In this issue

Will the OFS soften the economic blow?

Shotgun mergers boom around the world

Looking for a job? Uncle Sam is hiring

Protect your investments from the taxman

CFOs take on the HR role

Take a GIAnT step in decision-making

Protect your client base in tough times

Student ambassadors lead in the job game

Exchange of debt for equity points you in the right direction

Plus, 2009-2010

ICPAS Board of Directors announced

REARVIEW ECONOMICS

The Magazine of the Illinois C PA Society www.icpas.org / insight.htm | March/April 2009

Finding the road to financial stability

26 Heavy Burden

By C arolyn Tang

The Office of Financial Stability promises to lift us from the rocky economy and place us safely on even ground. But can it deliver on the promise?

30 Firesale M&A

By Sheryl Nance- Nash

A distressed economy sparks a rash of hasty M&A deals

34 Government Agent

By Derrick Lilly

As financial woes weigh on the country, finance professionals are in high demand from the US government.

10 Investing Relax Your Tax Burden

By Derrick Lilly

Tired of your earnings being eaten away by taxes?

14 CFO Hire Learning

By Meta Levin

CFOs are sharpening their soft skills to better handle the world of HR

16 Risk Recession-Proof Clients

By Janet Haney

Technology and face time help to foster client relationships in an economic downturn

18 Strategy Take a GIAnT Step

By Ted Sa n t o s & E d wa r d M Pet r o sk y

A new tool promises to assess your organization’s readiness to take on large - scale initiatives

20 Students Student Ambassadors

By Derrick Lilly

Want to impress recruiters straight out of college? This is how to do it

22 Tax Debt Navigator

By Harvey C oustan, C PA

Exchange of debt for equity gives partnerships a route to certainty

index March/April 2009 Vo l 5 8 N o 6 www icpas org / insight htm features colu m n s regulars

40 2009-2010 ICPAS Board of Directors 4 First Word 6 Seen+Heard 38 Classifieds

WE HAD TO MAKE JOINING OUR NETWORK A REAL VALUE. BECAUSE WE KNEW YOU’D RUN THE NUMBERS ON IT. As a member, not only do you get deep discounts on Sage products* and VIP customer support, you also become part of the Accountants Network online directory. Where clients find you. And you find more business. When you join as a SAN Peachtree Premier Advisor, you receive a free copy of Peachtree by Sage - Quantum, Accountants’ Edition. Go to www.SageAccountantsNetwork.com/Join or call 866-565-2726. As an accountant, there’s nothing more valuable than, well, finding value. And there’s no better example than the Sage Accountants Network. Join now and get $50 off membership fees when you reference promo code “SANIL”. © 2009 Sage Software, Inc. All rights reserved. Sage, the Sage logos and the Sage product and service names mentioned herein are registered trademarks or trademarks of Sage Software, Inc. or its affiliated entities. You must be a practicing accountant or bookkeeper with multiple fee-paying clients to join. *The following Sage products are available through our Accountants Network: Peachtree by Sage, Sage MAS 90 & 200, Sage Abra, ACT! by Sage, Sage BusinessWorks, Sage FAS, Sage Master Builder, Sage Timberline Office, Sage MIP Fund Accounting, Timeslips by Sage & Sage Accpac. Accountants Network N

I C P A S O F F I C E R S

Chairperson, Sheldon P Holzman, CPA Virchow Krause & Company LLP

Senior Vice Chairperson, Lee A Gould, CPA Gould & Pakter Associates LLC

Vice Chairperson, James P Jones, CPA Edward Don & Company

Vice Chairperson, Michael J Pierce, CPA RSM McGladrey Inc

Vice Chairperson, Ray Whittington, CPA College of Commerce Depaul University

Secretary, Charles F G Kuyk III, CPA Crowe Horwath and Company LLP

Treasurer, Sara J Mikuta, CPA The Leaders Bank

Immediate Past Chairperson, Debra R Hopkins, CPA Northern Illinois University CPA Review I

Brent A. Baccus, CPA Washington Pittman & McKeever

Therese M. Bobek, CPA PricewaterhouseCoopers LLP

Robert E. Cameron, CPA Cameron Smith & Company PC

William J Cernugel, CPA Alberto-Culver Company (Retired)

Anthony Fuller Grant Thornton LLP

William P Graf, CPA Deloitte & Touche LLP

Cara C Hoffman, CPA Blackman Kallick LLP

Charlotte A Montgomery, CPA Illinois State Museum

Gerald A Olsen, CPA Illinois Wesleyan University

Annette M O’Connor, CPA RR Donnelley Logistics

Mary Lou Pier, CPA Pier & Associates Ltd

Marian Powers, PhD Northwestern University

Daniel F Rahill, CPA KPMG LLP

Lawrence H Shanker, CPA Shanker Valleau Accountants Inc

Th e e c o n o m y h a s t h r o w n a l e f t c u r v e a t everyone’s plans, and the Securities and E x c h a n g e C o m m i s s i o n ’s ( S E C ) r o a d m a p f o r I n t e r n a t i o n a l F i n a n c i a l R e p o r t i n g S t a n d a r d s

(IFRS) is no exception

Financial woes and a change in leadership at the SEC may have complicated the shift to IFRS from US GAAP, but they haven’t stopped it And a variety of lively discussions have resulted from efforts to grapple with issues such as fair market value, m a r k - t o - m a r k e t a c c o u n t i n g , r e q u i r e d c o s t s a n d training, educational readiness and the onslaught of globalism.

According to an AICPA survey conducted last fall, 55 percent of CPAs at firms and companies nationwide are preparing for IFRS, up from 41 percent in April 2008 Global convergence of US GAAP and IFRS, in fact, is one of the top concerns for CEOs in 2009, according to Financial Executives International

Yet another survey, this time conducted by Deloitte, indicates that 42 percent of the 200 finance professionals surveyed would consider implementation of IFRS sooner than 2014 if p e r m i t t e d b y t h e S E C . C u r r e n t l y, i f c e r t a i n m i l e s t o n e s a r e a c h i e v e d , t h e S E C ’s p r o p o s e d roadmap could lead to required use of IFRS in 2014. However, consideration is being given to permit use by a limited number of companies as early as 2010.

The changing economic and political climate may have put the pause button on IFRS implementation, but we still need to pay attention Newly appointed SEC Chairman Mary Schapiro has said she does not feel bound by the existing IFRS roadmap that’s out for public comment and plans to proceed with caution Yet whether it arrives fast or slow, it will be a part of our lives At some point in the not so distant future we’ll find ourselves in uncharted territory namely, an accounting world with IFRS in it

The Illinois CPA Society continues to monitor the impact and implementation of IFRS, among other issues relevant to the profession. We will stand by you ready with information and assistance for wherever it is we’re headed. The journey is a little less intimidating when you have someone along for the ride

ICPAS President & CEO

C P A S B O A R D O F D I R E C T O R S

4 INSIGHT www icpas org/insight htm F I R S T W O R D

Publisher

ICPAS President & CEO

Elaine Weiss

Editor-in-Chief

Publications Director

Judy Giannetto

Creative Services Director

Gene Levitan

Creative Services Manager

Rosa Garcia

Publications Specialist

Derrick Lilly

National Sales & Advertising

Janis L Mason

medrepcons@ aol com

Offi ce: 773- 325- 1804

Cel l : 312- 560- 3081

Information Systems Manager

Jim Jarocki

j arocki j @ i cpas org

Editorial Office

550 W Jackson Blvd , Suite 900, Chicago, IL 60661

Advertising Sales Office 3711 N Ravenswood Ave , Suite 146, Chicago, IL 60613

INSIGHT is the official magazine of the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Its purpose is to serve as the primary news and information vehicle for some 23,000 CPA members and professional affiliates

Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published bimonthly except monthly in July and August by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA, 312-9930393 or 800-993-0393, fax 312-993-0307 Subscription price for non-members: $30 U S , $40 Canada and International addresses, $42 Mexico Copyright © 2008 No part of the contents may be reproduced by any means without the written consent of INSIGHT Permission requests may be sent to: Editorial Director, at the address above Periodicals postage paid at Chicago, IL and at additional mailing offices POSTMASTER:

Send address changes to: INSIGHT, I l l i n o i s C PA S o c i e t y, 550 W Jackson, Suite 900, Chicago, IL 60661, U S A Controllers March 17 - Rosemont, IL Government April 29 - Rosemont, IL April 30 - Springfield, IL Business Valuation May 5 - Chicago, IL International Issues May 12 - Chicago, IL Taxation on Real Estate May 14 - Chicago, IL Business Tax May 19 - Springfield, IL Estate & Gift Tax May 21 - Chicago, IL Employee Benefits May 27 - Chicago, IL 2009 SPRING CONFERENCES Mark Your Calendar! Dates and locations are subject to change. All conferences offer CPE Credit; check our website for info on CLE and other specialty credits. NEW! NEW! 2009 is a CPE Reporting Year Licensed CPAs need 120 hours of CPE* by September 30, 2009. *Must include 4 hours of Ethics CPE For the most current info or to register, visit www.icpas.org. www icpas org / insight htm MARCH/APRIL 2009 5 I N S I G H T A W A R D S 2008 Apex Award, Magazine & Journal Writing 2007 Magnum Opus Award, Best All-around Association Publication 2006 Apex Award, Magazines & Journals 2006 Apex Award, Magazine & Journal Writing 2004 Apex Award, Magazines & Journals 2004 Apex Award, Magazine & Journal Writing 2002 Apex Award, Magazine & Journal Writing 2002 Chicago Women in Publishing Excellence Award, Writing/Editing 2001 Apex Award, Feature Writing 2001 Apex Award, Best Redesigns 2000 Apex Award, Magazine & Journal Writing 2000 Apex Award, Best Rewrites

