Businesses get creative in their hunt for everelusive

search

investor

funding In this issue Make your investments recession-proof Nonprofits struggle in a down economy Overseas assignments jet propel careers Twitters, blogs and Facebooks hit the office Supply chain muscle wrestles hard times Women in public accounting hit the glass ceiling Get creative to save on training dollars Find a new definition for recession era success Tax changes impact US small businesses Ira Solomon CPA, PhD takes a bow The Magazine of the Illinois C PA Society www icpas org / insight htm | July 2009

30 Desperately Seeking Investors

B y Sh er yl N a n c e - N a sh

Businesses are searching high and low for scarce investment dollars

34

Capital Conscience

B y D er r i c k Li l l y Nonprofits are feeling the pinch

38

Recession-proof Investments

B y C a r o l yn Ta n g

We’ve seen the collapse of glorified investment houses, government takeovers of bereft corporations and a steep downturn in the markets Given these conditions, the question of where to put your investment dollars is a heady one

6

The Chair Lee A. Gould, CPA/ABV, JD, CFE, CFF

Incoming Society Chairperson Lee A Gould shares his hopes and aspirations for the year ahead

12

Career Jet Set

B y C ec i l y O’ C o n n o r

Working abroad can fast-track you to the top

14 Technology Twitterblogiverse

B y A l l i so n E n r i g h t

Can you social network your way to business success?

16 Supply Chain Heavy Lifting

B y Sel en a C h a vi s

Build a strong supply chain to wrestle a weak economy.

20 Diversity Accounting Women

B y IC PA S Wo m en ’ s E xec u t i ve C o m m i t t ee

Why hasn’t anything significantly changed for women in public accounting leadership roles?

24 Development Goodbye Training Program?

B y Ren ee B ec k m a n , C PA

Don’t bid adieu to your staff development dollars quite yet Find budget-friendly training alternatives instead

26

Strategy Set the Standard

B y D ea n K . Ma t t , C PA

How do you define success in an uncertain economy?

28

Tax Small Biz, Big Impact

B y H a r vey C o u st a n , C PA

Tax act provisions could mean significant changes for the nation’s small businesses

index July 2009 Vo l 5 8 N o 8

icpas org / insight htm features colu m n s regulars

www

4 First Word 8 Seen+Heard 42 Classifieds

Garelli

To learn more about our dedication to finding the right fit, visit us on the web or call your local office.

Wong and Jackson Wabash are Chicagoland’s experts in financial recruiting and staffing. Our team unites employers with the right accounting and finance talent for direct hire, temporary and consulting assignments. We look and listen beyond the job description to combine the right skills with the desired experience.

Clients Great Candidates Great Fit Chicago Schaumburg Oakbrook Terrace 312.583.9264 847.397.9700 630.792.1660 WWW.GARELLIWONG.COM WWW.JACKSONWABASH.COM

Great

Publisher

ICPAS President & CEO

Elaine Weiss, JD

Editor-in-Chief

Editor-in-Chief

Publications Director

Judy Giannetto

Creative Services Director

Gene Levitan

Creative Services Manager

Rosa Garcia

Publications Specialist

Derrick Lilly

National Sales & Advertising

Stephanie Bunsick

The YGS Group

1808 Colonial Village Lane Lancaster, PA 17601

Phone: 1 800 501 9571, ext 137

Fax: 1 717 390 9891

stephanie.bunsick@theygsgroup.com

Information Systems Manager

Jim Jarocki

j arocki j @ i cpas org

Editorial Office

550 W Jackson Blvd , Suite 900, Chicago, IL 60661

INSIGHT is the official magazine of the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Its purpose is to serve as the primary news and information vehicle for some 23,000 CPA members and professional affiliates Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race,religion, sex, age or origin

The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred asa result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published bimonthly except monthly in July and August by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA, 312 993 0393 or 800 993 0393, fax 312 993 0307

Subscription price for non-members: $30 U S , $40 Canada and International addresses, $42 Mexico Copyright © 2009 No part of the contents may be reproduced by any means without the written consent of INSIGHT Permission requests may be sent to: Editorial Director, at the address above Periodicals postage paid at Chicago, IL and at additional mailing offices POSTMASTER: Send address changes to: INSIGHT, I l l i n o i s C PA S o c i e t y, 550 W Jackson, Suite 900, Chicago, IL 60661, U S A

I N S I G H T A W A R D S

2008 Apex Award, Magazine & Journal Writing

2007 Magnum Opus Award, Best All-around Association Publication

2006 Apex Award, Magazines & Journals

2006 Apex Award, Magazine & Journal Writing

2004 Apex Award, Magazines & Journals

2004 Apex Award, Magazine & Journal Writing

2002 Apex Award, Magazine & Journal Writing

2002 Chicago Women in Publishing Excellence Award, Writing/Editing

2001 Apex Award, Feature Writing

2001 Apex Award, Best Redesigns

2000 Apex Award, Magazine & Journal Writing

2000 Apex Award, Best Rewrites

The economy tanked, the stock market crashed, t h e u n e m p l o y m e n t r a t e s o a r e d , t h e r e a l e s t a t e sector collapsed Bernard Madoff was caught in t h e b i g g e s t P o n z i s c h e m e i n r e c e n t h i s t o r y a n d m a j o r banks and investment firms with distinguished names and records of success disappeared overnight Other than that, Mrs Lincoln it was a quiet year

Despite the historic and tumultuous year, with its economic turbulence and significant impact on savings and investments, I am gratified to report that the Illinois CPA Society ends its own fiscal year on solid ground, bolstered by its strong leadership, active membership and professional commitment to serving the CPA community and the public at large

Under the impressive leadership of Sheldon Holzman, the ICPAS calmly navigated through the year, serving the needs of our members in a rapidly changing business environment We developed programs to address the increasing number of members who found themselves facing career transitions in uncertain times Our Town Hall forums around the state saw increased turnout as members were anxious to stay up-to-speed on professional issues and to maintain contact with professional colleagues.

The media turned to the ICPAS for assistance in unraveling the economic complexity of the world around us From the President’s economic stimulus plan to the Governor ’s budget proposal, the media now seeks ICPAS members to provide the context, quotes and background to make sense of financial developments and the day-to-day world around them

The emerging issue of International Financial Reporting Standards captured the attention of the CPA profession this year The ICPAS provided programs and resources to help our members get up-tospeed on the wide range of issues corresponding to IFRS Our public service efforts increased this year, as CPA members gave their time and expertise to assist people in critical need of financial assistance, from flood victims in Iowa to military personnel and their families around the state The ICPAS also continued its outreach to students and young professionals, to engage them in service and social networking opportunities that will keep them connected to their professional community and ensure a future pipeline of smart, savvy CPAs in coming years. Our government affairs team worked hard to advocate on behalf of Illinois CPAs and finance professionals, leading our efforts in both Springfield and Washington, D C

While the economy dominated our thoughts and activities in recent months, I believe the ICPAS ends the fiscal year on a positive note Membership is up slightly over last year Our operational budget stayed the course. The student pipeline into the profession remains robust. Our members continue to give their time and talents to serving the ICPAS even while their day-to-day work lives get tougher and their own workforce challenges get greater Make no mistake The past year has been rough The year ahead looks to be challenging. But the ICPAS is prepared to meet the challenge.

Today you can link-in, twitter, friend us or just show up at an old-fashioned seminar The ICPAS stands ready to serve In a very tough year, I want to thank the staff and the volunteer leadership for stepping up to the plate and serving the CPA community with energy, expertise and enthusiasm. El ai

ne W ei ss, JD, ICPAS Presi dent & CEO 4 INSIGHT www icpas org/insight htm

F I R S T W O R D

We value your membership. The Illinois CPA Society... experience the advantage. Was it simply an oversight? Renew your Illinois CPA Society Membership Today. During these tough economic times, it’s more important than ever to stay connected to your profession. Your Illinois CPA Society membership provides you: > Free or low-cost monthly career events > Local, affordable, high-quality CPE > Member Buying Advantage discount programs > Publications such as INSIGHT magazine, CCFL NewsFlash, Practice Advantage and HYPE Don’t risk losing these and other valuable member benefits. RENEW ONLINEat www.icpas.org or call 800-993-0393.

I C

P A S O F F I C E R S

Chairperson, Lee A Gould, CPA/ABV, JD, CFE, CFF Gould & Pakter Associates LLC

Vice Chairperson, Sara J. Mikuta, CPA The Leaders Bank

Secretary, Charles F. G. Kuyk III, CPA Crowe Horwath and Company LLP

Treasurer, Robert E Cameron, CPA Cameron Smith & Company PC

Immediate Past Chairperson, Sheldon P Holzman, CPA, CFE, CFF Baker Tilly Virchow Krause, LLP

I C P A S B O A R D

O F D I R E C T O R S

Brent A Baccus, CPA Washington Pittman & McKeever

Therese M Bobek, CPA PricewaterhouseCoopers LLP

William P Graf, CPA Deloitte & Touche LLP

Kelly J Grier, CPA Ernst & Young LLP

Cara C. Hoffman, CPA Blackman Kallick LLP

James P Jones, CPA Edward Don & Company

Charlotte A Montgomery, CPA Illinois State Museum

Elizabeth A Murphy, PhD DePaul University

Annette M O’Connor, CPA RR Donnelley & Sons Company

Michael J Pierce, CPA RSM McGladrey Inc

Marian Powers, PhD Northwestern University

Daniel F Rahill, CPA KPMG LLP

Lawrence H. Shanker, CPA Shanker Valleau Accountants Inc

Edward H Stassen, CPA Recycled Paper Greetings Inc

It is with great pride and respect for those who have held this position before me that I embark on my year as chair of the Illinois CPA Society

W h e n I b e g a n m y p r o f e s s i o n a l c a r e e r a s a y o u n g auditor (and, might I add, naïve; but, of course, with a dose of healthy skepticism imbedded in me by my auditing professors at the University of Illinois), I had dreams and ambitions of a career in public accounting as an auditor Although my career path has dram a t i c a l l y c h a n g e d f r o m m y i n i t i a l y e a r s i n p u b l i c accounting (for those whom I have not yet had the privilege to meet, I am now on the consulting side of the profession), I am an auditor at heart and remain a very proud CPA

As a longtime member of the Illinois CPA Society, I value all that I have learned as a volunteer on various Society committees and special interest groups, and during my tenure as a Board member As a result of these contributions, I have learned how the Illinois CPA Society affects and enriches our profession.

