E x p l o r i n g t h e i s s u e s t h a t s h a p e t o d a y ’ s b u s i n e s s w o r l d g w w w i c p a s o r g / i n s i g h t S U M M E R 2 0 1 6 THE MAGAZINE OF THE Conflict in the C-Suite n 21st Centur y Heists n Jet Set Business n The Hush on Trade Secrets S TEM Talent in Illinois n Managing t he Managers n Big Data n Cyber Def ense...& more! G, BAD AMERICAN MERGERS 5 BE SEEN HERE : 2016 Midwest Accounting & Finance Showcase / 8.23 & 8.24 / Rosemont, IL

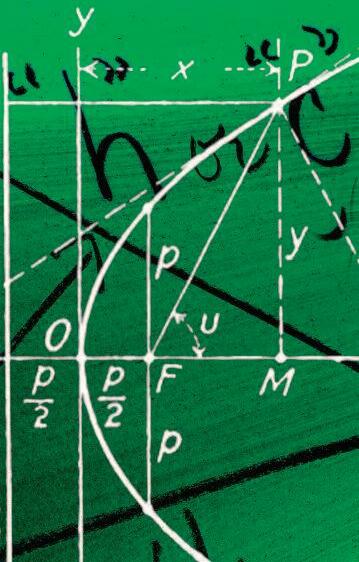

Get the Whole Picture with Checkpoint

Thomson Reuters Checkpoint Catalyst® delivers trusted tax research answers framed in an entirely new way, so you can see the clarity, color and context you need to get the whole picture of each business tax issue.

Checkpoint Catalyst is a truly integrated research experience that streamlines the tax research process, eliminating extra steps and guiding you from question to answer to action. Federal, state and U.S. international tax implications are part of the main topic discussion, so there’s no need to look anywhere else. Multiple perspectives from leading industry experts and embedded tools and diagrams provide clear answers and the confidence that comes from knowing you haven’t missed a thing.

To learn more or for a FREE trial, visit checkpointcatalyst.com

©2016 Thomson Reuters

I

tax research process?

How can

eliminate unnecessary steps in my

Catalyst

2 INSIGHT www icpas org/insight i n d e x @IllinoisCPA #INSIGHTmag on the cover 28 5 Epic M&A Fails 32 The 21st Century Heist While technology enables businesses to innovate faster than ever, it also invites evermore ambitious criminals to steal on an ever greater scale 36 Chasing the Global Dream Planning and a healthy dose of foresight help globally minded companies overcome the many complexities and challenges of expanding business abroad. 6 Seen Heard Ice - Cream Socials / Green Tech & Profit / Flextime That Works / Q&A with Jay Levine 12 Tech Pulse Banks & Biometrics / Audit Automation / Meditating Apps / Tax Foundation Goes Digital 16 Young Pros Managing Up The definitive guide to winning over your bosses 18 Leadership The C(onflict)-Suite The CFO’s guide to navigating difficult CEO relationships 20 Workforce Outrageous Expenses Helicopter ride you say? Some expense attempts border on hilarity, but they ’ re also what ’ s wrong with the world of expense reporting 22 Legalities Costly Secrets Are preliminary business negotiations putting your trade secrets at risk? 24 Investing Crowdfunding & the Future It ’ s the darling of the investment world But who’s using it? And how do you get in on the act? 26 Economy STEM Sells Illinois’ competitive edge hinges on preparing its workforce for continued innovation in science, technology, engineering and math 4 Today’s CPA The CPA Pipeline Todd Shapiro 14 Hype It Define Your Own Success and Happiness Sarah Herrmann 40 Tax Decoded Ball of Confusion Keith Staats, JD 42 Inside Fraud Cyber Defense Systems Are Go Theresa Mack, CPA, CFF, CAMS, PI 44 Corporate Minds A Dash of Big Data Rose Cammarata, CPA, CGMA 48 Capitol Report Crisis & Deadlock Marty Green, Esq columnists trending topics features S U M M E R 2 0 1 6 | w w w . i c p a s . o r g / i n s i g h t

gambled and lost in the high-stakes mergers & acquisitions game.

They

INSIGHTS & SOCIETY NEWS FROM TODD SHAPIRO, ICPAS PRESIDENT & CEO today

INSIGHTS & SOCIETY NEWS FROM TODD SHAPIRO, ICPAS PRESIDENT & CEO today

’sCPA

{Follow Todd on Twitter @Todd ICPAS}

{Watch Todd’s CEO Video Series on YouTube}

The CPA Pipeline

are you part of the problem or the sol ution?

We have an economy that is growing. In study after study, the accounting profession is viewed as one of the top professions to work in There are more accounting majors today than ever before over 250,000 So what’s the problem? And why does

“pipeline” continually come up as one of the top issues facing the profession?

We have to look at the environment a bit more closely to get at the answers. Yes, there are more accounting majors than ever before, but 49 percent of those accounting majors will never sit for the CPA Exam, and one-third of those who do sit for the exam will never complete it As a result, only one-third of accounting majors ever pass the exam With such a coveted credential, why do so few complete the process?

There are many factors driving down the number of new CPAs We can blame a vibrant economy where many companies willingly hire accounting graduates without requiring a CPA We can blame the growth in advisory services at firms that don’t require a CPA. We can blame the 150-hour rule. We can blame the exam format. But in the end, we have to look inward and challenge ourselves on how much we are supporting, pushing and requiring accounting majors to become CPAs.

In an AICPA survey, staff identified work environment as the number one factor influencing whether they follow through and become CPAs a work environment that encourages and supports them in attaining the credential Reasons respondents gave for not finishing the exam included conflicts with work, cost of the exam, the need for time to study, and multiple tries to complete all parts Only 27 percent of test-takers finish all four parts on the first try On average, passing candidates require about 6 5 attempts to pass the four parts The cost to complete four parts and a review class can reach almost $5K

This is where we become either part of the problem or part of the solution. We have to ask ourselves, “Are we creating and fostering an environment that encourages staff to complete the CPA Exam?” Many companies are happy to hire accounting majors and not require a CPA Is that best for your company’s and your staff ’s long-term prospects?

Public accounting firms, too, have to look inwards. In a recent Illinois CPA Society survey of the top 25 public accounting firms in the Chicagoland area, 98 percent said they’re struggling to meet CPA needs or would like a larger pool of CPAs to recruit from Yet 12 percent said they only provide financial assistance for a review course (not the exam) and 12 percent said they provide no financial assistance at all. Of those that do provide financial assistance, only two firms will pay for more than one attempt of a section Yet, the average candidate requires 6 5 attempts to pass all four parts Lastly, 20 percent said they don’t provide PTO or flexible work schedules for the review course or the exam

So, at the end of the day, are we putting our money (literally not proverbially) where our mouths are? If we’re serious about the need for more accounting majors to become CPAs, we need to provide the financial and environmental support to complete the process Yes, it will require an investment of time and money However, with three-out-of-four current CPAs projected to retire in the next 15 years, the pipeline issue is bound to only get worse. In the end, this is time and money we can’t afford not to invest.

The pipeline also hinges on the issue of diversity or lack thereof I’ll talk more about that in my next column