SEEN H E A R D

$1,009,100,000,000 US Government ’ s FY 2008 budget deficit. Source: Government Accountability Office report, A Citizen's Guide to the 2008 Financial Report of the US Government

Enter Financial Services

So you want your CPA firm to expand into investments? Here are four ways to do it:

1 A c q u i r e a f i n a n c i a l s e r v i c e s f i r m This allows you to expand services to the existing clients of both firms while increasing the size of your client base

2 E s t a b l i s h y o u r o w n f i n a n c i a l s e r v i c e s p r a c t i c e This is a much less expensive option, and allows you to tailor services to your overall goals, maintain your existing clients, and keep control over your practice

3 P a r t n e r w i t h a n i n v e s t m e n t f i r m This doesn't require you to expand your payroll or infrastructure, maintains control of your clients, and allows you to expand your services and client base

4 I m p l e m e n t a r e f e r r a l p r o g r a m Although requiring little time and no investment, you face the risk of losing both your clients and your control over the services being offered.

Source: Frankle, N , CFP (2008, December 18) “Offering Financial Services to Clients in This Market? Are You Nuts?” Wealth Management Insider.

“A r e c e s s i o n i s w h e n y o u r n e i g h b o r loses his job A depression is when you lose yours. ” (Ronald Reagan, 1982)

Retention a Big Worry

A recent survey developed by Robert Half International suggests that today ’ s senior executives are increasingly worried about hanging on to good employees and bringing in new ones Thirty-nine p e r c e n t o f t h e 1 5 0 p a r t i c i p a t i n g e x e c u t i v e s f r o m s o m e o f t h e nation’s largest companies cited employee retention as their greate s t w o r r y, w h i l e 2 2 p e r c e n t c i t e d r e c r u i t m e n t Pr o d u c t i v i t y a n d employee morale were each named by 17 percent of respondents

Source: Robert Half International [www rhi com]

$68 bil lion

Decline in FY 2008 corporate tax revenue collected by the US Government due to the weakening economy

Source: Government Accountability Office report, A Citizen's Guide to the 2008 Financial Report of the US Government

6 INSIGHT www icpas org/insight htm

N E W S B Y T E S , S O U N D A D V I C E A N D P R A C T I C A L B U S I N E S S T I P S

[ ]

Garelli

Wong and Jackson Wabash are Chicagoland’s experts in financial recruiting and staffing. Our team unites employers with the right accounting and finance talent for direct hire, temporary and consulting assignments. We look and listen beyond the job description to combine the right skills with the desired experience.

Clients Great Candidates Great Fit Chicago Schaumburg Oakbrook Terrace 312.583.9264 847.397.9700 630.792.1660 WWW.GARELLIWONG.COM WWW.JACKSONWABASH.COM

To learn more about our dedication to finding the right fit, visit us on the web or call your local office. Great

3.4 percent

Overall salary increase projected for finance and accounting staff in 2009. Source: Robert Half International 2009 Salary Guide.

10 Tips for Surviving Career Blips

Career expert Ford R Myers, president of Career Potential LLC and author of Get the Job You Want, Even When No One's Hiring, says, "Even in this difficult economic climate, job seekers have more control over their career circumstances than they might think There are specific strategies and tactics that consistently generate strong results in a bad job market " Myers offers the following 10 tips to get you through these tough times:

1 M a i n t a i n y o u r m o m e n t u m Stay busy, get active and be productive in both job search and non-job search related pursuits

2 S e e k h e l p Get career support from a professional career coach who can better prepare you for your next position Consult a counselor if you are struggling emotionally

3 R e a d c a r e e r b o o k s a n d a t t e n d c a r e e r s e m i n a r s Staying informed of industry trends will help you gain greater knowledge of the careers poised for future growth

4 L e v e r a g e t e c h n o l o g y Utilize websites, online services and social networking sites like LinkedIn to keep in touch with peers and colleagues

5 D i f f e r e n t i a t e y o u r s e l f Get involved in professional organizations and position yourself as an expert by writing articles, giving presentations and teaching classes

6 U s e o f f t i m e w i s e l y Gain more education by participating in classes and seminars, work towards a certification or attend professional conferences

7 P u r s u e a t e m p o r a r y, p a r t - t i m e o r c o n t r a c t p o s i t i o n Volunteer, offer pro bono work or take part in an internship/apprenticeship, especially when considering a change in industry

8 . Ta k e c a r e o f y o u r s e l f . Eat well, exercise, get plenty of rest, keep in touch with friends and family, and keep up with hobbies and favorite activities

9 R e l o c a t e Consider shifting industries and/or being more geographically flexible to expand your career options

1 0 E n h a n c e a l l t h e d o c u m e n t s i n y o u r c a r e e r p o r t f o l i o Practice interviewing and negotiation skills Focus your message on the tangible results you can produce

Source: Career Potential, 2008 Ford R Myers can be contacted at contact@careerpotential com or www careerpotential com

T h e Wo r k We e k Just Got Longer

The recently released results of a Robert Half International (RHI) study commissioned in 2007 reveal that financial professionals around the world have significantly different work hour practices The report of this study, Working Hours: A Global Comparison, includes the opinions of 2,283 financial managers in 17 countries

While the average number of work-week hours varies from country to country, globally many financial professionals (52 percent) are working longer hours than they did in previous years Reasons include increased responsibility, company growth, increasing globalization, the need to accommodate international clients, and imp r o v e d t e c h n o l o g i e s , w h i c h k e e p e m p l o y e e s connected to work 24/7

Financial professionals in Luxembourg, Japan and Ireland lead in hours worked In fact, 60 percent of Japanese workers say they work 46 or more hours per week, and 19 percent say they log over 55 hours a week (compared to 12 percent in the United States, 11 percent in the United Kingdom and 9 percent in France ) Forty- seven percent of respondents from Ireland say they work between 46 and 55 hours a week 17 percent above the global average The average number of hours worked in Luxembourg is 47 6

For more on this report, visit www rhi com

8 INSIGHT www icpas org/insight htm

How fast can you deposit checks? Well, how fast is your internet connection? NationalCity.com/RemoteDeposit Remote Deposit can save you a trip to the bank. Now you can deposit checks 24/7 right from your office. Just scan the checks, validate the totals, and then securely send images of those checks for deposit. It’s one of the many features of Business Checking Plus that help you customize your account and manage your cash flow at a discounted rate. Open an account today. Just stop by any National City branch, visit NationalCity.com/RemoteDeposit, or call 1-866-874-3675. National City Bank, Member FDIC ©2009 The PNC Financial Services Group, Inc. y.com NationalCit RemoteDeposit / n s w f Ho t c as ou n y a e s t m e n t s M o r t g a g e L o a t i We dep t w f o , h ll che osit ti o s y t i as cks? ? ur B u s i n e s s B a n k i n g I n v e n co rne on nnec P e r s o n a l B a n k i n g it nal C Natio o e y manag f B s o feature ure c se then / 4 s 2 check e D Remot y ationalCit it N is , v ranch y b d r iscounte t a d w a o h fl as r c u s t lu g P heckin s C usines se c o h f t s o e ag d im n ly se u . J fice f r o ou m y ro t f igh 7 r u a t o e y v n sa a t c eposi r c , o RemoteDeposit / .com od t t ccoun n a n a pe . O ate ou e y ustomiz u c o p y el t h ha n s o ’ t . I it os p e r d o s f k c he alida , v hecks e c h n t ca st s w y No . nk e ba h o t p t ri 74-3675.-874 -866 l 1 al ny y a p b o st st u . J ay nd t a coun c r a any e m h f t e o nd , a otals e t h e t t eposit n d a u c o n a in C F N e P h 9 T 0 0 2 © e M , nk a y B t i l C a ion t a N c n , I oup r s G e c i v er l S a i c C I D r F e b m

Relax Your Tax Burden

Tired of your earnings being eaten away by taxes?

By Derrick Lilly

Sa d l y, w e ’ v e a l l h a d t o a c c e p t t h e f a c t t h a t m o n e y d o e s n ’t g r o w o n t r e e s , w h i c h m e a n s a l t e r n a t i v e methods for growing and protecting wealth are essential to long-term financial stability.

Regardless of whether you already own or are thinking of purchasing bonds, ETFs, mutual funds, individual stocks, or all of the above, the long-term implications of paying federal and state taxes on earned interest, dividends and capital gains can significantly erode overall investment returns.

However, tax-advantage investing offers the means to dull the taxman’s axe.