Although the ICPAS strives to proactively meet the needs of our membership, and is one of the most respected contributing state societies to the AICPA, we need to continue to grow and evolve To accomplish that end, the Board of Directors and the ICPAS undertook a Board Governance initiative that began three years ago. The initiative’s purpose is to align the ICPAS w i t h t h e b e s t p r a c t i c e s i n n o n p r o f i t g o v e r n a n c e , a n d c r e a t e a s t r a t e g i c m i s s i o n - f o c u s e d agenda. Our focus includes, among other goals and objectives, to:

n Anchor and align the Society with its mission (“Enhancing the Value of the CPA Profession”) and ends policies (which describe the results the Society strives to accomplish in support of its mission)

n S t r e n g t h e n a n d g r o w n o t o n l y o u r m e m b e r s h i p b u t a l s o t h e i n v o l v e m e n t o f a l l o f o u r members, especially our young professionals (our future leaders)

n Maintain and enhance services to our valued membership.

n Embrace and nurture the growth of diversity within the profession and the Society

As a result of this focus, as well as the many other initiatives undertaken by the ICPAS on our behalf, I am very excited about the direction in which the ICPAS is headed.

The initiatives undertaken by the ICPAS are far too numerous to list in these brief remarks, but needless to say, their impact has been extremely positive However, I believe we must continue to improve and enhance the value of all CPAs Part of that goal the need to increase the diversity of our membership and persuade a wide range of minorities to join our noble ranks remains a priority I am proud of the ICPAS’ outreach programs and initiatives currently in place, and am deeply pleased with and excited about the diversity initiatives currently being developed in partnership with the CPA Endowment Fund

I look forward to beginning my year as chair Although I believe that the ICPAS will continue to make a positive impact on the profession, I encourage you to provide input and guidance on how we can better serve you

To the numerous CPAs that I am already acquainted with, I hope to see you in attendance at one of several Society Town Hall Forums, conferences or seminars I am eager to hear about what your CPA means to you and how we can further its value for you To those of you whom I have not yet met, I look forward to meeting you to learn your personal story, and what being a CPA means to you.

Lee A Gould, CPA/ABV, JD, CFE, CFF, ICPAS Chairperson

6 INSIGHT www icpas org/insight htm

T H E C H A I R

SEEN H E A R D

$11.6 bil lion

Compensation earned by the top 25 hedge fund managers in 2008.

Source: Institutional Investor/Alpha Magazine

Recession Changes Accountant’s Role

While the US Bureau of Labor Statistics continues to report month- over-month job

Reporting Standards (IFRS), the Economic Stimulus Package and

need for financial analysis, budgeting and forecasting during the recession Their responsibilities, however, are changing

Ajilon Finance polled 688 finance and accounting professionals as part of the Institute of Management Accountants' Inside Talk Webinar Series, to gauge how the current economy is impacting jobs, companies and the accounting profession According to the survey, 75 percent feel that the recession has changed their on-the-job responsibilities, with 59 percent citing more time spent on cost-cutting initiatives Twenty-seven percent cited more time spent on risk assessment, a further 27 percent cited providing financial advice to their companies, and 9 percent cited a focus on regulatory work In the face of these changes, Ajilon offers finance professionals these tips:

1 S t a y f o c u s e d It ’ s easy to lose sight of the most important task fostering and growing business profitability Finance managers should work closely with all stakeholders and anticipate their needs in the current economy

2 Fo l l o w t h e s t i m u l u s Company leaders should think about how this capital infusion will affect their company ' s business, in order to better prepare for market changes

3 P a y a t t e n t i o n t o T A R P Companies should review their accounting and legal teams to ensure they have the necessary talent to handle increased government regulation should their business participate in the Troubled Asset Relief Program (TARP)

4 R e d u c e c a r b o n f o o t p r i n t s An easy way to trim costs is to reduce office energy usage Significant cost savings can be realized by turning off office equipment at night and switching off unnecessary lighting

For more information, visit www ajilon com

IFRS Inspires Mixed Feelings

Grant Thornton LLP ’ s national survey of CFOs and senior comptrollers from public and private entities reveals that 49 percent believe US companies should be permitted to use IFRS instead of US GAAP for filing financial statements with the SEC The remaining 51 percent, however, sits on the other side of the fence Given the choice, 40 percent would choose to never use IFRS, while the rest are looking to bide time before implementation Twenty percent said they would start using IFRS in 2011, 19 percent would prefer to start using IFRS some time after 2016, and another 18 percent favor 2014

Visit www grantthornton com for more

1.5 million

The number of accountants and auditors

States by 2016.

Source: Bureau of Labor Statistics, Occupational Outlook Handbook, 2008-09 Edition

8 INSIGHT www icpas org/insight htm

N E W S B Y T E S , S O U N D A D V I C E A N D P R A C T I C A L B U S I N E S S T I P S

w h o w i l l b e e m p l o y e d i n t h e U n i t e d

l o s s e s , a c c o u n t a n t s s t i l l s e e a s t r o n g j o b m a r k e t d u e t o I n t e r n a t i o n a l Fi n a n c i a l

the

overall

90 million

The number of tax returns filed electronically this year; a new record, led by a big increase in people using home computers

Source: Internal Revenue Service

The World’s Top 10 Business Risks

Late last year, Aon began surveying business leaders from 40 countries in 31 industries to determine the world’s greatest emerging and escalating business risks The recently released Definitive Report on Risk – Aon’s 2009 Global Risk Management Survey reveals that the top 10 most pressing risks are: 1 The economic slowdown 2 Regulatory/legislative changes

3 Business interruption 4 Increasing competition 5 Commodity price risk 6 Damage to reputation 7 Cash flow/liquidity risk 8 Distribution or supply chain failure 9 Third-party liability 10 Failure to attract or retain top talent

For more on the survey, visit www aon com

Question Your Way to Success

According to the Gallup Organization, determining why one organization, division, department or any other managerial unit is happier and more profitable than another comes down to the answers to these 12 questions:

1 Does everybody know what is expected of them?

2 Do they have the materials and equipment they need to do the work correctly?

3 Do team members have the opportunity to do what they do best every day?

4 In the last seven days, have they received recognition or praise for good work?

5 Does their manager, or someone else in the team, care about each individual as a person?

6 Does every person in the team have someone who encourages his or her development?

7 Does everybody's opinion in the team seem to count?

8 Is the company ’ s mission explained in such a way that the team feels its work is important?

9 Are all the people in the team visibly committed to doing quality work?

10 Does everybody in the team have a best friend at work?

11 In the last six months, has the manager talked to each team member about progress?

12 Does every person have the opportunities to learn and grow at work?

The questions and their ability to analyze managerial performance are documented in First Break all the Rules, by Marcus Buckingham (Simon & Schuster, 1999) [Source: Coaching for Leadership, coachingleadership blogspot com]

Worries Linger Among Real Estate CFOs

A recent Grant Thornton LLP survey of 28 CFOs and senior comptrollers from public and private companies in the real estate industry reveals that 93 percent expect commercial real estate values to continue their decline through the year What’s worse, 63 percent report that their property tax assessments have continued to increase during the past three years

Adding to the glum outlook is the fact that more than four-out-of-five (82 percent) real estate CFOs believe the US economy will remain in a recession through the end of the year; 75 percent expect it to remain the same or get worse during the next six months; and 39 percent expect layoffs at their companies

Facing pricing pressures themselves, 71 percent of real estate CFOs are concerned about the cost of employee benefits, while 74 percent are cutting costs by not giving raises this year and refining and streamlining processes

For more on the survey, visit www.grantthornton.com.

The Illinois CPA Society has made it easier than ever to identify the up and comers in the accounting profession. Just visit the Illinois CPA Society’s Career Center and search student resumes to fill your next internship.

All across the state, Illinois CPA Society student members have uploaded their resumes for you to view online. These students represent the future of the profession and your guidance as a seasoned member of the profession can put them on the right track. These students are available for summer, fall or spring internships.

Search by various criteria, including:

www icpas org / insight htm July 2009 9

The best and brightest interns are at your fingertips.

and

on the Career Center.

