ON BECOMING FUTURE READY

Breaking Through the Glass Ceiling

Recruiting in the New Roaring 20s

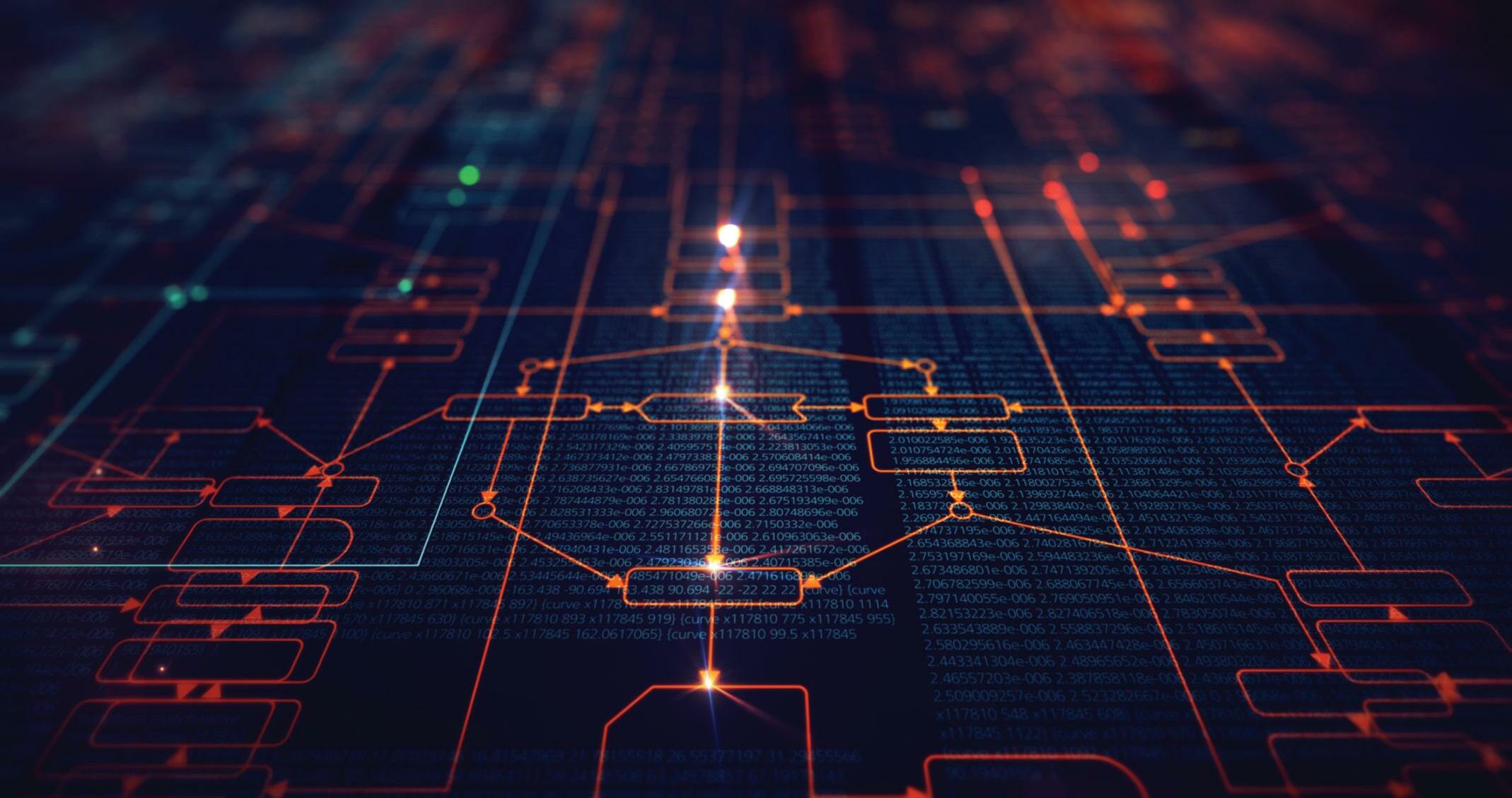

Building Blocks of Blockchain

Expanding ESG Emphasis

Upskilling Your EQ

Getting RPA Right

Exploring the issues that shape today’s business world

Spring

2020

By Dorri C McWhorter, CPA , CGMA , CITP, MBA

By Dorri C McWhorter, CPA , CGMA , CITP, MBA

The Building Blocks of Blockchain

Bridget McCrea

Wilder

34 Director ’s Cut

The Business Case for Expanding ESG Emphasis

By JoAnna Fu Simek,

Publisher/President & CEO Note: The COVID -19 pandemic continues to dominate our world, and we are all doing our part to stop the spread of the virus We understand that you, our members, have had your lives disrupted, and we hope that you are safe and healthy As we all look forward to a post-pandemic future, we hope that this issue of Insight will provide you with thoughtful information on a variety of important issues impacting the accounting and finance profession

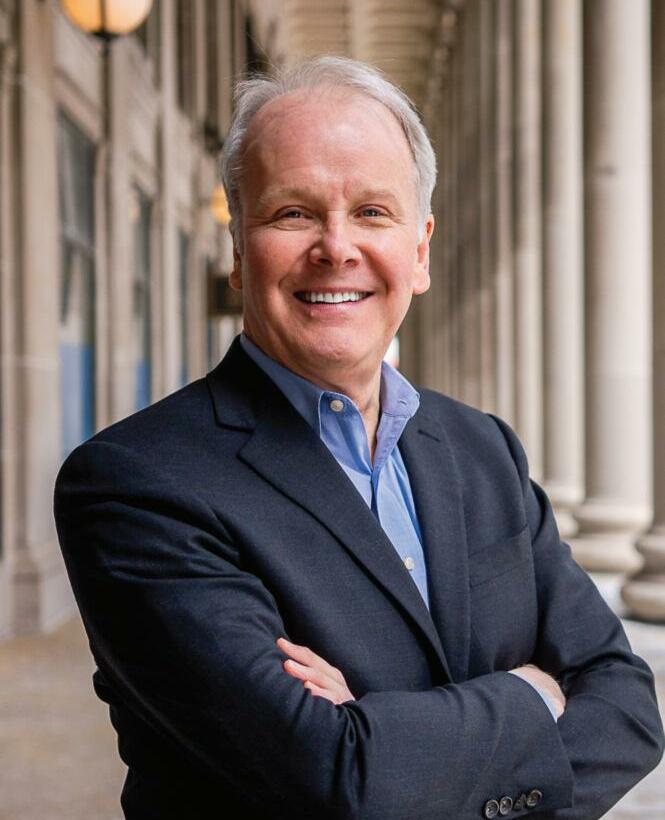

Todd Shapiro

By

Kristie

P Paskvan, CPA

, MBA 36 Financially Speaking Building Women’s Wealth

By Mark J Gilbert, CPA/PFS,

38 Leadership Matters

MBA

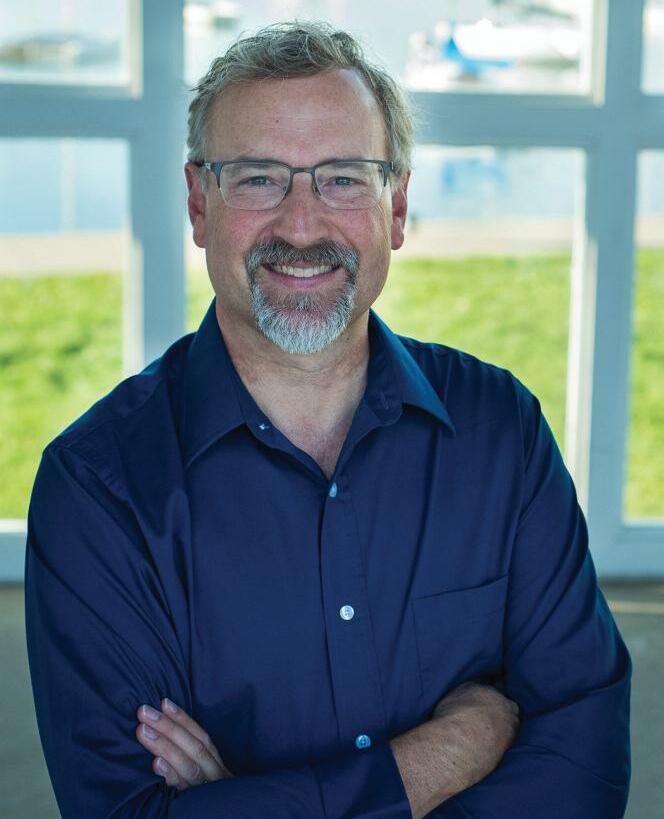

The Case for Upskilling Your EQ By Jon Lokhorst, CPA , ACC

40 Ethics Engaged

Character: What CPAs Can Learn From Aristotle

By Elizabeth Pittelkow

Kittner,

CPA , CGMA , CITP, DTM

42 Practice Perspectives Are You Ready to Fire Your Worst Clients?

By Art Kuesel

By Art Kuesel

44 Tax Decoded Illinois Tax Potpourri: Three Issues of Interest to Taxpayers

By Keith Staats,

JD

46 Inside Finance

Non- GAAP Measures: Seeking Clarity

By Nancy Miller, CPA

48 Firm Journey

How ‘OK , Boomer ’ Is Holding You Back

By Tim Jipping, CPA , CGMA

2 | www icpas org/insight SPRING 2020 www icpas org/insight FOCUSING ON BECOMING FUTURE READY 2 22 5 2 6

2 9 REVVING UP RECRUITING IN THE NEW ROARING 20s BREAKING THROUGH THE GLASS CEILING spotlights

’s View CPAs Are the Superheroes of Business!