Uncle Sam Borrows a Buck

By purchasing US Treasury securities and savings bonds, you are essentially making a loan to the government over a fixed period, ranging from a matter of weeks to 30 years Because Treasury securities are backed by t h e “ f u l l f a i t h a n d c r e d i t ” o f t h e g o v e r nm e n t w h i c h c a n r a i s e t a x r e v e n u e s t o cover debts this type of investment is considered to have no credit risk

“All investors should consider the appropriateness of Treasuries for some portion of t h e i r p o r t f o l i o , ” s a y s M a r k J G i l b e r t , C PA / P F S / M B A , p r i n c i p a l a t R e a s o n F i nancial Advisors Inc “For investors in states w i t h h i g h m a r g i n a l i n c o m e t a x r a t e s , d e v e l o p i n g a t a x - c o n s c i o u s i n v e s t m e n t portfolio should consider both federal and s t a t e i n c o m e t a x e s T h e r e f o r e , Tr e a s u r i e s become an increasingly important part of an investor ’s portfolio ”

In terms of savings bonds, federal taxes can be deferred until redemption, and may be redeemed fully tax-free if used for qualifying education expenses

Consider Your Municipal Pals

“If a client is willing to take on relatively small risk, he or she could invest in AAAr a t e d m u n i c i p a l b o n d s i n o r d e r t o e a r n interest that is free of federal income taxes,” says Gilbert

M u n i c i p a l b o n d s , o r “ m u n i s , ” a r e d e b t obligations issued by local and state governm e n t e n t i t i e s t o f i n a n c e t h e b u i l d i n g o f schools, hospitals, roads, utilities and other public projects Munis typically offer higher yields than Treasury securities, carry a credit r a t i n g t o d e t e r m i n e q u a l i t y a n d r i s k , a n d offer interest that is generally exempt from federal income tax However, the interest on some munis may be subject to the alternative minimum tax What’s more, as long as you live in the offering locale, interest is sometimes free of state and local income taxes as well

Munis do carry some risks, however For one, they are increasingly sensitive to interest rate changes in the markets and their values fluctuate based on market conditions.

“Ordinarily, in an environment of rising i n c o m e t a x e s , t a x - f r e e m u n i c i p a l b o n d s would climb in value,” says Gilbert “Howe v e r, t h e c u r r e n t f i n a n c i a l c r i s i s h a s d epressed municipal bond prices as investors w o r r y o v e r t h e a b i l i t y o f i s s u e r s t o e i t h e r r e p a y o r r e f i n a n c e o u t s t a n d i n g b o n d s I don’t believe municipals will rise in value until investors believe that the financial crisis is under control.”

Credit ratings can impact valuations as well Generally, a bond issuer with a lower credit rating will offer a higher yield, but the risk of default may be greater.

“As the client is willing to take on greater risk, he or she could invest in lower-rated municipal bonds to earn higher amounts of tax-free income,” says Gilbert However, a general risk-aversion practice is to only purc h a s e “ i n v e s t m e n t - g r a d e ” b o n d s b o n d s that rating agencies, Moody's, Standard & Poor's and Fitch rate as BBB, Baa or better Bond

with a Fund Manager

Ta x - f r e e b o n d f u n d s a n d t a x - m a n a g e d income funds (i e mutual funds that primar i l y i n v e s t i n g o v e r n m e n t a n d m u n i c i p a l bonds and securities) can be a great way to enter bond investing without the hassle of

10 INSIGHT www icpas org/insight htm I N V E S T I N G

Ifyouhaveaninsuranceclaim, thelast thingyouwanttoworryaboutiswhetheror notyouhavethepropercoverage.

That’swhytheICPAS-sponsoredgroup insuranceprogramissoimportant.

Theseplansaredesignedspecificallyforyou. It’sworthaphonecalltoexplorethis importantmemberbenefit.

Wethinkyou’llfindtheICPAS-sponsored insuranceprogramsoarsabovethecompetition whenitcomestoprovidingyouandyour familywitheconomicalfinancialsecurity.

•ProfessionalLiabilityInsurance*††

•LifeInsurance*††

•DisabilityIncome*†† •GroupDentalInsurance*†

•HealthInsuranceMart*

•GroupAccidentalDeathand DismembermentInsurance*†

•Long-TermCare*††

•HospitalIncome*††

•GroupCatastrophicMajorMedicalInsurance*†

•VeterinaryPetInsurance*††

1-800-842-ICPA(4272) www.personal-plans.com/icpas Takethefirststeps towardhelpingsecureyourfamily’sfuture withtheICPAS-sponsoredInsurancePlans CA#0633005 AdministeredandbrokeredbyMarshAffinityGroupServices,aserviceof Seabury&Smith,Inc.,InsuranceProgramManagement †UnderwrittenbyTheUnitedStatesLifeInsuranceCompanyintheCityofNewYork. d/b/ainCASeabury&SmithInsuranceProgramManagement AG-6750 40075,41157,41158,40280,41159,41254,41160,41161 MarshAffinityGroupServices,aserviceofSeabury&Smith,Inc.2009 ††UnderwrittenbyHartfordLifeandAccidentInsuranceCompany, Simsbury,CT06089 * Theplansaresubjecttotheterms,conditions,exclusions,andlimitationsofthe grouppolicy.Forcostsandcompletedetailsofcoverage,contacttheplan administrator.Coveragemayvaryandmaynotbeavailableinallstates. www icpas org / insight htm MARCH/APRIL 2009 11

•10YLTLifeInsurance*†† Formoreinformation,contactMarshAffinityGroupServicesat:

evaluating individual bonds and their tax policies. Funds require much less money in order to establish a diversified portfolio, and commonly make monthly or quarterly dividend distributions as opposed to the semi-annual or annual interest payouts of many individual securities

However, unlike individually purchased bonds, a fund’s holdings are determined by the will of its manager, who may move in and out of different positions. The fund’s yield or dividend rate fluctuates based on its earnings and holdings at the time of payout

“I would pay close attention to factors you'd look at in analyzing any fund Ask yourself, is the manager experienced? Are fees low? How does long-term performance look on an after-tax basis?” says Christopher Davis, mutual fund analyst at Morningstar Inc. “Overall, tax-managed funds are very underutilized They can offer you the tax benefits of investing in a Roth IRA, but you have none of the restrictions ”

A Piggy Bank Can’t Hold it All

W h a t ’s m o r e , a f u n d ’s s h a r e s a r e i s s u e d t o s e v e r

i n v e s t o r s , meaning that the share value fluctuates based on the fund’s asset value, the number of outstanding shares and other liabilities Subsequently, there is no guarantee that the redemption price will be the same or greater than the initial purchasing price. Management fees, commissions, or purchasing and redemption limitations also may be involved

Aside from employer-matched retirement plans like the 401(k), two account types are most often considered when it comes to investments and retirement money: A traditional IRA and a Roth IRA.

Gilbert stresses that, “All investors, regardless of their income tax bracket, should be encouraged to invest through 401(k), IRA and Roth investment structures where permitted by the tax code These vehicles provide current or future income tax savings, which results in more investment principal to grow on a tax-deferred or possibly tax-free basis ”

A significant difference between the traditional IRA and Roth IRA is the way taxes are handled. In a traditional IRA taxes are deferred, so if $10,000 is earned over the year and $1,000 is contributed, the contribution amount will be deducted from taxa b l e i n c o m e H o w e v e r, a l l c o n t r i b u t i o n s a n d c a p i t a l g a i n s , d i v i d e n d s a n d i n t e r e s t earned over the years will be subject to taxation once withdrawals are made If a lower tax rate is in effect by the time withdrawals begin, this may not be a deal-breaker, but if a h i g h e r t a x r a t e i s i n p l a c e , v a l u e s m a y decrease significantly

I n t h e c a s e o f a R o t h I R A , t h e s a m e $ 1 0 , 0 0 0 w o u l d b e f u l l y t a x e d a s r e g u l a r e a r n e d i n c o m e W h i l e t h e i n i t i a l i n c o m e tax deduction is lost, a $1,000 contribution m a d e a f t e r t a x e s c o u l d b e w i t h d r a w n i n retirement with any gains paid tax-free (as long as the contributions have been held in the account for at least five years)

“A Roth can be very beneficial over the traditional IRA and 401(k) if the employee finds they’re in a higher income tax bracket in retirement than at the time the contributions were made,” says Gilbert.