Geographic Location Timeframe Paid or College Credit Internships Visit www.icpas.org

click

51 percent

Decline in Q1 2009 IPOs compared to Q1 2008

Source: Ernst & Young US IPO Pipeline study

Fast Track Back to the Manager ’s Seat

In a recent Robert Half Management Resources survey, executives polled felt that, on average, a senior manager could be out of work for nine months before his or her career prospects were adversely affected If nine months seems too long a stretch, however, these five tips may help to speed the process

1 . B e f l e x i b l e . Explore ways to apply your expertise in new areas and highlight your transferable skills

2 N e t w o r k e f f e c t i v e l y Make sure your network includes people both inside and outside of your industry, and at various experie n c e l e v e l s N e t w o r k i n g w e b s i t e s l i k e L i n k e d I n c a n e x t e n d y o u r reach even further

3 . K n o w t h e c o m p a n y. The more you can find out about a business ’ strengths, weaknesses and corporate culture, the better you can tailor your resume to fit its needs

4 C o n s i d e r r e l o c a t i n g Be open to opportunities in other cities or states, particularly if your skills are highly specialized or few job openings exist locally

5 S t a y p o s i t i v e Finding a management position can take longer than you expect, simply because there are fewer positions currently available Try not to be discouraged, however, since you’ll wear away the very confidence you’ll need to win over recruiters For more information, visit www rhi com

C o r r e c t i o n : Please note that in the May/June 2009 edition’s Cutting Room article, Crowe Chizek should have appeared as Crowe Horwath Also, Mike Hillgameyer was intended to appear as Mike Hillgamyer

Obama’s 2010 Budget & Illinois

Under President Barack Obama’s 2010 budget, which strives to create jobs and boost the economy, Illinois will see a range of changes in healthcare, education, veteran affairs and infrastructure funding Highlights include:

n Tax cuts for 4 8 million families

n $17 5 billion in small biz loan guarantees to get credit flowing

n $4 5 billion in new funding for Pell Grants to help families pay rising college fees

n $1 2 billion for schools, students and teachers

n A 2 9-percent pay raise for the 47,900 men and women in Illinois serving in our Armed Forces

n The establishment of a national Infrastructure Bank to fund Illinois infrastructure projects

n A $76 6 million investment in the federal HOME program

n $63 3 million for the Housing Choice Voucher program to help Illinois families find affordable, good quality places to live

n $643 9 million for state and local student achievement initiatives in low-income areas

n $119 1 million for teacher and principal training and recruitment efforts in high-need school districts

n $12 4 million for the state’s School Breakfast program and $55 million for its School Lunch program

Source: WhiteHouse gov

Higher Pay is the Way to Play

Overall, an increase in salary is the most popular means of compensation among 2,000 senior executives and managers, according to a worldwide NFI Research survey The next most popular method is performance -based bonuses (16 percent), closely followed by more vacation time (15 percent) Almost half (49 percent) of respondents at large companies rank salary increases top, compared to 38 percent at small companies

Visit NFIResearch com for more survey results

10 INSIGHT www icpas org/insight htm

buying advantage program save mney on the products and services you use every day. A BENEFIT OF YOUR ILLINOIS CPA SOCIETY MEMBERSHIP

member discount on tax and accounting books. Email: http://tax.cchgroup.com/members/icpas (Enter member discount code: Y6202) Discounts on products and services. Phone: 800.325.7000 Up to 15% off on auto insurance and 10% on home insurance. Call today for your no-obligation rate quote! Be sure to mention group #3408. Phone: 800.835.0894 Special group discounts on life, disability, major medical and liability plans. Phone: 800.323.2106 (liability) or 800.842.ICPA (medical & life plans) Offering more than 65,000 products at competitive prices. Phone: Wanda Brooks: 708.969.5355 | Email: wbrooks@warehousedirect.com Competitive loan rates and dividends, and access to a diverse line of products and services. Phone: 800.328.1935 | Web: www.alliantcreditunion.org/ilcpa Earn points and get rewards you want, with a no annual fee Platinum Plus MasterCard. Phone: 866.438.6262| Apply Online: www.bankofamerica.com/creditcards Complete administration of 125 Cafeteria Plan. 10% off of enrollment and administrative fees. Phone: 800.422.4661, press 7

effective and ethical solutions for collecting debts and improving cash flow. Phone: 800.279.3511 | Web: www.icmemberbenefits.com

member

30%

Provides

Jet Set

Wo r k i n g a b ro a d c a n fa s t - t ra c k yo u t o t h e t o p

By Cecily O’Connor

In 2003, Alan Jagiello was offered a position at Deloitte’s Brussels office to serve t h e n e e d s o f v a r i o u s l a rg e E u r o p e a n manufacturing clients Although on track to make partner back at home, the insights he gained into European markets by accepting the Brussels assignment prov-ed invaluable w h e n i t c a m e t o h i s l a t e r m o v e u p t h e career ladder

“My career has definitely been enhanced, and I was able to progress faster as a result of my international assignment,” he explains. Jagiello is now an audit partner in Deloitte’s Chicago office He credits his overseas experience with broadening his professional network and providing him with opportunities to work on high-level engagements in the United States Working overseas can be o n e o f t h e r i c h e s t e x p e r ie n c e s o f a n a c c o u n t a n t ’s career Relocating is never e a s y, b u t t h e c h a n c e t o b r o a d e n t a x a n d a c c o u n ting experience on a global s c a l e i n p l a c e s s u c h a s I n d i a , M e x i c o , C h i n a a n d Europe is hard to pass up. In fact, all but three of 400 D e l o i t t e p r o f e s s i o n a l s s u rv e y e d i n 2 0 0 8 s a i d t h e i r overseas experience was so beneficial that they’d consider doing it again

While it’s not a guarantee o f a d v a n c e m e n t , “ I t c a n and often does position you ahead of your peers,” says M a r i l i n M a rz a n , n a t i o n a l human resources manager for Grant Thornton’s global mobility program, Chicago.

The impending adoption

o f I n t e r n a t i o n a l F i n a n c i a l Reporting Standards (IFRS)

and ongoing globalization will drive demand for accounting and finance professionals with international business acumen, according to a 2008 Robert Half International survey About 71 percent of CFOs said overseas experience will be necessary for accounting and finance professionals five years from now an increase from 56 percent in 2002

I n a d d i t i o n t o t h e c o n v e rg e n c e o f U S

G A A P a n d I F R S , t h e d e m a n d f o r i n t e r n ational experience is being driven by factors s u c h a s c l i e n t r e q u e s t s f o r m u l t i n a t i o n a l buy in, the need to maintain foreign relat i o n s w i t h s u p p l i e r s , a n d t h e d e s i r e t o strengthen a corporate brand worldwide.

“As a firm, we have gone as far as to position mobility as one of our 10 global priori t i e s , ” e x p l a i n s Wa r r e n S m i t h , d i r e c t o r o f HR for Ernst & Young’s Midwest area, based in Chicago

O p p o r t u n i t i e s f o r i n t e r n a t i o n a l a s s i g nment vary widely depending on the firm, and the current slowing of the global economy is taking its toll. Grant Thornton, for e x a m p l e , h a s s e e n a 1 0 - p e rc e n t d r o p i n outbound long- and short-term assignments from last year, Marzan explains The number of inbound assignments has decreased by about 40 percent She expects to see a bit more slowdown before the number of placements turns around

Nevertheless, executives do expect numbers to grow in the not-too-distant future Ray Lombardi, US managing partner of Deloitte’s Office of Global Deployment in Chicago, foresees the number of deployed Deloitte professionals increasing steadily over the next four years, with the number of US inbound and outbound assignments reaching 1,900 by 2012, up from 1,100 today For all member firms in the Deloitte network, that number was around 1,500 last year, and is likely to grow to 3,000 by 2012

G i v e n c u r r e n t s h i f t s i n t h e a c c o u n t i n g p r o f e s s i o n , n o w i s t h e t i m e f o r y o u n g e r

12 INSIGHT www icpas org/insight htm C A R E E R

professionals to plan for overseas development, says Louise Hraur DeSina, a director i n t h e c o m m u n i c a t i o n s d i v i s i o n o f t h e A m e r i c a n I n s t i t u t e o f C e r t i f i e d P u b l i c A c c o u n t a n t s ( A I C PA ) “ T h a t p l a n w i l l b e your roadmap to get you where you want to be in the world,” she says

She offers some tips: Ask “What do I want to achieve?” “Where would I like to live?” a n d “ Wo u l d I p r e f e r a l o n g - o r s h o r t - t e r m assignment?” If you have a family, how will they feel about relocating? If you’re not currently employed, target job opportunities that o f f e r m u l t i n a t i o n a l o p p o r t u n i t i e s a n d s t a r t networking. Also get up to speed on international accounting issues And pay attention to global trends Specialty areas like forensics and corporate compliance are becoming hotter and hotter in the march towards increased financial transparency The green movement is also noteworthy as more accountants deal w i t h e n v i r o n m e n t a l r e p o r t i n g r e q u i r e m e n t s on a global platform

As you look ahead, however, be prepared f o r f i e rc e c o m p e t i t i o n a m o n g s t a s s i g n m e n t c a n d i d a t e s , s a y s S m i t h E r n s t & Yo u n g , f o r one, will likely become even more discriminating in selecting global deployment candidates “to ensure we have the right roles and the right people on assignment ”

G e n e r a l l y s p e a k i n g , w h a t a r e f i r m s l i k e Ernst & Young looking for? Strong leadership a n d o rg a n i z a t i o n a l s k i l l s , t e c h n i c a l k n o w ledge and a demonstrated interest in working w i t h o t h e r c u l t u r e s . P r o f e s s i o n a l s w h o a r e bilingual and are familiar with another count r y ’s t a x , c o m p l i a n c e , l e g a l a n d r e g u l a t o r y issues also are extremely attractive as overseas assignment recruits

Long-term assignments typically last a year or more, while short-term stints can range anywhere from a couple of weeks to a couple of months It all depends on client needs and the scope of work involved Firms such as Ernst & Young also offer volunteer programs abroad, through which professionals can assist an entrepreneur in an emerging country

Most important in your hunt for internat i o n a l o p p o r t u n i t i e s i s c o m m u n i c a t i o n o f your desires to the people at the top Talk to p a r t n e r s a b o u t t h e i r o v e r s e a s e x p e r i e n c e s , t e l l t h e m a b o u t y o u r i n t e r n a t i o n a l a s p i r ations, offer to work on international projects while you’re still stateside, and learn all you c a n a b o u t t h e t e c h n i c a l i t i e s o f t h e g l o b a l financial landscape

www icpas org / insight htm JULY 2009 13

keep your career on track [in today’s job market] Career Center A benefit of your Illinois CPA Society Membership Search Job Listings | Post Your Resume Locate Search Firms | Explore Career Resources Find a Career Coach* Check out the Career Center today at www.icpas.org *fee-based service Members-Only Career Event: LOOKING FOR A JOB? Positioning Yourself in a Tough Job Market July 30, 2009 | 8:00AM - 12:00PM | Chicago, IL | Cost: $25 Register online at www.icpas.org

Twitterblogiverse

Can you social network your way to business success?