-

4 Chair

6 Today ’s CPA The Strategy? No More Excuses

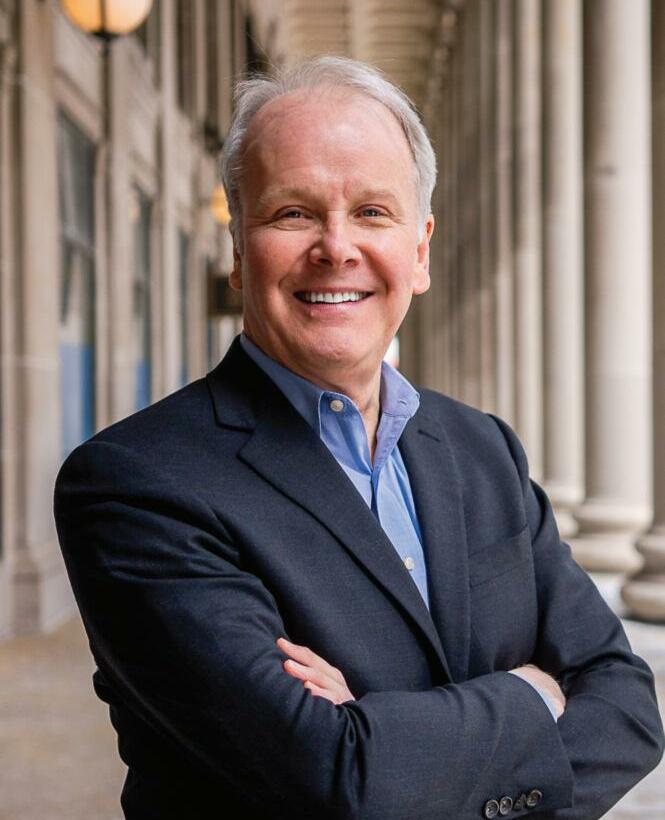

Todd

8 Capitol Report Spring Cleaning in the Statehouse

Esq 50 Gen Next Three Lessons for Leaping Into Leadership

By

Shapiro

By Marty Green,

CPA , MST 52 IN Play Q&A With Anna Kooi, CPA, Partner and National Financial Services Practice Lead at Wipfli LLP

trends

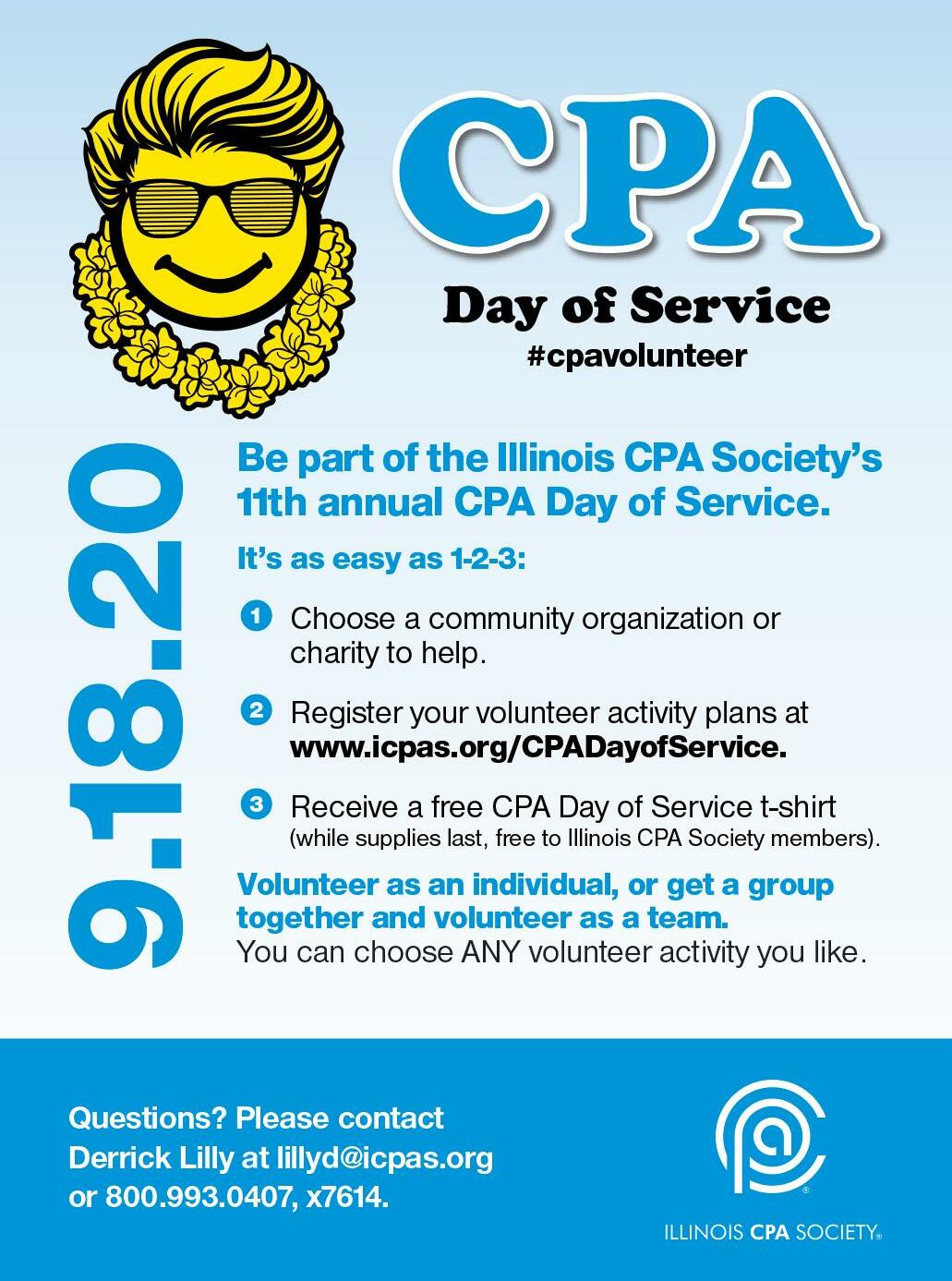

By Derrick Lilly

14 Technology

insights

By

16 Artificial Intelligence The Bots Are Coming By Lisa

1 82 1

ILLINOIS CPA SOCIET Y 550 W Jackson Boulevard, Suite 900, Chicago, IL 60661

www icpas org

Publisher/President & CEO

Todd Shapiro

Editor Derrick Lilly

Assistant Editor

Hilary Collins

Creative Director

Gene Levitan

Copy Editors

Nancy Clarke | Mari Watts | Jennifer Schultz, CPA

Photography

Derrick Lilly | iStock

Circulation

John McQuillan

ICPAS OFFICERS

Chairperson

Dorri C McWhorter, CPA, CGMA, CITP | YWCA Metropolitan Chicago

Vice Chairperson

Thomas B Murtagh, CPA, JD | BKD CPAs & Advisors

Secretar y

Mary K Fuller, CPA | Shepard Schwartz & Harris LLP

Treasurer

Jonathan W Hauser, CPA | KPMG LLP

Immediate Past Chairperson

Geoffrey J Harlow, CPA | Wipfli LLP

ICPAS BOARD OF DIRECTORS

John C Bird, CPA | RSM US LLP

Brian J Blaha, CPA | Wipfli LLP

Jennifer L Cavanaugh, CPA | Grant Thornton LLP

Stephen R Ferrara, CPA | BDO USA LLP

Jennifer L Goettler, CPA, CFE | Heinold Banwart Ltd

Scott E Hurwitz, CPA | Deloitte LLP

Joshua D Lance, CPA, CGMA | Lance CPA Group

Enrique Lopez, CPA | Lopez and Company CPAs Ltd

Elizabeth Pittelkow Kittner, CPA, CGMA, CITP, DTM | International Legal Technology Association

Deborah K Rood, CPA | CNA Insurance

Seun Salami, CPA | Teachers Insurance and Annuity Association of America

Stella Marie Santos, CPA | Adelfia LLC

Brian B Stanko, Ph D , CPA | Loyola University

Mark W Wolfgram, CPA | Bel Brands USA Inc

BACK ISSUES + REPRINTS

Back issues may be available Articles may be reproduced with permission Please send requests to lillyd@icpas org

ADVERTISING

Want to reach 23,000+ accounting and finance professionals? Advertising in Insight and with the Illinois CPA Society gives you access to Illinois’ largest financial community Contact Mike Walker at mike@rwwcompany com

Insight is the magazine of the Illinois CPA Society Statements or articles of opinion appearing in Insight are not necessarily the views of the Illinois CPA Society The materials and information contained within Insight are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is Insight ’ s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet Insight ’ s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within Insight, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for Insight The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering Insight Insight (ISSN1053-8542) is published four times a year, in spring, summer, fall, and winter, by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA, 312 993 0407

Copyright © 2020 No part of the contents may be reproduced by any means without the written consent of Insight Send requests to the address above Periodicals postage paid at Chicago, IL and at additional mailing offices POSTMASTER: Send address changes to: Insight, Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA

EDUCATION | INFORMAT ON | ADVOCACY | CONNECT ONS

today at www.icpas.org

Renew

covered.

We’ve got

you

Take advantage of all the ways your ICPAS membership can help you to keep moving forward.

chair ’sview

A LETTER FROM YOUR BOARD CHAIR

DORRI C. MCWHORTER, CPA, CGMA, CITP, MBA CHIEF EXECUTIVE OFFICER, YWCA METROPOLITAN CHICAGO

CPAs Are the Superheroes of Business!

The way forward for CPAs all comes down to strategy.

Dear Santa,

Ho w are yo u? Yo u w ill never believe what I want for X-mas Ju st 3 simple thing s: 1) To make ever yo ne alive to day be ok. 2) To g ive m e a little so m ething, like a picture of yo u, to sho w peo ple yo u are real. (If yo u have a picture w ith yo u no w, please g ive m e o ne if possible.)

3) This is a big o ne! What I want is for yo u to ask my parents if I co u ld be their acco untant for 1 mo nth. It w ill not cost them a thing! ( Well maybe a few $100s! Ha-Ha). I ju st kno w I co u ld do it They can tr u st m e I ju st kno w I can do it! Please ask them for m e! If they say no, please ask them to g ive m e an explanatio n why or why not. I co u ld start Jan. 1st, 1985. Please have them see m e for more info Thank yo u, Santa Lo ve, yo ur fr ien d, Dor r i McGee

P S I left yo u a sucker! Wr ite back please

As I look at my 11-year-old writing style, I haven’t changed much! And maybe that’s what I want you to know about me I have wanted to be an accountant for what feels like my entire life Don’t believe me? I have photos of my childhood letter to Santa to prove it! My point in sharing this is that I want you to see that I care deeply about our profession So deeply that I literally wrote a non-fiction book report about accountants in middle school and watched the Academy Awards to see the PwC (Pricewaterhouse at the time) folks present the Oscar envelopes But in all seriousness, we play such an important role in society, from clearly supporting the business world to helping families make good financial decisions

I consider myself fortunate because my requests of Santa all those years ago have mostly been filled I am still waiting on that picture! Today, I am a leader in the nonprofit world, working to make sure “ everyone alive today” is okay And while I didn’t officially become my parents’ accountant, I rose to leadership levels at various accounting and management consulting firms and businesses of all sizes Now, I have been appointed to lead the Illinois CPA Society Board of Directors and it is truly a little girl’s dream come true!