“ I t m a k e s s e n s e t o b e i n v e s t e d i n b o t h vehicles as a way of diversifying your future t a x e x p o s u r e , ” D a v i s n o t e s . “ Yo u n e v e r k n o w w h a t y o u r t a x s i t u a t i o n w i l l b e i n r e t i r e m e n t , e s p e c i a l l y i f i t ' s d e c a d e s o r even years away ”

If you’d like more information on tax-sensitive options in investing, pay a visit to www.usbonds.gov, www.morningstar.com, www investinginbonds com, or www reasonfinancial com

a l

Are you a Complete Tax Professional? A Masters in Tax from ILLINOIS will give you what you’ve been missing. e MS Tax Program. Chicago. A graduate program of the Department of Accountancy in the College of Business at the University of Illinois at Urbana-Champaign Prentice Barbee, CPA Senior Tax Consultant, Class of ‘07 Prentice Barbee, CPA Senior Tax Consultant, Class of ‘07 Classes start May 2008 Classes start May 2009 12 INSIGHT www icpas org/insight htm

Email: http://tax.cchgroup.com/members/icpas (Enter member discount code: Y6202)

Phone: Wanda Brooks: 708.969.5355

Email: wbrooks@warehousedirect.com

Phone: 800.328.1935

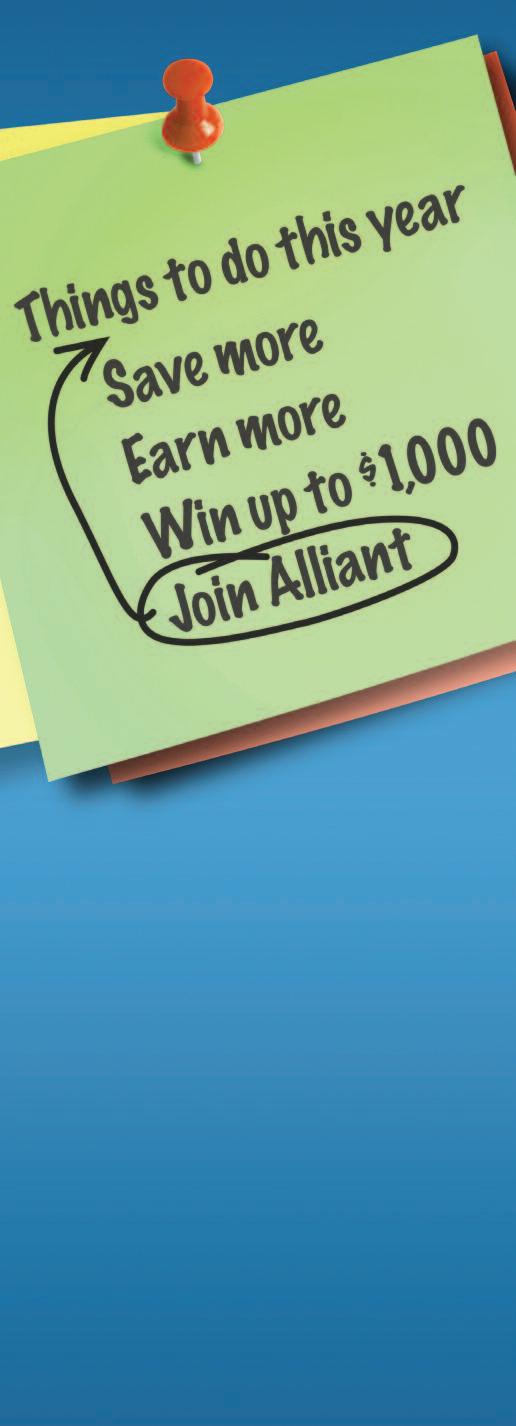

Web: www.alliantcreditunion.org/ilcpa

Phone: 800.422.4661,

Phone: 800.835.0894

Phone: 800.323.2106 (liability) or 800.842.ICPA (medical & life plans)

800.325.7000

Become a provider. For more information about becoming a Member Buying Advantage program provider of the Illinois CPA Society, please contact us at 800.993.0407, ext. 286. NEW! Publications

Offering more than 65,000 products at competitive prices. Office Products

30% member discount on tax and accounting books.

Competitive loan rates and dividends as well as access to a diverse line of products and services. Credit Union

Up to 15% off on auto insurance and 10% on home insurance. Call today for your no-obligation rate quote! Be sure to mention group #3408. Home/Auto Insurance

Complete administration of 125 Cafeteria Plan. 10% off of enrollment and administrative fees. Section 125 Cafeteria Plans

866.438.6262 Earn points and get rewards you want - with no annual fee. Mention priority code FACYMG. Credit Card

press 7

Phone:

Special group discounts on life, disability, major medical and liability plans. Various Insurance Plans Phone:

Discounts on products and services. UPS A benefit of your Illinois CPA Society membership...

Advantage Program Save money on the products and services you use everyday. Contact a carefully selected Member Buying Advantage Program provider today and start saving.

MemberBuying

Hire Learning

CFOs are sharpening their soft skills to better handle the world of HR.

By Meta Levin

Small and mid-sized company CFOs are taking on responsibilities that, traditionally, aren’t exactly the province of finance executives Often, in fact, they’re delving into the softer side of business, more commonly known as HR.

“CFOs now are expected and required to be more well-rounded as professional people,” says Cal Stuart, CFO of Elk Grove Village, Ill.-based Aquion® Water Treatment Products LLC “The days of the bean counter are gone ”

Stuart took over responsibility for human resource functions at Aquion last year. The transition has been smooth for several reasons First, he served as CFO of other comparably sized companies before joining Aquion two years ago, which means he has had contact with and experience in various areas of business In addition, he knew from the start that HR eventually would report to him, and worked closely with the head of human resources prior to the change.

Often in an effort to streamline an organiz a t i o n ’s p r o c e s

v a l u a b l e t i m e , d e p a r t m e n t s s u c h a s H R become the domain of either the CFO or legal counsel Recruiting firm Robert Half International has noticed the trend.

“ T h e c u r r e n t r e g u l a t o r y e n v i r o n m e n t may have a lot to do with the shift,” says Mike Shapow, Chicago regional VP “It is incumbent on the CFO to be more involved in human resources.”

“Of the seven CFO positions I held, I had HR reporting to me in five of them,” says Cindie Jamison, national managing director of CFO Services for Tatum™, an executive services firm focused on creating and supporting the office of the CFO “I was always very careful to hire strong HR people to run the show,” she notes.

Tatum has pushed its CFOs to get training i n w h a t J a m i s o n c a l l s “ t h e s o f t e r s k i l l s , ” including communications and negotiation “Any CFO who runs human resources has to be strong in these areas,” she says.

Professor Arup Varma, PhD, of Chicago’s L o y o l a U n i v e r s i t y H u m a n R e s o u rc e a n d Employment Relations master ’s degree pro-

14 INSIGHT www icpas org/insight htm

e

a n d f r e e u p t h e C E O

s

s

’s

C F O

gram, explains that accounting and finance MBA students in his Performance Management class are “somewhat uncomfortable when I talk about perception, feelings and emotions, but relax when I connect it all to the bottom line. I tell them that as they go higher in the corporation, they are going to be managers and they will have people working for them,” he says. “That’s HR. They are going to need HR

“In the last 10 to 15 years the emphasis in HR has been that it is not just a cost center; the emphasis is on measuring and doing a cost-benefit analysis,” he adds. “The CFO will want to track and measure that ”

Those who head HR functions have mixed feelings about the CFO trend “In some cases this helps streamline activities,” says Varma. “But it can be negative if the numbers become too important and the emphasis on employee development is pushed aside ”

Human resources has reported to Bob Cantwell, VP of Finance/ CFO of B&G Foods, Inc in Parsippany, NJ, since the early 1990s “It allows us to handle situations such as insurance and employee issues much quicker,” he says “The VP of HR and I communicate regularly and discuss solutions together ”

Cantwell, who has worked for B&G Foods since 1983, took over HR when he moved up from company controller to CFO In r e t r o s p e c t , h e b e l i e v e s h i s p o s i t i o n a s c o m p a n y c o n t r o l l e r h e l p e d t o f a m i l i a r i z e h i m w i t h t h e H R f u n c t i o n T h a t a n d h i s c o l l e g e m i n o r i n p s y c h o l o g y, h e s a y s , h a v e s e r v e d h i m w e l l when working with HR issues “A CFO needs more than just a financial background,” he explains “He or she needs a wellrounded education ”

Cynthia Wojcek, VP of Human Relations at B&G Foods, notes that the relationship has had its upside “It has made me more aware of the financial aspects,” she says Wojcek has learned to speak the language of finance in order to better communicate with her boss. And, in fact, to better prepare for the current business environment, Varma encourages his HR students to take an accounting and finance course, and emphasizes the importance of being able to justify wants, needs and activities in business terms. “I tell them that they have to be able to demonstrate that they understand,” he says

“In the best-case scenario, HR sits at the table with other key players,” says Kathy Lunsky, a former corporate HR director “The challenge in reporting to the CFO is that you don’t have a place at the table and you are relying on someone whose prime background and focus has been finance to represent HR. That can mean that HR gets reduced to ‘how costly are you?’”

O n e o f t h e e t e r n a l s t r u g g l e s , s a y s L u n s k y, i s t o e n s u r e t h a t human resources is seen as a business partner You have to be “much more focused on numbers,” she says. “There’s definitely more pressure to make sure that you thoroughly articulate issues in those terms.”

“ Ty p i c a l l y t h e p e o p l e c o s t s s a l a r y, b e n e f i t s a n d t r a i n i n g comprise 35 percent of a company’s costs,” says Shapow. “It’s a significant expense item, so HR people have to become numbers-savvy.”