4 INSIGHT www icpas org/insight

INSIGHT MAGAZINE

Publisher/President & CEO Todd Shapiro

Editor-in- Chief Judy Giannetto

Art Direction & Design Judy Giannetto

Production Design Rosa Garcia

Managing Editor Derrick Lilly

Photography Jay Rubinic, Derrick Lilly, Nancy Cammarata

Circulation Carl Siska

National Sales & Advertising

Michael W Walker

The RW Walker Company P: 213 896 9210

E : mike@rwwcompany com

Editorial Offices

550 W Jackson Boulevard, Suite 900, Chicago, IL 60661

ICPAS OFFICERS

Chairperson, Scott D Stef fens, CPA Grant Thornton LLP

Vice Chairperson, Lisa A Har tkopf, CPA Ernst & Young LLP

Secretary, Rosaria Cammarata, CPA , CGMA Mattersight Corporation

Treasurer, Margaret M Hunn, CPA , CFE, CFF Rozovics Group LLP

Immediate Past Chairperson, Edward J. Hannon, CPA , JD, LLM Quarles & Brady LLP

ICPAS BOARD OF DIRECTORS

Brent A Baccus, CPA Washington Pittman & McKeever LLC

Christopher F Beaulieu, CPA, MST CliftonLarsonAllen LLP

Terry A Bishop, CPA Sikich LLP

Jon S. Davis, CPA University of Illinois at Urbana

Eileen M Felson, CPA, CFF PricewaterhouseCoopers LLP

Stephen R Ferrara, CPA BDO USA LLP

Jonathan W Hauser, CPA KPMG LLP

Anne M Kohler, MBA, CPA, CGMA The Mpower Group

Thomas B Murtagh, CPA, JD BKD LLP

Elizabeth S Pittelkow, CPA, CITP, CGMA ArrowStream Inc

Maria de J Prado, CPA Prado & Renteria CPAs

Kelly Richmond Pope, Ph D , CPA DePaul University

Andrea K Urban, CPA ThoughtWorks Inc

Kevin V Wydra, CPA Crowe Horwath LLP

INSIGHT is the official magazine of the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA Its purpose is to serve as the primary news and information vehicle for some 24,000 CPA members and professional affiliates Statements or articles of opinion appearing in INSIGHT are not necessarily the views of the Illinois CPA Society The materials and information contained within INSIGHT are offered as information only and not as practice, financial, accounting, legal or other professional advice Readers are strongly encouraged to consult with an appropriate professional advisor before acting on the information contained in this publication It is INSIGHT’s policy not to knowingly accept advertising that discriminates on the basis of race, religion, sex, age or origin The Illinois CPA Society reserves the right to reject paid advertising that does not meet INSIGHT’s qualifications or that may detract from its professional and ethical standards The Illinois CPA Society does not necessarily endorse the non-Society resources, services or products that may appear or be referenced within INSIGHT, and makes no representation or warranties about the products or services they may provide or their accuracy or claims The Illinois CPA Society does not guarantee delivery dates for INSIGHT The Society disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delays in delivering INSIGHT INSIGHT (ISSN-1053-8542) is published four times a year, in Spring, Fall, Fall, Winter, by the Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA , 312 993 0407 or 800 993 0407, fax: 312 993 7713

of the contents may be reproduced by any means without the written consent of INSIGHT

Specialist, at the address above Periodicals postage paid at Chicago, IL and at additional mailing offices

to: INSIGHT, Illinois CPA Society, 550 W Jackson, Suite 900, Chicago, IL 60661, USA

A Good Day for Doing Good #CPAvolunteer

Copyright © 2016 No part

to:

POSTMASTER: Send address changes

Permission requests may be sent

Publications

www icpas org/insight | SUMMER 2016 5 Day of Ser vice

SEEN HEARD

$119,570

income needed to live comfortably in san francisco compared to $68,782 in chicago [GoBankingRates]

HOW TO

THROW AN ICE-CREAM SOCIAL

It doesn’t have to be a mess It doesn’t have to be complicated But a sweet summer treat does have to be fun

Here’s how to throw an adult ice-cream party every employee will love, courtesy of Sam Mason, owner of Oddfellows Ice Cream Co , and The Wall Street Journal

1 Offer four varieties of ice-cream vanilla as the staple, a chocolate option, a wild card, and at least one nondairy option, like a sorbet

2 Use cardboard cups to make clean-up easy

3 Shoot for a buffet so guests can create their custom sundaes on the fly

4 Keep the ice-cream cold using dry ice or salted ice on the table

5 Don’t skimp on the toppings rainbow sprinkles and chocolate pearls, granola, hot fudge and chocolate sauce, caramels, fresh fruit, etc Also try some adult toppings, like brandied cherries or whiskey whipped cream.

6 Set out a blender and maybe even some spirits if this is an all-out, happy-hour style social

MAKE FLEXIBILITY WORK

Work/life balance and schedule flexibility are hot topics in today ’ s accounting world Some employers offer it, some waffle on it, and others just don’t have a clue Offering flexibility doesn’t have to be complicated, however Isaac O’Bannon, managing editor of CPA Practice Advisor, offers up these three simple rules to make a flexible work schedule work for all:

RULE #1: Get the job done

RULE #2: Be damn good at your job, consistently

RULE #3: Be responsive to your boss, your clients and anyone else you do business with or for, so that it ’ s just like you ’ ve been in the office all day

6 INSIGHT www icpas org/insight

N E W S B Y T E S , S O U N D A D V I C E A N D P R A C T I C A L B U S I N E S S T I P S

"Sometimes, the best part of my job is that my chair swivels." anonymous

79

billionaires who live in new york city, more than any other city in the world.

[forbes]

Green Tech Grows Your Greenbacks

Reducing your carbon footprint might not be your top priority, but it can actually save money for you and your business and improve your workplace culture CNBC offers these four ways to make it happen.

1 See better: The Department of Energy says widespread LED use could save the U S more than $30B by 2027

2 Stay home: According to Global Workplace Analytics, the average real estate savings for a full-time teleworker is roughly $10K per employee per year.

3 Conser ve more: Water- and energy-efficient appliances can save about $300 annually for a small office Even fixing a leaky faucet or toilet can save up to 90 gallons of water a month

4. Go paper less: Businesses like Lockheed Martin and General Electric are saving $250K to $10B by digitizing paper manuals and processes

This Career Center ’ s For You!

On the hunt for a new gig? Looking to land top talent? ICPAS has launched an all new Career Center that offers job seekers and employers more resources than ever New job search features include the ability to create a free professional profile and portfolio highlighting your top-notch talents, automatic email notifications of new jobs that match your career criteria, and the option to save jobs listings to apply for or revisit later For employers, the service offers unrestricted access to the ICPAS job board, meaning job listings are seen by not only ICPAS members, but also anyone who visits the site We’ve also simplified the prospecting process by launching a resume search tool that notifies you when a candidate has your most needed skills What ’ s more, our new job listing management platform makes it easy to create job posts, check their status and add upgraded features to attract more views

Visit the Career Center today at www icpas org/careers for more info

8 INSIGHT www icpas org/insight SEEN HEARD

6 WAYS TO MAKE LINKEDIN WORK FOR YOU

Just because you create a LinkedIn profile doesn’t mean you’ll automatically attract hundreds or thousands of connections and clients right away. But with a little work, and these 6 tips from Brilliant, you’ll be on the right track.

1. Add a picture

Profiles with a photo receive 14 times more views, so be sure to use a professional photo (no selfies or family snapshots) Headshots, i e shoulders and up, with a simple background are best And don’t forget to smile

2 Customize your URL

LinkedIn allows you to make your own URL when editing your profile Don’t overlook this feature A customized URL with your first and last name makes it easy to use on your business cards, in email signatures, on your resume, in search engines, and more

3 Be searchable

First, include strong keywords in your title, summary and job experience sections Next, complete your skills section (you can list up to 50) Last, make sure your job listings link to the business’ page to increase your visibility with current and past employees

4. Join groups

There’s a LinkedIn group for nearly everything. Find the groups that most closely align with your professional goals and join them. Then connect with group members, share articles and comment on posts to increase your visibility

5. Connect with others

This is what LinkedIn is all about Adding connections increases the likelihood that your profile will be seen by individuals looking to connect with you or hire you

6. Stay active

Write or share relevant articles, make new connections, share job opportunities with your network, and comment on posts and discussions

Whether

www icpas org/insight | SUMMER 2016 9

RENEW TODAY!

you work in public accounting, corporate finance, not-for-profit, consulting, government or education, the Illinois CPA Society provides you with access to an extraordinary community of 24,000 accounting and finance professionals.

www.icpas.org

WHAT’S HAPPENING : 2016 Midwest Accounting & Finance Showcase

KEYNOTE: Jay Levine

q&a

With a career spanning 42 years with the likes of CBS and ABC, this award-winning journalist, reporter and chief correspondent is bringing something new to this year ’ s Midwest Accounting & Finance Showcase keynote For the full interview, visit INSIGHT online at www icpas.org/INSIGHT

q:You’ve covered so many complex topics. How were you able to shift gears with such varied audiences, which CPAs also often have to do?

a:I’ve covered a lot of fascinating people and events in my career, and what you have to concentrate on is the story. If you can convey interest and enthusiasm and involvement in the story, people will listen But you have to show how and why you’re interested and why the story is important I always reflect back on Mrs Peterson, my daughter ’s fourth grade teacher here in Chicago, who said that you have to start every story you write with a ‘wow sentence’ a sentence that makes people sit up and pay attention I take that message to heart every time I write a story: What’s my wow sentence? What’s my hook? What will get people interested? That’s what people in the field need to think about

q:Were any of those fascinating people and events career changers?