What can I dream of next? More importantly, what can we dream of next? Our profession is at a crossroads Our challenge is making sure that we stay relevant and evolve with the speed of change that is

happening in business The roles that we play as CPAs are changing, but we are uniquely positioned to redefine what those roles are

As CPAs, we understand how businesses work We know what the growth drivers are We know where to push, pull, and play it safe We need to express this and share our insights We need to become strategic partners to our clients and companies and grow into new markets That, I believe, is how we move forward

And so, having been in just about everybody’s shoes throughout my career, I hope to actively develop meaningful content and education for all CPAs as we embark on moving us from being not only the most trusted business advisors but also the most strategic advisors Dare I say that CPAs are well positioned to be the “superheroes of business” as we continue to hone our craft to save the day and help companies and clients avoid pitfalls!

I admit that I’m still a little girl at heart and still love the idea of Santa and superheroes! I am excited to be on this journey with you as your chairperson, and I look forward to engaging with you throughout the year ahead, gaining your insights, sharing mine, and working together to show the world all that CPAs are!

4 INSIGHT | www icpas org/insight

today’sCPA

The Strategy? No More Excuses

The time to evolve as accounting and finance professionals is now.

Ensuring

the future relevance of CPAs is something that I think about virtually every day as president and CEO of the Illinois CPA Society I’ve said it before, but I’ll say it again: We are facing a pace and type of change unlike any we ’ ve experienced before in the CPA profession the rules of the game are literally being rewritten by technology Artificial intelligence and robotic process automation will forever change accounting, audit, finance, tax, and more The ways we provide services to companies and clients certainly won’t change overnight, but that doesn’t mean we don’t prepare for the dramatic changes coming ahead The greatest challenge I see facing the CPA profession now is just how, exactly, CPAs evolve to continue providing truly valued assurances and insights

For decades, CPAs and their associations like the AICPA, and even your Illinois CPA Society have cultivated the CPA brand as the “most trusted business advisor ” Trust is at the core of everything we do; it is something to be very proud of That said, trust is and always should have been just the beginning Why? Because “trust” literally means something different to each and every one of us I’ve asked countless CPAs what they think it means to be the “most trusted business advisor ” The answers are all over the board accurate, dependable, knowledgeable, trustworthy, etc While trust is critical to the credential, I contend value is what ensures companies and clients continue to rely on their partnerships with CPAs

To be truly valued as we race into the future, CPAs must make the shift from being the most trusted business advisors to being the most trusted and strategic business advisors Strategy is where there’s value Strategy cannot be replaced by technology And what I mean by becoming a strategic advisor is that you shift your focus to helping your clients and companies increase their profitability through increased revenues or decreased cost structures An audit, no matter how clean it is, doesn’t drive profitability A tax return or tax plan may help an individual’s wealth, or these could lower a company ’ s costs, but they don’t typically lower cost structures As CPAs, we have access to almost unlimited client and company data;

we need to use it We need to become providers of strategic advice and real profitability drivers

Now, I’ve heard many reasons why CPAs can’t be strategic advisors If you ’ re an auditor, you may say that it’s a violation of independence However, there’s no issue with supplying a client with a historical analysis of days sales outstanding, or DSOs, which can drive increased cash flow Every audit looks at obsolete inventory, but does it look at inventory turns which can change a company ’ s cost structure? I’ve heard people say that clients won’t pay for strategic advice Have we tried? Often, people say that they simply don’t have time to provide these types of information or insight Well, with the way the world is changing around us, we may have plenty of time in the future if we don’t become strategists

There’s an almost endless list of reasons, roadblocks, and excuses for not acting as a strategic advisor However, as our profession advances and typical compliance services diminish in value, I don’t think we have any choice but to change The Illinois CPA Society’s mission is to “enhance the value of the CPA profession ” To do that, we must ensure the CPA’s relevance for generations to come My commitment to you is that we will help lead the way, working diligently to change public perceptions, rebrand CPAs, and provide a road map to achieving the skills and knowledge for long-term success

Becoming the most trusted and strategic business advisor is an evolution that we are committed to Together, we can ensure both the relevance and value of our profession for years to come

To share your thoughts, email me at shapirot@icpas org or just give me a call 800 993 0407

INSIGHTS FROM TODD SHAPIRO, ICPAS PRESIDENT & CEO @Todd ICPAS

6 | www icpas org/insight

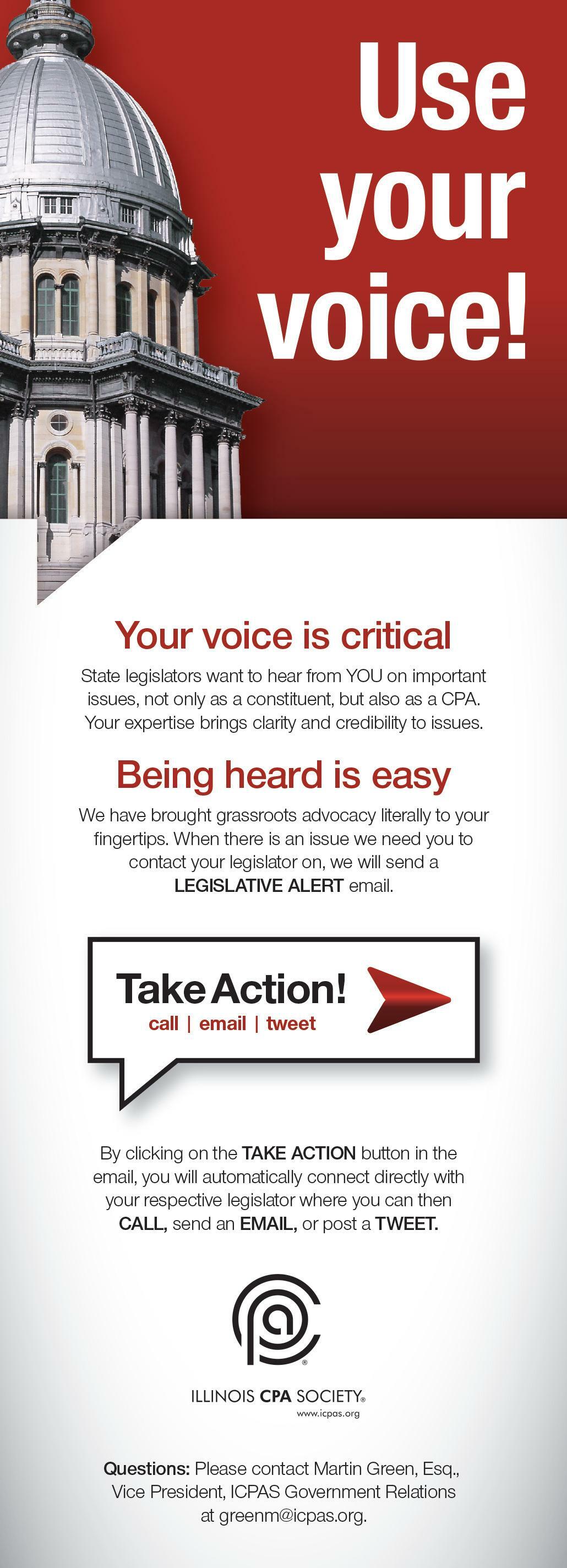

capitolreport

Spring Cleaning in the Statehouse

Inthe 30 years I have been involved with state government, including 12 years as executive assistant attorney general, I have never seen such a broad and bright light cast upon Illinois state government It seems Illinois’ unsavory political reputation is due for a thorough spring cleaning

The scrutiny within the statehouse is being driven by multiple structural and cultural changes underway within the Illinois General Assembly Aside from turnover shifting the broader composition of the General Assembly, particularly in the Senate chamber, a new leadership roster of senators in the upper chamber is set to make its mark External forces are also influencing cultural changes in Illinois politics, courtesy of federal law enforcement’s broad probe of state and local officials, which is casting an even bigger spotlight on legislative processes, political campaigns, and lobbyist activities These developments have led Illinois legislators to closely scrutinize internal processes and accompanying state laws, paving the way for vast and welcomed change

STRUCTURAL CHANGES

Earlier this year, former Senate President John Cullerton announced his retirement, vacating both the position and his seat as representative of the sixth Senate district The Senate Democratic majority selected Sen Don Harmon (D-39, Oak Park) as its new chamber leader The Senate president is an influential position, serving not only as the leader and presiding officer of the Senate chamber but also as one of four legislative leaders representing their respective chambers and caucuses on legislative issues and in negotiations with the governor, the Senate Republican leader, and the speaker of the House

Harmon has held various leadership positions during his 17 years in the Senate He is also a licensed attorney who resigned his partnership with a Chicago law firm upon being elected Senate president As the new Senate president, Harmon has already assembled a cadre of confidants to serve on his leadership team while keeping the existing Senate majority leader and assistant majority leader intact And while there was a rotation of committee chairs with the appointment of assistant majority leaders, CPAs should take note that Sen Christina Castro (D-22, Elgin) was appointed as chair of the Senate Revenue Committee, filling the vacancy left by Toi Hutchinson, who resigned to become the cannabis czar

8 | www icpas org/insight

With the spring legislative session well underway, legislators are attempting to clean up Illinois’ politics.