Tr u e e n o u g h , C F O s t e n d t o b e b o t t o m - l i n e , r e s u l t s - o r i e n t e d c o m m u n i c a t o r s , w h i l e h u m a n r e s o u rc e l e a d e r s t e n d t o b e a l l about people Their shared goals, however, center on costs, which is what makes the pairing so logical

Your savings federally insured to at least $250,000 and backed by the full faith and credit of the United States Government National Credit Union Administration, a U.S. Government Agency Find out all the ways to win with Alliant at alliantcreditunion.org/ilcpa © 2009 Alliant Credit Union. All Rights Reserved. SEG292-R02/09 www icpas org / insight htm MARCH/APRIL 2009 15

Recession-Proof Clients

By Janet Haney

By Janet Haney

While individuals carefully watch their personal portfolios during the current recession, accounting and finance professionals continue to c

Companies have to dig deep to stay on top of their clients’ changing business needs

Turn to Tech

KPMG is doing a variety of things to keep clients informed, says Dan Rahill, CPA/JD/

. Efforts include inviting them to tune in to webinars, listen to weekly podcasts, watch relevant webcasts, and attend an ongoing seminar series The firm offers discussions

o n t o p i c s s u c h a s t a x i m p l i c a t i o n s i n a r e c e s s i o n , m a x i m i z i n g t a x f l o w, a n d t h e i m p a c t o f S a r b a n e s - O x l e y K P M G ' s T h i s W eek i n State Tax podcasts, for example, aim to help state and local tax specialists keep up with the latest legislative, regulat o r y a n d j u d i c i a l s t a t e a n d l o c a l t a x c h a n g e s . F i r m s e v e n o f f e r C P E c r e d i t f o r some discussions

A recent Forrester Research report, Ten W ays to Recessi on- Proof Market Research, offers ideas that can be applied to various i n d u s t r i e s t r y i n g t o r e a c h c u s t o m e r s i n a downturn The report’s findings emphasize the importance of utilizing Web 2 0 technologies to get the word out about market i n t e l l i g e n c e , s t u d i e s , s y n d i c a t e d r e s e a rc h access and how-to guides.

16 INSIGHT www icpas org/insight htm R I S K

Te c h n o l og y a n d fa c e t i m e h e l p t o fo s t e r c l i e n t re l a t i o n s h i p s i n a n e co n o m i c d ow n t u r n .

h e i r p r i m a r y i n v e s t m e n t t h e i r c l i e n t s . K e e p i n g u p w i t h c h a n g e s i n t h e g l o b a l e c o n o m y i s n ’t e n o u g h a n y m o r e

a t e r t o t

L M

p a r t n e r a t K P M G i n C h i c a g o

L

, t a x

“Distribution starts with a publishing mentality preparing information for mass distribution and a portal strategy,” writes the report’s author, Ted Schadler “The value of market research to the business is directly related to the number of business decisions affected by it. The best way to increase the value of a study or report is to get it into the hands of more people ”

Forrester Research also recommends turning to wikis, internal blogs and RSS feeds to extend information even further, noting that such technologies push data into users’ inboxes and browsers. In essence, this method creates a self-service distribution center with all the relevant text information and graphics in one location Companies typically rely on email alerts and website postings to get the word out about what they are currently

offering

E-News Spreads the Word

Jamshed B. Gandi’s firm Bertorelli, Gandi, Won & Behti saw the need for a client enewsletter some years ago Gandi, CPA/CFP®/CVA/Ms Tax, says this format allows the firm to make announcements and provide pertinent prepackaged and original content to approximately 450 clients on a weekly basis.

“This is an extra value-added service we give out. It’s a great marketing tool,” he says “The articles are in line with the times Anytime there is something significant happening, you have to make sure the client has the information ”

Rather than being a tool for new business, says Gandi, the e-newsletter adds to the firm’s overall visibility and timeliness Instead of having to seek out industry-wide and general information elsewhere, clients can simply click on links provided in the body of the email, log on to a webinar or attend a short panel discussion in person To keep track of the firm’s e-newsletter effectiveness, Gandi receives an email every time someone opens up an article

Forrester Research agrees that email communication is a valuable means of disseminating information to current clients, particularly in uncertain times

“Email targets your existing customers, a group far more likely to listen to your messages in a recession than new prospects,” writes author Josh Bernoff in Strategi es for Interacti ve Marketi ng i n a Recessi on “A recession is likely to increase email marketing volume.”

Face Time

Often, though, the personal touch really matters most when the economy is in the tank and people are concerned about their company’s financial future

“When it comes to selling your services, a webinar can’t replace face-to-face communication,” says Shawn Kane, a state and local tax executive for Crowe Horwath LLP. Although his firm relies on both webinars and e-newsletters to reach clients, Kane feels that partnerships are imperative “Clients are having a tough time and want us to partner with them,” he says “If it’s a company we’ve had a strong relationship with, we’re willing to make that investment.”

Ka ne a dmits tha t the na ture of the pa rtne rship is de te rmine d on a c a se -by -c a se basis maybe they’ll investigate keeping the client’s fees flat or explore above-the-line s a v i n g s o p t i o n s a n d s o m e t i m e s t h e f i r m ’s s e r v i c e m o d e l h a s t o c h a n g e t o f i t t h e client’s requests.

“Our business is based on personal interaction with our clients,” says Kim Rice, CPA/MST, partner at R&M Consulting LLC “You make that effort up front then in tough economic times you don’t have to change.”

Part of R&M Consulting’s strategy is to invite clients to lunches, dinners and netw o r k i n g o p p o r t u n i t i e s R i c e n o t e s t h a t h e r e x e c u t i v e - l e v e l c l i e n t s u n d e r s t a n d t h e power of face-to-face interaction “Our focus is always to be engaged with our clients,” she says. “When our clients need help they continue to call us.”

It takes a vigorous balance of face time, technology and marketing savvy to keep current clients As Schadler writes, “In a downturn, companies will focus more on their customers than on their prospects for the simple reason that it’s easier to make money from existing customers than to spend money acquiring new ones.”

The Thirteenth Annual Multistate Tax Institute Institute highlights include: ✓ A nationwide and regional perspective of the year’s most important state and local tax developments by the “best in the business.” ✓ The state of critical multistate tax issues. ✓ Expert insight into numerous money saving opportunities. ✓ Cutting edge planning techniques being used in the nexus area. ✓ Department of Revenue roundtable on critical audit issues. June 18, 2009 Milwaukee, WI For program and registration information, call us at 414-229-3821 or email us at salt-conf@uwm.edu Deloitte Center for Multistate Taxation www icpas org / insight htm MARCH/APRIL 2009 17

Take a GIAnT Step

By Ted Santos & Edward M. Petrosky

By Ted Santos & Edward M. Petrosky

The future success of an organization often depends on disruptive initiatives that drive new revenues and p o s i t i o n t h e o rg a n i z a t i o n a s a m a r k e t leader. While it’s the Board of Directors’ job t o i n t e n t i o n a l l y c r e a t e s t r a t e g i c p r o b l e m s for the CEO to solve, board members are s o m e t i m e s r e l u c t a n t t o u s e t h i s a p p r o a c h for fear of overwhelming or disrupting the CEO and staff The result: Many great ideas are never attempted

But wait What if the Board and CEO had some way of measuring the organization’s readiness to execute large-scale initiatives? What if it was possible to prepare an entire o rg a n i z a t i o n t o e x e c u t e i n i t i a t i v e s t h a t appear to be disruptive to the existing busin e s s m o d e l ? W h a t i f t h e B o a r d a n d C E O could assess the unspoken objections and concerns that might derail a particular initiative before it’s even launched, and could take the necessary steps to avoid them?

The Great Idea Alignment Tool (GIAnT) was created to do just that This is how it works

The GIAnT is an organizational satellite that provides a comprehensive vertical and horizontal picture of your organization. It indicates who is prepared for an initiative, h o w p r e p a r e d t h e y a r e , a n d w h a t i t w i l l take to get staff ready for the initiative.