a:Back in the 80s I started traveling all around the world to cover stories going to the Vatican to cover the Pope, going to Central America to chase drug runners, going to Asia to see what they were doing for the Beijing Olympics I guess I have done so many different things and traveled to so many different places that I don’t think there’s been any one thing, it’s just been an evolution Whether it happened in Berwyn or Berlin, I would go there. This is the long way of getting to a short answer, but becoming familiar with the way people live around the world helped me to appreciate what we have here and shaped my perspective of the world, the people in it, and the stories I was covering

8.23 / 8.24

Catch Jay at the 2016 Midwest Accounting & Finance Showcase, held at the Donald E Stephens Convention Center in Rosemont, Ill Register at www.icpas.org/show.htm.

q:You’ve always been an advocate of spin-free journalism How do we find sources we can trust?

a : You know if you’re watching Fox News you’re getting one side, and if you’re watching MSNBC you’re probably getting another You as a viewer, listener or reader need to make your own judgements on what makes sense to you. You have to have your own ‘BS Meter,’ so to speak, to say, “Hey, come on, that’s spin, that’s not reporting ” You have to look very, very carefully at what everybody says and what their ulterior motives are, because sometimes it’s hard to put the blinders on and judge for merits

q:How has social media fundamentally changed how we do business today?

a:It’s having a huge impact and you have to again be very, very careful All too often people are taking something from a blog, which may just be the opinions of some guy sitting in his underwear in his basement who’s never gotten out onto the streets to cover or understand the story, and all of a sudden it becomes truth and reality. On the other hand, social media is very important, it’s an incredibly effective and valuable tool, it lets us multiply by the thousands our eyes and ears around the world.... Back in the day, I used to have to do man-on-the-street interviews to get an idea about what people were thinking; now you just hop on Twitter and Facebook and you get a good sense of that. We don’t operate in ivory towers, we operate in the real world, and without understanding how people are viewing things, it’s impossible for you to do a good job

10 INSIGHT www icpas org/insight

SEEN HEARD

TECH PULSE

revenue per pl ay artists receive every time you stream your favorite song on spotify or itunes [information is beautiful]

Banks & Biometrics

With password security seeming increasingly feeble in the face of hackers and cybercriminals, more and more banks are turning to biometric technologies for security think fingerprints, voice recognition, eye scans and face scans Since cybercrime costs the global economy an estimated $450B a year, according to the Center for Strategic and International Studies, the rush to biometrics in the financial industry is no surprise, and definitely a trend to watch for both finance/accounting professionals and consumers

[Source: Christian Science Monitor]

Tax Foundation Goes Digital

The Tax Foundation [www taxfoundation org] has been printing its Facts & Figures publication since 1941, and now it ’ s bringing it into the digital age with new Apple and Android smartphone apps The app platform will continue the print publication’s mission of delivering accurate data and a broader perspective of the challenges facing public finance today

It includes a variety of features that allow users to view tax rates and brackets for all 50 states, compare tax data with 39 different measures, see when Tax Freedom Day is for each state, compare states’ business tax climates, and much more

Audit Automation Proves Its Worth

Meditate With Omvana

Summer not enough to help you unwind? Try the Omvana Meditation app Available to iOS and Android users, Omvana has more than 500 tracks for meditation, focusing, relaxing, and even sleeping better Have your doubts? It ’ s the number one meditation app in more than 30 countries, and it has a variety of other content to help you find the zen in all aspects of your life Omvana can even help you break a bad habit with hypnosis!

In today ’ s digital age, technology- enabled auditing tools and processes are making waves. When business research firm APQC examined the number of internal control violations per year per 1,000 employees at 70 companies, the top performers experienced 3 51 or fewer violations while the weakest were dealing with 34 23 violations or more annually For a 10,000-employee company in the bottom quartile, that ’ s more than 340 controls violations. So how are the top companies avoiding the same mistakes? APQC found that companies in the top quartile had automated at least half of their primary audit controls compared to only about 12 percent or less for those in the bottom quartile. In other words, more automation means fewer violations. Subsequently, companies and large audit firms are investing heavily in internal audit automation, advanced data analytics and artificial intelligence technologies that can be customized to crawl through enormous volumes of data and learn to identify outliers, recurring patterns and audit risks

12 INSIGHT www icpas org/insight

T H E L AT E S T, G R E AT E S T T E C H N O LO G Y T R E N D S & P R O D U C T S

$0.001

If your clients require expert services, our Client Back Guarantee ensures our consultants are playing for your team. Contact our experts at 866-717-1607. James Schultz Jim Martin Harry Cendrowski CPA/CVA CFF MAFF CMA CIA CFE CPA/ABV CGMA CFF CFE CVA CFD MAFF Working with consultants? Make sure your clients stay with Your Firm. The Business of LINKING OPERATIONAL INTEGRITY For more than 30 years CHICAGO / BLOOMFIELD HILLS / 866-717-1607 / www.cca-advisors.com

CAREERS CONNECTIONS CREDIBILITY

Define Your Own Success ... and Happiness

June’s Young Professionals Leadership Conference, “The Art of Success,” kicked off a year of dynamic and engaging young professional programming Attendees mingled in the modern, industrial space of VenueOne in Chicago’s West Loop, while sharing their thoughts on personal goals, career success and happiness Speakers enthusiastically shared personal anecdotes and answered attendee questions, which made for our most interactive conference yet

For those of you who were unable to experience the fun in person, here are my five biggest takeaways:

1 . Fi n d i n g s u c c e s s i s a p e r s o n a l j o u r n e y. And it’s defined differently by each of us

2. Attitude is key in finding your own success and happiness

3. Make time for the things that make you happy. And try to work that happiness into your day job

4. Think of a jungle gym, not a ladder as you navigate your career trajectory

5. Ask yourself these three questions, courtesy of keynote speaker and bestselling author Jeff Goins: “What do I love?” “What am I good at?” and “What do people need?”

These key points really resonated with me, and I’m eager to put them to practice I hope all of you who attended left feeling energized and excited about forging ahead in your brilliant careers

don’t miss these events! n July 28 - Raise Your Glass! Fundraiser n August 18 - CPA and Attorney Speed Learning n September 23 - CPA Day of Service n October 20 - New Member Happy Hour n November 17 - Improve it! Taking Initiatives Improv Workshop Visit www icpas org/yp htm for details

M U S T- R E A D N E W S F O R U P- A N D - C O M I N G A C C O U N T I N G P R O S S a r a h H e r r m a n n H y p e I t E d i t o r I C P A S M e m b e r O u t r e a c h } YOUNG PROFESSIONALS CENTER WWW ICPAS ORG/YP HTM @ILLINOISCPA

HYPE IT

14 INSIGHT www icpas org/insight

Managing Up

The definitive guide to winning over your bosses

By Selena Chavis

By Selena Chavis

You may knock it out of the park as an accountant, but do you have what it takes to score on the executive team?

Thinking all it takes is getting the job done is a rookie mistake Relat i

executive coach “Often, people think if they do their jobs well, word will spread, and everyone will know. People don’t realize the importance of relationships and visibility, the importance of evangelizing what you’re doing in a diplomatic way ”

It comes down to thinking about the system rather than a job description, and understanding what really matters to your team’s leaders In essence, it’s about managing up, and it’s an “enormous part of anyone’s job,” Sloane emphasizes

The problem is that so many overlook this simple fact in their hurry to race up the corporate ladder “Young people in particular get frustrated that it’s not moving faster, that their job isn’t as glamorous as they want it to be,” says Bernie Layton, managing director of Stanton Chase’s Chicago operation “Professional development doesn’t happen overnight Be patient and learn how to become valuable ”

With that in mind, here’s how to get a jump on making your way to MVP

1. Be crisp. Be clear

Time is money When engaging C-Suite executives, “Don’t languish or linger,” Layton says “Make sure you’re prepared for the discussion Ask yourself, ‘Where do I expect this conversation to go?’ Then have an appropriate response and recommendation ready.”

2. Bring value

Moving up in the roster requires a clear value proposition “It’s our experience that the board of directors and CEO admire and respect those who offer critical thinking and advisory skills to a company, as opposed to just functionally solving the problems of day-to-day activities,” Layton explains, adding that the most effective professionals he sees driving a board room are those who are “nimble and able to pivot around the direction of the conversation.