LEGISLATIVE INSIGHTS FROM MARTY GREEN, ESQ , ICPAS VP OF GOVERNMENT RELATIONS @GreenMarty

CULTURAL CHANGES

Widespread high-profile raids and search warrants executed by federal authorities have ensnarled several aldermen, lobbyists, and legislators, casting a bright light on Illinois’ ethical and legal shortcomings and driving the U S attorney for the Northern District of Illinois to announce charges against several notable Illinois politicians who are now awaiting trial These enforcement efforts have further illuminated issues with elected officials serving as registered lobbyists, lobbying other governmental entities and officials on behalf of commercial enterprises and their own business interests This practice previously resulted in a now former state representative being charged with attempting to bribe another legislator in exchange for a legislative vote In another case, a former state senator was charged with accepting bribes in exchange for exercising legislative muscle in favor of red-light cameras, gambling, road paving, and ComEd

What does this all mean? New leadership and changing General Assembly demographics, coupled with the cultural impact of past and pending high-profile charges, have resulted in the Illinois House and Senate closely scrutinizing its internal processes

Last fall, the General Assembly created the bipartisan Senate and House Joint Commission on Ethics and Lobbying Reform and tasked it with drafting a final report on Illinois ethics laws recommendations The current legislative inspector general (LIG) and two previous legislative inspectors general testified before the commission on changing the LIG law to provide more authority to the LIG and for more transparency in the LIG process

This spring, over 94 bills were filed in relation to elected officials and ethics, financial disclosures by elected officials and registered lobbyists, and revolving door prohibitions

The outcome so far? What was once legally and politically acceptable in days long ago is no longer How many people will be enmeshed in the ongoing federal investigation is yet to be seen Clearly, the U S attorney is redefining the legal norms of Illinois politics by the exposure of the investigation and the charges brought thus far U S attorneys are not typically reckless in public corruption cases, nor are they careless in filing specific charges Meaning, when charges are filed, there’s typically a conviction on one or more counts The criminal process will undoubtedly expose the practices of the past and will continue to change political norms and legislative practices of the present We will also see how far the General Assembly is willing to go in policing its own with the passage of meaningful ethics legislation

While fresh faces in the General Assembly could potentially mean that issues previously debated and voted upon may be resurrected, they also bring fresh perspectives to lingering problems Former Senate President Cullerton was always accessible and responsive to the CPA profession, and we are grateful for that, but Senate President Harmon brings a new perspective and a new brand of leadership to the negotiating table This structural change, coupled with the cultural changes that have yet to fully play out, is already changing Illinois’ political dynamic and ethical landscape As you ’ ve probably gathered, my takeaway is that change is good and we should welcome more if it means Illinois’ reputation for dirty politics finally gets cleaned up

Author’s Note: This column includes my personal observations of the evolution of the legislative environment and are not necessarily the views of the Illinois CPA Society

www icpas org/insight | SPRING 2020 9

“All because of you, I am the first in my immediate family to attain a bachelor’s degree. You have lightened my financial burden and the stress of having to work full-time while in school. I feel very appreciative and proud to recognize that there are people out there that are unselfishly giving to help students like me achieve their dreams of becoming CPAs.”

Bryanna Morris

$110,000

Sikich LLP

$70,000

Dempsey J. Travis Foundation

$20,000 - $25,000

Illinois CPA Society

PricewaterhouseCoopers LLP

Patricia Rosenberg

$10,000 - $15,000

Crowe LLP

Hyatt Hotels Corporation

Joan Moore

Belverd Needles Jr. & Marian Powers

$2,500 - $5,000

Alverin M. Cornell Foundation

Follett Corporation

Kenneth & Jacqueline Hull

ICPAS O’Hare Chapter

ICPAS Women’s Committee

Dave & Darlene Landsittel

Gary Neubauer

Catherine Villinski

Wipfli Foundation Inc.

$1,000 - $2,499

AMD Family Fund

Maria Fides Balita

Howard Blumstein

Martrice Caldwell

Rose Cammarata

Jennifer Cavanaugh

CDK Global Inc.

Cameron Clark

CNA Foundation

Jan & Wayne Ebersberger

FOR PAVING THE WAY FOR TOMORROW’S CPAs

The CPA Endowment Fund of Illinois, the charitable partner of the Illinois CPA Society, graciously thanks our generous donors for their contributions and pledges throughout the past year.

These individuals and organizations help make a significant, life-changing impact on the lives of diverse and deserving future CPAs across the state.

HIGHLIGHTS:

$215K awarded 200 scholarships

1,135 donors

$500 - $999

John Bird

Therese Bobek

Rebekuh Eley

Lindy Ellis

Arthur Farber

Mark Glochowsky

Lee Gould

Geoffrey & Virginia Harlow

Sheldon Holzman

John E. & Jeanne T. Hughes Foundation

Scott Hurwitz & Kelly Austin

ICPAS Young Professional’s Group

Kenton Klaus

Joseph Kosinski

Dorri McWhorter

Sara Mikuta

Miller Cooper & Company Ltd.

Elizabeth Murphy

Beth Pagnotta

Floyd Perkins

Melody Ragan

Kimberly Rice

Jennifer Roan

Leilani Rodrigo

Michael Rodriguez

Deborah Rood

Seun Salami

Stella Marie Santos

J. Bradley Sargent

Todd Shapiro

Elizabeth Sloan

Duane Suits

Myra Swick

Richard & Nancy Thompson

Kimberley Waite

Jeffery Watson

Lawrence & Nancy Wojcik

Adriane Wong

Donna & Phillip Zarcone

Jennifer Cataldo Walters

Bill & Betsy Cook

Deloitte LLP

Gary Fish

Henry & Sandra Gentry

Mardel Graffy

Sharon Gregor

Lisa Hanlon

Edward Hannon

Lisa Hartkopf

Margaret Hickey

Joshua Lance

Miller Family Fund

Thomas Murtagh

Jason Parish

Gilda Priebe

John Rogers

Ronald Sonenthal

Meredith Vogel

$250 - $499

Anonymous (2)

Brent Baccus

Joseph Bigane III

Daniel Cadigan

Jennifer Carney

Harvey Coustan

Steve Ferrara

Anthony Fuller

Mary Fuller

Robert Giblichman

Lawrence Gill

Christina Golsch

Bill Graf

Gary & Carol Hart

Michael Hartley

Jonathan Hauser

Margreatha Hein

HMB Legal Counsel

Krista Kapsa

Wendy Kelly

Jeff Krol

Thomas Luken

Rita McConville

Elizabeth Pittelkow Kittner

Kenneth Posner

Roy Raemer

Walter Rein

Elizabeth Roghair

Kathy Scherer

Michael Singer

Claire Stevens

Andrea Urban

Lise Valentine

Mike & Kathy Wenzel

Richard Ziegler

$100 - $249

Anonymous (6)

Sheldon Abrams

Brian Amoroso

Michael Amoroso

Brian Blaha

Basil Booton

James Brennan

M. David Cain

Michelle Carrothers

Margaret Cartier

Nancy Cash

Jerry Catalano

Bridget Coleman

Arlene & David DeMotte

James Dolinar

Melody Driver

Amy Dybowski

Sarah Ference

Sharon Ferrin

James Forhan

Zachary Fortsch

Sharon Frydman

Fred Fugate

Kathy Garlow

Gary Genenbacher

Robert Gibson

Terry & Janet Godbold

Jennifer Goettler

Tricia Gorsky Kozlowski

Robert Grecco

GT Mechanical Inc.

Bernard Hicks

Russell Holmgren

Kathy Larson Horton

Deitra Jackson

JSG Financial Services Inc.

John Kaiser Jr.

David Kalet

Harry Kramer

Thomas Kuchta

Leynette Kuniej

Kathleen Lakowski

Margaret Lawlis

Larry Lonis

Steve & Donna Loraine

Glinda LoVerde

President’s Pavers (4.1.19 - 3.15.20)

Diane Lystlund

Robert Maas

Michael Maffei

Laura Maniola

Carlton Marcyan

Randy Markowitz

Joseph McDonnell

Terry Michaels

David Murphy

Kenneth & Kathleen Naatz

Ijeoma Nwabara

William O’Malley

William O’Neill

Jenni Perko

Charles Phillips

Ernest Potter

James Quaid

Daniel Rahill

Joan Rockey

Michael Santay

Victoria Schmuker

Jennifer Schultz

Brian Severns

Richard Shapiro

Christine Smith

Laurence Sophian

Warren Stippich

Michael Tadla

Jerry Turner

James Vourvoulias

Nicholas Vourvoulias

Julie Vuotto

Erin Wharton

Jay Wilensky

Jessica Winston

Mark Wolfgram

Carl Woodward

Kevin Wydra

Doyoung Yong

Kenneth Yu

Julie Zielke

Anthony Zordan

UP TO $99

Anonymous (10)

AbaCountax CPA Group Ltd.

Judith Aburmishan

Craig Acheson

Sandra Adam

Cheryl Aduana

Keshav Agrawal

Gary Agrest

Robert Aguada

Naveed Ahmed

Rao Akella

Jude Alagna

Omar Alaskari

Jon Aldrich

Michael Aleckson

Peter Aleszczyk

Abdullah Alhinai

Carl Allegretti

Alonzo Allen

Angela Allen

Alan Allphin

Paul Alpern

Patricia Alvino

Amazon Smile Foundation

Robert Amend

Daniel Ammentorp

Nikolaos Analitis

Jane Anderson

Nancy Anderson

Susan Anderson

Steven Andes

Ewa Anikiej

Gus Antonopoulos

Timothy Antos

John Apuzzo

Susan Arndt

Steven Aronson

Idayatu Atoe

Richard Ave Maria

Owen Bailitz

David Balderson

Mariah Baltzell

Dana Bangert

Subir Banik

Michael Bansley

Wayne Barbier

Karl Barnes

Roy Barnes

Amarinder Bartkoske

Jens Bauml

Howard Bayer

Charles Baygood

Dennis Beard

Anne Beason

Lori Beeler

John Belcik

Bruce Bell

Kristen Bellendir

Bashir Bello

Robert Ben

Benchmark Aspen & Associates Ltd.