T h e G I A n T c o n s i s t s o f m o r e t h a n 2 0 0 items that measure 18 human factors that w i l l d r i v e o r d e r a i l a n i n i t i a t i v e , s u c h a s u rg e n c y, i n n o v a t i o n , o w n e r s h i p , c o m m i tment, trust and sabotage These items are b a s e d o n a c o m b i n a t i o n o f c u t t i n g - e d g e r e s e a rc h , o rg a n i z a t i o n a l a n d l e a d e r s h i p d e v e l o p m e n t t h e o r y, a n d t h e c o l l e c t i v e coaching and consulting experience of the tool’s creators

T h e G I A n T i s u n i q u e i n s e v e r a l w a y s

First, it is individually tailored to assess preparedness for a specific organization initiative (i e the “great idea”) Second, whereas most comprehensive assessments focus on individual executives, the GIAnT assesses

the organization as a whole Third, many of the companies that use assessment tools to inform decision-making limit themselves to e m p l o y e e f e e d b a c k s u r v e y s T h e s e t o o l s often indicate what people are saying but not what caused them to feel the way they do The GIAnT, on the other hand, indicates not simply if people believe in an initiative, b u t w h y t h e y d o o r d o n ’t F i n a l l y, t h e G I A n T c o r r e c t s f o r p o s i t i v e a n d n e g a t i v e i m p r e s s i o n m a n a g e m e n t ; i n o t h e r w o r d s , the degree to which respondents portrayed themselves or their organization in an exaggeratedly favorable or unfavorable light

T h e G I A n T i s a d m i n i s t e r e d o n l i n e t o e a c h e m p l o y e e T h e r e s u l t i n g r e p o r t i s organized in a top-down format, beginning with a broad snapshot of the organization at 50k feet, and then drilling down by variables of interest The GIAnT indicates the percentage of the organization as a whole and the percentage of each business unit w i t h i n t h e o rg a n i z a t i o n t h a t i s a l i g n e d , r e s i s t a n t , c o n f l i c t e d / a m b i v a l e n t , a n d a p athetic towards the initiative

Leadership can take this information and use it to decide whether the organization is ready for a costly initiative Since results are also provided for each business unit, company leaders are able to determine where the most and least support lies Once they h a v e t h i s i n f o r m a t i o n i n h a n d , t h e y c a n d e c i d e w h i c h g e o g r a p h i c a l o r f u n c t i o n a l unit would be optimal for the disruptive initiative’s launch

P e r h a p s m o s t i m p o r t a n t l y, t h e G I A n T i n d i c a t e s w h y s t a f f m e m b e r s a r e e i t h e r a l i g n e d w i t h o r p u s h i n g b a c k a g a i n s t t h e i n i t i a t i v e C o m p a n y l e a d e r s c a n u s e t h i s i n s i g h t t o e x p l o i t t h e f a c t o r s s u p p o r t i n g alignment and to correct the factors causing push back

T h e e n t i r e a s s e s s m e n t p r o c e s s s p a n s about 4 weeks, and includes aligning leadership on an initiative and individualizing the GIAnT accordingly, a proprietary solu-

18 INSIGHT www icpas org/insight htm S T R AT E G Y

A n e w t o o l p ro m i s e s t o a ss e ss yo u r o r g a n i z a t i o n ’ s re a d i n e ss t o t a ke o n l a r g e - s c a l e i n i t i a t i ve s .

Cheryl

S Wilson,

CPA, principal of Wilson-Heidrich Associ-

CPA, principal of Wilson-Heidrich Associ-

explains, “A major capital improvements program along with the related financing has been approved for this corporation by the Board of Directors. Millions of dollars are to be spent over the next three years The additional debt service and continual increase in operating costs make improved operating efficiency and new revenue streams an imperative A focused, expeditious launch of a new initiative was called for and the Board didn’t have the time or skill sets to obtain the information we needed to evaluate our options or determine the probability of success

“I thought if we could obtain the organizational reasons why certain past initiatives were never fully launched or, if launched, were not successful, then this insight would provide the Board with the necessary information to modify our strategy and its e x e c u t i o n t o a l l o w u s t o a c h i e v e o u r d e s i r e d g r o w t h o b j e ctives,” she explains “The organizational assessment we chose, the GIAnT, could provide objective information we otherwise could not obtain ”

Wilson goes on to explain that, in essence, the GIAnT provides a virtual walk around the entire organization a walk around that leadership would never have the time to take on its own. It also provides a data-driven basis for predicting whether an initiative is likely to succeed and what needs to be done to increase the likelihood of success

“We interacted with the entire organization in less than two months and increased engagement throughout all levels of the corporation, therefore achieving alignment of the Board, CEO a n d m a n a g e m e n t a n d s t a f f o n a n i n n o v a t i v e i n i t i a t i v e , ” s a y s Wilson “Inv olv ing the e ntire org a niz a tion in the a sse ssme nt emphasized the importance of the project, instilled urgency and energized the management and staff.”

Today, the Board and CEO are taking action much more rapidly than they have in the past, says Wilson “Board member attendance and participation at meetings has increased. The entire Board is engaged and aligned on new initiatives with targ e t e d o u t c o m e s a n d c o m p l e t i o n d a t e s C o m m u n i c a t i o n h a s improved significantly and members of the Board are working as a team to address issues.”

Ted Santos, CEO of Turnaround Investment Partners (TIP), partners wi th CEOs and board members, serves as a trusted advi sor to compani es goi ng through change, and coaches ex ecuti ves to uncover and penetrate untapped markets, shi ft corporate cultures and al i gn staff and management to the corporate vi si on Dr Edward M Petrosky, a psychol ogi st by trai ni ng, focuses on o r g a n i z a ti o n a l a l i g n m e n t, r e te n ti o n , e x e c u ti v e de v e l o pm e n t, successi on pl anni ng, outcome measures and hi ri ng He has presented at nati onal professi onal conferences, publ i shed i n peerrevi ewed sci enti fi c j ournal s, and taught 11 di fferent psychol ogy courses to undergraduate and graduate students Dr Petrosky mai ntai ns a pri vate consul ti ng practi ce i n Forest Hi l l s, NY V i si t www turnaroundi p com for more i nformati on on GIAnT

You’ve come to us for years for high-quality education –now let us come to YOU! On-Site Learning allows your staff to receive customized training with their own colleagues without having to leave the office. To learn more, contact: Katrina Street at 800-634-6780, option 4, or Mary Ellen Thomas at 800-993-0407, ext. 298 Illinois CPA Society’s ON-SITE LEARNING PROGRAM If you are ready to sell your practice, start with Accounting Practice Sales. We have thousandsof qualifiedbuyers waiting to buy a practice. Selling doesn’t have to be painful. Call Trent Holmes today! 1.800.397.0249 trent@accountingpracticesales.com www.AccountingPracticeSales.com NORTH AMERICA'S LEADER IN PRACTICE SALES Sometimes You Need A Pro www icpas org / insight htm MARCH/APRIL 2009 19 t i o n t o m a x i m i z e t h e r a t e o f e m p l o y e e G I A n T c o m p l e t i o n , experientially based feedback sessions to leadership and staff, and action plan development and

execution

a t e s , F i n a n c i a l A c c o u n t i n g A d v i s o r s , s e r v e s o n a b o a r d t h a t r e c e n t l y u s e d t h e G I A n T t o l a u n c h a n e w i n i t i a t i v e A s s h e

Student Ambassadors

Want to impress recruiters straight out of college? This is how to do it.

By Derrick Lilly

By Derrick Lilly

Hello, I’m a Student Ambassador ” Sounds impressive, right? It seems l i k e a n i c e t i t l e t o i n c l u d e o n a resume or grad school application. But for those chosen to represent the accounting profession, it’s more than just a title.

The Illinois CPA Society (ICPAS) Student Ambassador Program was launched in conjunction with the CPA Endowment Fund of I l l i n o i s i n A u g u s t 2 0 0 8 , w i t h s i x s t u d e n t s serving five campuses College of DuPage, Eastern Illinois University, Illinois State Univ e r s i t y, S o u t h e r n I l l i n o i s U n i v e r s i t y a n d Western Illinois University.

T h e i n i t i a t i v e ’s m i s s i o n i s t o i n c r e a s e awareness of the importance of finance in o u r l i v e s , e n c o u r a g e s t u d e n t s t o c o n s i d e r accounting as a career choice, and publicize ICPAS benefits such as scholarship opportunities, CPA Exam awards and student memberships

Being a student ambassador means interacting with friends and colleagues, deve l o p i n g m a r k e t a b l e p r o f e ssional talents, garnering support from seasoned professionals and establishing networks for future success In other words, it means bridgi n g t h e g a p b e t w e e n s t u d y and the real world

“Serving as a student ambassador has given me many experiences to pull from during job interviews, and I believe it has added value to my resume Being one of the first ambassadors, I think employers are impressed and curious about the program It gives me a chance to talk about the ways I have been investing in my career,” says Heather Koertge, 21, an accounting undergraduate

and student ambassador at Eastern Illinois University.

“Many students at College of DuPage are unsure of their future careers,” says Stacey S a m s , 1 9 , a n a c c o u n t i n g u n d e rg r a d u a t e and student ambassador. “I want to expose o t h e r s t o t h e o p p o r t u n i t i e s a v a i l a b l e i n accounting and hopefully help them find a passion within the field,” she explains Brandon Vagner, 22, an accounting graduate student at Southern Illinois University, C a r b o n d a l e , a d d s , “ H a v i n g t h e a b i l i t y t o impact a student’s life in a positive way is extremely important to me. It gives me the chance to give back to my university and the accounting profession in general ”

“The ambassadors are given the responsibility to present programs and events for their fellow students,” explains Kathy Horton, CPA/CMA/MBA, professor of accounting at College of DuPage and chair of the ICPAS Student Outreach Task Force, under w h o s e u m b r e l l a t h e s t u d e n t a m b a s s a d o r p r o g r a m r e s i d e s . “ These experiences will add immensely to their personal and professional growth They will be so much further along than their peers when they start their careers. Not only does the student, their campus and the ICPAS benefit, but the profession as a whole benefits from the positive exposure It is truly a win-win situation ”

W h a t ’s m o r e , t h e I C PA S g r a n t s s t u d e n t ambassadors a stipend and academic financial aid through its Endowment Fund The Society awards more than $126,000 annua l l y i n s c h o l a r s h i p s t o s t u d e n t s w o r k i n g towards their CPA certification.