By Allison Enright

By Allison Enright

Twitter Hits the C-Suite

Twitter is being used by almost a third of senior executives for business purposes, according to a new worldwide NFI Research survey A fourth of senior executives, specifically, say they tweet, while two-thirds of senior executives and managers combined use LinkedIn for business purposes A further 26 percent use blogs and 22 percent use Facebook What ’ s more, the survey reveals that more small companies versus large companies use social networking

Visit www nfiresearch com for more

Bu s i n e s s u s e d t o b e d o n e w i t h a h a n d s h a k e S o m e t i m e s , i t s t i l l i s But for a growing number of potent i a l c u s t o m e r s , t h e m a j o r i t y o f r e s e a rc h , r e f e r r a l s a n d r e c o m m e n d a t i o n s a r e b e i n g done by virtual rather than physical word, via social networks like LinkedIn, Facebook and MySpace.

LinkedIn, a social network for business p r o f e s s i o n a l s , a t t r a c t s n e a r l y 6 9 m i l l i o n monthly unique visitors, according to web analytics firm Compete Inc Facebook, one o f t h e l a rg e s t g e n e r a l - i n t e r e s t s o c i a l w e b communities in the world, has more than 200 million active users (as of April 2009) More than half of that number log on to the network every day, sharing more than a billion pieces of content each week, according t o F a c e b o o k r e s e a rc h f i n d i n g s . B l o g s , i n w h i c h r e a d e r s c a n r e s p o n d t o c o n t e n t p o s t e d b y b l o g a u t h o r s , n u m b e r e d m o r e t h a n 11 2 m i l l i o n i n 2 0 0 8 , s t a t e s w e b r e s e a rc h f i r m Technorati And 33 percent of US Internet users say they read them

T h e u n b r i d l e d g r o w t h o f t h e s e c o m m u n i c a t i o n o u tl e t s h a s c o m p e l l e d a s e a c h a n g e i n t h e w a y b u s inesses communicate. From s o l e p r a c t i t i o n e r s t o l a rg e c o r p o r a t i o n s , p a r t i c i p a t i n g on the social web scene has become a near essential

“People need to wake up t o t h i s w h o l e t h i n g , ” s a y s N a t h a n E g a n , f o u n d e r a n d managing director of social w e b c o n s u l t a n t s , t h e F r e esource Agency. “Get involved and take it seriously.”

For those who are tempted to shrug off the idea of social media as something just for teens and twenty-

somethings, consider this: The fastest-growing user group on Facebook is women over 55, which grew almost 550 percent in just six months. The 25 and under crowd grew by less than 20 percent LinkedIn users have an average of eight years’ work experience, and 23 percent of MySpace’s 65.1 million active members in the United States are aged 35 years and older You do the math

Egan says the benefits of active participation in social media sites like LinkedIn can be huge Imagine, for instance, that you’re a sole practitioner connected to your clients via a virtual network. If you were to ask a satisfied client to write a recommendation f o r y o u , t h a t r e c o m m e n d a t i o n w o u l d b e broadcast to not only your connections, but those of your client as well That’s invaluable free marketing

“If a CPA has 30 recommendations and they are all from clients, who is going to get the look or the nod? It’s going to be the person with the most recommendations,”

Egan explains

Business professionals also can participate in LinkedIn Q&A forums, where they a n s w e r q u e s t i o n s p o s e d b y t h e L i n k e d I n community. Whenever you answer a question, that answer appears on your profile page. The more questions you answer, the greater your credibility, says Egan.

What’s more, members can join LinkedIn special interest groups, which help to further expand your network and build your reputation Since LinkedIn is tied to the algorithms Google uses to return search results in general web searches, boosting a profile on the network can increase a CPA’s visibility to non-LinkedIn participants as well

I n d i v i d u a l s e l f - p r o m o t i o n i s o n e t h i n g ; however, putting yourself “out there” as an organization can be intimidating.

“It’s already tough for corporate execut i v e s t o w r a p t h e i r m i n d s a r o u n d s o c i a l m e d i a , ” s a y s Va l o r i e L u t h e r, f o u n d e r a n d CEO of Creative Concepts Consultants, a

14 INSIGHT www icpas org/insight htm T E C H N O LO G Y

PR and social media consultancy “They are very leery of complete transparency, and are afraid of losing control What I say to every business afraid of this is, ‘You can only gain control once you lose control ’”

Also consider the fact that, in an ultra-competitive market for t a l e n t , h a v i n g a p r e s e n c e o n s o c i a l n e t w o r k i n g s i t e s t h a t a r e favored by young professionals may give your organization the edge it needs in the fierce recruiting game KPMG and Deloitte, for example, both use Facebook and MySpace as recruiting tools for internships and entry-level positions, in addition to promoting their on-campus events.

Other companies have used social web technologies to enhance their brand and business Wells Fargo & Company, for instance, is considered a pioneer in bringing the social web to financial services, says Luther The bank launched its first blog in 2006 and now supports five It further developed an online virtual world game called Stagecoach Island [blog.wellsfargo.com/StagecoachIsland], which targets teens with a message about fiscal responsibility. It also communicates via MySpace, Facebook and Twitter

“In every channel you can find your next consumer, an individual who is interested in hearing your brand’s message,” says Luther

As far as blogs go, though, Wells Fargo may be the exception rather than the rule. In fact, less than 15 percent of Fortune 500 companies maintain a corporate blog, according to PR firm Burson-Marsteller ’s blogging index survey

Nevertheless, blogs represent an easy entrée into the world of social media, and are a great way to build your personal brand and raise your profile to potential employers “Recruiters are using blogs to help to understand their potential employees. If there is a blog out there written by a candidate, they read it,” Egan explains. “It can really help to make a distinction between you and the guy next to you who doesn’t have a blog That level of transparency makes it easier to make a judgment call if they are going to hire ”

Some companies are going so far as to establish unique web s p a c e s a p a r t f r o m t h e i r m a i n p o r t a l s t o h e l p t o p r o m o t e t h e i r brand. In February 2009, for example, Boston-based insurer Libe r t y M u t u a l l a u n c h e d t h e R e s p o n s i b i l i t y P r o j e c t [ R e s p o n s i b i l it y P r o j e c t c o m ] , w h i c h c o m b i n e s b l o g s , v i d e o s a n d f o r u m s d e s i g n e d t o s t i m u l a t e c o n v e r s a t i o n s a b o u t p e r s o n a l f i n a n c i a l responsibility The site is a hybrid of consumer-generated content and content sourced by Liberty Mutual.

“Consumers today want to engage in conversation with companies and other consumers, not be spoken at through corporate press releases and glossy ads,” says Luther “Social media works because it is all about relationships ”

Zecco, a low-cost stock brokerage, launched ZeccoShare, a social community for investors, late in 2007, making it a key part of their customer acquisition and marketing plan. It now boasts more than 230,000 members that use the community think-tank to develop and manage their portfolios ZeccoShare allows investors to show off their profiles and trade wins Members also can join specific groups to participate in discussions on topics like socially responsible investing or diversity in investing

No matter how deeply you decide to wade into social networking waters, be aware that the systems only work if you are actively engaged in them “People say, ‘I joined LinkedIn but it didn’t do anything for me,’” says Egan “Well, it’s not going to do anything for you unless you make it work for you ”

*-

-)

!&(%

-)

-)

"!&'%(

+ )/

%

'

a CPE Reporting Year

*Must

- , ( &) -#)(, + ,. $ - -) " (! && )( + ( , ) + + #" % ).+ 0 ,#- )+ #( ) )( ( )-" + ,* # &-1 + #-, "% ' "&' (%% !' ! " "% '" % &' % ) & ' *** # & "% www icpas org / insight htm JULY 2009 15

! ) ( + , .&1 2 "# !) ( ' ## & , .!.,- 2 "# !) % %& $( & ' "!& *- ' + 2 "# !) ! ! !&' '(' "!&

' + 2 #,& + % ' ' "! %

+ 2 ), ')(-

!

+ 2 "# !) ' % " # ! % ( ,

+ 2 ), ')(-

' "! ! (&'% & -) + 2 % +))% ++

' + 2 ), ')(-

( )/ ' + 2 "# !) &' ' )/ ' + 2 ), ')("' "% %" ' ( , )/ ' + 2 ), ')("' "% %" ' ' + 2 *+#(! # & # ", ! '& , ' + 2 ), ')("(!' ! ( ' ! ' + 2 ), ')("(!' ! ( ' !

+ 2 *+#(! # & % "(% ! % 2009 is

Licensed CPAs need 120 hours of CPE* by September 30, 2009.

include 4 hours of Ethics CPE

Heavy Lifting

Build a strong supply chain to wrestle a weak economy

By Selena Chavis

In a global economy that is uncertain at best and plunging into a deeper chasm at worst, the concept of a strong and costeffective supply chain should be at the heart of every company’s agenda At least, that’s what a recent DSC Logistics survey says “We’ve seen that trend evolving for many y e a r s C o m p a n i e s b y a n d l a rg e c e r t a i n l y realize now that there is a lot of money and s a v i n g a t s t a k e i n t h e s u p p l y c h a i n . T h e r e c e n t c h a l l e n g e s h a v e b e e n f o c u s e d a r o u n d t h e d r a s t i c c h a n g e s t h a t h a v e o c c u r r e d i n a s h o r t p e r i o d o f t i m e , ” s a y s DSC Logistics VP of Customer Care Scott Morgan, adding that every year, the financ i a l p r o f e s s i o n a l ’s r o l e b e c o m e s m o r e prominent in this process

We are in the midst of an era marked by extreme changes in fuel and material costs, lower consumer spending, tightening capital, growing pessimism and fluctuating exchange rates. The challenges of building a strong supply chain are piling up, says Dave Pittman, US lead for PricewaterhouseCoopers’ Operations practice. “There is an absolute change in cost culture since the first of the year, and it increases daily It’s really en vogue to reduce costs,” he says.