John Berg

Dana Berglind

David Bergman

Howard Bernstein

Kenneth Bertrand

Rona Bezman

James Biegel

Lawrence Bielawski

George Bilek

Lydia Bilyeu

Brian Bird

Jess Birtcher

Jonathan Blake

Carla Blanchard

David Blum

Christopher Boes

Sarah Ann Bohnsack

Tamara Bokur

John Boncuore

Harry Bond

Irma Bondi

Zachary Bondi

Linda Bonelli

Carol Borecky

David Bos

Gary Bowen

Mary Bowman

Bruce Breitweiser

Thomas Brescia

Kristy Britt

Margaret Broderick

Barbara Brown

Dorothy Brown

John Brown

Robert Brown

Terrence Brown

William Bruno

Thomas Brya

Joseph Bryk

James Bunegar

Teresa Burczak

Erin Burke

Donald Bushen

Nicholas Caccamo

Allen Callender

Marcello Camoletto

LeRoy Carlson

Michael Carney

Thomas Carroll

Patrick Carter

Joseph Cascio

Carole Cederstrom

Catherine Chan

Vilma Chan

Melissa Chankin

Harpreet Chawla

Sinde Chekete

Chiung-Yu Chen

Hui Chen

Honglam Cheng

Scott Cheshareck

Nicholas Chibucos

Chiu-Yeung Chow

Marc Chudy

David Ciasto

Michael Ciesemier

Colleen Clark

John Clark

Susan Clarke

Ayala Clinkman

D. Close

Phyllis Cochran

Katherine Coddington

Alan Cohen

Neil Cohen

Jay Colbert

Kevin Conarchy

Bret Conklin

Christopher Conneely

Margaret Conneely

Thomas Connolly

John Conway

Russell Cook

Sarah Cook

Joy Coombes

Brian Corcoran

Ronald Cornell

Alan Cornue

Trisha Correa

Louis Cosentine

Ann Cotter

Melissa Coverdale

Daniel Craig

Marcia Craig

Timothy Crandall

Kenneth Creech

Kevin Crumly

James Cunningham

Thomas Curatolo

Kevin Currid

Edwin Czopek

Mercie Dahlgren

Lin Dai

Jacques Daigle

Christopher D’Andrea

Donald Danner

Mary Dante

Catherine Daubek

Abbie Davidson

Dana Davidson

Grant Davidson

Martha Davidson

Melissa Davidson

Mary Davolt

William Dean

William Debes

Paul DeFiore

Deborah DeHaas

William Del Principe

Alan DeMar

Alicia Derrah

Catherine Derus

Michael Devereux

Pedro Diaz de Leon

James Dickey

Joseph Diehl

Maria Diokno

Toni Diprizio

Stephen Ditman

David Dobson

Narwin Doekhi

Kevin Doherty

Kelley Donlan

Melissa Donoso

Neil Dougherty

Joel Downie

James Doyle

Jadranka Dragisic

Andrew Dreyfuss

Jeremy Dubin

Richard Duffy

Jonathan Dunmore

Daniel Dwyer

John Dyer

William Eagan

Michelle Ebner

Susan Eby

Sheila Edelstein

Russell Effrig

Mary Ann Egizio

Lisa Eichinger

Rolf Eilhauer

Timothy Elafros

Michael Emmert

Eric Ephraim

Michael Ericksen

Robert Eschbach

Natasha Escobedo

Mark Everette

Noreen Fahey

Dan Farrell

Scott Farrell

Pavlo Fedorchuk

Michael Fehlen

Bradley Feitl

Bridget Fergus

Anthony Ferreri

John Fischer

Ralph Fishman

Shari Fitzgerald

Robert Fitzjarrald

Sara Flaherty

Thomas Flavin

Edmund Fleming

Saundra Fleming

Erin Florczak

Jere Fluno

Elizabeth Folk

Vincent Forgione

Linda Forman

Kevin Foster

Irwin Friedman

Joseph Fruchter

David Fuehne

Richard Fugiel

Yasuhiro Fukuzawa

Annette Fulcher

Vivian Funches

Michael Gacek

Vishal Gandhi

Peter Gariepy

Colby Garman

John Gaynor

Nancy Geary

Ronald Geib

Mary Geissler

Kurian George

Frank Gersich

Stanley Gertzman

Mary Gharrity

Tracey Gibbons

Stacy Gilbert

Roxanne Gilbertsen

Thurman Gills

Edward Gin

Timothy Glaude

Thomas Glavin

Margaret Glynn

Wayne Goble

Gene Goldberg

Matthew Golland

Jamie Golombek

Anna Gomez

Solskin Gomez-Krogh

Elva Gonzalez

John Goode

Craig Gordon

Michael Gordon

Jeremy Gottardo

Ryan Goulding

Sarumathi Govindasamy

James Grady

Andrew Graf

Wendy Grano

Leland Graul

Brad Greenberg

Jack Greenberg

Tom Greenway

Steven Grimes

“The magnitude of your support over the past few years is hard to believe, and I am overwhelmed with gratitude for such transformative opportunities. In addition to financial support, you have given me the gift of knowledge and motivation to become a CPA. I have come away with so many new skills and ambitions, and it is because of your generosity that I am equipped with the tools I need to succeed.”

Morayma Barron

Kevin Grisamore

Donald Grossman

Mary Grossman

Raymond Grothaus

Robert Grottke

Helen Guagliardo

Frank Gulik

Jeffrey Gullang

Cameron Gunderson

Oleg Gurevich

William Guska

Ronald Guthoff

Josef Hajek

Harold Hale

Ethel Hall-Langworthy

M. Hamilton

Edward Hanacek

Nazar Hanafi

Georgann Hanna

Laura Hardy

Julia Haried

Effie Harrell

Deborah Harris

Norris Harstad

Patrick Hart

Marvin Haselhorst

Dennis Hawkins

James Heid

Edward Helfers

Timothy Helle

John Hellner

Curtis Helwig

Melinda Henbest

Kristy Hendry

Michael Heneghan

Craig Henry

Susan Henry

Marianne Herff

Dalia Hernandez

John Heshelman

Norman Hester

Andrew Hettermann

Scott Hickam

James Hilgenbrink

James Hill

John Hillenbrand

Frank Hladik

Man Kit Ho

John Hoeksema

Mark Hoffman

Jana Holt

James Holt

Theodore Homewood

David Hooker

Joel Hopkins

John Hopkins

Michael Horst

Shawn Horwitz

David Hough

John Houren

Jonathan Howard

Robert Hriszko

Ding Huang

Joseph Hubbard

Ann Hughes

John Hughes

Patrick Hurley

David Hutchison

“The road I took to becoming a CPA was demanding. I devoted huge amounts of time to studying and passing the exam while completing my master’s degree. This award took a huge weight off my shoulders and gave me a confidence boost. I do not think I could have done it without you.”