C o m m e n t i n g o n p l a n s f o r t h e f u t u r e d e v e l o p m e n t o f t h e S t u d e n t A m b a s s a d o r Program, Horton says, “My hope is that it can be extended to more and more schools in the state ”

If you woul d l i ke to hel p i n devel opi ng the Student Ambassador Program, contact Kel l y E Sl ay, ICPAS students and young professi onal s speci al i st, at sl ayk@ i cpas org

20 INSIGHT www icpas org/insight htm S T U D E N T S

“

Give back to the profession that’s been good to you Your support means a great deal to me and will help me achieve my goal of becoming a CPA. THE CPA ENDOWMENT FUND OF ILLINOIS Provides Scholarships for Accounting Students | Funds Career Awareness Programs Promotes Diversity in the Profession | Develops New Leaders The CPA Endowment Fund of Illinois, working in cooperation with the Illinois CPA Society, raises philanthropic support to fund programs that nurture and sustain the CPA profession. Paving the Way for Tomorrow’s CPAs For more information or to make a tax-deductible gift: Julie Lenner, Director of Development, 312.993.0407, ext. 290 or go to www.icpas.org.

Debt Navigator

Exchange of debt for equity gives partnerships a route to certainty

By Harvey Coustan, CPA

Tax considerations often mitigate the effects of an economic downturn.

P a s s - t h r o u g h e n t i t y o w n e r s w h o have loaned money to their businesses over t h e y e a r s a r e n o w l o o k i n g f o r w a y s t o spruce up their balance sheets and reduce their debt service where cash is short.

In the past, there was some uncertainty concerning the federal tax treatment of an exchange of debt for equity in a partnership setting However, Section 108 of the Intern a l R e v e n u e C o d e l i s t s s i t u a t i o n s w h e r e income from cancellation of indebtedness ( C O D i n c o m e ) i s e x c l u d e d f r o m t a x a b l e i n c o m e , a n d t h e A m e r i c a n J o b s C r e a t i o n Act of 2004 extended a limitation on inclus i o n t o p a r t n e r s h i p d e b t t h a t p r e v i o u s l y applied only to corporate debt

After amendment, if a partnership transfers capital or profit interest in the partnership to a creditor to satisfy debt, the partn e r s h i p i s t r e a t e d a s h a v i n g s a t i s f i e d t h e debt with an amount of money equal to the interest’s fair market value So, if that value is less than the amount of debt satisfied, the

C O D i n c o m e r e p o r t e d i s l i m i t e d t o t h e e x c e s s a m o u n t o f d e b t s a t i s f i e d o v e r t h e transferred interest value The COD income is allocated to partners who were partners immediately before the transaction

Proposed regulations interpreting the statute change were issued last fall, and hearings were held in February In addition to repeating the statutory language, the proposals provide a method for valuing the partnership interest transferred to satisfy the debt if four requirements are met The method results in a “liquidation value,” representative of the amount of cash the creditor would receive if the partnership liquidated all of its assets at fair market value immediately after the interest for debt transfer

The four requirements are:

(

1) Maintenance of capital accounts under Regs §1 704-1(b)(2)(iv)

(2). The creditor, debtor partnership, and i t s p a r t n e r s t r e a t t h e v a l u e o f t h e d e b t a s equal to the liquidation value of the debtfor-equity interest for purposes of determining the exchange’s tax consequences

22 INSIGHT www icpas org/insight htm TA X

making your life easier

www.CCFLinfo.org

Information & Research Center

Invaluable research assistance from professional librarians, access to a lending library of more than 6,000 titles, links to resources on frequently requested topics, and informal consultation from a volunteer group of members.

Executive Education

Competency building programs developed specifically for corporate finance professionals. Strengthen your business skills and bring value to your company through the “Certificate Program.”

NewsFlash

Bi-weekly email digest of the latest corporate finance news and trends.

upcoming events

Hot Topics Webcasts

Accessible via your computer, these programs are designed to inform you about emerging issues as they unfold.

Career Center

Hundreds of job opportunities, résumé posting service and career resources. Plus, access to career coaches (fee-based service).

Breakfast Series

Breakfast meetings to network with colleagues, share best practices and learn from experts.

March 17, 2009 - Rosemont, Illinois CONTROLLERS CONFERENCE: The Changing World of Corporate Finance. Are Your Ready?

May 11, 2009 - Chicago, Illinois

Astute Cash Flow Management: Improving Company Value

Marian Powers, PhD - Adjunct Associate Professor, Kellogg School of Management, Northwestern University

May 12, 2009 - Chicago, Illinois International Issues Conference

The Center for Corporate Financial Leadership’s Executive Education Certificate Program

= Core Class = Elective Class

Separate yourself from the pack. Complete five core classes and three electives to receive your certificate. For more information, visit www.CCFLinfo.org

The Center for Corporate Financial Leadership is a service of the Illinois CPA Society

e

e c

The Illinois CPA Society has made it easier than ever to identify the up and comers in the accounting profession. Just visit the Illinois CPA Society’s Career Center and search student resumes to fill your next internship.

All across the state, Illinois CPA Society student members have uploaded their resumes for you to view online. These students represent the future of the profession and your guidance as a seasoned member of the profession can put them on the right track. These students are available for summer, fall or spring internships.

(3) The exchange is an arms-length transaction, and ( 4 ) S u b s e q u e n t t o t h e e x c h a n g e , t h e p a r t n e r s h i p d o e s n o t r e d e e m a n d n o p e r s o n r e l a t e d t o t h e p a r t n e r s h i p p u rc h a s e s t h e d e b t - f o r- e q u i t y i n t e r e s t a s p a r t o f a p l a n p r i n c i p a l l y i n t e n d e d t o avoid COD income

Absent of compliance with these requirements, all facts and circ u m s t a n c e s w i l l b e c o n s i d e r e d t o d e t e r m i n e t h e d e b t - f o r- e q u i t y i n t e r e s t ’s f a i r m a r k e t v a l u e f o r p u r p o s e s o f a p p l y i n g I R C § 1 0 8 ’s COD rules.

If the partnership maintains capital accounts in accordance with the regulations for determining the presence of “substantial econ o m i c e f f e c t ” o f p a r t n e r s h i p a l l o c a t i o n s [ R e g u l a t i o n s § 1 7 0 41(b)(2)(iv)], the creditor partner ’s capital account will be increased by the fair market value of the indebtedness exchanged

The proposed regulations also indicate that, with some exceptions, certain other rules applicable to an exchange of property for a n i n t e r e s t i n a p a r t n e r s h i p s h o u l d a p p l y t o t h e d e b t - f o r- e q u i t y exchange. Under this application, neither the creditor nor the partnership will recognize gain or loss on the debt’s contribution for equity in the partnership. Unpaid interest (including accrued original discount), rent, or royalties are not eligible for this treatment.

Under the proposal, the creditor ’s tax basis in the partnership interest is increased by the creditor ’s tax basis in the debt transferred (See IRC §721) Therefore, the creditor does not report a tax loss equal to the excess of the transferred debt’s basis over the value of the partnership interest received Consistent with this, the holding period for the debt-for-equity interest includes the period during which the creditor held the debt [See IRC §§722 and 1223(1)]

The proposed regulations include an example: AB partnership owes C $1,000. In an arms-length transaction, C agrees to cancel the debt in exchange (debt-for-equity exchange) for an equity interest (debt-for-equity interest). The four requirements are satisfied. The fair market value of the debt is $700 This is based on the liquidation value of the debt-for-equity interest AB transfers C’s capital account is increased by $700 AB is treated as satisfying the debt for $700 Although this example doesn’t specifically indicate it, the COD income recognized by AB should be $300

If adopted as presently written, the proposals should provide a roadmap for determining the tax consequences that flow from a transaction that likely will become more common in these troubled economic times. A method for determining transferred interest fair market value that can be used in valuing debt provides certainty in a sometimes difficult calculation.

By applying the non-recognition rules for the exchange, a potential mismatch is avoided If the creditor partner was a partner before the transaction, and the non-recognition rules did not apply, a loss might be where the value of the debt-for-equity interest received was less than basis in the debt It’s likely that the loss would be a capital loss, and the creditor partner would have ordinary income on his share of the partnership’s COD income

I’ll keep an eye on this topic as it unfolds In the meantime, my suggestion is that you don’t rely on the proposed language.

Harvey Coustan i s an Ernst & Y oung reti red partner He i s presentl y c

24 INSIGHT www icpas org/insight htm

u l ti

g

s u bs ta n ti v e te c h n i c a l a n d pr o f e s s i o n a l s ta n da r ds i ssues

an ex pert wi tness i n a number of cases

o n s

n

o n

and has been

The best and brightest interns are at your fingertips.

Search by various criteria, including: Geographic Location Timeframe Paid or College Credit Internships Visit www.icpas.org and click on the Career Center.

appointed committees & task forces For more information about specific committee or task force activities and experience requirements, please contact Jennifer Schultz at 312.993.0407, ext. 211 or visit us online at www.icpas.org. share your skills & talents exercise your leadership grow your experience develop relationships that last a lifetime Opportunities are available in the areas of: > Professional Practice/Management > Quality Assurance and Public Protection > Member Programs/Special Issues Illinois CPA Society 2009-2010

HEAVY BURDEN

The Of fice of Financial S tability promises to lif t us from our rocky economy and place us safely on even ground But can it deliver on the promise?