“‘Here are the challenges; here are the risks; and here are the numbers a s s o c i a t e d w i t h b o t h ’ I t ’s v a l u e a r o u n d c r i t i c a l t h i n k i n g ; i t ’s v a l u e around being timely; it’s value around knowing the numbers,” he adds

3 Respect ranks

“If you’re ticking off your boss because you’re trying to have lunch with senior executives, it’s not going to work out really well for you,” Sloane warns In fact, you’re falling into a dangerous trap “Your relationship with your boss is going to have a big impact on anything you do and

16 INSIGHT www icpas org/insight YOUNG PROS

i p b u i l d i n g i s k e y, s a y s J a c k i e S l o a n e , M C C , a C h i c a g o - b a s e d

o n s h

your long-term success,” she explains. “A good boss has enormous impact on your career So, you need to know what really matters to them and what really matters to your boss’ boss ”

4. Play fair

N o t o n l y s h o u l d p r o f e s s i o n a l s b e c a r e f u l n o t t o l e a p f r o g t h e i r supervisors in an effort to reach the top, but they should also make a concerted effort to make that supervisor look good “You always want to make sure your boss is winning even as you’re cultivating these relationships with higher-level leaders,” Sloane explains “If you have an idea or information that could be useful, for example, most people you’re reporting to would want to be aware of it ”

5. Speak up

Being right is a valuable commodity, but Layton suggests that, right or wrong, just having a strong point of view can turn heads with senior executives The important value-add is being able to back up what you say. “Take a risk; have a point of view and support it with important information,” he says

6. Think globally

It’s easy to get caught up in your work, but failing to understand the big picture in terms of where the organization is heading is all wrong, Sloane cautions For instance, if your firm is looking to expand in Asia and you find helpful information for that initiative, here’s your golden opportunity to move the information up the food chain

It’s also important to consider how you conduct yourself outside of work Layton notes that social media, while an effective platform for a number of professional endeavors, is also full of trip wires “If you don’t think risk management in terms of social activities, it can have a negative impact,” he cautions.

7. Communicate often and well

While an introverted, analytical personality may prove advantageous when it comes to successfully navigating the technical role of accounting and finance, it may not carry you to the top spot. “There’s a bit of a glass ceiling that occurs when the nature of a p e r s o n i s t o o a n a l y t i c a l , n o t a d a p t i v e w i t h c o m m u n i c a t i o n a p p r o a c h e s a n d n o t c o l l e g i a l e n o u g h , ” L a y t o n o b s e r v e s “ T h e more technical your role, the more you need to step out of your comfort zone and have a personality that’s endearing to the C-suite and board ”

“There’s so much knowledge and expertise in the accounting field But really, in any industry, it’s the soft skills communication skills and that executive presence that, ironically, are going to trump your expertise,” Sloane explains “Your ability to influence and connect is what becomes critical ”

8. Sell yourself

Being an executive is about having the ability to influence people without really trying that hard to do it “There’s this grace about you, this ability to put people at ease, and there’s this intelligence in the questions you ask You’re not saying a whole bunch of stuff j u s t t o b e h e a r d , ” S l o a n e e x p l a i n s “ A l l o f t h a t b e c o m e s m u c h more important in leadership roles. Your role becomes more about getting people on the same page and creating unity ”

In a sense, you’re selling yourself, and you’re selling your agenda. While many accounting professionals tend to shy away from “selling” as a concept, Sloane asserts that anyone who wants to successfully manage up will need to do their fair share of it “Rather than getting people to do something they don’t want to do,” she says, “think about it as helping other people see what you see ”

Invigorate your career search

www.icpas.org/careers

As a benefit of your ICPAS membership, both job hunters and seekers can take advantage of the new Career Center:

SHARE

your resume with all employers (even confidentially)

RECEIVE

new job openings sent directly to your email

STRENGTHEN

your resume with career resources and coaches

POST jobs online quickly and simply*

CREATE alerts for resumes and manage applications

*fees apply

www icpas org/insight | SUMMER 2016 17

The C(onflict)-Suite

The CFO’s guide to navigating difficult CEO relationships

By Derrick Lilly

By Derrick Lilly

You’re supposed to be the sidekick, the number two, the right hand man (or woman), in a super duo that’s leading the company charge to incredible innovation and sensational success There’s just one problem: Instead of being Robin to your Batman, Batman is treating you like the Joker (or maybe vice versa). Sure, tiffs and riffs and competitions happen in the C-suite, but when the CFO and CEO are at odds well, let’s just say a super team can quickly turn super sucky

In the rare case when “conflict between the CEO and CFO shows up in a public way, it can cause significant damage to the organization,” warns executive coach Jay Scherer of Scherer Executive Advisors “The solution to touchy relationships, and a Golden Rule for anybody who works for anybody, is to have regular discussions and ask for feedback Unfortunately,” Scherer says, “Some CEOs don’t give very good feedback until the feedback is that today’s your last day.”

So before your super duo falls into super shambles, let’s take a look at some of the most common C-suite conflicts and what savvy CFOs can do to save the day and their jobs

Split strategies: The tone is set at the top, right? So when the CFO and CEO aren’t aligned with each other or the corporate strategy, all hell could break loose “The CFO is a critical enabler of the organizational strategy and most CEOs need the CFO to be 100-percent bought in for a strategy to succeed,” says Scherer. “If the CEO and CFO aren’t united and aligned in their thinking, they can’t expect the rest of the senior team and organizational staff to fully have their backs ” That could translate into low employee morale, wavering investor confidence, and the overall faltering of the business.

“There’s a cultural due diligence that an incoming CFO needs to do when joining a new company, and that also applies when it comes to the CEO,” explains Ajit Kambil, Ph D , global research director for Deloitte’s CFO Program. “A new CFO needs to learn the CEO’s style, what the CEO might be looking for, and what he or she believes in and expects Most CEOs want the CFO to be an effective business partner with them on the change journey that they are trying to execute in their organizations.”

18 INSIGHT www icpas org/insight LEADERSHIP

“Awareness by the CFO of what the CEO wants is key,” Scherer adds “Try to be forward-looking and action-oriented This way, you can try to stay a step or two ahead of the CEO and anticipate what’s needed to be done.”

Mixed Roles: “A lack of clarity around the specific definition and focus of the role of both the CFO and the CEO can be a recipe for disaster,” says Scherer In other words, there should be absolute clarity around what the CFO should be working on, as directed by the CEO, board or private equity owners or all of the above The last thing you want is to be stepping on each other ’s toes, butting heads over tasks, or wondering what the other is doing.

“Be very sure to work on specific definitions of the roles and understand specific expectations of the CEO,” Scherer emphasizes

C o m r a d e s v s C o m p e t i t o r s : CFOs are wearing more and more hats within organizations and taking on more public roles, dealing directly with board members, shareholders, private equity owners and activist investors. As a result, CFOs often emerge as the second highest ranking executives in a company and the logical successors to departing, underperforming or troubled CEOs.

B u t a c t i v e l y t r y i n g t o p u s h o u t t h e CEO rather than simply prepping for the r o l e i s a d i f f e r e n t m a t t e r a l t o g e t h e r “ H o w d e t a i l e d , h o w o f t e n , a n d h o w these communications look can create c o n f l i c t b e t w e e n t h e C E O a n d C F O , ” warns Scherer.

Risk Appetites: Here again, styles and philosophies can be a source of conflict and rivalry. CEOs are typically extroverted visionaries with lofty goals and an appetite for business risk, while CFOs are commonly the analytical ones, poised to offer a reality check “In some ways the role of CFO is to keep the CEO out of trouble,” Scherer says “Where conflict can arise is when the definition of ‘trouble’ is not shared between the two ”

Thankfully, most of these conflicts can be stemmed off with early relationship building at the first sign of disharmony. In most cases, Scherer explains that the CFO will need to be the one to take the initiative The same applies when a tiff, riff, misunderstanding or rivalry occurs.

“This means letting your guard down, opening up a discussion and having some humility Use statements like, ‘I feel like I’m not meeting your needs’; ‘I don’t feel like we are on the same page here’; ‘What am I missing?’ ‘Am I focusing on the right things?’” Scherer suggests

“We’re often afraid to have these conversations, we delay them, we don’t do it, we don’t open up, and before we know it, we’re too far apart,” he adds

Realistically speaking, once the partnership is beaten and battered, there are few choices left to make either you suck it up and get your CEO’s back or you plan your escape “Usually when a CEO takes a ‘my way or the highway attitude’ it’s because they d

Scherer If the misalignment is too great, the CFO should probably begin their search to find a place where they fit and can truly be a partner with the CEO ”

n ’t f e e l t h a t t h e C F O i s o n t h e s a m e p a g e w i t h t h e m , ” s a y s

www icpas org/insight | SUMMER 2016 19

o

Outrageous Expenses

Helicopter ride you say? Some expense attempts border on hilarity, but they ’ re also what ’ s wrong with the world of expense reporting.