Aamir Ibrahim

Nobuo Idesawa

Eileen Iles

Jim Isaacs

Kenneth Iwanicki

Joseph Izen

Andrea Izykowski

Ghassan Jaber

Kenyetta Jackson

James Japczyk

Ronald Jarvis

Ernest Jaseckas

Michael Jefvert

Mark Jewell

Michael Johnson

Paul Julien

Barry Jutovsky

Richard Kaczor

Kaname Kakuma

Kaori Kameya

Peter Kaminsky

Raj Kanal

Satoji Kaneko

Jennie Kang

Bennett Kaplan

Burton Kaplan

Howard Kaplan

Dustin Kapsa

Sharad Kapur

Frank Karall

Marylou Karkow

Robert Karnia

Michael Katsis

Barry Katz

Jerry Kavanagh

Karl Keane

Patrick Kelliher

Stacy Kelly

John Kent

Russell Kessler

Mark Kieffer

Tyler Kiefner

Thomas Kiesler

Chee-Young Kim

Youn Kim

Jeffrey King

Dawn Kink

John Kintner

Hal Kirby

Charles Kirk

Areno Kirkendoll

William Kistner

Yoshikazu Kitamura

Robert Kleczynski

Sara Klein

Diane Klocke

Kevin Klunder

Mark Knapczyk

Thomas Knieps

David Knuth

Ronald Knutson

Hung Ko

Brent Kochel

Alfred Koermer

Jason Komenda

Lester Koryczan

Jennifer Koss

James Kostrewa

Terence Kozicki

Debra Krillenberger

Andrew Krissinger

Elizabeth Kroger

Kevin Kroll

David Krupa

William Kulanda

Susan Kurowski

Deborah Kurtzke

John Kustes

Brandon LaBelle

Maureen Lagan

Ralph Land

Robert Landowski

James Lang

Tina Langston-Andersen

Edward Lannon

Mario LaPlaca

Christopher Larkin

Frank Larocca

Cheryl Laska

Jeffrey Lasky

Paul Lau

James Laubinger

Babatunde Lawal

Jacek Lazarczyk

Valentina Lazarova

Thomas Lechowicz

Daphne Lee

Robert Lee

Robert LeFevre

Laurie Leja

John LeMay

Jeffrey Lemke

William Lemna

Brian Lenihan

David Leonhardt

Debra Lessin

Mark Leveillee

Brian Levin

Jeffrey Levin

Stuart Levin

Julius Lewiel

Grace Li

Peter Liao

Michael Liccar

Juiyuan Lin

Lin Lin

Mayra Linares

Sherryl Lindish

Diane Linne

Caroline Linton

Harry Lipe

Janice Little

Mary Little

Cherry Llave

Norman Lo

Nicholas Lobraco

William Lock

Michael Lockett

Valerie Loftus

Michael LoGiudice

Lori Lorgeree

Quan Ly

Eric Lynch

Paul Lythberg

Laura Mack

Rose Marie Mack

Louis Mago

Cari Main

Dianne Malara

Kenneth Malek

Daniel Maloney

Theodore Mandigo

Ashley Manestar

Catherine Manning

Tammy Manship

Kristin Marano

Norman Mareci

Jennifer Mark

Andrew Markiewicz

Catherine Marks

Dandan Martello

Joseph Martin

George Martinez

Sarah Martino

Paul Martynowski

Margaret Masier

Anthony Massaro

Benjamin Mast

Thomas Masterson

Curt Mastio

Robert Masuga

Keiko Matsui

Hideki Matsumoto

Alan Maty

Joan Mazurek

Dale McCarrell

Patrick McCarthy

Timothy McCarty

Steven McCoin

Andrew McCormick

Betty McCormick

Mark McDonnell

James McEnerney

Kyle McGinnis

Terence McGrath

David McKeand

Edward McKenna

Laura McLeman

Thomas McNally

William McNulty

James McPhedran

Helen Meagher-Simmons

Timothy Medema

Charles Meeder

Neal Mehlman

John Meister

Tim Melevin

Leonard Metzl

Eugene Midlock

Anne Mieleszuk

Terence Mieling

Nichole Miksa

Leonard Miller

Mary Miller

Randall Miller

Lori Milosevich

Gary Mingle

Dan Mirjanich

Albert Mitchell

James Mitchell

Deborah Mitrenga

Matt Mitzen

Ericka Mixon

Taizo Mizusawa

Lawrence Mocadlo

Ilaria Mocciaro

Megan Mocogni

David Moes

Jack Monco

Tzvi Montrose

Cynthia Moody

Donna Moore

Henry Moore

Jodi Morady

L. Moravy

Karla Morgan

Stephanie Morgan

Richard Morris

Jim Motley

Gregory Mudd

Christine Mueller

Daniel Mueller

Jacob Mueller

Carmen Mugnolo

Maureen Mukai

Thomas Mula

Jessica Murphy

Craig Myers

John Myers

Michael Nadler

Edward Nadler

Alan Nadolna

Kari Natale

Chandanasseri Natarajan

Michael Nathanson

John Naughton

David Navarro

John Navetta

Lawrence Neal

Leonardus Neggers

Roger Nelson

Julie Nemmer

Brad Neuman

Carole Newmyer

Thu Nguyen

Robin Nimmo

Christine Nolan

Genna Notareschi

Robert O’Brien

William O’Brien

Annette O’Connor

Michael O’Connor

Patrick O’Connor

Edward Odmark

Phil Oertli

Joseph Olsen

Karen Olson

Akin Omotosho

James O’Neill

Suet Ching Ong

Kirk Openchowski

Gerard Oprins

Daniel Ostrowski

David Paczak

Robert Palasz

Andrew Palko

Louis Panoutsos

Susan Panzer

Heather Paquette

Donald Parker

Rob Pasquesi

Joanne Passmore

Amy Patton

Whitey Patton

Lorraine Pattullo Banks

Richard Paul

David Pavela

Ann Pelant

Jeannine Pellettiere

Linda Pellini

Linda Perri

Barrett Peterson

Carla Peterson

Kurt Peterson

Simon Petravick

Ryan Petrey

Benjamin Pettie

Anna Pettyjohn

John Pezzullo

Marianne Phelan

Dana Phillips

Pamela Piarowski

Andrew Piasecki

John Pierpoint

Paul Pierson

Samuel Pincich

William Piotrowski

Terry Pitcher

William Pittman

Krista Piwonka

Anna Plewa

Steven Poe

Leanne Pokorski

Peter Ponzio

Mark Porst

David Post

Richard Powell

Jeanne Poynton

Lawrence Prazak

Ronald Pressler

Kathryn Preston

David Prill

SanDee Priser

John Pritchard

Clyde Proctor

Garry Prokop

Steve Ptasinski

Sheridan Pulley

Daniel Kozlak, CPA

Sandra Pundmann

Kyle Putnam

Richard Putz

Patricia Quinlan

Kelley Quinn

James Raaf

Julie Randall

Blake Rasing

Donna Rebeck

John Reece

Michael Reeder

Michael Regan

Brian Registe

Arnold Reingold

Howard Renner

Ariste Reno

Hilda Renteria

Flora Reznik

Richard Rice

R. Richardson

Catherine Riddick

Rochelle Riffer

Frank Ring

Michelle Ringold

Robert Ripp

Sandra Ritter

Joseph Rivkin

Richard Rizzo

Elliott Robbins

James Roche

Fay Rofalikos

Nadine Roggeman

Barry Roman

Susan Romero

Dennis Ronowski

Kristine Ross

Martin Ross

Nancy Ross

Kate Rossi

Linda Rossi

Mark Rouck

Anna Rudawski

Robert Rush

Aaron Ruswick

Maurice Sabath

Imran Safvi

Clara Sage

Michael Saltzman

Alan Sanchez

Dan Sanchez

Bill Sanders

David Saner

Catherine Santoro

Everett Sather

Laurie Sauer

Marvin Schaar

Karen Schaefer

Margaret Schaefer

Phillip Schaefer

David Schafer

Michael Scharf

Michelle Scheffki

Robert Scheuermann

William Schirmang

Laurie Schmidgall

Michael Schneider

Daniel Schober

Nathan Schommer

Mary Schueren

Bryan Schulmeister

Richard Schultz

Florian Seidel

Chiharu Seike

Smajil Selimagic

Dominic Serpico

Craig Shaffer

David Shamsi

Michael Shapiro

Andrew Sharp

Mark Shaw

Becky Sheehan

Justin Shelman

James Sherman

Mustafa Sherwani

Walter Shriner

Barbara Siegel

Marvin Siegel

Steven Simons

Kui-Chong Sin-Fu-Wing

Rosemarie Sison

Joseph Skibinski

Tara Skole

Stephen Slaber

Andrea Smith

Andrew Smith

Dayton Smith

Joel Smith

Norris Smith

Beth Snider

Myron Solomon

Frank Sommario

Jeffrey Sorenson

Paula Sorrentino

Diane Sotiros

Robert Soule

Samantha Spalding Davis

Stephen Spanola

Joy Spencer

Joseph Spokas

Roy Sroka

David Stafford

Daniel Stanovich

Glenn Stears

James Stephenson

Christina Stevens

Elisa Stevens

Lee Stiles

Stephen Stockman

Jeff Stojak

Harold Sullivan

Patrick Sullivan

Peter Sullivan

Yamei Sun

Stephen Sutton

Jason Svestka

Steven Swan

Barry Swartz

Steven Swidler

Kimberley Szalkus

David Szerlag

Yuji Tachibana

Lamees Taha

James Taibleson

Donna Tam-Perez

Daniel Tanner

Anthony Testolin

Kenneth Thomalla

Desiree Thompson

Chengmei Tian

Benjamin Timmermann

Dale Timmermann

Christie Tipton

Frank Tlusty

Vicki Tlusty

Ramona Marijo Tomas

Stephen Tomei

Jacob Trepelkin

John Tribbey

Johannes Tromp

Paul Trotter

George Tsitouras

Kasumi Tsujimura

Our Students Count on You

Every year, more qualified candidates and deserving future CPAs apply for our scholarships and programs than we can support. You can help us close the gap.

Your generous financial contributions and volunteered time and expertise are crucial to the sustainability and reach of our programs including:

• Academic Scholarships

• CPA Exam Awards

• Student Ambassador Program

• Mary T. Washington Wylie Internship Preparation Program

• Virtual Internship/Job Fair

Get involved today to help ensure future CPAs can realize your same success. Together, we can make a difference.

Deborah Turner McKissic

Mihaela Tyler

Melissa Ulatowski

Stephanie Usalis

Mark Valdick

Mathew Vanderkloot

John Vant Hoff

Patricia Vardalos

Downey Varey

Daniel Vargo

James Vargo

Valerie Varney

Ryan Vaughan

John Verchota

Thomas Vicario

Karen Villaflor

William Vlazny

Gregory Voorhees

Raymond Voros

John Vosicky

Mark Vottero

Anthony Waelter

Jacqueline Wagner

Diana Walker

John Walsh

Frederick Walz

Wei Wang

Pamela Wankel

Marie Ward

Michiko Wargo

Bruce Warkentin

Matthew Warren

James Watson

Steven Watts

Jeffrey Webb

Volha Weber

Harald Weiler

Arvin Weindruch

Lesley Weinert McDonnell

Joanne Weiss

Matthew Welch

James Welge

John Wellhausen

Nicole Wells

Robert Westberg

Maureen Wheeler

Glen Wherfel

James White

Nancy Wilke

Richard Wilkens

James Wilkins

Kelly Willett

Jennifer Williams

James Winikates

Sharon Wiorek

Christopher Wojcicki

Agnieszka Wojtowicz

Charles Wolf

David Wolfe

John Wonak

Hiu Ling Wong

Mary Wood

Gregg Woodruff

Carol Wrobel

Steven Yang

Suzanne Yang

Cristy Young

Larry Yu

Carl Yudell

Craig Yuen

Brian Zabel

Dario Zanichelli

Junichi Zenimoto

Faye Zhang

Manshu Zhang

Mark Ziegenhorn

Robert Ziemann

Kristine Zitt

Roger Zmrhal

Eric Zurawski

Kenneth Zurek

Donors with a multi-year pledge are recognized for the full amount of their pledge in the first year and for their pledge installment amount paid in the remaining years of the pledge. Every attempt was made to acknowledge all donors who have given during this period. If you see a discrepancy, please call 312.517.7656.

Donate at www.icpas.org/annualfund

The Building Blocks of Blockchain

Accounting and finance professionals must have a fundamental knowledge of this technology moving forward Here’s why

BY BRIDGET McCREA

There’sa lot of buzz in the business world about blockchain, cryptocurrencies, and fintech (financial technology) for the future Emerging technologies that go beyond what we use in our day-today lives can be difficult to envision and even harder to apply in practice So, here’s the bottom line: “At this point, CPAs and financial professionals should focus on the basics and simply getting to know these concepts,” says Girish Ramachandra, technology industry leader with Wipfli LLP in Chicago

BLOCKCHAIN BASICS

A blockchain is a “shared, immutable ledger that facilitates the process of recording transactions and tracking assets in a business network,” according to IBM’s “Blockchain for Dummies ” The assets can be tangible (i e , a property, vehicle, cash, or land) or intangible (intellectual property, patents, copyrights, or branding) “Virtually anything of value can be tracked and traded on a blockchain network, reducing risk and cutting costs for all involved,” IBM states

At its simplest, a blockchain is a digital file where data is stored Through an open ledger, blockchains contain data that’s distributed across various computers This differs from traditional ledgers,

where information is stored in a single database and then in most cases processed by a central figure (e g , a person, organization, or government)

Because a blockchain involves multiple users, computers, and databases, it creates a multilayered transactional environment that’s theoretically more secure since the contents are immutable, accessible, and verified by user consensus

Within the blockchain ecosystem, the cryptocurrency Bitcoin is the most mainstream example of the technology in action Blockchain is the foundational technology that facilitates cryptocurrency transactions, which are reported and archived to shared public ledgers that verify each and every transaction

TAXING MATTERS

For many CPAs, their first foray into blockchain technology may be spurred by their clients’ tax returns Form 1040, Schedule 1, includes the question: “At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

14 | www icpas org/insight T E C H N O L O G Y

While most cryptocurrencies have fallen from their peak valuations, trading and transactions involving them continue to increase and become more accessible and commonplace, meaning more taxpayers will be responding “ yes ” to that question

Andrew Gordon, CPA, lawyer and director of The Blockchain Institute, says accountants should, in the best interest of their clients, understand the rules on reporting such transactions

“Something as simple as a client using Bitcoin to buy a cup of coffee now has to be reported,” Gordon says

INDUSTRY INNOVATION

On the other end of the blockchain spectrum, large corporations are using it for supply chain innovation For example, Walmart began using blockchain to track organic food products from farm to fork Walmart’s U S division implemented the IBM Food Trust blockchain for tracking leafy greens following 2018’s romaine lettuce contamination problems and has since begun using it to track shrimp exports from Indian farmers in Andhra Pradesh to select Sam’s Club locations in the U S In June 2019, Walmart China announced a partnership with PwC, blockchain firm VeChain, and a local trade association and beef producer to create the Walmart China Blockchain Traceability Platform, which is focused on ensuring food supply chain safety

“Conceptually, blockchain works really well in these situations,” Ramachandra says Shoppers can use their mobile phones to scan produce on the shelves, track it back to the source and region, trace shipping, and even get product inspection reports

That said, Ramachandra acknowledges the project’s success comes from Walmart’s entire supply chain ecosystem agreeing to use that system “It will take time for smaller organizations to roll out such initiatives and for everyone to realize the benefits, what the efficiencies are, and what transformations they can make using blockchain,” Ramachandra says

BANKING ON BLOCKCHAIN

The opportunities to apply blockchain in finance and accounting are plentiful, but audit is one area especially ripe for a technology overhaul, says Kirk Phillips of The Bitcoin CPA™, a Certified Bitcoin Professional and AICPA instructor

“The audit process is going to become more technological in nature rather than teams of auditors doing manual tasks,” Phillips predicts, pointing to Armanino’s TrustExplorer product as proof of concept TrustExplorer provides the first-ever real-time audit report, an ACT-205 examination opinion on the reserves of TrustToken’s stablecoin TrueUSD, a cryptocurrency According to California-based accounting and business consulting firm Armanino, TrustExplorer offers transparency to stablecoin holders regarding circulating supply of tokens and escrowed assets backing those tokens In other words, the web application verifies that TrustToken’s U S dollar reserves are equal to or greater than the TrueUSD tokens issued

“Prior to this service, TrustToken would hire an auditor to do a traditional engagement, which happened once every 30 days,” Phillips explains “Now, the work is automated and occurs in ‘block time’ once every 15 seconds, which is the average time a block is added to the Ethereum blockchain ”

WHAT’S AHEAD?