By Carolyn Tang

O c t o b e r 1 0 , 2 0 0 7 . T h e D o w I n d u s t r i a l Av e r a g e closed at 14,078.69. NASDAQ stood strong at 2,811.61. Analysts w e r e , f o r t h e m o s t p a r t , o p t i m i s t i c a s t h e d o m e s t i c e c o n o m y entered the fourth quarter.

O c t o b e r 1 0 , 2 0 0 8 . T h e D o w I n d u s t r i a l Av e r a g e closed at 8,451.19, a drastic 40-percent drop in value compared to the previous year. Stalwart stock AIG was removed from the I n d e x a n d r e p l a c e d w i

1,649.51, a 41-percent reduction in value. Analysts scrambled to keep up with the unraveling banking and finance sector.

www icpas org / insight htm MARCH/APRIL 2009 27

K

t h

r a f t . N A S D A Q s t o o d i n t a t t e r s a t

You could see the first fissure back in August, if you knew where to look. The FDIC took over XYZ Bank, then, within months, the giants began to fall When one fell, another was shaken First, a government takeover of troubled siblings, Fannie Mae and Freddie Mac. Then, investors helplessly watched as prestigious Lehman Brothers’ frenzied calls for help went unanswered Washington Mutual and AIG followed soon after, banking bastions no longer

Such change in the span of a year Could we have avoided this crisis? In hindsight, the temptation was too great. Interest rates were at such a record low that banks were almost incentivized to e x t e n d s u b p r i m e l o a n s t o l e s s - t h a n - q u a l i f i e d b o r r o w e r s M a n y consumers, both at the personal and the commercial level, were sufficiently enticed by free-flowing credit that they underestimated their security and overextended their spending

But as in every fairytale, doomsday finally came Foreclosed homes, a rash of bankruptcies, and complicated derivatives that, when unraveled, yielded nothing. The castle in the clouds collapsed, and at the end of the day, there was nothing on the books but empty, extended capital The economy grinded to a halt as credit froze and all forms of lending ceased.

“Imagine that you were driving down the road on a two-lane highway,” explains Gerry Sparrow, portfolio manager of Sparrow Growth Fund “You trust that the other guy is going to stay in his lane, but that doesn’t always happen. And if you see an accident like that, you start driving a little bit better, keep your eyes open, and you’re more careful about speed and such Right now, with the mortgages that went bad on the books of all the financial institutions, you can see why they’re a little reluctant to loan money.”

The US economy is reliant on the flow of credit For the system t o w o r k , b a n k s m u s t l e n d t o b u s i n e s s e s , c o n s u m e r s , a n d e v e n other banks However, when there is no trust in the system, there is no lending.

“The credit freeze up was a terrible problem for financial instit u t i o n s T h e y s i m p l y w e r e u n a b l e t o u n d e r s t a n d v a l u a t i o n s o n assets, and weren’t willing to lend to each other even That was a huge, terrible problem for those institutions and for our economy as a whole,” says John Douglas, a partner with the law firm of Paul Hastings

Wi t h b a n k s f e a r f u l a t t h e c r o s s r o a d s , c o n s u m e r s a n d b u s inesses clamped down on spending even harder “It is a vicious cycle,” says Dan Sondhelm, partner of SunStar, a finance indust r y c o n s u l t i n g f i r m . “There is significant fear and lack of confidence in the marketplace. As a result, businesses and individuals are paralyzed in terms of earning and spending It’s difficult for Americans to get the credit they need to pay bills, buy cars, renovate or buy homes At the same time, it‘s difficult for businesses to get paid from these services and expand,” he explains

And so, in October 2008, the US government passed the Emergency Economic Stabilization Act, which authorized the Treasury to establish a troubled asset relief program (TARP). Seven-hundred billion dollars was earmarked to lubricate the country’s economic gears: $250 billion was allocated upon enactment, with an additional $100 billion disbursed if the President certifies its need to Congress A final $350 billion will be disbursed upon presidential request, unless Congress disapproves. To administer this kitty, the Act established a new Office of Financial Stability (OFS), headed by Interim Assistant Secretary for Financial Stability Neel Kashkari

“The law gives the Treasury Secretary broad and flexible authority to purchase and insure mortgage assets, and to purchase any other financial instrument that the Secretary, in consultation with the Federal Reserve Chairman, deems necessary to stabilize our financial markets including equity securities,” Kashkari stated in a speech to the Institute of International Bankers in Washington, D C

Indeed, such a statement gives the Treasury significant leeway in determining how to apply the funds However, regardless of the vehicle, the OFS’ main charge is to provide the financial system with the resources necessary to jumpstart stalled markets

“This $700 billion is really designed to get our financial markets working again. Otherwise, economic activity as we know it may slow down dramatically, with severe repercussions in the economy,” says Douglas

Joseph Ament, professor of accounting and taxation at Roosevelt University, Chicago says the creation of the OFS is necessary in order to provide the financial system with the resources necessary to help alleviate the serious circumstances the domestic economy is facing in many of its basic and major sectors “In recent past

28 INSIGHT www icpas org/insight htm

“ T h e vo l a t i l i t y a n d vo l u m e o f t r a d i n g o n t h e ex c h a n g e s , a n d the deep dr ops and steep climbs in mar kets dail y, sometimes sev-

e r a

l

t i m e s

u p a n d d o w n e a c h d a y, a r e a c o n t i n u e d i n d i c at i o n of the g r eat uncer tainties pr evalent in the economy.”

decades, there hasn’t been a perceived need for such an agency in the US government. With the international and national financial crisis, such a requirement has been determined by our Congress and our Treasury,” Ament comments.

In conjunction with the OFS, the Treasury also announced the appointment of several key interim TARP leaders, including Tom Bloom as interim CFO, Jonathan Fiechter as interim CRO, Donna Gambrell as interim chief of homeownership preservation, Don Hammond as interim CCO, and Reuben Jeffrey as interim CIO.

No doubt an experienced cohort. But will it be enough? “Does anyone have the experience and knowledge to deal with the catastrophic set of circumstances that is now being faced?” Ament asks.

Initially, the program was established to purchase troubled assets from financial institutions, in essence removing them from the system However, this proved to be a difficult task “It’s actually very hard, and very complicated,” Douglas explains “It’s tough to figure out the pricing Once you buy assets, you’ve got to figure out what to do with them If you’re buying problem assets, you’ve got to figure out how to manage them The government is not a particu l a r l y g o o d m a n a g e r o f p r i v a t e - s e c t o r a s s e t s , s o i t w o u l d m o r e likely try to sell them Selling them might exacerbate losses ”

So instead the US government used the bailout funds to purchase preferred stock in some of the nation’s largest banks: Goldman Sachs, Morgan Stanley, JP Morgan Chase, Bank of America, Citigroup, Wells Fargo, Bank of New York Mellon and State Street C o r p T h e g o v e r n m e n t i s a l s o e x p e c t e d t o p u rc h a s e a d d i t i o n a l equity from potentially thousands of other insured financial institutions; raise the FDIC cap on deposit insurance for certain types of b a n k a c c o u n t s ; a n d r e s t r i c t e x e c u t i v e c o m p e n s a t i o n , b o n u s e s , “golden parachutes” and other incentives at institutions participating in TARP

“I think what happened is that the government decided that the best bang for the buck would be simply to take institutions that really are the lifeblood of our economy and strengthen those institutions through the capital program. Perhaps this approach would be easier, better and, in the long run, more effective. I hope they’re right,” says Douglas.

While many institutions have queued up for their share, there will be a small number of financially strong institutions that will c h o o s e n o t t o a p p l y f o r g o v e r n m e n t f u n d s . “ F r o s t B a n k s h a r e s down in Texas is one example,” Douglas explains.

“There also will be a number of institutions that won’t get the money because they are so financially weak that the Treasury is just not going to do it, and the regulators won’t support it. Those

institutions will either have to find new capital, find a merger partner, or fail. That’s going to be pretty dramatic,” says Douglas.

And with that, Douglas also notes the subtle irony of the bailout process “This money was put in place to strengthen the financial system, and yet it will accelerate the failure or consolidation of a number of institutions ”

“This is an experimental process an indicator of whether the business community is supportive of the steps that the Administrat i o n i s t a k i n g i n t h e f i n a n c i a l m a r k e t s , ” A m e n t e x p l a i n s “ T h e volatility and volume of trading on the exchanges, and the deep drops and steep climbs in markets daily, sometimes several times up and down each day, are a continued indication of the great uncertainties prevalent in the economy.”

It’s not as though the government has been entirely hands off with the nation’s economy In fact, the current level of involvement rivals that of the Great Depression. Additionally, with the purchase of equity, the government has in effect intertwined the fates of the banking sector with that of US taxpayers

“The levers the government is using on the fiscal and monetary side are normal levers, but I think that the degree is different,” says Sparrow “The magnitude is much larger than people expected, and bigger than anything in recent memory.”