, to be good corporate citizens, and to be a company with a purpose,” English says. “Because these expectations drive buying behaviors and affect whether you’re an employer who can attract top talent, they’re at the heart of why ESG is becoming such a critical focus area for companies today.”

The Regulatory Vacuum

Currently, ESG disclosure is a voluntary best practice, though the U.S. Securities and Exchange Commission (SEC) is signaling that more formal guidance may be coming soon. In March 2021, the SEC announced the creation of a climate and ESG task force in the Division of Enforcement that will develop initiatives to proactively identify ESG-related misconduct. Their initial focus will be identifying any material gaps or misstatements in climate risk disclosures. And in April 2021, the SEC’s Division of Examinations issued a risk alert, noting deficiencies and internal control weaknesses within investment funds that purported to be engaged in ESG investing. The seven-page alert included examples such as portfolio management practices that were “inconsistent with disclosures about ESG approaches,” controls that were “inadequate to maintain, monitor, and update clients’ ESG-related investing guidelines, mandates, and restrictions,” and proxy voting that “may have been inconsistent with advisors’ stated approaches.”

“Regulators have certainly increased their ESG scrutiny,” acknowledges Kristie Paskvan, CPA, MBA, board director of Smith Bucklin, NCCI, First Women’s Bank, and the United Way Metropolitan Chicago and an Illinois CPA Society member and Insight columnist. “In the United States, we expect rules will be implemented that require banks to account for the sustainability impact of their lending and investment policies. Therefore, all banks have this on their radar and are moving at various speeds to implement policies and procedures.”

Twete says there’s a natural tension between wanting to emphasize materiality and wanting to achieve standardization. “As readers of sustainability reports or ratings, we want to be able to easily compare Apple to Exxon, Macy’s to McDonalds, even though their business models and material issues are different,” she explains. “That kind of standardization is not only difficult, but it can also be a slippery slope. But while no system will be perfectly ‘one-size-fitsall,’ there’s hope for a more streamlined measurement framework for companies.”

English believes that we’re starting to see some standardization among ESG models that work best for businesses, though he’s still hesitant about the possibility of the level of standardization associated with traditional financial reports. “There are too many variances between businesses and their impact on consumers,

society at large, the planet, their own people, and the communities where they do business. When you standardize a reporting model, you leave out room for all the nuance—the good, the bad, and the ugly—that’s at the heart of why consumers care about ESG reporting in the first place,” English says.

Starting Your ESG Journey

Even without across-the-board standardization, English believes ESG reporting should be undertaken because it’s a powerful way to express corporate social responsibility. “ESG reporting backs up storytelling with data and facts, which adds credibility and helps distinguish those who are doing the work and making a real difference,” he says.

While each company’s ESG journey is unique, the process of implementation is similar across all industries. Here are Dougherty’s four steps to start your own journey:

1. Develop an ESG strategy. Understand and anticipate stakeholder expectations by identifying issues and assessing gaps, risks, and opportunities to integrate ESG into your business strategy.

2. Operationalize the strategy. Embed strategy into operations by understanding the implications for the workforce, supply chain, operations, controls, technology, infrastructure, and governance and managing the controls around collecting and processing data to track progress.

3. Measure, report, and assure. Understand the different standards, frameworks, and metrics for reporting ESG data, develop capabilities to measure the ROI of ESG initiatives, and provide accurate and fit-for-purpose disclosures and reporting.

4. Transform with ESG. Growing with ESG in mind requires a new approach to transactions, strategies, and partnerships. All these events create risks and opportunities for ESG strategy. Understanding those implications and developing processes to evaluate them during the transaction life cycle can future-proof your ESG approach.

Twete suggests that an initial step toward ESG reporting might be to conduct a materiality study to understand the risks and impact of ESG issues within your own company. “Consider which issues have the potential to negatively or positively impact your business. What do your stakeholders expect of you? From there, you can assess these key material ESG issues with your existing risk management process,” she says.

She emphasizes that companies need to address ESG issues with the same rigor they apply to operational or financial risk—and remember that ESG cannot succeed in a silo. These efforts will reach across and transform every aspect of an organization.

With increased regulatory and social attention on ESG issues, now is the time to identify, prioritize, and act on ESG measures that can improve your organization’s reputation and resilience—while also making the world a noticeably better place.

www.icpas.org/insight | FALL 2021 19

Carolyn Tang Kmet, MBA is a senior lecturer at the Quinlan School of Business at Loyola University Chicago.

20 | www.icpas.org/insight

Now that COVID-19 has receded just enough for the economy to rebound, an interesting trend is emerging: record resignations.

BY ANNIE MUELLER

The COVID-19 economy has been a wild ride, a roller coaster of recession and rebound in a compressed time period. But although reports suggest the economy is almost back to normal, there could be a big roadblock to full recovery: mass resignations.