“There are many different future opportunities for blockchain in finance and accounting,” Gordon says He sees more and more companies accepting cryptocurrencies and making digital

payments because these transactions can be settled within minutes (versus days or weeks) and involve multiple verification checkpoints along the way, making them both secure and reliable He also envisions a time soon when tax returns are prepared using data from blockchains and the technology is used to update and reconcile financial statements as transactions take place

“Accounting is all about recording data, looking at the past data, reconciling the data, and reporting on it,” Ramachandra says “If you look at blockchain from that perspective, I would say blockchain is an accounting technology CPAs should focus on what blockchain is, how it works, and why it’s important Blockchain data is basically preaudited that’s a significant difference from traditional approaches ”

As the world continues to shift from physical to digital documents, dollars, data, and more, Phillips says the accounting and finance fields will be pulled right along with it Stablecoins like TrueUSD, for example, represent a new class of cryptocurrencies backed by a reserve asset and centered on offering price stability “Stablecoins are basically a digitized version of the U S dollar, and there’s a whole world emerging around this concept,” Phillips explains “This is just one of several catalysts that promise to bridge the old world and the new world of money ”

It’s not much different than what happened when innovations like the internet, email, and smartphones came on the scene “At first, there’s always some confusion,” Phillips says, “but eventually it just becomes something we all use It will be the same with blockchain ”

MEMBER BENEFIT

CPE TRACKER

Keep all your CPE credits in one or g anized and easy to manag e place.

The CPE Tracker allows you to see a list of all completed CPE programs from ICPAS and those that you’ve com pleted from any third-par ty (non-ICPAS) provider s

www icpas org/insight | SPRING 2020 15

EDUCATION | NFORMATION | ADVOCACY | CONNECT ONS Get s t ated today at www.icpas.org/CPEtr acker

The Bots Are Coming

Getting robotic process automation right should be CPA firms’ future focus.

BY LISA WILDER

Doesthe possibility of robots in the workforce send chills down your spine? Whether you fear a robot uprising, or you ’ re just scared a robot might take your job, robotic process automation (RPA) can be a daunting prospect But the reality is that embracing RPA is unlikely to result in a scene from “I, Robot ”

In your office, the tasks most likely to be automated are boring chores, like payments processing or account reconciliations things you’ll likely be thrilled to hand off to an artificial mind The bottom line on bots is that RPA offers the tantalizing possibility of saving money and time while allowing workers to focus on more challenging and strategic tasks that require human skill and nuanced decision-making

At the most basic level, RPA is what it sounds like: a way to automate routine and repetitive work using software bots So, it should come as no surprise this technology is gaining prominence and importance in the business world The global market for automation technologies like RPA is growing by 20 percent a year and is estimated to reach $5 billion by 2024, according to Deloitte’s 2019 report, “Automation with Intelligence ” What’s more, Gartner’s 2019

paper, “Predicts 2020,” estimates organizations will be able to lower operational costs by 30 percent by 2023 by combining automation techniques with redesigned operational and human processes

With its potential for increased efficiencies, what could RPA mean for you? Chris Denver, CPA, MBA, national assurance practice director at International Financial Group, says it’s worthwhile to begin with discussing “the elephant in the room ” what bots could mean for hiring and recruitment of future accounting talent

“Can a bot replace a public accounting firm partner who has to exercise a lot of judgment in determining whether he or she believes a client’s financials are free of material misstatement? No And the technology will never get to that point,” says Denver, whose firm consults on and designs tailored RPA solutions for a range of financial clients “But could it mean the next hiring class doesn’t have to be as large? Possibly ”

His point: Future accounting professionals should consider building RPA skills, and current CPA firm leaders shouldn’t wait for new graduates to tell them about RPA Here’s what decision-makers need to know now:

16 | www icpas org/insight

A R T I F I C I A L I N T E L L I G E N C E

WHAT’S A BOT?

Maybe the better question is where’s a bot? You’ve probably already encountered bot software as a consumer or possibly when studying the customer-facing functions of various clients The travel industry, for instance, has become a major user of so-called chatbots, which essentially execute predetermined conversations with customers to make reservations or solve customer service problems

For accounting firms, a bot application can be as simple as directing a potential client to the right person to contact at the firm, or to perform data capture and reconciliation replacing human taskwork that might take staff hours or days to do What a bot isn’t is a solution for ambiguous tasks or functions requiring complicated judgments and decisions requiring weigh-in and review

WHAT CAN BOTS DO?

According to Jeff Aldridge, intelligent automation leader at EY, automation could help many organizations reach their long-term operational goals Leaders should approach RPA with a specific outcome they hope to achieve “What is your purpose in implementing automation? Is it efficiency and cutting costs or reducing head count?” Aldridge asks “Or could it free up an organization’s best people to do more value-added tasks?”

Generally speaking, bots can automate repetitive, static processes and functions that do not require human judgment With this in mind, large firms might consider an RPA approach among not just one but all departments burdened by repetitious tasks even the smallest firms can find value in automating at least some repeat tasks Why’s that?

Denver notes that as accounting firms and other professional service providers move toward more fixed-fee arrangements, strategic bot installations can cut costs in ways that allow them to focus on potentially more lucrative, high-value services

WHERE TO START?

Aldridge warns that even the simplest bots require customization based on the technology ecosystem they’re placed in “Each organization has unique processes and supporting systems that such bots need to access, ” he explains, which means your first step in the process should be designating “ a strong C-suite champion” who leads a discussion about the purpose and goals of automation overall before leaping into buying or building bots “It’s important to begin with a broader business case to justify the initial infrastructure investment and to see how such technology may be leveraged across the organization,” he adds

HOW MANY BOTS?

According to Aldridge, an average bot can accomplish up to three discrete automations intended to be run separately, which is why large organizations may run hundreds of bots “RPA works 24/7,” Aldridge explains, “but the one thing they can’t do is two things at once ”

Because of that, task scheduling is as critical as bot maintenance Denver adds that bot software can be very “fragile,” as the smallest change in the application’s ecosystem can slow or completely derail its functionality One example: If a bot pulls in information from a website that has recently been redesigned, even a seemingly small tweak like a form field name change could stop a bot cold Denver stresses that bot function needs to be constantly monitored not just for accuracy but for any change in their interaction with other

software Simply put, when tasks change, bots need to change “There needs to be a shelf life built into bots,” Denver cautions

HOW MUCH DO BOTS COST?

Since bots need to be designed for the software environment they’re living in, they require customization EY, which in recent years has applied RPA within its own infrastructure, offers a rough average estimate of what bot startup costs: A bot that performs up-to-three discrete functions requires a hardware investment (mostly servers) of around $20,000, a software investment of approximately $15,000, and development costs nearing $50,000 That said, Denver estimates some bots can be designed for considerably less or more based on purpose and needs While current technology and budgets often require a focus on simpler tasks, that will also change in the future The basic equation to justify the cost of investing in bots begins with accounting for staff time and compensation saved

WHERE TO LEARN?

Reading about artificial intelligence and RPA technologies and attending seminars helps, but it also pays to watch RPA development among peers and clients Sometimes the best learning is hands-on Aldridge points to Gartner statistics indicating 60 percent of companies with more than $1 billion in revenues have already started their RPA journey, adding that by 2022, it will be close to 85 percent

“One of my largest clients right now is a $20 billion manufacturer who is trying to be the most automated finance organization in the world by taking 50 percent of its current finance (human labor) hours out through automation,” Aldridge notes Meanwhile, EY has installed some 2,000 bots throughout its global operation, 700 of which are aimed at making internal operational tasks more efficient, including in finance and HR, making EY one of the largest users of RPA in the world, according to Aldridge

In other words, some of your own clients may be able to offer deep insight into bot technology

WHAT’S NEXT?

Gartner describes the current state of RPA as “toolboxes where customers are expected to build their own automation ” But rather than focusing on the construction, Gartner suggests that organizations spend more time thinking about goals because technology will change faster than long-term targets

In fact, Denver says that we ’ re not far away from a time when bots will become so sophisticated that they’ll be able to learn how to improve their performance and functionality That means the future leaders of the accounting industry don’t necessarily need to become computer engineers, but they’ll need to better understand technological evolution and how it can improve their performance

“One of the things that public accounting firms really ought to be looking for now are graduates with RPA skills at some level,” Denver suggests “A good cultural fit is most important in hiring, but it’s also going to be important to recruit professionals who have a greater comfort with technology and possibly some hands-on skills ” Further, Aldridge recommends recruiters focus on new graduates who arrive with business strategy and decision support skills that bots don’t yet possess and let bots do the rest

After all, who doesn’t want a new, quiet coworker who does all the boring drudge work? So, hand over your mind-numbing number crunching and paperwork and welcome the bots to work

www icpas org/insight | SPRING 2020 17

ON BECOMING FUTURE READY

Upskilling is key for young accounting and finance professionals aiming to drive business success and future-proof their positions as the most trusted and strategic business advisors.