By Sheryl Nance-Nash

Who’s Fault Is It Anyway?

Rental homes, beef in bulk, toilet paper, new cars, doggie day spas, vacations, flat-screen TVs, loans, rents, medications, taxidermy, dance classes, a welder, somebody else’s salary Apparently some employees mistake “think outside the box" to mean “get creative with your expense reporting ”

Truth be told, the number of improper expense report requests shows little sign of declining In fact, only 11 percent of executives said they saw a drop in inappropriate requests over the past few years in a recent Robert Half Management Resources survey.

“These outlandish and sometimes funny examples shed light on what can be a serious problem for businesses Inappropriate expense reports are costly both to the company’s bottom line and to the careers of the people who submit them,” says Tim Hird, executive director of Robert Half

We can’t tell you with any certainty how much outrageous expenses have cost companies, however After all, “Who would divulge such a thing; it’s embarrassing,” says Steve Lickus, regional vice president of Robert Half in Chicago.

Others simply squeeze their way through the approval process, like the employee who “submitted an $800 helicopter ride in the South of France It actually got approved as a safer form of travel,” Brian Bleifeld, CPA, recalls

And while business travel typically q u a l i f i e s a s a n o r m a l business expense, there are limitations to even this

“An employee needed to be in New York Monday but he wanted to fly out on Friday, because he said it was the same

It wouldn’t be fair to point the finger only at employees when it comes to issues surrounding expense reporting According to research commissioned by global software company Unit4, 32 percent of US employees are frustrated with their employer ’s expense process, and 42 percent feel financially taken advantage of through the expense reporting claim process

“The reasons for not submitting are varied: It’s time-consuming or frustrating, lost receipts, claim amounts are too low to bother, or some employees simply forget,” says Kara Walsh, chief human capital officer at Unit4.

The trouble here is that this could lead to a negative work environment where employees are short of money and feel disengaged in their jobs “Since people are the core of any company, particularly those in service industries, a disengaged workforce will inhibit long-term strength and stability,” says Walsh

Here, again, technology could be the solution “Make the expense management process easy, on-the-go and intuitive,” suggests Walsh, pointing to the benefits of mobile expense reporting apps. “Functionality like automatic tracking and filing mileage, and creating e-receipts from photos of receipts, frees people from inadequate processes and in turn makes for a happy employee,” she says

20 INSIGHT www icpas org/insight WORKFORCE

cost So when he got back from his business trip, he included his hotel bill, receipts for a Broadway show and tourist attractions He pleaded ignorance,” Lickus tells us.

Jesse Harrison of Zeus Legal Loans has seen some interesting claims as well. “I’ve seen employees claim more hours than exist in the day, which means they not only weren’t sleeping, but they magically added one more hour to the 24-hour clock,” he says. “Another ridiculous attempt I encountered was for a $1 pen. An employee had bought pens from the office supply store with his own money and he wanted to be compensated for the amount of pen used for work versus personal use

“Still another employee wanted to charge the company for an accident that she caused on her way to work, and another wanted to charge her employers for the depreciation of her car due to commuting to work ”

So how can businesses stem the tide of silliness? Here are four straightforward solutions

1. Train employees

“ We m a k e s u r e e v e r y e m p l o y e e u n d e r s t a n d s h i s o r h e r r i g h t s regarding expenses by having regular meetings,” says Harrison “But a good rule of thumb is to put yourself in your boss’ shoes If your boss would find the expense laughable, then don’t try it ”

2. Communicate clearly

Once clear-cut rules are in place, make sure you communicate them regularly “You have to remind employees of policies at least twice a year and it should be a part of the onboarding process,” Lickus explains

3. Go paperless

Another best practice is to eliminate paper processes altogether, says Phil Gorman, founder of ExpenseTech “Use software Rules or policies, such as requiring sufficient details about individual expenses, monthly submission deadlines and approval chains, are what we recommend most often Without structure, some employees may take advantage of the lack of oversight and ask for forgiveness later,” he warns

4. Ask questions

Before any expense is submitted, Robert Half suggests asking these three questions:

n “Is this within the company policy?” If there’s any question, check with the HR department Taking a few minutes at the outset can spare embarrassment later

n “Could there be any confusion?” If your boss doesn’t know the baseball tickets you bought were to entertain a client, you could be putting yourself in hot water unnecessarily.

n “Does this pass the grandma test?” “Would you be comfortable telling your grandma what you’re trying to put through,” asks Lickus. “If not, don’t do it.”

T h e w o r l d o f e x p e n s e r e p o r t i n g , m u c h l i k e t h e w o r l d o f t a x exemptions and excuses for being late to work, will remain filled with grey areas and the likelihood of a laugh or two Whatever you can do to keep things on the up and up will save company time and money, as well as employee morale

www icpas org/insight | SUMMER 2016 21 Dive deep into the topics impacting business, accounting & finance today. Your one-stop resource for today’s hotest topics in CORPOR ATE FINANCE CAREERS PR ACTICE MANAGEMENT LEGISL ATION PLUS: Exclusive Monthly Articles Check it out today! www.icpas.org/copydesk

Costly Secrets

Are preliminary business negotiations putting your trade secrets at risk?

By Brian J. Hunt, J.D.

By Brian J. Hunt, J.D.

Your team’s been working this deal for months, crunching all the numbers, diving deep into all aspects of the business, and planning every step of the strategic combination You think you’re about to sign on the dotted line, and then the firm you’ve been wooing all this time finds a better suitor

In a business climate that’s teeming with mergers and acquisitions, it’s not uncommon for some of these relationships to sour. But what happens to all of that important and sensitive business information you shared? What happens when that firm moves on without you, but with a wealth of confidential and competitive information about your business? What, then, can you do to protect yourself?

incentive-points program (Destiny was a pioneer of such points-based programs).

As expected, the parties executed a common-sense confidentiality agreement governing the exchange of business information during the negotiations, which prohibited them from using or misapp

agreement didn’t commit Cigna to a business relationship with Destiny, prohibit it from developing its own points-based program, or prevent it from contracting with another vendor

During their negotiations, Destiny provided Cigna with secret actuarial data, marketing data and other trade secrets to enable Cigna to “deep dive” into Destiny’s program Following this, however, Cigna informed Destiny that it couldn’t move forward with the business relationship, citing among other reasons the lack of customization available with Destiny’s program and Destiny’s refusal to consider a relationship other than a joint venture After breaking things off, Cigna moved on with one of Destiny’s competitors to implement a points-based program.

This understandably didn’t sit well with Destiny, which ultimately filed suit against Cigna, alleging misappropriation of trade secrets pursuant to the Illinois Trade Secrets Act, 765 ILCS 1065/1 et seq. (Trade Secrets Act), and breach of the confidentiality agreement.

Ultimately, however, the Circuit Court sided with Cigna, finding that Destiny failed to present any evidence that the organization used confidential information when implementing its program Destiny was dealt a further blow by the Illinois Appellate Court when, on appeal, it affirmed the Circuit Court’s decision, rejecting Destiny’s principal argument that Cigna used trade secrets in the development of its incentive-points program

through improper acquisition, disclosure, or use; and the owner of the trade secret was damaged by the misappropriation

With respect to whether a trade secret existed, the Court noted that Destiny failed to identify the alleged trade secrets or confidential information that Cigna used in the development of its points program with any degree of particularity

22 INSIGHT www icpas org/insight LEGALITIES

Destiny Health Inc v Connecticut General Life Insurance Co , 2 0 1 5 I L A p p ( 1 s t ) 1 4 2 5 3 0 , a d d r e s s e s t h i s v e r y q u e s t i o n H e r e , defendant Cigna Corporation (Cigna) was interested in expanding i t s e m p l o y e e w e l l n e s s p r o g r a m b y c o m b i n i n g i t w i t h D e s t i n y Health Inc ’s

i a t i n g a n y c o n f i d e n t i a l i n f o r m a t i o n N o t a b l y,

w e v e

e

r o p r

h o

r, t h

I n m a k i n g t h i s d e c i s i o n , t h e C o u r t r e v i e w e d t h e t h r e e e l e m e n t s r e q u i r e d t o e s t a b l i s h t h e i m p r o p e r u s e o f t r a d e s e c r e t s , n a m e l y, a t r a d e s e c r e t e x i s t e d ; t h e s e c r e t w a s m i s a p p r o p r i a t e d