T h e d y n a m i c n a t u r e o f t h e e c o n o m y, where fuel prices may reach more than $4 a g a l l o n o n e s u m m e r a n d d r o p t o n e a r l y half that the next, make flexibility and the

ability to adapt quickly critical components of effective supply chain strategies today.

“ C h a n g e s h a v e b e e n a b r u p t , f o rc i n g companies to be more adaptable,” Morgan explains “Companies need to avoid getting locked into long-term contracts and leases M a n y c o m p a n i e s a r e p u t t i n g o u t t r a n sportation RFPs to go back and rebid contracts based on lower fuel costs, for example It’s the right thing to do You can find deals you didn’t dream about a year ago If fuel costs are high, you want to be close to the customer When fuel costs are low, you can afford to be further from the customer. Being in a position to continually re-evaluate that is important.”

Pittman agrees, pointing to price drops in commodities such as steel, copper and cement in recent months. “There are a lot of companies going back to vendors to reduce costs,” he explains. “And there are mounting concerns over fluctuating exchange rates and the volatility of prices overseas as well People are looking at alternative suppliers that are closer to home ”

It’s not just about lowering costs, though; it’s also about keeping suppliers in play

“When I talk to financial people, one of the concerns they have is supplier viability,” says Pittman The current “here today, gone tomorrow” culture of startups and even mainstay businesses has many companies fearing that they’ll be caught off-guard if their main supplier closes its doors “How do they keep their fingers on the pulse of the supplier?” asks Pittman

It’s vital that companies use all the disparate pieces of information available to them to understand how economic conditions are affecting suppliers. “Look at all the different people touching suppliers in your company How do you accumulate that information? Also important to this process is an understanding of who the company’s critical vendors are. A lot of companies haven’t gone through that exercise ”

While flexibility to make changes and renegotiate contracts is one means of strategic improvement, savvy companies are

16 INSIGHT www icpas org/insight htm S U P P LY C H A I N

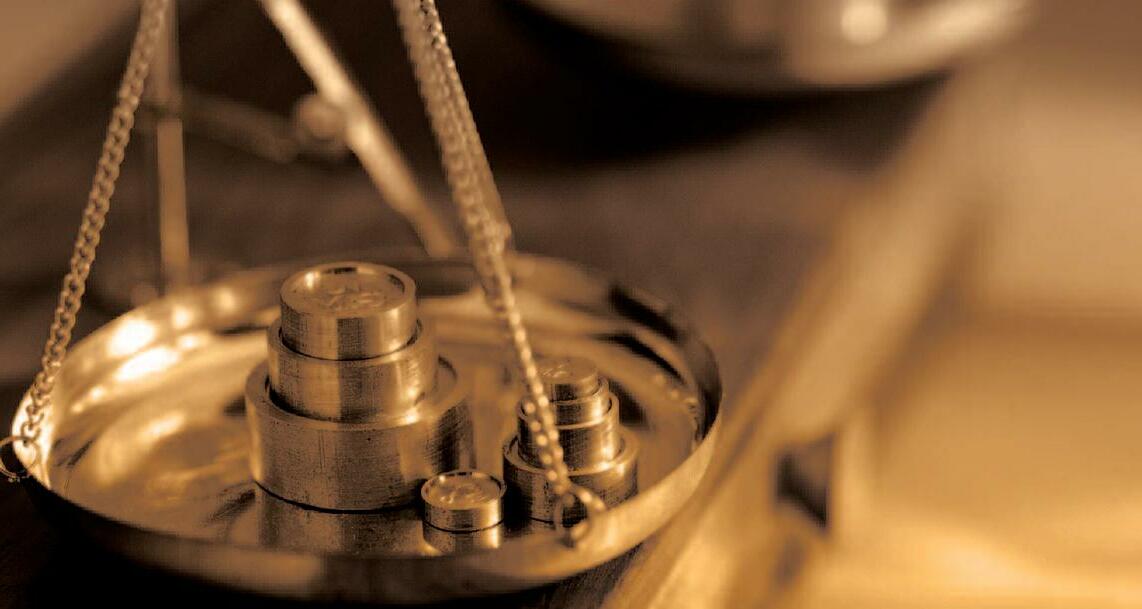

Yourcareercould hanginthebalance... Yourcareercould hanginthebalance...

AccountantsProliabilityProgram

Youprepareataxreturnforaclient.Itresultsinsevere penaltiesandinterestcharges...

Youfailtofileanamendmenttoaclient’staxreturn thatwouldhaveenabledhimtoreceivea$100,000 taxrefund...

Everytimeaclientfacesfinancialharm,youcouldfind yourselfincourt.Thecoststodefendyourselfcouldcost morethanthelawsuititself.

Ifsomeoneinyourfirmmakesanerror,doyouhavethe rightcoverage?

Sinceyoucan’tpredictwhichwaythescalesofjustice willtip,yourbestprotectionistheICPAS-endorsed ProfessionalLiabilityInsurancePlan.

Formoreinformationabouttheonly liabilityplanendorsedbytheICPAS: 1-800-337-2621 www.proliability.com/accountants CA#0633005 TheIllinoisCPASocietyendorsedProfessionalLiability Planprovides: •Competitivepricingthat savesyoumoney •Achoiceofliabilitylimits anddeductiblestofityour individualneeds •FullPriorActscoverage, changeinsurerswithout lossofprotection •Free60-dayExtended ReportingPeriod •Marsh,theprogram administrator,hasmore than25yearsofexperience servingaccountingfirms nationwide Administeredby:MarshAffinityGroupServices,aserviceofSeabury&Smith,Inc. Forpolicydetails,pleaseconsultpolicytermsandconditions.Issuanceofcoveragesubjecttounderwritingguidelines. d/b/ainCASeabury&SmithInsuranceProgramManagement ©Seabury&Smith,Inc.2009 40280,41254

going a step further by identifying ways to shorten the distance between points along the distribution channel and maximize less expensive modes of transport

“We’re seeing more attention being paid to shortening supply chains from overseas markets to more domestic locations,” says Pittman “For example, many continue to produce in Asian markets, but with more emphasis on Asian customers ”

“I have seen a lot of customers looking at rail as a viable option. People are considering rail from a greener or more sustainable point of view as well,” Morgan adds

What’s more, supply chain efficiencies often are achieved by consolidating vendors or using a transportation partner Pittman sees companies trying to use a greater number of common components in multiple products or models to consolidate vendor activity. Others eliminate the extra miles associated with moving products back and forth to and from a co-packer by handling value-added services where products are warehoused. Movement within the warehouse is also being scrutinized, since an enormous amount of time can be wasted by moving, storing and replenishing products

“There are two things driving this movement,” Morgan explains “First, it costs more to send something to a co-packer. Second, the lead time for these types of requests is shrinking dramatically ”

Transportation partners may contribute to that lean, mean supply chain strategy, since they can “see where freight is moving between a number of different companies and come to the table with creative and collaborative solutions for working together ”

Looking further down the supply chain, ineffective inventory control can wreak havoc on profit margins, says Pittman One

way to combat this is to simplify operations by reducing the number of SKUs or product offerings “Fewer SKUs can lead to lower c o s t s a n d i m p r o v e d c u s t o m e r s e r v i c e , a n d l e s s s l o w - m o v i n g inventory,” he says

Ever a balancing act, Morgan notes that it comes down to having the “right product in the right place at the right time” and pairing that effort against excess inventory “Customers are trying hard t o f o c u s o n o b s o l e t e i n v e n t o r y, t r y i n g n o t t o h o l d o n t o i t a n y longer than necessary That’s always a challenge,” he acknowledges, adding that too much material means that valuable space is needed to hold unnecessary stock.

On the other hand, a scarcity of items may lead to lost orders W h a t d o y o u d o t h e n ? P u t p r e s s u r e o n s u p p l i e r s t o b e m o r e responsive when needs arise, says Pittman. When the demand is there, you need to be able to get stock quickly

“Less demand lowers the amount of safety stock,” he says “Free cash flow and lower inventories have become a focal point for highly leveraged companies. Lowering inventories while maintaining customer service often requires improved demand planning, more focus on sourcing, and increased communications with vendors. Consequently, many companies are currently looking more closely at their demand planning and sourcing capabilities ”

W h i l e c o m p l e x i t i e s m a y b e h i g h a n d c h a l l e n g e s m a y b e mounting, Morgan encourages companies to take advantage of the opportunity to purge With a nod to the business concept that “ g o o d c o m p a n i e s g e t b e t t e r i n b a d t i m e s , ” h e c o n c l u d e s t h a t , “This is a great time to take a step back and revisit processes. Make sure you are eliminating the waste ”

We have many options for integrating financial advisory services with a collaborative approach designed to work within your firm’s philosophy.The proven expertise of PAA will not only strengthen your CPA practice, it will increase your value to your clients and help grow your business.

A9CD-0506-04

600 Dresher Road, Horsham, PA 19044 215.956.8529 PROFESSIONALADVISORS ALLIANCE.COM

your clients

for their

a

your

Enhance the services provided to your clients, by helping them plan for their future. A partnership with Professional Advisors Alliance (PAA) enables you to build on the trust and respect your clients already have for you, while giving them the additional services they need.

Helping

plan

future is

pretty good plan for

future.

18 INSIGHT www icpas org/insight htm

Ifyouhaveaninsuranceclaim, thelast thingyouwanttoworryaboutiswhetheror notyouhavethepropercoverage.

That’swhytheICPAS-sponsoredgroup insuranceprogramissoimportant.

Theseplansaredesignedspecificallyforyou. It’sworthaphonecalltoexplorethis importantmemberbenefit.