BY CLARE FITZGERALD

18 | www icpas org/insight

www icpas org/insight | SPRING 2020 19

According to the 2019 “Closing the Skills Gap” report from Wiley Education Services and Future Workplace, 64 percent of HR leaders surveyed say there’s a skills gap in their company up 12 percent from their 2018 findings

Given today’s pace of change, companies have no choice but to invest heavily and quickly in developing their workforces for the future and the accounting and finance profession is no exception In just one example, PwC recently announced a $3 billion investment to upskill its global workforce of 275,000 employees over the next three to four years

As organizations large and small across industries strategize to prepare their talent for a tech takeover, young accounting and finance professionals must make concerted efforts to capitalize on every opportunity to develop competencies and mindsets that will make them coveted resources and future leaders in an evolving business world That means prioritizing upskilling in key businesscritical areas, according to the accounting and finance leaders interviewed for this feature, which they say will help young professionals stand out as high performers and evolve into the new faces of the profession

The Technology Connection

Advancing and constantly changing technology is one of the main drivers of skills gaps In Robert Half ’ s 2019 “Future of Work: Adapting to Technological Change” report, 47 percent of more than 1,200 U S managers surveyed said they expect the rise of technological advancements such as artificial intelligence and robotics in the workplace will require their team members to learn new skills

“Every company will need to be a tech company in the future,” predicts Brian Blaha, CPA, growth partner at Wipfli LLP and a director on the Illinois CPA Society’s board of directors “Professionals will need to be familiar with various technologies and understand how technology can enable us to be innovative in how we deliver services and connect with our customers ”

Fellow Illinois CPA Society board member Josh Lance, CPA, CGMA, managing director of Lance CPA Group, agrees that it will be important for accounting and finance professionals to combine technology proficiency with an understanding of how technology can improve the user experience “Whether it’s as simple as video calls or cloud computing, younger professionals need to not only learn how to use technology tools but also how those tools add value for their clients,” he says, pointing out that identifying and enhancing value requires professionals to expand their knowledge beyond the technology they use daily

“Sometimes you can be in a bubble if you ’ re just using the technology at your firm It’s important to know what technology challenges other businesses and your clients are facing,” Lance continues Getting out of the office, talking to other professionals, and attending conferences are a few ways to maintain your awareness of changing technology and how it will affect your interactions with clients

The Strategy of Soft Skills

As automation and other advancing technologies become more widespread, upskilling will extend beyond technology According to Robert Half ’ s study, half of U S employers expect to see increasing demand for soft skills, such as written and verbal communication, collaboration, emotional intelligence, leadership, and creativity According to Blaha, accounting and finance professionals who can combine technology and soft skills with

financial acumen and a business mindset will be in high demand as clients increasingly need CPAs who can help them grow and sustain their businesses

“The CPAs of tomorrow will need to go beyond financial statements and compliance work They’ll be attesting to all sorts of things, and they will be involved in decisions related to supply chain, cyber, business operations, and more all while maintaining the trustworthiness that CPAs are known for,” Blaha stresses “Client surveys tell us they are looking for proactive, forward-looking advisors who can get results ”

Helping clients make good business decisions and understanding what they want is key to client retention, Lance adds: “Clients want help and assistance for the real-time world ”

Expectations are growing on the corporate side, too Corporate finance teams are no longer pencil-pushing reporters of financial results, says Anna Gomez, CFO of the Chicago-based advertising agency Leo Burnett Group: “We play a role at the forefront of the agency We’re involved in operations, corporate strategy, and running the business ”

Succeeding in that expanded role requires finance professionals to have a strong base of technical knowledge to fulfill compliance needs and a collaborative spirit to work with other departments and build a reputation as a trusted and strategic partner “Young finance professionals often mistakenly see the role as churning through back-office work, but they need to learn how to work in a team environment,” Gomez says “It’s not just about individual output ”

Developing a strategic mindset and having a deep knowledge of the business are also crucial to success in tomorrow’s finance world “You need to own the numbers, but you also need to understand how the numbers and metrics drive day-to-day business decisions Understanding the analytics that you ’ re presenting gives you a voice in making those decisions,” Gomez explains

Habitually being part of business conversations and understanding how other departments work helps raise your profile in the organization Leo Burnett’s finance team is involved in rate setting, negotiations, and staffing, and collaborates with the creative and account teams Gomez says some departments used to wonder why finance was in certain meetings they don’t anymore “The organization doesn’t make any decisions without finance now, ” she says “They know the value we bring We earned that seat at the table by being available and demonstrating the importance of finance’s point of view ”

Going Beyond Accounting

Developing the ability to provide strategic analysis and insight often means breaking out of the stereotypical CPA mindset

“CPAs can get stuck in cyclical patterns and habits The best way to break out of that is to constantly ask why things are done certain ways, ” Lance says, adding that professionals at all levels can and should cultivate an inquisitive mindset “Asking if there is a better way to accomplish a goal can help you avoid the ‘this is how we always do it’ mentality ”

It’s also important to find and build relationships with people who share that curiosity and are open to new ways of doing things Lance encourages young professionals to find fresh ways to expand their networks, such as meeting people for coffee to talk about industry changes and hear different perspectives that you can apply to your own work “Finding and talking to people doing innovative things in the industry, inside or outside your organization,

20 | www icpas org/insight

can help you learn new things and open up greater opportunities for you, ” he says

Successful upskilling ultimately hinges on a commitment to continuous learning “Today’s professionals need to be lifelong learners and they need to invest in self-directed learning,” Blaha says With a wealth of low-cost, easy-access programs through the Illinois CPA Society, other professional organizations, and on the internet, CPAs have no excuse for not expanding their knowledge base

Blaha also encourages younger professionals to follow and build on their natural curiosities “Don’t wait around for someone to tap you on the shoulder or to stumble upon your passions,” he advises “Have the mindset that you can direct your career to things that you are passionate about If you have an interest area, then work on becoming known in that specialty Lean in and earn recognition internally and externally by writing thought leadership pieces and finding other people with common interests Those are the types of activities that get you noticed and can give you access to new opportunities ”

Lance agrees that whether you work in corporate or in public accounting, establishing yourself as a thought leader and change agent helps you stand apart from your peers “You need to take the initiative to investigate how you can be a leader in the industry,” he says, adding that speaking, writing articles, and serving in industry organizations are great ways to share and test your opinions “Putting yourself out there allows you to chart your own path and be part of making and leading change ”

Gomez adds that accounting and finance professionals sometimes need to make an extra effort to get out of their shells and learn the soft skills that will help them develop into tomorrow’s thought leaders “Finance professionals of the future won’t be those who like to just sit at a desk,” she cautions

Organizing Organizational Support

While professionals should own their continual development, employers do their workers and their organizations a disservice when they don’t step up to help To retain top talent and drive business success, employers need to create upskilling opportunities and support the professionals who are committed to continuous learning

In fact, Blaha says firms need to protect those high-performing future leaders from getting poached by other firms “The job market is so competitive, you need to show you are invested in their success, ” he says “Providing robust leadership reviews and additional coaching and educational opportunities can show new hires and existing staff that the organization is committed to helping them acquire new skill sets and navigate change ”

Helping employees learn about new technologies also is important Whether it’s through in-person seminars, online courses, knowledge transfer from consultants and subject matter experts to staff, reimbursement for professional certification costs, or working with a mentor, organizations must provide timely training to stay ahead of the curve

Simply sitting down to a conversation with staff also helps guide upskilling Gomez, for instance, talks to her staff individually about the future of the industry and the professional environment And one of the things she tells them? “The industry has changed so much You need to maintain the technical skills but also learn how to build relationships and develop confidence in your ability to make an impact Learning that early in your career sets you on a successful path ”

www icpas org/insight | SPRING 2020 21

Get Future Ready Join us at the Young Professionals Leadership Conference To learn more, visit www.icpas.org/yplc

22 | www icpas org/insight

Revving Up Recruiting in the New Roaring 20s

Recruiting and retention has historically been a top issue for CPA firms. Here’s a new talent strategy for the next decade.

BY KRISTINE BLENKHORN RODRIGUEZ

www icpas org/insight | SPRING 2020 23

As accounting firms of all sizes take aim at strategic growth in a fresh decade, many are facing a historical challenge finding the right team

“This is the tightest labor market we ’ ve seen in years, ” says Ann Guerra, vice president and metro market manager for Robert Half Finance & Accounting in Chicago “Unemployment is the lowest it has been in 50 years, which is great, but it’s making it much harder to find talent in the marketplace It’s a candidate’s market ”

In a new Robert Half Finance & Accounting survey of CFOs, 93 percent said it’s challenging to find skilled candidates for professional-level positions As a result, respondents said their search could take a month or more to fill staff-level accounting or finance positions and five weeks to hire for management-level roles

Another survey from the firm found nearly six in 10 job seekers (59 percent) have received two or more offers simultaneously when applying for jobs

The takeaway: Many firms are having to get creative to gain a competitive advantage in signing the best and the brightest From expanding the candidates you ’ re considering, to fine-tuning culture, to harnessing the latest tech, here are some ways to build your dream team in a tight labor market

Untapped Talent

Janel O’Connor, chief human resources officer for professional services firm Sikich, has watched the hiring sea change “I entered this profession when you posted an ad in the newspaper, candidates flowed in, and you picked one, ” she explains “We’re so far from that now ”

Firms are increasingly looking at groups they might have traditionally overlooked years ago “In a market like this, you don’t want to beat your head against a brick wall Look for groups that are talented but have not traditionally been as sought after,” encourages Tiffany Dougherty, founder of Ardent Services, who has built her career on recruiting from the military; women ’ s, LGBT, and minority groups; and more

Military Might

“Who wouldn’t want a candidate from a culture where the motto is ‘Be all you can be?’” Dougherty asks “The level of urgency and attention to detail required in the military is a great fit for accounting and finance No one gets through the military by being just okay or skating by, so you ’ re getting a candidate used to giving 100-plus percent ”

Erik Casarez is proof of that mentality A former Green Beret, he and wife Rebecca own ProAdvisor CPA, a Silicon Valley-based accounting firm “A lot of the things I learned in my military career didn’t translate to me becoming a financial analyst at Goldman Sachs But what I lacked there I made up for in leadership skills and life experience, which go far beyond what your average job candidate brings to the table,” Casarez says, adding that his military experience taught him to solve problems using out-of-the-box thinking, which ultimately translated to him and his wife creating an accounting firm that is not dependent on tax season or hourly

billing Both decisions, he says, were made to benefit the firm and its employees, but he wouldn’t have had the courage to forego the traditional model and approach without his military training

Parental Prowess

“Returnships” are on the rise in many firms as leaders recognize the value of workers who have taken time off to care for families or pursue other interests Becky Egan and her husband started their accounting firm in 2005 Having two young children, they’re more than familiar with juggling the demands of home and work, and see the skills used at home as useful at work also