The Court then turned to the second element, misappropriation of trade secrets, which can be proved under the Trade Secrets Act in one of three ways: Improper acquisition, unauthorized disclosure, or unauthorized use To satisfy the unauthorized use prong, Destiny would have needed to show that Cigna couldn’t have created its points program without utilizing Destiny’s trade secrets However, Destiny’s own expert witness explicitly stated that he couldn’t point to any evidence that Cigna actually used Destiny’s trade secrets in the development of its program

Destiny further argued that the circumstantial evidence it presented required a reversal of summary judgment In essence, Destiny asked the Court to infer that Cigna misappropriated trade secrets because Cigna had access to its information and later developed a program similar to Destiny’s. The Court rejected this argument, noting that circumstantial evidence can be used to support a cause of action, but must demonstrate that the misappropriating party had access to the secret and that the secret and the defendant’s competing product share similar features The Court found that Destiny produced no direct or circumstantial evidence that the two programs were similar, and also noted key conceptual and operational differences between Cigna’s customizable program and Destiny’s fixed program

Destiny’s final, alternative argument asserted that it sufficiently established Cigna’s use of its trade secrets under the “inevitable disclosure doctrine.” Cigna, on the other hand, argued that the inevitable disclosure doctrine shouldn’t apply in the context of failed commercial transactions The Court again agreed with Cigna, noting that misappropriation means more than merely using information gained from an analysis of a possible target company or business partner. Notably, the Court held that the fact that information Destiny provided might have better informed Cigna’s evaluation of whether to partner with Destiny wasn’t enough to determine that Cigna misappropriated Destiny’s trade secrets. The Court reasoned that Destiny would need to show that Cigna could not have developed its program without the use of Destiny’s trade secrets Without that, the Court could not find that the use of trade secrets was inevitable.

F i n a l l y, b r i e f l y t u r n i n g t o D e s t i n y ’s claim arising out of breach of the confidentiality agreement, the Court ruled in favor of Cigna here as well, noting that Destiny set forth the same rejected arguments in support of this claim as those in its trade secrets claim.

The case of Destiny Health shows us how rough a breakup can sometimes be. The lesson here is simple: Be careful about the relat

Brian J Hunt is the managing principal of The Hunt Law Group LLC in Chicago He has been chosen as one of Chicago’s Top Lawyers and as one of Illinois’ Top Rated Lawyers Brian’s practice focuses on business litigation and the defense of corporations and individuals in the areas of construction, premises, transportation, product and professional liability He can be reached at bhunt@hunt-lawgroup com or 312 384 2301

i o n s h i p s y o u f o rg e a n d t h e p a r t n e r s y o u t h i n k a b o u t g e t t i n g involved with

www icpas org/insight | SUMMER 2016 23

Crowdfunding & the Future

It ’ s the darling of the investment world But who’s using it? And how do you get in on the act?

By Robert J Derocher

Want to follow the crowd to entrepreneurial fame and investor fortune? Tread carefully, warns longtime Chicago business adviser and attorney Bill Hubbard of Hubbard Business Counsel. “This is an important area of business growth and investment if it doesn’t get mucked up and it could get mucked up,” says Hubbard, former chair of the Illinois CPA Society Mergers and Acquisitions Special Interest Group “Yet if you really want to grow your business, this is a realistic growth opportunity for you to seriously explore.”

Although crowdfunding has been around in various forms for the last few years, recent law and rules changes in Illinois and nationally are likely to alter the business and investment landscape in the years ahead both for entrepreneurial business owners and eager investors

The evolving crowdfunding environment is also likely to mean more business opportunities for CPAs and finance professionals on both sides of the investment fence, as auditing, verification and solid financial and business plans and operations become critically necessary for entrepreneurs and investors alike

Crowdfunding defined

While the mention of crowdfunding conjures a mélange of fundraising images, from the inspirational (helping Boston Marathon bombing victims recover) to the bizarre (Help Me Buy a 20pc McNugget Meal!), it’s actually big business and a big deal in the corporate world today. A report released last year by crowdfunding research firm Massolution found that global crowdfunding jumped from $6 1B in 2013 to $16 2B in 2014, with another more-than-double increase to $34 4B expected in 2015

Crowdfunding is typically divided into four distinct types: donation-based (donors united behind a cause), reward-based (donors get a gift or reward from a company), lending-based (often called P2P or peer-to-peer business loans) and equity-based (donors receive financial shares in a business). Crowdfunding websites such as Kickstarter, GoFundMe and Indiegogo which focus on donation and reward-based programs have garnered some of the earliest attention and funds

But a combination of changes in federal and state regulation is expected to put a greater focus on and more money into debt- and equity-based crowdfunding On a national level, May 16 marked the initiation of Title III of the Jumpstart Our Business Startups (JOBS) Act of 2012, which opens the doors of business investment to non-accredited investors Depending on income and net worth, they can invest up to $100K in any year in companies that use online FINRA-registered crowdfunding portals or broker-dealers to raise capital under the US crowdfunding regulation.

Dara Albright, an investment and finance professional, and early advocate of crowd-structured financial products, prefers to call this newest wave of investment “crowd financing ”

“It’s really not anything different than the regulated financial industry Instead of money coming from large institutional investors, the capital is coming from ‘We, the People,’” she says “It represents a first step in democratizing access to capital We’re going to see an entirely new path for finance capitalization ”

Title III represents a significant shift for small and small middle-market businesses and startup owners, who previously tended to rely on generous family members, maxed-out credit cards,

24 INSIGHT www icpas org/insight INVESTING

bank loans, and a limited number of ‘accredited’ investors who had to certify their own financial stability and wealth, says Hubbard

“Any path to access investment capital for most entrepreneurs with a solid business and good operations and prospects has been significantly limited throughout my career,” he explains “This change provides such business owners with their first realistic opportunity one which has not, until now, existed in the United States It’s likely, if done right, to be exceptionally useful for a substantial minority of businesses if structured correctly for the business and each prospective investor alike ”

This is also an opportunity for entrepreneurs to devote more time to growing their business operations and financial bases, says L a u r e n L e i b o w i t z , m e m b e r s h i p a d m i n i s t r a t o r f o r t h e N a t i o n a l Crowdfunding Association (NLCFA) “Now they can go out and market their business and convert their customers into investors ”

For businesses treading into the crowdfunding arena, there are four major advantages, according to Anthony Zeoli, the Chicago finance and crowdfunding attorney who wrote Illinois’ state-level crowdfunding law: Good public relations, building brand loyalty, a cheaper source of capital than borrowing, and more independence, since power is not concentrated among fewer shareholders with large stakes

For Regular Joe investors, it’s a chance to use a relatively small amount of money to get ahead of the curve on a growing business or idea “Regular people have never been able to do this It’s always been a country club deal,” says Zeoli “This is exciting Now everyday investors will have the opportunity to invest in the types of ‘private company’ deals that were previously available only for highnet-worth and institutional investors.”

While the SEC has led federal crowdfunding regulations, more than 30 states have developed their own state-level crowdfundingrelated legislation and rules, with Illinois becoming one of the latest entrants on January 1 of this year Illinois HB 3420 permits unaccredited state residents to invest up to $5K per year (with no limits for accredited investors) in Illinois companies via online crowdfunding The bill further allows companies to raise as much as $4M per year via online equity and lending-based crowdfunding

Crowdfunding & the CPA

Whether the potential client is a neophyte investor or a regulatory minded entrepreneur, the crowdfunding rush is opening a growing market for CPAs and finance professionals Mindful of the potential for fraud and overeager over-investors, the SEC and the State of Illi-

nois have each put in multiple safeguards intended to protect investors That translates into opportunities for accounting and financial experts to offer their input

Among the requirements: Financial audits and reviews of financial statements performed by licensed accountants (depending on the amount of capital raised); compliance with Generally Accepted Account Principles (GAAP) if applicable; regular financial disclosures to investors, including an annual report and a business forecast; and third-party financial verification of accredited investors (required under an earlier section of the JOBS Act) In Illinois, companies raising $1M or more must have professionally audited financials, business plans and a determination of the company’s value

They must also provide quarterly or semi-annual financial statements to investors as applicable.

For many potential small businesses, preparing to go the crowdfunding route will require plenty of up-front work and plenty more to follow, says Hubbard “You might have to change your accounting operations, and it’s not going to happen overnight,” he explains

As for investors, while limits are in place to reduce any potentially large losses, they’ll still have to do their homework, Hubbard and others say. And with many first-time investors expected to wade into the crowd, financial literacy and advice are key.