Wethinkyou’llfindtheICPAS-sponsored insuranceprogramsoarsabovethecompetition whenitcomestoprovidingyouandyour familywitheconomicalfinancialsecurity.

•ProfessionalLiabilityInsurance*††

•GroupAccidentalDeathand DismembermentInsurance*†

•LifeInsurance*†† •DisabilityIncome*†† •GroupDentalInsurance*† •HealthInsuranceMart*

Formoreinformation,contactMarshAffinityGroupServicesat: 1-800-842-ICPA(4272) www.personal-plans.com/icpas Takethefirststeps towardhelpingsecureyourfamily’sfuture withtheICPAS-sponsoredInsurancePlans CA#0633005 AdministeredandbrokeredbyMarshAffinityGroupServices,aserviceof Seabury&Smith,Inc.,InsuranceProgramManagement †UnderwrittenbyTheUnitedStatesLifeInsuranceCompanyintheCityofNewYork. d/b/ainCASeabury&SmithInsuranceProgramManagement AG-6750 40075,41157,41158,40280,41159,41254,41160,41161 MarshAffinityGroupServices,aserviceofSeabury&Smith,Inc.2009 ††UnderwrittenbyHartfordLifeandAccidentInsuranceCompany, Simsbury,CT06089 * Theplansaresubjecttotheterms,conditions,exclusions,andlimitationsofthe grouppolicy.Forcostsandcompletedetailsofcoverage,contacttheplan administrator.Coveragemayvaryandmaynotbeavailableinallstates.

•Long-TermCare*†† •HospitalIncome*†† •GroupCatastrophicMajorMedicalInsurance*† •VeterinaryPetInsurance*†† •10YLTLifeInsurance*††

Accounting Women

Why hasn’t anything significantly changed for women in public accounting leadership roles?

Provided by the ICPAS Women’s Executive Committee

For seven years now, the Illinois CPA Society (ICPAS), through its Women’s Executive Committee, has explored the role of women CPAs in Illinois public accounting firms. And perhaps frustratingly, i t s r e c e n t l y r e l e a s e d s e v e n t h s u r v e y f i n d s that little has changed over the years

The survey was distributed to 90 Illinois firms with 15 or more professionals Its goal is to track the percentage of women at three levels of leadership partner/principal; senior manager/manager; and senior/staff as well as the percentage of women holding firm-wide leadership positions The survey also gauges the effectiveness of initiatives

a n d p r o g r a m s s p e c i f i c a l l y t a rg e t e d t o women, with findings based on responses from both individual women CPAs (all are ICPAS members) and their respective firms Assessing the success of these initiatives and programs prov i d e s a n e v a l u a t i o n o f b e s t p r a c t i c e s f o r r e t a i n i n g a n d promoting women CPAs.

The Numbers

While the percentage of women entering public accounting firms has decreased from 54 percent in 2003 to 49 percent in 2009, the number of women being retained at the senior manager/manager and partner/principal levels has slowly climbed from 40 percent to 43 percent and 15 percent to 18 percent, respectively, over this same time period (See Figure 1 opposite for 2009-2006 data ) Admittedly, this is a slow climb, but a climb nonetheless

T h a t s a i d , a l t h o u g h t h e number of men and women

i n t h e m o s t s e n i o r p o s i t i o n s b o t h increased in this year ’s survey, the number of men continues to far outweigh that

of women in the partner/principal positions. (See Figure 2 opposite.)

Leadership Positions

There is a bright spot, however The percentage of women in managing partner and executive management positions is a strong indicator of the growing acceptance of women CPAs in leadership roles among today’s firms In this year ’s survey, women represented 12 percent of firm/office managing partner positions, an increase of 2 percent from the previous year, which had been the high point of a steady 1-percent annual increase since the first survey was conducted in 2002.

The number of women in the most senior firm-wide leadership positions (namely, firm or office managing partners and execu t i v e m a n a g e m e n t ) r o s e t o 1 9 p e rc e n t , compared to 18 percent last year and a 10 to 13 percent range during the prior 5 years. For the second year in a row, this leadership percentage is actually higher than the percentage of Illinois women currently in partner/principal roles The increase over last year is due in large part to the rising number of women in the firm/office managing partner category (See Figure 3 opposite )

Although changes in management structure may cause some data inconsistencies from year to year, the increase in women h o l d i n g e x e c u t i v e m a n a g e m e n t r o l e s i s a step in the right direction.

Women’s Initiatives

Firms were asked to indicate which of nine workplace initiatives are currently in place at their firms, and to rate their effectiveness. Separately, women ICPAS members at the same firms were asked to respond to identical questions and to identify which programs they would like to see implemented at their firms

Eighty-two women and 52 of the 90 surveyed firms responded to these questions

20 INSIGHT www icpas org/insight htm D I V E R S I T Y

Both groups rated the following four initiatives as the most effective in retaining and promoting women:

Of these four programs, flexible work arrangements and mentoring programs continue to be the most in demand among women working at firms that currently do not offer these initiatives The discrepancy between the firms’ ratings of flexible work arrangements and the women CPAs’ ratings of the same initiative is particularly interesting, since it reveals a significant gap in perception between the two groups

The following initiatives were in place at only 26-38 percent of the firms that took part in the survey: childcare assistance, womenspecific mentoring programs, and programs to develop women as partners on high-profile client assignments Forty-three percent of the firms taking part in the survey had “part-time partner track” in place; this initiative continues to be the most sought-after among the women surveyed

The retention and promotion of women within public accounting firms continues to have a huge impact on the industry, and it’s disappointing to see so little movement after seven years of surv e y s . T h e Wo m e n ’s E x e c u t i v e C o m m i t t e e w i l l f o c u s i t s f u t u r e efforts on identifying and spotlighting firms that are making real progress in retaining and promoting their women professionals Perhaps their success can be a roadmap for other firms in Illinois

Turn the page for more stati sti cs from the 2009 Rol e of W omen i n CPA Fi rms survey

W e si ncerel y thank the fi rms and women that responded to our survey and wi l l i ngl y shared thei r i nformati on wi th us Thi s cooperati on i s appreci ated and necessary as we stri ve to advance the rol e of women i n publ i c accounti ng fi rms

16th Annual Midwest FINANCIAL REPORTING Symposium Accounting and Financial Reporting Updates from the SEC, FASB, IASB, AcSEC and PCAOB Friday, September 25, 2009 Donald E. Stephens Convention Center, Rosemont, IL 8 CPE Credits | $325 members/$395 non-members Don’t miss this unique opportunity to interact with an all-star lineup of financial reporting policy-setters. To register, or for more information visit www.CCFLinfo.org or call 800.993.0393.

60% 50% 40% 30% 20% 10% 0% 2006 41% 2007 42% 2008 42% 2009 43% 2006 17% 2007 18% 2008 17% 2009 18% Percentage of Women in

Partner/PrincipalSenior Manager/ManagerSenior/Staff 2006 50% 2007 49% 2008 48% 2009 49% FIGURE 1 2009200820072006 Women 346 (17.6%)330 (17.2%)353 (17.9%)306 (16.7%) Men 1,616 (82.4%)1,584 (82.8%)1,614 (82.1%)1,530 (83.3%) FIGURE2 Firm/Office MPExecutive ManagementTotal Executive Positions # Women% of Total# Women% of Total# Women% of Total 2009 6212.4%17722.6%23918.7% 2008 4910.0%18623.1%23518.2% 2007 469.7%10415.2%15013.0% 2006 408.8%7711.8%11710.6% FIGURE 3 % of Firms - Rating% of Women - Rating Flexible Work Arrangements57% - Highly Effective45% - Moderately Effective Mentoring Programs57% - Moderately Effective49% - Moderately Effective Family Leave Policies40% - Highly Effective28% - Highly Effective 30% - Moderately Effective49% - Moderately Effective Paid Time Off43% - Highly Effective46% - Highly Effective FIGURE 4 www icpas org / insight htm JULY 2009 21

Illinois by Position

Illinois CPA Society's 2009 Survey on the Role of Women in CPA Firms - Professional Personnel Who Office In Illinois - Percentage of Women by Position

*All information was provided by the firms. Surveys were sent to 90 Illinois firms that had 15 or more professionals as listed in the Illinois CPA Society's Peer Review or Membership Database and the 2008 Crain's Chicago Business list of Chicago's largest accounting firms. Surveys were mailed in January 2009 and firms were asked to provide the most recent available data, but to not use data earlier than December 31, 2008.

***Firm did not provide information for this year. NA = Information Not Applicable

(a) First included in survey population in 2009. (b)First included in survey population in 2008.

(c)First included in survey population in 2006.

The following firms declined to participate in the survey for all years: FGMK LLC; Gimbal Abrams & Singer; Scheffel & Co.; Sleeper Disbrow Morrison Tarro & Lively.

The following firms declined to participate in the survey for 2009, 2008, 2007, 2006 and 2005: Chunowitz, Teitelbaum & Baerson, Ltd.; Morrison & Morrison, Ltd.; Pasquesi Sheppard LLC

The following firms declined to participate in the survey for 2009, 2008, 2007 and 2006: Brook Weiner LLC; Medical Business Consultants - Midwest, Ltd., CPAs; Professional Business Consultants.

The following firms declined to participate in the survey for 2009, 2008 and 2007: Friedman & Huey Associates, LLP; L. J. Soldinger Associates; UHY LLP

The following firms declined to participate in the survey for 2009 and 2008: Ahlbeck & Company; Mulcahy Pauritsch Salvador & Co, Ltd.; Wermer Rogers Doran & Ruzon, LLC.