A record number of people quit their jobs in April 2021, according to the U.S. Bureau of Labor Statistics. Almost 4 million employees turned in resignations—the highest level since the Bureau started tracking quits in December 2000, and research suggests that the wave of resignations will continue to build.

Data from Microsoft’s Work Trend Index and Prudential’s Pulse of the American Worker survey show that up to 40 percent of U.S. workers plan to quit their jobs, with some industries already feeling the effects. Hospitality and retail, two of the industries most affected by the pandemic, are struggling to return to pre-pandemic employment rates. In hospitality, the 5.4 percent quit rate is more than double the average across all other industries, and 42 percent of retail workers say they’re considering or planning to leave retail altogether.

The hospitality and retail industries illustrate a key demographic in the big quit: workers who are not shopping for higher pay in a similar position, but who are planning to opt-out of their industry entirely. And they’re not coming back: According to a survey from JobList, more than 50 percent of former hospitality workers say that no pay increase or incentive could lure them back to their old restaurant, bar, or hotel job.

But labor shortages are not limited to the lower end of the wage spectrum or hourly workers: According to data from Visier, managerial resignation rates also rose during the pandemic, especially in health care and high-tech industries. Mid-career workers, ages 30 to 45, are the most likely to walk away from current positions.

Businesses are desperate for employees, says Sheldon Schur, CEO at Brilliant, an award-winning consulting firm. “Hiring has been on the rise since the beginning of the year, with a bigger acceleration in the last three months,” he notes. “As an employer, you cannot hide your head in the sand and think that none of your workers are part of those 40 percent who plan to quit—because they are. You have to adapt to that and understand what it means.”

The Foremost Factors

According to Prudential’s research, two crucial issues are driving workers to quit: a lack of potential for career growth within their current company or industry and the dramatic mindset changes created by the pandemic. When workers were sent home, remote work took away the distractions, good and bad, of office environments, casting the actual daily work of positions in harsh relief. For many, the stark distillation of an entire career down to a few distinct tasks and skills brought a wave of clarity that instigated change. For those with jobs that don’t translate to remote positions—such as retail, hospitality, and other service-based

positions—the perspective of time away from demanding, unstable, and often risky work made returning to those jobs unthinkable.

“There’s been a huge change in the cultural dynamic of what people are willing to do,” says Devin Wells, senior talent acquisition lead at the Georgia Nut Company. “More people are examining their work-life balance; more people want to work from home. The working atmosphere has changed, and companies and firms are going to have to change as well.”

A few additional factors come into play, such as the impact of higher unemployment benefits, the huge number of women leaving the workforce, and the ongoing health and safety concerns of returning to the workplace. There’s also an increasingly vocal contingent of workers demanding to work from home: A May 2021 survey for Bloomberg News found that 39 percent of respondents would consider quitting if their employers weren’t flexible about remote work—and that figure jumped to 49 percent among millennials and Gen Z.

“Basically, you have three categories of people: those who want to stay fully remote, those who want to return fully to the office, and those who want a hybrid work situation,” says Andrea Herran, founder and CEO of Focus HR Consulting. “How employers negotiate with all three of these groups will require a lot of flexibility and adaptability.”

And, of course, for many workers it’s likely that their decision was made from a unique combination of reasons. That’s exactly what makes it so difficult for employers to respond: While the big quit might be a mass event, each individual resignation is a risky personal decision.

What Workers Want

Given the wide variety of personal reasons driving these resignations, as well as the number of workers who flatly say they won’t return to their industry for any amount of money, employers will need to approach this challenge with creativity and open ears. Herran believes the future of the workplace is what she calls “personalized employment,” providing targeted incentives and greater flexibility to woo workers.

“Organizations that don’t adapt to more individualized employment situations will bear the brunt of this mass exodus,” Herran says. Schur agrees: “You have to stay close to the individuals. Do your frontline managers understand how each of their staff members lives and how they feel about the company and their personal goals in coming back to work?”

In the thick of pandemic shutdowns, companies and firms who quickly pivoted to remote work arrangements were the ones to thrive. In the post-pandemic world, an effective transition to personalized employment will play the same role.

www.icpas.org/insight | FALL 2021 21

To claim and keep the talent they need, leaders must focus on the issues most often cited by workers:

• Adequate compensation, including benefits.

• The need for flexibility in work hours and location, including options for remote work and/or a hybrid work schedule.

• Sensitivity to mental and physical health concerns, including burnout, exhaustion, and increased risk of exposure to COVID19 and its variants.

• Career growth opportunities and options for continuing education and training.

• An increased focus on quality of life, including adequate holiday time, and real help with childcare logistics.

• Good work conditions and company culture.

Of course, employers cannot meet every need or anticipate each unique situation. What they can do is focus on results. “When you’re paying people a salary, you’re not paying them for their time,” Herran says. “You’re paying for their expertise, their knowledge, and their ability to achieve a result.” If companies and firms focus on the results while offering more flexibility and creativity in how people achieve them, there’s room for unique solutions that meet individual needs while also attaining organizational goals.