“I would hope that the crowd will go to their trusted CPAs or finance professionals,” says Leibowitz “There’s a lot of consultation and advisement that can be done They can ask them, ‘Do you see this as viable? Do you see this as appropriate for me?’ It really gives investors an opportunity to put professional eyes on things ”

Although anticipation among investors has been building for the launch of Title III and possible further tweaks by the SEC and the states in the years ahead to grow equity-based crowdfunding many observers say it could take some time for it to become an established part of business growth and investment Albright expects that a generational shift will help speed the change, however

“There will be a great transfer of wealth from the Baby Boomers to the Millennials. They don’t trust Wall Street. They don’t trust banks. But they do trust the Internet,” she says. “When it starts to scale up is when you see the industry tapping into the $14T in retail retirement accounts ”

“The faucet has been turned on,” says Leibowitz “Now we’ll see what happens ”

www icpas org/insight | SUMMER 2016 25

STEM Sells

Illinois’ competitive edge hinges on preparing its workforce for continued innovation in science, technology, engineering and math.

By Carolyn Kmet

Boasting a $736B GDP, driven by 30-percent growth over the last decade, the State of Illinois is a key player in our domestic economy, ranking fifth in the nation in terms of gross domestic product With headlines constantly accusing Illinois of being a bad state for business, however, this may come as a bit of a surprise. The reality is that state efforts to nurture and drive advances in innovation and technology are showing significant signs of life

Skokie-based Technology Innovation Center (TIC) is a perfect example. TIC exists to support technology-based companies at the earliest stages of growth think pre-market, pre-money and even pre-employee. In 2014, for instance, TIC launched a laboratory-based incubator to provide entrepreneurs in the hard science industry with access to laboratories in a purely commercial environment. “This fills a critical gap in moving scientific innovation from the large institutions such as universities, hospitals and corporations where it is created, to the marketplace,” explains Tim Lavengood, executive director at TIC and Science Innovation Labs

TIC’s impact on the Illinois economy is nothing short of groundbreaking “We’ve graduated more than 350 companies, including Illinois Superconductor Corporation, Peapod Inc and Leapfrog Online,” Lavengood explains. “After 15 years, almost half of all TIC graduates are still in business. They’ve created more than 2,000 jobs, occupy more than 120,000 square feet of commercial space under rental, and have received more than $45M in private equity investments.”

While TIC is certainly a success story, Illinois’ economic growth remains vulnerable to a widening gap between business needs and workers’ skills in the advanced fields of science, technology, engin e e r i n g a n d m a t h (

advances, increased offshoring, and displacement of work to other states, which has thinned the ranks of manufacturing and high-tech positions What’s more, Illinois’ displaced workers are having difficulty finding new employment because they lack the advanced technical skills demanded by new jobs within these sectors

“The State must create high-paying jobs to bolster the middle class, while also significantly increasing the skill levels of the potential pool of workers so they are qualified to fill these jobs,” the Report states. “No matter how the State decides to overcome these challenges, a strong STEM education program is an inherent part of the solution ”

Indeed, if the State’s STEM initiative Illinois Pathways is right, by 2018 Illinois employers will offer more than 319,000 jobs requiring STEM education and training a nearly 20-percent increase since 2008

“The economy grows when individuals and businesses expand their presence or enter new markets Unfortunately, the skills gap in STEM leaves engineering leaders, executives and HR professionals looking for the needle in a haystack, and without top talent, it’s hard to capitalize on the opportunities these new markets represent,” says Bassanio Peters, CEO of Assist 2 Develop

In essence, the future of the Illinois economy and its ability to capitalize on STEM opportunities hinges on the future of our education system Recognizing this, the State is looking to not only increase the number of STEM-educated individuals entering its workforce, but also change the way it approaches education on a fundamental level For Illinois to remain competitive, school curricula must include an international perspective, learning and thinking skills, information and technology skills, and life skills, all taught starting in kindergarten, says the Illinois STEM Education Report “The 21st Century worker needs to understand multiple disciplines; for example, an engineer needs to understand human factors, marketing, financial planning, and entrepreneurship,” the Report states

Part of the State’s initiative includes the creation of the Illinois P-20 Council, which will foster collaboration between state agencies, educational institutions, community groups, employers and

26 INSIGHT www icpas org/insight ECONOMY

S T E M ) A c c o r d i n g t o N o r t h e r n I l l i n o i s U n i v e r s i t y ’s I l l i n o i s S T E M E d u c a t i o n R e p o r t , t h e S t a t e i s f a c i n g s e v e r a l h e a d w i n d s : I n c r e a s e d p r o d u c t i v i t y d r i v e n b y t e c h n o l o g i c a l

taxpayers in order to develop a sustainable statewide system of quality education and support. The “P” in the Council’s name represents preschool, and the 20 represents grade 20, or education after college The goal: To increase the proportion of Illinoisans with high-quality degrees and credentials from 44 percent to 60 percent by the year 2025

To further support this goal, Illinois Pathways has formed Learning Exchanges around high-demand career clusters and industries, i n c l u d i n g A g r i c u l t u r e , F o o d a n d N a t u r a l R e s o u rc e s ; E n e rg y ; Finance; Health Science; Information Technology; Research and Development; and Transportation, Distribution and Logistics. Each Learning Exchange identifies local and regional business needs, f a c i l i t a t e s p a r t n e r s h i p s a n d e x p e r i e n c e s t o s u p p o r t e d u c a t i o n a l pathways, and builds a framework of opportunities and resources to encourage student success within the nine industries What’s especially unique here is that while each Exchange must have a S t a t e - a p p r o v e d s t r a t e g i c p l a n , t h e y a r e o p e r a t e d v o l u n t a r i l y b y independent organizations

For instance, the Learning Exchange for Finance is led by Econ Illinois, a unit of Northern Illinois University’s Outreach, Engagement and Regional Development department. Beth Metzler, Econ Illinois’ vice president of Programs and Partnerships and lead for the STEM Learning Exchange for Finance, believes that by renewing the focus on science-based, STEM-related education, and by continuously challenging students to build decision-making and critical-thinking skills, Illinois grads will be uniquely positioned to e n t e r t h e w o r k f o rc e A k e y i n i t i a t i v e o f t h e F i n a n c e L e a r n i n g Exchange, for example, is to bring high school students into the business environment to gain an understanding of the variety of jobs available within the finance field. And, in fact, the Exchange has coordinated several student/educator visits with Chicago’s second-largest public accounting firm PwC that include dialog with young professionals, participation in curriculum activities, a tour of the offices and more

“It’s critical for educational institutions and businesses to work together to realize economic growth in Illinois Both entities can play a unique role in preparing students for employment and for building a knowledgeable, competent and sustainable citizenship that has an opportunity to positively impact our state,” says Metzler.

The educational system is indeed changing. Starting this year, the State is requiring fifth- and eighth-grade students to take a new science assessment test High school students taking biology or advanced biology classes also will be required to take the test, w h i c h i s a l i g n e d w i t h t h e n e w l e a r n i n g s t a n d a r d s f o r s c i e n c e adopted by the State in 2014 The new Illinois Learning Standards in Science has three dimensions: Disciplinary core ideas, scientific and engineering practices, and crosscutting concepts The integration of these dimensions is intended to reflect how science and engineering are practiced in the corporate environment.

“The demand for STEM-educated individuals is driven by the increasing integration of technology within our society,” says Alexis Sheehy, an online marketing specialist with Klara, a startup in the healthcare industry “STEM backgrounds are more marketable in the workplace for a few reasons: STEM roles are growing as technology begins to further integrate within our daily lives and industry, STEM roles can be applied to a number of industries as they continue to modernize, and traditional roles such as CMOs now benefit from knowledge of STEM concepts as data-driven decision-making increases in business.”

www icpas org/insight | SUMMER 2016 27

5 Epic M&A Fails

They gambled and lost in the high-stakes mergers & acquisitions game.