The following firms declined to participate in the survey for 2009: BIK & Co.; Kutchins, Robbins & Diamond Ltd.; Michael James Liccar & Co.; Mowery &

Shoenfeld LLC; Smith, Koelling, Dystra & Ohm, P.C. Total # ofPartner/PrincipalSenior Manager/ManagerSenior/Staff Illinois' Largest Accounting Firms* Professionals 200920082007200620092008200720062009200820072006 Deloitte & Touche LLP2,748 21%21%20%18%38%37%39%36%45%45%46%46% PricewaterhouseCoopers LLP1,573 20%20%24%22%43%43%49%48%47%46%46%48% Ernst & Young LLP1,363 16%19%19%19%42%40%36%42%44%44%45%46% KPMG LLP1,317 14%14%13%14%38%38%37%33%44%43%41%42% RSM McGladrey Inc.1,308 13%12%13%10%44%45%46%43%55%56%55%53% Crowe Horwarth LLP 634 23%20%17%19%52%52%49%47%47%45%48%51% Grant Thornton LLP344 19%16%14%12%41%37%40%38%50%51%56%53% Clifton Gunderson LLP281 10%10%7%9%42%42%43%47%55%58%62%61% Blackman Kallick LLP265 22%18%22%23%39%41%46%41%46%49%49%48% Sikich LLP237 16%17%17%13%65%64%58%54%53%66%66%47% BDO Seidman183 43%26% ****** 37%39% ****** 48%52% ****** Miller Cooper & Co., Ltd.166 14%13%15%20%45%38%30%33%47%48%51%53% Virchow, Krause & Co., LLP 146 12%8%8%9%23%23%31%31%47%44%41%45% Plante & Moran PLLC 134 4%0%0%0%58%51%49%46%54%48%56%57% Wolf & Co. LLP101 23%25%19%19%45%52%50%52%65%58%55%61% Frost Ruttenberg & Rothblatt P.C.97 16%12%11%14%56%65%67%58%50%57%53%67% Legacy Professionals89 28%28%33%25%37%50%39%15%33%29%33%32% Kerber, Eck & Braeckel LLP 85 27%25%29%29%59%47%53%67%67%48%62%62% Ostrow Reisin Berk & Abrams, Ltd.85 15%11%12%13%0%NANANA59%44%57%53% Lindgren, Callihan, Van Osdol & Co., Ltd. 84 5%4%4%5%25%21%33%21%67%62%70%67% Bansley & Kiener LLP73 10%17%17%17%100%80%80%80%39%33%34%33% Mueller & Co. LLP72 23%15%25%8%60%54%50%69%86%84%85%88% Mayer Hoffman McCann P.C.67 29%29%32%24%50%30%27%46%50%51%57%53% Reznick Group, P.C. 64 0%0%0% *** 36% 18%33% *** 35% 36%38% *** Warady & Davis LLP 63 20%20% ****** 52%43% ****** 53%36% ****** Smart Business Advisory and Consulting LLC 57 9%7% *** 21%18%17% *** 35%59%56% *** 65% E.C. Ortiz & Co., LLP (b)53 83%83% ****** 67%70% ****** 74%75% ****** Ganim, Meder, Childers & Hoering, P.C. 53 8%8% *** 0%85%90% *** 92%67%70% *** 86% Gray Hunter Stenn LLP48 14%21%20%27%NANANANA68%63%66%63% Michael Silver & Co.45 11%12%12%6%80%70%80%90%63%46%42%45% West & Company LLC45 25%25%33%29%33%25%27%22%71%71%84%87% DiGiovine, Hnilo, Jordan & Johnson, Ltd. 44 31%29%27%29%62%75%73%78%47%53%53%50% Porte Brown LLC44 0%0% *** 0%67%40% *** 40%47%36% *** 40% Heinold-Banwart, Ltd.43 20%20%20%13%57%75%67%60%85%69%75%76% Topel Forman LLC43 10%11%0% *** 67%40%33% *** 48%48%56% *** Selden Fox, Ltd.42 0%11%10%14%44%44%44%36%24%29%21%20% Shepard, Schwartz & Harris LLP42 31%31%31%31%0%0%29%25%62%59%60%67% Corbett, Duncan & Hubly, P.C.39 0%0%0%0%80%60%50%57%50%64%77%72% Coleman Joseph Blitstein & Stuart LLC36 0%0%0%0%33%29%40%40%59%35%57%47% Kessler, Orlean, Silver & Co., P.C.35 0%0%0%0%25%33%33%33%72%67%62%55% Eric J. Fernandez & Co.34 0%0%0%0%33%33%20%20%71%71%86%87% Martin, Hood, Friese & Associates, LLC34 17%30%20%20%50%78%40%43%58%50%68%70% Silver Lerner Schwartz & Fertel (c)34 17%17% ****** 60%60% ****** 67%75% ****** Weiss & Company LLP32 9%11%11%10%63%40%44%29%69%69%62%60% Lauterbach & Amen, LLP (b)31 50% ********* 69% ********* 69% ********* Dugan & Lopatka, CPAs, P.C.30 25%25%25%13%78%67%50%57%54%76%77%68% Steinberg Advisors (c)30 0%0%0%0%40%50%50%67%83%91%82%92% Washington, Pittman & McKeever30 50%50%50%50%40%40%50%50%52%57%54%54% Cray, Kaiser Ltd., CPAs26 20%20%20%17%60%50%50%50%50%40%46%50% Russell Novak & Company26 0% ********* 50% ********* 50% ********* Krehbiel & Associates LLC23 14% ****** 0%25% ****** 50%92% ****** 78% May, Cocagne & King, P.C. (a)22 25% ********* 67% ********* 88% ********* Striegel, Knobloch & Co. LLC21 13%11%11%13%0%0%25%25%73%63%63%64% Doehring, Winders & Co. LLP20 0%0%0%0%0%0%50%50%62%60%80%70% Borhart, Spellmeyer & Co.19 20%20%20%20%71%80%40%40%29%40%50%56% Dunbar, Breitweiser & Co. LLP19 0%0%0%0%33%50%33%50%73%73%71%54% Eck, Schafer & Punke LLP (b)18 0%0% ****** 17%0% ****** 57%83% ****** J.W. Boyle & Co., Ltd.17 0% *** 0%0%75% *** 50%50%86% *** 88%71% Pritchard Osborne LLC16 0%0%0%0%17%0%0%0%33%25%25%0% Graff, Ballauer, Blanski & Friedman, P.C.14 0%0%0%0%0%0%33%33%43%38%25%29% Capin Crouse LLP13 33%50%0%0%100%50%50%50%44%33%71%60% Rome Associates LLP4 50%0%0%0%0%100%100%75%50%50%20%67% Coleman, Epstein, Berlin & Company LLP - ****** 0%0% ****** 67%0% ****** 56%64% DBH & Associates, LLC- *** 17% *** 17% ************************ Hill, Taylor LLC- *** 0%0%0% *** 33%25%33% *** 56%52%57% Kemper CPA Group LLC- ****** 46%42% ****** 86%62% ****** 59%81% Knutte & Associates, P. C.- ****** 0% ********* 57% ********* 45% *** Larsson, Woodyard & Henson LLP- ****** 40%40% ****** 50%67% ****** 100%100%

Totals/Percentages12,761 17.6%17.3%17.9%16.7%42.6%41.6%42.4%41.2%49.2%48.2%49.0%49.8% CHART 1 - 04.16.09

Illinois CPA Society's 2009 Survey on the Role of Women in CPA Firms - Percentage of Firm-wide Leadership Positions Held by Women

*All information was provided by the firms. Surveys were sent to 90 Illinois firms that had 15 or more professionals as listed in the Illinois CPA Society's Peer Review or Membership Database and the 2008 Crain's Chicago Business list of Chicago's largest accounting firms. Surveys were mailed in January 2009 and firms were asked to provide the most recent available data, but to not use data earlier than December 31, 2008.

***Firm did not provide information for this year. NP = Information Not Provided

(a) First included in survey population in 2009. (b)First included in survey population in 2008.

(c)First included in survey population in 2006.

The following firms declined to participate in the survey for all years: FGMK LLC; Gimbal Abrams & Singer; Scheffel & Co.; Sleeper Disbrow Morrison Tarro & Lively.

The following firms declined to participate in the survey for 2009, 2008, 2007, 2006 and 2005: Chunowitz, Teitelbaum & Baerson, Ltd.; Morrison & Morrison, Ltd.; Pasquesi Sheppard LLC

The following firms declined to participate in the survey for 2009, 2008, 2007 and 2006: Brook Weiner LLC; Medical Business Consultants - Midwest, Ltd., CPAs; Professional Business Consultants.

The following firms declined to participate in the survey for 2009, 2008 and 2007: Friedman & Huey Associates, LLP; L. J. Soldinger Associates; UHY LLP

The following firms declined to participate in the survey for 2009 and 2008: Ahlbeck & Company; Mulcahy Pauritsch Salvador & Co, Ltd.; Wermer Rogers Doran & Ruzon, LLC.

The following firms declined to participate in the survey for 2009: BIK & Co.; Kutchins, Robbins & Diamond Ltd.; Michael James Liccar & Co.; Mowery & Shoenfeld LLC; Smith, Koelling, Dystra & Ohm, P.C.