Small businesses and businesses that rely on hourly and/or inperson employees face unique challenges in fending off the big quit as they often lack either the resources or the flexibility to meet worker demands. However, small businesses have the advantage of being able to provide flexibility and personalization faster than their larger counterparts—an advantage they need.

“Small businesses are now reporting that their biggest business problem is not finding new customers or making new sales, it’s finding employees,” says Derek Sasveld, senior investment strategist at BMO Global Asset Management.

For hourly workers and positions in which remote work is not an option, employers can focus on creating short-term incentives and improving the overall satisfaction of a given position. “We try to be as flexible as possible with scheduling, but there’s not much we can do in terms of flexibility from an hourly worker standpoint,” Wells says. “So, we’ve developed internal incentives for short-term goals and rolled out a plan to revamp our whole employee experience.”

The Brand of a Business

Employers expect job candidates to come in with a pitch for themselves as workers, but today’s employees expect the same from potential workplaces. “What’s your message? Why should people come in and join your company? Present your pitch on social media, on your website, on LinkedIn, and with your team,” Schur says.

Consistent branding will help get candidates in the door, while a good hiring strategy will get them on the payroll. “A hiring strategy should tell you what kind of people you’re looking to bring in while also ensuring that it’s a good place for them to work,” Herran says.

After all, bringing in the wrong people or promising a culture or benefits you can’t deliver will only lead to more resignations. “What the candidate sees during the interview process and what they see on day 30 or day 90 should all connect,” Schur says.

A strong hiring strategy also means moving quickly when you find the right candidate: When it’s a good fit, there’s no time to waste. “You can’t take 10 days to interview candidates,” Schur explains. “Our strategy internally is 48 hours from the first interview to making an offer. We know that if we wait, the best people are going to get another offer.”

CPAs can help their business clients understand and respond to the big quit by being a source of helpful and relevant information and identifying a financial path toward making necessary changes. After all, the financial risks of inadequate staffing and ongoing turnover can quickly outweigh the price tag of new incentives or workplace changes.

“There’s always something that can be done to improve on whatever perceived shortcomings exist,” Herran says. “You can always take a step in the right direction.”

Clients will need accurate numbers and excellent forecasting to build effective strategies, and they will need industry-specific advice and sound financial insights to identify and execute the right moves. “You cannot wait to make this a priority,” Schur says. “The most important thing I do every day is help bring the right talent on board.”

All in all, workers finally feeling able to ask for what they really want is a boon for companies and firms willing to make creative changes quickly. Employers who take worker demands seriously can develop a huge strategic advantage over those who dismiss the big quit as a trend and refuse to adapt. “It’s an unusual wrinkle that we’ve had this short, severe shock to the economy,” Sasveld says. “There’s much more uncertainty, but overall it’s still a pretty positive picture.”

Annie Mueller is an experienced Puerto Rico-based financial writer. She is a frequent contributor to various industry publications.

22 | www.icpas.org/insight

PEACE OF MIND

You probably already have life insurance. But do you have enough?

Over the years, your living expenses may have increased. Could your current life insurance benefits:

• Help your family maintain their lifestyle?

• Pay for your kids’ college education?

• Allow your spouse to retire comfortably?

It’s always a struggle to lose someone you love. But your family’s emotional struggles don’t need to be compounded by financial problems.

That’s why the Group 10-Year Level Term Life Insurance Plan is made available to ICPAS members.* This valuable insurance program offers:

• Your choice of benefit amounts up to $250,000.

• Rates that are locked in for 10 full years.

• Benefit amounts remain steady for the 10-year coverage period. There are no age reductions.

See

*Underwritten by Hartford Life and Accident Insurance Company, Hartford, CT 06155. Life Form Series includes GBD-1000, GBD-1100, or state equivalent. All benefits are subject to the terms and conditions of the policy. Policies underwritten by Hartford Life and Accident Insurance Company detail exclusions, limitations, and terms under which the policies may be continued in force or discontinued. Program Administered by Mercer Health & Benefits Administration LLC AR Insurance License #100102691 CA Insurance License #0G39709 In CA d/b/a Mercer Health & Benefits Insurance Services LLC 92581 (8/21) Copyright 2021 Mercer LLC. All rights reserved.

Help protect your loved ones — when they may need it the most— with economical life insurance

Happens, lifehappens.org,

Two thirds (67 percent) of Americans say the pandemic has been a wake-up call for them to reevaluate their finances.1

1Life

2020

how affordable additional peace of mind can be — for you and your family. (Information includes eligibility, benefits, premium rates, exclusions, limitations and termination provisions.*) Learn more today! Visit www.plansforICPASmembers.com Call 1-800-842-4272

Returning to the Of昀 ce: A Guide for Accountants