By Timothy Inklebarger

An emotional purchase, a botched integration, a lack of cultural synthesis a million things can go wrong when two entities join forces, especially when buying a company that was rotten to begin with. The worst purchases can mean billions in losses and even bankruptcy In fact, 70 to 90 percent of M&A deals fail to ever hit their revenue targets, according to Harvard Business Review

Perhaps that’s why deal-making has cooled in 2016, down 17 percent from the same period last year, says Takashi Toyokawa, senior editor for Mergermarket and Dealreporter, which provide M&A news and analysis. Nevertheless, even with a dip there’s still plenty of megadeals on the horizon the $130B “merger of equals” is still in negotiation between Dow Chemical and Dupont, for example, and Charter Communications recently undertook the $71B acquisition of Time Warner Cable. Which means the next epic M&A catastrophe could be in the making And when the mighty fall, they fall hard (do Bank of America and Countrywide Financial, and AOL and Time Warner ring a bell?)

Considering every economic sector has its own pitfalls, failure is often easier than it looks, Toyokawa explains, noting that fluctuating commodities prices can spell disaster in the energy sector, and pharmaceutical and tech sector deals often hinge on the perceived value of future returns

Whatever the sector, and whatever the pitfalls, commonalities in misjudgment remain, most notably insensitivity towards company cultures, failure to develop a solid integration model, and an inability to slow or halt deals once momentum begins

To illustrate the point in bright neon colors, here we highlight five of the worst M&As in recent memory

28 INSIGHT www icpas org/insight

www icpas org/insight | SUMMER 2016 29

ONE: Bank of America/Countrywide

Bank of America’s purchase of Countrywide Financial for $2.5B in 2008 is often touted as the worst acquisition in history. The deal aimed at making the bank the largest mortgage lender in the country resulted in more than $100B in write-downs, legal settlements and other losses.

Closing the deal a little over two months prior to the 2008 financial crisis, Bank of America was considered a “white knight” for the troubled subprime mortgage lender. But even when plans for the purchase were first announced in January 2008, industry anal y s t s w a r n e d t h a t t a k i n g o w n e r s h i p o f t o x i c h o m e l o a n s w a s a high-risk proposition. Analysts have pointed to Bank of America chief executive Ken Lewis’ cozy relationship with Angelo Mozilo, former chairman of the board and CEO of Countrywide Financial, as among the reasons for the company’s unwillingness to put the brakes on what some saw as a bad deal from the start.

C o u n t r y w i d e w a s n ’t t h e o n l y o n e w i t h p r o b l e m s B a n k o f America and its subsidiary Merrill Lynch also had subprime loans on the books but Countrywide held the vast majority of the new c o r p o r a t e e n t i t y ’s b a d a s s e t s w h e n t h e w o r l d e c o n o m y c a m e c r a s h i n g t o a h a l t . B a n k o f A m e r i c a u l t i m a t e l y a g r e e d t o p a y $ 9 . 3 B $ 6 . 3 B i n c a s h a n d $ 3 . 2 B i n s e c u r i t i e s t o t h e F e d e r a l Housing Finance Agency to settle allegations that it had sold bad m o r t g a g e s e c u r i t i e s t o F a n n i e M a y a n d F r e d d i e M a c M o z i l o ended up paying $67 5M to settle a civil fraud case with the SEC in 2010 The SEC also banned him for life from ever serving as a director or officer with any publicly traded company

TWO: Wachovia/Golden West Financial

While Bank of America took a massive hit from which it is still recovering, the failed acquisition was better than Wachovia Bank’s untimely $25 5B purchase of Golden West Financial at the peak of the 2006 housing market, says Ken Thomas, a Miami-based i n d e p e n d e n t b a n k i n g c o n s u l t a n t a n d p r e s i d e n t o f C o m m u n i t y

Development Fund Advisors “When you buy a bank that puts you under, that’s a lot different than when you buy a bank that cripples you,” Thomas explains of the deal, which finalized in 2008 “No matter how many losses you had at Countrywide, they weren’t as big as Wachovia’s because it brought the bank down ”

Adjustable-rate mortgages were the main culprit in Wachovia’s precipitous market decline and ultimately resulted in a $15 4B m e rg e r w i t h We l l s F a rg o T h e s o - c a l l e d “ p i c k - a n d - p a y m e n t ” o p t i o n s a l l o w e d b o r r o w e r s t o c h o o s e t h e a d j u s t a b l e - r a t e m o r tgages that contributed to the tidal wave of foreclosures defining

the financial crisis “This deal caused the fourth largest bank in America to fail,” Thomas states plainly

THREE: HP/Autonomy

T h o u g h M & A d e a l s c a n b e a t o u g h l a n d s c a p e t o t r a v e r s e , t h e inability to see the warning signs hiding in plain sight guarantees epic failure Like watching a train wreck in slow motion, emotion sometimes takes over and not even the best advice can stop a deal once it gains momentum.

Case in point is Hewlett-Packard’s (HP) $11B purchase of British software company Autonomy in 2011. A year later, after discovering what it claimed were accounting improprieties with Autono m y, H P a n n o u n c e d i t w a s w r i t i n g d o w n $ 8 . 8 B i n l o s s e s . T h e company accused Autonomy’s management team of inflating its value in “a willful effort to mislead investors and potential buyers, and severely impacted HP management’s ability to fairly value Autonomy at the time of the deal,” according to a 2012 press statement Angry investors would later sue HP, arguing the company knew of fundamental shortcomings at Autonomy but did nothing to stop the acquisition

Dan Avery, a principal in national management consulting and v e n t u r e i n v e s t m e n t f i r m P o i n t B ’s M & A p r a c t i c e , c a u t i o n s t h a t companies need to recognize “deal fever ” “Bad buys can grow out of a previous business relationship, a pet project or a flawed idea that gets momentum,” he says “Then it becomes a self-fulfilling prophecy, and buyers ignore red flags They get far enough along that they feel they have to go through with it Caution gets drowned out.”

The lesson? “A questionable acquisition strategy can be overcome by a good integration strategy,” says Avery.

FOUR: AOL/Time Warner

Sometimes deals just never live up to expectations Other times a f a i l e d i n t e g r a t i o n c a n m a k e t h e b e s t l o o k i n g d e a l s f a l l a p a r t overnight.

In 2000, AOL and Time Warner made a catastrophic attempt to m e rg e v i r t u a l m e d i a a n d I n t e r n e t t o c r e a t e t h e w o r l d ’s l a rg e s t media company. In essence, this was a culture-changing purchase from which there was no returning. “If you’re evolving or transforming your business with an acquisition, it’s likely a new and different culture will be part of the deal You’ve got to check your ego at the door and be ready to change, too,” Avery warns

In this case, a clash of cultures between employees of the two companies surfaced during their integration, explains a Fortune Magazine post-mortem on the 15th anniversary of the failed deal

30 INSIGHT www icpas org/insight

With the tech bubble adding fuel to the fire, the company posted a stunning $99B loss just two years later

Avery advises companies to put integration risks front and center and to consider the impact a merger will have on their respective cultures He and co-author Otto Ramos wrote in 2013 that integration risks “can range from business disruption to loss of customers and key employees, culture clash, productivity declines and delays in realizing synergies ” Identifying culture gaps is key to a smooth integration strategy, he writes. Sometimes, he tells me, operating companies separately makes the most sense

FIVE: Peabody Energy/McArthur Coal

Similar to Bank of America’s and Wachovia’s acquisitions at the height of the housing boom and AOL’s merger with Time Warner during the fat and happy days of the tech bubble, Peabody Energy

paid a pretty penny about $4 9B for Macarthur Coal when coal prices were soaring in 2011 Toyokawa explains that it was seen as a great deal at the time, “But the headline price tag was very big ”

demand has substantially diminished between then and now A lot of that in the US has to do with federal regulations limiting the amount of coal that can be produced That’s a classic case that falls into commodities,” Toyokawa explains

Former Macarthur Coal Chairman Keith De Lacy acknowledged in a 2015 interview with the Sydney Morning Herald that the mining company probably paid too much at “the peak of the boom ”

With every boom there is likely to be a bust Learning from past b

(majority of) mergers and acquisitions to come.

www icpas org/insight | SUMMER 2016 31

S u b s t a n t i a l d e m a n d f r o m C h i n a a n d o t h e r e m e rg i n g m a r k e t s l i k e I n d i a w e r e f u e l i n g t h e d e m a n d f o r c o a l , h e s a y s “ T h a t

u n d e r s w i l l h o p e f u l l y u p t h e c h a n c e s o f f u t u r e g l o r y f o

l

r t h e

32 INSIGHT www icpas org/insight

t he 2 1s t centur y heis t

While technology enables businesses to innovate faster than ever, it also invites evermore ambitious criminals to steal on an ever greater scale.

By Kristine Blenkhorn Rodriguez

By Kristine Blenkhorn Rodriguez