Firm/Office Managing PartnersExecutive Management Total # of Total Women Professionals in Illinois Illinois' Largest Accounting Firms* 20092008200720062009200820072006 Illinois Prof. 2009200820072006 Deloitte & Touche USA LLP21%33%26%25%26%28%17%16%2,748 40%39%41%40% PricewaterhouseCoopers LLPNPNPNPNPNPNPNPNP1,573 43%42%42%42% Ernst & Young LLP18%14%13%14%25%17%18%17%1,363 39%39%38%41% KPMG LLP11%8%8%8%9%22%22%21%1,317 39%39%37%36% RSM McGladrey Inc. 9%9%5%0%19%21%23%NP1,308 46%48%46%42% Crowe Horwath LLP0%0%0%0%12%5%0%6%634 44%42%42%45% Grant Thornton LLP8%4%6%3%66%60%13%12%344 42%41%44%42% Clifton Gunderson LLP 14%14%11%15%17%13%9%15%281 43%44%46%47% Blackman Kallick LLP0%0%0%0%0%0%0%0%265 40%41%43%41% Sikich LLPNPNPNP0%13%13%NP0%237 49%52%51%37% BDO Seidman11%0%NPNP0%0%NPNP183 44%43%NPNP Miller Cooper & Co., Ltd. 0%0%0%0%20%20%20%20%166 40%39%41%44% Virchow, Krause & Co., LLP 0%0%0%0%7%7%0%3%146 33%33%32%29% Plante & Moran PLLC13%13%13%13%14%22%22%11%134 46%41%43%45% Wolf & Co. LLP0%0%0%0%0%0%15%15%101 50%48%45%48% Frost Ruttenberg & Rothblatt P.C.NPNPNPNP0%12%11%10%97 42%48%40%48% Legacy Professionals0%0%0%0%40%40%20%20%89 33%34%35%27% Kerber, Eck & Braeckel LLP0%0%0%0%0%11%33%11%85 60%44%52%56% Ostrow Reisin Berk & Abrams, Ltd.0%0%0%0%8%8%8%9%85 48%36%46%43% Lindgren, Callihan, Van Osdol & Co., Ltd. 0%0%0%0%18%14%14%0%84 43%41%44%41% Bansley & Kiener LLP0%0%0%0%0%0%0%0%73 40%33%34%34% Mueller & Co. LLP0%0%0%0%0%0%0%0%72 69%67%67%70% Mayer Hoffman McCann P.C.0%0%0%0%0%0%NP0%67 43%41%43%42% Reznick Group, P.C.NPNPNPNPNPNPNPNP64 30%28%31% *** Warady & Davis LLP0%0%NPNP11%11%NPNP63 40%30% ****** Smart Business Advisory and Consulting LLC 0%17%NP11%7%0%NP7%57 37%36% *** 48% E.C. Ortiz & Co., LLP (b)0%0%NPNP75%100%NPNP53 74%75% ****** Ganim, Meder, Childers & Hoering, P.C.0%0%NP0%7%7%NPNP53 60%64% *** 74% Gray Hunter Stenn LLP 0%0%0%0%NPNPNPNP48 52%50%50%51% Michael Silver & Co.0%0%0%0%0%0%0%0%45 44%38%38%39% West & Company LLC0%0%0%0%NPNPNPNP45 56%55%65%65% DiGiovine, Hnilo, Jordan & Johnson, Ltd.0%0%0%0%42%36%36%40%44 45%51%49%49% Porte Brown LLC0%0%NP0%0%0%NP0%44 36%28% *** 28% Heinold-Banwart, Ltd.0%0%0%0%0%0%0%0%43 65%58%59%59% Topel Forman LLC0%0%NPNPNPNPNPNP43 42%39%41% *** Selden Fox, Ltd.23%23%10%14%NPNP50%40%42 24%28%24%24% Shepard, Schwartz & Harris LLP50%50%50%50%30%0%30%30%42 48%45%43%49% Corbett, Duncan & Hubly LLC 0%0%0%0%0%0%21%33%39 46%53%58%55% Coleman Joseph Blitstein & Stuart LLC0%0%0%0%0%0%0%0%36 33%22%38%31% Kessler, Orlean, Silver & Co., P.C.0%0%0%0%0%100%0%0%35 40%35%31%26% Eric J. Fernandez & Co.0%0%0%0%15%15%8%7%34 50%50%59%60% Martin, Hood, Friese & Associates, LLCNPNPNPNPNPNPNPNP34 50%52%55%56% Silver Lerner Schwartz & Fertel, CPAs (c) 0%0%NPNP0%0%NPNP34 47%47% ****** Weiss & Company LLP0%0%0%0%0%0%0%0%32 47%44%42%33% Lauterbach & Amen, LLP (b)50%NPNPNPNPNPNPNP31 68% ********* Dugan & Lopatka, CPAs, P.C.0%0%0%0%0%0%25%13%30 53%62%61%53% Steinberg Advisors (c)0%0%0%0%0%0%0%0%30 40%54%48%57% Washington, Pittman & McKeever0%0%0%0%NPNPNPNP30 50%52%53%53% Cray, Kaiser Ltd., CPAs0%0%0%0%0%0%0%0%26 46%38%41%42% Russell Novak & Company0%NPNPNPNPNPNPNP26 38% ********* Krehbiel & Associates LLC0%NPNP0%0%NPNPNP23 57% ****** 50% May, Cocagne & King, P.C. (a)0%NPNPNPNPNPNPNP22 59% ********* Striegel, Knobloch & Co. LLC0%0%0%0%NPNPNPNP21 43%30%33%39% Doehring, Winders & Co. LLP0%0%0%0%NPNPNPNP20 40%35%53%47% Borhart, Spellmeyer & Co.0%0%0%0%NPNPNPNP19 42%45%40%42% Dunbar, Breitweiser & Co. LLP0%0%0%0%0%14%13%14%19 47%50%50%40% Eck, Schafer & Punke LLP (b)0%NPNPNPNPNPNPNP18 28%33% ****** J.W. Boyle & Co., Ltd.0%NP0%0%NPNP0%0%17 53% *** 64%40% Pritchard Osborne LLC0%0%0%0%0%0%0%0%16 19%13%14%0% Graff, Ballauer, Blanski & Friedman, P.C.0%0%0%0%0%0%0%0%14 21%20%24%27% Capin Crouse LLP0%0%0%0%0%0%NPNP13 46%40%60%50% Rome Associates LLP0%0%0%0%NP33%NPNP4 50%33%22%50% Coleman, Epstein, Berlin & Company LLP NPNP0%0%NPNP0%0%- ****** 44%47% DBH & Associates LLCNP0%NP0%NP20%NPNP- *** 17% *** 17% Hill, Taylor LLCNP0%0%0%NP20%17%17%- *** 50%45%50% Kemper CPA Group LLCNPNP12%8%NPNP8%9%- ****** 31%60% Knutte & Associates, P. C.NPNP0%NPNPNPNPNP- ****** 39% *** Larsson, Woodyard & Henson LLPNPNP40%25%NPNPNPNP- ****** 62%67%

Total12,761 CHART 2 - 04.16.09

Goodbye Training Program?

Don’t bid adieu to your staff development dollars quite yet Find budget-friendly training alternatives instead

By Renee Beckman, CPA

In a n e c o n o m i c d o w n t u r n , c o m p a n i e s move into survival mode. Priorities are shifted. Cost cuts are implemented. Pers o n n e l i s l e t g o A n d t h o s e t h a t a r e l e f t b e h i n d a r e f o rc e d t o m a n a g e w i t h f e w e r resources, perks and rewards Growth becomes a priority for the future, just as long as the company can survive the present

A s l e w o f s u r v e y s o v e r t h e p a s t y e a r highlight the fact that training programs, in particular, are among the first incentives to w a l k t h e c o s t - c u t t i n g p l a n k . “ W h y ? B ecause training is expensive and difficult to measure,” says Colleen Coursey, a Chicago corporate trainer

Eighteen percent of CFOs interviewed for a n A c c o u n t e m p s s u r v e y s a i d t h e y d o n ’t e x p e c t t o o f f e r e m p l o y e e t r a i n i n g i n t h e next two years Among companies that do have training programs planned, 30 percent will invest in IT skills development and another 26 percent fores e e o f f e r i n g c o u r s e s i n a c c o u n t i n g and finance Average training expenditures per employee has fallen 11 percent in the past year, from $1,202 p e r l e a r n e r i n 2 0 0 7 t o $ 1 , 0 7 5 i n 2008, according to a Bersin & Associates report issued in January. And t h e U S c o r p o r a t e t r a i n i n g m a r k e t shrank from $58 5 billion in 2007 to $ 5 6 2 b i l l i o n i n 2 0 0 8 , t h e g r e a t e s t d e c l i n e i n m o r e t h a n 1 0 y e a r s , Bersin & Associates states.

While employers may be tempted to eliminate training budgets during lean times, investing in staff education is a vital tool for retention and business growth. “Human capital is an organization’s single most important resource Ensuring they perform well shouldn’t even be a question,” says Coursey.

As the economy gets stronger, corporations need to stay ahead of their

competitors and position themselves for higher productivity and profitability While doing more with less may work in the short term, in the long term organizations will suffer. Companies will start to feel the financial effects of the layoffs lower productivity, reduced performance, unnecessary overtime, low morale and increased turnover (including the loss of intellectual capital and company knowledge) The cost of employee turnover to for-profit organizations, in fact, is estimated to be up to 150 percent of the employees' remuneration package.

Rather than cutting training loose entirely, wouldn’t it make more sense to find an alternative, less costly way to invest in your people? After all, if you found training valuable during the fat years, doesn’t it stand to reason that it’s important in lean times as well? Isn’t it all about maintaining a competitive edge? Isn’t that the key to survival?

As they watch their budgets shrink, business and finance professionals are indeed l o o k i n g f o r l o w - c o s t t r a i n i n g o p t i o n s t h a t can still get the job done without an expensive price tag The following four strategies offer companies the chance to do just that

1. eLearning

The advantages of eLearning are many. For s t a r t e r s , i t ’s e a s y t o d e l i v e r a n d a v a i l a b l e 24/7, fitting into pretty much any schedule B e c a u s e t h e r e a r e n o t r a v e l e x p e n s e s involved or trainer salaries to pay, the costs are comparatively low as well According t o T r a i n i n g M a g a z i n e , c o r p o r a t i o n s s a v e between 50 and 70 percent of costs when replacing instructor-led training with electronic content delivery

Opting for eLearning also means that courses can be pared into shorter sessions and spread out over several days or weeks so that companies don’t lose access to their human capital for entire days at a time

24 INSIGHT www icpas org/insight htm D E V E LO P M E N T

2. Mentoring